Exercising unilateral market power in the wholesale electricity

- Slides: 83

Exercising unilateral market power in the wholesale electricity market Briefing to MEUG on Wolak Methodology Johannah Branson, 4 June 2009

Purpose of briefing ► Wolak’s conclusion: – Four largest suppliers to NZ’s wholesale electricity market have, at times, had substantial ability and incentive to exercise unilateral market power – By increasing or reducing their offer prices to raise or lower market-clearing prices – Earning them large market power rents in the wholesale market over several sustained periods ► Commerce Commission’s conclusion: – Suppliers have exercised market power, but no evidence that for any anti-competitive purpose 2

Purpose of briefing ► Briefing: – Explain Wolak methodology (for non-economists) – Explain New Zealand results – Identify potential concerns on applicability to New Zealand (initial comments) 3

Context

Main report ► Wolak (2009) An Assessment of the Performance of the New Zealand Wholesale Electricity Market ► Report to Commerce Commission ► Public version released 19 May 2009 5

Wolak’s work for Commerce Commission ► Three phases: – Qualitative study on design and performance of NZ electricity market (completed December 2006) – Quantitative analysis of performance of wholesale market (current report) – Quantitative analysis of performance of retail market, including effects of vertical integration (halted) 6

Wolak’s work for Commerce Commission ► Purpose of quantitative analysis: – To investigate whether any market participants have a substantial degree of market power – If so, to investigate whether these market participants have taken advantage of this market power 7

Traditional approach ► Built on standard models from economic theory ► Need to know or assume characteristics of: – Market demand (e. g. price elasticity) – Firm-level costs (e. g. form of marginal cost curve) – Strategic interaction between firms (e. g. behaviour in imperfectly competitive markets) ► Findings of empirical analysis – conditional on assumed economic models ► If assumptions not applicable, findings may be incorrect 8

Alternative approach ► Bid based wholesale electricity markets ► Data rich – opportunity to investigate market power from actual data, without assumptions of traditional approach 9

Wholesale market in New Zealand ► Bid based market ► Market participants submit willingness-to-sell and willingness-to-buy curves to market operator ► Each curve shows quantity that a market participant is willing to sell or buy at each possible price ► Market operator uses all curves to compute market-clearing price and quantities sold and bought by each market participant at this price 10

Wholesale market in New Zealand ► Optimises allocation to serve total demand at lowest total cost ► Allowing for transmission losses between supply and demand locations ► Locational marginal pricing/nodal pricing – prices differ between locations due to transmission losses (persistent) and transmission congestion (very infrequent) 11

Wholesale market in New Zealand ► Large number of mostly small consumers ► Small number of large suppliers ► So main competition concern is market power of suppliers in influencing market prices 12

Wolak methodology

Alternative approach ► Only economic assumption: – Firms seek to maximise profits – Supplier constructs its willingness-to-supply (offer) curve to maximise its expected profits given the offers of its competitors and bids of demanders 14

Summary ► Framework: – Residual demand curve faced by a supplier = bids of all demanders minus offers of other suppliers – Supplier constructs offer curve to maximise expected profits given the residual demand curve it faces – Maximises profits by supplying quantity at which marginal revenue = marginal cost • Where one unit more would cost more to produce than the additional revenue it would earn; one unit less would reduce revenue by more than it would save in costs 15

Summary – Therefore profit maximising price-quantity combinations on offer curve depend on supplier’s marginal cost curve and residual demand curve – So can use suppliers’ offer curves and system demand: • To identify for each supplier whether it could increase profits by increasing or decreasing quantity supplied • To measure each supplier’s ability and incentive to exercise unilateral market power 16

Summary ► Market power: – If a market participant can take unilateral actions to influence the market price and to profit from the resulting price change – Firm is only serving its “fiduciary responsibility to its shareholders to take all legal actions to maximize the profits it earns” – Ability to exercise – whether a supplier is able to influence the market-clearing price by raising or lowering its offer prices – Incentive to exercise – whether doing so would increase its profits 17

Main steps ► Main steps: – Residual demand – facing a supplier – Elasticity of residual demand – ability to exercise market power – Simultaneous offers and bids – uncertain residual demand – Fixed-price forward market obligations – incentive to exercise market power – Pivotal suppliers – more extreme ability and incentive – Regression analysis – relationships with prices – Market power rents – the impact of higher prices 18

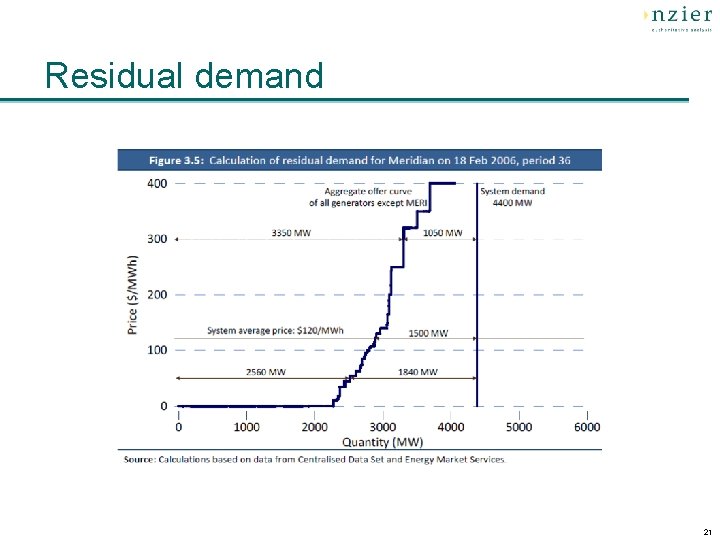

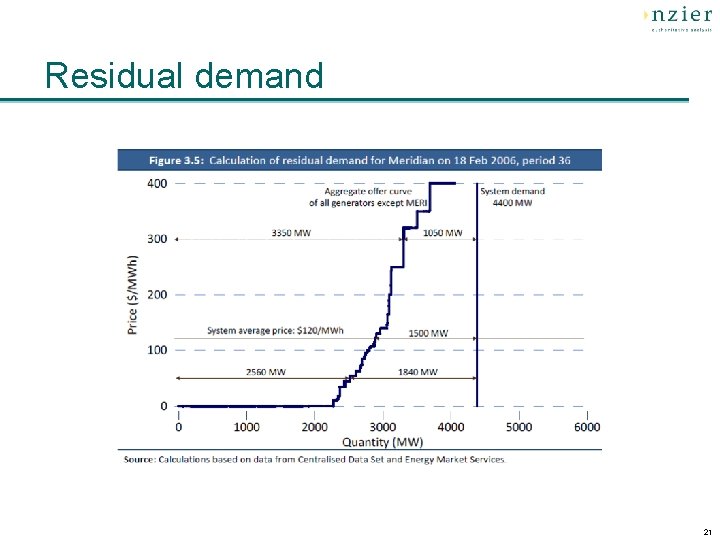

Residual demand ► First step: – Aggregate offer curves across all suppliers: • Price and quantity steps • Offered by each supplier • For one of the 48 half-hour pricing periods of the day – Subtract offer curve of one supplier (e. g. Meridian) to give offer curve of all suppliers except this one – Compare with level of demand – Level of demand minus total offer curve of all suppliers except this one gives residual demand curve facing this supplier 19

Residual demand 20

Residual demand 21

Residual demand 22

Residual demand ► Residual demand curve: – Shows quantity that this supplier could sell at each price given the offer curves of its competitors – Reflects supply response of competitors and demand response of demanders – Gives set of feasible price-quantity combinations that this supplier can choose from to maximise its profits – Intercepts with offer curve at market-clearing price 23

Residual demand 24

Elasticity of residual demand ► Next step: – Calculate inverse elasticity of residual demand curve – Indicates how much this supplier could increase market price by reducing the quantity it offers: • E. g. if this supplier could have increased market price by 108% by reducing its quantity supplied by 15% • Inverse elasticity = 108%/15% = 7. 2 – Shows tradeoff between higher system price and lower quantity from this supplier because of higher supply offered by its competitors at higher prices 25

Elasticity of residual demand 26

Elasticity of residual demand ► Provides measure of ability to exercise unilateral market power: – Higher inverse elasticity of residual demand: • Indicates greater ability to unilaterally change the market price • Due to smaller supply response from competitors – Lower inverse elasticity: • Indicates less ability • Due to larger supply response from competitors 27

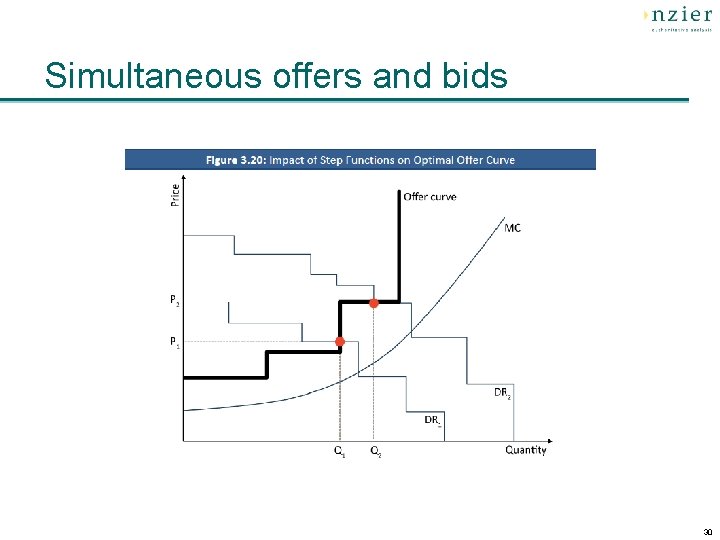

Simultaneous offers and bids ► Next step: – Offers and bids are submitted simultaneously – Market demand other suppliers’ offer curves are uncertain at time supplier submits own offer curve – But supplier does have good idea of likely set of possible residual demand curves: • Set of possible offer curves from each supplier is constrained by characteristics of each generation plant and market rules • Offer curves can be changed up to two hours before trading period, by which time system demand is fairly certain 28

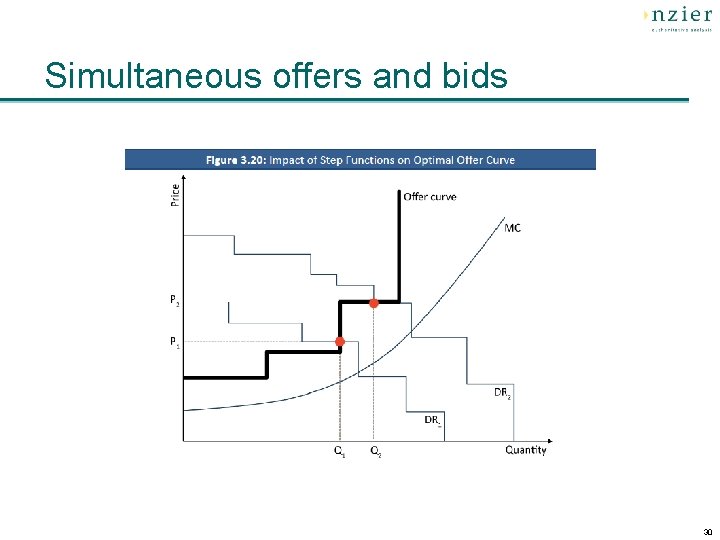

Simultaneous offers and bids ► So this supplier formulates its offer curve: – To supply the profit maximising quantity (where marginal revenue = marginal cost (MC)) – Under each of the possible residual demand curves it’s likely to face (DR 1, DR 2, etc) 29

Simultaneous offers and bids 30

Simultaneous offers and bids ► Inverse elasticity of residual demand influences supplier’s offer curve through profit maximising quantity: – Steeper residual demand: • Smaller supply response from competitors • Greater ability to unilaterally change market price • Price (offer curve) much higher than marginal cost – Flatter residual demand: • Larger supply response from competitors • Less ability to unilaterally change market price • Price (offer curve) closer to marginal cost 31

Simultaneous offers and bids – Flat (perfectly elastic) residual demand: • Sufficient competition that change in quantity has no affect on market price • Price (offer curve) = supplier’s marginal cost 32

Fixed-price forward market obligations ► Next step: – Bring in fixed-price forward market obligations – Under vertical integration, generators sell to: • Wholesale market at short-term market-clearing prices • Wholesale market through fixed-price forward contracts • Retail customers at retail prices that don’t vary with halfhourly prices in wholesale market – pre-committed to fixedprice retail load obligations – Supplier’s net position influences its incentive to exercise unilateral market power to change price 33

Fixed-price forward market obligations ► Net long: – Energy available to sell > fixed-price forward market obligations (contract + retail) – Residual demand net of forward market obligations = positive – Net seller to short-term market – Incentive to raise market price: • Increases cost of fixed-price forward market obligations • Increases revenue from sales to short-term market if rise in price outweighs fall in quantity • Net gain if increase in revenue from short-term market > increase in cost of fixed-price forward market obligations 34

Fixed-price forward market obligations ► Net short: – Fixed-price forward market obligations > energy available to sell – Residual demand net of forward market obligations = negative – Net buyer from short-term market – Incentive to lower market price: • Reduces cost of fixed-price forward market obligations • Reduces revenue from sales to short-term market if fall in price outweighs rise in quantity • Net gain if reduction in revenue from short-term market < reduction in cost of fixed-price forward market obligations 35

Fixed-price forward market obligations ► Without fixed-price forward market obligations: – Lower profit maximising quantity at higher price – Higher offer curve – Further from marginal cost ► With fixed-price forward market obligations: – Higher profit maximising quantity at lower price – Lower offer curve – Closer to marginal cost 36

Fixed-price forward market obligations ► Provides measure of incentive to exercise unilateral market power: – Depends on exposure to fixed-price forward market obligations – Calculate inverse elasticity of residual demand curve net of forward market obligations: • Higher inverse elasticity of net residual demand indicates greater incentive to unilaterally raise the market price • Can be zero – if short-term market sales = fixed-price forward market obligations • Negative if fixed-price forward market obligations > short-term market sales 37

Pivotal suppliers ► Next step: – Identify pivotal suppliers (can be more than one) – Provides additional measure of more extreme ability and incentive to exercise unilateral market power – Does aggregate willingness-to-supply of all other suppliers reach capacity before system demand met? – If so, supplier is “pivotal” – regardless of its offer price, system needs at least some of its supply – This supplier’s residual demand curve becomes perfectly inelastic at pivotal supply 38

Pivotal suppliers 39

Pivotal suppliers ► If pivotal: – Supplier has ability to set market price as high as wishes, if willing to sell only pivotal quantity – But may not have incentive – if fixed-price forward market obligations > pivotal quantity, supplier is a net buyer ► Net pivotal: – If pivotal net of fixed-price forward market obligations – Has ability, but also very strong incentive to exercise unilateral market power – Greater incentive the larger its net pivotal quantity 40

Pivotal suppliers ► Whether pivotal: – Uncertain at time supplier submits offer curve – More likely when unexpectedly high demand or large generation or transmission outage ► Supplier’s strategy: – If submits offers as if isn’t pivotal, but is – lost opportunity to exploit market power – If submits offers as if is, but isn’t – zero sales – Estimates probability of being pivotal – Calculates offer curve to maximise expected profits given probabilities and payoffs of being/not being pivotal 41

Regression analysis ► Next step: – Run regressions to test relationships between measures of ability and incentive to exercise market power and actual offer prices – Controlling for exogenous factors such as daily changes in input fossil fuel prices and water levels – Test null hypothesis that thermal generation suppliers are behaving as if had no ability to exercise market power 42

Market power rents ► Final step: – Calculate competitive benchmark prices if no market power (by four different approaches) – Compare with actual market prices – Multiply price differences by quantities supplied to give measures of market power rents earned by suppliers from wholesale market – Run regressions to test relationships between measures of ability and incentive and measures of market power rents 43

Where else used ► ► ► Established, widely recognised approach (first published in late 1990 s) Same or similar methodology used around the world to assess market power in wholesale markets for electricity USA: – All wholesale market monitoring agencies – Federal Energy Regulatory Commission (wholesale market regulator) – California market – Pennsylvania-New Jersey-Maryland (PJM) Interconnection market (merger analysis) ► ► Colombia Australia (merger analysis) 44

Where else used ► Europe: – European Commission’s Directorate General of Competition (2007 report on performance of six European wholesale electricity markets) – Germany – Spain – Denmark – UK (underway) 45

Results

New Zealand application ► Applies methodology to: – Data on half-hourly offer curves and market-clearing prices and quantities – Over 1 Jan 2001 to 30 June 2007 – For four largest suppliers in NZ wholesale market 47

Summary ► General findings: – NZ’s four largest suppliers have some ability to exercise unilateral market power – When have ability, are successful in raising market-clearing prices by increasing their offer prices – Sometimes have ability but no incentive to exercise unilateral market power – When have both ability and incentive, can exercise unilateral market power by raising or lowering their offer prices and thereby market-clearing prices – Whether raise or lower prices depends on their fixed-price forward market commitments relative to sales into short-term market – Earns them large market power rents in wholesale market over several sustained periods 48

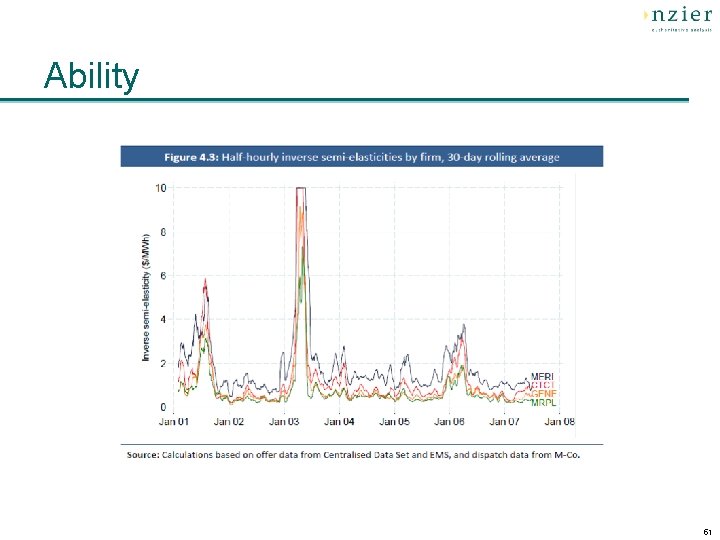

Ability ► Inverse semi-elasticity of residual demand: – Measure of ability to exercise unilateral market power – Shows $/MWh increase in market-clearing price associated with a 1% reduction in supplier’s quantity – Approximated from step functions by examining window to either side (e. g. price +/-10%) 49

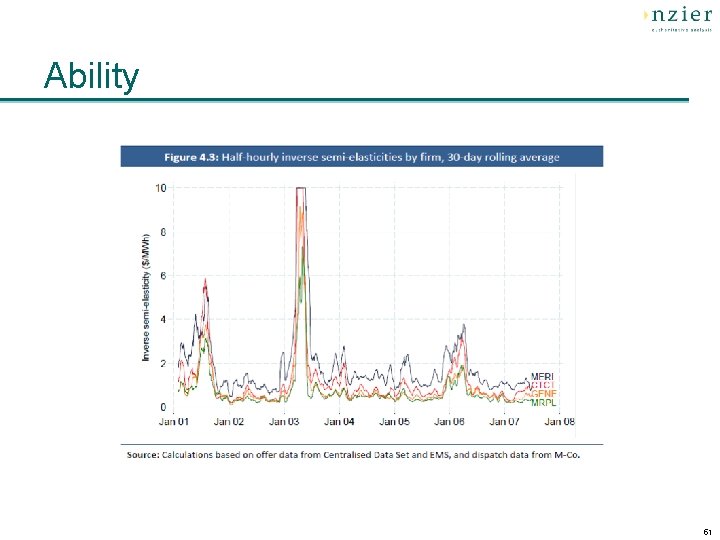

Ability ► Inverse semi-elasticities: – Over sample period and by time of day – Similar pattern for each of the four suppliers – Persistently higher for some suppliers – Meridian highest, Mighty River Power lowest – Average across four suppliers – high positive correlation with market-clearing prices – Mid-2001, early 2003 and early 2006 – high ability, high price – 2002, 2004 and 2005 – low ability, low price 50

Ability 51

Ability 52

Ability 53

Ability 54

Incentive ► Net inverse semi-elasticity of residual demand: – Net of fixed-price forward market obligations – Measure of incentive to exercise unilateral market power – Shows $/MWh increase in market-clearing price associated with a 1% reduction in supplier’s net position 55

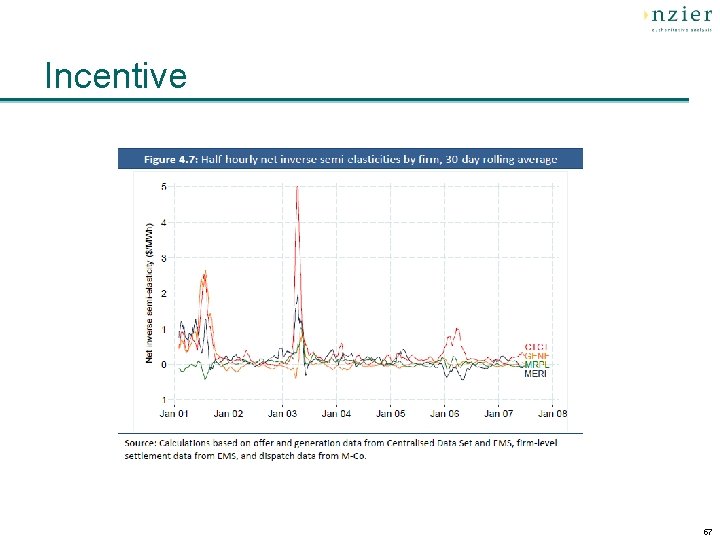

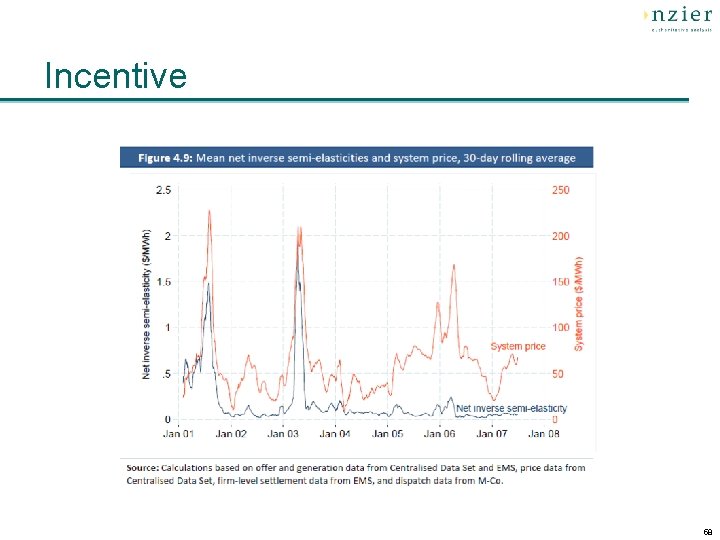

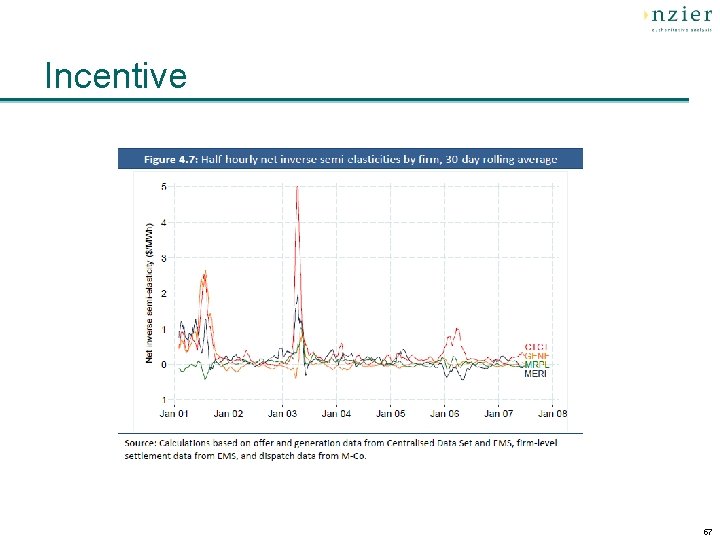

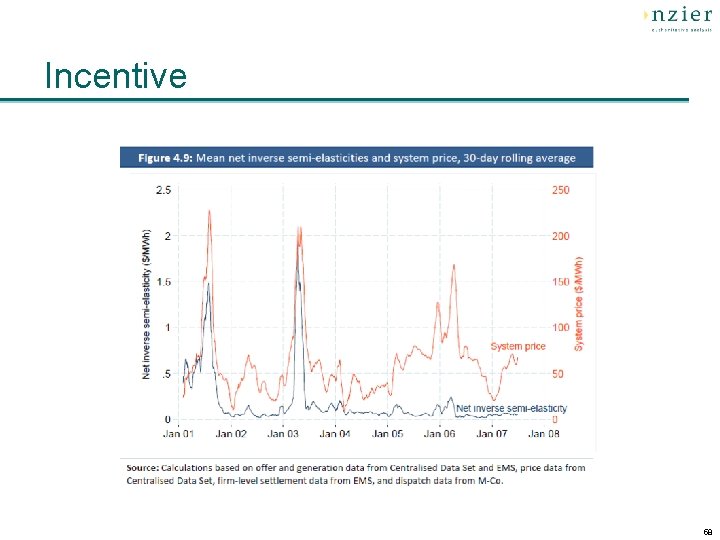

Incentive ► Net inverse semi-elasticities: – – Shows mitigating effect of fixed-price forward market obligations For all four suppliers, incentive much lower than ability Mid-2001 – three suppliers had high ability and incentive Early 2003 – all four had high ability, only Contact had high incentive – Negative incentive where fixed-price forward market obligations > sales into short-term market – frequently the case for Meridian, Genesis and Mighty River Power – Positive correlation with market-clearing price – when high incentive, high price 56

Incentive 57

Incentive 58

Pivotal suppliers ► Pivotal supplier status: – Meridian has highest pivotal and net pivotal frequency, Might River Power lowest – Net pivotal – very rare event for all but Meridian – High ability for Meridian, but incentive mitigated by fixed-price forward market obligations 59

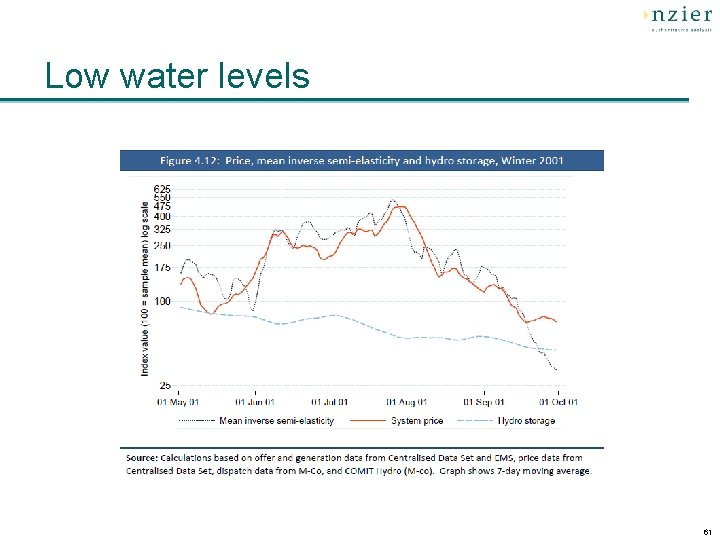

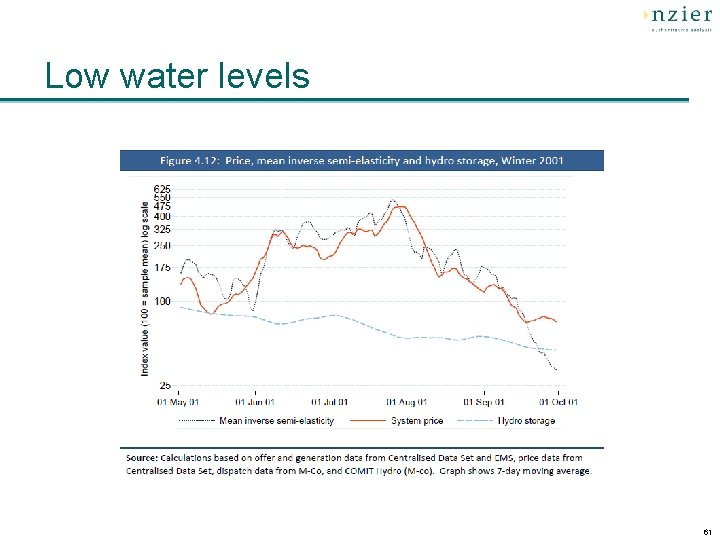

Low water levels ► Higher market-clearing prices when low hydro storage levels ► Changes in water levels contribute to but don’t fully explain price movements ► Price movements much more highly correlated with changes in ability and incentive 60

Low water levels 61

Low water levels 62

Relationships with prices ► Regressions – test size and significance of relationships: – After controlling for daily changes in input fossil fuel prices and water levels – Increasing relationships between measures of ability and incentive and offer prices submitted by suppliers: • Submit higher offer prices when have higher ability and incentive to exercise market power to raise market price • Also submit lower offer prices when have higher ability and incentive to exercise market power to lower market price 63

Relationships with prices – Statistically significant relationships – Larger regression coefficient for incentive – key determinant if supplier has fixed-price forward market obligations (all four do) – Strong evidence against null hypothesis that thermal generation suppliers are behaving as if had no ability to exercise market power 64

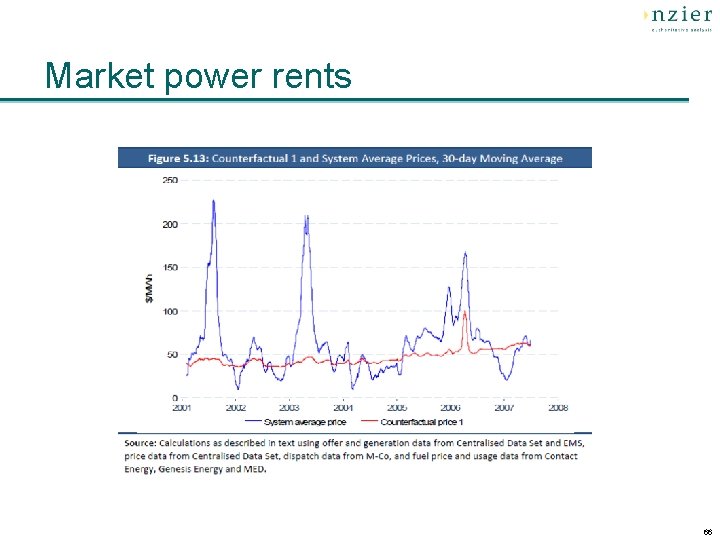

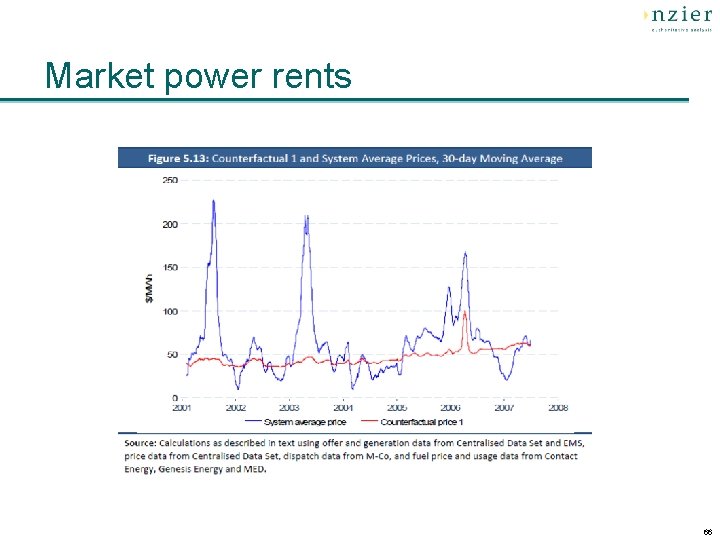

Market power rents ► Average difference between actual marketclearing prices and competitive benchmark prices (counterfactuals 1 and 2): – Very small: • For majority of half-hours • For majority of years – But extremely large: • In at least three periods lasting three to six months • Coincides with high ability and incentive 65

Market power rents 66

Market power rents 67

Market power rents ► Results market: in large market power rents in wholesale – Total $4. 3 billion over 2001 to 2007 – Vary by year, some negative – Annual range from -$263 million to $1. 496 billion -19% to 50% of wholesale market revenues) ( ► Empirical evidence suggests passed through to higher retail prices with a lag ► Regressions show larger market power rents when higher ability and incentive to exercise unilateral market power 68

Potential concerns

Potential concerns ► Wolak’s methodology too theoretical? ► New Zealand different to other countries where applied? : – Transmission grid – Reliance on hydro ► Short-run marginal cost as competitive benchmark price doesn’t allow sufficient revenue? ► Higher wholesale prices passed through to retail customers? 70

Too theoretical ► No, not just economic theory: – Established, widely recognised approach – Same or similar methodology applied around the world to assess market power in wholesale markets for electricity 71

New Zealand’s transmission grid ► NZ has long thin network ► More grid-like networks in other countries where applied ► Long thin networks: – Greater risk of transmission constraints – Cause large differences in nodal prices – May be more appropriate to assess competition within separate geographical markets than nationally 72

New Zealand’s transmission grid ► Wolak’s approach: – Correlation analysis found that for most of year, nodal prices across New Zealand move together – Implies that in most time periods, transmission constraints are not a significant obstacle to flows across network – Also tested validity of single-zone approach for calculating competitive benchmark prices ► Does not seem inappropriate to apply methodology to wholesale market nationally 73

New Zealand’s reliance on hydro ► Makes opportunity cost of stored water important: – In setting offers into wholesale market, hydro generators take into account opportunity cost of using water now that could be stored for future use when wholesale prices possibly higher ► Potential criticism of Wolak methodology: – Understates this opportunity cost – Option value may be even higher due to uncertainty 74

New Zealand’s reliance on hydro ► Wolak’s approach: – Sets upper bound of opportunity cost of water = marginal cost of highest variable cost fossil fuel unit needed to serve demand – Calls this conservative – claims may overestimate competitive benchmark prices – Argues that opportunity cost of water not relevant most of the time – only in actual/expected dry spells 75

New Zealand’s reliance on hydro ► Applicability in New Zealand: – May be reasonable in other countries, where hydro less important and larger capacity thermal generation – May be less so in NZ given reliance on hydro – When run short of water, prices in NZ can rise and stay high for months – can be several times short-run marginal cost of gas or other fossil fuel generation – Not enough gas or other fossil fuel generation capacity in NZ to serve all demand – can’t provide cap to hydro price 76

New Zealand’s reliance on hydro – Very high costs if run out of water – rolling blackouts and economic losses – Probability rises as shortage approaches – raises expected opportunity cost of water, beyond most expensive thermal generation – Implies Wolak’s methodology overstates market power rents in dry years 77

Short-run or long-run marginal cost ► Potential criticism of Wolak methodology: – Short-run marginal cost benchmark for competitive benchmark prices doesn’t cover full costs of generation – over long run, need to cover more than short-run marginal costs, also capital costs and fixed operating costs – Risk to sufficient investment in generation capacity to ensure security of supply – Over sample period – constraints in building new generation capacity and significant uncertainty in fuel supplies – Even providers of goods and services regulated under Part 4 of Commerce Act are allowed to earn an adequate return of and on capital 78

Short-run or long-run marginal cost ► Wolak’s approach: – Short-run marginal cost: • Appropriate benchmark for assessing whether wholesale market (or any short-run market) is competitive • Relevant to decision on quantity to supply to short-term market – Long-run marginal cost – relevant to decisions on market entry and exit and whether to increase or decrease generation capacity – If insufficient generation capacity – prices rise, attracting investment in more capacity 79

Short-run or long-run marginal cost – All supply selected for dispatch receives marketclearing price: • Set by last supplier with highest offer needed to meet system demand • For most suppliers this market price > their offer prices 80

Pass through to retail ► Potential criticism of interpretation of Wolak methodology: – $4. 3 billion market power rents interpreted as transfer of wealth from consumers to suppliers – But relate to wholesale market only – Generators have some fixed-price contracts and retail load obligations at fixed prices – Under vertical integration, generators effectively sell to their retail businesses – Therefore make net gain from higher prices in wholesale market on only some of their generation, so wealth transfer lower than Wolak’s estimate of market power rents 81

Pass through to retail – Doesn’t establish conclusively whether, and if so to what extent, high spot prices in dry years passed through to future retail prices – Need to analyse along with underlying drivers of retail price rises (e. g. input prices – risen over past 10 years) 82

Conclusion ► ► ► Methodology = established, widely recognised and applied worldwide But some questions remain about how applied to NZ Adjustment may reduce estimates of market power rents But finding remains that suppliers have had substantial ability and incentive to exercise unilateral market power, in wholesale market, to raise or lower market-clearing prices by increasing or reducing their offer prices Price movements explained more by ability and incentive than changes in hydro storage levels 83

Unilateral power adalah

Unilateral power adalah Static electricity and current electricity

Static electricity and current electricity Current electricity

Current electricity How are static electricity and current electricity alike

How are static electricity and current electricity alike Exercising

Exercising Exercising self control

Exercising self control Negetive sentences

Negetive sentences Strict constructionists favored congress exercising

Strict constructionists favored congress exercising Wholesale market near me

Wholesale market near me Western wholesale market

Western wholesale market Wholesalesolar com

Wholesalesolar com Market leader challenger follower nicher

Market leader challenger follower nicher Segmentation target market and positioning

Segmentation target market and positioning Market power market failure

Market power market failure Draw power triangle

Draw power triangle Wa electricity market

Wa electricity market Electricity powerpoint

Electricity powerpoint Unilateral superior laryngeal nerve injury

Unilateral superior laryngeal nerve injury Unilateral tolerance and bilateral tolerance

Unilateral tolerance and bilateral tolerance Unilateral tolerance definition

Unilateral tolerance definition Band and loop space maintainer advantages

Band and loop space maintainer advantages Test bilatéral ou unilatéral

Test bilatéral ou unilatéral Balanced vs lingualized occlusion

Balanced vs lingualized occlusion Hareketli bölümlü protezlerde oklüzyon

Hareketli bölümlü protezlerde oklüzyon What is retruded contact position

What is retruded contact position Structura actului juridic civil

Structura actului juridic civil Silicon unilateral switch applications

Silicon unilateral switch applications Difference between allowance and tolerance

Difference between allowance and tolerance Erythomatous

Erythomatous Hanau quint formula

Hanau quint formula Test bilatéral ou unilatéral

Test bilatéral ou unilatéral 40h11 tolerance

40h11 tolerance Space maintainer fixed unilateral

Space maintainer fixed unilateral Multilateral competition games

Multilateral competition games Códigos de comunicación no verbal

Códigos de comunicación no verbal Unilateral laplace transform

Unilateral laplace transform Unilateral presentation

Unilateral presentation Placods

Placods Visual neglect

Visual neglect Unilateral contract

Unilateral contract Nasal

Nasal Unilateral neglect

Unilateral neglect Limits

Limits Use of laplace transform

Use of laplace transform Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Gấu đi như thế nào

Gấu đi như thế nào Glasgow thang điểm

Glasgow thang điểm Hát lên người ơi

Hát lên người ơi Môn thể thao bắt đầu bằng chữ đua

Môn thể thao bắt đầu bằng chữ đua Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Công thức tính thế năng

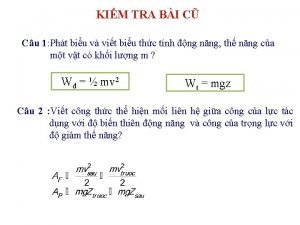

Công thức tính thế năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Cách giải mật thư tọa độ

Cách giải mật thư tọa độ 101012 bằng

101012 bằng Phản ứng thế ankan

Phản ứng thế ankan Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thể thơ truyền thống

Thể thơ truyền thống Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Một số thể thơ truyền thống

Một số thể thơ truyền thống Cái miệng nó xinh thế chỉ nói điều hay thôi

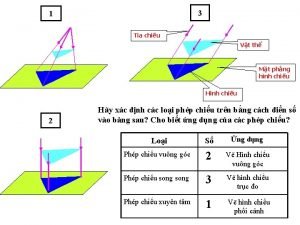

Cái miệng nó xinh thế chỉ nói điều hay thôi Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Thế nào là sự mỏi cơ

Thế nào là sự mỏi cơ đặc điểm cơ thể của người tối cổ

đặc điểm cơ thể của người tối cổ Thế nào là giọng cùng tên?

Thế nào là giọng cùng tên? Vẽ hình chiếu đứng bằng cạnh của vật thể

Vẽ hình chiếu đứng bằng cạnh của vật thể Phối cảnh

Phối cảnh Thẻ vin

Thẻ vin đại từ thay thế

đại từ thay thế điện thế nghỉ

điện thế nghỉ Tư thế ngồi viết

Tư thế ngồi viết Diễn thế sinh thái là

Diễn thế sinh thái là Dot

Dot Số.nguyên tố

Số.nguyên tố Tư thế ngồi viết

Tư thế ngồi viết Lời thề hippocrates

Lời thề hippocrates Thiếu nhi thế giới liên hoan

Thiếu nhi thế giới liên hoan ưu thế lai là gì

ưu thế lai là gì Sự nuôi và dạy con của hổ

Sự nuôi và dạy con của hổ Sự nuôi và dạy con của hổ

Sự nuôi và dạy con của hổ Sơ đồ cơ thể người

Sơ đồ cơ thể người