Secured Transactions Assignment 8 Formalities for Attachment 1

![Basic Concepts Value has been given [by the secured party] 10 Basic Concepts Value has been given [by the secured party] 10](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-10.jpg)

![Basic Concepts Value has been given [by the secured party] ? Secured party Debtor Basic Concepts Value has been given [by the secured party] ? Secured party Debtor](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-11.jpg)

![Basic Concepts Value has been given [by the secured party] Secured party Loan or Basic Concepts Value has been given [by the secured party] Secured party Loan or](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-12.jpg)

![Basic Concepts Value has been given [by the secured party] Secured party Previously unsecured Basic Concepts Value has been given [by the secured party] Secured party Previously unsecured](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-13.jpg)

![Basic Concepts Value has been given [by the secured party] § 1 -204. [A] Basic Concepts Value has been given [by the secured party] § 1 -204. [A]](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-14.jpg)

![Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] 15 Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] 15](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-15.jpg)

![Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-16.jpg)

![Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-17.jpg)

![Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-18.jpg)

![Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] § 2 Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] § 2](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-19.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-55.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-56.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-57.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-58.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-59.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-60.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-61.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-62.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-63.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-64.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-65.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-66.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-69.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-70.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-71.jpg)

![Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-72.jpg)

- Slides: 94

Secured Transactions Assignment 8 Formalities for Attachment 1

The Big Picture Chapter 1. Creditors’ Remedies Under State Law Chapter 2. Creditors’ Remedies in Bankruptcy Chapter 3. Creation of Security Interests Assignment 8: Formalities for Attachment Assignment 9: What Collateral and Obligations are Covered? Assignment 10: Proceeds (State Law) Assignment 11: Proceeds (Bankruptcy) Assignment 12: Skip 2

The Big Picture Chapter 1. Creditors’ Remedies Under State Law Chapter 2. Creditors’ Remedies in Bankruptcy Chapter 3. Creation of Security Interests Assignment 8: Formalities for Attachment Assignment 9: What Collateral and Obligations are Covered? Assignment 10: Proceeds (State Law) Assignment 11: Proceeds (Bankruptcy) Assignment 12: Skip 3

The Big Picture Chapter 1. Creditors’ Remedies Under State Law Chapter 2. Creditors’ Remedies in Bankruptcy Chapter 3. Creation of Security Interests Assignment 8: Formalities for Attachment Assignment 9: What Collateral and Obligations are Covered? Assignment 10: Proceeds (State Law) Assignment 11: Proceeds (Bankruptcy) 4

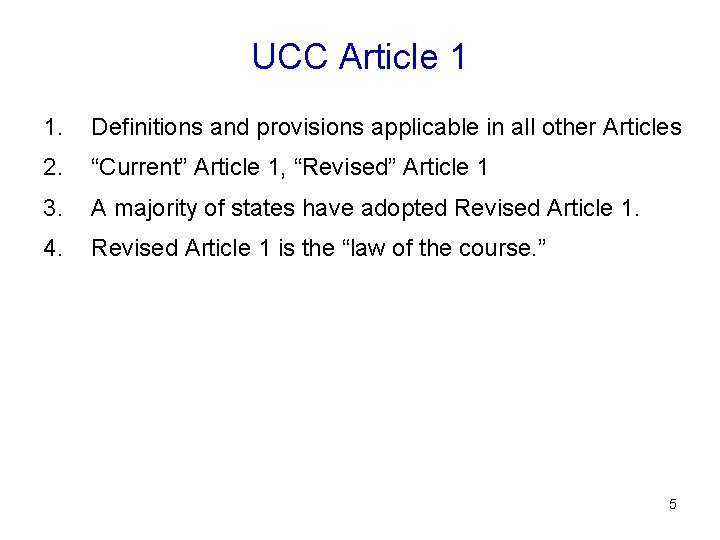

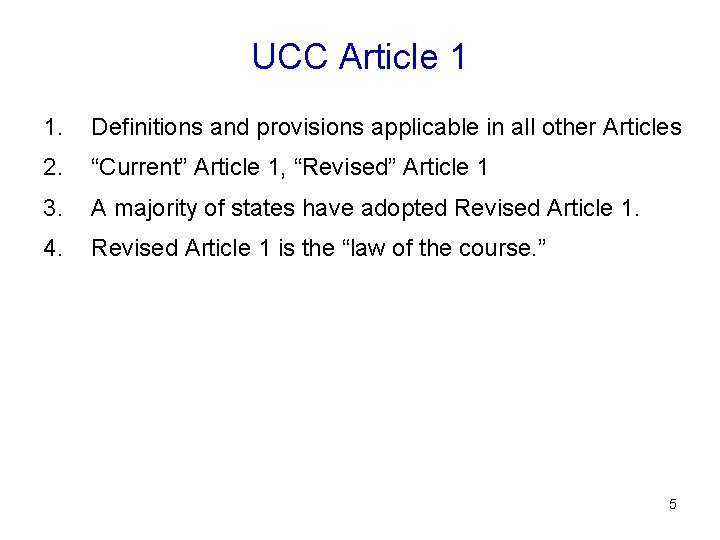

UCC Article 1 1. Definitions and provisions applicable in all other Articles 2. “Current” Article 1, “Revised” Article 1 3. A majority of states have adopted Revised Article 1. 4. Revised Article 1 is the “law of the course. ” 5

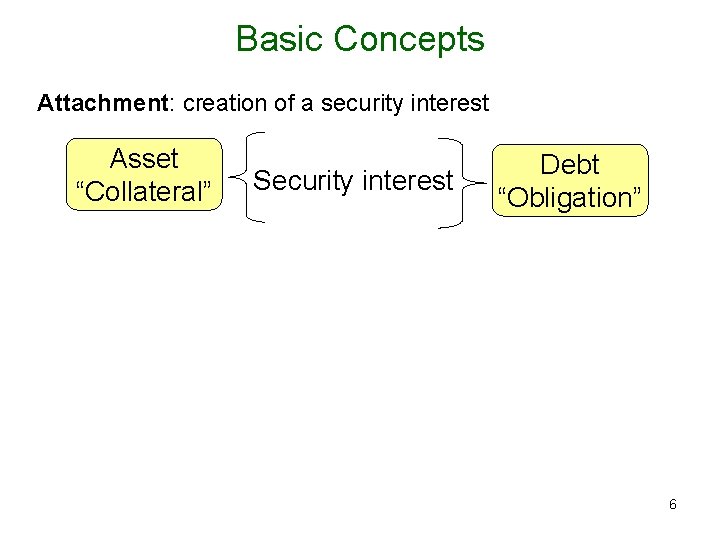

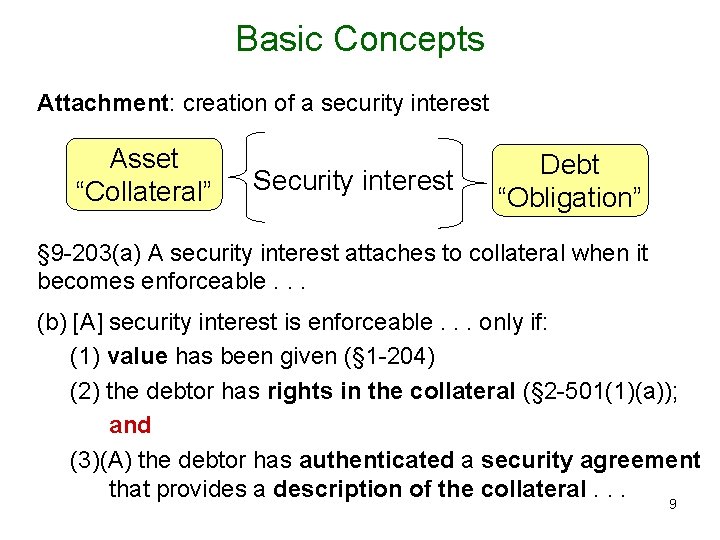

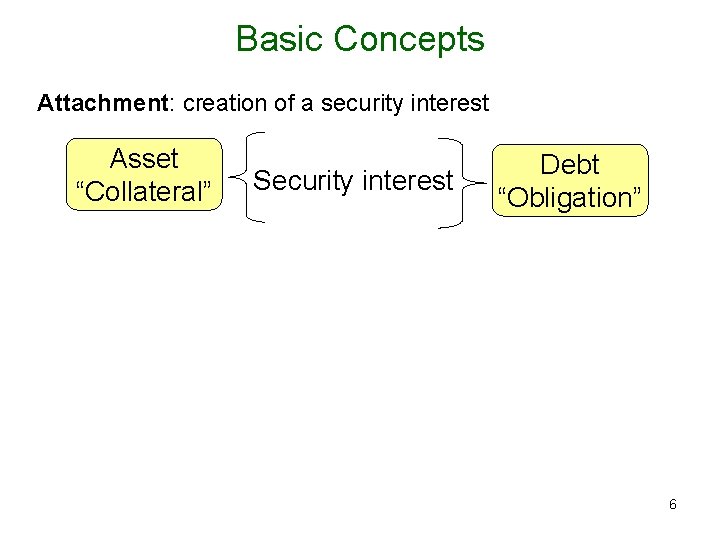

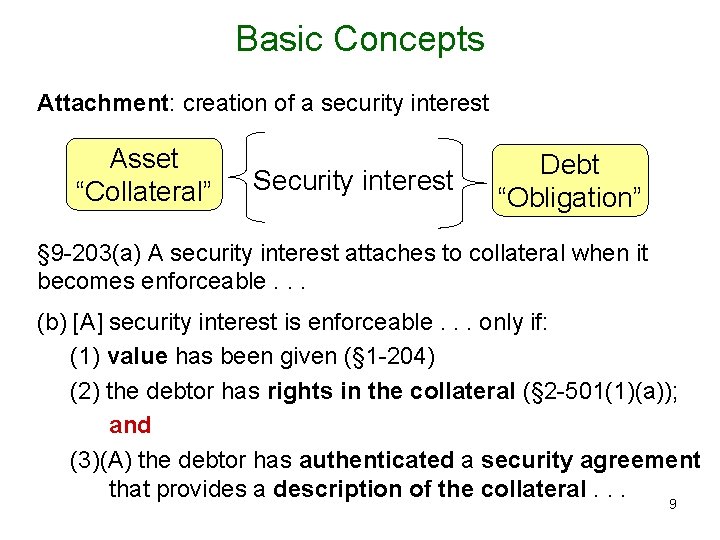

Basic Concepts Attachment: creation of a security interest Asset “Collateral” Lien Security interest Debt “Obligation” § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -201(44)) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 6

Basic Concepts Attachment: creation of a security interest Asset “Collateral” Lien Security interest Debt “Obligation” § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -201(44)) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 7

Basic Concepts Attachment: creation of a security interest Asset “Collateral” Lien Security interest Debt “Obligation” § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -204) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 8

Basic Concepts Attachment: creation of a security interest Asset “Collateral” Lien Security interest Debt “Obligation” § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -204) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 9

![Basic Concepts Value has been given by the secured party 10 Basic Concepts Value has been given [by the secured party] 10](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-10.jpg)

Basic Concepts Value has been given [by the secured party] 10

![Basic Concepts Value has been given by the secured party Secured party Debtor Basic Concepts Value has been given [by the secured party] ? Secured party Debtor](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-11.jpg)

Basic Concepts Value has been given [by the secured party] ? Secured party Debtor Security interest 11

![Basic Concepts Value has been given by the secured party Secured party Loan or Basic Concepts Value has been given [by the secured party] Secured party Loan or](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-12.jpg)

Basic Concepts Value has been given [by the secured party] Secured party Loan or loan commitment Debtor Security interest 12

![Basic Concepts Value has been given by the secured party Secured party Previously unsecured Basic Concepts Value has been given [by the secured party] Secured party Previously unsecured](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-13.jpg)

Basic Concepts Value has been given [by the secured party] Secured party Previously unsecured loan Debtor Security interest A loan made unsecured (“past consideration”) is value with respect to a later-granted security interest 13

![Basic Concepts Value has been given by the secured party 1 204 A Basic Concepts Value has been given [by the secured party] § 1 -204. [A]](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-14.jpg)

Basic Concepts Value has been given [by the secured party] § 1 -204. [A] person gives “value” for rights if the person acquires them. . . (2) as security for. . . a pre-existing claim. . . or (4) in return for any consideration sufficient to support a simple contract. Secured party Previously unsecured loan Debtor Security interest A loan made unsecured (“past consideration”) is value with respect to a later-granted security interest 14

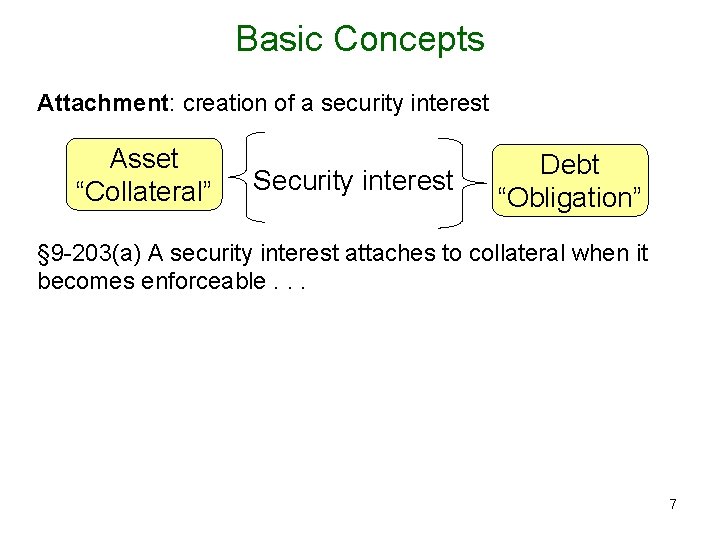

![Basic Concepts Debtor has rights in the collateral ownership lease etc 15 Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] 15](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-15.jpg)

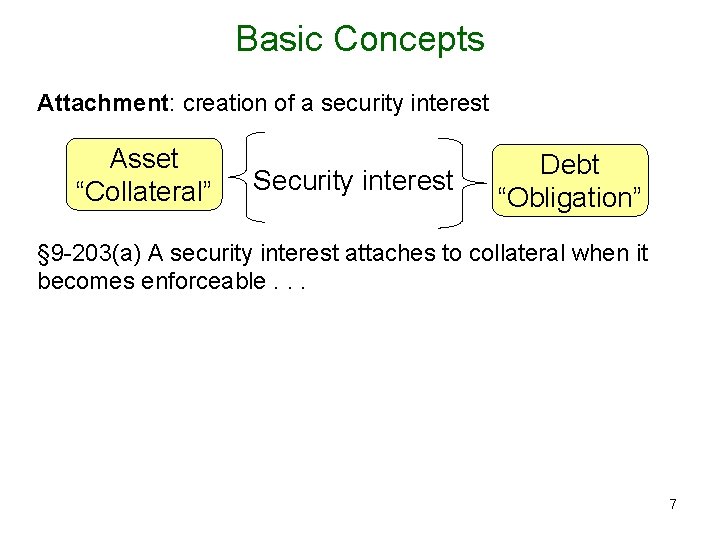

Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] 15

![Basic Concepts Debtor has rights in the collateral ownership lease etc Secured party Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-16.jpg)

Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party License Trademark owner Security interest In “trademark” Debtorlicensee 16

![Basic Concepts Debtor has rights in the collateral ownership lease etc Secured party Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-17.jpg)

Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party Title to goods Seller Security interest Debtor Bad check 17

![Basic Concepts Debtor has rights in the collateral ownership lease etc Secured party Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-18.jpg)

Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] Secured party Rights in goods not yet delivered Seller Security interest Debtor No consideration yet paid 18

![Basic Concepts Debtor has rights in the collateral ownership lease etc 2 Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] § 2](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-19.jpg)

Basic Concepts Debtor has rights in the collateral [ownership, lease, etc. ] § 2 -501(1)(a) The buyer obtains a special property. . . interest in goods by identification of existing goods as goods to which the contract refers. . In the absence of explicit agreement identification occurs when the contract is made if it is for the sale of goods already existing and identified. Secured party “Identification” Seller Security interest Debtor No consideration paid 19

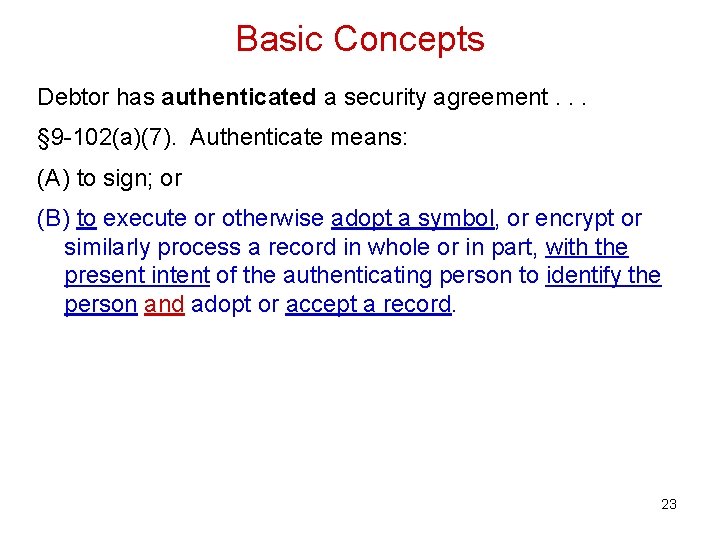

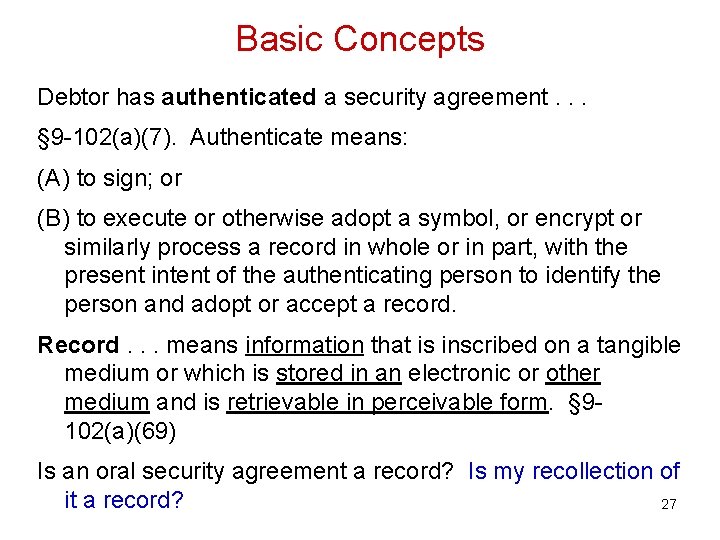

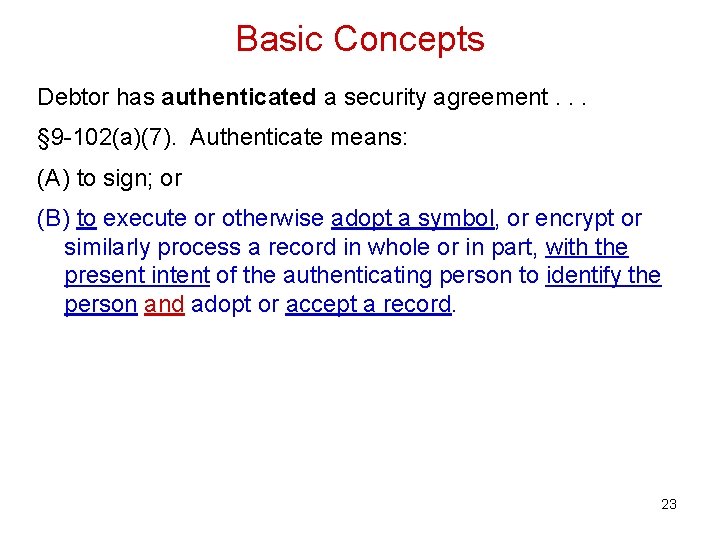

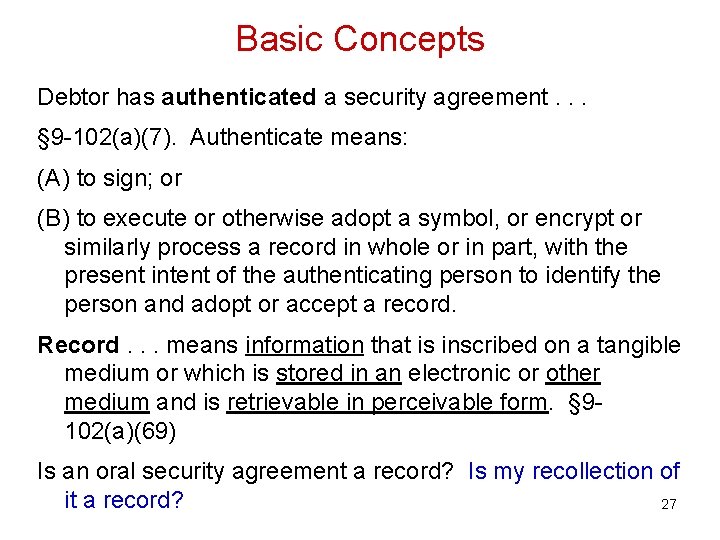

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is something in my memory a record? 20

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is something in my memory a record? 21

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is something in my memory a record? 22

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is something in my memory a record? 23

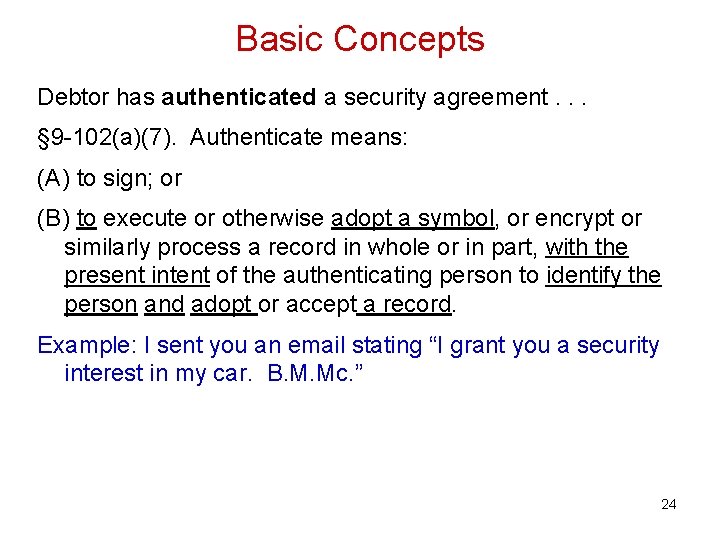

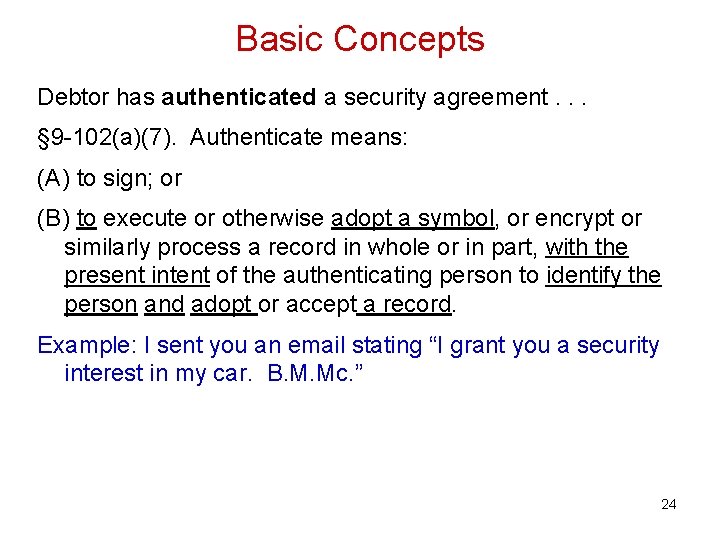

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Example: I sent you an email stating “I grant you a security interest in my car. B. M. Mc. ” tronic or other medium and is retrievable in perceivable form. § 9 -102(a)(69) Is something in my memory a record? 24

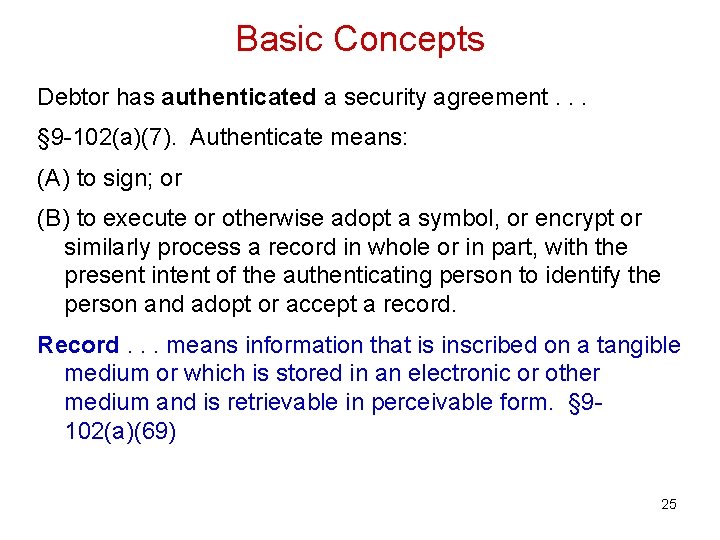

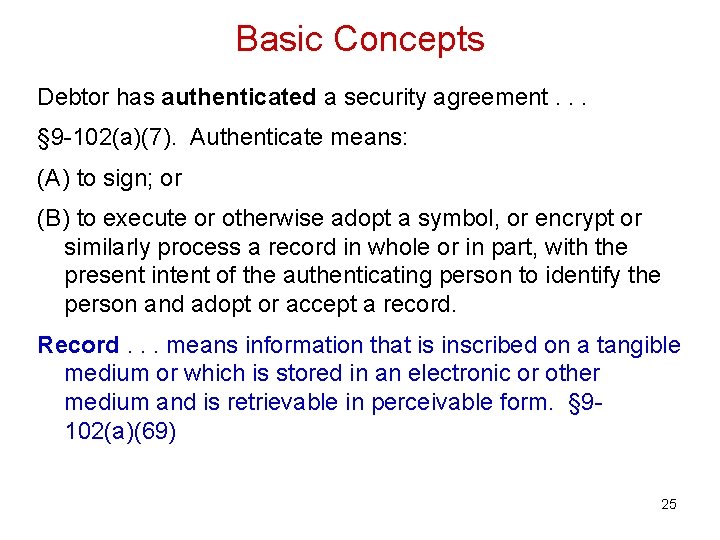

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is something in my memory a record? 25

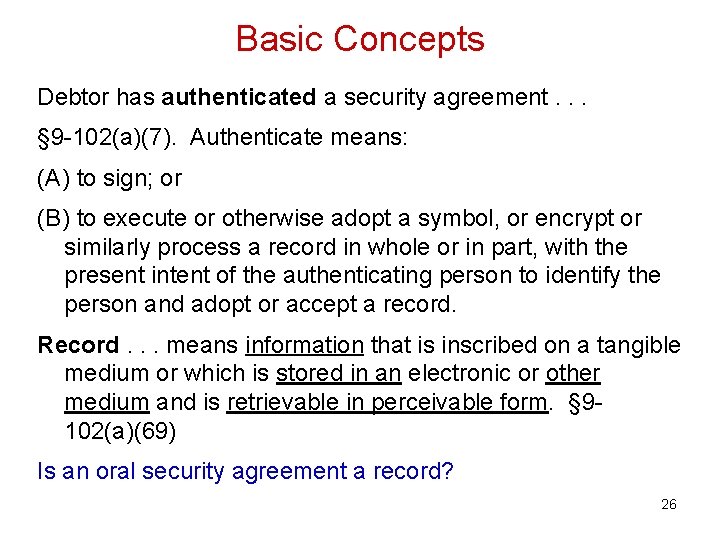

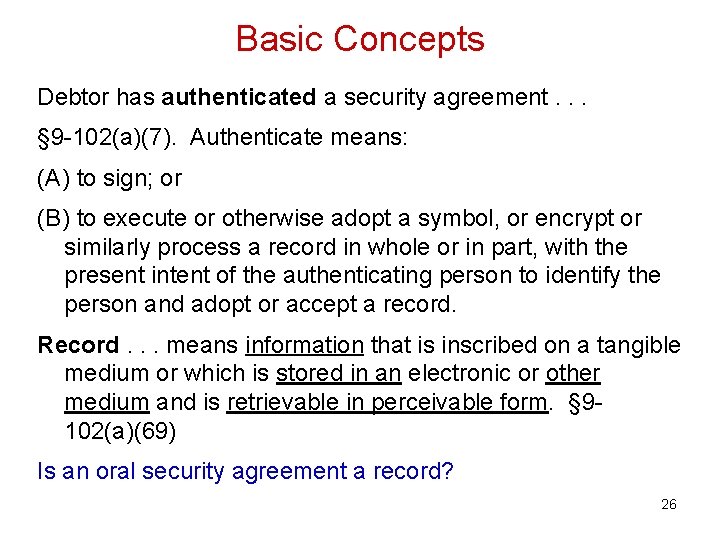

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is an oral security agreement a record? 26

Basic Concepts Debtor has authenticated a security agreement. . . § 9 -102(a)(7). Authenticate means: (A) to sign; or (B) to execute or otherwise adopt a symbol, or encrypt or similarly process a record in whole or in part, with the present intent of the authenticating person to identify the person and adopt or accept a record. Record. . . means information that is inscribed on a tangible medium or which is stored in an electronic or other medium and is retrievable in perceivable form. § 9102(a)(69) Is an oral security agreement a record? Is my recollection of it a record? 27

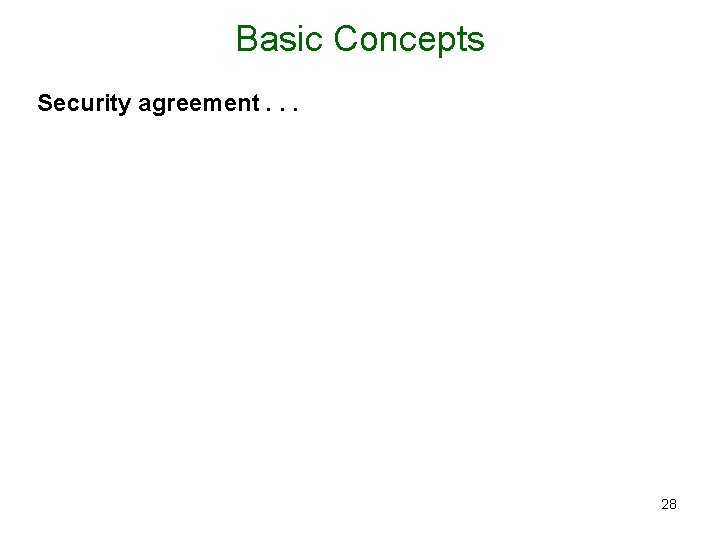

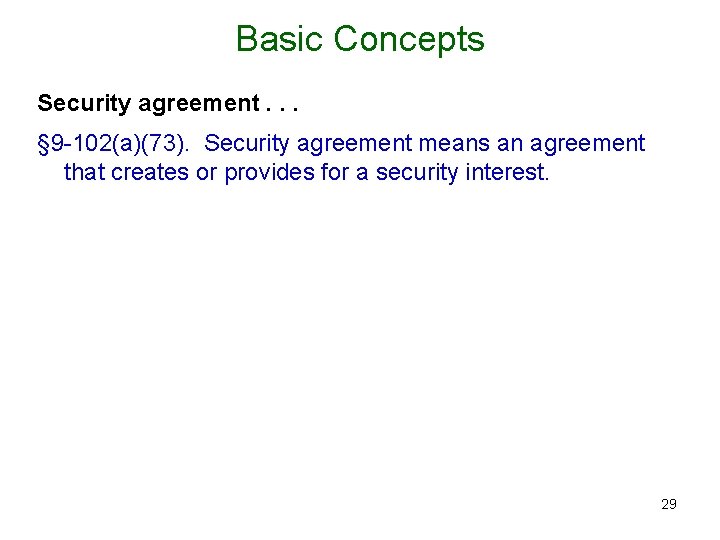

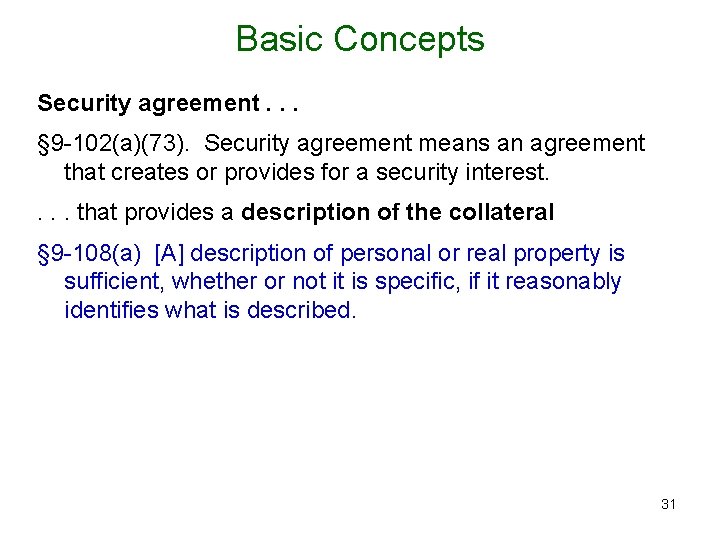

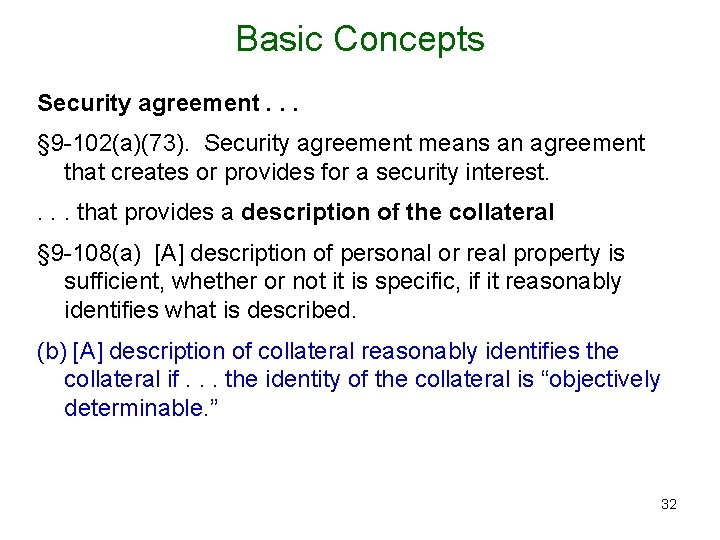

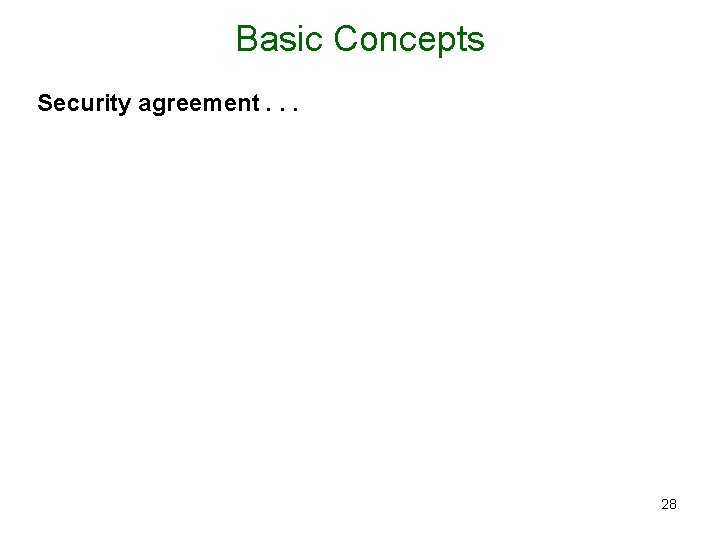

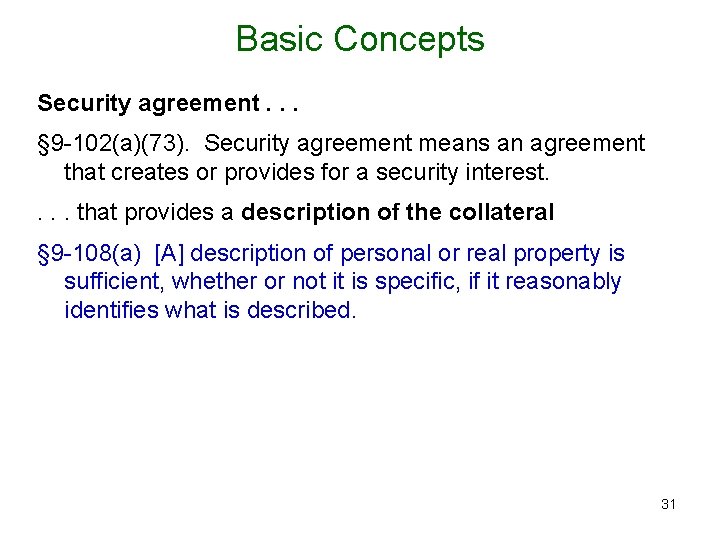

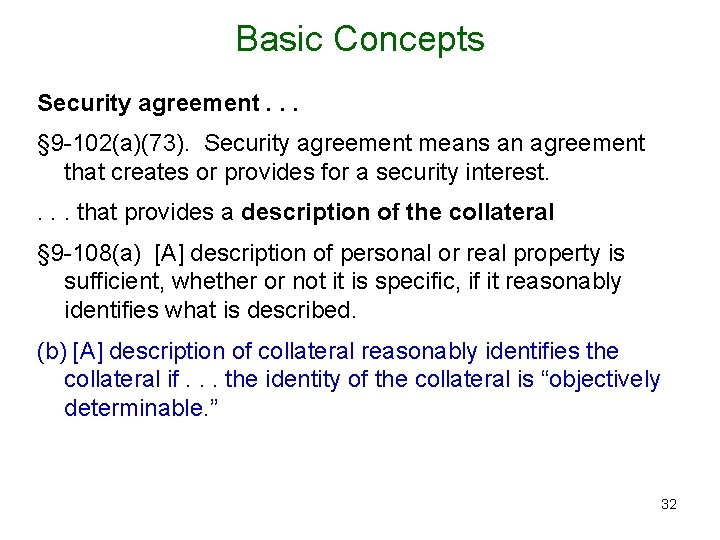

Basic Concepts Security agreement. . . § 9 -102(a)(73). Security agreement means an agreement that creates or provides for a security interest. That provides a description of the collateral § 9 -108(a) [A] description of personal or real property is sufficient, whether or not it is specific, if it reasonably identifies what is described. (b) [A] description of collateral reasonably identifies the collateral if. . . the identity of the collateral is “objectively determinable. 28

Basic Concepts Security agreement. . . § 9 -102(a)(73). Security agreement means an agreement that creates or provides for a security interest. That provides a description of the collateral § 9 -108(a) [A] description of personal or real property is sufficient, whether or not it is specific, if it reasonably identifies what is described. (b) [A] description of collateral reasonably identifies the collateral if. . . the identity of the collateral is “objectively determinable. 29

Basic Concepts Security agreement. . . § 9 -102(a)(73). Security agreement means an agreement that creates or provides for a security interest. . that provides a description of the collateral § 9 -108(a) [A] description of personal or real property is sufficient, whether or not it is specific, if it reasonably identifies what is described. (b) [A] description of collateral reasonably identifies the collateral if. . . the identity of the collateral is “objectively determinable. 30

Basic Concepts Security agreement. . . § 9 -102(a)(73). Security agreement means an agreement that creates or provides for a security interest. . that provides a description of the collateral § 9 -108(a) [A] description of personal or real property is sufficient, whether or not it is specific, if it reasonably identifies what is described. (b) [A] description of collateral reasonably identifies the collateral if. . . the identity of the collateral is “objectively determinable. 31

Basic Concepts Security agreement. . . § 9 -102(a)(73). Security agreement means an agreement that creates or provides for a security interest. . that provides a description of the collateral § 9 -108(a) [A] description of personal or real property is sufficient, whether or not it is specific, if it reasonably identifies what is described. (b) [A] description of collateral reasonably identifies the collateral if. . . the identity of the collateral is “objectively determinable. ” 32

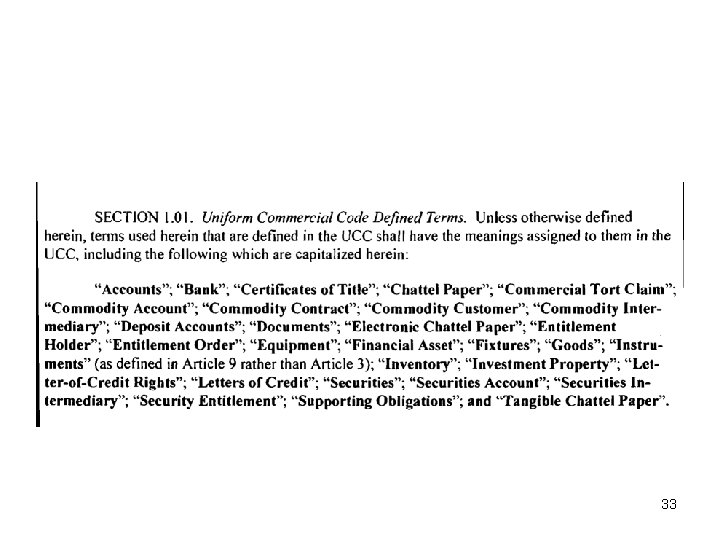

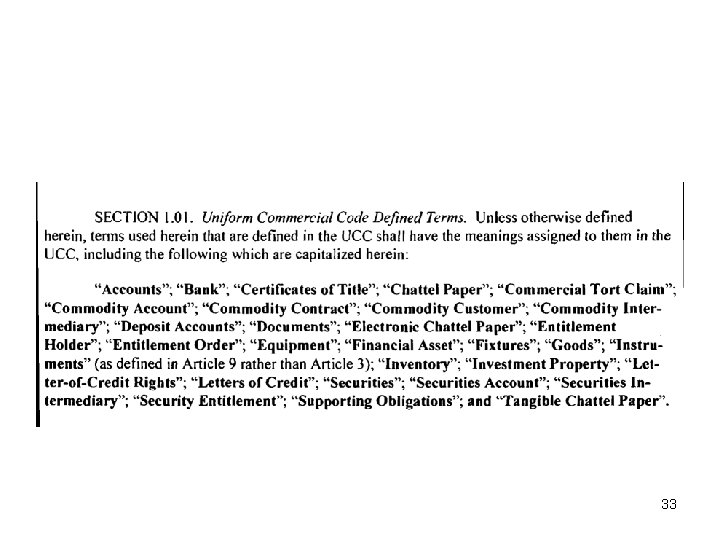

33

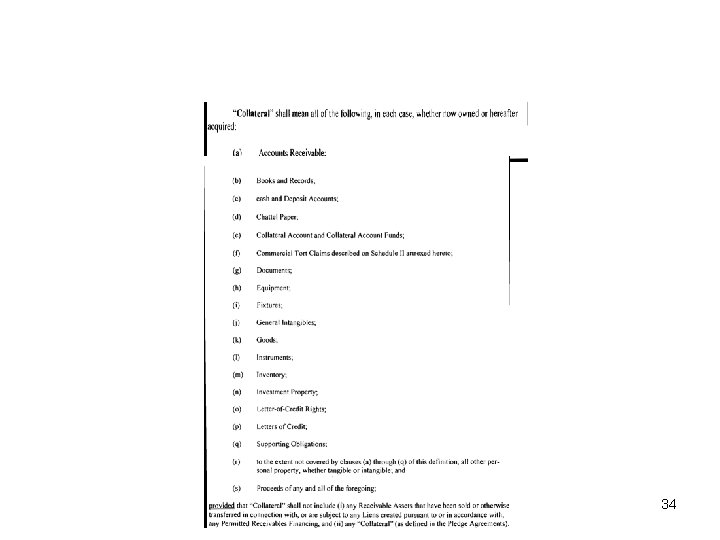

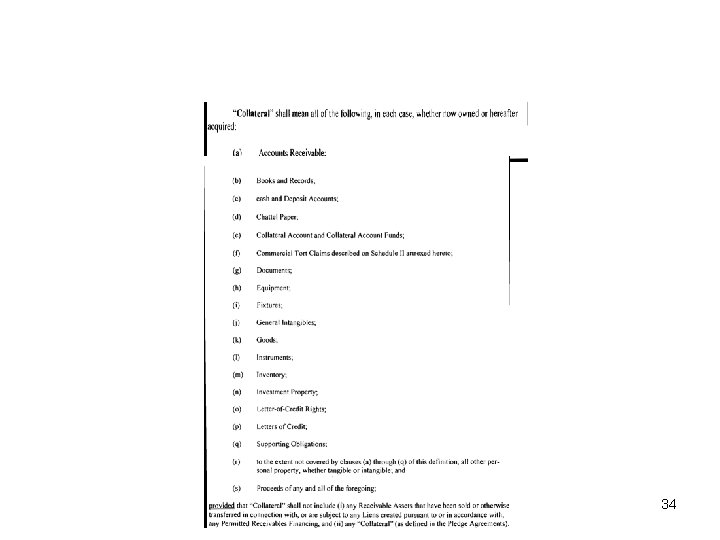

34

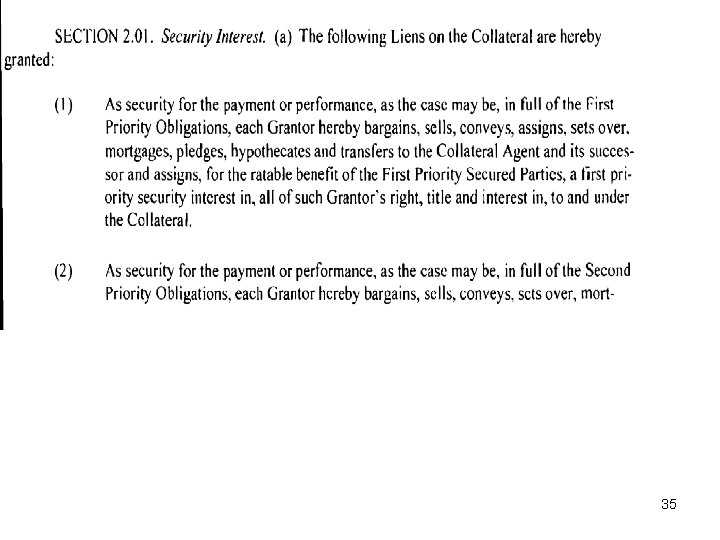

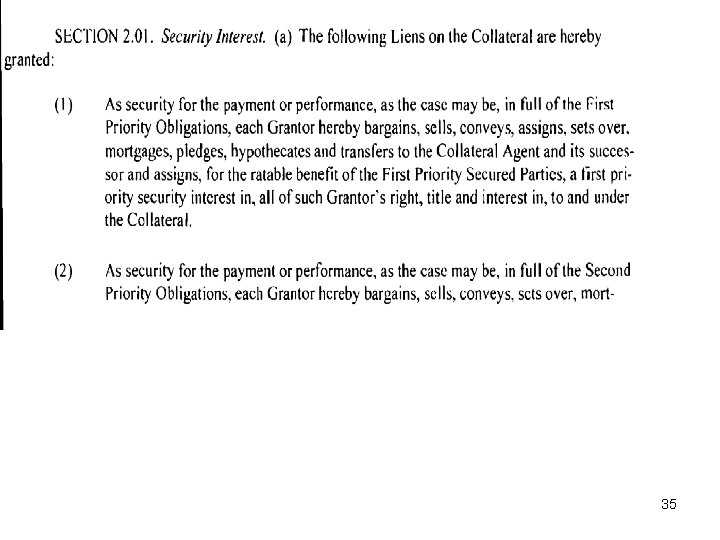

35

36

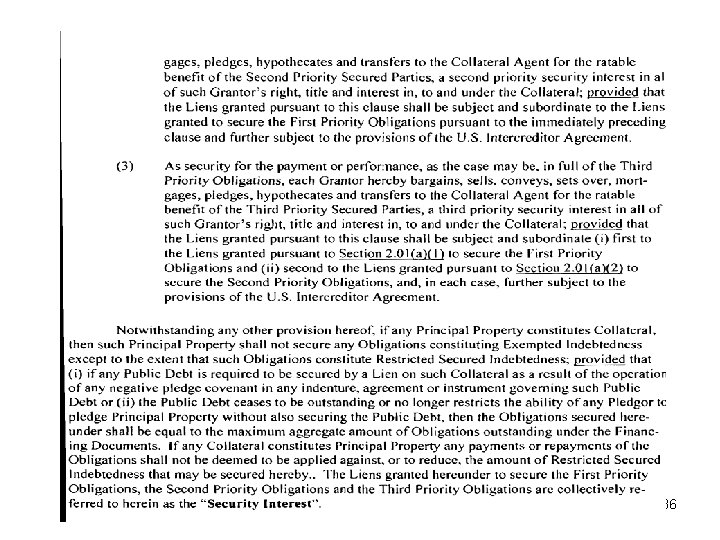

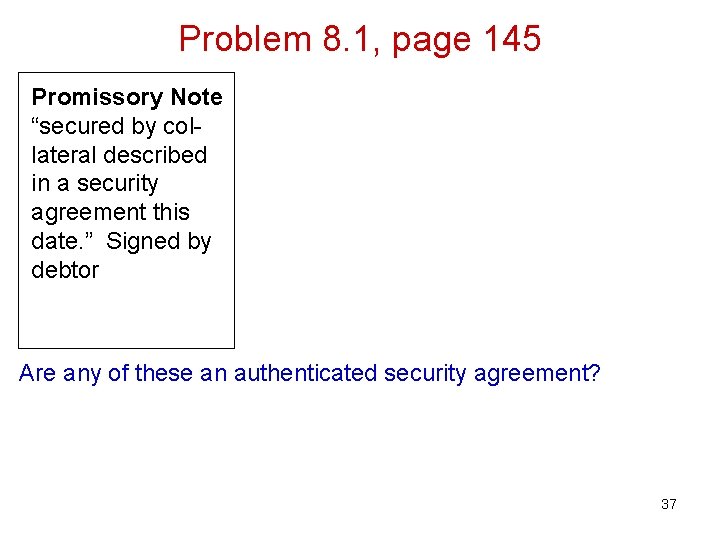

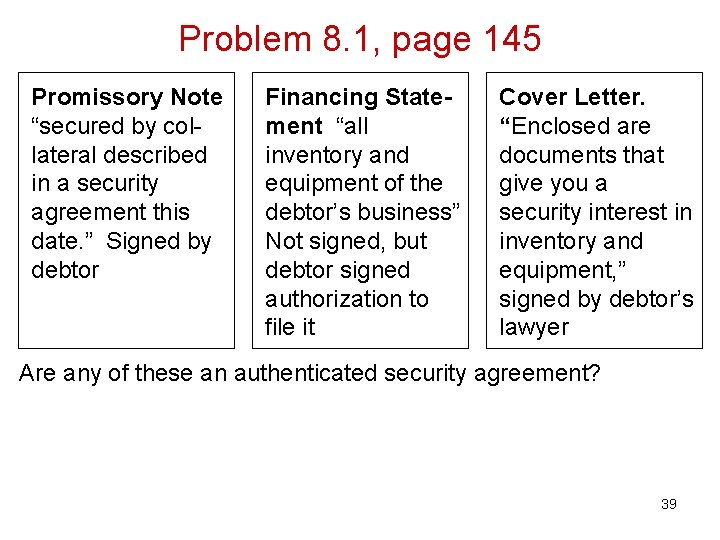

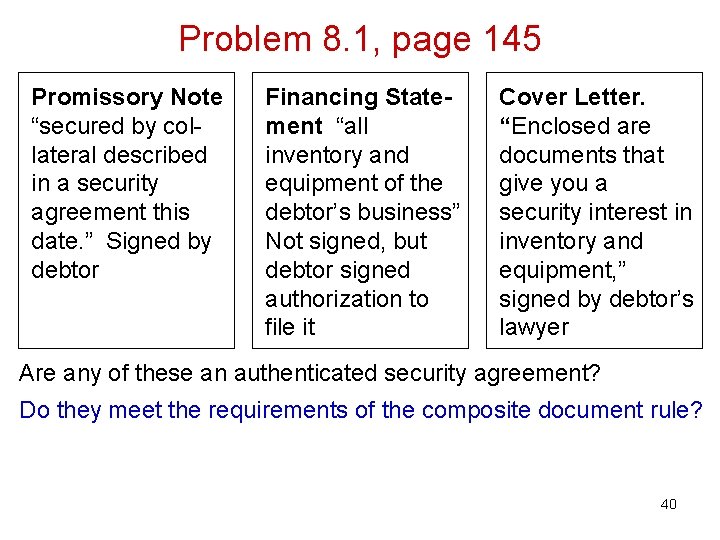

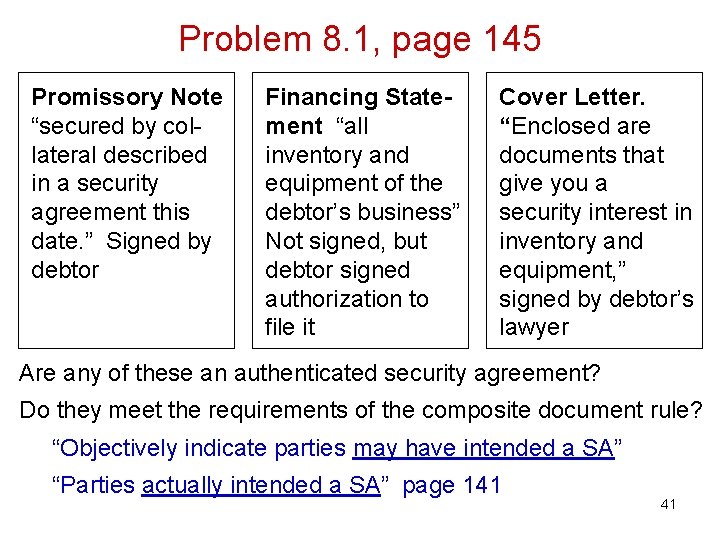

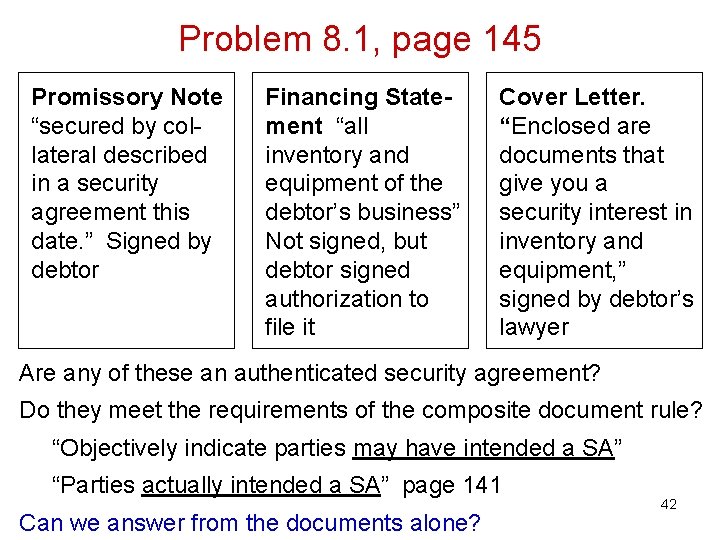

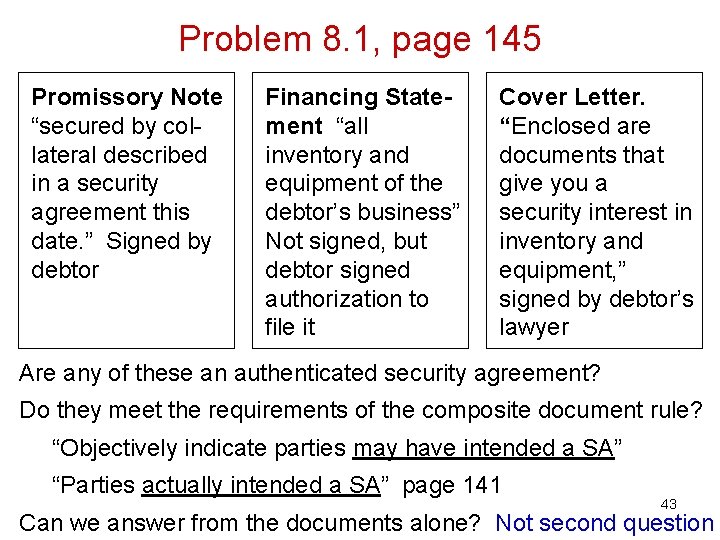

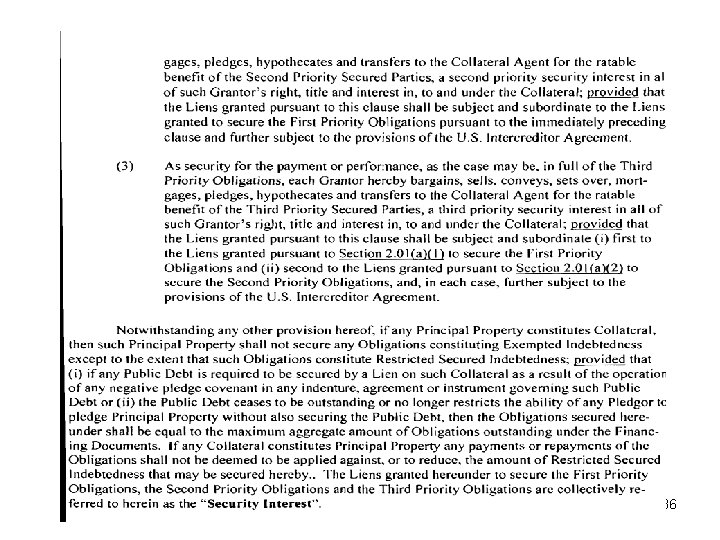

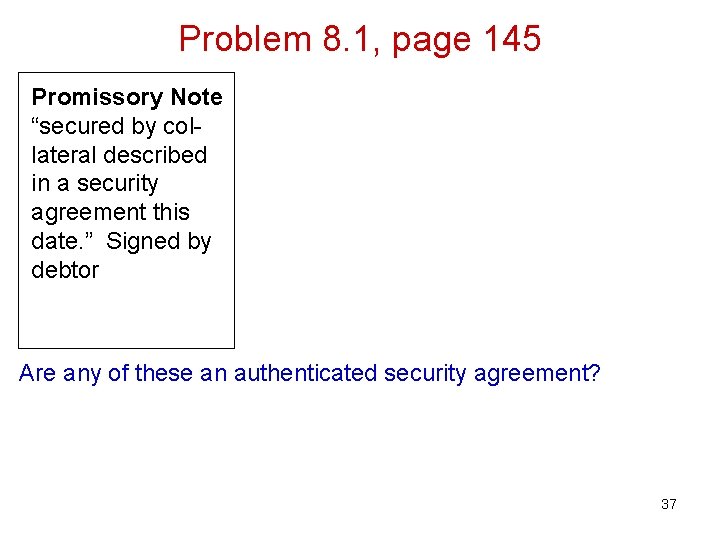

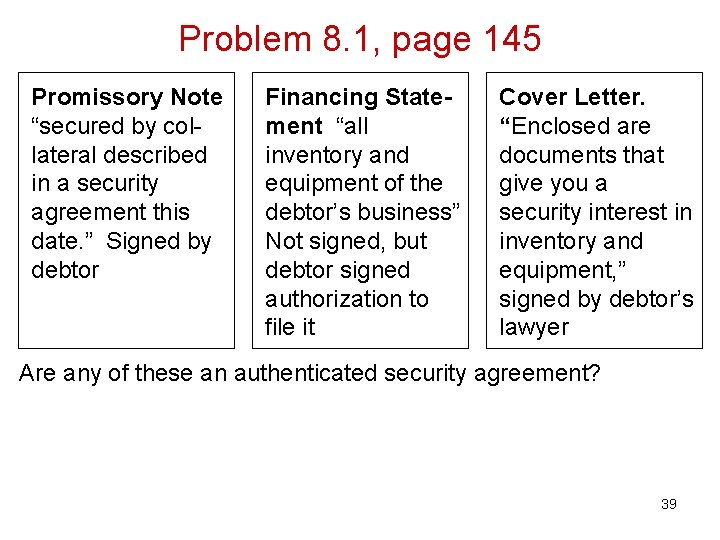

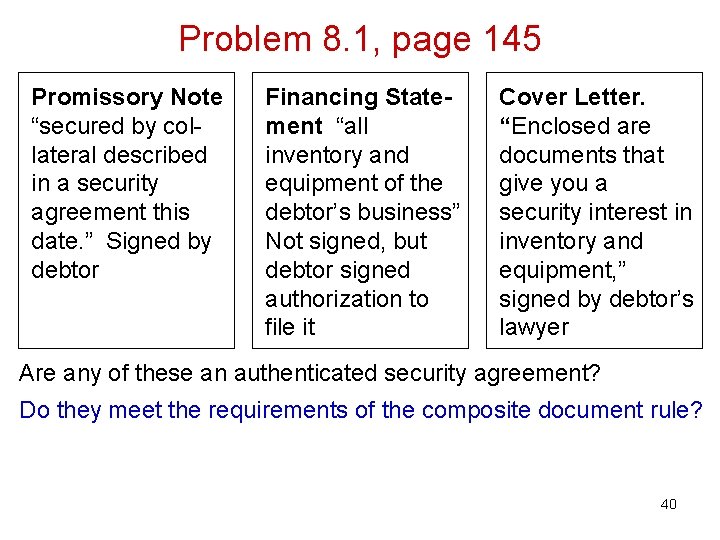

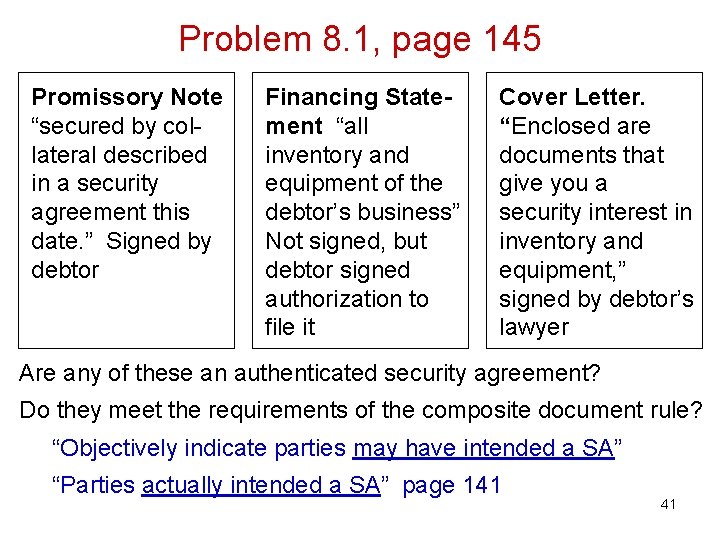

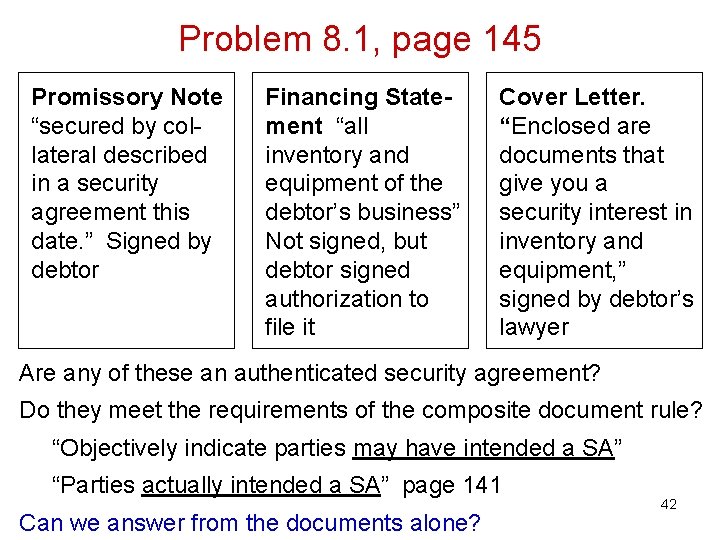

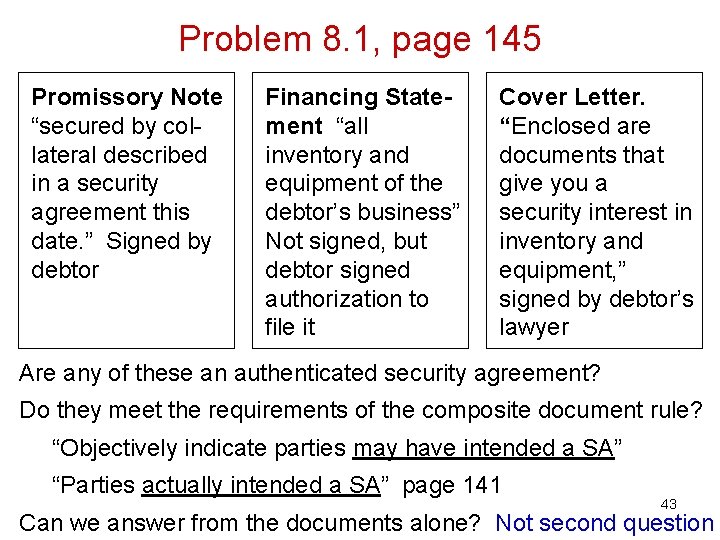

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA? ” “Parties actually intended a SA” page 144 Can we answer from the documents alone? 37

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Financing Statement “all inventory and equipment of the debtor’s business” Not signed, but debtor signed authorization to file it Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA? ” “Parties actually intended a SA” page 144 Can we answer from the documents alone? 38

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Financing Statement “all inventory and equipment of the debtor’s business” Not signed, but debtor signed authorization to file it Cover Letter. “Enclosed are documents that give you a security interest in inventory and equipment, ” signed by debtor’s lawyer Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA? ” “Parties actually intended a SA” page 144 Can we answer from the documents alone? 39

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Financing Statement “all inventory and equipment of the debtor’s business” Not signed, but debtor signed authorization to file it Cover Letter. “Enclosed are documents that give you a security interest in inventory and equipment, ” signed by debtor’s lawyer Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA? ” “Parties actually intended a SA” page 144 Can we answer from the documents alone? 40

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Financing Statement “all inventory and equipment of the debtor’s business” Not signed, but debtor signed authorization to file it Cover Letter. “Enclosed are documents that give you a security interest in inventory and equipment, ” signed by debtor’s lawyer Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA” “Parties actually intended a SA” page 141 Can we answer from the documents alone? 41

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Financing Statement “all inventory and equipment of the debtor’s business” Not signed, but debtor signed authorization to file it Cover Letter. “Enclosed are documents that give you a security interest in inventory and equipment, ” signed by debtor’s lawyer Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA” “Parties actually intended a SA” page 141 Can we answer from the documents alone? 42

Problem 8. 1, page 145 Promissory Note “secured by collateral described in a security agreement this date. ” Signed by debtor Financing Statement “all inventory and equipment of the debtor’s business” Not signed, but debtor signed authorization to file it Cover Letter. “Enclosed are documents that give you a security interest in inventory and equipment, ” signed by debtor’s lawyer Are any of these an authenticated security agreement? Do they meet the requirements of the composite document rule? “Objectively indicate parties may have intended a SA” “Parties actually intended a SA” page 141 43 Can we answer from the documents alone? Not second question

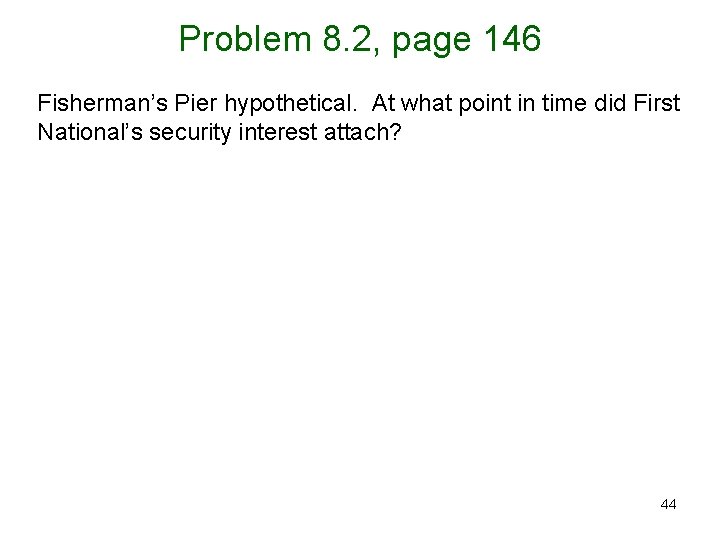

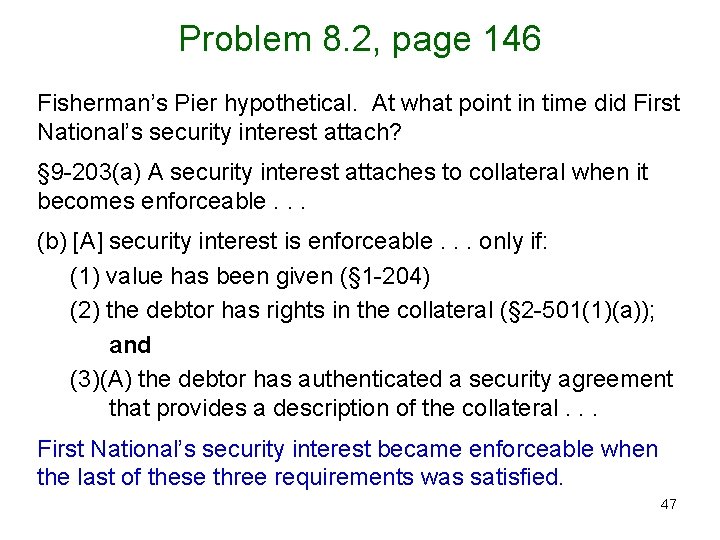

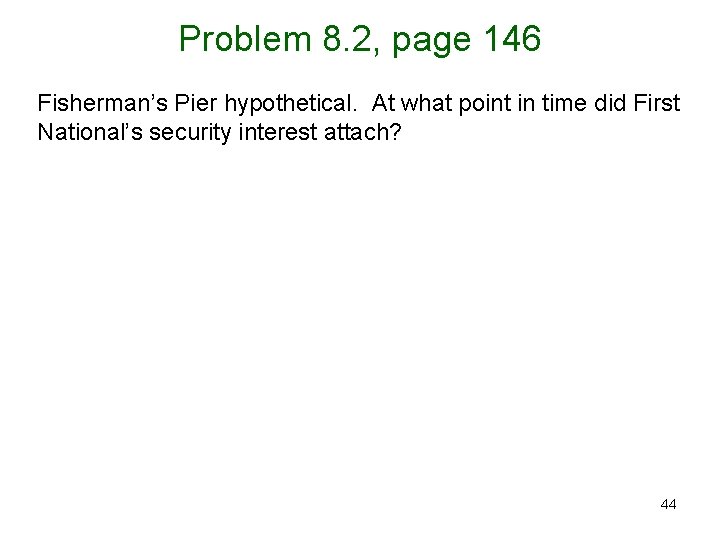

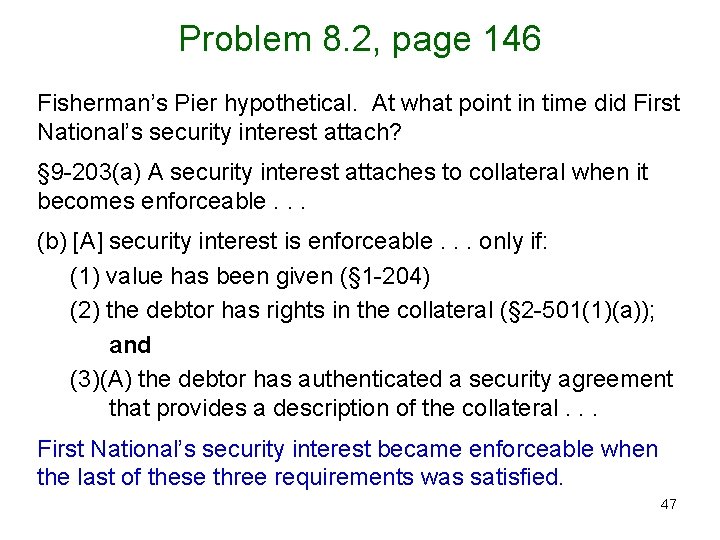

Problem 8. 2, page 146 Fisherman’s Pier hypothetical. At what point in time did First National’s security interest attach? § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -201(44)) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 44

Problem 8. 2, page 146 Fisherman’s Pier hypothetical. At what point in time did First National’s security interest attach? § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -201(44)) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 45

Problem 8. 2, page 146 Fisherman’s Pier hypothetical. At what point in time did First National’s security interest attach? § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -204) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . 46

Problem 8. 2, page 146 Fisherman’s Pier hypothetical. At what point in time did First National’s security interest attach? § 9 -203(a) A security interest attaches to collateral when it becomes enforceable. . . (b) [A] security interest is enforceable. . . only if: (1) value has been given (§ 1 -204) (2) the debtor has rights in the collateral (§ 2 -501(1)(a)); and (3)(A) the debtor has authenticated a security agreement that provides a description of the collateral. . . First National’s security interest became enforceable when the last of these three requirements was satisfied. 47

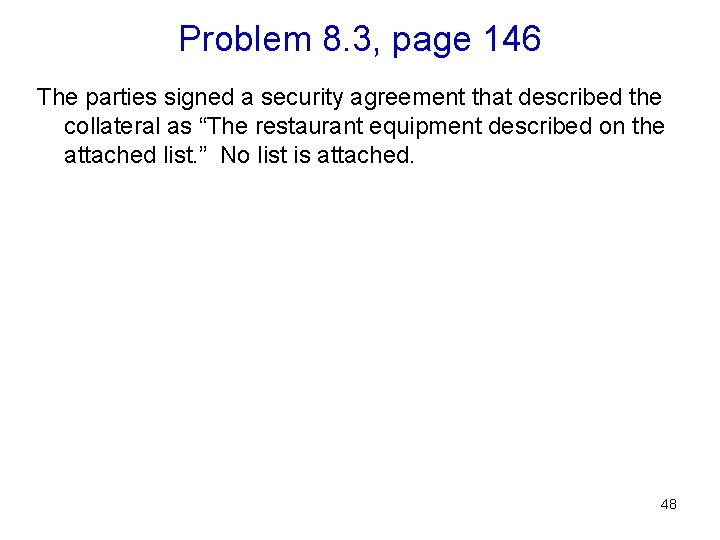

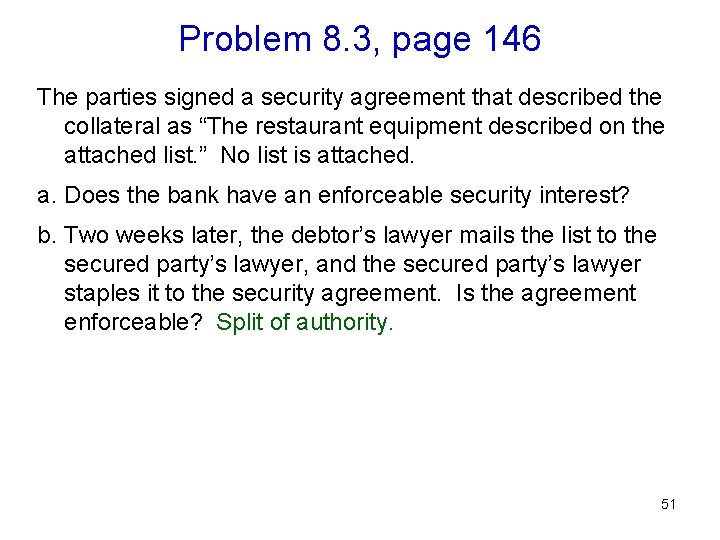

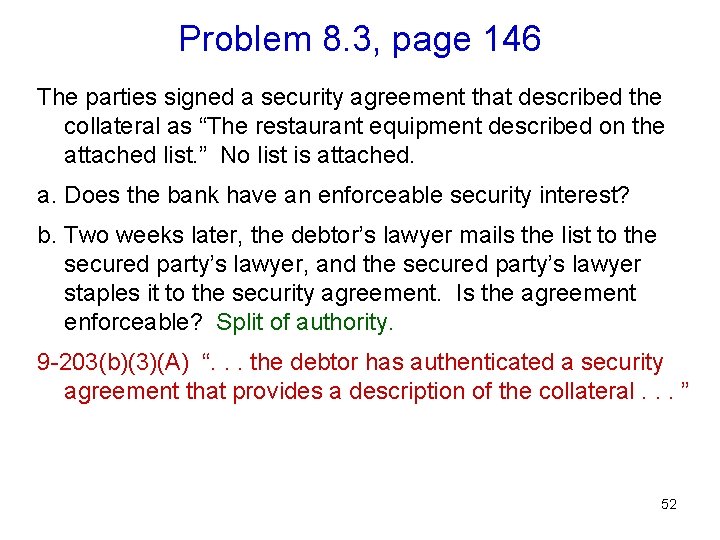

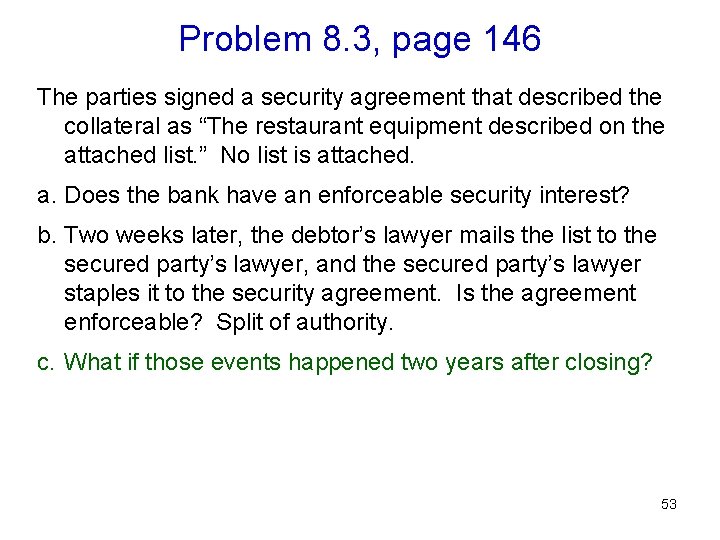

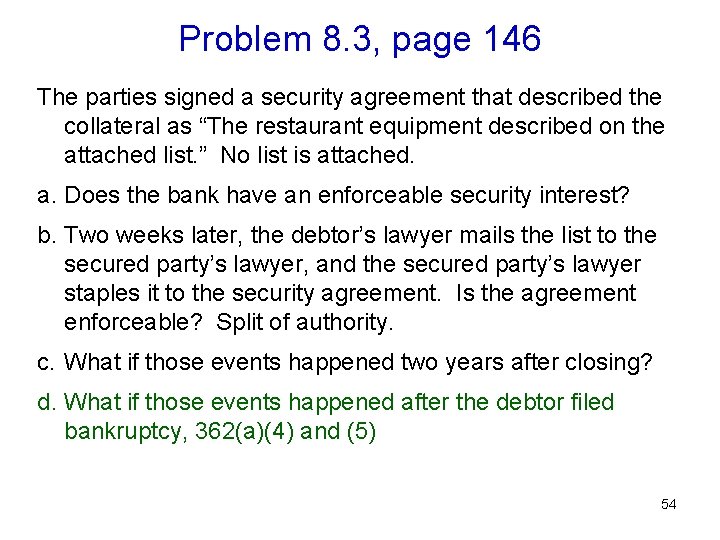

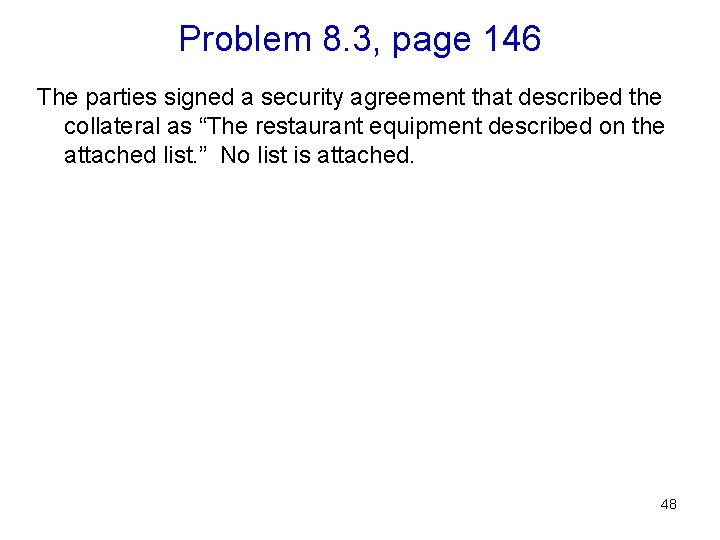

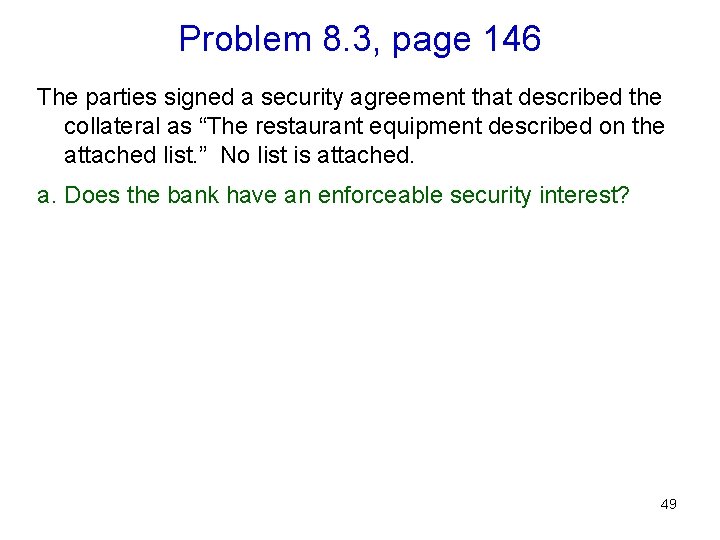

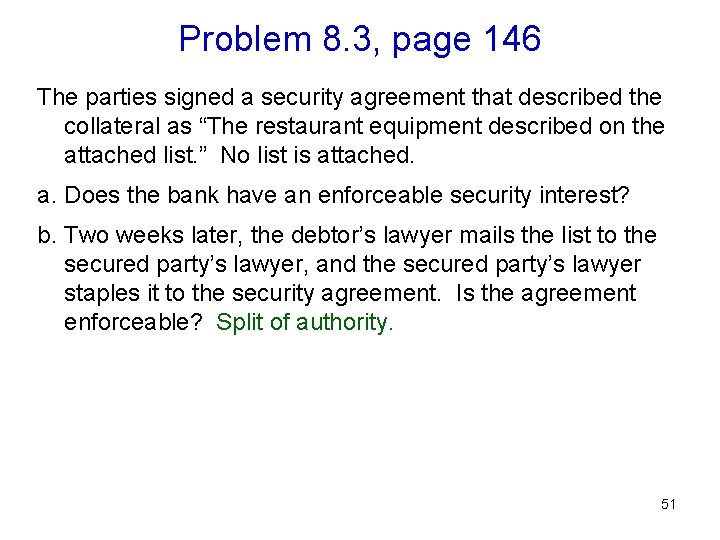

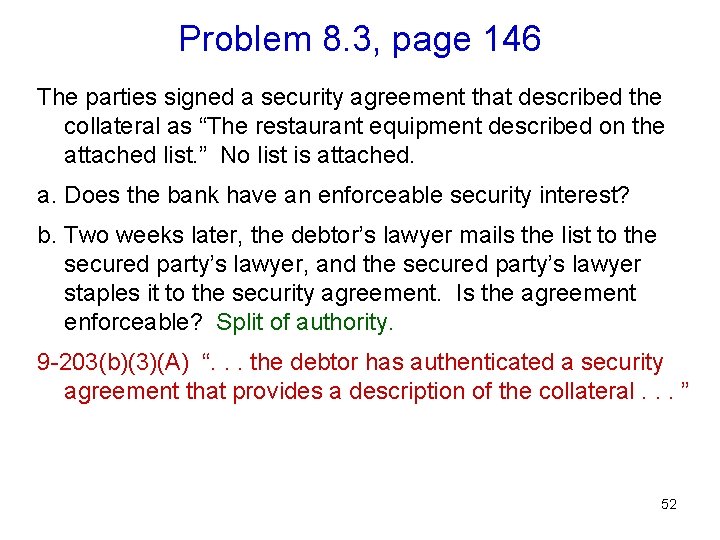

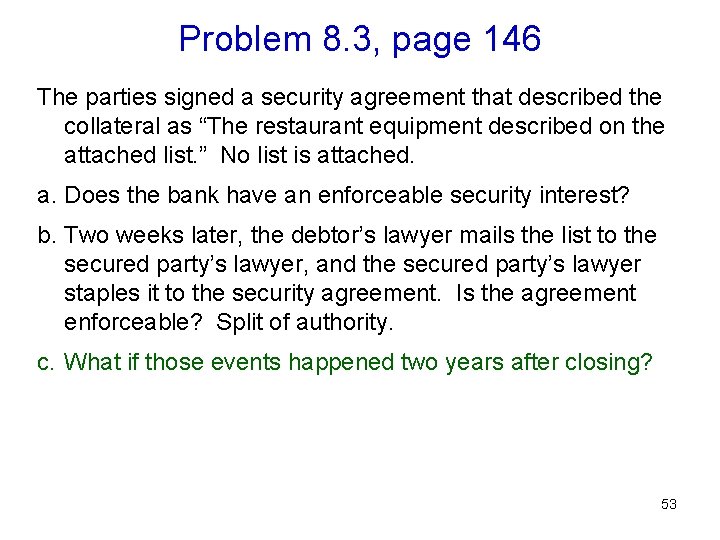

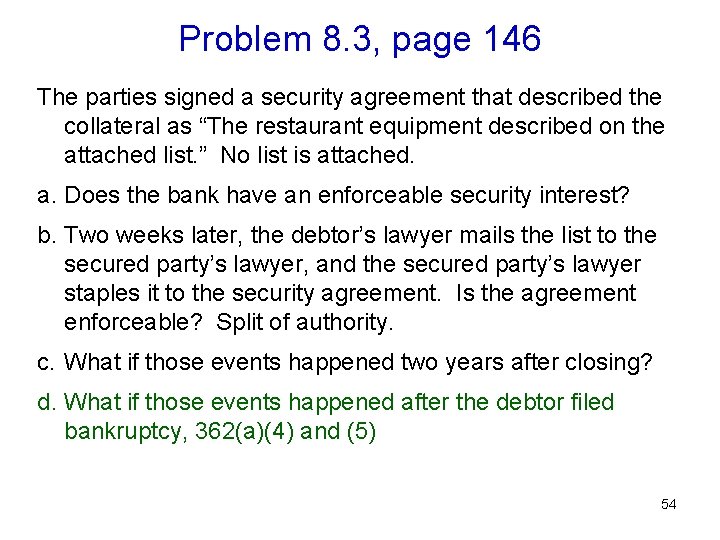

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? c. What if those events happened two years later? d. What if those events happened after the debtor filed bankruptcy, 362(a)(4) and (5) 48

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? c. What if those events happened two years later? d. What if those events happened after the debtor filed bankruptcy, 362(a)(4) and (5) 49

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? No unless composite document available. b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? c. What if those events happened two years later? d. What if those events happened after the debtor filed bankruptcy, 362(a)(4) and (5) 50

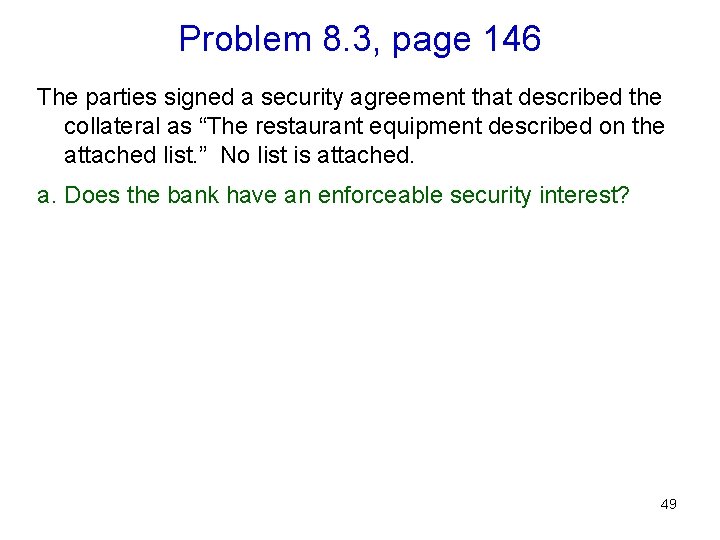

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? Split of authority. c. What if those events happened two years later? d. What if those events happened after the debtor filed bankruptcy, 362(a)(4) and (5) 51

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? Split of authority. 9 -203(b)(3)(A) “. . . the debtor has authenticated a security agreement that provides a description of the collateral. . . ” a. What if those events happened after the debtor filed ban 52

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? Split of authority. c. What if those events happened two years after closing? d. What if those events happened after the debtor filed bankruptcy, 362(a)(4) and (5) 53

Problem 8. 3, page 146 The parties signed a security agreement that described the collateral as “The restaurant equipment described on the attached list. ” No list is attached. a. Does the bank have an enforceable security interest? b. Two weeks later, the debtor’s lawyer mails the list to the secured party’s lawyer, and the secured party’s lawyer staples it to the security agreement. Is the agreement enforceable? Split of authority. c. What if those events happened two years after closing? d. What if those events happened after the debtor filed bankruptcy, 362(a)(4) and (5) 54

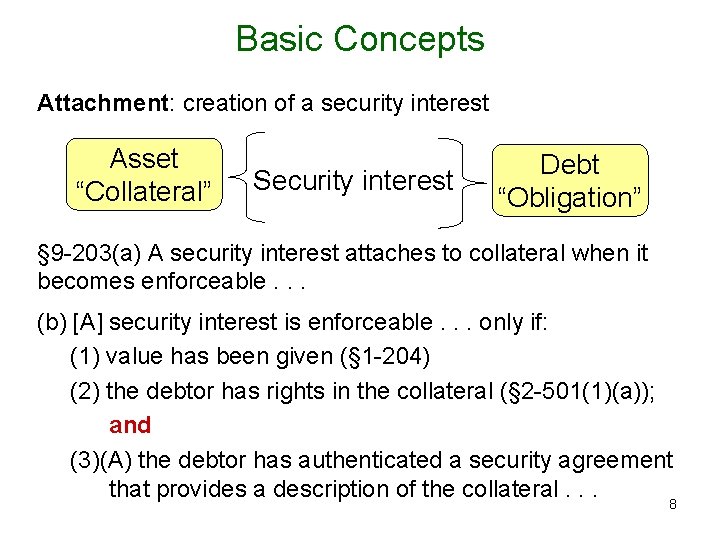

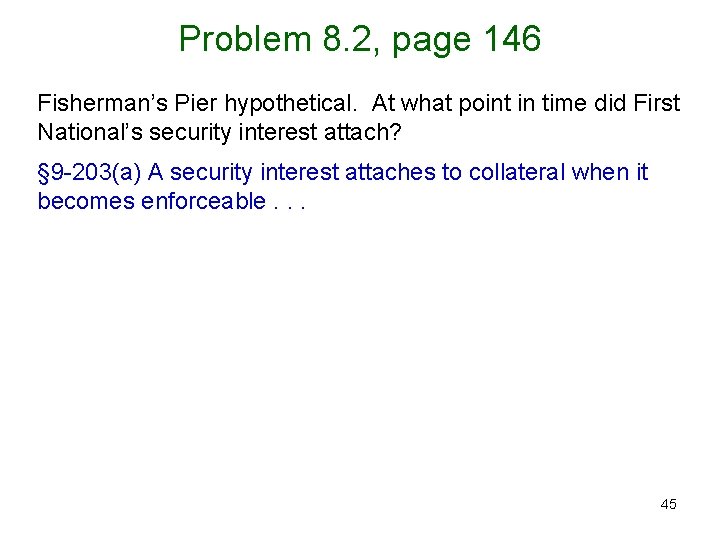

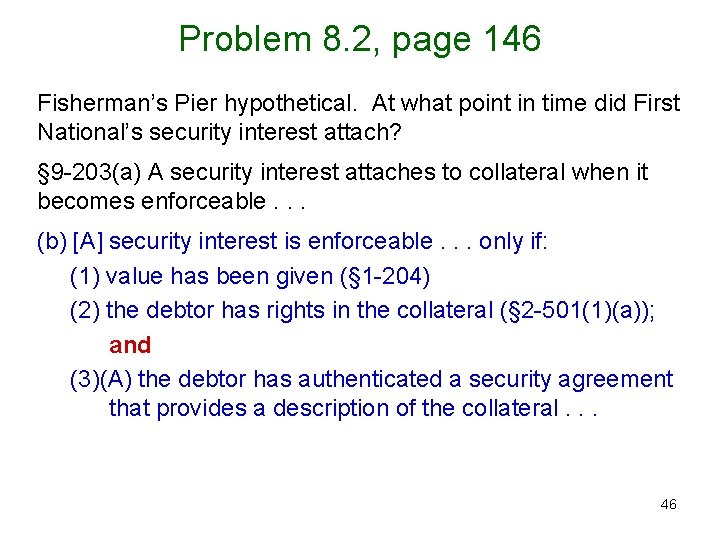

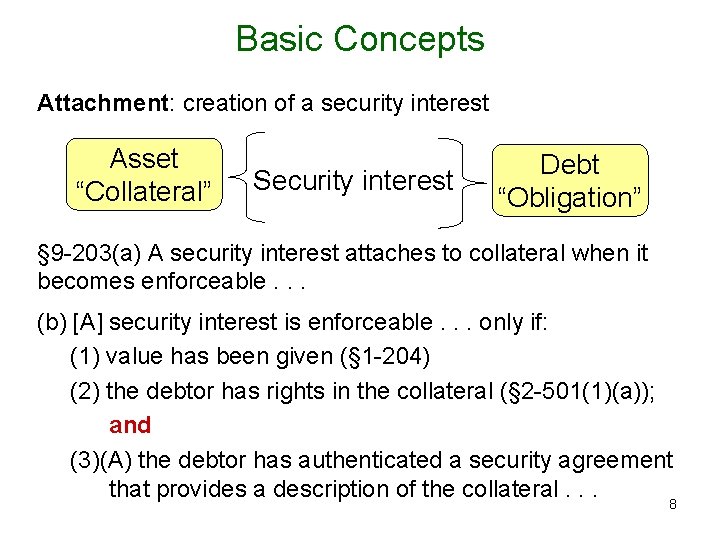

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-55.jpg)

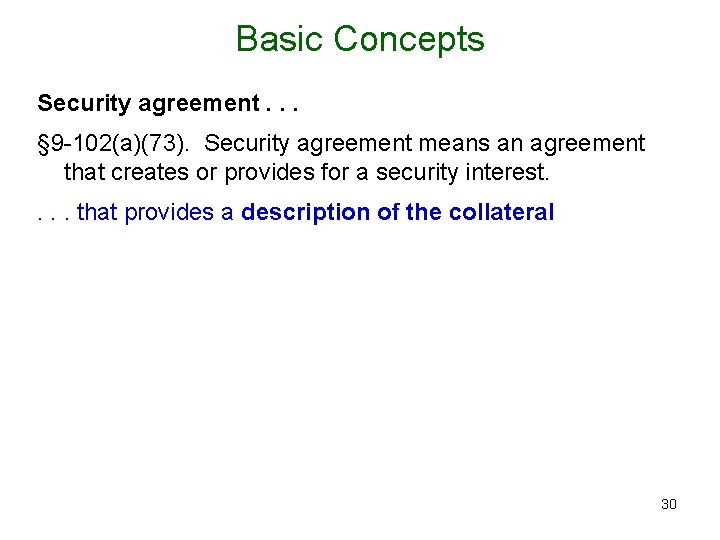

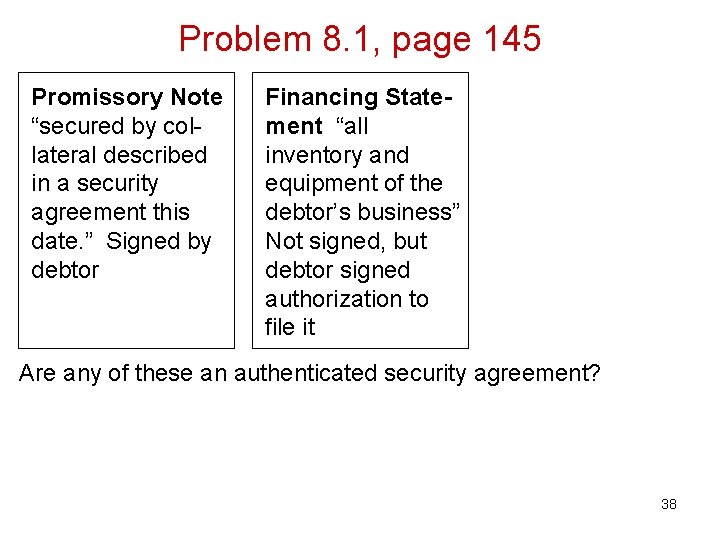

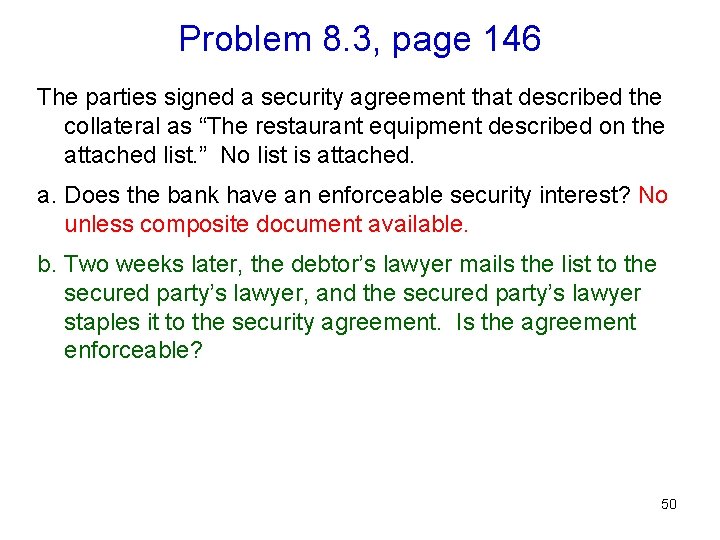

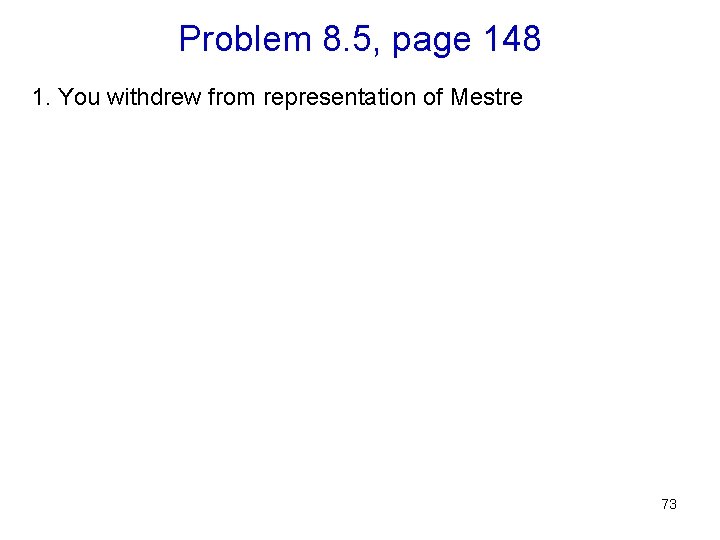

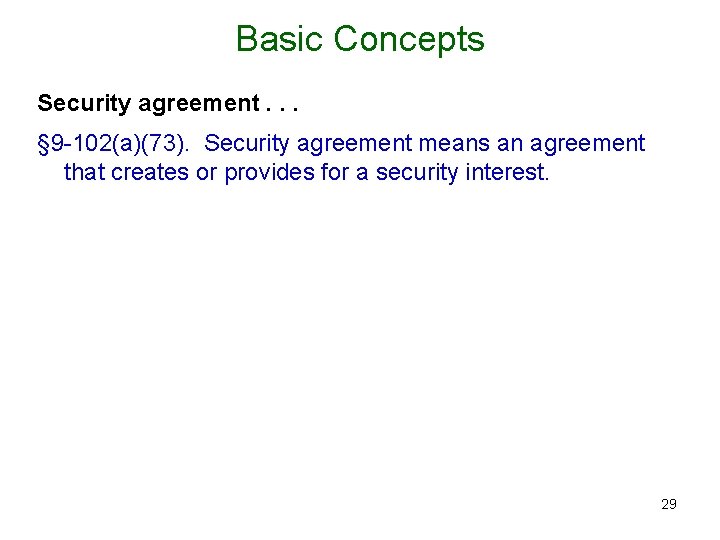

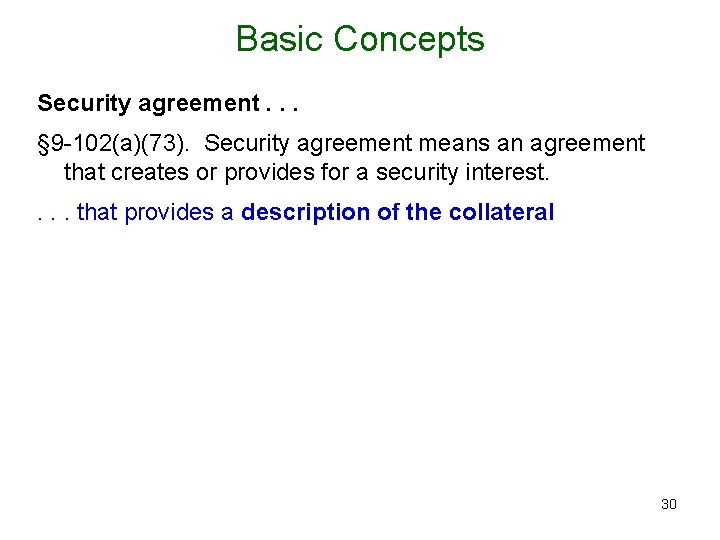

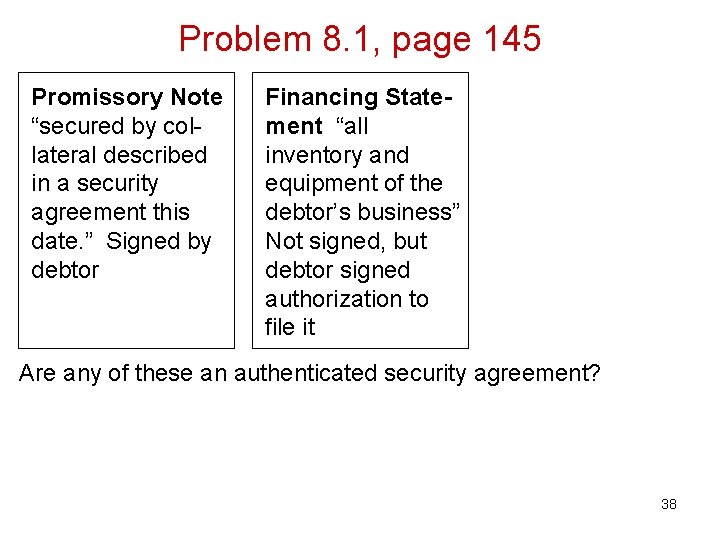

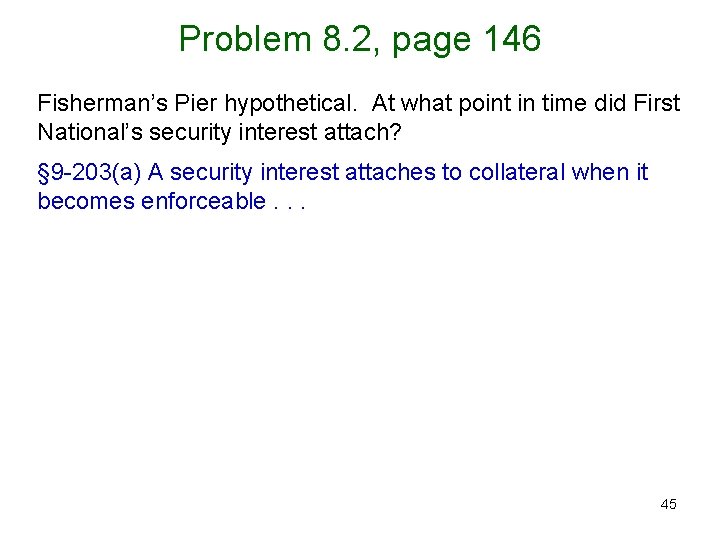

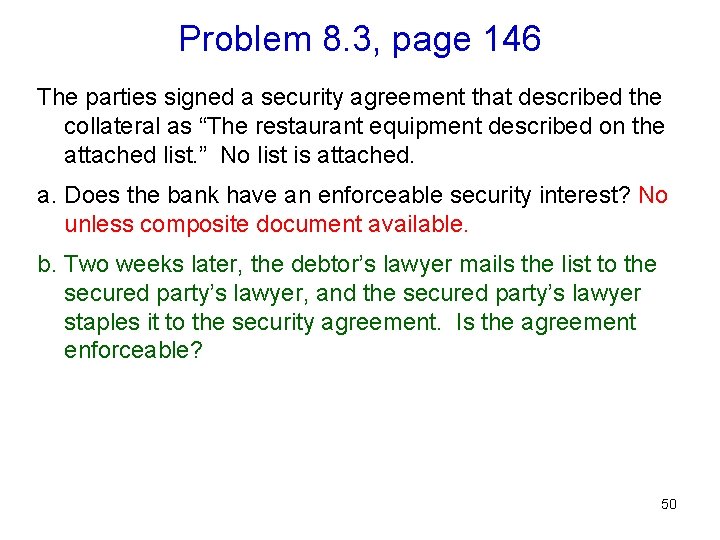

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 55

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-56.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 56

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-57.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 57

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-58.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 58

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-59.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 59

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-60.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 60

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-61.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 61

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-62.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 62

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-63.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? What are the options? Whose bulldozer is this? 63

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-64.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? Client: “You fill in the blank. ” What are the options? Whose bulldozer is this? 64

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-65.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? Client: “You fill in the blank. ” “No. ” What are the options? Whose bulldozer is this? 65

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-66.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement If we send it as is, what will happen? Staple description? Whose decision is this? Client: “You fill in the blank. ” “No. ” 66 Client: I will fill in the blank. Will you maintain confidentiality?

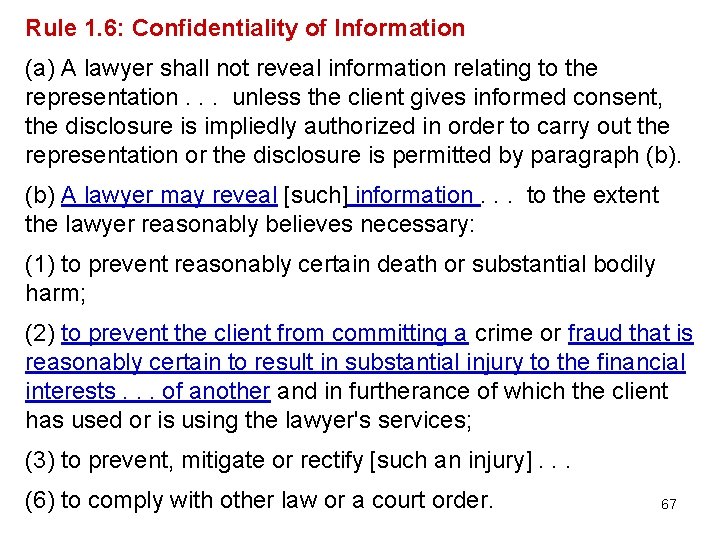

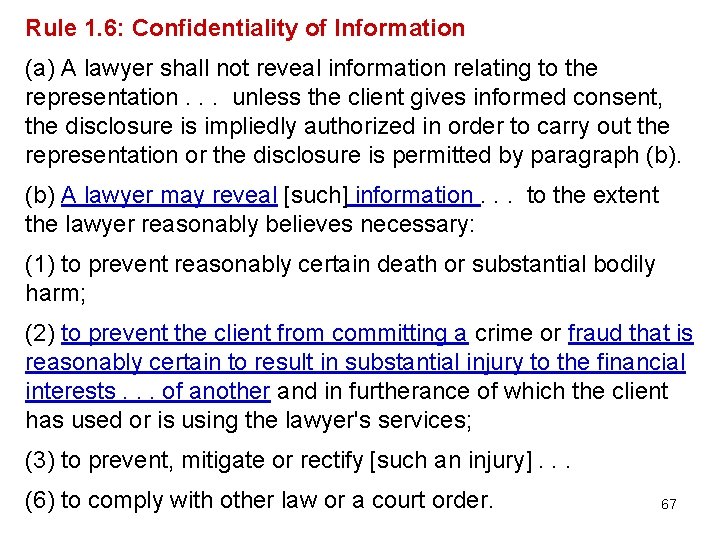

Rule 1. 6: Confidentiality of Information (a) A lawyer shall not reveal information relating to the representation. . . unless the client gives informed consent, the disclosure is impliedly authorized in order to carry out the representation or the disclosure is permitted by paragraph (b) A lawyer may reveal [such] information. . . to the extent the lawyer reasonably believes necessary: (1) to prevent reasonably certain death or substantial bodily harm; (2) to prevent the client from committing a crime or fraud that is reasonably certain to result in substantial injury to the financial interests. . . of another and in furtherance of which the client has used or is using the lawyer's services; (3) to prevent, mitigate or rectify [such an injury]. . . (6) to comply with other law or a court order. 67

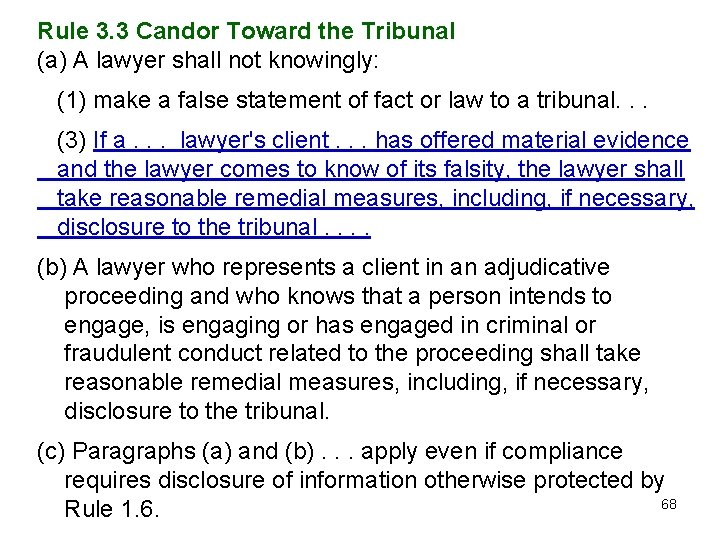

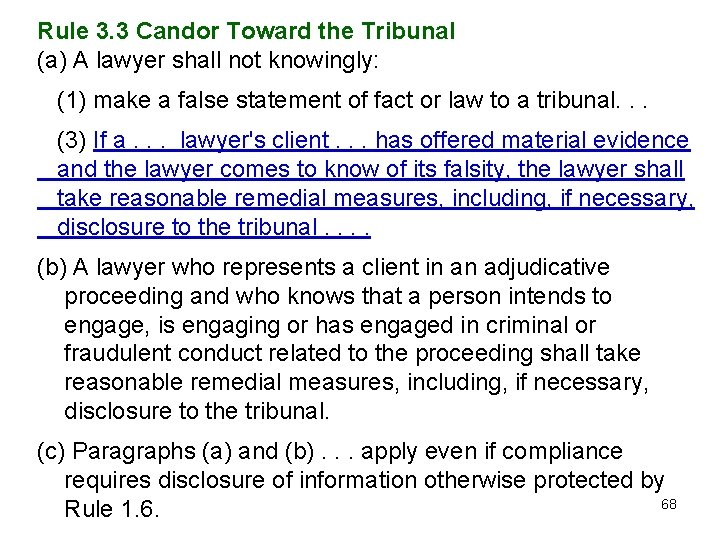

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . (b) A lawyer who represents a client in an adjudicative proceeding and who knows that a person intends to engage, is engaging or has engaged in criminal or fraudulent conduct related to the proceeding shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. (c) Paragraphs (a) and (b). . . apply even if compliance requires disclosure of information otherwise protected by 68 Rule 1. 6.

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-69.jpg)

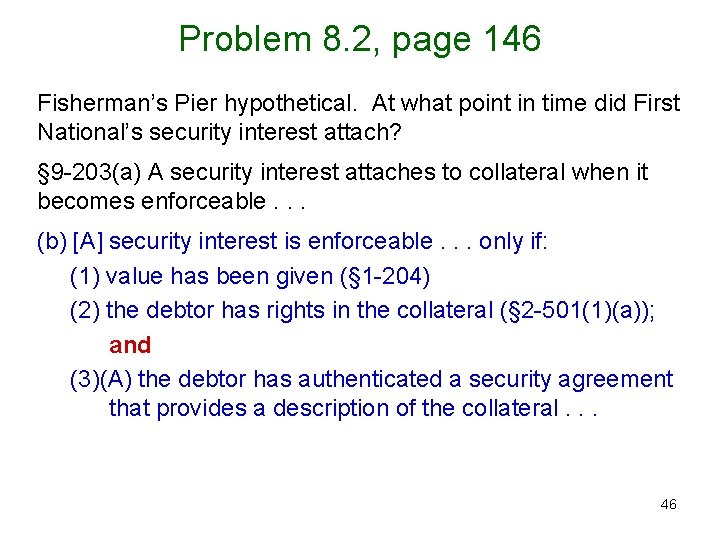

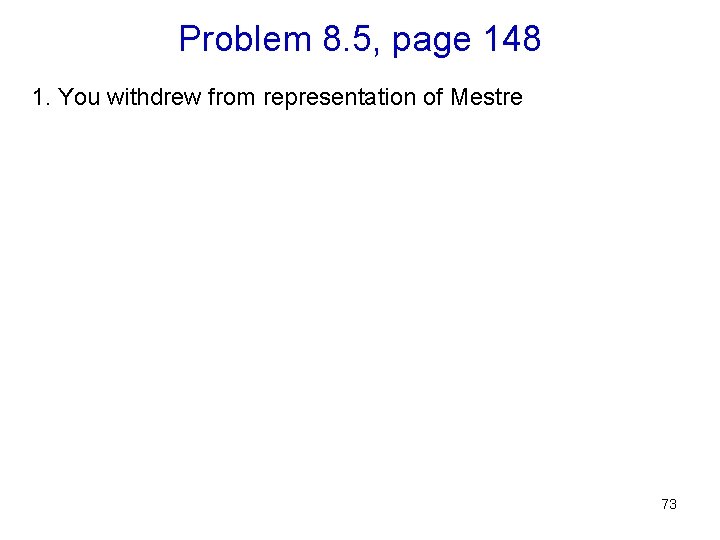

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement Right now, what are the options? 69

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-70.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement Right now, what are the options? Morally and ethically, whose bulldozer is this? 70

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-71.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement Right now, what are the options? Morally and ethically, whose bulldozer is this? Who will be hurt by filling in the blank? 71

![Problem 8 4 page 146 Read from facts 1 The debtor signed a security Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security](https://slidetodoc.com/presentation_image_h/9fb6cb9fe8ebf77fb0fd1f673f75334a/image-72.jpg)

Problem 8. 4, page 146 [Read from facts] 1. The debtor signed a security agreement that contained no description of collateral. 2. The debtor authorized us (the secured party’s lawyer) to fill in the description 3. We did not fill it in 4. The debtor filed bankruptcy 5. The trustee has requested a copy of the security agreement Right now, what are the options? Morally and ethically, whose bulldozer is this? Who will be hurt by filling in the blank? Vote 72

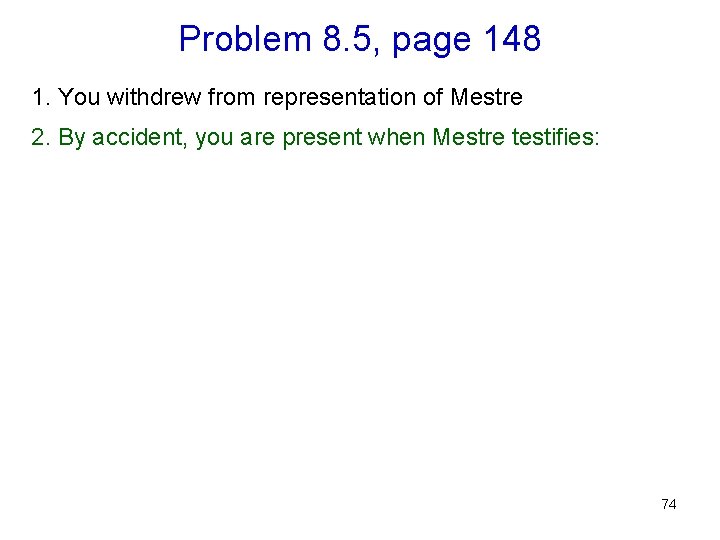

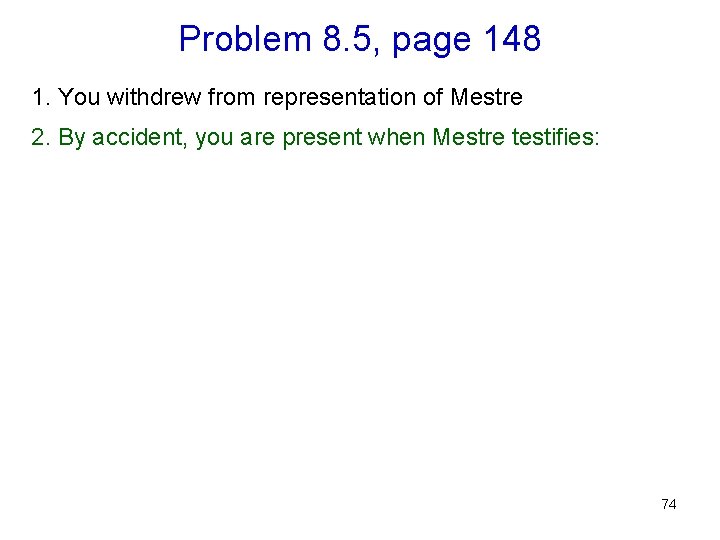

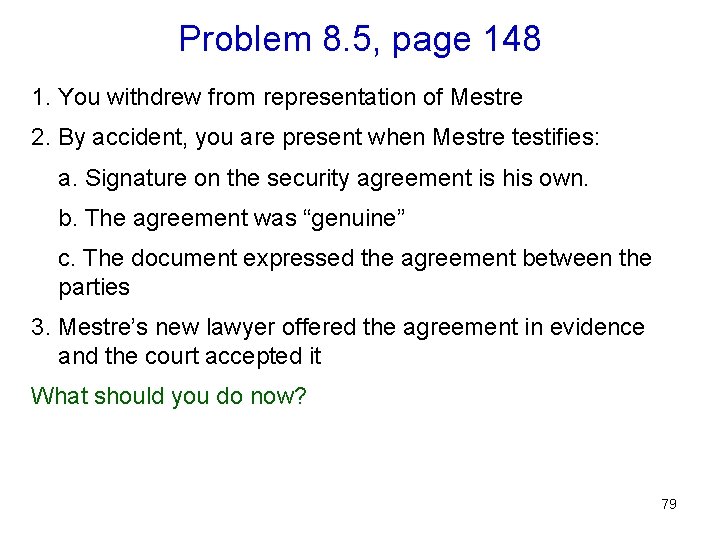

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 73

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 74

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 75

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 76

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 77

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 78

Problem 8. 5, page 148 1. You withdrew from representation of Mestre 2. By accident, you are present when Mestre testifies: a. Signature on the security agreement is his own. b. The agreement was “genuine” c. The document expressed the agreement between the parties 3. Mestre’s new lawyer offered the agreement in evidence and the court accepted it What should you do now? 79

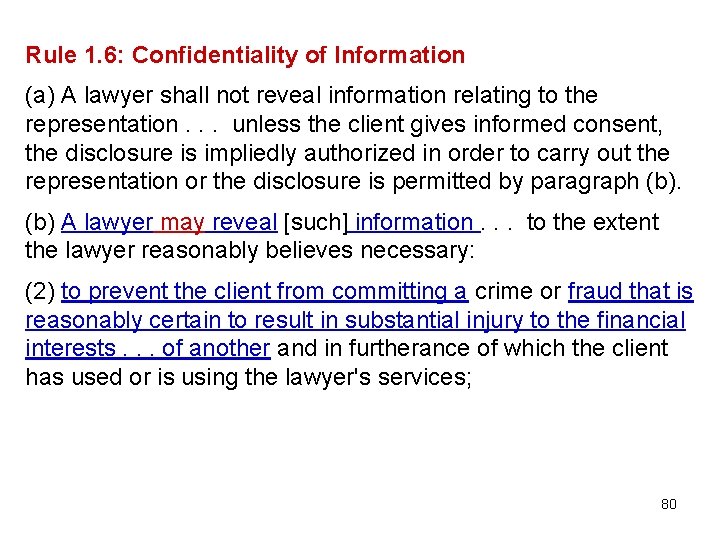

Rule 1. 6: Confidentiality of Information (a) A lawyer shall not reveal information relating to the representation. . . unless the client gives informed consent, the disclosure is impliedly authorized in order to carry out the representation or the disclosure is permitted by paragraph (b) A lawyer may reveal [such] information. . . to the extent the lawyer reasonably believes necessary: (2) to prevent the client from committing a crime or fraud that is reasonably certain to result in substantial injury to the financial interests. . . of another and in furtherance of which the client has used or is using the lawyer's services; 80

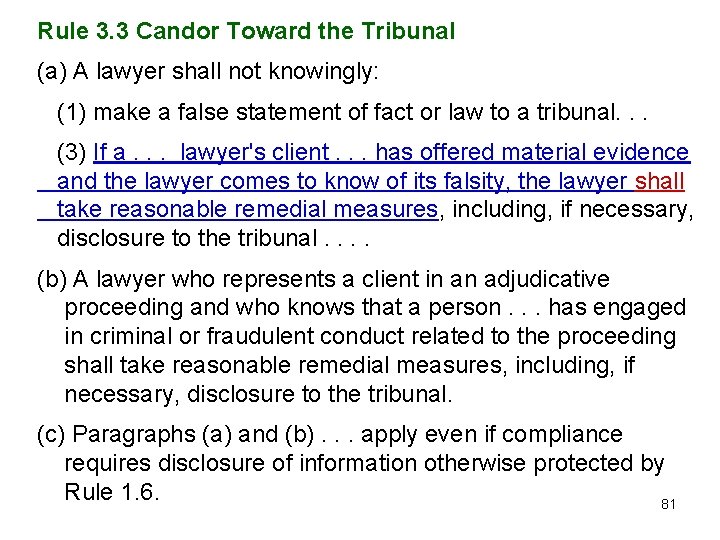

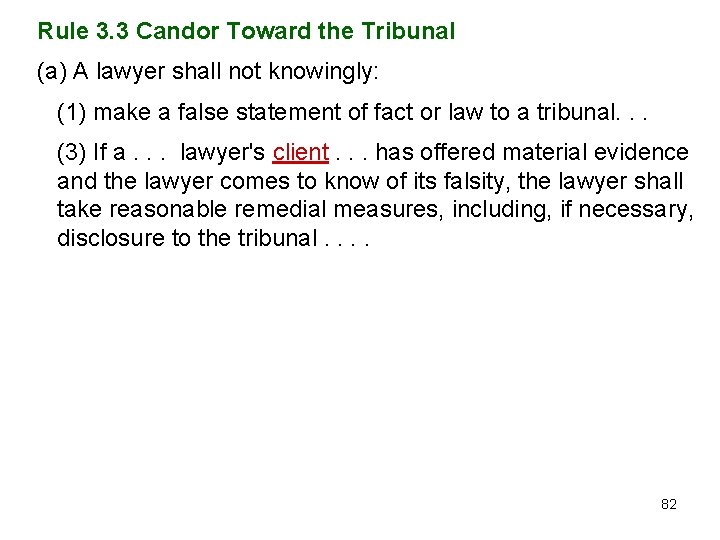

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . (b) A lawyer who represents a client in an adjudicative proceeding and who knows that a person. . . has engaged in criminal or fraudulent conduct related to the proceeding shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. (c) Paragraphs (a) and (b). . . apply even if compliance requires disclosure of information otherwise protected by Rule 1. 6. 81

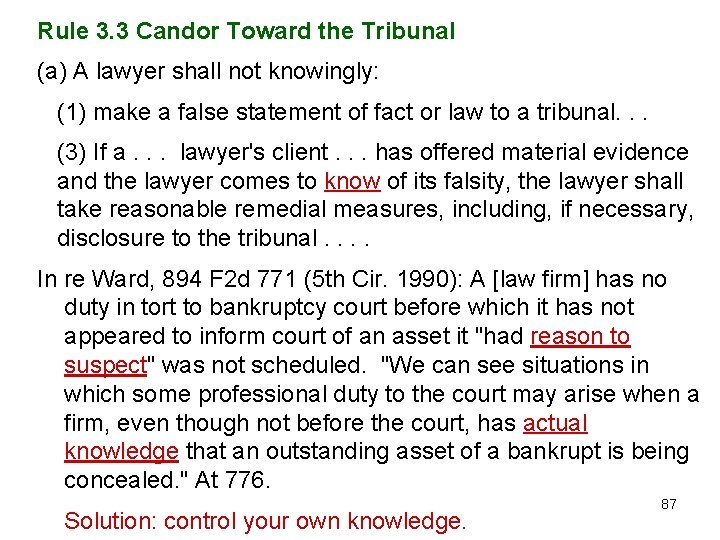

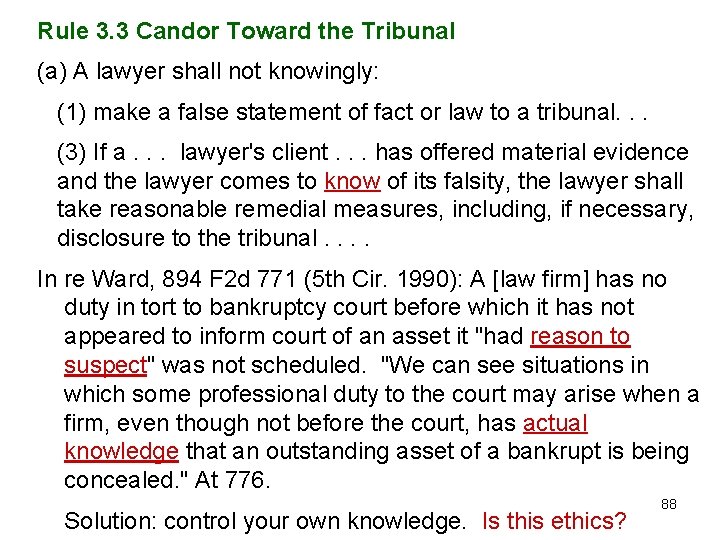

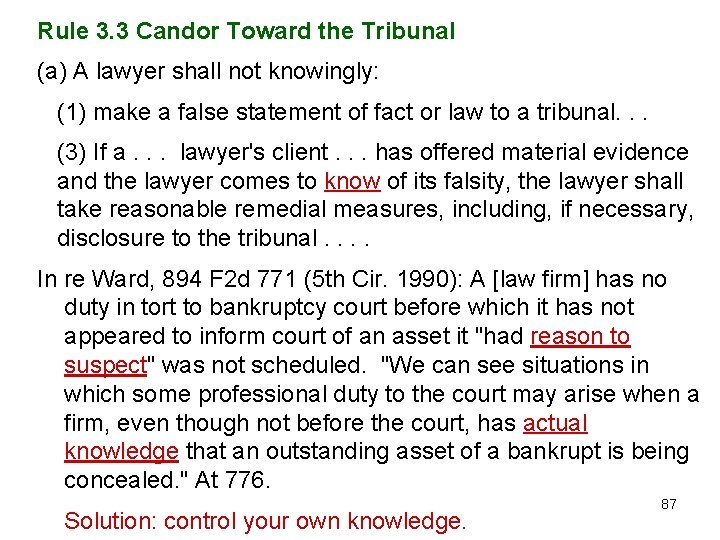

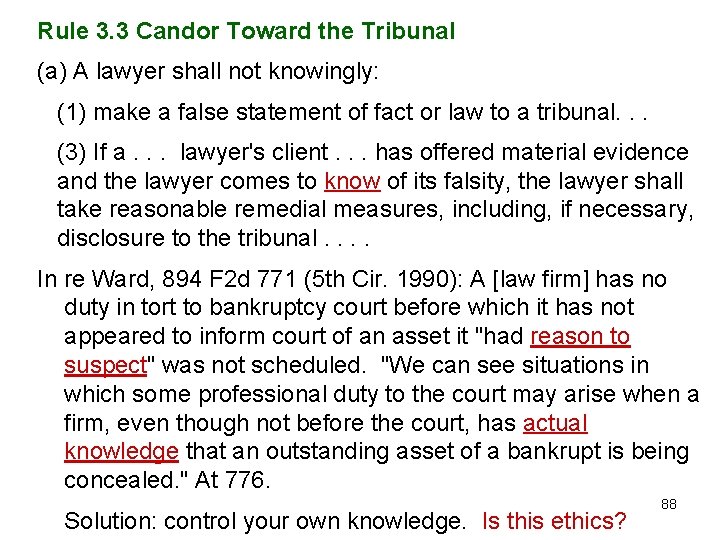

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . In re Ward, 894 F 2 d 771 (5 th Cir. 1990): A lawyer has no duty in tort to bankruptcy court before which it has not appeared to inform court of an asset it "had reason to suspect" was not scheduled. "We can see situations in which some professional duty to the court may arise when a firm, even though not before the court, has actual knowledge that an outstanding asset of a bankrupt is being concealed. " At 776. 82

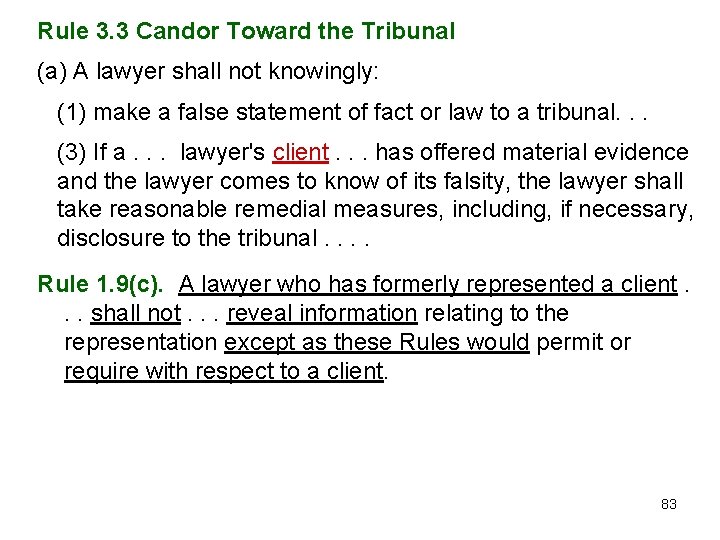

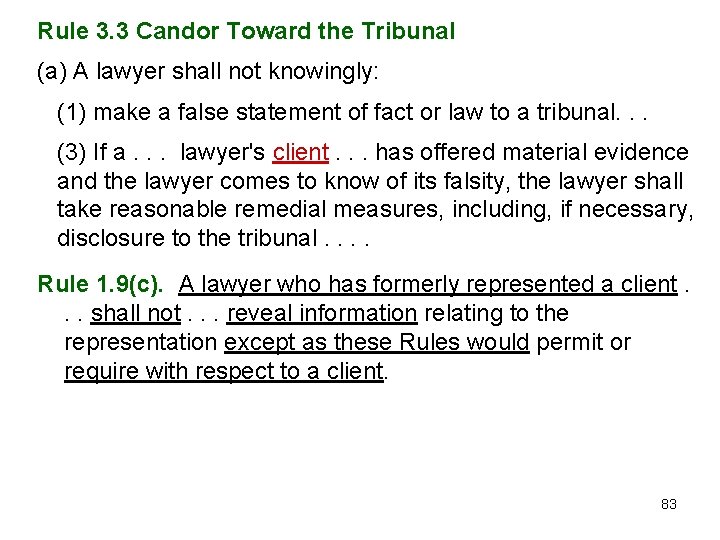

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . Rule 1. 9(c). A lawyer who has formerly represented a client. . . shall not. . . reveal information relating to the representation except as these Rules would permit or require with respect to a client. 83

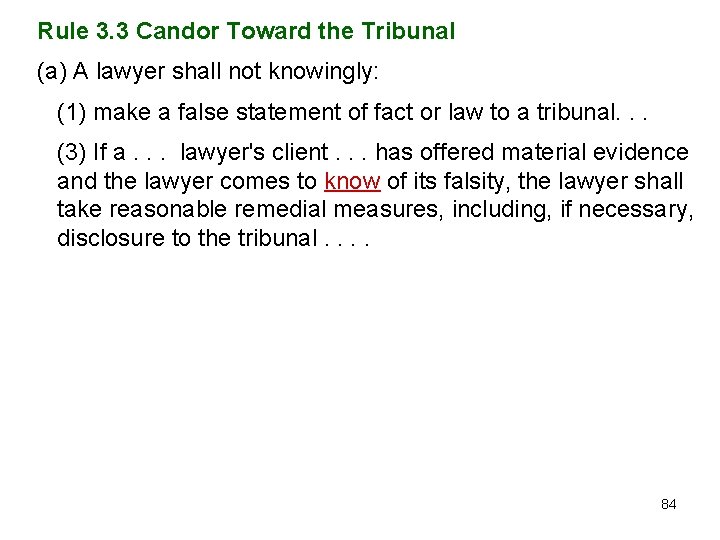

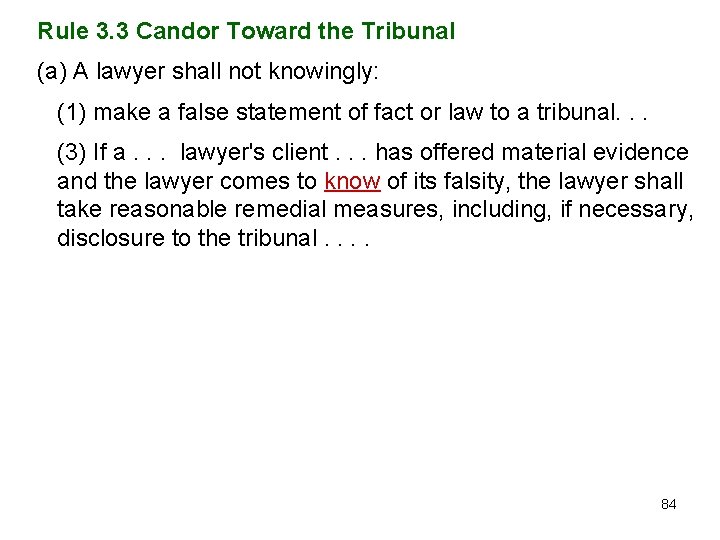

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . "We can see situations in which some professional duty to the court may arise when a firm, even though not before the court, has actual knowledge that an outstanding asset of a bankrupt is being concealed. " At 776. 84

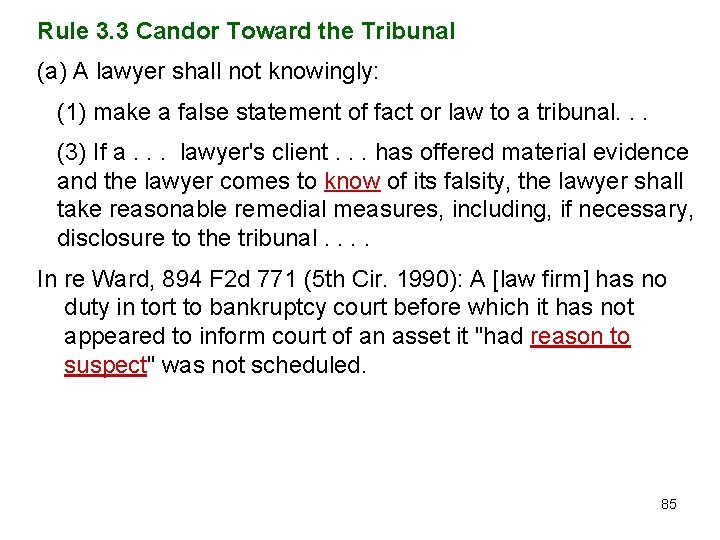

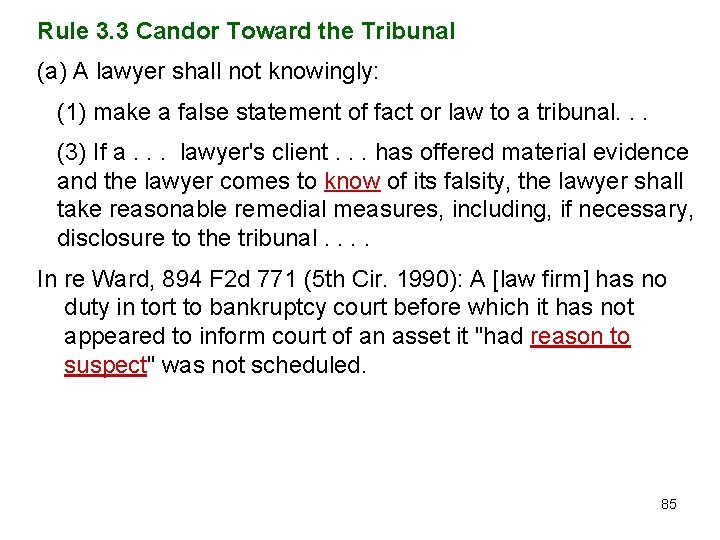

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . In re Ward, 894 F 2 d 771 (5 th Cir. 1990): A [law firm] has no duty in tort to bankruptcy court before which it has not appeared to inform court of an asset it "had reason to suspect" was not scheduled. "We can see situations in which some professional duty to the court may arise when a firm, even though not before the court, has actual knowledge that an outstanding asset of a bankrupt is being concealed. " At 776. 85

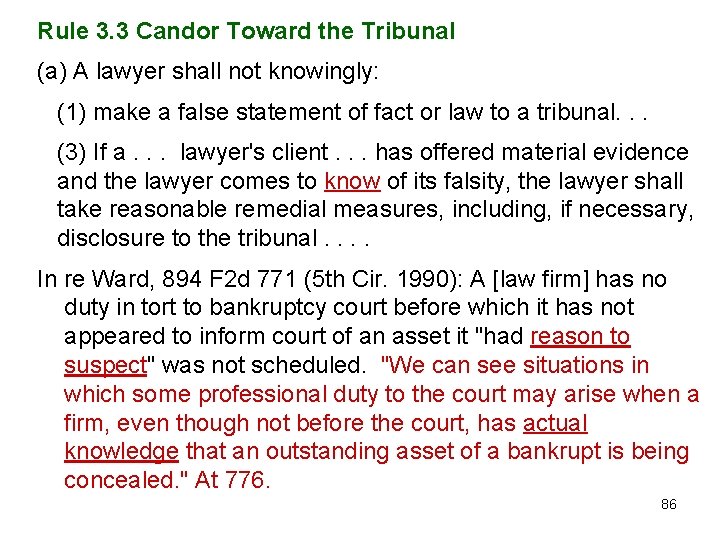

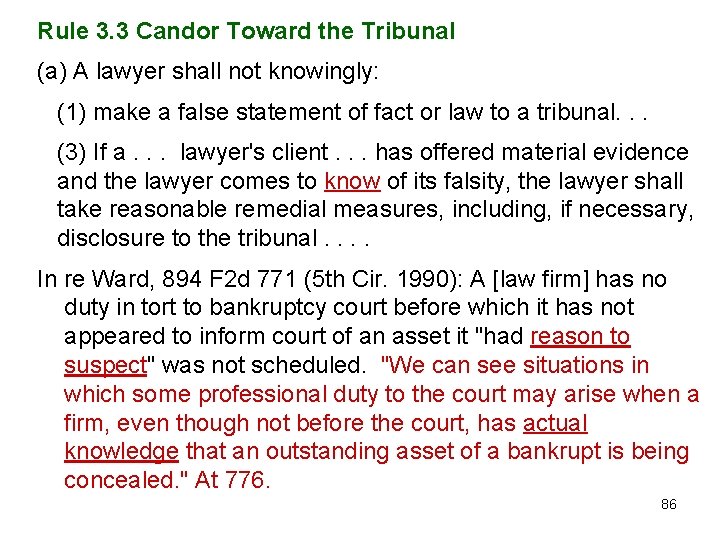

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . In re Ward, 894 F 2 d 771 (5 th Cir. 1990): A [law firm] has no duty in tort to bankruptcy court before which it has not appeared to inform court of an asset it "had reason to suspect" was not scheduled. "We can see situations in which some professional duty to the court may arise when a firm, even though not before the court, has actual knowledge that an outstanding asset of a bankrupt is being concealed. " At 776. 86

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . In re Ward, 894 F 2 d 771 (5 th Cir. 1990): A [law firm] has no duty in tort to bankruptcy court before which it has not appeared to inform court of an asset it "had reason to suspect" was not scheduled. "We can see situations in which some professional duty to the court may arise when a firm, even though not before the court, has actual knowledge that an outstanding asset of a bankrupt is being concealed. " At 776. Solution: control your own knowledge. 87

Rule 3. 3 Candor Toward the Tribunal (a) A lawyer shall not knowingly: (1) make a false statement of fact or law to a tribunal. . . (3) If a. . . lawyer's client. . . has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal. . In re Ward, 894 F 2 d 771 (5 th Cir. 1990): A [law firm] has no duty in tort to bankruptcy court before which it has not appeared to inform court of an asset it "had reason to suspect" was not scheduled. "We can see situations in which some professional duty to the court may arise when a firm, even though not before the court, has actual knowledge that an outstanding asset of a bankrupt is being concealed. " At 776. Solution: control your own knowledge. Is this ethics? 88

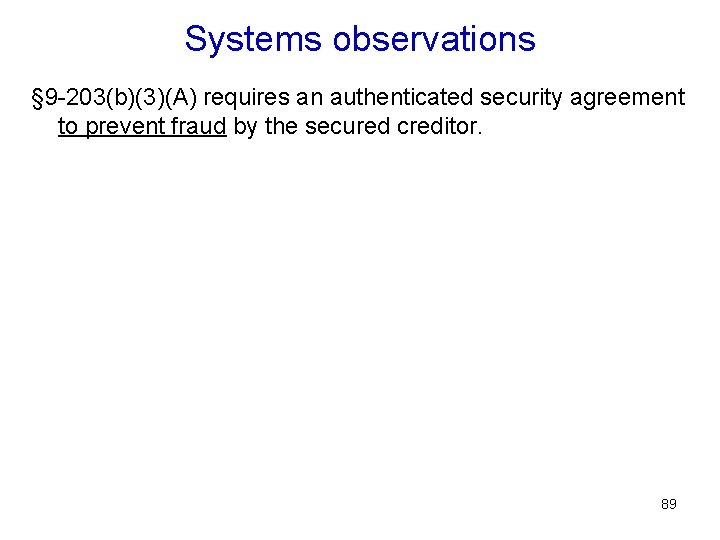

Systems observations § 9 -203(b)(3)(A) requires an authenticated security agreement to prevent fraud by the secured creditor. Article 9 does not require the secured creditor to publicly file the security agreement; the secured creditor can keep it in a private file Article 9 requires the secured creditor to file a financing statement. A financing statement rarely qualifies as a security agreement. Fraud is easy. How does the real estate system deal with this problem? 89

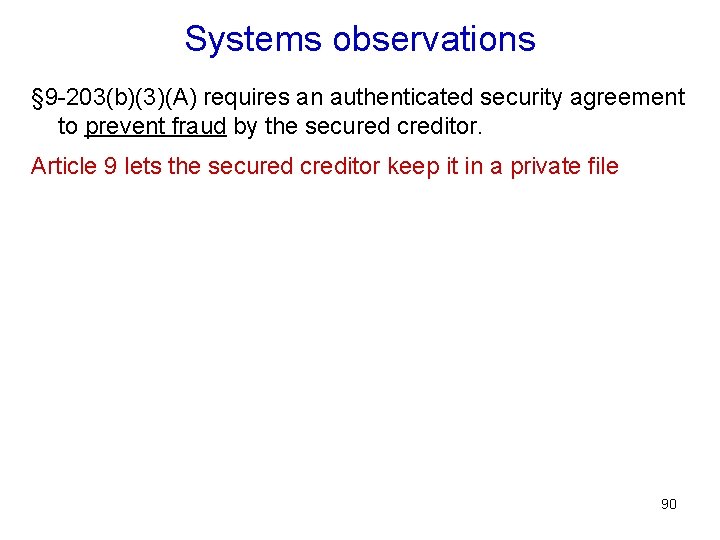

Systems observations § 9 -203(b)(3)(A) requires an authenticated security agreement to prevent fraud by the secured creditor. Article 9 lets the secured creditor keep it in a private file Article 9 requires the secured creditor to file a financing statement. A financing statement rarely qualifies as a security agreement. Fraud is easy. How does the real estate system deal with this problem? 90

Systems observations § 9 -203(b)(3)(A) requires an authenticated security agreement to prevent fraud by the secured creditor. Article 9 lets the secured creditor keep it in a private file Article 9 requires a public filing, but not of the security agreement. Fraud is easy. How does the real estate system deal with this problem? 91

Systems observations § 9 -203(b)(3)(A) requires an authenticated security agreement to prevent fraud by the secured creditor. Article 9 lets the secured creditor keep it in a private file Article 9 requires a public filing, but not of the security agreement. Security agreement fraud is easy. Common problem. How does the real estate system deal with this problem? 92

Systems observations § 9 -203(b)(3)(A) requires an authenticated security agreement to prevent fraud by the secured creditor. Article 9 lets the secured creditor keep it in a private file Article 9 requires a public filing, but not of the security agreement. Security agreement fraud is easy. Common problem. How does the real estate system deal with this problem? 93

Systems observations § 9 -203(b)(3)(A) requires an authenticated security agreement to prevent fraud by the secured creditor. Article 9 lets the secured creditor keep it in a private file Article 9 requires a public filing, but not of the security agreement. Security agreement fraud is easy. Common problem. How does the real estate system deal with this problem? Can mortgagees “fix” their mortgages when trouble arises? 94