TakeHome Pay The deductions taken out of your

- Slides: 82

Take-Home Pay The deductions taken out of your paycheck help support schools, roads, national parks, and more. Why do you think you have to pay taxes?

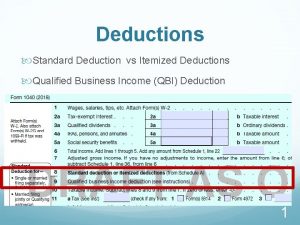

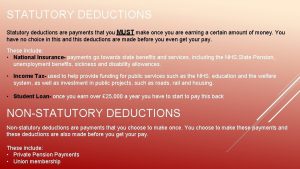

Lesson Objective Determine the amount withheld for federal income tax. Content Vocabulary federal income tax withholding allowance federal income withholding allowance tax The number Money withheld of people by an employer an employee from an employee’s supports, whichpaycheck helps employers to pay federalhow know government much money taxes. to withhold for federal income tax.

Example 1 Carla Garza’s gross pay for this week is $425. 88. She is married and claims 2 allowances—herself and her husband. What amount will be withheld from Garza’s pay for FIT?

Example 1 Answer Steps: 1. Find the income range from the federal tax tables on pages 788 -791 in your textbook. 2. Find the column for 2 allowances. 3. The amount of income to be withheld is $19.

Example 2 Lance Han’s gross pay for this week is $386. 88. He is married and claims 1 allowance. What amount will be withheld from Han’s pay for FIT?

Example 2 Answer Steps: 1. Find the income range from the federal tax tables on pages 788 -791 in your textbook. 2. Find the column for 1 allowance. 3. The amount of income to be withheld is $31.

Practice 1 Use the tax tables on pages 788 -791 in your texbook to find the amount withheld. Joseph Napoli, single. Earns $524 per week. Claims 2 allowances. What is the FIT withheld?

Practice 1 Answer $48

Practice 2 Use the tax tables on pages 788 -191 in your textbook to find the amount withheld. Amanda Hagel earns $476 a week. She is married and claims 2 allowances. Next year she will have a child and will claim an additional allowance. How much less will be withheld for federal income tax next year?

Practice 2 Answer $312

Lesson Objective Compute state taxes on a straight percent basis. Content Vocabulary exemption Withholding allowances, which allow for supporting yourself, your spouse, and others in your family who are your dependents.

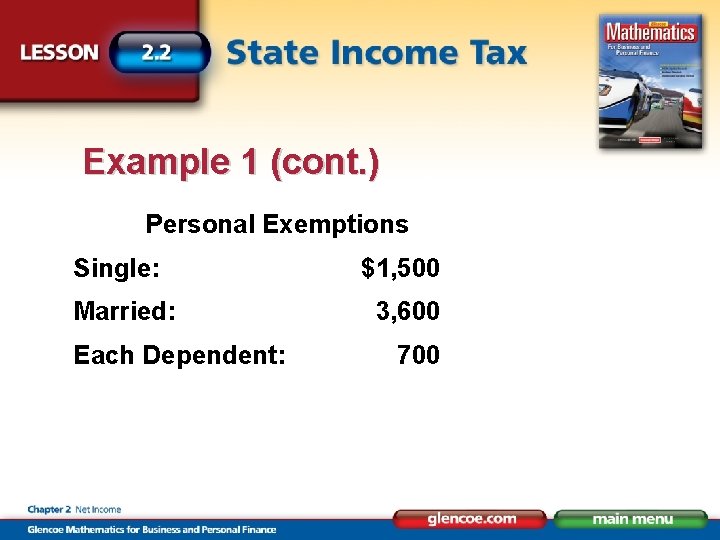

Example 1 Patricia Line’s gross pay is $65, 800 a year. The state income tax rate is 3 percent of taxable wages. Line takes a married exemption for herself and her husband. Use the Personal Exemptions table below to find out how much is withheld from her gross earnings for state income tax within the year.

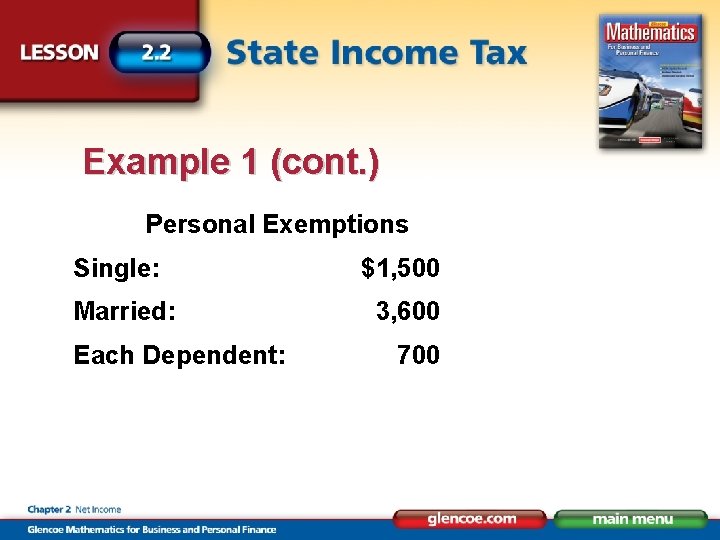

Example 1 (cont. ) Personal Exemptions Single: Married: Each Dependent: $1, 500 3, 600 700

Example 1 Answer: Step 1 Find the taxable wages. Annual Gross Pay – Personal Exemptions $65, 800. 00 – $3, 000. 00 = $62, 800. 00

Example 1 Answer: Step 2 Find the annual tax withheld. Taxable Wages × Tax Rate $62, 800. 00 × 3% = $1, 884. 00

Practice 1 Use the Personal Exemptions table in Example 1 above to find the amount withheld. Tomoko Nakazawa. Earns $38, 657 annually. Married, no dependents. What are her personal exemptions?

Practice 1 Answer $3, 000

Practice 2 Paul Chamello earns $168, 000. He is single. His personal exemptions include himself and his five children. The state tax rate is 2. 5 percent of taxable income. What amount is withheld yearly for state income tax?

Practice 2 Answer $4, 075

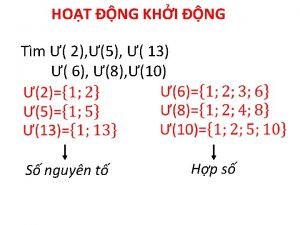

Lesson Objective Determine state taxes on a graduated income tax basis. Content Vocabulary graduated income tax A system that increases the tax rate at different levels of income.

Example 1 Louise Maffeo’s annual salary is $34, 500. She is paid semi-monthly. Her personal exemptions total $1, 500. How much does her employer deduct from each of Maffeo’s semi-monthly paychecks for state income tax?

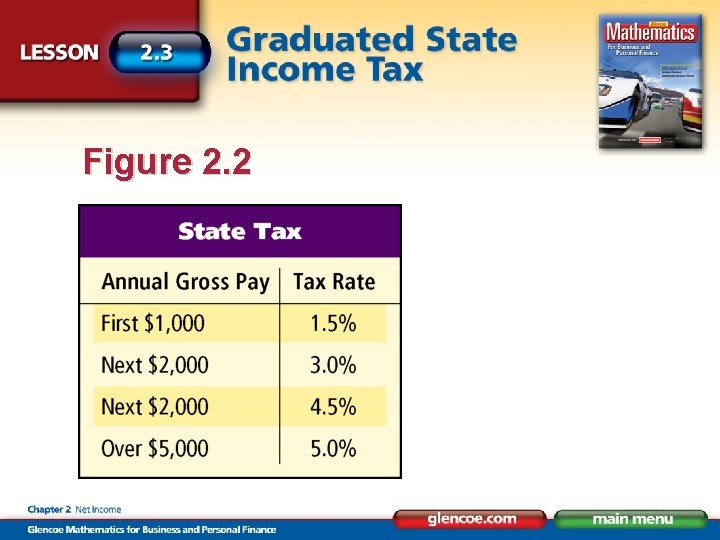

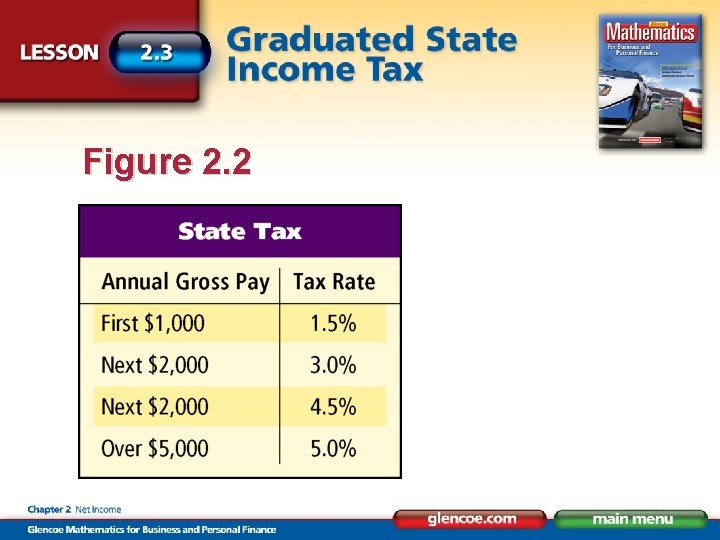

Figure 2. 2

Example 1 Answer: Step 1 Find the taxable wages. Annual Gross Pay – Personal Exemptions $34, 500. 00 – $1, 500. 00 = $33, 000. 00

Example 1 Answer: Step 2 Find the annual tax withheld. 1. First $1, 000: 1. 5% of $ 1, 000. 00 = $ 15. 00 2. Next $2, 000: 3. 0% of $ 2, 000. 00 = 60. 00 3. Next $2, 000: 4. 5% of $ 2, 000. 00 = 90. 00 4. Over $5, 000: 5. 0% of ($33, 000. 00 – $5, 000. 00) 5. 0% of $28, 000. 00 = 1, 400. 00 Total $1, 565. 00

Example 1 Answer: Step 3 Find the tax withheld per pay period. Annual Tax Withheld ÷ Number of Pay Periods per Year $1, 565. 00 ÷ 24 = $65. 208 or $65. 21

Practice 1 Patricia Hanson. Annual gross pay of $24, 300. Personal exemption of $1, 500. 2 percent state tax on first $5, 000. 3 percent state tax on amount over $5, 000. What is her taxable income?

Practice 1 Answer $22, 800

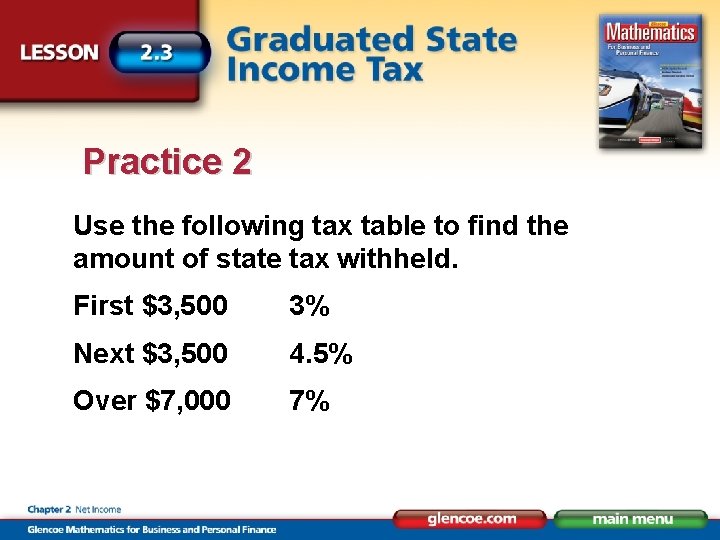

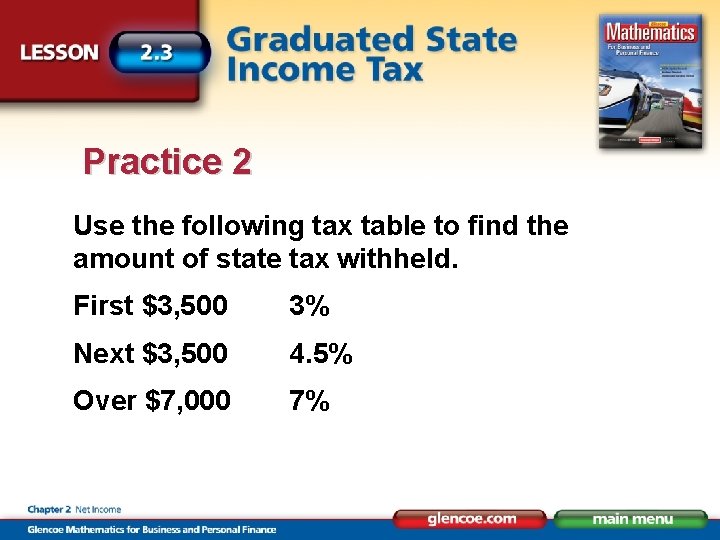

Practice 2 Use the following tax table to find the amount of state tax withheld. First $3, 500 3% Next $3, 500 4. 5% Over $7, 000 7%

Practice 2 (cont. ) Caroline Pollack’s gross pay is $31, 452. She has personal exemptions of $3, 600. How much is withheld from her semimonthly paycheck for state income tax? Round to the nearest cent.

Practice 2 Answer $71. 76

Lesson Objective Compute the amount withheld for Social Security and Medicare taxes. Content Vocabulary Social Security Medicare A federal government program to pay for retirement provide medical insurance. and disability benefits.

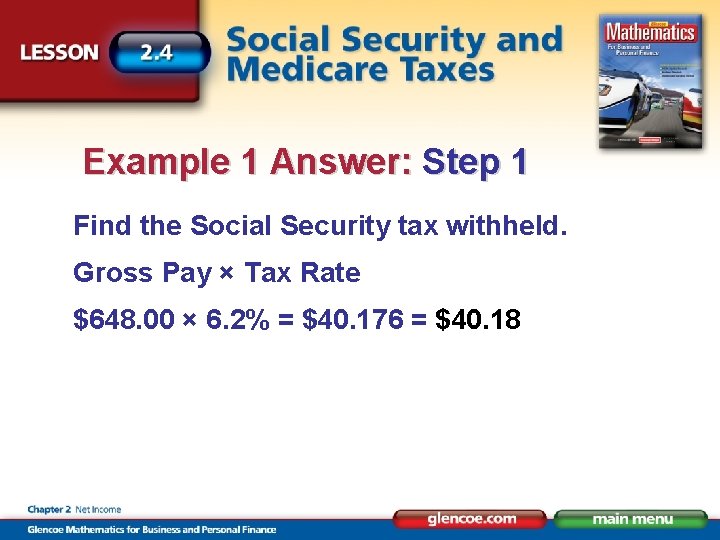

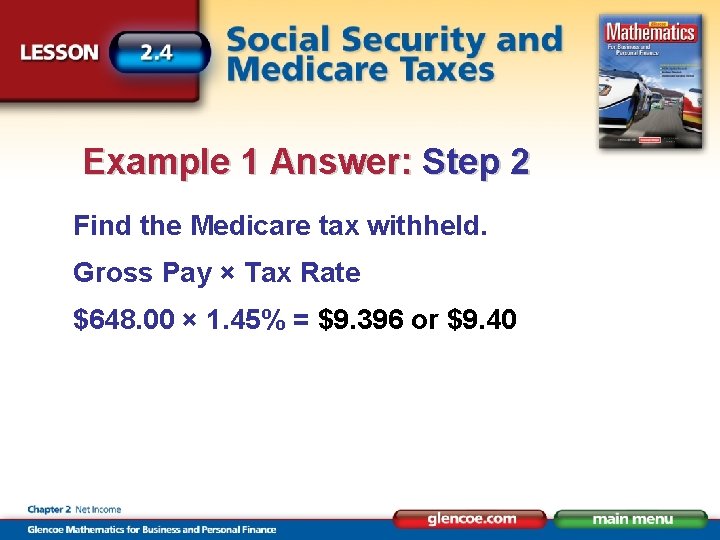

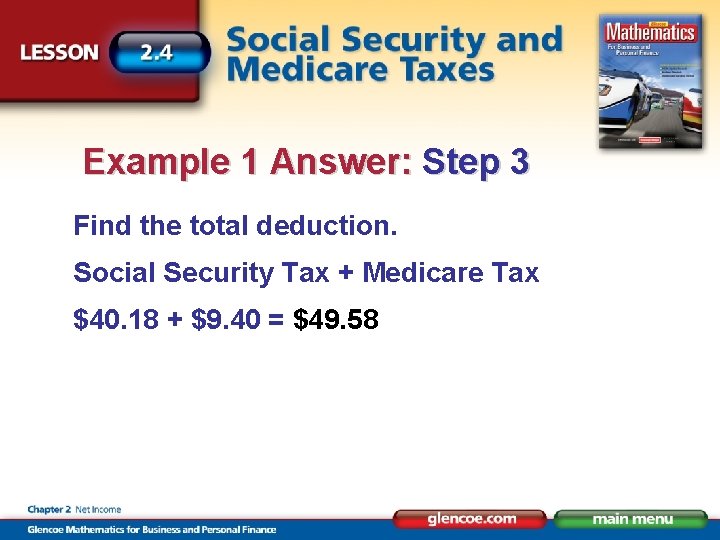

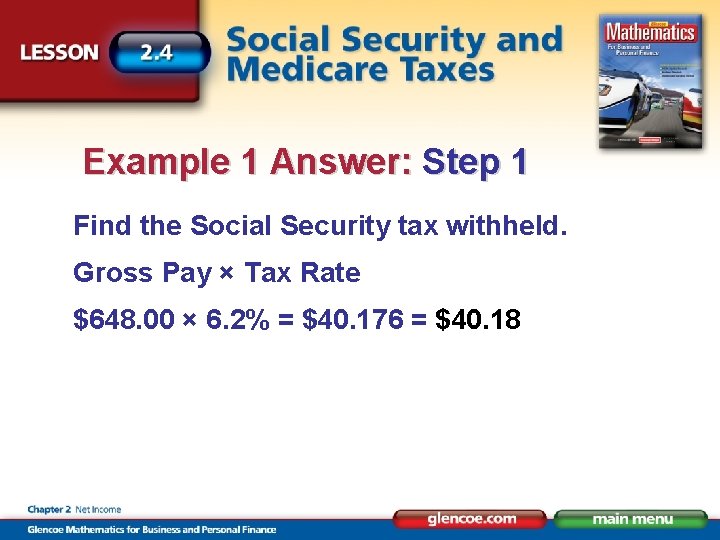

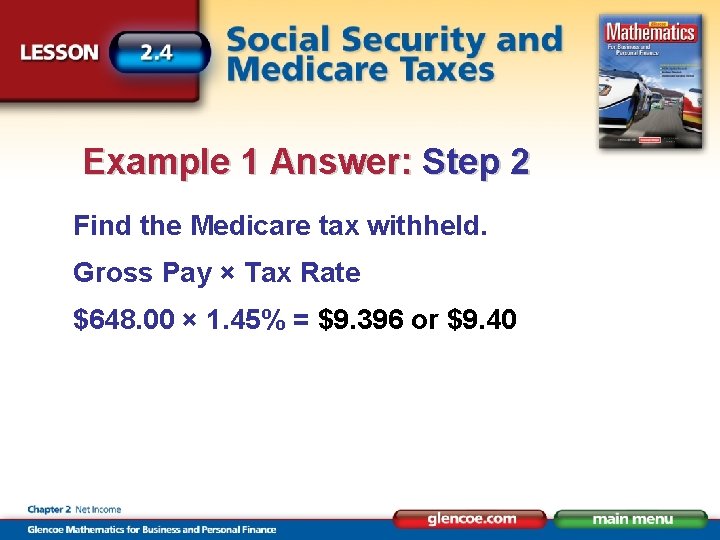

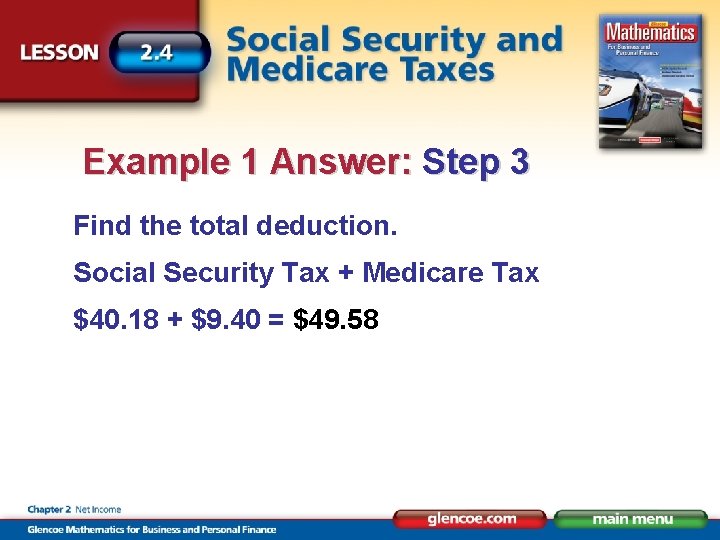

Example 1 Otis Hassan’s gross biweekly pay is $648. 00. His earnings to date for the year total $15, 228. What amount is deducted from his pay this week for Social Security? For Medicare? What is the total deduction?

Example 1 Answer: Step 1 Find the Social Security tax withheld. Gross Pay × Tax Rate $648. 00 × 6. 2% = $40. 176 = $40. 18

Example 1 Answer: Step 2 Find the Medicare tax withheld. Gross Pay × Tax Rate $648. 00 × 1. 45% = $9. 396 or $9. 40

Example 1 Answer: Step 3 Find the total deduction. Social Security Tax + Medicare Tax $40. 18 + $9. 40 = $49. 58

Practice 1 Find the Social Security and Medicare taxes withheld for this pay period. Tom Mendoza. Monthly salary $4, 800. $52, 800 earned this year to date. How much deducted this pay period for Social Security? For Medicare?

Practice 1 Answer For Social Security: $297. 60 For Medicare: $69. 60

Practice 2 Stephanie Metcalf earns $91, 992 a year. Her salary is paid monthly. What are her year-todate earnings for November? How much is deducted from her check in November for Social Security? For Medicare? How much is deducted from her check in December for Social Security? For Medicare?

Practice 2 Answer Year-to-date earnings for November: $84, 326 Social Security deduction in November: $475. 29 Medicare deduction in November: $111. 16 Social Security deduction in December: $35. 59 Medicare deduction in December: $111. 16

• Assignment -

Lesson Objective Calculate the deduction for group insurance. Content Vocabulary group insurance Social Security group insurance A federal government program to Health insurance offered by many pay for retirement and disability businesses to employees, pain in benefits. part by the business and in part by the employee.

Example 1 Lawrence Butler has family medical coverage through the group medical plan his employer provides. The annual cost of the plan is $4, 500. The company pays 80 percent. How much does Butler pay annually?

Example 1 Answer: Step 1 Find the percent paid by employee. 100% – Percent Company Pays 100% – 80% = 20%

Example 1 Answer: Step 2 Find the total amount paid by employee. Annual Amount × Employee’s Percent $4, 500 × 20% = $900. 00

Example 2 Nicholette Mc. Clure has family medical coverage through the group medical plan her employer provides. The annual cost of the plan is $5, 000. The company pays 75 percent. How much is deducted from her biweekly paycheck for medical insurance?

Example 2 Answer: Step 1 Find the percent paid by employee. 100% – Percent Company Pays 100% – 75% = 25%

Example 2 Answer: Step 2 Find the total amount paid by employee. Annual Amount × Employee’s Percent $5, 000 × 25% = $1, 250

Example 2 Answer: Step 3 Find the deduction per pay period. Total Annual Amount Paid by Employee Number of Pay Periods per Year $1, 250 ÷ 26 = $48. 08

Practice 1 Annual cost of insurance: $4, 160. Employer pays 80 percent. 52 pay periods. Find the deduction per pay period.

Practice 1 Answer $16

Practice 2 Ken Fujimoto’s employer pays 90 percent of his medical insurance and 60 percent of his dental insurance. Medical insurance costs $3, 400 per year and dental insurance is $1, 300. How much is deducted from Ken’s semimonthly pay for medical insurance? How much for dental insurance?

Practice 2 Answer Medical: $14. 17 Dental: $21. 67

Lesson Objective Calculate net pay period. Content Vocabulary net pay The amount of money you have left after your employer subtracts all tax withholdings and personal deductions from your gross pay, also called net income or take-home pay.

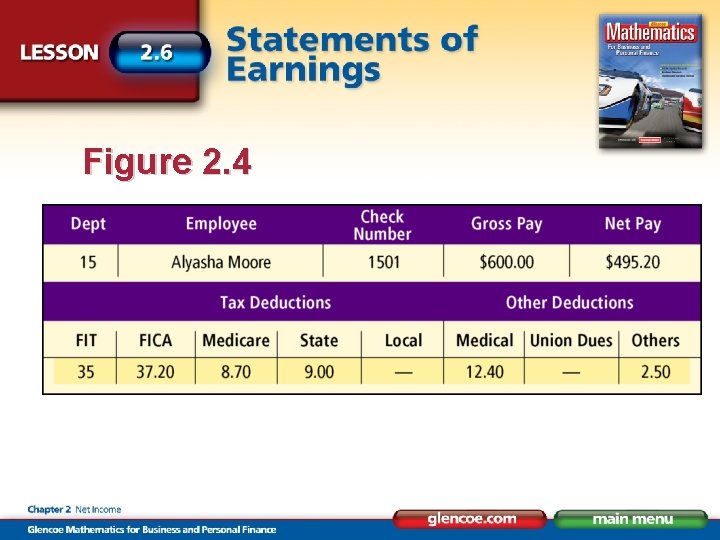

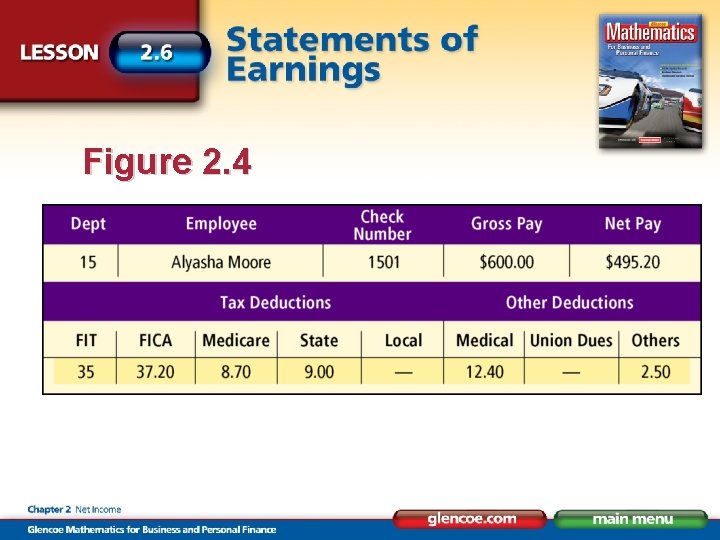

Example 1 Alysha Moore’s gross weekly salary is $600. She is married and claims 3 allowances. The Social Security tax is 6. 2 percent. The Medicare tax is 1. 45 percent. The state tax is 1. 5 percent. Each week she pays $12. 40 for medical insurance and $2. 50 for charity. Is Moore’s earnings statement correct?

Figure 2. 4

Example 1 Answer: Step 1 Find the total deductions. a. Federal withholding b. Social Security: 6. 2% of $600. 00 $35. 00 37. 20 c. Medicare: 1. 45% of $600. 00 8. 70 d. State tax: 1. 5% of $600. 00 9. 00 e. Medical insurance f. Charity 12. 00 2. 50 Total $104. 80

Example 1 Answer: Step 2 Find the net pay. Gross Pay – Total Deductions $600. 00 – $104. 80 = $495. 20 Her statement is correct.

Practice 1 Find the deductions and the net pay. Social Security is 6. 2 percent of the first $84, 900. Medicare is 1. 45 percent of all income. Use the tax tables on pages 788 -791 in your textbook for federal tax. Round to the nearest cent.

Practice 1 (cont. ) Pierre Lamont is married and claims 4 allowances. His gross weekly salary is $628. Each week he pays federal, Social Security, and Medicare taxes, as well as $28 for medical insurance and $12 for union dues. What are his deductions and his net pay?

Practice 1 Answer Federal: $29 Social Security: $38. 94 Medicare: $9. 11 Net pay: $510. 95

Practice 2 Find the deductions and the net pay. Social Security is 6. 2 percent of the first $84, 900. Medicare is 1. 45 percent of all income. Use the tax tables on pages 788 -791 in your textbook for federal tax. Round to the nearest cent.

Practice 2 (cont. ) Michele Sawyer is single and claims 1 allowance. She earns $11. 50 per hour as a pest controller and works 40 hours. Deductions include federal income tax, Social Security, and Medicare.

Practice 2 (cont. ) State taxes are 4 percent of gross income, and local taxes are 2 percent of gross income. She pays $42. 75 per week for medical insurance. What are her deductions and net pay for the week?

Practice 2 Answer Federal: $48 Social Security: $28. 52 Medicare: $6. 67 State tax: $18. 40 Local tax: $9. 20 Medical insurance: $42. 75 Net pay: $306. 46

Summary Federal Income Tax State Income Tax Types of Agencies Social Security pays for retirement and disability benefits. Pay Deductions Your employer takes deductions from your paycheck for the government and other agencies. Group Health Insurance is often less expensive than individual insurance.

1. Tonya Westin’s gross pay for the week is $357. 89. She is married and claims no allowances. Use the table on page A 4 in the text. What amount will be withheld for FIT? A. B. C. D. $14. 00 $15. 00 $19. 00 $20. 00

2. Dwight Fisher earns $42, 500. He is married with three dependents which gives him a $10, 000 exemption. His state had an income tax rate of 4. 5%. How much does Dwight’s employer withhold annually from his gross earnings for state income tax? A. B. C. D. $450. 00 $1, 230. 90 $1, 462. 50 $1, 912. 50

3. ALGEBRA Reena Garcia is a sales manager. She is single and takes a $2, 000 exemption. The state income tax rate is 3%. If her employer withholds $3, 900 for state income tax annually, find her annual salary. A. B. C. D. $85, 400 $101, 250 $125, 600 $132, 000

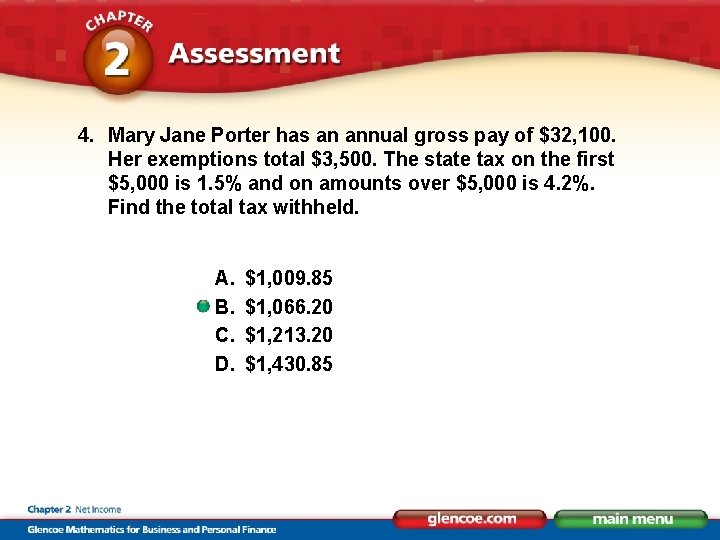

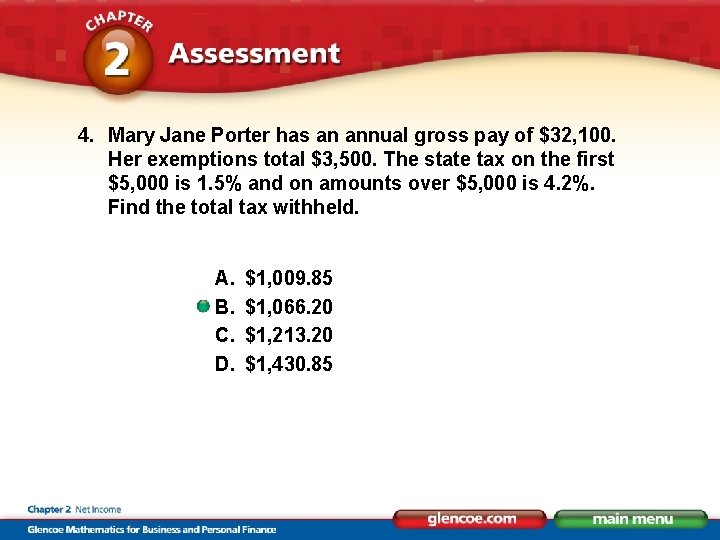

4. Mary Jane Porter has an annual gross pay of $32, 100. Her exemptions total $3, 500. The state tax on the first $5, 000 is 1. 5% and on amounts over $5, 000 is 4. 2%. Find the total tax withheld. A. B. C. D. $1, 009. 85 $1, 066. 20 $1, 213. 20 $1, 430. 85

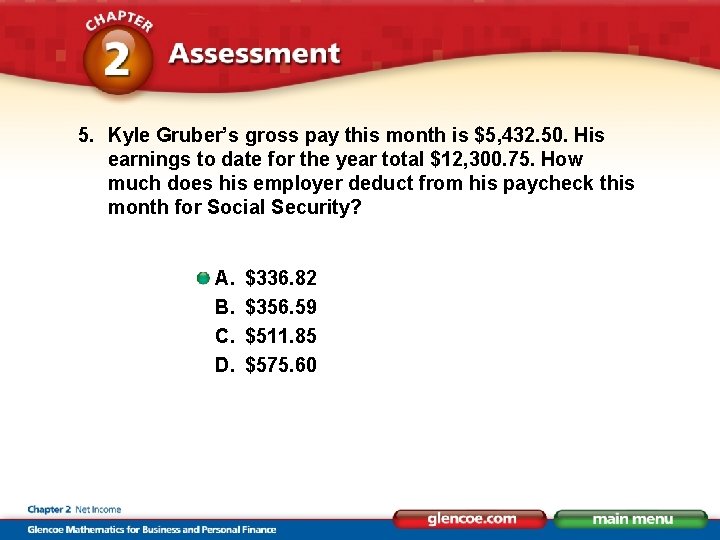

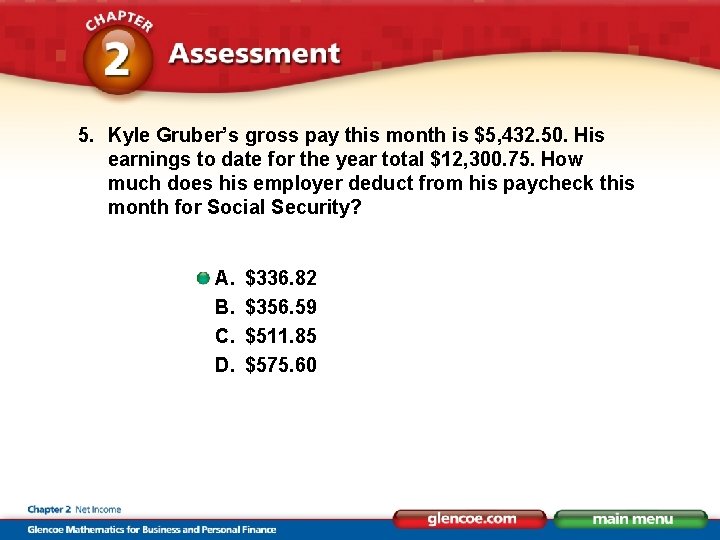

5. Kyle Gruber’s gross pay this month is $5, 432. 50. His earnings to date for the year total $12, 300. 75. How much does his employer deduct from his paycheck this month for Social Security? A. B. C. D. $336. 82 $356. 59 $511. 85 $575. 60

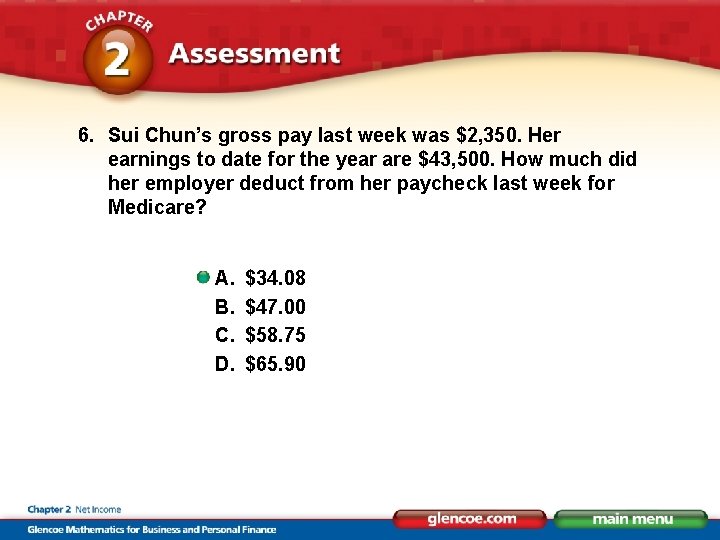

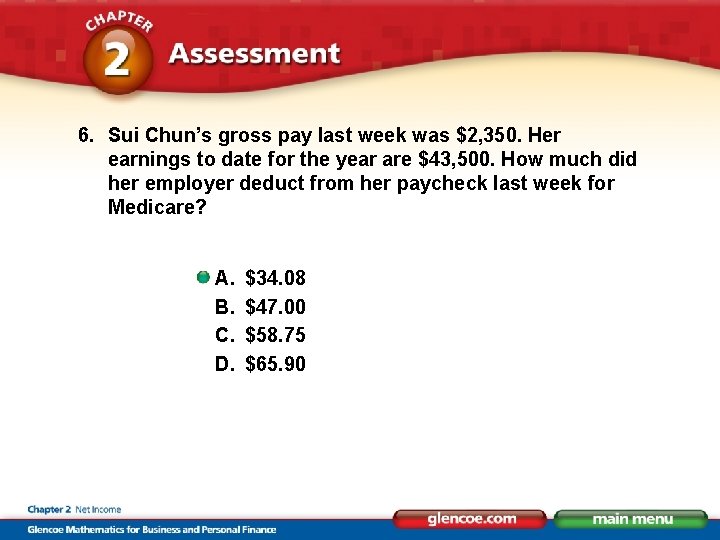

6. Sui Chun’s gross pay last week was $2, 350. Her earnings to date for the year are $43, 500. How much did her employer deduct from her paycheck last week for Medicare? A. B. C. D. $34. 08 $47. 00 $58. 75 $65. 90

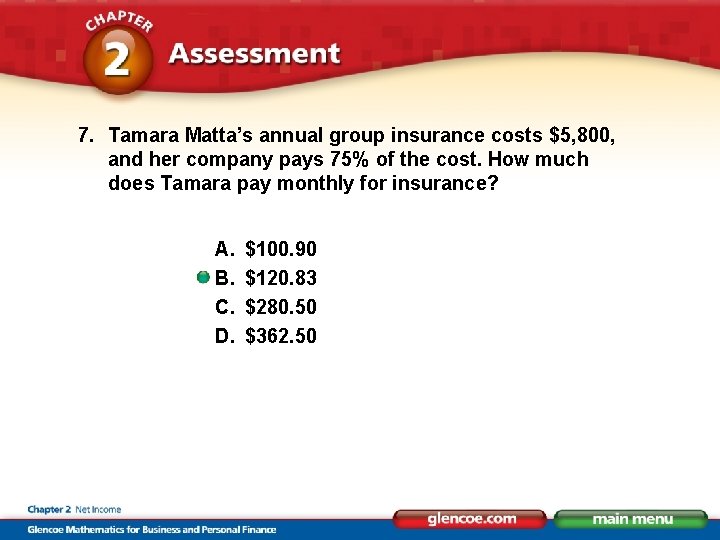

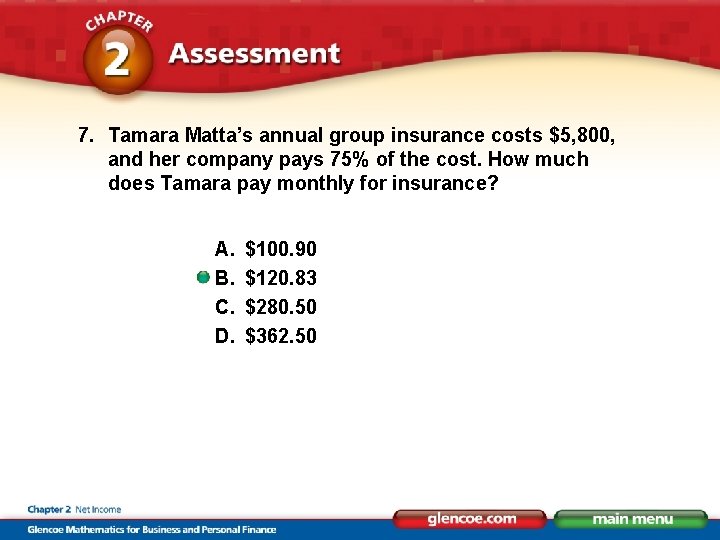

7. Tamara Matta’s annual group insurance costs $5, 800, and her company pays 75% of the cost. How much does Tamara pay monthly for insurance? A. B. C. D. $100. 90 $120. 83 $280. 50 $362. 50

8. ALGEBRA Danford Kayne pays $231. 60 per month for his group medical coverage. His employer pays 35% of the cost. How much is the annual premium for Danford’s health insurance? A. B. C. D. $2, 779. 20 $3, 843. 10 $4, 275. 69 $5, 904. 33

9. Erika Morley’s gross weekly salary is $825. 75. She is married with no dependents. The following deductions are made each week: $31. 00 for federal tax; 6. 45% for Social Security and 1. 45% for Medicare; $42. 50 for medical insurance. The state tax rate is 1. 5% of gross. What is Erika’s net pay? A. B. C. D. $543. 96 $550. 76 $612. 09 $676. 69

10. ALGEBRA The deductions from Allana Cole’s monthly pay are federal income tax of $98, state income tax of 2. 1%, city income tax of 1. 1%, Social Security of 6. 45%, and Medicare of 1. 45%. Her monthly net pay is $2, 754. 80. Find Allana’s monthly gross pay. A. B. C. D. $2, 900 $3, 200 $3, 500 $4, 000

End of Chapter 2 Net Income

Take home messages

Take home messages What are deductions

What are deductions Online levy brief

Online levy brief Permissible deductions

Permissible deductions Below the line vs above the line

Below the line vs above the line Shana ross bayhealth

Shana ross bayhealth General deductions

General deductions One thing by one direction

One thing by one direction How much does wanda earn per hour?

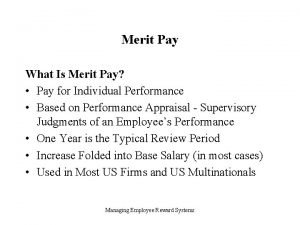

How much does wanda earn per hour? Pay level and pay mix

Pay level and pay mix Demotivators and edward deci theory

Demotivators and edward deci theory Chapter 1 gross income

Chapter 1 gross income You put your right hand in

You put your right hand in Give us your hungry your tired your poor

Give us your hungry your tired your poor Ernie break his leg four times

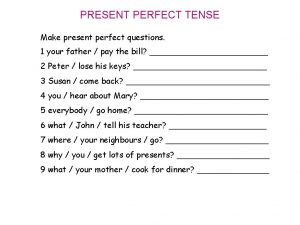

Ernie break his leg four times You ____ pay attention in the class

You ____ pay attention in the class Please pay your fees

Please pay your fees Pay careful attention to your own work

Pay careful attention to your own work Put out the light and then put out the light

Put out the light and then put out the light Stove-length sticks of wood

Stove-length sticks of wood Outta sight outta mind quotes

Outta sight outta mind quotes Out out robert frost summary

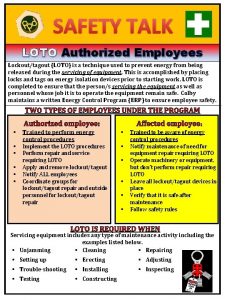

Out out robert frost summary Lock out tag out safety talk

Lock out tag out safety talk Out out robert frost summary

Out out robert frost summary Out of sight out of time

Out of sight out of time Matthew 11:28 the message

Matthew 11:28 the message Loto

Loto Out, damned spot! out, i say!

Out, damned spot! out, i say! Harmony not discord

Harmony not discord Makna out of sight out of mind

Makna out of sight out of mind Log out tag out deutsch

Log out tag out deutsch Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Ng-html

Ng-html Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Voi kéo gỗ như thế nào

Voi kéo gỗ như thế nào Tư thế worm breton là gì

Tư thế worm breton là gì Alleluia hat len nguoi oi

Alleluia hat len nguoi oi Môn thể thao bắt đầu bằng từ đua

Môn thể thao bắt đầu bằng từ đua Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Công thức tính thế năng

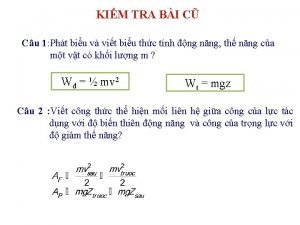

Công thức tính thế năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Mật thư tọa độ 5x5

Mật thư tọa độ 5x5 Phép trừ bù

Phép trừ bù Phản ứng thế ankan

Phản ứng thế ankan Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thể thơ truyền thống

Thể thơ truyền thống Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Một số thể thơ truyền thống

Một số thể thơ truyền thống Cái miệng nó xinh thế chỉ nói điều hay thôi

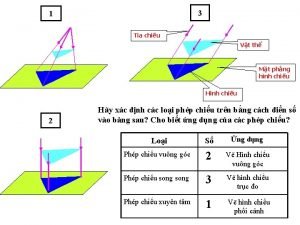

Cái miệng nó xinh thế chỉ nói điều hay thôi Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Nguyên nhân của sự mỏi cơ sinh 8

Nguyên nhân của sự mỏi cơ sinh 8 đặc điểm cơ thể của người tối cổ

đặc điểm cơ thể của người tối cổ Thế nào là giọng cùng tên? *

Thế nào là giọng cùng tên? * Vẽ hình chiếu đứng bằng cạnh của vật thể

Vẽ hình chiếu đứng bằng cạnh của vật thể Phối cảnh

Phối cảnh Thẻ vin

Thẻ vin đại từ thay thế

đại từ thay thế điện thế nghỉ

điện thế nghỉ Tư thế ngồi viết

Tư thế ngồi viết Diễn thế sinh thái là

Diễn thế sinh thái là Các loại đột biến cấu trúc nhiễm sắc thể

Các loại đột biến cấu trúc nhiễm sắc thể So nguyen to

So nguyen to Tư thế ngồi viết

Tư thế ngồi viết Lời thề hippocrates

Lời thề hippocrates Thiếu nhi thế giới liên hoan

Thiếu nhi thế giới liên hoan ưu thế lai là gì

ưu thế lai là gì Hổ đẻ mỗi lứa mấy con

Hổ đẻ mỗi lứa mấy con Sự nuôi và dạy con của hươu

Sự nuôi và dạy con của hươu Hệ hô hấp

Hệ hô hấp Từ ngữ thể hiện lòng nhân hậu

Từ ngữ thể hiện lòng nhân hậu Thế nào là mạng điện lắp đặt kiểu nổi

Thế nào là mạng điện lắp đặt kiểu nổi Work out your salvation

Work out your salvation Take out your notebook

Take out your notebook Take out your homework

Take out your homework Pirate name generator

Pirate name generator Take out your notebooks

Take out your notebooks Homework out

Homework out Take out your homework

Take out your homework Take out your homework

Take out your homework Take out your homework

Take out your homework Take out your notebook

Take out your notebook