A quick guide to automatic enrolment and the

- Slides: 54

A quick guide to automatic enrolment and the employer duties from an IFA perspective Stewart Tomlinson - Mc. Parland & Partners Erica Dietsch – Hawsons Wealth Management Ltd

What we are looking at today… • • • Employer duties Worker status Pay Reference Periods Postponement Directors Occupational vs GPP (Master Trusts) Choosing Pension Schemes Process Declaration of Compliance

Employer Duties… • The Pensions Regulator has listed 11 main steps that it considers all employers need to complete to fulfil their legislation • These steps are the basic processes; some are easy to complete, others require much more time and knowledge and this is what you are needed for • It’s much more than just providing a pension scheme…

The employer duties and automatic enrolment • From October 2012 every UK employer must: – Register with The Pensions Regulator and provide details of workforce and pension scheme – Automatically enrole certain workers – Arrange membership of a pension scheme for other workers So what are their duties?

The employer duties and automatic enrolment The Pensions Regulator has listed 11 main steps that it considers all employers need to complete to fulfil their legislation

First steps… 1. Know when they need to be ready – what is their staging date? 2. Work with the legislation – they must provide a point of contact for The Regulator to write to 3. Develop their initial plans with them

Before the staging date… 4. Find out who to enrol – who is a worker? 5. Choose payroll software and check employee records 6. Choose a pension scheme that will meet the legislative “qualifying” requirements

At the staging date… 7. Automatically enrol staff 8. Tell the staff about this – letters and/or presentations 9. Complete the declaration of compliance to The Pensions Regulator

Is it all over? … NO 10. The employer must maintain records for The Regulator as they can ask to access them at any time 11. The employer must continue to fulfil ongoing responsibilities

So what makes a worker?

So what makes a worker? According to The Pensions Regulator, a worker is defined as any individual who: ■ Works under a contract of employment (an employee) or ■ Has a contract to perform work or services personally and is not undertaking the work as part of their own business Anyone who has entered into a contract of this type with an individual is an employer and is required to comply with the new duties

So…who is a worker? • Problem is that…. The Pensions Regulator’s definition of Self. Employment differs from that of HMRC • So what is a Personal Services Worker?

Which workers may be affected? People could be subject to the automatic enrolment legislation if they are: ü Full or part-time ü Permanent, temporary or casual workers ü On ‘zero hours’ contracts ü A contractor (even if considered self employed for tax purposes) ü Agency staff ü Staff seconded overseas, and/or ü Home workers

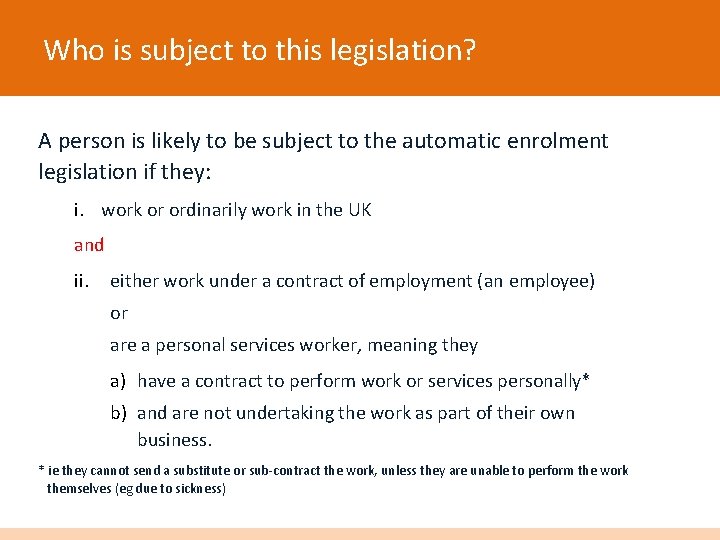

Who is subject to this legislation? A person is likely to be subject to the automatic enrolment legislation if they: i. work or ordinarily work in the UK and ii. either work under a contract of employment (an employee) or are a personal services worker, meaning they a) have a contract to perform work or services personally* b) and are not undertaking the work as part of their own business. * ie they cannot send a substitute or sub-contract the work, unless they are unable to perform the work themselves (eg due to sickness)

Are they a personal services worker? The employer needs to judge whether or not an individual (who is not a director) with a contract to perform work or services personally is undertaking the work as part of their own business.

Are they a personal services worker? Does the employer… • Have control over an individual’s method of work (eg hours worked)? • Provide any employee benefits? • Bear all the significant financial risks in carrying out the work (eg the worker is not financially responsible for their faulty work)? • Provide what is required for the individual to carry out the work (eg tools)? If most or all of the above are true, then it would be reasonable to consider that they are not undertaking the work as part of their own business…and they are a personal services worker. The list above is not exhaustive and an employer must take into account all relevant considerations and make a reasonable judgement.

Example 1: Is Eddie a worker? Eddie is a self employed graphic designer. He works regularly for a company, Acme Workshops Ltd. His role is unique. He designs (and, if necessary, prints on his own equipment) all the flyers and magazine ads. He also designs and updates their website and forum. Eddie is very important to Acme Workshops’ marketing strategy. It is a nightmare when Eddie is too busy working for other customers, because his contract with Acme does not permit him to send a replacement. Eddie works unsupervised and, generally, he works from home, but sometimes he works in the offices of Acme Workshops. Eddie invoices Acme Workshops at the end of each campaign design and guarantees the quality of his material. Q. Should Acme Workshops consider Eddie to be their worker?

Example 1: Is Eddie a worker? Eddie is a self employed graphic designer. He works regularly for a company, Acme Workshops Ltd. His role is unique. He designs (and, if necessary, prints on his own equipment) all the flyers and magazine ads. He also designs and updates their website and forum. Eddie is very important to Acme Workshops’ marketing strategy. It is a nightmare when Eddie is too busy working for other customers, because his contract with Acme does not permit him to send a replacement. Eddie works unsupervised and, generally, he works from home, but sometimes he works in the offices of Acme Workshops. Eddie invoices Acme Workshops at the end of each campaign design and guarantees the quality of his material. Eddie cannot reasonably be considered a worker.

Example 1: Is Eddie a worker? Eddie cannot reasonably be considered a worker, because: Ø He is not an employee; Ø He sometimes uses his own equipment; Ø He is not permitted to send a replacement; Ø He works unsupervised, and: Ø He guarantees the quality of his work.

Example 2: Is Georgina a worker? Georgina is a self employed IT professional who works full time for Acme Workshops Ltd. Georgina supports Acme Workshops’ in house payroll system and is very important to Acme Workshops and no one else has the expertise to do her work when she’s on holiday. Georgina works in Acme Workshops’ payroll team, alongside Acme Workshops’ own employees in their offices, but sometimes she is allowed to work from home. Georgina invoices Acme Workshops at the end of each month based on the number of days she has worked. Q. Should Acme Workshops consider Georgina to be their worker?

Example 2: Is Georgina a worker? Georgina is a self employed IT professional who works full time for Acme Workshops Ltd. Georgina supports Acme Workshops’ in house payroll system and is very important to Acme Workshops and no one else has the expertise to do her work when she’s on holiday. Georgina works in Acme Workshops’ payroll team, alongside Acme Workshops’ own employees in their offices, but sometimes she is allowed to work from home. Georgina invoices Acme Workshops at the end of each month based on the number of days she has worked. Georgina can reasonably be considered a worker.

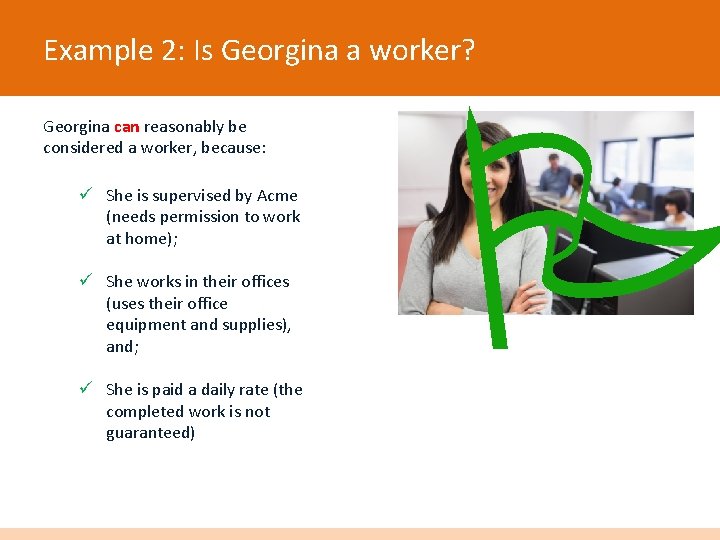

Example 2: Is Georgina a worker? Georgina can reasonably be considered a worker, because: ü She is supervised by Acme (needs permission to work at home); ü She works in their offices (uses their office equipment and supplies), and; ü She is paid a daily rate (the completed work is not guaranteed)

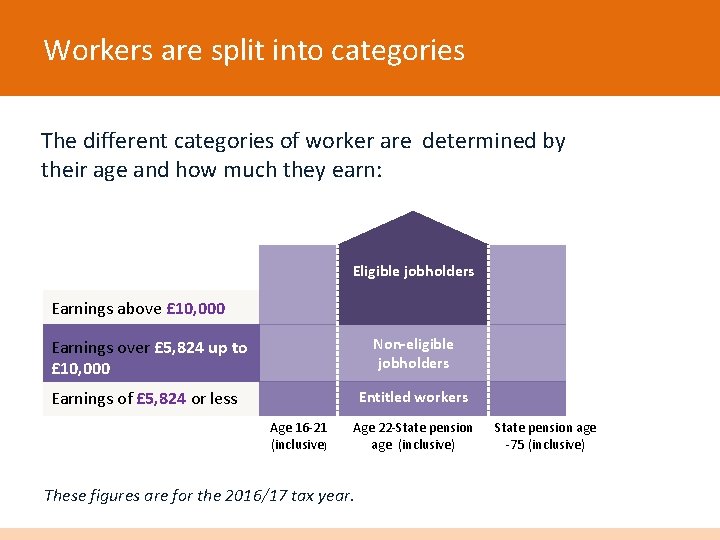

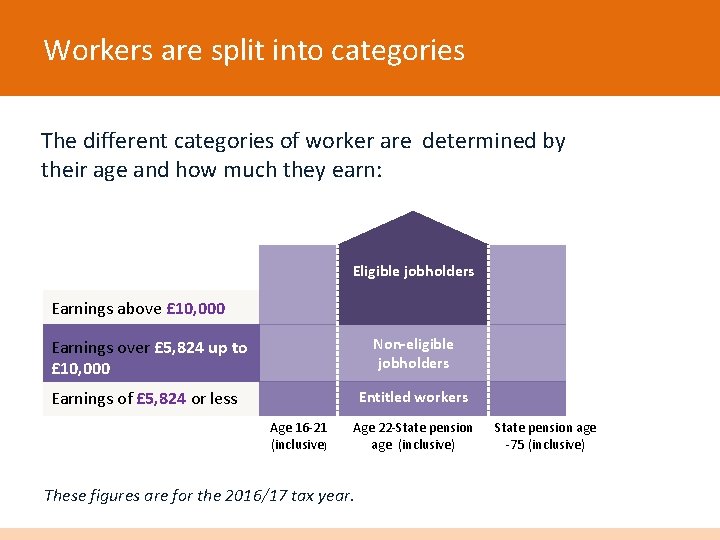

Workers are split into categories Eligible jobholders Non-eligible jobholders Entitled workers

Workers are split into categories The different categories of worker are determined by their age and how much they earn: Eligible jobholders Earnings above £ 10, 000 Non-eligible jobholders Earnings over £ 5, 824 up to £ 10, 000 Earnings of £ 5, 824 or less Entitled workers Age 16 -21 (inclusive) Age 22 -State pension age (inclusive) These figures are for the 2016/17 tax year. State pension age -75 (inclusive)

Payroll Reference Periods • The term ‘Pay Reference Period’ is used in two different ways within the employer duties • There also two definitions of a pay reference period in legislation and an employer is able to choose which definition they wish to adopt as the basis for assessing earnings • One definition of a pay reference period is aligned to tax weeks or months and one is aligned to the period by reference to which a person is paid their regular wage or salary

Payroll Reference Periods • An employer can choose to change from using one definition to another • There is nothing that prevents an employer using one definition for some workers and the other definition for other workers

Payroll Reference Periods This can be an area of much confusion… …there are examples out there to help understand this.

Postponement Cause of much confusion!! Maximum period is 3 months • It is only postponement of starting contributions, but the employer MUST have a scheme in place at Staging Date • In reality period is actually shorter

Postponement • Sage (the most popular payroll package) works in tax months commenced 6 th of month • Therefore, end of a 3 month postponement would be 6 th of month 2, not 3!

Directors and automatic enrolment

Directors and automatic enrolment Should they be automatically enrolled? • If the director has no contract of employment, then N 0 • For example, a director of a husband wife owned company • The answer is yes for an employee director, e. g. nonshareholding finance director of a company, but only if there is another director working under a contract of employment.

Questions and answers Question 1: A director of a company with two employees does not draw a salary, but only takes dividends. Is the director considered a worker? Answer: If a director is not drawing a salary, but is simply drawing the profits from the business that he or she has an ownership in, then the director would not be a worker (providing the director is not working under an employment contract or personal services contract). However, the two employees would be considered as workers.

Questions and answers Question 2: A director of a company is the only employee of the company and she does earn a salary. Would the director be considered a worker? Answer: No, if an individual is a director of a company and the company has no other employees, that individual is not a worker by virtue of any office that they hold or contract of employment under which they work. The company is therefore not subject to the employer duties.

Occupational schemes vs. GPPs • Good, bad and ugly – master trusts and how these work • Sustainability

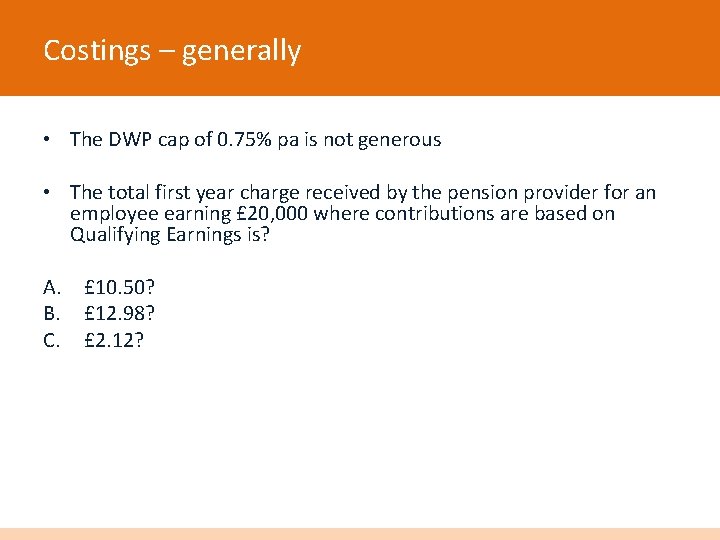

Costings – generally • The DWP cap of 0. 75% pa is not generous • The total first year charge received by the pension provider for an employee earning £ 20, 000 where contributions are based on Qualifying Earnings is? A. £ 10. 50? B. £ 12. 98? C. £ 2. 12?

Costings C. £ 2. 12! • In addition, if using an Occupational Scheme, e. g. a Master Trust, then scheme must pay a levy of 87 p per member per year, leaving a net charge of

Costings • £ 1. 25!! • Are Master Trusts sustainable in the long-term? In addition, Master Trusts have to meet further requirements….

Master Trust Assurance • Independent Audit of Master Trust Schemes • Costs about £ 100, 000!! • List of schemes on The Pension Regulator’s Website

Master Trust Assurance Participants • • • BCF Pension Trust National Employment Savings Trust (NEST) National Pension Trust NOW: Pensions SEI Master Trust The Blue. Sky Pension Scheme (TBPS) The Pensions Trust The People’s Pension Welplan

Choosing a pension scheme

Choosing a pension scheme • It’s not as simple as it looks – you often can’t use the existing scheme and new schemes have to do particular things • Will the existing pension allow the employer to run autoenrolment? It has to meet two particular requirements – and most don’t • If the employer doesn’t have a pension you will need to get one that meets three sets of requirements

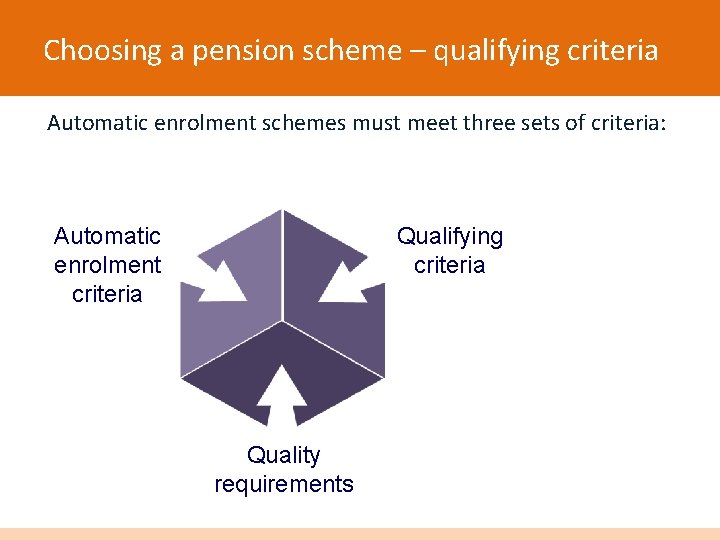

Choosing a pension scheme – qualifying criteria Automatic enrolment schemes must meet three sets of criteria: Automatic enrolment criteria Qualifying criteria Quality requirements

Choosing a pension scheme – qualifying criteria • To be an AE scheme, a scheme must meet the “Qualifying Criteria” and in addition it must not contain any provisions that: • Prevent the employer from making the required arrangements to automatically enrol, opt in or re-join a jobholder • Require the jobholder to express a choice in relation to any matter, or to provide any information, in order to remain an active member of the scheme • In addition there are to be no deductions from the jobholders pot to pay to a third party, except to the scheme provider • It also needs to have its main administration held in the UK or EEA

Choosing a pension scheme – qualifying criteria The scheme must: ü Be an occupational or personal pension scheme ü Be tax registered ü And satisfy certain minimum(qualifying) requirements ü It can be a UK or non UK scheme but has differing minimum requirements according to the country of origin

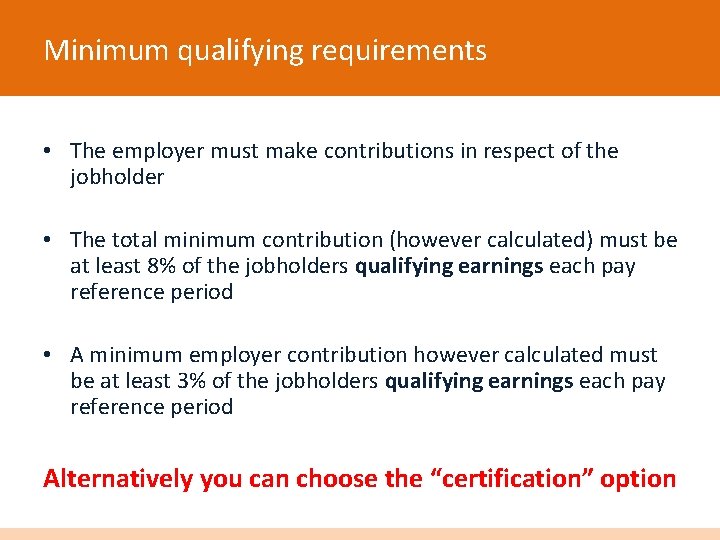

Minimum qualifying requirements • The employer must make contributions in respect of the jobholder • The total minimum contribution (however calculated) must be at least 8% of the jobholders qualifying earnings each pay reference period • A minimum employer contribution however calculated must be at least 3% of the jobholders qualifying earnings each pay reference period Alternatively you can choose the “certification” option

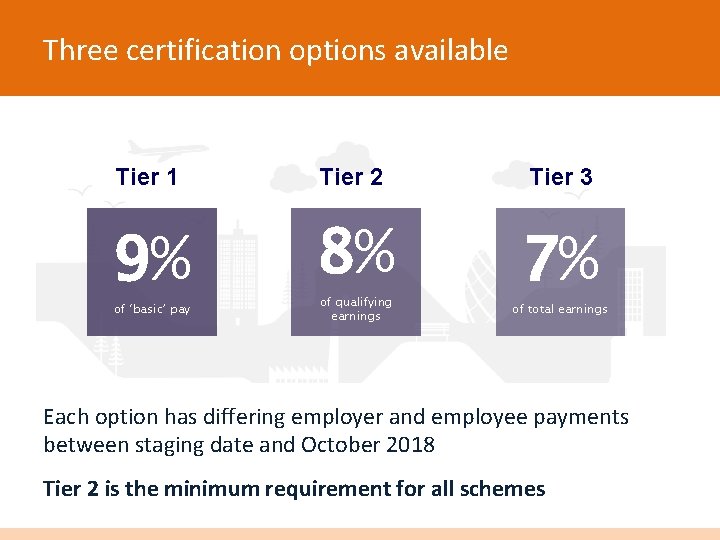

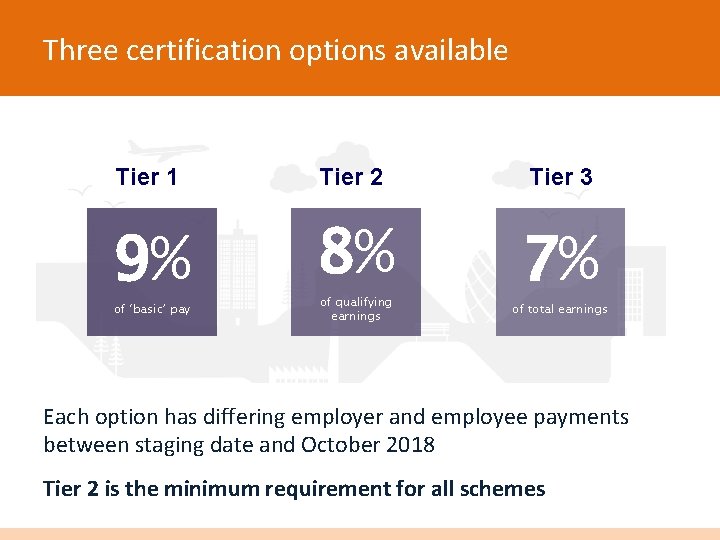

Three certification options available Tier 1 Tier 2 Tier 3 9% 8% 7% of ‘basic’ pay of qualifying earnings of total earnings Each option has differing employer and employee payments between staging date and October 2018 Tier 2 is the minimum requirement for all schemes

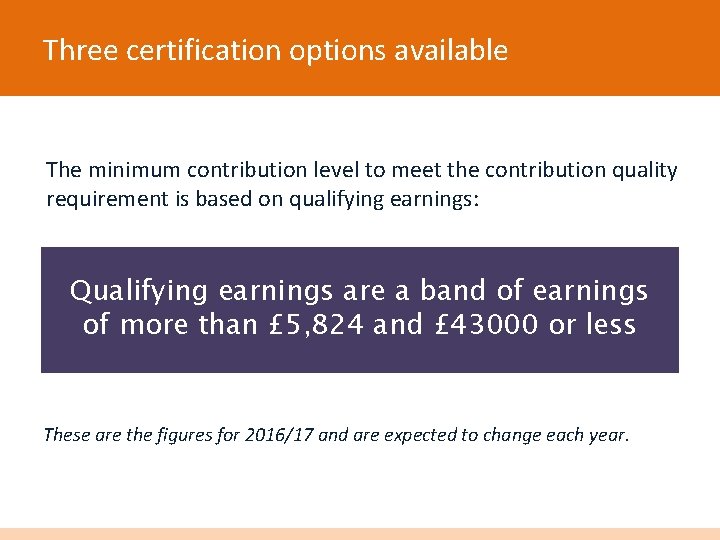

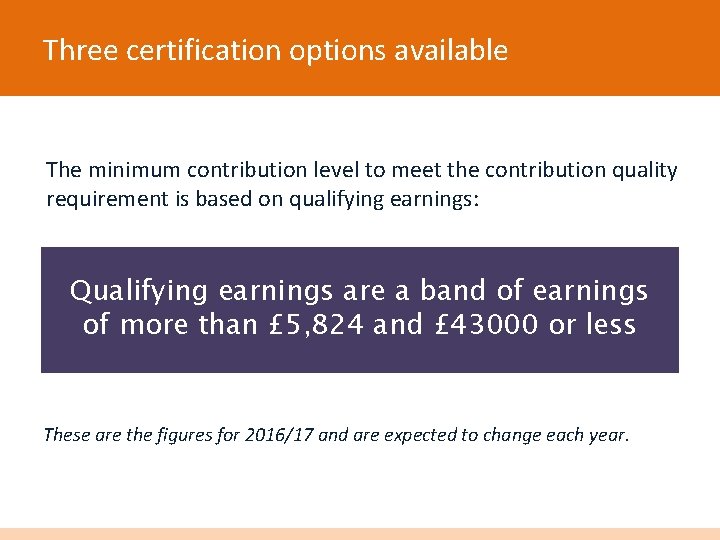

Three certification options available The minimum contribution level to meet the contribution quality requirement is based on qualifying earnings: Qualifying earnings are a band of earnings of more than £ 5, 824 and £ 43000 or less These are the figures for 2016/17 and are expected to change each year.

Qualifying earnings? Consists of the following components of pay: • • Salary Wages Commission Bonuses Overtime Statutory Sick Pay Statutory Maternity or Paternity pay Statutory Adoption Pay

Basic pay vs. total pay – who is it suitable for? • Basic Pay basis is generally recommended when employer has workers with high commission or bonus earnings. • Pensionable Earnings definition is Basic Pay. • Permitted to have more than one category, so different groups of workers can have different bases. • This will require you to do some calculations to determine which is best for the employer.

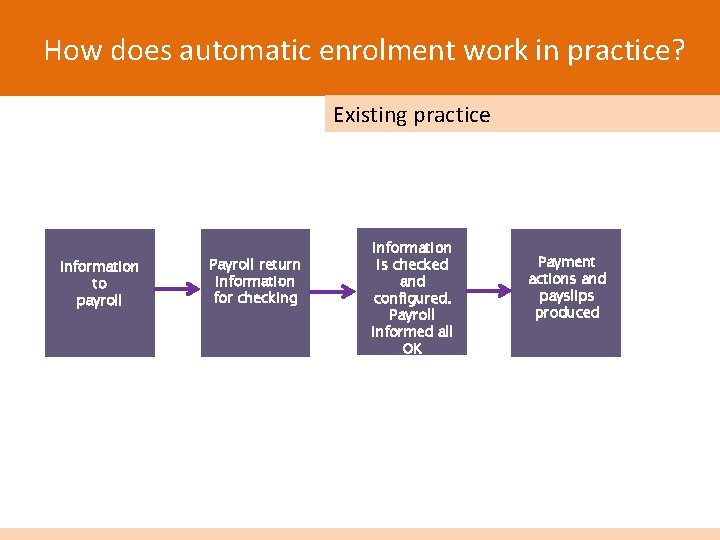

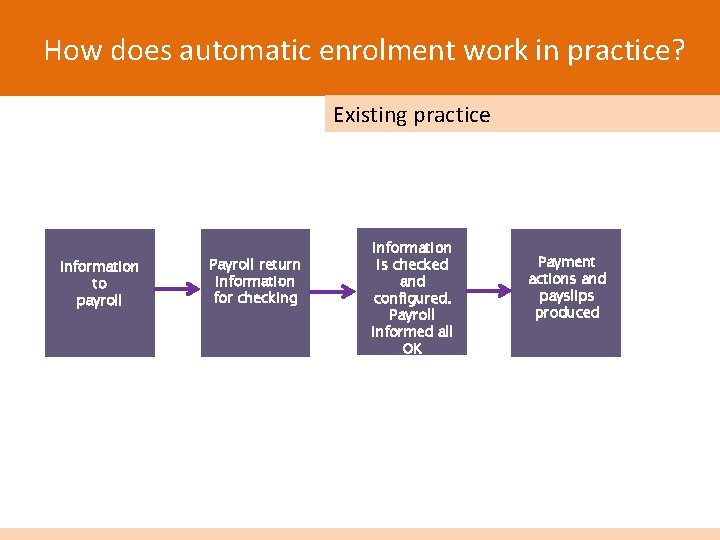

How does automatic enrolment work in practice? Existing practice Information to payroll Payroll return information for checking Information is checked and configured. Payroll informed all OK Payment actions and payslips produced

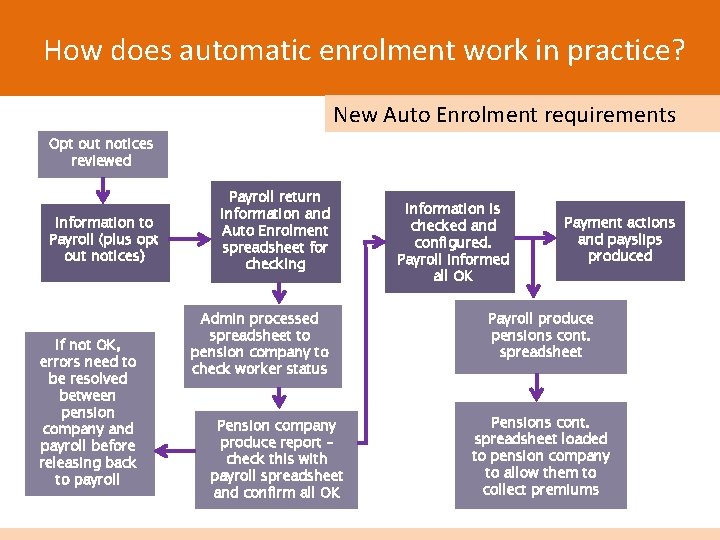

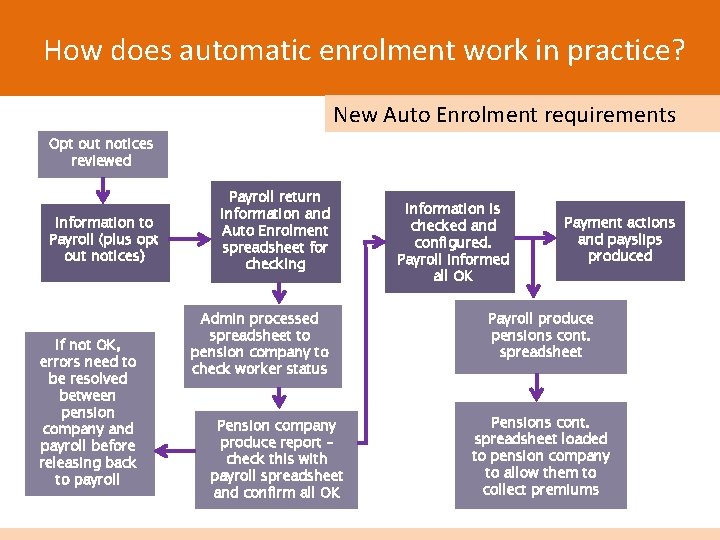

How does automatic enrolment work in practice? New Auto Enrolment requirements Opt out notices reviewed Information to Payroll (plus opt out notices) If not OK, errors need to be resolved between pension company and payroll before releasing back to payroll Payroll return information and Auto Enrolment spreadsheet for checking Admin processed spreadsheet to pension company to check worker status Pension company produce report – check this with payroll spreadsheet and confirm all OK Information is checked and configured. Payroll informed all OK Payment actions and payslips produced Payroll produce pensions cont. spreadsheet Pensions cont. spreadsheet loaded to pension company to allow them to collect premiums

Extras…. • Existing payroll companies – good and bad – do you know what they do? Some payrolls will do assessments, others won’t – and they provide different outputs. • Payroll Reference Period - what is it – how does it work? It is really important to understand these as these determine what you are assessing and when. • Non eligible staff – do I need a scheme for these and what do I tell The Pensions Regulator? YES and NO!

Any questions? Stewart Tomlinson - Mc. Parland & Partners Erica Dietsch – Hawsons Wealth Management Ltd

Information and disclaimer All of the information is based on our current understanding of the relevant legislation and regulations (including drafts) and may be subject to change. Hawsons Wealth Management Limited is authorised and regulated by the Financial Conduct Authority, Number 586696. Mc. Parland Partners is authorised and regulated by the Financial Conduct Authority, Number 475973 Please note that the value of investments and the income derived from them may fluctuate and investors may not receive back the amount originally invested. Past performance is not necessarily a guide to the future. Current tax levels and reliefs may change and the investments and investment services referred to may not be suitable for all investors. Hawsons Wealth Management Limited is registered in England. Registered No. 3508607. Registered office: Pegasus House, 463 a Glossop Road, Sheffield, S 10 2 QD.