Automatic enrolment Self Directed Support Scotland Ken Tymms

- Slides: 58

Automatic enrolment Self Directed Support Scotland Ken Tymms Industry liaison manager The Pensions Regulator 15 July 2015 The information we provide is for guidance only and should not be taken as a definitive interpretation of the law. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Topics • Why is automatic enrolment being introduced? • What employers need to do • Staging dates and overall timetable • Who are your workers? • Worker categories and the duties and rights for pension scheme enrolment • Communicating with workers • Qualifying earnings and the automatic enrolment processes • Postponement • Opt-ins and Opt-outs • Monitoring worker status and re-enrolment • Keeping records • Declaration of compliance DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Why is automatic enrolment being introduced? • As a society we are living longer, healthier lives. • There are currently four people of working age for every pensioner by 2050 there will be just two. • Millions of people are under-saving for their retirement. • Only 1 in 3 private sector workers were in a pension scheme in 2012 and the trend has been downwards for the last 40 years. • The reforms being introduced now will help millions of individuals to save more (or save for the first time) for their retirement. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Overview of legal duties and safeguards Automatic enrolment legislation gives employers a duty to: ü automatically enrol all eligible jobholders ü communicate to workers providing timely and appropriate information ü allow non-eligible jobholders to opt-in and entitled workers to join ü manage opt-outs within the opt-out period and promptly refund contributions ü automatically re-enrol eligible jobholders every three years ü complete declaration of compliance with the Regulator ü keep records ü maintain payments of contributions The employee safeguards state that employers: must not induce workers to opt-out or cease membership of a scheme must not indicate to a potential jobholder that their decision to opt-out will affect the outcome of the recruitment process DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

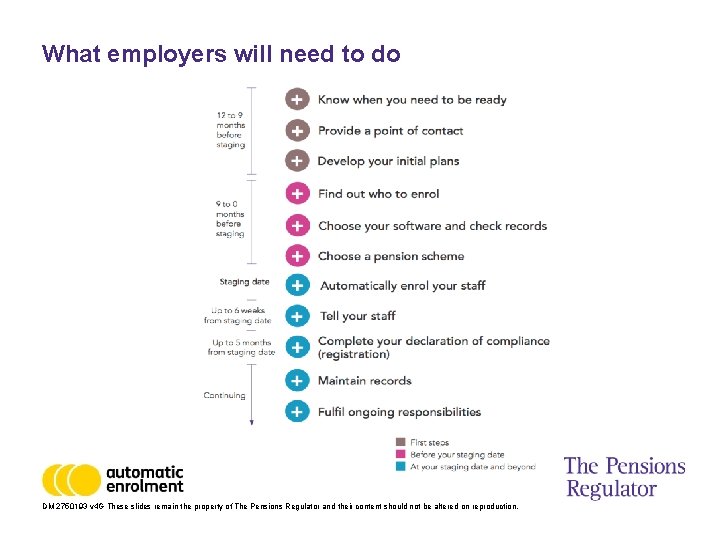

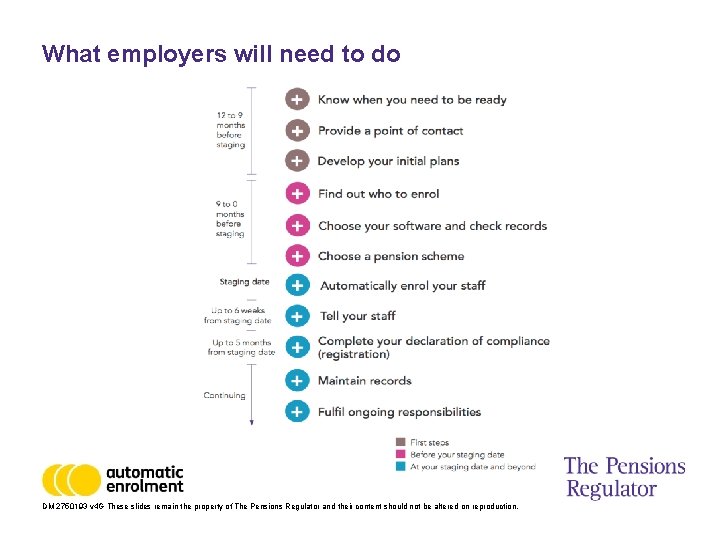

What employers will need to do DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

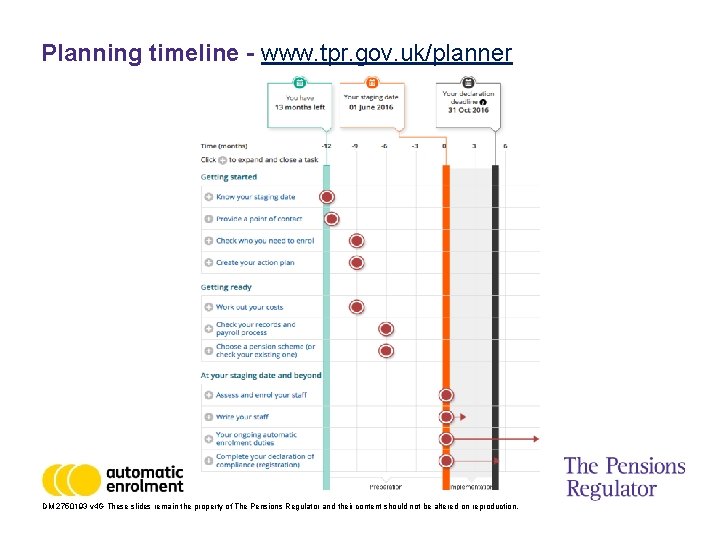

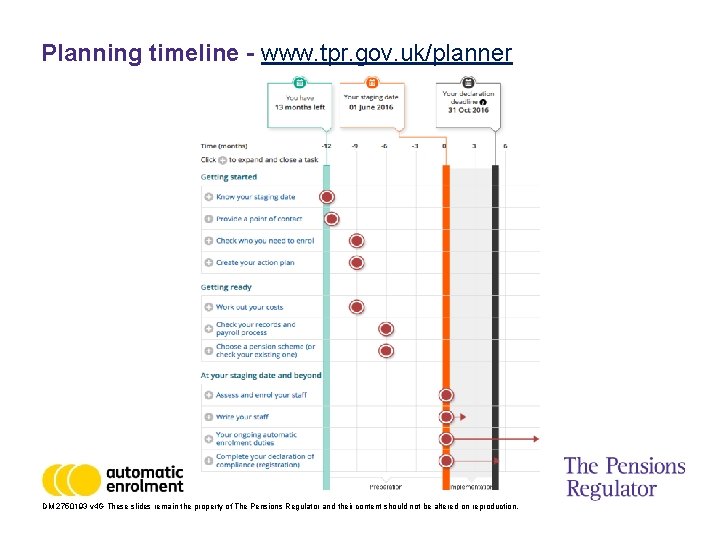

Planning timeline - www. tpr. gov. uk/planner DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

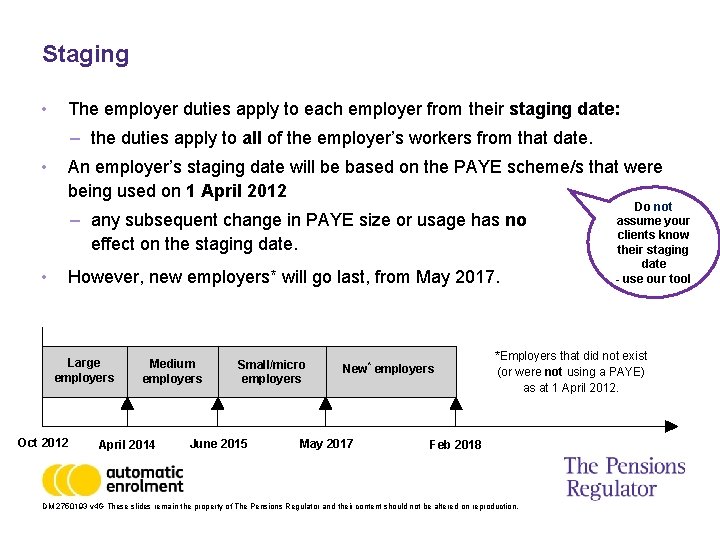

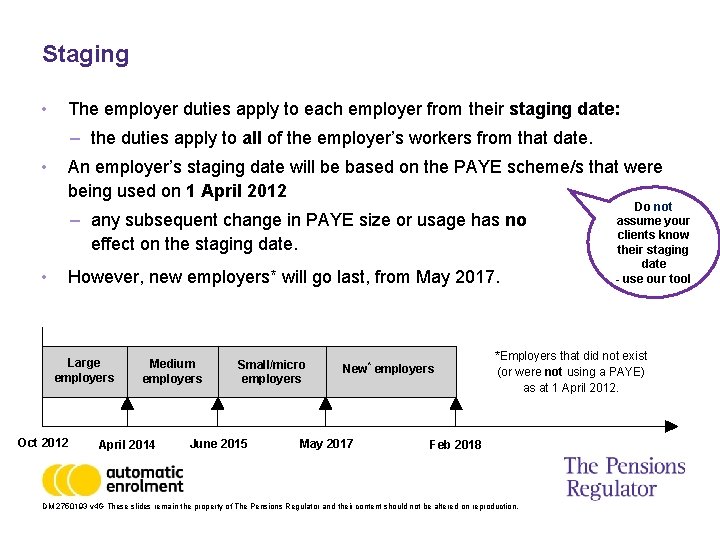

Staging • The employer duties apply to each employer from their staging date: – the duties apply to all of the employer’s workers from that date. • An employer’s staging date will be based on the PAYE scheme/s that were being used on 1 April 2012 – any subsequent change in PAYE size or usage has no effect on the staging date. • However, new employers* will go last, from May 2017. Large employers Oct 2012 Medium employers April 2014 Small/micro employers June 2015 New* employers May 2017 Do not assume your clients know their staging date - use our tool *Employers that did not exist (or were not using a PAYE) as at 1 April 2012. Feb 2018 DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

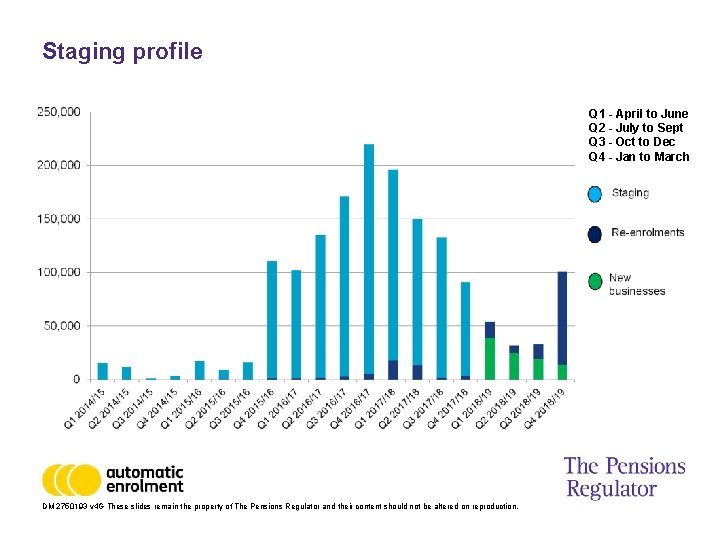

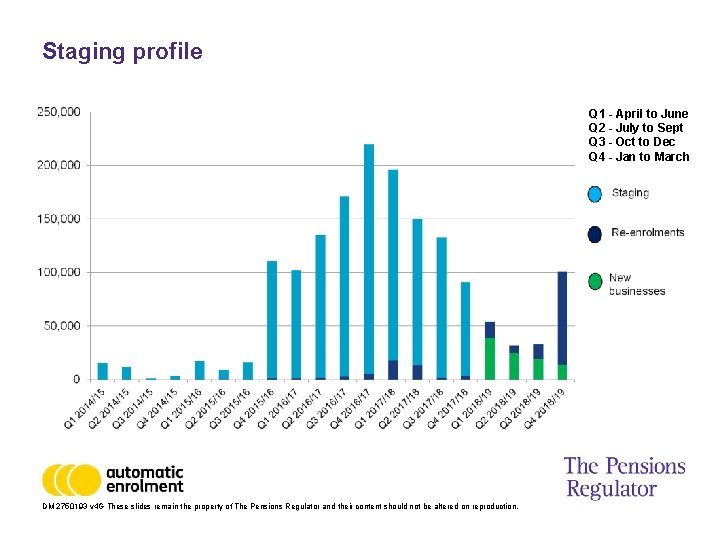

Staging profile Q 1 - April to June Q 2 - July to Sept Q 3 - Oct to Dec Q 4 - Jan to March DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

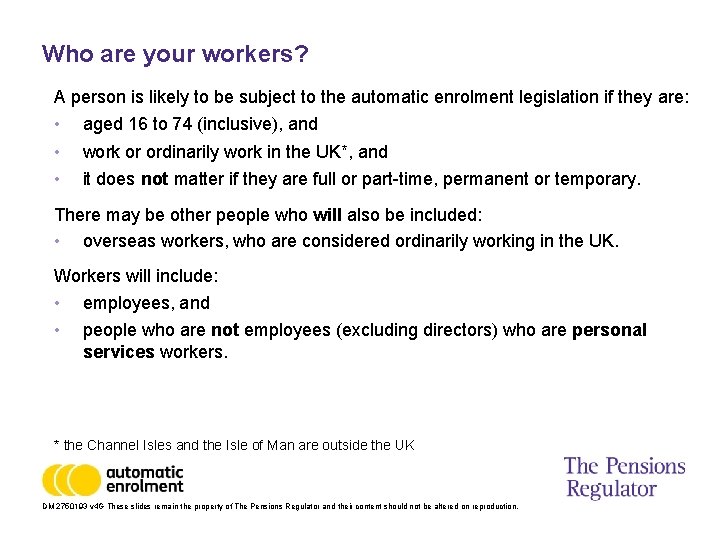

Who are your workers? A person is likely to be subject to the automatic enrolment legislation if they are: • • • aged 16 to 74 (inclusive), and work or ordinarily work in the UK*, and it does not matter if they are full or part-time, permanent or temporary. There may be other people who will also be included: • overseas workers, who are considered ordinarily working in the UK. Workers will include: • employees, and • people who are not employees (excluding directors) who are personal services workers. * the Channel Isles and the Isle of Man are outside the UK DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

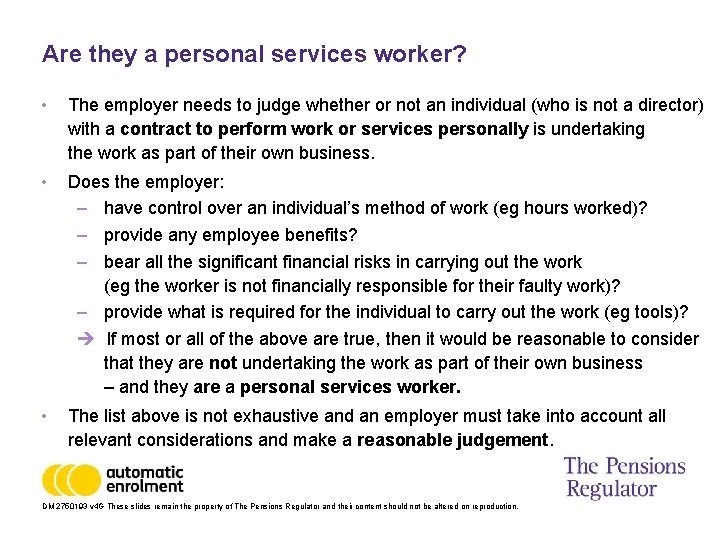

Are they a personal services worker? • The employer needs to judge whether or not an individual (who is not a director) with a contract to perform work or services personally is undertaking the work as part of their own business. • Does the employer: – have control over an individual’s method of work (eg hours worked)? – provide any employee benefits? – bear all the significant financial risks in carrying out the work (eg the worker is not financially responsible for their faulty work)? – provide what is required for the individual to carry out the work (eg tools)? If most or all of the above are true, then it would be reasonable to consider that they are not undertaking the work as part of their own business – and they are a personal services worker. • The list above is not exhaustive and an employer must take into account all relevant considerations and make a reasonable judgement. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

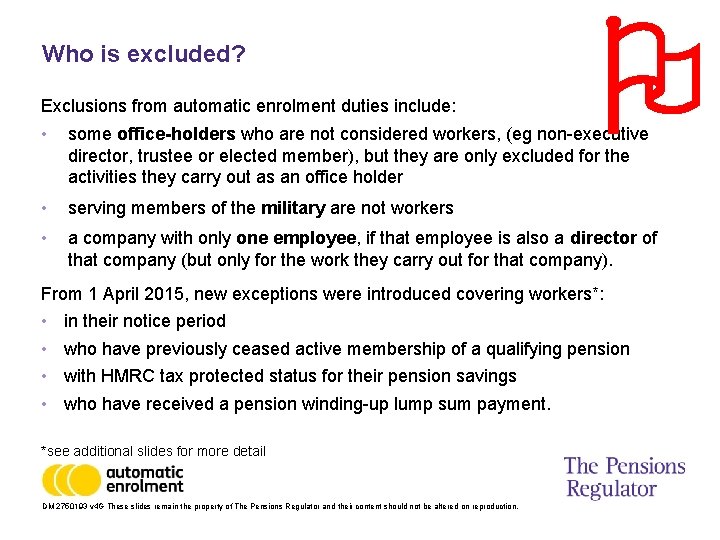

Who is excluded? Exclusions from automatic enrolment duties include: • some office-holders who are not considered workers, (eg non-executive director, trustee or elected member), but they are only excluded for the activities they carry out as an office holder • serving members of the military are not workers • a company with only one employee, if that employee is also a director of that company (but only for the work they carry out for that company). From 1 April 2015, new exceptions were introduced covering workers*: • • in their notice period who have previously ceased active membership of a qualifying pension with HMRC tax protected status for their pension savings who have received a pension winding-up lump sum payment. *see additional slides for more detail DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

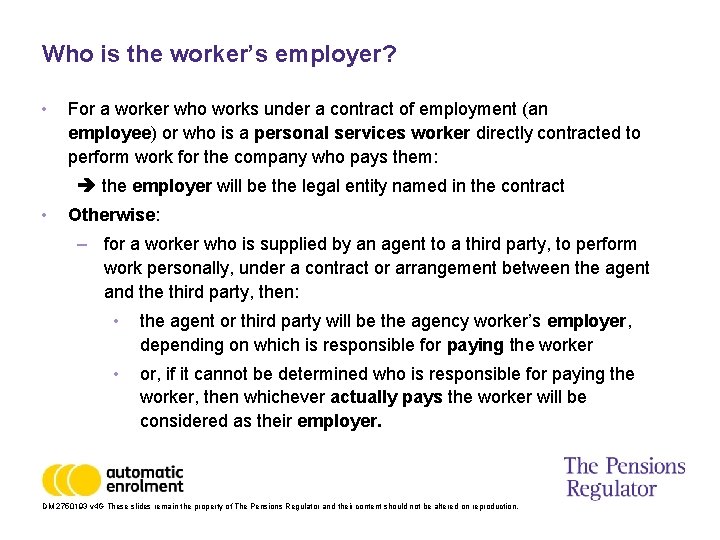

Who is the worker’s employer? • For a worker who works under a contract of employment (an employee) or who is a personal services worker directly contracted to perform work for the company who pays them: the employer will be the legal entity named in the contract • Otherwise: – for a worker who is supplied by an agent to a third party, to perform work personally, under a contract or arrangement between the agent and the third party, then: • the agent or third party will be the agency worker’s employer, depending on which is responsible for paying the worker • or, if it cannot be determined who is responsible for paying the worker, then whichever actually pays the worker will be considered as their employer. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

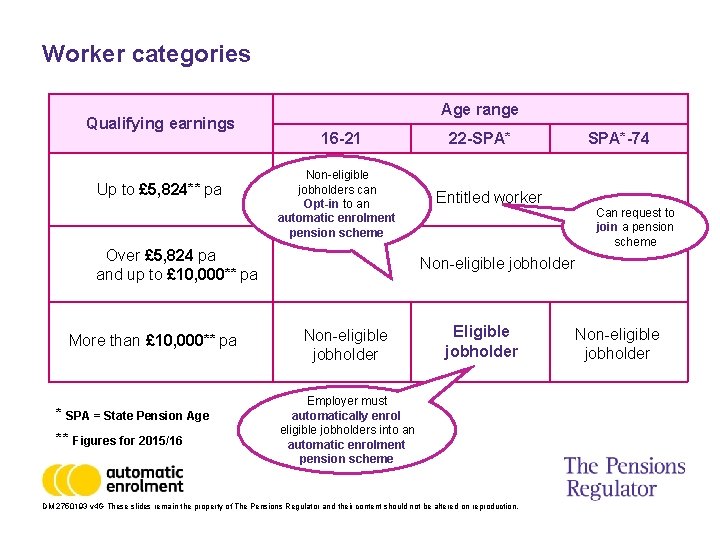

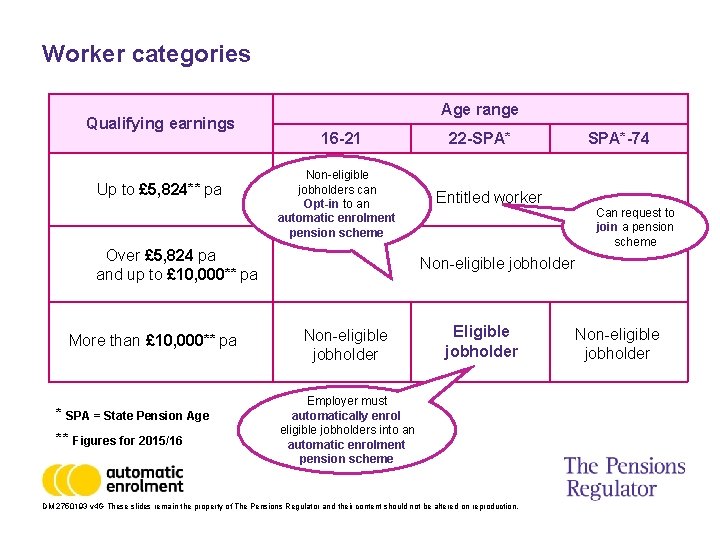

Worker categories Qualifying earnings Up to £ 5, 824** Under £ 5, 668† pa pa Between £ 5, 668 Over £ 5, 824 papa pa and up up to to £ 10, 000** £ 9, 440† pa Morethan£ 10, 000** £ 9, 440† pa pa * SPA = State Pension Age ** Figures for 2015/16 Age range 16 -21 22 -SPA* Non-eligible jobholders can Opt-in to an automatic enrolment pension scheme SPA*-74 Entitled worker Non-Eligible Jobholder Non-eligible jobholder Non-Eligible Jobholder Non-eligible jobholder Employer must automatically enrol eligible jobholders into an automatic enrolment pension scheme DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction. Can request to join a pension scheme Non-Eligible Non-eligible Jobholder jobholder

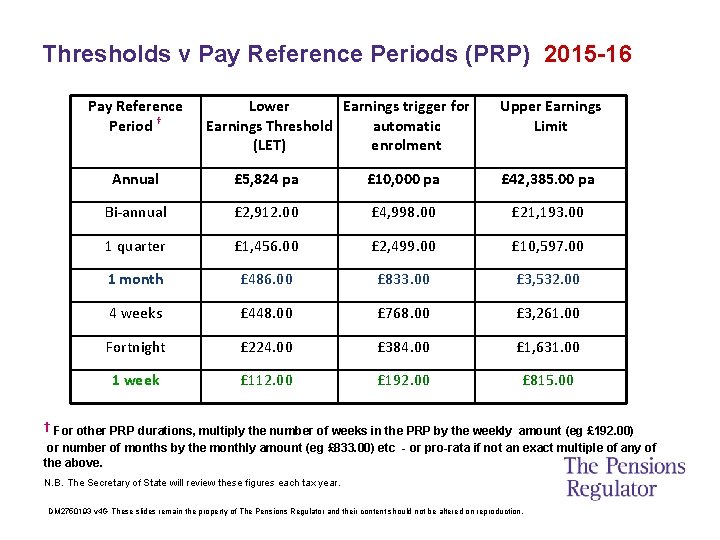

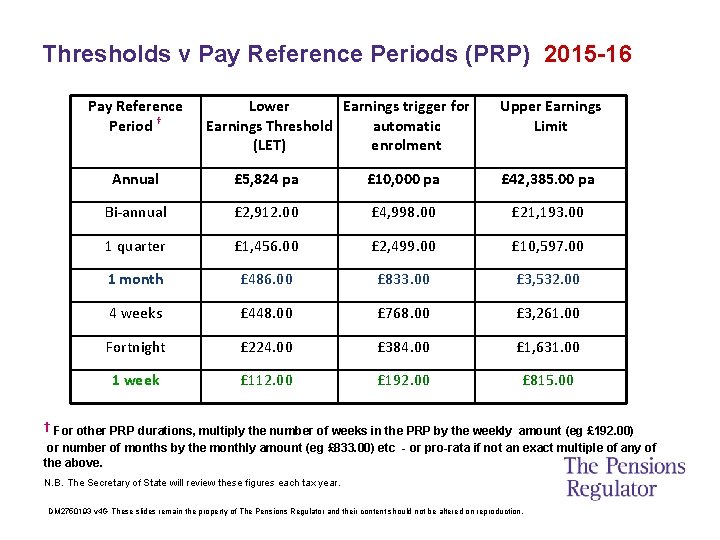

Thresholds v Pay Reference Periods (PRP) 2015 -16 Pay Reference Period † Lower Earnings trigger for Earnings Threshold automatic (LET) enrolment Upper Earnings Limit Annual £ 5, 824 pa £ 10, 000 pa £ 42, 385. 00 pa Bi-annual £ 2, 912. 00 £ 4, 998. 00 £ 21, 193. 00 1 quarter £ 1, 456. 00 £ 2, 499. 00 £ 10, 597. 00 1 month £ 486. 00 £ 833. 00 £ 3, 532. 00 4 weeks £ 448. 00 £ 768. 00 £ 3, 261. 00 Fortnight £ 224. 00 £ 384. 00 £ 1, 631. 00 1 week £ 112. 00 £ 192. 00 £ 815. 00 † For other PRP durations, multiply the number of weeks in the PRP by the weekly amount (eg £ 192. 00) or number of months by the monthly amount (eg £ 833. 00) etc - or pro-rata if not an exact multiple of any of the above. N. B. The Secretary of State will review these figures each tax year. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

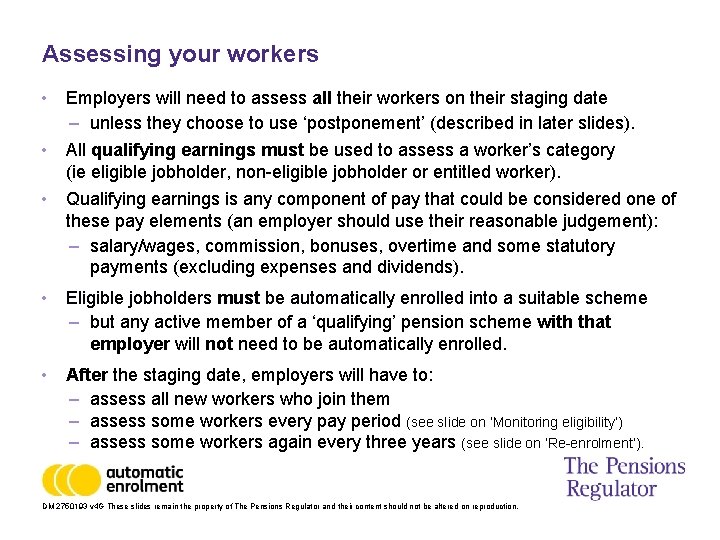

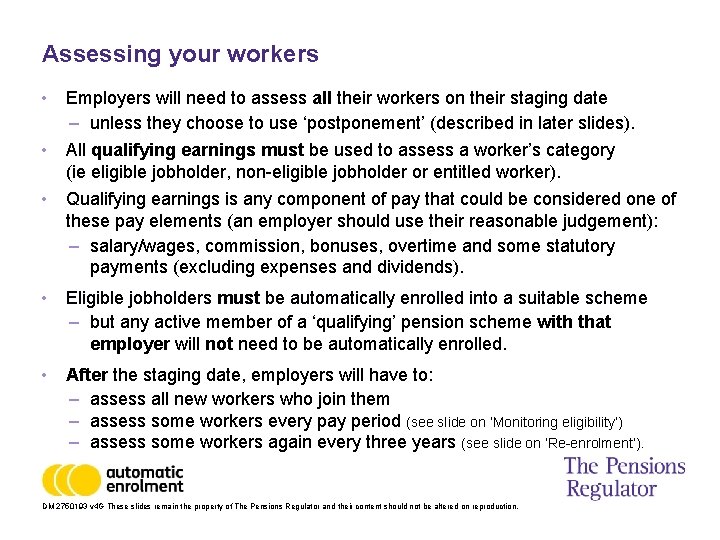

Assessing your workers • Employers will need to assess all their workers on their staging date – unless they choose to use ‘postponement’ (described in later slides). • All qualifying earnings must be used to assess a worker’s category (ie eligible jobholder, non-eligible jobholder or entitled worker). • Qualifying earnings is any component of pay that could be considered one of these pay elements (an employer should use their reasonable judgement): – salary/wages, commission, bonuses, overtime and some statutory payments (excluding expenses and dividends). • Eligible jobholders must be automatically enrolled into a suitable scheme – but any active member of a ‘qualifying’ pension scheme with that employer will not need to be automatically enrolled. • After the staging date, employers will have to: – assess all new workers who join them – assess some workers every pay period (see slide on ‘Monitoring eligibility’) – assess some workers again every three years (see slide on ‘Re-enrolment’). DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

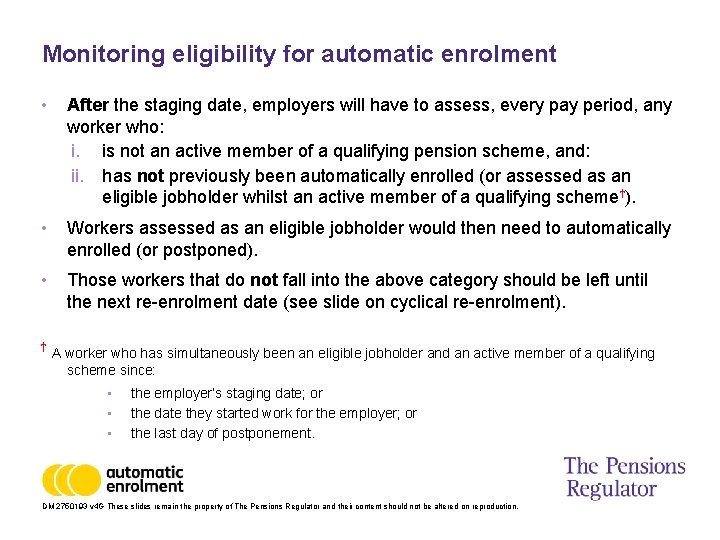

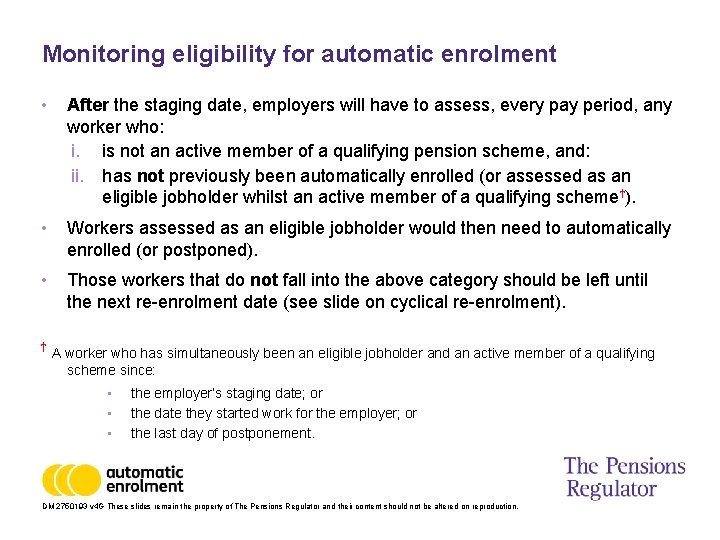

Monitoring eligibility for automatic enrolment • After the staging date, employers will have to assess, every pay period, any worker who: i. is not an active member of a qualifying pension scheme, and: ii. has not previously been automatically enrolled (or assessed as an eligible jobholder whilst an active member of a qualifying schemeϮ). • Workers assessed as an eligible jobholder would then need to automatically enrolled (or postponed). • Those workers that do not fall into the above category should be left until the next re-enrolment date (see slide on cyclical re-enrolment). Ϯ A worker who has simultaneously been an eligible jobholder and an active member of a qualifying scheme since: • • • the employer’s staging date; or the date they started work for the employer; or the last day of postponement. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

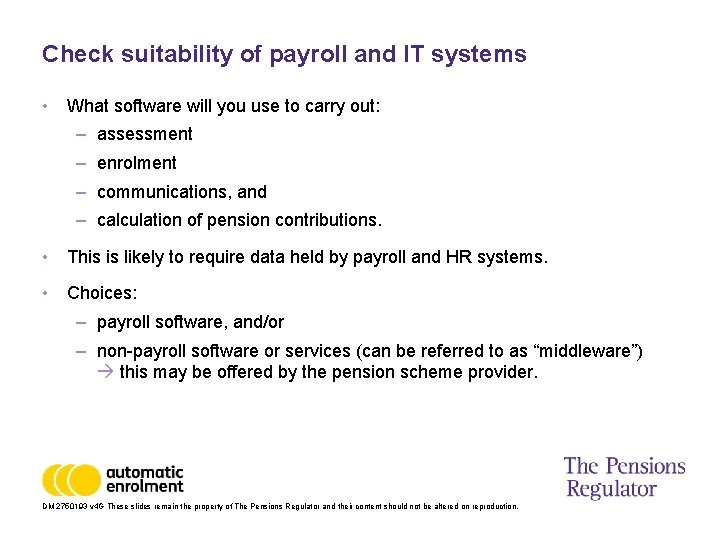

Check suitability of payroll and IT systems • What software will you use to carry out: – assessment – enrolment – communications, and – calculation of pension contributions. • This is likely to require data held by payroll and HR systems. • Choices: – payroll software, and/or – non-payroll software or services (can be referred to as “middleware”) this may be offered by the pension scheme provider. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

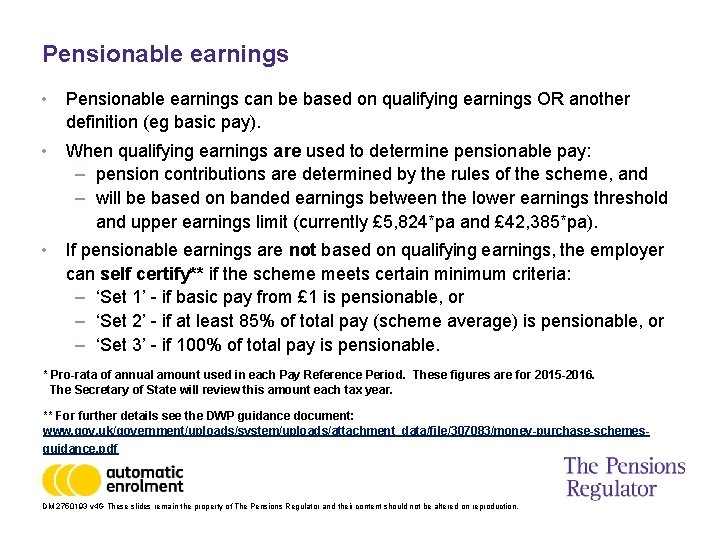

Pensionable earnings • Pensionable earnings can be based on qualifying earnings OR another definition (eg basic pay). • When qualifying earnings are used to determine pensionable pay: – pension contributions are determined by the rules of the scheme, and – will be based on banded earnings between the lower earnings threshold and upper earnings limit (currently £ 5, 824*pa and £ 42, 385*pa). • If pensionable earnings are not based on qualifying earnings, the employer can self certify** if the scheme meets certain minimum criteria: – ‘Set 1’ - if basic pay from £ 1 is pensionable, or – ‘Set 2’ - if at least 85% of total pay (scheme average) is pensionable, or – ‘Set 3’ - if 100% of total pay is pensionable. * Pro-rata of annual amount used in each Pay Reference Period. These figures are for 2015 -2016. The Secretary of State will review this amount each tax year. ** For further details see the DWP guidance document: www. gov. uk/government/uploads/system/uploads/attachment_data/file/307083/money-purchase-schemesguidance. pdf DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

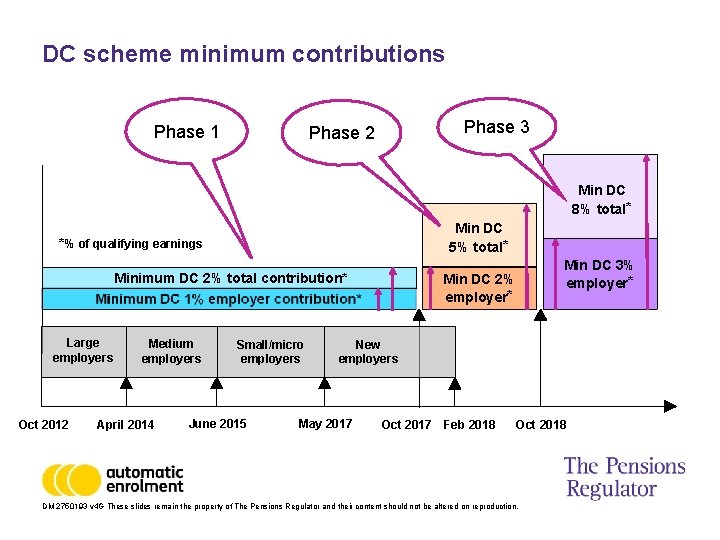

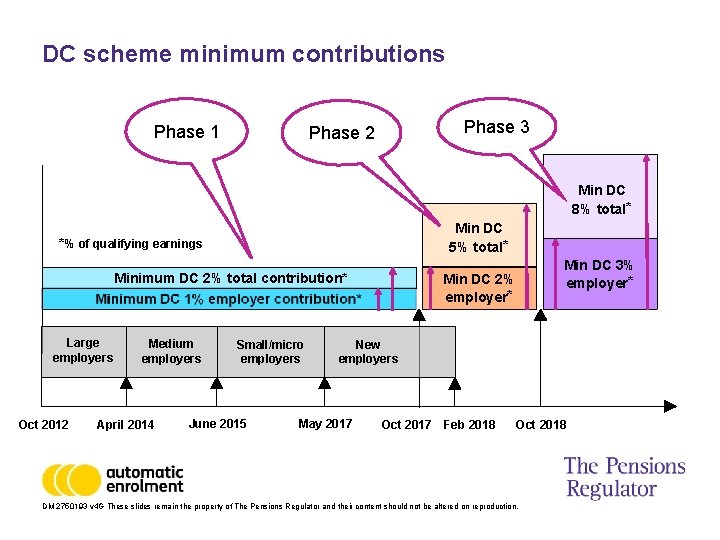

DC scheme minimum contributions Phase 1 Phase 3 Phase 2 Min DC 8% total* Min DC 5% total* *% of qualifying earnings Minimum DC 2% total contribution* Large employers Oct 2012 Medium employers April 2014 Small/micro employers June 2015 Min DC 3% employer* Min DC 2% employer* New employers May 2017 Oct 2017 Feb 2018 Oct 2018 DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

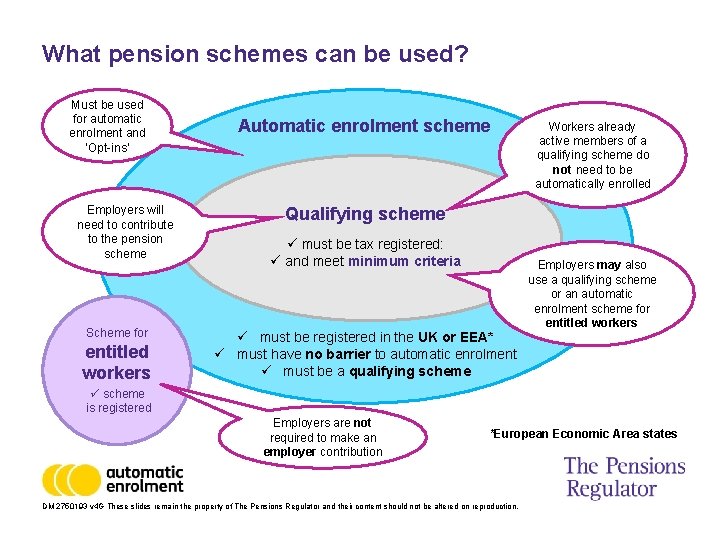

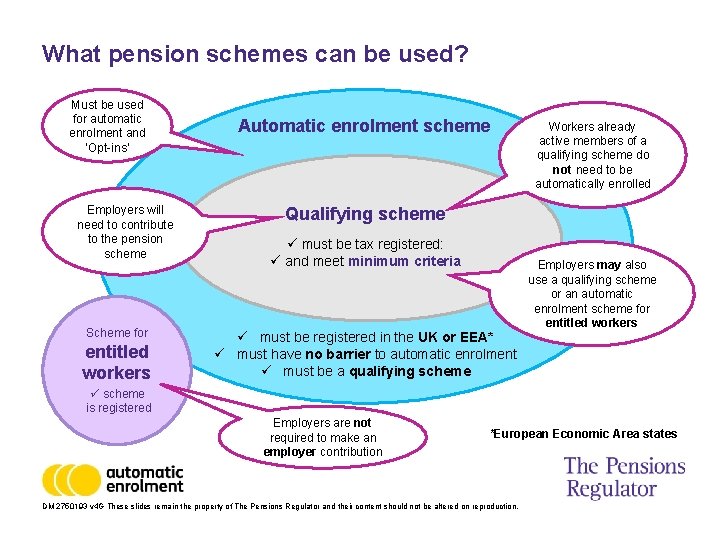

What pension schemes can be used? Must be used for automatic enrolment and ‘Opt-ins’ Employers will need to contribute to the pension scheme Scheme for entitled workers Automatic enrolment scheme Workers already active members of a qualifying scheme do not need to be automatically enrolled Qualifying scheme ü must be tax registered: ü and meet minimum criteria ü must be registered in the UK or EEA* ü must have no barrier to automatic enrolment ü must be a qualifying scheme Employers may also use a qualifying scheme or an automatic enrolment scheme for entitled workers ü scheme is registered Employers are not required to make an employer contribution *European Economic Area states DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

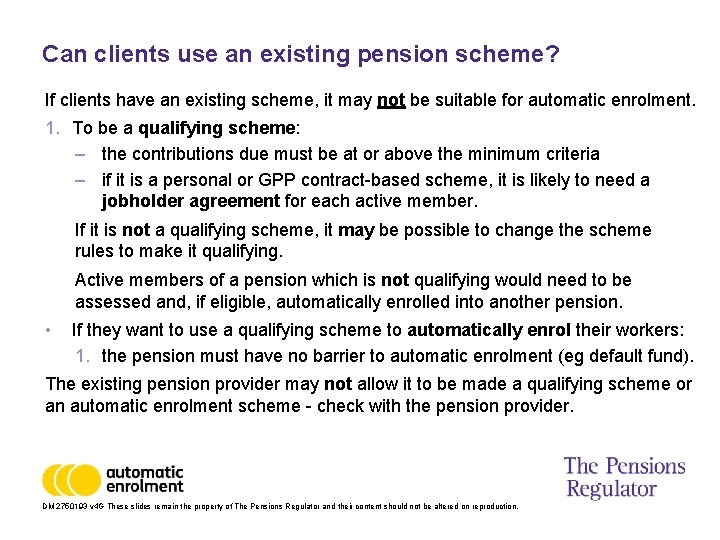

Can clients use an existing pension scheme? If clients have an existing scheme, it may not be suitable for automatic enrolment. 1. To be a qualifying scheme: – the contributions due must be at or above the minimum criteria – if it is a personal or GPP contract-based scheme, it is likely to need a jobholder agreement for each active member. If it is not a qualifying scheme, it may be possible to change the scheme rules to make it qualifying. Active members of a pension which is not qualifying would need to be assessed and, if eligible, automatically enrolled into another pension. • If they want to use a qualifying scheme to automatically enrol their workers: 1. the pension must have no barrier to automatic enrolment (eg default fund). The existing pension provider may not allow it to be made a qualifying scheme or an automatic enrolment scheme - check with the pension provider. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Choosing a new pension - how to find one How will you find a pension if you need or want to use a new scheme? • For further information and a list of pension providers see: – The National Association of Pension Funds (NAPF)* – The Association of British Insurers(ABI)* • Pension providers: – – • not all pension providers may offer you a pension scheme some providers may be at full capacity or have long waiting times you should investigate more than one pension provider at a time information about their pensions can typically be found on their websites National Employment Savings Trust (NEST)* is a pension scheme that all employers can use to meet their duties but don’t leave it too late. * These can be found on our Useful links slide DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Choosing a new pension - factors to consider • It is the employer’s responsibility to choose a pension scheme for their workers. • Employers should consider what features are important for their workers, for example: – charges (there is an annual 0. 75% charge cap on the default fund) – – – • choice of funds other than the default strategy (eg Sharia, ethical) options at retirement and/or from age 55 (eg drawdown options) whether they provide ‘one pot per member’ and rules on transfers how tax relief is applied (eg through payroll or by the pension provider) online member services member communications (may be available in multiple languages) For help on how to select a good qualifying pension, please see: www. tpr. gov. uk/employers/setting-up-a-pension-scheme. aspx DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Postponement • • • Postponement does not change or delay the staging date Postponement suspends the duty of automatic enrolment and the need to assess and can be used: – at the employer’s staging date for any or all existing workers – on the first day of employment for any new joiner after the staging date, and – on the date a worker meets the criteria to be an eligible jobholder. Only one postponement per worker can be made at a given time. Each worker can be postponed from one day up to maximum of three months. The employer must notify any postponed worker within six weeks and a day of the start of postponement. The worker has the right to opt-in or join during postponement. Employer must assess on the last day of postponement and: – automatically enrol eligible jobholders, and – for those workers not eligible, monitor them each future pay period. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Opting-in and joining • Entitled workers can request to join a scheme at any time, including during postponement. • Jobholders can Opt-in at any time, including during postponement. • However, workers will not necessarily know whether they are jobholders or entitled workers and this could vary over time. • All requests (whether an Opt-in or join request) are treated the same way. • On receipt of any request to Opt-in or join a pension from a worker, employers need to: – assess the worker, to see if they are a jobholder or entitled worker, then – enrol jobholders into an automatic enrolment scheme, and – enrol entitled workers into a scheme of the employer’s choice. • A jobholder must not be required to carry out any further action to achieve active membership (eg the pension scheme should have a default fund). DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

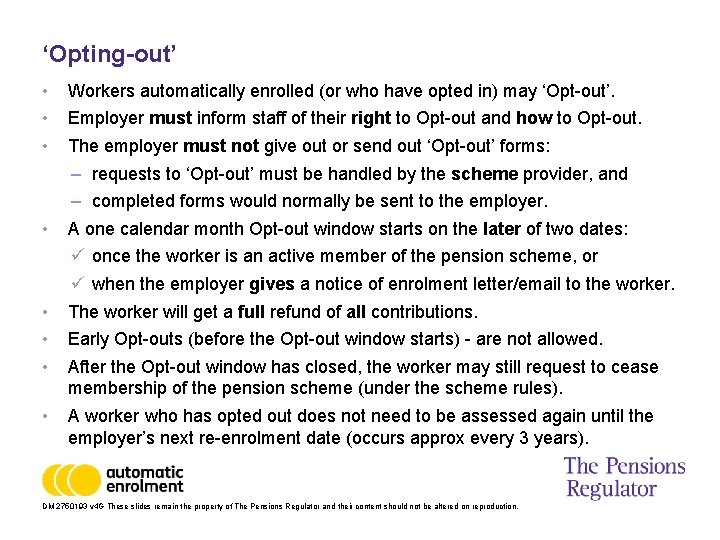

‘Opting-out’ • • Workers automatically enrolled (or who have opted in) may ‘Opt-out’. Employer must inform staff of their right to Opt-out and how to Opt-out. The employer must not give out or send out ‘Opt-out’ forms: – requests to ‘Opt-out’ must be handled by the scheme provider, and – completed forms would normally be sent to the employer. A one calendar month Opt-out window starts on the later of two dates: ü once the worker is an active member of the pension scheme, or ü when the employer gives a notice of enrolment letter/email to the worker. The worker will get a full refund of all contributions. Early Opt-outs (before the Opt-out window starts) - are not allowed. After the Opt-out window has closed, the worker may still request to cease membership of the pension scheme (under the scheme rules). A worker who has opted out does not need to be assessed again until the employer’s next re-enrolment date (occurs approx every 3 years). DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

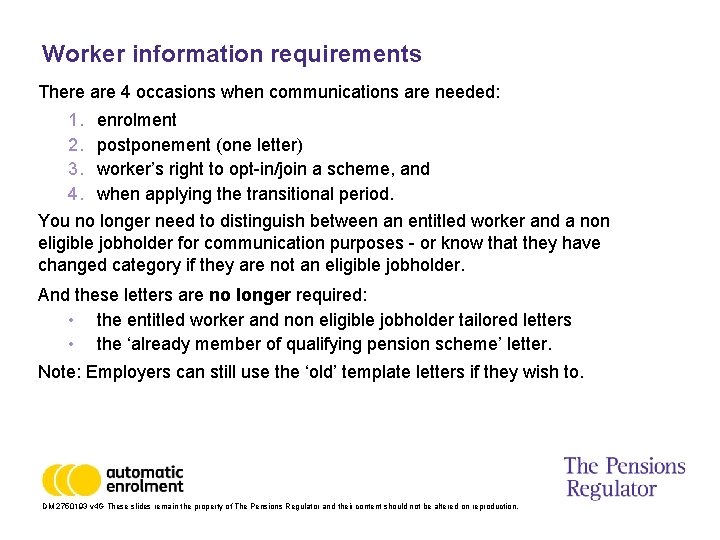

Worker information requirements There are 4 occasions when communications are needed: 1. enrolment 2. postponement (one letter) 3. worker’s right to opt-in/join a scheme, and 4. when applying the transitional period. You no longer need to distinguish between an entitled worker and a non eligible jobholder for communication purposes - or know that they have changed category if they are not an eligible jobholder. And these letters are no longer required: • the entitled worker and non eligible jobholder tailored letters • the ‘already member of qualifying pension scheme’ letter. Note: Employers can still use the ‘old’ template letters if they wish to. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

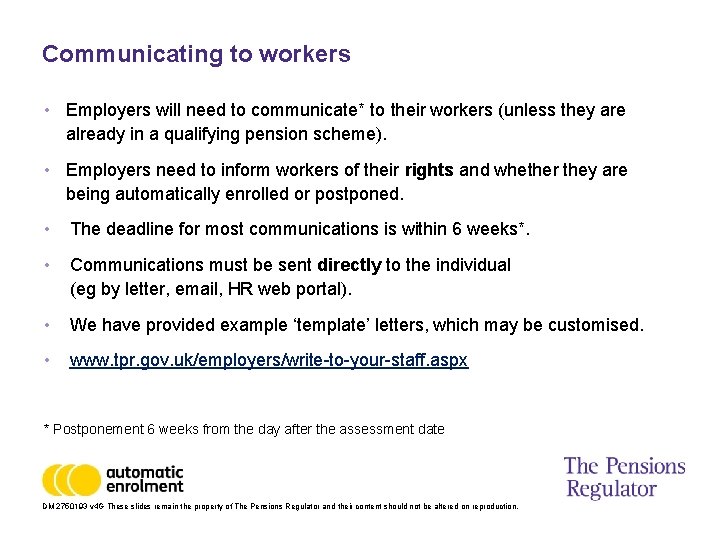

Communicating to workers • Employers will need to communicate* to their workers (unless they are already in a qualifying pension scheme). • Employers need to inform workers of their rights and whether they are being automatically enrolled or postponed. • The deadline for most communications is within 6 weeks*. • Communications must be sent directly to the individual (eg by letter, email, HR web portal). • We have provided example ‘template’ letters, which may be customised. • www. tpr. gov. uk/employers/write-to-your-staff. aspx * Postponement 6 weeks from the day after the assessment date DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

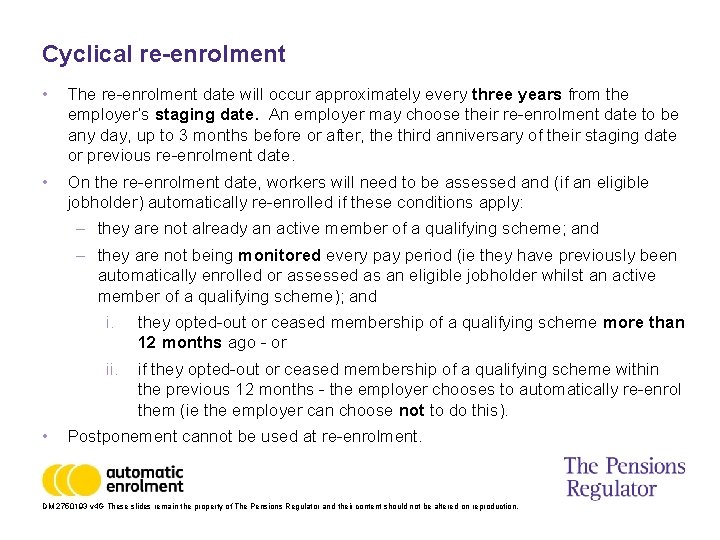

Cyclical re-enrolment • The re-enrolment date will occur approximately every three years from the employer’s staging date. An employer may choose their re-enrolment date to be any day, up to 3 months before or after, the third anniversary of their staging date or previous re-enrolment date. • On the re-enrolment date, workers will need to be assessed and (if an eligible jobholder) automatically re-enrolled if these conditions apply: – they are not already an active member of a qualifying scheme; and – they are not being monitored every pay period (ie they have previously been automatically enrolled or assessed as an eligible jobholder whilst an active member of a qualifying scheme); and • i. they opted-out or ceased membership of a qualifying scheme more than 12 months ago - or ii. if they opted-out or ceased membership of a qualifying scheme within the previous 12 months - the employer chooses to automatically re-enrol them (ie the employer can choose not to do this). Postponement cannot be used at re-enrolment. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Record-keeping • Employers must keep records* about their workers and the pension scheme used to comply with the employer duties (pension providers and trustees will also have duties to keep records). • An employer can use electronic or paper filing systems to keep or store any records, as long as these records can be produced in a legible way. • Most records must be kept for six years. Those that relate to opting-out must be kept for four years. • The records must be provided to The Pensions Regulator, on request. • We can conduct an inspection, if we have reasonable grounds to do so (for example, this may be as a result of a whistleblower alert). * See planning tool and ‘keep records’ DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Declaration of compliance • • • After staging, employers must complete a declaration of compliance – and it must be completed within five months of the staging date and – within two months after every re-enrolment date Employers may receive a penalty fine if they do not complete their declaration on time. Employers will need to provide certain details, for example: – which pension schemes were used to comply with the duties, and – the number of eligible jobholders automatically enrolled into each scheme. All postponements applied at the staging date must have come to an end before the declaration can be completed. You can start the online process early and partially complete your declaration. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Any questions? DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Useful tools • Create an action plan and add important dates to calendar: www. tpr. gov. uk/employers/planning-for-automatic-enrolment. aspx • Nominate a contact: https: //automation. thepensionsregulator. gov. uk/Nomination • Staging date tools: – finding out a staging date www. tpr. gov. uk/employers/tools/staging-date. aspx – staging date for a “new” company set up after 1 April 2012 – www. tpr. gov. uk/employers/exceptions. aspx – bringing staging date forward – www. autoenrol. tpr. gov. uk – getting bulk staging dates and exporting bulk declaration of compliance – AEData. Request@thepensionsregulator. gov. uk DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Useful tools • Find a letter code online: https: //automation. thepensionsregulator. gov. uk/Letter. Code • Tell us if you are not an employer: https: //automation. thepensionsregulator. gov. uk/notanemployer • Work out pension contributions: www. tpr. gov. uk/employers/employer-contributions. aspx • Pay your fine online: www. tpr. gov. uk/employers/what-happens-if-i-dont-comply. aspx DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Useful links • Event presentations: www. tpr. gov. uk/doc-library/ae-presentations. aspx • The essential guide to automatic enrolment: www. tpr. gov. uk/employers/e-brochure/index. html • Our detailed guides for employers and pension professionals: www. tpr. gov. uk/pensions-reform/detailed-guidance. aspx • Information about declaration of compliance: www. tpr. gov. uk/declaration • Letter templates for employers: www. tpr. gov. uk/employers/letter-templates-for-employers. aspx • ‘We’re all in’ poster available to download on our website (you can add your company name and logo) at www. tpr. gov. uk/employers/raising-awareness-about-automatic-enrolment. aspx DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Useful links More information about pensions and automatic enrolment: • The Association of British Insurers: www. abi. org. uk/pensionproviders • The National Association of Pension Funds: www. napf. co. uk • National Employment Savings Trust: www. nestpensions. org. uk • Independent Financial Advisers: www. unbiased. co. uk www. vouchedfor. co. uk • Friends of Automatic Enrolment: www. cipp. org. uk/en/Pensions/friends-of-automatic-enrolment/ • The Pensions Regulator: www. tpr. gov. uk/docs/selecting-a-good-automatic-enrolment-scheme. pdf www. tpr. gov. uk/docs/introduction-code-13. pdf DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Useful links - webinars and videos • Director exemptions explained: www. tpr. gov. uk/ILT-director-video • Automatic enrolment – for business advisers. www. tpr. gov. uk/press/webinar-automatic-enrolment-for-business-advisers. aspx • Automatic enrolment question time. www. tpr. gov. uk/press/webinar-automatic-enrolment-question-time. aspx • Automatic enrolment declaration of compliance. www. tpr. gov. uk/press/webinar-automatic-enrolment-declaration-of-compliance. aspx • Automatic enrolment – are you ready? www. tpr. gov. uk/press/webinar-automatic-enrolment-are-you-ready. aspx • Automatic enrolment – dispelling the myths. www. tpr. gov. uk/press/webinar-automatic-enrolment-dispelling-the-myths. aspx • Implementing automatic enrolment systems and pension schemes. www. tpr. gov. uk/press/webinar-implementing-automatic-enrolment-systems-schemes. aspx DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Thank you We are here to help! Request a guest speaker: https: //secure. tpr. gov. uk/speaker-request. aspx Contact us at: www. tpr. gov. uk/contact-us. aspx Subscribe to our news by email: https: //forms. thepensionsregulator. gov. uk/subscribe. aspx The information we provide is for guidance only and should not be taken as a definitive interpretation of the law. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Additional slides DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Exception - workers in notice period If notice is given or received by the worker (eg resignation or dismissal): • before, or up to 6 weeks after, the automatic enrolment/re-enrolment date then the employer does not have to enrol the worker. During their notice period the worker cannot opt-in or join. If notice is withdrawn, then the enrolment duty will be effective from this date. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

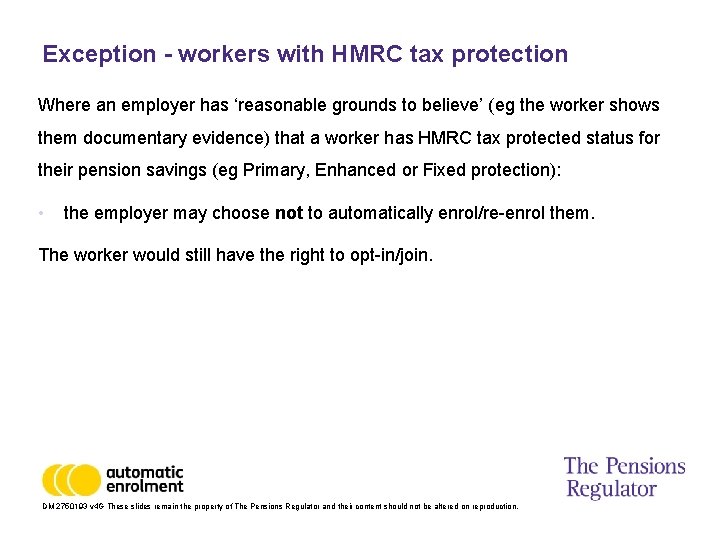

Exception - workers with HMRC tax protection Where an employer has ‘reasonable grounds to believe’ (eg the worker shows them documentary evidence) that a worker has HMRC tax protected status for their pension savings (eg Primary, Enhanced or Fixed protection): • the employer may choose not to automatically enrol/re-enrol them. The worker would still have the right to opt-in/join. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

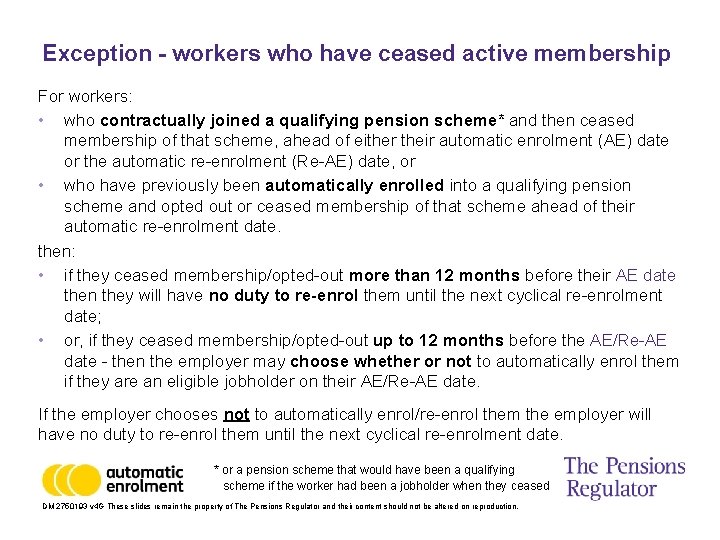

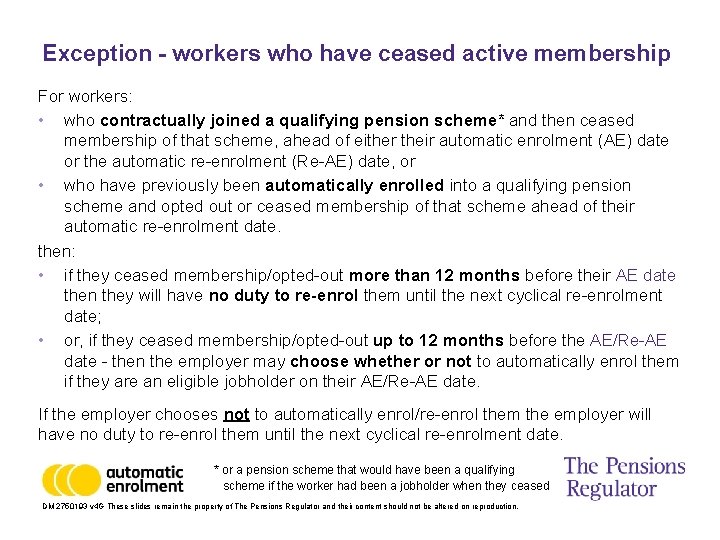

Exception - workers who have ceased active membership For workers: • who contractually joined a qualifying pension scheme* and then ceased membership of that scheme, ahead of either their automatic enrolment (AE) date or the automatic re-enrolment (Re-AE) date, or • who have previously been automatically enrolled into a qualifying pension scheme and opted out or ceased membership of that scheme ahead of their automatic re-enrolment date. then: • if they ceased membership/opted-out more than 12 months before their AE date then they will have no duty to re-enrol them until the next cyclical re-enrolment date; • or, if they ceased membership/opted-out up to 12 months before the AE/Re-AE date - then the employer may choose whether or not to automatically enrol them if they are an eligible jobholder on their AE/Re-AE date. If the employer chooses not to automatically enrol/re-enrol them the employer will have no duty to re-enrol them until the next cyclical re-enrolment date. * or a pension scheme that would have been a qualifying scheme if the worker had been a jobholder when they ceased DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

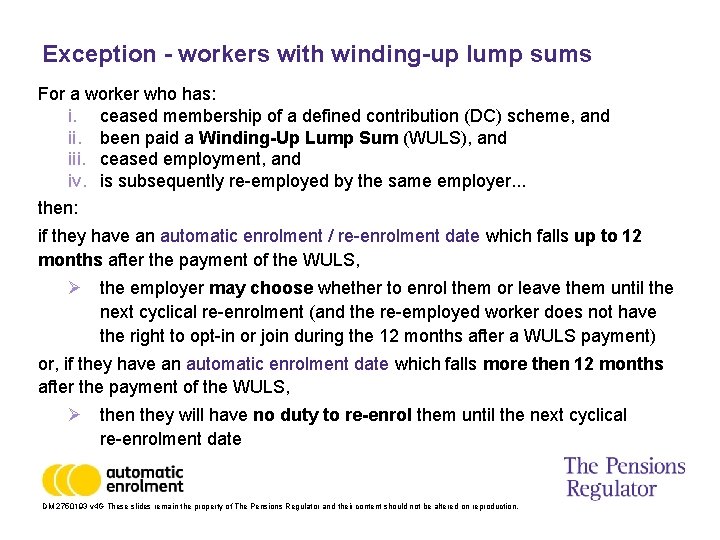

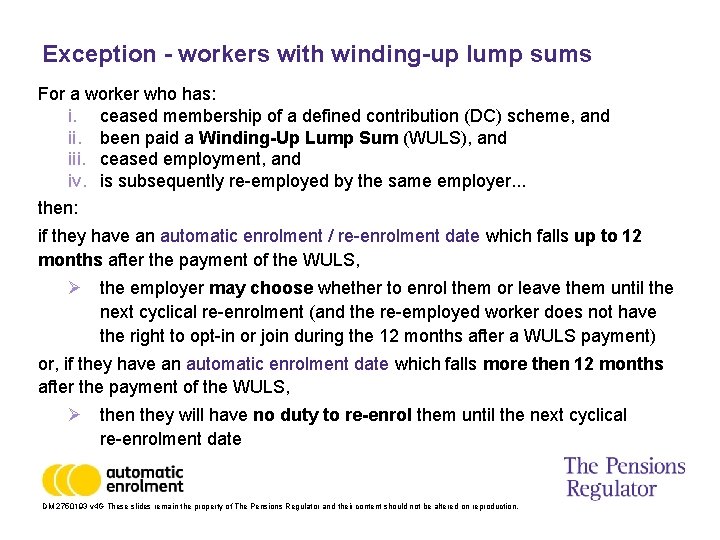

Exception - workers with winding-up lump sums For a worker who has: i. ceased membership of a defined contribution (DC) scheme, and ii. been paid a Winding-Up Lump Sum (WULS), and iii. ceased employment, and iv. is subsequently re-employed by the same employer. . . then: if they have an automatic enrolment / re-enrolment date which falls up to 12 months after the payment of the WULS, Ø the employer may choose whether to enrol them or leave them until the next cyclical re-enrolment (and the re-employed worker does not have the right to opt-in or join during the 12 months after a WULS payment) or, if they have an automatic enrolment date which falls more then 12 months after the payment of the WULS, Ø then they will have no duty to re-enrol them until the next cyclical re-enrolment date DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

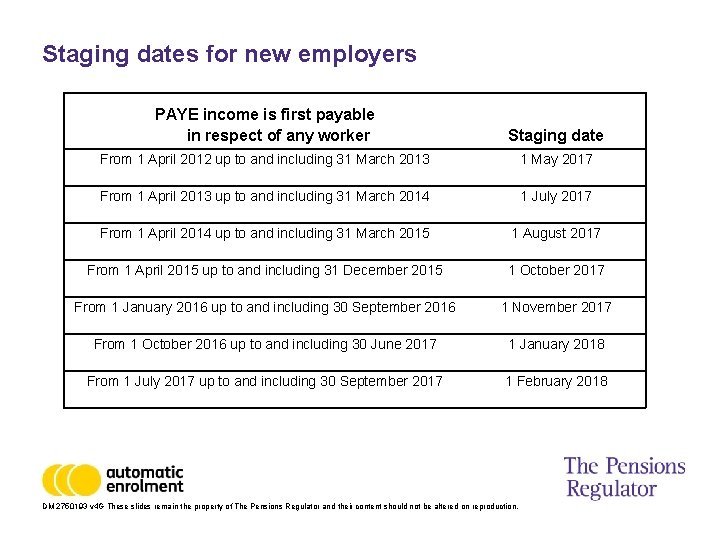

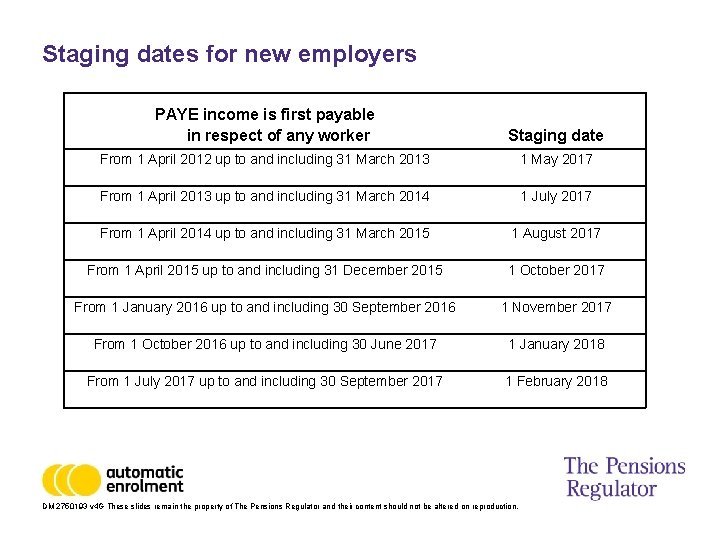

Staging dates for new employers PAYE income is first payable in respect of any worker Staging date From 1 April 2012 up to and including 31 March 2013 1 May 2017 From 1 April 2013 up to and including 31 March 2014 1 July 2017 From 1 April 2014 up to and including 31 March 2015 1 August 2017 From 1 April 2015 up to and including 31 December 2015 1 October 2017 From 1 January 2016 up to and including 30 September 2016 1 November 2017 From 1 October 2016 up to and including 30 June 2017 1 January 2018 From 1 July 2017 up to and including 30 September 2017 1 February 2018 DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

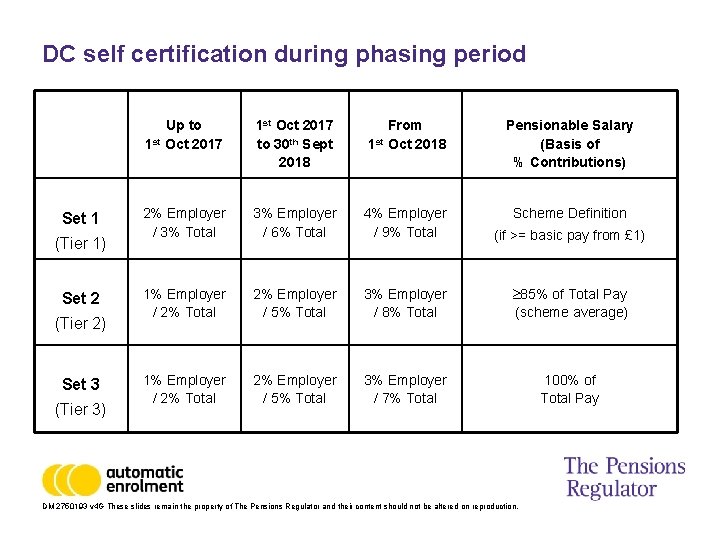

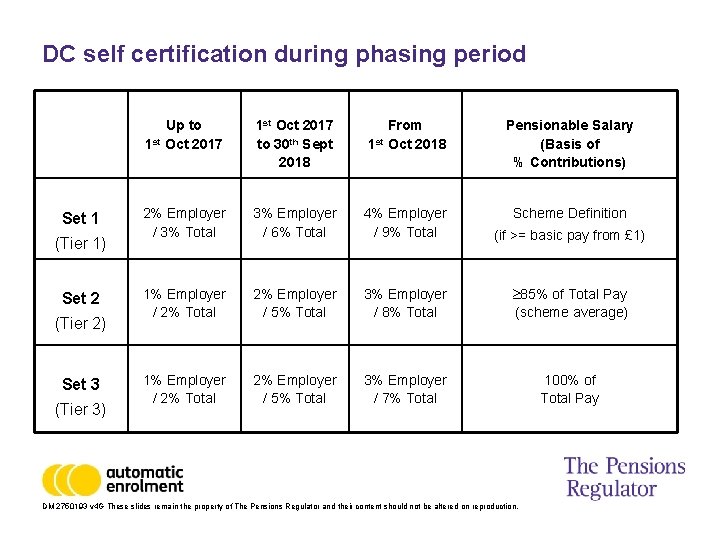

DC self certification during phasing period Set 1 (Tier 1) Set 2 (Tier 2) Set 3 (Tier 3) Up to 1 st Oct 2017 to 30 th Sept 2018 From 1 st Oct 2018 Pensionable Salary (Basis of % Contributions) 2% Employer / 3% Total 3% Employer / 6% Total 4% Employer / 9% Total Scheme Definition (if >= basic pay from £ 1) 1% Employer / 2% Total 2% Employer / 5% Total 3% Employer / 8% Total 85% of Total Pay (scheme average) 1% Employer / 2% Total 2% Employer / 5% Total 3% Employer / 7% Total 100% of Total Pay DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

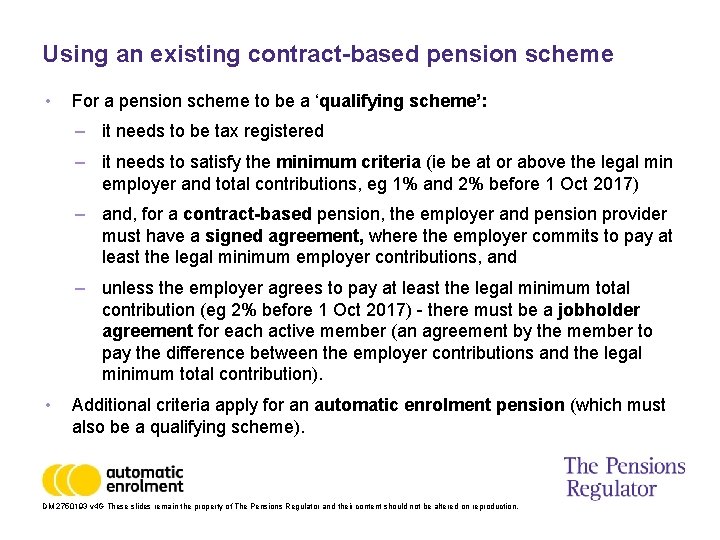

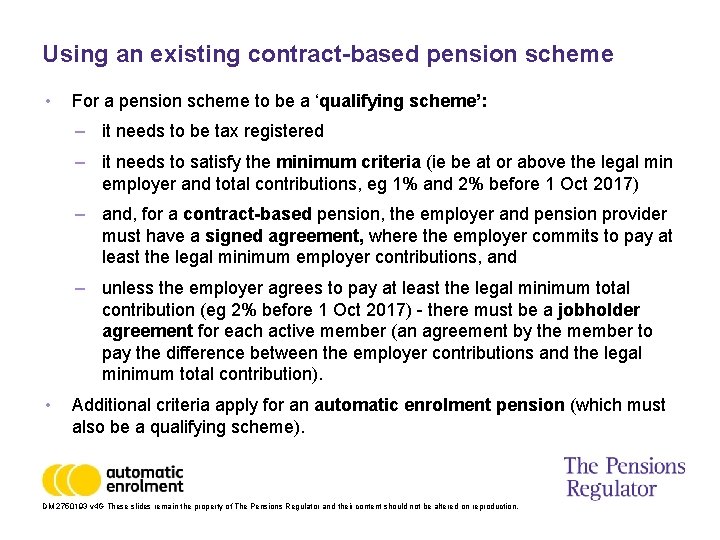

Using an existing contract-based pension scheme • For a pension scheme to be a ‘qualifying scheme’: – it needs to be tax registered – it needs to satisfy the minimum criteria (ie be at or above the legal min employer and total contributions, eg 1% and 2% before 1 Oct 2017) – and, for a contract-based pension, the employer and pension provider must have a signed agreement, where the employer commits to pay at least the legal minimum employer contributions, and – unless the employer agrees to pay at least the legal minimum total contribution (eg 2% before 1 Oct 2017) - there must be a jobholder agreement for each active member (an agreement by the member to pay the difference between the employer contributions and the legal minimum total contribution). • Additional criteria apply for an automatic enrolment pension (which must also be a qualifying scheme). DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

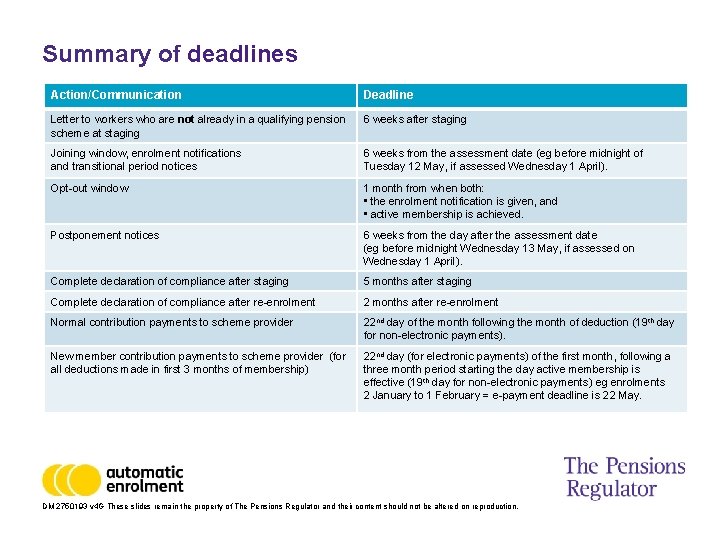

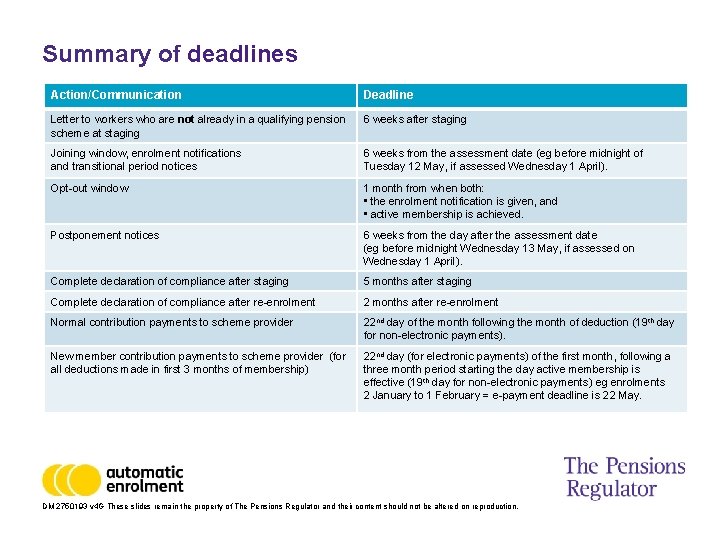

Summary of deadlines Action/Communication Deadline Letter to workers who are not already in a qualifying pension scheme at staging 6 weeks after staging Joining window, enrolment notifications and transitional period notices 6 weeks from the assessment date (eg before midnight of Tuesday 12 May, if assessed Wednesday 1 April). Opt-out window 1 month from when both: • the enrolment notification is given, and • active membership is achieved. Postponement notices 6 weeks from the day after the assessment date (eg before midnight Wednesday 13 May, if assessed on Wednesday 1 April). Complete declaration of compliance after staging 5 months after staging Complete declaration of compliance after re-enrolment 2 months after re-enrolment Normal contribution payments to scheme provider 22 nd day of the month following the month of deduction (19 th day for non-electronic payments). New member contribution payments to scheme provider (for all deductions made in first 3 months of membership) 22 nd day (for electronic payments) of the first month, following a three month period starting the day active membership is effective (19 th day for non-electronic payments) eg enrolments 2 January to 1 February = e-payment deadline is 22 May. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

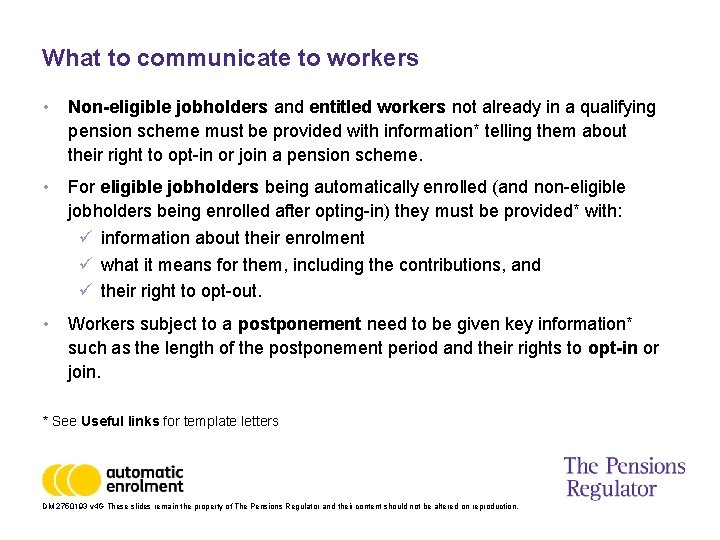

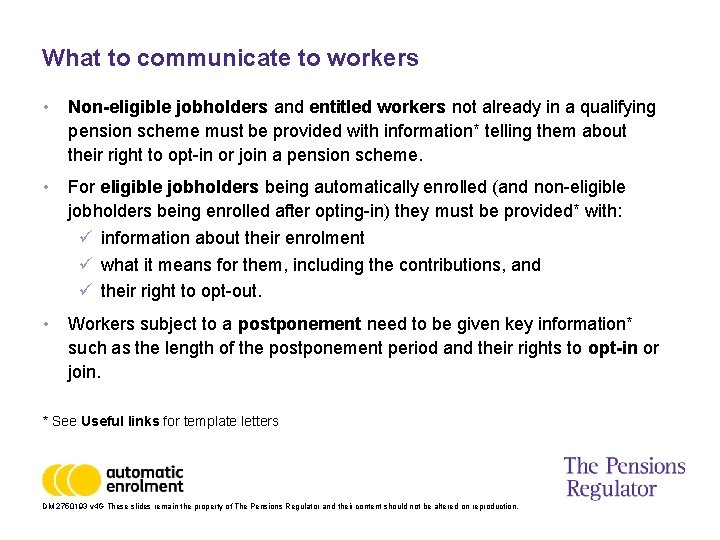

What to communicate to workers • Non-eligible jobholders and entitled workers not already in a qualifying pension scheme must be provided with information* telling them about their right to opt-in or join a pension scheme. • For eligible jobholders being automatically enrolled (and non-eligible jobholders being enrolled after opting-in) they must be provided* with: ü information about their enrolment ü what it means for them, including the contributions, and ü their right to opt-out. • Workers subject to a postponement need to be given key information* such as the length of the postponement period and their rights to opt-in or join. * See Useful links for template letters DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

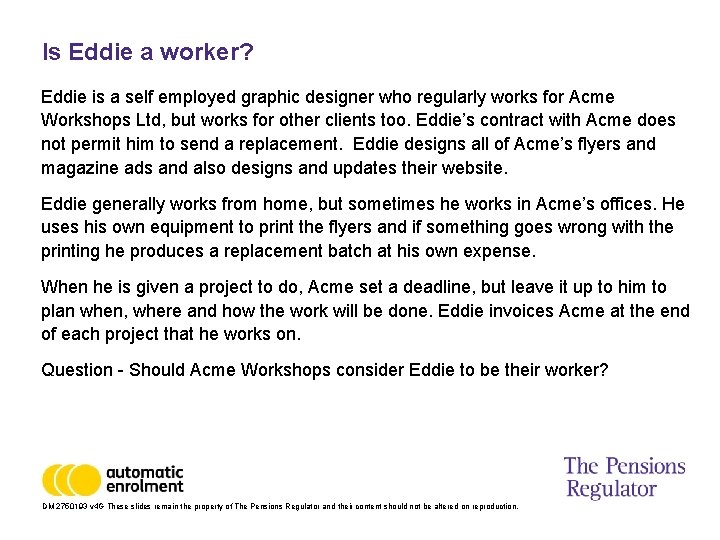

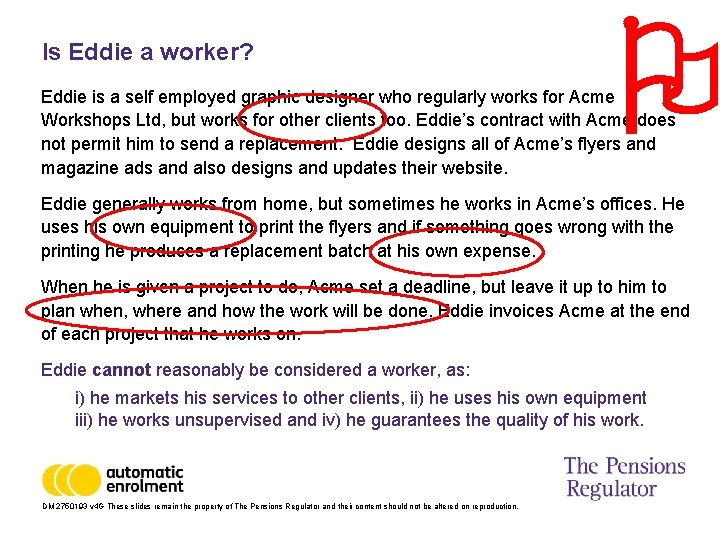

Is Eddie a worker? Eddie is a self employed graphic designer who regularly works for Acme Workshops Ltd, but works for other clients too. Eddie’s contract with Acme does not permit him to send a replacement. Eddie designs all of Acme’s flyers and magazine ads and also designs and updates their website. Eddie generally works from home, but sometimes he works in Acme’s offices. He uses his own equipment to print the flyers and if something goes wrong with the printing he produces a replacement batch at his own expense. When he is given a project to do, Acme set a deadline, but leave it up to him to plan when, where and how the work will be done. Eddie invoices Acme at the end of each project that he works on. Question - Should Acme Workshops consider Eddie to be their worker? DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Is Eddie a worker? Eddie is a self employed graphic designer who regularly works for Acme Workshops Ltd, but works for other clients too. Eddie’s contract with Acme does not permit him to send a replacement. Eddie designs all of Acme’s flyers and magazine ads and also designs and updates their website. Eddie generally works from home, but sometimes he works in Acme’s offices. He uses his own equipment to print the flyers and if something goes wrong with the printing he produces a replacement batch at his own expense. When he is given a project to do, Acme set a deadline, but leave it up to him to plan when, where and how the work will be done. Eddie invoices Acme at the end of each project that he works on. Eddie cannot reasonably be considered a worker, as: i) he markets his services to other clients, ii) he uses his own equipment iii) he works unsupervised and iv) he guarantees the quality of his work. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

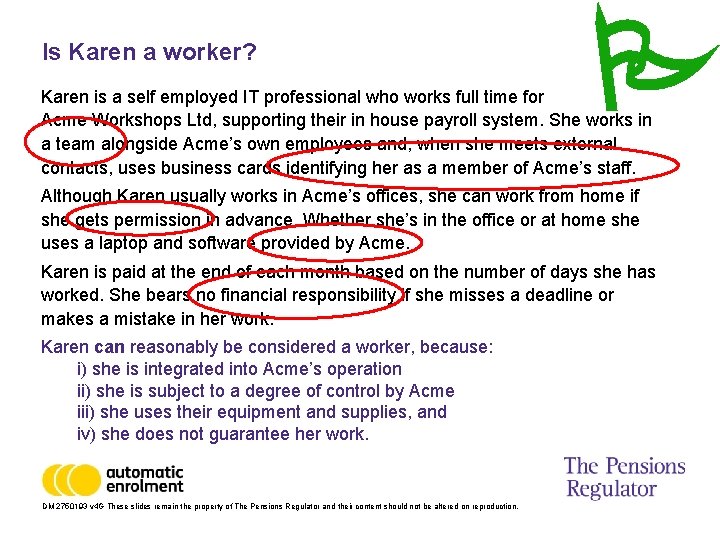

Is Karen a worker? Karen is a self employed IT professional who works full time for Acme Workshops Ltd, supporting their in house payroll system. She works in a team alongside Acme’s own employees and, when she meets external contacts, uses business cards identifying her as a member of Acme’s staff. Although Karen usually works in Acme’s offices, she can work from home if she gets permission in advance. Whether she’s in the office or at home she uses a laptop and software provided by Acme. Karen is paid at the end of each month based on the number of days she has worked. She bears no financial responsibility if she misses a deadline or makes a mistake in her work. - Should Acme Workshops consider Karen to be their worker? DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

Is Karen a worker? Karen is a self employed IT professional who works full time for Acme Workshops Ltd, supporting their in house payroll system. She works in a team alongside Acme’s own employees and, when she meets external contacts, uses business cards identifying her as a member of Acme’s staff. Although Karen usually works in Acme’s offices, she can work from home if she gets permission in advance. Whether she’s in the office or at home she uses a laptop and software provided by Acme. Karen is paid at the end of each month based on the number of days she has worked. She bears no financial responsibility if she misses a deadline or makes a mistake in her work. Karen can reasonably be considered a worker, because: i) she is integrated into Acme’s operation ii) she is subject to a degree of control by Acme iii) she uses their equipment and supplies, and iv) she does not guarantee her work. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

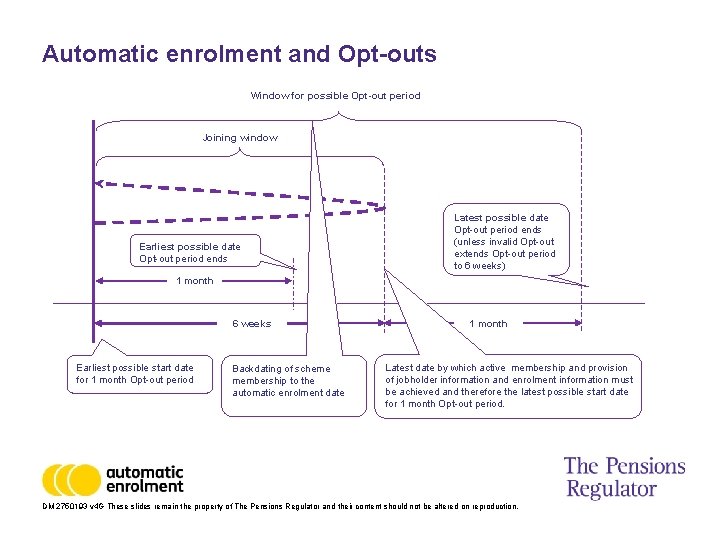

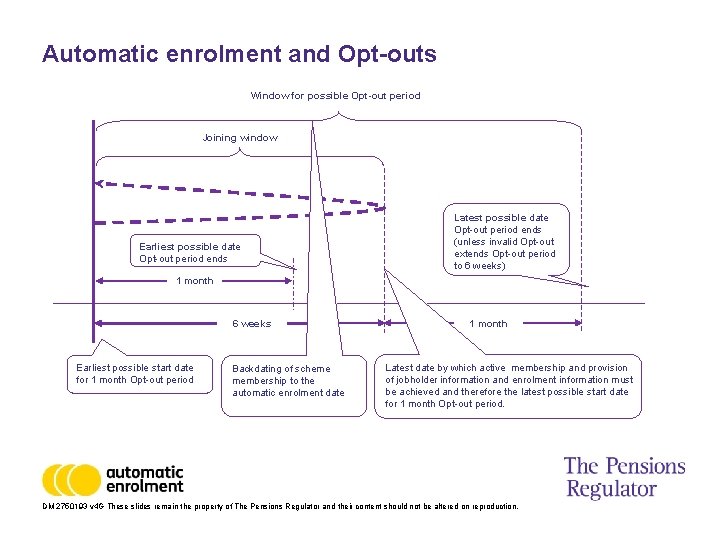

Automatic enrolment and Opt-outs Window for possible Opt-out period Joining window Earliest possible date Opt-out period ends Latest possible date Opt-out period ends (unless invalid Opt-out extends Opt-out period to 6 weeks) 1 month 6 weeks Earliest possible start date for 1 month Opt-out period Backdating of scheme membership to the automatic enrolment date 1 month Latest date by which active membership and provision of jobholder information and enrolment information must be achieved and therefore the latest possible start date for 1 month Opt-out period. DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

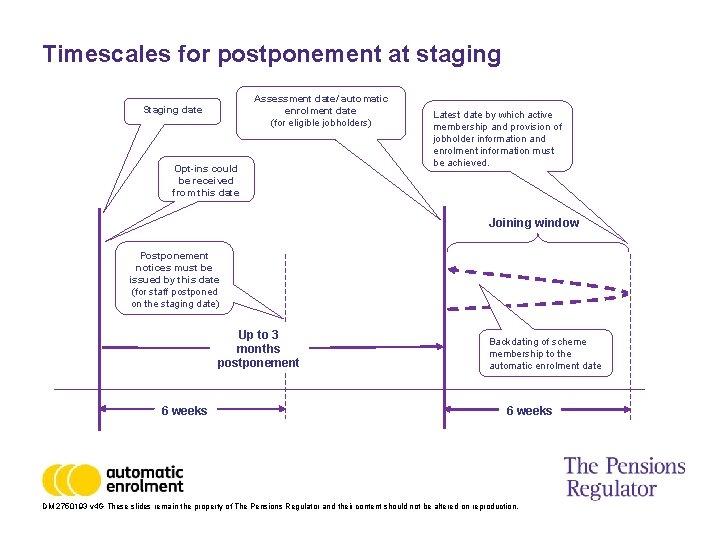

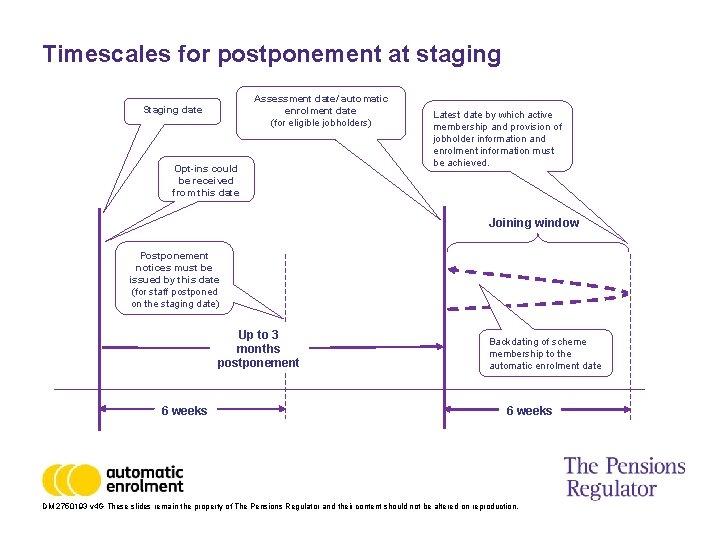

Timescales for postponement at staging Assessment date/ automatic enrolment date (for eligible jobholders) Staging date Opt-ins could be received from this date Latest date by which active membership and provision of jobholder information and enrolment information must be achieved. Joining window Postponement notices must be issued by this date (for staff postponed on the staging date) Up to 3 months postponement 6 weeks Backdating of scheme membership to the automatic enrolment date 6 weeks DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

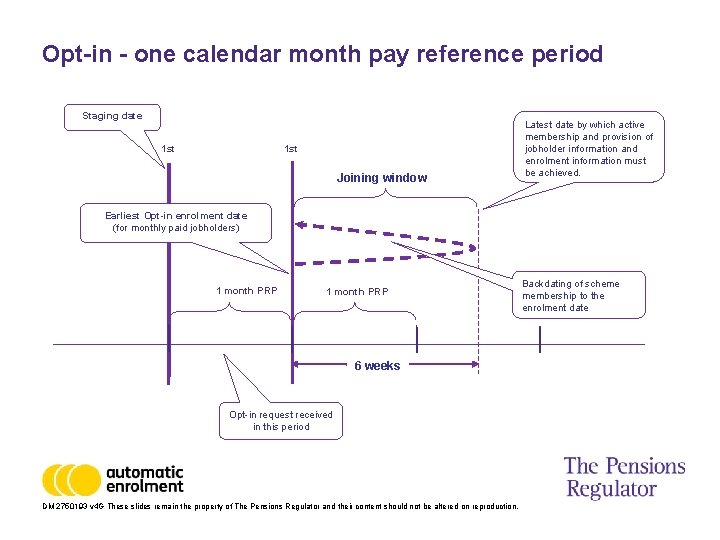

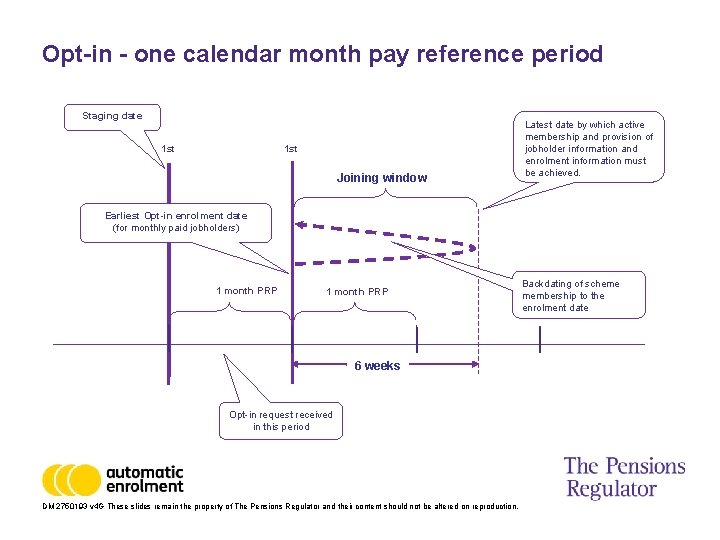

Opt-in - one calendar month pay reference period Staging date 1 st Joining window Latest date by which active membership and provision of jobholder information and enrolment information must be achieved. Earliest Opt-in enrolment date (for monthly paid jobholders) 1 month PRP 6 weeks Opt-in request received in this period DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction. Backdating of scheme membership to the enrolment date

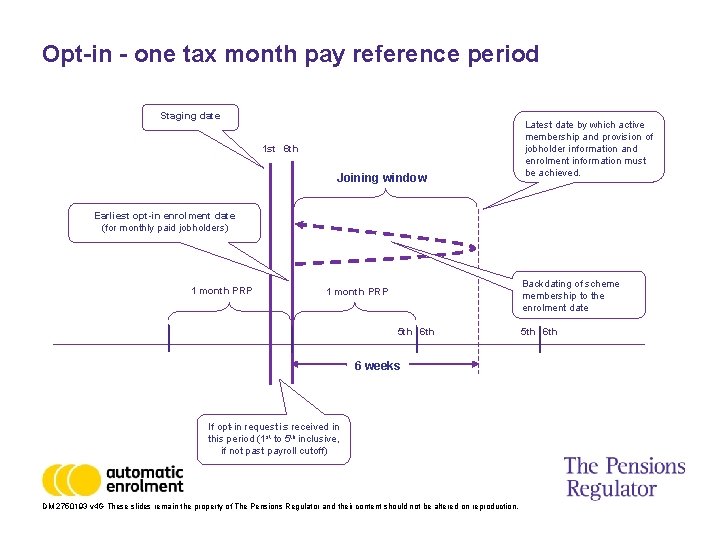

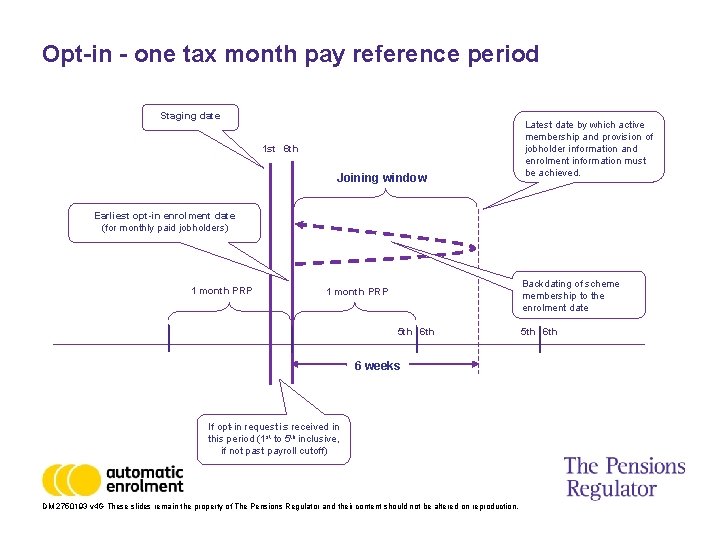

Opt-in - one tax month pay reference period Staging date 1 st 6 th Joining window Latest date by which active membership and provision of jobholder information and enrolment information must be achieved. Earliest opt-in enrolment date (for monthly paid jobholders) 1 month PRP Backdating of scheme membership to the enrolment date 1 month PRP 5 th 6 weeks If opt-in request is received in this period (1 st to 5 th inclusive, if not past payroll cutoff) DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction. 5 th 6 th

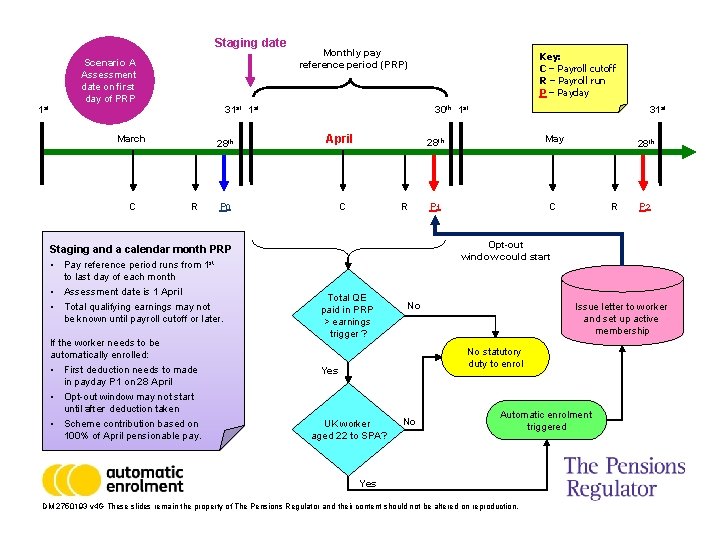

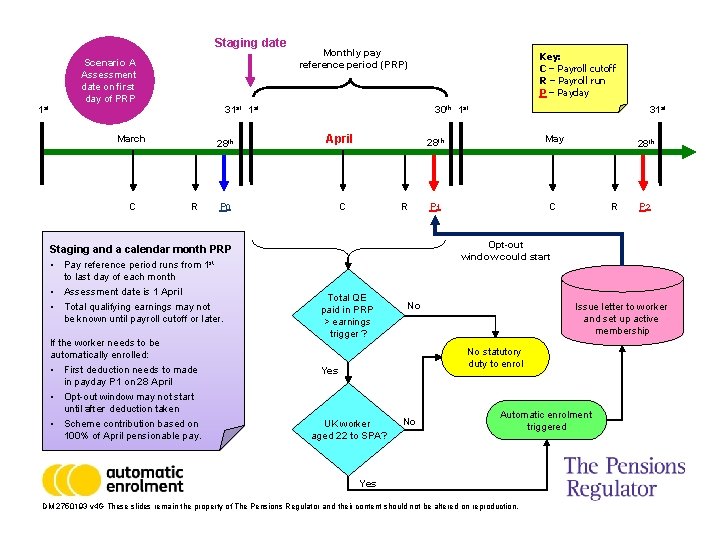

Staging date 1 st Scenario A Assessment date on first day of PRP 31 st March C Monthly pay reference period (PRP) R 30 th 1 st 28 th April P 0 C R If the worker needs to be automatically enrolled: • First deduction needs to made in payday P 1 on 28 April • Opt-out window may not start until after deduction taken • Scheme contribution based on 100% of April pensionable pay. 31 st 28 th May P 1 C 28 th R P 2 Opt-out window could start Staging and a calendar month PRP • Pay reference period runs from 1 st to last day of each month • Assessment date is 1 April • Total qualifying earnings may not be known until payroll cutoff or later. Key: C – Payroll cutoff R – Payroll run P – Payday Total QE paid in PRP > earnings trigger ? No Issue letter to worker and set up active membership No statutory duty to enrol Yes UK worker aged 22 to SPA? No Automatic enrolment triggered Yes DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.

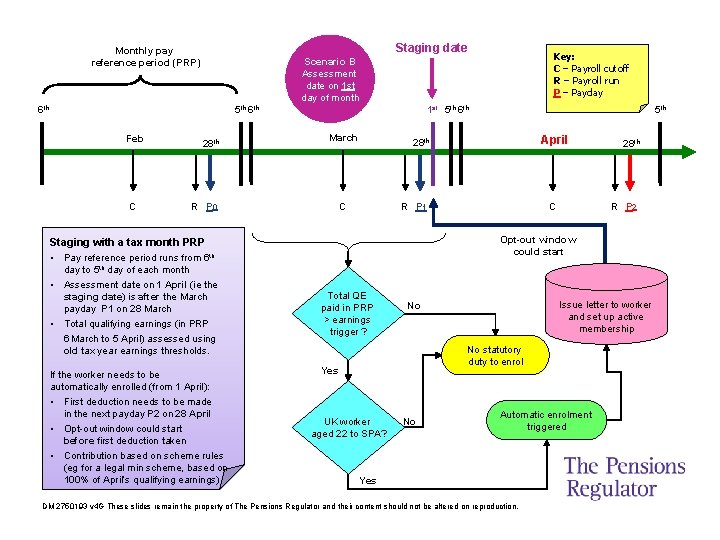

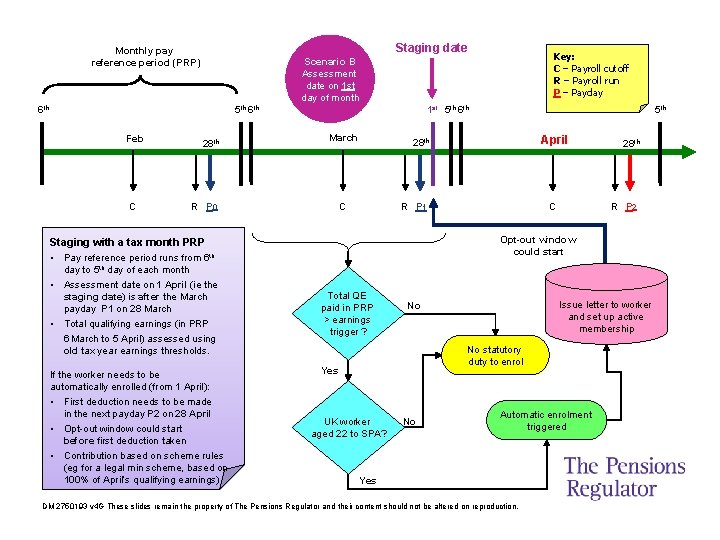

Staging date Monthly pay reference period (PRP) 6 th 5 th 6 th Feb C 28 th 1 st 5 th 6 th March R P 0 • day to 5 th day of each month Assessment date on 1 April (ie the staging date) is after the March payday P 1 on 28 March Total qualifying earnings (in PRP 6 March to 5 April) assessed using old tax year earnings thresholds. If the worker needs to be automatically enrolled (from 1 April): • First deduction needs to be made in the next payday P 2 on 28 April • Opt-out window could start before first deduction taken • Contribution based on scheme rules (eg for a legal min scheme, based on 100% of April’s qualifying earnings). 5 th April 28 th C R P 1 C 28 th R P 2 Opt-out window could start Staging with a tax month PRP • Pay reference period runs from 6 th • Key: C – Payroll cutoff R – Payroll run P – Payday Scenario B Assessment date on 1 st day of month Total QE paid in PRP > earnings trigger ? Issue letter to worker and set up active membership No No statutory duty to enrol Yes UK worker aged 22 to SPA? No Automatic enrolment triggered Yes DM 2750193 v 4 G These slides remain the property of The Pensions Regulator and their content should not be altered on reproduction.