Income Tax Accounting SFAS 109 ASC 740 10

- Slides: 132

Income Tax Accounting SFAS 109 (ASC 740 -10)

Course Objectives Understand apply basic concepts and procedures of SFAS 109 Understand the how to identify temporary differences Understand how to calculate the current and deferred tax provisions Understand the basics of the valuation allowance Understand how the tax provision affects financial statements and its role in the audit Ensure client compliance with financial statement disclosure requirements

Objectives of ASC 740 -10 Recognize: 1. The amount of taxes payable or refundable for the current year 2. Deferred tax liabilities and assets for the future tax consequences of events that have been recognized in a company’s financial statements or tax returns

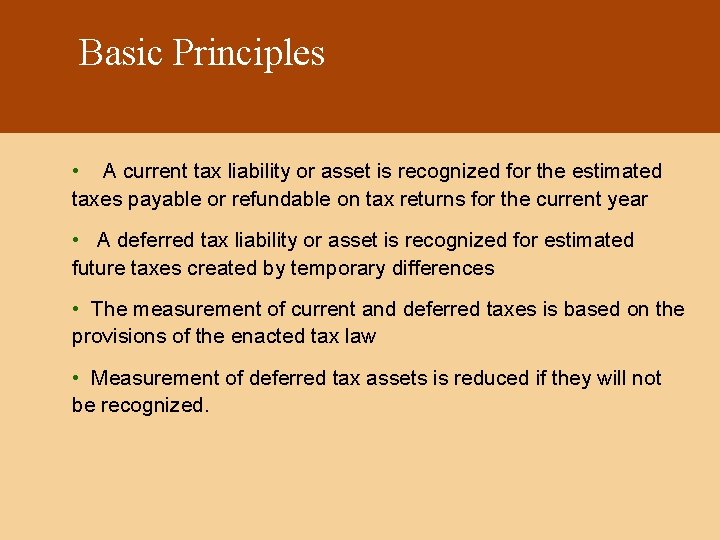

Basic Principles • A current tax liability or asset is recognized for the estimated taxes payable or refundable on tax returns for the current year • A deferred tax liability or asset is recognized for estimated future taxes created by temporary differences • The measurement of current and deferred taxes is based on the provisions of the enacted tax law • Measurement of deferred tax assets is reduced if they will not be recognized.

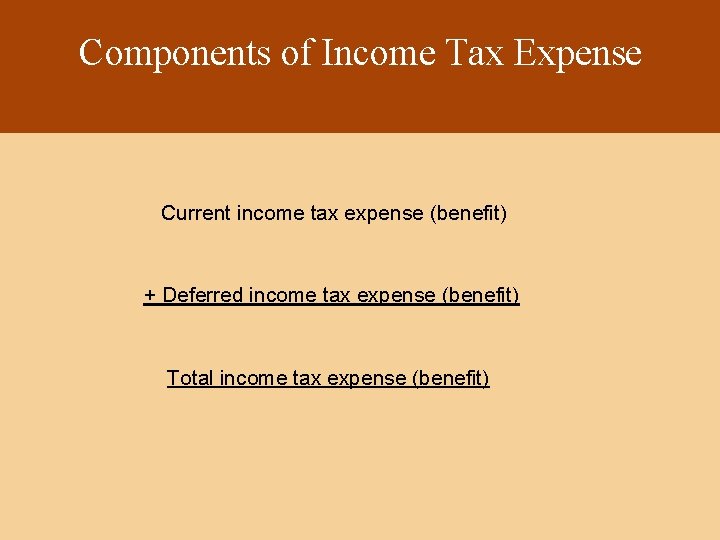

Components of Income Tax Expense Current income tax expense (benefit) + Deferred income tax expense (benefit) Total income tax expense (benefit)

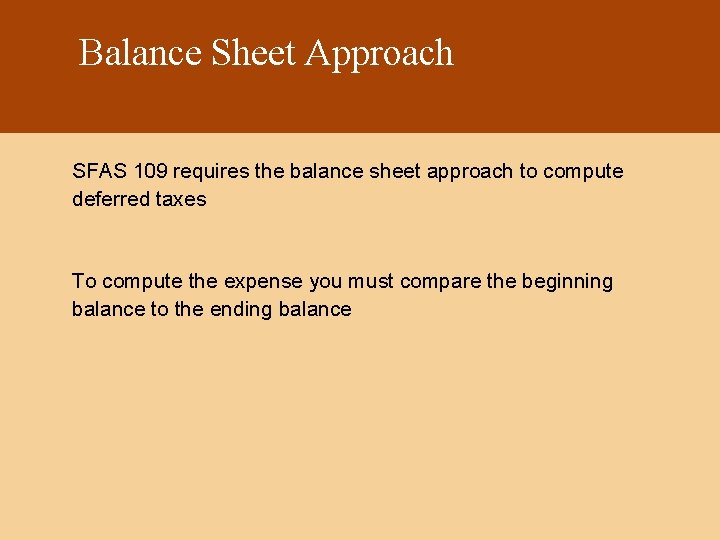

Balance Sheet Approach SFAS 109 requires the balance sheet approach to compute deferred taxes To compute the expense you must compare the beginning balance to the ending balance

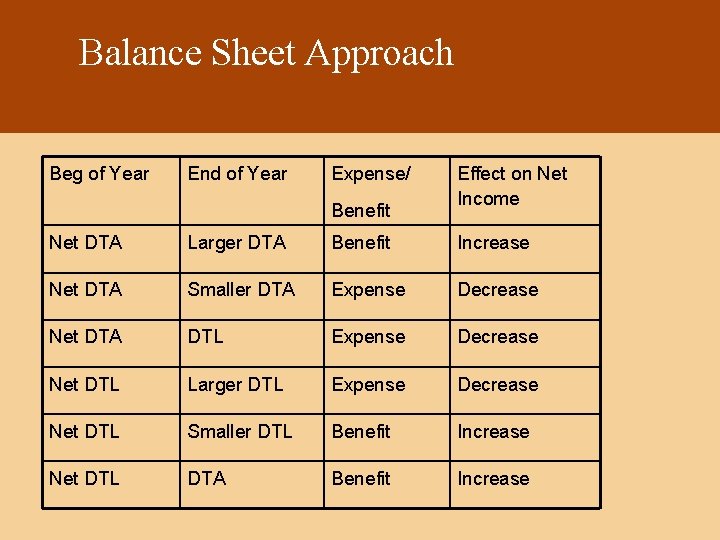

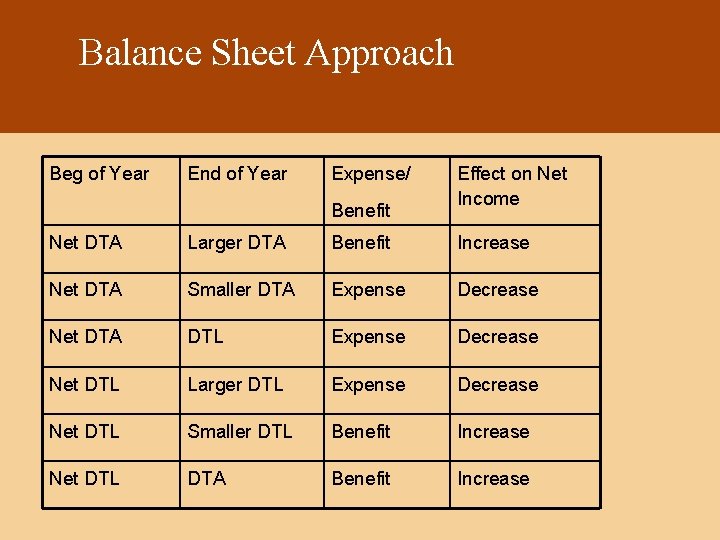

Balance Sheet Approach Beg of Year End of Year Expense/ Benefit Effect on Net Income Net DTA Larger DTA Benefit Increase Net DTA Smaller DTA Expense Decrease Net DTA DTL Expense Decrease Net DTL Larger DTL Expense Decrease Net DTL Smaller DTL Benefit Increase Net DTL DTA Benefit Increase

ASC 740 -10 Applicability • Domestic federal income taxes • Foreign, state and local taxes based on income • Domestic and foreign operations that are consolidated, combined or accounted for by the equity method • Foreign enterprises in preparing financial statements under US GAAP

Hi Course History of Objectives Accountingstory for Income Taxes • APB 11 – Issued in 1967 – Used the Deferred Method – Calculation was a “with” and without” method

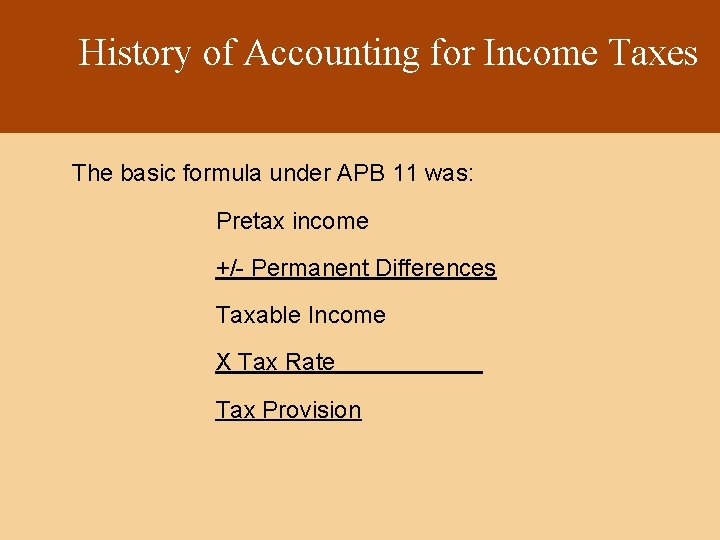

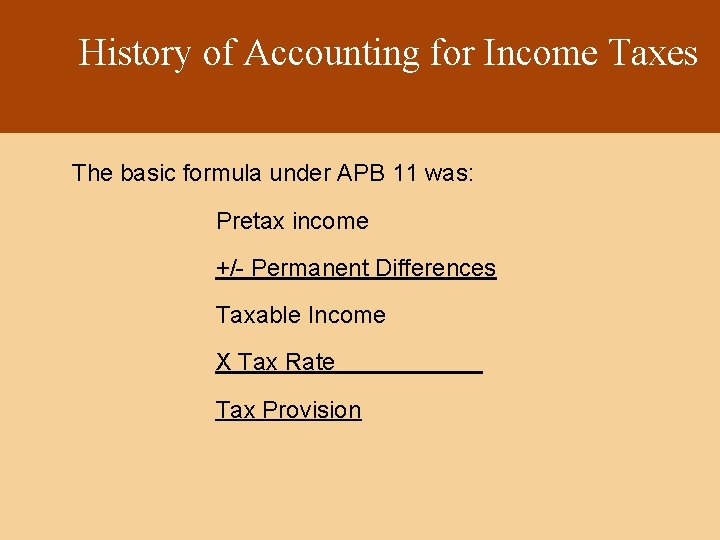

History of Accounting for Income Taxes The basic formula under APB 11 was: Pretax income +/- Permanent Differences Taxable Income X Tax Rate Tax Provision

History of Accounting for Income Taxes • FASB 96 – Issued in 1996 – Used the Liability Method – Required extensive scheduling – Assumed co. would have not future income

History of Accounting for Income Taxes • FASB 109 – Issued in 1992 – Maintained liability method – Simplified the scheduling requirement – Required all deferred assets to be recorded – Introduced the concept of a valuation allowance

Temporary Differences The difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively.

Types of Temporary Differences Taxable Temporary Differences that will result in taxable amounts in future years when the related asset or liability is recovered or settled. Deductible Temporary Differences that will result in deductible amounts in future years when the related asset or liability is recovered or settled

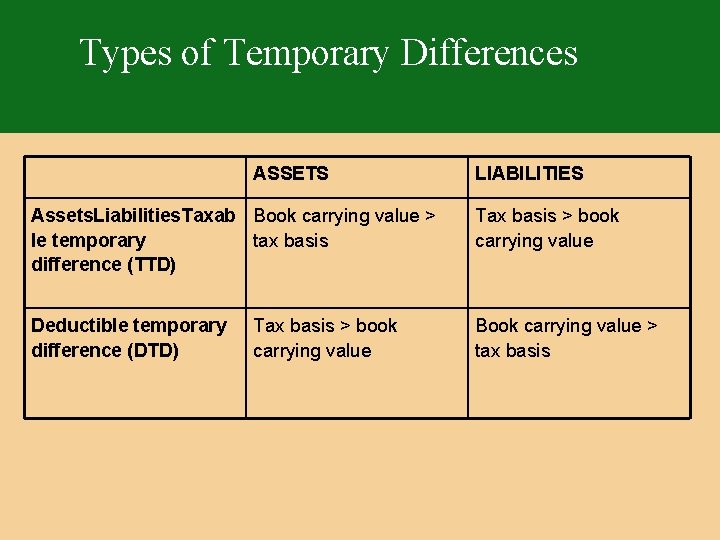

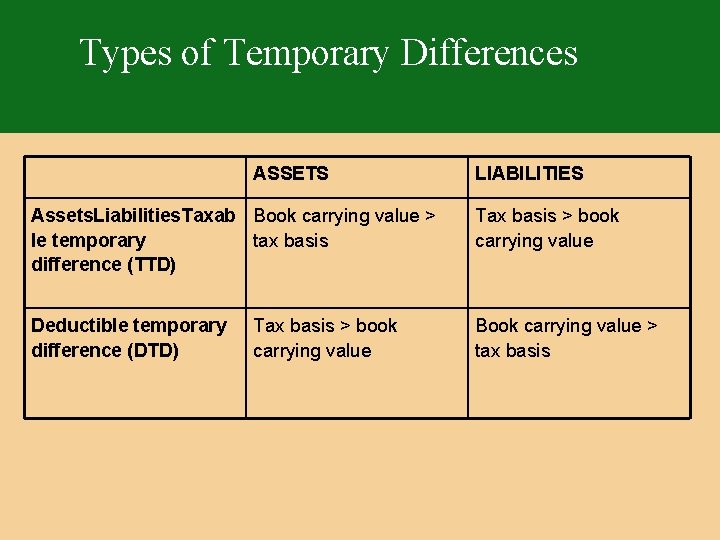

Types of Temporary Differences ASSETS LIABILITIES Assets. Liabilities. Taxab Book carrying value > le temporary tax basis difference (TTD) Tax basis > book carrying value Deductible temporary difference (DTD) Book carrying value > tax basis Tax basis > book carrying value

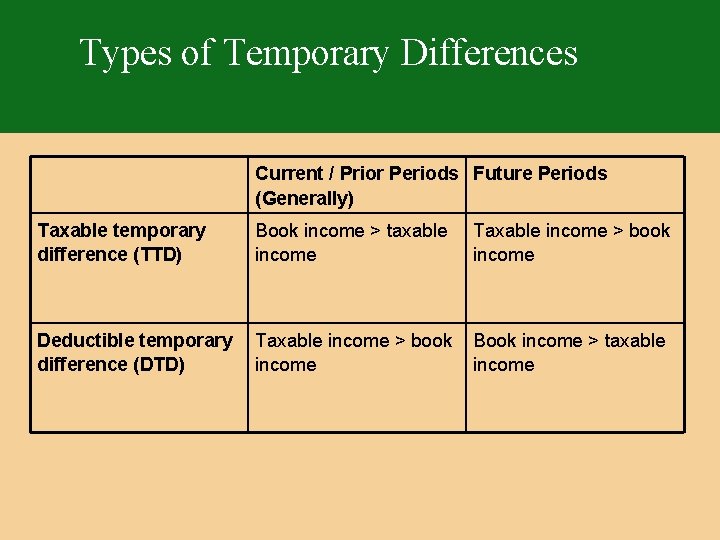

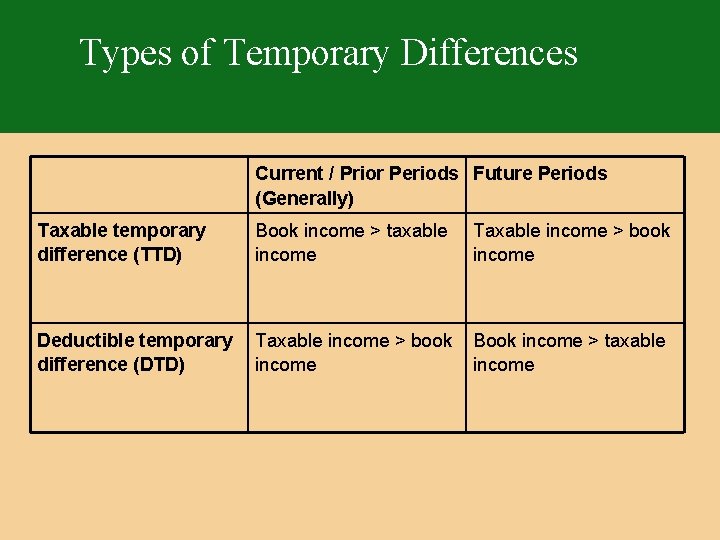

Types of Temporary Differences Current / Prior Periods Future Periods (Generally) Taxable temporary difference (TTD) Book income > taxable income Taxable income > book income Deductible temporary difference (DTD) Taxable income > book income Book income > taxable income

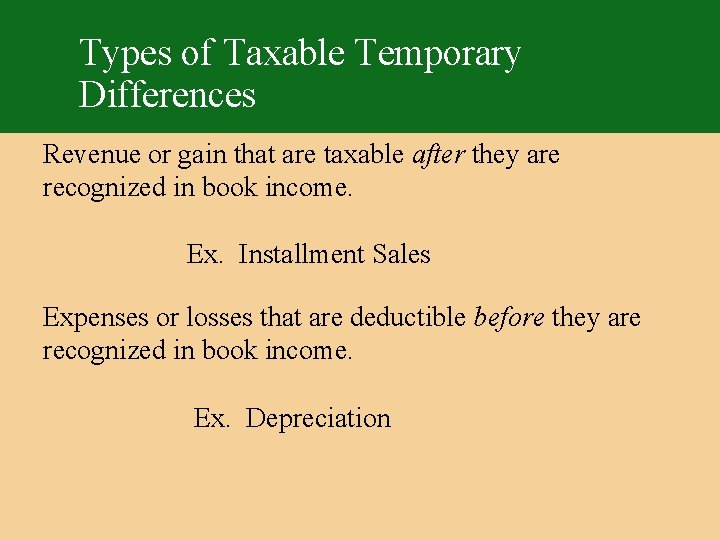

Types of Taxable Temporary Differences Revenue or gain that are taxable after they are recognized in book income. Ex. Installment Sales Expenses or losses that are deductible before they are recognized in book income. Ex. Depreciation

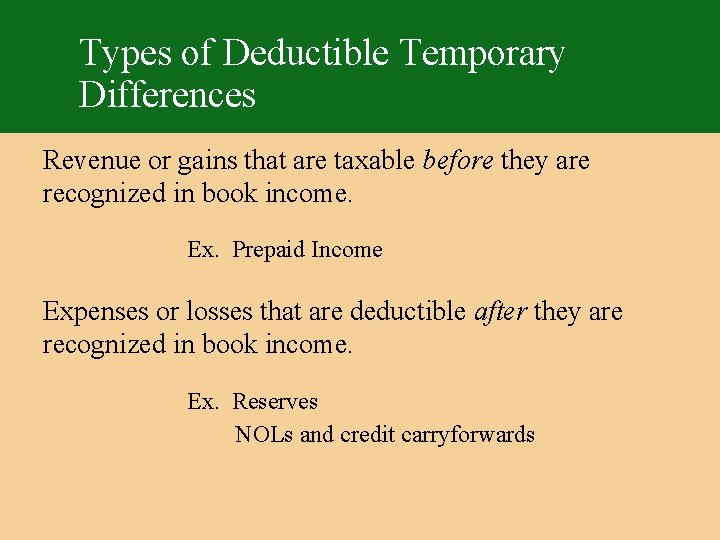

Types of Deductible Temporary Differences Revenue or gains that are taxable before they are recognized in book income. Ex. Prepaid Income Expenses or losses that are deductible after they are recognized in book income. Ex. Reserves NOLs and credit carryforwards

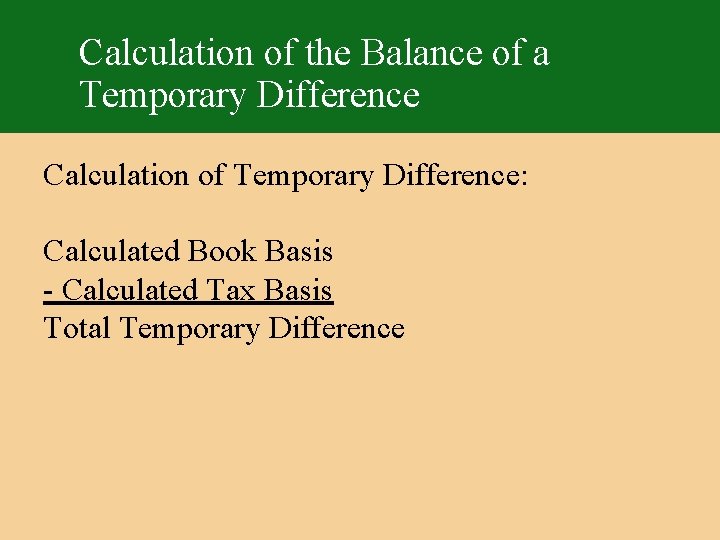

Calculation of the Balance of a Temporary Difference Calculation of Temporary Difference: Calculated Book Basis - Calculated Tax Basis Total Temporary Difference

Deferred Tax Provision – “Five Step Process” 1. Estimate the applicable tax rate 2. Determine the gross deferred tax liability 3. Determine the gross deferred tax asset 4. Determine the gross deferred tax asset for credit carryforwards 5. Record a valuation allowance, if necessary

Tax Rates Used • U. S. Federal Income Tax Rate – Regular – AMT • State Income Taxes – Blended Tax Rate • Foreign Income Taxes

Deferred Tax Liability DTL = Taxable temporary differences X applicable tax rate

Deferred Tax Asset DTA = [(Deductible temporary differences + loss and deduction carryforwards) X applicable federal rate] + tax credit carryforwards.

Deferred Tax Expense/Benefit Net DTA or DTL at end of year Less: Net DTA or DTL at beginning of year Deferred income tax expense (benefit)

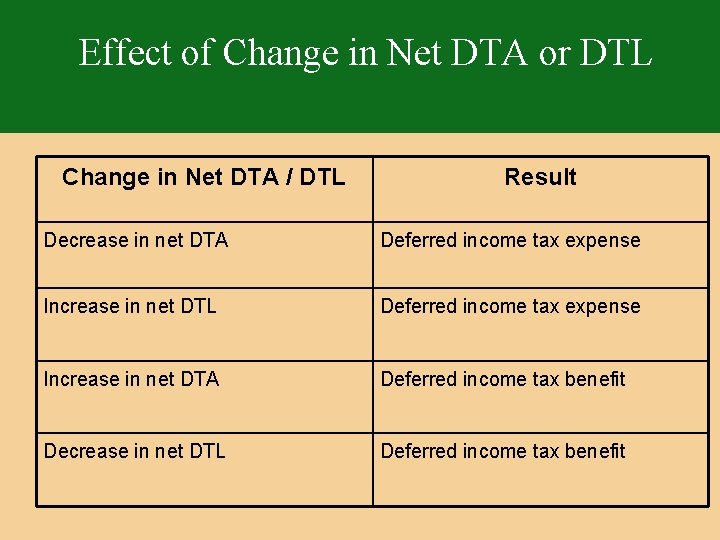

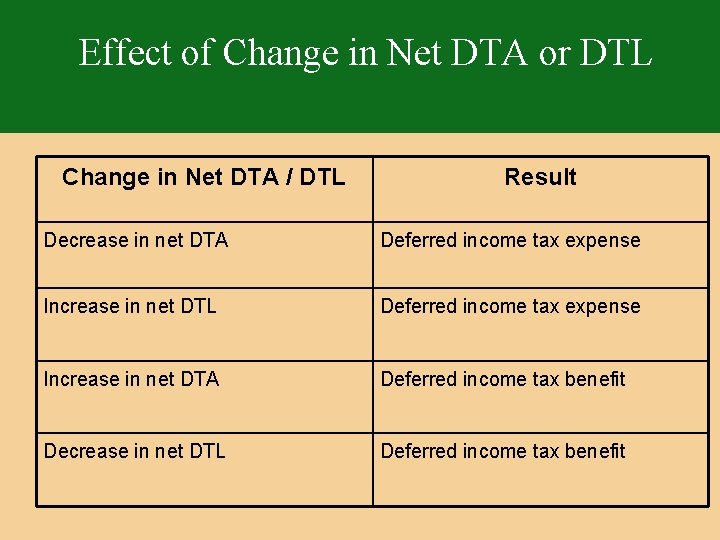

Effect of Change in Net DTA or DTL Change in Net DTA / DTL Result Decrease in net DTA Deferred income tax expense Increase in net DTL Deferred income tax expense Increase in net DTA Deferred income tax benefit Decrease in net DTL Deferred income tax benefit

Exception to the General Rule APB 23 – Permanently reinvested earnings in a foreign subsidiary

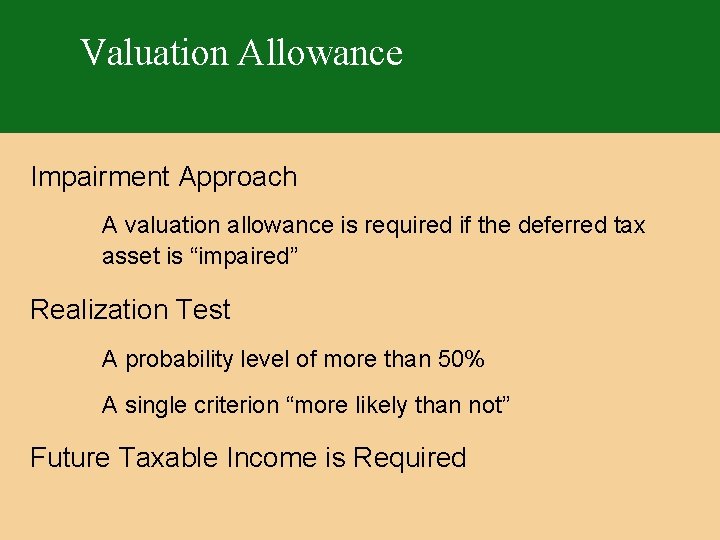

Valuation Allowance Impairment Approach A valuation allowance is required if the deferred tax asset is “impaired” Realization Test A probability level of more than 50% A single criterion “more likely than not” Future Taxable Income is Required

Future Taxable Income • Future reversals of existing taxable temporary differences • Taxable income in carryback years • Tax-planning strategies • Future taxable income (exclusive of reversing temporary differences and carryforwards)

Tax Planning Strategies Tax-planning strategies will accelerate income so that the company can take advantage of future deductible differences. Tax-planning strategies must be prudent and feasible. The company does not have to actually implement the strategy.

Tax Planning Strategies Sale of operating assets Change of inventory method Elect out of the installment method Elect the alternative depreciation system

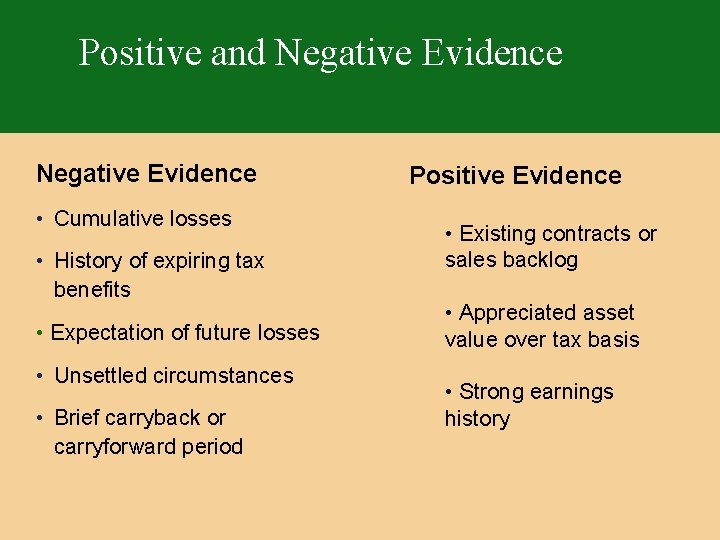

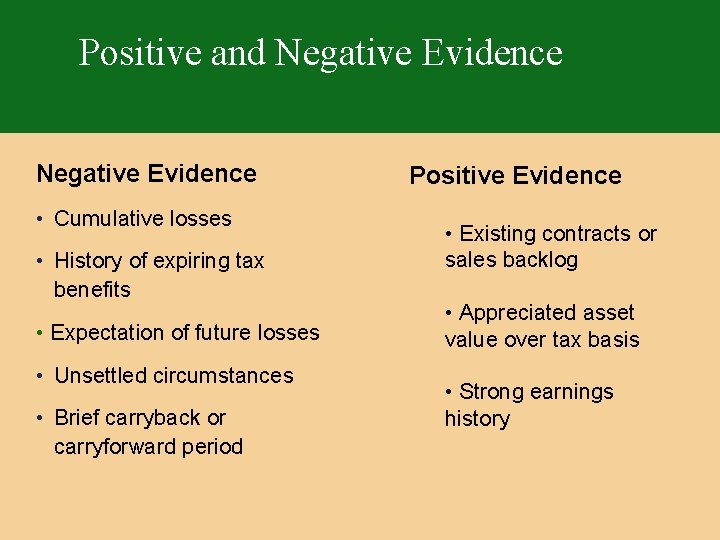

Positive and Negative Evidence • Cumulative losses • History of expiring tax benefits • Expectation of future losses • Unsettled circumstances • Brief carryback or carryforward period Positive Evidence • Existing contracts or sales backlog • Appreciated asset value over tax basis • Strong earnings history

Valuation Allowance RECOGNITION OF AN OPERATING LOSS OR ADJUSTMENTS TO BEGINNING-OF-YEAR VALUATION ALLOWANCE • When incurred - source of loss • Subsequently – Operations if based on future income – Source of income if based solely on current year income

Valuation Allowance - Change EFFECT OF A CHANGE IN THE VALUATION ALLOWANCE THAT RESULTS FROM A CHANGE IN CIRCUMSTANCES MUST BE INCLUDED IN INCOME FROM CONTINUING OPERATIONS.

Valuation Allowance - Change CHANGE IN JUDGMENT ABOUT REALIZABILITY • Affects Current Quarter If For Future Years • Affects Remaining Interim Periods If For Future Interim Periods

Valuation Allowance – Change at Interim Date DECREASE IN VALUATION ALLOWANCE IS SEGREGATED INTO TWO COMPONENTS • Portion related to a change in estimate regarding the current year's income – Taken into income by prospectively adjusting effective tax rate for current year • Portion related to a change in estimate about future years' income – Taken into income as a discrete event in the quarter of the change in estimate

Tax Effect of a Change in Tax Law MEASURED AND RECORDED ON THE ENACTMENT DATE – May be necessary to estimate temporary difference at interim dates RETROACTIVE APPLICATION - EITF ISSUE 93 -13 – Impact on disc. operations, extraordinary and cumulative effect items REQUIRED DISCLOSURES

Change in Tax Law or Tax Rate u. CURRENT – – – TAX EXPENSE Calculate New ETR Apply New ETR To Year-To-Date Income Cumulative Catch-Up Adjustment u. DEFERRED – – TAX EXPENSE Apply New Tax Rate to Deferred Tax Accounts Impact of Change in Deferred Taxes Affects Quarter of Enactment

Current Tax liability The amount of income taxes paid or payable (or refundable) for a year as determined by applying the provisions of the enacted tax law to the taxable income or excess of deductions over revenues for that year.

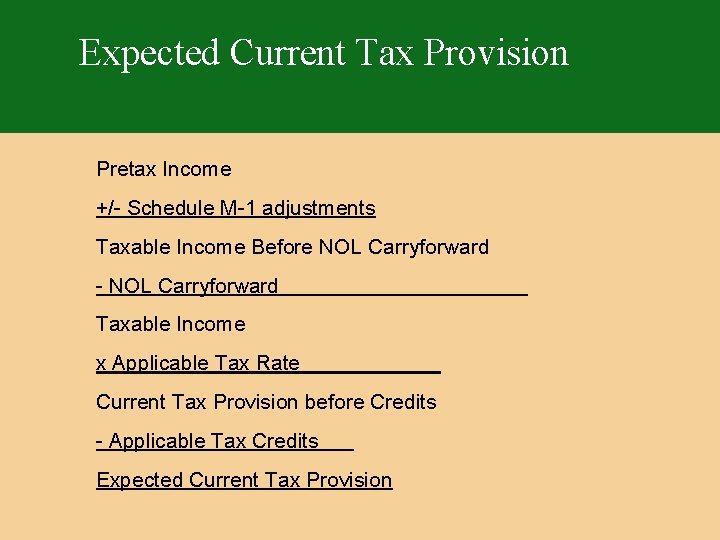

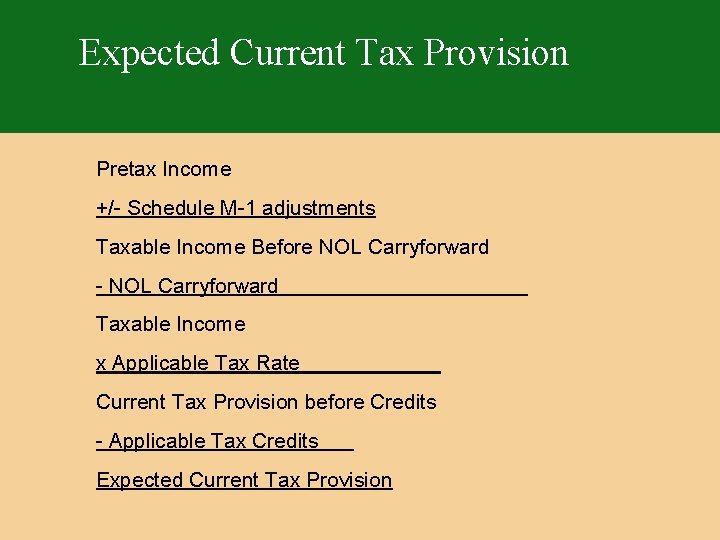

Expected Current Tax Provision Pretax Income +/- Schedule M-1 adjustments Taxable Income Before NOL Carryforward - NOL Carryforward Taxable Income x Applicable Tax Rate Current Tax Provision before Credits - Applicable Tax Credits Expected Current Tax Provision

Permanent Differences arise from income that is permanently nontaxable and expense items are permanently nondeductible. Another way of saying it: Permanent differences are items that impact either the financial statements or the tax return but not the other

Examples of Permanent Differences 50% of Meal and Entertainment Fines and Penalties Officers’ Life Insurance Premiums and Proceeds Municipal Bond Interest Dividends Received Deduction

Cases

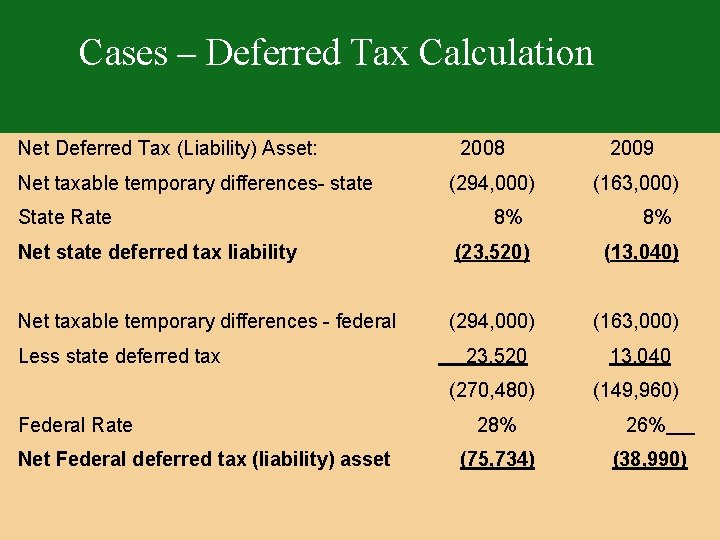

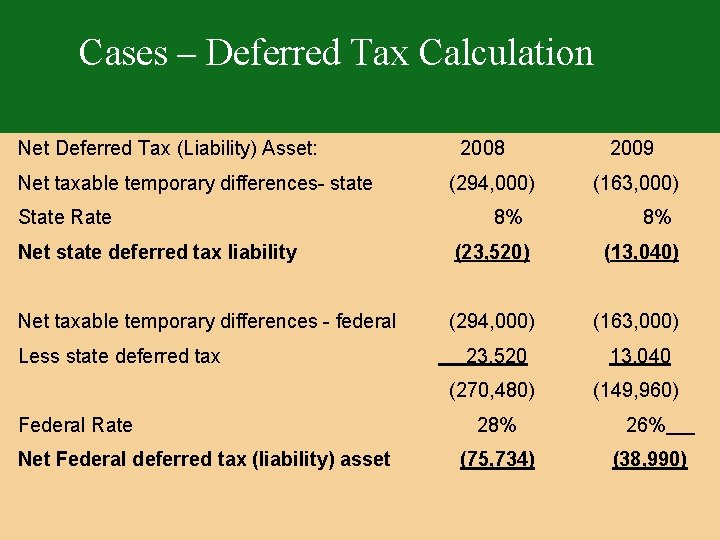

Cases – Deferred Tax Calculation Net Deferred Tax (Liability) Asset: Net taxable temporary differences- state State Rate 2008 (294, 000) 8% 2009 (163, 000) 8% Net state deferred tax liability (23, 520) (13, 040) Net taxable temporary differences - federal (294, 000) (163, 000) 23, 520 13, 040 (270, 480) (149, 960) Less state deferred tax Federal Rate Net Federal deferred tax (liability) asset 28% 26% (75, 734) (38, 990)

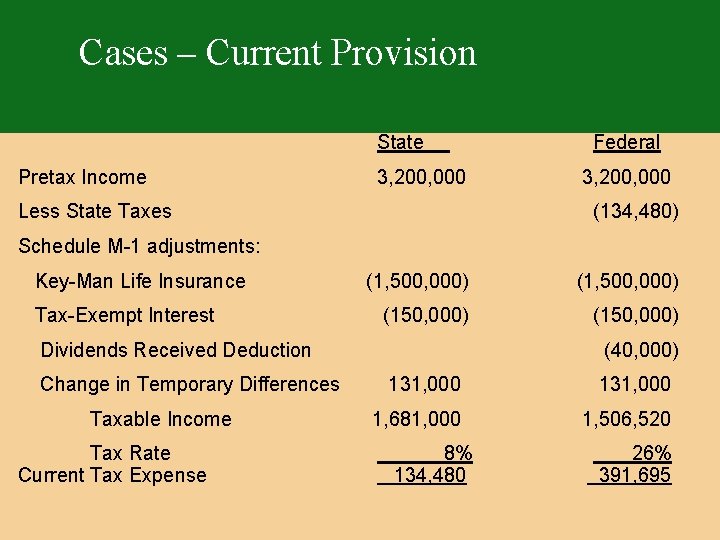

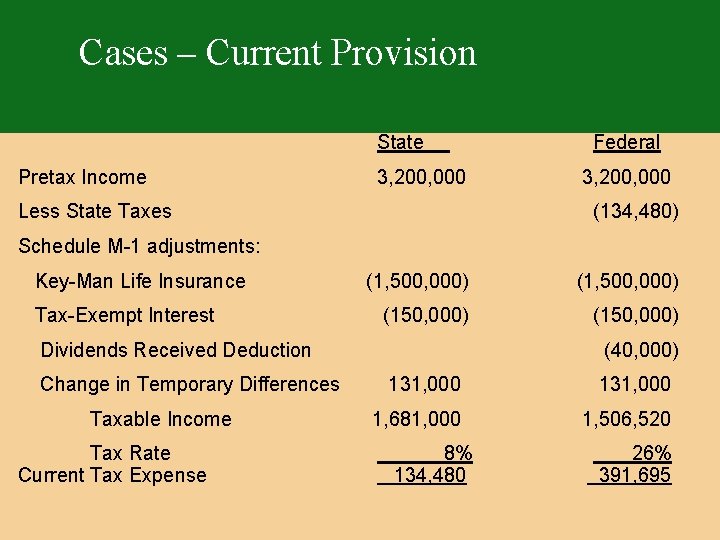

Cases – Current Provision State Pretax Income 3, 200, 000 Less State Taxes Federal 3, 200, 000 (134, 480) Schedule M-1 adjustments: Key-Man Life Insurance Tax-Exempt Interest (1, 500, 000) (150, 000) Dividends Received Deduction Change in Temporary Differences Taxable Income Tax Rate Current Tax Expense (40, 000) 131, 000 1, 681, 000 1, 506, 520 8% 134, 480 26% 391, 695

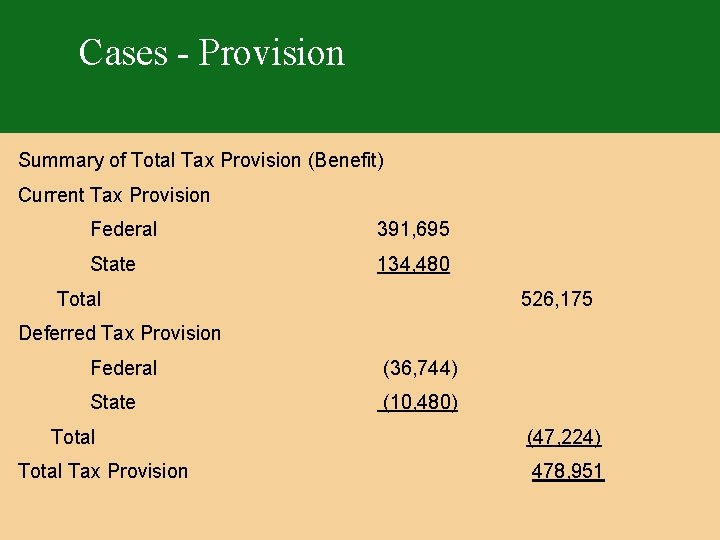

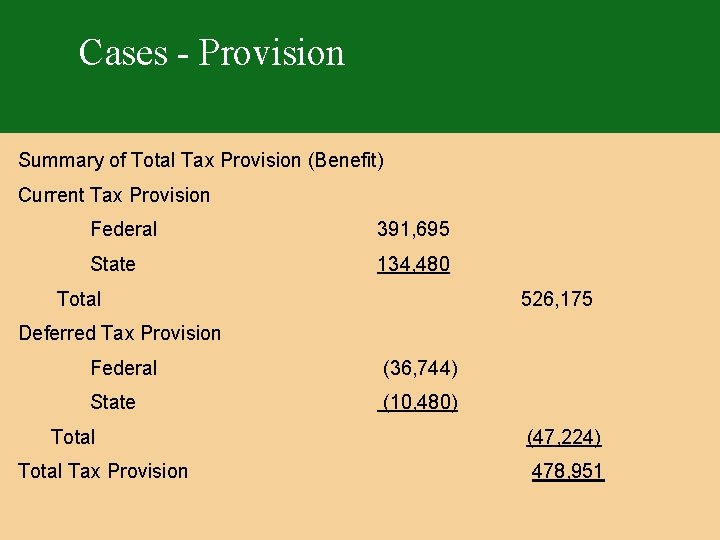

Cases - Provision Summary of Total Tax Provision (Benefit) Current Tax Provision Federal 391, 695 State 134, 480 Total 526, 175 Deferred Tax Provision Federal (36, 744) State (10, 480) Total Tax Provision (47, 224) 478, 951

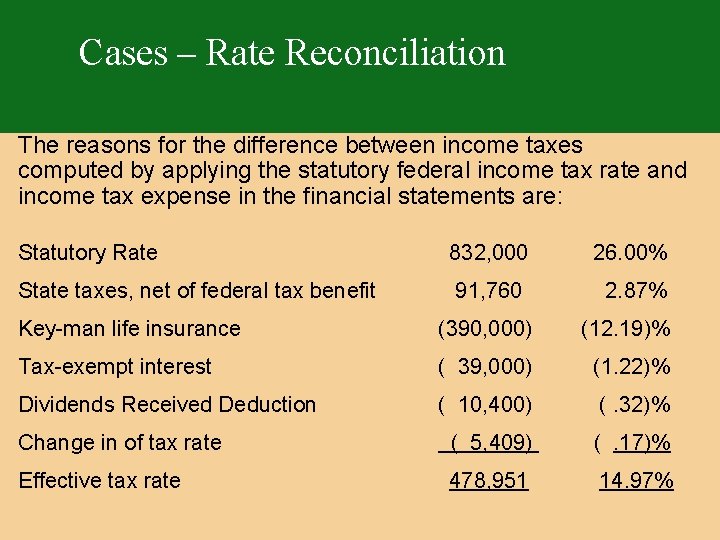

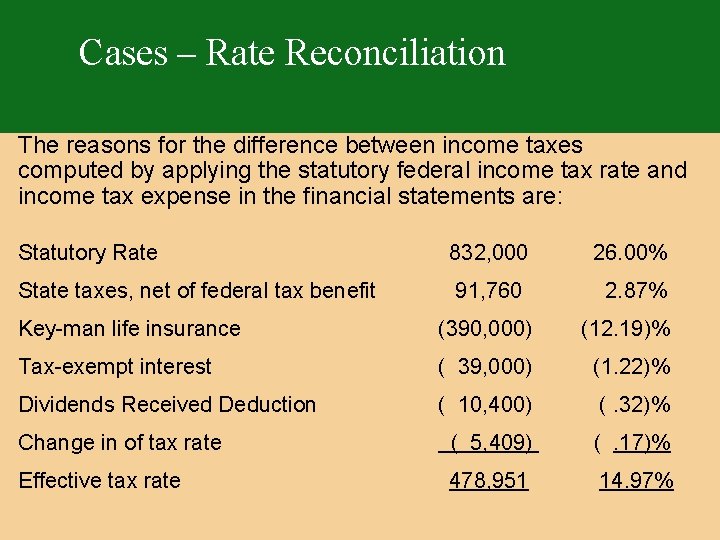

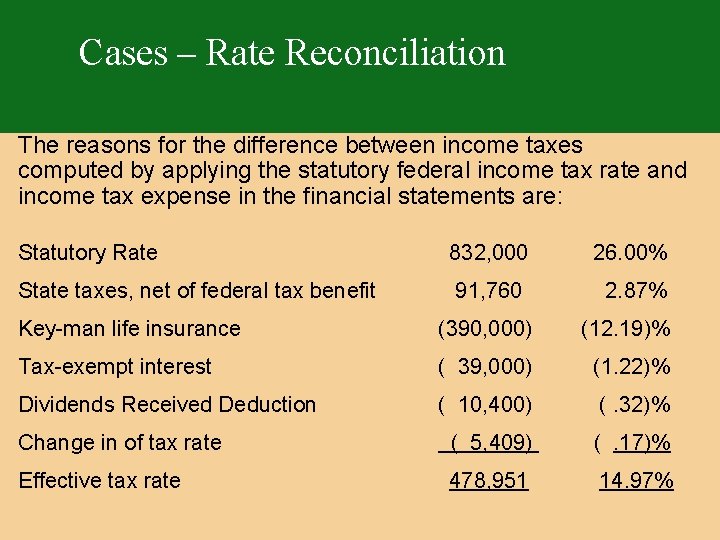

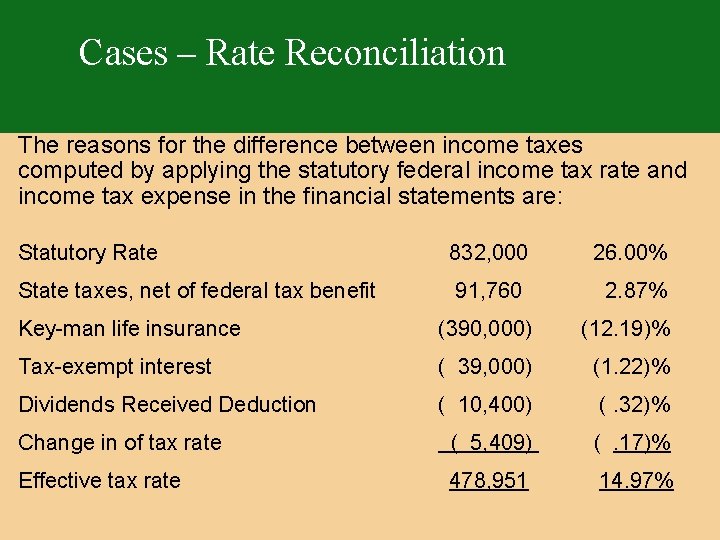

Cases – Rate Reconciliation The reasons for the difference between income taxes computed by applying the statutory federal income tax rate and income tax expense in the financial statements are: Statutory Rate 832, 000 26. 00% State taxes, net of federal tax benefit 91, 760 2. 87% Key-man life insurance (390, 000) (12. 19)% Tax-exempt interest ( 39, 000) (1. 22)% Dividends Received Deduction ( 10, 400) (. 32)% Change in of tax rate ( 5, 409) (. 17)% Effective tax rate 478, 951 14. 97%

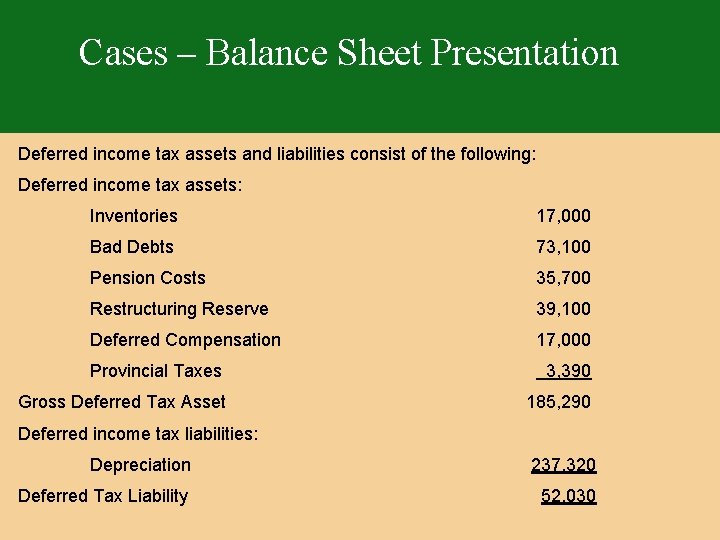

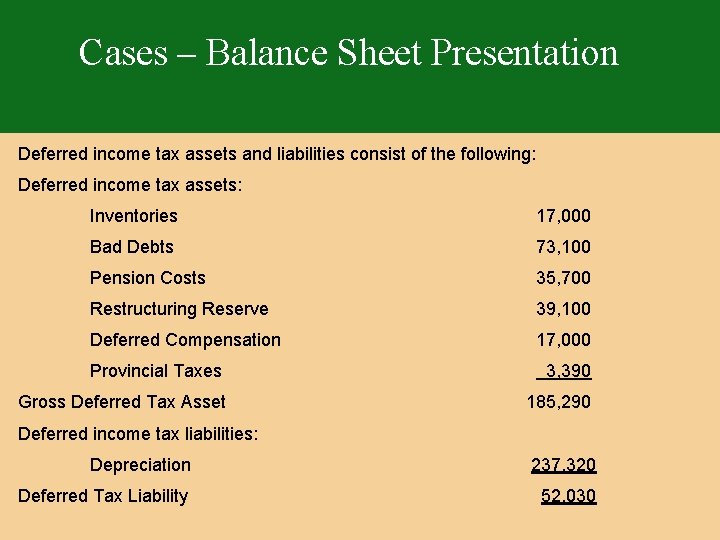

Cases – Balance Sheet Presentation Deferred income tax assets and liabilities consist of the following: Deferred income tax assets: Inventories 17, 000 Bad Debts 73, 100 Pension Costs 35, 700 Restructuring Reserve 39, 100 Deferred Compensation 17, 000 Provincial Taxes 3, 390 Gross Deferred Tax Asset 185, 290 Deferred income tax liabilities: Depreciation 237, 320 Deferred Tax Liability 52, 030

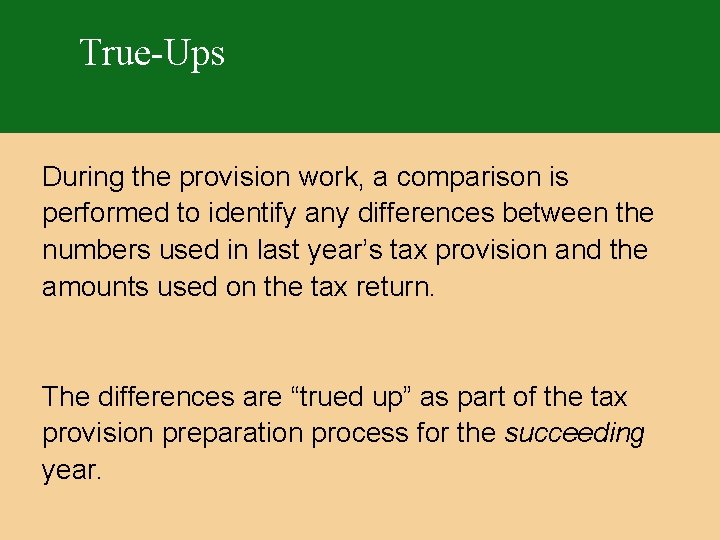

True-Ups During the provision work, a comparison is performed to identify any differences between the numbers used in last year’s tax provision and the amounts used on the tax return. The differences are “trued up” as part of the tax provision preparation process for the succeeding year.

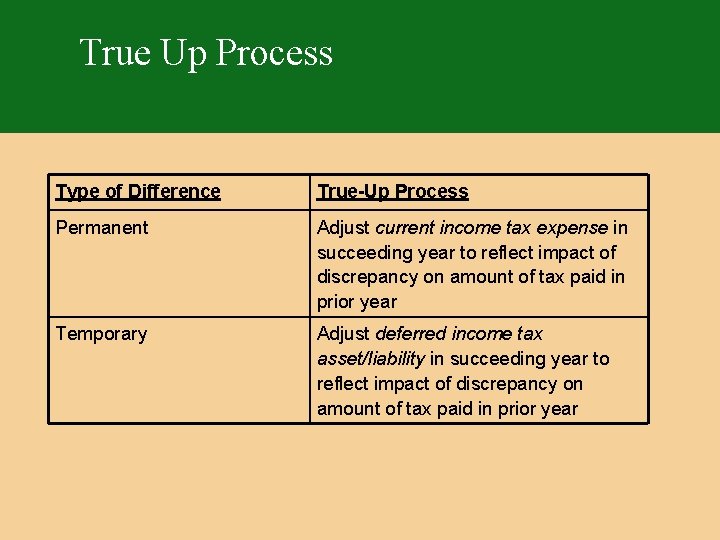

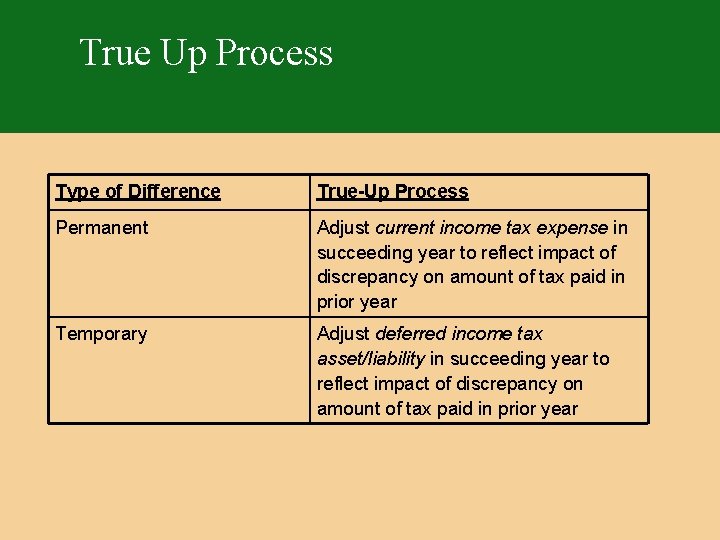

True Up Process Type of Difference True-Up Process Permanent Adjust current income tax expense in succeeding year to reflect impact of discrepancy on amount of tax paid in prior year Temporary Adjust deferred income tax asset/liability in succeeding year to reflect impact of discrepancy on amount of tax paid in prior year

True Up Process Temporary Difference End of Year 20 X 1 True Up Beginning Year 20 X 2

True Up Process - Example For 20 X 9, its initial year of operations, Gamma Corporation reported current income tax expense of $358, 000 and deferred income tax expense of $62, 000, i. e. , total income tax expense of $420, 000. (A 40% tax rate was used in all computations. ) A reconciliation of Gamma’s 20 X 9 tax provision to its 20 X 9 income tax return is as follows:

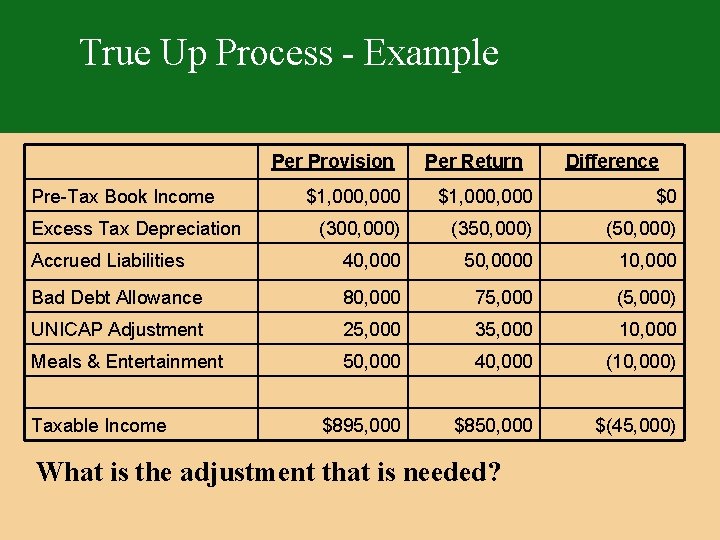

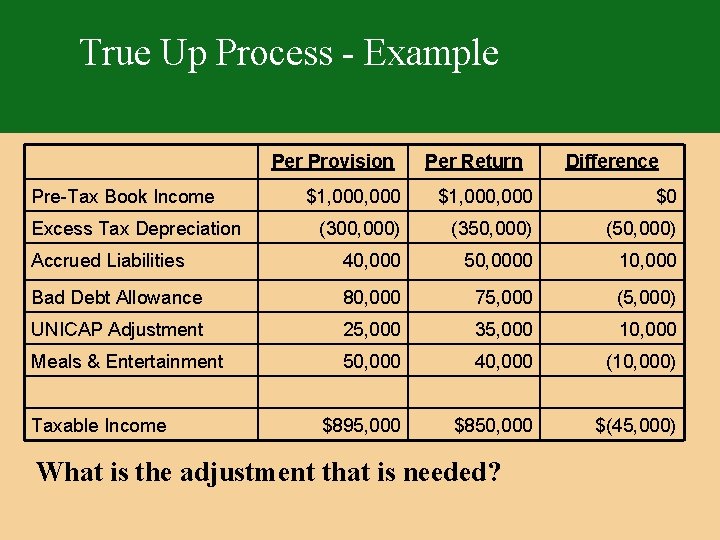

True Up Process - Example Per Provision Pre-Tax Book Income Per Return Difference $1, 000, 000 $0 (300, 000) (350, 000) (50, 000) Accrued Liabilities 40, 000 50, 0000 10, 000 Bad Debt Allowance 80, 000 75, 000 (5, 000) UNICAP Adjustment 25, 000 35, 000 10, 000 Meals & Entertainment 50, 000 40, 000 (10, 000) $895, 000 $850, 000 $(45, 000) Excess Tax Depreciation Taxable Income What is the adjustment that is needed?

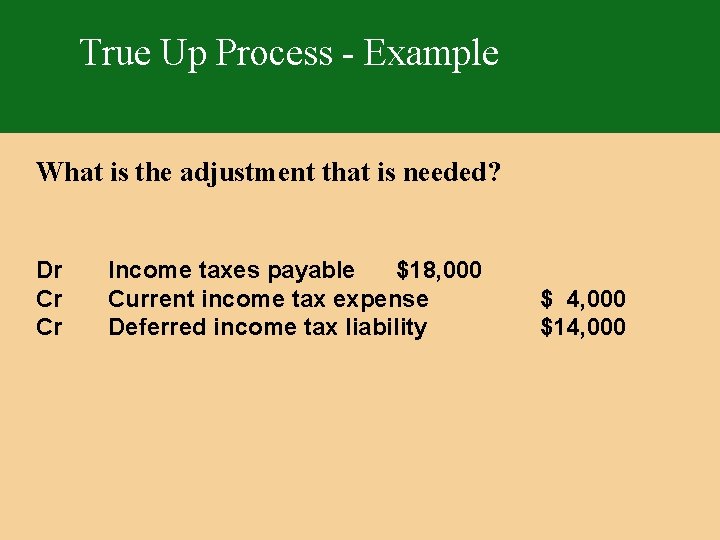

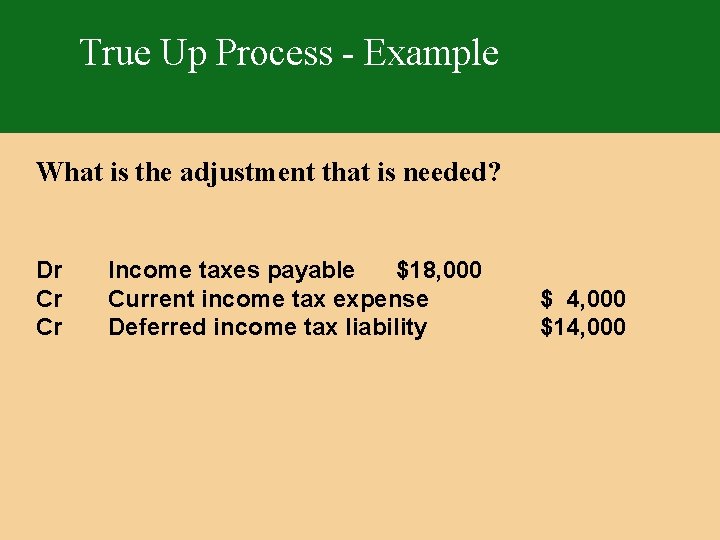

True Up Process - Example What is the adjustment that is needed? Dr Cr Cr Income taxes payable $18, 000 Current income tax expense Deferred income tax liability $ 4, 000 $14, 000

Uncertain Tax Positions Tax issues created the most problems found under Sarbanes-Oxley and 404 Numerous restatements were required because of the tax provision In response FASB undertook a project to govern how uncertain tax positions would be reported

Former Practices Tax Contingencies or cushion were hid and not disclosed in detail Tax Directors were very proprietary with the calculation and were reluctant to discuss with the auditors Concern that if the information was included in the audit workpapers the IRS would have access to them

Former Practices Tax Contingencies are reported using either: “Loss Contingency” approach – SFAS 5 “Best Estimate” approach – 50/50 “Tax Advantaged Transaction” approach – reverse SFAS 5

Former Practices Had to use a consistent approach The likelihood of a taxing authority discovering the issue on examination should not be considered Support for each reserve amount and any change was required

FASB’s Concerns Diversity of reporting of tax contingencies Felt the standards needed strengthening Use of tax contingencies had become too flexible and used to manipulate income Reporting and disclosure lacked transparency

SEC’s Position SEC also concerned about the reporting of tax contingencies Many SEC letters were been issued on this matter in the 6 to 9 months prior to the issuance of FIN 48 (ASC 740 -10) Dealing with the SEC very different than FASB and IRS

FIN 48 (ASC 740 -10) Released July 13, 2006 “Benefit Recognition” Approach “More likely than not” threshold “Cumulative Probability”

Objectives of FIN 48 (ASC 740 -10) Clarify accounting for income taxes Provide greater consistency in criteria used to recognize, derecognize, and measure benefits related to income taxes Establish consistent thresholds, thereby improving relevance and comparability of financial statement reporting

Scope of FIN 48 (ASC 740 -10) Applies to all income tax positions A tax position is defined as a position taken in a previously filed return or expected to be taken in a future return A position can result in a permanent reduction of taxes (permanent differences), a deferral of taxes (temporary differences), or a change in the expected realizability of deferred tax assets FIN 48 also encompasses decisions not to file an income tax return, jurisdictional allocations (i. e. , transfer pricing) and characterization of income

FIN 48 (ASC 740 -10) Recognition criteria focuses primarily on technical tax law “Widely understood” administrative procedures considered Each position assessed separately Detection risk not considered

Highly Certain Tax Positions • FIN 48 applies to all income tax positions Distinguishes between “highly certain” and “uncertain” tax positions Highly certain tax positions Clearly meets the MLTN recognition standard and greater than 50% likely that 100% of benefit will be sustained based on clear and unambiguous tax law

FIN 48 (ASC 740 -10) Introduces concept of “Unit of Account” Based on facts and circumstances • Aggregate or • Separate each project

Unit of Account The appropriate unit of account for a tax position is a matter of judgment and requires consideration of • The manner in which the enterprise prepares and supports income tax return, and • The approach the enterprise anticipates the taxing authority will take during an examination Once established, should be consistently applied to similar positions from period to period unless change in facts and circumstances indicates that a different unit of account is more appropriate

Two Step Process The application of FIN 48 to an uncertain tax position (UTP) requires a two-step process that separates recognition from measurement Step 1: Recognition Threshold Step 2: Measurement of the Benefit

Step 1: Initial Recognition A tax benefit is recognized when it is “more likely than not” to be sustained based on the technical merits of the position • Conclusion regarding financial statement recognition takes into account technical merits and facts and circumstances • Assumes that tax position will be examined by the taxing authority • Each position must stand on its own merits • Administrative practices and precedents deal with limited technical violations of the tax law • • Authority will not take issue with the tax position Broad understanding in practice

Step 2: Measurement A tax position that meets the MLTN recognition threshold shall initially and subsequently be measured as the largest amount of tax benefit that is greater than 50% likely of being realized (cumulative probability concept) • Based upon facts and circumstances determined at the reporting date

Step 2: Measurement Differences related to timing (deduction itself is not in question) • Recognition threshold is achieved Not all tax positions require detailed consideration of possible outcome amounts and percentage likelihood associated with each amount (cumulative probability approach)

Example – Step 1 A company takes a deduction that creates a tax benefit of $100. How likely of being sustained on technical merit must the deduction be before the company can record the benefit? Under the first step the position must be more than 50% likely of being sustained on its technical merit to take the benefit. The amount that should be recognized will depend on the cumulative probability in the second step.

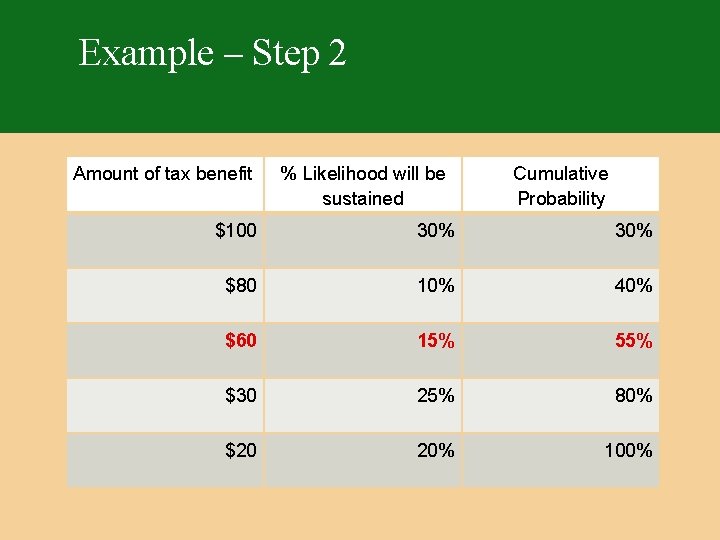

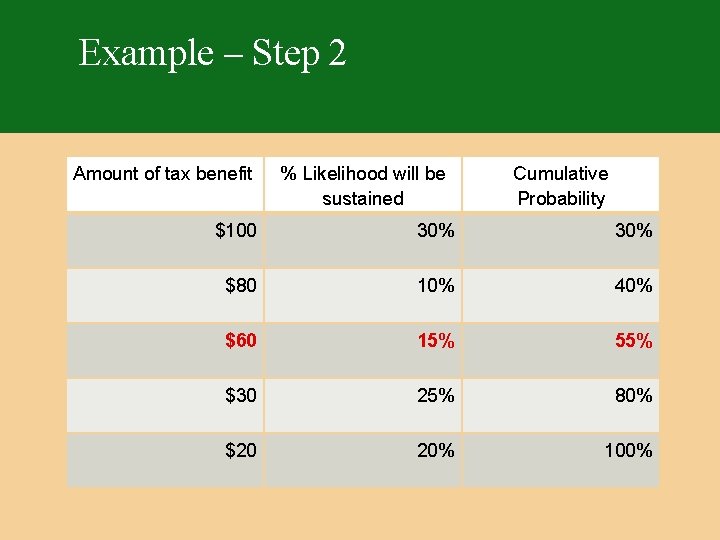

Example – Step 2 From the previous example if the cumulative probability the position will be sustained is 30% for a $100 deduction, 40% for an $80 deduction, 55% for a $60 deduction and 80% for a $30 deduction. How much should be deducted?

Example – Step 2 Amount of tax benefit % Likelihood will be sustained Cumulative Probability $100 30% $80 10% 40% $60 15% 55% $30 25% 80% $20 20% 100%

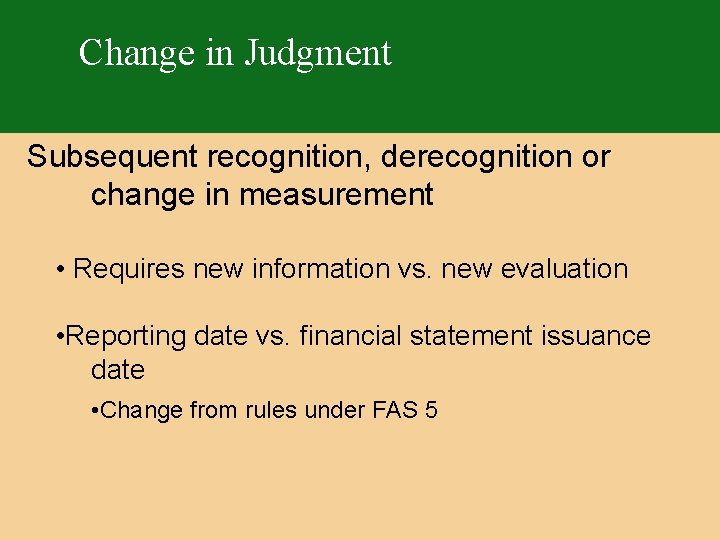

Change in Judgment Subsequent recognition, derecognition or change in measurement • Requires new information vs. new evaluation • Reporting date vs. financial statement issuance date • Change from rules under FAS 5

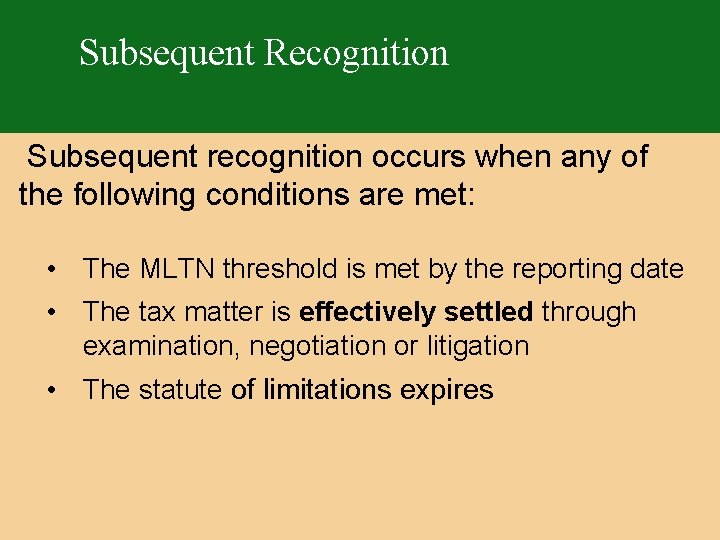

Subsequent Recognition Subsequent recognition occurs when any of the following conditions are met: • The MLTN threshold is met by the reporting date • The tax matter is effectively settled through examination, negotiation or litigation • The statute of limitations expires

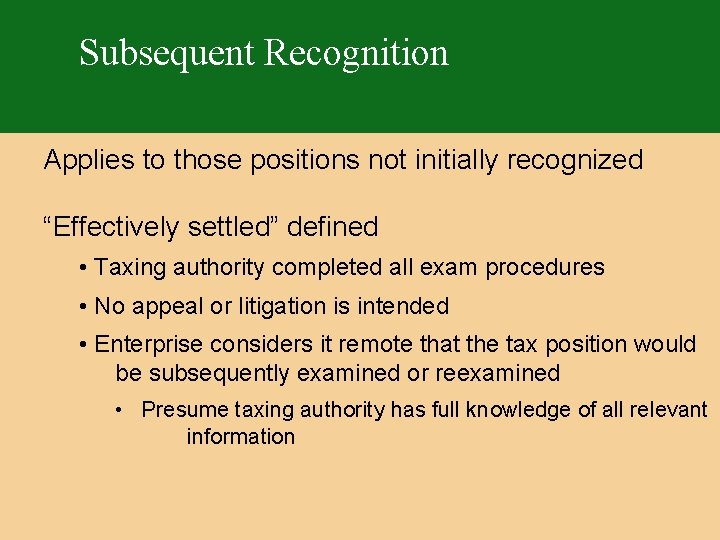

Subsequent Recognition Applies to those positions not initially recognized “Effectively settled” defined • Taxing authority completed all exam procedures • No appeal or litigation is intended • Enterprise considers it remote that the tax position would be subsequently examined or reexamined • Presume taxing authority has full knowledge of all relevant information

Sources of New Information • Developments in the audit • Revenue Agent’s report • Changes in the law • Notice of Proposed Adjustment • Experience in prior audits • APA • Taxing authority program changes • Public statements by tax authority

Balance Sheet Presentation Tax contingencies should be included in the current income tax payable for amounts expected to be paid within 12 months. Amounts that are expected to be paid after 12 months should be in a long-term payable. FIN 48 does not allow tax contingencies to be part of the deferred tax accounts or the valuation allowance.

Effective Date FIN 48 applies to annual periods beginning after December 15, 2006 for public companies; Effective for annual periods beginning after December 15, 2008 for private companies Same rules apply for public and nonpublic companies One-time disclosure of cumulative effect

Cumulative Effect The cumulative effect of the change in net assets requires an adjustment to beginning retained earnings. If the adjustment relates to a business combination, the effect requires an adjustment to goodwill.

Disclosure Requirements FIN 48 requires additional footnote disclosure including: • An annual reconciliation of “unrecognized tax benefits” on an aggregated world-wise basis • Gross amount of increases or decreases relating to prior period positions • Gross amount of increases or decreases relating to the current period • Amounts of decreases relating to settlements with taxing authorities • Reductions due to expiration of statute of limitations

Disclosure Requirements FIN 48 requires additional footnote disclosure including: Amount of unrecognized tax benefits that if recognized would impact the ETR Open years by jurisdiction Total amounts of interest and penalties Policy election on classification of interest and penalties

Disclosure Requirements FIN 48 requires additional footnote disclosure including: “Reasonably possible” significant changes in recognized tax benefits over the next 12 months Qualitative and quantitative disclosure Nature of the uncertainty Events that could cause a change Estimate of the range of the change

Changes Caused by FIN 48 (ASC 74010) Must reexamine: Non-income based taxes Planning and controls Regulations S-K and MD & A disclosures Implementation of other new accounting standards

Interest and Penalties • Interest is a period cost • Interest accrual is based upon the difference between the amount of tax benefit recognized in the financial statements and the amount recognized in the tax return • Accrue statutory penalties when a tax position does not meet the minimum statutory threshold required to avoid penalties • Consider administrative practices and precedents of the tax authority

Interest and Penalties Tax law provisions that address interest and penalties may vary between jurisdictions, periods Classification of interest and penalties is an accounting policy election

Other Related Topics

Application of ASC 740 -10 to Foreign Subsidiaries • MEASURE TEMPORARY DIFFERENCES SEPARATELY FOR EACH FOREIGN SUBSIDIARY • U. S. GAAP v. TAX BASIS UNDER FOREIGN LAW • VALUATION ALLOWANCES DETERMINED IN LIGHT OF FOREIGN LAW • REVIEW UNCERTAIN FOREIGN TAX POSITIONS

Application of ASC 740 -10 to Foreign Branches u BRANCH INCOME SUBJECT TO BOTH FOREIGN AND US TAX u ADDITIONAL • SET OF TEMPORARY DIFFERENCES US GAAP vs. US Tax u US TAX RECORDED NET OF US FOREIGN TAX CREDIT u TAX POSTURE OF US HEAD OFFICE RELEVANT IN DETERMINING NEED FOR VALUATION ALLOWANCE

Inside Basis Temporary Difference u FAS 109 APPLIES TO DIFFERENCES IN FINANCIAL REPORTING CARRYING VALUE AND TAX BASIS OF FOREIGN SUBSIDIARIES’ ASSETS (i. e. , INSIDE BASIS) u MEASURE TEMPORARY DIFFERENCES SEPARATELY FOR EACH FOREIGN SUBSIDIARY u US GAAP vs. TAX BASIS UNDER FOREIGN LAW u VALUATION ALLOWANCES DETERMINED IN LIGHT OF FOREIGN LAW

“Outside” Basis Temporary Difference • THE DIFFERENCE BETWEEN THE FINANCIAL REPORTING AMOUNT AND THE TAX BASIS OF THE INVESTMENT ON THE INVESTOR’S FINANCIAL STATEMENTS.

Methods Of Accounting For Investments • COST • EQUITY • CONSOLIDATION

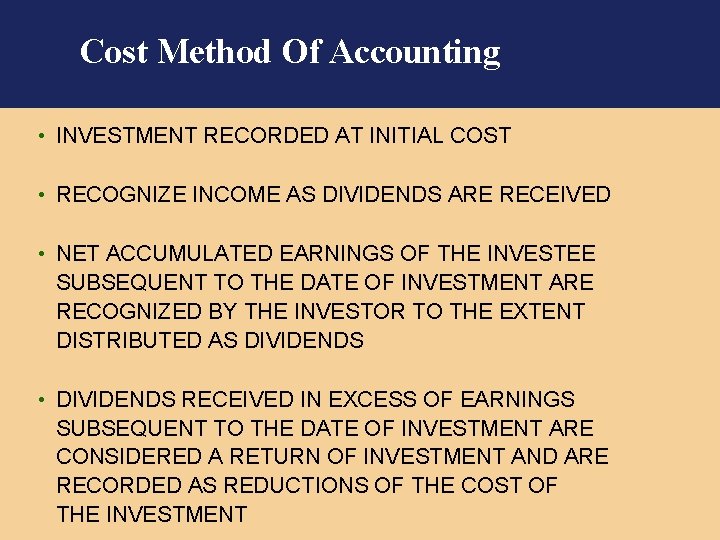

Cost Method Of Accounting • INVESTMENT RECORDED AT INITIAL COST • RECOGNIZE INCOME AS DIVIDENDS ARE RECEIVED • NET ACCUMULATED EARNINGS OF THE INVESTEE SUBSEQUENT TO THE DATE OF INVESTMENT ARE RECOGNIZED BY THE INVESTOR TO THE EXTENT DISTRIBUTED AS DIVIDENDS • DIVIDENDS RECEIVED IN EXCESS OF EARNINGS SUBSEQUENT TO THE DATE OF INVESTMENT ARE CONSIDERED A RETURN OF INVESTMENT AND ARE RECORDED AS REDUCTIONS OF THE COST OF THE INVESTMENT

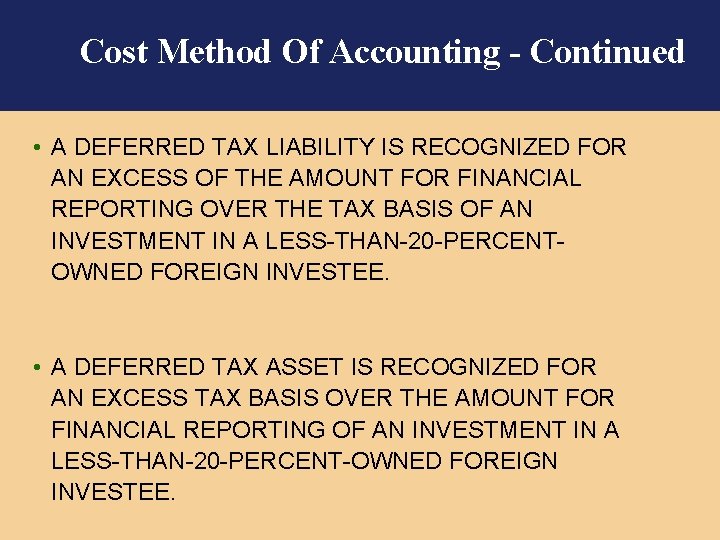

Cost Method Of Accounting - Continued • A DEFERRED TAX LIABILITY IS RECOGNIZED FOR AN EXCESS OF THE AMOUNT FOR FINANCIAL REPORTING OVER THE TAX BASIS OF AN INVESTMENT IN A LESS-THAN-20 -PERCENTOWNED FOREIGN INVESTEE. • A DEFERRED TAX ASSET IS RECOGNIZED FOR AN EXCESS TAX BASIS OVER THE AMOUNT FOR FINANCIAL REPORTING OF AN INVESTMENT IN A LESS-THAN-20 -PERCENT-OWNED FOREIGN INVESTEE.

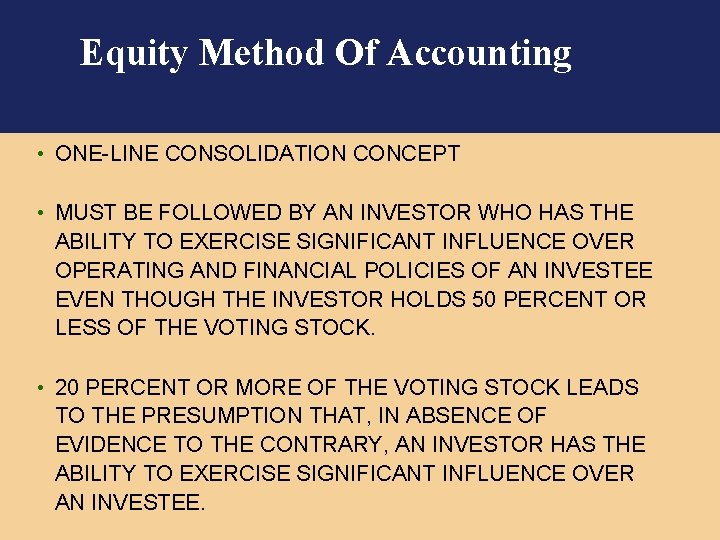

Equity Method Of Accounting • ONE-LINE CONSOLIDATION CONCEPT • MUST BE FOLLOWED BY AN INVESTOR WHO HAS THE ABILITY TO EXERCISE SIGNIFICANT INFLUENCE OVER OPERATING AND FINANCIAL POLICIES OF AN INVESTEE EVEN THOUGH THE INVESTOR HOLDS 50 PERCENT OR LESS OF THE VOTING STOCK. • 20 PERCENT OR MORE OF THE VOTING STOCK LEADS TO THE PRESUMPTION THAT, IN ABSENCE OF EVIDENCE TO THE CONTRARY, AN INVESTOR HAS THE ABILITY TO EXERCISE SIGNIFICANT INFLUENCE OVER AN INVESTEE.

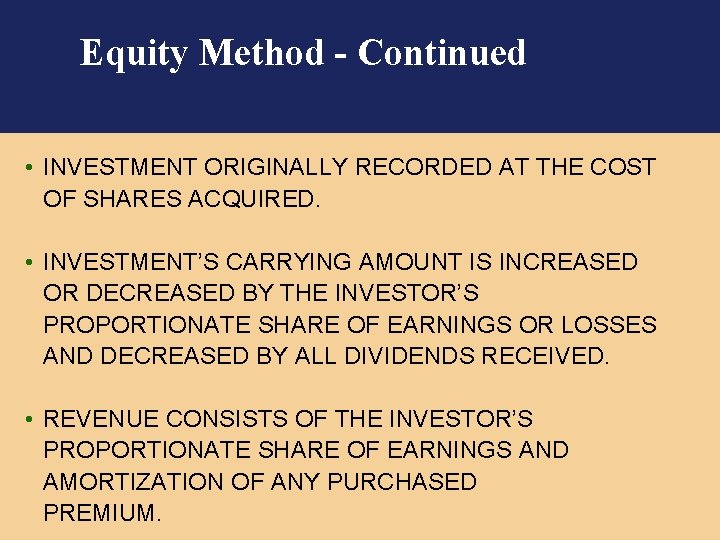

Equity Method - Continued • INVESTMENT ORIGINALLY RECORDED AT THE COST OF SHARES ACQUIRED. • INVESTMENT’S CARRYING AMOUNT IS INCREASED OR DECREASED BY THE INVESTOR’S PROPORTIONATE SHARE OF EARNINGS OR LOSSES AND DECREASED BY ALL DIVIDENDS RECEIVED. • REVENUE CONSISTS OF THE INVESTOR’S PROPORTIONATE SHARE OF EARNINGS AND AMORTIZATION OF ANY PURCHASED PREMIUM.

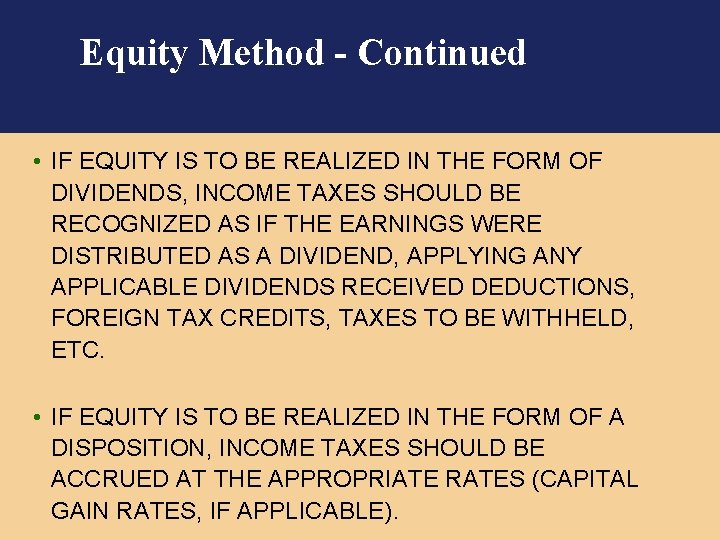

Equity Method - Continued • IF EQUITY IS TO BE REALIZED IN THE FORM OF DIVIDENDS, INCOME TAXES SHOULD BE RECOGNIZED AS IF THE EARNINGS WERE DISTRIBUTED AS A DIVIDEND, APPLYING ANY APPLICABLE DIVIDENDS RECEIVED DEDUCTIONS, FOREIGN TAX CREDITS, TAXES TO BE WITHHELD, ETC. • IF EQUITY IS TO BE REALIZED IN THE FORM OF A DISPOSITION, INCOME TAXES SHOULD BE ACCRUED AT THE APPROPRIATE RATES (CAPITAL GAIN RATES, IF APPLICABLE).

Foreign Subsidiaries • A DEFERRED TAX LIABILITY IS NOT RECOGNIZED FOR THE EXCESS OF THE AMOUNT FOR FINANCIAL REPORTING OVER THE TAX BASIS OF AN INVESTMENT IN A FOREIGN SUBSIDIARY OR A FOREIGN CORPORATE JOINT VENTURE THAT IS ESSENTIALLY PERMANENT IN DURATION (i. e. , THE OUTSIDE BASIS DIFFERENCE).

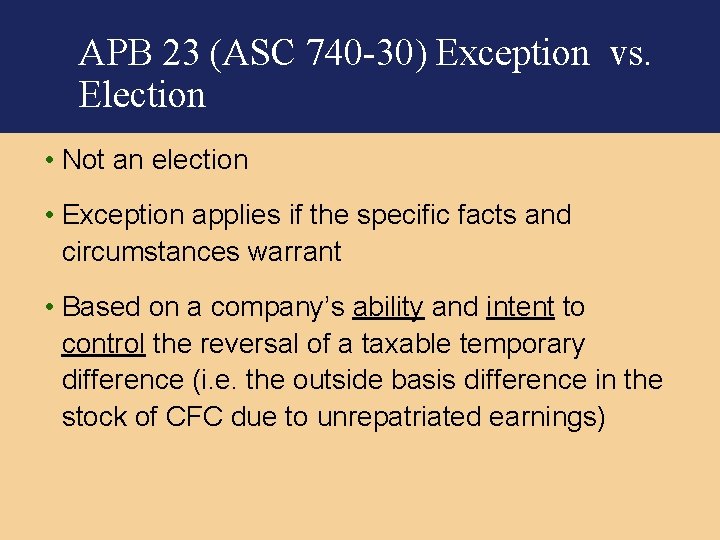

APB 23 (ASC 740 -30) Exception vs. Election • Not an election • Exception applies if the specific facts and circumstances warrant • Based on a company’s ability and intent to control the reversal of a taxable temporary difference (i. e. the outside basis difference in the stock of CFC due to unrepatriated earnings)

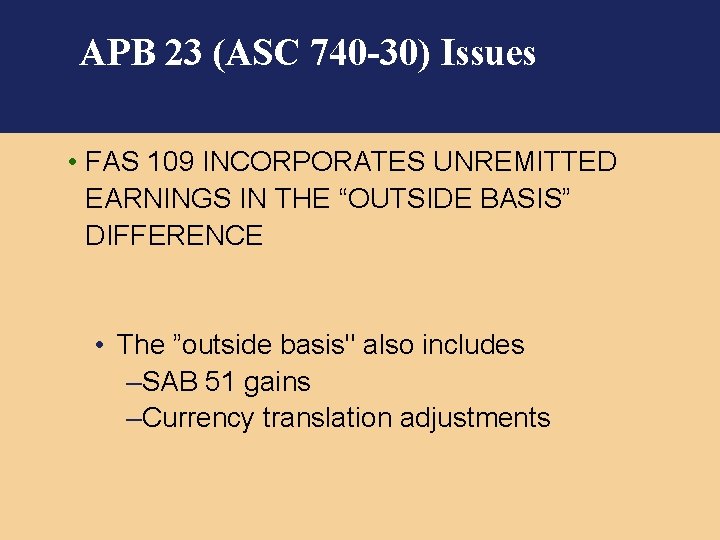

APB 23 (ASC 740 -30) Issues • FAS 109 INCORPORATES UNREMITTED EARNINGS IN THE “OUTSIDE BASIS” DIFFERENCE • The ”outside basis" also includes –SAB 51 gains –Currency translation adjustments

SFAS 123 R • SFAS 123 R applies to all transactions involving the issuance by a company of its own equity in exchange for goods or services • Currently SFAS 123 R does not apply to sharebased payment transactions with nonemployees or ESOPs.

SFAS 123 R • 123 R requires all entities to recognize compensation expense in an amount equal to the fair value of share-based payments granted to employees.

Compensation Expense • Compensation expense will be recognized over the requisite service period • How the compensation is recorded depends on the vesting schedule – Cliff Vesting – Graded Vesting

Forfeitures • 123 R requires companies to estimate forfeitures on the date of grant • In subsequent periods, estimates can be adjusted • Changes in estimates will be a cumulative effect of a change in accounting estimate

Stock Compensation • SFAS 123 R requires companies to use fair value to measure share-based payments to employees • Fair Value is determined at date of grant • Value is never remeasured

Fair Value u If an observable market price exists for an option with the same or similar terms, companies should use that price u Otherwise, a valuation technique based on established financial economic theory should be used

Valuation Models • Must be consistent with the fair value measurement objective and • Capable of incorporating all the substantive characteristics unique to employee stock options

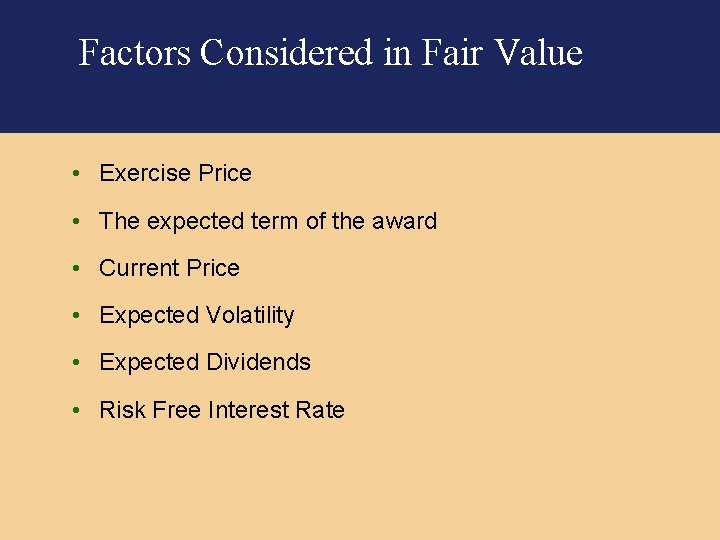

Factors Considered in Fair Value • Exercise Price • The expected term of the award • Current Price • Expected Volatility • Expected Dividends • Risk Free Interest Rate

Application of ASC 740 -10 to Stock Options • The compensation deduction on the financial statements give rise to a deferred tax asset under SFAS 109. • The deferred tax is not remeasured for any future changes in the fair value before the tax deduction is taken • A need for a valuation allowance should be considered

Effect on DTA – Tax Deduction • At the time of the tax deduction is taken the DTA is written off • If the tax deduction is larger than the book deduction the excess tax benefit is treated as an increase to paid-in capital • If there is a tax benefit deficiency it is recorded as a decrease in paid-in capital if excess tax benefits exist

SFAS 123 R • A company should not recognize a credit to APIC for windfall tax benefits unless such windfall benefit reduces taxes payable. Therefore, a company would only be allowed to credit APIC when a benefit is received.

Effect of ASC 740 -10 for ISOs • Companies should not record a deferred tax asset for ISO’s because they cannot assume that these awards will result in a tax deduction • A current tax benefit will result if there is a disqualifying dispostion

Accounting for Income Taxes - Interim • FIN 18 “Accounting for Income Taxes in Interim Periods” amended APB 28 • Tackles how to measure the tax provision for interim reports when the actual tax expense is based on annual income. • Allows estimates and judgments to determine the interim tax provision

Accounting for Income Taxes • Income taxes for interim reporting is divided into: 1. Those applicable to income from continuing operations 2. Those applicable to significant, unusual or infrequently occurring items, discontinued items and extraordinary items • Tax effect of the second set of items are calculated separately and added to tax expense for the quarter

Annual Effective Rate Method • To calculate the provision under the annual effective rate method you must: 1. Determine the projected income, all permanent and temporary differences, credits and carryforwards for the entire year 2. Calculate the tax liability for the year 3. Calculate the ETR for the year; and 4. Apply the ETR to quarterly earnings

Annual Effective Rate Method • Estimated ETR is applied to year-to-date income • Prior quarter income taxes are deducted to compute the current quarterly income tax expense

Post Sarbanes-Oxley • Prior to Sarbanes-Oxley many companies did not separate the income tax provision into current and deferred – APB 11 approach • Currently, a complete tax provision that shows a breakdown of current and deferred taxes are required for public companies

Updating the Annual Estimate • A company must update its ETR each quarter • An accurate projection of ETR is very important • Because it is an estimate the amount may change during the year • If ETR is miscalculated early in the year it is better to overstate taxes in the earlier quarter

Operating Losses in an Interim Period • SFAS 109 addresses the case where a company has an operating loss for a quarter • Under SFAS 109 realization of a tax benefit must be assured beyond a reasonable doubt before the benefit may be recognized in the financial statements

Operating Losses in an Interim Period • A company can recognize a tax benefit of a to-date operating loss • Prior periods of income are present against which the current loss can be applied • Tax credits are available to offset the tax effect of the operating loss • The company has established seasonal patterns of income in subsequent interim periods

Accounting Changes in Interim Periods • SFAS 3 deals with how to report accounting changes in interim reports • General recommendation is that changes should be made in the first quarter • Cumulative effect of change – if change is made any a subsequent quarter all prior quarters must be restated • Retroactive type change – if previous annual reports must be restates so do the interim reports

Intraperiod Tax Allocations • Income tax expense or benefit must be allocated among – Continuing operations – Discontinued operations – Extraordinary items – Items charged or credited directly to shareholder’s equity

Intraperiod Tax Allocations • The tax effects of the following items are charged or credited directly to equity: – Adjustments of opening RE for certain changes in accounting principles or a correction of an error – Gains and losses included in comprehensive income but excluded from net income – A change in contributed capital – Change in basis of tax assets in a pooling of interest – Dividends that are paid on unallocated shares held by an ESOP – Deductible temporary differences that existed at the date of a quasi reorganization

Intraperiod Tax Allocations • Tax benefit of NOLs are reported in the same manner as the source of the income or loss in the current year • Exceptions to this rule are: • Tax effects of deductible temporary differences that existed at the date of a purchase business combination • Tax effects of deductible temporary differences that are allocated directly to stockholder’s equity

Allocation Between Types of Income • If there is only one item other than continuing operations, the portion of income tax expense or benefit that remains after the allocation to continuing operations is allocated to that item. – Use a with and without calculation

Allocation Between Types of Income • If there are two or more other items, the amount of tax that remains after the allocation to continuing operations shall be allocated among the other items in proportion to their individual effect on income tax expense or benefit for the year. • The sum of the separate tax effects may not equal the amount of income tax that remain to be allocated.

Balance Sheet Presentation Classified Balance Sheet • Break out current and noncurrent portions Netting of Deferred Tax Assets and Liabilities of the Same Jurisdiction No Netting of Deferred Tax Assets and Liabilities from Different Jurisdictions

Financial Statement Disclosures Tax expense or benefit allocated to continuing operations and other categories Significant components of income tax Effective rate reconciliation Gross deferred tax liabilities, gross deferred tax assets, the valuation allowance and the net change in the valuation allowance

Financial Statement Disclosure Tax effect of each type of temporary difference and carryforward that gives rise to significant portions of the deferred tax liabilities or assets Significant matters affecting comparability of information for all periods presented Amounts and expiration dates of tax loss and credit carryforwards

Financial Statement Disclosure Any portion of the valuation allowance or deferred tax assets for which subsequent recognition would be used to reduce goodwill or other noncurrent intangible assets of an acquired entity or would be allocated directly to equity

Rate Reconciliation The objective of the rate reconciliation is to reconcile the “expected” US federal statutory income tax rate of 34% or 35% with the company’s “actual” or “effective” tax rate. Items that Impact the Effective Tax Rate State and foreign taxes (net of federal benefit) Permanent Differences Changes in the Valuation Allowance Income Tax Credits True Ups and changes in Cushion or change in prior year tax Changes in Tax Rates

Cases – Rate Reconciliation The reasons for the difference between income taxes computed by applying the statutory federal income tax rate and income tax expense in the financial statements are: Statutory Rate 832, 000 26. 00% State taxes, net of federal tax benefit 91, 760 2. 87% Key-man life insurance (390, 000) (12. 19)% Tax-exempt interest ( 39, 000) (1. 22)% Dividends Received Deduction ( 10, 400) (. 32)% Change in of tax rate ( 5, 409) (. 17)% Effective tax rate 478, 951 14. 97%

Fas 109 accounting for income taxes

Fas 109 accounting for income taxes Gabriel deloitte

Gabriel deloitte Asc 740

Asc 740 Deloitte asc 740

Deloitte asc 740 Income tax expense

Income tax expense Deferred tax asset journal entry

Deferred tax asset journal entry F 740

F 740 Prof. onur mutlu

Prof. onur mutlu R 740

R 740 Who wrote the ffa creed? when was it adopted?

Who wrote the ffa creed? when was it adopted? Cs 740

Cs 740 14-740

14-740 740

740 Non operating income

Non operating income How to calculate real gdp per capita

How to calculate real gdp per capita What is tax id

What is tax id How to compute federal income tax

How to compute federal income tax Features of income tax

Features of income tax 5 heads of income

5 heads of income Income tax meaning

Income tax meaning Income tax expense

Income tax expense Mcit bir regulation 9-98

Mcit bir regulation 9-98 Chapter 7 federal income tax

Chapter 7 federal income tax Individual tax computation format

Individual tax computation format 195 of income tax act

195 of income tax act Mcit tax

Mcit tax Income tax meaning

Income tax meaning Lgutef

Lgutef Income tax computation format

Income tax computation format Winman software download

Winman software download Taxes in russia

Taxes in russia Easyoffice

Easyoffice Kansas income tax rates

Kansas income tax rates Rumusan pengiktirafan hasil dan belanja

Rumusan pengiktirafan hasil dan belanja James wilson income tax

James wilson income tax Perquisites in income tax

Perquisites in income tax Income tax ordinance 2001

Income tax ordinance 2001 Form 35 income tax

Form 35 income tax Income tax expense

Income tax expense Perquisites in income tax

Perquisites in income tax Find the local tax deducted: $456 biweekly, 2 1/2 % tax.

Find the local tax deducted: $456 biweekly, 2 1/2 % tax. Direct tax and indirect tax

Direct tax and indirect tax Sfas matrix steps

Sfas matrix steps Sfas no 132

Sfas no 132 Mutual service consortia

Mutual service consortia Sfas 142

Sfas 142 Mutual service consortia example

Mutual service consortia example Sfas 142

Sfas 142 Chem 109

Chem 109 Karakteristik organisasi pemerintahan

Karakteristik organisasi pemerintahan Xm 109

Xm 109 Psalms 109 1-31

Psalms 109 1-31 100 101 102

100 101 102 Tercom

Tercom Ab 109 housing

Ab 109 housing Cs 109

Cs 109 Bp 109/64

Bp 109/64 Prime numbers 100 to 1000

Prime numbers 100 to 1000 Euplectella

Euplectella 109 hesap

109 hesap Dot/faa/ar-02/110

Dot/faa/ar-02/110 46 en binaire

46 en binaire Micro unit symbol

Micro unit symbol Ansi 97 de luz filtrada

Ansi 97 de luz filtrada Issa tb 109

Issa tb 109 105 106 107

105 106 107 Cs 109

Cs 109 5,6,26,109,?

5,6,26,109,? 109+138

109+138 Fixed income accounting

Fixed income accounting Gnp vs gdp

Gnp vs gdp Ano ang formula sa pagsukat sa pamamaraan ng gastusin

Ano ang formula sa pagsukat sa pamamaraan ng gastusin Period cost

Period cost Income statement in financial accounting

Income statement in financial accounting Income statement intermediate accounting

Income statement intermediate accounting Income accounting u of u

Income accounting u of u What is the purpose of taxation

What is the purpose of taxation Glencoe accounting chapter 12

Glencoe accounting chapter 12 Auxiliary services corporation of suny cortland

Auxiliary services corporation of suny cortland Asc 718

Asc 718 Uninstalled materials asc 606

Uninstalled materials asc 606 Ices asc

Ices asc Atlas asc

Atlas asc Deloitte asc 606

Deloitte asc 606 Tamu asc

Tamu asc Equipment leasing and finance industry snapshot

Equipment leasing and finance industry snapshot Asc 450 decision tree

Asc 450 decision tree Pier abutment in rpd

Pier abutment in rpd Asc 606 short term lease

Asc 606 short term lease Asc control system

Asc control system Qué proyectos y talleres podemos crear asc

Qué proyectos y talleres podemos crear asc Asc 805 business combinations

Asc 805 business combinations Split lingual bar

Split lingual bar Itfma 2019

Itfma 2019 Sigma levels

Sigma levels Asc college panvel

Asc college panvel Kim fleck

Kim fleck Currency translation adjustment calculation

Currency translation adjustment calculation Acs gci pharmaceutical roundtable

Acs gci pharmaceutical roundtable Asc cybersecurity

Asc cybersecurity Asc code

Asc code Ny metro asc symposium new york

Ny metro asc symposium new york Irb acronym

Irb acronym Operating lease

Operating lease Asc valuation

Asc valuation Non lease components

Non lease components Financial accounting chapter 1

Financial accounting chapter 1 Introduction to accounting system

Introduction to accounting system Basic accountin

Basic accountin Responsibility center ppt

Responsibility center ppt Accrued revenue adjusting entry

Accrued revenue adjusting entry Balance sheet title

Balance sheet title Ifrs meaning

Ifrs meaning Virginia preschool initiative income guidelines 2020

Virginia preschool initiative income guidelines 2020 Variable costing and segment reporting

Variable costing and segment reporting Appi fund

Appi fund Gaap income statement

Gaap income statement Sole proprietorship income statement

Sole proprietorship income statement Retained earnings components

Retained earnings components Housing income management brighton

Housing income management brighton Calculate residual income

Calculate residual income Carriage inwards debit or credit

Carriage inwards debit or credit Oepic income guidelines 2020

Oepic income guidelines 2020 List the four sections of an income statement.

List the four sections of an income statement. Balance sheet income statement

Balance sheet income statement How do career choices affect your income? explain

How do career choices affect your income? explain Income capitalization method

Income capitalization method Margin of safety ratio

Margin of safety ratio Usana ranking

Usana ranking National income formula

National income formula Levels of herbalife

Levels of herbalife Fdt sellus

Fdt sellus Cvp income statement

Cvp income statement