The Income Statement Comprehensive Income and the Statement

- Slides: 43

The Income Statement, Comprehensive Income, and the Statement of Cash Flows Chapter 4 Power. Point Authors: Susan Coomer Galbreath, Ph. D. , CPA Charles W. Caldwell, D. B. A. , CMA Jon A. Booker, Ph. D. , CPA, CIA Cynthia J. Rooney, Ph. D. , CPA Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

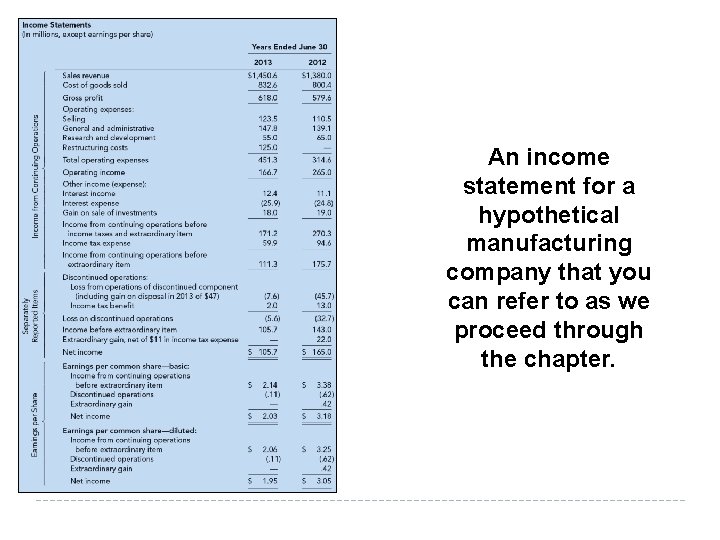

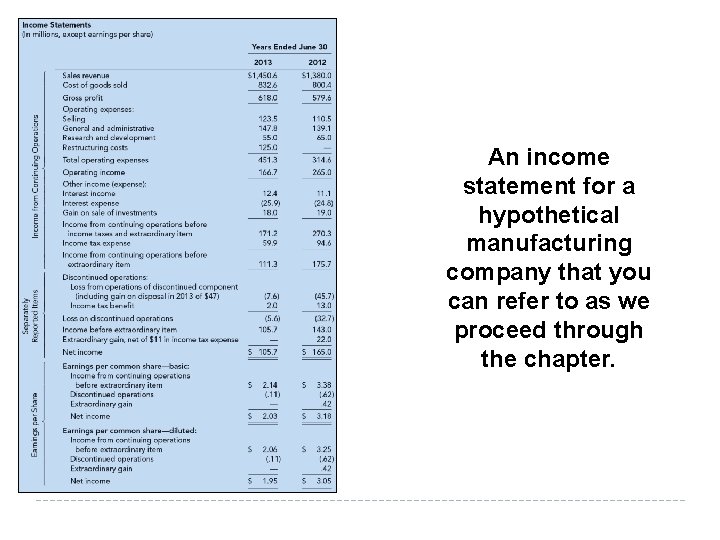

An income statement for a hypothetical manufacturing company that you can refer to as we proceed through the chapter.

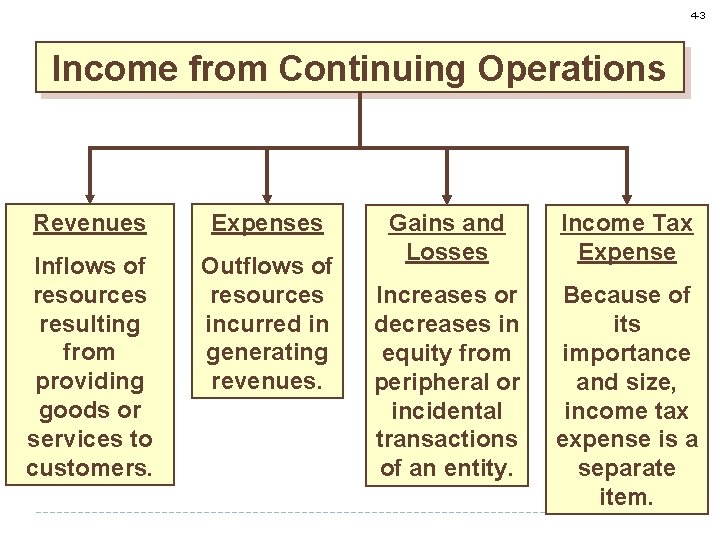

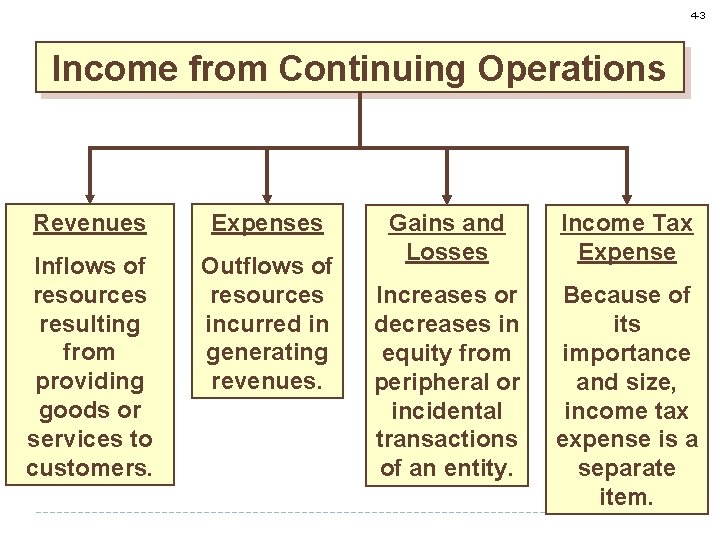

4 -3 Income from Continuing Operations Revenues Expenses Inflows of resources resulting from providing goods or services to customers. Outflows of resources incurred in generating revenues. Gains and Losses Income Tax Expense Increases or decreases in equity from peripheral or incidental transactions of an entity. Because of its importance and size, income tax expense is a separate item.

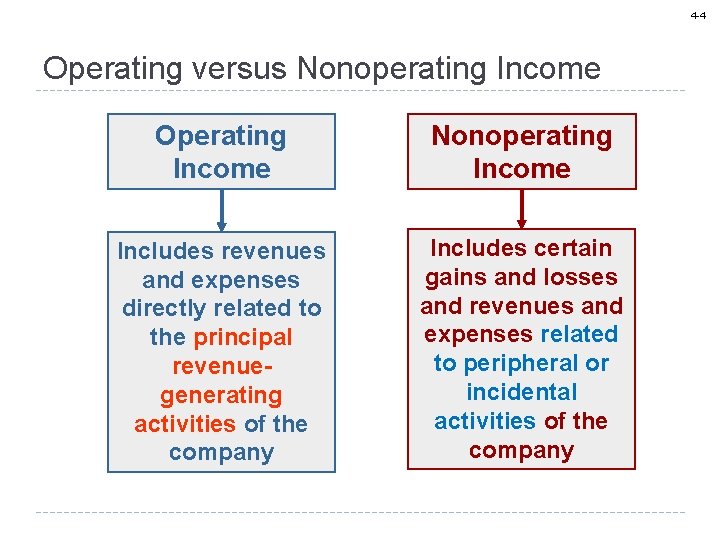

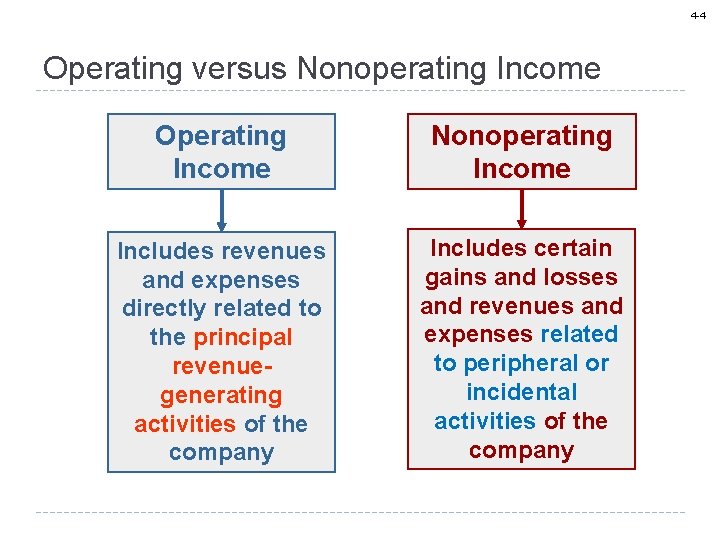

4 -4 Operating versus Nonoperating Income Operating Income Nonoperating Income Includes revenues and expenses directly related to the principal revenuegenerating activities of the company Includes certain gains and losses and revenues and expenses related to peripheral or incidental activities of the company

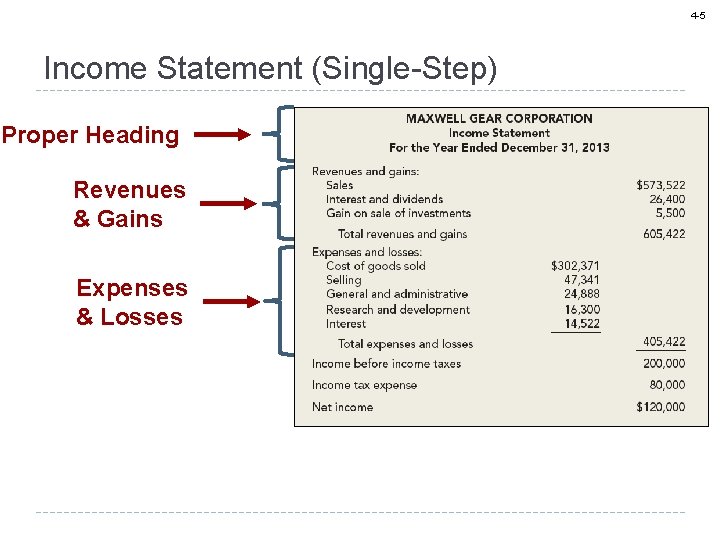

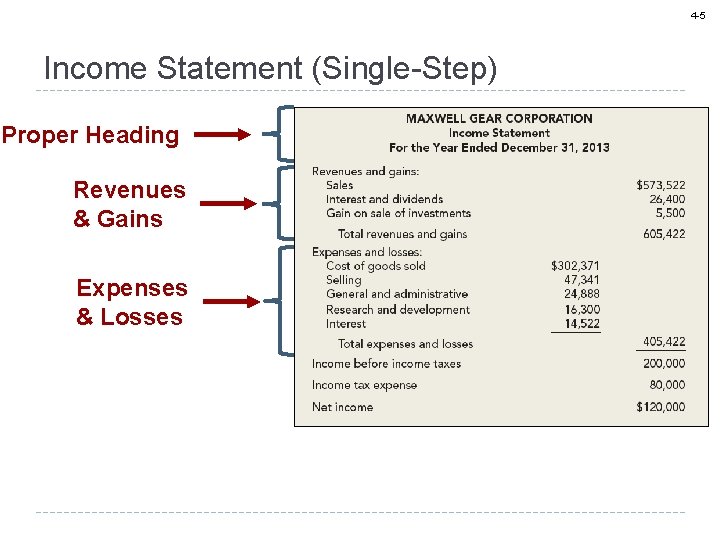

4 -5 Income Statement (Single-Step) Proper Heading Revenues & Gains Expenses & Losses

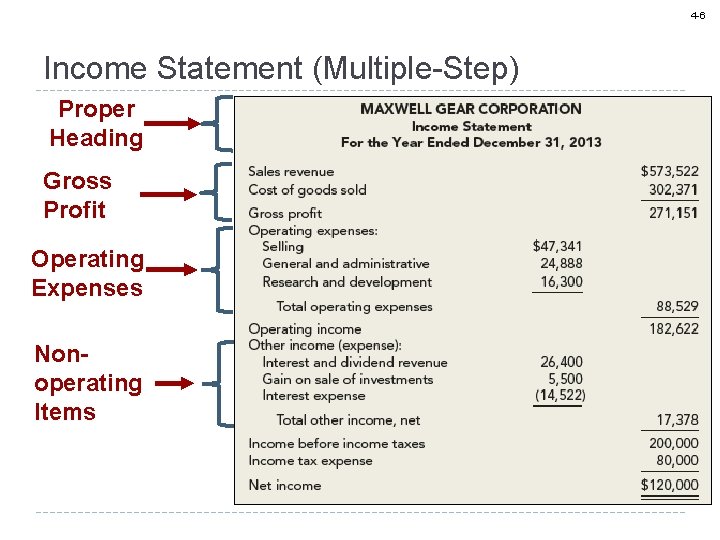

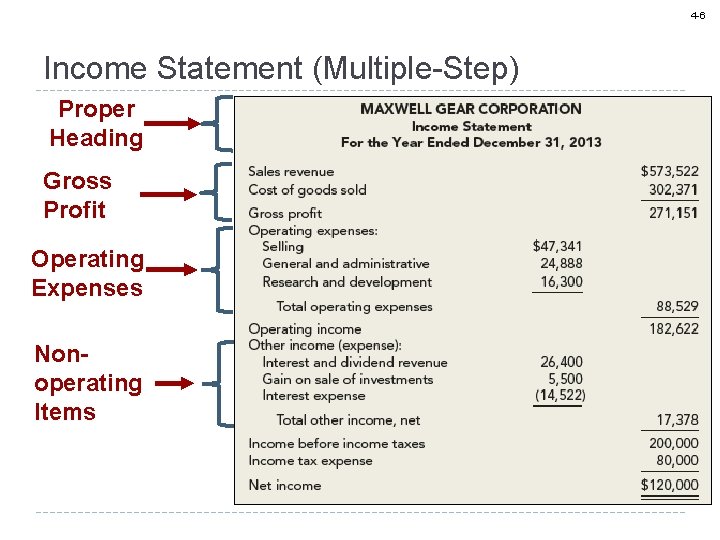

4 -6 Income Statement (Multiple-Step) Proper Heading Gross Profit Operating Expenses Nonoperating Items

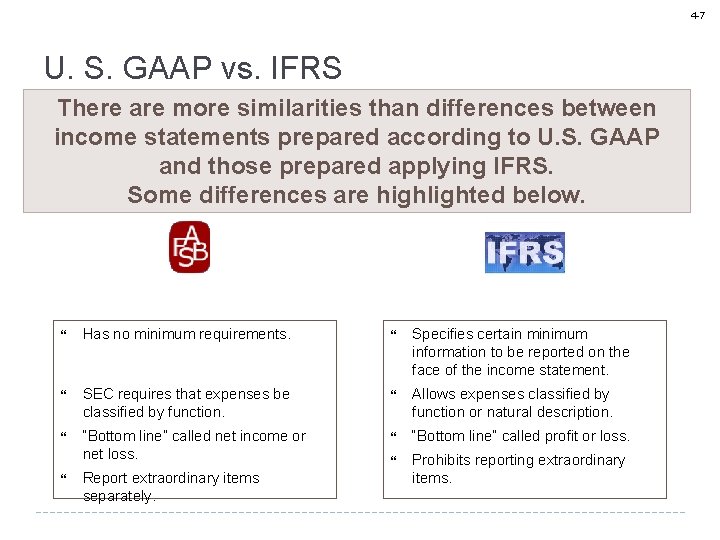

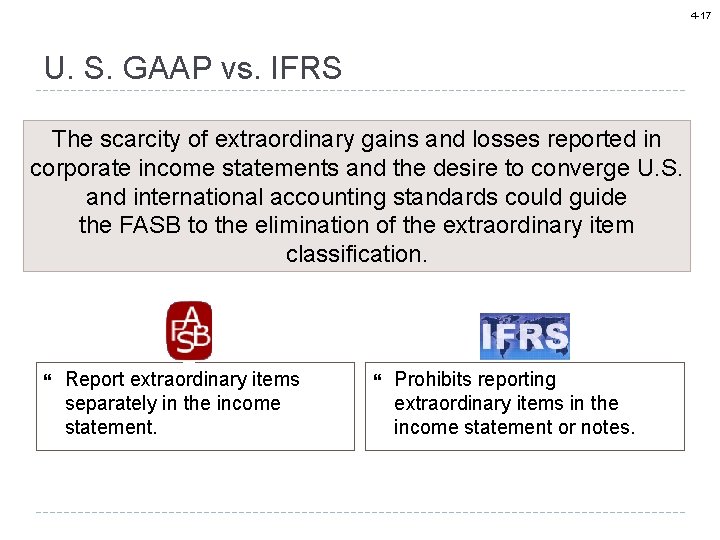

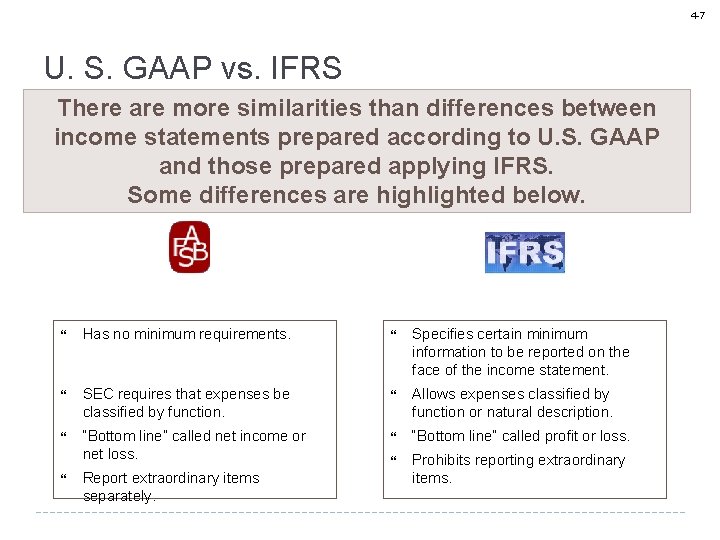

4 -7 U. S. GAAP vs. IFRS There are more similarities than differences between income statements prepared according to U. S. GAAP and those prepared applying IFRS. Some differences are highlighted below. Has no minimum requirements. Specifies certain minimum information to be reported on the face of the income statement. SEC requires that expenses be classified by function. Allows expenses classified by function or natural description. “Bottom line” called net income or net loss. “Bottom line” called profit or loss. Prohibits reporting extraordinary items. Report extraordinary items separately.

4 -8 Earnings Quality Earnings quality refers to the ability of reported earnings to predict a company’s future earnings. Transitory Earnings versus Permanent Earnings

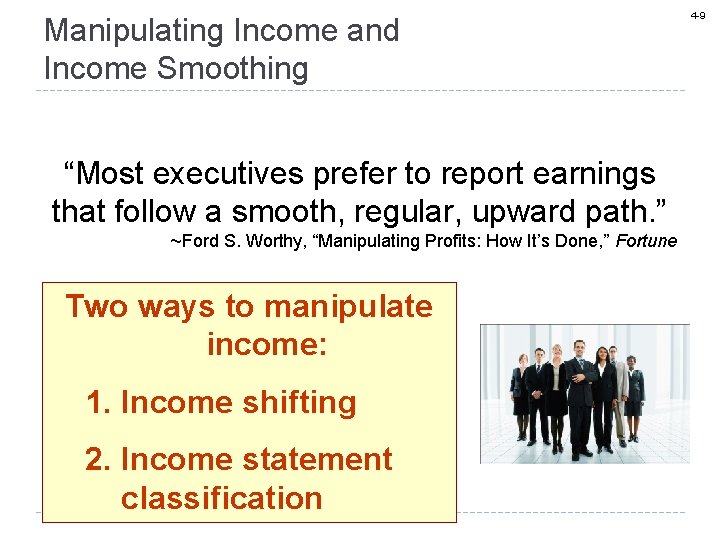

Manipulating Income and Income Smoothing “Most executives prefer to report earnings that follow a smooth, regular, upward path. ” ~Ford S. Worthy, “Manipulating Profits: How It’s Done, ” Fortune Two ways to manipulate income: 1. Income shifting 2. Income statement classification 4 -9

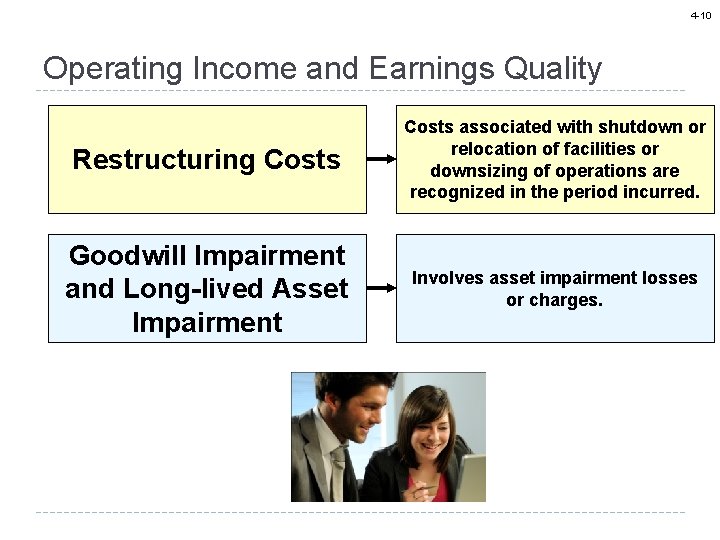

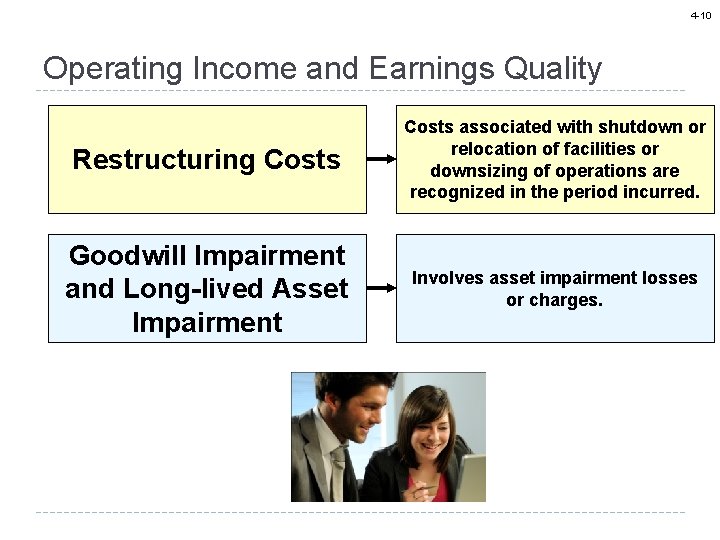

4 -10 Operating Income and Earnings Quality Restructuring Costs associated with shutdown or relocation of facilities or downsizing of operations are recognized in the period incurred. Goodwill Impairment and Long-lived Asset Impairment Involves asset impairment losses or charges.

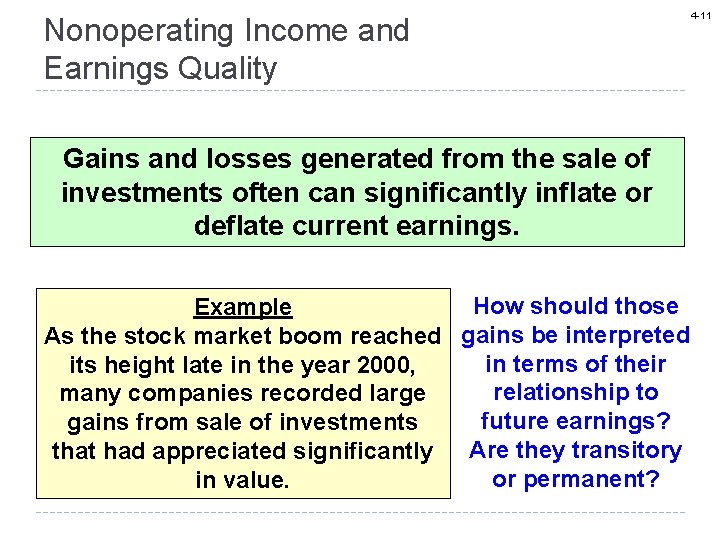

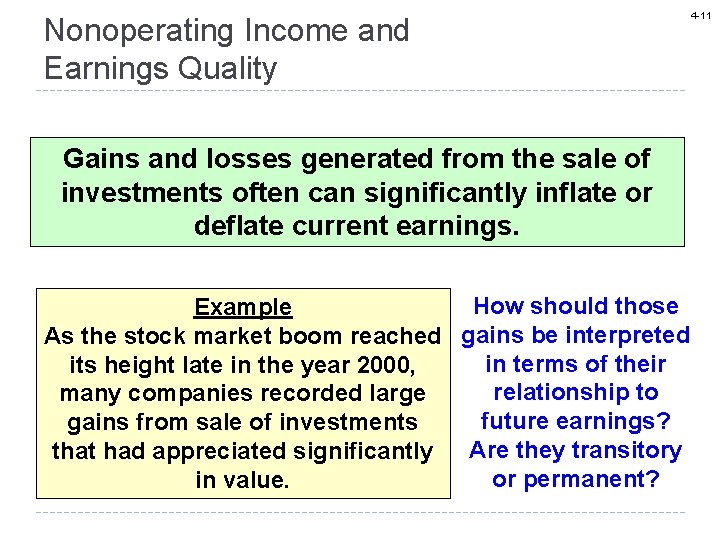

Nonoperating Income and Earnings Quality Gains and losses generated from the sale of investments often can significantly inflate or deflate current earnings. How should those Example As the stock market boom reached gains be interpreted in terms of their its height late in the year 2000, relationship to many companies recorded large future earnings? gains from sale of investments that had appreciated significantly Are they transitory or permanent? in value. 4 -11

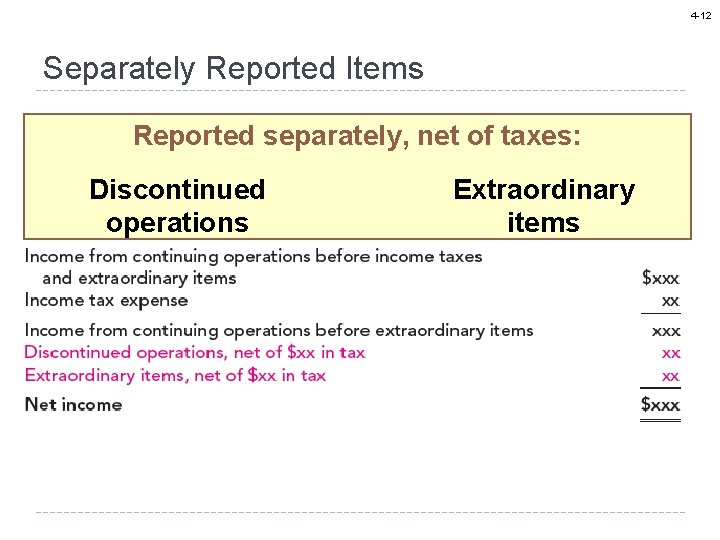

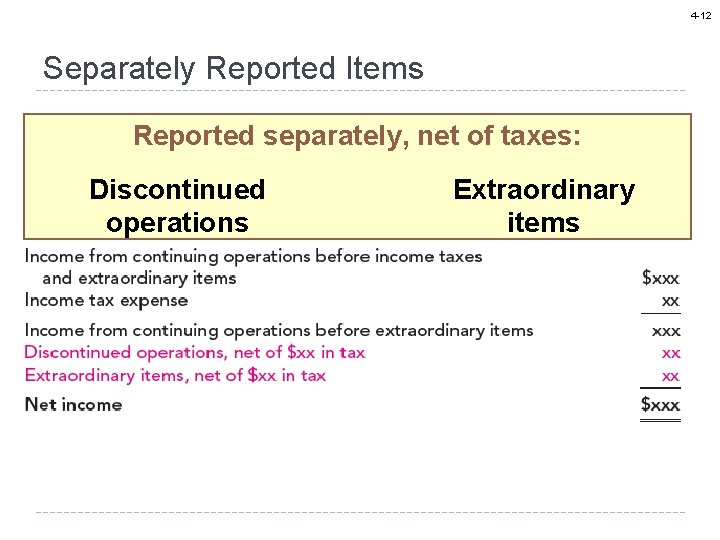

4 -12 Separately Reported Items Reported separately, net of taxes: Discontinued operations Extraordinary items

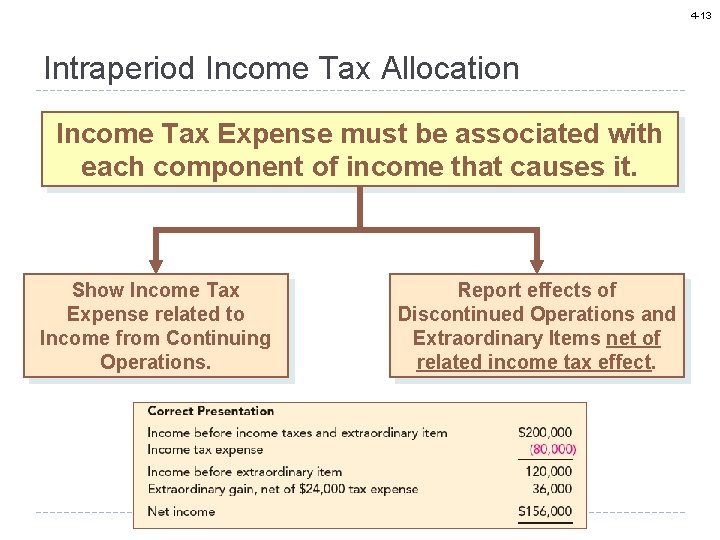

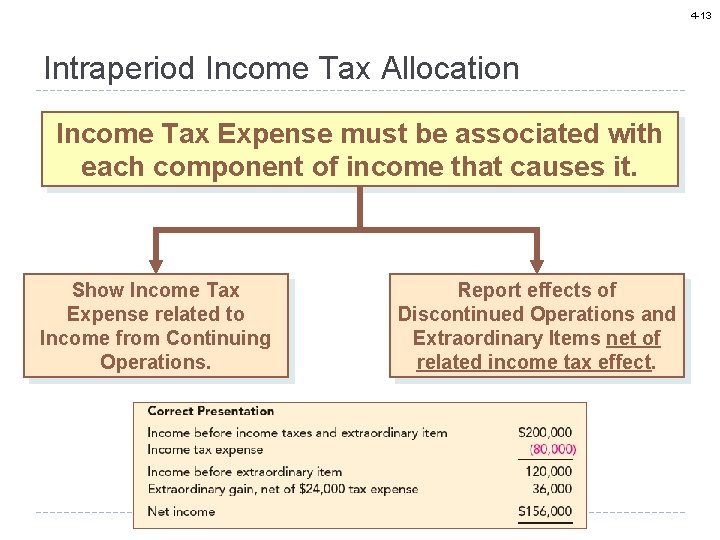

4 -13 Intraperiod Income Tax Allocation Income Tax Expense must be associated with each component of income that causes it. Show Income Tax Expense related to Income from Continuing Operations. Report effects of Discontinued Operations and Extraordinary Items net of related income tax effect.

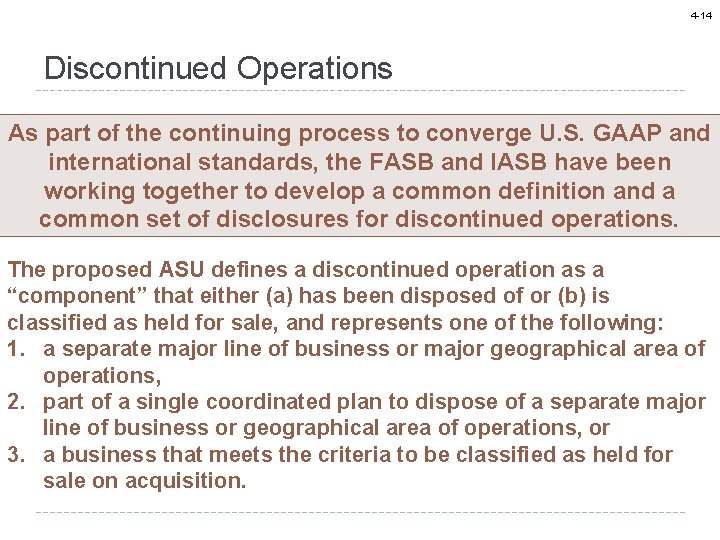

4 -14 Discontinued Operations As part of the continuing process to converge U. S. GAAP and international standards, the FASB and IASB have been working together to develop a common definition and a common set of disclosures for discontinued operations. The proposed ASU defines a discontinued operation as a “component” that either (a) has been disposed of or (b) is classified as held for sale, and represents one of the following: 1. a separate major line of business or major geographical area of operations, 2. part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations, or 3. a business that meets the criteria to be classified as held for sale on acquisition.

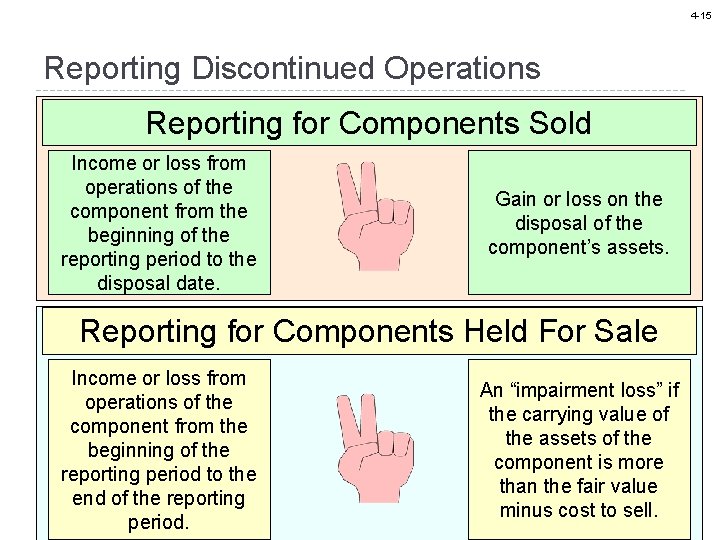

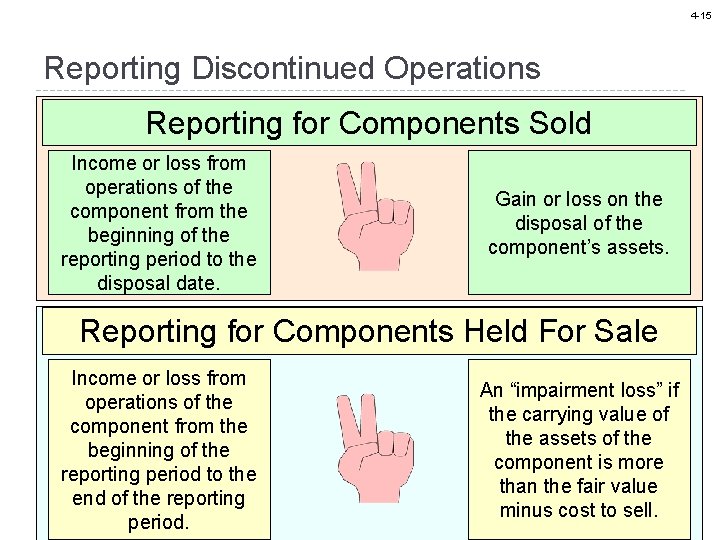

4 -15 Reporting Discontinued Operations Reporting for Components Sold Income or loss from operations of the component from the beginning of the reporting period to the disposal date. Gain or loss on the disposal of the component’s assets. Reporting for Components Held For Sale Income or loss from operations of the component from the beginning of the reporting period to the end of the reporting period. An “impairment loss” if the carrying value of the assets of the component is more than the fair value minus cost to sell.

4 -16 Extraordinary Items An extraordinary item is a material event or transaction that is both: 1. Unusual in nature, and 2. Infrequent in occurrence Extraordinary items are reported net of related taxes

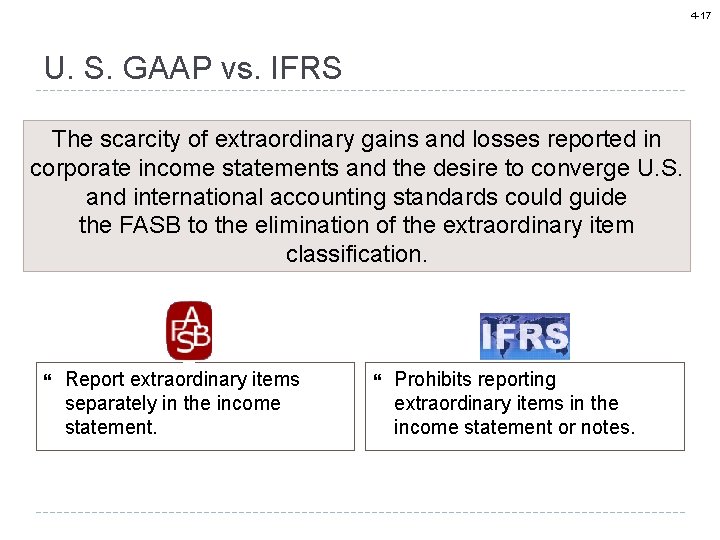

4 -17 U. S. GAAP vs. IFRS The scarcity of extraordinary gains and losses reported in corporate income statements and the desire to converge U. S. and international accounting standards could guide the FASB to the elimination of the extraordinary item classification. Report extraordinary items separately in the income statement. Prohibits reporting extraordinary items in the income statement or notes.

4 -18 Unusual or Infrequent Items that are material and are either unusual or infrequent—but not both—are included as separate items in continuing operations.

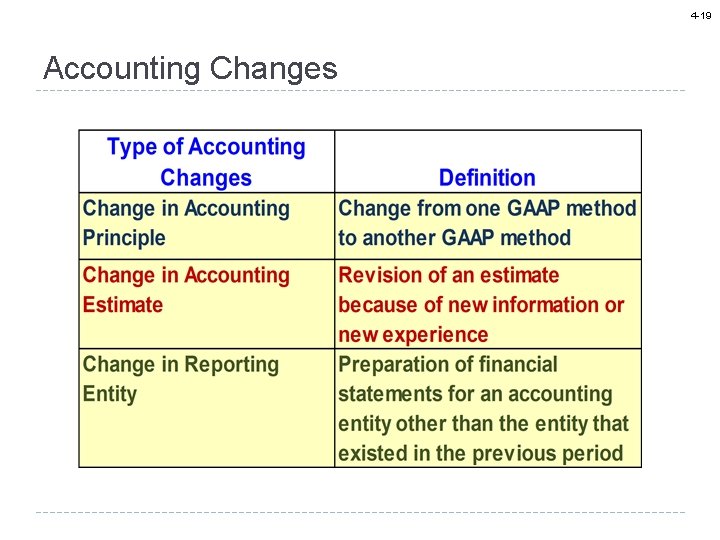

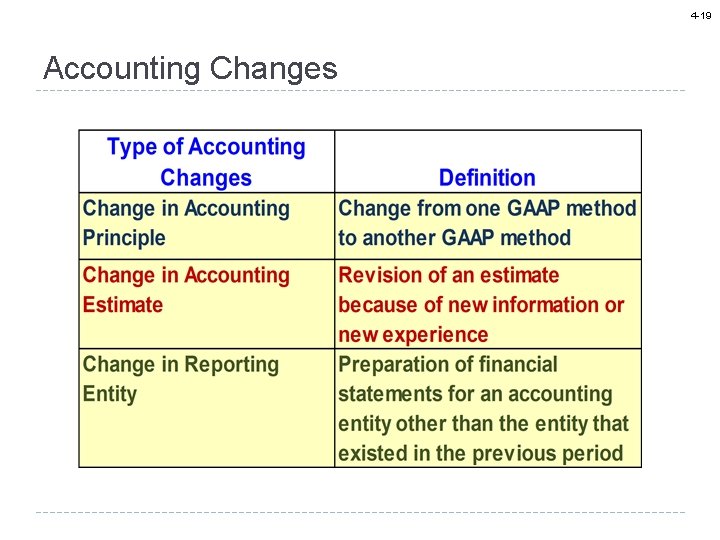

4 -19 Accounting Changes

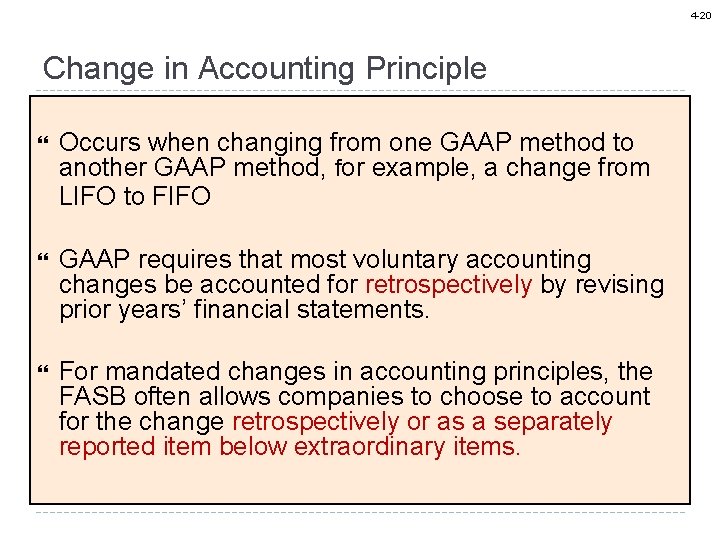

4 -20 Change in Accounting Principle Occurs when changing from one GAAP method to another GAAP method, for example, a change from LIFO to FIFO GAAP requires that most voluntary accounting changes be accounted for retrospectively by revising prior years’ financial statements. For mandated changes in accounting principles, the FASB often allows companies to choose to account for the change retrospectively or as a separately reported item below extraordinary items.

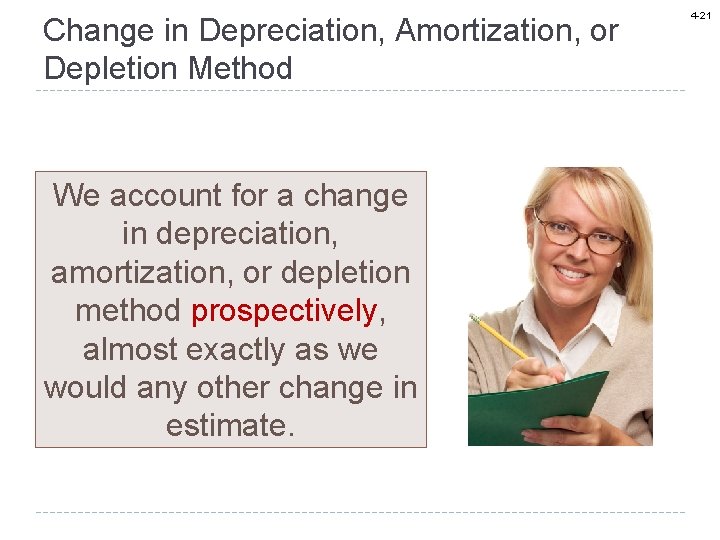

Change in Depreciation, Amortization, or Depletion Method We account for a change in depreciation, amortization, or depletion method prospectively, almost exactly as we would any other change in estimate. 4 -21

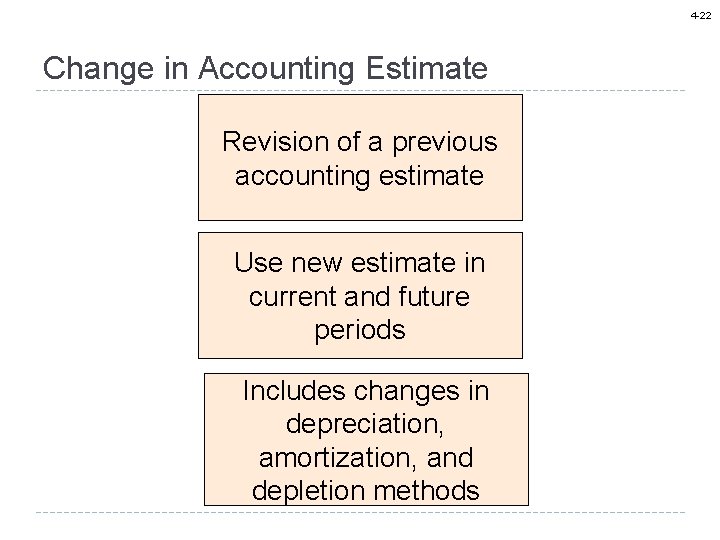

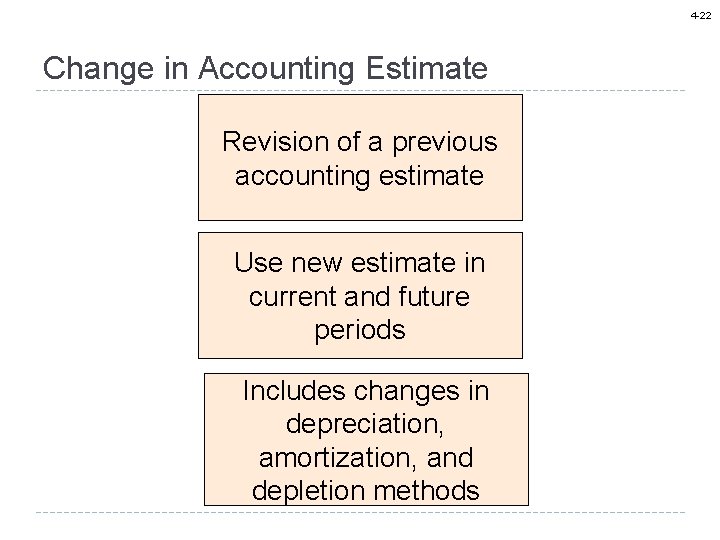

4 -22 Change in Accounting Estimate Revision of a previous accounting estimate Use new estimate in current and future periods Includes changes in depreciation, amortization, and depletion methods

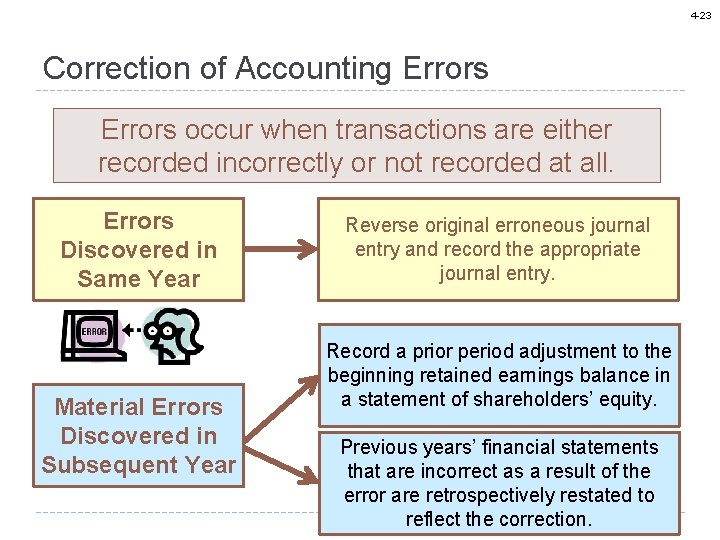

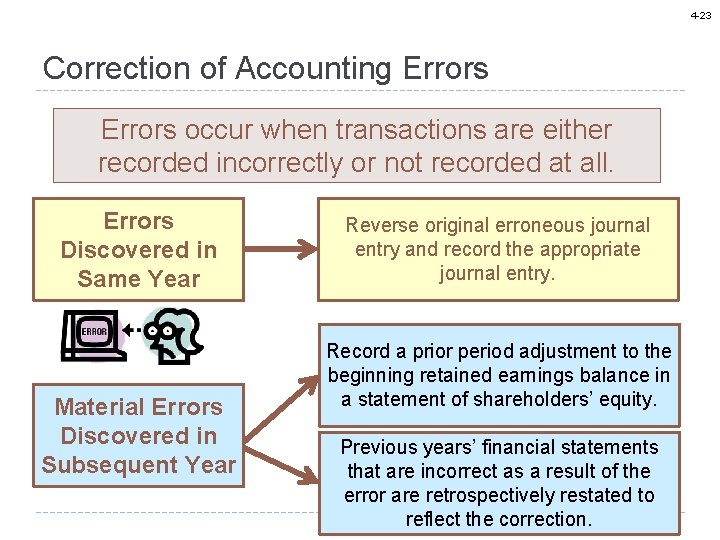

4 -23 Correction of Accounting Errors occur when transactions are either recorded incorrectly or not recorded at all. Errors Discovered in Same Year Material Errors Discovered in Subsequent Year Reverse original erroneous journal entry and record the appropriate journal entry. Record a prior period adjustment to the beginning retained earnings balance in a statement of shareholders’ equity. Previous years’ financial statements that are incorrect as a result of the error are retrospectively restated to reflect the correction.

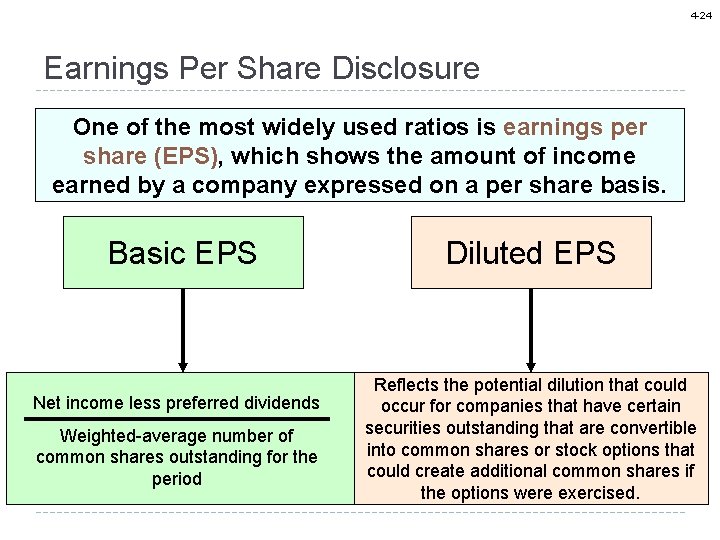

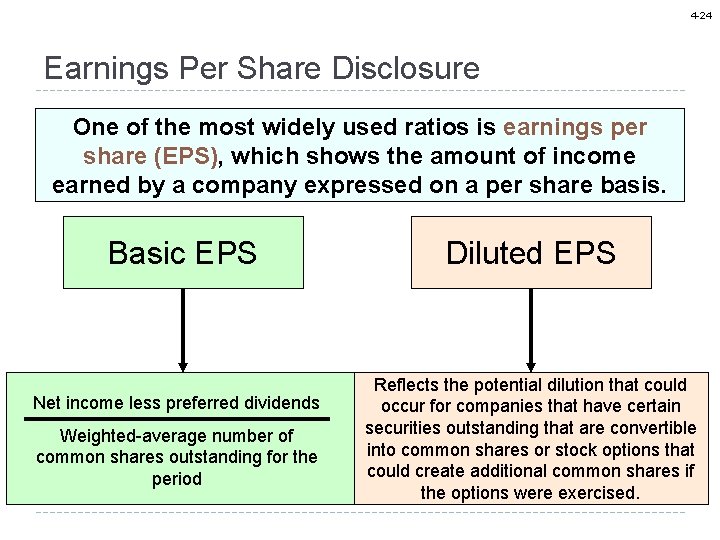

4 -24 Earnings Per Share Disclosure One of the most widely used ratios is earnings per share (EPS), which shows the amount of income earned by a company expressed on a per share basis. Basic EPS Net income less preferred dividends Weighted-average number of common shares outstanding for the period Diluted EPS Reflects the potential dilution that could occur for companies that have certain securities outstanding that are convertible into common shares or stock options that could create additional common shares if the options were exercised.

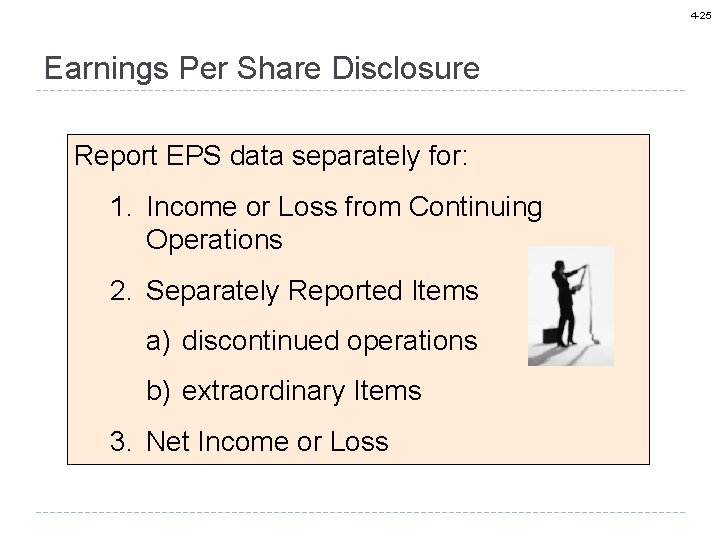

4 -25 Earnings Per Share Disclosure Report EPS data separately for: 1. Income or Loss from Continuing Operations 2. Separately Reported Items a) discontinued operations b) extraordinary Items 3. Net Income or Loss

4 -26 Comprehensive Income An expanded version of income that includes four types of gains and losses that traditionally have not been included in income statements.

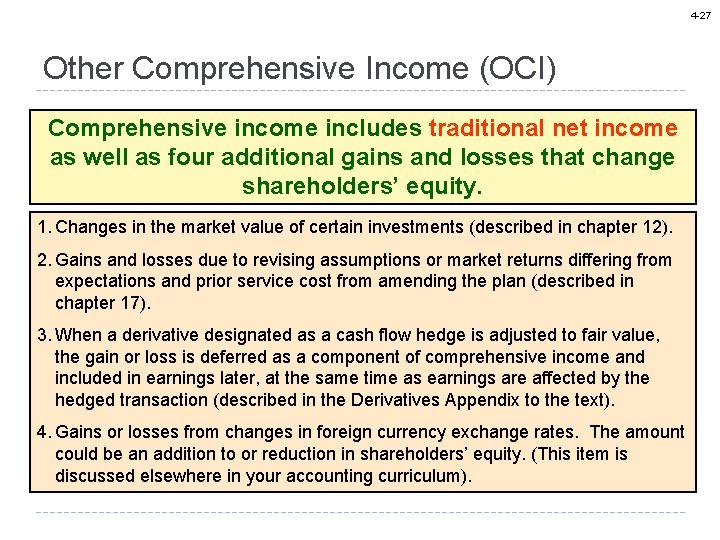

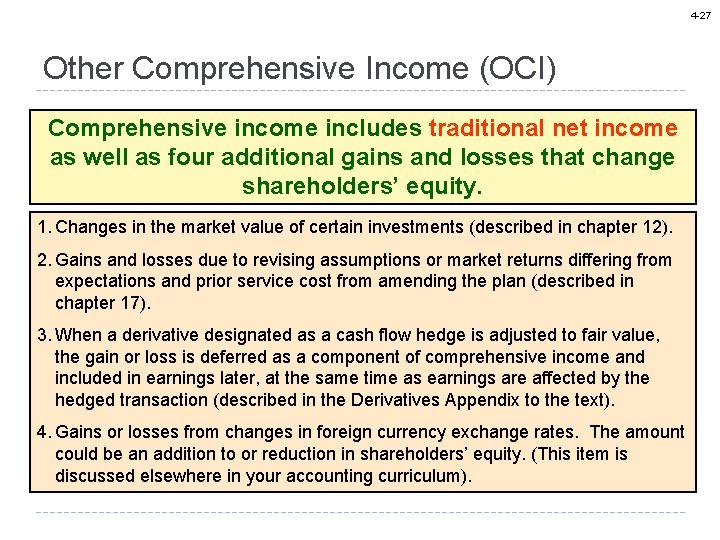

4 -27 Other Comprehensive Income (OCI) Comprehensive income includes traditional net income as well as four additional gains and losses that change shareholders’ equity. 1. Changes in the market value of certain investments (described in chapter 12). 2. Gains and losses due to revising assumptions or market returns differing from expectations and prior service cost from amending the plan (described in chapter 17). 3. When a derivative designated as a cash flow hedge is adjusted to fair value, the gain or loss is deferred as a component of comprehensive income and included in earnings later, at the same time as earnings are affected by the hedged transaction (described in the Derivatives Appendix to the text). 4. Gains or losses from changes in foreign currency exchange rates. The amount could be an addition to or reduction in shareholders’ equity. (This item is discussed elsewhere in your accounting curriculum).

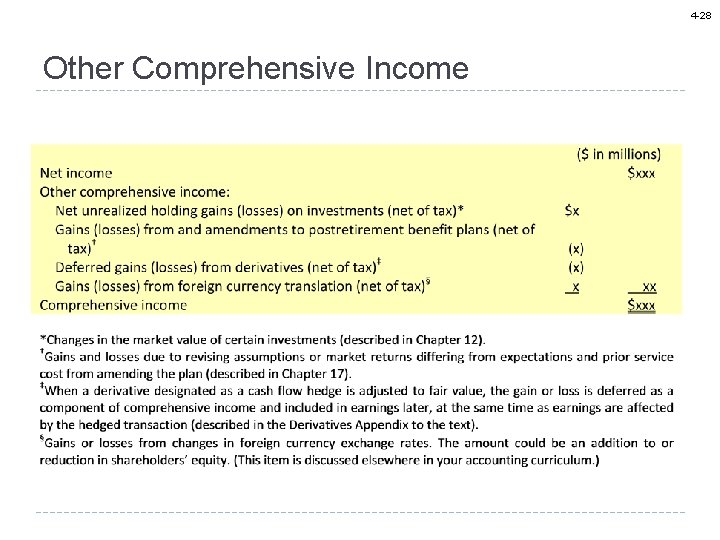

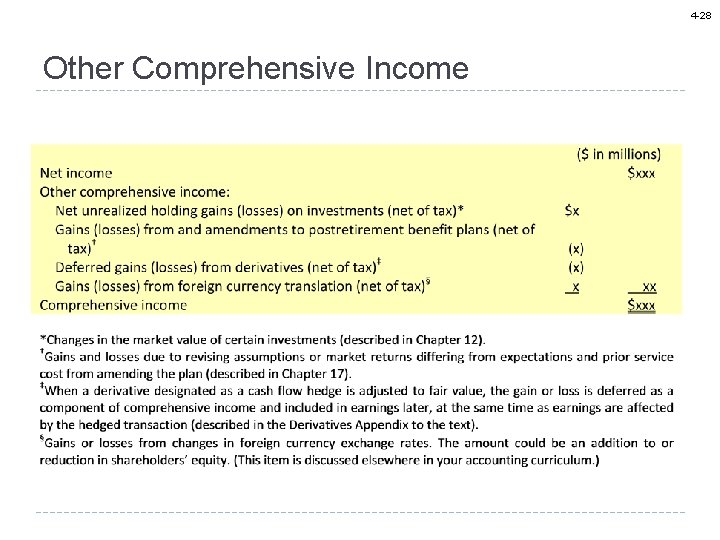

4 -28 Other Comprehensive Income

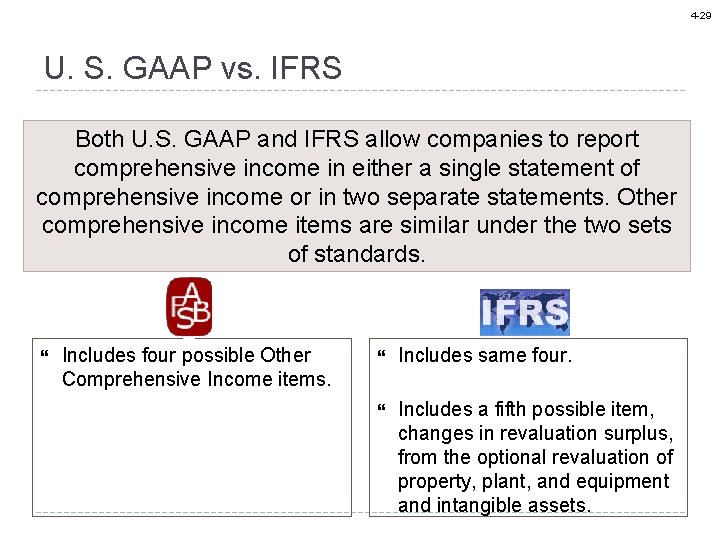

4 -29 U. S. GAAP vs. IFRS Both U. S. GAAP and IFRS allow companies to report comprehensive income in either a single statement of comprehensive income or in two separate statements. Other comprehensive income items are similar under the two sets of standards. Includes four possible Other Comprehensive Income items. Includes same four. Includes a fifth possible item, changes in revaluation surplus, from the optional revaluation of property, plant, and equipment and intangible assets.

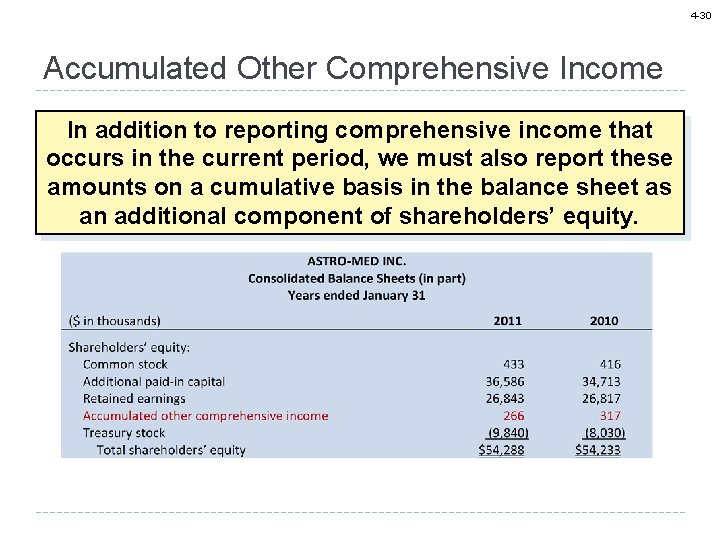

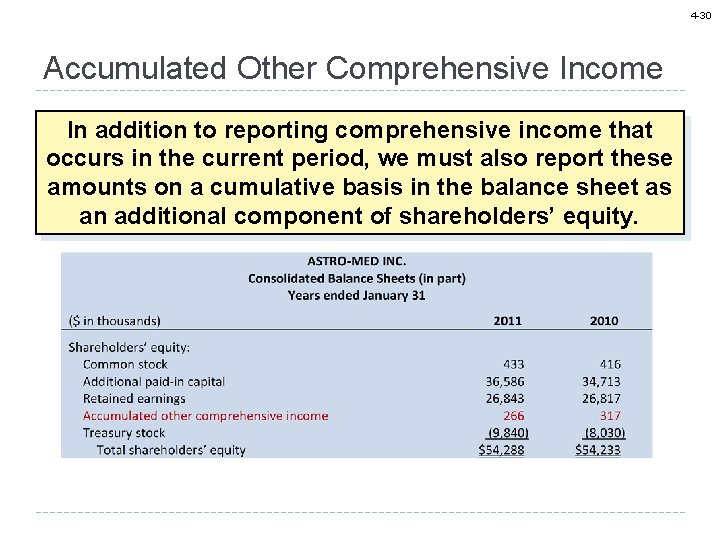

4 -30 Accumulated Other Comprehensive Income In addition to reporting comprehensive income that occurs in the current period, we must also report these amounts on a cumulative basis in the balance sheet as an additional component of shareholders’ equity.

4 -31 The Statement of Cash Flows Provides relevant information about a company’s cash receipts and cash disbursements. Helps investors and creditors to assess future net cash flows liquidity long-term solvency. Required for each income statement period reported.

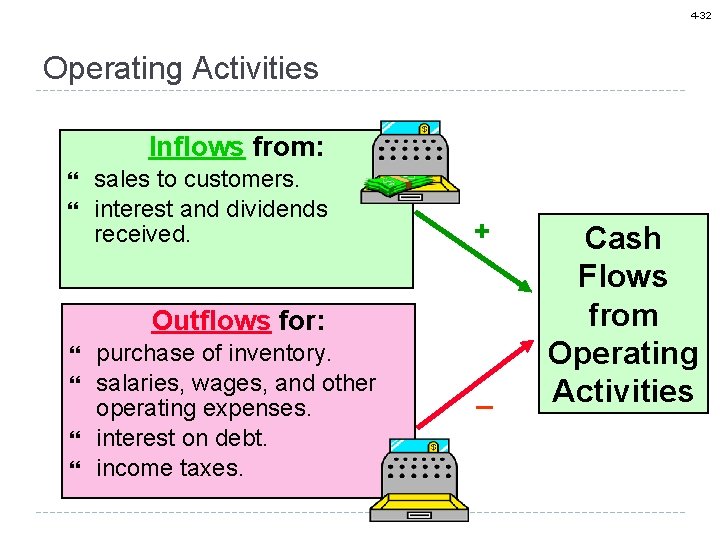

4 -32 Operating Activities Inflows from: sales to customers. interest and dividends received. + Outflows for: purchase of inventory. salaries, wages, and other operating expenses. interest on debt. income taxes. _ Cash Flows from Operating Activities

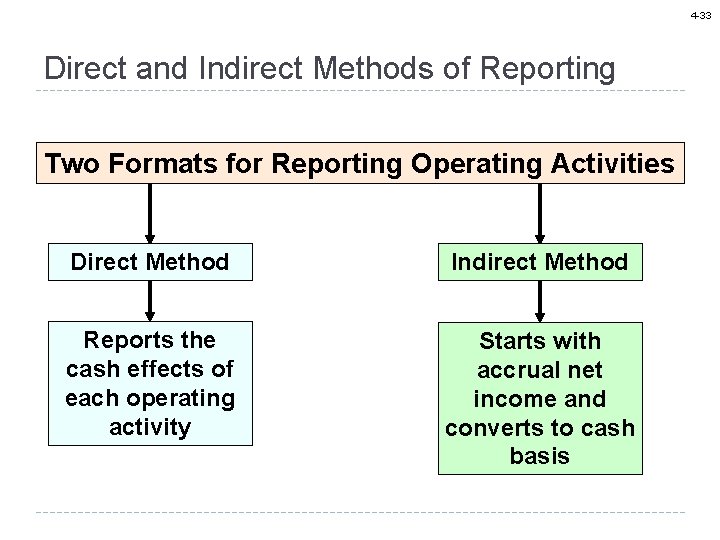

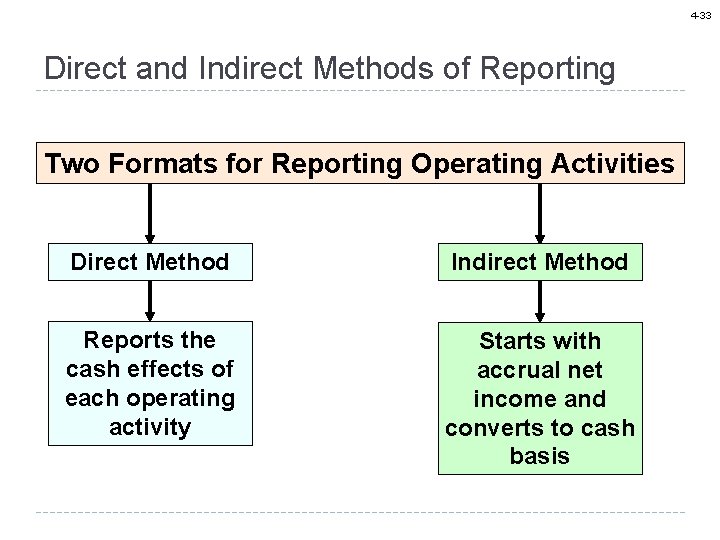

4 -33 Direct and Indirect Methods of Reporting Two Formats for Reporting Operating Activities Direct Method Indirect Method Reports the cash effects of each operating activity Starts with accrual net income and converts to cash basis

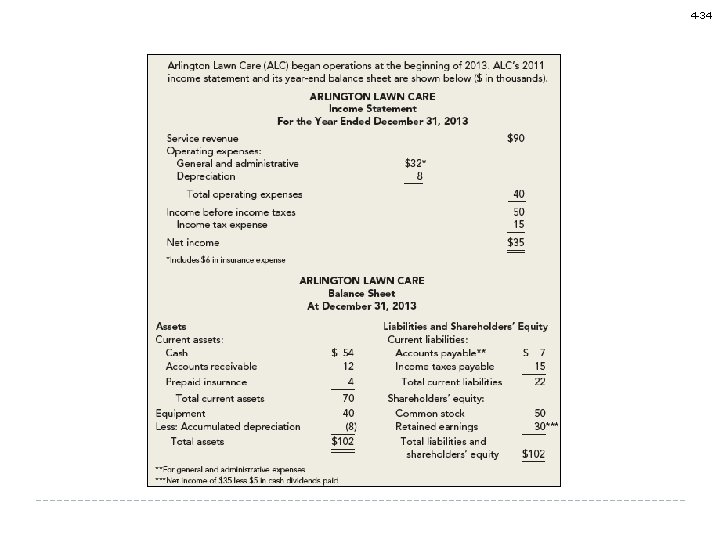

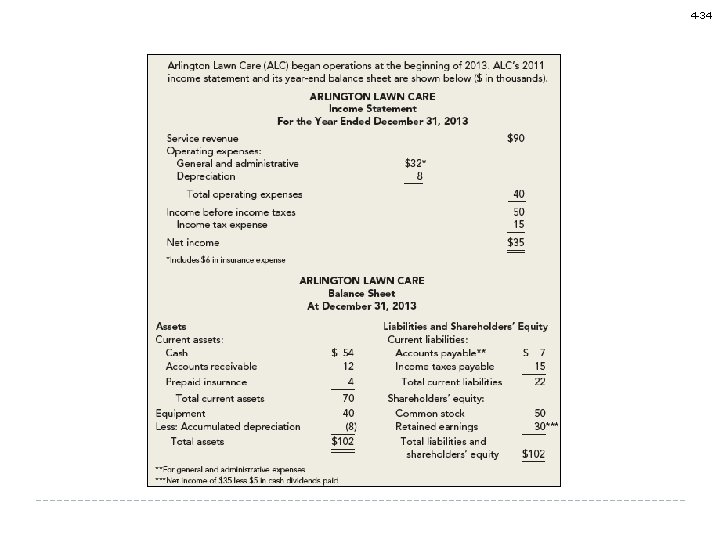

4 -34

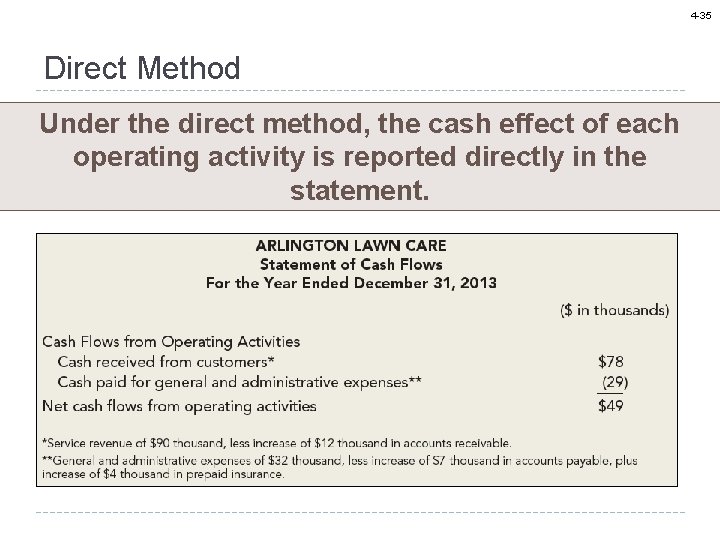

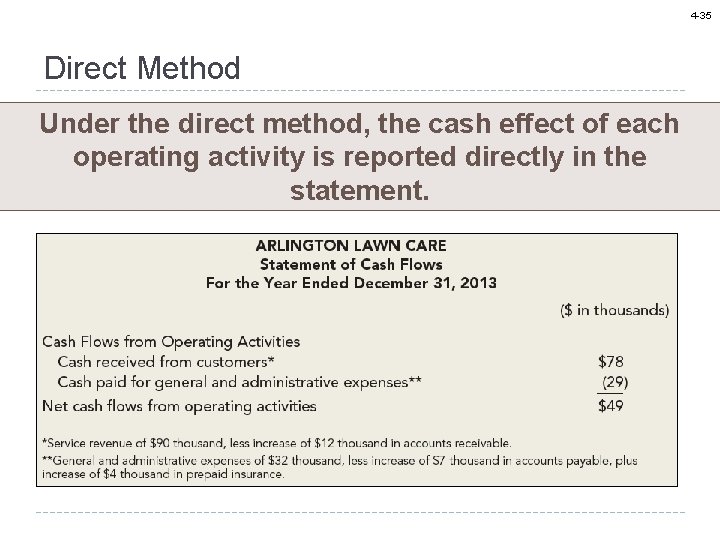

4 -35 Direct Method Under the direct method, the cash effect of each operating activity is reported directly in the statement.

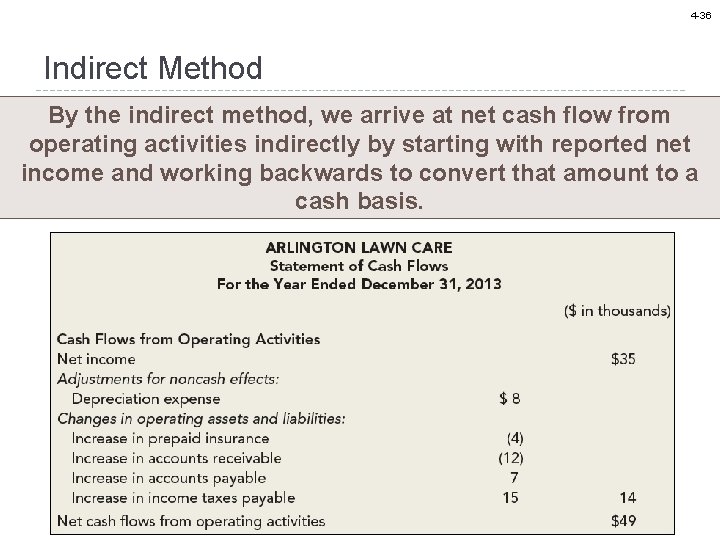

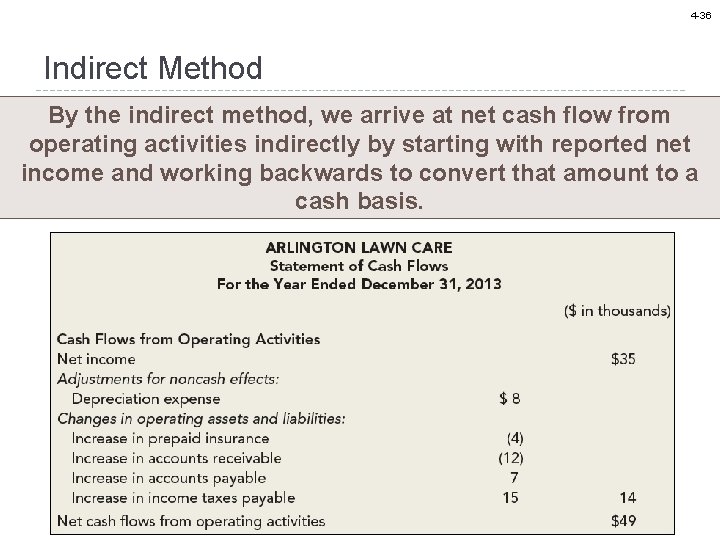

4 -36 Indirect Method By the indirect method, we arrive at net cash flow from operating activities indirectly by starting with reported net income and working backwards to convert that amount to a cash basis.

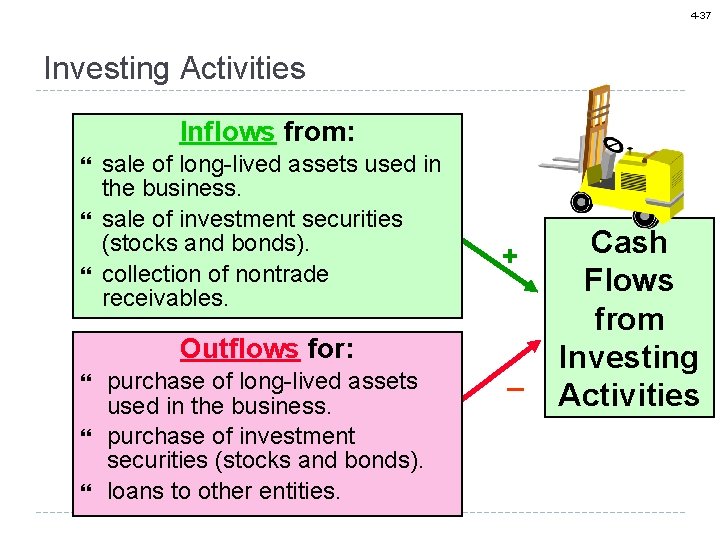

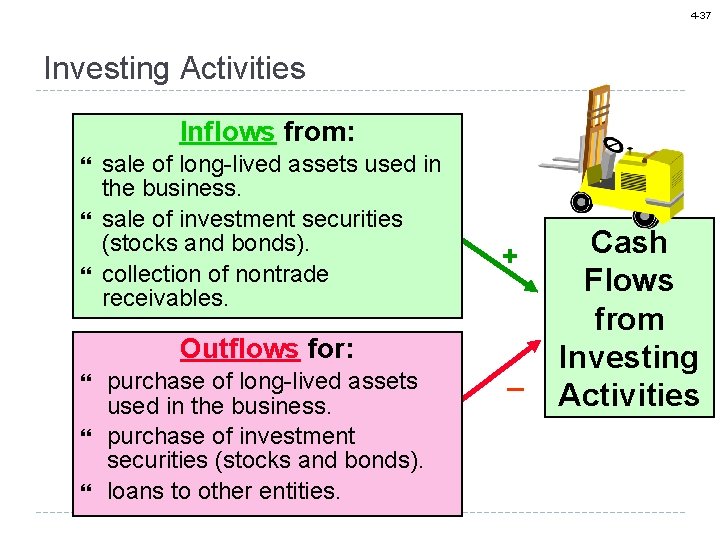

4 -37 Investing Activities Inflows from: sale of long-lived assets used in the business. sale of investment securities (stocks and bonds). collection of nontrade receivables. Outflows for: purchase of long-lived assets used in the business. purchase of investment securities (stocks and bonds). loans to other entities. + _ Cash Flows from Investing Activities

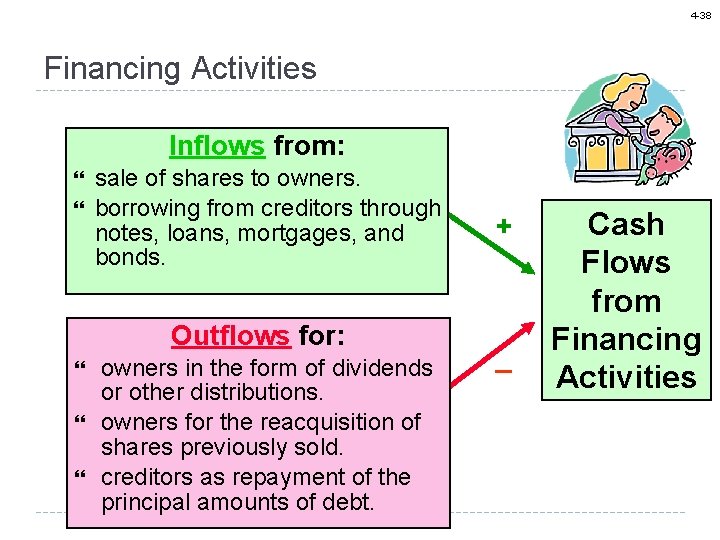

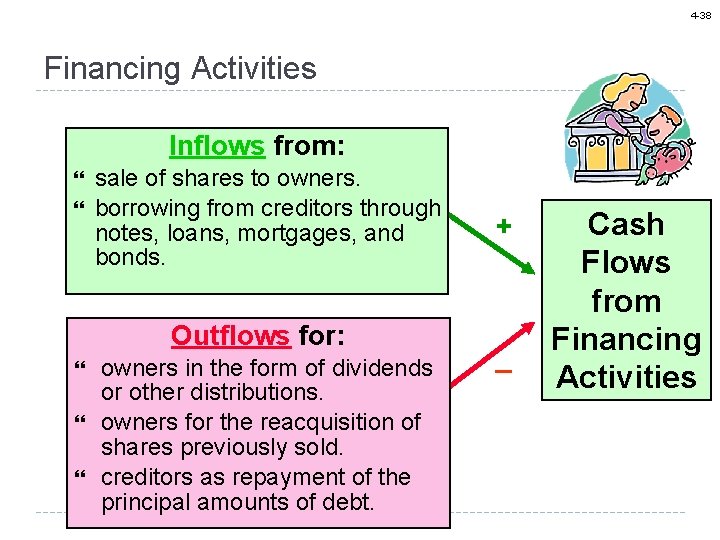

4 -38 Financing Activities Inflows from: sale of shares to owners. borrowing from creditors through notes, loans, mortgages, and bonds. Outflows for: owners in the form of dividends or other distributions. owners for the reacquisition of shares previously sold. creditors as repayment of the principal amounts of debt. + _ Cash Flows from Financing Activities

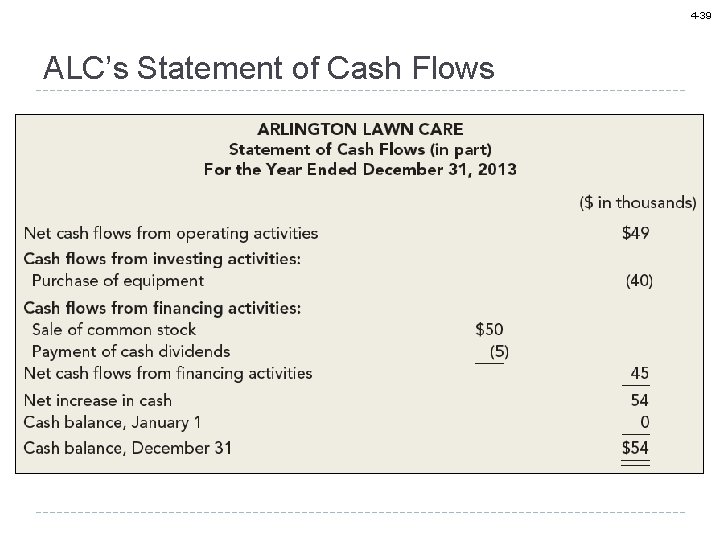

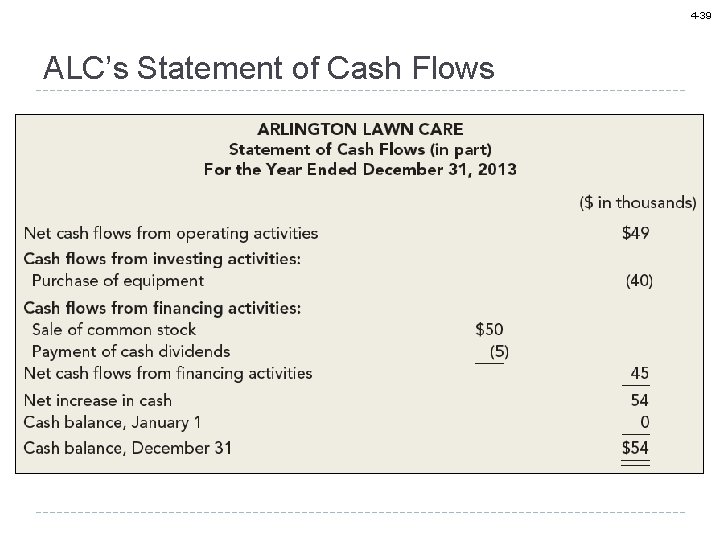

4 -39 ALC’s Statement of Cash Flows

4 -40 Noncash Investing and Financing Activities Significant investing and financing transactions not involving cash also are reported. Acquisition of equipment (an investing activity) by issuing a long-term note payable (a financing activity).

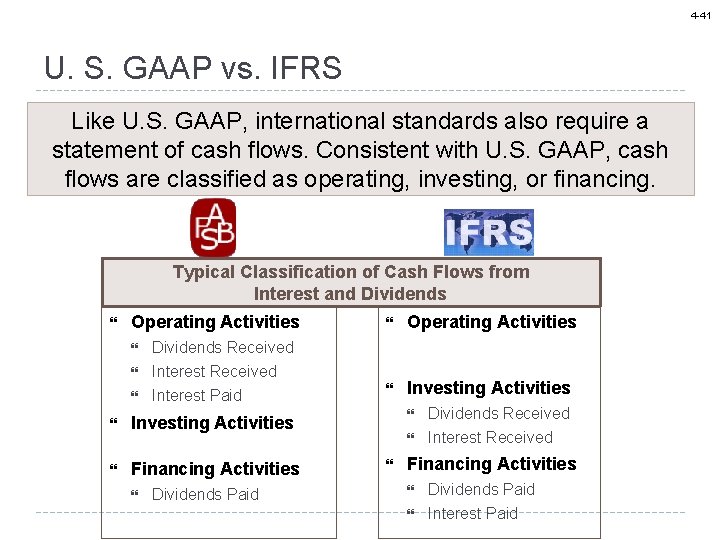

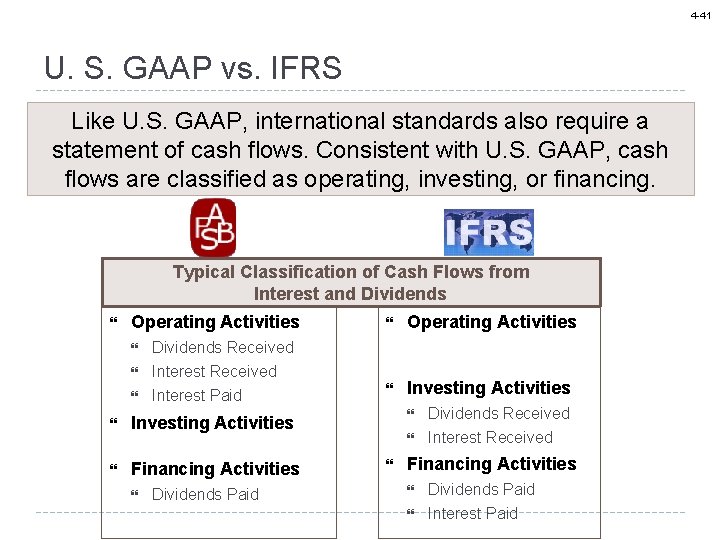

4 -41 U. S. GAAP vs. IFRS Like U. S. GAAP, international standards also require a statement of cash flows. Consistent with U. S. GAAP, cash flows are classified as operating, investing, or financing. Typical Classification of Cash Flows from Interest and Dividends Operating Activities Dividends Received Interest Paid Operating Activities Investing Activities Financing Activities Dividends Paid Dividends Received Interest Received Financing Activities Dividends Paid Interest Paid

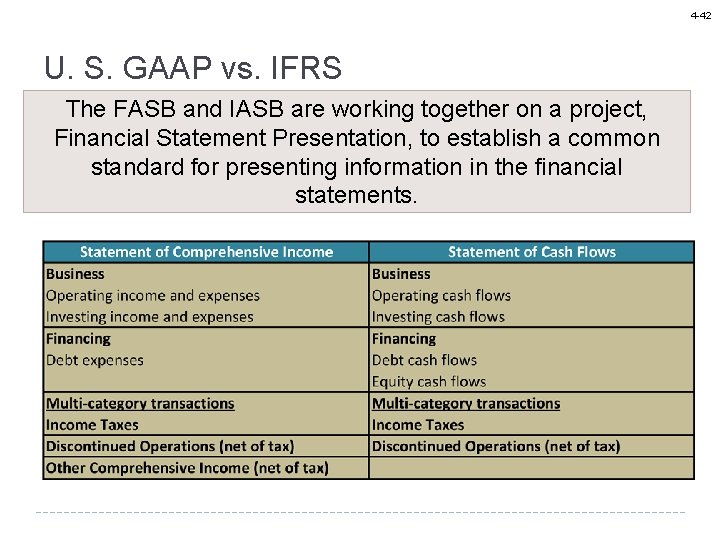

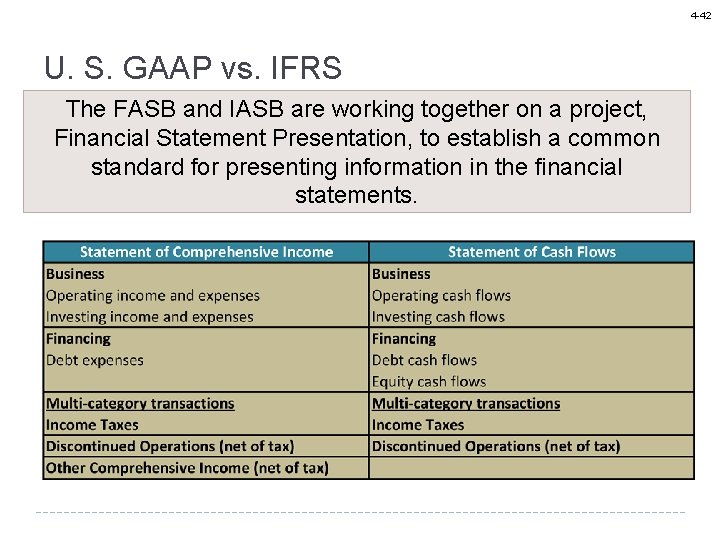

4 -42 U. S. GAAP vs. IFRS The FASB and IASB are working together on a project, Financial Statement Presentation, to establish a common standard for presenting information in the financial statements.

4 -43 End of Chapter 4