NATIONAL INCOME ACCOUNTING What is Income 1 Income

- Slides: 27

NATIONAL INCOME ACCOUNTING

What is Income? 1. Income is the earnings of individuals. 2. The income of a corporation is called revenue. 3. One way that government derives income is through taxing individual and firms. NATIONAL INCOME ACCOUNTING INCOME AND EXPENDITURE

What is Expenditure? 1. Expenditure is what individual, firms and the government spend on. - Expenditure of Individuals is denoted as C. - Expenditure of firms (corporations) is denoted as I - Expenditure of governemnt is denoted as G. NATIONAL INCOME ACCOUNTING INCOME AND EXPENDITURE

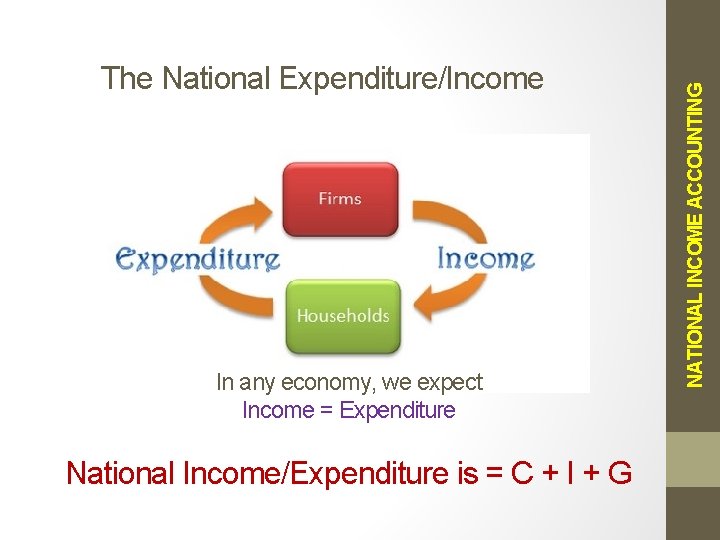

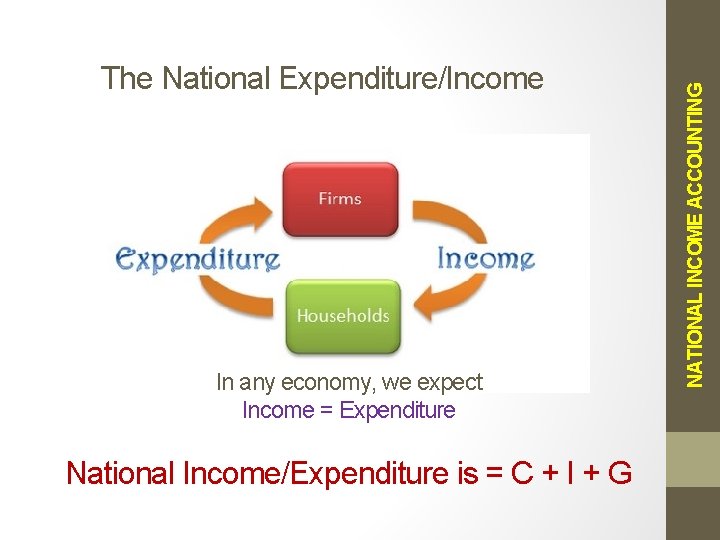

In any economy, we expect Income = Expenditure National Income/Expenditure is = C + I + G NATIONAL INCOME ACCOUNTING The National Expenditure/Income

The total or aggregate expenditure of an economy that does not import or export any goods and services is calculated by using the formula below: Aggregate Expenditure = C + I + G (without imports or exports) NATIONAL INCOME ACCOUNTING To Calculate the Expenditure of an Economy

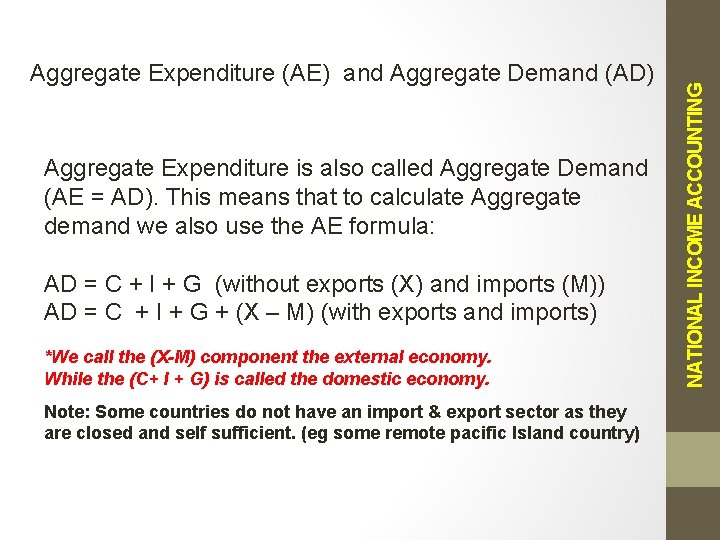

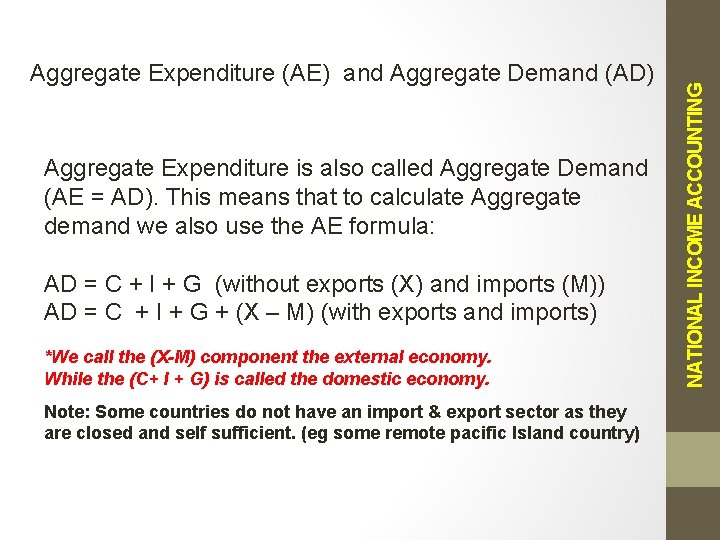

Aggregate Expenditure is also called Aggregate Demand (AE = AD). This means that to calculate Aggregate demand we also use the AE formula: AD = C + I + G (without exports (X) and imports (M)) AD = C + I + G + (X – M) (with exports and imports) *We call the (X-M) component the external economy. While the (C+ I + G) is called the domestic economy. Note: Some countries do not have an import & export sector as they are closed and self sufficient. (eg some remote pacific Island country) NATIONAL INCOME ACCOUNTING Aggregate Expenditure (AE) and Aggregate Demand (AD)

Aggregate demand is the total expenditure of an economy. It consist of the spending of consumers (C) + firms (I) + government (G) + (X-M). AS AD The AD curve looks like a normal demand curve but is actually different from a demand curve. AD is the total demand of the whole country at a certain price level while the regular demand curve represents a the demand of a person, a firm or an industry for a good or service. NATIONAL INCOME ACCOUNTING Aggregate Demand (AD)

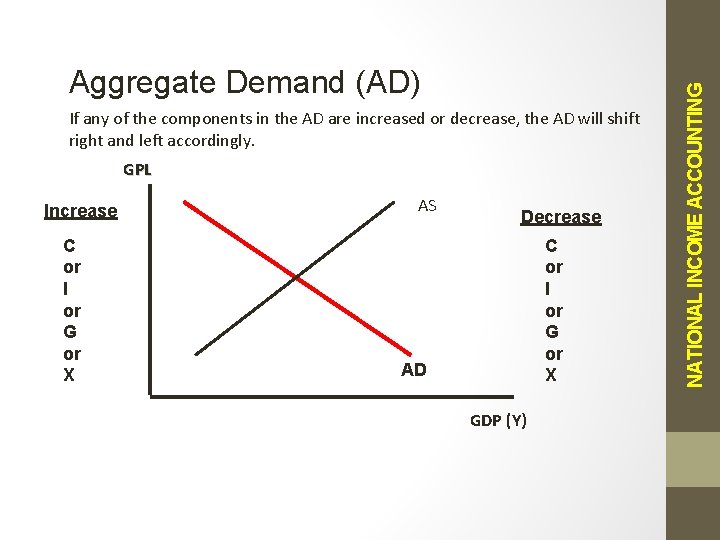

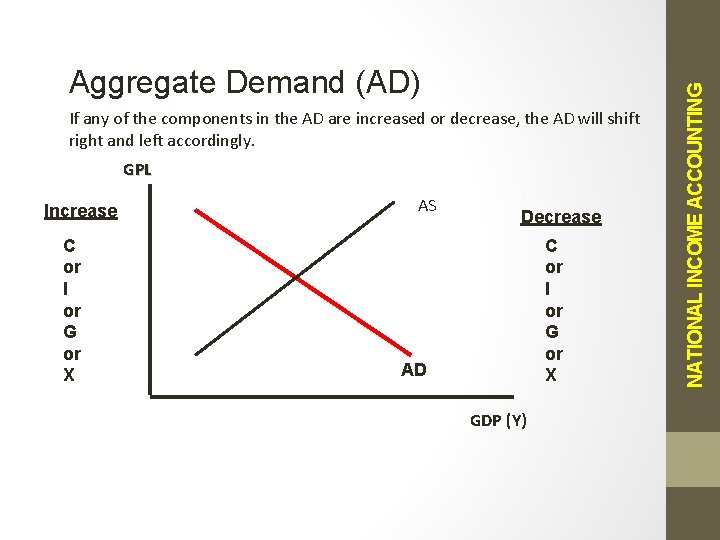

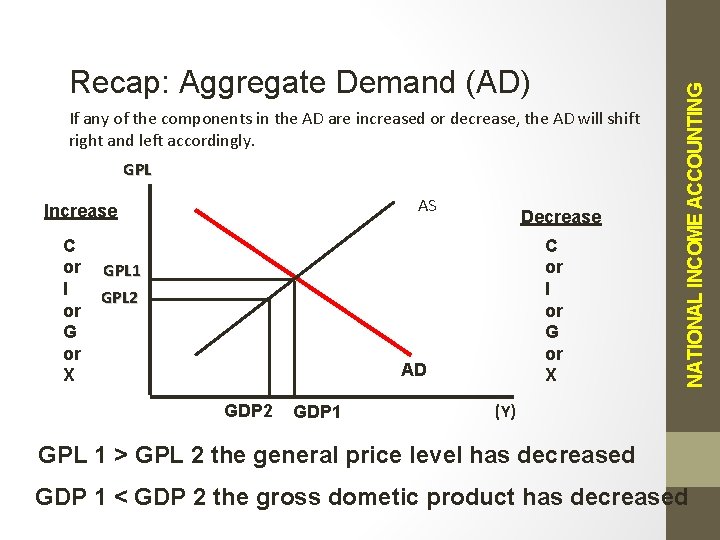

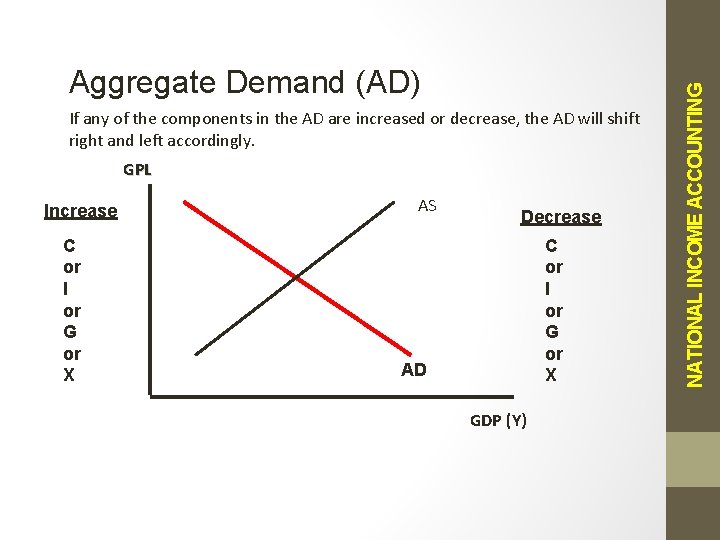

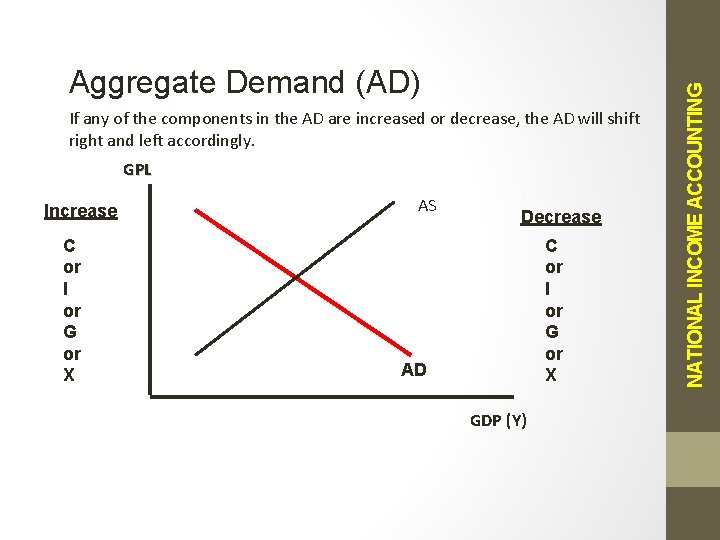

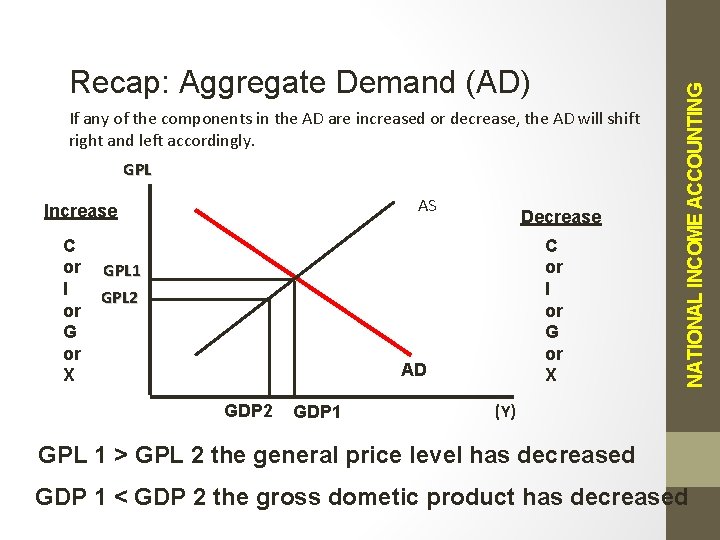

If any of the components in the AD are increased or decrease, the AD will shift right and left accordingly. GPL Increase C or I or G or X AS Decrease C or I or G or X AD GDP (Y) NATIONAL INCOME ACCOUNTING Aggregate Demand (AD)

If any of the components in the AD are increased or decrease, the AD will shift right and left accordingly. GPL Increase C or I or G or X AS Decrease C or I or G or X AD GDP (Y) NATIONAL INCOME ACCOUNTING Aggregate Demand (AD)

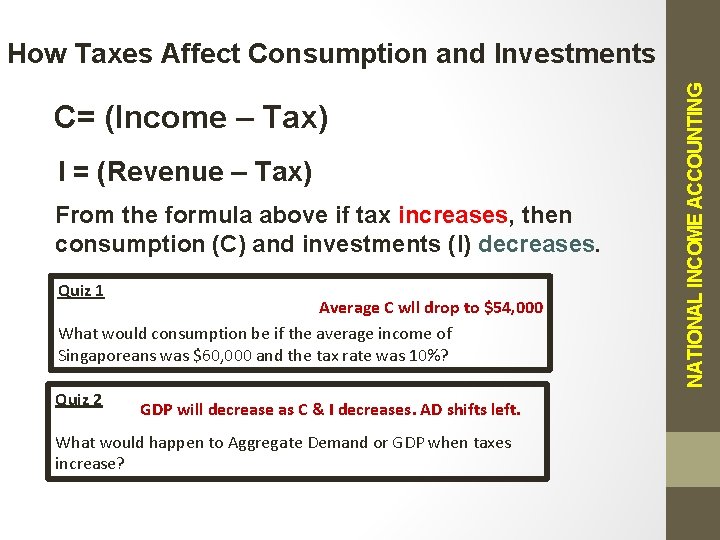

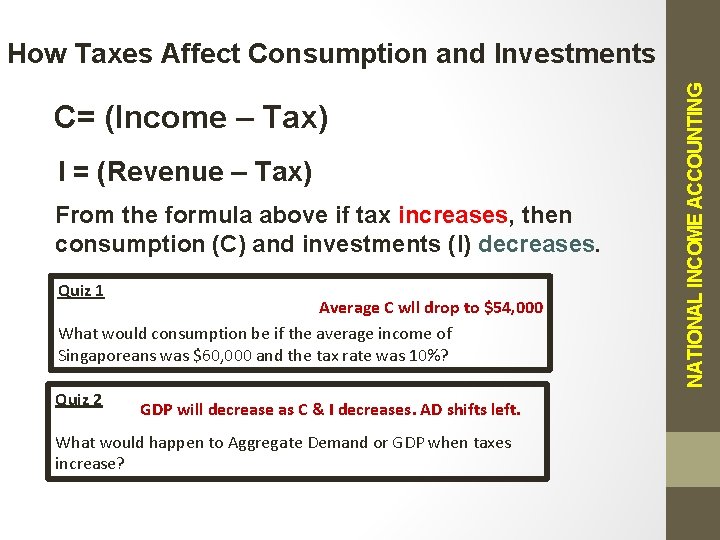

C= (Income – Tax) I = (Revenue – Tax) From the formula above if tax increases, then consumption (C) and investments (I) decreases. Quiz 1 Average C wll drop to $54, 000 What would consumption be if the average income of Singaporeans was $60, 000 and the tax rate was 10%? Quiz 2 GDP will decrease as C & I decreases. AD shifts left. What would happen to Aggregate Demand or GDP when taxes increase? NATIONAL INCOME ACCOUNTING How Taxes Affect Consumption and Investments

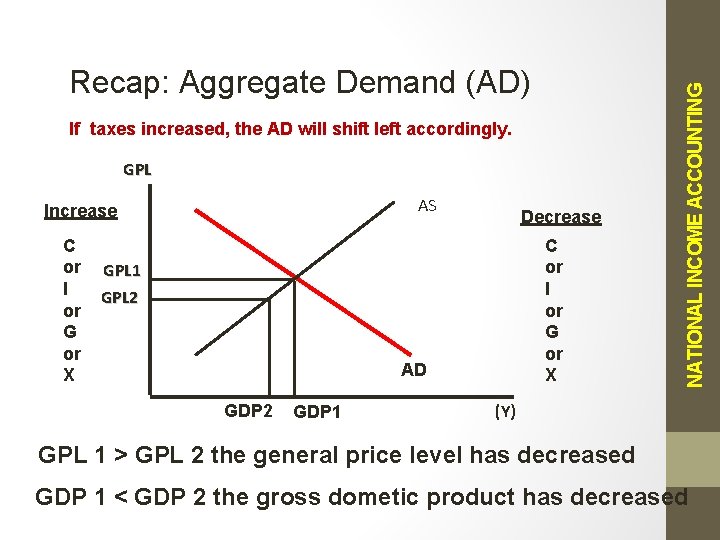

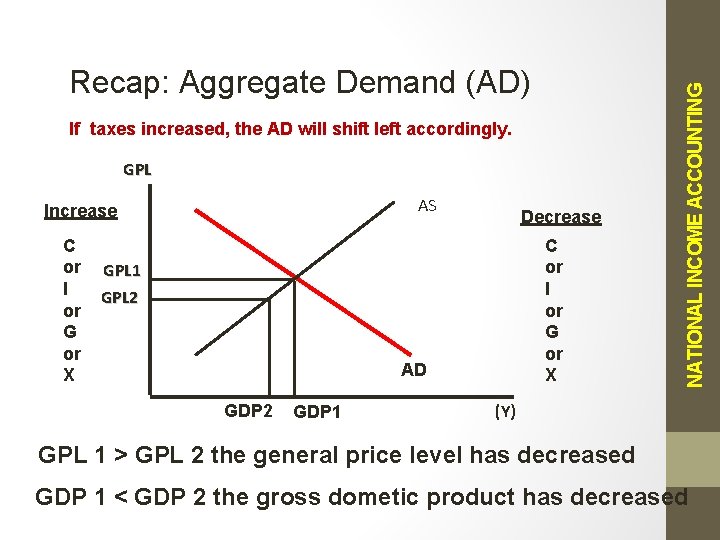

If taxes increased, the AD will shift left accordingly. GPL AS Increase C or I or G or X Decrease C or I or G or X GPL 1 GPL 2 AD GDP 2 GDP 1 NATIONAL INCOME ACCOUNTING Recap: Aggregate Demand (AD) (Y) GPL 1 > GPL 2 the general price level has decreased GDP 1 < GDP 2 the gross dometic product has decreased

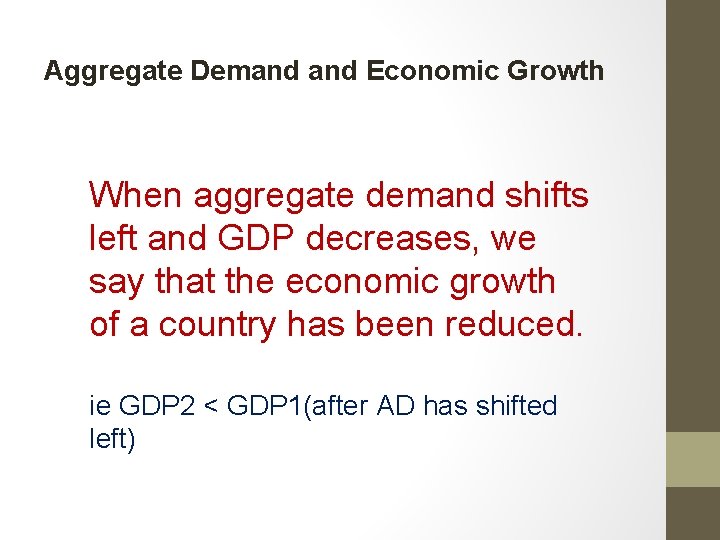

Aggregate Demand Economic Growth When aggregate demand shifts left and GDP decreases, we say that the economic growth of a country has been reduced. ie GDP 2 < GDP 1(after AD has shifted left)

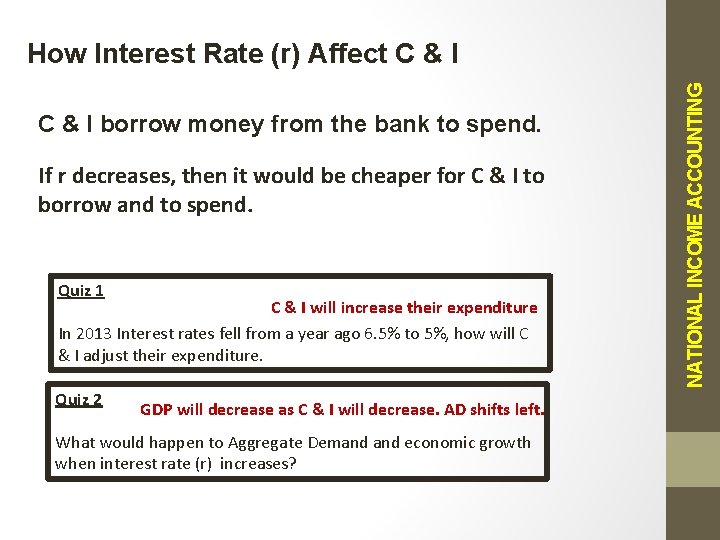

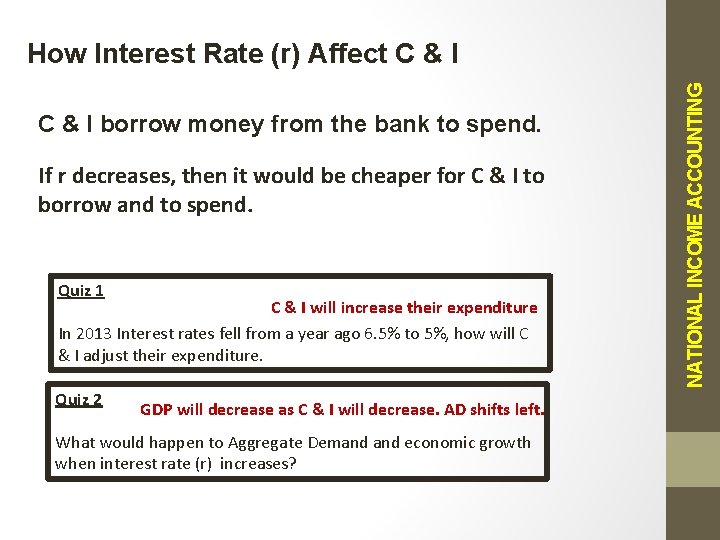

C & I borrow money from the bank to spend. If r decreases, then it would be cheaper for C & I to borrow and to spend. Quiz 1 C & I will increase their expenditure In 2013 Interest rates fell from a year ago 6. 5% to 5%, how will C & I adjust their expenditure. Quiz 2 GDP will decrease as C & I will decrease. AD shifts left. What would happen to Aggregate Demand economic growth when interest rate (r) increases? NATIONAL INCOME ACCOUNTING How Interest Rate (r) Affect C & I

If any of the components in the AD are increased or decrease, the AD will shift right and left accordingly. GPL AS Increase C or I or G or X Decrease C or I or G or X GPL 1 GPL 2 AD GDP 2 GDP 1 NATIONAL INCOME ACCOUNTING Recap: Aggregate Demand (AD) (Y) GPL 1 > GPL 2 the general price level has decreased GDP 1 < GDP 2 the gross dometic product has decreased

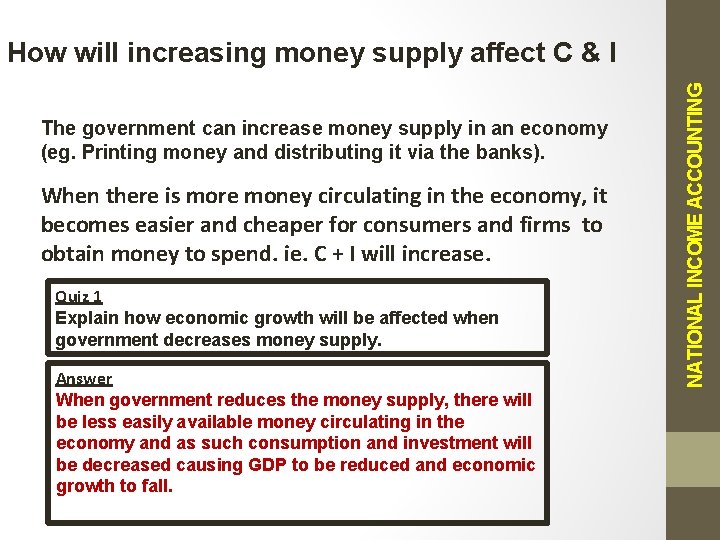

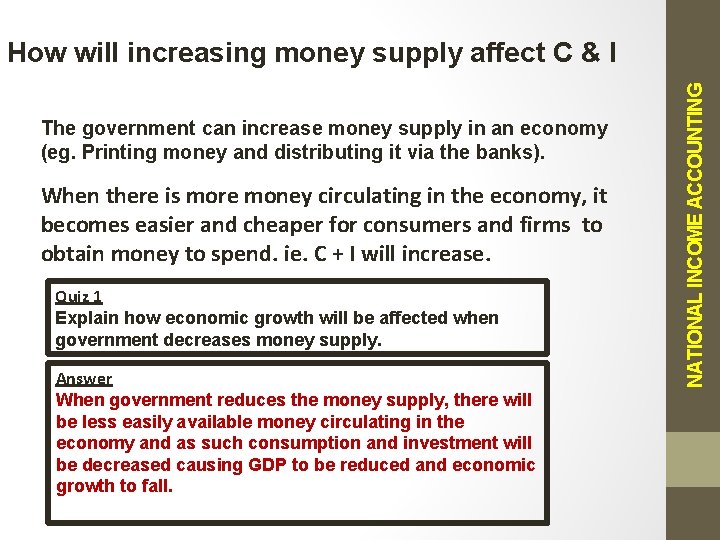

The government can increase money supply in an economy (eg. Printing money and distributing it via the banks). When there is more money circulating in the economy, it becomes easier and cheaper for consumers and firms to obtain money to spend. ie. C + I will increase. Quiz 1 Explain how economic growth will be affected when government decreases money supply. Answer When government reduces the money supply, there will be less easily available money circulating in the economy and as such consumption and investment will be decreased causing GDP to be reduced and economic growth to fall. NATIONAL INCOME ACCOUNTING How will increasing money supply affect C & I

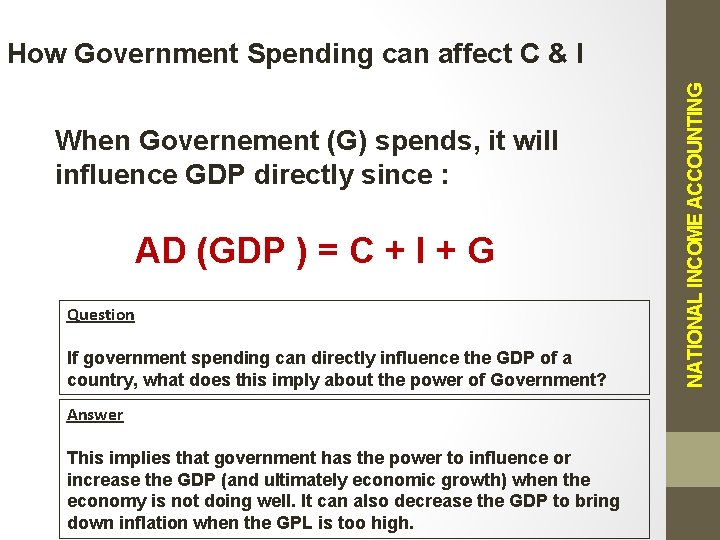

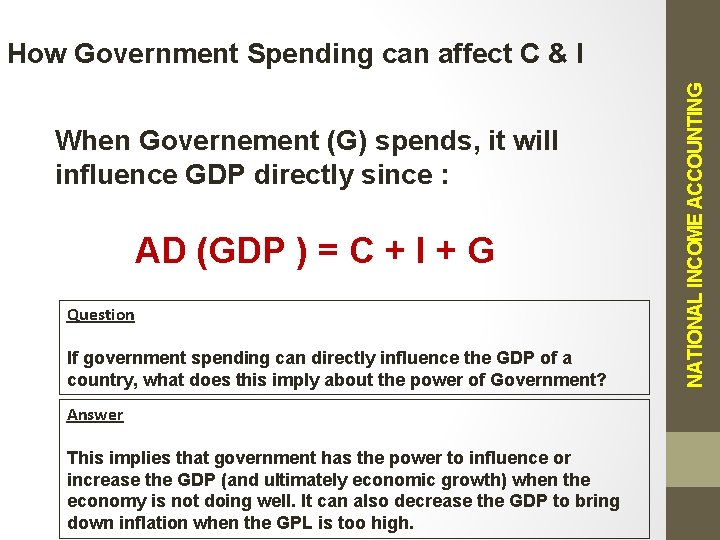

When Governement (G) spends, it will influence GDP directly since : AD (GDP ) = C + I + G Question If government spending can directly influence the GDP of a country, what does this imply about the power of Government? Answer This implies that government has the power to influence or increase the GDP (and ultimately economic growth) when the economy is not doing well. It can also decrease the GDP to bring down inflation when the GPL is too high. NATIONAL INCOME ACCOUNTING How Government Spending can affect C & I

Any government policies that government implement that can affect the aggregate demand to increase or decrease are called demand-side policies. Demand Side Policies Consist of: - Fiscal Policies : a. Government influencing AD/GDP via increasing/decreasing taxes. b. Government influencing AD/GDP via increase/decreasing government spending (G) - Monetary Policy: a. Government influencing AD/GDP via increasing or decreasing money supply. b. Increasing, decreasing the interest rate. NATIONAL INCOME ACCOUNTING Government Policies – Demand Side

Answer: 1. Gov. can use fiscal policy: • Reduce Taxes • Increase government spending (eg. on infrastructure, retraining etc) • Appropriate diagram to illustrated 2. Monetary policy: • Increase money supply so as to make funds more readily available for consumers and firms to spend. • Decreasing the interest rate. NATIONAL INCOME ACCOUNTING Q 1: The economy of the United States has not been growing for the last 5 years. Explain the policies the Fed (US central bank) implement to spur economic growth. (6 points) Hint: slide 17

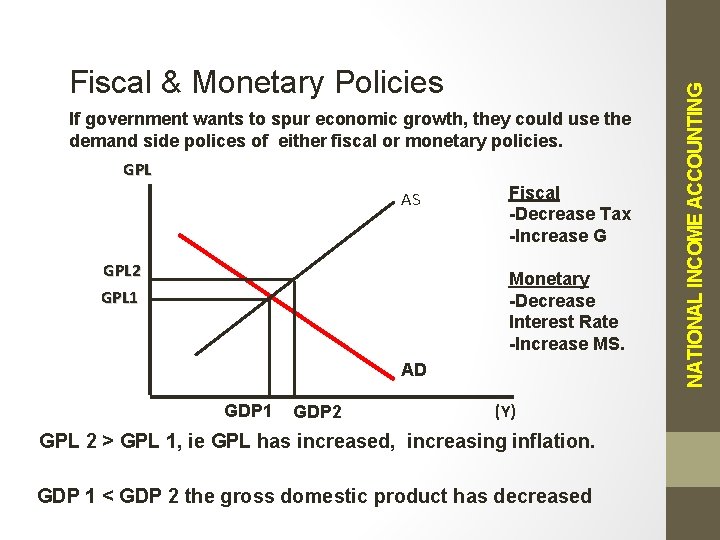

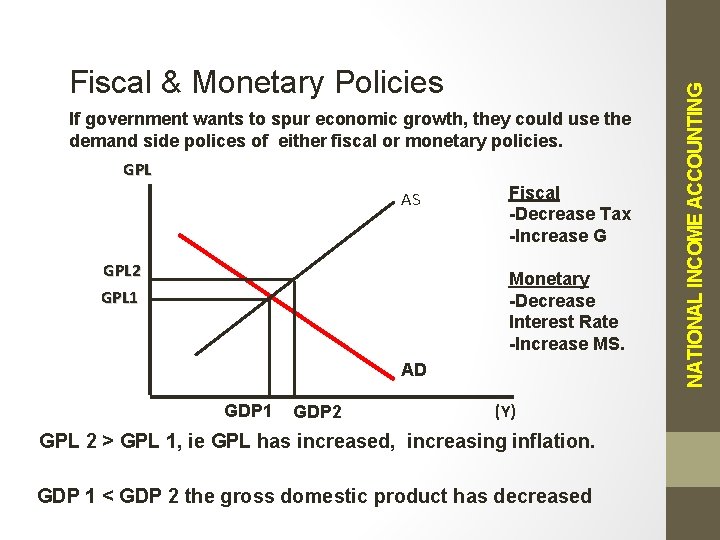

If government wants to spur economic growth, they could use the demand side polices of either fiscal or monetary policies. GPL AS GPL 2 GPL 1 Fiscal -Decrease Tax -Increase G Monetary -Decrease Interest Rate -Increase MS. AD GDP 1 GDP 2 (Y) GPL 2 > GPL 1, ie GPL has increased, increasing inflation. GDP 1 < GDP 2 the gross domestic product has decreased NATIONAL INCOME ACCOUNTING Fiscal & Monetary Policies

Answer: 1. Gov. can use fiscal policy: • Increase Taxes • Decrease government spending (eg. on infrastructure, retraining etc) • Appropriate diagram to illustrated 2. Monetary policy: • Decrease money supply so as to make funds more readily available for consumers and firms to spend. • Increase interest rate to make it more expensive to borrow and spend. NATIONAL INCOME ACCOUNTING Q 2. If a country is suffering high prices (as in high inflation), what policy tool can the Gov. use to tame inflation? (6 points)

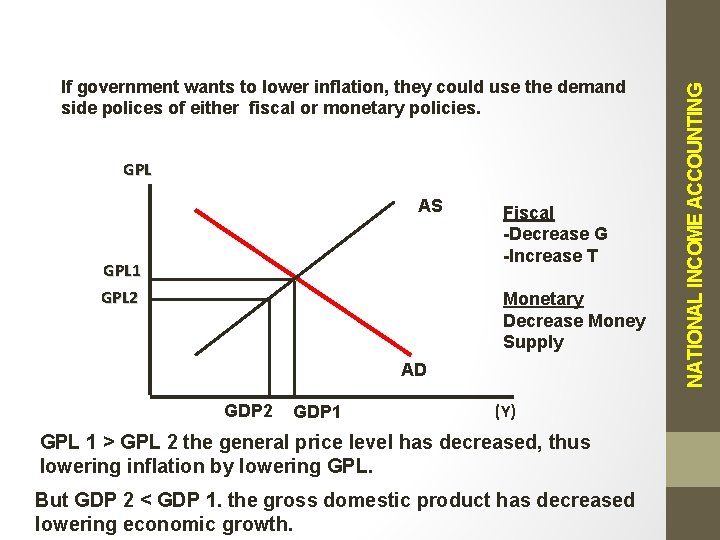

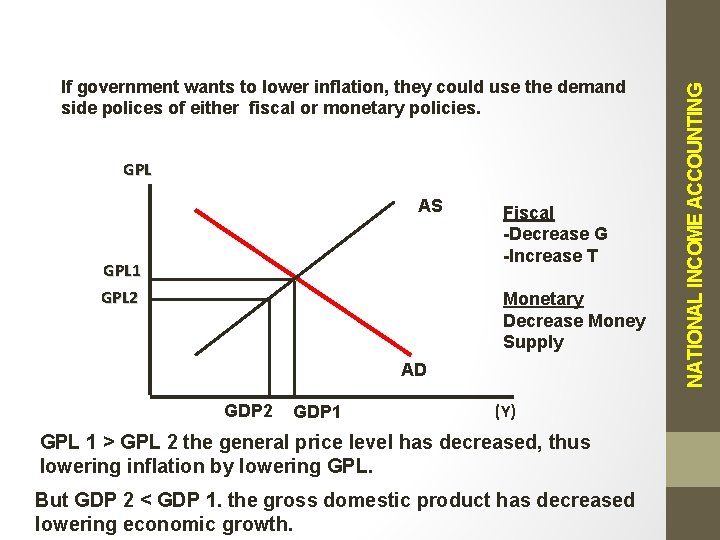

GPL AS GPL 1 GPL 2 Fiscal -Decrease G -Increase T Monetary Decrease Money Supply AD GDP 2 GDP 1 (Y) GPL 1 > GPL 2 the general price level has decreased, thus lowering inflation by lowering GPL. But GDP 2 < GDP 1. the gross domestic product has decreased lowering economic growth. NATIONAL INCOME ACCOUNTING If government wants to lower inflation, they could use the demand side polices of either fiscal or monetary policies.

NATIONAL INCOME ACCOUNTING

NATIONAL INCOME ACCOUNTING

NATIONAL INCOME ACCOUNTING

NATIONAL INCOME ACCOUNTING

NATIONAL INCOME ACCOUNTING

NATIONAL INCOME ACCOUNTING

Dtl dta

Dtl dta Chapter 16 accounting for income taxes

Chapter 16 accounting for income taxes Gdp calculation expenditure approach

Gdp calculation expenditure approach Ano ang nfia

Ano ang nfia Gnp vs gdp

Gnp vs gdp Total income

Total income Income statement in financial accounting

Income statement in financial accounting Income accounting u of u

Income accounting u of u Fixed income accounting

Fixed income accounting Cost accounting income statement

Cost accounting income statement Intermediate accounting chapter 5

Intermediate accounting chapter 5 Sfas 109

Sfas 109 Income tax expense

Income tax expense National income formula

National income formula National income and product accounts

National income and product accounts National income lesson plan

National income lesson plan National income formula

National income formula Lgutef

Lgutef Measuring domestic output and national income

Measuring domestic output and national income Solve the national income model by matrix inversion

Solve the national income model by matrix inversion National income data

National income data What is national income

What is national income Outputs

Outputs Measuring domestic output and national income

Measuring domestic output and national income Measuring domestic output and national income

Measuring domestic output and national income Financial accounting chapter 1

Financial accounting chapter 1 Introduction to computerised accounting

Introduction to computerised accounting Going concern assumption

Going concern assumption