Measuring Domestic Output and National Income Topic 1

- Slides: 26

Measuring Domestic Output and National Income Topic- 1. 0

Learning objectives • Importance of national income accounting • How gross domestic product (GDP) is defined and measured. • The relationships between GDP, net domestic product (NDP), national income (NI), personal income (PI), and disposable income (DI). • The difference between nominal GDP and real GDP. • Some limitations of the GDP measure.

Importance of NI accounting • National Income Accounting - measures the economy’s performance by measuring the flows of income and expenditures over a period of time. • Gives a picture of economic status/health of the country in comparison with other countries. • provides a basis formulating appropriate public policies to improve the economic performance of the country.

Gross Domestic Product • Gross Domestic Product (GDP) is the monetary measure of the total market value of all final goods and services produced within a country in one year. • Market value = Quantity of all final goods and services multiplied by the market prices per unit of those goods and services • Final goods are consumption goods, capital goods & services that are bought by their final users, rather than the goods for resale or further processing or manufacturing

GDP excludes Intermediate Goods GDP includes only the market value of final products (G) and services (S) by eliminating the value of any intermediate goods used in production of these final Gs & Ss. This is done to avoid double/multiple counting. • Intermediate goods are goods & services are semifinished goods and goods which cannot be used independently; they are bought for resale for further processing or manufacturing.

Double counting • Double counting/Multiple counting could be avoided by cumulating only the value added at each stage • Value added is the market value of a firm’s product minus the value of the inputs the firm has bought from others • GDP is the value of what has been produced in the economy over the year, not what was actually sold. (use example in Table 24. 2, page 481, Mc. Connell)

Nonproduction Transactions are excluded such as: • Purely financial transactions – Public transfer payments, like social security or cash welfare benefits to some people – Private transfer payments, like student allowances or payments made to children by their parents – sale of stocks and bonds represent a transfer of existing assets. (However, the brokers’ fees are included for services rendered. ) • Secondhand sales since they do not represent current output (However, any value added between purchase and resale is included, e. g. used car dealers).

Two Approaches to measure GDP • Income Approach (The sum of all incomes in a year) – Wages – Rental Incomes – Interest Incomes – Profits • Expenditure Approach The Sum of the Money Spent to buy the Output i. e. goods and services in a year • (Illustration with circular flow diagram)

Expenditure Approach • GDP is divided into the categories of buyers in the market; household consumers, businesses, government, and foreign consumers/buyers • Personal Consumption Expenditures (C ) – Durable Consumer Goods – Nondurable Consumer Goods – Consumer Expenditures for Services • Gross Private Domestic Investment (Ig) – Machinery, Equipment, and Tools – All Construction – Changes in Inventories

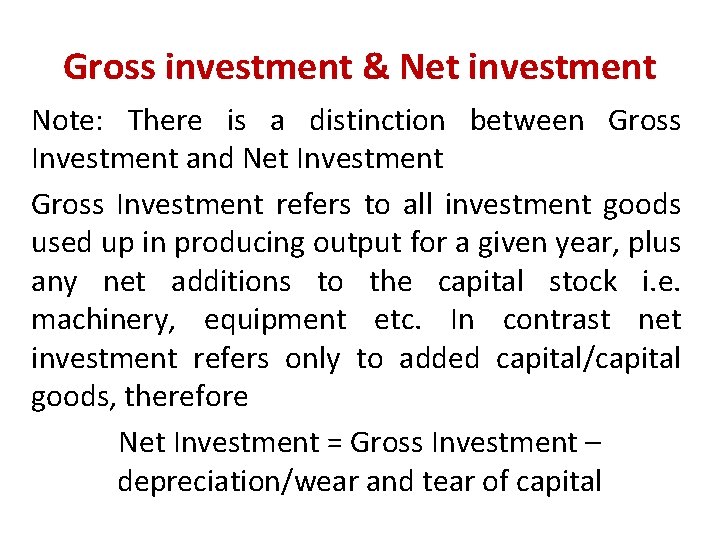

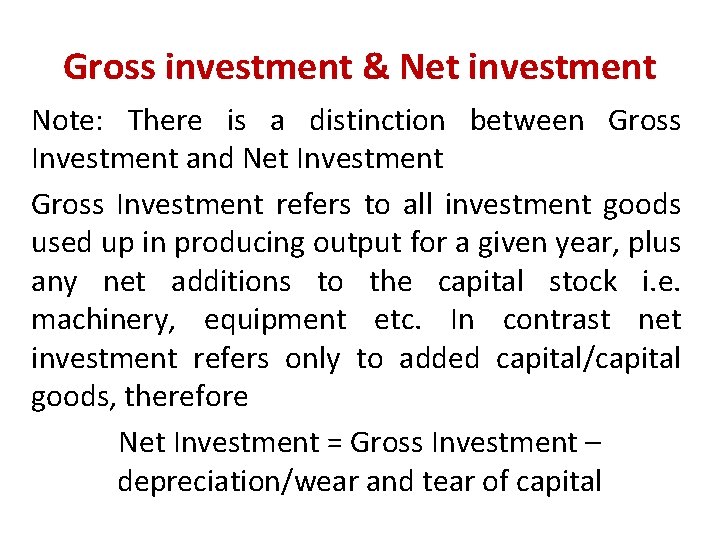

Gross investment & Net investment Note: There is a distinction between Gross Investment and Net Investment Gross Investment refers to all investment goods used up in producing output for a given year, plus any net additions to the capital stock i. e. machinery, equipment etc. In contrast net investment refers only to added capital/capital goods, therefore Net Investment = Gross Investment – depreciation/wear and tear of capital

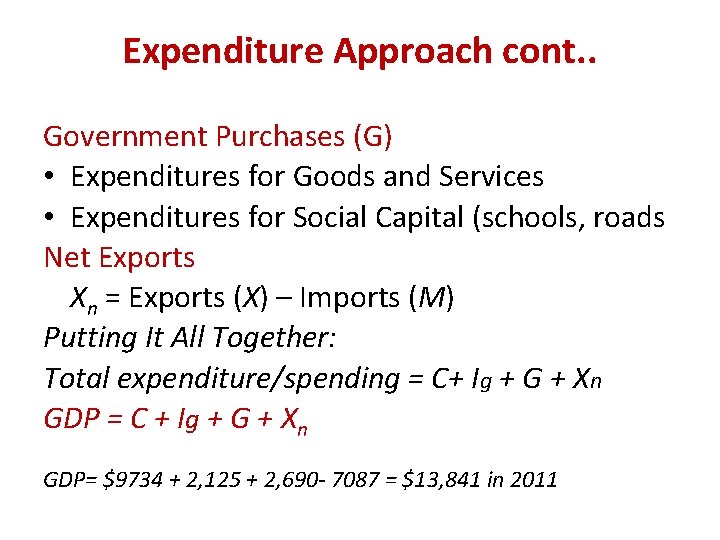

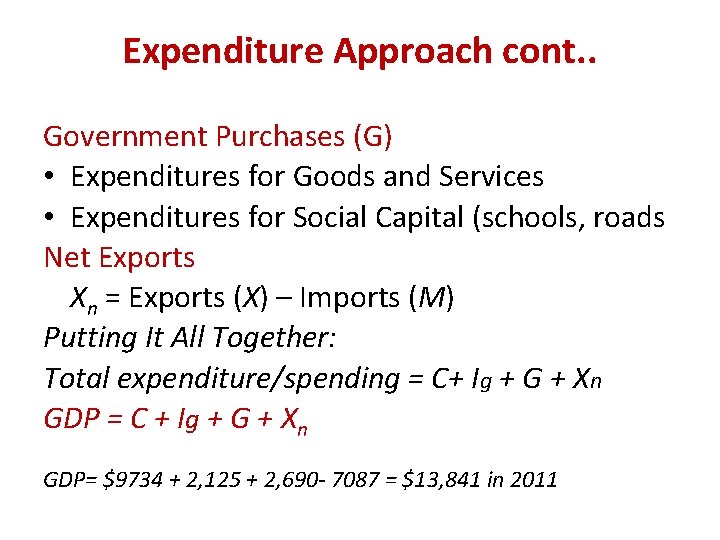

Expenditure Approach cont. . Government Purchases (G) • Expenditures for Goods and Services • Expenditures for Social Capital (schools, roads Net Exports Xn = Exports (X) – Imports (M) Putting It All Together: Total expenditure/spending = C+ Ig + G + Xn GDP = C + Ig + G + Xn GDP= $9734 + 2, 125 + 2, 690 - 7087 = $13, 841 in 2011

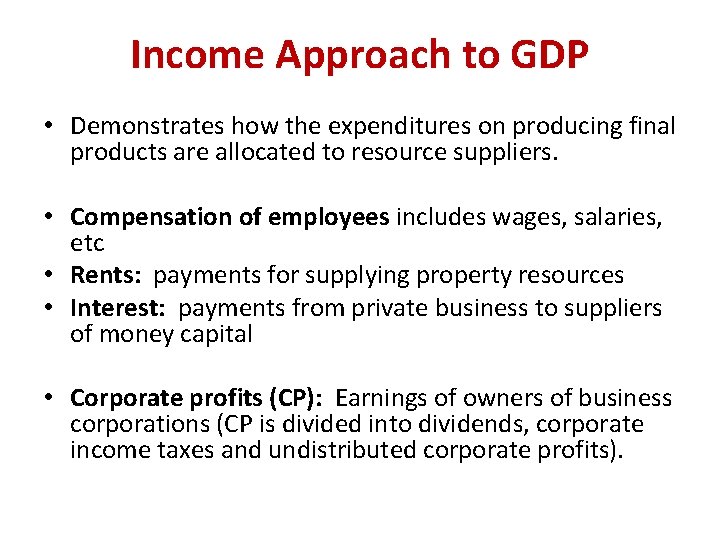

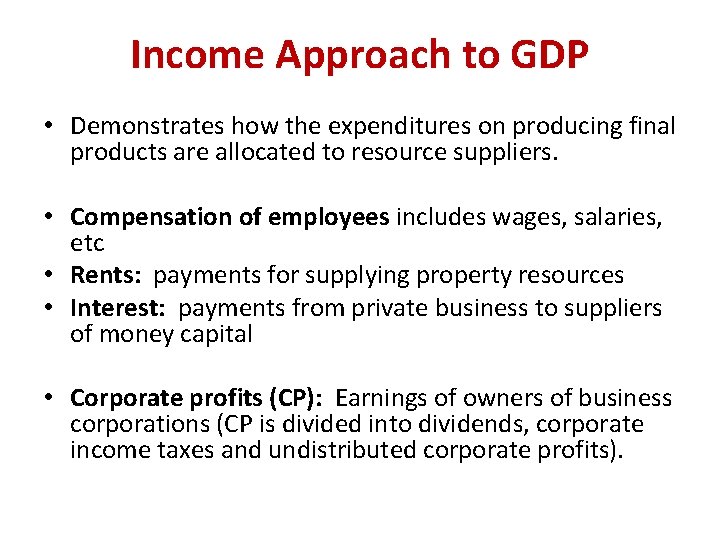

Income Approach to GDP • Demonstrates how the expenditures on producing final products are allocated to resource suppliers. • Compensation of employees includes wages, salaries, etc • Rents: payments for supplying property resources • Interest: payments from private business to suppliers of money capital • Corporate profits (CP): Earnings of owners of business corporations (CP is divided into dividends, corporate income taxes and undistributed corporate profits).

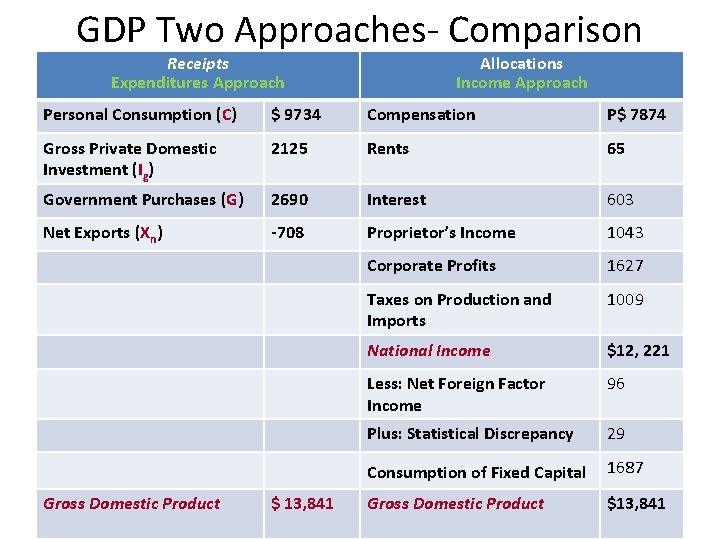

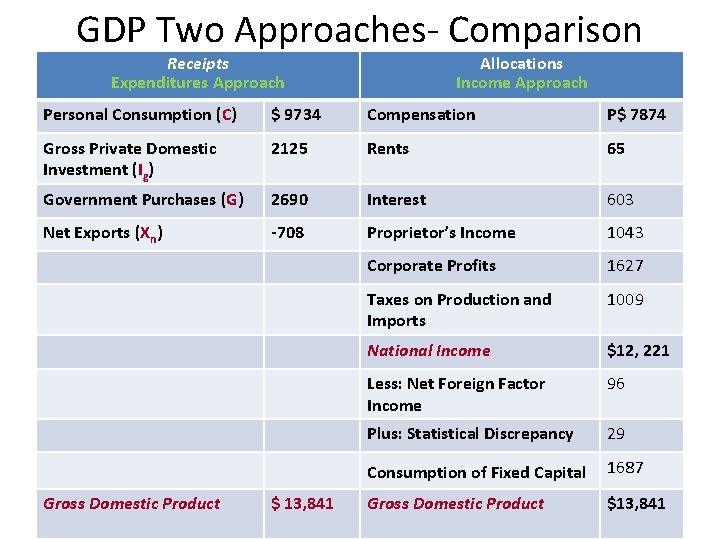

GDP Two Approaches- Comparison Receipts Expenditures Approach Allocations Income Approach Personal Consumption (C) $ 9734 Compensation P$ 7874 Gross Private Domestic Investment (Ig) 2125 Rents 65 Government Purchases (G) 2690 Interest 603 Net Exports (Xn) -708 Proprietor’s Income 1043 Corporate Profits 1627 Taxes on Production and Imports 1009 National Income $12, 221 Less: Net Foreign Factor Income 96 Plus: Statistical Discrepancy 29 Consumption of Fixed Capital 1687 Gross Domestic Product $13, 841 Gross Domestic Product $ 13, 841

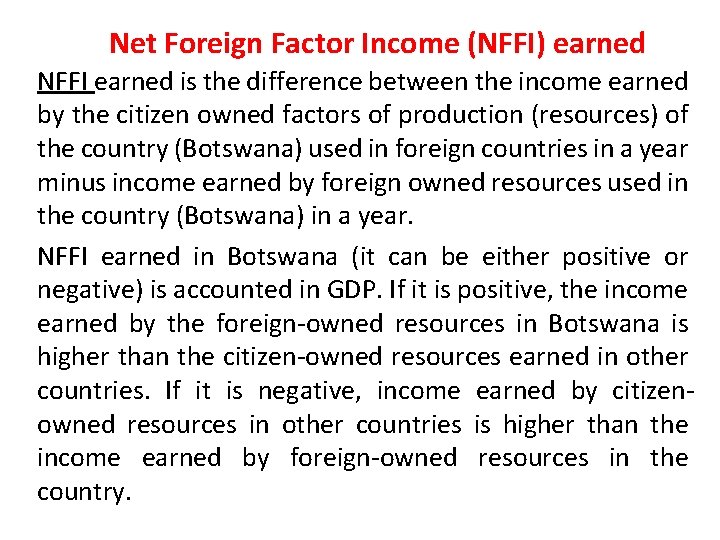

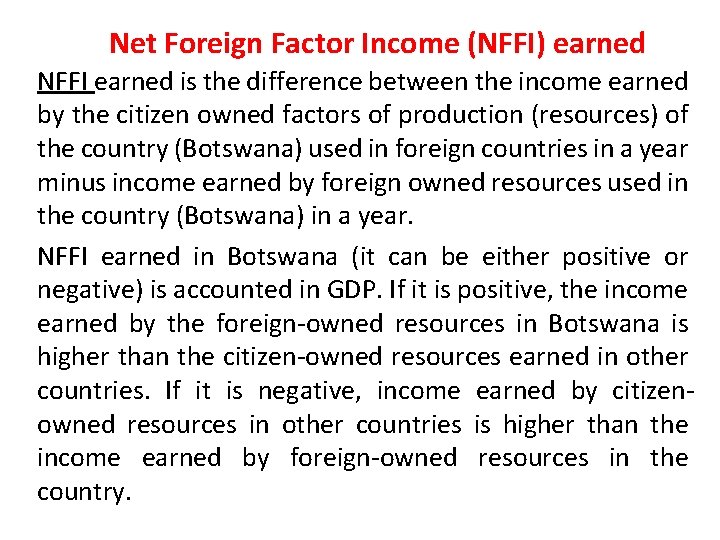

Net Foreign Factor Income (NFFI) earned NFFI earned is the difference between the income earned by the citizen owned factors of production (resources) of the country (Botswana) used in foreign countries in a year minus income earned by foreign owned resources used in the country (Botswana) in a year. NFFI earned in Botswana (it can be either positive or negative) is accounted in GDP. If it is positive, the income earned by the foreign-owned resources in Botswana is higher than the citizen-owned resources earned in other countries. If it is negative, income earned by citizenowned resources in other countries is higher than the income earned by foreign-owned resources in the country.

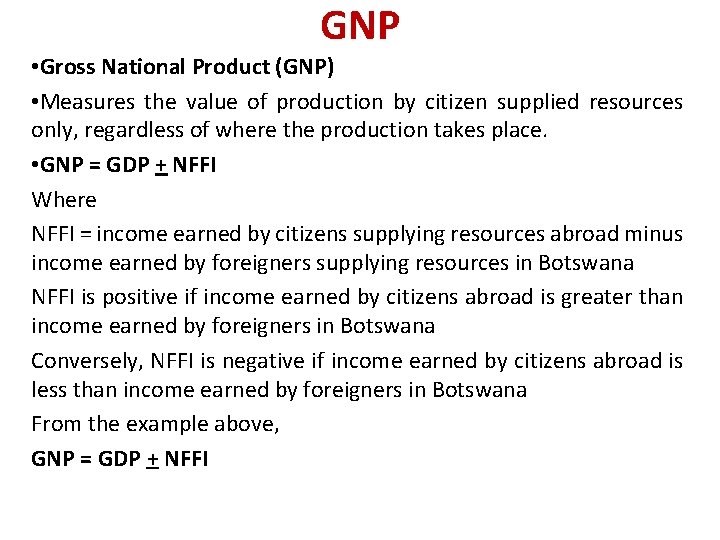

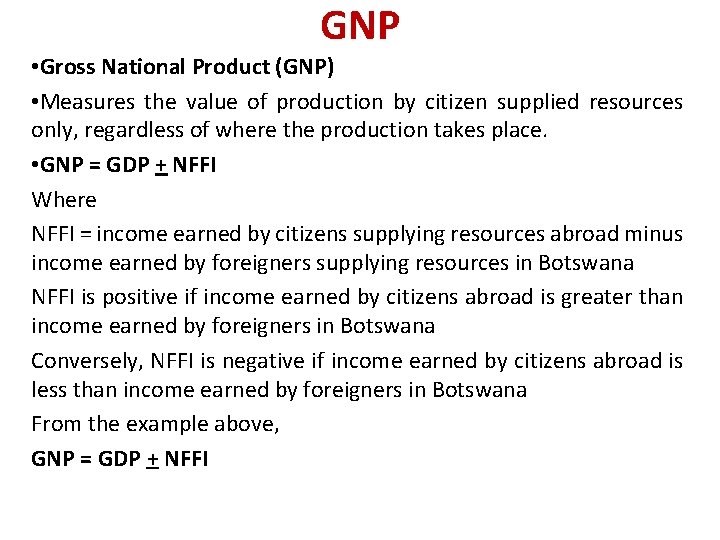

GNP • Gross National Product (GNP) • Measures the value of production by citizen supplied resources only, regardless of where the production takes place. • GNP = GDP + NFFI Where NFFI = income earned by citizens supplying resources abroad minus income earned by foreigners supplying resources in Botswana NFFI is positive if income earned by citizens abroad is greater than income earned by foreigners in Botswana Conversely, NFFI is negative if income earned by citizens abroad is less than income earned by foreigners in Botswana From the example above, GNP = GDP + NFFI

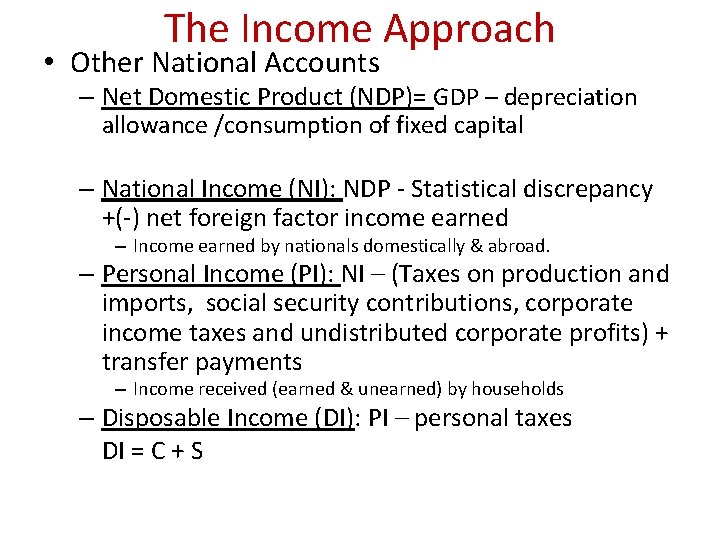

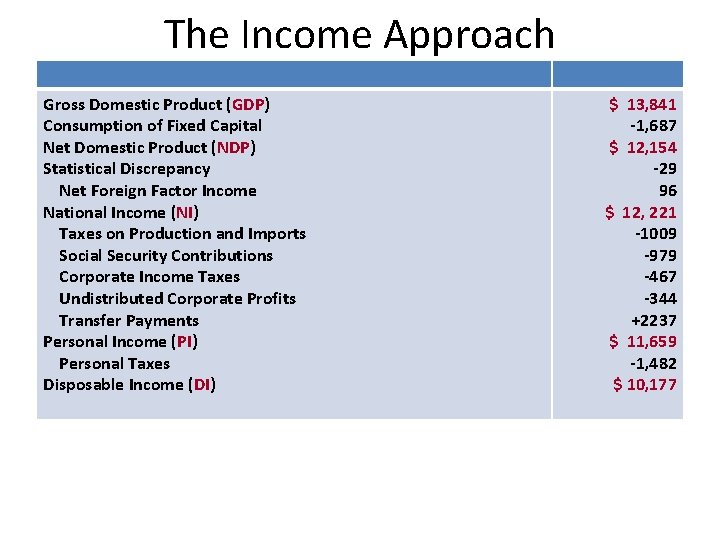

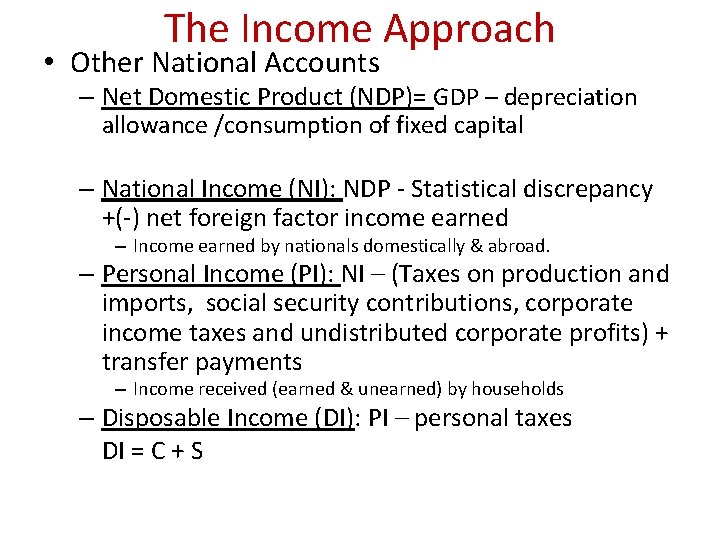

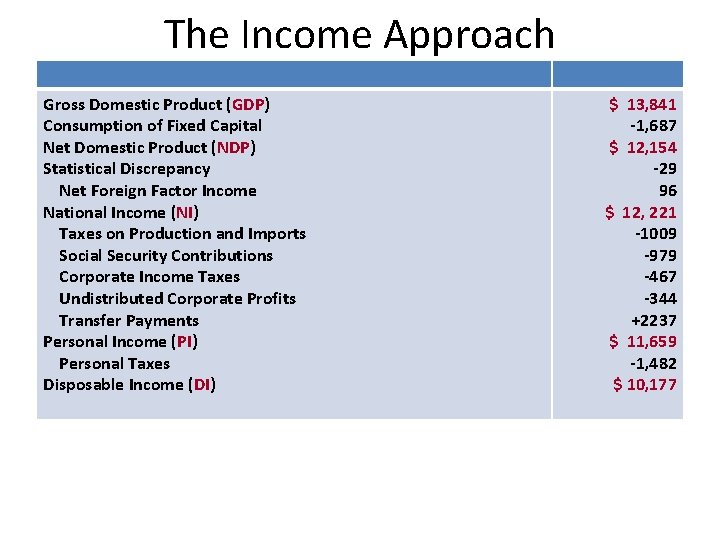

The Income Approach • Other National Accounts – Net Domestic Product (NDP)= GDP – depreciation allowance /consumption of fixed capital – National Income (NI): NDP - Statistical discrepancy +(-) net foreign factor income earned – Income earned by nationals domestically & abroad. – Personal Income (PI): NI – (Taxes on production and imports, social security contributions, corporate income taxes and undistributed corporate profits) + transfer payments – Income received (earned & unearned) by households – Disposable Income (DI): PI – personal taxes DI = C + S

The Income Approach Gross Domestic Product (GDP) Consumption of Fixed Capital Net Domestic Product (NDP) Statistical Discrepancy Net Foreign Factor Income National Income (NI) Taxes on Production and Imports Social Security Contributions Corporate Income Taxes Undistributed Corporate Profits Transfer Payments Personal Income (PI) Personal Taxes Disposable Income (DI) $ 13, 841 -1, 687 $ 12, 154 -29 96 $ 12, 221 -1009 -979 -467 -344 +2237 $ 11, 659 -1, 482 $ 10, 177

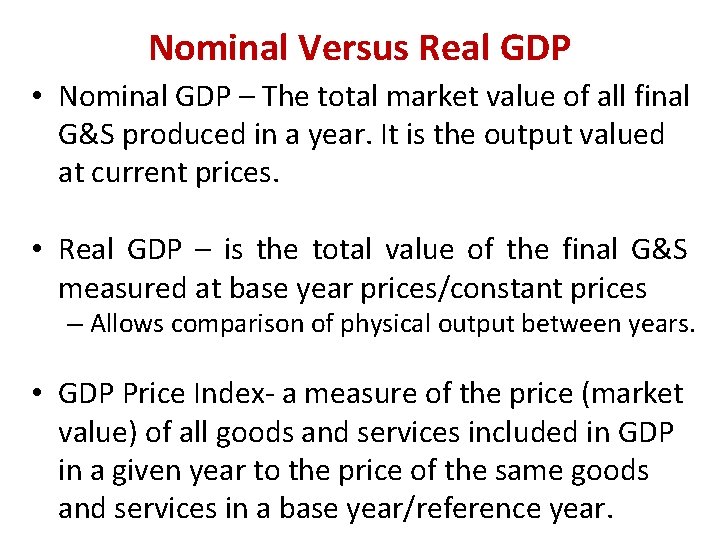

Nominal Versus Real GDP • Nominal GDP – The total market value of all final G&S produced in a year. It is the output valued at current prices. • Real GDP – is the total value of the final G&S measured at base year prices/constant prices – Allows comparison of physical output between years. • GDP Price Index- a measure of the price (market value) of all goods and services included in GDP in a given year to the price of the same goods and services in a base year/reference year.

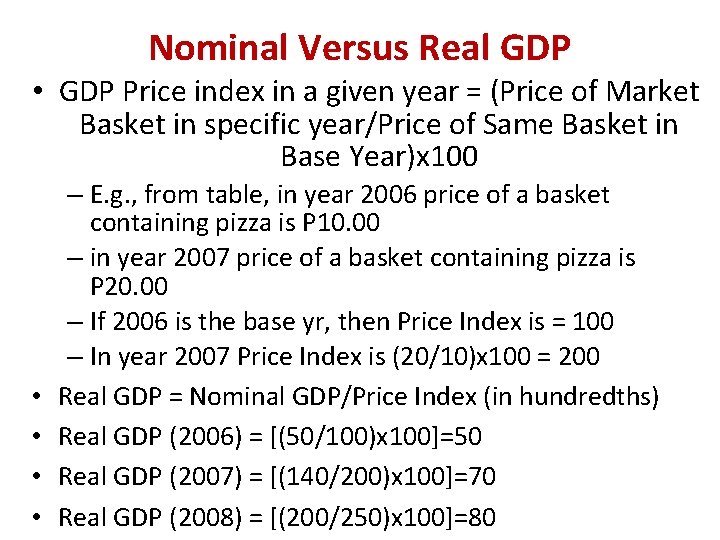

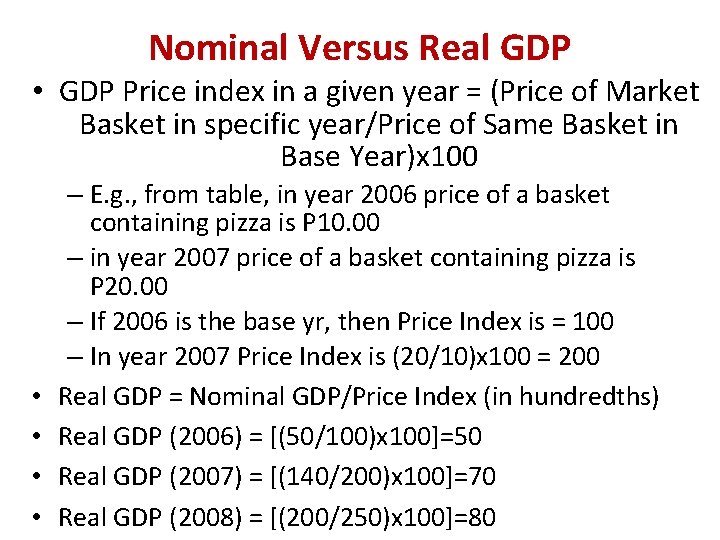

Nominal Versus Real GDP • GDP Price index in a given year = (Price of Market Basket in specific year/Price of Same Basket in Base Year)x 100 • • – E. g. , from table, in year 2006 price of a basket containing pizza is P 10. 00 – in year 2007 price of a basket containing pizza is P 20. 00 – If 2006 is the base yr, then Price Index is = 100 – In year 2007 Price Index is (20/10)x 100 = 200 Real GDP = Nominal GDP/Price Index (in hundredths) Real GDP (2006) = [(50/100)x 100]=50 Real GDP (2007) = [(140/200)x 100]=70 Real GDP (2008) = [(200/250)x 100]=80

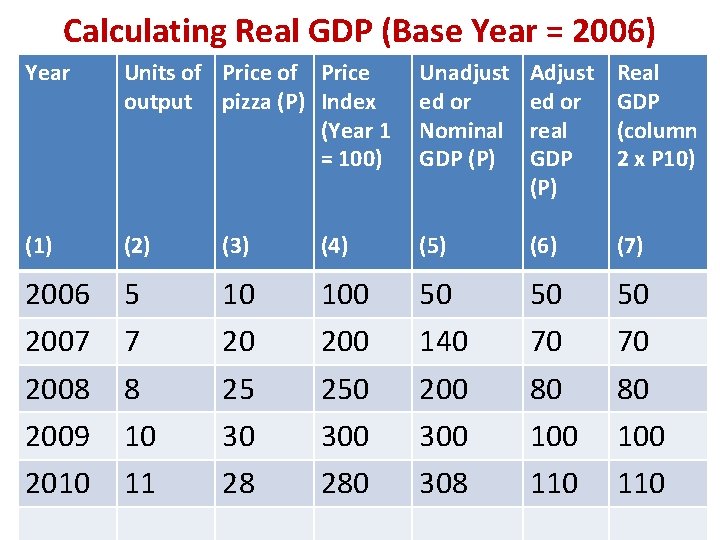

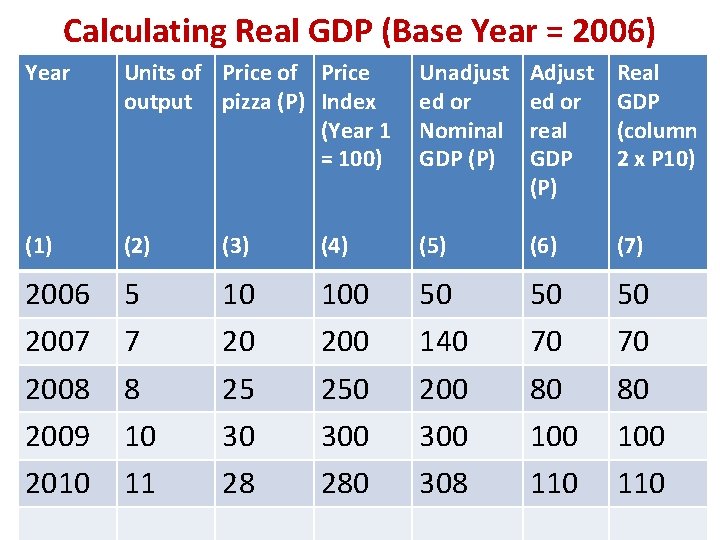

Calculating Real GDP (Base Year = 2006) Year Units of Price output pizza (P) Index (Year 1 = 100) Unadjust ed or Nominal GDP (P) Adjust ed or real GDP (P) Real GDP (column 2 x P 10) (1) (2) (3) (4) (5) (6) (7) 2006 2007 2008 2009 2010 5 7 8 10 11 10 20 25 30 28 100 250 300 280 50 140 200 308 50 70 80 100 110

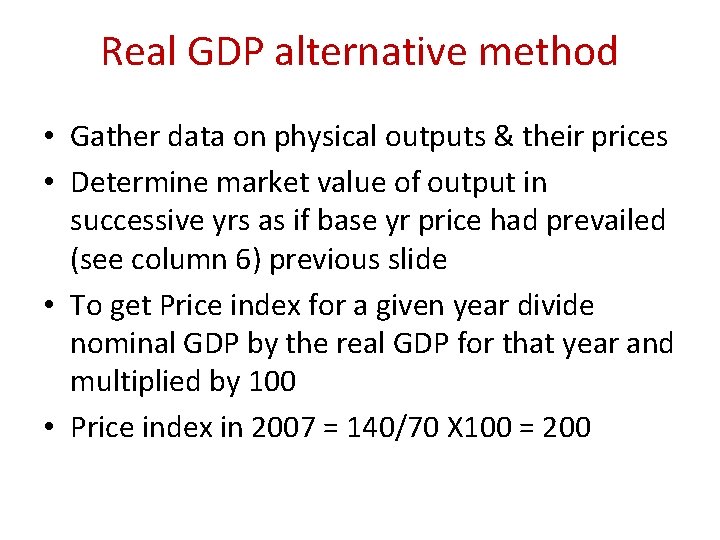

Real GDP alternative method • Gather data on physical outputs & their prices • Determine market value of output in successive yrs as if base yr price had prevailed (see column 6) previous slide • To get Price index for a given year divide nominal GDP by the real GDP for that year and multiplied by 100 • Price index in 2007 = 140/70 X 100 = 200

Circular flow of income – open economy Domestic households/consumers and suppliers of resources Government Domestic producers/suppliers of goods and services Abroad/Foreign sector Exports & Imports

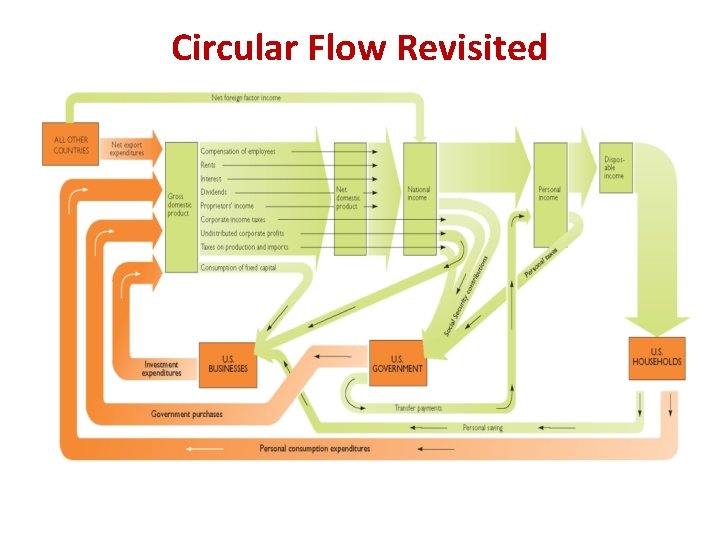

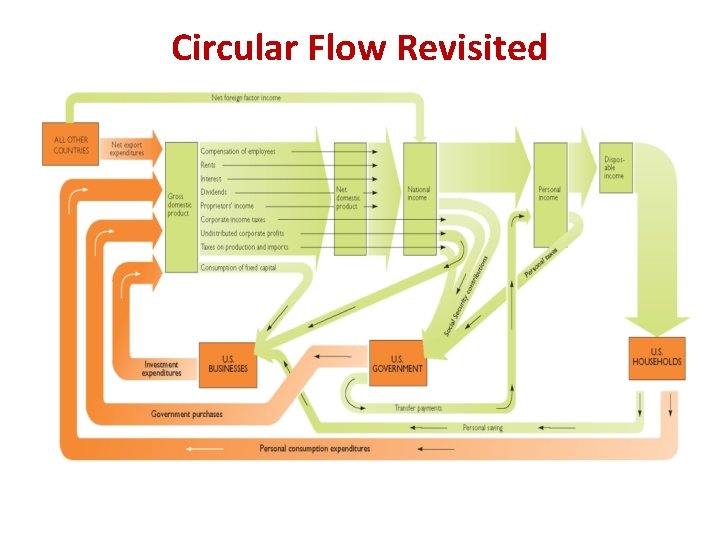

Circular Flow Revisited

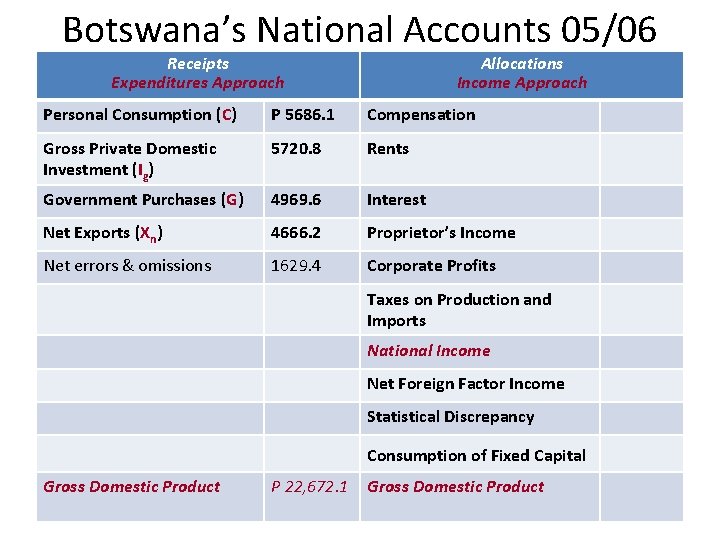

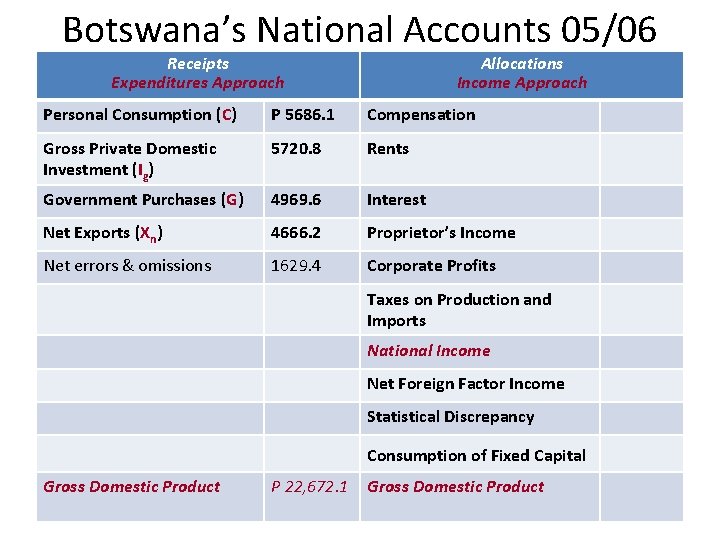

Botswana’s National Accounts 05/06 Receipts Expenditures Approach Allocations Income Approach Personal Consumption (C) P 5686. 1 Compensation Gross Private Domestic Investment (Ig) 5720. 8 Rents Government Purchases (G) 4969. 6 Interest Net Exports (Xn) 4666. 2 Proprietor’s Income Net errors & omissions 1629. 4 Corporate Profits Taxes on Production and Imports National Income Net Foreign Factor Income Statistical Discrepancy Consumption of Fixed Capital Gross Domestic Product P 22, 672. 1 Gross Domestic Product

Shortcomings/problems in the preparation of National Income Accounts The accuracy of GDP figures is always questioned because of two sets of problems that arise in the estimation of GDP of a country Conceptual problems Practical problems 25

Shortcomings of GDP • Double counting • Informal sector activities • Non-marketed output and services – production made for household consumption, homemakers‘ services etc • Leisure – improves living conditions, but is not included • Improved Product Quality • Unrecorded economic activities • The Underground Economy • GDP and social and environment factors – harmful effects of pollution not subtracted from GDP • Composition and Distribution of the Output and income. GDP makes no difference between the quantity of output of guns or tractors. • Non-economic Sources of well-being – crime prevention not covered in GDP (Each one of the above needs to be explained with details)

Measuring domestic output and national income

Measuring domestic output and national income Outputs

Outputs Measuring domestic output and national income

Measuring domestic output and national income Measuring domestic output and national income

Measuring domestic output and national income Gdp per capita formula

Gdp per capita formula Gnp at gdp

Gnp at gdp Measuring a nation's income

Measuring a nation's income Deferred tax asset and liability

Deferred tax asset and liability Comprehensive income reports an expanded version

Comprehensive income reports an expanded version Calculate income tax

Calculate income tax Clincher sentence examples

Clincher sentence examples Narrowed down topic examples

Narrowed down topic examples National income and product accounts

National income and product accounts National income accounting tagalog

National income accounting tagalog Nnp calculation formula

Nnp calculation formula National income lesson plan

National income lesson plan National income formula

National income formula National income tax workbook

National income tax workbook Solve the national income model by matrix inversion

Solve the national income model by matrix inversion Final expenditure approach

Final expenditure approach What is national income

What is national income National income accounting equation

National income accounting equation National unification and the national state

National unification and the national state What is national output

What is national output Soil conservation and domestic allotment act

Soil conservation and domestic allotment act Soil conservation and domestic allotment act

Soil conservation and domestic allotment act A sexual reproduction

A sexual reproduction