PART III Decision Tools Lecture 30 Cost Volume

- Slides: 59

PART III: Decision Tools Lecture 30 Cost Volume Profit Relationship Instructor Adnan Shoaib 1

Learning Objectives 2 1. Distinguish between variable and fixed costs. 2. Explain the significance of the relevant range. 3. Explain the concept of mixed costs. 4. List the five components of cost-volume-profit analysis. 5. Indicate what contribution margin is and how it can be expressed 6. Identify the three ways to determine the break-even point. 7. Give the formulas for determining sales required to earn target net income 8. Define margin of safety, and give the formulas for computing it. 9. Describe the essential features of a cost-volume-profit income statement.

Preamble To manage any business, you must understand: How costs respond to changes in sales volume and The effect of costs and revenues on profit To understand cost-volume-profit (CVP), you must know how costs behave 3

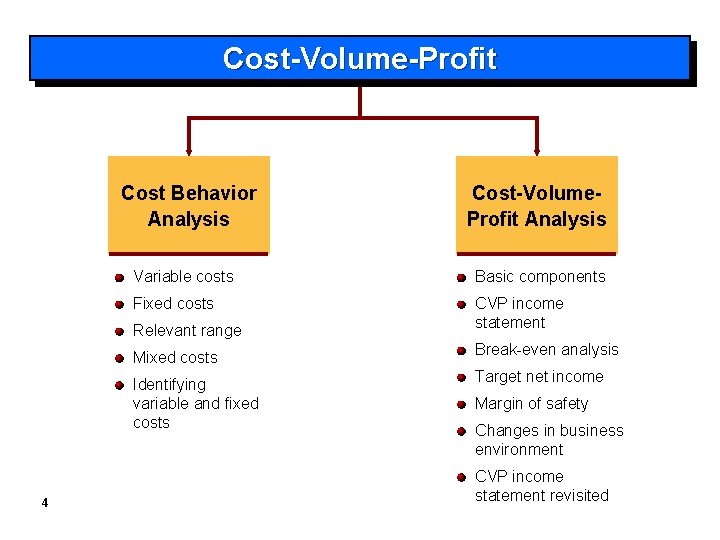

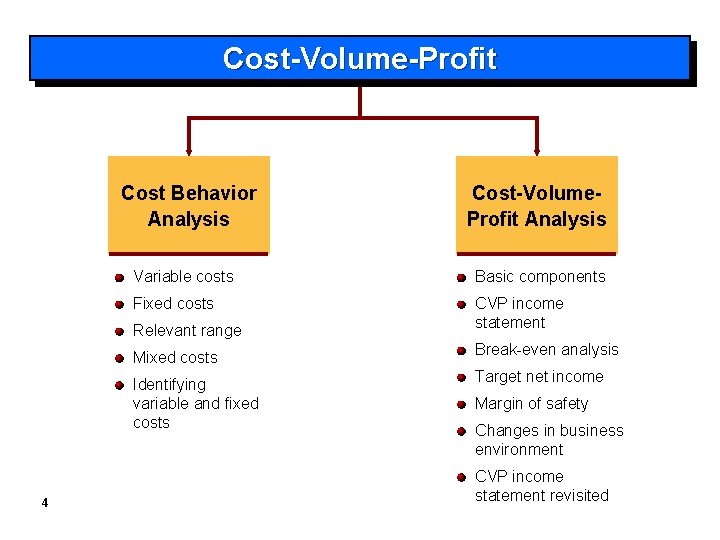

Cost-Volume-Profit Cost Behavior Analysis 4 Cost-Volume. Profit Analysis Variable costs Basic components Fixed costs Relevant range CVP income statement Mixed costs Break-even analysis Identifying variable and fixed costs Target net income Margin of safety Changes in business environment CVP income statement revisited

Cost Behavior Analysis is the study of how specific costs respond to changes in the level of business activity. Some costs change; others remain the same Helps management plan operations and decide between alternative courses of action Applies to all types of businesses and entities 5 LO 1: Distinguish between variable and fixed costs.

Cost Behavior Analysis - continued Starting point is measuring key business activities Activity levels may be expressed in terms of: Sales dollars (in a retail company) Miles driven (in a trucking company) Room occupancy (in a hotel) Dance classes taught (by a dance studio) Many companies use more than one measurement base 6 LO 1: Distinguish between variable and fixed costs.

Cost Behavior Analysis - continued For an activity level to be useful: Changes in the level or volume of activity should be correlated with changes in costs The activity level selected is called the activity or volume index The activity index: Identifies the activity that causes changes in the behavior of costs Allows costs to be classified according to their response to changes in activity as either: Variable Costs 7 Fixed Costs Mixed Costs LO 1: Distinguish between variable and fixed costs.

Variable Costs that vary in total directly and proportionately with changes in the activity level Example: If the activity level increases 10 percent, total variable costs increase 10 percent Example: If the activity level decreases by 25 percent, total variable costs decrease by 25 percent Variable costs remain constant per unit at every level of activity. 8 LO 1: Distinguish between variable and fixed costs.

Variable Costs – Example Damon Company manufactures radios that contain a $10 clock Activity index is the number of radios produced For each radio produced, the total cost of the clocks increases by $10: If 2, 000 radios are made, the total cost of the clocks is $20, 000 (2, 000 X $10) If 10, 000 radios are made, the total cost of the clocks is $100, 000 (10, 000 X $10) 9 LO 1: Distinguish between variable and fixed costs.

Variable Costs – Graphs 10 LO 1: Distinguish between variable and fixed costs.

Fixed Costs that remain the same in total regardless of changes in the activity level. Per unit cost varies inversely with activity: As volume increases, unit cost declines, and vice versa Examples include: Property taxes Insurance Rent Depreciation on buildings and equipment 11 LO 1: Distinguish between variable and fixed costs.

Fixed Costs - Example Damon Company leases its productive facilities for $10, 000 per month Total fixed costs of the facilities remain constant at all levels of activity - $10, 000 per month On a per unit basis, the cost of rent decreases as activity increases and vice versa At 2, 000 radios, the unit cost is $5 ($10, 000 ÷ 2, 000 units) At 10, 000 radios, the unit cost is $1 ($10, 000 ÷ 10, 000 units) 12 LO 1: Distinguish between variable and fixed costs.

Fixed Costs - Graphs 13 LO 1: Distinguish between variable and fixed costs.

Variable Costs Review Question Variable costs are costs that: a. Vary in total directly and proportionately with changes in the activity level b. Remain the same per unit at every activity level. c. Neither of the above. d. Both (a) and (b) above. 14 LO 1: Distinguish between variable and fixed costs.

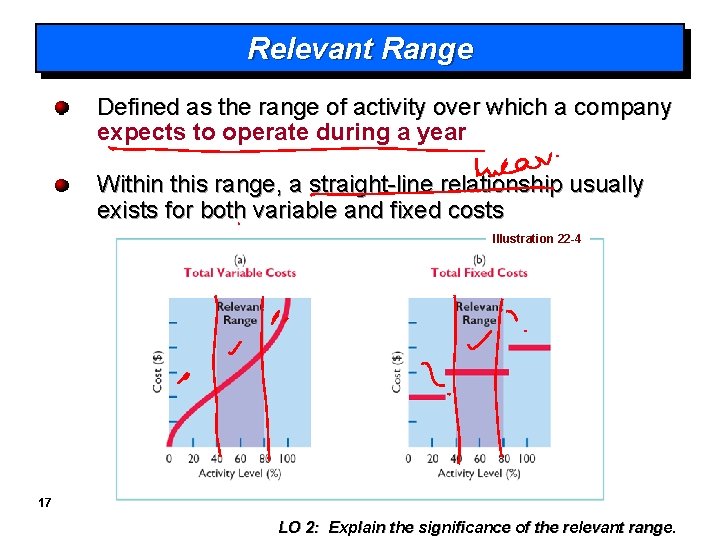

Relevant Range Throughout the range of possible levels of activity, a straight-line relationship usually does not exist for either variable costs or fixed costs The relationship between variable costs and changes in activity level is often curvilinear For fixed costs, the relationship is also nonlinear – some fixed costs will not change over the entire range of activities while other fixed costs may change 15 LO 2: Explain the significance of the relevant range.

Relevant Range - Graphs 16 LO 2: Explain the significance of the relevant range.

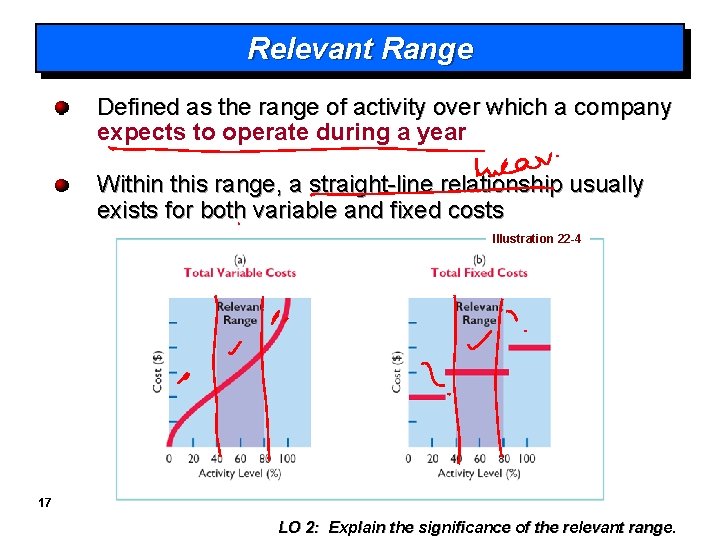

Relevant Range Defined as the range of activity over which a company expects to operate during a year Within this range, a straight-line relationship usually exists for both variable and fixed costs Illustration 22 -4 17 LO 2: Explain the significance of the relevant range.

Relevant Range Review Question The relevant range is: a. The range of activity in which variable costs will be curvilinear b. The range of activity in which fixed costs will be curvilinear. c. The range over which the company expects to operate during a year. d. Usually from zero to 100% of operating capacity. 18 LO 2: Explain the significance of the relevant range.

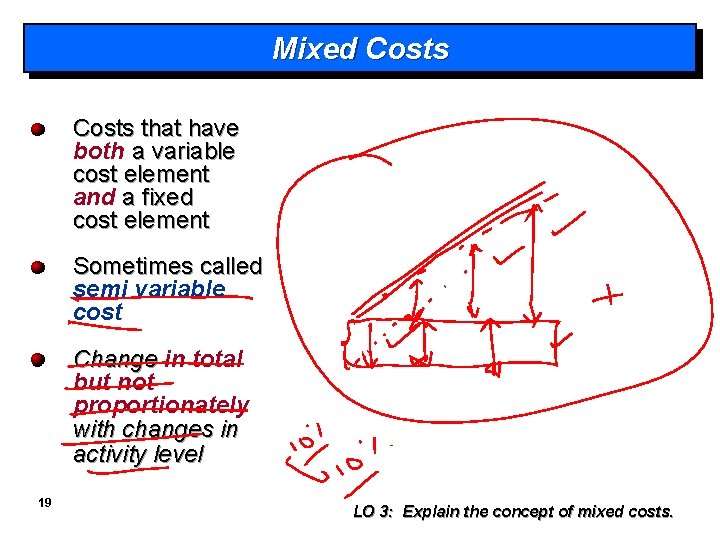

Mixed Costs that have both a variable cost element and a fixed cost element Sometimes called semi variable cost Change in total but not proportionately with changes in activity level 19 LO 3: Explain the concept of mixed costs.

Mixed Costs: High–Low Method Mixed costs must be classified into their fixed and variable elements One approach to separate the costs is called the high-low method Uses the total costs incurred at both the high and the low levels of activity to classify mixed costs The difference in costs between the high and low levels represents variable costs, since only variable costs change as activity levels change 20 LO 3: Explain the concept of mixed costs.

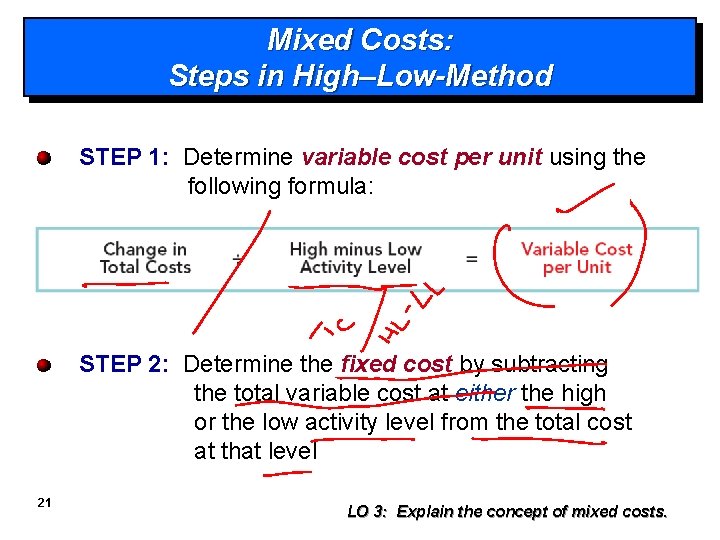

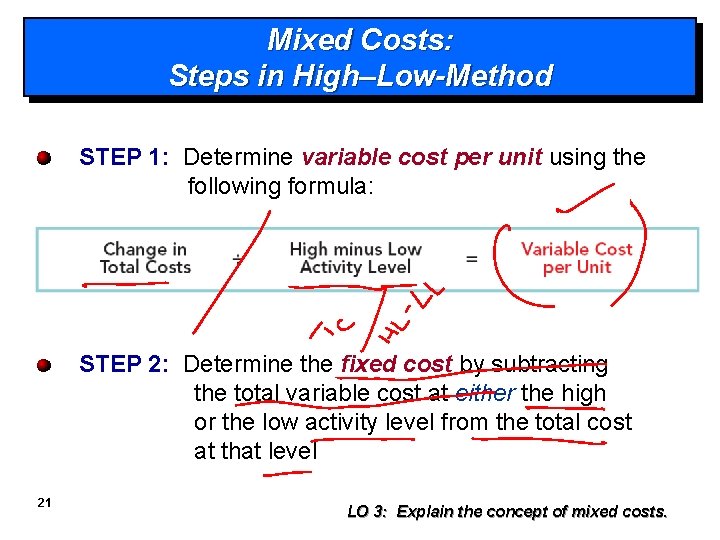

Mixed Costs: Steps in High–Low-Method STEP 1: Determine variable cost per unit using the following formula: STEP 2: Determine the fixed cost by subtracting the total variable cost at either the high or the low activity level from the total cost at that level 21 LO 3: Explain the concept of mixed costs.

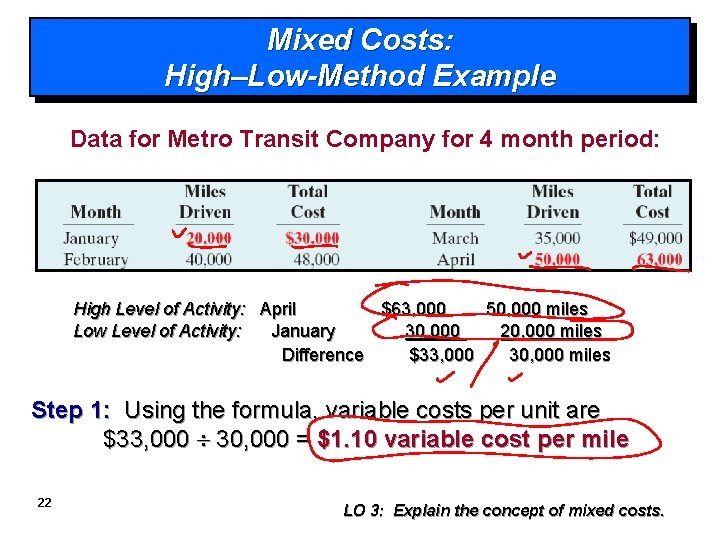

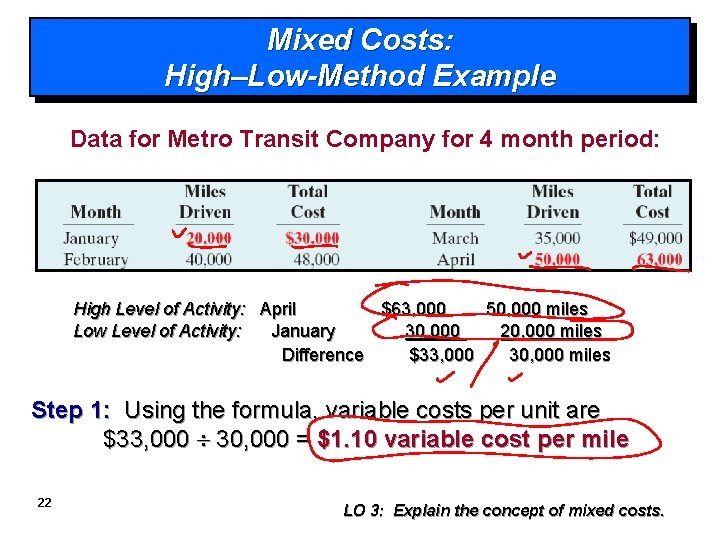

Mixed Costs: High–Low-Method Example Data for Metro Transit Company for 4 month period: High Level of Activity: April $63, 000 50, 000 miles Low Level of Activity: January 30, 000 20, 000 miles Difference $33, 000 30, 000 miles Step 1: Using the formula, variable costs per unit are $33, 000 30, 000 = $1. 10 variable cost per mile 22 LO 3: Explain the concept of mixed costs.

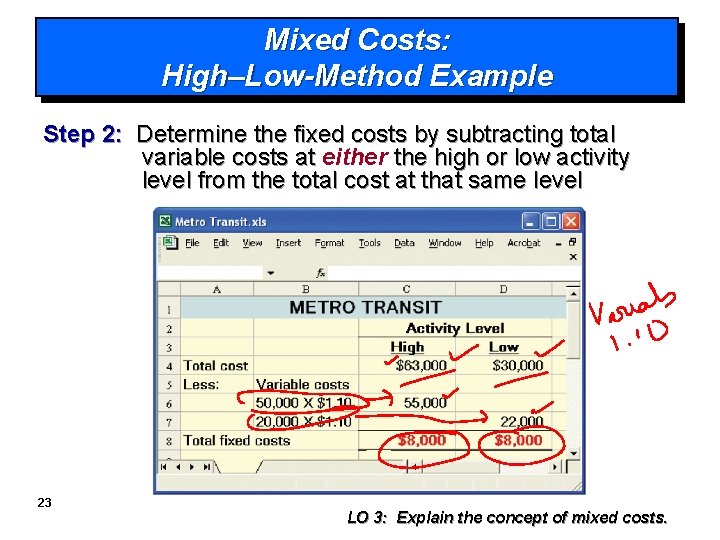

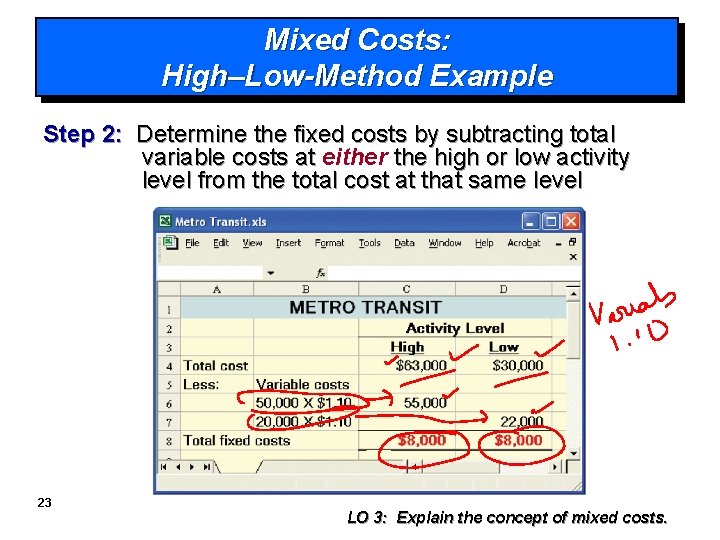

Mixed Costs: High–Low-Method Example Step 2: Determine the fixed costs by subtracting total variable costs at either the high or low activity level from the total cost at that same level 23 LO 3: Explain the concept of mixed costs.

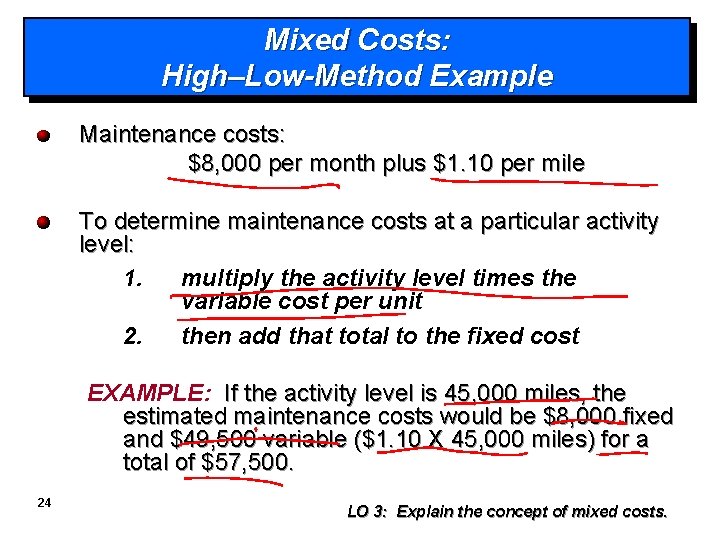

Mixed Costs: High–Low-Method Example Maintenance costs: $8, 000 per month plus $1. 10 per mile To determine maintenance costs at a particular activity level: 1. multiply the activity level times the variable cost per unit 2. then add that total to the fixed cost EXAMPLE: If the activity level is 45, 000 miles, the estimated maintenance costs would be $8, 000 fixed and $49, 500 variable ($1. 10 X 45, 000 miles) for a total of $57, 500. 24 LO 3: Explain the concept of mixed costs.

High–Low Method Review Question Mixed costs consist of a: a. Variable cost element and a fixed cost element b. Fixed cost element and a controllable cost element. c. Relevant cost element and a controllable cost element. d. Variable cost element and a relevant cost element. 25 LO 3: Explain the concept of mixed costs.

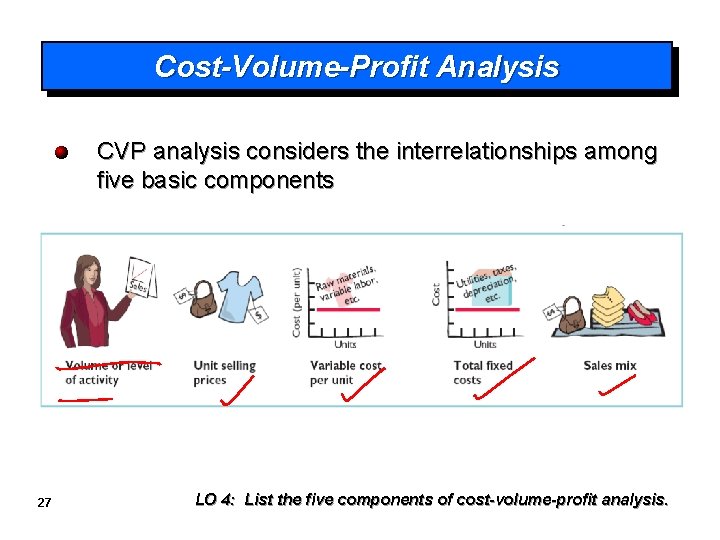

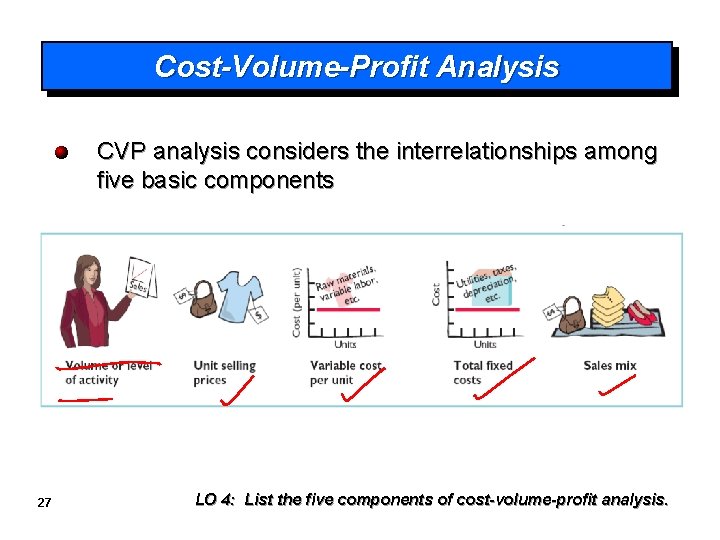

Cost-Volume-Profit Analysis Study of the effects of changes of costs and volume on a company’s profits A critical factor in management decisions Important in profit planning 26 LO 4: List the five components of cost-volume-profit analysis.

Cost-Volume-Profit Analysis CVP analysis considers the interrelationships among five basic components 27 LO 4: List the five components of cost-volume-profit analysis.

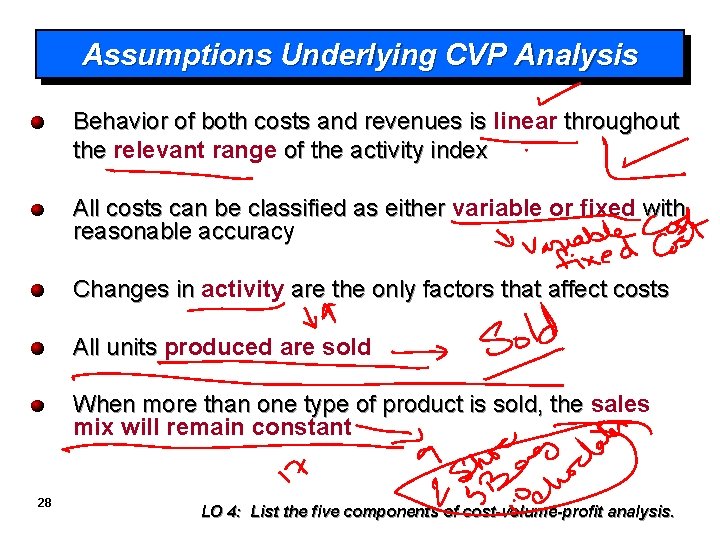

Assumptions Underlying CVP Analysis Behavior of both costs and revenues is linear throughout the relevant range of the activity index All costs can be classified as either variable or fixed with reasonable accuracy Changes in activity are the only factors that affect costs All units produced are sold When more than one type of product is sold, the sales mix will remain constant 28 LO 4: List the five components of cost-volume-profit analysis.

Cost-Volume-Profit Analysis Review Question Which of the following is NOT involved in CVP analysis? a. Sales mix b. Unit selling prices. c. Fixed costs per unit. d. Volume or level of activity. 29 LO 4: List the five components of cost-volume-profit analysis.

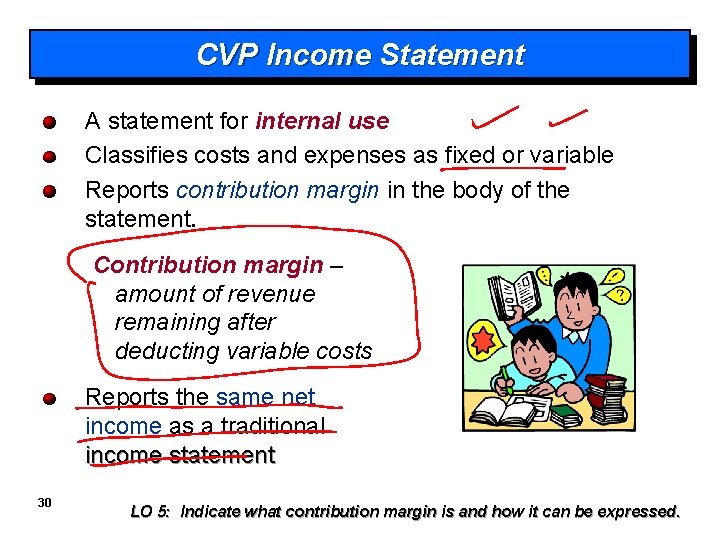

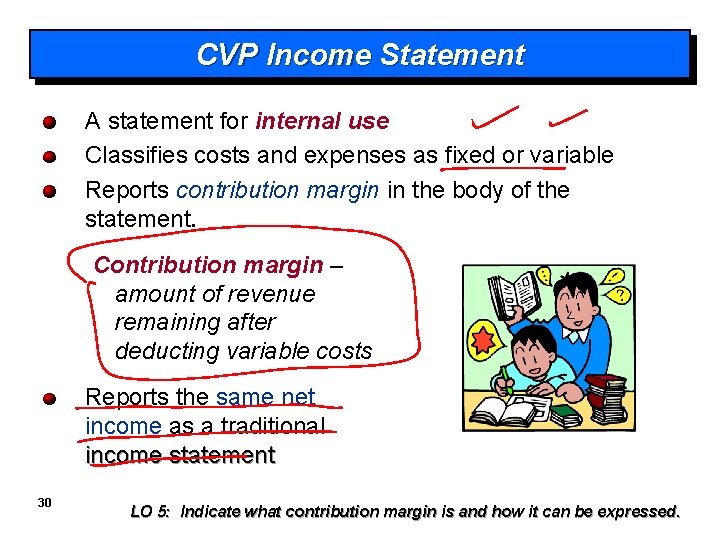

CVP Income Statement A statement for internal use Classifies costs and expenses as fixed or variable Reports contribution margin in the body of the statement. Contribution margin – amount of revenue remaining after deducting variable costs Reports the same net income as a traditional income statement 30 LO 5: Indicate what contribution margin is and how it can be expressed.

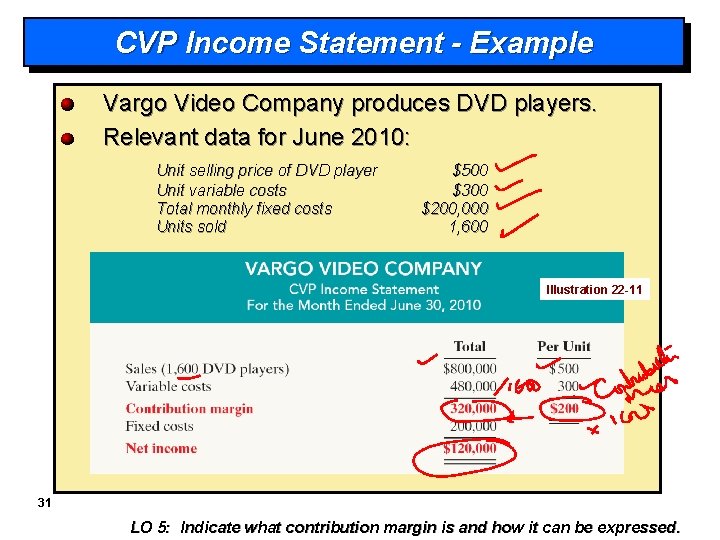

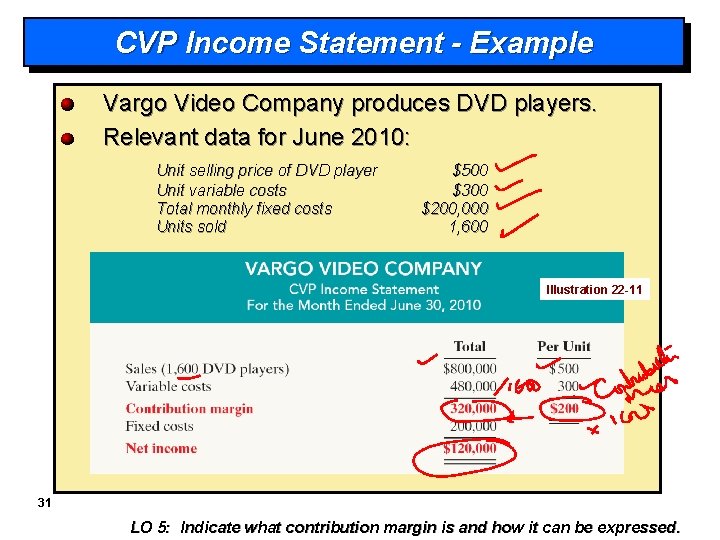

CVP Income Statement - Example Vargo Video Company produces DVD players. Relevant data for June 2010: Unit selling price of DVD player Unit variable costs Total monthly fixed costs Units sold $500 $300 $200, 000 1, 600 Illustration 22 -11 31 LO 5: Indicate what contribution margin is and how it can be expressed.

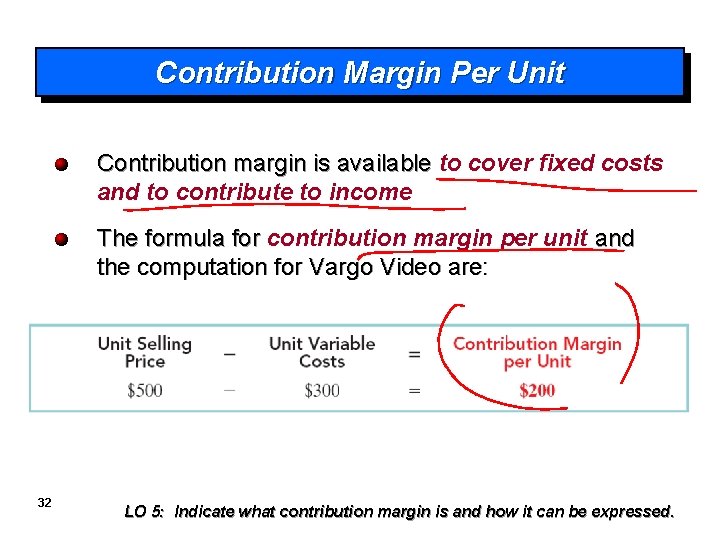

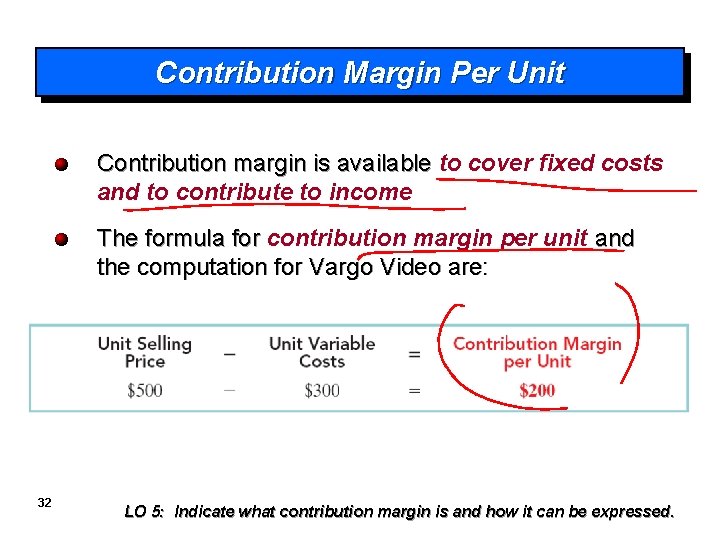

Contribution Margin Per Unit Contribution margin is available to cover fixed costs and to contribute to income The formula for contribution margin per unit and the computation for Vargo Video are: 32 LO 5: Indicate what contribution margin is and how it can be expressed.

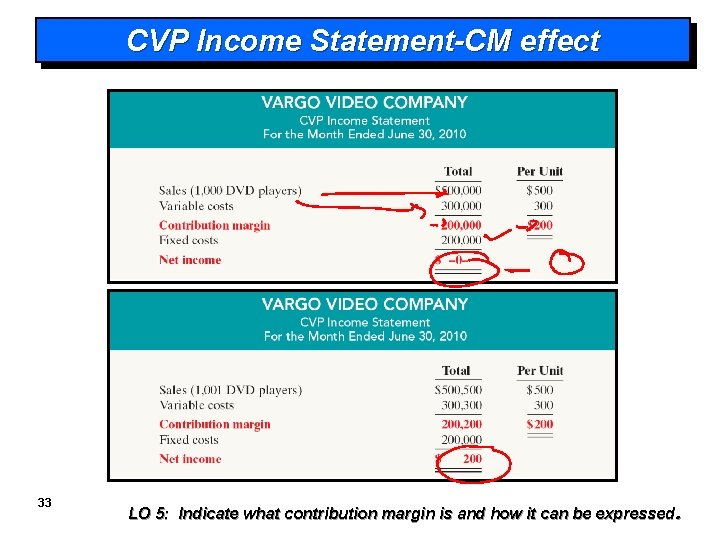

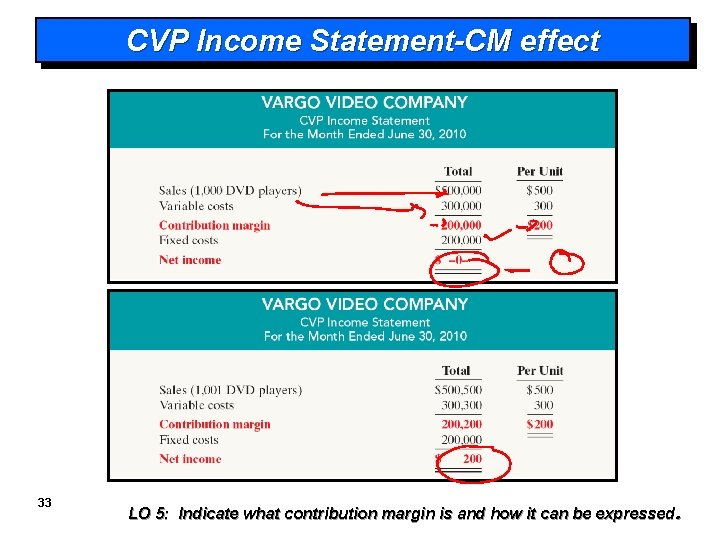

CVP Income Statement-CM effect 33 LO 5: Indicate what contribution margin is and how it can be expressed.

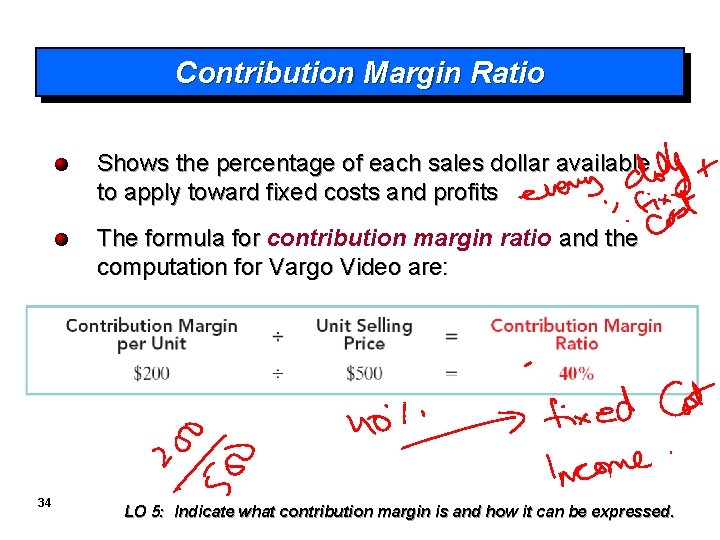

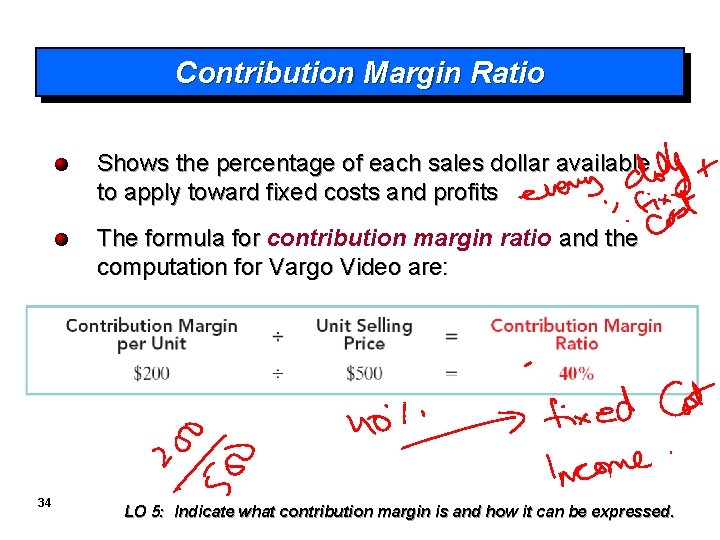

Contribution Margin Ratio Shows the percentage of each sales dollar available to apply toward fixed costs and profits The formula for contribution margin ratio and the computation for Vargo Video are: 34 LO 5: Indicate what contribution margin is and how it can be expressed.

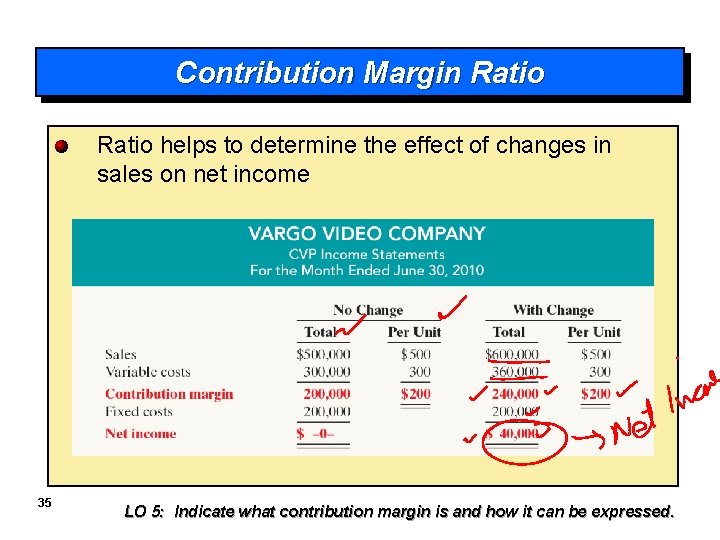

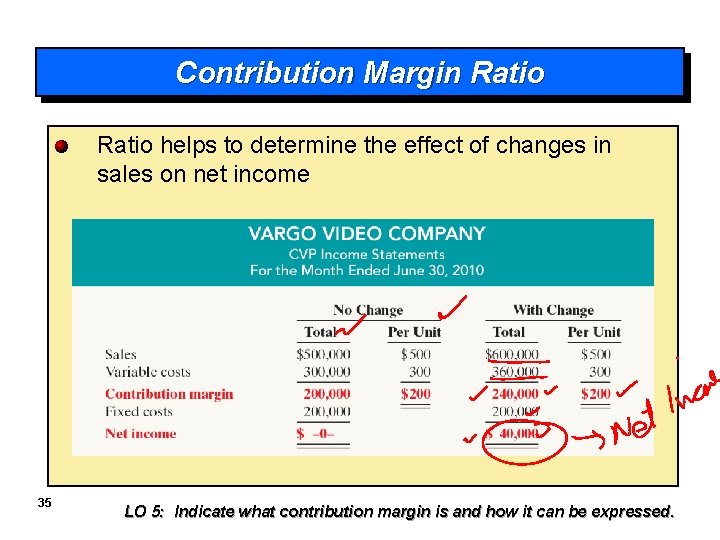

Contribution Margin Ratio helps to determine the effect of changes in sales on net income 35 LO 5: Indicate what contribution margin is and how it can be expressed.

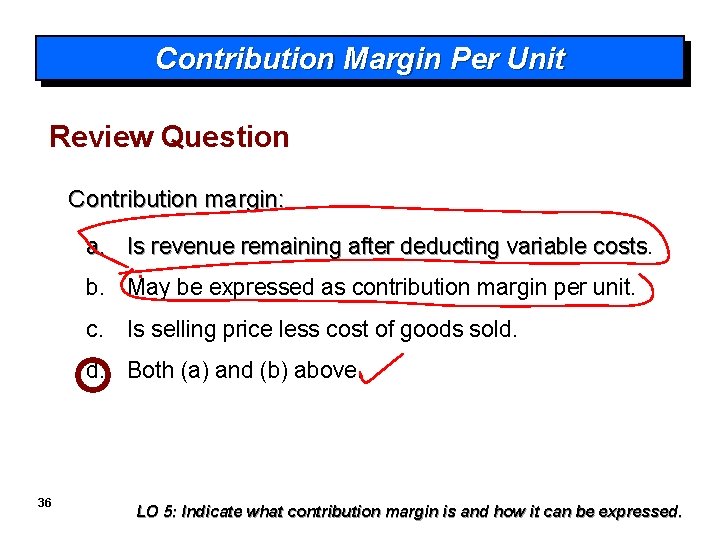

Contribution Margin Per Unit Review Question Contribution margin: a. Is revenue remaining after deducting variable costs b. May be expressed as contribution margin per unit. c. Is selling price less cost of goods sold. d. Both (a) and (b) above. 36 LO 5: Indicate what contribution margin is and how it can be expressed.

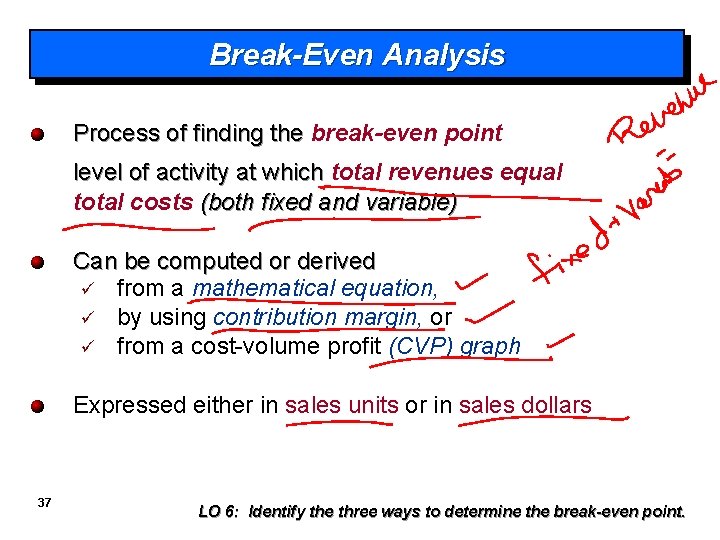

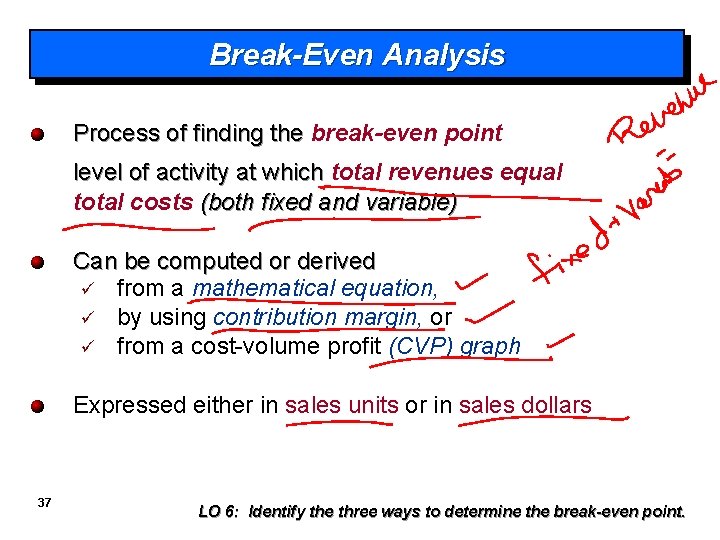

Break-Even Analysis Process of finding the break-even point level of activity at which total revenues equal total costs (both fixed and variable) Can be computed or derived ü from a mathematical equation, ü by using contribution margin, or ü from a cost-volume profit (CVP) graph Expressed either in sales units or in sales dollars 37 LO 6: Identify the three ways to determine the break-even point.

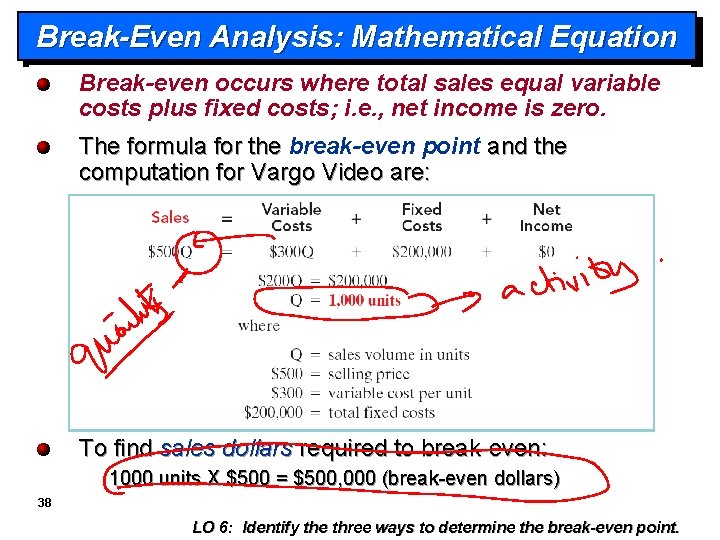

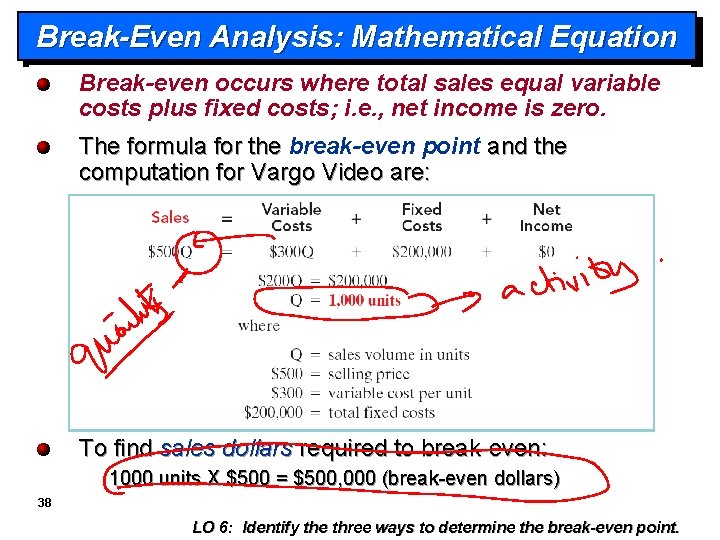

Break-Even Analysis: Mathematical Equation Break-even occurs where total sales equal variable costs plus fixed costs; i. e. , net income is zero. The formula for the break-even point and the computation for Vargo Video are: To find sales dollars required to break-even: 1000 units X $500 = $500, 000 (break-even dollars) 38 LO 6: Identify the three ways to determine the break-even point.

Break-Even Analysis: Contribution Margin Technique At the break-even point, contribution margin must equal total fixed costs (CM = total revenues – variable costs) The break-even point can be computed using either contribution margin per unit or contribution margin ratio. 39 LO 6: Identify the three ways to determine the break-even point.

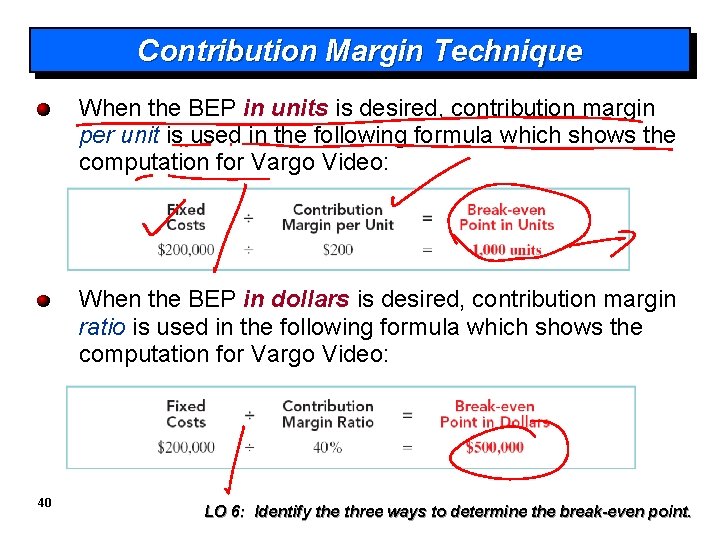

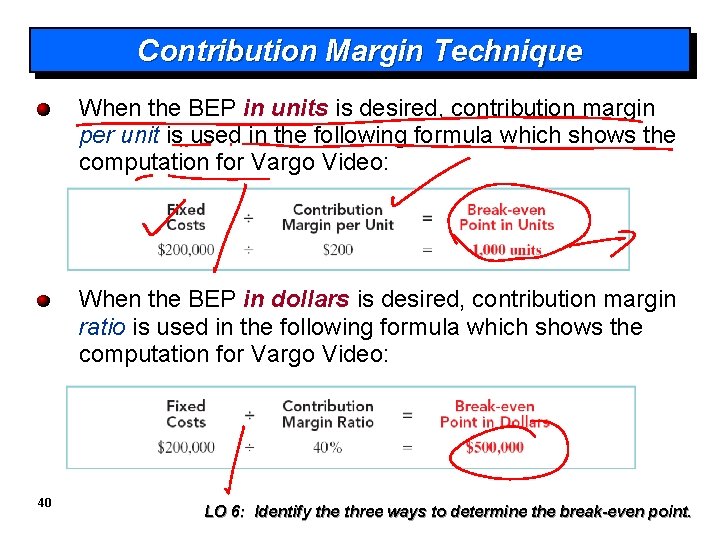

Contribution Margin Technique When the BEP in units is desired, contribution margin per unit is used in the following formula which shows the computation for Vargo Video: When the BEP in dollars is desired, contribution margin ratio is used in the following formula which shows the computation for Vargo Video: 40 LO 6: Identify the three ways to determine the break-even point.

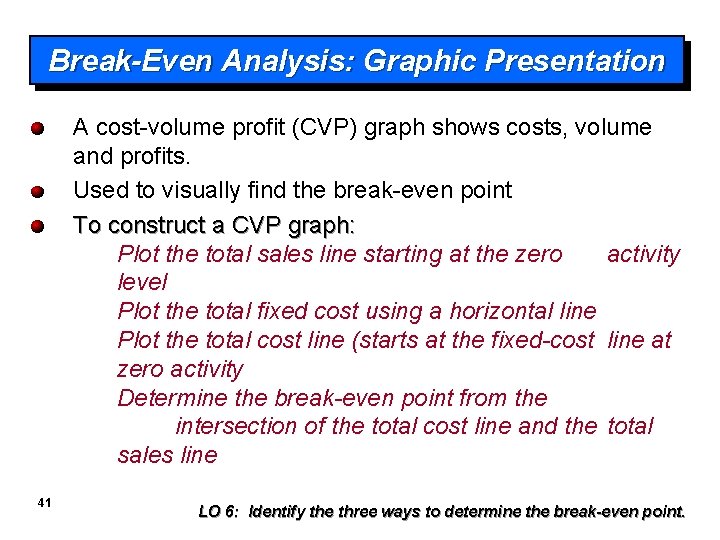

Break-Even Analysis: Graphic Presentation A cost-volume profit (CVP) graph shows costs, volume and profits. Used to visually find the break-even point To construct a CVP graph: Plot the total sales line starting at the zero activity level Plot the total fixed cost using a horizontal line Plot the total cost line (starts at the fixed-cost line at zero activity Determine the break-even point from the intersection of the total cost line and the total sales line 41 LO 6: Identify the three ways to determine the break-even point.

Break-Even Analysis: Graphic Presentation 42 LO 6: Identify the three ways to determine the break-even point.

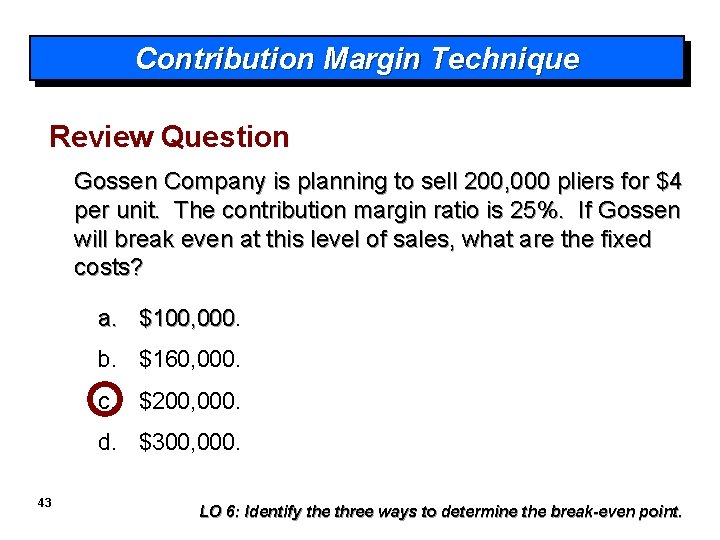

Contribution Margin Technique Review Question Gossen Company is planning to sell 200, 000 pliers for $4 per unit. The contribution margin ratio is 25%. If Gossen will break even at this level of sales, what are the fixed costs? a. $100, 000 b. $160, 000. c. $200, 000. d. $300, 000. 43 LO 6: Identify the three ways to determine the break-even point.

Break-Even Analysis: Target Net Income Level of sales necessary to achieve a specified income Can be determined from each of the approaches used to determine break-even sales/units: from a mathematical equation, by using contribution margin, or from a cost-volume profit (CVP) graph Expressed either in sales units or in sales dollars 44 LO 7: Give the formulas for determining sales required to earn target net income.

Break-Even Analysis: Target Net Income Mathematical Equation Using the formula for the break-even point, simply include the desired net income as a factor. The computation for Vargo Video is as follows: 45 LO 7: Give the formulas for determining sales required to earn target net income.

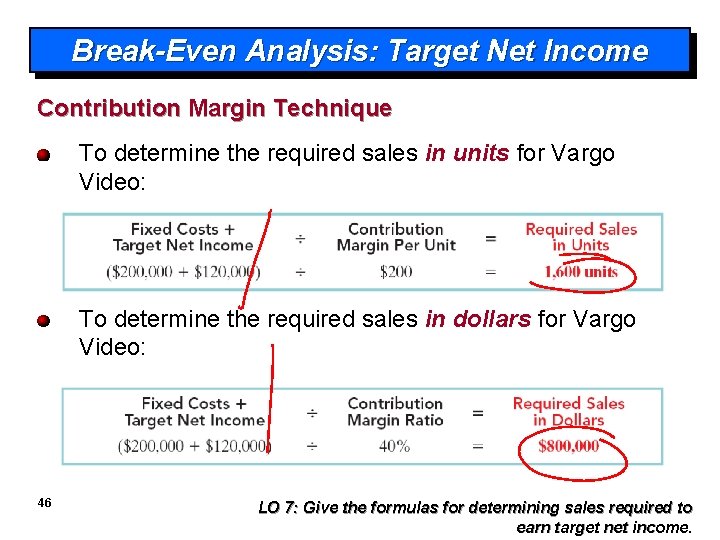

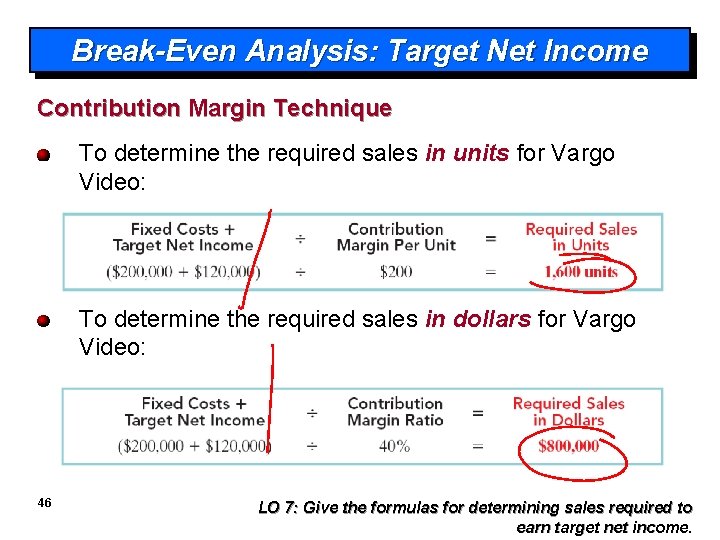

Break-Even Analysis: Target Net Income Contribution Margin Technique To determine the required sales in units for Vargo Video: To determine the required sales in dollars for Vargo Video: 46 LO 7: Give the formulas for determining sales required to earn target net income.

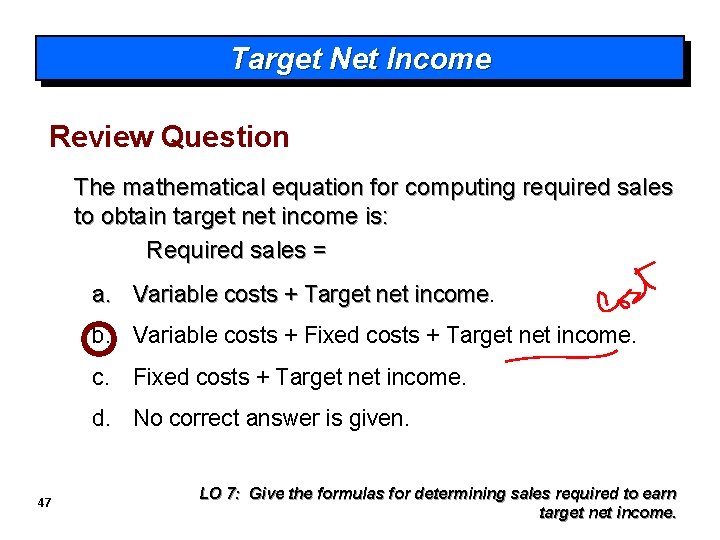

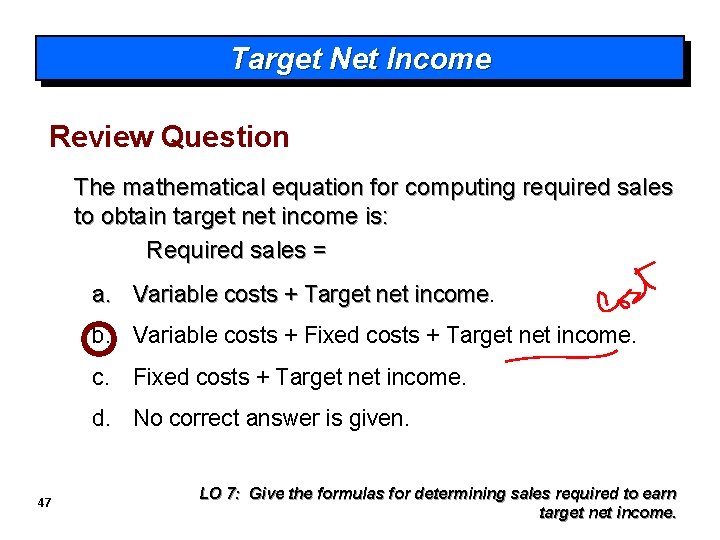

Target Net Income Review Question The mathematical equation for computing required sales to obtain target net income is: Required sales = a. Variable costs + Target net income b. Variable costs + Fixed costs + Target net income. c. Fixed costs + Target net income. d. No correct answer is given. 47 LO 7: Give the formulas for determining sales required to earn target net income.

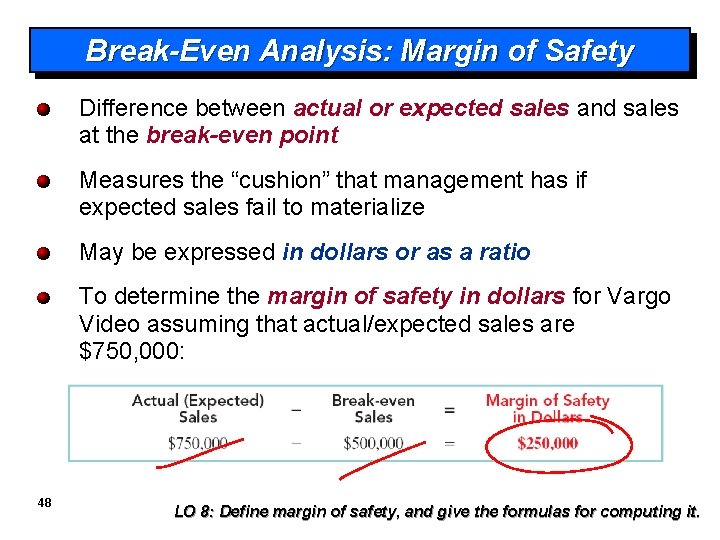

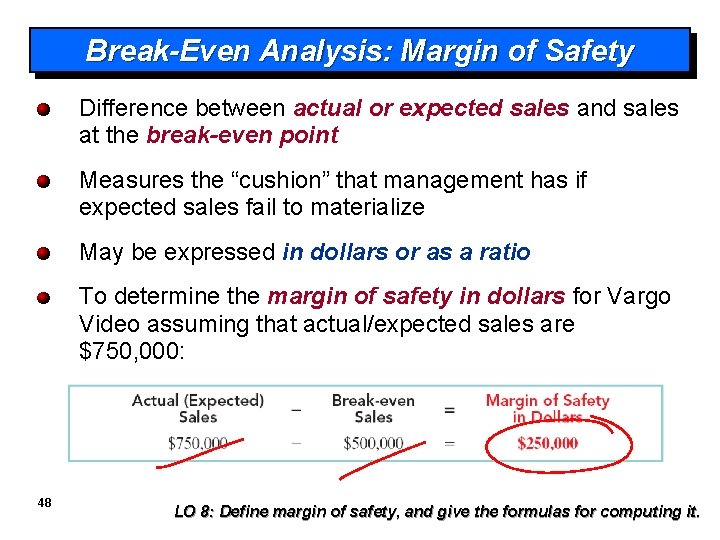

Break-Even Analysis: Margin of Safety Difference between actual or expected sales and sales at the break-even point Measures the “cushion” that management has if expected sales fail to materialize May be expressed in dollars or as a ratio To determine the margin of safety in dollars for Vargo Video assuming that actual/expected sales are $750, 000: 48 LO 8: Define margin of safety, and give the formulas for computing it.

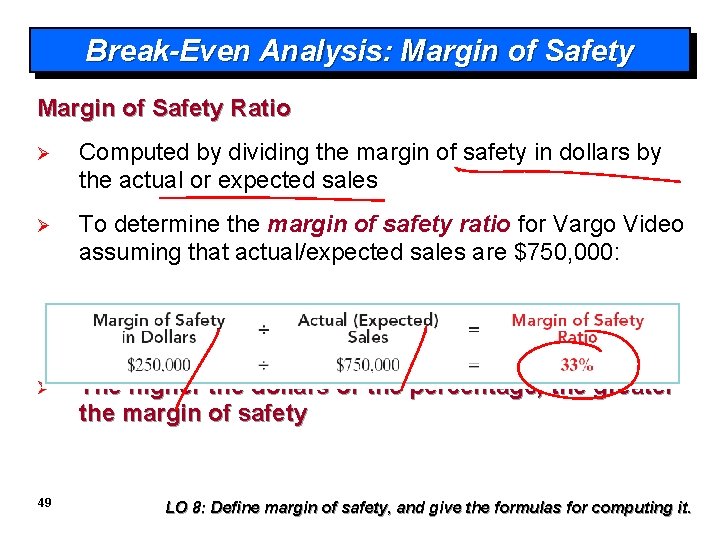

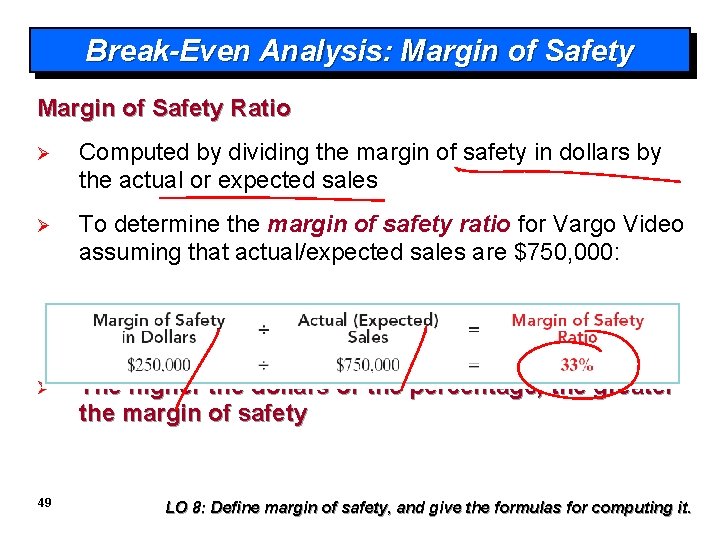

Break-Even Analysis: Margin of Safety Ratio Ø Computed by dividing the margin of safety in dollars by the actual or expected sales Ø To determine the margin of safety ratio for Vargo Video assuming that actual/expected sales are $750, 000: Ø The higher the dollars or the percentage, the greater the margin of safety 49 LO 8: Define margin of safety, and give the formulas for computing it.

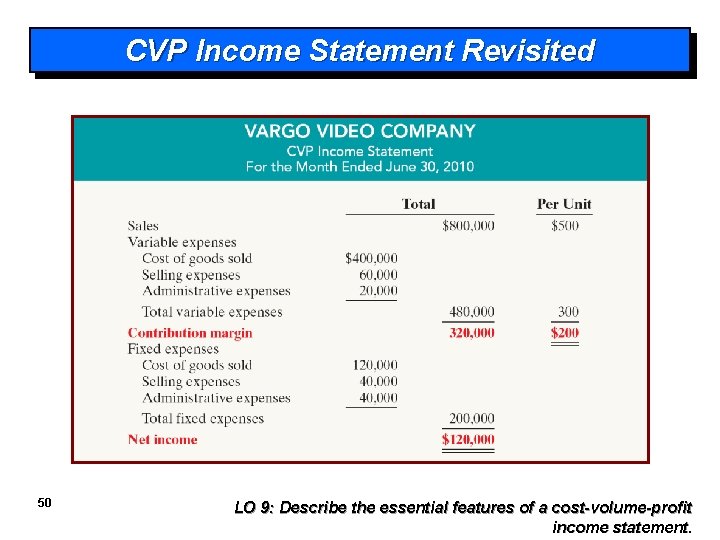

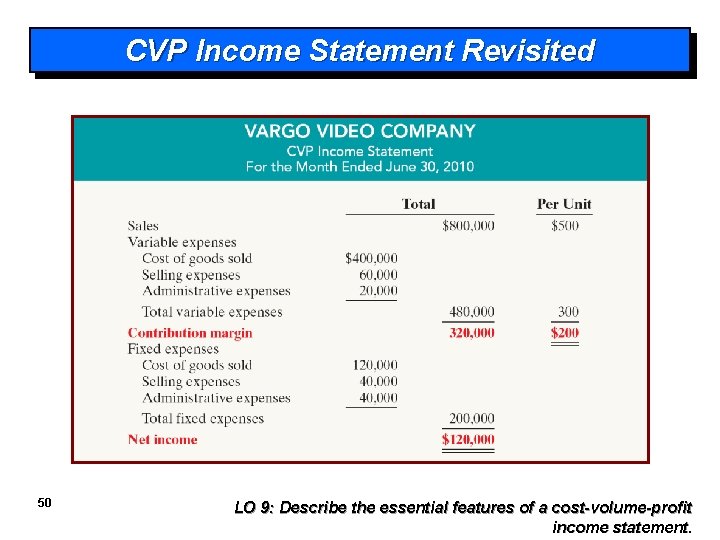

CVP Income Statement Revisited 50 LO 9: Describe the essential features of a cost-volume-profit income statement.

Margin of Safety Review Question Marshall Company had actual sales of $600, 000 when break-even sales were $420, 000. What is the margin of safety ratio? a. 25% b. 30%. c. 33 1/3%. d. 45%. 51 LO 8: Define margin of safety, and give the formulas for computing it.

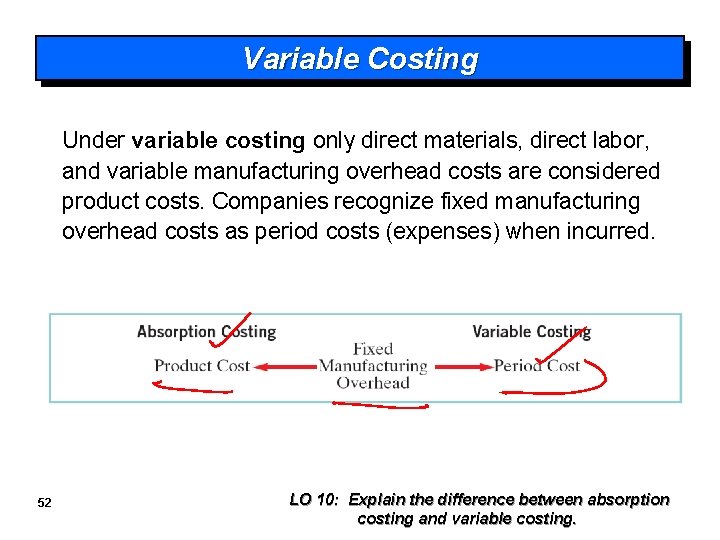

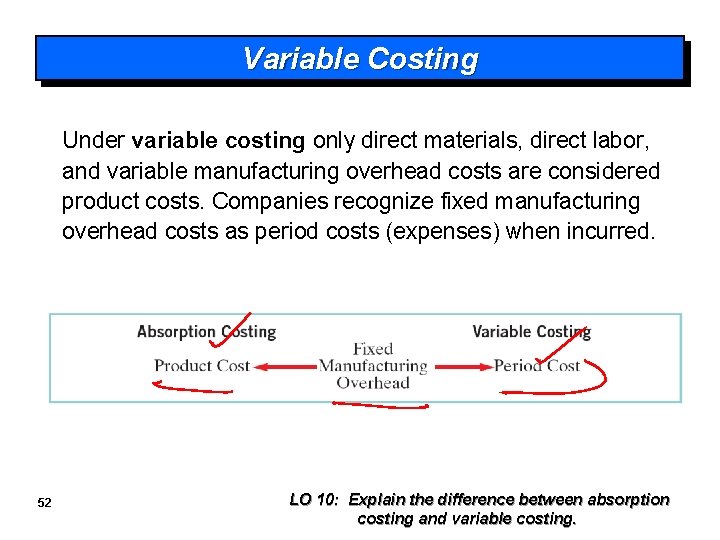

Variable Costing Under variable costing only direct materials, direct labor, and variable manufacturing overhead costs are considered product costs. Companies recognize fixed manufacturing overhead costs as period costs (expenses) when incurred. 52 LO 10: Explain the difference between absorption costing and variable costing.

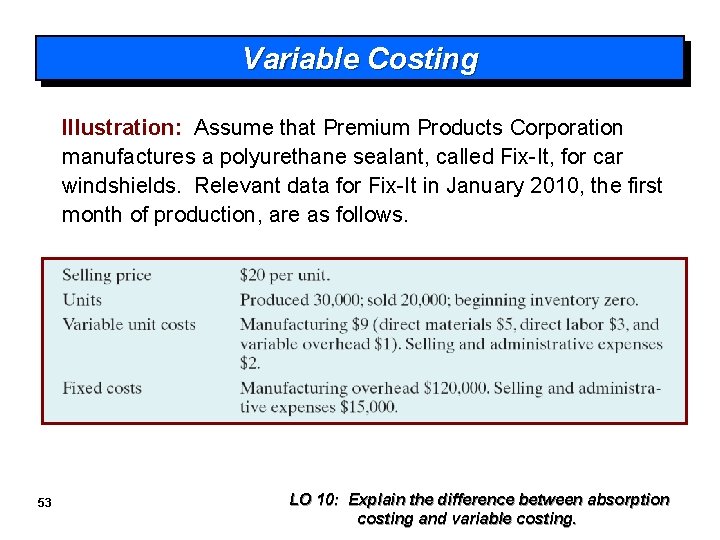

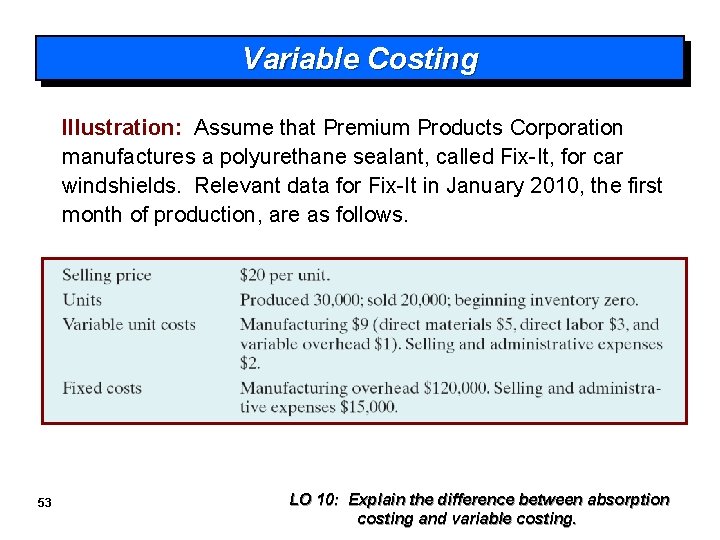

Variable Costing Illustration: Assume that Premium Products Corporation manufactures a polyurethane sealant, called Fix-It, for car windshields. Relevant data for Fix-It in January 2010, the first month of production, are as follows. 53 LO 10: Explain the difference between absorption costing and variable costing.

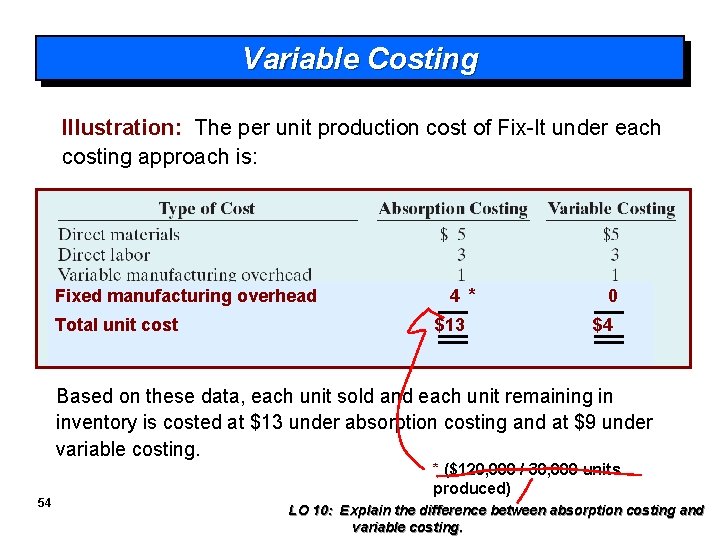

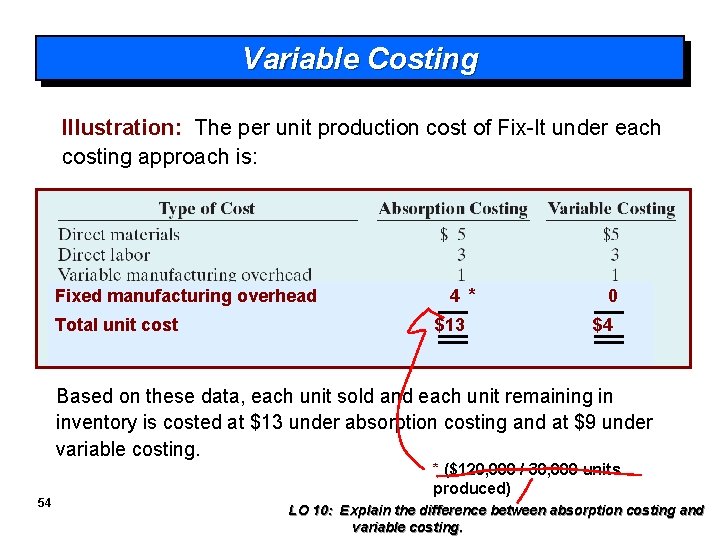

Variable Costing Illustration: The per unit production cost of Fix-It under each costing approach is: Fixed manufacturing overhead Total unit cost 4 * $13 0 $4 Based on these data, each unit sold and each unit remaining in inventory is costed at $13 under absorption costing and at $9 under variable costing. 54 * ($120, 000 / 30, 000 units produced) LO 10: Explain the difference between absorption costing and variable costing.

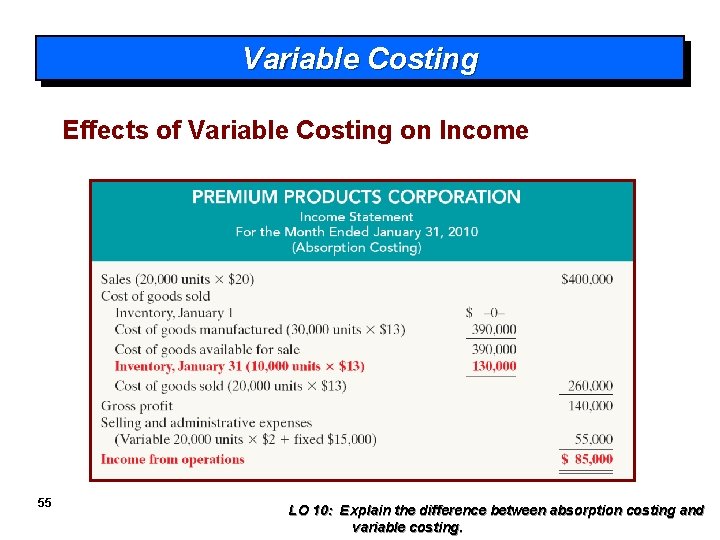

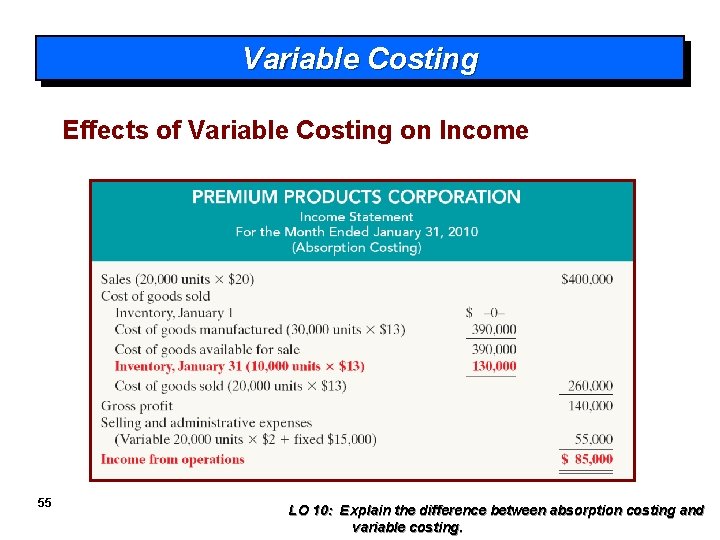

Variable Costing Effects of Variable Costing on Income 55 LO 10: Explain the difference between absorption costing and variable costing.

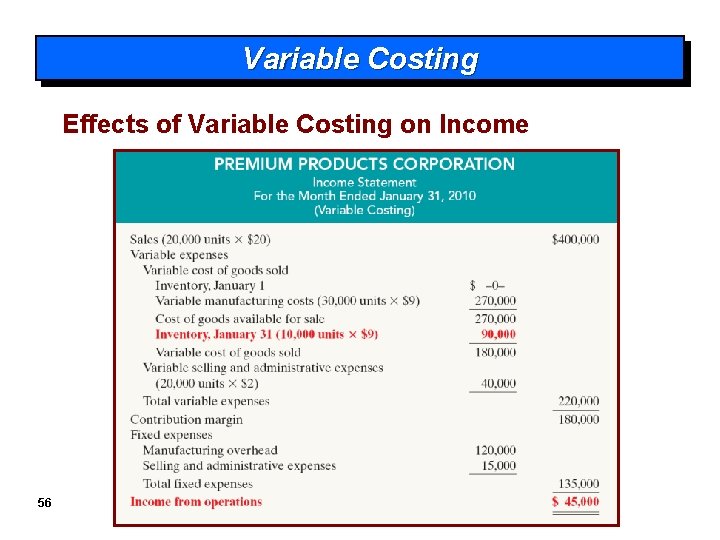

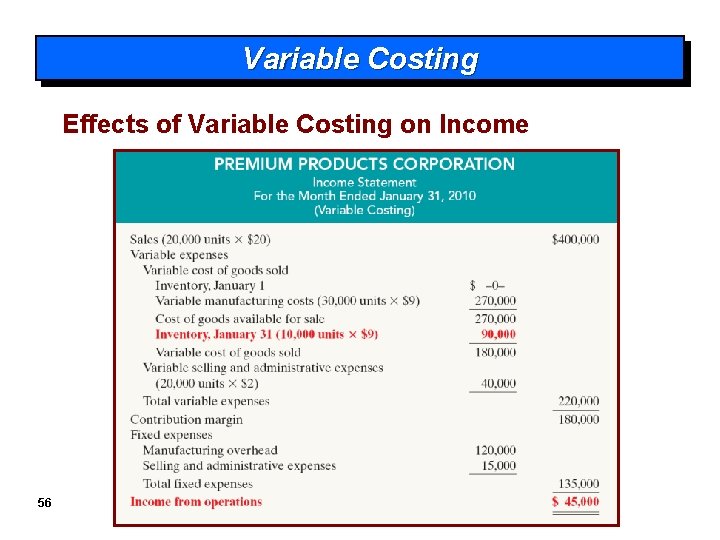

Variable Costing Effects of Variable Costing on Income 56

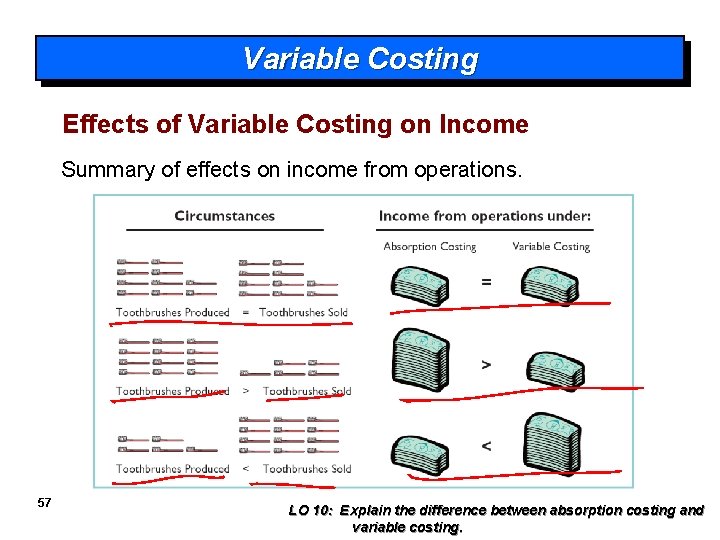

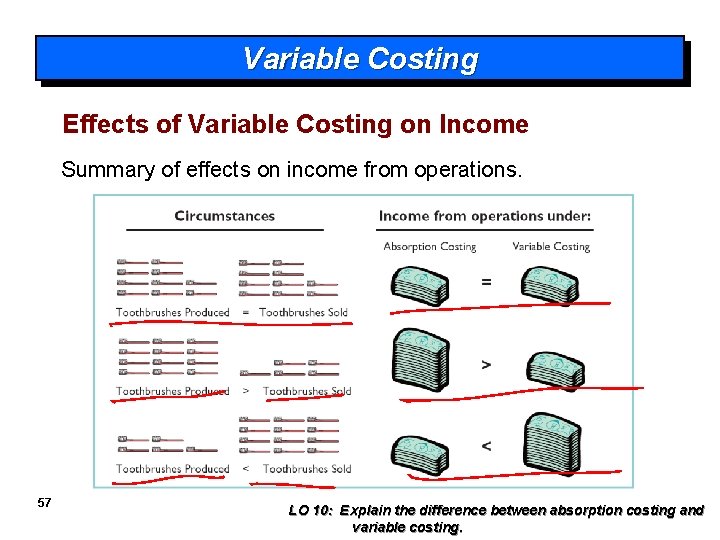

Variable Costing Effects of Variable Costing on Income Summary of effects on income from operations. 57 LO 10: Explain the difference between absorption costing and variable costing.

Variable Costing Rationale for Variable Costing ü The purpose of fixed manufacturing costs is to have productive facilities available for use. ü The use of variable costing is acceptable only for internal use by management. 58

End of Lecture 30 59