Multiplier Definition Calculating the value of multiplier Importance

- Slides: 32

Multiplier � Definition � Calculating the value of multiplier � Importance of multiplier � Uses of multiplier � Limitations of multiplier � Mathematics

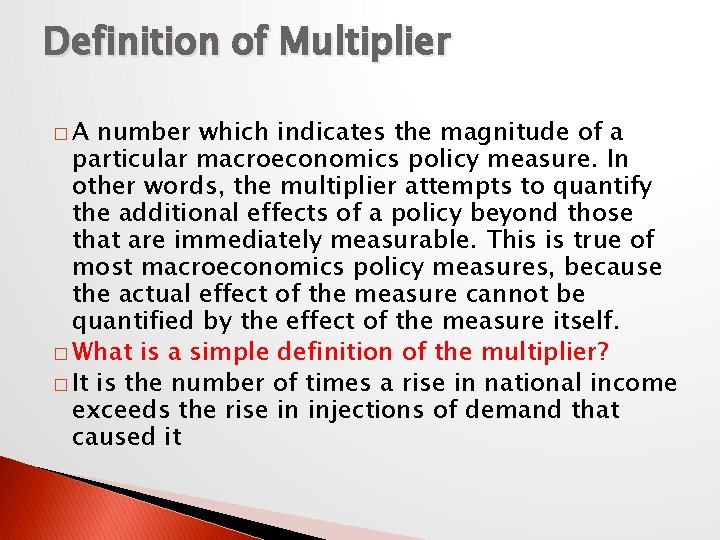

Definition of Multiplier �A number which indicates the magnitude of a particular macroeconomics policy measure. In other words, the multiplier attempts to quantify the additional effects of a policy beyond those that are immediately measurable. This is true of most macroeconomics policy measures, because the actual effect of the measure cannot be quantified by the effect of the measure itself. � What is a simple definition of the multiplier? � It is the number of times a rise in national income exceeds the rise in injections of demand that caused it

Contd. . � We propose to study how much or how many times income increases as investment is done. This can be known from the concept of Multiplier.

Calculating the value of multiplier � Marginal propensity to consume. � In economics the marginal propensity to consume (MPC) is an empirical metric that quantifies induced consumption the concept that the increase in personal consumer spending consumption occurs with an increase in disposable income (income after taxes and transfers). � The proportion of the disposable income which individuals desire to spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual desires to consume. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0. 65, then of that dollar, the household will spend 65 cents and save 35 cents.

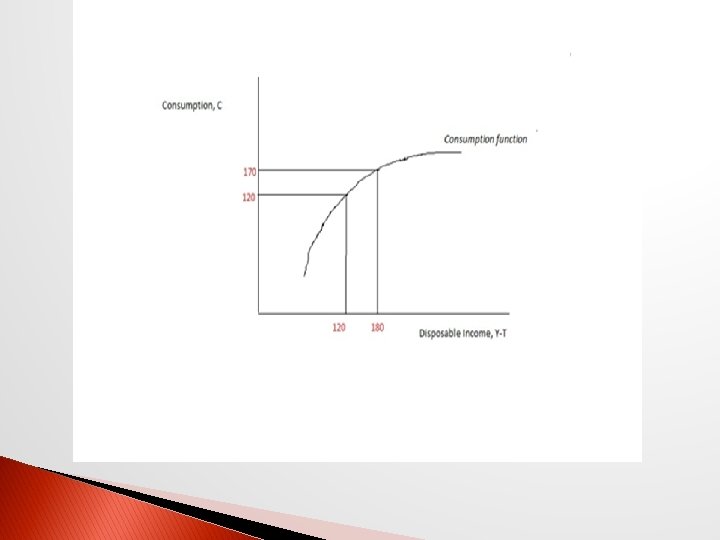

� Mathematically, the function is expressed as the derivative of the consumption function with respect to disposable income. � or � , where is the change in consumption, and is the change in disposable income that produced the consumption. � Marginal propensity to consume can be found by dividing change in consumption by a change in income, or. The MPC can be explained with the simple example:

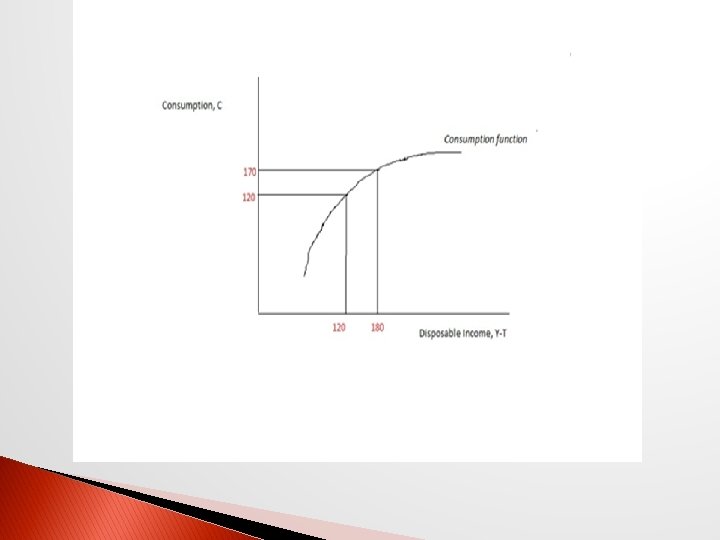

Calculating the value of multiplier INCOME 120 180 CONSUMPTION 120 170

Importance of multiplier

Uses of Multiplier � The multiplier principles occupies a very important place not only in economic theory but also in shaping economic policy. � It plays a vital role as an instrument of income building. � It tells us how a small increase in investment can result in large increase in income. � Multiplier uses control of business cycles. � It furnishes guidelines for appropriate income and employment policies.

Uses of Multiplier � It also explains the expansion of public sector in modern times.

Limitations of Multiplier � Efficiency of production: If the production system of the country cannot cope with increased demand for consumption goods and make them readily available, the income generated will not be spend as visualised. As a result the MPC may decline. � Regular investment: The value of multiplier will also depend on regularity repeated investment.

� Multiplier period: Successive doses of investment must be injected at suitable intervals if the multiplier effect is not be lost. � Full employment celling: As soon as full employment of the idle resources is achieved, further beneficial effect of the multiplier will practically cease.

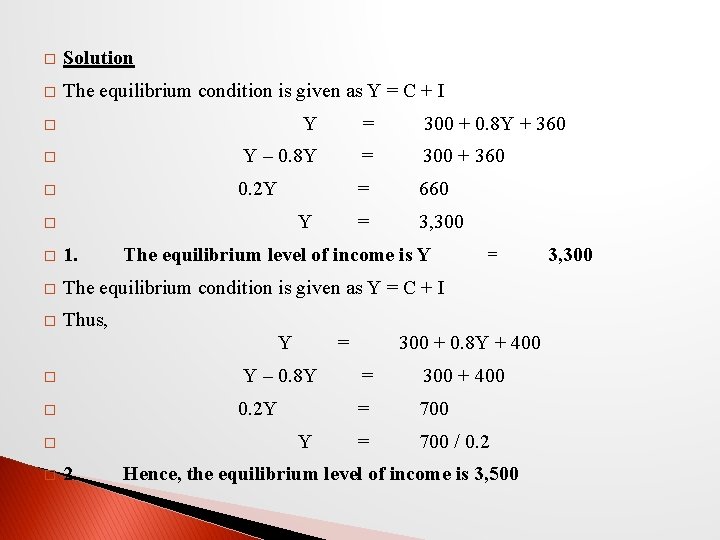

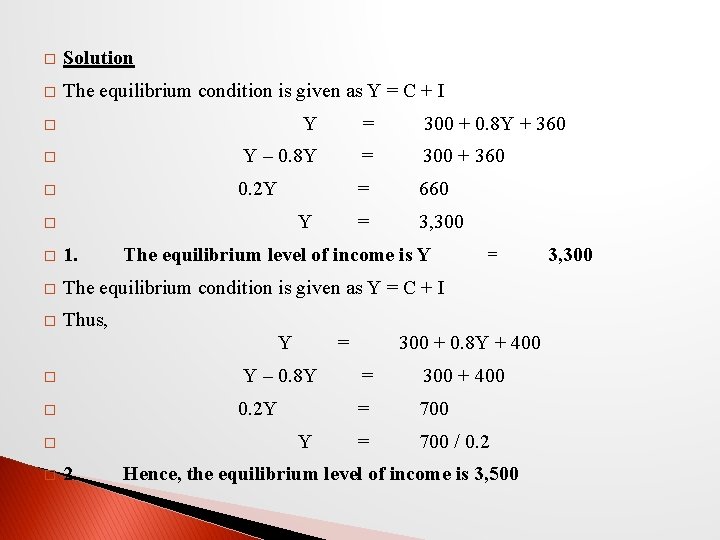

� Illustration 1 � In an economy, the basic equations are as follows: the consumption function is C = 300 + 0. 8 Y and investment is � I= $ 360 millions. You are required to ascertain the following 1. The equilibrium level of income 2. The equilibrium level of income when planned investment increases from 360 to 400 millions, a total increases of 40 millions 3. The multiplier effect of the 40 millions increases in planned investment.

� Solution � The equilibrium condition is given as Y = C + I � Y = 300 + 0. 8 Y + 360 � Y – 0. 8 Y = 300 + 360 0. 2 Y = 660 = 3, 300 � Y � � 1. The equilibrium level of income is Y � The equilibrium condition is given as Y = C + I � Thus, Y � � 2. 300 + 0. 8 Y + 400 Y – 0. 8 Y = 300 + 400 0. 2 Y = 700 / 0. 2 Y � � = = Hence, the equilibrium level of income is 3, 500 3, 300

� The equilibrium level of income increases from 3, 300 to 3, 500 crores when planned investment increases from 360 to 400 millions. There is an increase in income by 200 millions. Hence the multiplier effect is = 1 1–b � = 1 1 – 0. 8 � = 1 0. 2 � � 3. m The multiplier effect is m is 5

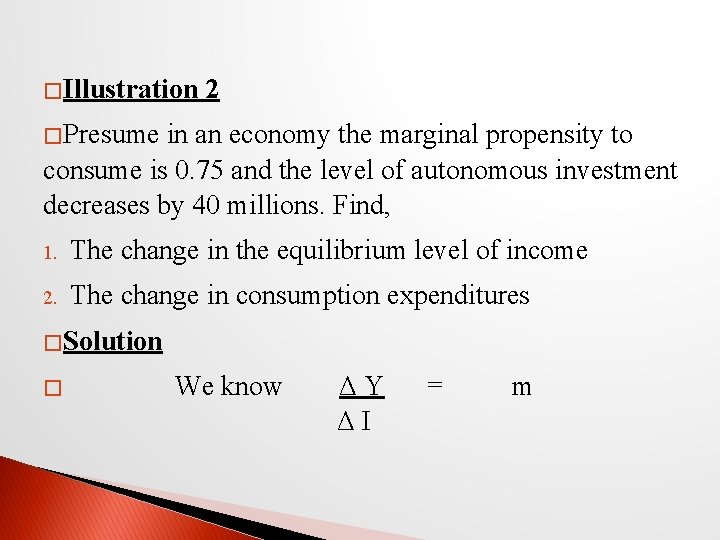

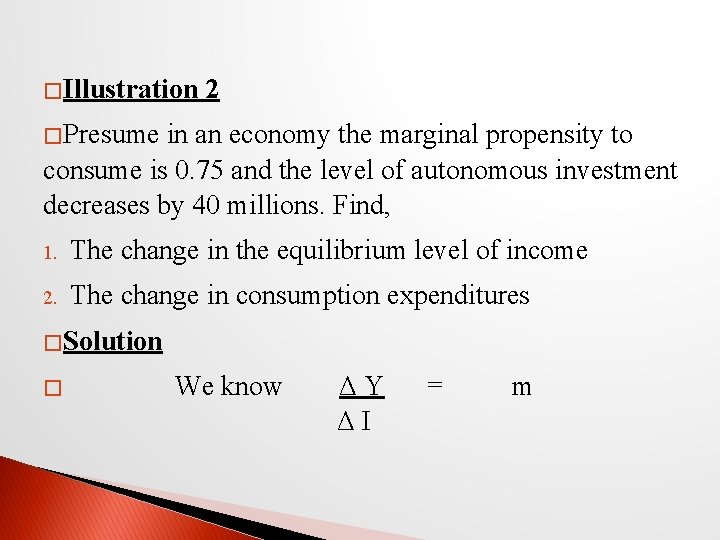

� Illustration 2 � Presume in an economy the marginal propensity to consume is 0. 75 and the level of autonomous investment decreases by 40 millions. Find, 1. The change in the equilibrium level of income 2. The change in consumption expenditures � Solution � We know ΔY ΔI = m

� Also, m = 1 1–b � � So ΔY ΔI = 1 1–b � � ΔY = ΔI 1 1–b � = -40 x 1 1 – 0. 75 � = -160 (1) Thus, the decrease in autonomous investment causes a decrease in the equilibrium level of income by 160 millions. This effect occurs due to the reverse multiplier. �

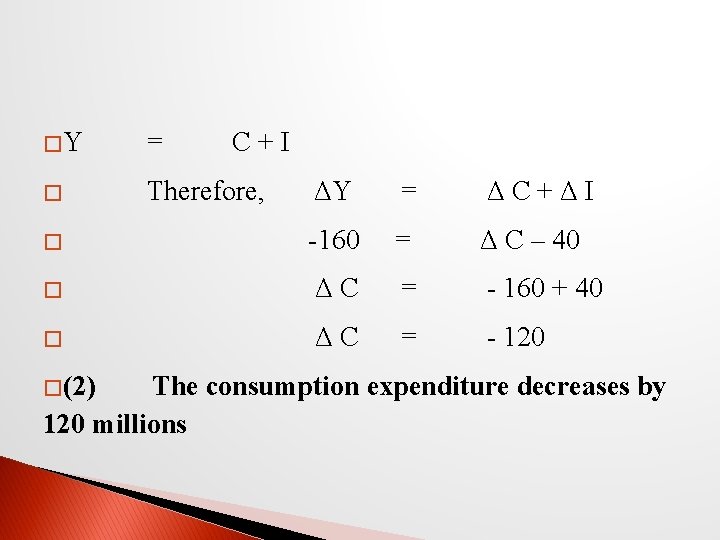

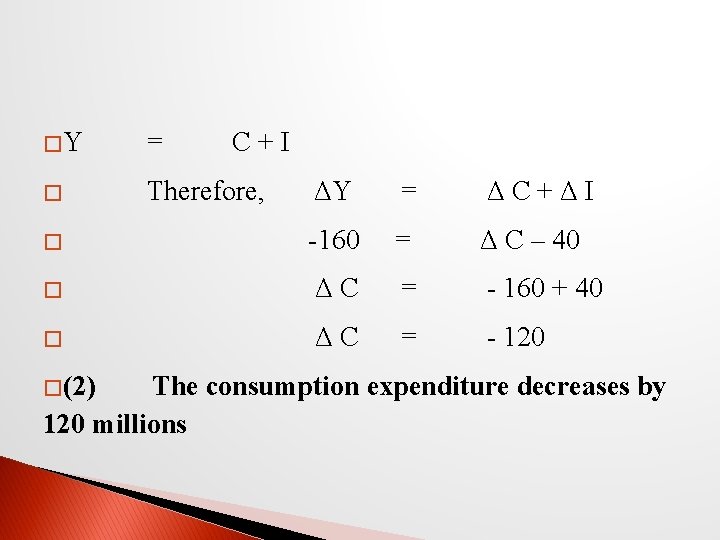

�Y = C+I � Therefore, ΔY = ΔC+ΔI � -160 = Δ C – 40 � ΔC = - 160 + 40 � ΔC = - 120 � (2) The consumption expenditure decreases by 120 millions

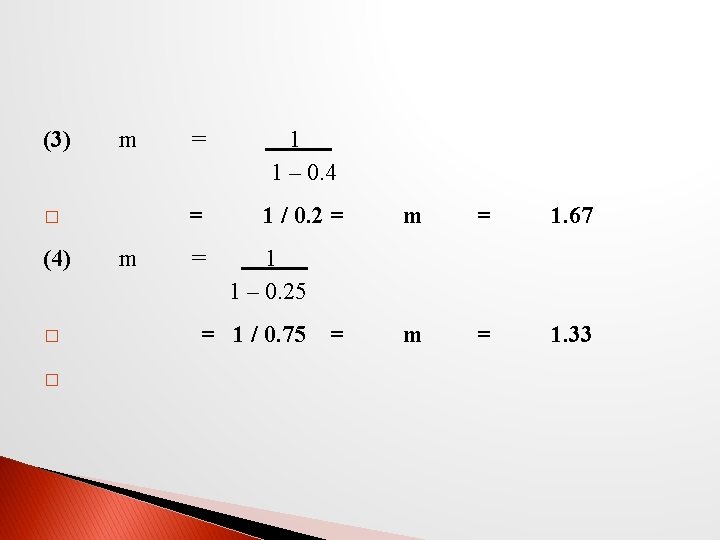

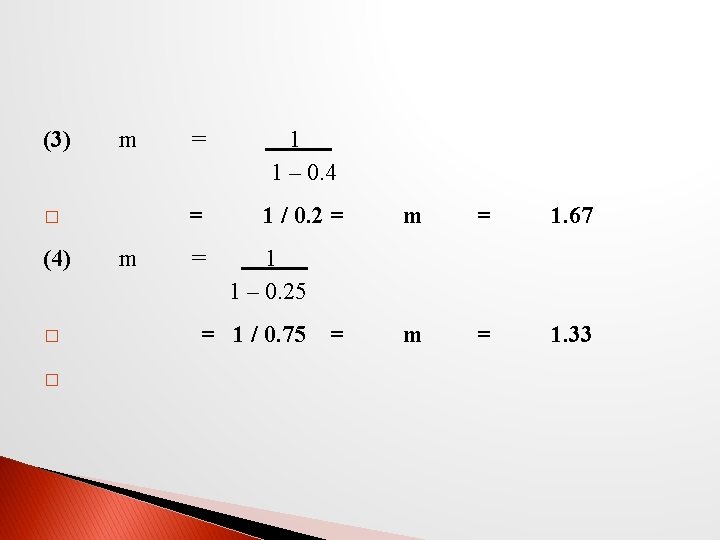

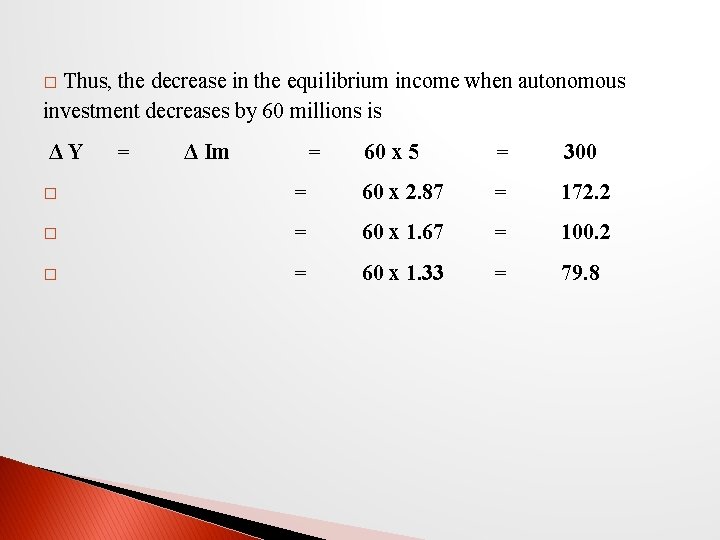

� Illustration 3 � Compute the value of the investment multiplier when the marginal propensity to consume is � (1) 0. 80, (2) 0. 65, (3) 0. 40 and (4) 0. 25 � Find the effect of a decrease in the equilibrium income when autonomous investment decreases by 60 millions when the marginal propensity to consume is (1) 0. 80, (2) 0. 65, (3) 0. 40 and (4) 0. 25

� Solution � The value of m, the investment multiplier is � � m = 1 1–b m = 1 1 – 0. 8 Hence, � (1) = � � (2) 1 / 0. 2 m = = = m = 5 = m = 1 1 – 0. 65 1 / 0. 35 2. 87

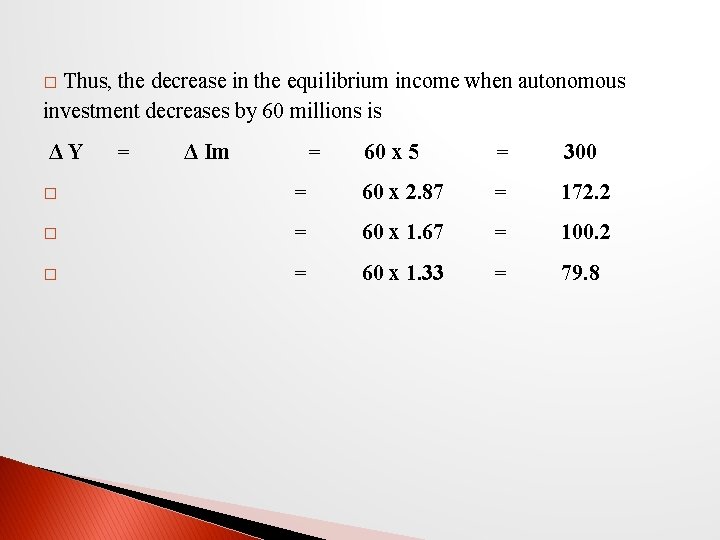

Thus, the decrease in the equilibrium income when autonomous investment decreases by 60 millions is � ΔY = Δ Im = 60 x 5 = 300 � = 60 x 2. 87 = 172. 2 � = 60 x 1. 67 = 100. 2 � = 60 x 1. 33 = 79. 8

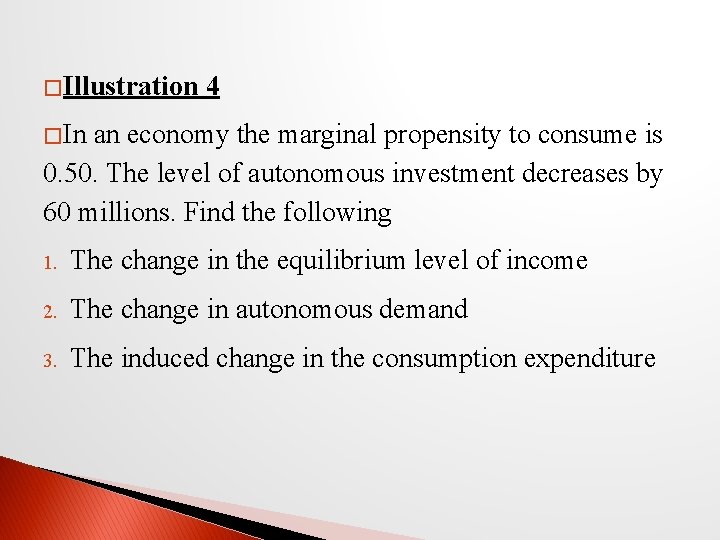

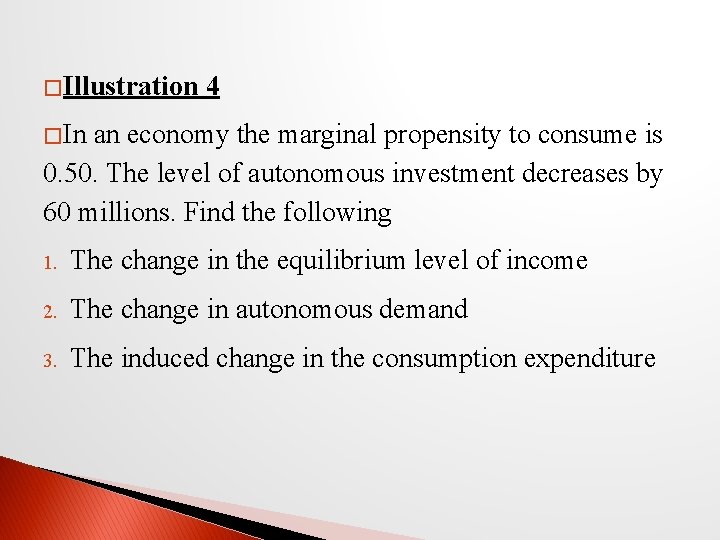

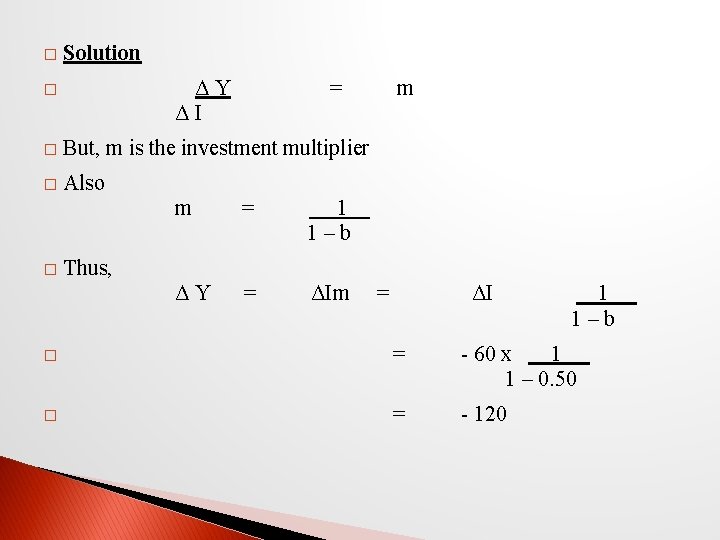

� Illustration 4 � In an economy the marginal propensity to consume is 0. 50. The level of autonomous investment decreases by 60 millions. Find the following 1. The change in the equilibrium level of income 2. The change in autonomous demand 3. The induced change in the consumption expenditure

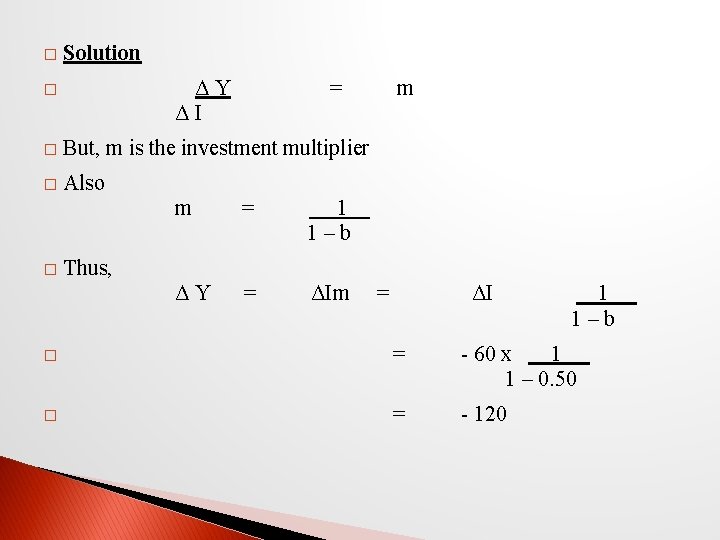

� Solution ΔY ΔI � = � But, m is the investment multiplier � Also � m = 1 1–b ΔY = ΔIm m Thus, = ΔI 1 1–b � = - 60 x 1 1 – 0. 50 � = - 120

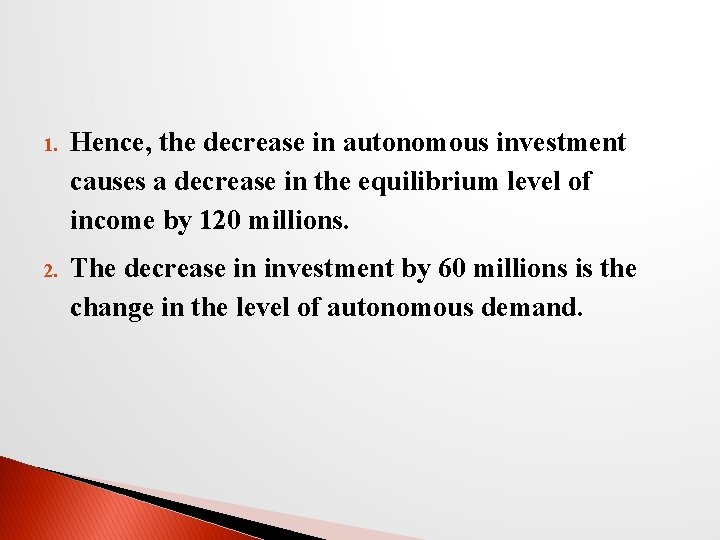

1. Hence, the decrease in autonomous investment causes a decrease in the equilibrium level of income by 120 millions. 2. The decrease in investment by 60 millions is the change in the level of autonomous demand.

�Y = C + I ΔY = Δ C + ΔI � -120 = ΔC – 60 � ΔC = -120 + 60 ΔC = -60 � Therefore, � 3. The Consumption expenditure falls by 60 millions

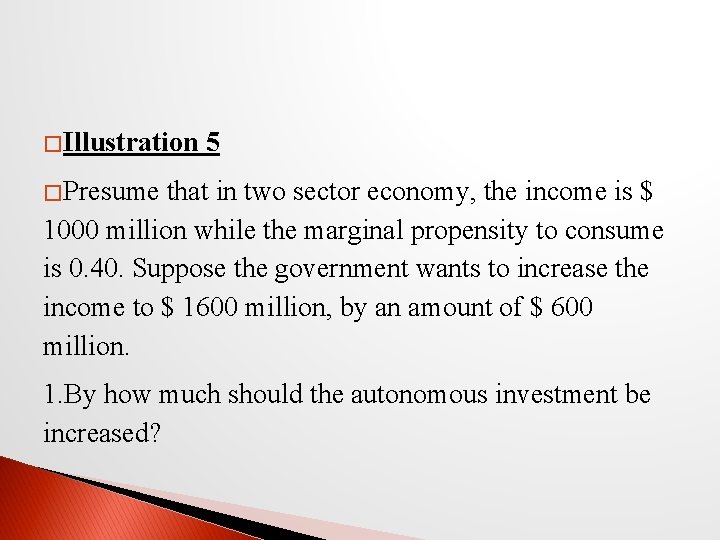

� Illustration 5 � Presume that in two sector economy, the income is $ 1000 million while the marginal propensity to consume is 0. 40. Suppose the government wants to increase the income to $ 1600 million, by an amount of $ 600 million. 1. By how much should the autonomous investment be increased?

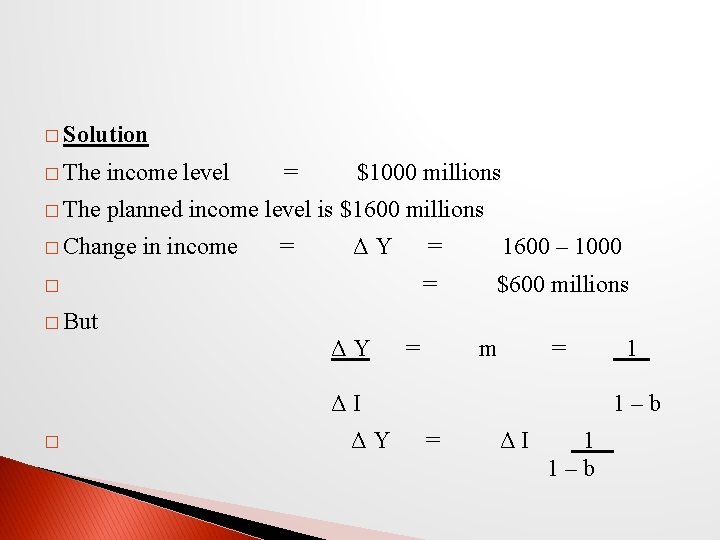

� Solution � The income level � The planned income level is $1600 millions � Change in income = = $1000 millions ΔY � = 1600 – 1000 = $600 millions � But ΔY = m = ΔI � ΔY 1 1–b = ΔI 1 1–b

600 = ΔI 1 1–b � = ΔI 1 / 1 -0. 4 � = ΔI 1 / 0. 6 1. 66667 � 600 = ΔI � ΔI = 600 / 1. 66667 Thus, the autonomous investment should be increased by $360 millions for the income to increase to $ 1600 millions. An increase in income by $ 600 millions �

Apa itu value creation

Apa itu value creation Sources of added value

Sources of added value Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Chó sói

Chó sói Thang điểm glasgow

Thang điểm glasgow Chúa yêu trần thế

Chúa yêu trần thế Môn thể thao bắt đầu bằng chữ f

Môn thể thao bắt đầu bằng chữ f Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

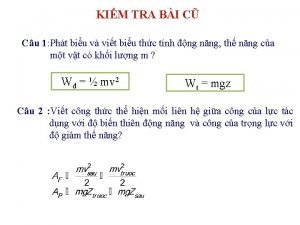

Các châu lục và đại dương trên thế giới Công thức tính độ biến thiên đông lượng

Công thức tính độ biến thiên đông lượng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Cách giải mật thư tọa độ

Cách giải mật thư tọa độ Phép trừ bù

Phép trừ bù độ dài liên kết

độ dài liên kết Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Một số thể thơ truyền thống

Một số thể thơ truyền thống Cái miệng nó xinh thế chỉ nói điều hay thôi

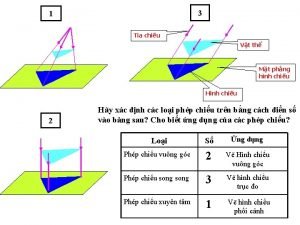

Cái miệng nó xinh thế chỉ nói điều hay thôi Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Thế nào là sự mỏi cơ

Thế nào là sự mỏi cơ đặc điểm cơ thể của người tối cổ

đặc điểm cơ thể của người tối cổ Thế nào là giọng cùng tên

Thế nào là giọng cùng tên Vẽ hình chiếu đứng bằng cạnh của vật thể

Vẽ hình chiếu đứng bằng cạnh của vật thể Tia chieu sa te

Tia chieu sa te Thẻ vin

Thẻ vin đại từ thay thế

đại từ thay thế điện thế nghỉ

điện thế nghỉ Tư thế ngồi viết

Tư thế ngồi viết Diễn thế sinh thái là

Diễn thế sinh thái là