Helpful Hints for Medicare and Medicaid FollowUp Presented

- Slides: 87

Helpful Hints for Medicare and Medicaid Follow-Up Presented by: Patti Day, Billing Manager, Mercy Medical Center & Erica Fletcher, CPAT/CCAT, Medicare Reimbursement Specialist, Mercy Medical Center Janet Wells, Medicaid Reimbursement, Mercy Medical Center December 9, 2011

DISCLAIMER This information shared here today is intended to help our fellow PFS members. The interpretation is based on the information gathered from webinars, handouts, day to day experiences and internet exploration. The information gathered by Patti Day, Erica Fletcher & Janet Wells are not necessarily the thoughts and beliefs of Mercy Medical Center. It is recommend that each person research the websites to further interpret the Medicare and Medicaid reimbursement policies. Solicitation of Erica or Janet for possible employment is strictly forbidden!

Self-Administered Drug Billing on same claim with the other services from the date of service. Bill Revenue code 637 with HCPCS code A 9270 with modifier GY and place the charges in the non-covered column.

Self-Administered Drug Billing Advantages Not having to pay for two claims to be transmitted through clearinghouse or electronic claims vendor. Self-administered drug charges automatically crossed over to secondary insurance Provides for improved customer service Reduces patient complaints Reduces special requests to have self-administered drug charges billed to secondary insurance companies Reduces number of EOB’s to store

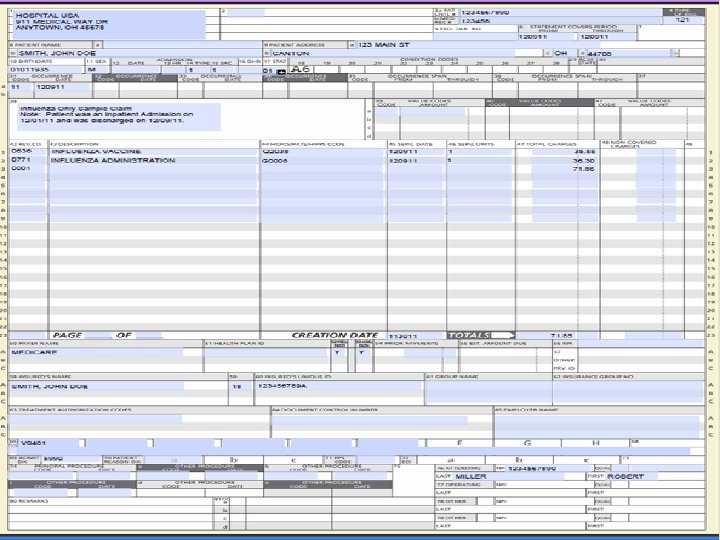

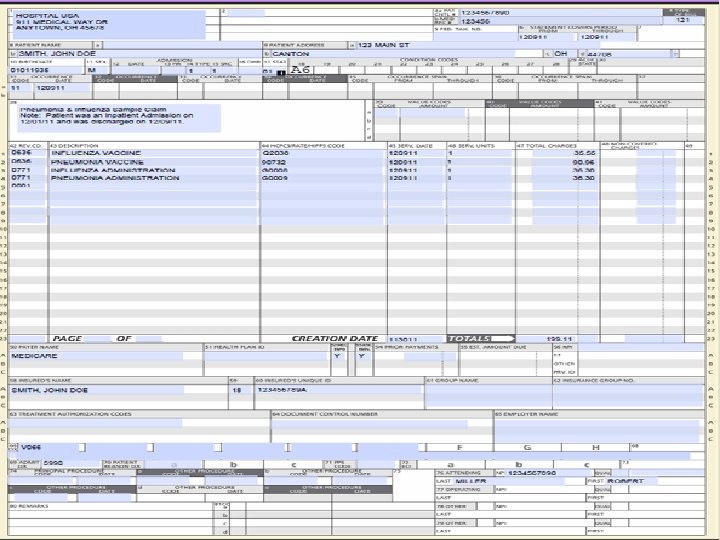

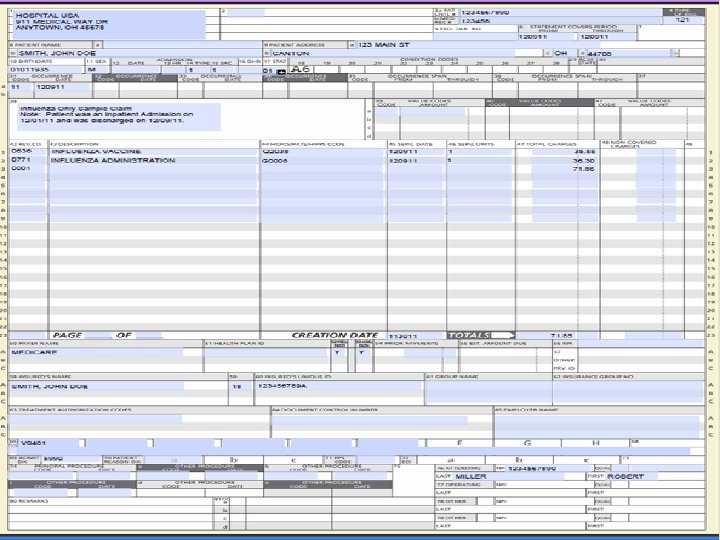

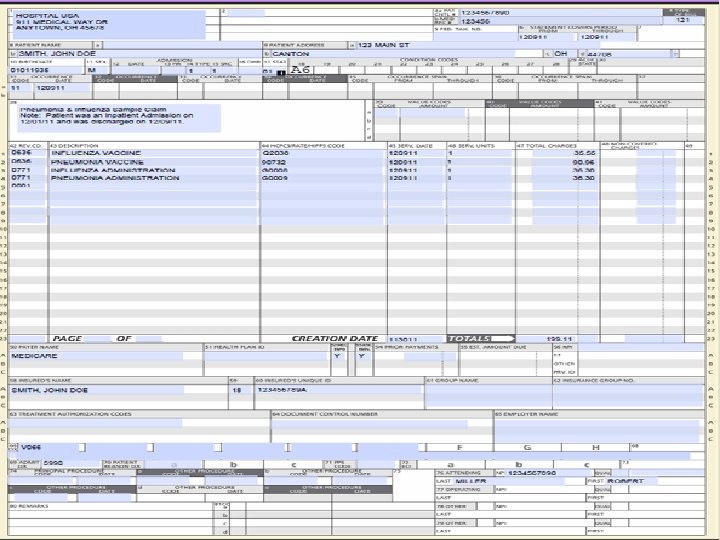

Billing Pneumonia and Influenza Vaccine Administration Type of bill=121 From and Thru Dates = date of inpatient discharge Condition Code= A 6 Revenue Code= 636 with the appropriate HCPCS/CPT Code for the Vaccine Revenue Code= 771 with the appropriate HCPCS Code for the Administration Use the date of discharge from the inpatient stay for the line item date of service

Billing Pneumonia and Influenza Vaccine Administration Advantages of billing for Inpatient Pneumonia and Influenza Vaccine and Administration on a 121 bill vs. through Roster billing Increase productivity-By sending the charges on the UB, it allows the remit to automatically post in the mainframe system because the hospital account number is used. Increased accuracy-The EOB will be attached to the claim in the billing software

Billing Pneumonia and Influenza Vaccine Administration Increased efficiency-It helps to identify cases where the doctor had ordered the vaccine(s) to be administered, but the patient refused it, or the patient was discharged prior to it being administered. Increased accuracy-Many systems charge the drugs as they are dispensed through automated pharmacy systems for the patient, and not when the medication is actually administered.

Billing Pneumonia and Influenza Vaccine Administration Increase accuracy-It adds a double check, because Medical Records must code one of the 3 special diagnosis’s that indicate that the pneumonia only, flu only or both were administered to the patient. When Roster billing, you don’t use or need the special diagnosis that indicate that the vaccine was administered, you only use the admitting diagnosis. Having Medical Records code the diagnosis for the correct administration can identify cases where the account has been charged, but the vaccine(s) were not given.

Billing Pneumonia and Influenza Vaccine Administration Assisted with avoiding potential Billing errors that may not have been identified until a RAC audit, Cert Audit or ADR request. Some providers have found that this identified as much as 10 -25% of the vaccine and administrations charged to the patients account were not documented in the medical record. If it’s not documented, it didn’t happen.

Billing Pneumonia and Influenza Vaccine Administration Providers are receiving denials from Medicare due to patient exceeding the frequency limits for Flu & Pneumonia Flu once per flu season Pneumonia one per lifetime Can appeal if there is medical justification documented in the medical record to explain the need for more frequent vaccinations. Exceeding the frequency limitations should be a rare thing, not a common practice. MLN Product, Quick Reference Information: Medicare Immunization Billing http: //www. cms. gov/MLNProducts/downloads/qr_immun_bill. pdf

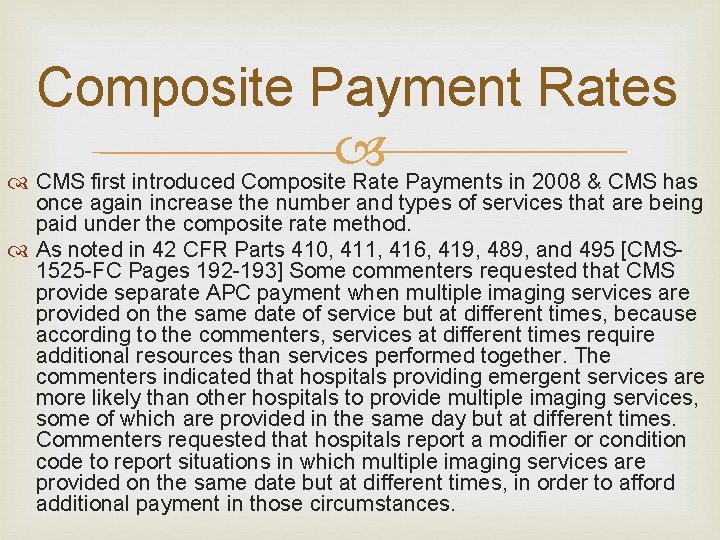

Composite Payment Rates CMS first introduced Composite Rate Payments in 2008 & CMS has once again increase the number and types of services that are being paid under the composite rate method. As noted in 42 CFR Parts 410, 411, 416, 419, 489, and 495 [CMS 1525 -FC Pages 192 -193] Some commenters requested that CMS provide separate APC payment when multiple imaging services are provided on the same date of service but at different times, because according to the commenters, services at different times require additional resources than services performed together. The commenters indicated that hospitals providing emergent services are more likely than other hospitals to provide multiple imaging services, some of which are provided in the same day but at different times. Commenters requested that hospitals report a modifier or condition code to report situations in which multiple imaging services are provided on the same date but at different times, in order to afford additional payment in those circumstances.

Composite Payment Rates CMS’s response “as stated in the CY 2010 and CY 2011 final rules , we do not agree with the commenters that multiple imaging procedures of the same modality provided on the same date of service but at different times should be exempt from the multiple imaging composite payment methodology. As we indicated in the CY 2009 through CY 2011 OPPS/ASC final rules, we believe that composite payment is appropriate even when procedures are provided on the same date of service but at different times because hospitals do not expend the same facility resources each and every time a patient is seen for a distinct imaging service in a separate imaging session. ”

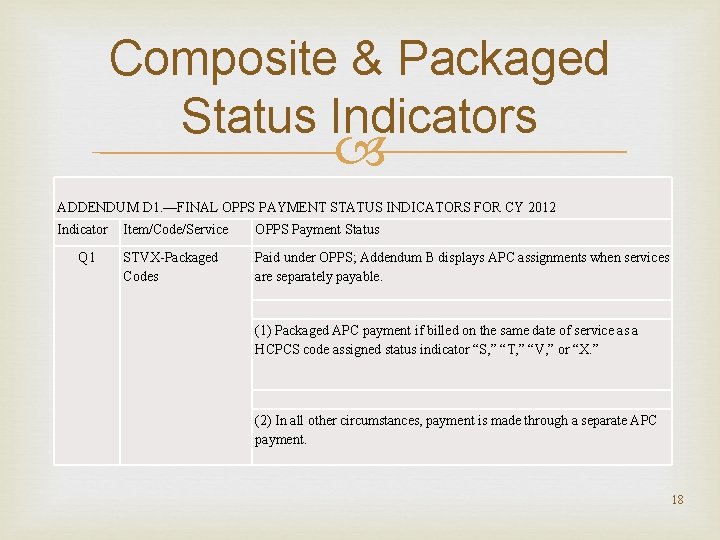

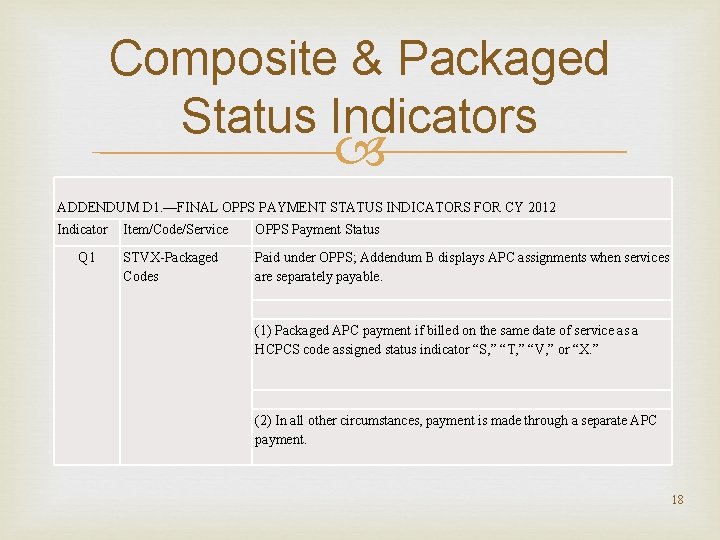

Composite & Packaged Status Indicators ADDENDUM D 1. —FINAL OPPS PAYMENT STATUS INDICATORS FOR CY 2012 Indicator Item/Code/Service Q 1 STVX-Packaged Codes OPPS Payment Status Paid under OPPS; Addendum B displays APC assignments when services are separately payable. (1) Packaged APC payment if billed on the same date of service as a HCPCS code assigned status indicator “S, ” “T, ” “V, ” or “X. ” (2) In all other circumstances, payment is made through a separate APC payment. 18

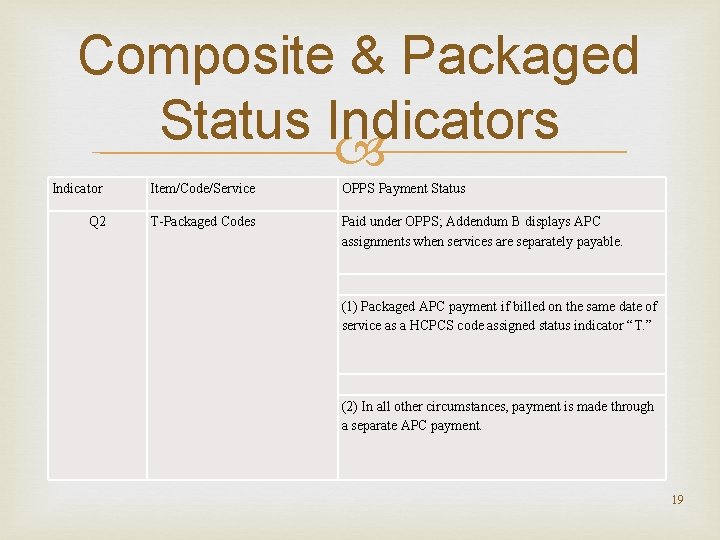

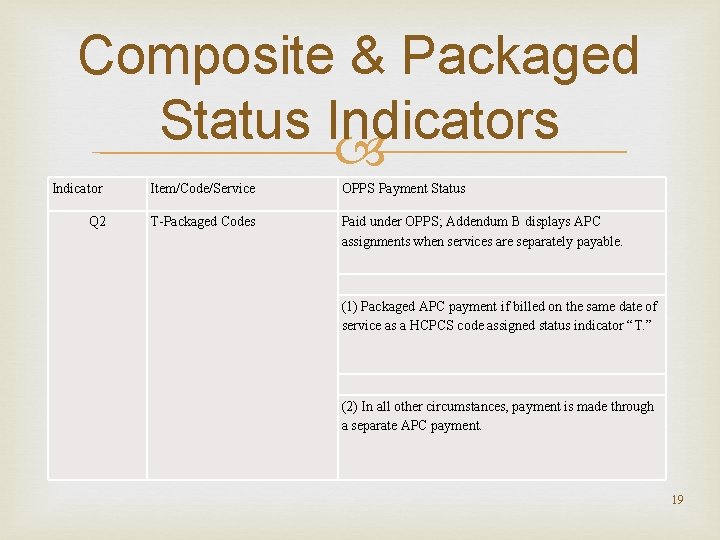

Composite & Packaged Status Indicators Indicator Item/Code/Service OPPS Payment Status Q 2 T-Packaged Codes Paid under OPPS; Addendum B displays APC assignments when services are separately payable. (1) Packaged APC payment if billed on the same date of service as a HCPCS code assigned status indicator “T. ” (2) In all other circumstances, payment is made through a separate APC payment. 19

Composite & Packaged Status Indicators Indicator Q 3 Item/Code/Service OPPS Payment Status Codes That May Be Paid Through Paid under OPPS; Addendum B displays APC a Composite APC assignments when services are separately payable. Addendum M displays composite APC assignments when codes are paid through a composite APC. (1) Composite APC payment based on OPPS composite -specific payment criteria. Payment is packaged into a single payment for specific combinations of services. (2) In all other circumstances, payment is made through a separate APC payment or packaged into payment for other services. 20

Composite Payment Rates Review Addendum M for list of composite services

Packaged Service Medicare has encouraged providers to report all services separately even if the payment for the service is packaged to allow for more accurate future payment setting. If there is a HCPCS or CPT Code, the item should be reported with that code in order to allow for accurate claims payment rate setting in the future.

Condition Code G 0 NHIC, Corp. , Medicare Administrative Contractor Jurisdiction 14 A/B MAC (J-14 MAC) has release a “Reminder on Proper Use of Condition Code G 0” dated July 21, 2011 http: //www. medicarenhic. com/providers/articles/Remi nderon. Proper. Useof. CCG 0. pdf States “by definition, Condition Code 'G 0' indicates that a 'distinct medical visit' has occurred. ”

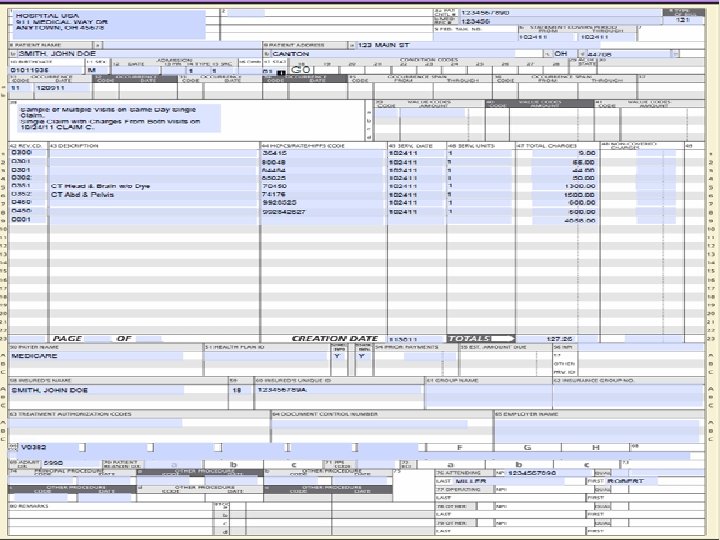

Condition Code G 0 When to use condition code G 0 (zero): Condition Code 'G 0' is reported by Outpatient Prospective Payment System (OPPS) hospitals when multiple medical visits occur on the same day (bill type 13 X), with the same revenue center, but only when the visits were not similar and represent separate trips or appointments. For example: Patient was first seen in emergency room in the morning for chest pains, and returned later on the same day with a broken arm. Multiple medical visits in the same revenue center may be submitted on two claims as long as one of the claims is submitted with CC G 0. A single claim can be submitted as well as long as CC G 0 is on the claim.

Condition Code G 0 When not to use condition code G 0 (zero): Do not use condition code G 0 (zero) when the claim has rejected as a duplicate. Providers are finding that appending condition code G 0 does the following: Bypasses National Correct Coding (CCI) edits Bypasses Medically Unlikely Edits (MUE) edits Bypasses Duplicate Service Edits Even if every service on the claim is an exact match

Condition Code G 0 has a greater potential for fraud, abuse and misuse than modifier 59. Modifier 59 bypasses edits at the line level Condition Code G 0 bypasses edits on a claim level When 2 claims are billed, one without condition code G 0 and one with condition code G 0, both claims will pay, the concern is will that payment be correct and will it withstand the review of CERT, ADR & RAC.

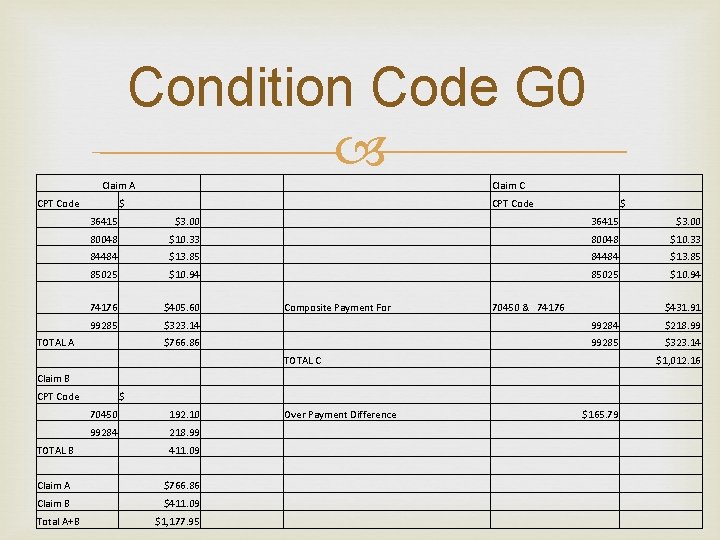

Condition Code G 0 If services are billed on different claims with condition code G 0, the composite payment rate will not correctly apply.

Condition Code G 0 Hospitals need to have a clear policy in place that defines situations where using the G 0 condition code is appropriate. Hospitals G 0 policy should include specifics of what defines a separate distinct visit. Is it a different location? A different time, how will time be determined? Does the patient actually need to level the premises and how will that be determined?

Condition Code G 0 I. e. : is the patient presenting for PAT on the same day as surgery an appropriate use of condition code G 0

Condition Code G 0 Remember to use measurable items that can be duplicated in case of an audit. Policy should address that if billing 2 separate bills, only the 2 nd E&M should be billed on a separate claim with the condition code G 0, all other services should be combined to allow for correct processing of the claim. This would allow for CCI edits, MUE edits, Duplicate edits and packaging rules to correctly be applied to the claim and avoid the potential for incorrect payments.

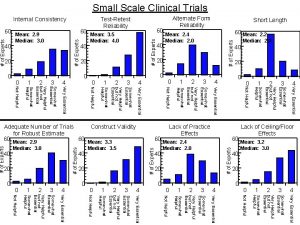

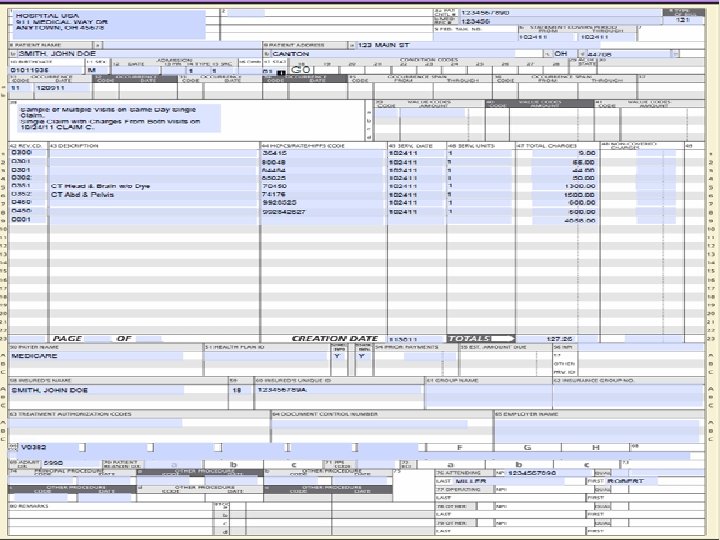

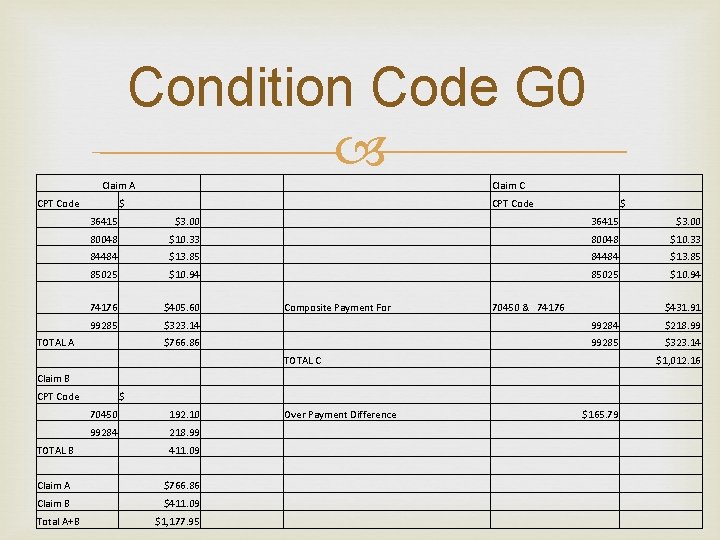

Condition Code G 0 Claim A Claim C CPT Code $ 36415 $3. 00 80048 $10. 33 84484 $13. 85 85025 $10. 94 74176 $405. 60 Composite Payment For 99285 $323. 14 99284 $218. 99 $766. 86 99285 $323. 14 CPT Code $ TOTAL A 70450 & 74176 $431. 91 TOTAL C $1, 012. 16 Claim B CPT Code $ 70450 192. 10 Over Payment Difference 99284 218. 99 411. 09 Claim A $766. 86 Claim B $411. 09 $1, 177. 95 TOTAL B Total A+B $165. 79

Condition Code G 0 Condition code G 0 has the potential to become the next major watch or audit issue much like one day stays. Hospitals policy should include safe guards and specify reviews of compliance with the policy that will be done.

Condition Code G 0 Advantages of sending 1 bill for all services for a single date of service with modifier 25 on the first E&M and modifier 25 & 27 on the second and subsequent E&M’s with condition code G 0 instead of sending multiple claims with modifier 25 on the first E&M and condition code G 0 an modifier 25 & 27 on the E&M on second claim include: CCI edits fire MUE edits fire Duplicate services edits fire Situational Packaging Rules Q 1, Q 2 & Q 3 are correctly applied

Condition Code G 0 Hospitals Policy on the use of Condition code G 0 should Clearly define when appropriate to use condition code G 0 Clearly define what constitutes a distinct or multiple visits on the same day Clearly define what service will be billed separately and what services need to be billed all on one claim. Address if merely having a different ordering doctor is enough to meet requirements to bill separately Address difference between giving 2 accounts at registration to ensure sending records only to the ordering doctor vs. billing the services as 2 separate accounts.

Condition Code G 0 Hospitals need to include safeguards to avoid potential for inappropriate payments. Train staff on appropriate use of condition code G 0. Monitor compliance to hospital policy for correct payments. Condition code G 0 needs to be treated with the same care, guidance and monitoring that most facilities are currently using with modifier 59.

Condition Code G 0 The following situation could occur Claim is billed twice, 1 pays and 1 denies for duplicate. The denial is received first the other claim is still in process to pay. Biller rebills the claim that denied for duplicate with condition code G 0 and the provider receives a duplicate payment for the exact same account & services.

Condition Code G 0 Address issue of Urgent Care & ER on same day, the E&M’s needs to be billed on to 2 separate claims. First visit with modifier 25 and 2 nd visit with a G 0 condition code and modifier 25 & 27 on the E&M.

Inpatient CERT Requests The Cert Contractor is now targeting accounts where the provider’s total charges on the inpatient claim were less than the Medicare DRG allowed amount. Providers may want to review these accounts to determine if their charges are accurately capturing the facilities cost to care for these patients. Review to verify that all services performed where correctly charged to the patients account.

RAC Audits are being expanded, they will continue to include post pay reviews, and beginning in 2012, CMS is expanding RAC reviews in the state of Ohio to include prepay reviews too. They will be focusing on short inpatient stays i. e. , 1 and 2 day stays.

ADR ADR’s no longer being used to review outpatient accounts only anymore. Providers are beginning to see ADR requests on inpatient acute care stays. CGS is currently conducting an ADR Prepay probe on inpatient stays; providers are beginning to receive requests. Disadvantages Potential Impact on AR Days Potential Impact on Cash Flow

ADR Advantages If denied, normal appeal rights will apply Potential to rebill as 121 ancillary services bill if denial received within timely filing limits Request limits for RAC Post Pay- 300 every 45 days CERT Post Pay- no provider limit, only a random sample limit ADR Pre Pay- no disclosed limits RAC Pre Pay- no limit disclosed yet It’s hard enough to get the correct payment to begin with; you need to make sure that you will be able to keep the payments.

Inpatient Readmissions According to CMS research, hospitals have made almost no headway in cutting readmissions in 2009, the most recent data available, 1 in 6 Medicare patients were readmitted within 30 days for the same condition. Hospitals will begin to see payment penalties for high readmissions rates starting in 2012. Medicare is focusing on readmission rates for: CHF Pneumonia Surgery, and surgery complications Hip fractures And other Medical conditions Surgery patients were the least likely to be readmitted

Observation On November 4, 2011, a group of 7 patients in Connecticut, Massachusetts & Texas filed a lawsuit challenging a Medicare policy that allows hospitals to place patients under “observation status” for days without admitting the patients. According to CMS data, hospitals’ use of observation status has increased from 828, 000 claims in 2006 to more than 1. 1 million in 2009. CMS data also shows that claims for observation stays greater than 48 hours has increased by nearly 300% from 2006 to 2009.

Signature requirements for lab test Per (42 CFR Part 410, CMS-1436 -P pages 38342 -38343. ) Hospitals may perform lab tests without a physician signature required on the “requisition”, but the hospital will be required to get a copy of the signed “order” from the physicians chart if the records are requested for review or an appeal is filed.

Signature requirements for lab test Many providers use the term “order” & “requisition” interchangeable, however CMS has two distinct definitions for these terms. an ‘‘order’’ is defined in Pub 100– 02, Chapter 15, Section 80. 6. 1, as a communication from the treating physician or NPP requesting that a diagnostic test be performed for a beneficiary. (74 FR 61930) States that an “order” may be delivered via any of the following forms of communication:

Signature requirements for lab test A written document signed by the treating physician, which is hand-delivered, mailed, or faxed to the testing facility. A telephone call by the treating physician or his or her office to the testing facility. An electronic mail, or other electronic means, by the treating physician or his or her office to the testing facility. If the “order” is communicated via telephone, both the treating physician, or his or her office, and the testing facility must document the telephone call in their respective copies of the beneficiary’s medical records.

Signature requirements for lab test (74 FR 33642) defined a ‘‘requisition’’ as the actual paperwork, such as a form, which is furnished to a clinical diagnostic laboratory that identifies the test or tests to be performed for a patient. The “requisition” may contain patient information, ordering physician information, referring institution information, information on where to send reports, billing information, specimen information, shipping addresses for specimens or tissue samples, and checkboxes for test selection.

Signature requirements for lab test CMS stated that they believed that a written “order”, which may be part of the medical record, and the “requisition”, were two different documents, although a “requisition” that is signed may serve as an “order”. The rule does not preclude labs from requiring a physician signature on the requisition as part of their facilities policies. Hospitals should use caution if accepting unsigned requisitions, if the physician fails to maintain or provide to the hospital in a timely manner the sign order to send to Medicare, the lab services will be denied making the facility responsible.

Drug Screens Medicare clarified that G 0430 & G 0431 are one per encounter no matter how many drugs are tested for and no matter the number of tests that are used. Medicare stated that they will not pay for more than one just because a provide choose to use individual tests; rather than one test that can test for multiple drugs.

Looking for possible lost revenue Review outpatient accounts that have high dollar amounts being reported under revenue code 250. You could have services that are separately billable and payable inappropriately assigned to revenue code 250, which is packaged, instead of being captured under revenue code 634, 635, or 636. Review high cost pharmacy items to verify that the correct multiplier or conversion factor is being reported based on the HCPCS Code description.

Looking for possible lost revenue Do periodic reviews of high cost and separately billable pharmacy items to assure that the correct units are being captured on the bill. Remember the units are determined based on the HCPCS code description and not based on the way that the medication is purchased. Ex per bottle, per vial, etc. Sort Addendum B to review J-codes that are separately payable, and make sure that these items are set up correctly in the charge master.

Looking for possible lost revenue Identify your facilities top services and review and evaluate the facilities charge amounts for these services taking into account the allowed amounts for Fee Schedules that are available for public use Medicare, Medicaid and Worker’s Compensation. Review charges to make sure that you are not losing revenue because your charges are less than the allowed amounts under these programs. Don’t leave revenue on the table due to your charges being less than the allowed amounts.

GI Services for 2012 were split from 2 APC’s into 3 APC’s which overall resulted in an increase in payments. Review and evaluate GI services to be sure that your charges are accurately representing the facilities cost to provide the service.

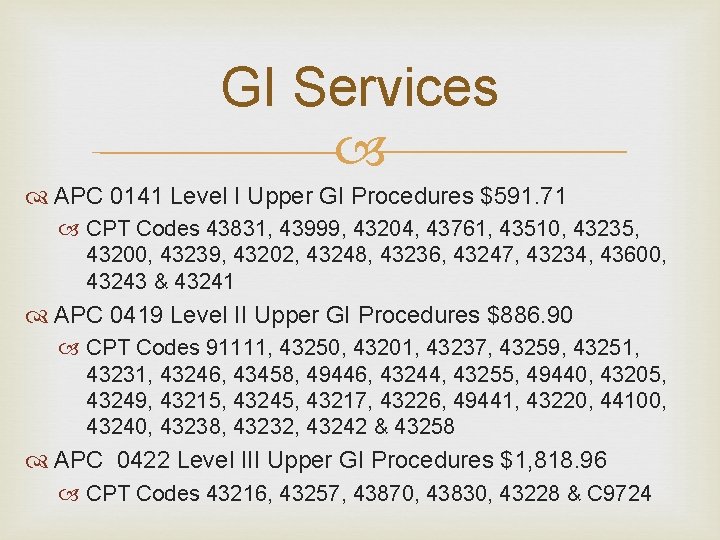

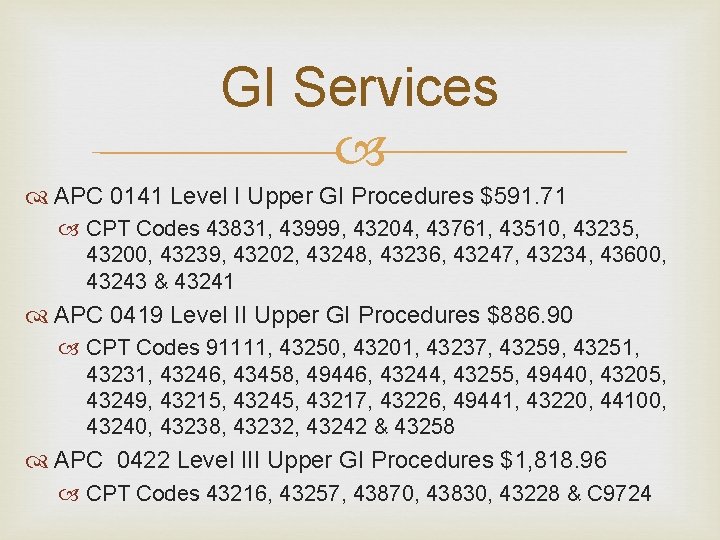

GI Services APC 0141 Level I Upper GI Procedures $591. 71 CPT Codes 43831, 43999, 43204, 43761, 43510, 43235, 43200, 43239, 43202, 43248, 43236, 43247, 43234, 43600, 43243 & 43241 APC 0419 Level II Upper GI Procedures $886. 90 CPT Codes 91111, 43250, 43201, 43237, 43259, 43251, 43231, 43246, 43458, 49446, 43244, 43255, 49440, 43205, 43249, 43215, 43245, 43217, 43226, 49441, 43220, 44100, 43240, 43238, 43232, 43242 & 43258 APC 0422 Level III Upper GI Procedures $1, 818. 96 CPT Codes 43216, 43257, 43870, 43830, 43228 & C 9724

5010, the new version of the x 12 standards for HIPPA transactions All electronic claims transmitted on or after January 1, 2012. 5010 conversion will affect these transactions Sending electronic claims (837 I Institutional & 837 P Professional Claims) Claim status requests (276) and responses (277) Payments (EFT) & remittance advices (835) Eligibility Inquiries (270) & responses (271)

5010 increases the number of diagnosis’s allowed on a claim. 5010 distinguishes between principal diagnosis, admitting diagnosis, external cause of injury and patient reason for visit codes. 5010 will increase name fields for providers, patients, & subscribers from 35 characters to 60 characters, this will allow for more accurate reporting of full names. 5010 will increase the length of the taxonomy codes field from 30 characters to 50 characters. 5010 will increase the number of reportable insurance or payers from 3 to 12. BWC has stated a tentative readiness date of February 2012 for 5010 transactions.

ICD-10 Required on all claims with dates of service on or after October 1, 2013. For claims with dates of service prior to October 1, 2013, ICD-9 coding is to be used. On inpatient claims, the date of discharge will determine the correct version of ICD to use. Example patient admitted September 30, 2013 and discharge October 1, 2013, would be coded using ICD-10. For both all outpatient claims that span from September 30, 2013 to October 1, 2013, the claims would need to be split billed. This would include ER and observation patients. 1 claim for services thru September 30, 2013 coded using ICD 9 And a 2 nd claim for services beginning October 1, 2013 coded using ICD-10. 60

ICD-10 The first 3 -6 months after transition will require a learning curve for Providers to learn & code correctly Health plans to interpret the codes & process them correctly for payment. There is a great volume of unpredictability in revenue flow as the new codes are being used to make payment decisions that providers needs to be aware of and prepared for. Have extra cash on hand. Reduce billing and coding back logs and try to have all coding, billing and follow-up current.

ICD-10 Scared of ICD-10? ICD-11 is in the wings, ICD-10 is coming in 2013 and ICD-11 is likely coming in 2015, they are already in the process of revising and modifying ICD-10, and the United States hasn’t even begun to use it yet! It has taken the U. S. healthcare industry 23 years to implement ICD-10, since it was first released and ready for use. ICD-9 was originally released in 1977. ICD-10 is currently being used in 117 of 193 countries. ICD-11 better referred to as ICD-2015 will be built on an internet platform to allow for easier updates and conversions.

ICD-10 If providers fail to be prepared and convert to ICD-10, they will no longer be paid for their services. ICD-10 will force clinicians to become more detailed with documentation and will force hospitals to more closely monitor that the medical record is being completely and accurately documented. ICD-10 is just one of the many issues that are currently straining providers resources, others include Meeting meaningful use Building accountable care organizations Reviewing the potential impact that Value based purchasing could have on the organizations Myriad of reporting requirements Trying to achieve reductions in readmissions

ICD-10 CMS says Implementing ICD-10 will allow for Accurate anatomical descriptions Differentiation of risk & severity Key parameters to differentiate disease manifestations Optimal claim reimbursement Value-based purchasing methodologies For analyzing of healthcare utilization Costs & outcomes Resource use & allocation Performance measurement Further streamline automated claim processing Reduction in claims-payment delays or denials Provides opportunities to develop & implement new pricing & reimbursement structures including fee schedules & hospital & ancillary pricing scenarios. Allow for more effective detection & investigation of potential fraud or abuse Expand available code from 13, 000 to 68, 000 potential codes

ICD-10 will affect not only almost every department within a hospital with few exceptions like Housekeeping, Maintenance and Cafeteria. BWC has stated that they will accept ICD-10 codes by the October 1, 2013 implementation date.

Medicare Credit Balances Providers must report all credit balance that result in a change in payment, if the credit balance existed and was not resolved by the last day of the reporting quarter. Providers need to maintain supporting documentation that all the Medicare accounts that had credit balances on there were reviewed, recommend notating the report with who the refund is needed to or that it was due to a posting, or contractual issue. Just keeping the attestation sheet is not sufficient and would not provide adequate supporting documentation in case of an audit.

Medicare Credit Balances Accounts where the credit balance is due to a change in contractual only do not need to be report on the CMS 838 credit balance report, but should be resolved by the end of the reporting period. All supporting documentation including copies or originals of the attestation sheets should be maintained in one location, sorted by quarter, even if multiple staff members are responsible for working/resolving the credit balances, such as with an alpha split, in case of an audit. CGS Medicare is not currently able to accept the 838 Medicare credit balance report electronically through the DDE, it must be manually logged and faxed or mailed to them with a signed attestation sheets.

Accountable Care Organizations will require the following Network development and management Care coordination on all levels, between Hospitals Doctors Health plans Pharmacies Patients Family

Accountable Care Organizations A Providers care for patients will no longer begin when the patient presents to the providers facility and end when the patient leaves the facility. Under Medicare’s vision for ACO’s, the provider will be responsible for the health, welfare and care of the patient 24 hours a day 7 days a week. Providers will be expected to initiate a tremendous volume of the contact with the patient, providers will no longer be able to wait for the patient to contact your organization for appointments and testing, providers will have to contact the patient to coordinate and schedule necessary screening exams and follow-up care, as well as making “well check” phone calls to see how the patient is doing.

Miscellaneous Tidbits For HCPCS Codes that end with a T, if there is no LCD for these codes, the code is considered experimental or investigational and is only payable in some areas, not nationally covered by Medicare. CGS has stated that for Pharmacy Waste, that modifier JW is required on the claim on a separate line with the corresponding HCPCS Code and date of service if providers wish to request payment for the waste, in addition to documenting the waste in the Medical Record. This is a change from NGS, which had allowed providers to bill for the total amount given plus the waste all on 1 line and just document the wasted units in the Medical Record.

Miscellaneous Tidbits If Physician Supervision requirements are not meet, based on CPT Code description, every service that was provided for that date of service can be denied. If audited, what documentation will you be able to produce to ensure the auditors that physician supervision was in place and maintained? Hospitals that fail to meet quality reporting program requirements will face a 2% reduction in reimbursement in 2012. This will also reduce beneficiary liability to the hospital.

Miscellaneous Tidbits CGS Medicare is no longer supplying providers with the contact information of the overlapping facilities, like NGS used to. CGS is only providing the Medicare Provider numbers of the overlapping facilities. There is a listing of providers by provider numbers available at http: //www. cms. gov/costreports/ The website includes the contact information for hospitals, skilled nursing facilities, renal facilities, hospice providers and home health agencies. Sort the files by state, county and city to make the files more usable to match your service area.

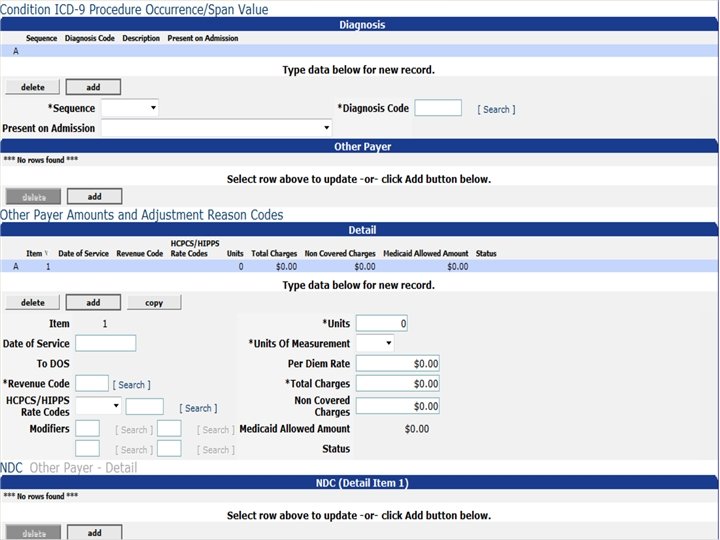

MITS

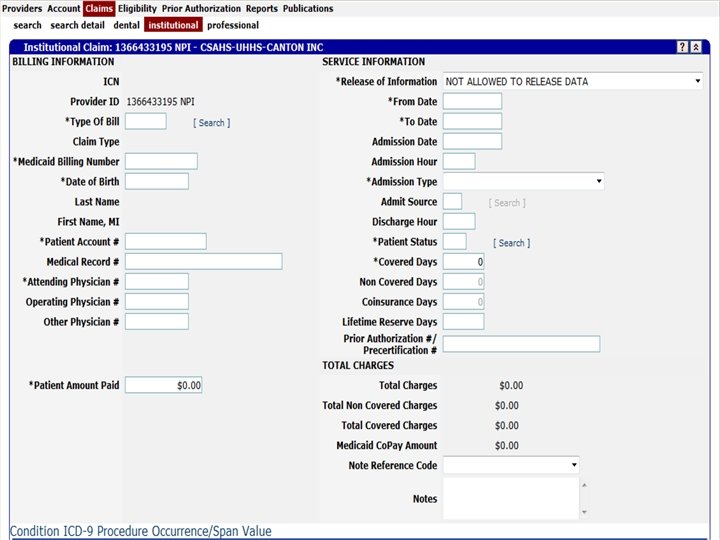

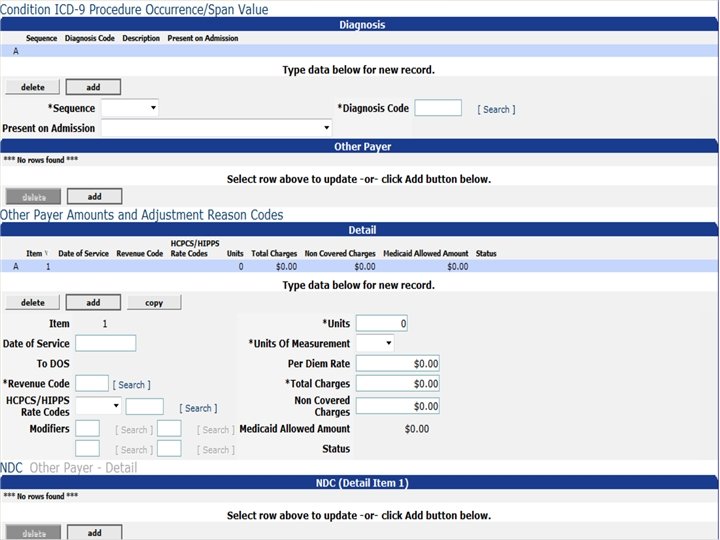

MITS Use the cancel button if you make a mistake while working on a claim in the system. You can reload the original claim you were correcting. Once you have a processed claim and you have an ICN# the option for RESUBMIT – CANCEL – VOID OR CANCEL ALL APPEARS. Once you have voided a claim you have the option to copy a claim. You can make your corrections and when you submit it you will know at that moment if the claim will pay or not. If you have a paid claim and want the payment taken back or a zero pay you use the VOID button. Make sure you LOG your issues with ODJFS. Request a ticket number. According to customer service you can expect a call back in 2 -3 MONTHS. If you have the error code 7400 and are unable to get these claims to go through RECHECK the payer portion. This amount is filled in by MITS and we found to be incorrect.

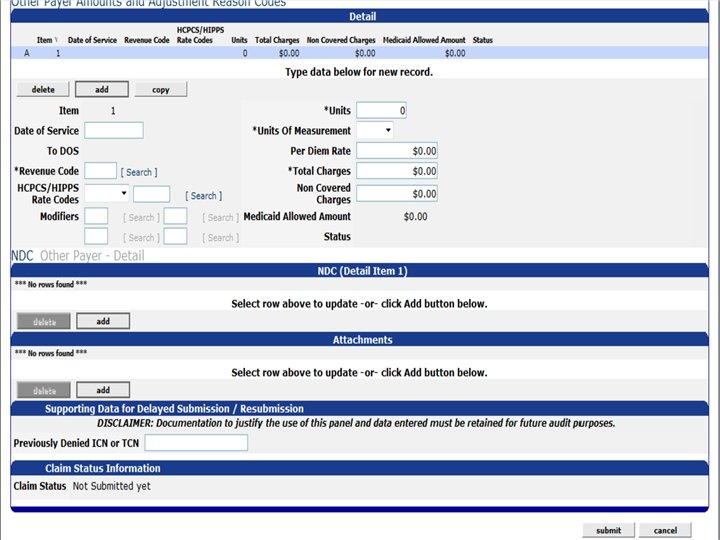

MITS CONTINUED Claim form 6653 – Is a Claim Review Request form. It is uploaded as an attachment. We have been told by ODJFS Customer Service to fill out this form with every attachment you upload or send.

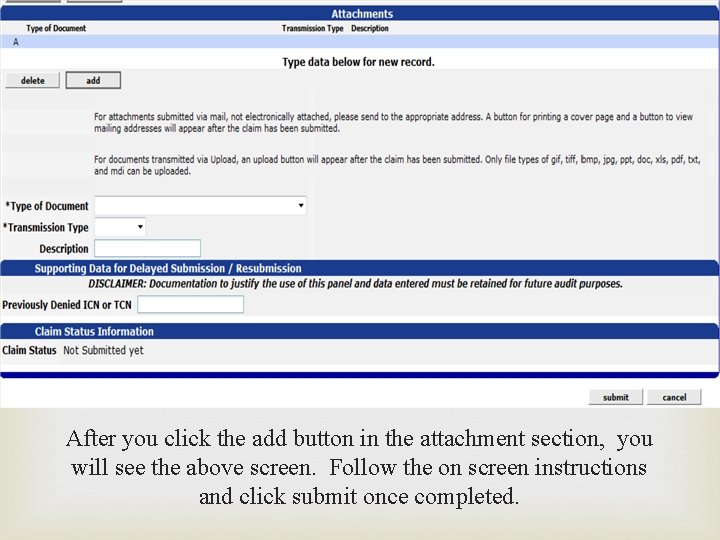

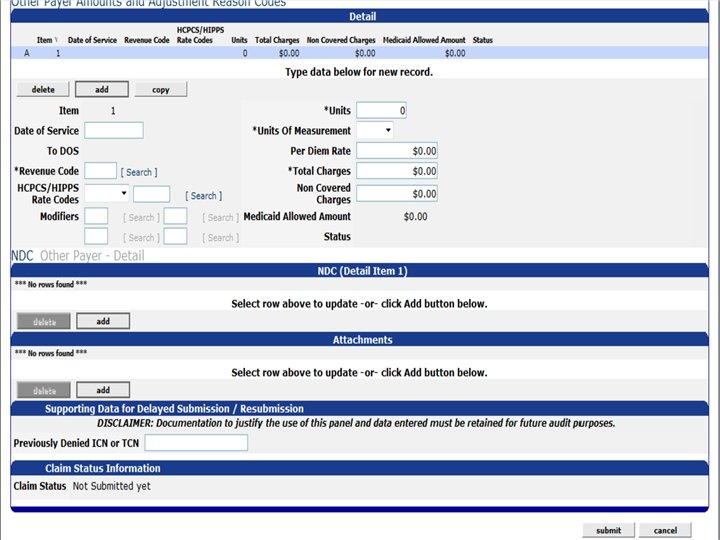

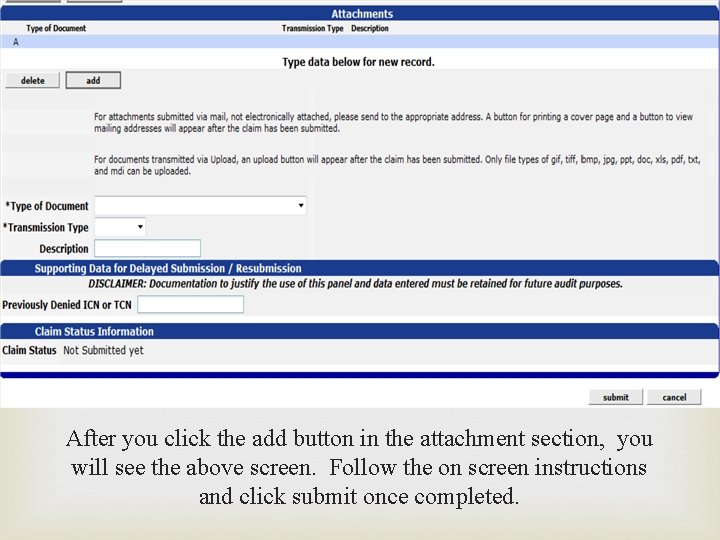

MITS CONTINUED For the attachments, go to the section marked attachments hit the add button to add an attachment. It will then bring up a box for mailing or upload. To upload hit the upload button it will bring up a drop down box with the description pick the one that best describes the upload. There is also a description box to add a note of your own which is optional. Submit the claim it will then give you the option to hit the upload again. When you press that button you get a second page. Click on the attachment on the top line it will give you the option to browse for your attachment. Once you have found your desired attachment hit the submit button it will give you a tracking number for your attachment.

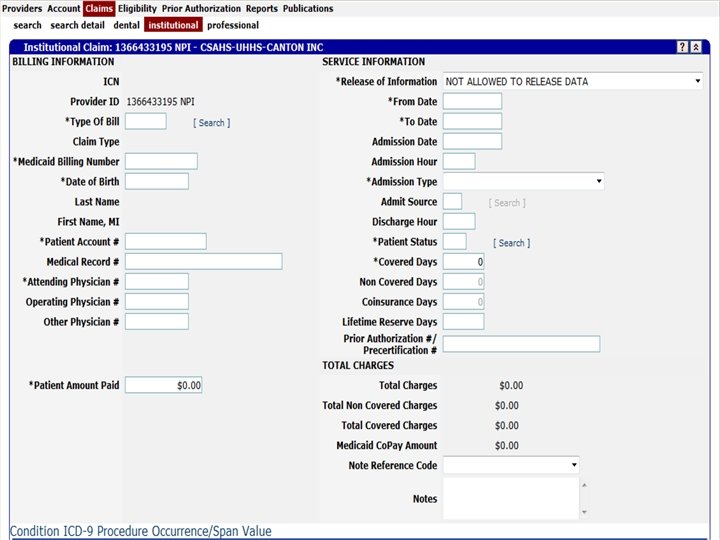

After you click the add button in the attachment section, you will see the above screen. Follow the on screen instructions and click submit once completed.

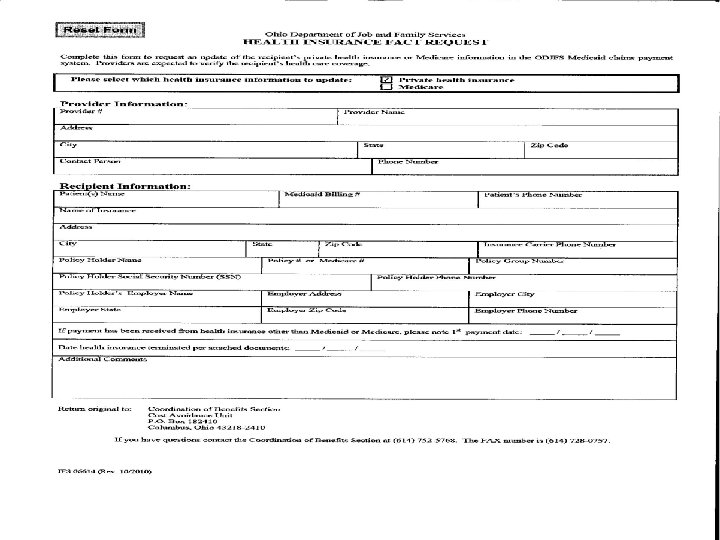

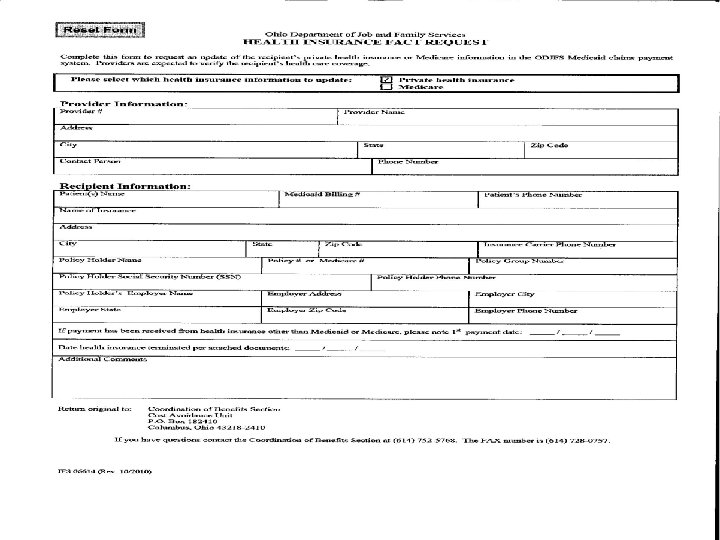

MITS CONTINUED Claim form 6614 - The Health Insurance Fact Request is the only way to get the MITS system corrected for the TPL (Third Party Liability) coverage. Fax this form to (614) 728 -0757. Check eligibility screen in two weeks if the TPL is not corrected refax form.

MITS CONTINUED PARAGRAPH K- This option may soon go away, but in the meantime if you have a high dollar supply OR lab you may chose to bill the one charge only for higher reimbursement. You need to follow the rules in the hospital handbook in paragraphs J and K. Some pregnancy services may also reimburse more if billed without the other charges.

THANK YOU Happy Holidays From Your Friends at Mercy Medical Center

Acls helpful hints

Acls helpful hints Governors scholars program

Governors scholars program Medicare medicaid and schip extension act of 2007

Medicare medicaid and schip extension act of 2007 Shiba rainbow chart

Shiba rainbow chart Weathermen apush

Weathermen apush Followup edge

Followup edge Followup:actionitems

Followup:actionitems Follow up visit

Follow up visit Good helpful results or effects

Good helpful results or effects Harmful microorganisms

Harmful microorganisms A scout is trustworthy

A scout is trustworthy Pagpapahalaga sa pamilya filipino values

Pagpapahalaga sa pamilya filipino values Hope you find it helpful

Hope you find it helpful Prewriting strategies definition

Prewriting strategies definition Fred has a fluffy down pillow

Fred has a fluffy down pillow Positive, constructive, helpful behavior

Positive, constructive, helpful behavior Secondary reinforcer

Secondary reinforcer Not very helpful

Not very helpful Beneficial mutations examples

Beneficial mutations examples Drama format

Drama format ความผิดปกติของตา

ความผิดปกติของตา Helpful

Helpful The most helpful classmates are the ones who

The most helpful classmates are the ones who Chapter 23 dying death and hospice

Chapter 23 dying death and hospice Helpful hint

Helpful hint 6-2 rational exponents

6-2 rational exponents Chapter 19 confusion dementia and alzheimer's disease

Chapter 19 confusion dementia and alzheimer's disease Mpi_comm_split_type

Mpi_comm_split_type Ppv yrsel

Ppv yrsel Supraglenoid gland

Supraglenoid gland Sentence expressing purpose

Sentence expressing purpose Guess the country by hints

Guess the country by hints Acrophobia antonym

Acrophobia antonym Hints of story writing

Hints of story writing Flush shared pool

Flush shared pool Hints that the author gives to help

Hints that the author gives to help Describe the setup of montag's tv room

Describe the setup of montag's tv room Olle hints

Olle hints Shape hints merupakan jenis animasi untuk mengatur

Shape hints merupakan jenis animasi untuk mengatur Dnslint

Dnslint Analytical verbs

Analytical verbs Word scramble hints

Word scramble hints Foreshadowing in little red riding hood

Foreshadowing in little red riding hood Settings in jekyll and hyde

Settings in jekyll and hyde Hate in romeo and juliet

Hate in romeo and juliet Ozymandias narrator

Ozymandias narrator Ozymandias and london venn diagram

Ozymandias and london venn diagram Signal words for cause and effect text structure

Signal words for cause and effect text structure Downstream entity examples

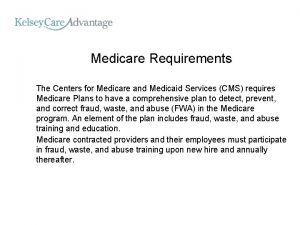

Downstream entity examples Medicare sales certification and recertification

Medicare sales certification and recertification Laws governing medicare parts c and d

Laws governing medicare parts c and d Medicare improvements for patients and providers act

Medicare improvements for patients and providers act Formuö

Formuö Novell typiska drag

Novell typiska drag Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Ekologiskt fotavtryck

Ekologiskt fotavtryck Varför kallas perioden 1918-1939 för mellankrigstiden?

Varför kallas perioden 1918-1939 för mellankrigstiden? En lathund för arbete med kontinuitetshantering

En lathund för arbete med kontinuitetshantering Särskild löneskatt för pensionskostnader

Särskild löneskatt för pensionskostnader Personlig tidbok för yrkesförare

Personlig tidbok för yrkesförare Sura för anatom

Sura för anatom Förklara densitet för barn

Förklara densitet för barn Datorkunskap för nybörjare

Datorkunskap för nybörjare Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Debattinlägg mall

Debattinlägg mall Delegerande ledarstil

Delegerande ledarstil Nyckelkompetenser för livslångt lärande

Nyckelkompetenser för livslångt lärande Påbyggnader för flakfordon

Påbyggnader för flakfordon Tryck formel

Tryck formel Publik sektor

Publik sektor Lyckans minut erik lindorm analys

Lyckans minut erik lindorm analys Presentera för publik crossboss

Presentera för publik crossboss Jiddisch

Jiddisch Kanaans land

Kanaans land Klassificeringsstruktur för kommunala verksamheter

Klassificeringsstruktur för kommunala verksamheter Luftstrupen för medicinare

Luftstrupen för medicinare Bästa kameran för astrofoto

Bästa kameran för astrofoto Centrum för kunskap och säkerhet

Centrum för kunskap och säkerhet Programskede byggprocessen

Programskede byggprocessen Bra mat för unga idrottare

Bra mat för unga idrottare Verktyg för automatisering av utbetalningar

Verktyg för automatisering av utbetalningar Rutin för avvikelsehantering

Rutin för avvikelsehantering Smärtskolan kunskap för livet

Smärtskolan kunskap för livet Ministerstyre för och nackdelar

Ministerstyre för och nackdelar Tack för att ni har lyssnat

Tack för att ni har lyssnat Referatmarkering

Referatmarkering Redogör för vad psykologi är

Redogör för vad psykologi är Stål för stötfångarsystem

Stål för stötfångarsystem