Valuation Custom Law INTRODUCTION Most of the custom

![Transaction Value of Identical Goods [Rule 4] When valuation method according to rule 3 Transaction Value of Identical Goods [Rule 4] When valuation method according to rule 3](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-10.jpg)

![Transaction Value of Similar Goods [Rule 5] Rule 5 provides for transaction value of Transaction Value of Similar Goods [Rule 5] Rule 5 provides for transaction value of](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-14.jpg)

![Deductive Value [Rule 7] Rule 7 of Custom Valuation Rules provides that if the Deductive Value [Rule 7] Rule 7 of Custom Valuation Rules provides that if the](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-17.jpg)

![Computed Value [Rule 8] This is the fifth method of valuation. This method is Computed Value [Rule 8] This is the fifth method of valuation. This method is](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-19.jpg)

![Residual Method [Rule 9] This is the sixth and the last method of valuation. Residual Method [Rule 9] This is the sixth and the last method of valuation.](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-21.jpg)

- Slides: 37

Valuation ( Custom Law )

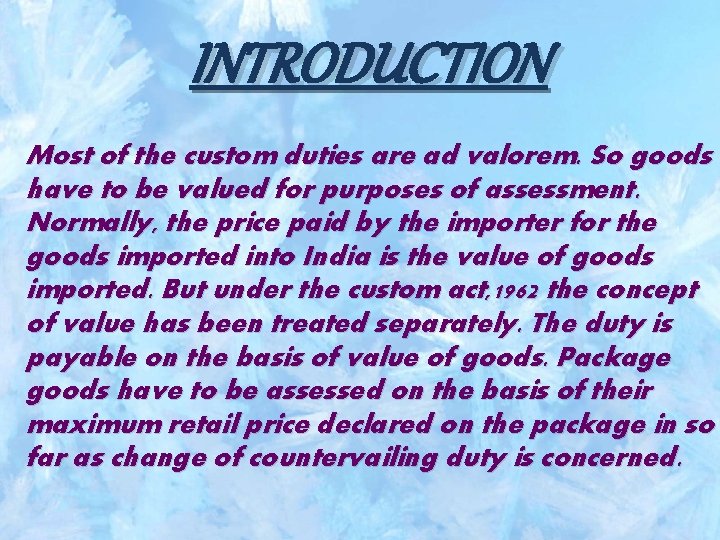

INTRODUCTION Most of the custom duties are ad valorem. So goods have to be valued for purposes of assessment. Normally, the price paid by the importer for the goods imported into India is the value of goods imported. But under the custom act, 1962 the concept of value has been treated separately. The duty is payable on the basis of value of goods. Package goods have to be assessed on the basis of their maximum retail price declared on the package in so far as change of countervailing duty is concerned.

(A) Tariff value fixed by the central government by notification in the official gazette. (B) ‘Value’ fixed under section 14(1) of the custom act, 1962 (A) Tariff value. (section 14(2): In some cases, tariff values are fixed by the central government from time to time for some specified goods. Once the tariff value of any commodity is fixed then the value for the determination of duty is not the value under section 14(1) but the tariff. The custom duty is payable according to the tariff value fixed. Custom duty may be a percentage which should be applied to the tariff value for determination of duty. (B) Value When Tariff Value Not Fixed: The value of the imported goods and export goods shall be the transaction value of such goods, as determined in accordance with the rules made in this behalf.

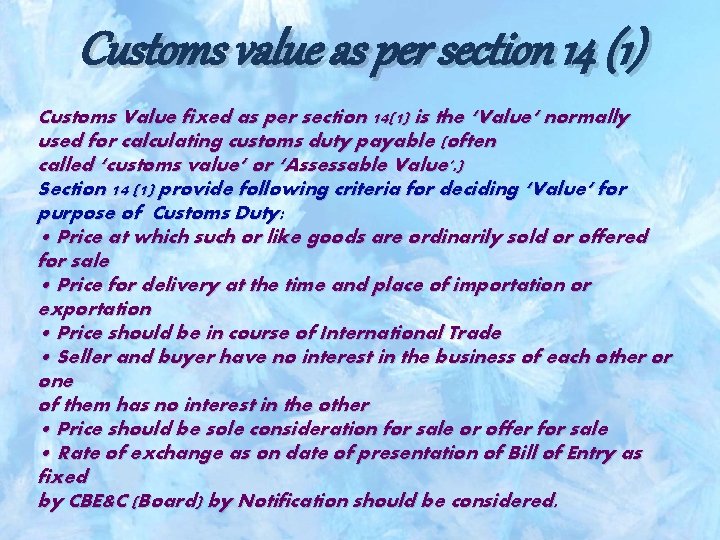

Customs value as per section 14 (1) Customs Value fixed as per section 14(1) is the ‘Value’ normally used for calculating customs duty payable (often called ‘customs value’ or ‘Assessable Value'. ) Section 14 (1) provide following criteria for deciding ‘Value’ for purpose of Customs Duty: • Price at which such or like goods are ordinarily sold or offered for sale • Price for delivery at the time and place of importation or exportation • Price should be in course of International Trade • Seller and buyer have no interest in the business of each other or one of them has no interest in the other • Price should be sole consideration for sale or offer for sale • Rate of exchange as on date of presentation of Bill of Entry as fixed by CBE&C (Board) by Notification should be considered.

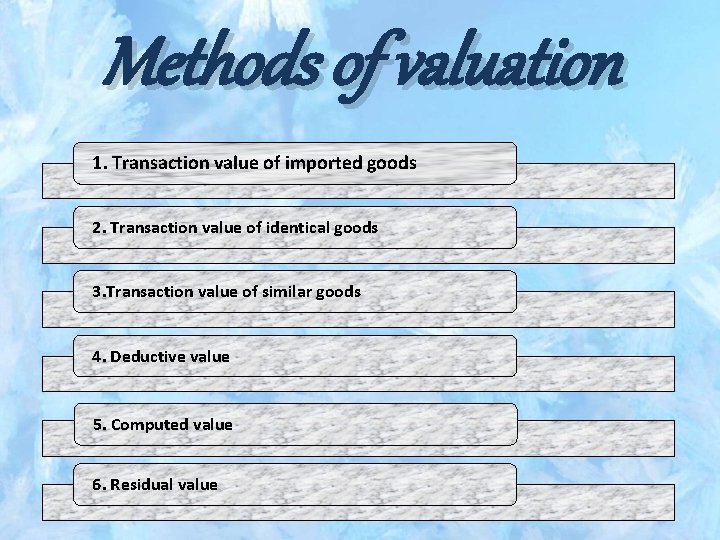

Methods of valuation 1. Transaction value of imported goods 2. Transaction value of identical goods 3. Transaction value of similar goods 4. Deductive value 5. Computed value 6. Residual value

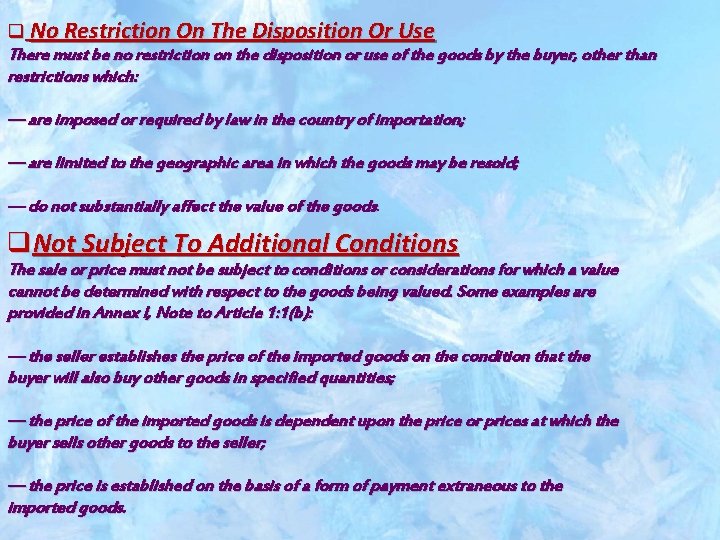

q No Restriction On The Disposition Or Use There must be no restriction on the disposition or use of the goods by the buyer, other than restrictions which: — are imposed or required by law in the country of importation; — are limited to the geographic area in which the goods may be resold; — do not substantially affect the value of the goods. q. Not Subject To Additional Conditions The sale or price must not be subject to conditions or considerations for which a value cannot be determined with respect to the goods being valued. Some examples are provided in Annex I, Note to Article 1: 1(b): — the seller establishes the price of the imported goods on the condition that the buyer will also buy other goods in specified quantities; — the price of the imported goods is dependent upon the price or prices at which the buyer sells other goods to the seller; — the price is established on the basis of a form of payment extraneous to the imported goods.

q. Full Prices, Unless. . . No part of the proceeds of any subsequent resale, disposal or use of the goods by the buyer will accrue directly or indirectly to the seller, unless adjustment can be made in accordance with provisions in Article 8. q. Sufficient Information For Adjustments Sufficient information is available to enable the specific adjustments to be made under Article 8 to the price paid or payable such as; — commissions and brokerage, except buying commissions — packing and container costs and charges — assists — royalties and license fees — subsequent proceeds — the cost of transport, insurance and related charges up to the place of importation if the Member bases evaluation on a C. I. F. basis. — but not: costs incurred after importation

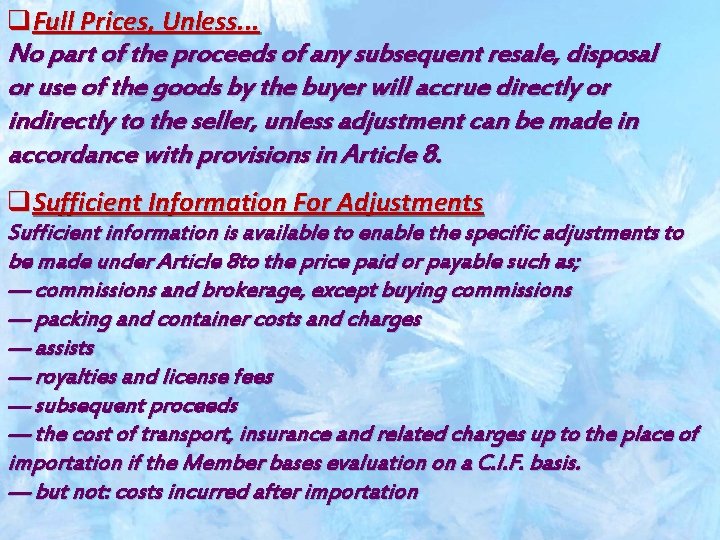

q. Related parties The definition of related persons is found in Article 15 of the Agreement, which states that persons are to be deemed to be related only if: — they are officers or directors of one another's businesses; — they are legally recognized partners in business; — they are employer and employee; — any person directly or indirectly owns, controls or holds 5 per cent or more of the outstanding voting stock or shares of both of them; — one of them directly or indirectly controls the other (the Interpretative Note to Article 15 provides that for the purposes of the Agreement, one person shall be deemed to control another when the former is legally or operationally in a position to exercise restraint or direction over the latter. The note also states that “persons” includes a legal person, where appropriate). — both of them are directly or indirectly controlled by a third person; or — they are members of the same family.

q. Buyer And Seller Not Related, Otherwise. . . The buyer and seller are not related, but even if so, the use of the transaction value is acceptable if the importer demonstrates that: — the relationship did not influence the price, or — the transaction value closely approximates a test value.

![Transaction Value of Identical Goods Rule 4 When valuation method according to rule 3 Transaction Value of Identical Goods [Rule 4] When valuation method according to rule 3](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-10.jpg)

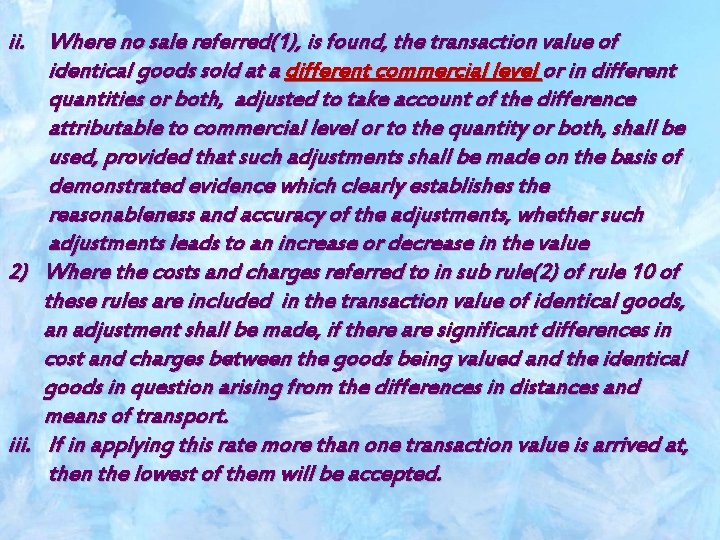

Transaction Value of Identical Goods [Rule 4] When valuation method according to rule 3 cannot be adopted, this rule comes into use. Identical goods are those goods which are same in all respects including physical characteristics, quality etc. As the goods being valued except for minor differences in appearance that do not effect the value of goods. In applying this rule following conditions must be satisfied: - i. The sale of identical goods should be at same commercial level and substantially in the same quantities. If such sale can’t be found then both the factors could be adjusted to arrive at a transaction value. Eg: There is an import of 50 units of a commodity. Rule 4 is not applicable. And the only identical import is of 1000 units and the seller gives discount if the sale quantity is more. In such a situation, the value can be determined by referrig to the seller’s price list.

ii. Where no sale referred(1), is found, the transaction value of identical goods sold at a different commercial level or in different quantities or both, adjusted to take account of the difference attributable to commercial level or to the quantity or both, shall be used, provided that such adjustments shall be made on the basis of demonstrated evidence which clearly establishes the reasonableness and accuracy of the adjustments, whether such adjustments leads to an increase or decrease in the value 2) Where the costs and charges referred to in sub rule(2) of rule 10 of these rules are included in the transaction value of identical goods, an adjustment shall be made, if there are significant differences in cost and charges between the goods being valued and the identical goods in question arising from the differences in distances and means of transport. iii. If in applying this rate more than one transaction value is arrived at, then the lowest of them will be accepted.

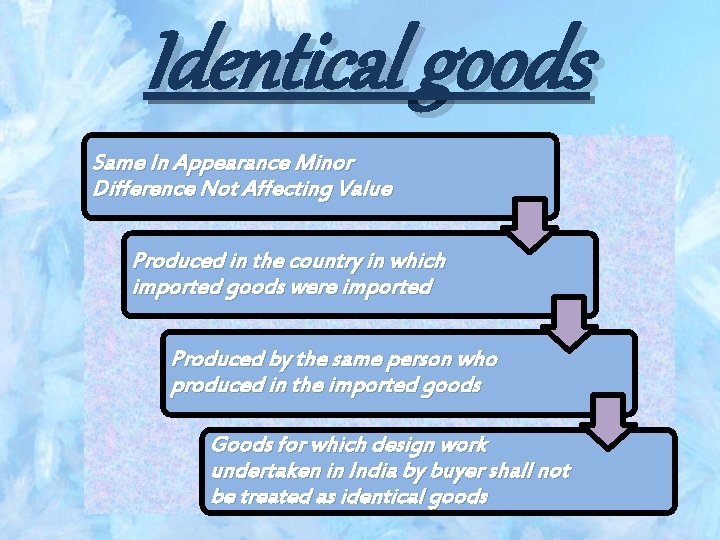

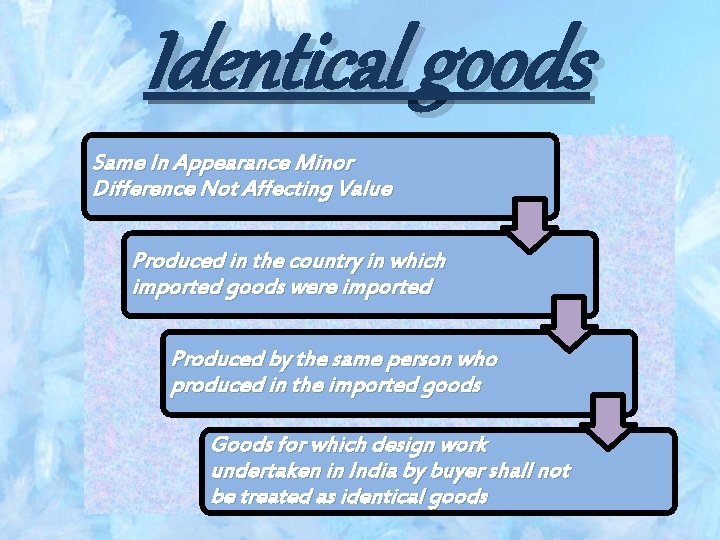

Identical goods Same In Appearance Minor Difference Not Affecting Value Produced in the country in which imported goods were imported Produced by the same person who produced in the imported goods Goods for which design work undertaken in India by buyer shall not be treated as identical goods

Exceptions Some exceptions are accepted, in particular: — where there are no identical goods produced by the same person in the country of production of the goods being valued, identical goods produced by a different person in the same country may be taken into account. — minor differences in appearance would not preclude goods which otherwise conform to the definitions from being regarded as identical. The definition excludes imported goods which incorporate engineering, artwork etc, provided by the buyer to the producer of goods free of charge or at a reduced cost, undertaken in the country of importation for which no adjustment has been made under Article 8.

![Transaction Value of Similar Goods Rule 5 Rule 5 provides for transaction value of Transaction Value of Similar Goods [Rule 5] Rule 5 provides for transaction value of](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-14.jpg)

Transaction Value of Similar Goods [Rule 5] Rule 5 provides for transaction value of similar goods. Similar goods means imported goods which although not like in all respects have characteristics and like material which enable them to perform some functions and make them commercially interchangeable with the goods being valued. All conditions applicable to the transaction value of identical goods are applicable to similar goods. In both cases of identical and similar goods if some engineering work, development work, art work design work, etc. in connection with the production of imported goods was done by the buyer directly or indirectly in India free of charge or at a lower cost, then the goods can’t be regarded as identical or similar goods.

SIMILAR GOODS Not alike in appearance Produced in the country in which imported goods were imported Produced by the same person who produced imported goods (if not by the same person then produced by different person) Goods for which design work undertaken in India by buyer shall not be treated as identical goods

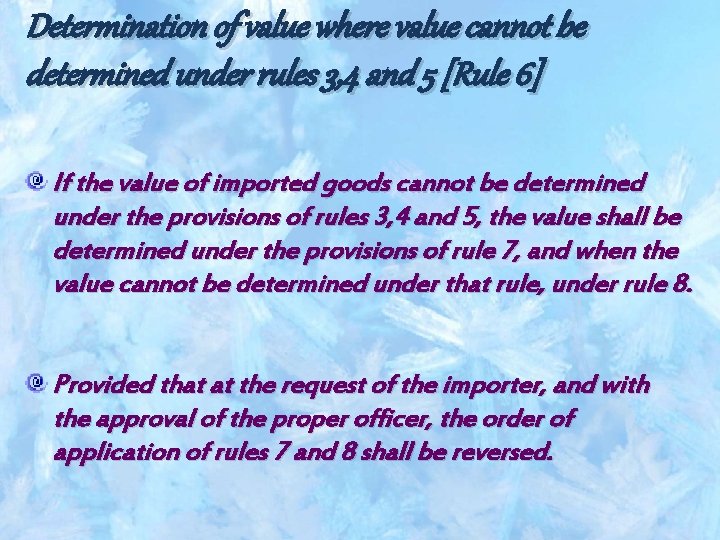

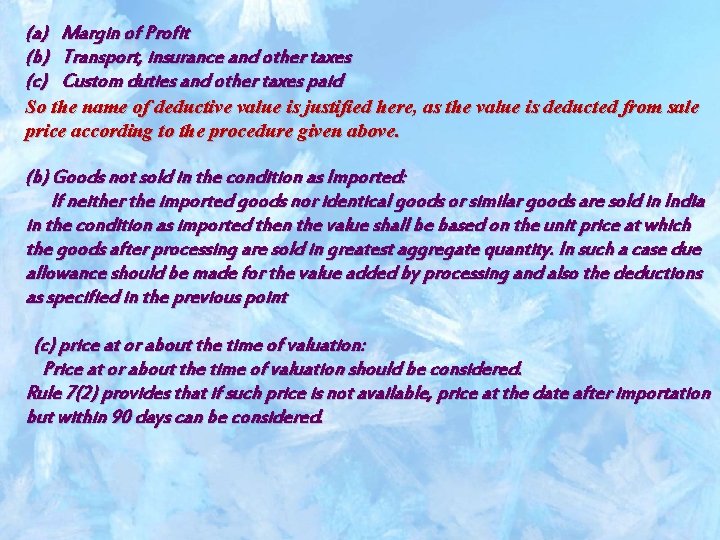

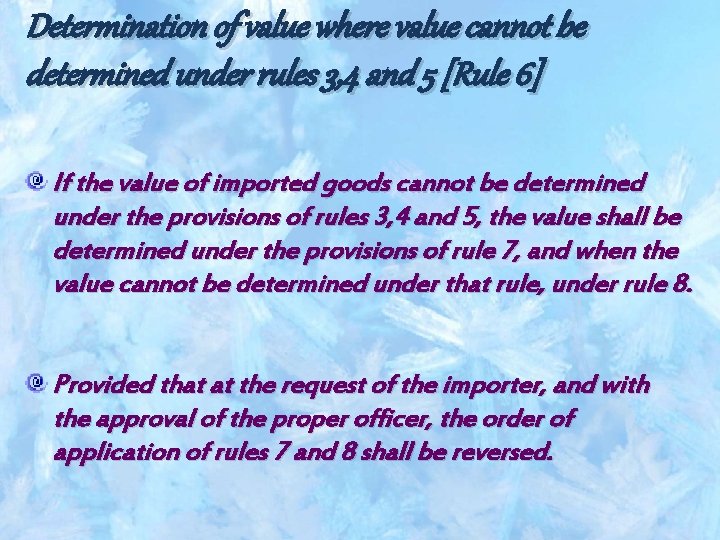

Determination of value where value cannot be determined under rules 3, 4 and 5 [Rule 6] If the value of imported goods cannot be determined under the provisions of rules 3, 4 and 5, the value shall be determined under the provisions of rule 7, and when the value cannot be determined under that rule, under rule 8. Provided that at the request of the importer, and with the approval of the proper officer, the order of application of rules 7 and 8 shall be reversed.

![Deductive Value Rule 7 Rule 7 of Custom Valuation Rules provides that if the Deductive Value [Rule 7] Rule 7 of Custom Valuation Rules provides that if the](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-17.jpg)

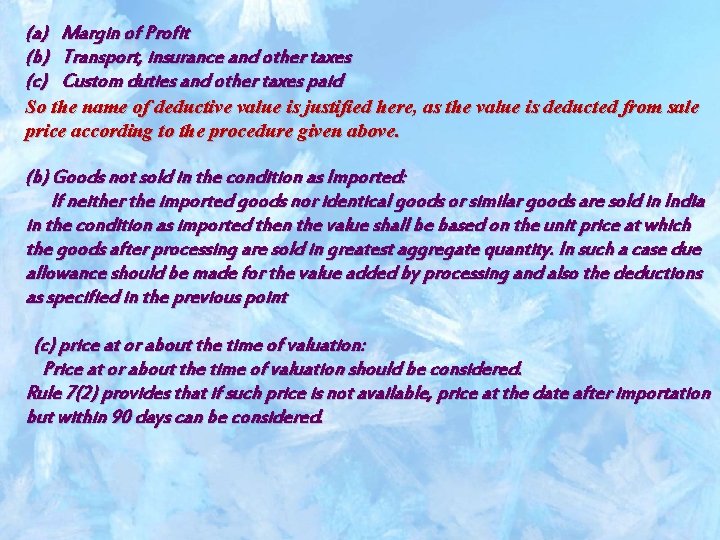

Deductive Value [Rule 7] Rule 7 of Custom Valuation Rules provides that if the goods cannot be valued according to the previous three methods, the Deductive Value method should be adopted. Following points demand consideration for valuating the goods: (a) Goods sold in the condition as imported If the goods imported are sold in the same condition in which they were imported, then the value of imported goods or identical goods or similar shall be based on the unit price at which the imported goods or identical goods or imported similar goods are sold in the greatest aggregate quantity to persons who are not related to seller in India. From the price obtained above, the following deductions shall be made:

(a) Margin of Profit (b) Transport, insurance and other taxes (c) Custom duties and other taxes paid So the name of deductive value is justified here, as the value is deducted from sale price according to the procedure given above. (b) Goods not sold in the condition as Imported: If neither the imported goods nor identical goods or similar goods are sold in India in the condition as imported then the value shall be based on the unit price at which the goods after processing are sold in greatest aggregate quantity. In such a case due allowance should be made for the value added by processing and also the deductions as specified in the previous point (c) price at or about the time of valuation: Price at or about the time of valuation should be considered. Rule 7(2) provides that if such price is not available, price at the date after importation but within 90 days can be considered.

![Computed Value Rule 8 This is the fifth method of valuation This method is Computed Value [Rule 8] This is the fifth method of valuation. This method is](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-19.jpg)

Computed Value [Rule 8] This is the fifth method of valuation. This method is the only exception to the sequential order condition. This method can be used before deductive value method if and only if he custom officer approves on the request of the assessee. Under this method the value is the sum of the following: (a) Cost of value of materials and processing charges involved in producing the imported goods. (b) amount of profit and general expenses equal to reflected in sales of goods of the same class or kind. (c) the cast and value of all other expenses under Rule 10 i. e. transport, insurance, loading and handling charges. Computed value= (a)+(b)+(c) Cost of commission and brokerage and packing cost has to be added. Similarly development cost, engineering cost, tooling costs etc. has to be added to the above three elements (a), (b) and (c) of cost.

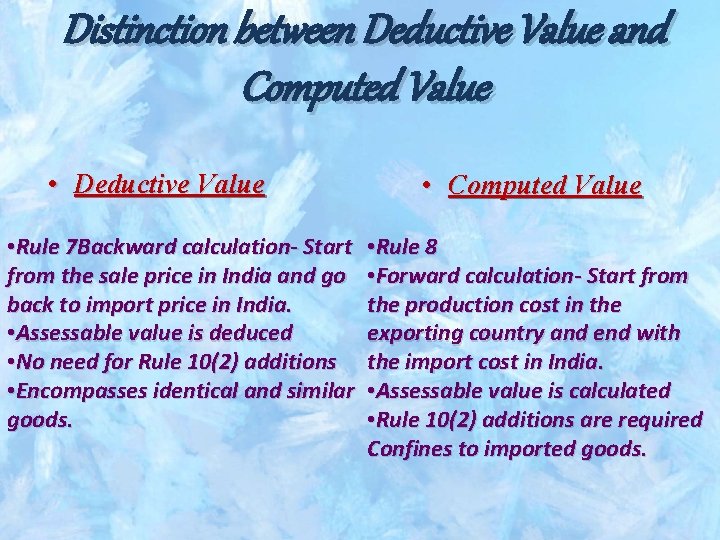

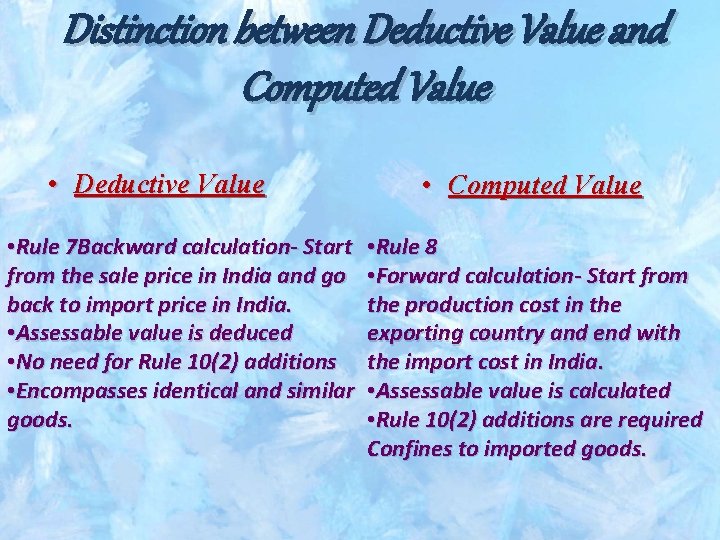

Distinction between Deductive Value and Computed Value • Deductive Value • Rule 7 Backward calculation- Start from the sale price in India and go back to import price in India. • Assessable value is deduced • No need for Rule 10(2) additions • Encompasses identical and similar goods. • Computed Value • Rule 8 • Forward calculation- Start from the production cost in the exporting country and end with the import cost in India. • Assessable value is calculated • Rule 10(2) additions are required Confines to imported goods.

![Residual Method Rule 9 This is the sixth and the last method of valuation Residual Method [Rule 9] This is the sixth and the last method of valuation.](https://slidetodoc.com/presentation_image_h/f6338832c72e08e11f730798f19322f3/image-21.jpg)

Residual Method [Rule 9] This is the sixth and the last method of valuation. Where the value of imported goods cannot be determined under any of the provisions of the preceding rules, the value shall be determined using reasonable means consistent with the provision of previous rules and Section 14(1). This method is also compared to “Best Judgment Method” of Central Excise and Income Tax Act. Three basic conditions, features for the application of this Rule are: (a) It was not possible to determine the value under any of the preceding rules. (b) The proper officer should be satisfied with the conditions. (c) The value is then determined according to best judgment and means consistent with the principles and general rules of these Rules.

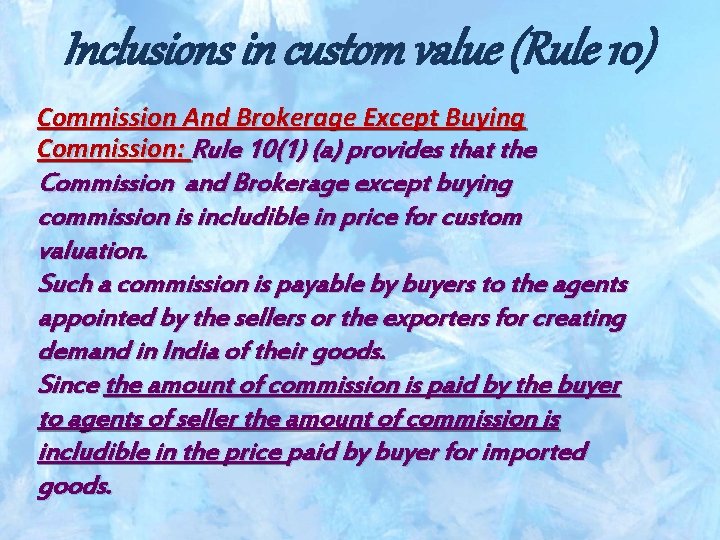

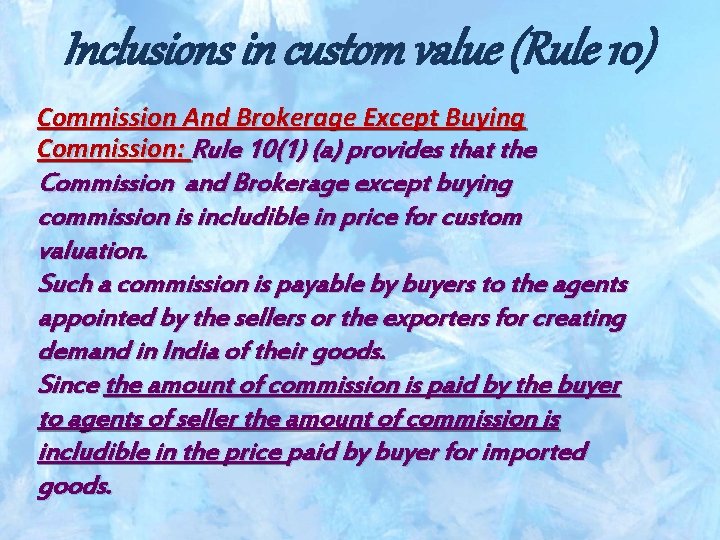

Inclusions in custom value (Rule 10) Commission And Brokerage Except Buying Commission: Rule 10(1) (a) provides that the Commission and Brokerage except buying commission is includible in price for custom valuation. Such a commission is payable by buyers to the agents appointed by the sellers or the exporters for creating demand in India of their goods. Since the amount of commission is paid by the buyer to agents of seller the amount of commission is includible in the price paid by buyer for imported goods.

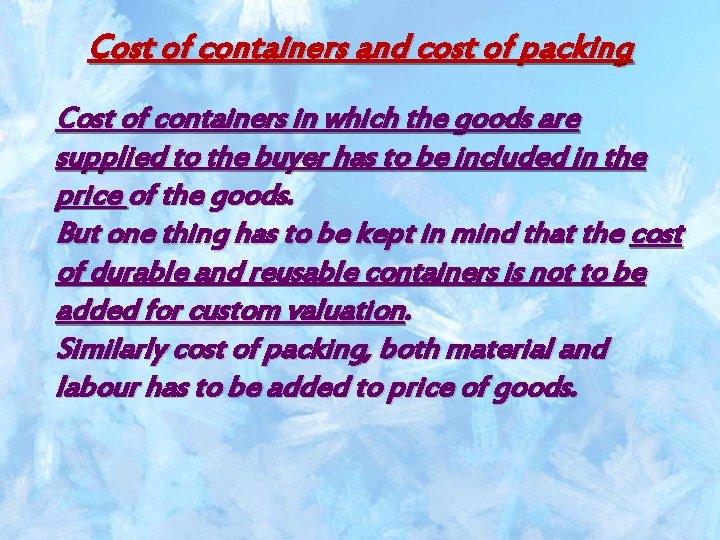

Cost of containers and cost of packing Cost of containers in which the goods are supplied to the buyer has to be included in the price of the goods. But one thing has to be kept in mind that the cost of durable and reusable containers is not to be added for custom valuation. Similarly cost of packing, both material and labour has to be added to price of goods.

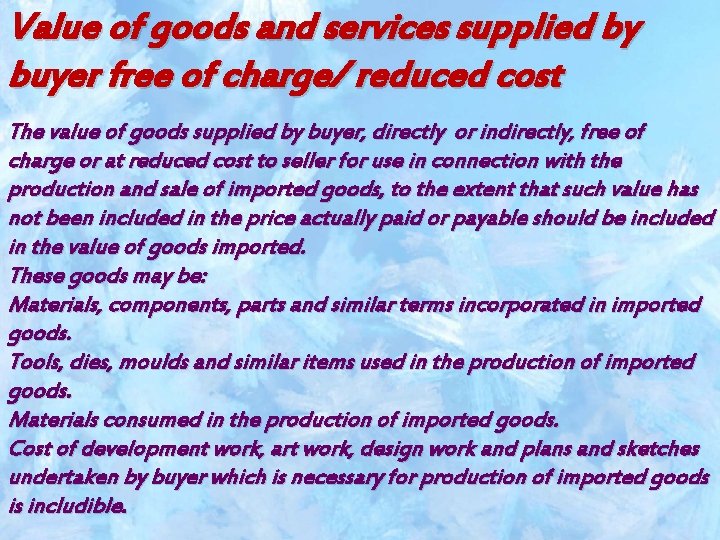

Value of goods and services supplied by buyer free of charge/ reduced cost The value of goods supplied by buyer, directly or indirectly, free of charge or at reduced cost to seller for use in connection with the production and sale of imported goods, to the extent that such value has not been included in the price actually paid or payable should be included in the value of goods imported. These goods may be: Materials, components, parts and similar terms incorporated in imported goods. Tools, dies, moulds and similar items used in the production of imported goods. Materials consumed in the production of imported goods. Cost of development work, art work, design work and plans and sketches undertaken by buyer which is necessary for production of imported goods is includible.

Royalties and licensee fee Buyer may be required to pay the royalty and licence fee to the seller, such expenses shall be added to transaction value provided these are not already included. Proceeds of subsequent resale If the proceeds of subsequent sale or the part of the proceeds is paid directly or indirectly to the seller then it is included in the assessable value of the imported goods. For example: Mr. A imports goods worth Rs. 10, 000. on selling these goods for Rs. 20, 000/- in India he pays Rs. 1, 500 to an employee of the exporter. In this case there is an indirect accrual of part of proceeds to the seller. Because such payment if not made by buyer would have been made by seller. So Rs. 1, 500 is includible.

Other payments made to exporter If the buyer has made any payment to the exporter/seller or to the third party on behalf of the seller, such payment should be included. This is because the buyer is again meeting an obligation of seller which otherwise is the liability of the seller. Cost of transport to the place of importation The cost of transport from the country of exportation to the place of importation should be included as per rules. Landing charges/ loading and unloading charges All the costs related with unloading or landing of imported goods shall be included in value of goods as per rules. Insurance cost on goods imported shall be included. If such cost is not ascertainable then such cost shall be 1. 125% of FOB value of goods. Insurance up to the place of importation are includible.

Exclusions from custom value Commission, General Expenses And Profit The commission paid or payable for sales affected in India should be reduced from the invoice value to arrive at customs value. Since such customs relate to the period after import. Similarly general expenses related to imported goods after their importation should be reduced from the invoice value. To arrive at the custom value the profit element will be reduced from invoice value.

Cost of transport and insurance after importation does not form a part of total custom value. They are exclusively deducted from custom value. Duties and taxes in India Local taxes and duties paid or payable after import in India is not includible. Demurrage charges payable to port trust The importer due to some reasons may get delayed in clearing his goods from port authorities. For this he may has to bear demurrage charges. These demurrage is not includible because these charges relates to the period after importation.

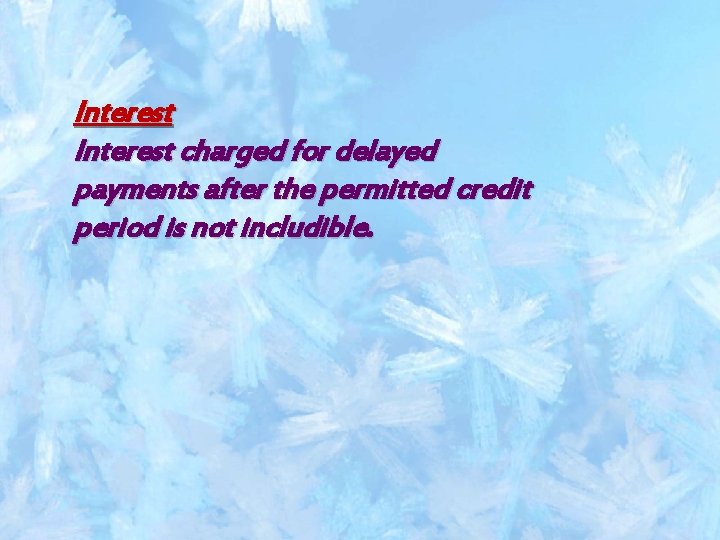

Interest charged for delayed payments after the permitted credit period is not includible.

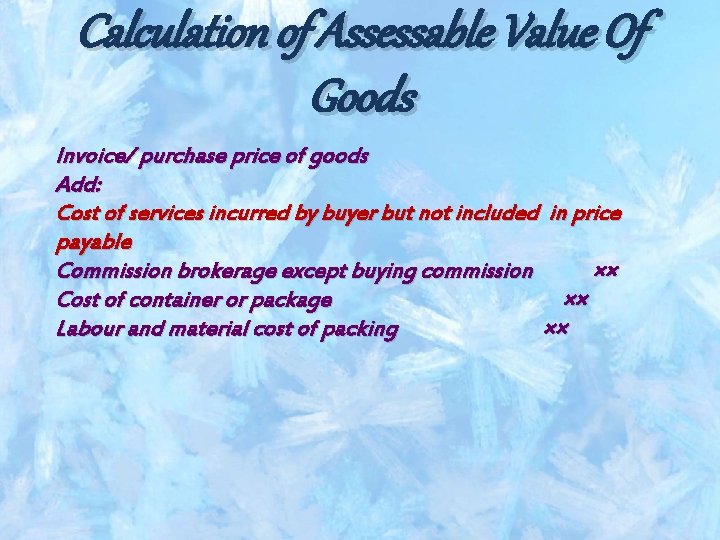

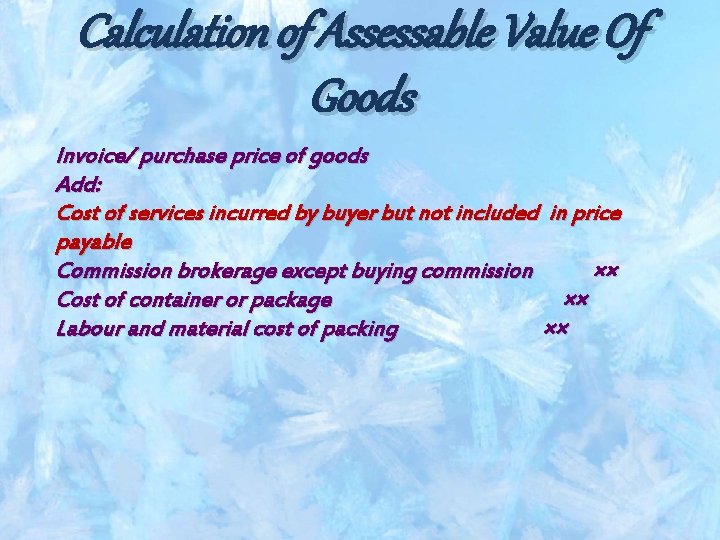

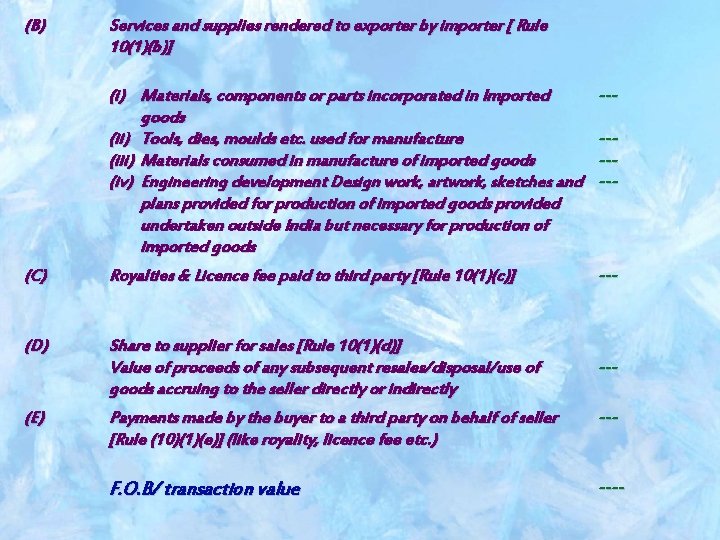

Calculation of Assessable Value Of Goods Invoice/ purchase price of goods Add: Cost of services incurred by buyer but not included in price payable Commission brokerage except buying commission ×× Cost of container or package ×× Labour and material cost of packing ××

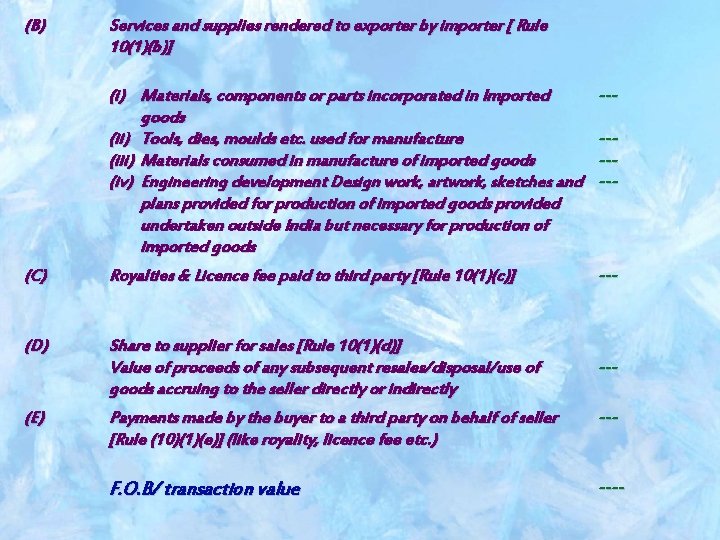

(B) (C) (D) (E) Services and supplies rendered to exporter by importer [ Rule 10(1)(b)] (i) Materials, components or parts incorporated in Imported goods (ii) Tools, dies, moulds etc. used for manufacture (iii) Materials consumed in manufacture of imported goods (iv) Engineering development Design work, artwork, sketches and plans provided for production of imported goods provided undertaken outside India but necessary for production of imported goods Royalties & Licence fee paid to third party [Rule 10(1)(c)] Share to supplier for sales [Rule 10(1)(d)] Value of proceeds of any subsequent resales/disposal/use of goods accruing to the seller directly or indirectly Payments made by the buyer to a third party on behalf of seller [Rule (10)(1)(e)] (like royality, licence fee etc. ) F. O. B/ transaction value ----- ----

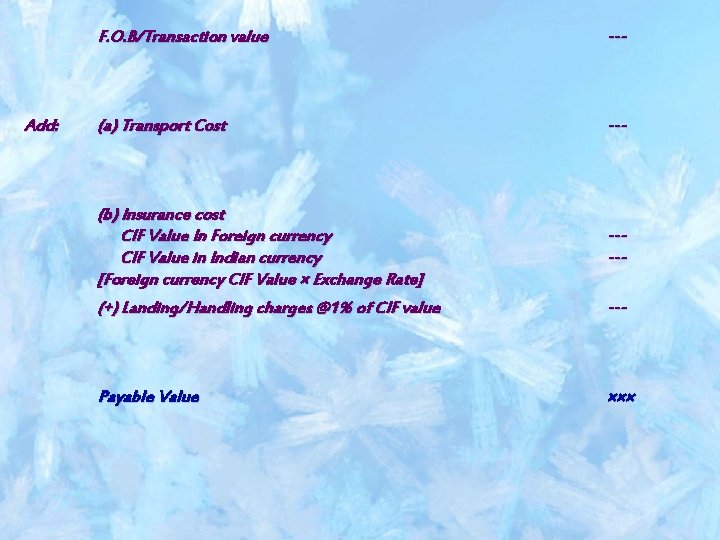

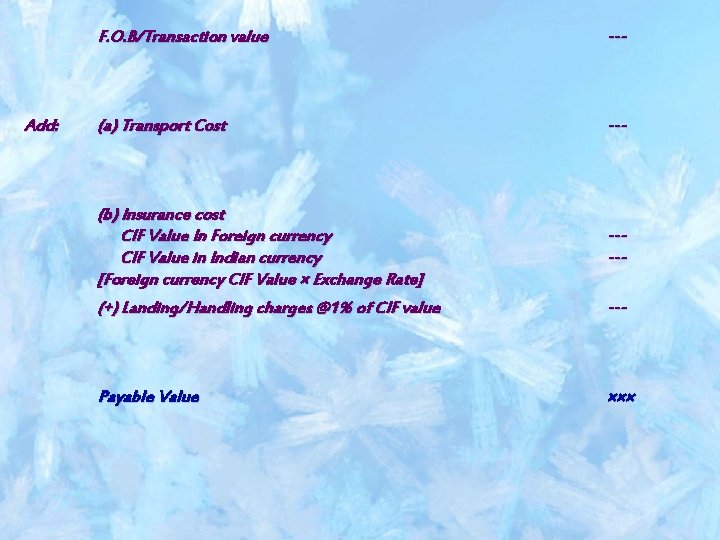

Add: F. O. B/Transaction value --- (a) Transport Cost --- (b) Insurance cost CIF Value In Foreign currency CIF Value in Indian currency [Foreign currency CIF Value × Exchange Rate] (+) Landing/Handling charges @1% of CIF value Payable Value ------- ×××

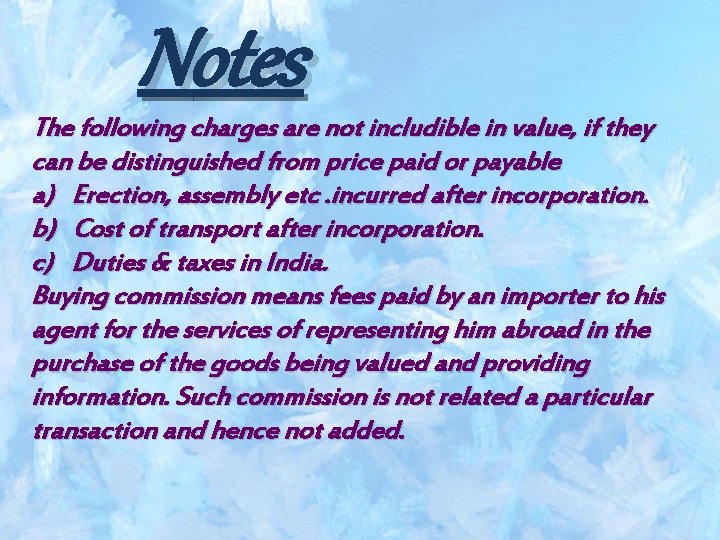

Notes The following charges are not includible in value, if they can be distinguished from price paid or payable a) Erection, assembly etc. incurred after incorporation. b) Cost of transport after incorporation. c) Duties & taxes in India. Buying commission means fees paid by an importer to his agent for the services of representing him abroad in the purchase of the goods being valued and providing information. Such commission is not related a particular transaction and hence not added.

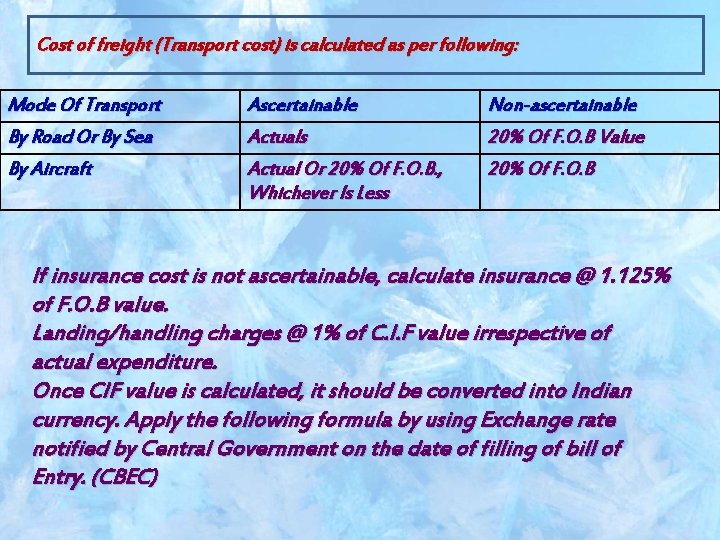

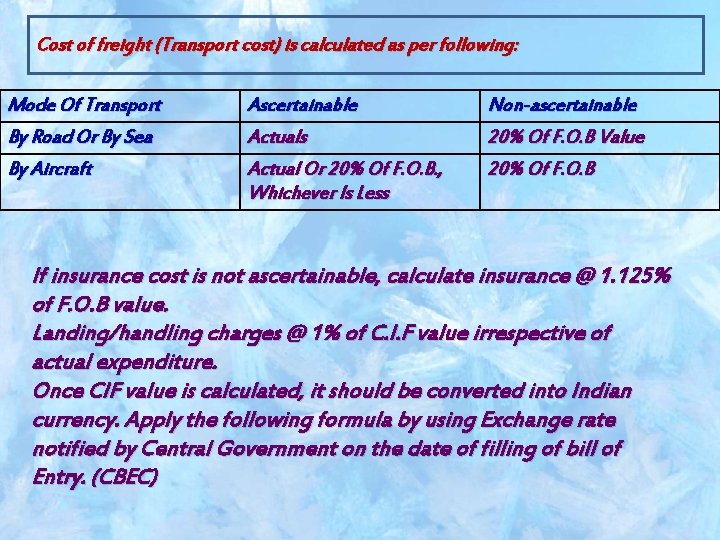

Cost of freight (Transport cost) is calculated as per following: Mode Of Transport By Road Or By Sea Ascertainable Actuals Non-ascertainable 20% Of F. O. B Value By Aircraft Actual Or 20% Of F. O. B. , Whichever Is Less 20% Of F. O. B If insurance cost is not ascertainable, calculate insurance @ 1. 125% of F. O. B value. Landing/handling charges @ 1% of C. I. F value irrespective of actual expenditure. Once CIF value is calculated, it should be converted into Indian currency. Apply the following formula by using Exchange rate notified by Central Government on the date of filling of bill of Entry. (CBEC)

Education Cess on Customs Duty: Education Cess is 2% of the aggregate duty of customs (but excluding safe guard duty. Anti-Dumping duty and Additional Custom Duty. Finance Act, 2007 provides Secondary and Higher Education Cess on imported goods @ 1% calculated likewise.

Export goods- valuation of Assessment The customs valuation (Determination of value of Export Goods) Rules 2007 provide the methods of valuation of export goods which are: Transaction Value (Rule 3) Comparative Value (Rule 4) Computed Value (Rule 5) Residual Value (Rule 6) For export goods, F. O. B Value is the basis for valuation normally. But if F. O. B Value is not available and CIF value is available then from CIF value, port exportation charges i. e. insurance and freight outward will be deducted.

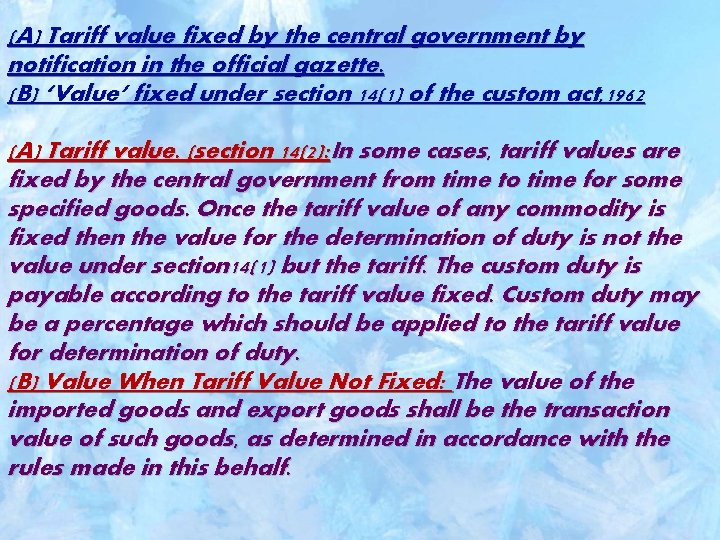

Rejection of declared value When the proper officer has reason to doubt the truth or accuracy of the value declared in relation to any imported goods, he may ask the importer of such goods to furnish further information including documents or other evidence and if, after receiving such further, or in the absence of a response of such importer/exporter, the proper officer still has reasonable doubt about the truth or accuracy of the value so declared, it shall be deemed that the transaction value of such imported goods cannot be determined. At the request of an importer/exporter, the proper officer, shall intimate the importer/exporter in writing the grounds for doubting the truth or accuracy of the value declared in relation to goods imported/exported and provide a reasonable opportunity of being heard, before taking a final decision.

Valuation of fixed income securities or valuation of bonds

Valuation of fixed income securities or valuation of bonds Newton's first law and second law and third law

Newton's first law and second law and third law Newton's first law and second law and third law

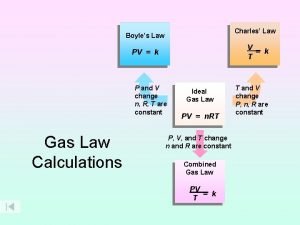

Newton's first law and second law and third law V=k/p

V=k/p Avogadro's law constant

Avogadro's law constant Introduction to valuation the time value of money

Introduction to valuation the time value of money Introduction to valuation

Introduction to valuation Contractors method of valuation

Contractors method of valuation Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Frameset trong html5

Frameset trong html5 Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Chó sói

Chó sói Chụp phim tư thế worms-breton

Chụp phim tư thế worms-breton Chúa sống lại

Chúa sống lại Các môn thể thao bắt đầu bằng tiếng chạy

Các môn thể thao bắt đầu bằng tiếng chạy Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

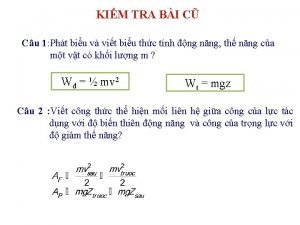

Các châu lục và đại dương trên thế giới Công thức tiính động năng

Công thức tiính động năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Mật thư tọa độ 5x5

Mật thư tọa độ 5x5 Làm thế nào để 102-1=99

Làm thế nào để 102-1=99 Phản ứng thế ankan

Phản ứng thế ankan Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Một số thể thơ truyền thống

Một số thể thơ truyền thống Cái miệng bé xinh thế chỉ nói điều hay thôi

Cái miệng bé xinh thế chỉ nói điều hay thôi Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Biện pháp chống mỏi cơ

Biện pháp chống mỏi cơ đặc điểm cơ thể của người tối cổ

đặc điểm cơ thể của người tối cổ Thế nào là giọng cùng tên

Thế nào là giọng cùng tên Vẽ hình chiếu đứng bằng cạnh của vật thể

Vẽ hình chiếu đứng bằng cạnh của vật thể Fecboak

Fecboak Thẻ vin

Thẻ vin đại từ thay thế

đại từ thay thế điện thế nghỉ

điện thế nghỉ Tư thế ngồi viết

Tư thế ngồi viết