Introduction to Valuation Stock Valuation Financial Management P

- Slides: 27

Introduction to Valuation Stock Valuation Financial Management P. V. Viswanath For a First course in Finance

Absolute and Relative Pricing w In economics, we tend to price goods and assets by considering the factors affecting the supply and demand for them. w The number of goods and assets are very many. Each of them is different in some way or another from the other. w Computing the price of one good does not allow us to price another good, except to the extent that other goods are substitutes or complements for the first good. w In finance, the number of assets can be reasonably characterized in terms of a smaller number of basic characteristics. w Hence most assets can, to a first approximation be priced by considering them as combinations of more fundamental assets. P. V. Viswanath 2

Relative pricing of financial assets w Consider first riskless financial assets, i. e, assets that are claims on riskless cashflows over time. w Consider a fundamental asset, i, defined by a claim to $1 at time t = i. w There can be T such fundamental assets, corresponding to the t = 1, . . , T time units. w Then, any arbitrary riskless financial asset that is a claim to $ci at time i, i = 1, . . , T can be considered a portfolio of these T fundamental assets. w Hence, the price, P* of any such asset is related to the prices of these first T fundamental assets, Pi, i = 1, …, T. w In fact, the price of this asset would simply be P. V. Viswanath 3

Relative pricing of risky financial assets w What about risky financial assets? w We can equivalently imagine, for every level of risk, a set of T fundamental risky assets. Then, for any arbitrary risky asset of this level of risk, we can equivalently write: w Of course, this is not entirely satisfactory, because we’d have Tx. M fundamental assets corresponding to each of M levels of risk. We will come back to this when we talk about the CAPM. w In any case, we need to examine how this pricing is established in the market-place. P. V. Viswanath 4

Arbitrage and the Law of One Price w Law of One Price: In a competitive market, if two assets generate the same cash (utility) flows, they will be priced the same. w How is this enforced? w If the law is violated – if asset 1 sells for more than asset 2, then investors can make a riskless profit by buying asset 2 and selling it as asset 1! w In practice – we need to take transactions costs into account. w Also, it may be difficult to execute the two transactions at the same time – prices might change in that interval – this introduces some risk. P. V. Viswanath 5

Exchange Rates and Triangular Arbitrage w Consider the exchange rates reigning at closing on January 30. n n n The yen/euro rate was 157. 87 yen per euro The euro/$ rate was $1. 4835 per euro. The yen/$ rate was 106. 4 yen per dollar. w If we start with a dollar, we can buy 106. 4 yen; these can then be used to buy 106. 4/157. 87 or 0. 674 euros, which can, in turn, be used to acquire $0. 9998, which is very close to a dollar. P. V. Viswanath 6

Triangular Currency Arbitrage w Suppose the euro/$ rate had been $1. 50 per euro. w Then, it would have been possible to start with one dollar, acquire 0. 674 euros, as above, and then get (0. 674)(1. 5) or $1. 011, or a gain of 1. 1% on the initial investment of a dollar. w This would imply that the dollar was too cheap, relative to the euro and the yen. w Many traders would attempt to perform the arbitrage discussed above, leading to excess supply of dollars and excess demand for the other currencies. w The net result would be a drop a rise in the price of the dollar vis-à-vis the other currencies, so that the arbitrage trades would no longer be profitable. P. V. Viswanath 7

Risk Arbitrage w In this case, trading will continue until there are no more riskfree profit opportunities. w Thus, arbitrage can ensure that the sorts of pricing relationships referred to above can be supported in the marketplace, viz: w What if there are still opportunities that will, on average, lead to profit, but the investors intending to benefit from this profit will have to take on some risk? w Presumably investors will trade off the risk against the expected profit so that there will be few of these expected profit opportunities, as well; this brings us to the notion of the informational efficiency of financial markets. P. V. Viswanath 8

Efficient Markets Hypothesis – EMH w An asset’s current price reflects all available information– this is the EMH. w If it didn’t, there would be an incentive for investors to act on that information. w Suppose, for example, that investors noticed that good news led to stock prices rising slowly over two consecutive days. w This would mean that at the end of the first day, the good news was not all incorporated in the stock price. P. V. Viswanath 9

Efficient Markets Hypothesis w In this situation, it would be optimal for traders to buy even more of a stock that was noted to be rising on a given day, since the stock would rise more the next day, giving the trader an unusually good chance of making money on the trade. w But if many traders pursue this strategy, the stock price would rise on the first day, itself, and the informational inefficiency would be eliminated. w Empirically, financial markets seem to be reasonably close to being efficient. w This allows us to price financial assets with respect to fundamentals without worrying about deviations from these fundamental prices. P. V. Viswanath 10

Stock Price Fundamentals w What determines the price of a stock? Or, in other words, why would an investor hold stocks? w The answer is that s/he expects to receive dividends and hopefully benefit from a price increase, as well. w In other words, P 0 = PV(D 1) + PV(P 1) , where P 0 is the price today and P 1 is the price tomorrow. w However what determines P 1? w Again, using the previous logic, we must say that it’s the expectation of a dividend in period 2 and hopefully a further price rise. Continuing, in this vein, we see that the stock price must be the sum of the present values of all future dividends. P. V. Viswanath 11

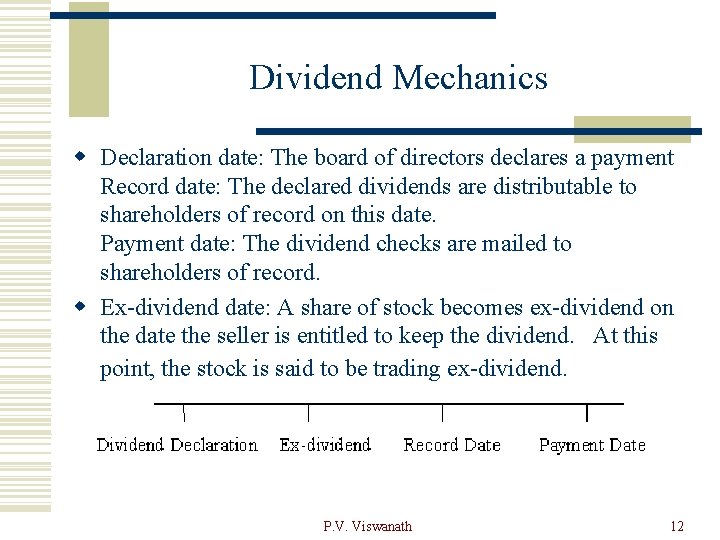

Dividend Mechanics w Declaration date: The board of directors declares a payment Record date: The declared dividends are distributable to shareholders of record on this date. Payment date: The dividend checks are mailed to shareholders of record. w Ex-dividend date: A share of stock becomes ex-dividend on the date the seller is entitled to keep the dividend. At this point, the stock is said to be trading ex-dividend. P. V. Viswanath 12

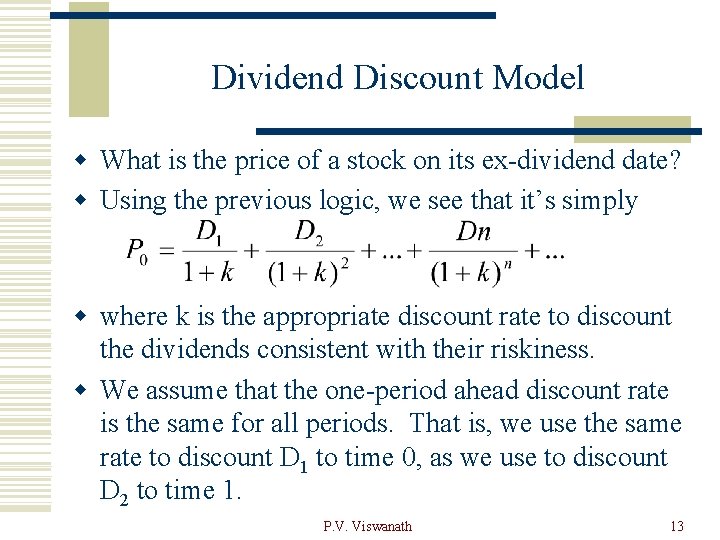

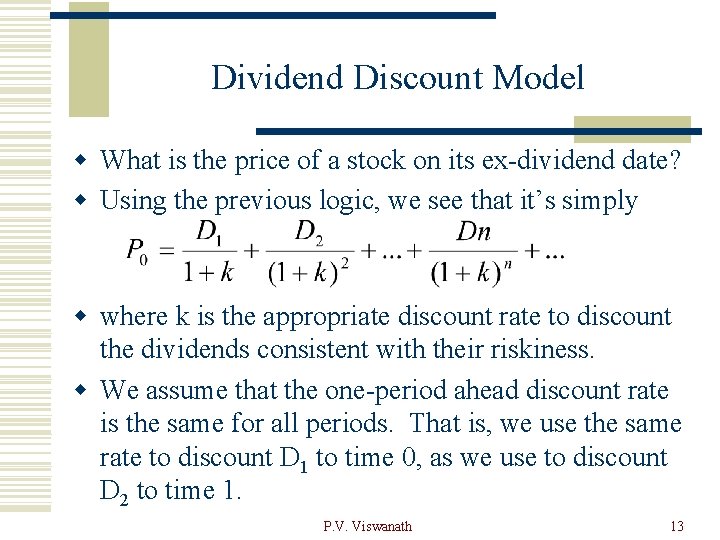

Dividend Discount Model w What is the price of a stock on its ex-dividend date? w Using the previous logic, we see that it’s simply w where k is the appropriate discount rate to discount the dividends consistent with their riskiness. w We assume that the one-period ahead discount rate is the same for all periods. That is, we use the same rate to discount D 1 to time 0, as we use to discount D 2 to time 1. P. V. Viswanath 13

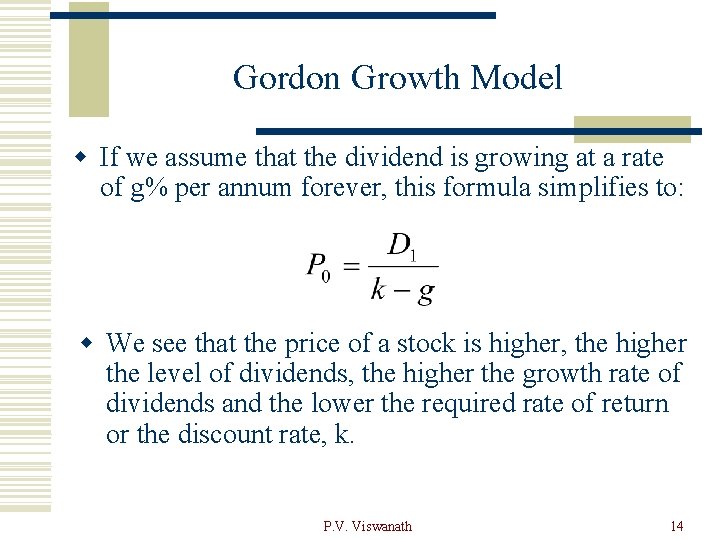

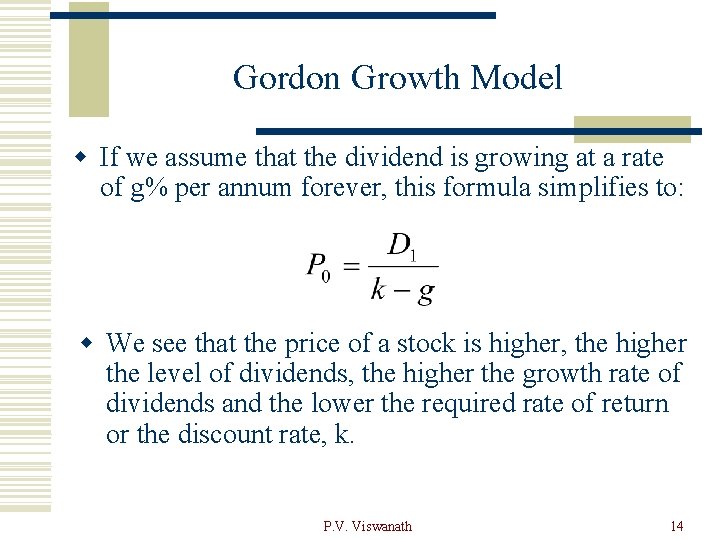

Gordon Growth Model w If we assume that the dividend is growing at a rate of g% per annum forever, this formula simplifies to: w We see that the price of a stock is higher, the higher the level of dividends, the higher the growth rate of dividends and the lower the required rate of return or the discount rate, k. P. V. Viswanath 14

Earnings and Investment Opportunities w Dividends = Earnings – Net New Investment w Hence a firm’s stock price cannot be the present value of discounted earnings! n Unless the firm needs no new investment to maintain its earnings. w What determines the price of the stock of a company that reinvests part of its earnings? P. V. Viswanath 15

Reinvestment and Stock Price w Suppose a firm starts out with a certain stock of investment capital at the beginning of period 1 (end of period 0). w Assume that it earns a return, ROE, on this capital, so as to assure it of earnings of $E 1 each period forever. w Assume, furthermore, that this firm pays out all of these earnings as dividends, each period. w Then, its stock price today, P 0 will be equal to E 1/k. P. V. Viswanath 16

Reinvestment and Stock Price w Now assume, in addition to its existing investments, that the firm expects to have at t=1, an investment opportunity with a t=1 value of $M 1 (that is, this is the present value at t=1 of all the future cashflows that will be generated by this investment opportunity. w Implementation of this idea requires additional capital of DI 1, which the firm raises from the marketplace. w If the capital market is efficient, the firm will have to pay for this additional capital with promises of future cashflows with a present value equal to the amount of additional capital raised. P. V. Viswanath 17

Reinvestment and Stock Price w Hence the t=1 value that will accrue to the firm’s shareholders is only M 1 - DI 1. w Denote by NPV 1, the t=0 value of M 1 - DI 1. That is, NPV 1= (M 1 - DI 1)/(1+k). w Taking this additional investment opportunity into account, the firm’s stock price will not just be E 1/k, but E 1/k + NPV 1. w Similarly, let NPVi represent the t=0 value of investment opportunities that the firm expects to have a time t=i, for each future time period. w Proceeding thus, we see that P 0 = E 1/k + NPVGO, where NPVGO = S NPVi for all i = 2, … P. V. Viswanath 18

Reinvestment and Stock Price w Upto this point, we have assumed that the firm has raised this additional capital from other investors in the market place. w Suppose, however, that the firm raises the additional capital in period 1 from its own shareholders, by reducing the amount of dividends that it pays. That is, D 1 = E 1 – DI 1. w This reduction in dividends will cause the stock price to drop by an amount equal to the present value of DI 1. However, the firm will no longer have to pay the outside investors future compensation for the contribution of the additional capital, DI 1. w These two quantities will cancel each other out. We, see, therefore, that P 0 = E 1/k + NPVGO. P. V. Viswanath 19

Fundamental Determinant of Growth Rate w What are the determinants of growth in a firm’s earnings? w Earnings in any period depends on the investment base, as well as the rate of return that the firm earns on that investment base: w Et+1 = (It)ROE w = (It-1 + DIt)(ROE), where DIt is the increment in investment in period t over and above that in period t-1. w = (It-1)ROE + (DIt)(ROE) w = Et + (DIt)(ROE); w Hence Et+1 - Et = (DIt)(ROE) w Dividing both sides by Et , we get gt = (Retention Ratio)(ROE), assuming that the additional investment is made possible by retaining part of the firm’s earnings. P. V. Viswanath 20

Reinvestment and Stock Price w We see from the previous demonstration that retention of earnings by a firm for reinvestment will not increase in a higher stock price if that additional investment has a zero NPV w That is, if it earns a return no greater than the rate of return required by the market on financial investments of similar risk, already available to investors in the marketplace. w We see, furthermore, that it is not the firm’s dividend policy that causes the firm’s stock price to be higher, but rather the availability of positive NPV investment opportunities. w This can be seen clearly in the following example. P. V. Viswanath 21

Example of Dividend Irrelevance w Stellar, Inc. has decided to invest $10 m. in a new project with a NPV of $20 m. , but it has not made an announcement. w The company has $10 m. in cash to finance the new project. w Stellar has 10 m. shares of stock outstanding, selling for $24 each, and no debt. w Hence, its aggregate value is $240 m. prior to the announcement ($24 per share). P. V. Viswanath 22

Example of Dividend Irrelevance Two alternatives: One, pay no dividend and finance the project with cash. The value of each share rises to $26 following the announcement. Each shareholder can sell 0. 0385 (= 1/26) shares to obtain a $1 dividend, leaving him with. 9615 shares value at $25 (26 x 0. 9615). Hence the shareholder has one share worth $26, or one share worth $25 plus $1 in cash. P. V. Viswanath 23

Example of Dividend Irrelevance Two, pay a dividend of $1 per share, sell $10 m. worth of new shares to finance the project. w After the company announces the new project and pays the $1 dividend, each share will be worth $25. w To raise the $10 m. needed for the project, the company must sell 400, 000 (=10, 000/25) shares. Immediately following the share issue, Stellar will have 10, 400, 000 shares trading for $25 each, giving the company an aggregate value of 25 x 10, 400, 000 = $260 m. w If a shareholder does not want the $1 dividend, he can buy 0. 04 shares (1/25). w Hence, the shareholder has one share worth $25 and $1 in dividends, or 1. 04 shares worth $26 in total. P. V. Viswanath 24

Assumptions for Dividend Irrelevance 1. The issue of new stock (to replace excess dividends) is costless and can, therefore, cover the shortfall caused by paying excess dividends. 2. Firms that face a cash shortfall do not respond by cutting back on projects and thereby affect future operating cash flows. 3. Stockholders are indifferent between receiving dividends and price appreciation. 4. Any cash remaining in the firm is invested in projects that have zero net present value. (such as financial investments) rather than used to take on poor projects. P. V. Viswanath 25

Implications of Dividend Irrelevance w A firm cannot resurrect its image with stockholders by offering higher dividends when its true prospects are bad. w The price of a company's stock will not be affected by its dividend policy, all other things being the same. (Of course, the price will fall on the exdividend date. ) P. V. Viswanath 26

Dividends in the Real World w In practice, dividends are taxed higher than capital gains. Hence investors may prefer that the firm retain funds for new investment rather than raise it from the financial marketplace. w On the other hand, managers have to justify the need for additional funds in order to get them from investors. This ensures a greater check on managers. Hence, the marketplace might prefer that managers raise funds externally. w In practice, firms have to take both factors into account and craft the best dividend policy. P. V. Viswanath 27

Fixed income securities

Fixed income securities Company analysis and stock valuation

Company analysis and stock valuation Avco method of stock valuation

Avco method of stock valuation Company analysis stock valuation

Company analysis stock valuation Characteristics of stock valuation

Characteristics of stock valuation Inventory grade 12 accounting

Inventory grade 12 accounting Equity markets and stock valuation

Equity markets and stock valuation Dividend growth model formula

Dividend growth model formula Preferred stock valuation

Preferred stock valuation Features of preferred stock

Features of preferred stock Apa itu stock dalam kitchen

Apa itu stock dalam kitchen Preferred stock characteristics

Preferred stock characteristics Stock final de marchandises

Stock final de marchandises What is financial risk 1

What is financial risk 1 Introduction to construction financial management

Introduction to construction financial management Introduction to financial management

Introduction to financial management Financial literacy and stock market participation

Financial literacy and stock market participation Introduction to valuation the time value of money

Introduction to valuation the time value of money Introduction to valuation

Introduction to valuation Contractors method of valuation

Contractors method of valuation Financial methods of motivation

Financial methods of motivation Ward stock management

Ward stock management Ward stock management

Ward stock management Introduction to finance

Introduction to finance Introduction of financial statement analysis

Introduction of financial statement analysis Scheduled banks vs non scheduled banks

Scheduled banks vs non scheduled banks Scientific management

Scientific management Top management middle management first line management

Top management middle management first line management