The Option Pit Method Portfolio Management Option Pit

- Slides: 38

The Option Pit Method Portfolio Management Option Pit

Portfolio Management • • • Risk Management Lesson- LTCM Diagnose Market Conditions- VIX Zones Managing position Adding positions together Learn how to find edge in the market-Gold Course

First a story on Risk Management • Risk Management is about what you don’t know • The entire financial crisis was a risk no one thought of, but there was an earlier one: LTCM • What killed them? Short option positions and trying to pick up nickels that cost 100’s of millions of dollars to billions of dollars

What Brought Them Down? • Risk Arb in the Ciena/Tellabs take over (CIEN collapsed as LTCM lost 100 s’ of millions chasing a $1 arb which was essentially selling an ATM (lots of short gamma) put in a $100 stock) • Carry trade in two different securities causing long/short misallocation (3 nd World Debt/US Treasuries on the Russian default) • Selling Premium in the SPX at 13 IV – tens of millions of dollars- Yes selling near position limit at a 13 VIX. – Data set only went back to the early 90’s

LTCM Implosion Is Instructive. • Remember according to LTCM, the risks they were taking were next to impossible to lose money on • REALLY? • If they could have held on, LTCM would have eventually made money – The key is risk management!

Vanilla Risk Brought Down LTCM • Risk Management is for what you don’t know – Retail traders experience ‘Mini-LTCM’ all of the time – You can’t win if a single loss is too big • Use the Greeks – Delta, Gamma, Theta, Vega • Profit and Loss targets to help manage risk – Set up the best risk reward scenarios you can

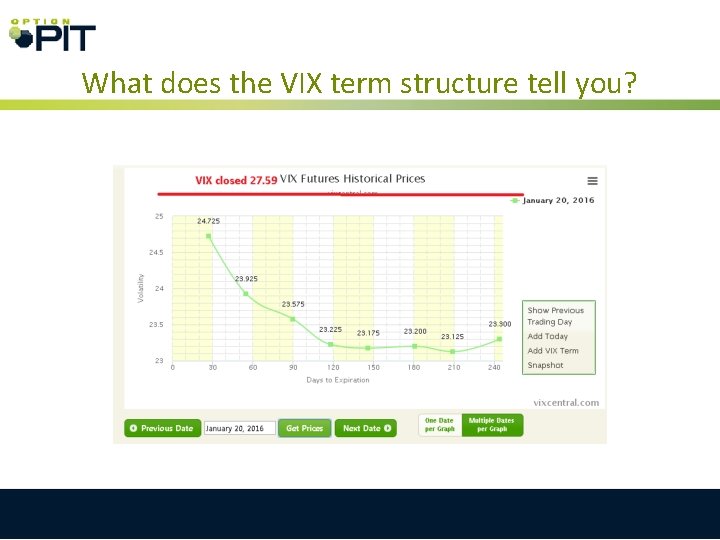

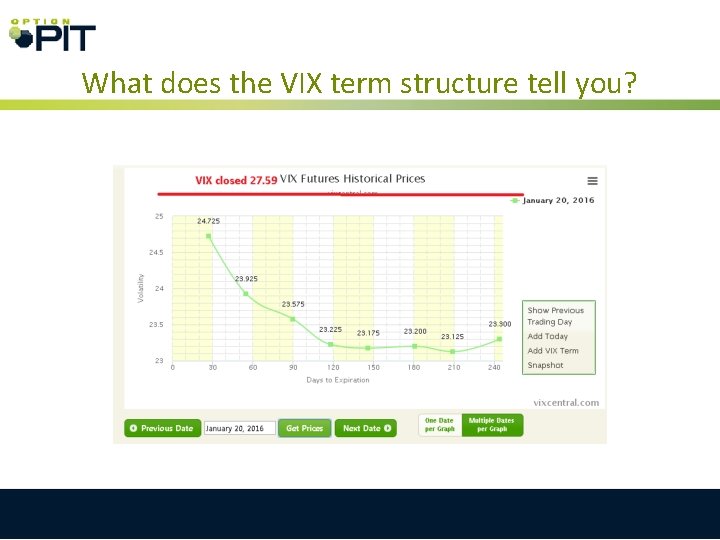

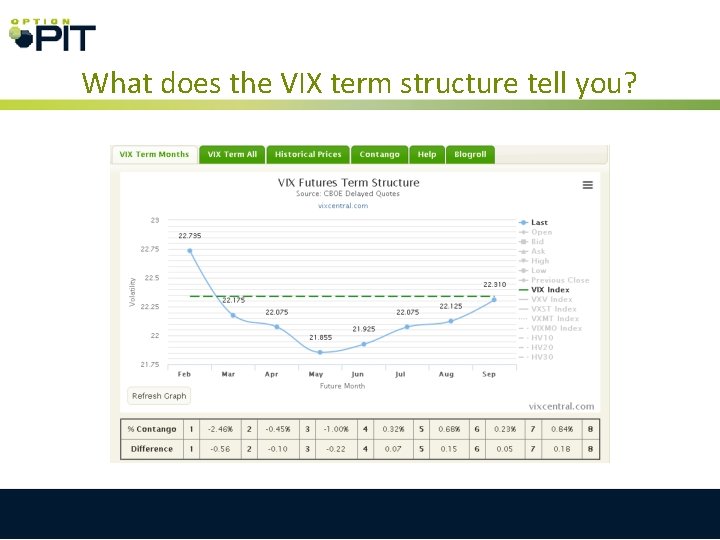

What does the VIX term structure tell you?

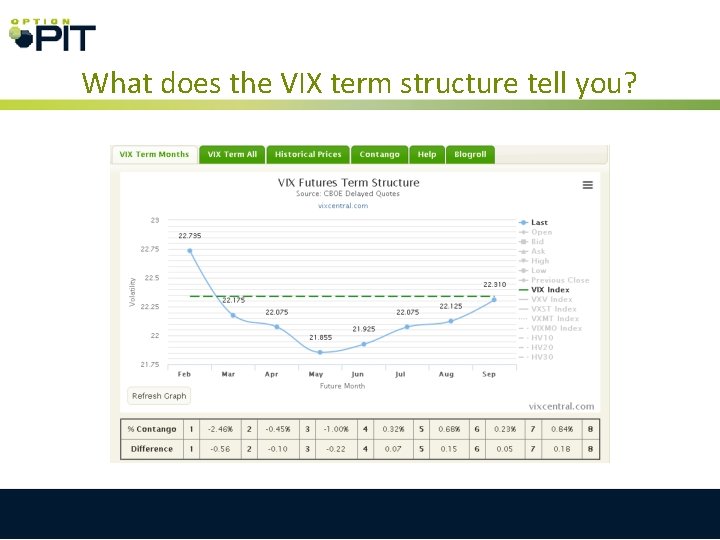

What does the VIX term structure tell you?

Volatility based Risk Management • VIX is generally pricing the expected move – Zone 1 VIX 10 -13 – Zone 2 VIX 14 -17 – Zone 3 VIX 18 -21 – Zone 4 VIX 22< and bigger The VIX is telling you what the expectation is at any point in the market cycle. Does you book of positions fit what is going on?

Volatility based risk management • Positions that work in a falling VIX are very different from ones that work in a rising VIX • The recent changes in volatility have been quite large. – What is your net Vega? • Did your positions fit what was going on? – Trouble comes from a change in VIX Zone most of the time • For an individual equity or ETF that is a change in volatility (think quartiles for volatility)

Option Prices Matter • Simply put why are things trading the way they are? Investors need to understand how to price options first. - Option Pit calls this “conditional trading” - The VIX Zone is a market condition and effect how a position will perform

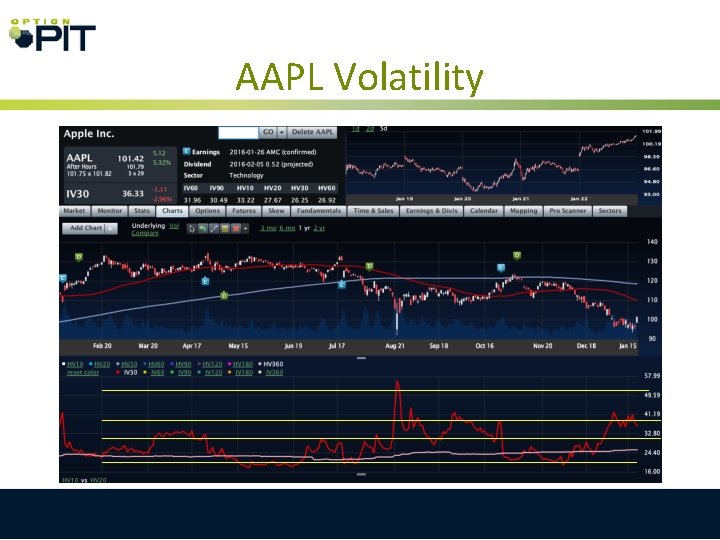

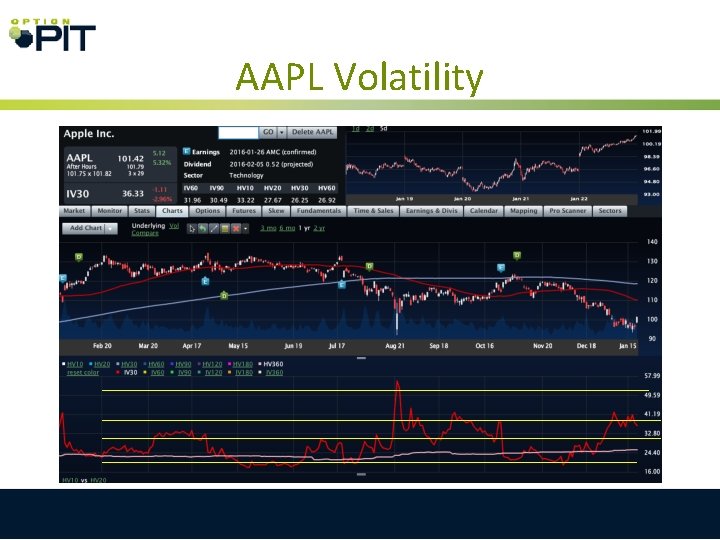

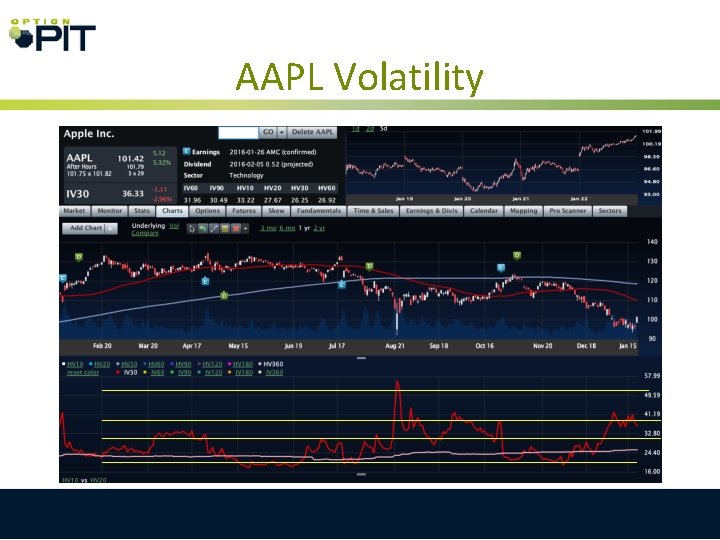

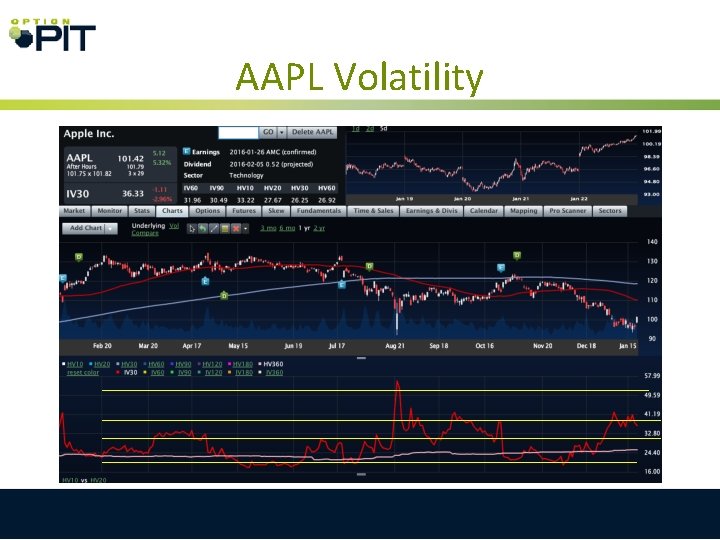

AAPL Volatility

What is “Conditional Trading” • A concept of creating options positions best suited to perform in the current and future market conditions. • Managing Risk is also part of conditional trading. The first thing to realize is putting on positions that have little chance of success is a losing battle.

AAPL Volatility

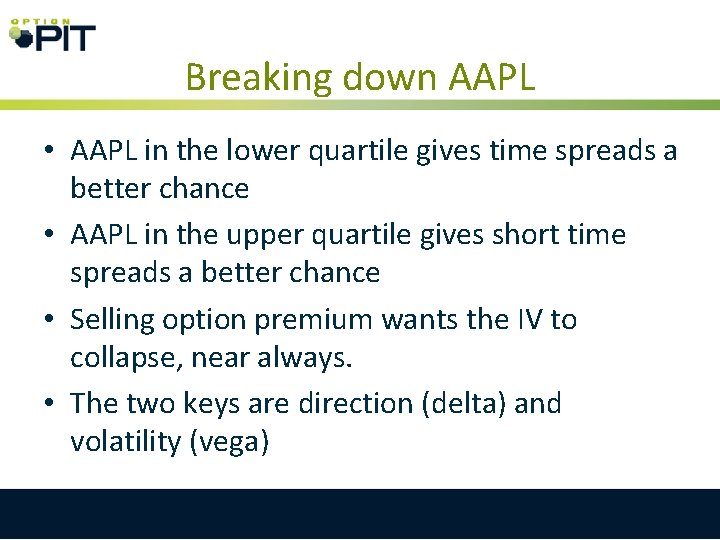

Breaking down AAPL • AAPL in the lower quartile gives time spreads a better chance • AAPL in the upper quartile gives short time spreads a better chance • Selling option premium wants the IV to collapse, near always. • The two keys are direction (delta) and volatility (vega)

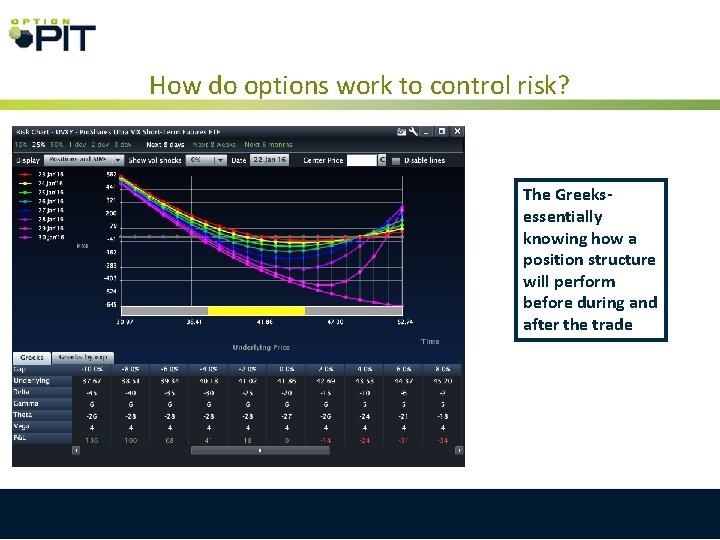

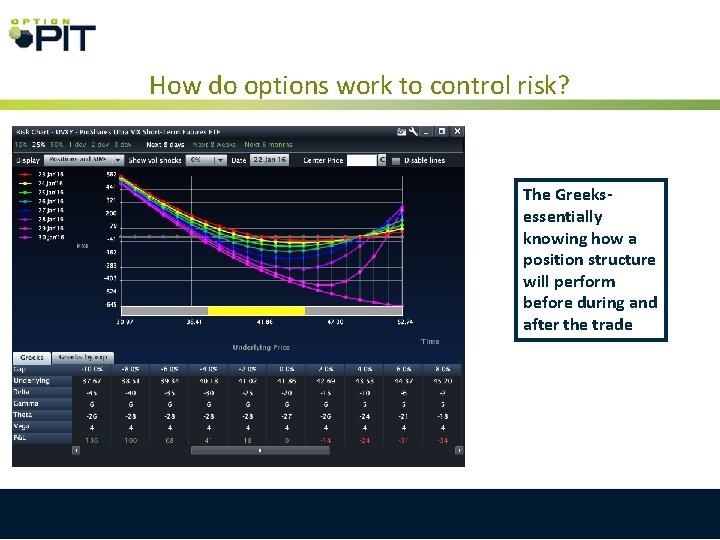

How do options work to control risk? The Greeksessentially knowing how a position structure will perform before during and after the trade

What is “Conditional Trading” • Selecting positions in terms of Greeks and Risk Management techniques – as in instead of ‘I like a stock” the trader sees the Greeks associated with the underlying at current pricing levels will help generate “edge” in a trade.

What is Portfolio Risk Management? • Finally- Creating a balanced book of option trades so if disaster falls from the sky you as an investor can respond when conditions are multiple times better to trade. – You need to have cash available – Some trades need to be “working” if other ones are not – You need to close or adjust

Beginning Risk Management Watching your trade Go downhill with no plan Is the road to ruin. However if you know your Positions changes when Something happens that Is a different story.

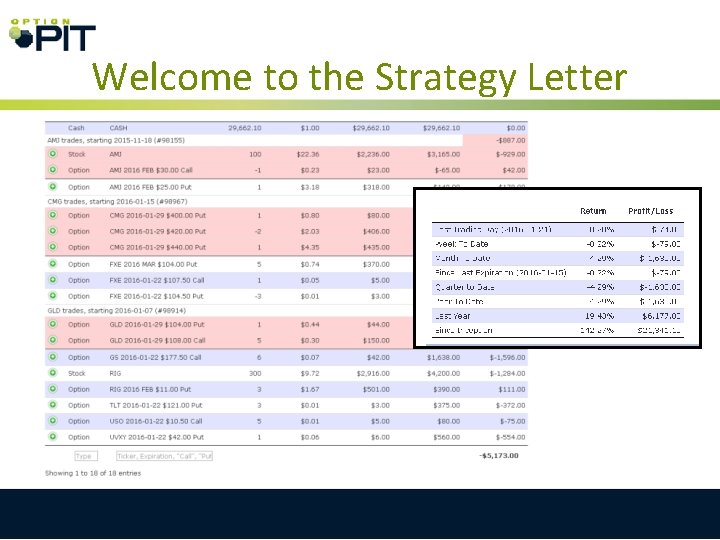

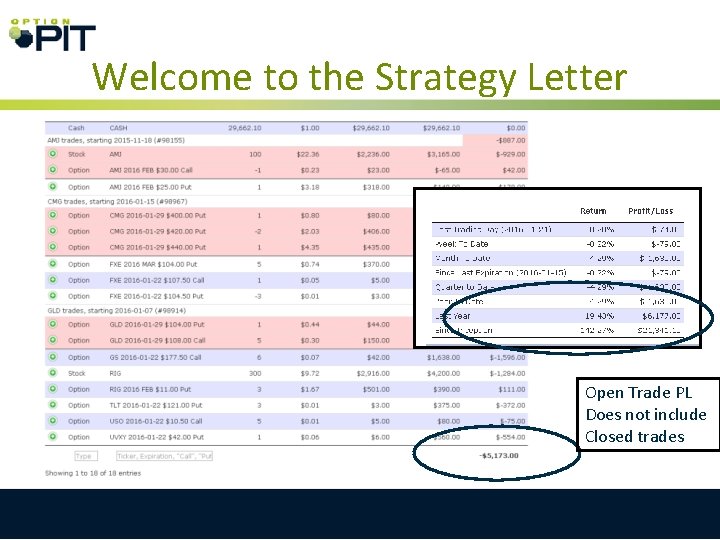

Welcome to the Strategy Letter

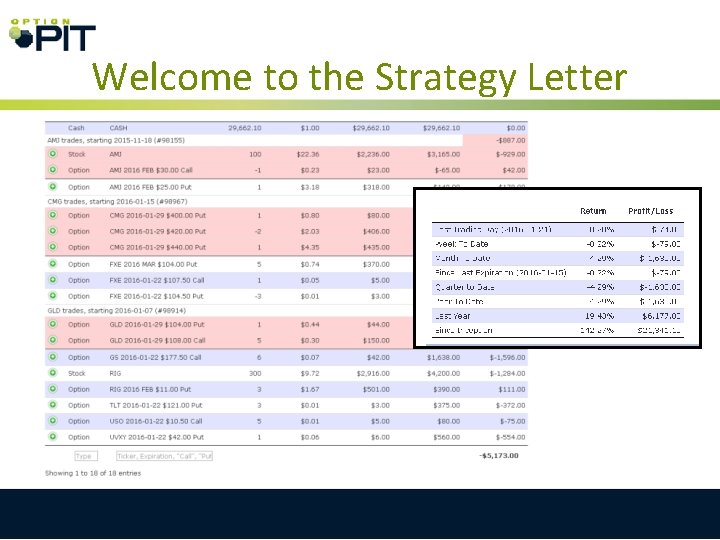

Setting up the SL and a book of trades • The SL has had a tough start in 2016 – Too many “oil bottom’’ trades – Not taking profits from 2015 – But ultimately risk control kept things from getting out of hand • Friday added around $400 to the PL BUT We are doing better than the market as a whole We have lots of available dollars

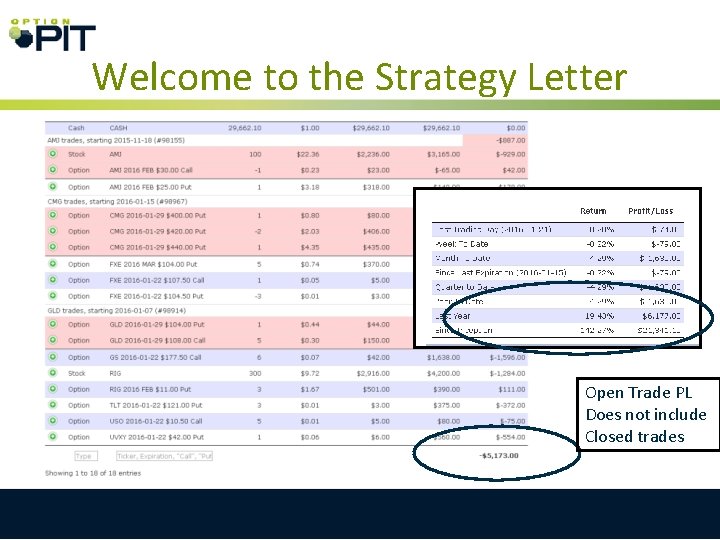

Welcome to the Strategy Letter Open Trade PL Does not include Closed trades

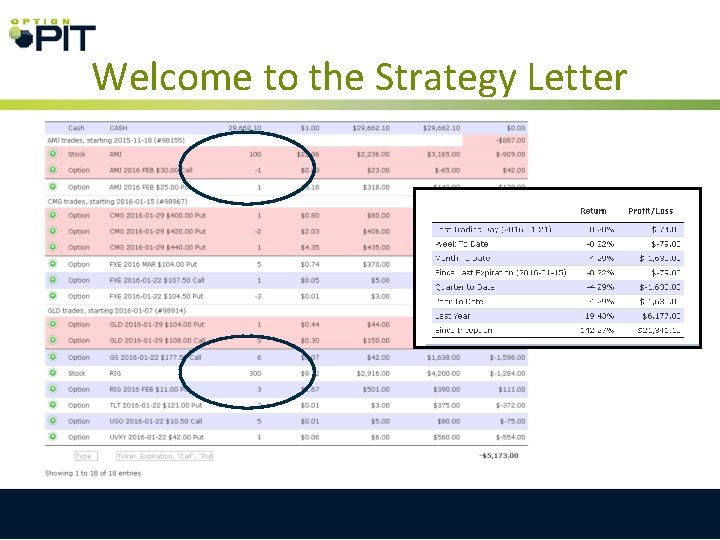

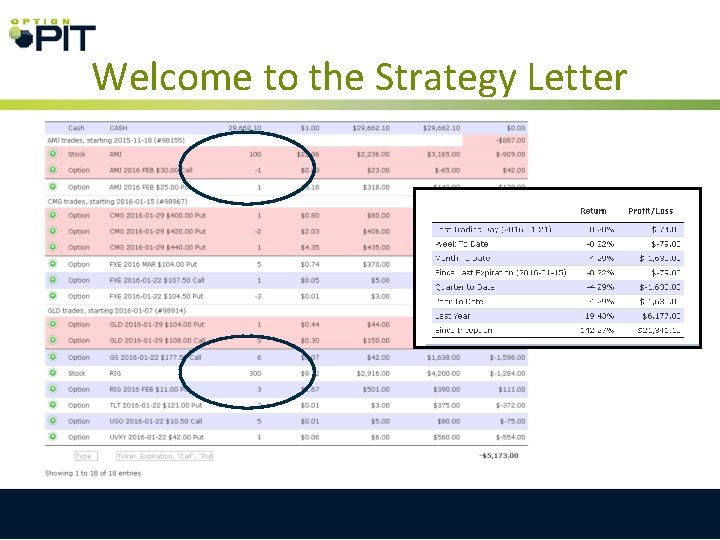

Welcome to the Strategy Letter

Stock and put positions • In a short term (or long term) stock positon, you need a kill spot – That number is around 20% – Use a mental stop – Or you can buy a put • This way you can manage the dollars at risk – I will roll once – Writing calls can help – The net synthetic call goes into the risk cal

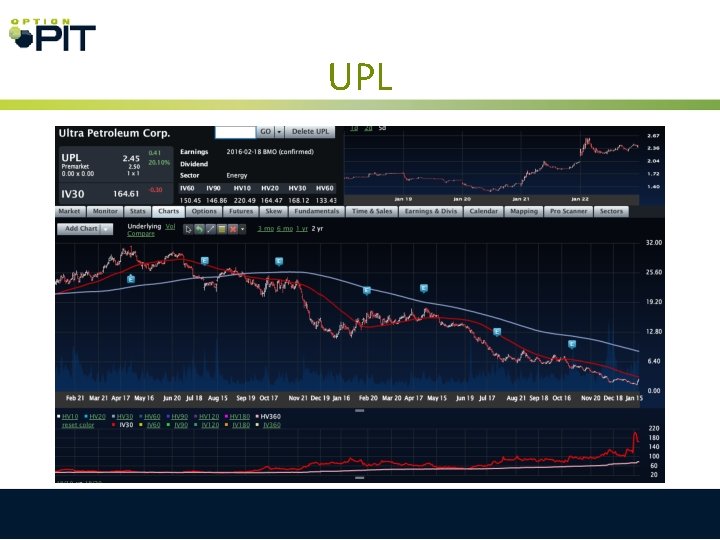

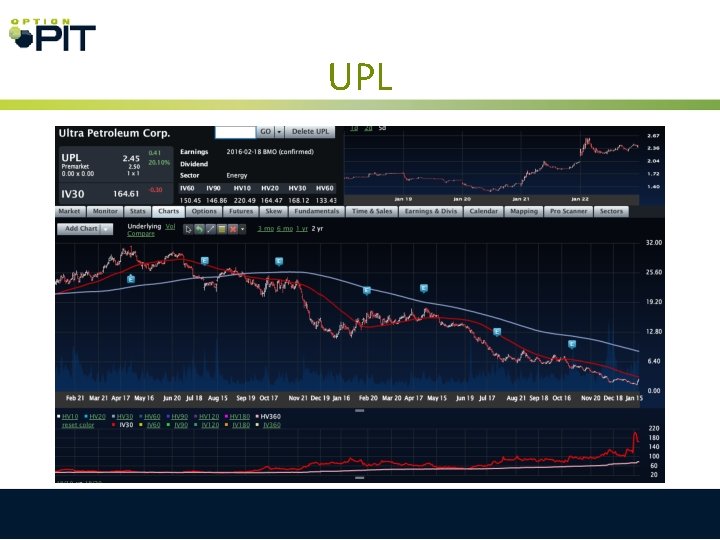

UPL

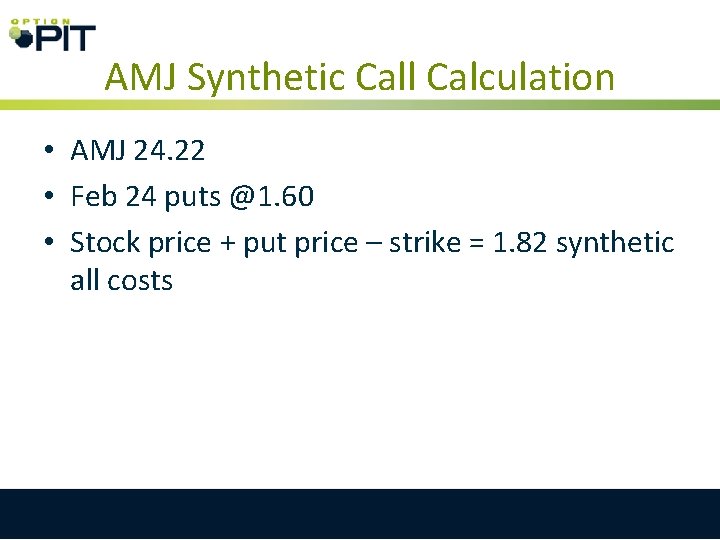

AMJ Sample

AMJ Synthetic Call Calculation • AMJ 24. 22 • Feb 24 puts @1. 60 • Stock price + put price – strike = 1. 82 synthetic all costs

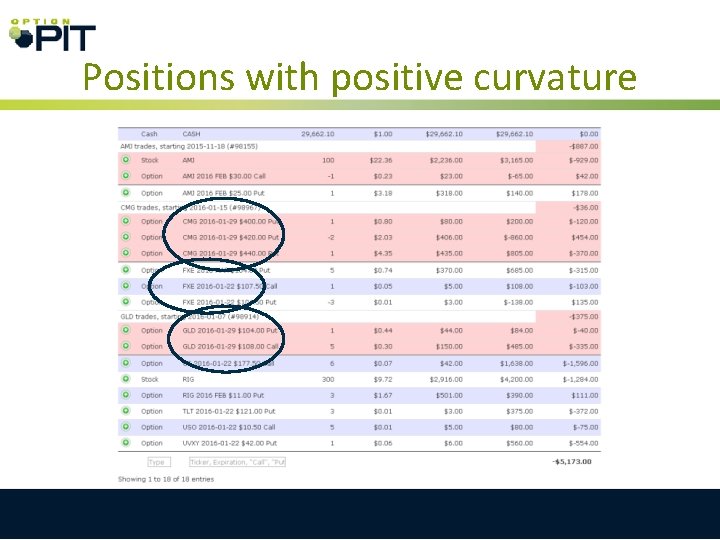

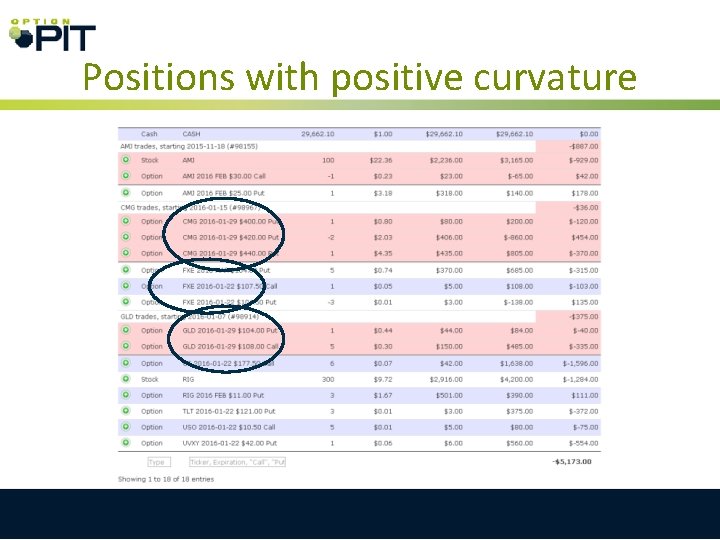

Positions with positive curvature

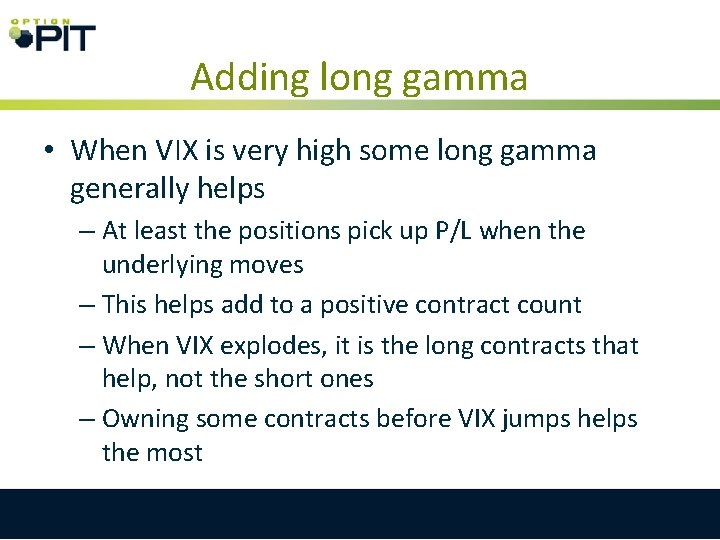

Adding long gamma • When VIX is very high some long gamma generally helps – At least the positions pick up P/L when the underlying moves – This helps add to a positive contract count – When VIX explodes, it is the long contracts that help, not the short ones – Owning some contracts before VIX jumps helps the most

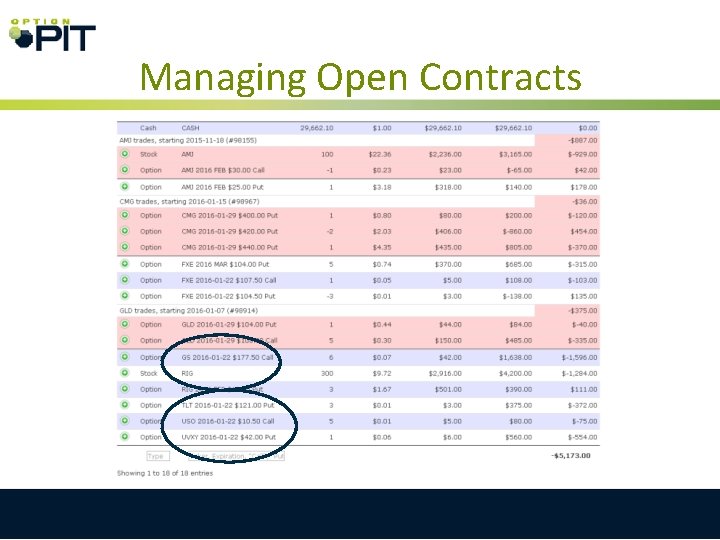

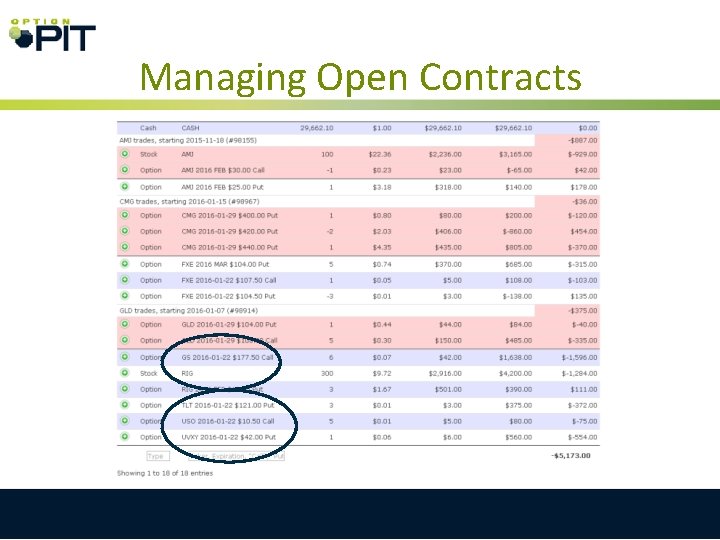

Managing Open Contracts

Managing Open Contracts • After closing parts of a position there are usually left over contracts • We keep them to trade against, as in sell options • Hold them as a lottery ticket in case the underlying makes a strange move

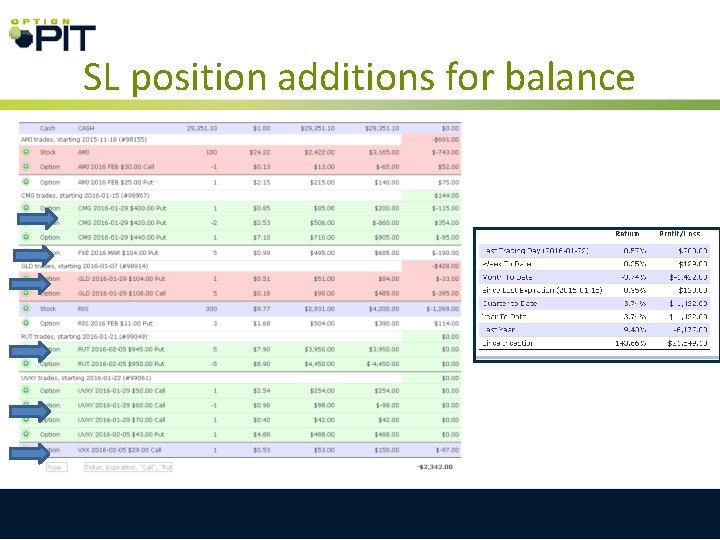

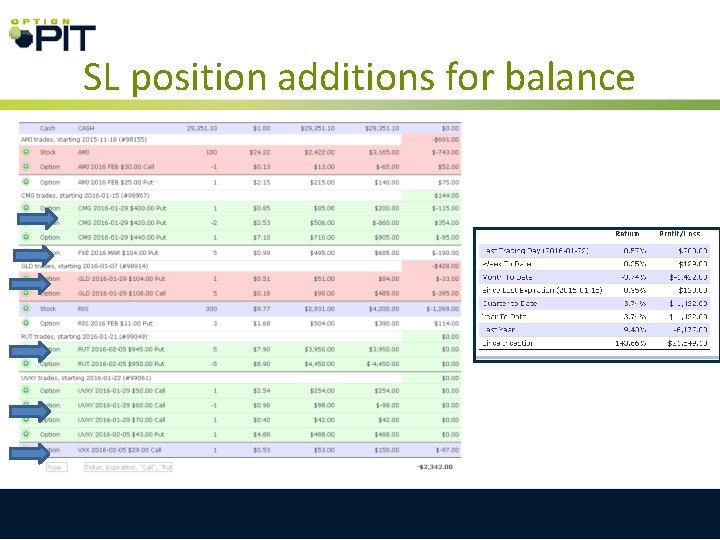

SL position additions for balance

SL positons additions • CMG – TAKING PROFITS • GLD – Closing due to no action (short contracts closed previous) • FXE- Will sell forward contracts • RUT- Taking profits • UVXY- more VIX curvature • VXX- Long volatility call for a credit

Managing a book • For the SL, 10 position is about max • Take profits in the winners ABC • When adding position, how does it fit our risk profile? • Walk through the Greeks • Keep cash available- at least 50% • No more than 1% of risk per position Let’s do this live now with the current SL

SL Beta Weighted

Reviewing Positions • Adding same side-of-the-market positions should be for more “edge” • We learn about “edge” in the Gold Course – Essentially it is buying cheaper volatility, selling more expensive volatility and managing the risk in between.

Summary • The market moves per VIX Zone • All option positions will move to their Greek character • Understand how the Greeks work to construct and manage positions • Add and subtract positions that help balance the overall portfolio of options

Special Offer The Option Pit Gold Course This was just the beginning: understand how to trade like a professional learn from the masters Ø Access to our special Gold Members Training Ø Review ALL past Saturday Class, plus the next 4 free Ø For months of Option Pit Live Ø Email and phone support Normally 1950. 00 Dollars yours for Just 1097. 00 Dollars Use code GOLDCAMP Email: info@optionpit. com Phone: (888) TRADE-01 (888 -872 -3301) www. optionpit. com/memberships/gold