ENGAGING PRIVATE SECTOR INVESTMENT AT SCALE FOR CLIMATE

- Slides: 52

ENGAGING PRIVATE SECTOR INVESTMENT AT SCALE FOR CLIMATE CHANGE MITIGATION IN EMERGING ECONOMIES Insights from a Gtriple. C Project funded by the ASIAN DEVELOPMENT BANK and the UNITED NATIONS FOUNDATION Developed by Murray Ward Gtriple. C www. Gtriple. C. co. nz

SHOW ME THE MONEY

SHOW ME THE MONEY

SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY

SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY

SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME

SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME

SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME THE MONEY SHOW ME SOME LIGHT SHOW ME THE MONEY SHOW ME SOME HEAT SHOW ME THE MONEY SHOW ME SOME COOL SHOW ME THE MONEY SHOW ME SOME MOVES SHOW ME THE MONEY SHOW ME SOME GREEN SHOW ME

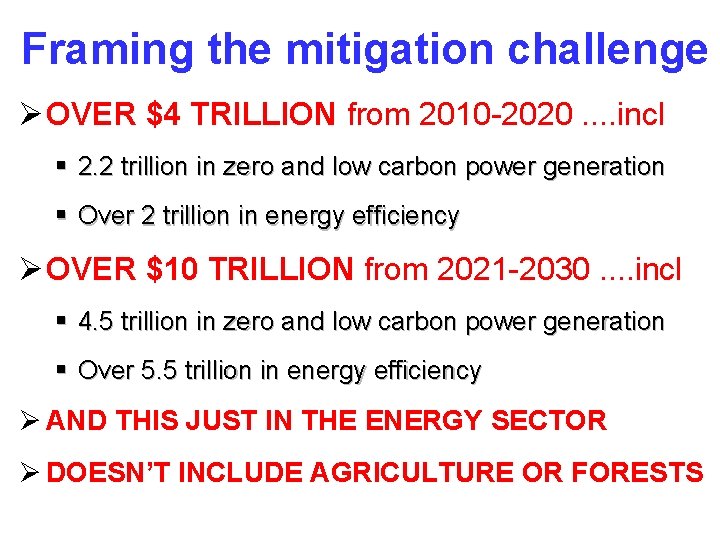

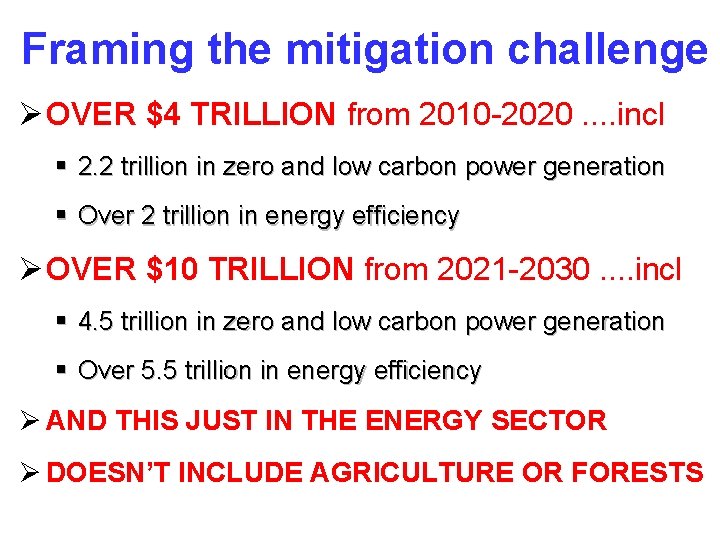

Framing the mitigation challenge Ø OVER $4 TRILLION from 2010 -2020. . incl § 2. 2 trillion in zero and low carbon power generation § Over 2 trillion in energy efficiency Ø OVER $10 TRILLION from 2021 -2030. . incl § 4. 5 trillion in zero and low carbon power generation § Over 5. 5 trillion in energy efficiency Ø AND THIS JUST IN THE ENERGY SECTOR Ø DOESN’T INCLUDE AGRICULTURE OR FORESTS

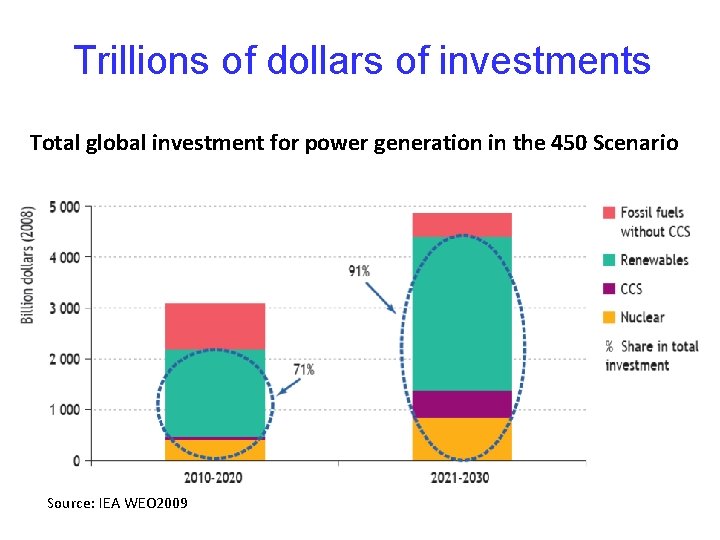

Trillions of dollars of investments Total global investment for power generation in the 450 Scenario Source: IEA WEO 2009

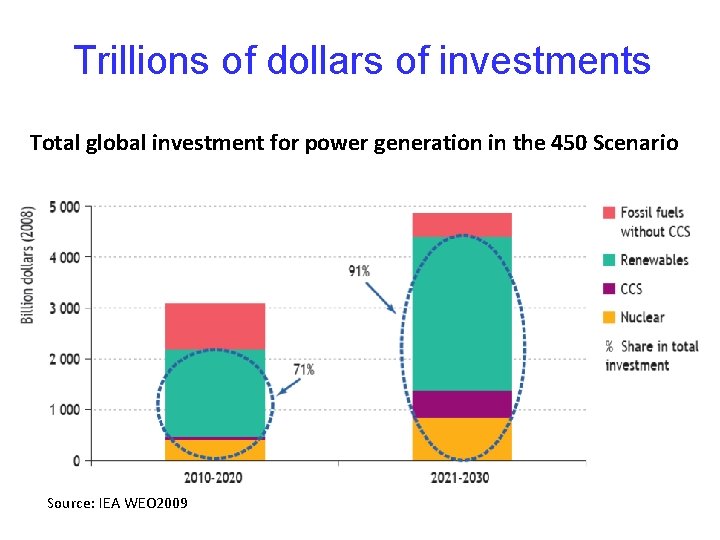

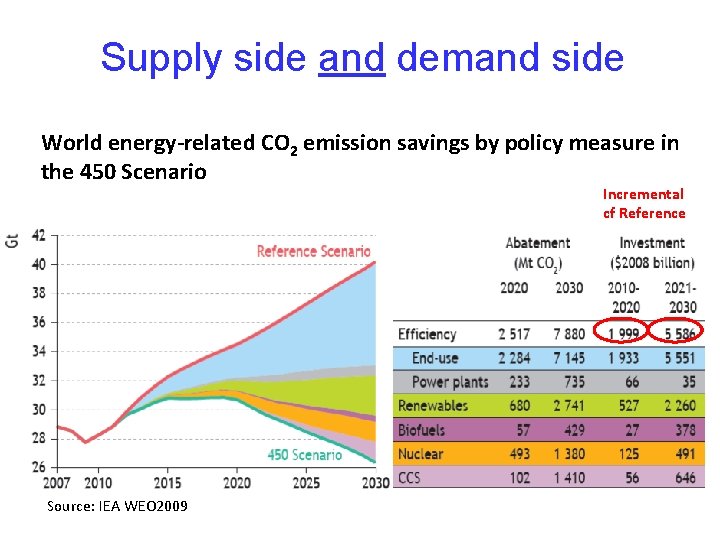

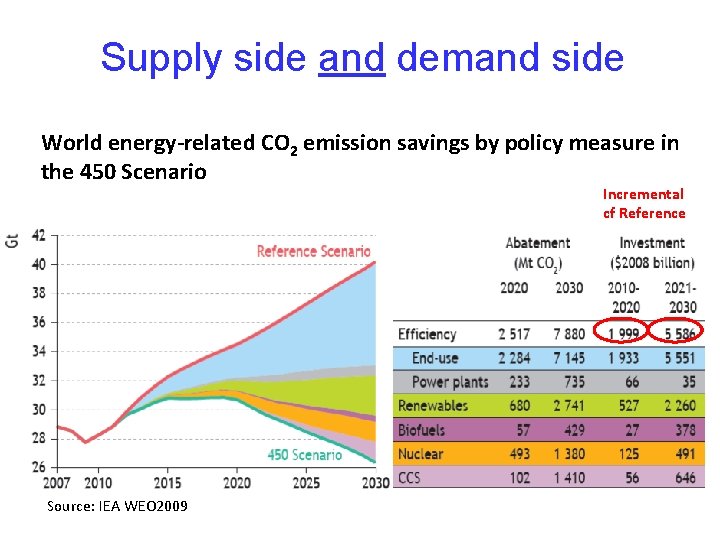

Supply side and demand side World energy-related CO 2 emission savings by policy measure in the 450 Scenario Incremental cf Reference Source: IEA WEO 2009

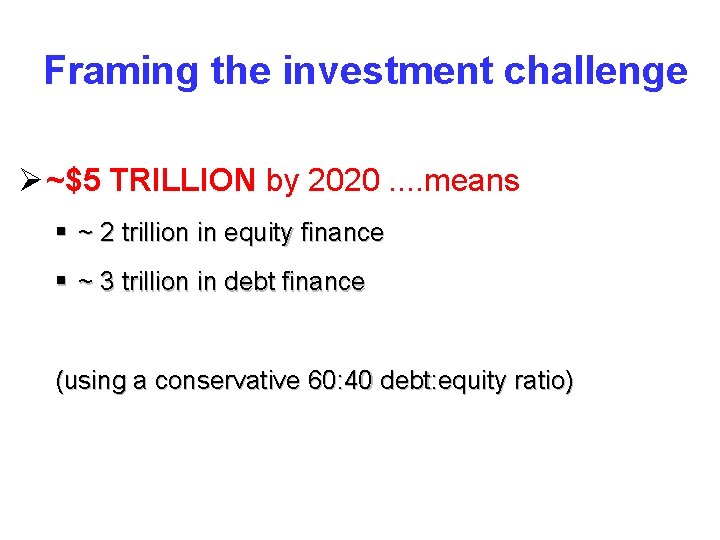

Framing the investment challenge Ø ~$5 TRILLION by 2020. . means § ~ 2 trillion in equity finance § ~ 3 trillion in debt finance (using a conservative 60: 40 debt: equity ratio)

Framing the investment challenge Ø ~$5 TRILLION by 2020. . means § ~ 2 trillion in equity finance § ~ 3 trillion in debt finance (using a conservative 60: 40 debt: equity ratio)

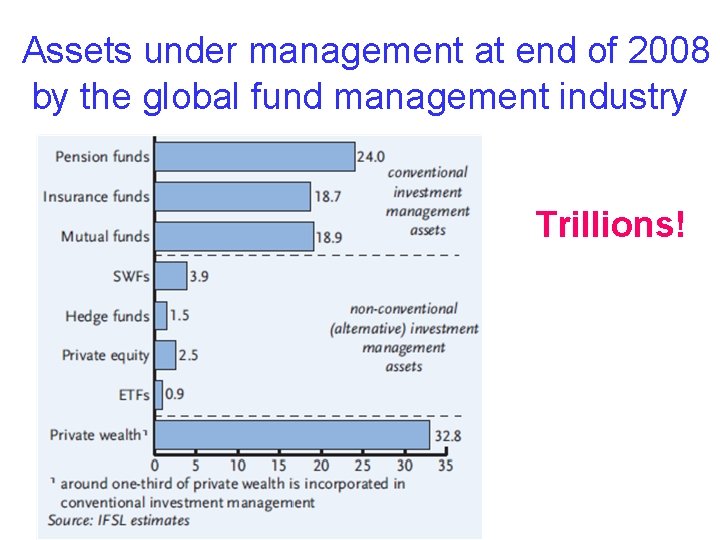

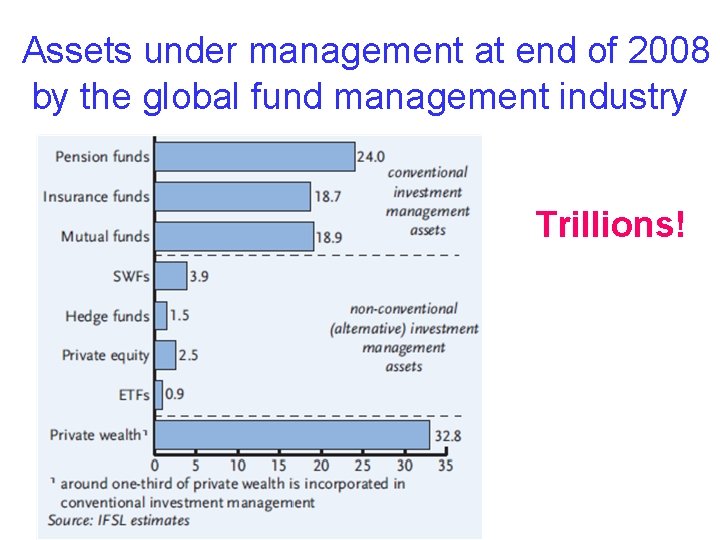

Assets under management at end of 2008 by the global fund management industry Trillions!

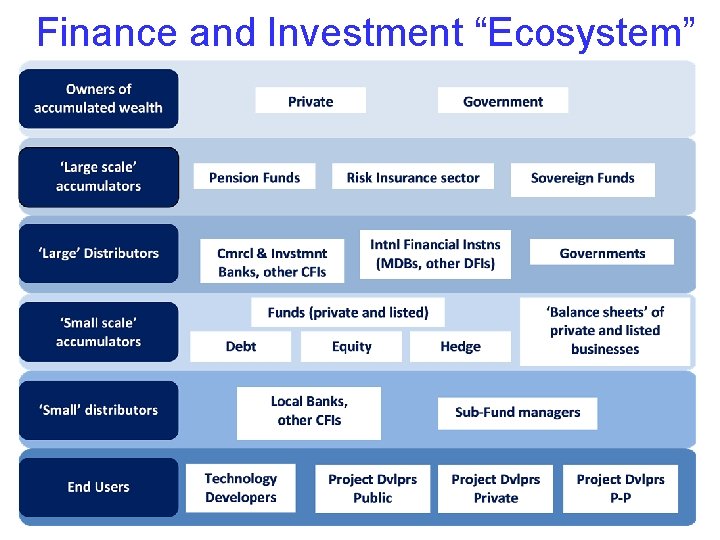

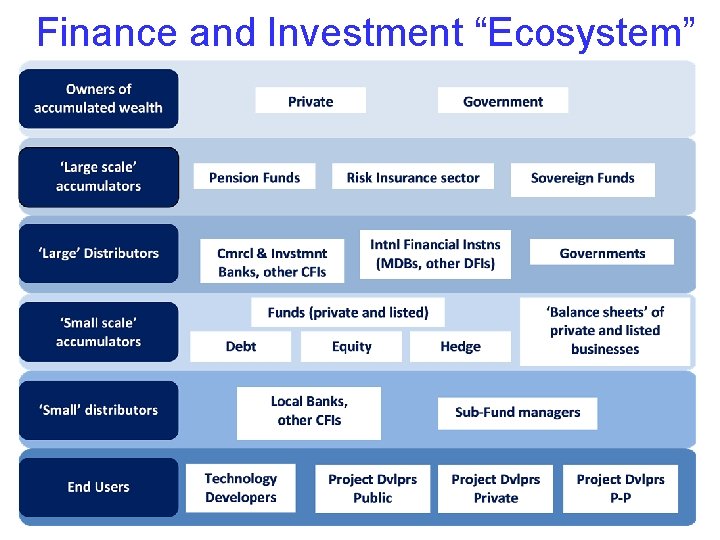

Finance and Investment “Ecosystem”

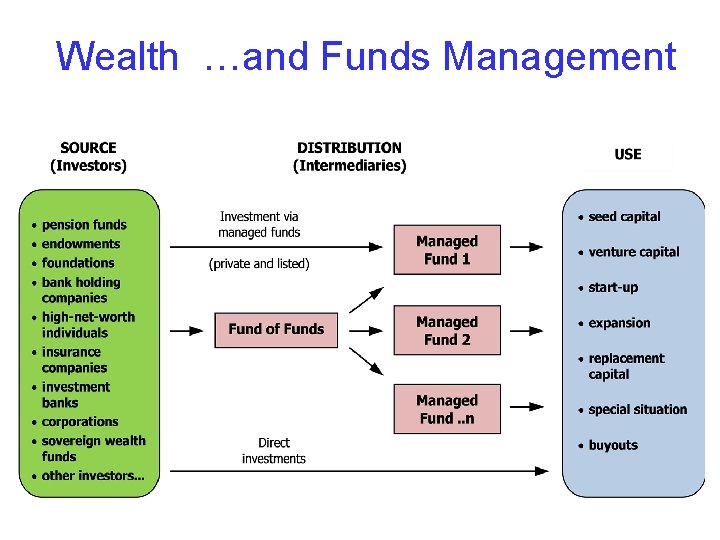

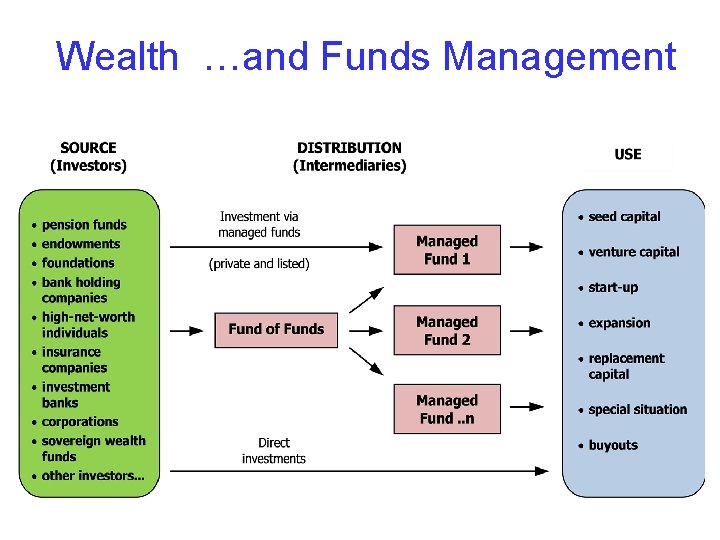

Wealth …and Funds Management

Climate Change Mitigation Policy Through the lens of investment

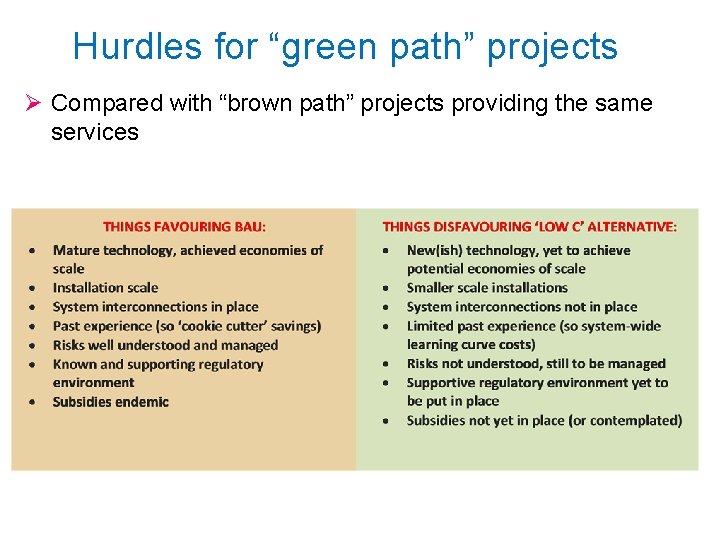

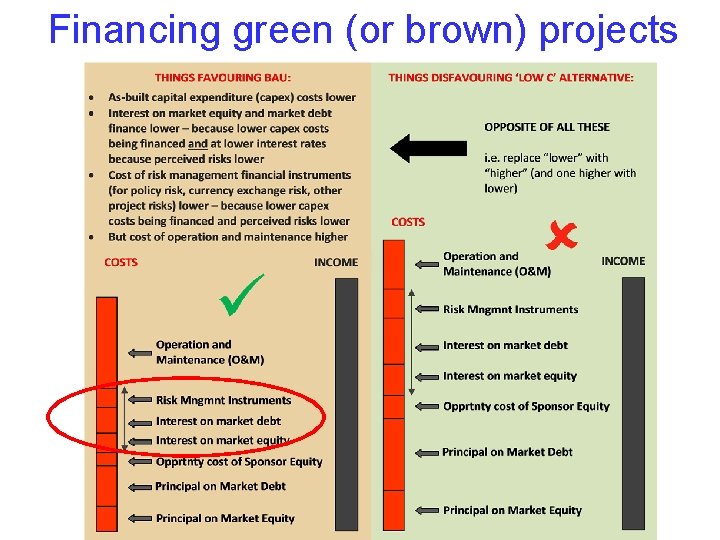

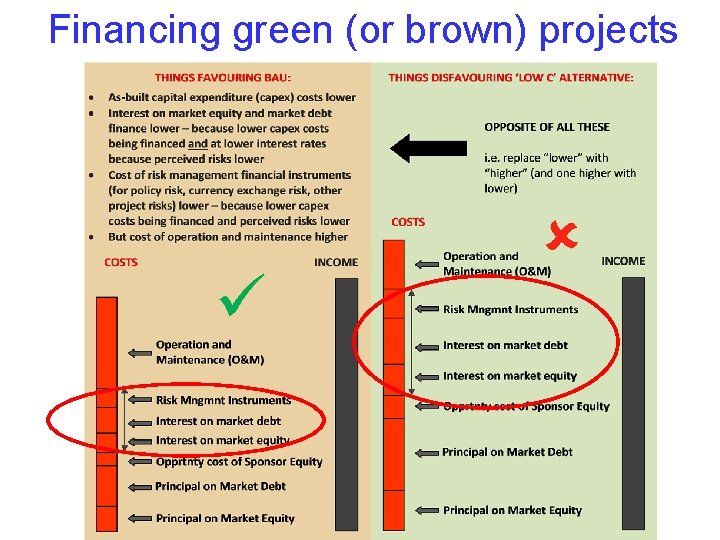

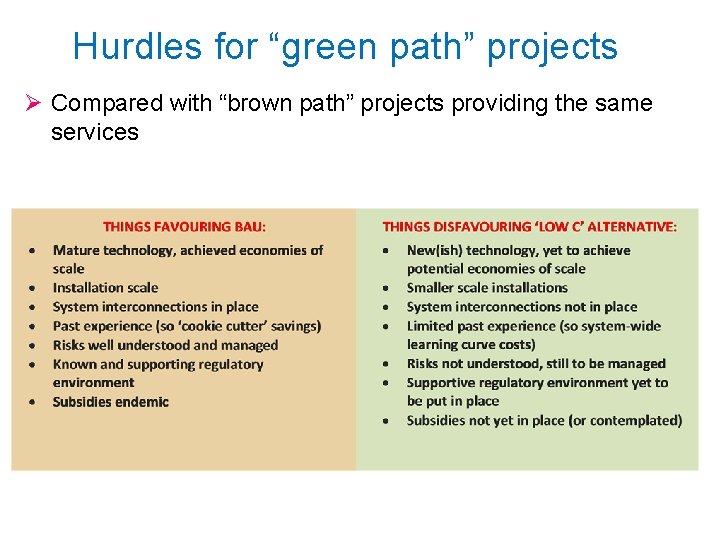

Hurdles for “green path” projects Ø Compared with “brown path” projects providing the same services

Risk Clouds

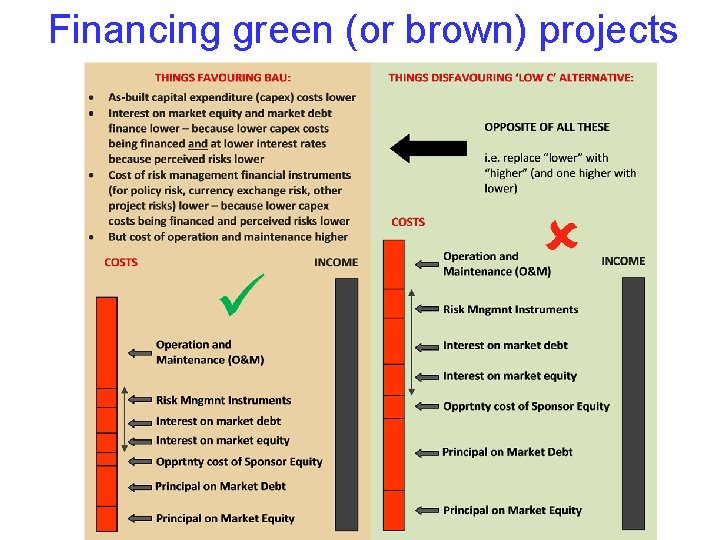

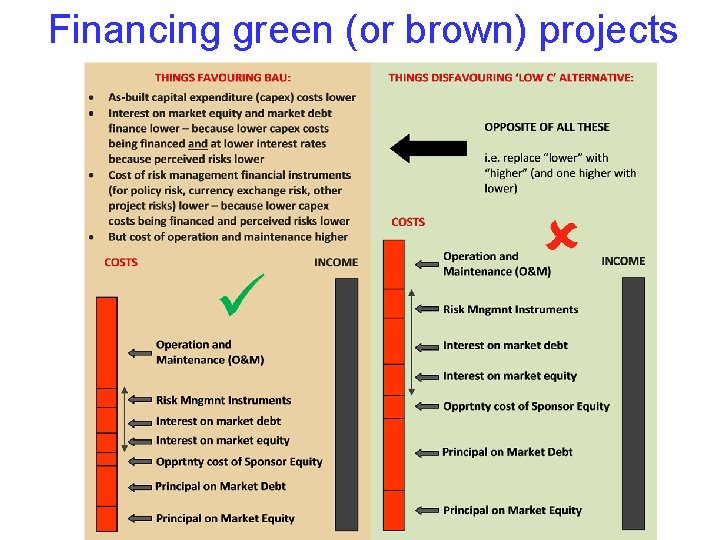

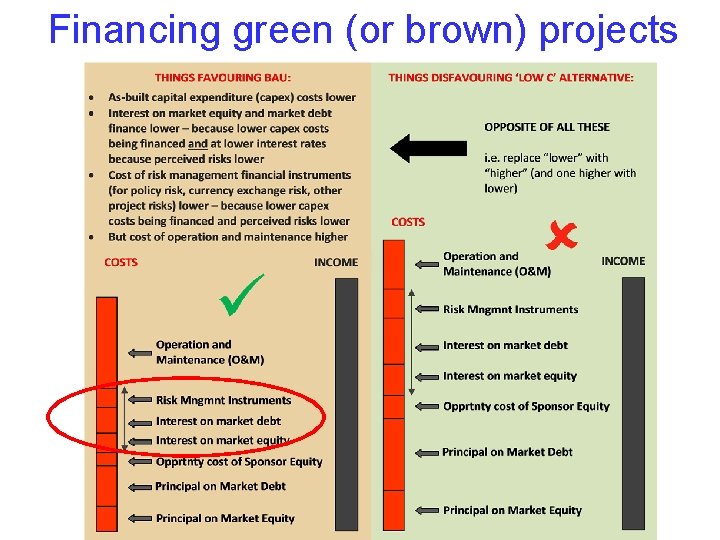

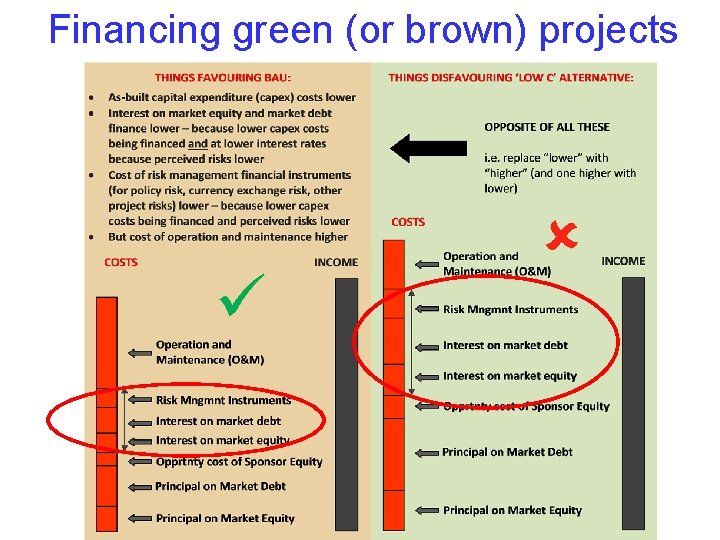

Financing green (or brown) projects

Financing green (or brown) projects

Financing green (or brown) projects

Risk Clouds

Rolling away the Risk Clouds

Rolling away the Risk Clouds

Rolling away the Risk Clouds

Rolling over the Risk Clouds

Rolling over the Risk Clouds

Examples of new and innovative ideas UNEP FI World Economic Forum Nicholas Stern / LSE Meeting the Climate Challenge: Using Public Funds to Leverage Private Investment in Developing Countries

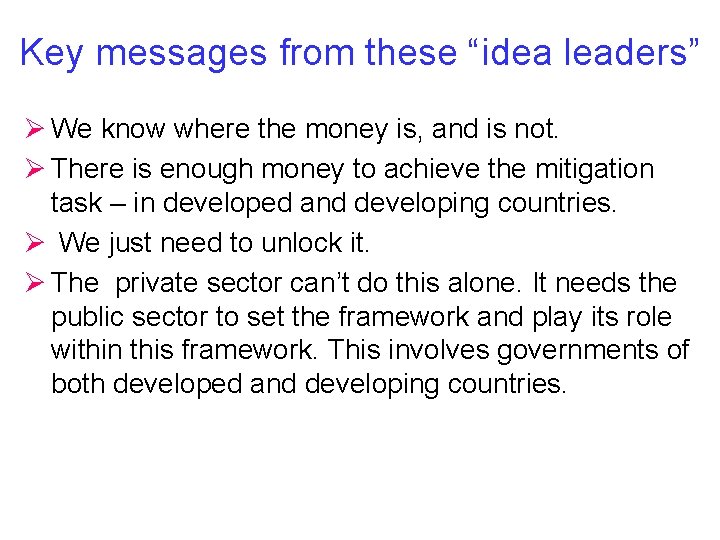

Key messages from these “idea leaders” Ø We know where the money is, and is not. Ø There is enough money to achieve the mitigation task – in developed and developing countries. Ø We just need to unlock it. Ø The private sector can’t do this alone. It needs the public sector to set the framework and play its role within this framework. This involves governments of both developed and developing countries.

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

KEY QUESTION Is it possible through smart and targeted public sector interventions (policies and finance mechanisms) to sufficiently lower the risk environment of green investments in infrastructure in developing countries to enable lower cost-of-capital finance from institutional investors to be attracted. . . at scale?

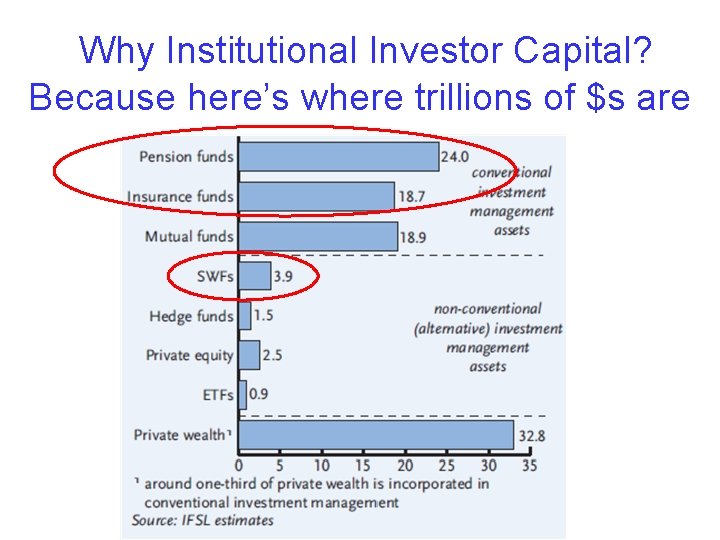

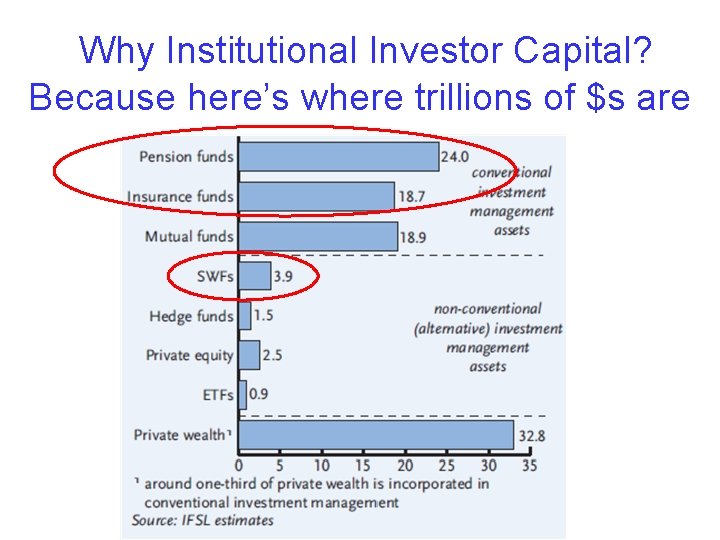

Why Institutional Investor Capital? Because here’s where trillions of $s are

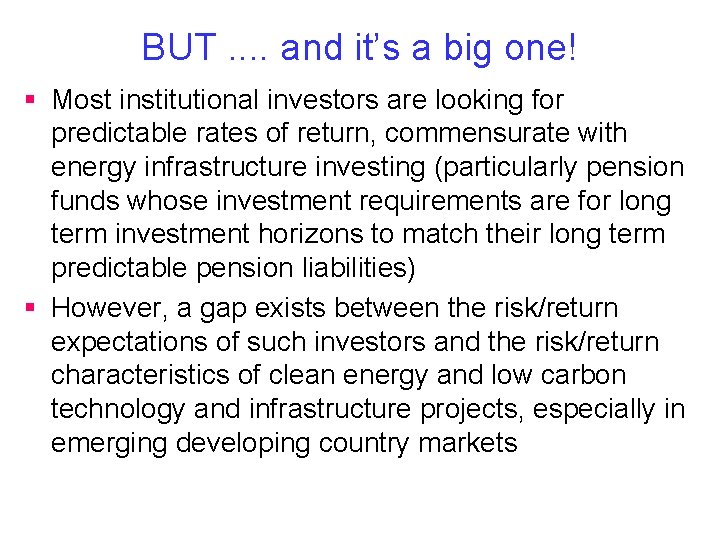

BUT. . and it’s a big one! § Most institutional investors are looking for predictable rates of return, commensurate with energy infrastructure investing (particularly pension funds whose investment requirements are for long term investment horizons to match their long term predictable pension liabilities) § However, a gap exists between the risk/return expectations of such investors and the risk/return characteristics of clean energy and low carbon technology and infrastructure projects, especially in emerging developing country markets

Something of a “Catch 22” § Green investments in developing countries are too risky for institutional investors – so these trillions go elsewhere § Investors with higher risk appetite want correspondingly higher returns – so this cost of capital too high to bridge the “green gap” Ø Need a comprehensive ‘de-risking’ programme

“De-risk elements”. . a beginning menu Ø Host country policies that specifically and directly are supportive of investments in these sectors, including needed support for these to be implemented Ø Political and policy risk insurance Ø Mechanisms to address foreign currency exchange risk Ø In-depth capacity building of relevant public and private institutions and groups that are instrumental to the success, or otherwise, of investments in these sectors in these countries

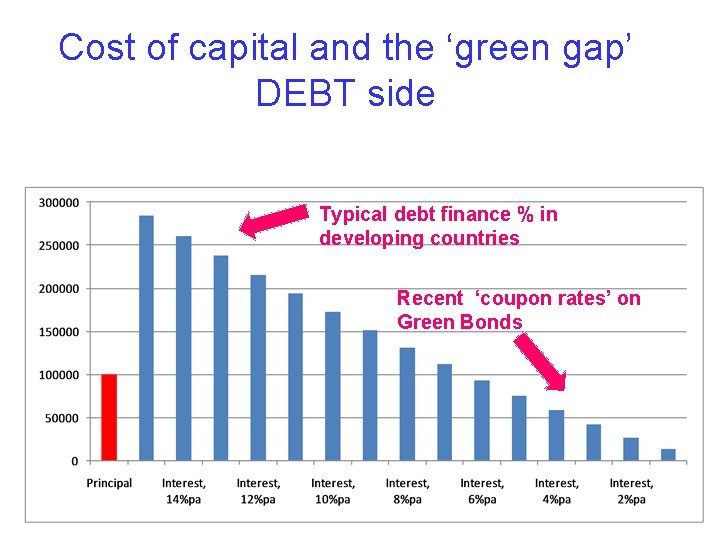

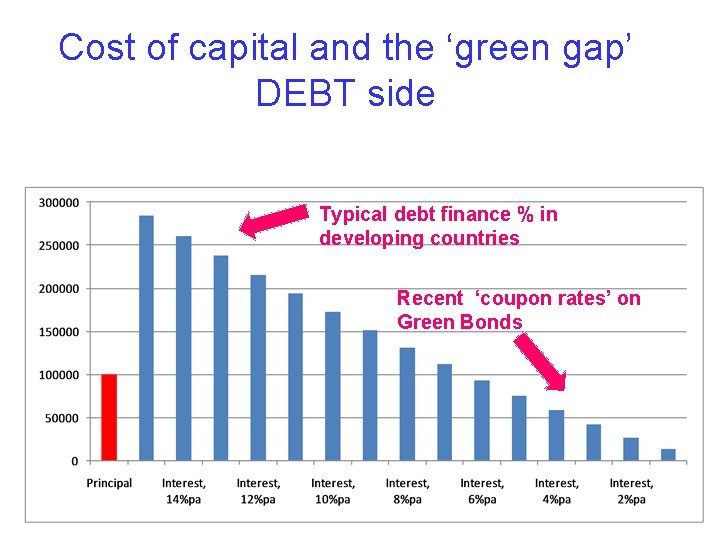

Cost of capital and the ‘green gap’ DEBT side Typical debt finance % in developing countries Recent ‘coupon rates’ on Green Bonds

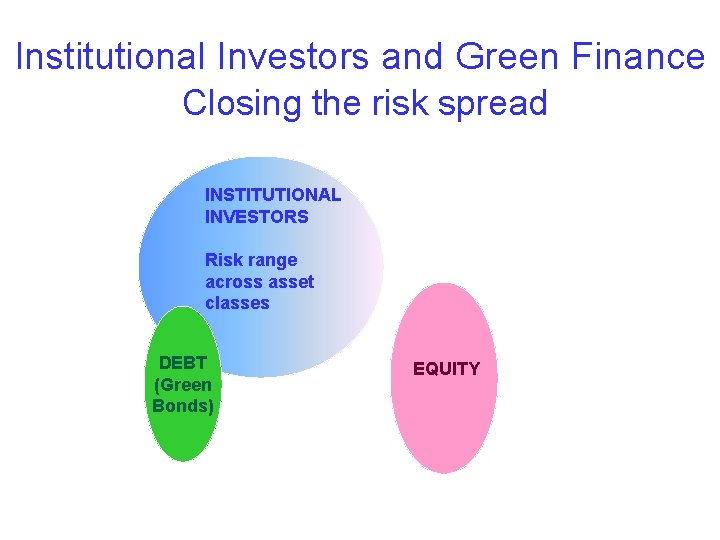

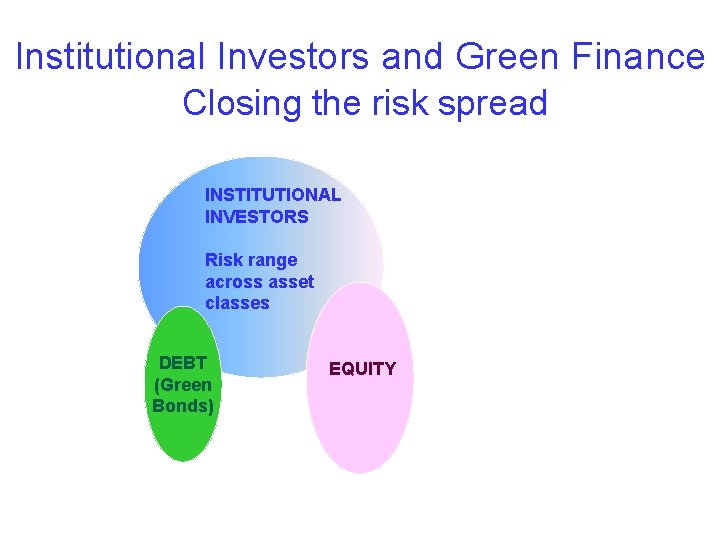

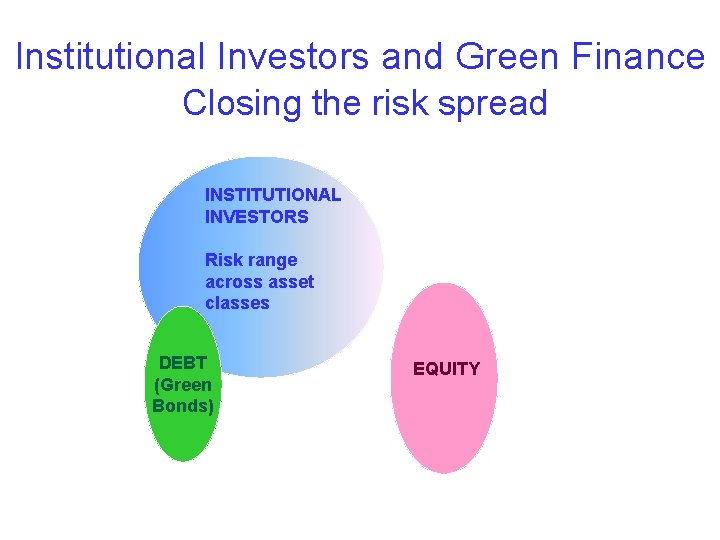

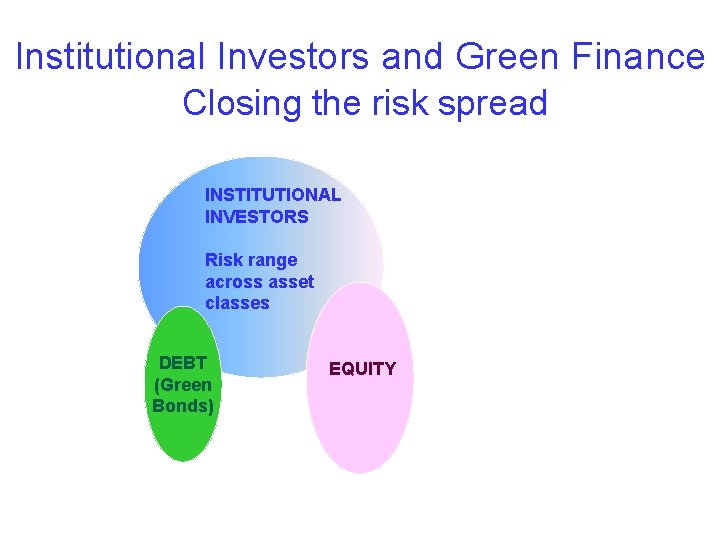

Institutional Investors and Green Finance Closing the risk spread INSTITUTIONAL INVESTORS Risk range across asset classes DEBT (Green Bonds) EQUITY

Institutional Investors and Green Finance Closing the risk spread INSTITUTIONAL INVESTORS Risk range across asset classes DEBT (Green Bonds) EQUITY

Institutional Investors and Green Finance Closing the risk spread INSTITUTIONAL INVESTORS Risk range across asset classes DEBT (Green Bonds) EQUITY

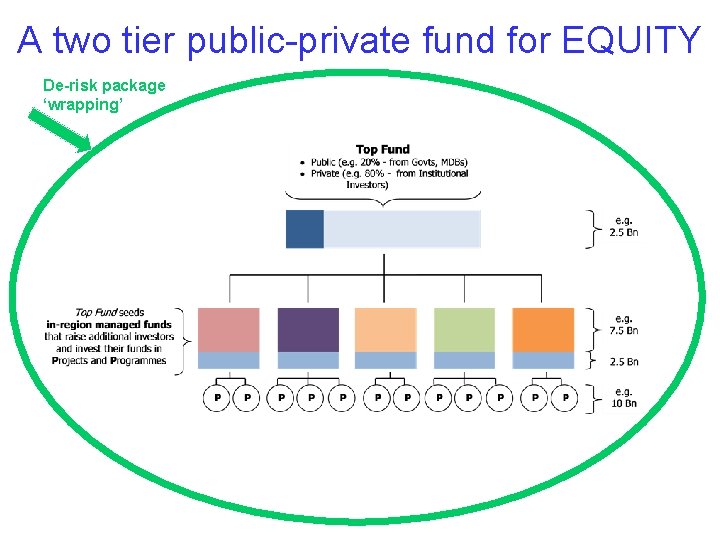

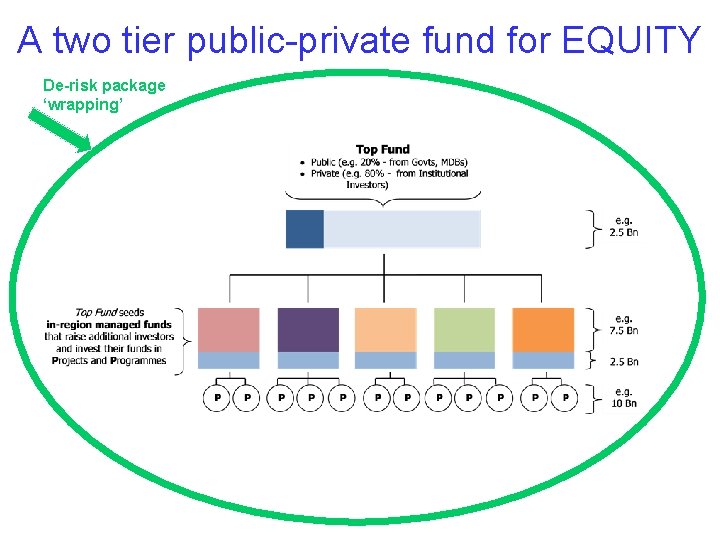

A two tier public-private fund for EQUITY

A two tier public-private fund for EQUITY De-risk package ‘wrapping’

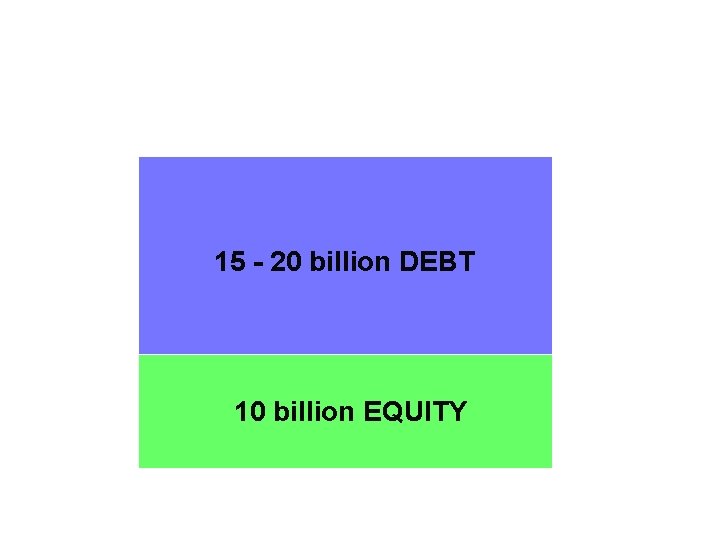

10 billion EQUITY

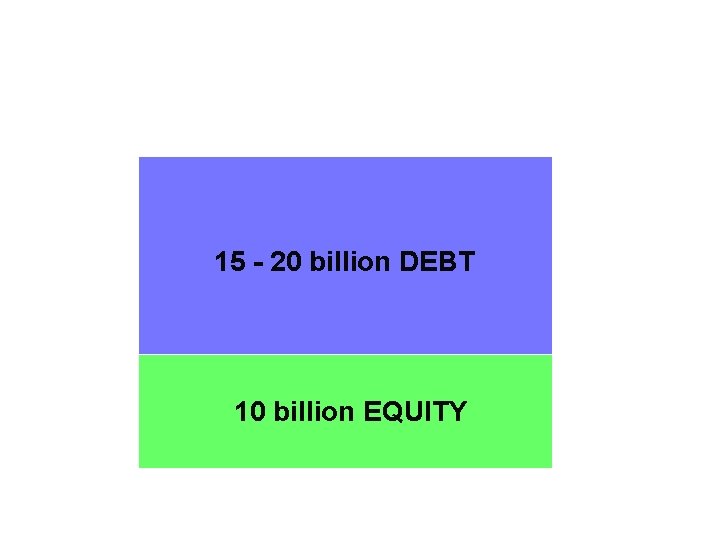

15 - 20 billion DEBT 10 billion EQUITY

A question (or two) for today Ø Assume this model is successful. . and can flow tens of billions (and in time trillions) into mitigation projects and programmes in developing countries v How does this connect with the discussions on finance and funds and institutions currently occurring in the UNFCCC negotiations? v Should (and if so why and where? ) public funds included in the “ 100 billion per annum from 2020” from developed countries be used for mitigation given the likely overwhelming needs for adaptation?

THANK YOU Further information: murray. ward@gtriplec. co. nz www. Gtriple. C. co. nz Gtriple. C

Fundal level

Fundal level Dynamisch verbinden

Dynamisch verbinden Marketing involve engaging directly with carefully targeted

Marketing involve engaging directly with carefully targeted Marketing involve engaging directly with carefully targeted

Marketing involve engaging directly with carefully targeted Climate change 2014 mitigation of climate change

Climate change 2014 mitigation of climate change Fixed investment and inventory investment

Fixed investment and inventory investment Political management in strategic triangle

Political management in strategic triangle Kuwaitization private sector

Kuwaitization private sector Tanzania private sector foundation

Tanzania private sector foundation Private limited company advantages and disadvantages gcse

Private limited company advantages and disadvantages gcse Overseas private investment corp

Overseas private investment corp Net exports formula

Net exports formula Large scale global investment

Large scale global investment Fspos

Fspos Novell typiska drag

Novell typiska drag Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Returpilarna

Returpilarna Varför kallas perioden 1918-1939 för mellankrigstiden?

Varför kallas perioden 1918-1939 för mellankrigstiden? En lathund för arbete med kontinuitetshantering

En lathund för arbete med kontinuitetshantering Personalliggare bygg undantag

Personalliggare bygg undantag Personlig tidbok för yrkesförare

Personlig tidbok för yrkesförare A gastrica

A gastrica Vad är densitet

Vad är densitet Datorkunskap för nybörjare

Datorkunskap för nybörjare Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Hur skriver man en debattartikel

Hur skriver man en debattartikel Magnetsjukhus

Magnetsjukhus Nyckelkompetenser för livslångt lärande

Nyckelkompetenser för livslångt lärande Påbyggnader för flakfordon

Påbyggnader för flakfordon Kraft per area

Kraft per area Offentlig förvaltning

Offentlig förvaltning Kyssande vind analys

Kyssande vind analys Presentera för publik crossboss

Presentera för publik crossboss Vad är ett minoritetsspråk

Vad är ett minoritetsspråk Bat mitza

Bat mitza Klassificeringsstruktur för kommunala verksamheter

Klassificeringsstruktur för kommunala verksamheter Fimbrietratt

Fimbrietratt Claes martinsson

Claes martinsson Centrum för kunskap och säkerhet

Centrum för kunskap och säkerhet Verifikationsplan

Verifikationsplan Mat för idrottare

Mat för idrottare Verktyg för automatisering av utbetalningar

Verktyg för automatisering av utbetalningar Rutin för avvikelsehantering

Rutin för avvikelsehantering Smärtskolan kunskap för livet

Smärtskolan kunskap för livet Ministerstyre för och nackdelar

Ministerstyre för och nackdelar Tack för att ni har lyssnat

Tack för att ni har lyssnat Referatmarkeringar

Referatmarkeringar Redogör för vad psykologi är

Redogör för vad psykologi är Stål för stötfångarsystem

Stål för stötfångarsystem Tack för att ni har lyssnat

Tack för att ni har lyssnat Borra hål för knoppar

Borra hål för knoppar Orubbliga rättigheter

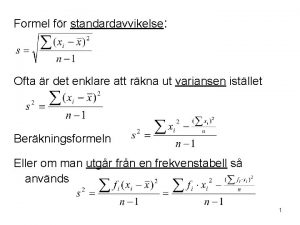

Orubbliga rättigheter Stickprovsvarians

Stickprovsvarians