The management of a financial conglomerate A challenge

- Slides: 37

The management of a financial conglomerate : A challenge for the actuaries ? By Luc Henrard – Chief Risk Officer at Fortis AFIR Maastricht – September 17 -19, 2003 1

Overview 1. Introduction 2. The internal challenge: consistent measurement of risks 3. How to prioritize the business applications ? 4. Food for thought: economic solvency framework 5. Role of the actuary 6. Conclusion 2

1. INTRODUCTION 3

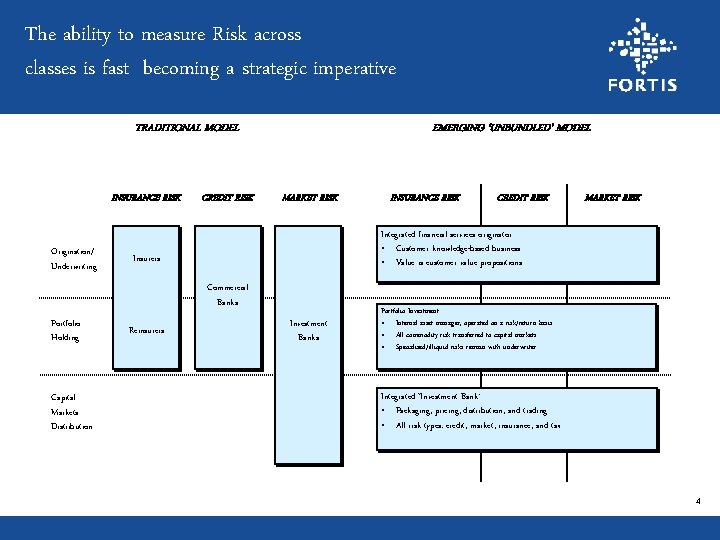

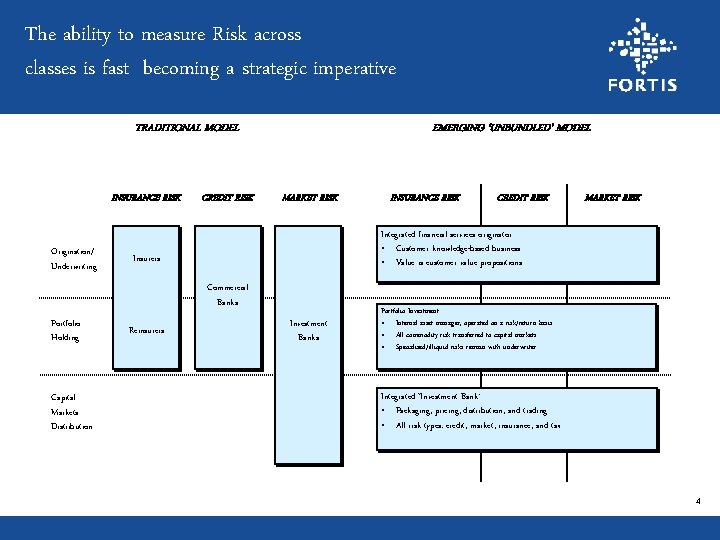

The ability to measure Risk across classes is fast becoming a strategic imperative TRADITIONAL MODEL INSURANCE RISK Origination/ Underwriting CREDIT RISK EMERGING ‘UNBUNDLED’ MODEL MARKET RISK Insurers Capital Markets Distribution Reinsurers CREDIT RISK MARKET RISK Integrated financial services originator • Customer knowledge-based business • Value is customer value propositions Commercial Banks Portfolio Holding INSURANCE RISK Investment Banks Portfolio Investment • Internal asset manager, operated on a risk/return basis • All commodity risk transferred to capital markets • Specialised/illiquid risks remain with underwriter Integrated ‘Investment Bank’ • Packaging, pricing, distribution, and trading • All risk types: credit, market, insurance, and tax 4

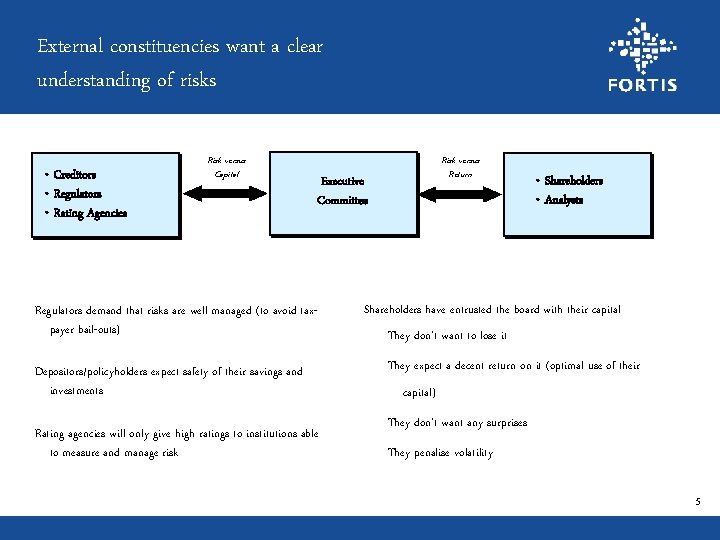

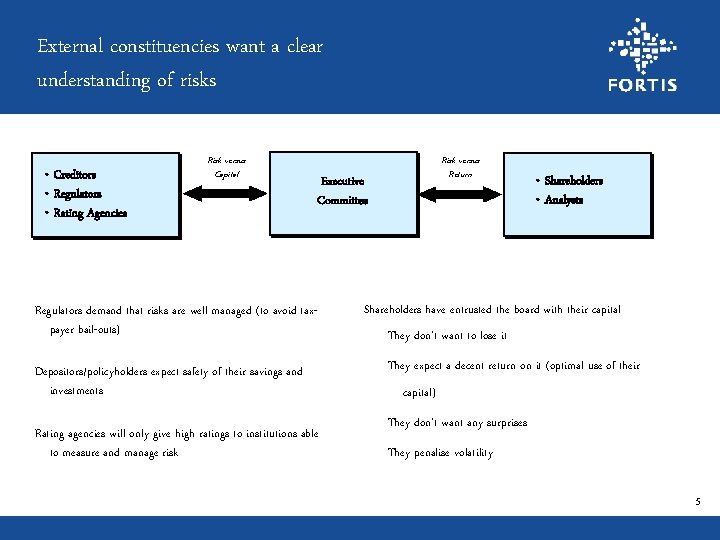

External constituencies want a clear understanding of risks • Creditors • Regulators • Rating Agencies Risk versus Capital Risk versus Return Executive Committee Regulators demand that risks are well managed (to avoid taxpayer bail-outs) Depositors/policyholders expect safety of their savings and investments Rating agencies will only give high ratings to institutions able to measure and manage risk • Shareholders • Analysts Shareholders have entrusted the board with their capital They don’t want to lose it They expect a decent return on it (optimal use of their capital) They don’t want any surprises They penalise volatility 5

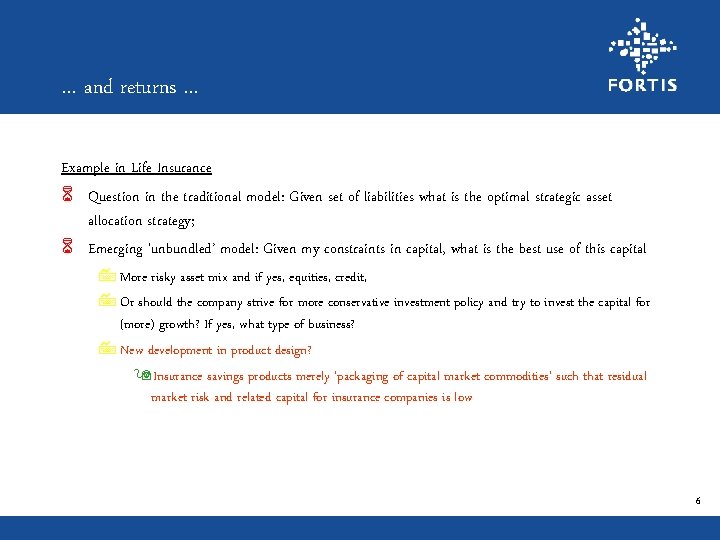

… and returns … Example in Life Insurance 6 Question in the traditional model: Given set of liabilities what is the optimal strategic asset allocation strategy; 6 Emerging ‘unbundled’ model: Given my constraints in capital, what is the best use of this capital 7 More risky asset mix and if yes, equities, credit, 7 Or should the company strive for more conservative investment policy and try to invest the capital for (more) growth? If yes, what type of business? 7 New development in product design? 9 Insurance savings products merely ‘packaging of capital market commodities’ such that residual market risk and related capital for insurance companies is low 6

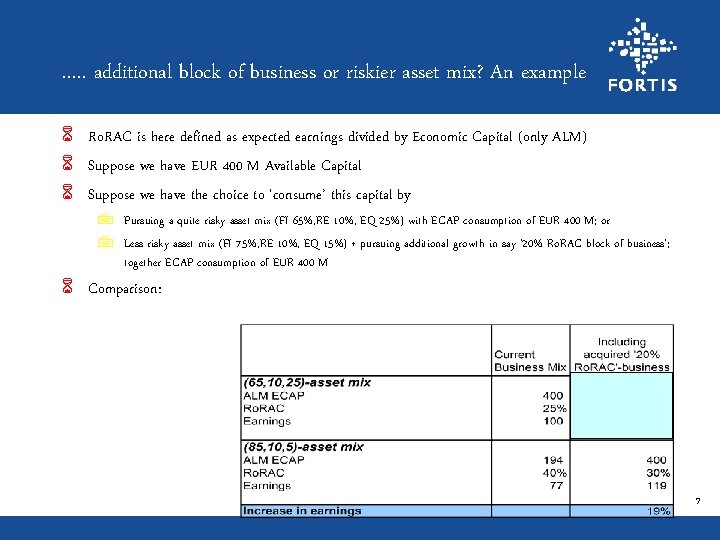

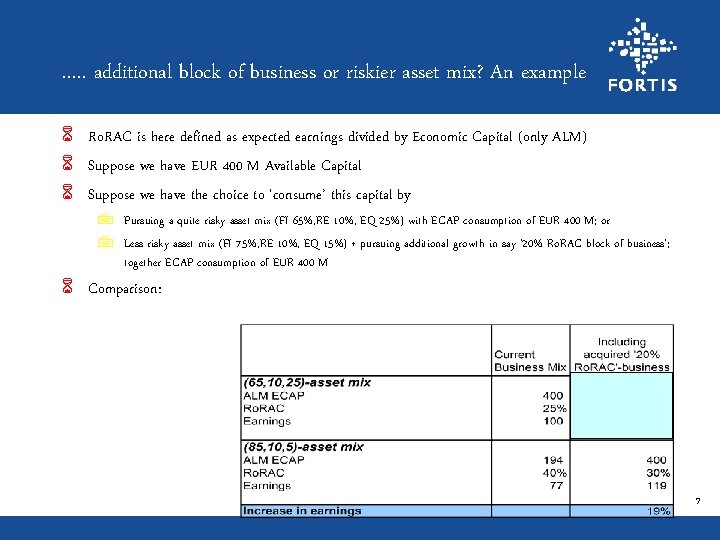

…. . additional block of business or riskier asset mix? An example 6 Ro. RAC is here defined as expected earnings divided by Economic Capital (only ALM) 6 Suppose we have EUR 400 M Available Capital 6 Suppose we have the choice to ‘consume’ this capital by 7 Pursuing a quite risky asset mix (FI 65%, RE 10%, EQ 25%) with ECAP consumption of EUR 400 M; or 7 Less risky asset mix (FI 75%, RE 10%, EQ 15%) + pursuing additional growth in say ’ 20% Ro. RAC block of business’; together ECAP consumption of EUR 400 M 6 Comparison: 7

2. THE INTERNAL CHALLENGE Developing comparable measures of capital and value 8

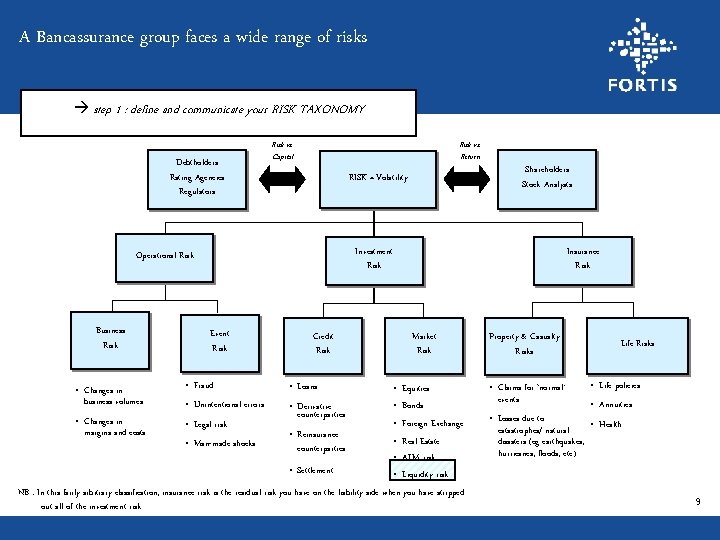

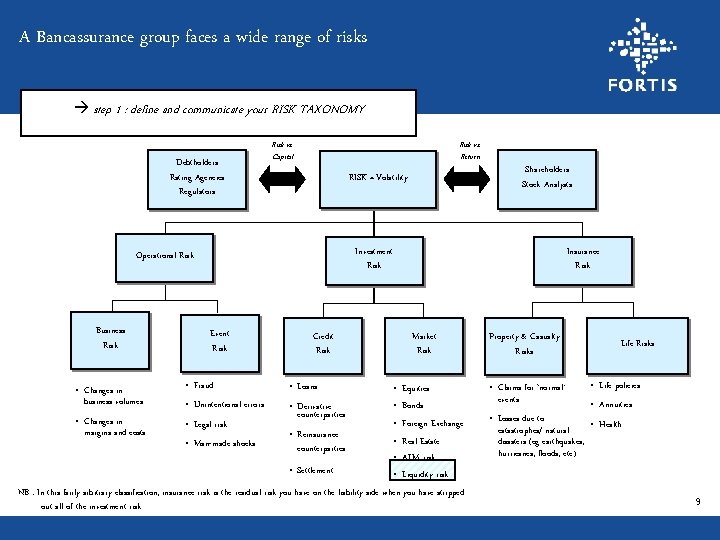

A Bancassurance group faces a wide range of risks step 1 : define and communicate your RISK TAXONOMY Debtholders Rating Agencies Regulators Risk vs. Return Risk vs. Capital RISK = Volatility Investment Risk Operational Risk Business Risk Event Risk • Fraud Credit Risk • Loans Insurance Risk Market Risk • Equities • Unintentional errors • Bonds • Derivative counterparties • Changes in • Foreign Exchange • Legal risk margins and costs • Reinsurance • Real Estate • Man-made shocks counterparties • ALM risk • Settlement • Liquidity risk NB : In this fairly arbitrary classification, insurance risk is the residual risk you have on the liability side when you have stripped out all of the investment risk. • Changes in business volumes Shareholders Stock Analysts Property & Casualty Risks • Claims for ‘normal’ events Life Risks • Life policies • Annuities • Losses due to • Health catastrophes/ natural disasters (eg earthquakes, hurricanes, floods, etc) 9

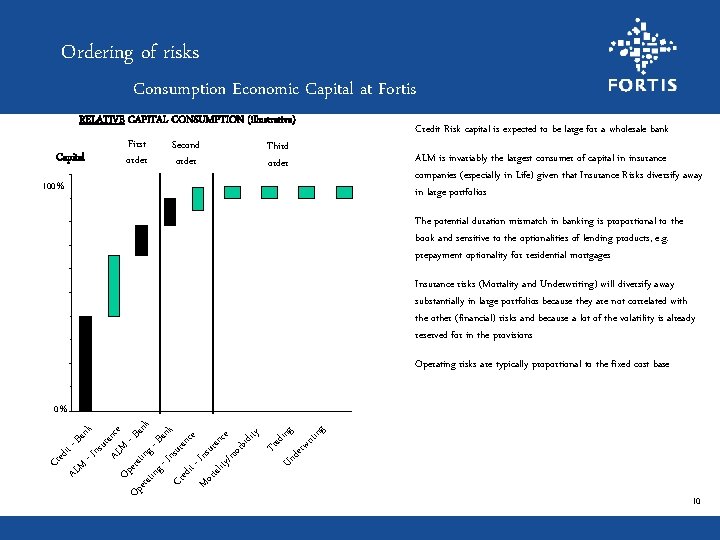

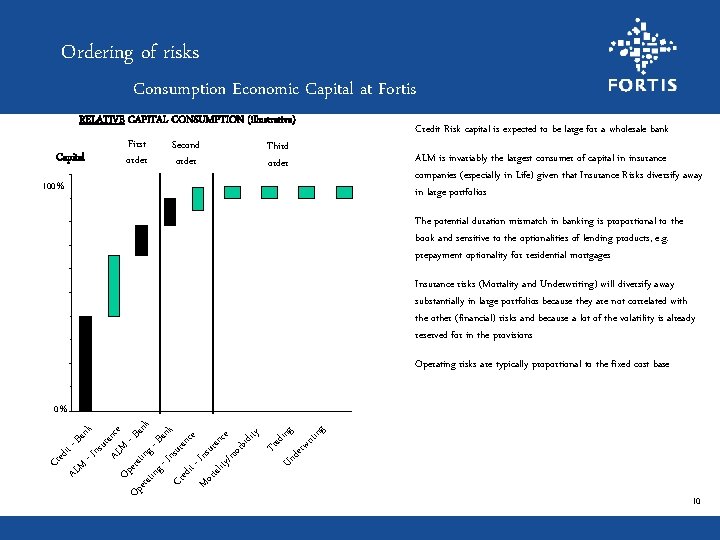

Ordering of risks Consumption Economic Capital at Fortis RELATIVE CAPITAL CONSUMPTION (illustrative) Capital First order Second order Third order 100% Credit Risk capital is expected to be large for a wholesale bank ALM is invariably the largest consumer of capital in insurance companies (especially in Life) given that Insurance Risks diversify away in large portfolios The potential duration mismatch in banking is proportional to the book and sensitive to the optionalities of lending products, e. g. prepayment optionality for residential mortgages Insurance risks (Mortality and Underwriting) will diversify away substantially in large portfolios because they are not correlated with the other (financial) risks and because a lot of the volatility is already reserved for in the provisions Operating risks are typically proportional to the fixed cost base Cr ed AL it - B M a - In nk sur A anc Op LM e Op era - Ba era ting nk tin g - - Ba n I Cr nsura k edi t - nce Mo Insu rta lity rance /m orb idi ty Tra Un ding der wr itin g 0% 10

Side step: Role Actuaries in risk management process 6 Traditionally Actuaries focussed on technical insurance risks (mortality, disability, P&C claims risks, etc). 6 Today actuaries also are involved in the whole risk taxonomy 7 Example: integration of ALM and Actuarial departments is a must 7 This also has consequences for the academic actuarial curriculum: transition to curriculum all-round financial risk manager integration actuarial science, (mathematical) finance, econometrics financial markets, etc 11

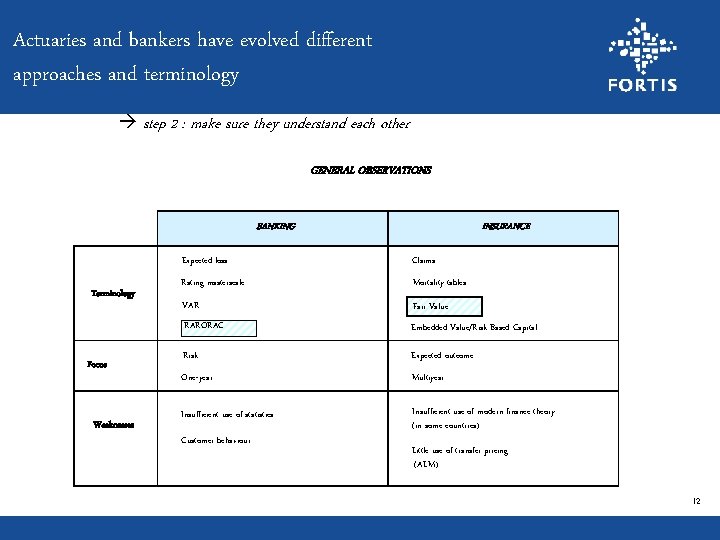

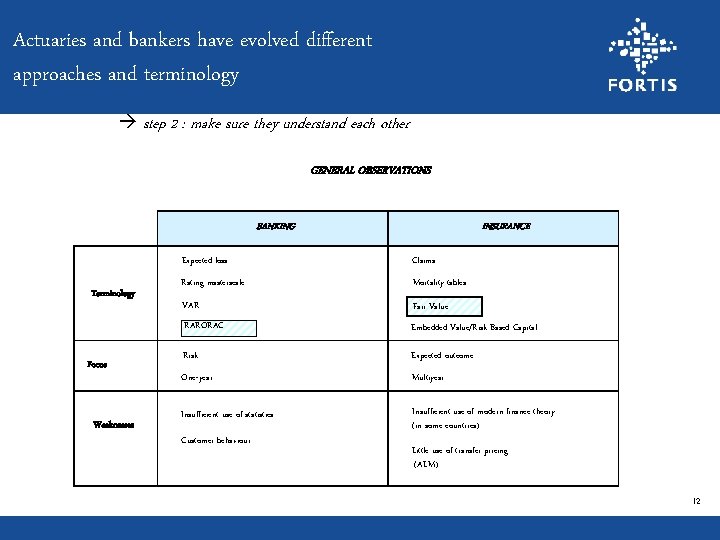

Actuaries and bankers have evolved different approaches and terminology step 2 : make sure they understand each other GENERAL OBSERVATIONS BANKING Terminology Focus Weaknesses INSURANCE · Expected loss · Claims · Rating masterscale · Mortality tables · VAR · Fair Value · RARORAC · Embedded Value/Risk Based Capital · Risk · Expected outcome · One-year · Multiyear · Insufficient use of statistics · · Customer behaviour · Insufficient use of modern finance theory (in some countries) Little use of transfer pricing (ALM) 12

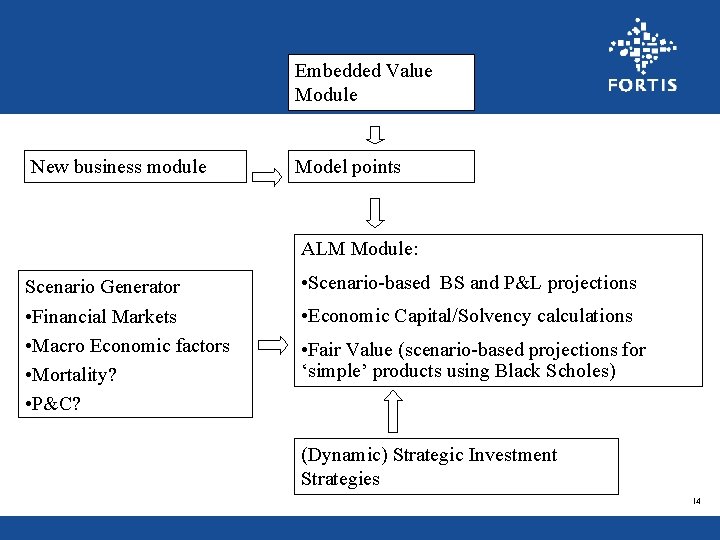

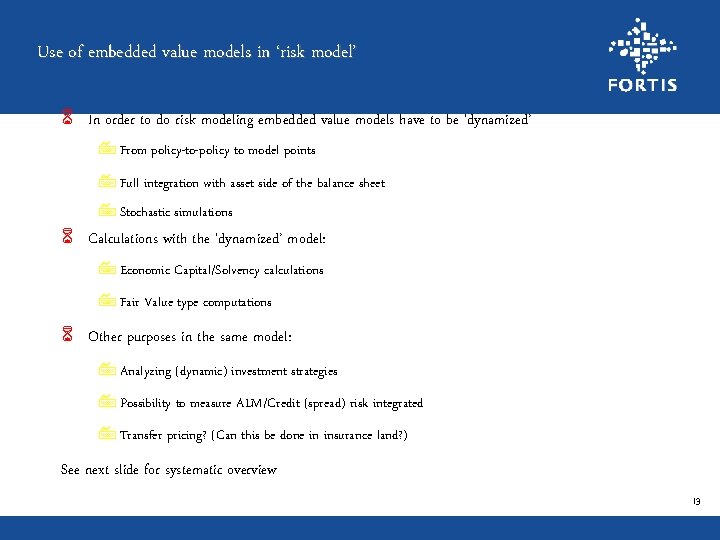

Use of embedded value models in ‘risk model’ 6 In order to do risk modeling embedded value models have to be ‘dynamized’ 7 From policy-to-policy to model points 7 Full integration with asset side of the balance sheet 7 Stochastic simulations 6 Calculations with the ‘dynamized’ model: 7 Economic Capital/Solvency calculations 7 Fair Value type computations 6 Other purposes in the same model: 7 Analyzing (dynamic) investment strategies 7 Possibility to measure ALM/Credit (spread) risk integrated 7 Transfer pricing? (Can this be done in insurance land? ) See next slide for systematic overview 13

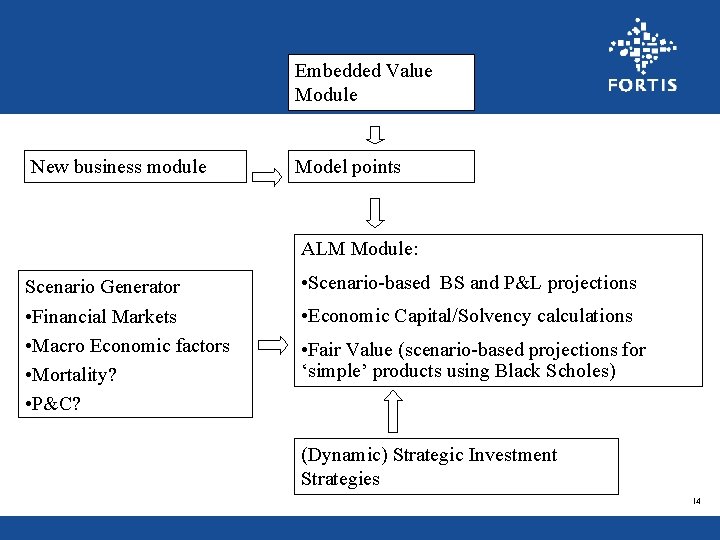

Embedded Value Module New business module Model points ALM Module: Scenario Generator • Scenario-based BS and P&L projections • Financial Markets • Macro Economic factors • Mortality? • P&C? • Economic Capital/Solvency calculations • Fair Value (scenario-based projections for ‘simple’ products using Black Scholes) (Dynamic) Strategic Investment Strategies 14

A common risk measurement framework is the prerequisite to effectively measure/ manage risk and capital step 3 : define the models to be used for each risk type (Business - Event - Credit - Market - P and C - Life) in a consistent way. 15

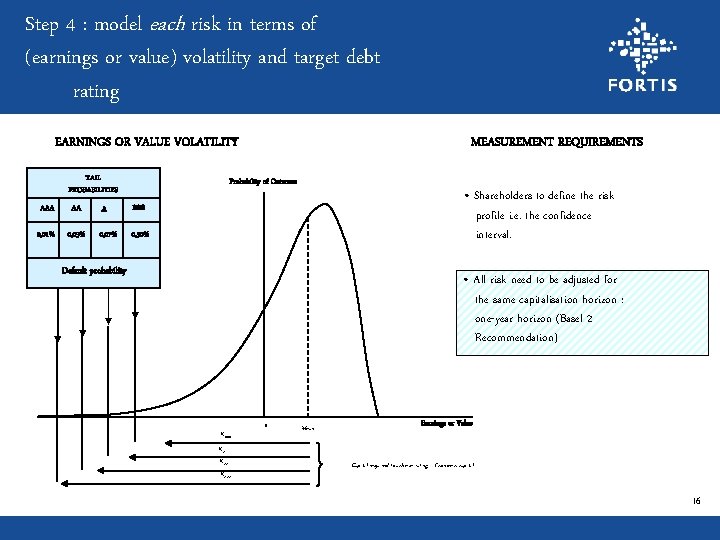

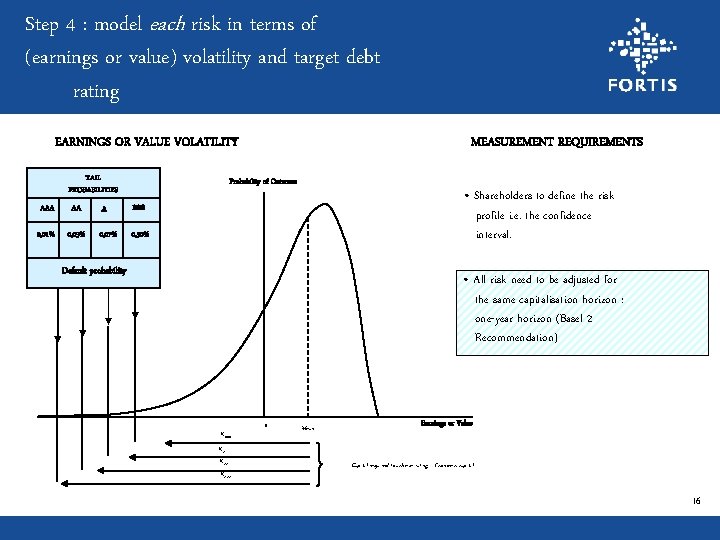

Step 4 : model each risk in terms of (earnings or value) volatility and target debt rating EARNINGS OR VALUE VOLATILITY TAIL PROBABILITIES AAA AA 0, 01% 0, 03% MEASUREMENT REQUIREMENTS Probability of Outcome A BBB 0, 07% 0, 30% • Shareholders to define the risk profile i. e. the confidence interval. Default probability • All risk need to be adjusted for the same capitalisation horizon : one-year horizon (Basel 2 Recommendation) KBBB 0 Mean Earnings or Value KA KAAA Capital required to achieve rating = Economic capital 16

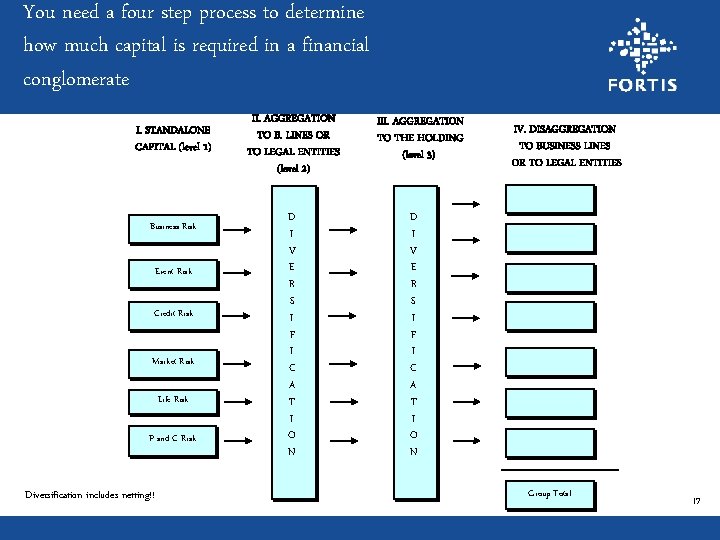

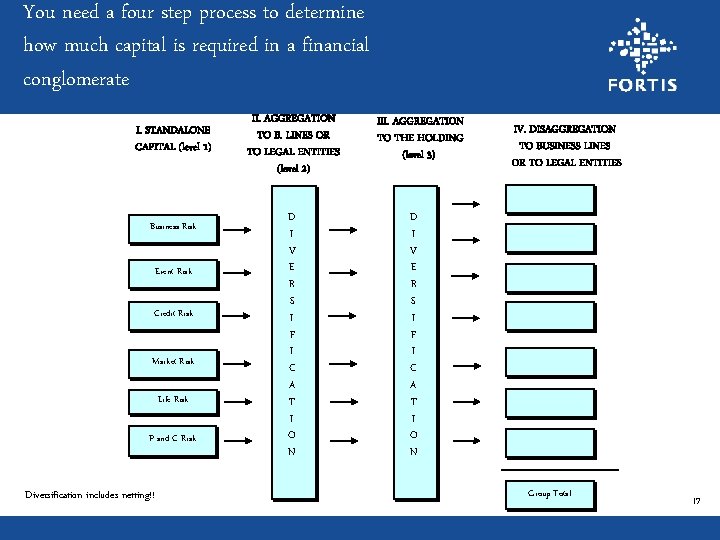

You need a four step process to determine how much capital is required in a financial conglomerate I. STANDALONE CAPITAL (level 1) Business Risk Event Risk Credit Risk Market Risk Life Risk P and C Risk Diversification includes netting!! II. AGGREGATION TO B. LINES OR TO LEGAL ENTITIES (level 2) D I V E R S I F I C A T I O N III. AGGREGATION TO THE HOLDING (level 3) IV. DISAGGREGATION TO BUSINESS LINES OR TO LEGAL ENTITIES D I V E R S I F I C A T I O N Group Total 17

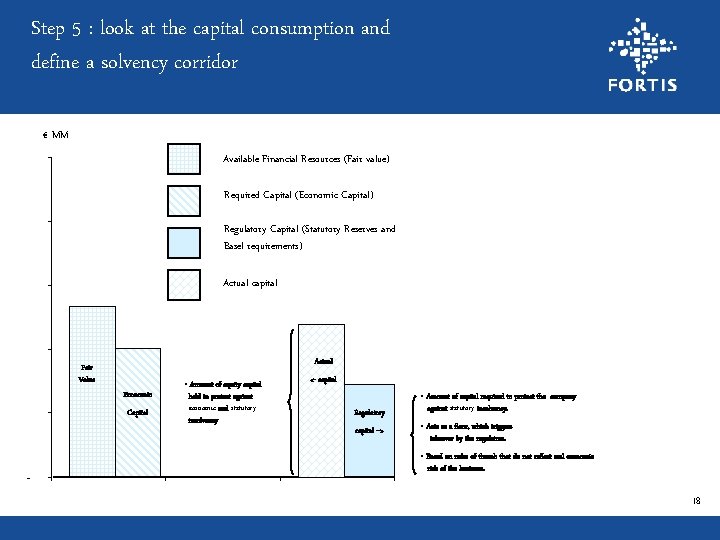

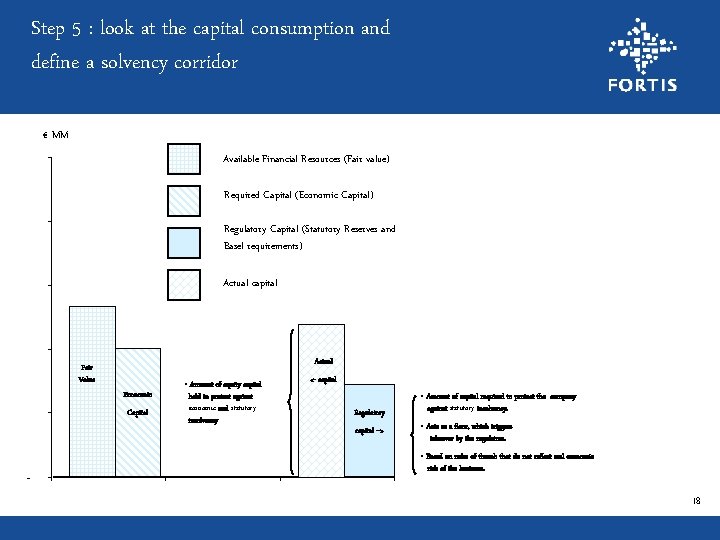

Step 5 : look at the capital consumption and define a solvency corridor € MM Available Financial Resources (Fair value) Required Capital (Economic Capital) Regulatory Capital (Statutory Reserves and Basel requirements) Actual capital Actual Fair Value Economic Capital - • Amount of equity capital held to protect against economic and statutory insolvency <- capital Regulatory capital --> • Amount of capital required to protect the company against statutory insolvency. • Acts as a floor, which triggers takeover by the regulators. • Based on rules of thumb that do not reflect real economic risk of the business. 18

Step 5: look at the capital consumption and define a solvency corridor 6 Remark: 7 Many banks/insurance companies use Fair Value at Risk with a 1 year horizon as a measure for economic solvency (Economic Capital) 6 Is this a practical measure of economic solvency? 6 Advantage: 7 One unified risk measurement for banks and insurance companies 6 Drawback: 7 Economic Solvency capital defined in this way is quite volatile 7 Quite complicated/time consuming to calculate 7 Usually based on not very realistic VAR/COVAR approach (diversification) 19

Side step: Alternative Economic Solvency Measure? 6 Needed: discussion between experts (actuaries and non-actuaries) on pragmatic economic solvency measure 6 PVK working party 6 In light of Solvency II 6 Important that regulators and rating agencies are familiar with the way banks/insurance companies measure economic solvency based on ‘real measurement’ of risk; no ‘fixed rules of thumb’ Only then financial institutions can start managing risks and capital 6 Example: roll-forward method next slide 20

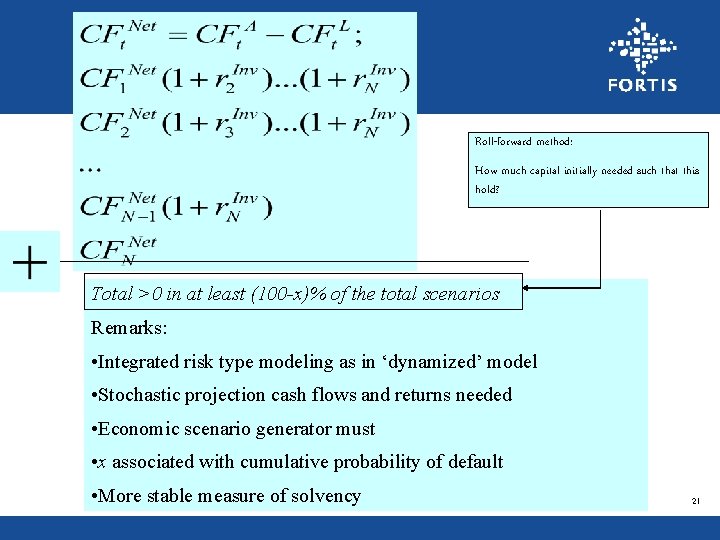

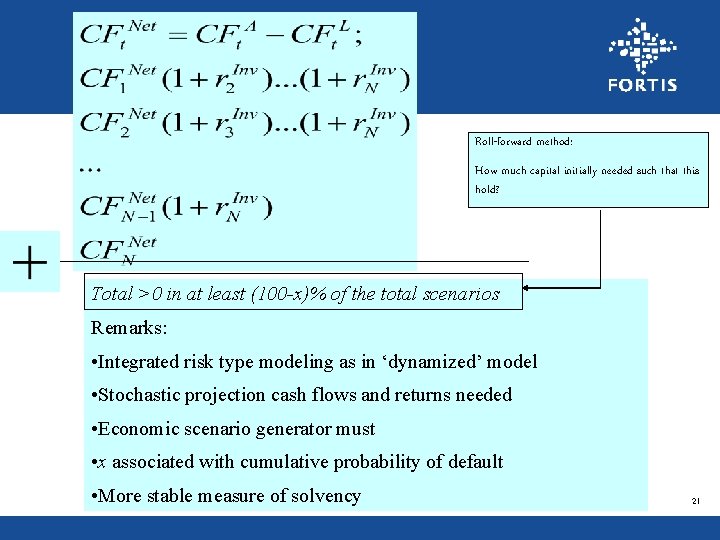

Roll-forward method: How much capital initially needed such that this hold? Total >0 in at least (100 -x)% of the total scenarios Remarks: • Integrated risk type modeling as in ‘dynamized’ model • Stochastic projection cash flows and returns needed • Economic scenario generator must • x associated with cumulative probability of default • More stable measure of solvency 21

Look at the risk/return “Framework” ROA --> ROE (accounting view) --> RORE (regulatory view : Basel 1, Basel 2, …) RARORAC RAROC (Economic view - Basel 3 ? ) RORAC 22

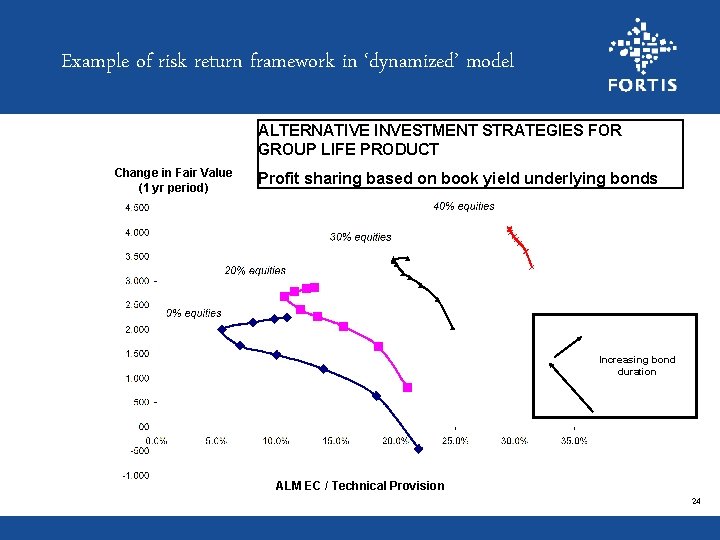

Example of risk return framework in ‘dynamized’ model 6 Testing of different strategic asset mixes, and compare these assets mixes in terms of 7 Impact on Fair Value creation 7 Impact on Earnings 7 Impact on Economic Capital (ALM) & Solvency 7 Impact on Profit Sharing (client perspective) 6 Development: integration of other risk types (e. g. credit), new product strategies, etc. in model 23

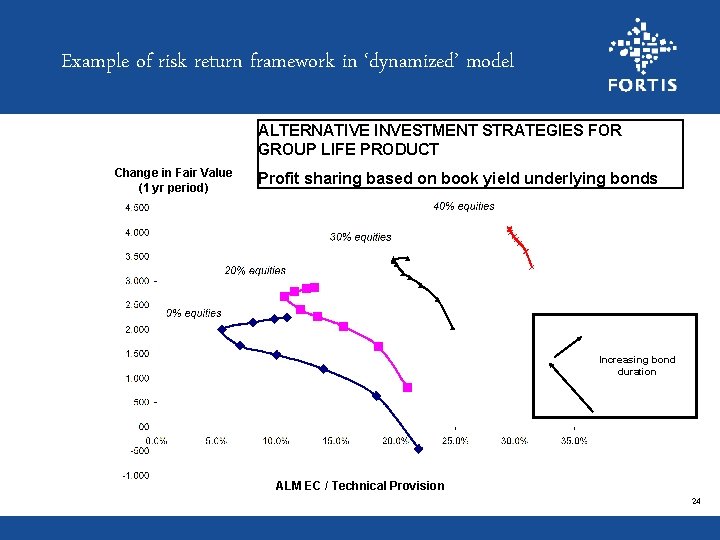

Example of risk return framework in ‘dynamized’ model ALTERNATIVE INVESTMENT STRATEGIES FOR GROUP LIFE PRODUCT Change in Fair Value (1 yr period) Profit sharing based on book yield underlying bonds Increasing bond duration ALM EC / Technical Provision 24

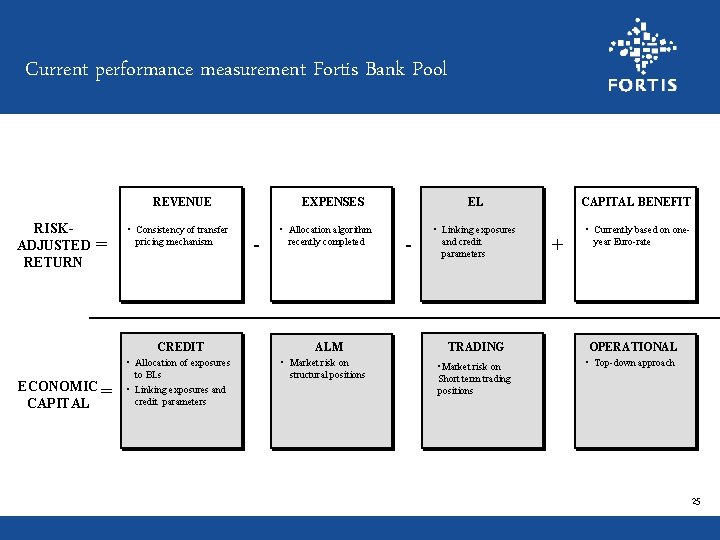

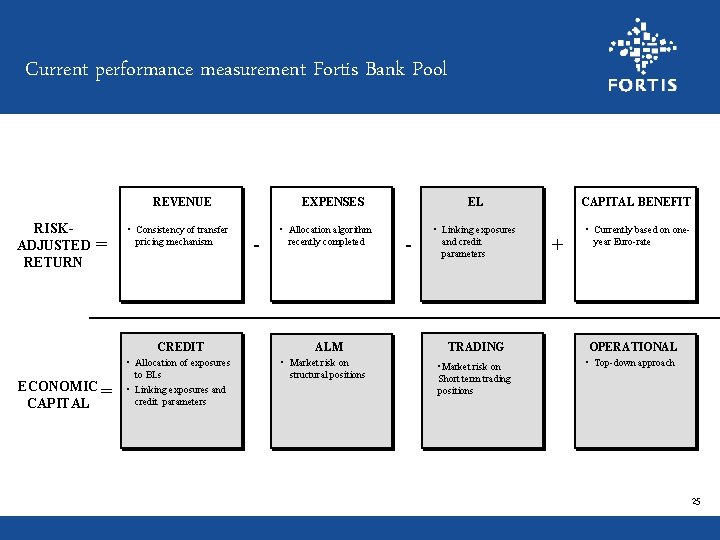

Current performance measurement Fortis Bank Pool REVENUE RISKADJUSTED RETURN = • Consistency of transfer pricing mechanism CREDIT ECONOMIC = CAPITAL • Allocation of exposures to BLs • Linking exposures and credit parameters EXPENSES - • Allocation algorithm recently completed ALM • Market risk on structural positions - EL CAPITAL BENEFIT • Linking exposures and credit parameters • Currently based on oneyear Euro-rate + TRADING OPERATIONAL • Market risk on Short term trading positions • Top-down approach 25

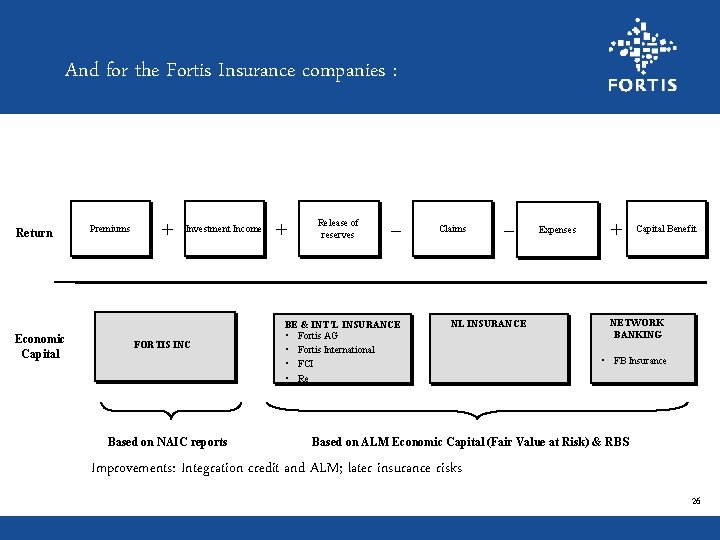

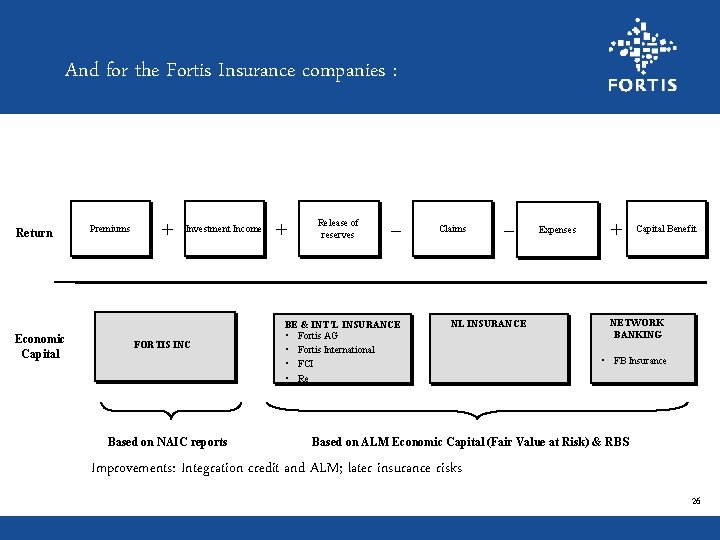

And for the Fortis Insurance companies : Return Economic Capital Premiums + Investment Income FORTIS INC Based on NAIC reports + Release of reserves – BE & INT’L INSURANCE • Fortis AG • Fortis International • FCI • Re Claims – NL INSURANCE Expenses + Capital Benefit NETWORK BANKING • FB Insurance Based on ALM Economic Capital (Fair Value at Risk) & RBS Improvements: Integration credit and ALM; later insurance risks 26

3. HOW TO PRIORITIZE THE BUSINESS APPLICATIONS ? 27

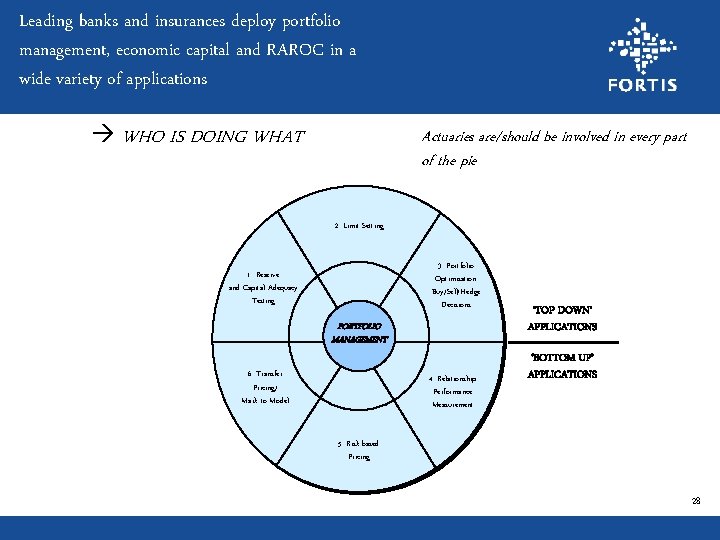

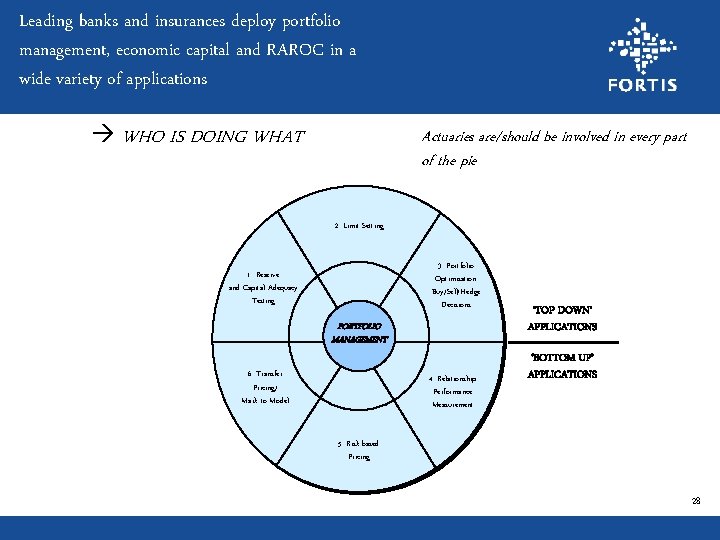

Leading banks and insurances deploy portfolio management, economic capital and RAROC in a wide variety of applications WHO IS DOING WHAT ? Actuaries are/should be involved in every part of the pie 2. Limit Setting 3. Portfolio Optimisation Buy/Sell/Hedge Decisions 1. Reserve and Capital Adequacy Testing PORTFOLIO MANAGEMENT 6. Transfer Pricing/ Mark-to-Model 4. Relationship Performance Measurement ‘TOP DOWN’ APPLICATIONS ‘BOTTOM UP’ APPLICATIONS 5. Risk-based Pricing 28

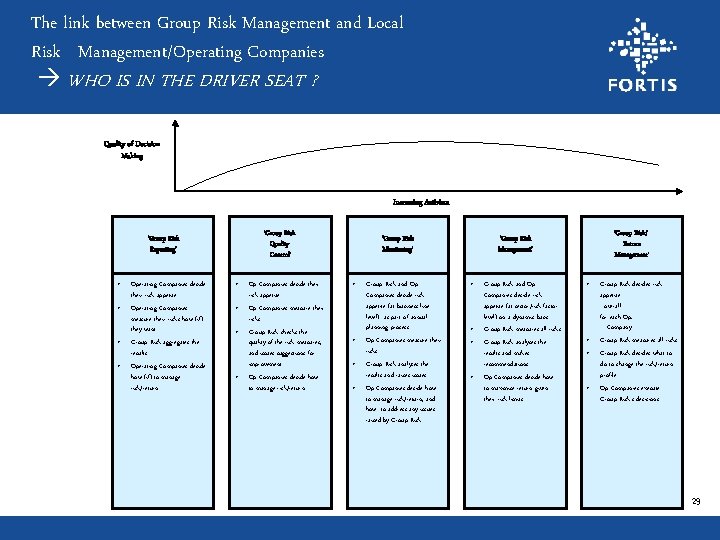

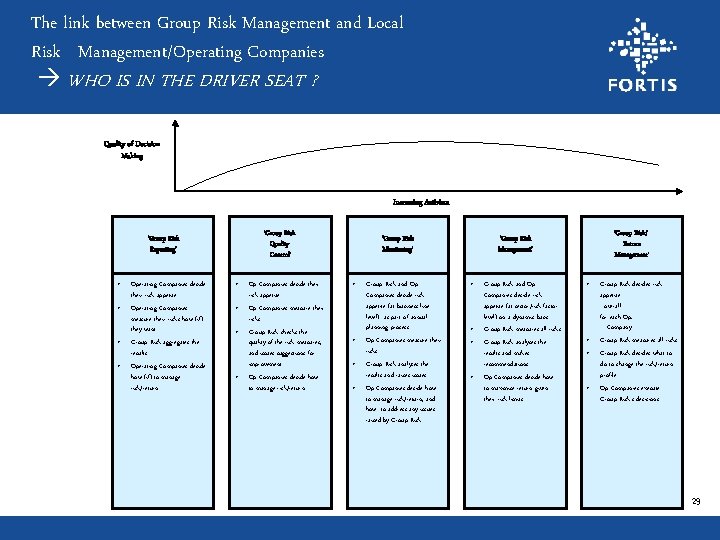

The link between Group Risk Management and Local Risk Management/Operating Companies WHO IS IN THE DRIVER SEAT ? Quality of Decision Making Increasing Activism ‘Group Risk Quality Control’ ‘Group Risk Reporting’ • • Operating Companies decide their risk appetite Operating Companies measure their risks how (if) they want Group Risk aggregates the results Operating Companies decide how (if) to manage risk/return • • Op Companies decide their risk appetite Op Companies measure their risks Group Risk checks the quality of the risk measures, and issues suggestions for improvement Op Companies decide how to manage risk/return ‘Group Risk Monitoring’ • • Group Risk and Op Companies decide risk appetite (at business line level) as part of annual planning process Op Companies measure their risks Group Risk analyses the results and raises issues Op Companies decide how to manage risk/return, and how to address any issues raised by Group Risk ‘Group Risk/ Return Management’ ‘Group Risk Management’ • • Group Risk and Op Companies decide risk appetite (at sector/risk factor level) on a dynamic basis Group Risk measures all risks Group Risk analyses the results and makes recommendations Op Companies decide how to maximise return given their risk limits • • Group Risk decides risk appetite - overall for each Op. Company Group Risk measures all risks Group Risk decides what to do to change the risk/return profile Op Companies execute Group Risk’s decisions 29

4. FOOD FOR THOUGHT 30

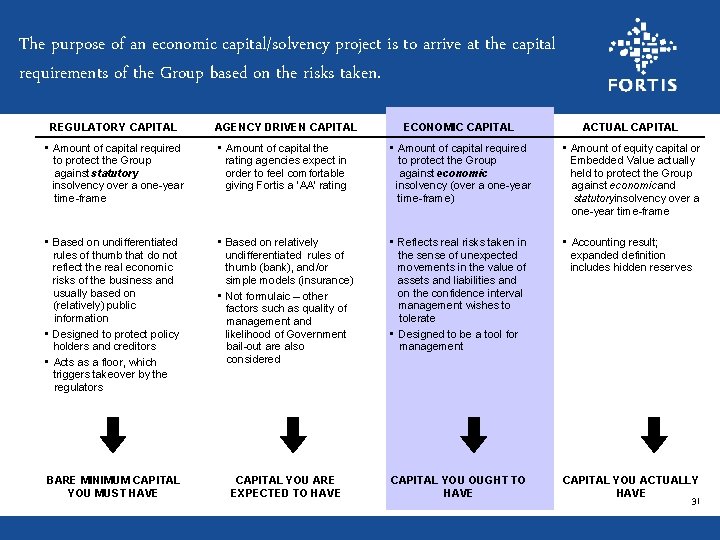

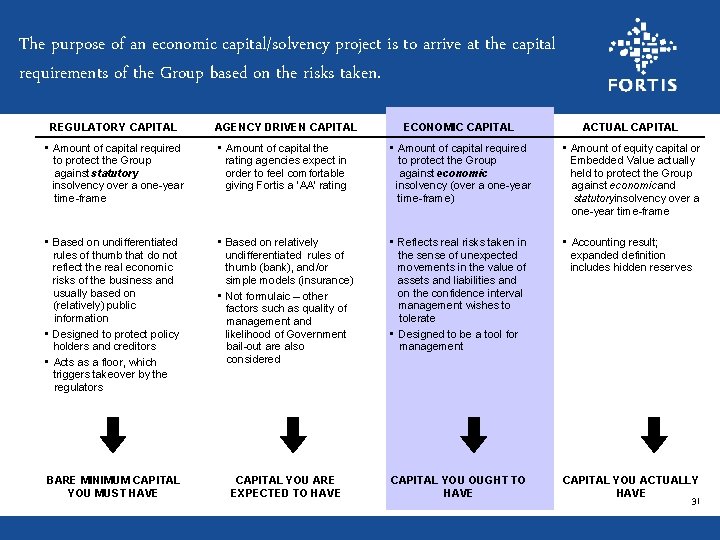

The purpose of an economic capital/solvency project is to arrive at the capital requirements of the Group based on the risks taken. REGULATORY CAPITAL AGENCY DRIVEN CAPITAL ECONOMIC CAPITAL ACTUAL CAPITAL • Amount of capital required to protect the Group against statutory insolvency over a one-year time-frame • Amount of capital the rating agencies expect in order to feel comfortable giving Fortis a ‘AA’ rating • Amount of capital required to protect the Group against economic insolvency (over a one-year time-frame) • Amount of equity capital or Embedded Value actually held to protect the Group against economic and statutoryinsolvency over a one-year time-frame • Based on undifferentiated rules of thumb that do not reflect the real economic risks of the business and usually based on (relatively) public information • Designed to protect policy holders and creditors • Acts as a floor, which triggers takeover by the regulators • Based on relatively undifferentiated rules of thumb (bank), and/or simple models (insurance) • Not formulaic – other factors such as quality of management and likelihood of Government bail-out are also considered • Reflects real risks taken in the sense of unexpected movements in the value of assets and liabilities and on the confidence interval management wishes to tolerate • Designed to be a tool for management • Accounting result; expanded definition includes hidden reserves BARE MINIMUM CAPITAL YOU MUST HAVE CAPITAL YOU ARE EXPECTED TO HAVE CAPITAL YOU OUGHT TO HAVE CAPITAL YOU ACTUALLY HAVE 31

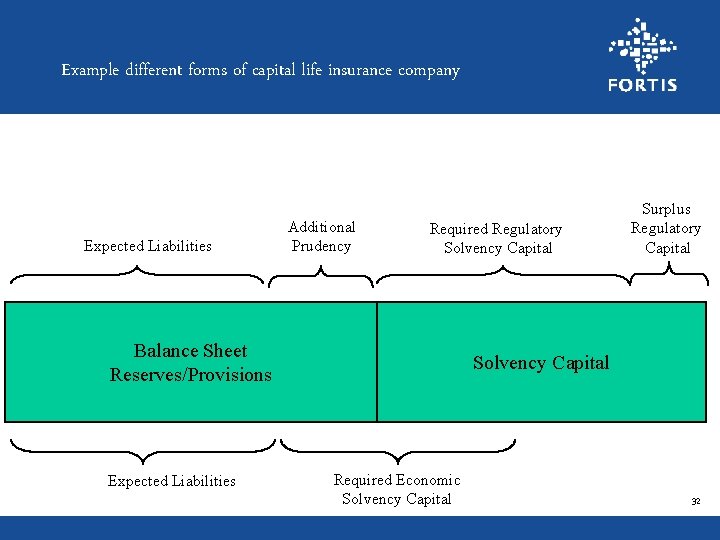

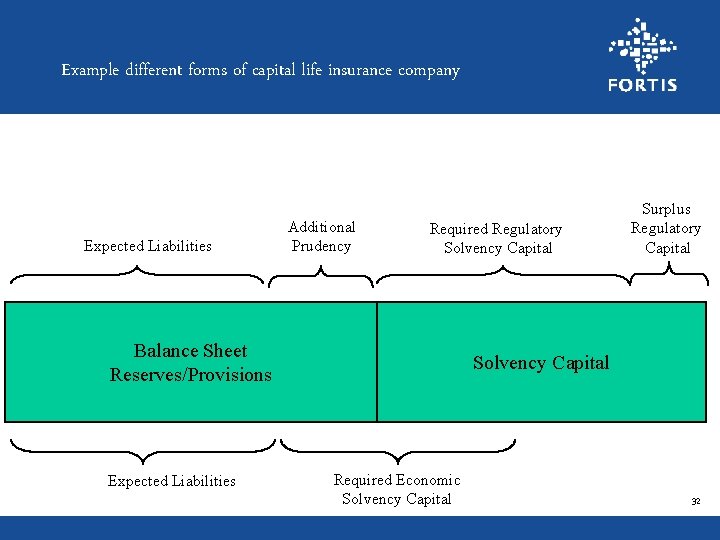

Example different forms of capital life insurance company Expected Liabilities Additional Prudency Required Regulatory Solvency Capital Balance Sheet Reserves/Provisions Expected Liabilities Surplus Regulatory Capital Solvency Capital Required Economic Solvency Capital 32

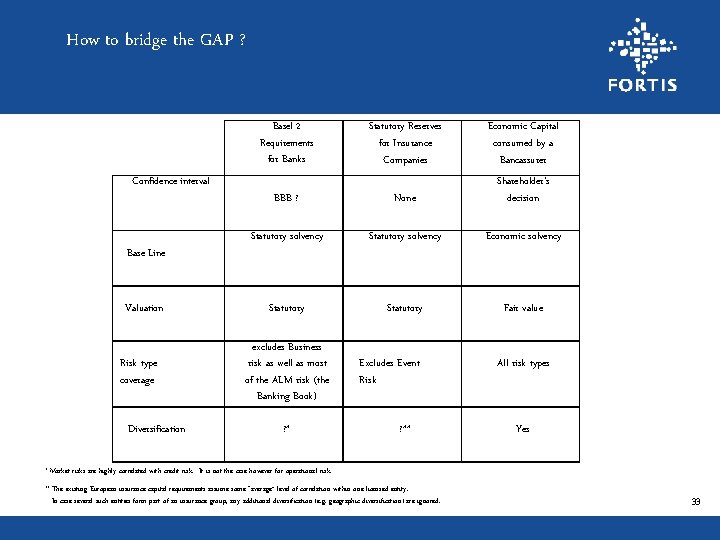

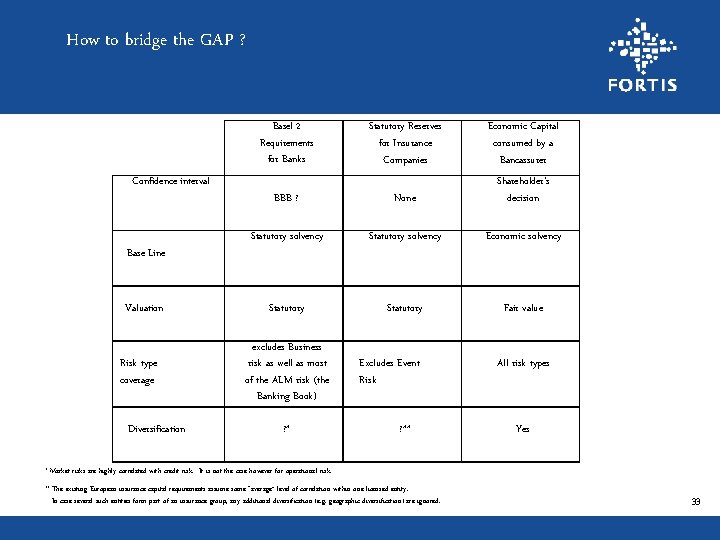

How to bridge the GAP ? Basel 2 Requirements for Banks Confidence interval Base Line Valuation Risk type coverage Diversification Statutory Reserves for Insurance Companies Economic Capital consumed by a Bancassurer BBB ? None Shareholder's decision Statutory solvency Economic solvency Statutory Fair value excludes Business risk as well as most of the ALM risk (the Banking Book) ? * Excludes Event Risk ? ** All risk types Yes * Market risks are highly correlated with credit risk. It is not the case however for operational risk. ** The existing European insurance capital requirements assume some “average” level of correlation within one licensed entity. In case several such entities form part of an insurance group, any additional diversification (e. g. geographic diversification) are ignored. 33

5. Role of the Actuary 34

Role of the actuarial profession 6 Entire risk taxonomy 6 From detailed static embedded value to more flexible risk models (for Life; P&C actuaries traditionally do more stochastic analyses) 6 Development of robust Economic Solvency Framework in the light of Solvency 2 and link to pricing 6 Actuarial and other financial experts have to educate the external constituencies re the economic risk picture 7 For bank-insurance groups: how can diversification-netting benefits be explained to rating agencies? 6 … 35

6. CONCLUSION 36

Conclusions 1. We need a more rational and appropriate framework for responding in an appropriate manner to the issues and opportunities raised by the convergence of the Banking and Insurance models. - Role of the actuary crucial - Embedded value models have to be turned into risk models 2. It is only in this spirit of co-operation and mutual willingness to learn from each other that we will reap the full benefits of convergence. 3. Basel 2/Solvency 2 is a necessary condition to reach that objective: uniform economic solvency framework -> Still quite a lot of issues to be discussed 4. Internal reporting external reporting 5. Integration of the major regulators (Bank – Insurance – Stock exchange) 37

Financial conglomerate definition

Financial conglomerate definition What is a conglomerate

What is a conglomerate Matrix supported conglomerate

Matrix supported conglomerate Introduction of merger and acquisition

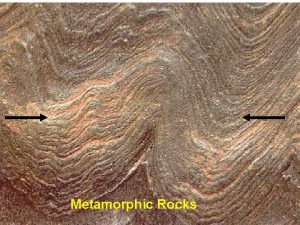

Introduction of merger and acquisition Detrital sedimentary rocks

Detrital sedimentary rocks Super conglomerate

Super conglomerate Metamorphosed conglomerate

Metamorphosed conglomerate Conglomerate

Conglomerate Blank brothers us entertainment conglomerate

Blank brothers us entertainment conglomerate Conglomerate h form design

Conglomerate h form design Tropic thunder actor salaries

Tropic thunder actor salaries Mass media conglomerate

Mass media conglomerate Conglomerate diversification

Conglomerate diversification Whitchester house

Whitchester house Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Slidetodoc

Slidetodoc Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Gấu đi như thế nào

Gấu đi như thế nào Chụp phim tư thế worms-breton

Chụp phim tư thế worms-breton Alleluia hat len nguoi oi

Alleluia hat len nguoi oi Các môn thể thao bắt đầu bằng tiếng đua

Các môn thể thao bắt đầu bằng tiếng đua Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Công thức tính thế năng

Công thức tính thế năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Mật thư anh em như thể tay chân

Mật thư anh em như thể tay chân Phép trừ bù

Phép trừ bù độ dài liên kết

độ dài liên kết Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thể thơ truyền thống

Thể thơ truyền thống Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Một số thể thơ truyền thống

Một số thể thơ truyền thống Bàn tay mà dây bẩn

Bàn tay mà dây bẩn Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Biện pháp chống mỏi cơ

Biện pháp chống mỏi cơ đặc điểm cơ thể của người tối cổ

đặc điểm cơ thể của người tối cổ Ví dụ giọng cùng tên

Ví dụ giọng cùng tên