Summary of Courses in Finance Revision for the

- Slides: 39

Summary of Courses in Finance (Revision for the State Exam) Mihály Ormos Summary in finance, MBA 2002 1

Business Economics & Corporate Finance 4. Markowitz’s portfolio theory – Maximization of expected utility and risk-aversion – Diversification, diversifiable and nondiversifiable risk – Efficient portfolio, investor decision in the Markowitz model 5. CAPM by Sharpe – Risk-free opportunity, homogeneous expectations – Market portfolio and the capital market line – Beta and the security market line 6. Market efficiency – Definition of perfect efficiency, and its properties – Forms of market efficiency (definitions, tests, reasons of existence) – Perfect vs. efficient, adaptive complex systems Summary in finance, MBA 2002 2

Business Economics & Corporate Finance 7. Basics of investment decisions – Owner’s value maximisation, the opportunity cost approach – Opportunity cost from the capital market, through CAPM – Mini-firm approach 8. Taxation – Principles of taxation, basic types – Value Added Tax, Corporate Tax, Personal Income Tax – Consideration of taxes in corporate financial analyses 9. Dividend policy – Indicators of dividend, practices – Indifference of dividend policy in perfect and imperfect market – Significance of indifference of dividend policy in financial analyses, consequences Summary in finance, MBA 2002 3

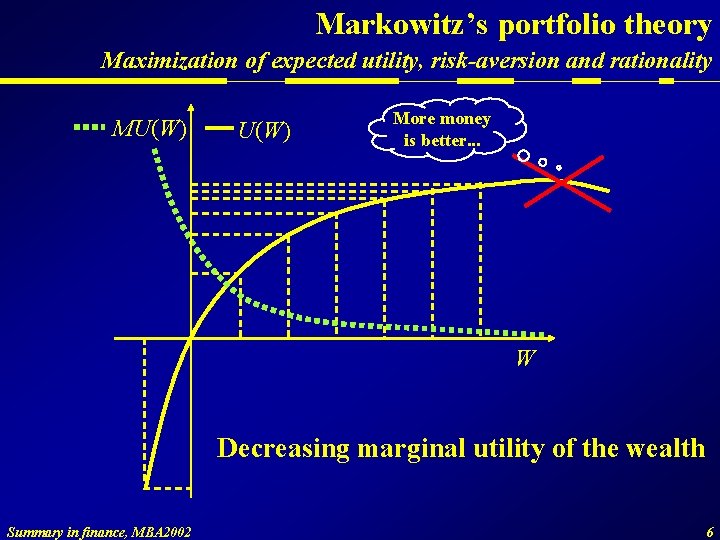

Markowitz’s portfolio theory Maximization of expected utility, risk-aversion and rationality Investors compare investment possibilities with different risk and return. How do investors decide in a risky situation? Bernoulli was the first who argued that investors decide upon the maximisation of expected value (return). Investors’ decisions are made upon the expected utility (satisfaction) of the wealth. So investors try to maximise the expected utility, NOT the expected value of the wealth Summary in finance, MBA 2002 4

Markowitz’s portfolio theory Maximization of expected utility, risk-aversion and rationality The expected utility of an output is not proportionally related to expected value of the same output. The relationship can be represented by the utility function of the wealth. Summary in finance, MBA 2002 5

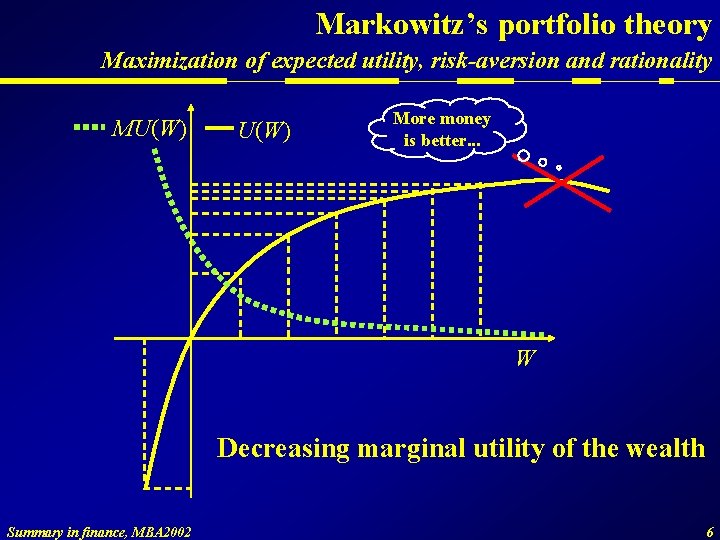

Markowitz’s portfolio theory Maximization of expected utility, risk-aversion and rationality MU(W) More money is better. . . W Decreasing marginal utility of the wealth Summary in finance, MBA 2002 6

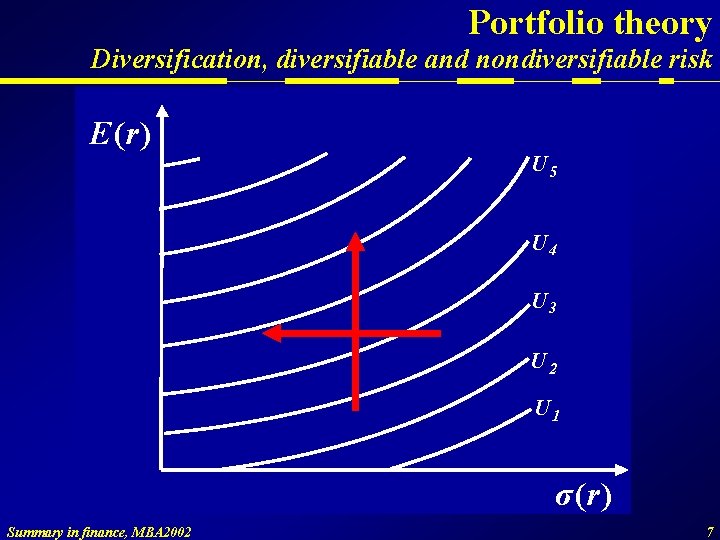

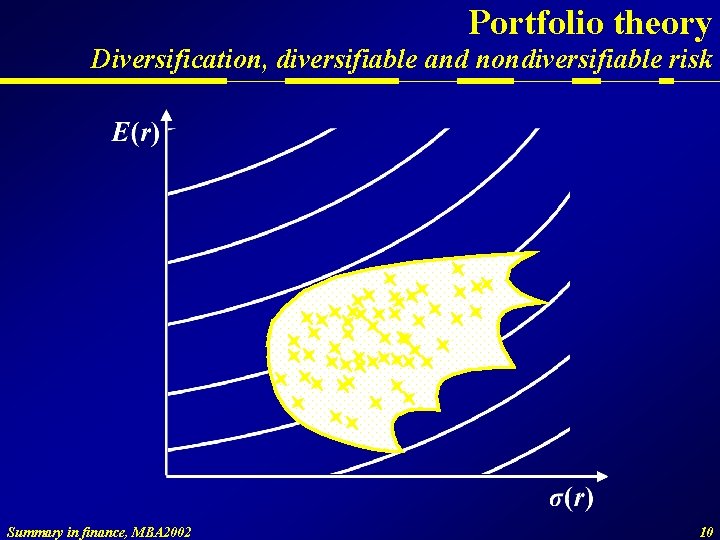

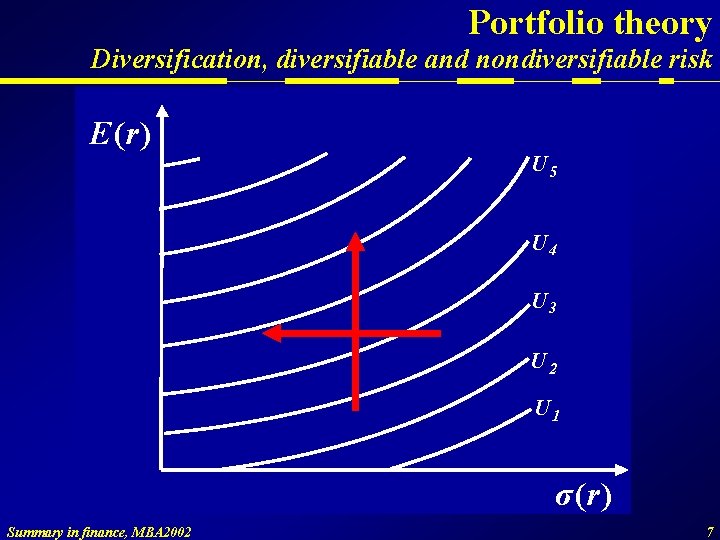

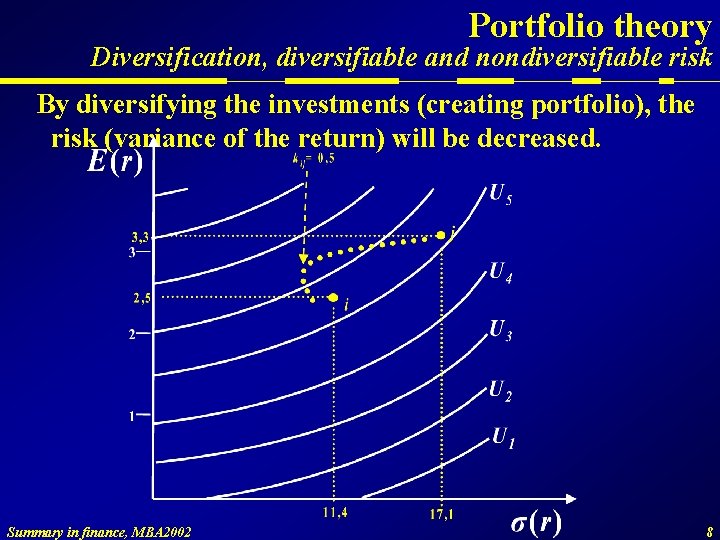

Portfolio theory Diversification, diversifiable and nondiversifiable risk E(r) U 5 U 4 U 3 U 2 U 1 σ(r) Summary in finance, MBA 2002 7

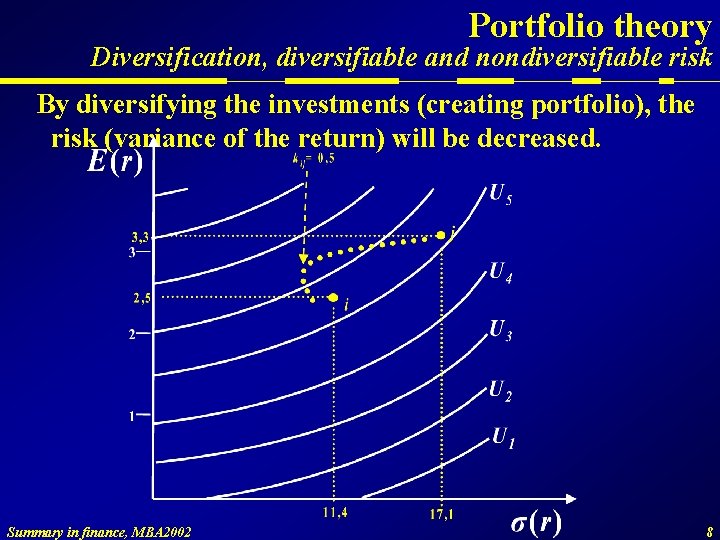

Portfolio theory Diversification, diversifiable and nondiversifiable risk By diversifying the investments (creating portfolio), the risk (variance of the return) will be decreased. Summary in finance, MBA 2002 8

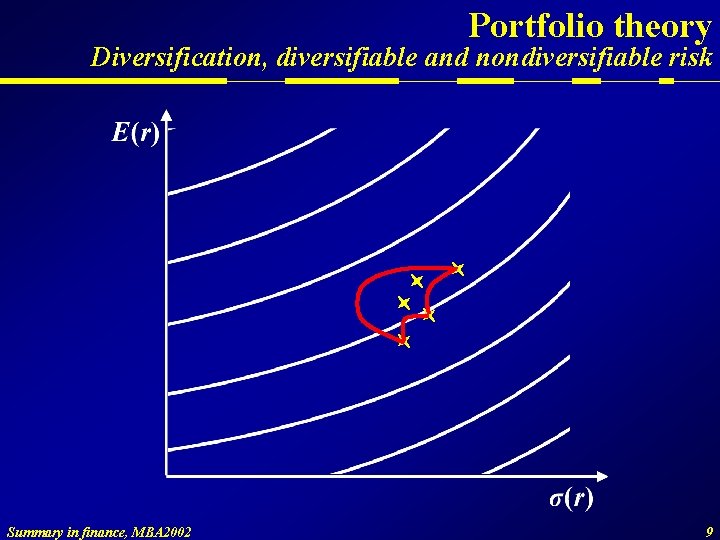

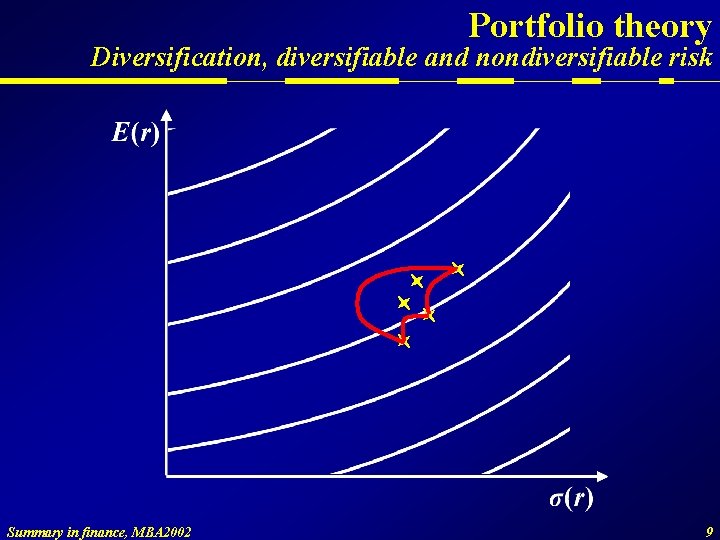

Portfolio theory Diversification, diversifiable and nondiversifiable risk Summary in finance, MBA 2002 9

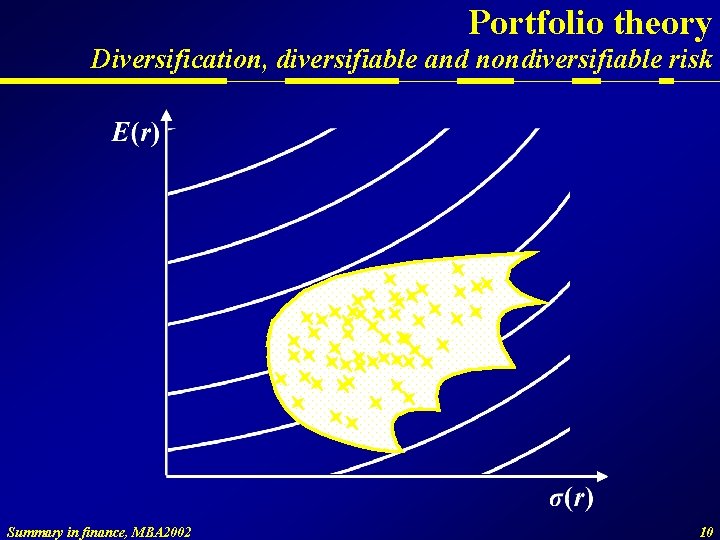

Portfolio theory Diversification, diversifiable and nondiversifiable risk Summary in finance, MBA 2002 10

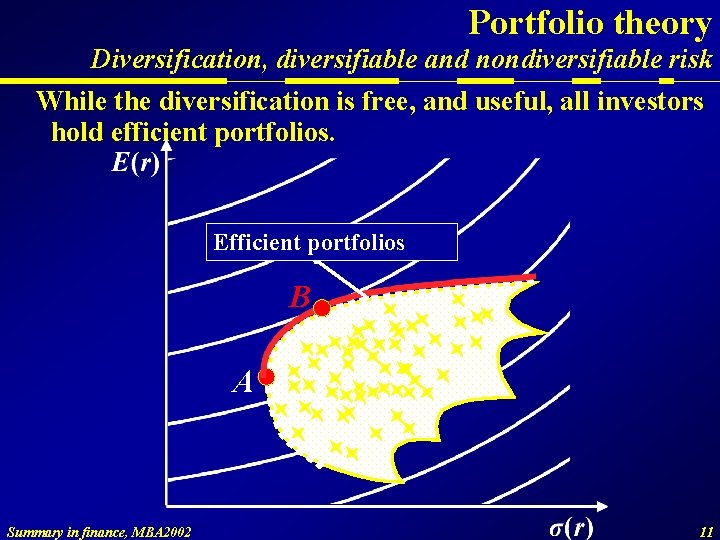

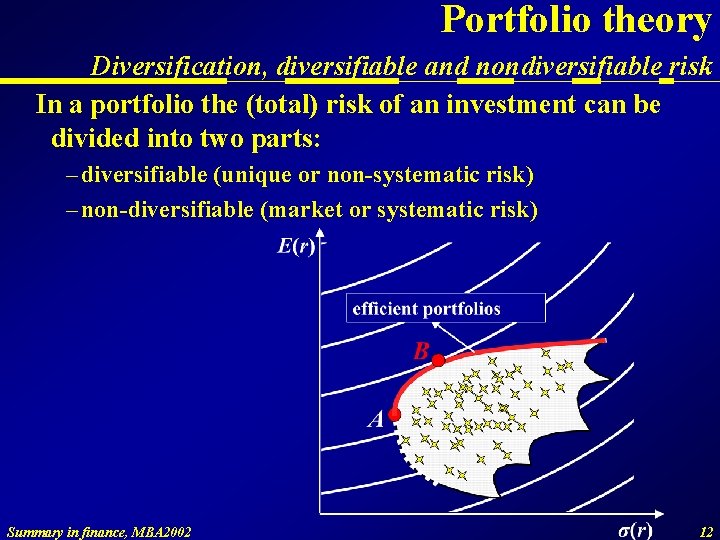

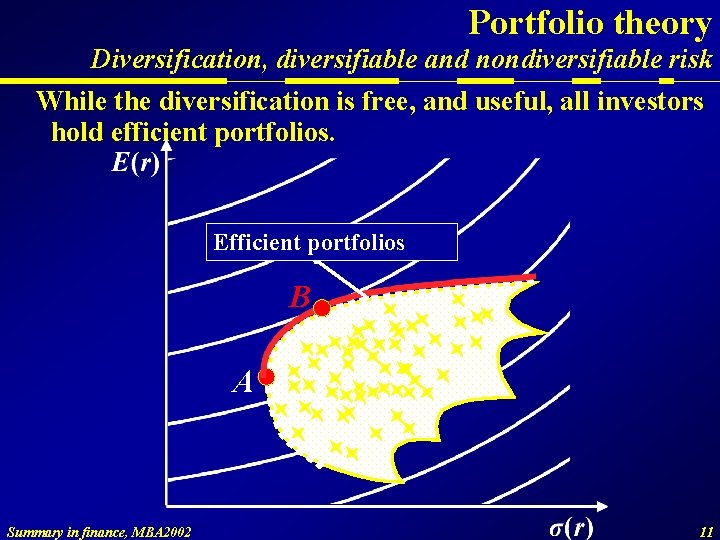

Portfolio theory Diversification, diversifiable and nondiversifiable risk While the diversification is free, and useful, all investors hold efficient portfolios. Efficient portfolios B A Summary in finance, MBA 2002 11

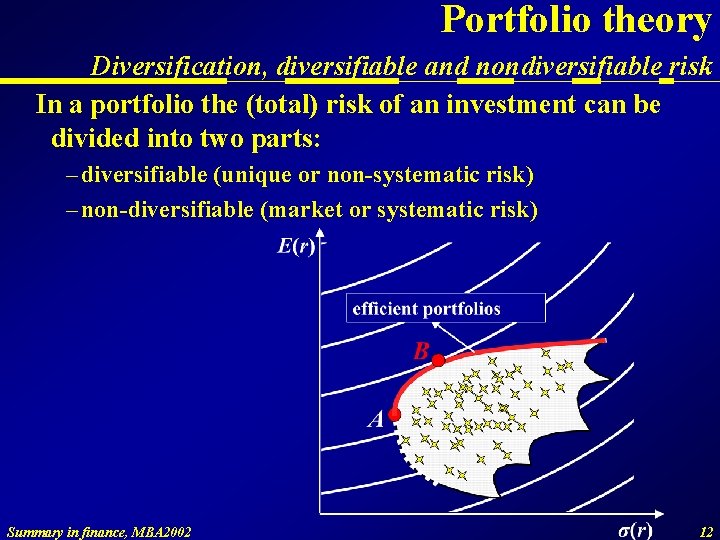

Portfolio theory Diversification, diversifiable and nondiversifiable risk In a portfolio the (total) risk of an investment can be divided into two parts: – diversifiable (unique or non-systematic risk) – non-diversifiable (market or systematic risk) Summary in finance, MBA 2002 12

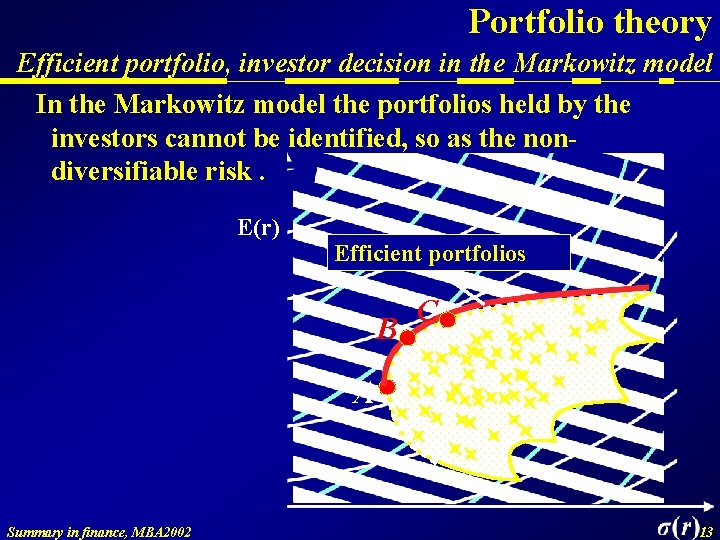

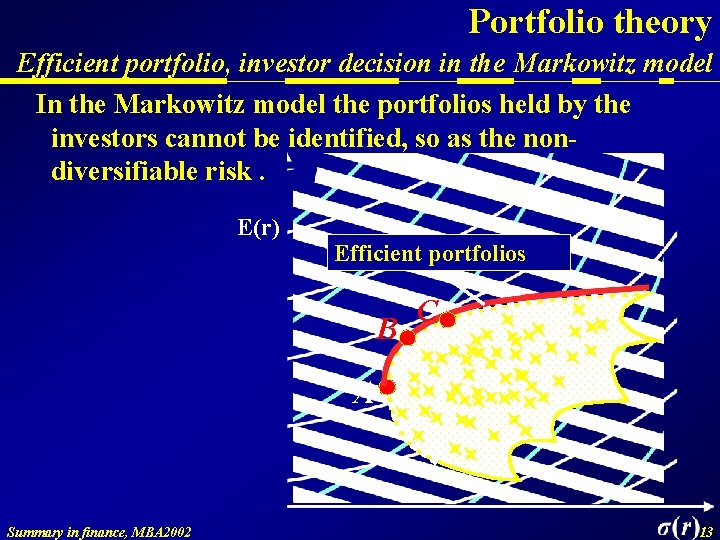

Portfolio theory Efficient portfolio, investor decision in the Markowitz model In the Markowitz model the portfolios held by the investors cannot be identified, so as the nondiversifiable risk. E(r) Efficient portfolios B C A Summary in finance, MBA 2002 13

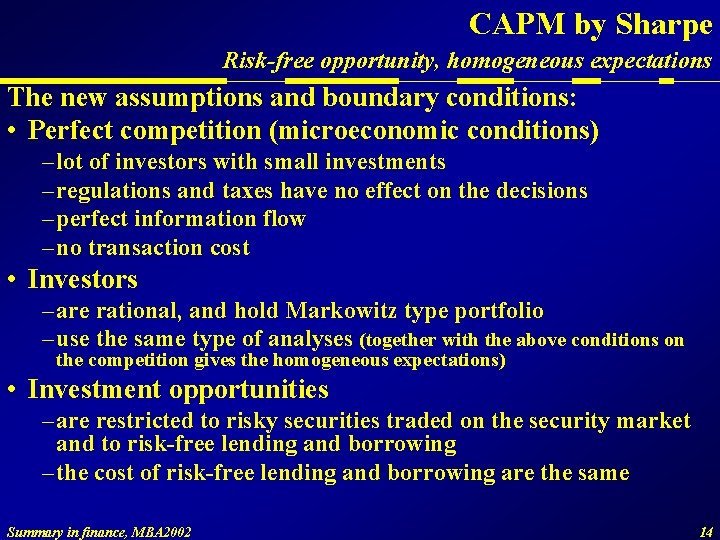

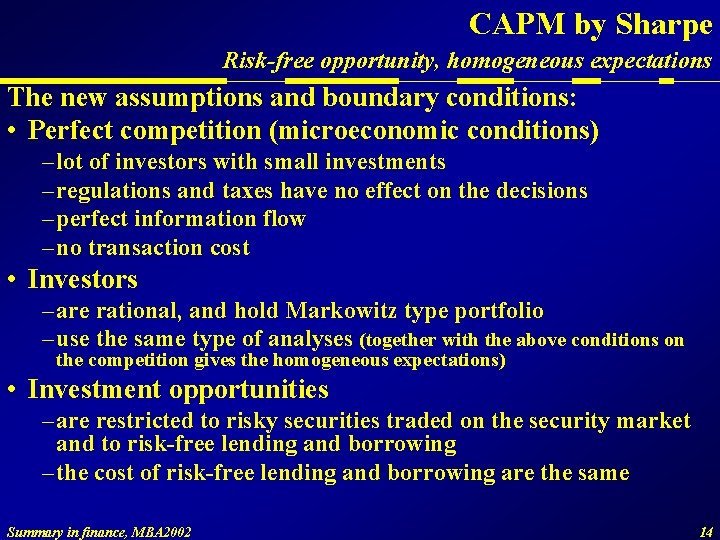

CAPM by Sharpe Risk-free opportunity, homogeneous expectations The new assumptions and boundary conditions: • Perfect competition (microeconomic conditions) – lot of investors with small investments – regulations and taxes have no effect on the decisions – perfect information flow – no transaction cost • Investors – are rational, and hold Markowitz type portfolio – use the same type of analyses (together with the above conditions on the competition gives the homogeneous expectations) • Investment opportunities – are restricted to risky securities traded on the security market and to risk-free lending and borrowing – the cost of risk-free lending and borrowing are the same Summary in finance, MBA 2002 14

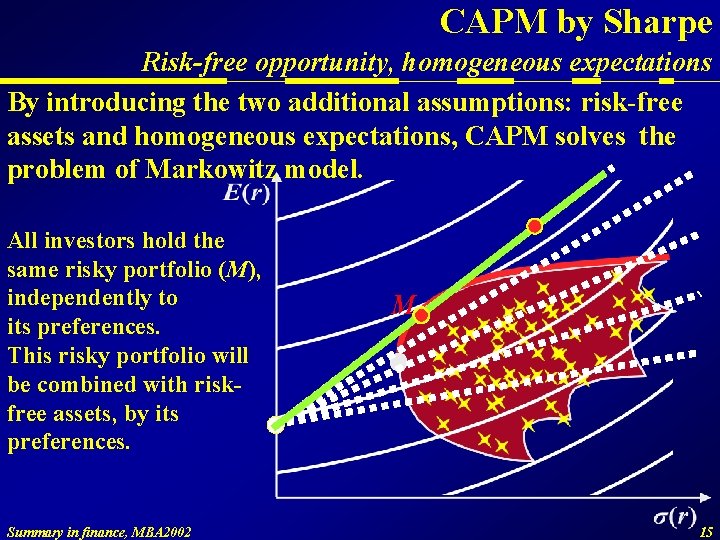

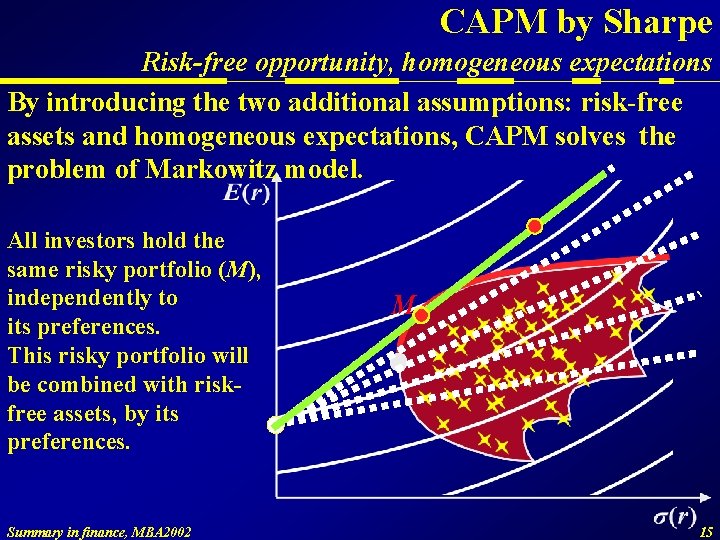

CAPM by Sharpe Risk-free opportunity, homogeneous expectations By introducing the two additional assumptions: risk-free assets and homogeneous expectations, CAPM solves the problem of Markowitz model. All investors hold the same risky portfolio (M), independently to its preferences. This risky portfolio will be combined with riskfree assets, by its preferences. Summary in finance, MBA 2002 M 15

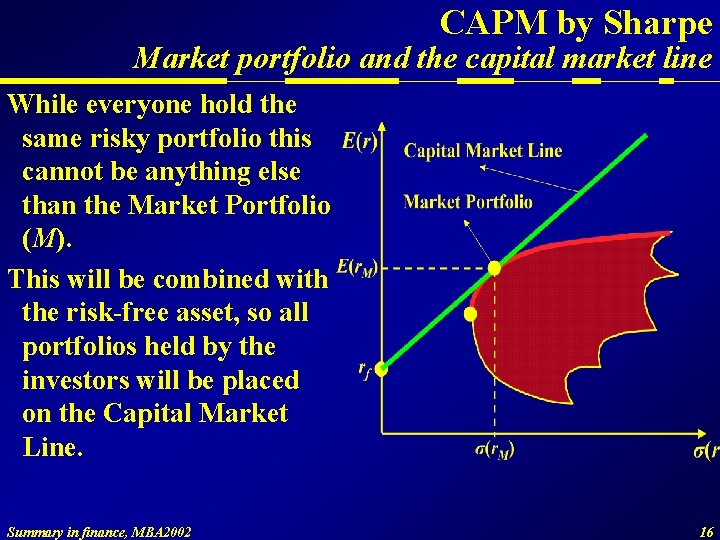

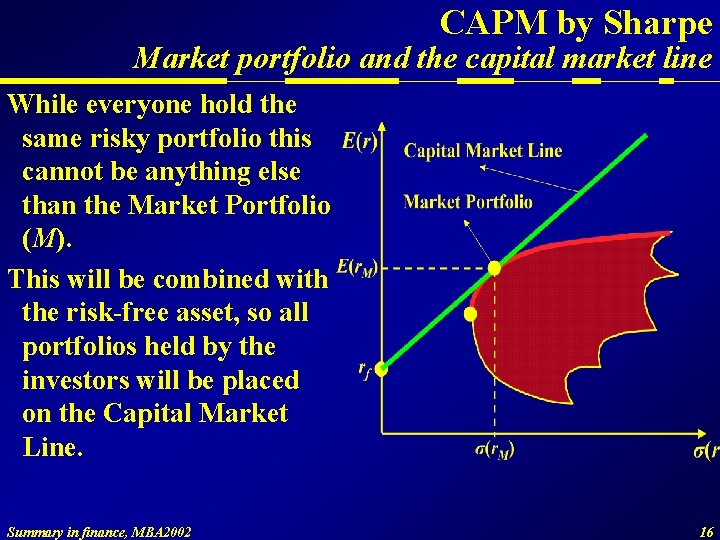

CAPM by Sharpe Market portfolio and the capital market line While everyone hold the same risky portfolio this cannot be anything else than the Market Portfolio (M). This will be combined with the risk-free asset, so all portfolios held by the investors will be placed on the Capital Market Line. Summary in finance, MBA 2002 16

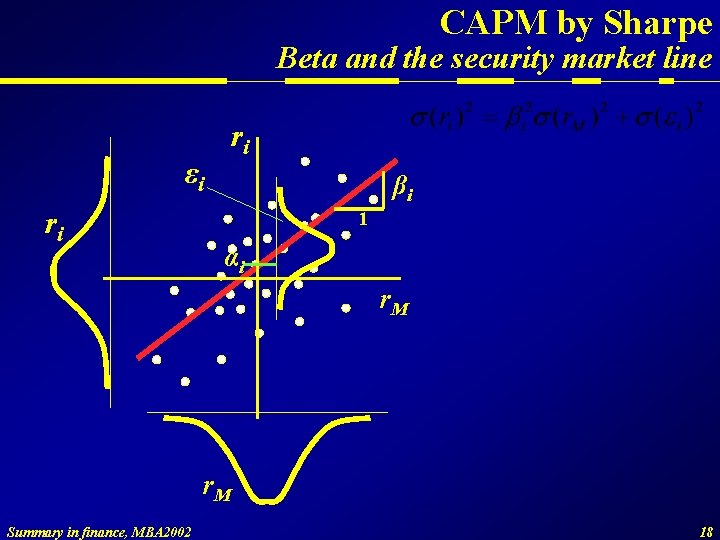

CAPM by Sharpe Market portfolio and the capital market line After all the question is, that how a given security affects the risk of the Market Portfolio. – Only the affect on the market portfolio has to be examined, because the risk free return does not influence the diversification or the perception of the relevant risk. This depends on what extent the given security gains in average the deviation of the Market Portfolio. This is shown by the slope of characteristic line. Summary in finance, MBA 2002 17

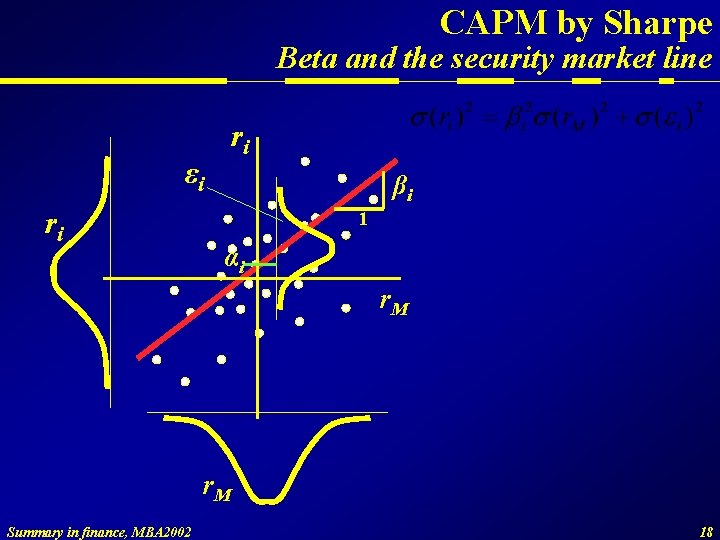

CAPM by Sharpe Beta and the security market line εi ri ri βi 1 αi r. M Summary in finance, MBA 2002 18

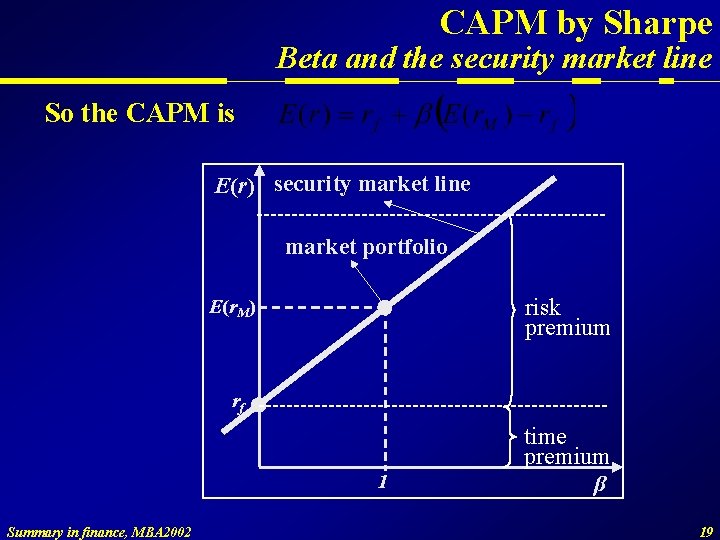

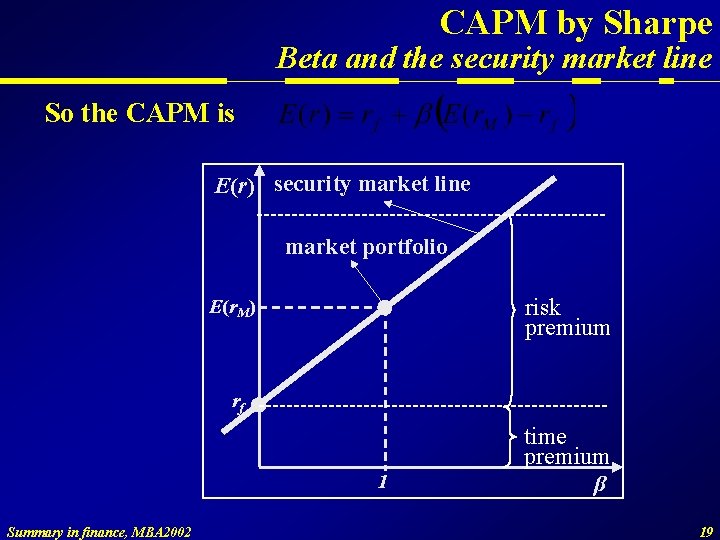

CAPM by Sharpe Beta and the security market line So the CAPM is E(r) security market line market portfolio risk premium E(r. M) rf 1 Summary in finance, MBA 2002 time premium β 19

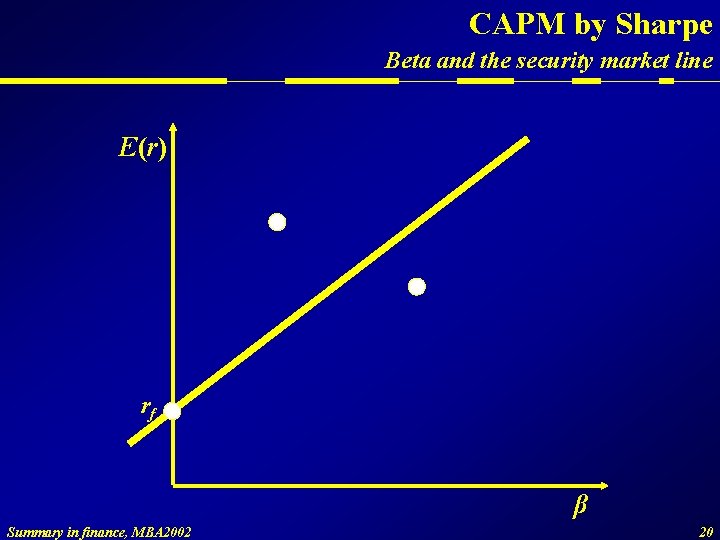

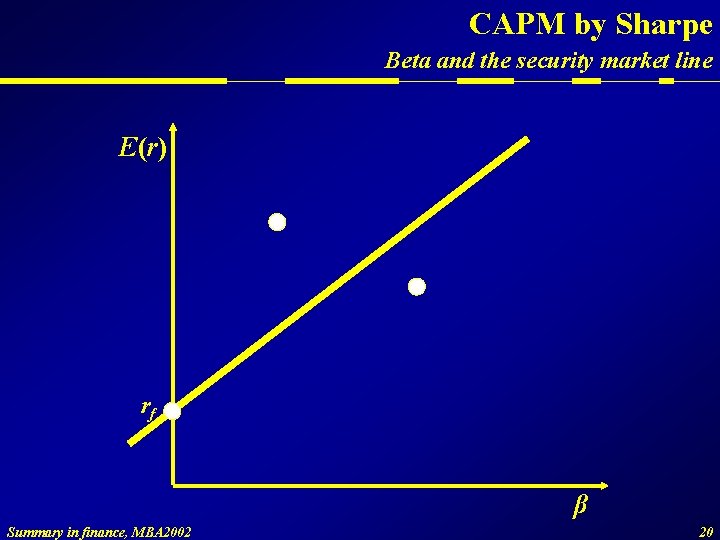

CAPM by Sharpe Beta and the security market line E(r) rf β Summary in finance, MBA 2002 20

Market efficiency Definition of perfect efficiency, and its properties The market is perfectly efficient if all available information on securities (and everything that can be connected to the securities) is immediately and in a correct way built in to the prices. In general this means that it is not possible that a security bought or sold on the market price can produce positive NPV. Continuous buying and selling, and continuous information collection and “in building” with zero transaction- and information acquiring cost. While the transactions, collection and processing information can take cost the prices will reflect all information until the marginal cost of transactions are less than the return connected to the transaction. Summary in finance, MBA 2002 21

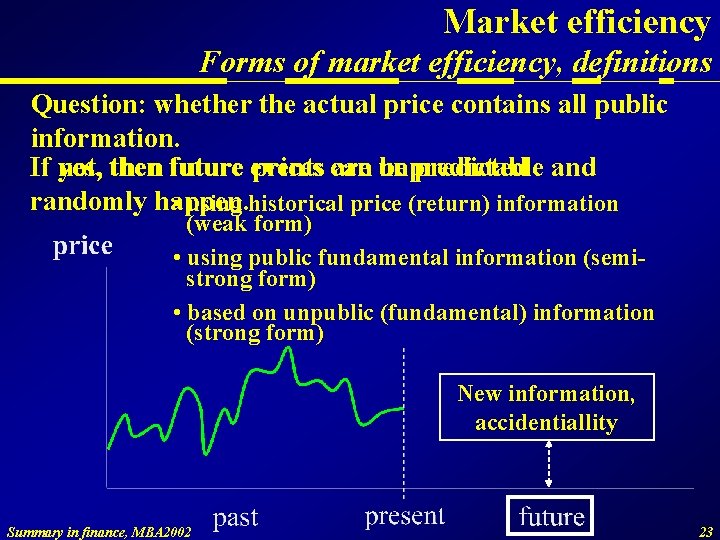

Market efficiency Forms of market efficiency, definitions Weak form of market efficiency: all historical price (return) information available is immediately built in, Semi-strong form of market efficiency: also all public (fundamental) information is immediately built in the securities’s price, Strong form of market efficiency: all public and non-public information is immediately built in the prices as well. Summary in finance, MBA 2002 22

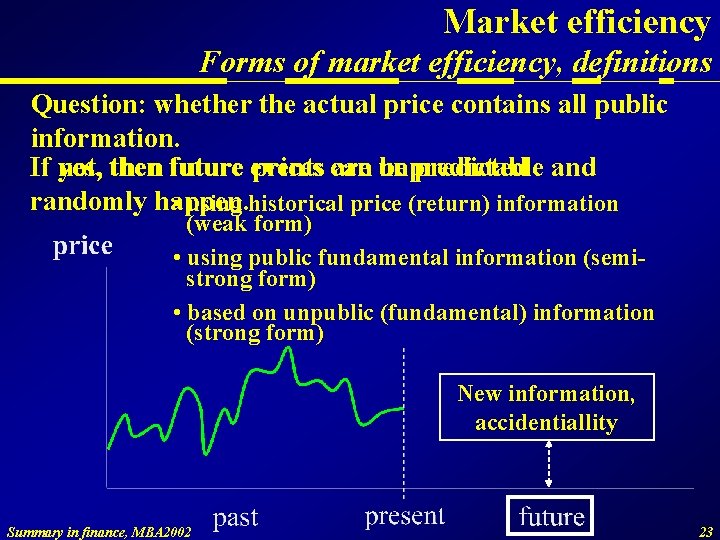

Market efficiency Forms of market efficiency, definitions Question: whether the actual price contains all public information. If not, prices can be predicted and yes, then future events are unpredictable randomly happen. • using historical price (return) information (weak form) • using public fundamental information (semistrong form) • based on unpublic (fundamental) information (strong form) New information, accidentiallity Summary in finance, MBA 2002 23

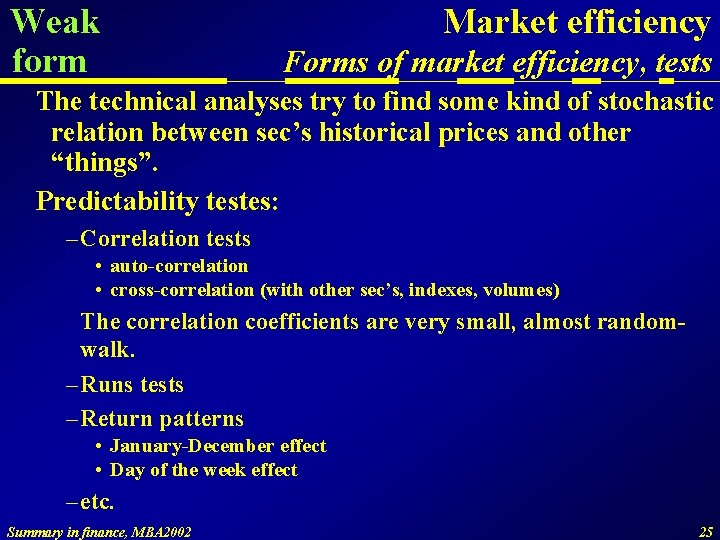

Market efficiency Forms of market efficiency, tests Two types of analyses: – technical analyses – fundamental analyses If the technical analyses proved to be useless this verifies the weak form of market efficiency. By the examination of the fundamental analyses the semi -strong and strong form of market efficiency can be tested. Summary in finance, MBA 2002 24

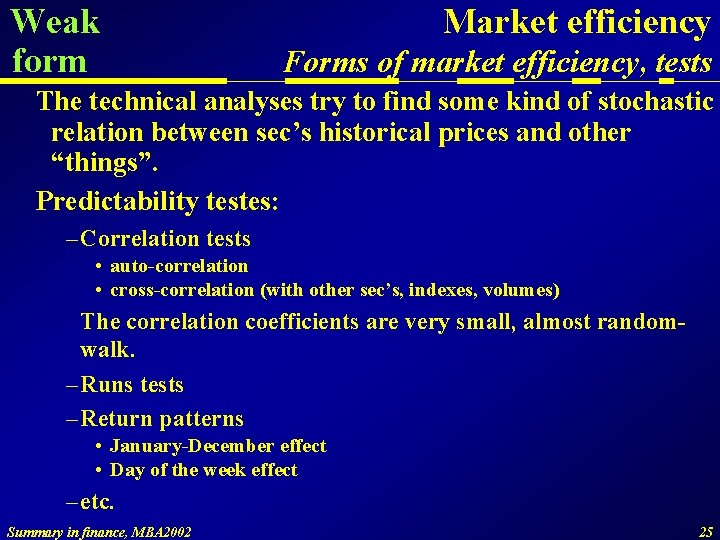

Weak form Market efficiency Forms of market efficiency, tests The technical analyses try to find some kind of stochastic relation between sec’s historical prices and other “things”. Predictability testes: – Correlation tests • auto-correlation • cross-correlation (with other sec’s, indexes, volumes) The correlation coefficients are very small, almost randomwalk. – Runs tests – Return patterns • January-December effect • Day of the week effect – etc. Summary in finance, MBA 2002 25

Weak form Market efficiency Forms of market efficiency, tests Conclusion: The prices are unpredictable by technical analyses in Hungary as well. The stock prices do not have memory. Summary in finance, MBA 2002 26

Semi-strong form Market efficiency Forms of market efficiency, tests Testing of consultants companies and managed mutual founds past forecasts and compared them to the later reality. The results are: – – on the long run: nothing on the short run: nothing by industrial segment, region, etc. : nothing the managed portfolios gives the same nothing in average There is no consistent winner. Summary in finance, MBA 2002 27

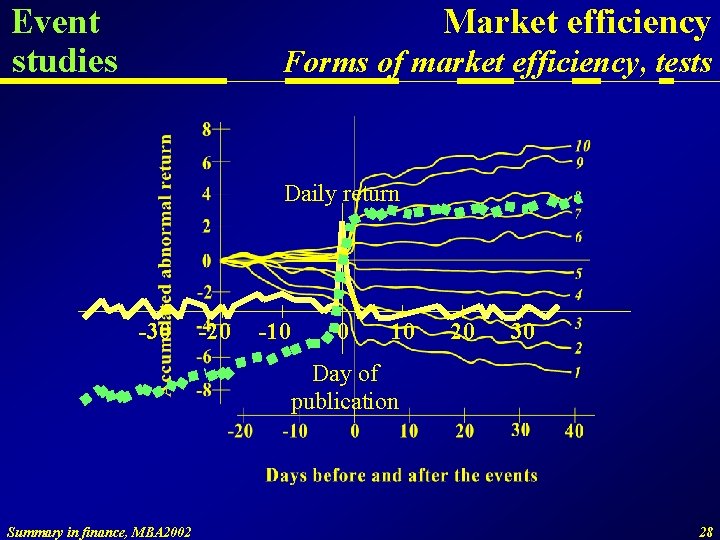

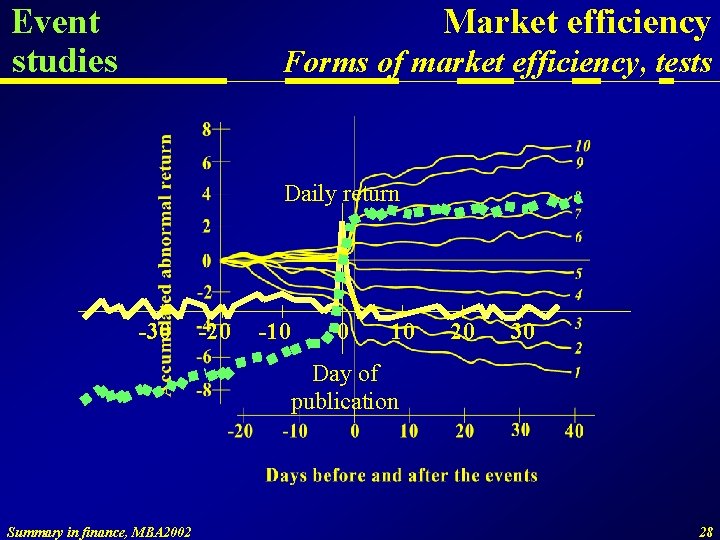

Event studies Market efficiency Forms of market efficiency, tests Daily return -30 -20 -10 0 10 20 30 Day of publication Summary in finance, MBA 2002 28

Market efficiency Forms of market efficiency, reasons of existence If the markets are proved to be efficient, than any kind of analyses are proved to be useless. If these are useless, no one would do them, but the markets are efficient because lot of analysts work on, If the number of analysts decreases they would have the opportunity to gain excess profit, so the number will increases. Summary in finance, MBA 2002 29

Basics of investment decisions Owner’s value maximisation, the opportunity cost approach Development of public limited corporations Early capitalism • individuals and families, with unlimited liability • the owner and the manager is the same • Development of technology and mass production required the concentration of capital Limited liability • more owner one company • legal entity • management and ownership are separated, but • the goals are different • shares are tradable • stock exchange • agency problem However, the management makes the decisions, as a starting point we presume, that the decisions will be made upon theory of shareholder’s value. Summary in finance, MBA 2002 30

Basics of investment decisions Owner’s value maximisation, the opportunity cost approach The goal of the owners’ is the maximisation value, that is the maximisation of the value of the corporation. – If this is the goal of the owner -by the shareholder’s valuethis will be goal in any business decision. The wealth of the owner can be increased through dividend pay off or stock price increase. Only those investment decisions suits to the value maximisation approach, which promise higher return than others. Others means in investment decisions the opportunity cost. Opportunity cost is the return of other investments on the capital market with similar risk. Summary in finance, MBA 2002 31

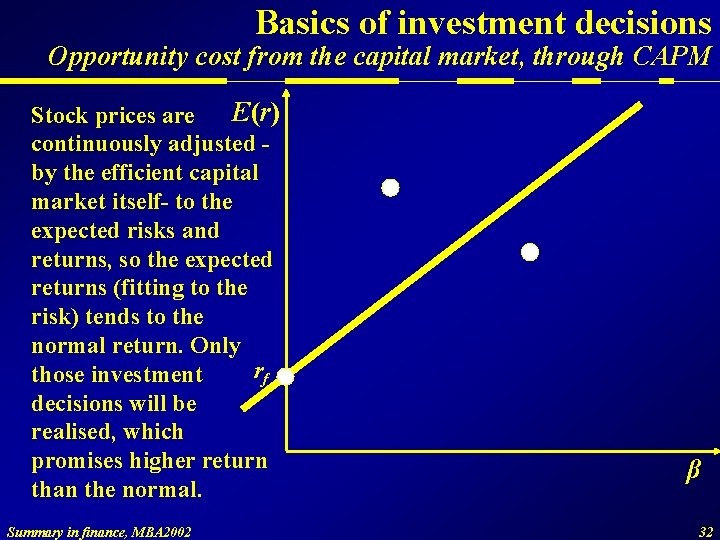

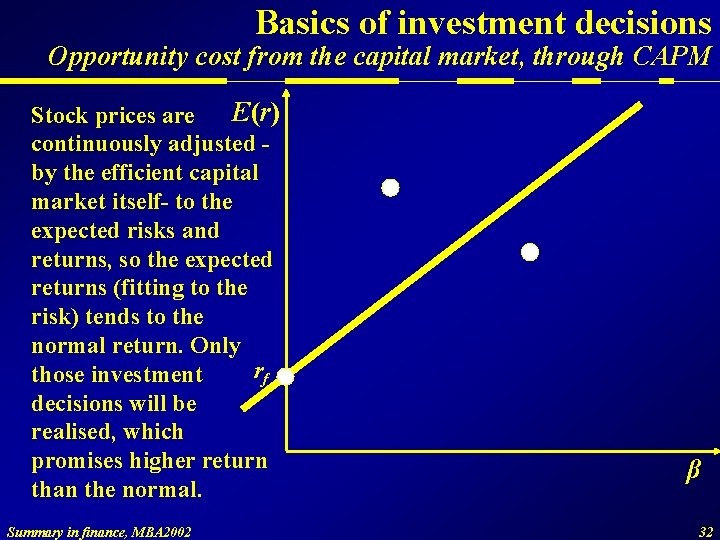

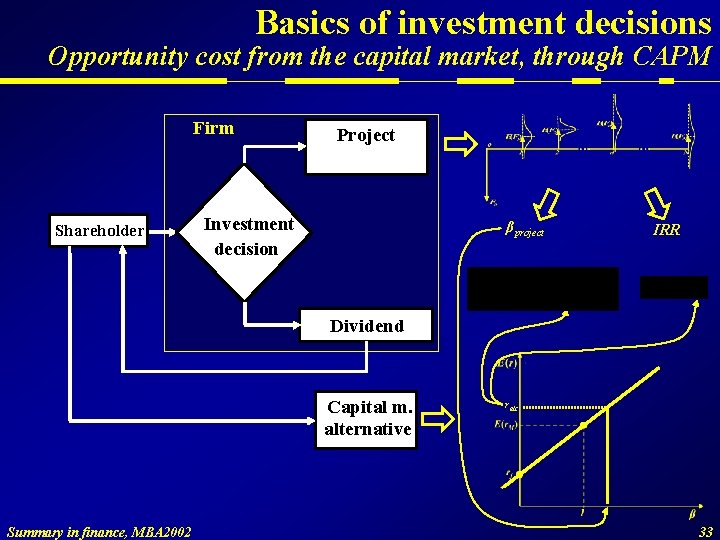

Basics of investment decisions Opportunity cost from the capital market, through CAPM E(r) Stock prices are continuously adjusted by the efficient capital market itself- to the expected risks and returns, so the expected returns (fitting to the risk) tends to the normal return. Only rf those investment decisions will be realised, which promises higher return than the normal. Summary in finance, MBA 2002 β 32

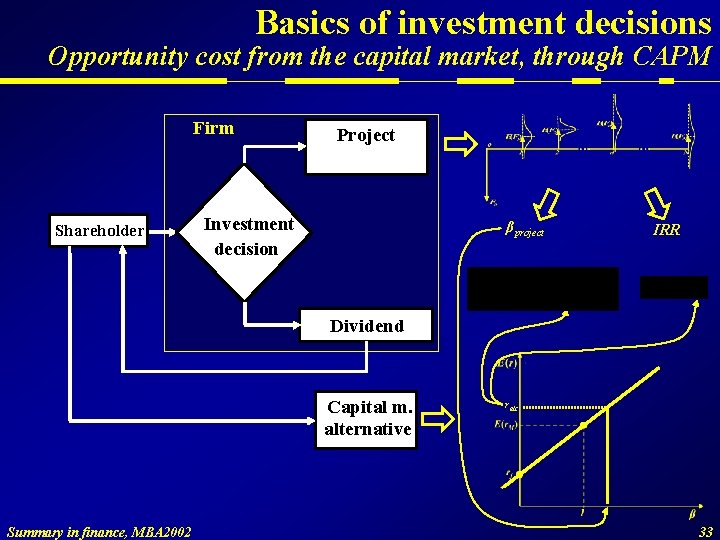

Basics of investment decisions Opportunity cost from the capital market, through CAPM Firm Shareholder Project Investment decision βproject IRR Dividend Capital Tőkepiaci m. alternative alternatíva Summary in finance, MBA 2002 ralt 33

Basics of investment decisions Mini-firm approach All investments will be implemented which is better than the similar risk capital market investment. Better means positive NPV or IRR exceeds ralt. The opportunity cost is estimated through CAPM. The risk (so the opportunity cost) of any arbitrary elements of the shareholder’s portfolio depend on the stochastic relationship with the market portfolio but not each other. So, if the CAPM is used than the risk of any single entity -as well as the risk of any project- individually with respect to the market portfolio will be examined, i. e. independently from its corporate environment. The single projects will be considered as “mini-firms”. Summary in finance, MBA 2002 34

Taxation Principles of taxation, basic types Two basic principles of taxation: – Principle of benefit The value of contribution “to the common” is fair if it is proportional to the received benefit form the “common”. – Principle of solvency Determining the value contribution, the income and the financial position should be considered Two basic types of taxation was settled: – Indirect types These do not consider the personal conditions, these are connected to the consumption and to the turnover (e. g. VAT) – Direct types • These are strictly connected to the individual conditions (like income, or profit) of the person or corporation (e. g. PIT, or CT) Summary in finance, MBA 2002 35

Taxation Value Added Tax, Corporate Tax, Personal Income Tax Connected to almost all products and services. In this case the authority does not have any connection to the taxing individuals, because the supplier pays after all transaction, actually the purchaser pays the tax but the price contains it. If the purchased good or service will be used for business activity the tax payable can be reduced with the shifted tax, so only the added value will be charged by this tax. The general degree of VAT in Hungary is 25%. Advantages: – if a wide black market exists, than from the income side it is difficult to collect the tax – strengthening the documentation of transactions – the consumer does not sense, “hidden tax” Disadvantages: – higher administrative task – intellectual crimes (negative tax) – not proportional contribution (with higher income, the less amount will be used for consumption) Summary in finance, MBA 2002 36

Taxation Value Added Tax, Corporate Tax, Personal Income Tax The tax base is coming form the accounting pre-tax profit. This accounting pre-tax profit has to be modified according to the differences between the law of accounting and taxation. From the corrected positive pre-tax profit 18% corporate tax has to be paid. Summary in finance, MBA 2002 37

Taxation Value Added Tax, Corporate Tax, Personal Income Tax In case of private domestic individuals the sum of all income (money or payments in kind) forms the tax base There are two types of income tax – aggregated income • tax brackets (higher income – higher tax rate) – separated income • revenue on capital investment: 20% tax rate (the interest is 0%, price earnings 20%, dividend tax 20%, etc. ) Summary in finance, MBA 2002 38

Taxation Consideration of taxes in corporate financial analyses VAT: net amounts are used in the calculations (the company actually just an intermediary) Other taxes, which are not connected to the accounting profit e. g. consumption tax are considered in the cash flow as simple costs (cash outflow) Corporate tax and personal income tax: These types reduce the shareholder’s value, the main difference is the level on which they act. The two tax types are summarized in the so called effective tax rate teff=1 -(1 -tc)(1 -tp) As a basic principle in determination of the expected cash-flows and opportunity cost, that the same taxation should be considered. If the opportunity cost were determined after all tax liability, than the cash flows should be calculated on the same way. Summary in finance, MBA 2002 39

Passive progressive

Passive progressive Kontinuitetshantering

Kontinuitetshantering Typiska novell drag

Typiska novell drag Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Vad står k.r.å.k.a.n för

Vad står k.r.å.k.a.n för Varför kallas perioden 1918-1939 för mellankrigstiden

Varför kallas perioden 1918-1939 för mellankrigstiden En lathund för arbete med kontinuitetshantering

En lathund för arbete med kontinuitetshantering Personalliggare bygg undantag

Personalliggare bygg undantag Personlig tidbok

Personlig tidbok Sura för anatom

Sura för anatom Förklara densitet för barn

Förklara densitet för barn Datorkunskap för nybörjare

Datorkunskap för nybörjare Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Att skriva debattartikel

Att skriva debattartikel Delegerande ledarstil

Delegerande ledarstil Nyckelkompetenser för livslångt lärande

Nyckelkompetenser för livslångt lärande Påbyggnader för flakfordon

Påbyggnader för flakfordon Lufttryck formel

Lufttryck formel Publik sektor

Publik sektor Urban torhamn

Urban torhamn Presentera för publik crossboss

Presentera för publik crossboss Vad är ett minoritetsspråk

Vad är ett minoritetsspråk Plats för toran ark

Plats för toran ark Klassificeringsstruktur för kommunala verksamheter

Klassificeringsstruktur för kommunala verksamheter Fimbrietratt

Fimbrietratt Bästa kameran för astrofoto

Bästa kameran för astrofoto Centrum för kunskap och säkerhet

Centrum för kunskap och säkerhet Lågenergihus nyproduktion

Lågenergihus nyproduktion Mat för unga idrottare

Mat för unga idrottare Verktyg för automatisering av utbetalningar

Verktyg för automatisering av utbetalningar Rutin för avvikelsehantering

Rutin för avvikelsehantering Smärtskolan kunskap för livet

Smärtskolan kunskap för livet Ministerstyre för och nackdelar

Ministerstyre för och nackdelar Tack för att ni har lyssnat

Tack för att ni har lyssnat Hur ser ett referat ut

Hur ser ett referat ut Redogör för vad psykologi är

Redogör för vad psykologi är Matematisk modellering eksempel

Matematisk modellering eksempel Tack för att ni har lyssnat

Tack för att ni har lyssnat Borra hål för knoppar

Borra hål för knoppar Orubbliga rättigheter

Orubbliga rättigheter