Financial Executives International When the taps run dry

- Slides: 65

Financial Executives International When the taps run dry: getting things done during a credit crunch November 24, 2008

Current State of the Capital Markets FEI: Managing Funding Requirements November 2008 Ernst & Young Orenda Corporate Finance Inc. Brian Allard

Table of Contents ► ► ► Current Market Conditions – Subprime Impact Market Stabilization – Money Market Indicators Canadian Perspective Availability of Financing Treasury – Focus on Short Term Liquidity Financing Today – Conclusion 2

Current Market Conditions – Subprime Impact 3

Where We Are Today ► Despite repeated efforts by Congress and the Federal Reserve, including the passing of the $700 billion bailout and the takeover of Fannie Mae and Freddie Mac and the reduction in the benchmark rate, the U. S. economy continues to slide towards recession ► ► Consumers continue to face enormous pressure to cut spending due to an uncertain housing market and weak job market According to Moody’s Economy. com, of the 75. 5 million U. S. households that own their homes, 12 million, or 16%, owe more than their homes are worth 4

Where We Are Today (cont’d) ► ► In an effort to stimulate lending in a concerted effort, the Fed, together with the European Central Bank, the Bank of Canada and 3 other central banks, cut benchmark rates on October 8, 2008 Despite these efforts, the International Monetary Fund states that the global economy is headed for a recession in 2009 and estimates losses from the financial crisis to be $1. 4 trillion (worldwide losses are currently just below the $1 trillion mark) 5

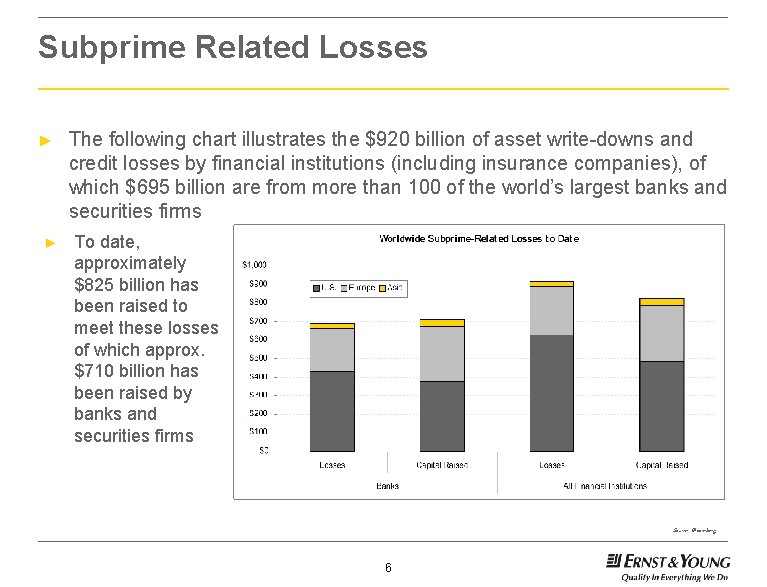

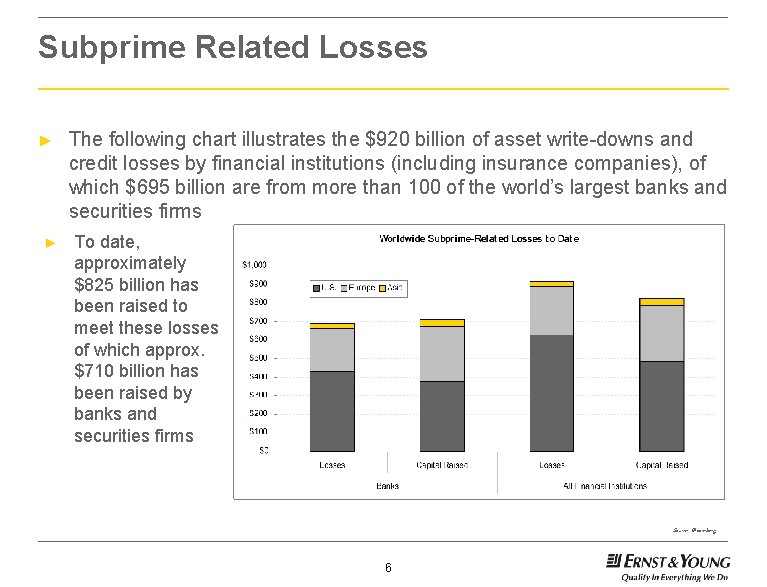

Subprime Related Losses ► ► The following chart illustrates the $920 billion of asset write-downs and credit losses by financial institutions (including insurance companies), of which $695 billion are from more than 100 of the world’s largest banks and securities firms To date, approximately $825 billion has been raised to meet these losses of which approx. $710 billion has been raised by banks and securities firms Source: Bloomberg 6

Subprime’s Impact on Financial Services ► The impact of the increasing defaults in the subprime market began to trickle into the financial services sector in late 2006 and early 2007 ► ► In July 2007, credit rating agencies began to downgrade certain mortgage backed securities resulting in the evaporation of the subprime market Financial institutions were forced to write-down the book value of the securities held as assets on their books ► According to Bloomberg, banks’ losses from the U. S. subprime crisis and ensuing credit crunch stand at approximately $695 billion as of November 11, 2008 ► Some of the highest losses have been incurred by U. S. banks such as Citigroup ($68 B), Merrill Lynch ($56 B), UBS ($44 B) and Wachovia ($97 B) ► Canadian banks CIBC and RBC have also had writedowns 7

Subprime’s Impact on Financial Services (cont’d) ► As a result of these write-downs which began in the summer of 2007, lenders further tightened borrowing terms to preserve their remaining capital ► ► ► Covenant lite loans disappeared while the use of PIKs became heavily restricted The subprime crisis came to a dramatic head when the Federal Reserve facilitated the purchase of Bear Stearns by JP Morgan in the spring of 2008 And credit markets, which began seizing up after BNP Paribas SA halted withdrawals on three funds in August 2007, froze after Lehman Brothers Holdings Inc. collapsed on September 15 2008, negatively impacting lenders’ confidence of repayment 8

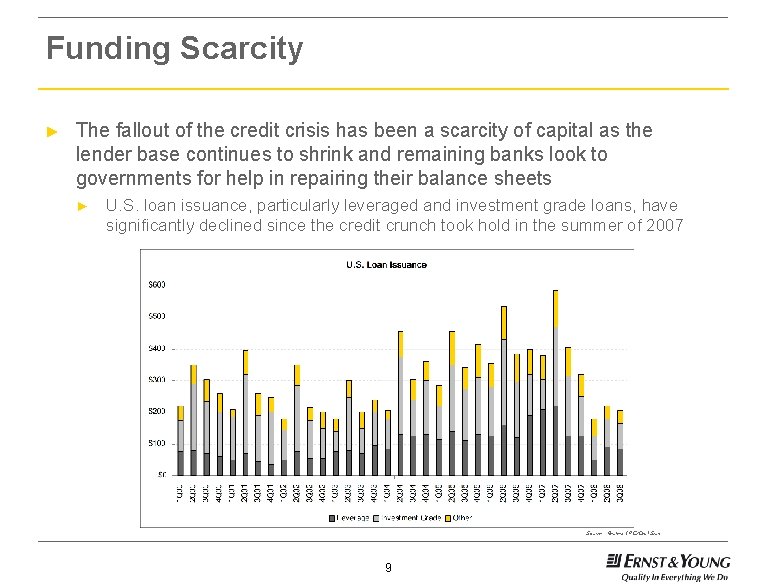

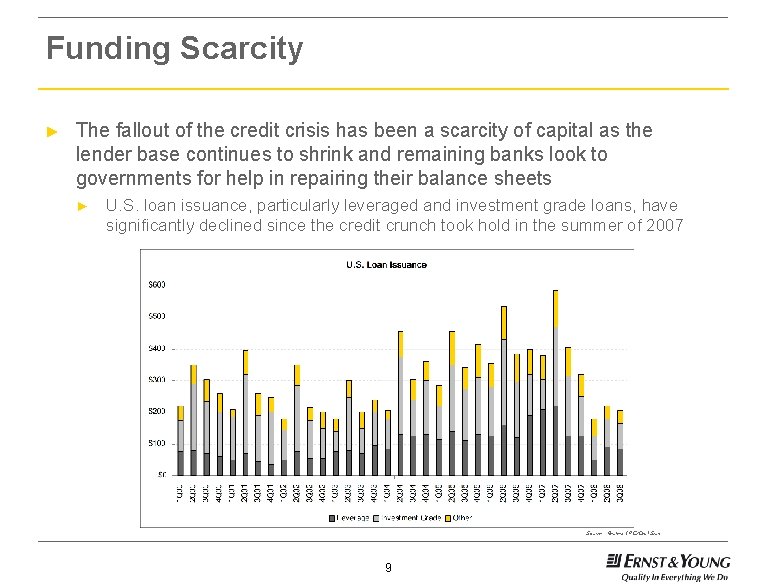

Funding Scarcity ► The fallout of the credit crisis has been a scarcity of capital as the lender base continues to shrink and remaining banks look to governments for help in repairing their balance sheets ► U. S. loan issuance, particularly leveraged and investment grade loans, have significantly declined since the credit crunch took hold in the summer of 2007 Source: Reuters LPC/Deal Scan 9

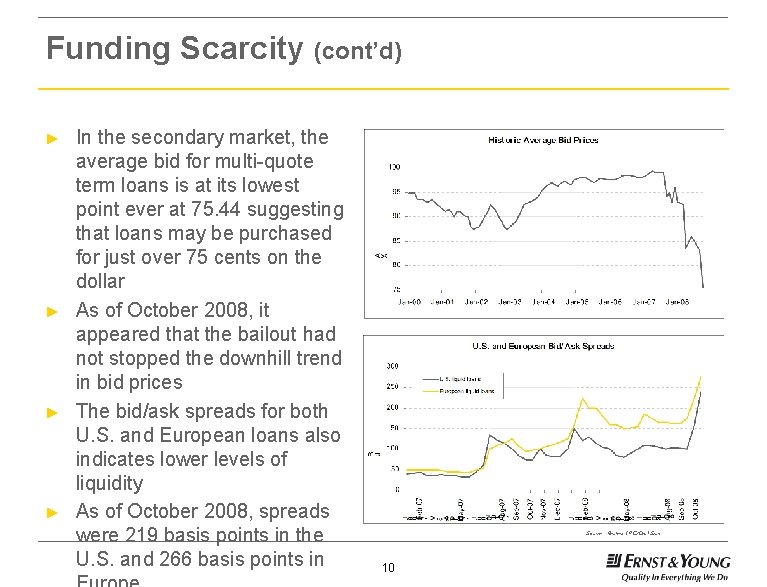

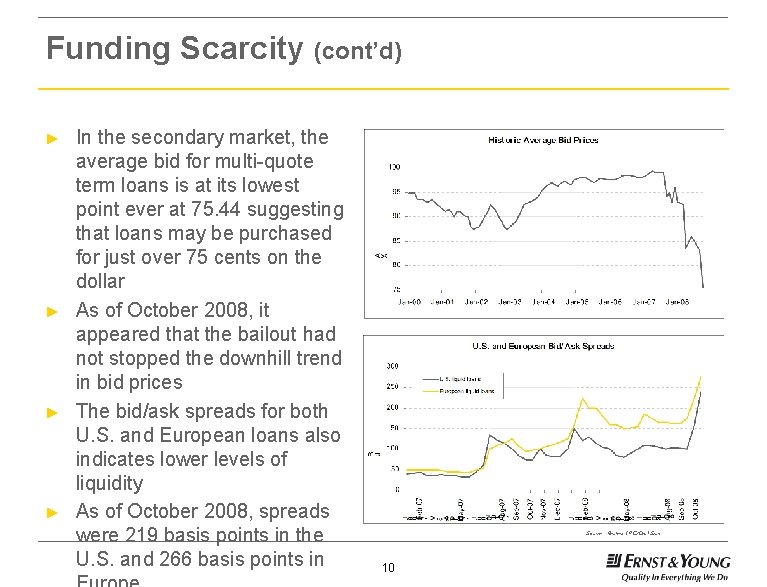

Funding Scarcity (cont’d) ► ► In the secondary market, the average bid for multi-quote term loans is at its lowest point ever at 75. 44 suggesting that loans may be purchased for just over 75 cents on the dollar As of October 2008, it appeared that the bailout had not stopped the downhill trend in bid prices The bid/ask spreads for both U. S. and European loans also indicates lower levels of liquidity As of October 2008, spreads were 219 basis points in the U. S. and 266 basis points in Source: Reuters LPC/Deal Scan 10

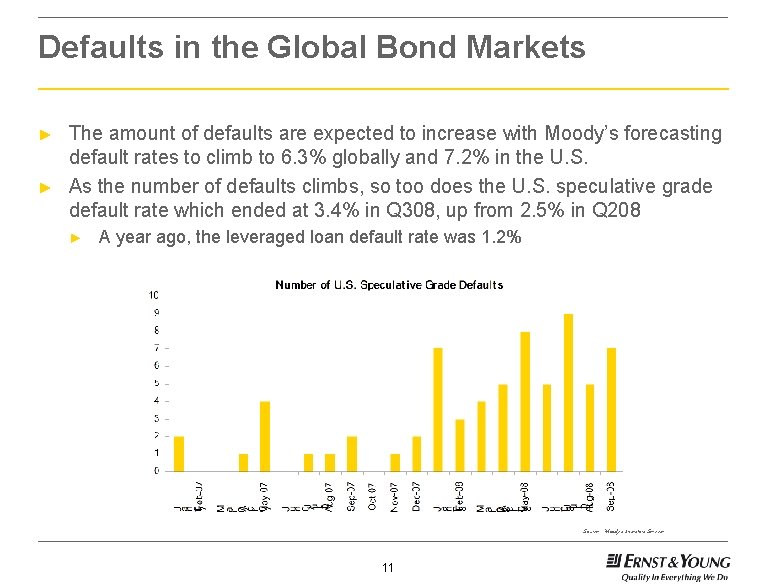

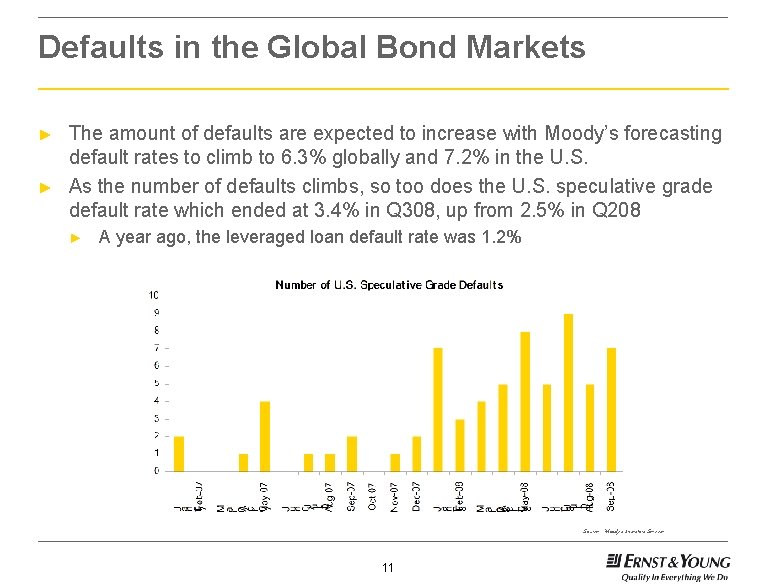

Defaults in the Global Bond Markets ► ► The amount of defaults are expected to increase with Moody’s forecasting default rates to climb to 6. 3% globally and 7. 2% in the U. S. As the number of defaults climbs, so too does the U. S. speculative grade default rate which ended at 3. 4% in Q 308, up from 2. 5% in Q 208 ► A year ago, the leveraged loan default rate was 1. 2% Source: Moody’s Investors Service 11

Market Stabilization – Money Market Indicators 12

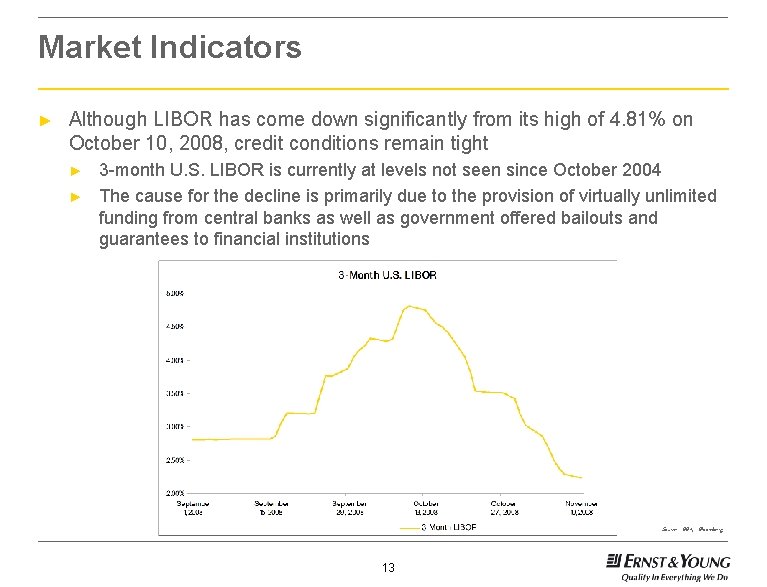

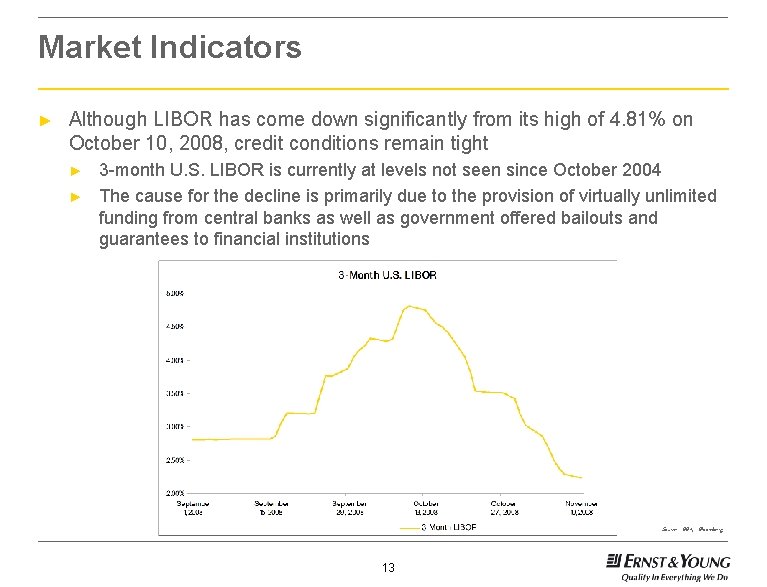

Market Indicators ► Although LIBOR has come down significantly from its high of 4. 81% on October 10, 2008, credit conditions remain tight ► ► 3 -month U. S. LIBOR is currently at levels not seen since October 2004 The cause for the decline is primarily due to the provision of virtually unlimited funding from central banks as well as government offered bailouts and guarantees to financial institutions Source: BBA, Bloomberg 13

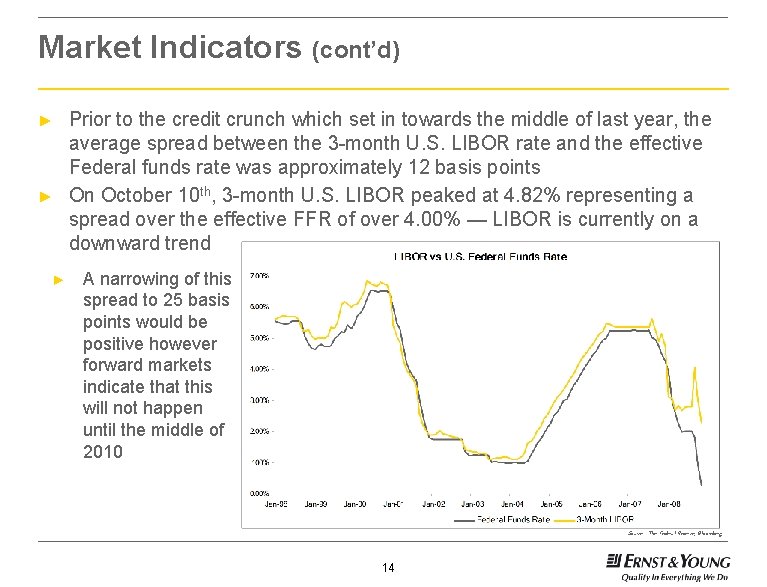

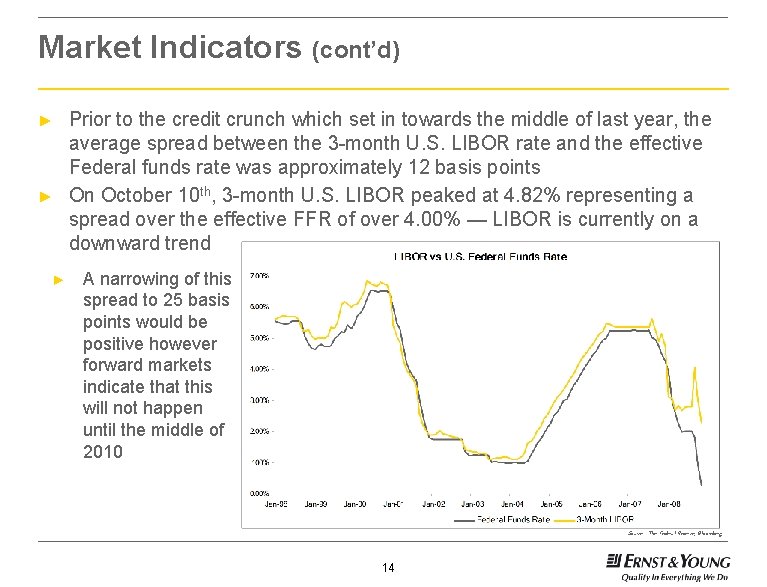

Market Indicators (cont’d) ► ► ► Prior to the credit crunch which set in towards the middle of last year, the average spread between the 3 -month U. S. LIBOR rate and the effective Federal funds rate was approximately 12 basis points On October 10 th, 3 -month U. S. LIBOR peaked at 4. 82% representing a spread over the effective FFR of over 4. 00% — LIBOR is currently on a downward trend A narrowing of this spread to 25 basis points would be positive however forward markets indicate that this will not happen until the middle of 2010 Source: The Federal Reserve, Bloomberg 14

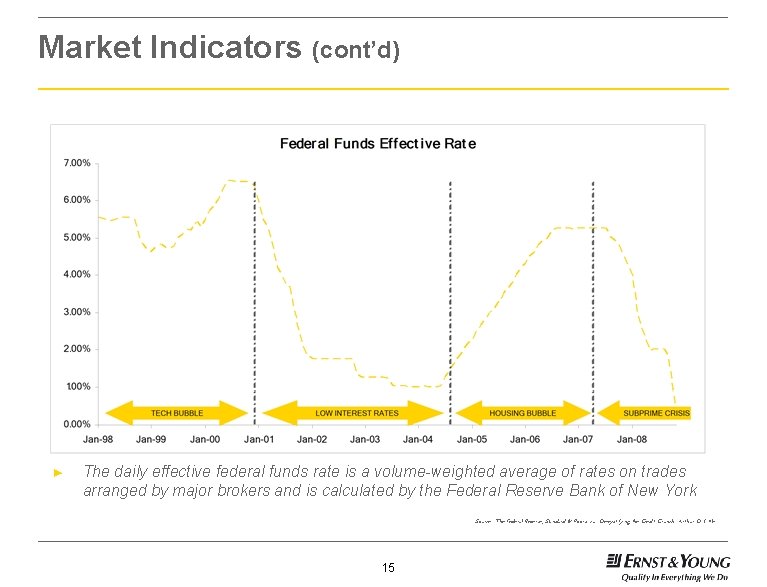

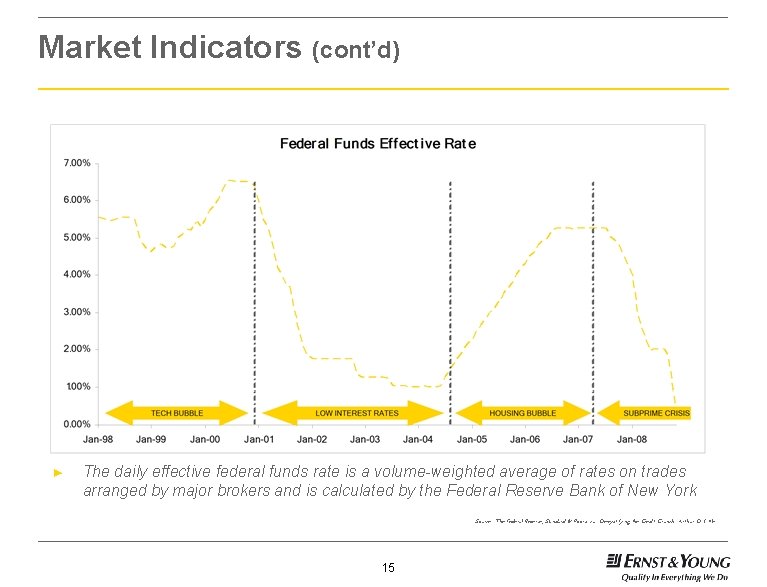

Market Indicators (cont’d) ► The daily effective federal funds rate is a volume-weighted average of rates on trades arranged by major brokers and is calculated by the Federal Reserve Bank of New York Source: The Federal Reserve, Standard & Poor’s via “Demystifying the Credit Crunch” Arthur D. Little 15

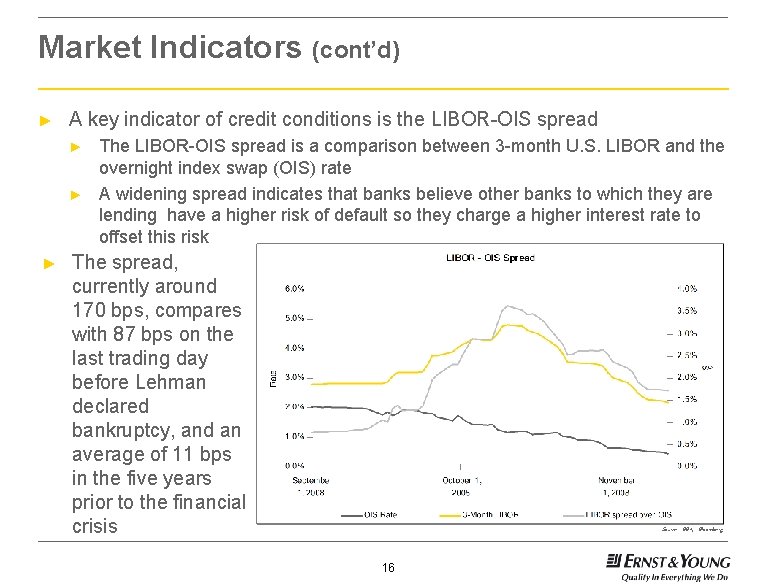

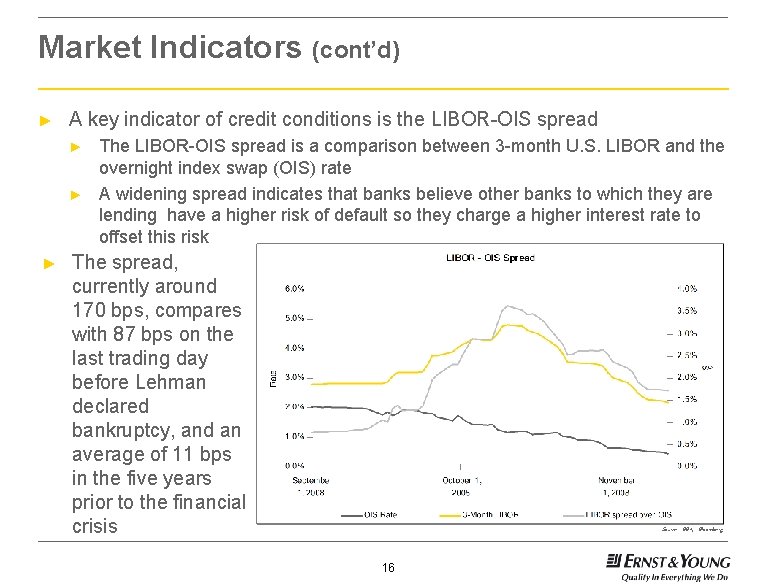

Market Indicators (cont’d) ► A key indicator of credit conditions is the LIBOR-OIS spread ► ► ► The LIBOR-OIS spread is a comparison between 3 -month U. S. LIBOR and the overnight index swap (OIS) rate A widening spread indicates that banks believe other banks to which they are lending have a higher risk of default so they charge a higher interest rate to offset this risk The spread, currently around 170 bps, compares with 87 bps on the last trading day before Lehman declared bankruptcy, and an average of 11 bps in the five years prior to the financial crisis Source: BBA, Bloomberg 16

Canadian Perspective 17

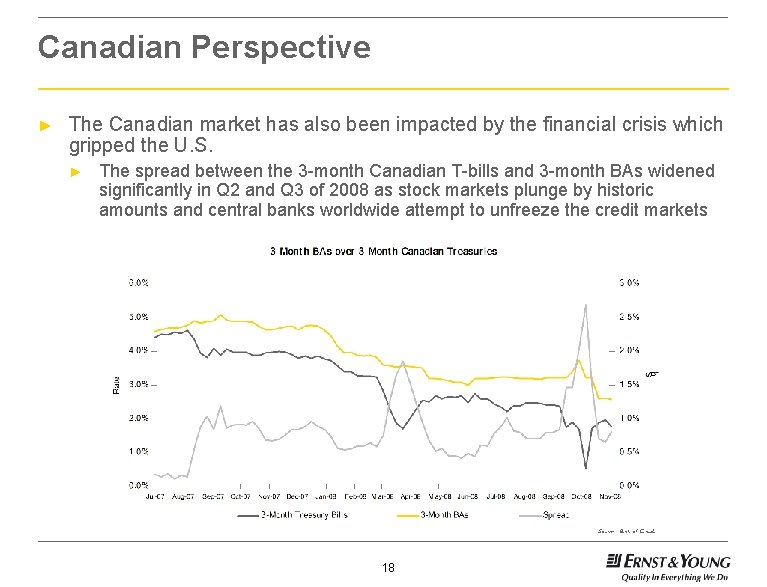

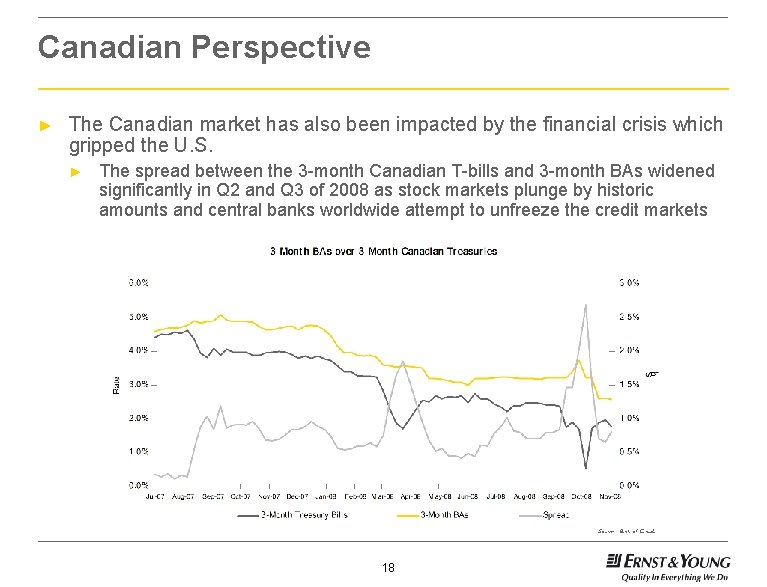

Canadian Perspective ► The Canadian market has also been impacted by the financial crisis which gripped the U. S. ► The spread between the 3 -month Canadian T-bills and 3 -month BAs widened significantly in Q 2 and Q 3 of 2008 as stock markets plunge by historic amounts and central banks worldwide attempt to unfreeze the credit markets Source: Bank of Canada 18

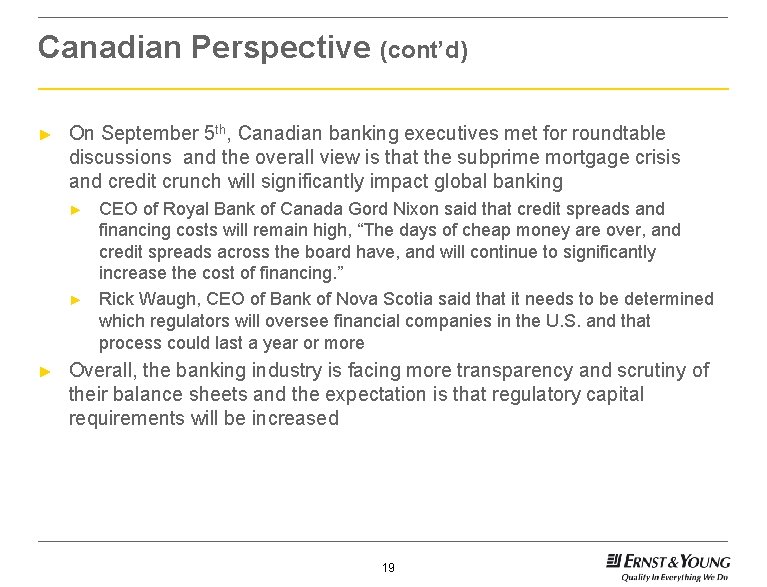

Canadian Perspective (cont’d) ► On September 5 th, Canadian banking executives met for roundtable discussions and the overall view is that the subprime mortgage crisis and credit crunch will significantly impact global banking ► ► ► CEO of Royal Bank of Canada Gord Nixon said that credit spreads and financing costs will remain high, “The days of cheap money are over, and credit spreads across the board have, and will continue to significantly increase the cost of financing. ” Rick Waugh, CEO of Bank of Nova Scotia said that it needs to be determined which regulators will oversee financial companies in the U. S. and that process could last a year or more Overall, the banking industry is facing more transparency and scrutiny of their balance sheets and the expectation is that regulatory capital requirements will be increased 19

Canadian Perspective (cont’d) ► ► On October 8 th, the Bank of Canada, Federal Reserve, European Central Bank and 3 other central banks lowered interest rates in an unprecedented coordinated effort to ease the economic effects of the credit crisis The Bo. C cut the overnight rate by 50 bps to 2. 5%, however, Canada’s major banks did not initially follow suit and only lowered their prime rates by 25 bps to 4. 5% citing high borrowing costs in global credit markets On October 21, the Bo. C cut the overnight rate again by 25 bps to 2. 25% Canadian banks followed suit resulting in a Canadian prime rate of 4. 0% “Three major interrelated developments are having a profound impact on the Canadian economy. First, the intensification of the global financial crisis has led to severe strains in financial markets. The associated need for the global banking sector to continue to reduce leverage will restrain growth for some time. Second, the global economy appears to be heading into a mild recession, led by a U. S. economy already in recession. Third, there have been sharp declines in many commodity prices. The outlook for growth and inflation in Canada is now more uncertain than usual. ” - Bank of Canada press release dated October 21, 2008 20

Availability of Financing 21

Availability of Financing ► ► Credit markets in Canada are changing daily Many international and U. S. institutions have pulled away from the Canadian market or are in a state of uncertainty: ► ► ► CIT GMAC Wachovia GE Capital Deutsche Bank Remaining institutions may be “open for business” but there is effectively no secondary market to syndicate or sell down exposure ► Lending institutions are focused on optimizing the allocation of scarce capital 22

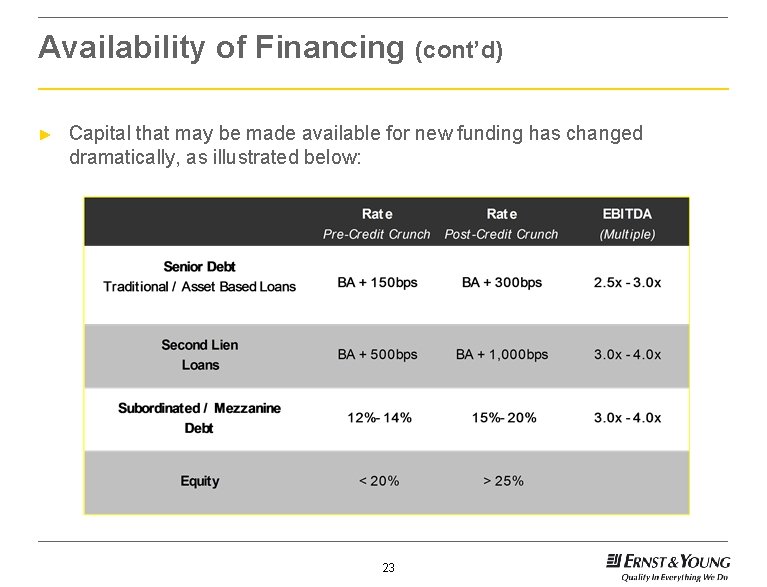

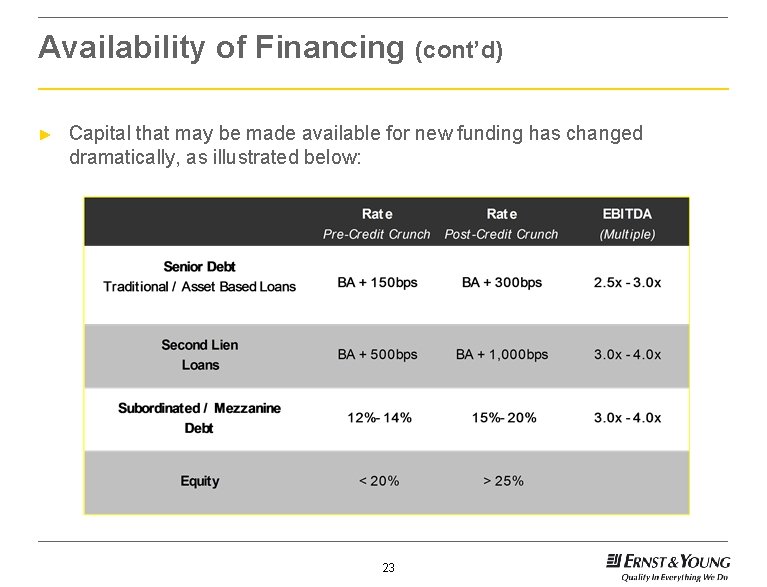

Availability of Financing (cont’d) ► Capital that may be made available for new funding has changed dramatically, as illustrated below: 23

Availability of Financing (cont’d) ► Lending is being governed by greater discipline as underwriting standards have become more stringent resulting in lower multiples, higher pricing and tighter covenants ► ► The impact of the credit crunch to senior cash flow lending has resulted in lower debt to EBITDA multiples which are currently in the 2. 5 – 3. 0 x range with up to 1. 5 x incrementally available from mezzanine lenders Moreover, subjective “addbacks”, “adjustments” or “normalizing entries” to earnings are also coming under greater scrutiny Borrowers are being faced with increased due diligence from an ever shrinking base of lenders resulting in elongated deal timetables “Fully underwritten” transactions are history ► Borrowers are being forced to piece together club deals to meet capital needs 24

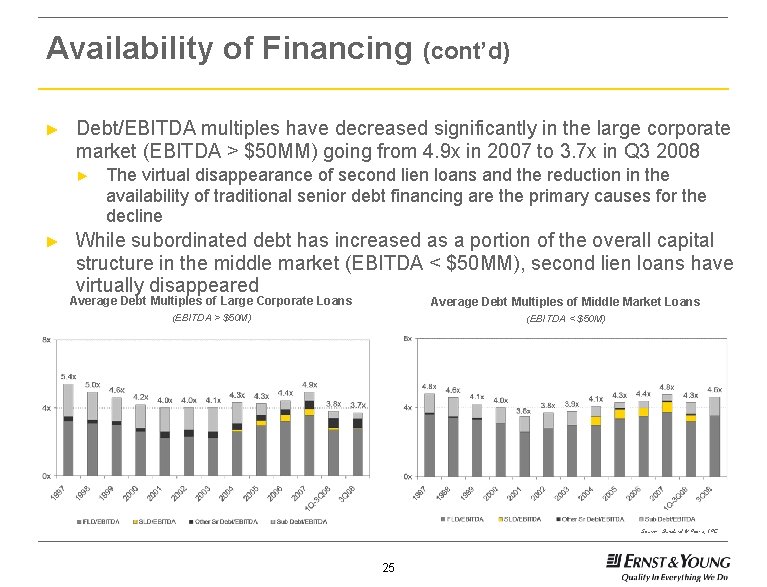

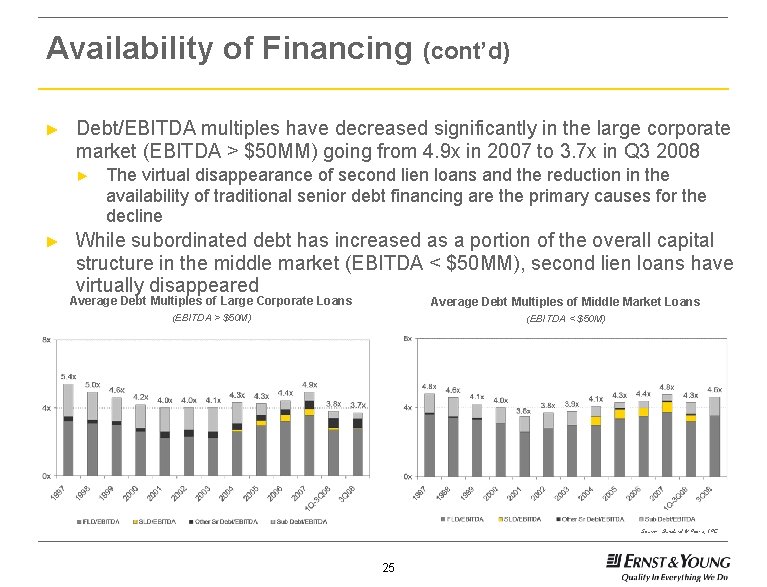

Availability of Financing (cont’d) ► Debt/EBITDA multiples have decreased significantly in the large corporate market (EBITDA > $50 MM) going from 4. 9 x in 2007 to 3. 7 x in Q 3 2008 ► ► The virtual disappearance of second lien loans and the reduction in the availability of traditional senior debt financing are the primary causes for the decline While subordinated debt has increased as a portion of the overall capital structure in the middle market (EBITDA < $50 MM), second lien loans have virtually disappeared Average Debt Multiples of Large Corporate Loans Average Debt Multiples of Middle Market Loans (EBITDA > $50 M) (EBITDA < $50 M) Source: Standard & Poor’s, LPC 25

What Can Get Done? ► Asset based loans are becoming increasingly attractive to certain borrowers ► ► Loans > $30 MM pose a syndication risk Market flex risk on terms, structure, pricing, etc. Spreads in the range of 300 bps Cashflow loans to borrowers of “strategic relevance” to lenders ► ► Leverage < 3. 0 x Industry specific Sponsor makes deal “easier” Spreads in the range of 400 bps 26

Treasury – Focus on Short Term Liquidity 27

Treasury – Focus on Short Term Liquidity ► ► Current market dislocations require Treasurers to more closely focus on short term liquidity A more disciplined approach is in order ► ► Stronger focus on quality of investments Better understanding of organizations liquidity requirements 28

Treasury – Focus on Short Term Liquidity (cont’d) ► A portfolio approach to manage risk makes sense: ► ► Understand the liabilities, i. e. the liquidity needs of the company Measurement/forecasting needs to be done on a weekly if not daily basis Manage investments or borrowings to meet that liability stream Manage portfolio to: 1. 2. Understand degree of counterparty risk ► Review investment policy Align maturities with requirements ► Limit exposure to any single point in time ► Ladder portfolio to reduce exposure to short term market dislocations 29

Treasury – Focus on Short Term Liquidity (cont’d) ► Manage counterparty risk ► ► ► Traditional approach of heavy reliance on debt ratings needs review Additional due diligence required Clearly define goal of investment policy: income generation, or secure and efficient store of liquidity ► Increase requirement for lower yielding but more secure investments ► Governments ► BAs from Canadian chartered banks ► Careful review of money market funds 30

Financing Today – Conclusion 31

Financing Today – Conclusion ► ► To obtain financing in today’s market, businesses need to be cognisant of the supply and demand constraints with which they are faced Transactions are subject to more scrutiny and aggressive due diligence requirements The terms under which different lending institutions are willing to lend may vary significantly To succeed in this market, businesses must recognize that the path to funding starts significantly ahead of the formal financing process 32

Financing Today – Conclusion (cont’d) ► Plan early to deal with debt maturities ► ► Expect increased pricing and tighter covenants Expect a reduction in unutilized credit availability/carve back of acquisition and expenditure accommodations In large syndicates, plan for fall-out of fringe participants Review short to mid-term capital needs and strive to preserve capital ► ► ► Review working capital cycle Capital expenditures Sale of non-core/redundant assets 33

Turning adversity into opportunity Aroon Sequeira

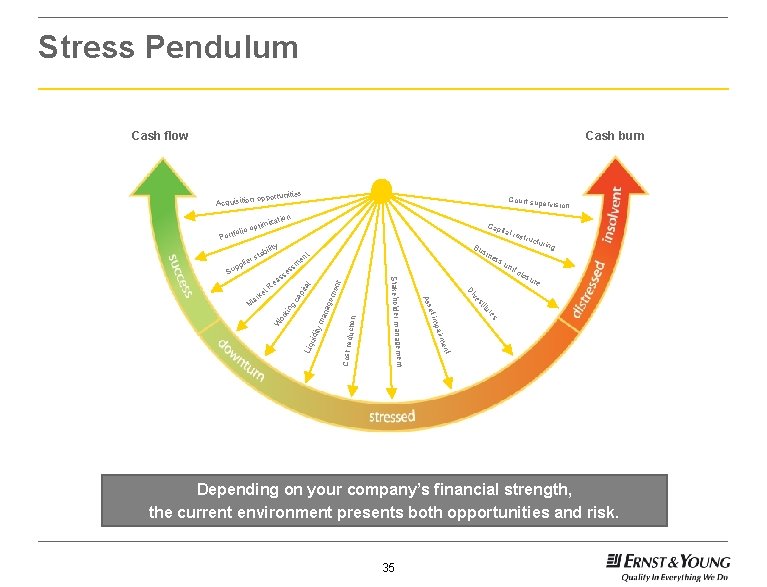

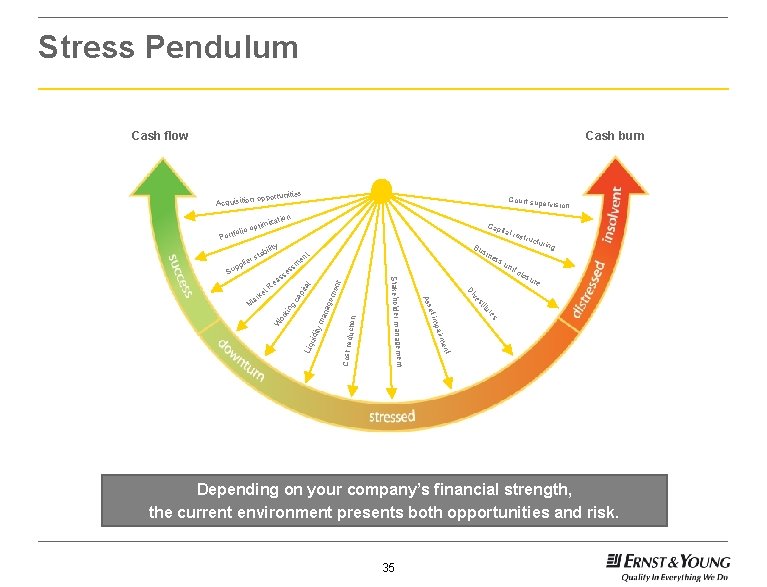

Stress Pendulum Cash flow Cash burn nities n o pportu Acquisitio iz Cap ital r ty bili ent duction s t men pair Liq re re ana gem al pit ca g su itu kin clo ring st et im W or uctu ve ar M Ass ke estr Di t. R es su nit gement Stakeholder mana ea t en m ss e ss sin Cost re ta rs Bu uid ity m plie p Su rvision ation ptim lio o fo Port Court supe Depending on your company’s financial strength, the current environment presents both opportunities and risk. 35

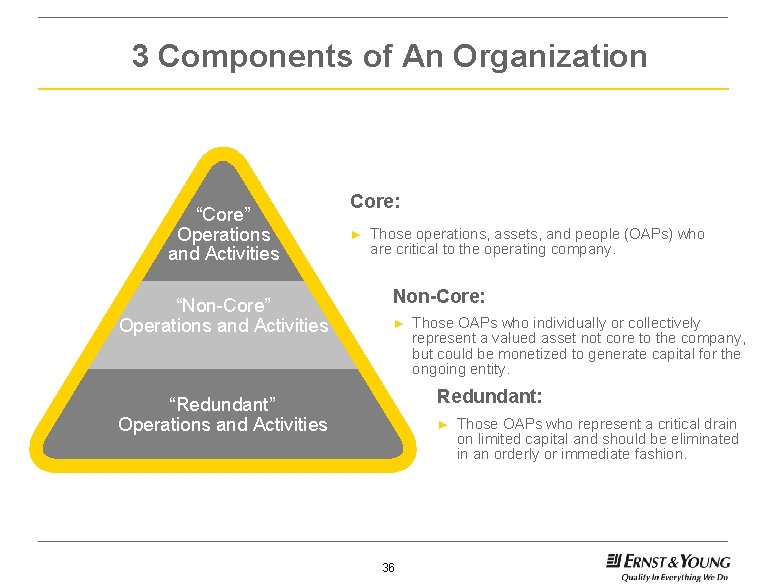

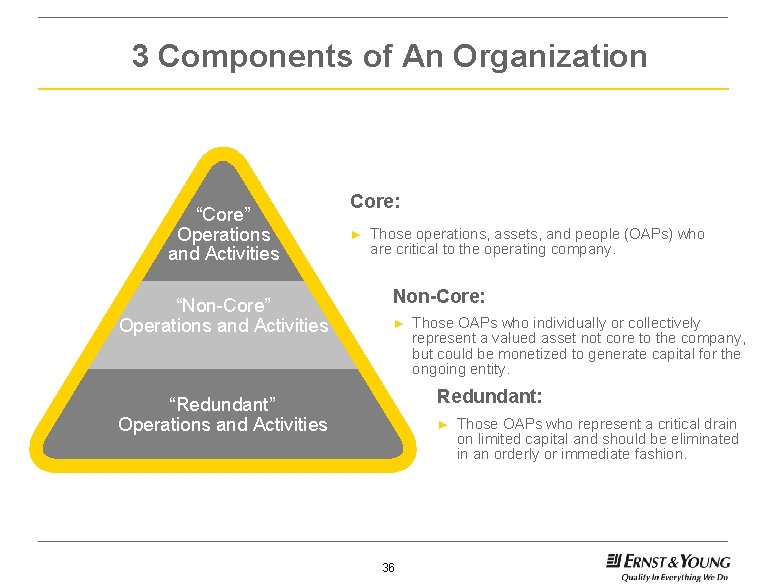

3 Components of An Organization “Core” Operations and Activities “Non-Core” Operations and Activities Core: ► Those operations, assets, and people (OAPs) who are critical to the operating company. Non-Core: ► Those OAPs who individually or collectively represent a valued asset not core to the company, but could be monetized to generate capital for the ongoing entity. Redundant: “Redundant” Operations and Activities ► 36 Those OAPs who represent a critical drain on limited capital and should be eliminated in an orderly or immediate fashion.

Corporate Hygiene ► Cost management ► Head count management ► Capital expenditure management Be Proactive with Scenario Analysis 37

Assess Counter Party Risk ► Capital sources ► Supply chain ► Customers ► “Insurance” Ongoing Due Diligence is a Must 38

Manage Cash ► Liberate cash from working capital ► Weekly rolling cash flow ► Review dividends and share buy back programs ► Sell viable non-core divisions ► Liquidate non-viable or excess assets ► Sale lease back arrangements Cash is King 39

If There’s Trouble on the Horizon… ► Proactively manage lender relationships ► Proactively assess divestiture opportunities ► Consider risk theory Time is of the Essence 40

Carpe Diem ► Opportunistic Acquisitions ► EBITDA assumptions ► Multiples ► Balance sheet ► Increased due diligence ► Increased orphaned public companies ► Increased creative structures ► Opportunistic hires There Will Be Many Opportunities for Bold Moves 41

Valuation in Today’s Economic Environment Al Burant

Valuation Challenges ► Fair Value standard refers to values in an Active market and assumption of a Willing seller of a control position ► Current market capitalizations often not determinative of value, including: ► Reference to own stock price ► Reference to comparable public companies ► Reduced number of market transactions as reference points ► Some transaction multiples may reflect distressed sale ► Limited number of analyst reports and updated financial forecasts 43

What We Have Seen ► Reliance on Discounted Cash Flow models ► Impact on Cash Flow Projections ► Revenue assumptions ► Timing of cash flows ► Margin assumptions ► Working capital assumptions ► Capex assumptions ► Impact on Weighted Average Cost of Capital (WACC) ► Cost of debt ► Cost of equity ► Leverage assumptions ► Dealing with Uncertainty: Scenario Analysis and Sensitivity Analysis ► Use of independent specialists 44

Potential Impacts on Financial Reporting ► Annual Goodwill Impairment Test ► Interim Goodwill Impairment Test ► Long-Lived Asset Impairment Tests 45

Considerations in Current Market ► Going Private Transactions ► Formal Valuation ► Fairness opinion ► Responding to Takeover Bids ► Share Repurchase 46

Conclusion Can’t paint all scenarios with a broad brush – need to review the facts and circumstances relative to each Company and to each Reporting Unit in today’s economic environment. 47

Tax Issues Peter Stephen

What are we seeing in the marketplace? ► The current economic climate is a crucial time to leverage tax opportunities to create and preserve value ► Tax strategies may need to shift in focus to: ►Releasing cash ►Reducing costs ►Efficient refinancing/restructuring ► Restructuring may be more complex than ever before given the predominance of highly geared tax-driven structures 49

Cash ► Converting tax assets to cash ► Realizing or securing tax benefits ► Deferral of Tax ► Repatriation and Cross Border 50

Cash ► Factoring receivables ► Sale and lease back ► Loss planning ► Accuracy of forecasts 51

Cash ► Commodity taxes - Apply a variety of strategies to improve commodity taxes cash flow: ► Offsetting payroll remittances ► Accelerating input tax credit ► Have early billing date on transactions ► For significant purchases with GST payable, use a legal entity that is in a net payable position for the purchase (and re-supply) ► Where significant amounts of GST are payable, consider use of the administrative “FAST-TRACK” Process with CRA ► Use of Leasing Co. for PST purposes 52

Accounting for tax ► Tax provisions – accuracy; review ► Impairments – how will they impact tax accounting? ► Deferred Tax Assets – should they continue to be recognized? 53

Review of current structure ► Is the current group / tax structure optimal for the current downturn? ► Transfer pricing – is methodology consistently applied? ► International Assignment Policy - is it too expensive? 54

Staying on course Kent Kaufield

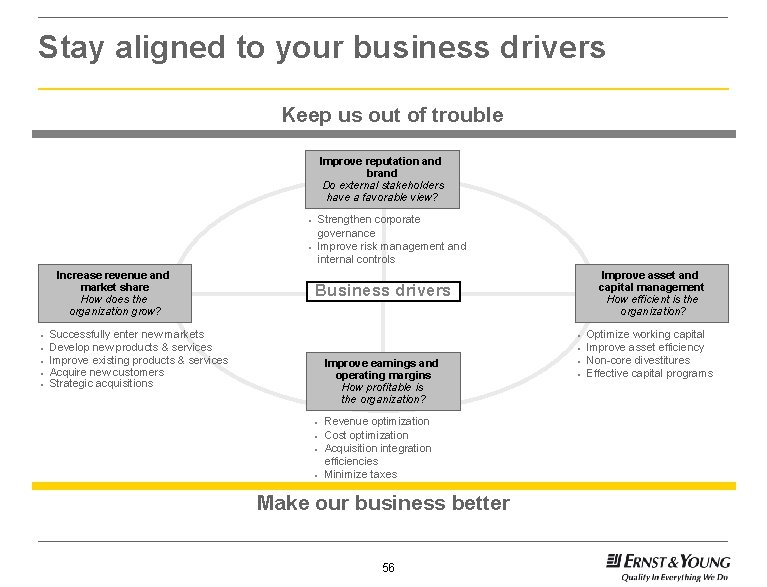

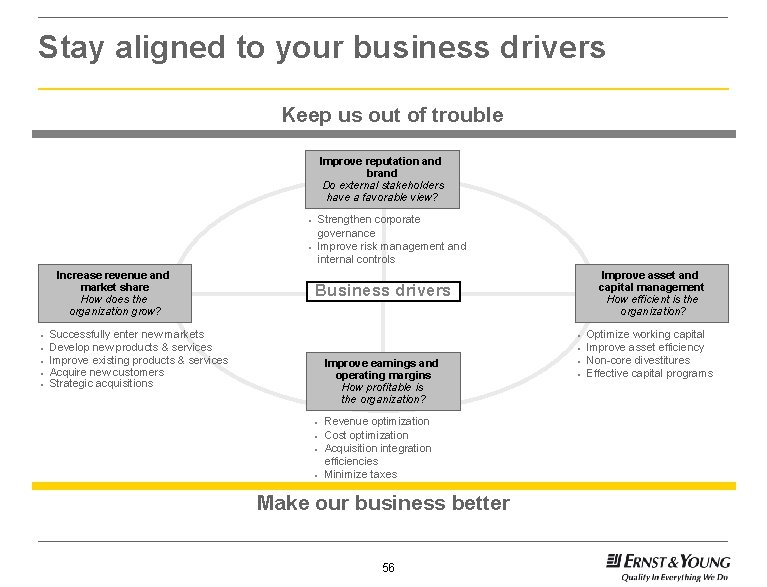

Stay aligned to your business drivers Keep us out of trouble Improve reputation and brand Do external stakeholders have a favorable view? • Strengthen corporate governance • Improve risk management and internal controls Increase revenue and market share How does the organization grow? • • • Successfully enter new markets Develop new products & services Improve existing products & services Acquire new customers Strategic acquisitions Improve asset and capital management How efficient is the organization? Business drivers Improve earnings and operating margins How profitable is the organization? • Revenue optimization • Cost optimization • Acquisition integration efficiencies • Minimize taxes Make our business better 56 • • Optimize working capital Improve asset efficiency Non-core divestitures Effective capital programs

Companies should take a strategic view in developing initiatives to manage in the current economic environment Maintaining business success Business challenges Lessons learned ► Credit environment ► ► Falling consumer confidence ► ► Inflation concerns ► ► Declining revenue and profits ► Decreased equity values ► General uncertainty ► ► Focus on cost and revenue optimization vs. cost reduction Improve operations, including execution of major capital projects Focus on protecting company brand reputation Prioritize and enhance strategic market opportunities Focus on timely and transparent communication with all major stakeholders An effective cost reduction program will focus on delivering sustainable results that can be leveraged when economic conditions change Results from programs initiated in previous economic downturns suggest that companies should balance short-term results with long-term business strategies 57

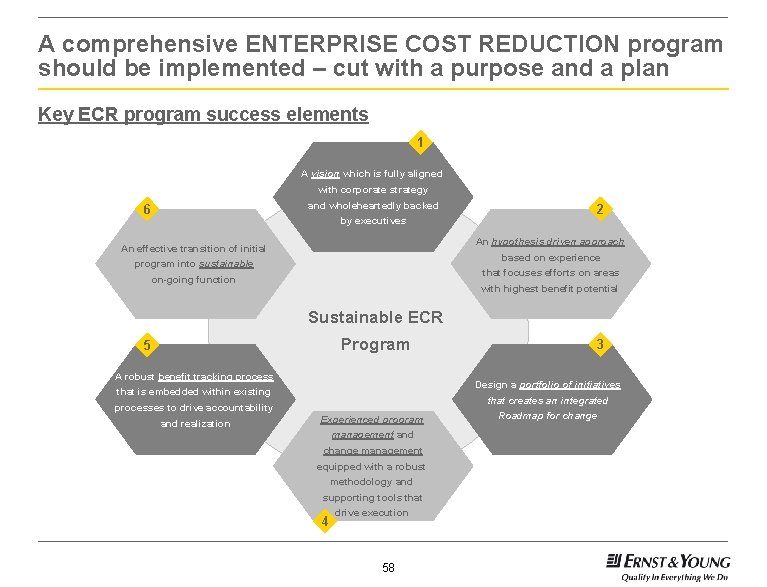

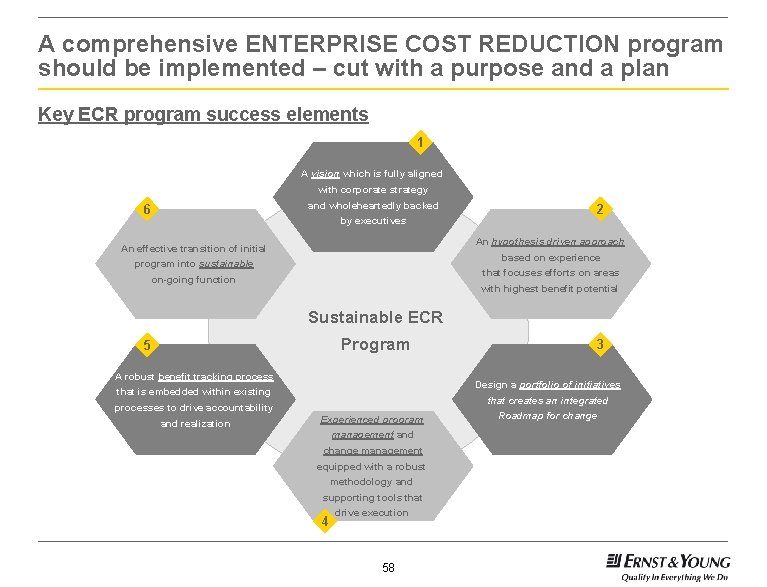

A comprehensive ENTERPRISE COST REDUCTION program should be implemented – cut with a purpose and a plan Key ECR program success elements 1 A vision which is fully aligned with corporate strategy and wholeheartedly backed 6 by executives 2 An hypothesis driven approach An effective transition of initial based on experience program into sustainable that focuses efforts on areas on-going function with highest benefit potential Sustainable ECR Program 5 A robust benefit tracking process Design a portfolio of initiatives that is embedded within existing that creates an integrated processes to drive accountability and realization 3 Experienced program management and change management equipped with a robust methodology and supporting tools that 4 drive execution 58 Roadmap for change

Q&A

Contact Information

Contact Information Brian Allard Senior Vice-President Ernst & Young Orenda Corporate Finance Inc. (416)943 -2665 Brian. Allard@ca. ey. com Aroon Sequeira Partner Ernst & Young Orenda Corporate Finance Inc. (780) 633 -5200 Aroon. Sequeira@ca. ey. com

Contact Information Al Burant Senior Manager, Valuations Ernst & Young LLP (780)412 -2385 Al. Burant@ca. ey. com Kent Kaufield Partner Ernst & Young LLP (403) 206 -5378 Kent. D. Kaufield@ca. ey. com

Contact Information Peter Stephen Partner Ernst & Young LLP (780)441 -2445 Peter. R. Stephen@ca. ey. com

Ernst & Young Assurance | Tax | Transactions | Advisory Transaction Advisory Services (TAS) Our Transaction Advisory Services team works with some of the world’s largest organizations, fastest growing companies and private equity firms on some of the biggest and most complex cross-border deals in the global market. We can help you achieve the growth, performance improvement and returns your stakeholders expect. We offer integrated, objective advisory services that are designed to help you evaluate opportunities, make your transactions more efficient and achieve your strategic goals. We have an extensive global reach, with 7, 000 transaction professionals worldwide, and the experience of thousands of transactions across all markets and industry sectors. We can bring together the people you need, wherever you need them, to focus on helping you achieve success throughout the transaction lifecycle — and beyond. Whether it’s a merger, acquisition, strategic alliance, divestment, equity offering or restructuring, we offer you the advice you need to help you make the right deal at the right price at the right time. It’s how Ernst &Young makes a difference. For more information, please visit ey. com/ca. © 2008 Ernst & Young Orenda Corporate Finance Inc. All rights reserved. Proprietary and confidential. Do not distribute without written permission. Ernst & Young refers to the global organization of member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. 0000121108 TTSLBA