CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS LESSON

- Slides: 57

CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS LESSON 5

CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS 1. Identify contemporary economic issues facing the Filipino Entrepreneurs. 2. Analyze the effects of these economic issues on the purchasing power of the people.

What is Entrepreneurship? Entrepreneurship is the art of turning an idea into a business. Venture Capitalist (Fred Wilson)

What is Entrepreneurship? Entrepreneurship is the ability to know what products and services are needed by people and to be able to provide these things at the right time, at the right place and to the right people, and at the right price.

What Entrepreneurs Do? Entrepreneurs assemble and then integrate all the resources needed –the money, the people, the business model, the strategy—needed to transform an invention or an idea into a viable business.

HENRY SY, SR. Founder SM Group

TONY TAN CAKTIONG Founder, Chairman & CEO, Jollibee Foods Corporation

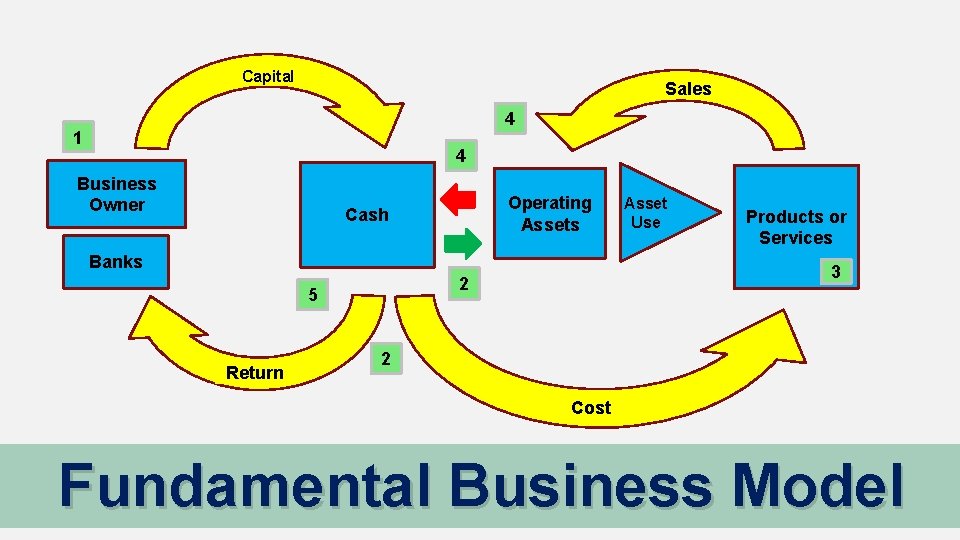

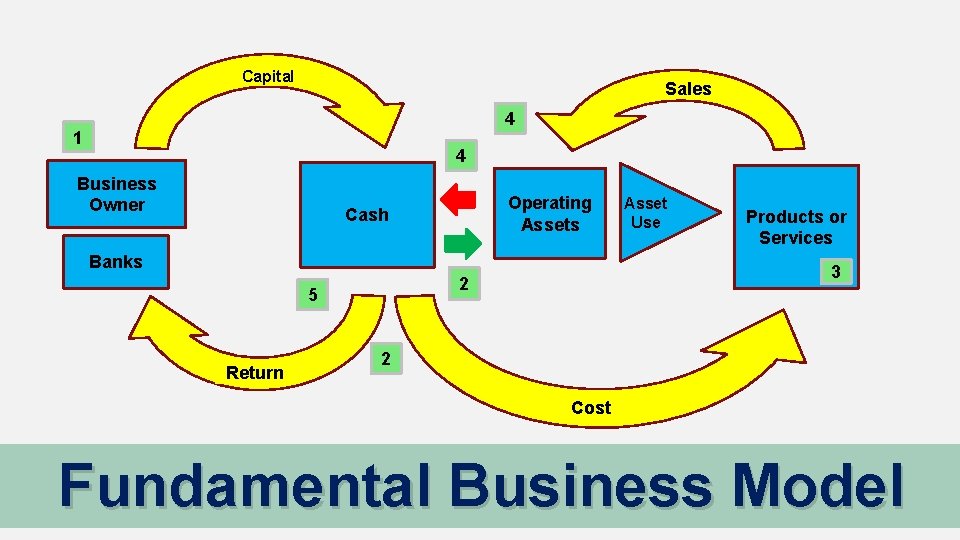

Fundamental Business Model

Capital Sales 4 1 4 Business Owner Operating Assets Cash Banks Return Products or Services 3 2 5 Asset Use 2 Cost Fundamental Business Model

INVESTMENT AND INTEREST RATES CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS

INVESTMENT Investment is an asset or item acquired with the goal of generating income or appreciation. Appreciation refers to an increase in the value of an asset over time.

INVEST TO EARN A RETURN Investing includes the purchase of new plants, new equipment, new homes and net increases in inventories. Investing generally refers to using one's savings in a way that earns a return.

LONG-TERM INVESTMENT These are assets of the company which include stocks, bonds and real estate. Longterm investments are assets that a company intends to hold for more than a year.

INVEST IN CORPORATE STOCK When corporations are formed they sometimes raise funds by selling shares of ownership, or stocks to the public. Investors purchase shares of corporate stock hoping to earn a return.

INVEST IN CORPORATE STOCK Stockholders may earn a return from their stocks in two ways. They may receive a share of the corporation's earnings as a dividend payment or they may earn a capital gain if they sell their stock for more than they paid for it.

COMMON STOCK Shares of common stock give their owners one vote per share when important decisions are made for the firm. These decisions include electing a board of directors to oversee the firm's operations.

COMMON STOCK Owners of common stocks do not receive a dividend unless one is declared by the firm's board of directors.

PREFERRED STOCK Shares of preferred stock do not give their owners a vote on how the corporation is operated. They do, however, provide a fixed dividend that is equal to a percentage of the original sales price of the stock.

PREFERRED STOCK A corporation generally will pay this fixed dividend each year unless it suffers a large loss.

INVEST IN CORPORATE BONDS Loan that entitles an investor to be repaid at the specified date and receive interest until that date.

INVEST IN CORPORATE BONDS Investing in corporate bonds involves less risk than buying stock in that firm because the bonds must be repaid whether or not the business earns a profit.

SHORT-TERM INVESTMENT This is an investment that will mature to cash within a one-year time period and is considered liquid. When someone invests in short-term stock and bonds, the thinking is that these assets can be cashed in quickly.

SHORT-TERM INVESTMENT An asset is liquid if the owner can readily access it, and it has an established market where prices cannot be manipulated by one buyer or seller.

SHORT-TERM INVESTMENT Short-term investments have two main requirements. 1. These must readily be convertible to cash. 2. Management must intend to convert or sell the investment within 3 to 12 months.

INTEREST RATES The interest rate is the amount a lender charges for the use of assets expressed as a percentage of the principal. The interest rate is typically noted on an annual basis known as the annual percentage rate (APR). The assets borrowed could include cash, consumer goods, or large assets such as a vehicle or building.

INTEREST RATES A loan that is considered low risk by the lender will have a lower interest rate. A loan that is considered high risk will have a higher interest rate.

When are interest rates applied?

INTEREST RATES Businesses take loans to fund capital projects and expand their operations by purchasing fixed and long-term assets such as land, buildings, and machinery. Borrowed money is repaid either in a lump sum by a pre-determined date or in periodic installments.

INTEREST RATES The money to be repaid is usually more than the borrowed amount since lenders require compensation for the loss of use of the money during the loan period. The lender could have invested the funds during that period instead of providing a loan, which would have generated income from the asset.

INTEREST RATES The difference between the total repayment sum and the original loan is the interest charged. The interest charged is applied to the principal amount.

Assume that you have P 500, 000 worth of savings and you want to raise P 1, 000 to start your own business. You could borrow funds from a bank, form a corporation and sell stock to the public, or sell corporate bonds. Which of these alternatives would you choose? Explain how you would try to convince the bank or investors to provide you with the funds you need.

RENTALS CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS

RENTALS A property from which the owner receives payment from the occupant(s), known as tenants, in return for occupying or using the property.

RENT CONTROL ACT IN THE PHILIPPINES Republic Act 9653, better known as the Rent Control Act of 2009, is the law that protects housing tenants (especially in the lower-income class) against unreasonable rent increases. It also provides the eviction rules that both landlords and tenants must observe.

CIVIL CODE OF THE PHILIPPINES The Civil Code has lease provisions that cover rentals above PHP 10, 000 and those not covered by the Rent Control Act of 2009, including commercial spaces and rent-to-own units.

MINIMUM WAGE CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS

MINIMUM WAGE This refers to the minimum amount of remuneration that an employer is required to pay wage earners for the work performed during a given period, which cannot be reduced by collective agreement or an individual contract.

MINIMUM WAGE LAW This law establishes a minimum amount that an employer can pay a worker for one day of labor. For example, the current minimum wage for nonagricultural work is P 491 a day and an average of P 410 a day for agricultural work.

TAXES CONTEMPORARY ECONOMIC ISSUES FACING THE FILIPINO ENTREPRENEURS

TAXES A tax is a mandatory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund various public expenditures. Failure to pay, along with evasion of or resistance to taxation, is punishable by law.

TAXES Taxes are considered inflows for the government and outflows for firms. The way a tax is imposed often is justified in the basis of one of two general principles: the benefits received and the ability to pay.

BENEFITS-RECEIVED TAX PRINCIPLE This principle relates taxes to the benefits taxpayers receive from a public good. For example, gasoline tax payments increase the more people drive. The more people drive, the more they benefit from roads that the gasoline tax finances.

ABILITY TO PAY TAX PRINCIPLE This approach to taxes relates that those with a greater ability to pay are taxed more. Income and property taxes usually rely on the ability to pay tax approach.

TAXES At the national level, taxes are imposed and collected pursuant to the National Internal Revenue Code, the Tariff and Customs Code, and several special laws. There are four main types of national internal revenue taxes: income, indirect (value-added and percentage taxes), excise and documentary stamp taxes, all of which are administered by the Bureau of Internal Revenue (BIR).

TAXES At the local level, governments have some autonomy to impose taxes on business and ownership of real property.

CORPORATE INCOME TAXES The regular corporate income tax (RCIT) is 30% on net taxable income. There is a minimum corporate income tax (MCIT) equivalent to 2% of gross income, which applies beginning on the fourth year of commercial operation.

WITHHOLDING TAXES Most income is subject to withholding of taxes. If the payor is classified as a top-20, 000 corporation or a top-5000 individual engaged in business, it is required to withhold on all payments for the purchase of goods (1%) and services (2%). Withholding taxes on income subject to the RCIT are creditable against the calculated liability.

INDIRECT TAXES A 12% VAT is imposed on the gross selling price on the sale, barter or exchange of goods and properties, as well as on the gross receipts from the sale of services within the Philippines, including the lease of properties.

EXCISE TAXES In addition to VAT, excise taxes are imposed on the following: alcohol, tobacco, petroleum products, automobiles, mineral products, and nonessential goods such as jewellery and precious stones, perfumes, yachts and other sport vessels.

DOCUMENTARY STAMP TAX A documentary stamp tax (DST) is required for certain documents, transactions or instruments specified in the tax code when the obligation or right arises from Philippine sources or when the property is situated in the Philippines.

DOCUMENTARY STAMP TAX A documentary stamp tax (DST) is required for certain documents, transactions or instruments specified in the tax code when the obligation or right arises from Philippine sources or when the property is situated in the Philippines.

PERFORMANCE TASK NO. 1 ENDTERM As the CEO of a business firm, how will you strengthen your business operations when you are faced with the previously identified contemporary economic issues? This 150 -word essay shall be submitted via LMS.

Contemporary issues facing the filipino entrepreneurs

Contemporary issues facing the filipino entrepreneurs Contemporary business world

Contemporary business world Identifying strategic issues facing the organization

Identifying strategic issues facing the organization Economic systems lesson 2 our economic choices

Economic systems lesson 2 our economic choices Contemporary health issues

Contemporary health issues Mrp system ppt

Mrp system ppt R051 contemporary issues in sport

R051 contemporary issues in sport Contemporary leadership roles

Contemporary leadership roles What are contemporary management issues

What are contemporary management issues Contemporary issues in marketing

Contemporary issues in marketing Contemporary issues in hrm

Contemporary issues in hrm Contemporary issues in managing change

Contemporary issues in managing change Contemporary issues in hospitality industry

Contemporary issues in hospitality industry Contemporary issues in engineering

Contemporary issues in engineering Contemporary issues in marine insurance

Contemporary issues in marine insurance Contemporary issues in marketing

Contemporary issues in marketing Contemporary tourism issues

Contemporary tourism issues The calm waters metaphor

The calm waters metaphor Log 470

Log 470 Ro51 contemporary issues in sport

Ro51 contemporary issues in sport Behaviour modifier

Behaviour modifier Contemporary nursing definition

Contemporary nursing definition Contemporary issues in information systems

Contemporary issues in information systems Contemporary issues in organizational behavior

Contemporary issues in organizational behavior Contemporary issues in planning

Contemporary issues in planning Contemporary issues in planning

Contemporary issues in planning Contemporary issues in auditing

Contemporary issues in auditing Social accounting definition

Social accounting definition Contemporary leadership issues

Contemporary leadership issues Contemporary leadership issues

Contemporary leadership issues Contemporary food issues

Contemporary food issues Contemporary issues in tourism

Contemporary issues in tourism What is economic problem

What is economic problem Economic growth vs economic development

Economic growth vs economic development Prof. meier and baldwin

Prof. meier and baldwin Postwar issues lesson 2

Postwar issues lesson 2 Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Lp html

Lp html Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Gấu đi như thế nào

Gấu đi như thế nào Tư thế worms-breton

Tư thế worms-breton Alleluia hat len nguoi oi

Alleluia hat len nguoi oi Các môn thể thao bắt đầu bằng từ đua

Các môn thể thao bắt đầu bằng từ đua Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

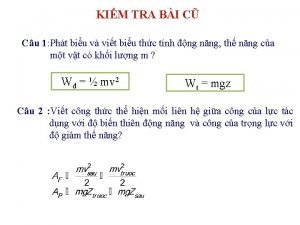

Các châu lục và đại dương trên thế giới Cong thức tính động năng

Cong thức tính động năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Mật thư anh em như thể tay chân

Mật thư anh em như thể tay chân 101012 bằng

101012 bằng Phản ứng thế ankan

Phản ứng thế ankan Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Một số thể thơ truyền thống

Một số thể thơ truyền thống Cái miệng xinh xinh thế chỉ nói điều hay thôi

Cái miệng xinh xinh thế chỉ nói điều hay thôi Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Nguyên nhân của sự mỏi cơ sinh 8

Nguyên nhân của sự mỏi cơ sinh 8