Comparative Study EuroArea and Prospective AEC Euro Origins

- Slides: 44

Comparative Study: Euro-Area and Prospective AEC Euro: Origins, Development, Performance and Lessons Djamester Simarmata ISEAS 2011 Djamester A. SIMARMATA

Overview • Euro – Historical Background – Several Exchange Rate Systems were in Use – EURO and Political Support • ASEAN Economic Community Prospects – East Asian Crisis as a Trigger for EAEC – Diversity level of developments, Divergence – Prospects AEC Common Currency • Local Currency: old instruments for new phenomena? Or…? Djamester A. SIMARMATA 2

Background & Precedent to Euro • WW II, devastating effects: materials losses & human lives • ≈ 25 mlln Russian, 7 mlln German, French 0. 8 mlln, British 0. 4 mlln, total ≈ 61 mlln fatalities of WW II. A huge human losses • Winston Churchill speech: University of Zurich, 1946 (German Problem) – German Problem: WW I left a reparatory burden for Germany beyond the capacity of the German Economy [Keynes was against] – Urging the unification of Europe continental, especially including German and France Djamester A. SIMARMATA 3

Vital Steps after Churchill speech until 1993 • Schuman Declaration 1950 (rapprochement) leading to ECSC (European Coal and Steel Community), 1952 (German war capacity) • Treaty of Rome, 1957 (Benelux, France, Italy, Germany) forming Customs Union : EEC • Werner Report for Europe, 1970: Wanted deeper integration, convertible currency, stable ER with free flow of capital • 1972 “Snake” fixed exchange rate • 1978, Helmut Schmidt and Giscard d’Estaing together, agreed to replace the “snake ER system” but anchored in DM • 1979: The European Monetary System, EMS is instituted with the objectives: • a zone of monetary stability via the EEC members, • low inflation rate, • stable Exchange Rate → ERM, ± 2. 25 %, Djamester A. SIMARMATA 4

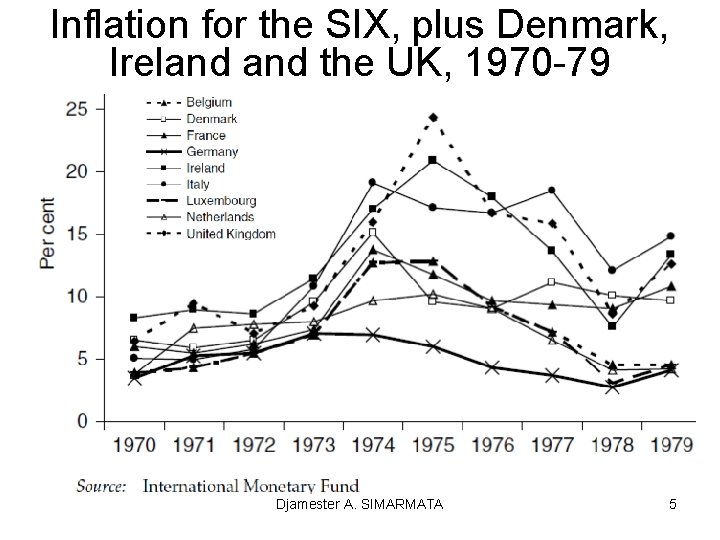

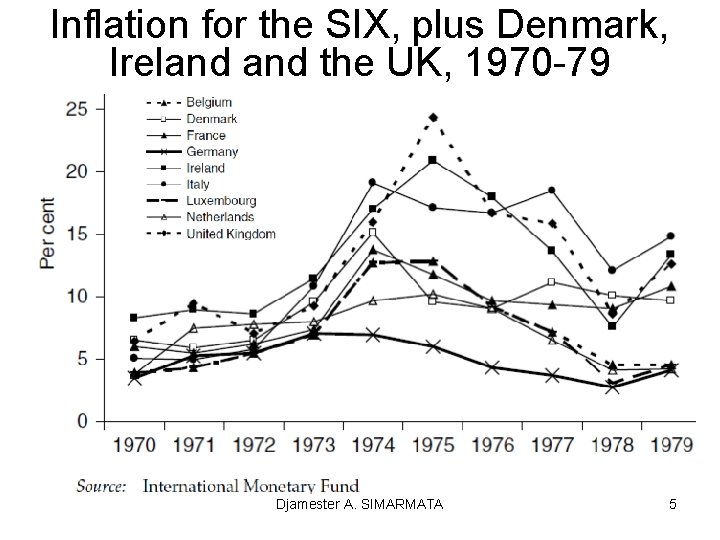

Inflation for the SIX, plus Denmark, Ireland the UK, 1970 -79 Djamester A. SIMARMATA 5

ER & Other Development after. The Crisis of ERM in 1993 • Since 1979, the nature of the ERM (of EMS) has changed drastically, then the 1993 Crisis • from a system of fixed but adjustable rates with limited international capital mobility – [ ± 2, 25 % band of ER] • to the "hard" mechanism in 1987: stable and narrow target zones and the removal of capital controls. • Crises 1993: fundamental# and speculative@ • # Macroecnomic and political factors: German Unification needed new monetary and fiscal policy mix • # The divergent costs & prices (due to monetary and fiscal divergence, liberalization of international financial movement, …Danish referendum 1992, weak result) • @ Speculative: sudden & arbitrary shift of expectations Djamester A. SIMARMATA 6

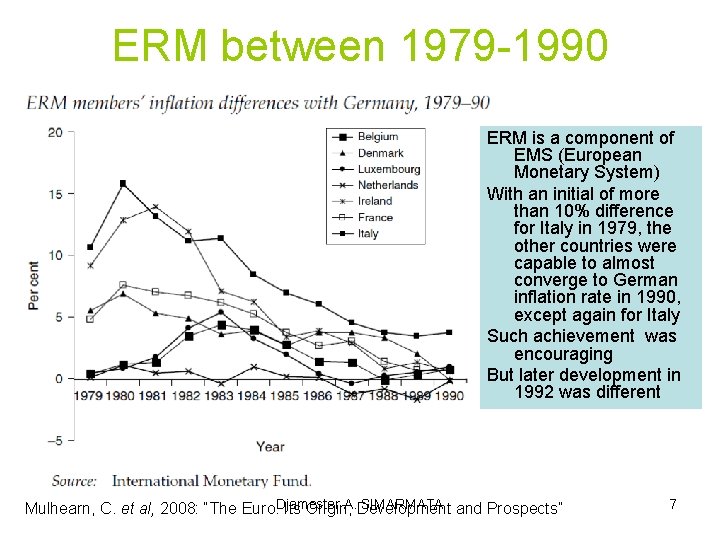

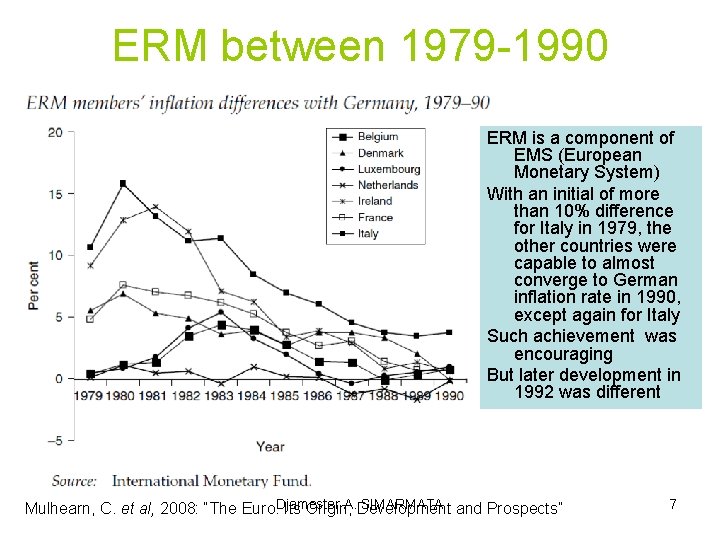

ERM between 1979 -1990 ERM is a component of EMS (European Monetary System) With an initial of more than 10% difference for Italy in 1979, the other countries were capable to almost converge to German inflation rate in 1990, except again for Italy Such achievement was encouraging But later development in 1992 was different A. Development SIMARMATA and Prospects” Mulhearn, C. et al, 2008: “The Euro. Djamester Its Origin, 7

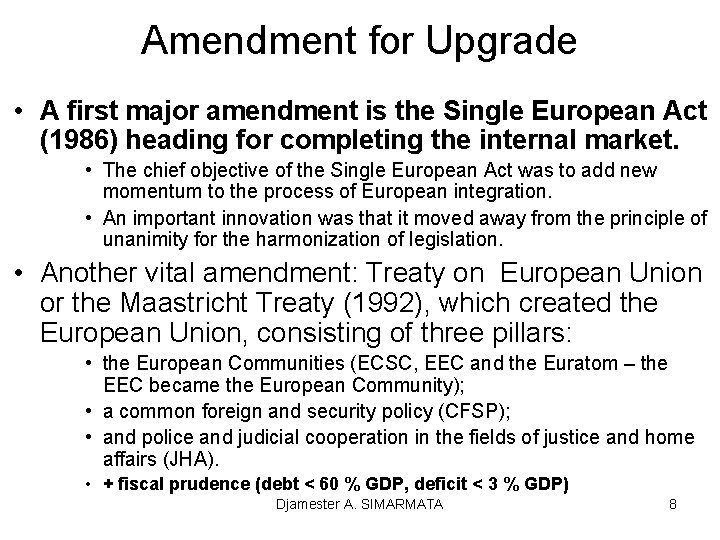

Amendment for Upgrade • A first major amendment is the Single European Act (1986) heading for completing the internal market. • The chief objective of the Single European Act was to add new momentum to the process of European integration. • An important innovation was that it moved away from the principle of unanimity for the harmonization of legislation. • Another vital amendment: Treaty on European Union or the Maastricht Treaty (1992), which created the European Union, consisting of three pillars: • the European Communities (ECSC, EEC and the Euratom – the EEC became the European Community); • a common foreign and security policy (CFSP); • and police and judicial cooperation in the fields of justice and home affairs (JHA). • + fiscal prudence (debt < 60 % GDP, deficit < 3 % GDP) Djamester A. SIMARMATA 8

Further Important Development • Another significant treaty is Stability and Growth Pact and Treaty of Amsterdam (1997). – Fiscal prudence: Debt < 60 % GDP; Deficit < 3% GDP, for those countries aspiring to adopt the one euro currency – The Amsterdam Treaty is an amendment for the Treaties on the EC and on the EU • Further amendment: the Treaty of Nice (2001). – The Nice Treaty deals with reforming the institutions so that the EU could continue to function effectively after its enlargement to 25 Member States in 2004 and subsequently to 27 Member States in 2007. • Revised SGP (2005): more flexible due to the failure of both German and France on the fiscal prudence • The referendum in France and the Netherlands, 2005 rejected the European Constitution: Euro Currency failed to have a Political Support [ It is a long way ] 9 Djamester A. SIMARMATA

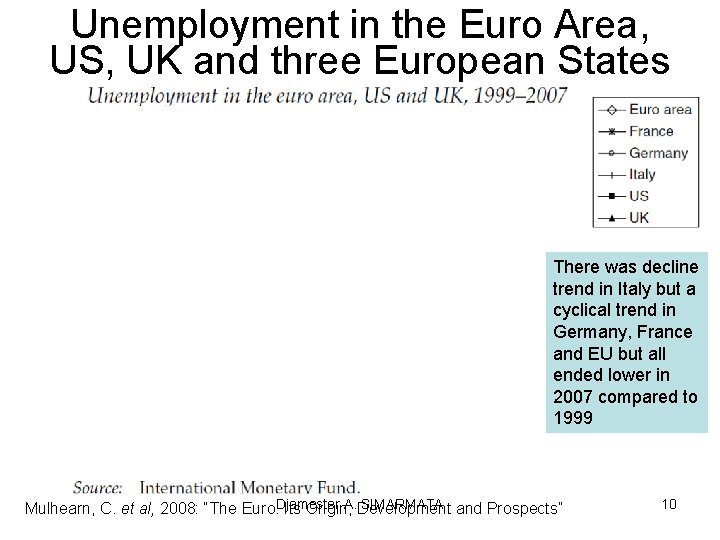

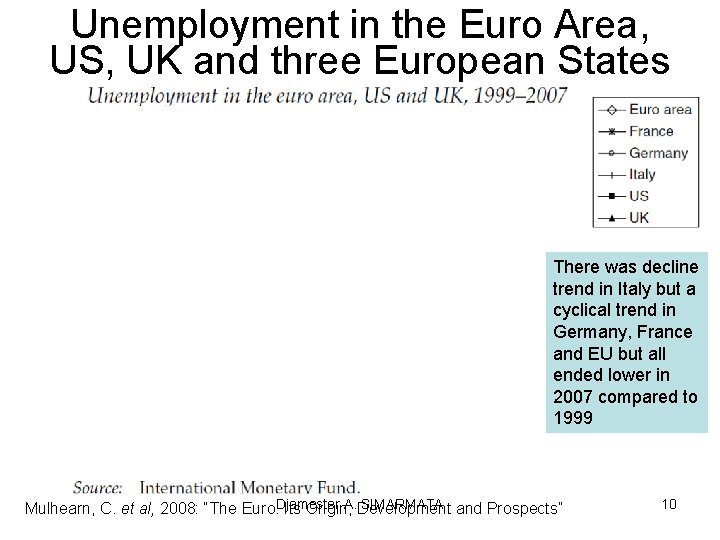

Unemployment in the Euro Area, US, UK and three European States There was decline trend in Italy but a cyclical trend in Germany, France and EU but all ended lower in 2007 compared to 1999 A. Development SIMARMATA and Prospects” Mulhearn, C. et al, 2008: “The Euro. Djamester Its Origin, 10

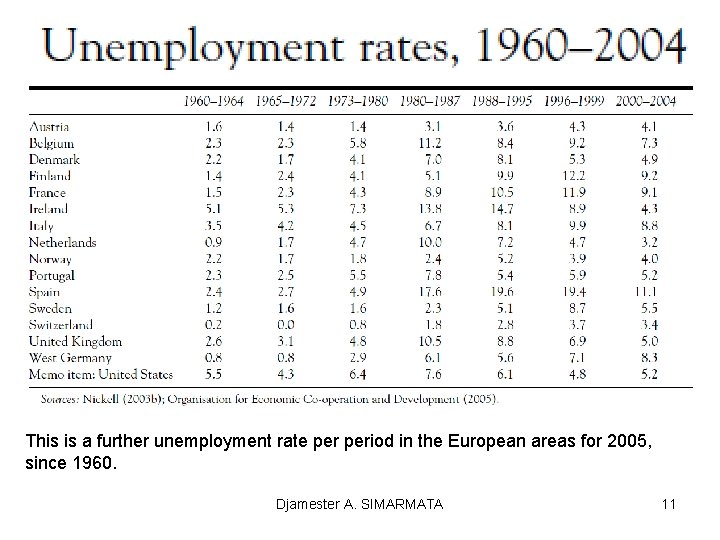

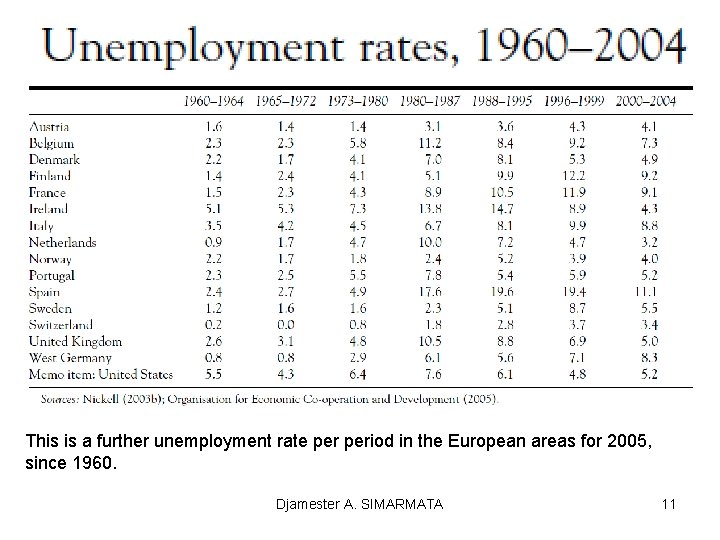

This is a further unemployment rate period in the European areas for 2005, since 1960. Djamester A. SIMARMATA 11

Unemployment • In the two previous slides it is shown that the rate of unemployment in 2007 were lower than those in 1979, with a cyclical form in between. • Nonetheless the 2007 rates were mostly higher than those in the period of 1960 -1980 • Those in Europe were higher than in the US and the UK • By observing the periods before 1979, the overall rise happened in the period of 1980 -1987. • As in 1973, there was a significant rise in oil price in 1979 due to the Iran-Iraq war, leading to less investments outside oil sectors • In the period of 1996 -1999, the highest rates occurred in Spain (19. 4%), Finland (12. 2%) and then France (11. 9%). • Other big economy in the region: Italy (9. 9%), West Germany (7. 1%), Djamester A. SIMARMATA 12

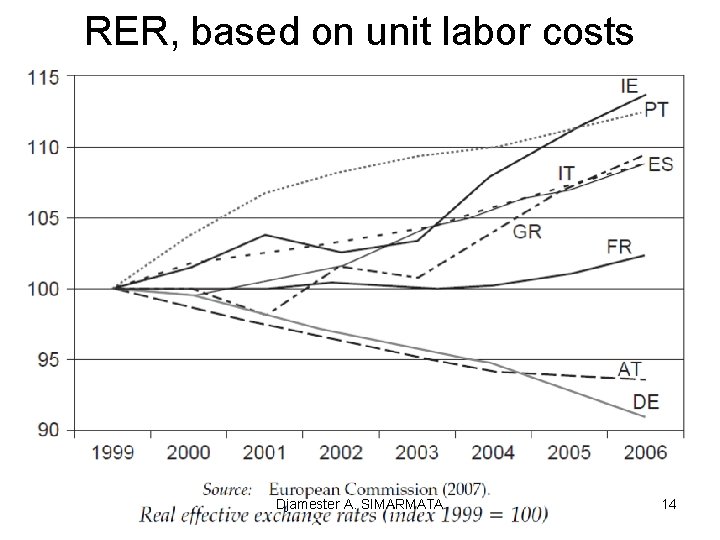

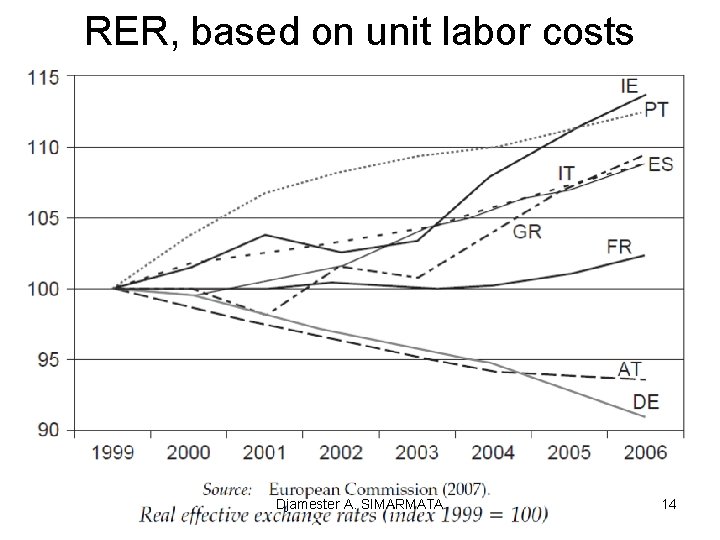

Real Effective ER after 1999 • The next slide shows the development of REER, which is reflected by its unit labor cost • Germany had a decline REER, increasing the competitiveness of the German Goods • The decline of Germany’s REER to some extent disturb the role of euro as a common currency (This is a shocks for other countries) • Portugal experienced the highest REER during the period after 1999, followed by Italy and then Spain • This will deteriorate the competitiveness of these countries, which will disturb internal balance in economic development [import↑] • France was almost flat, with a small rise in the period approaching 2006 Djamester A. SIMARMATA 13

RER, based on unit labor costs Djamester A. SIMARMATA 14

Greece, Ireland, … Euro Crisis • In 1992 the crisis hit the ERM system • In 2010, the crises in the Euro hit the states, firstly Greece, Ireland, and then … • The crises were provoked by the fiscal imprudence of Greece government; budget average deficit was 5 % between 2001 -2008 and the CA deficit was 9 %. • The average budget deficit of the euro-area was 2 % of GDP while that of CA was 1 %. • Greece’s deficit violated both the deficit and the debt limits as stated in the SGP (fiscal imprudence) • Its membership in the euro area reduced the Greece’s risks, raising its grade for credits, pushing up the loans for the country beyond its suatainability level. But now its membership. Djamester is seen as a negative factor A. SIMARMATA 15

Greece, Ireland, … Euro Crisis… • The Ireland crisis is related to sovereign as well as the banks debts. • The banks have been lending too much to the real estate, as also happened in Spain. • The most urgent problem is to save the banks, due to its immense recapitalization needs • The Irish government encourage the family housing construction, and the banks seized the opportunity • The Irish banks are in deep trouble after the property price crash, could lead to whole banks bankruptcy • At last the whole financial problems become at the burden of the government Djamester A. SIMARMATA 16

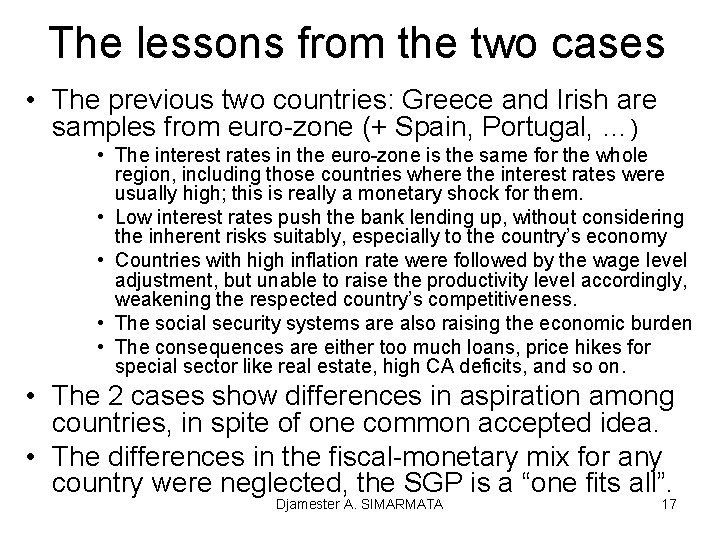

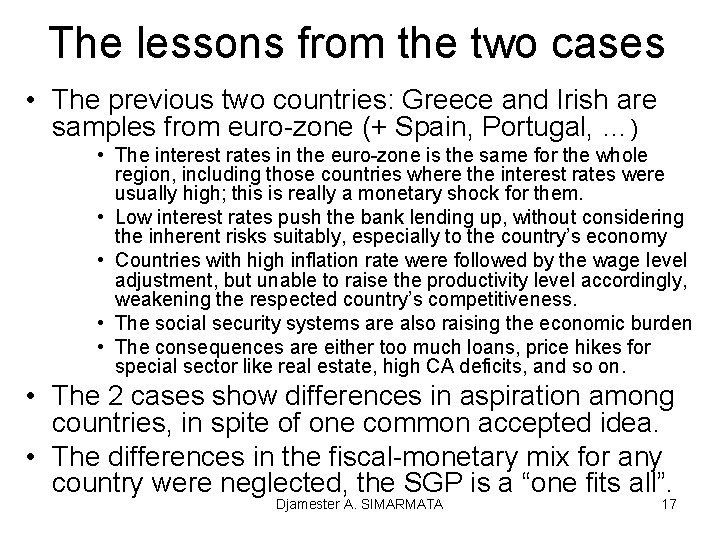

The lessons from the two cases • The previous two countries: Greece and Irish are samples from euro-zone (+ Spain, Portugal, …) • The interest rates in the euro-zone is the same for the whole region, including those countries where the interest rates were usually high; this is really a monetary shock for them. • Low interest rates push the bank lending up, without considering the inherent risks suitably, especially to the country’s economy • Countries with high inflation rate were followed by the wage level adjustment, but unable to raise the productivity level accordingly, weakening the respected country’s competitiveness. • The social security systems are also raising the economic burden • The consequences are either too much loans, price hikes for special sector like real estate, high CA deficits, and so on. • The 2 cases show differences in aspiration among countries, in spite of one common accepted idea. • The differences in the fiscal-monetary mix for any country were neglected, the SGP is a “one fits all”. Djamester A. SIMARMATA 17

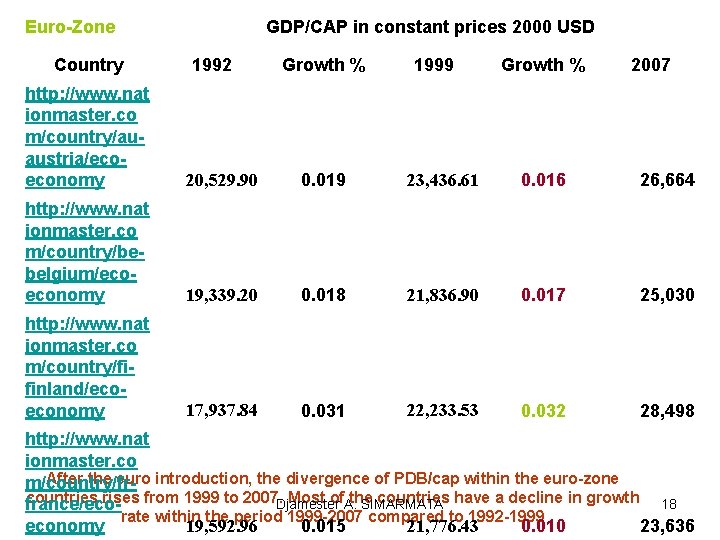

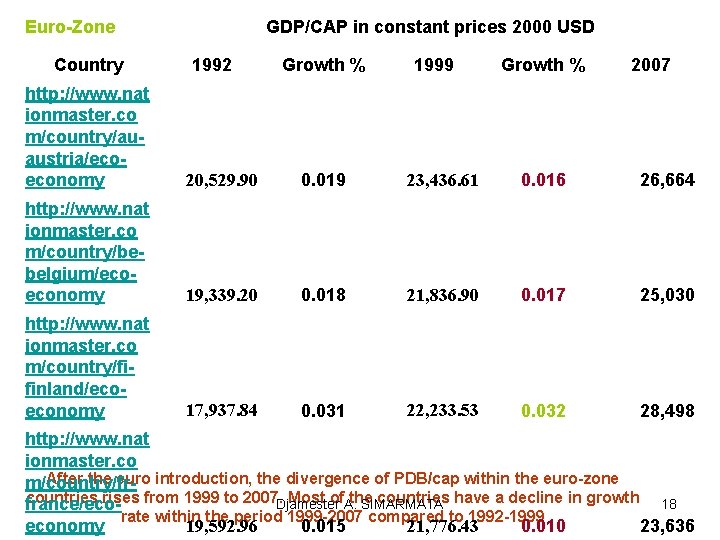

Euro-Zone Country GDP/CAP in constant prices 2000 USD 1992 Growth % 1999 Growth % 2007 http: //www. nat ionmaster. co m/country/auaustria/ecoeconomy 20, 529. 90 0. 019 23, 436. 61 0. 016 26, 664 http: //www. nat ionmaster. co m/country/bebelgium/ecoeconomy 19, 339. 20 0. 018 21, 836. 90 0. 017 25, 030 http: //www. nat ionmaster. co m/country/fifinland/ecoeconomy 17, 937. 84 0. 031 22, 233. 53 0. 032 28, 498 http: //www. nat ionmaster. co After the euro introduction, the divergence of PDB/cap within the euro-zone m/country/frcountries rises from 1999 to 2007. Djamester Most of. A. the countries have a decline in growth 18 SIMARMATA france/ecorate within the period 1999 -2007 compared to 1992 -1999 19, 592. 96 21, 776. 43 economy 0. 015 0. 010 23, 636

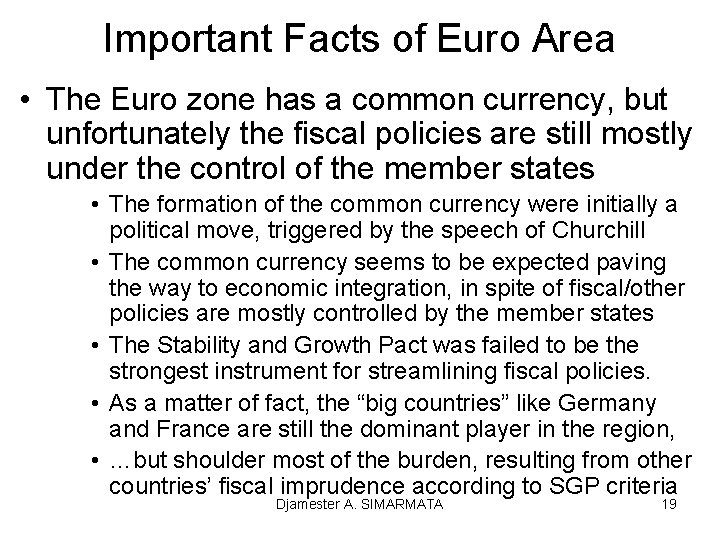

Important Facts of Euro Area • The Euro zone has a common currency, but unfortunately the fiscal policies are still mostly under the control of the member states • The formation of the common currency were initially a political move, triggered by the speech of Churchill • The common currency seems to be expected paving the way to economic integration, in spite of fiscal/other policies are mostly controlled by the member states • The Stability and Growth Pact was failed to be the strongest instrument for streamlining fiscal policies. • As a matter of fact, the “big countries” like Germany and France are still the dominant player in the region, • …but shoulder most of the burden, resulting from other countries’ fiscal imprudence according to SGP criteria Djamester A. SIMARMATA 19

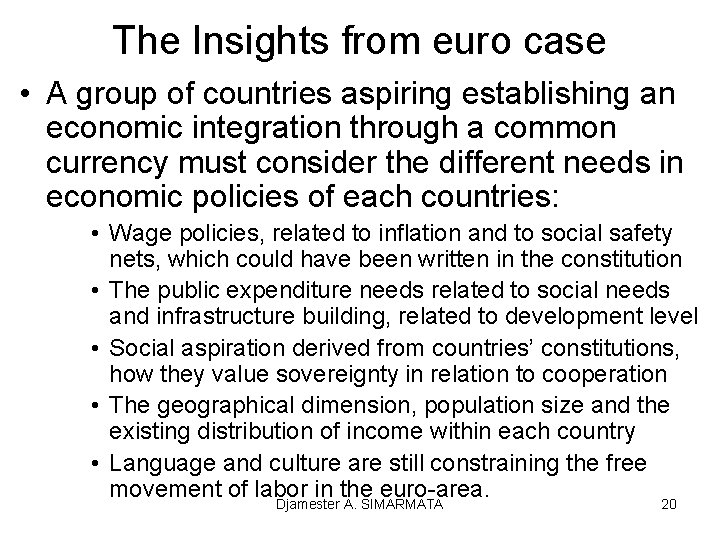

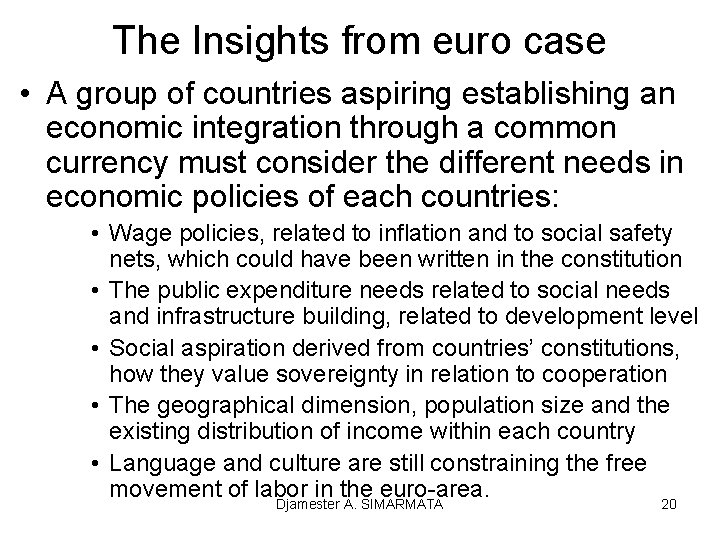

The Insights from euro case • A group of countries aspiring establishing an economic integration through a common currency must consider the different needs in economic policies of each countries: • Wage policies, related to inflation and to social safety nets, which could have been written in the constitution • The public expenditure needs related to social needs and infrastructure building, related to development level • Social aspiration derived from countries’ constitutions, how they value sovereignty in relation to cooperation • The geographical dimension, population size and the existing distribution of income within each country • Language and culture are still constraining the free movement of labor in the euro-area. Djamester A. SIMARMATA 20

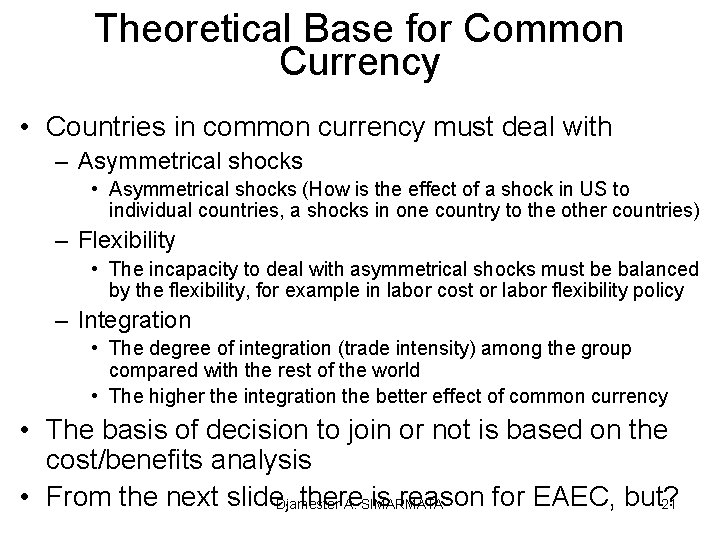

Theoretical Base for Common Currency • Countries in common currency must deal with – Asymmetrical shocks • Asymmetrical shocks (How is the effect of a shock in US to individual countries, a shocks in one country to the other countries) – Flexibility • The incapacity to deal with asymmetrical shocks must be balanced by the flexibility, for example in labor cost or labor flexibility policy – Integration • The degree of integration (trade intensity) among the group compared with the rest of the world • The higher the integration the better effect of common currency • The basis of decision to join or not is based on the cost/benefits analysis • From the next slide, there is reason for EAEC, but? Djamester A. SIMARMATA 21

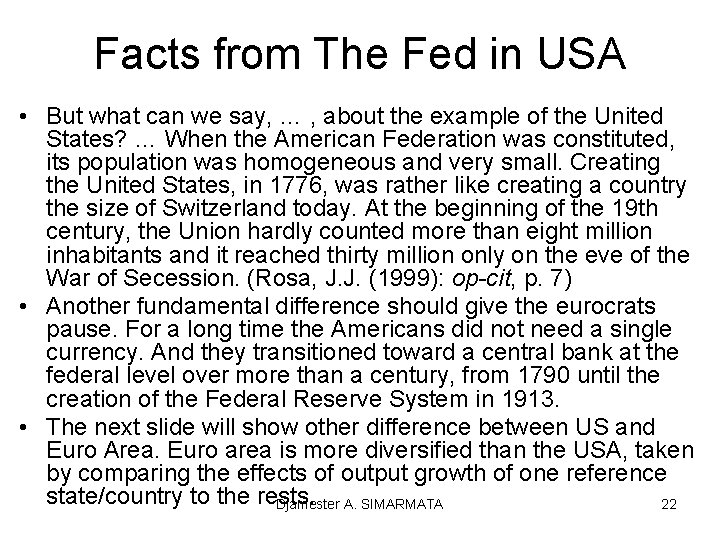

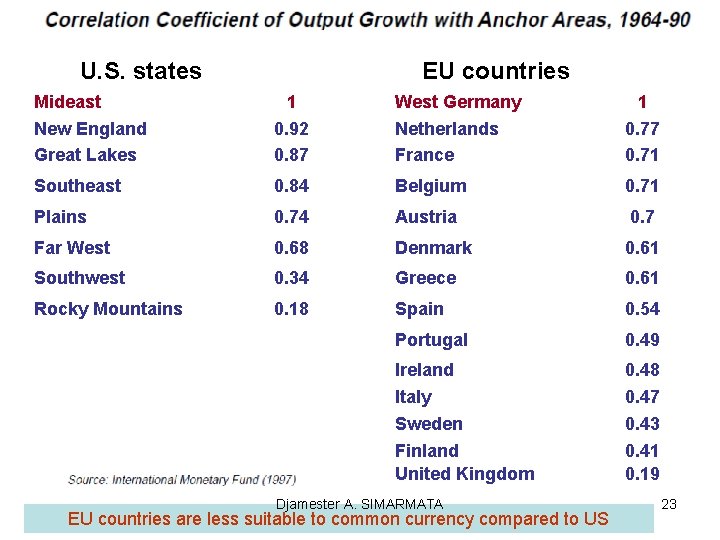

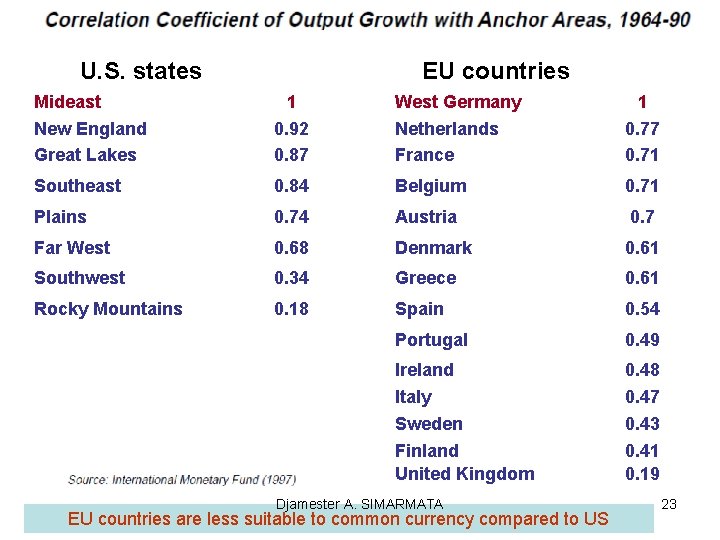

Facts from The Fed in USA • But what can we say, … , about the example of the United States? … When the American Federation was constituted, its population was homogeneous and very small. Creating the United States, in 1776, was rather like creating a country the size of Switzerland today. At the beginning of the 19 th century, the Union hardly counted more than eight million inhabitants and it reached thirty million only on the eve of the War of Secession. (Rosa, J. J. (1999): op-cit, p. 7) • Another fundamental difference should give the eurocrats pause. For a long time the Americans did not need a single currency. And they transitioned toward a central bank at the federal level over more than a century, from 1790 until the creation of the Federal Reserve System in 1913. • The next slide will show other difference between US and Euro Area. Euro area is more diversified than the USA, taken by comparing the effects of output growth of one reference state/country to the rests. Djamester A. SIMARMATA 22

U. S. states EU countries Mideast New England Great Lakes 1 0. 92 0. 87 West Germany Netherlands France 1 0. 77 0. 71 Southeast 0. 84 Belgium 0. 71 Plains 0. 74 Austria 0. 7 Far West 0. 68 Denmark 0. 61 Southwest 0. 34 Greece 0. 61 Rocky Mountains 0. 18 Spain 0. 54 Portugal 0. 49 Ireland Italy Sweden Finland United Kingdom 0. 48 0. 47 0. 43 0. 41 0. 19 Djamester A. SIMARMATA EU countries are less suitable to common currency compared to US 23

Second Part: The Lessons For ASEAN Economic Community Comparative Study: Euro-Area and Prospective AEC ISEAS 2011 Djamester A. SIMARMATA

Two Different Concepts of AEC • According to Erle Frayne Argonza y Delago • Integration would go beyond tariff reforms, for a reminder. An economic union would need central institutions to note: (a) central bank, (b) regional currency, and (c) related regulatory institutions. [Philippines, 03 November 2010] • According to Datuk Dr Rebecca Fatima Sta Maria • The AEC is, in a nutshell, the realisation of a competitive and dynamic region which allows for free flow of goods, services and investment, and freer flow of capital and skilled workers by 2015. Tariff and non-tariff barriers are to be gradually eliminated. • In its external relations, the AEC is to observe open regionalism. This means that as a regional entity, ASEAN will negotiate joint trade agreements with external dialogue partners. • At the same time, member countries are free to sign individual trade arrangements. Djamester A. SIMARMATA 25

Divergence of AEC views • The previous two concepts show that the idea of ASEAN economic integration is different from one another • That from Delago could be attributed to that of the euro model, which at the end will be analogous to the USA. It could be related to its country origin, the Philippines, which are culturally close to that of the USA • That of Sta Maria is very typical of Asian attitudes, that the meaning of integration could be interpreted as a soft integration, where the member countries are still free to form a bilateral relation to other countries outside the integrated countries. • The concept of ASEAN economic integration Djamester A. SIMARMATA 26 is not uniform, leading to divergence of views

WB Study: Infrastructure • WPS 4615 (2010) conclusion: facilitation of trade is more important for ASEAN trade than the tariffs and the non-tariffs barriers: • the infrastructures in the ASEAN countries are still lacking, namely roads, ports & facilities, and so on. • The WB study concentrated on 4 issues related to the reduction of transaction costs: ports and airports infrastructure, services sector development, customs • In addition to that, the case of Indonesia is related to the tantamount lack of roads for goods transportation • In a nutshell, trade facilitation refers to the set of policies, that reduces the cost of exporting and importing. Djamester A. SIMARMATA 27

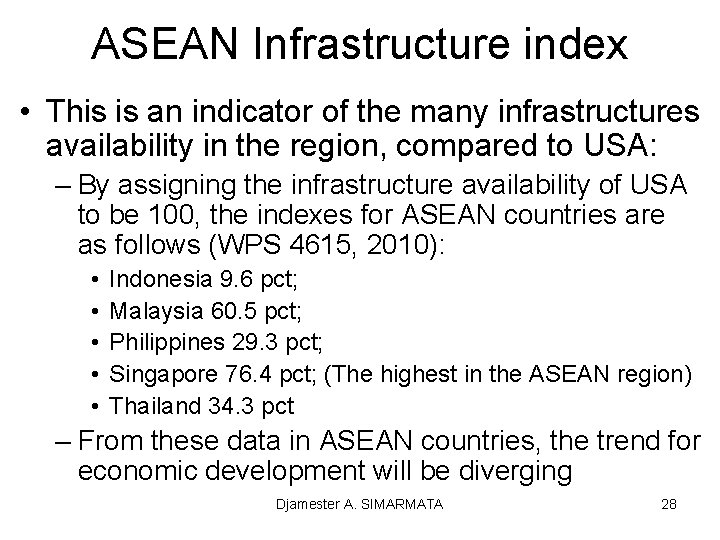

ASEAN Infrastructure index • This is an indicator of the many infrastructures availability in the region, compared to USA: – By assigning the infrastructure availability of USA to be 100, the indexes for ASEAN countries are as follows (WPS 4615, 2010): • • • Indonesia 9. 6 pct; Malaysia 60. 5 pct; Philippines 29. 3 pct; Singapore 76. 4 pct; (The highest in the ASEAN region) Thailand 34. 3 pct – From these data in ASEAN countries, the trend for economic development will be diverging Djamester A. SIMARMATA 28

Export Import in ASEAN 8 Djamester A. SIMARMATA 29

Intra-ASEAN Trade is low • From previous slide, intra-regional exports is around 20 percent of the total trade, while import is a little more than exports • Based on the vital criteria of economic integration, namely common currency, in the sense of Delago, benefits of economic integration is less than if the ASEAN countries are not integrated in the sense of an idea, which leads to common currency. • By regarding the economic structure of the countries in the ASEAN region, they are almost similar with only minor differences, except for Singapore • The difference of infrastructure availability will be one factor for products development, not bound in the primary sector. • Being a vital factor for economic integration, the low intra-regional trade in ASEAN is not favorable for that effort, at least. Djamester for the present era. A. SIMARMATA 30

Djamester A. SIMARMATA Source: ASEAN Trade Integration 31

Djamester A. SIMARMATA 32

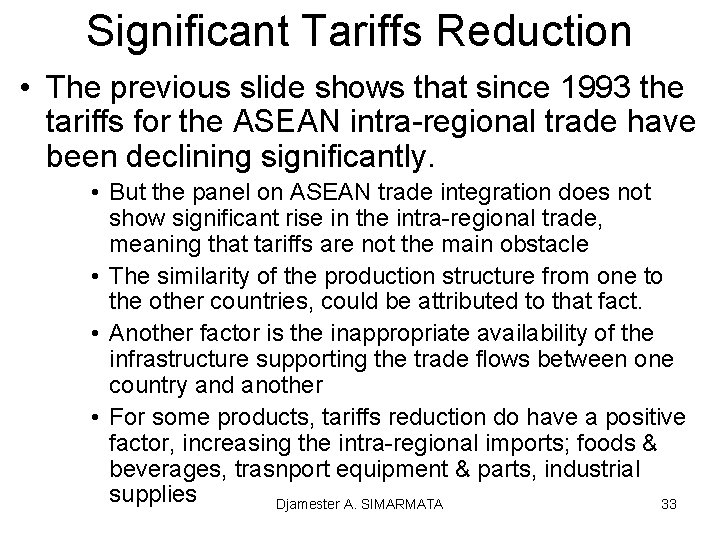

Significant Tariffs Reduction • The previous slide shows that since 1993 the tariffs for the ASEAN intra-regional trade have been declining significantly. • But the panel on ASEAN trade integration does not show significant rise in the intra-regional trade, meaning that tariffs are not the main obstacle • The similarity of the production structure from one to the other countries, could be attributed to that fact. • Another factor is the inappropriate availability of the infrastructure supporting the trade flows between one country and another • For some products, tariffs reduction do have a positive factor, increasing the intra-regional imports; foods & beverages, trasnport equipment & parts, industrial supplies Djamester A. SIMARMATA 33

Djamester A. SIMARMATA 34

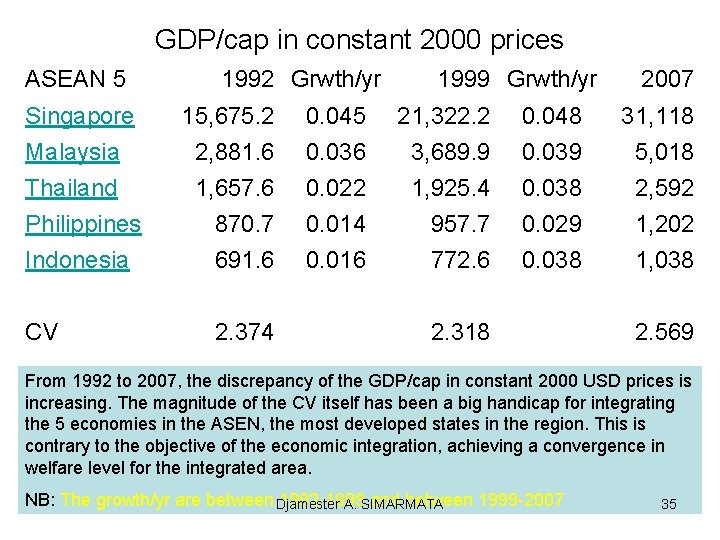

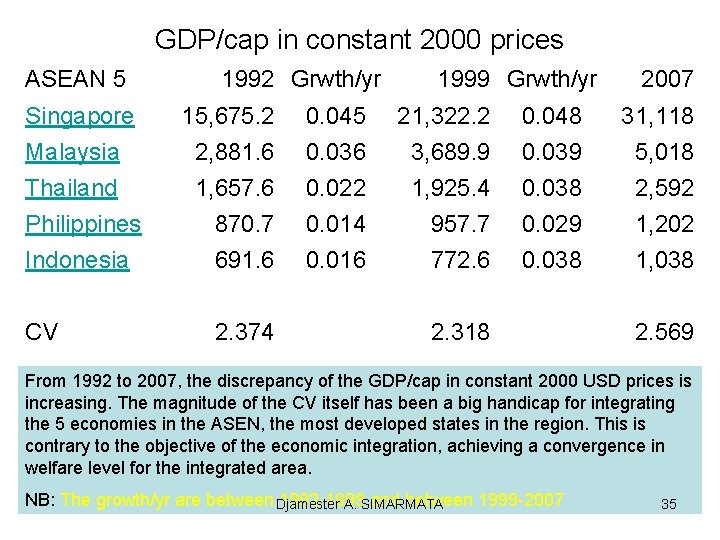

GDP/cap in constant 2000 prices ASEAN 5 1992 Grwth/yr 1999 Grwth/yr 2007 Singapore Malaysia 15, 675. 2 2, 881. 6 0. 045 0. 036 21, 322. 2 3, 689. 9 0. 048 0. 039 31, 118 5, 018 Thailand Philippines Indonesia 1, 657. 6 870. 7 691. 6 0. 022 0. 014 0. 016 1, 925. 4 957. 7 772. 6 0. 038 0. 029 0. 038 2, 592 1, 202 1, 038 CV 2. 374 2. 318 2. 569 From 1992 to 2007, the discrepancy of the GDP/cap in constant 2000 USD prices is increasing. The magnitude of the CV itself has been a big handicap for integrating the 5 economies in the ASEN, the most developed states in the region. This is contrary to the objective of the economic integration, achieving a convergence in welfare level for the integrated area. NB: The growth/yr are between Djamester 1992 -1999 and between 1999 -2007 A. SIMARMATA 35

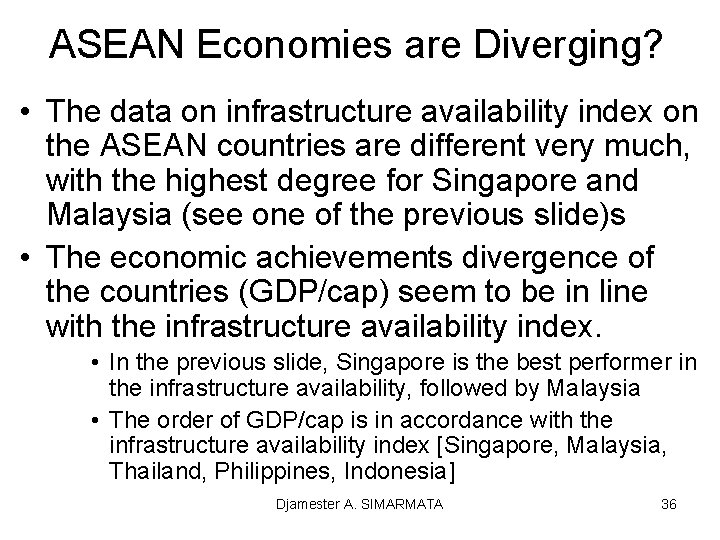

ASEAN Economies are Diverging? • The data on infrastructure availability index on the ASEAN countries are different very much, with the highest degree for Singapore and Malaysia (see one of the previous slide)s • The economic achievements divergence of the countries (GDP/cap) seem to be in line with the infrastructure availability index. • In the previous slide, Singapore is the best performer in the infrastructure availability, followed by Malaysia • The order of GDP/cap is in accordance with the infrastructure availability index [Singapore, Malaysia, Thailand, Philippines, Indonesia] Djamester A. SIMARMATA 36

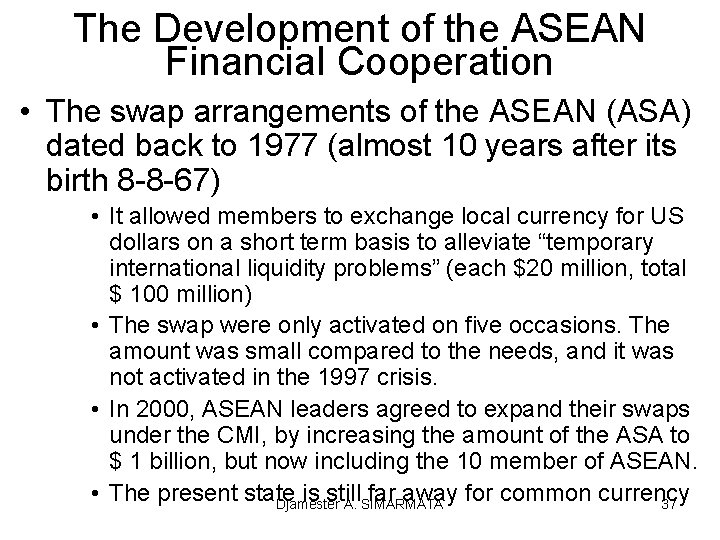

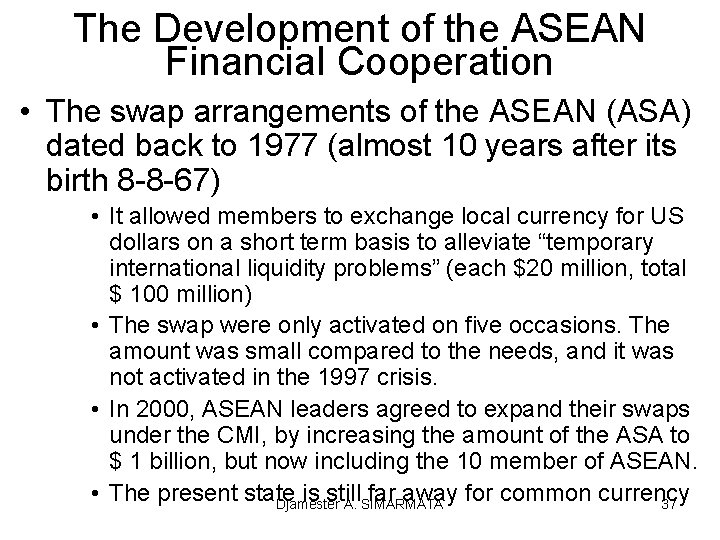

The Development of the ASEAN Financial Cooperation • The swap arrangements of the ASEAN (ASA) dated back to 1977 (almost 10 years after its birth 8 -8 -67) • It allowed members to exchange local currency for US dollars on a short term basis to alleviate “temporary international liquidity problems” (each $20 million, total $ 100 million) • The swap were only activated on five occasions. The amount was small compared to the needs, and it was not activated in the 1997 crisis. • In 2000, ASEAN leaders agreed to expand their swaps under the CMI, by increasing the amount of the ASA to $ 1 billion, but now including the 10 member of ASEAN. • The present state is still far away for common currency Djamester A. SIMARMATA 37

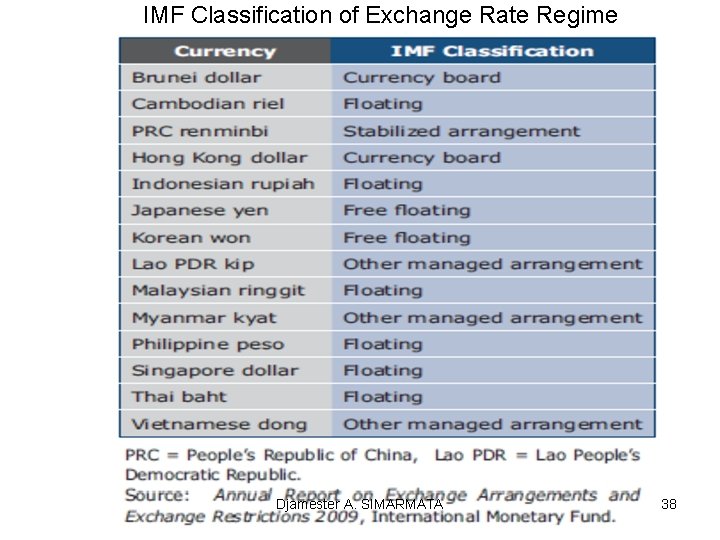

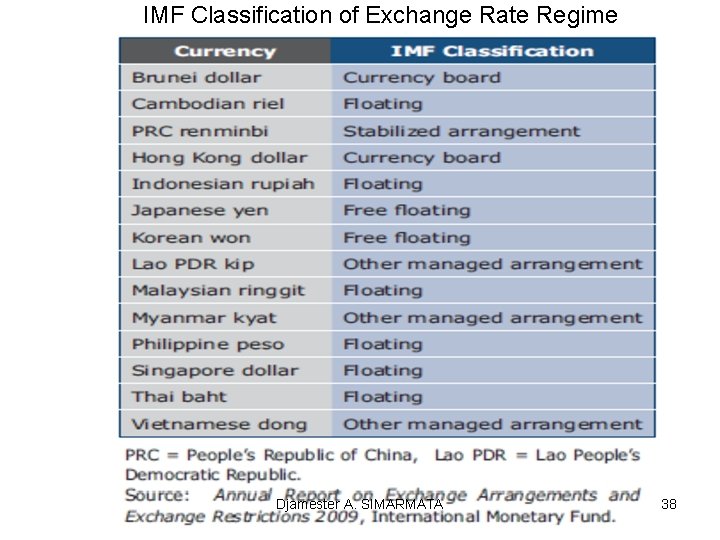

IMF Classification of Exchange Rate Regime Djamester A. SIMARMATA 38

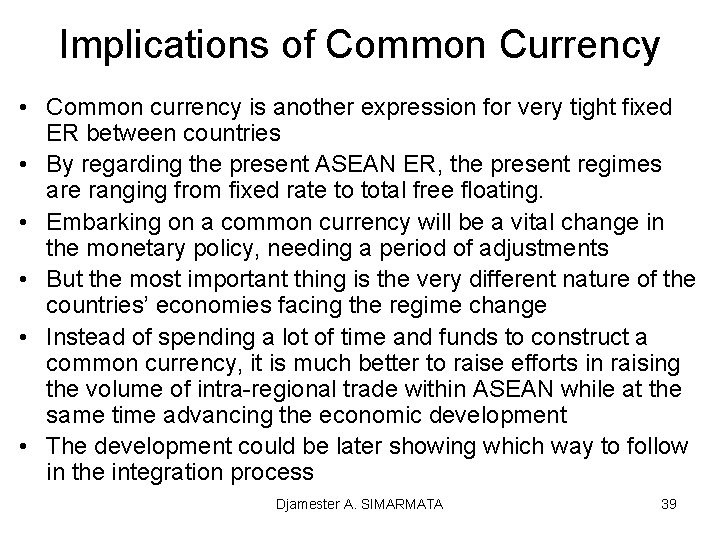

Implications of Common Currency • Common currency is another expression for very tight fixed ER between countries • By regarding the present ASEAN ER, the present regimes are ranging from fixed rate to total free floating. • Embarking on a common currency will be a vital change in the monetary policy, needing a period of adjustments • But the most important thing is the very different nature of the countries’ economies facing the regime change • Instead of spending a lot of time and funds to construct a common currency, it is much better to raise efforts in raising the volume of intra-regional trade within ASEAN while at the same time advancing the economic development • The development could be later showing which way to follow in the integration process Djamester A. SIMARMATA 39

Third Part: Local Currency, and its potential impacts in ASEAN. Comparative Study: Euro-Area and Prospective AEC ISEAS 2011 Djamester A. SIMARMATA

Reemergence of Local Currency • Now in Germany there are 16 regions using local currency as an alternative to euro • A signal of the resistance to the euro at the local level, where local economies seem losing their importance in the process of globalization • The local currency: Schwundgeld, losing value after a certain period of time, intended to encourage to spend the money quickly, stimulus for regional economy • So the use of euro is felt not to help raising the regional economic progress, compared to the previous national currency. Djamester A. SIMARMATA 41

Other Local Currency • There has been local currency in Switzerland in the Great Depression period: • WIR money, due to scarcity of credits from normal banking. • It happened nonetheless in the US • Recently in Ithaca there appeared similar alternative, the HOURS due to the difficulty to get money for business in 1991. • A doubt for common currency for a large area in advanced countries, provokes such a doubt in EM • The recent crises in the era of intensive globalization could be a source of strong doubt on the effectiveness of a common currency even at the global level. • Being a strong flavor of sovereignty, money could be defended as a symbol of a nation state Djamester A. SIMARMATA 42

ASEAN common currency? • The not so success of euro, and the repeating failure of ER system in Europe, could provoke a psychological handicap for ASEAN common currency • The emergence of local currency, both recent or ancient cases, could be adding another negative factor for such a common currency • The shallow analysis of the suitability of Euro area and the USA as a common currency, concludes the less suitability of the Euro area compared to that of the USA. • One of the suspected factor is the heterogeneity of those euro countries in many respects, which could be more intense in the ASEAN countries. Djamester A. SIMARMATA 43

Short Conclusions • Common currency is not a guarantee for better development for the whole member countries, irrespective of the level of development. The example is the euro area • The idea of ASEAN economic community should be based on the idea of elaborating a more trade friendly cooperation, without stressing on the basis of common currency in the region, at least for now. • Those efforts necessitated for establishing the common currency should be directed for pushing up the economic development of each country but with more trade intensification in the background. Djamester A. SIMARMATA 44

Retrospective cohort study

Retrospective cohort study Retrospective causal-comparative research

Retrospective causal-comparative research Cross sectional study

Cross sectional study Longitudinal research design example

Longitudinal research design example Difference between case control and cohort study

Difference between case control and cohort study Root word anthrop

Root word anthrop Study of word origins

Study of word origins Site:slidetodoc.com

Site:slidetodoc.com Persistence of learning over time

Persistence of learning over time Institute for prospective technological studies

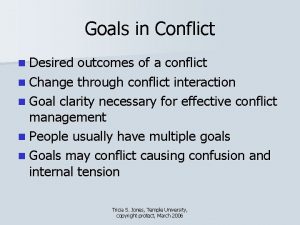

Institute for prospective technological studies Transactive goals develop

Transactive goals develop Iceberg phenomenon related to chronic diseases

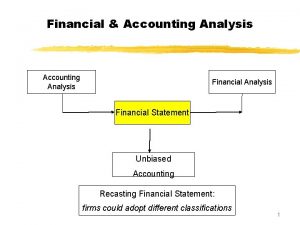

Iceberg phenomenon related to chronic diseases Recasting financial statements

Recasting financial statements Veille prospective

Veille prospective Prospero registry

Prospero registry Types of process validation

Types of process validation Validation definition

Validation definition Prospective memory psychology definition

Prospective memory psychology definition Retrospective validation

Retrospective validation Validation definition

Validation definition Prospective-glass

Prospective-glass Prospective analysis financial statements

Prospective analysis financial statements Aec model

Aec model Uri 101

Uri 101 Tali busur

Tali busur Sjsu aec

Sjsu aec Major arc geometry

Major arc geometry Aec format example

Aec format example Aec quality control

Aec quality control Aec upgrade

Aec upgrade Aec qatar

Aec qatar Flisteos

Flisteos Aec tutoring uri

Aec tutoring uri Comparative de excited

Comparative de excited Hip and leg muscles

Hip and leg muscles Virtual circuit approach

Virtual circuit approach Where did christianity originate

Where did christianity originate Beowulf discussion questions

Beowulf discussion questions How do the origins of folk and popular culture differ?

How do the origins of folk and popular culture differ? Folk culture origins

Folk culture origins Guided reading activity foundations of government lesson 1

Guided reading activity foundations of government lesson 1 The origins of hospitality and tourism

The origins of hospitality and tourism The origins of hospitality and tourism

The origins of hospitality and tourism Ancient rome and the origins of christianity

Ancient rome and the origins of christianity The origins of hospitality and tourism

The origins of hospitality and tourism