Chapter 7 Rate of Return Analysis 1 Chapter

- Slides: 57

Chapter 7 Rate of Return Analysis 1

Chapter Contents Internal Rate of Return Calculations Plot of NPW versus interest rate i Fees or Discounts Examples Incremental Analysis Using Spreadsheet Engineering Economics 2

Rate of Return Analysis Rate of return analysis is the most frequently used exact analysis technique in industry. Major advantages • Rate of return is a single figure of merit that is readily understood. • Calculation of rate of return is independent from the minimum attractive rate of return (MARR). Engineering Economics 3

Internal Rate of Return What is the internal rate of return (IRR)? IRR is the interest rate at which present worth or equivalent uniform annual worth is equal to 0. In other words, the internal rate of return is the interest rate at which the benefits are equivalent to the costs. Engineering Economics 4

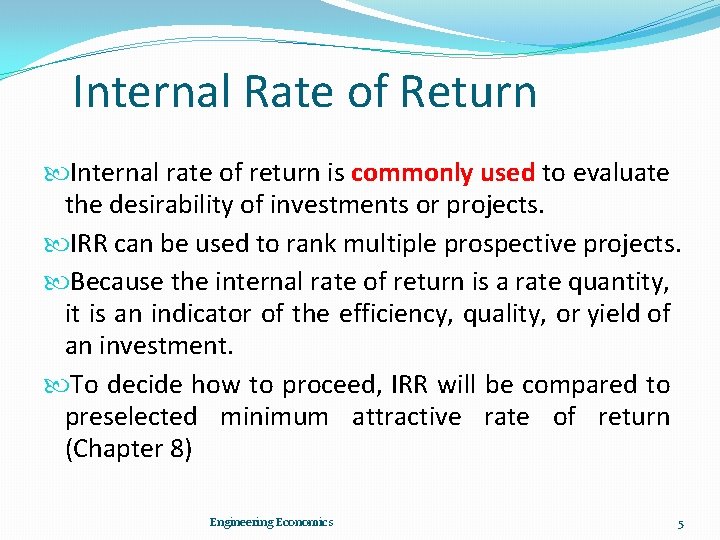

Internal Rate of Return Internal rate of return is commonly used to evaluate the desirability of investments or projects. IRR can be used to rank multiple prospective projects. Because the internal rate of return is a rate quantity, it is an indicator of the efficiency, quality, or yield of an investment. To decide how to proceed, IRR will be compared to preselected minimum attractive rate of return (Chapter 8) Engineering Economics 5

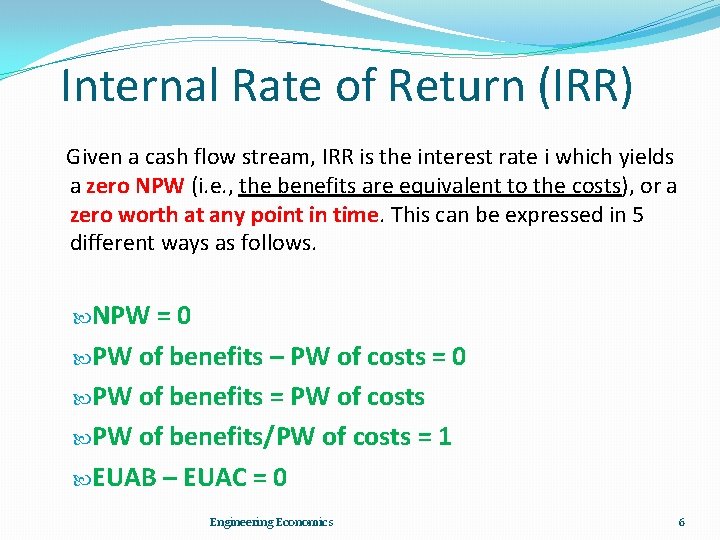

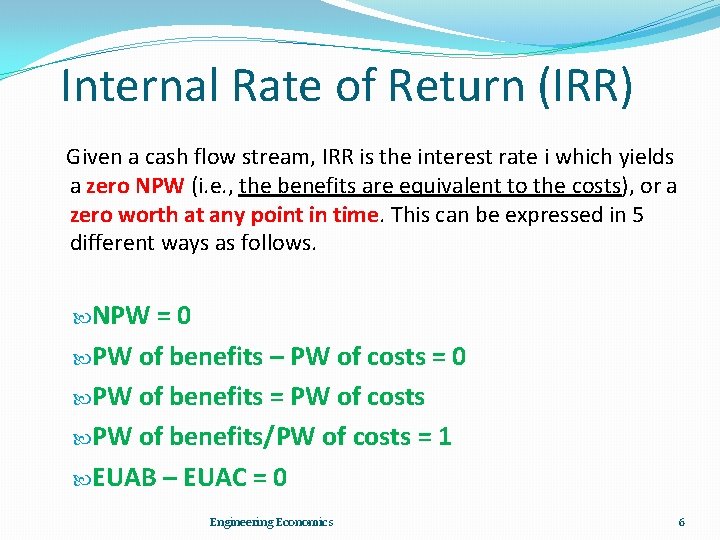

Internal Rate of Return (IRR) Given a cash flow stream, IRR is the interest rate i which yields a zero NPW (i. e. , the benefits are equivalent to the costs), or a zero worth at any point in time. This can be expressed in 5 different ways as follows. NPW =0 PW of benefits – PW of costs = 0 PW of benefits = PW of costs PW of benefits/PW of costs = 1 EUAB – EUAC = 0 Engineering Economics 6

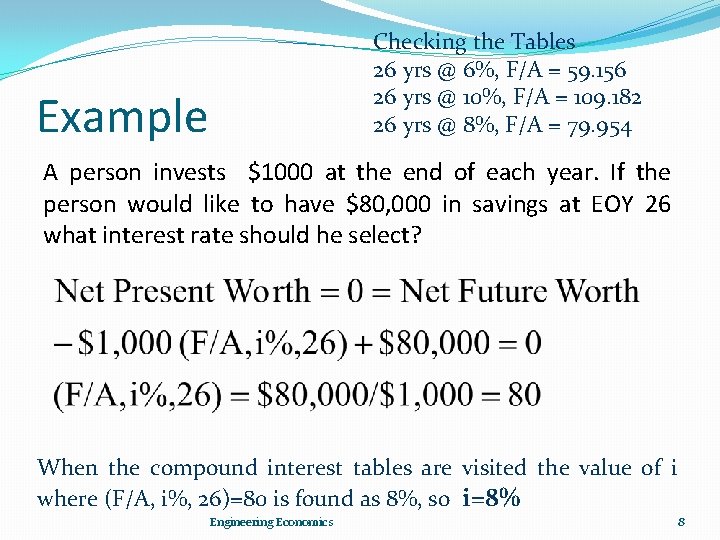

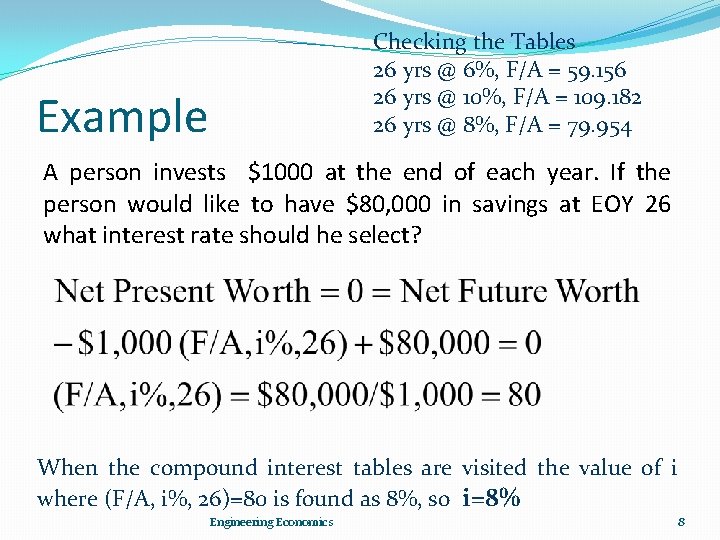

Example A person invests $1000 at the end of each year. If the person would like to have $80, 000 in savings at EOY 26 what interest rate should he select? Checking the Tables 26 yrs @ 6%, F/A = 59. 156 When the 10%, compound interest tables are visited the value of i 26 yrs @ F/A = 109. 182 where 26)=80 is found as 8%, so i=8% 26 yrs (F/A, @ 8%, i%, F/A = 79. 954 Engineering Economics 7

Checking the Tables 26 yrs @ 6%, F/A = 59. 156 26 yrs @ 10%, F/A = 109. 182 26 yrs @ 8%, F/A = 79. 954 Example A person invests $1000 at the end of each year. If the person would like to have $80, 000 in savings at EOY 26 what interest rate should he select? When the compound interest tables are visited the value of i where (F/A, i%, 26)=80 is found as 8%, so i=8% Engineering Economics 8

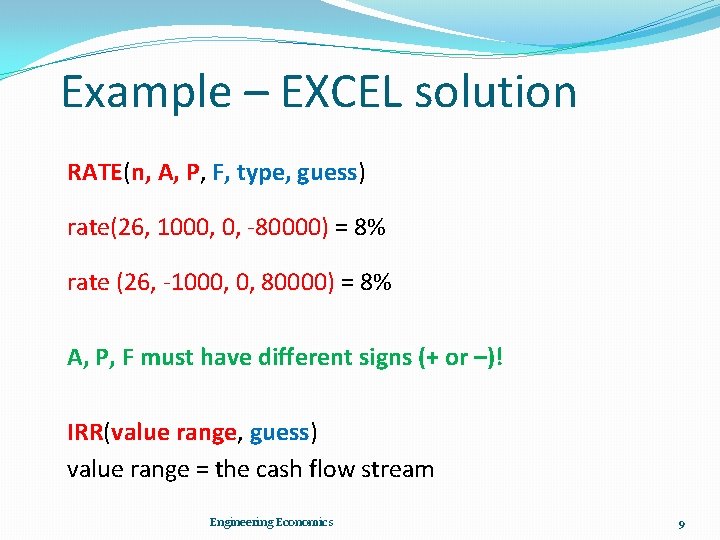

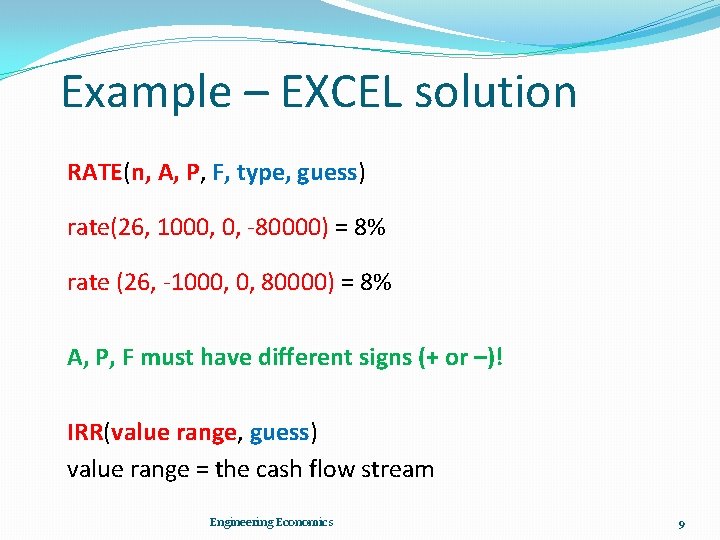

Example – EXCEL solution RATE(n, A, P, F, type, guess) rate(26, 1000, 0, -80000) = 8% rate (26, -1000, 0, 80000) = 8% A, P, F must have different signs (+ or –)! IRR(value range, guess) value range = the cash flow stream Engineering Economics 9

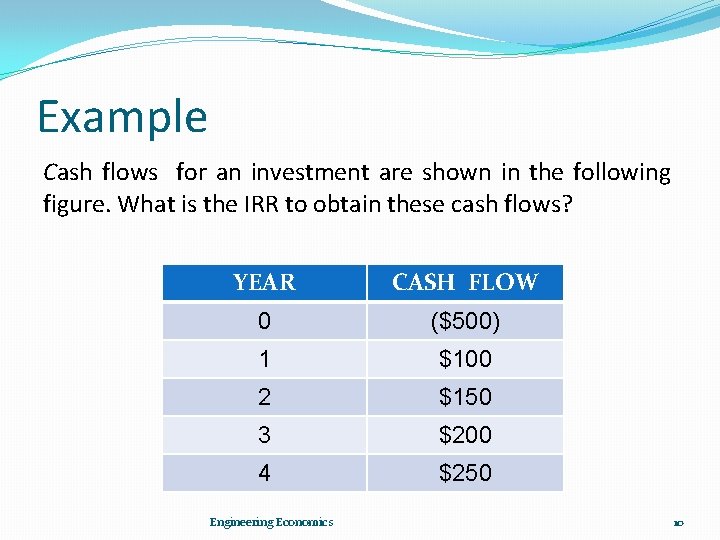

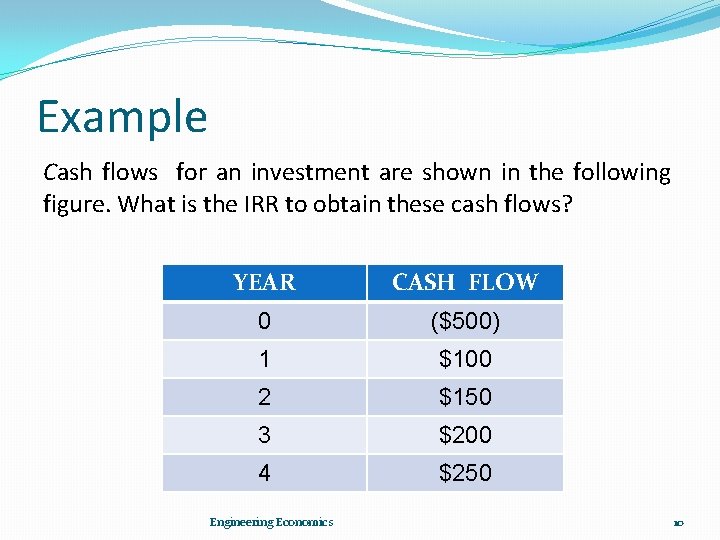

Example Cash flows for an investment are shown in the following figure. What is the IRR to obtain these cash flows? YEAR CASH FLOW 0 ($500) 1 $100 2 $150 3 $200 4 $250 Engineering Economics 10

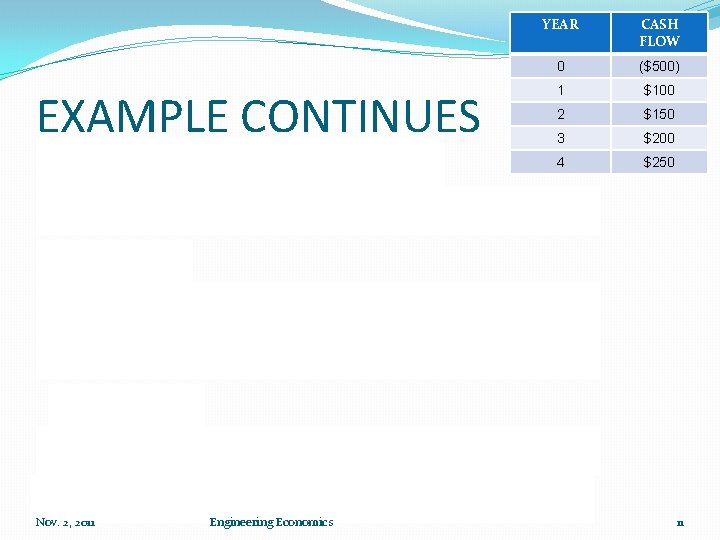

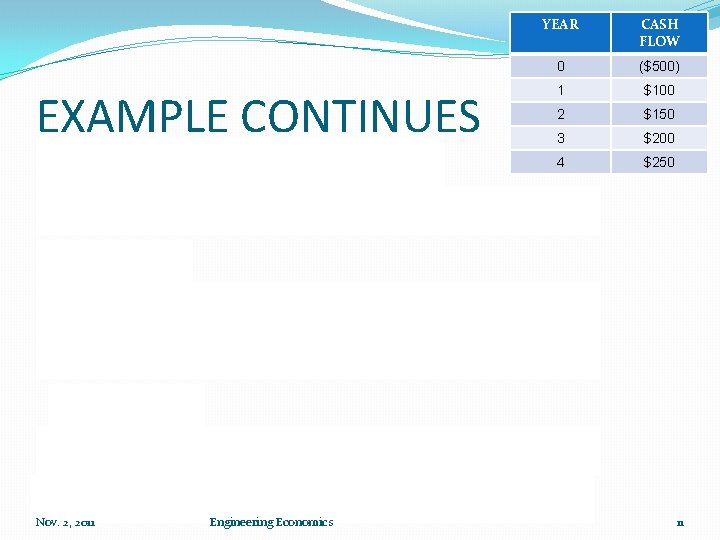

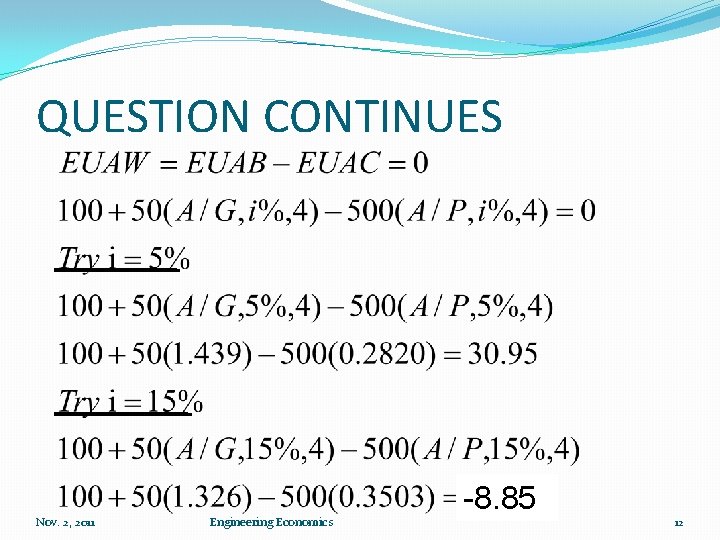

EXAMPLE CONTINUES Nov. 2, 2011 Engineering Economics -8. 85 YEAR CASH FLOW 0 ($500) 1 $100 2 $150 3 $200 4 $250 11

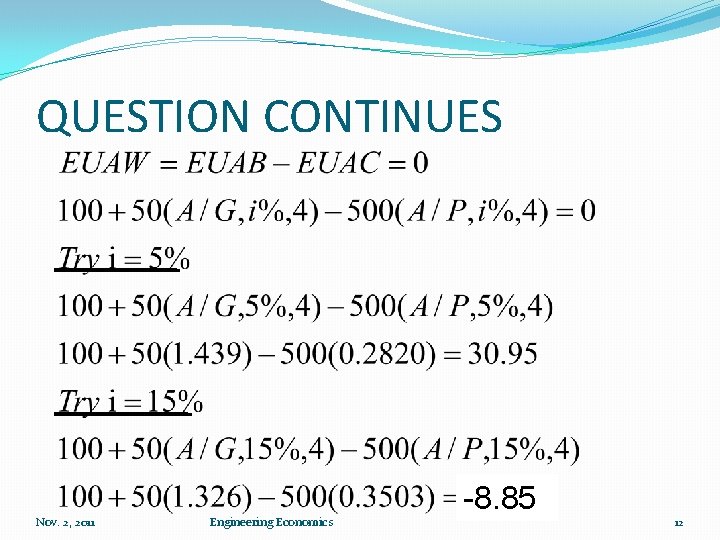

QUESTION CONTINUES Nov. 2, 2011 Engineering Economics -8. 85 12

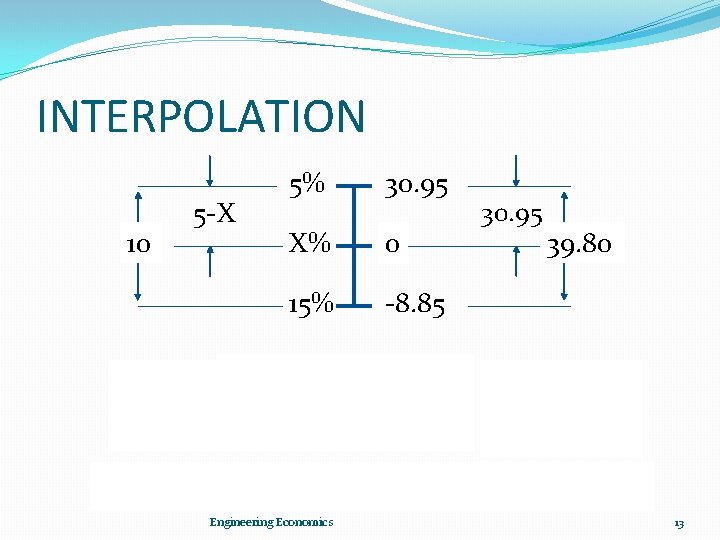

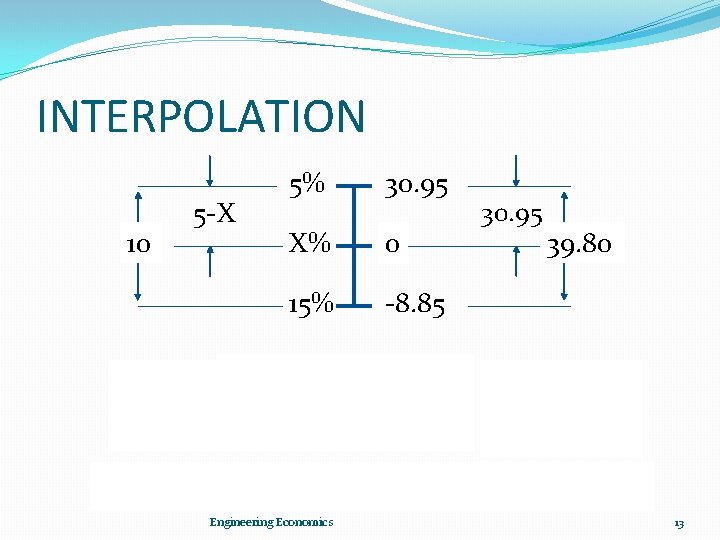

INTERPOLATION 10 5 -X 5% 30. 95 X% 0 15% -8. 85 Engineering Economics 30. 95 39. 80 13

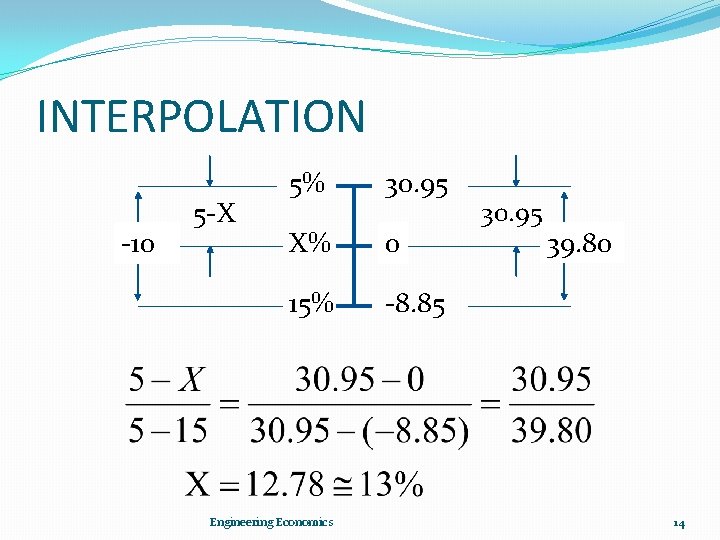

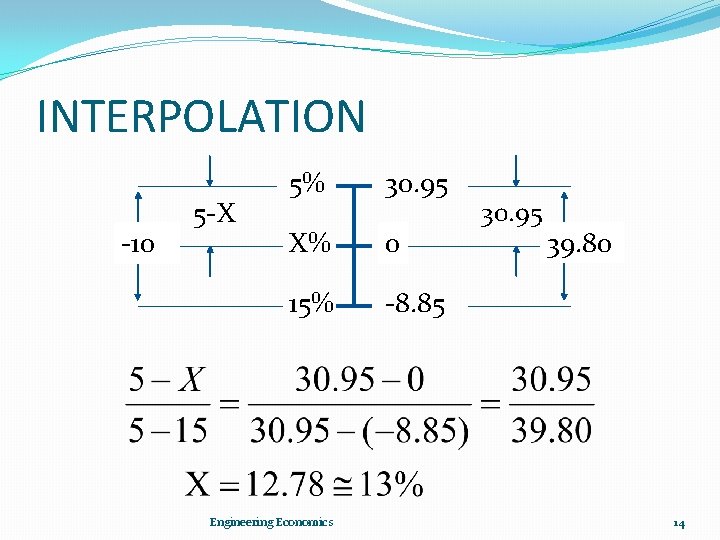

INTERPOLATION -10 5 -X 5% 30. 95 X% 0 15% -8. 85 Engineering Economics 30. 95 39. 80 14

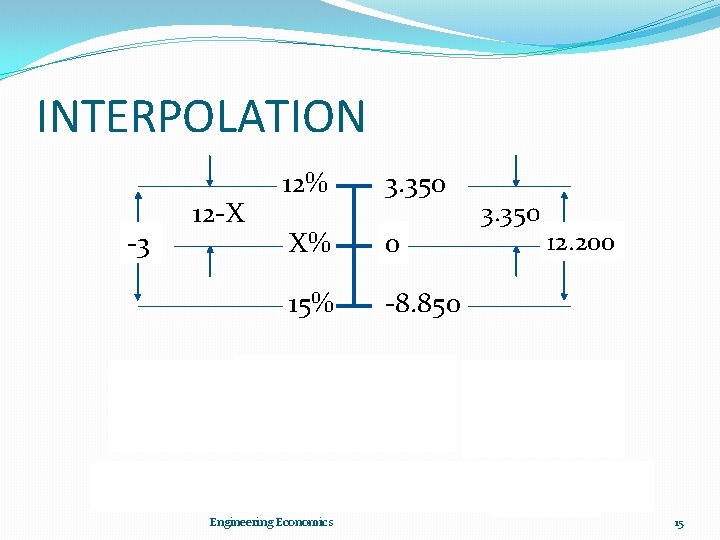

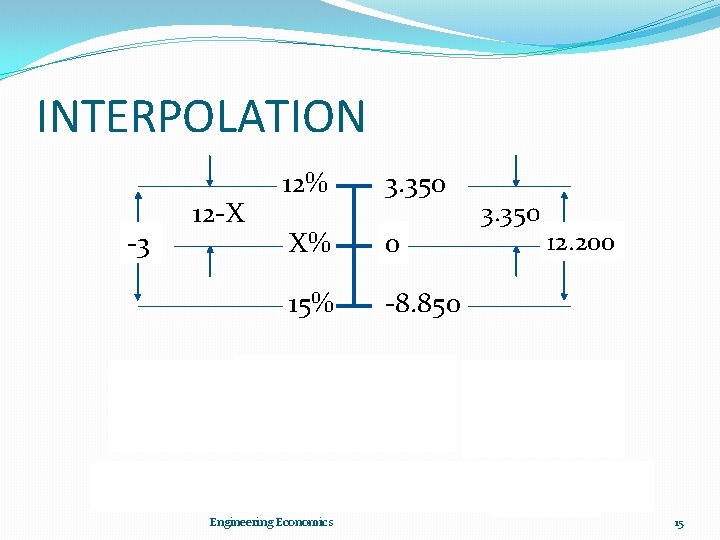

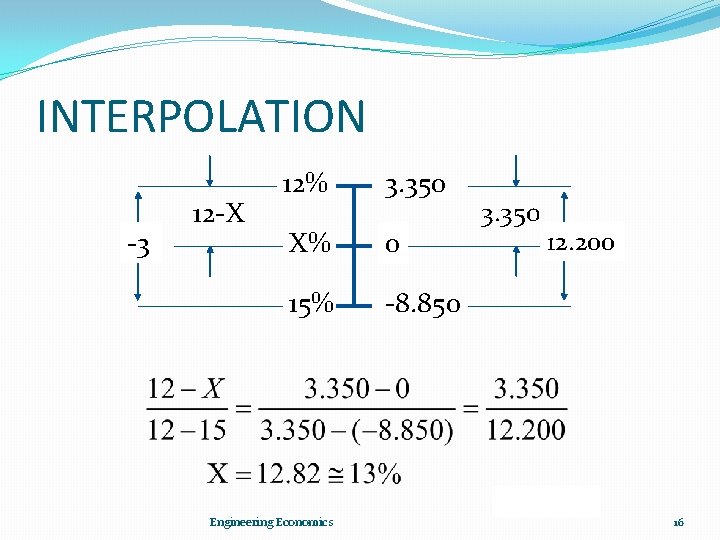

INTERPOLATION -3 12 -X 12% 3. 350 X% 0 15% -8. 850 Engineering Economics 3. 350 12. 200 15

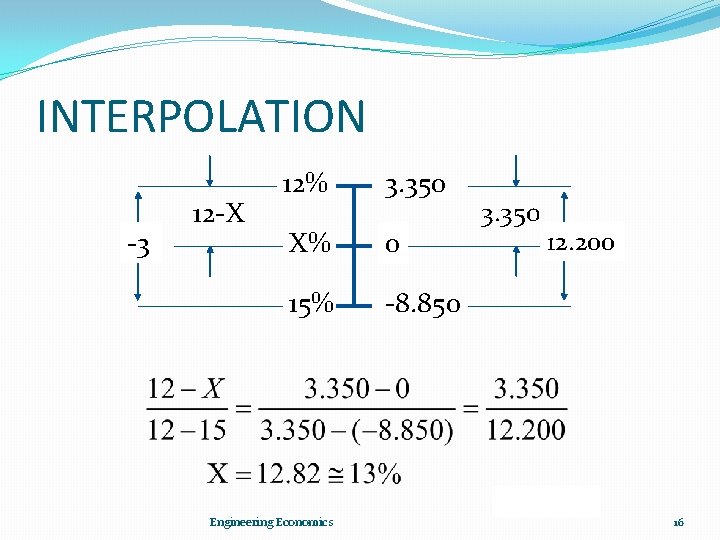

INTERPOLATION -3 12 -X 12% 3. 350 X% 0 15% -8. 850 Engineering Economics 3. 350 12. 200 16

EXCEL solution IRR(C 1: C 5) = 12. 83% C 1 ~ C 5 stores the stream of the 5 cash flows: -500, 150, 200, 250 Engineering Economics 17

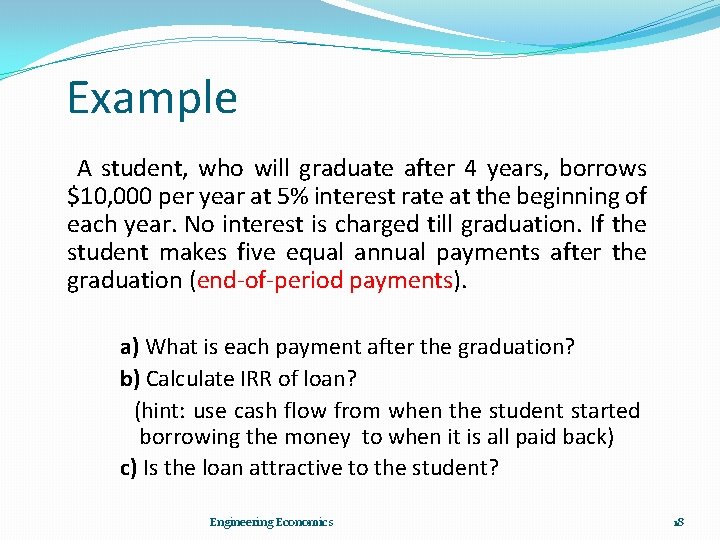

Example A student, who will graduate after 4 years, borrows $10, 000 per year at 5% interest rate at the beginning of each year. No interest is charged till graduation. If the student makes five equal annual payments after the graduation (end-of-period payments). a) What is each payment after the graduation? b) Calculate IRR of loan? (hint: use cash flow from when the student started borrowing the money to when it is all paid back) c) Is the loan attractive to the student? Engineering Economics 18

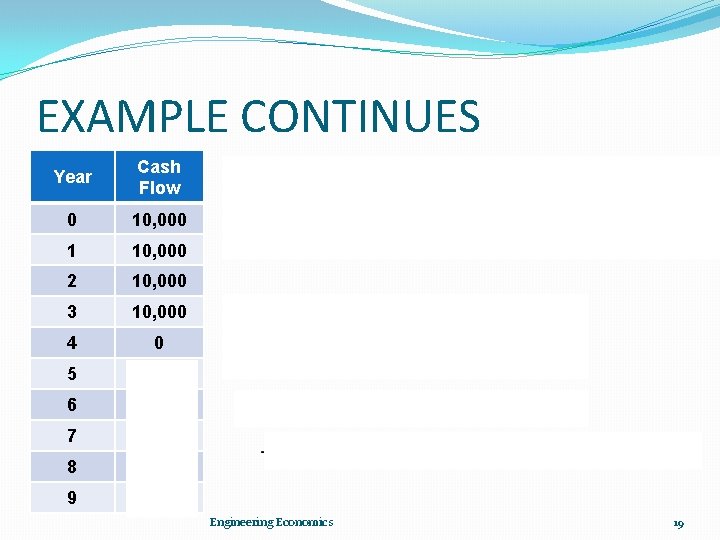

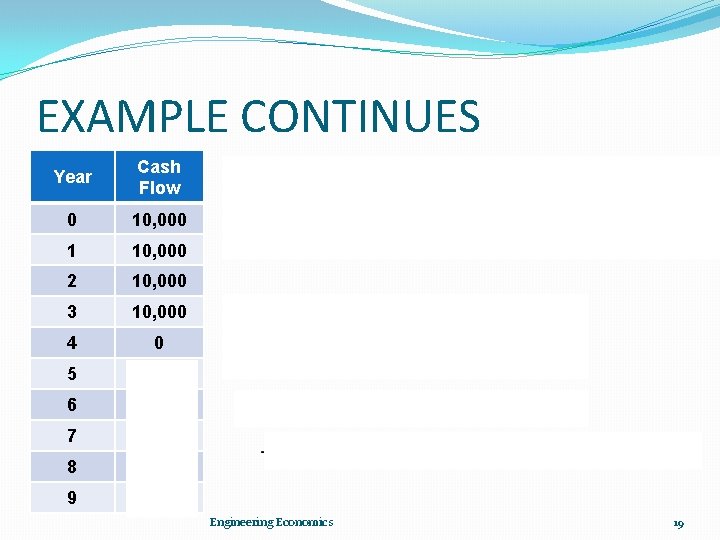

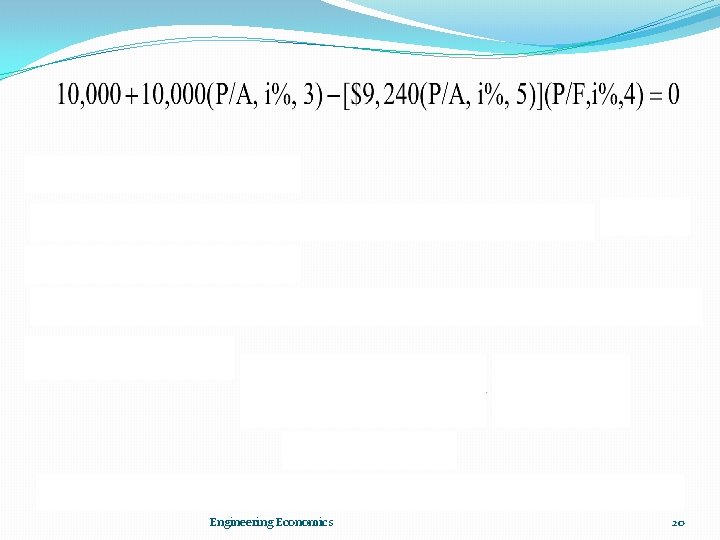

EXAMPLE CONTINUES Year Cash Flow 0 10, 000 1 10, 000 2 10, 000 3 10, 000 4 0 5 (9240) 6 (9240) 7 (9240) 8 (9240) 9 (9240) a) b) Engineering Economics 19

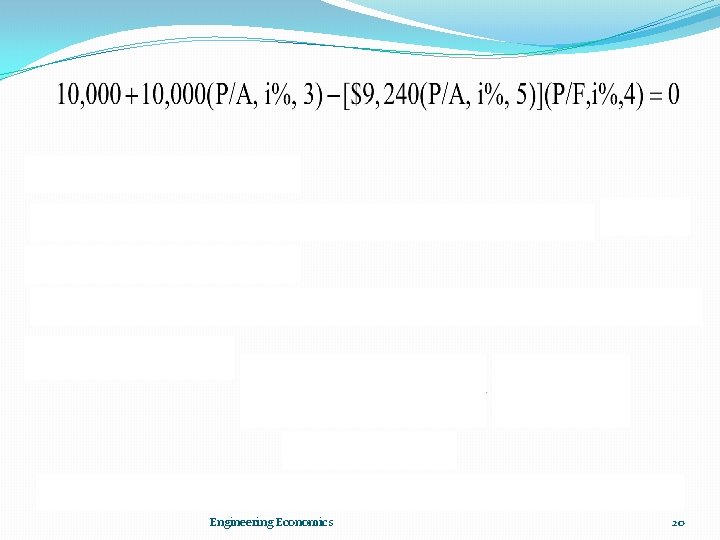

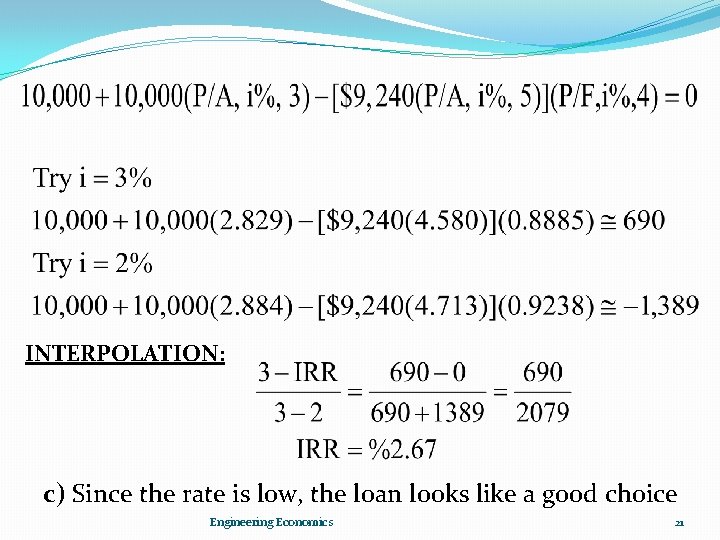

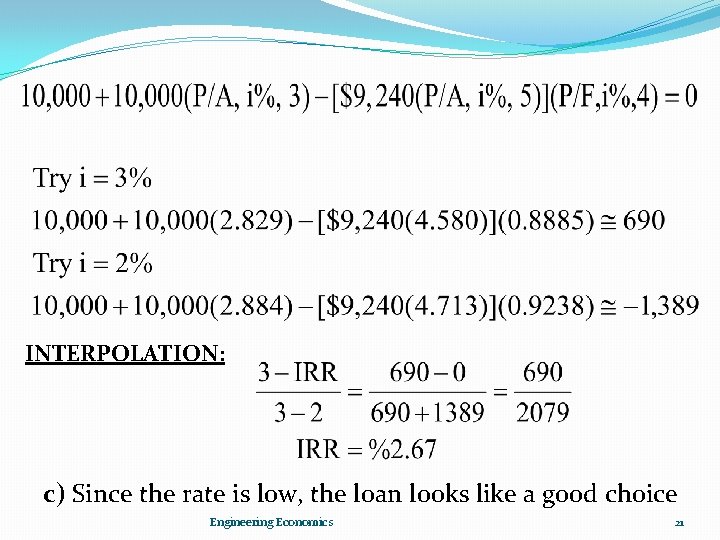

INTERPOLATION: c) Since the rate is low, the loan looks like a good choice. Engineering Economics 20

INTERPOLATION: c) Since the rate is low, the loan looks like a good choice Engineering Economics 21

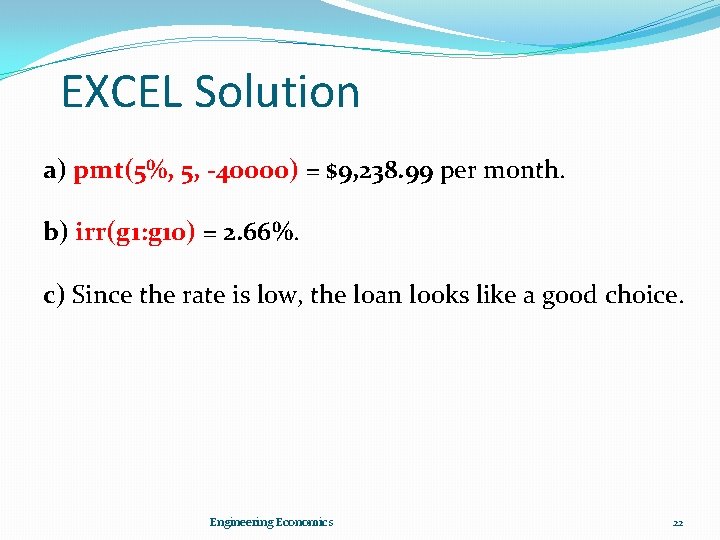

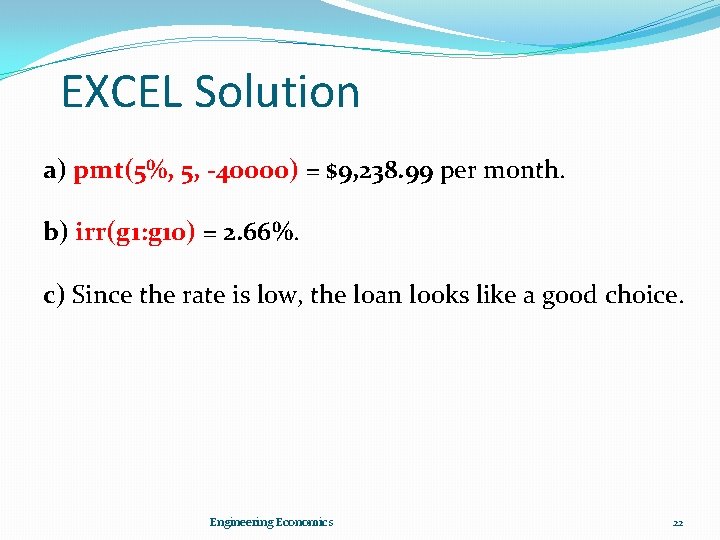

EXCEL Solution a) pmt(5%, 5, -40000) = $9, 238. 99 per month. b) irr(g 1: g 10) = 2. 66%. c) Since the rate is low, the loan looks like a good choice. Engineering Economics 22

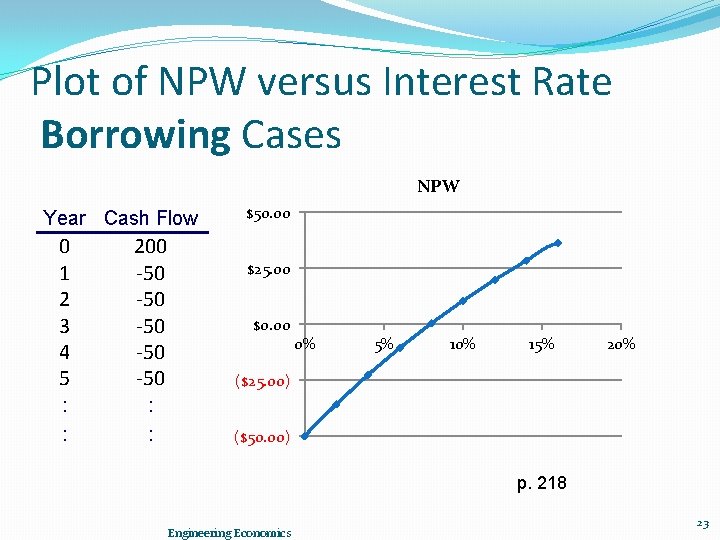

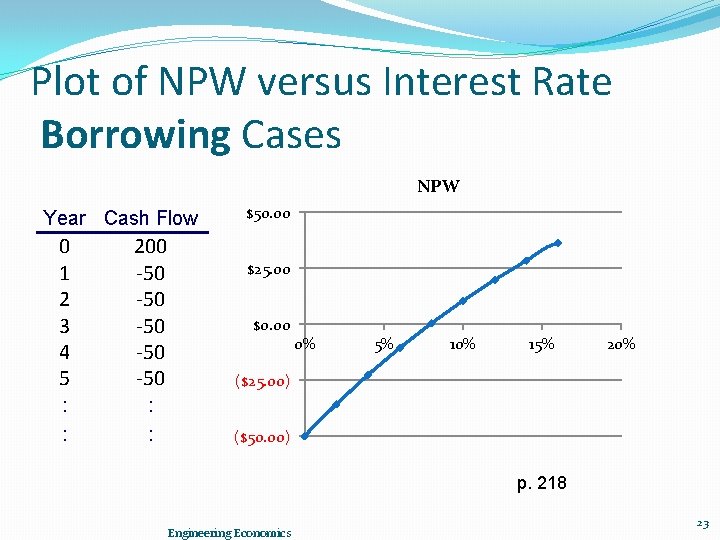

Plot of NPW versus Interest Rate Borrowing Cases NPW Year Cash Flow $50. 00 0 1 2 3 4 5 200 -50 -50 -50 ($25. 00) : : ($50. 00) $25. 00 $0. 00 0% 5% 10% 15% 20% p. 218 Engineering Economics 23

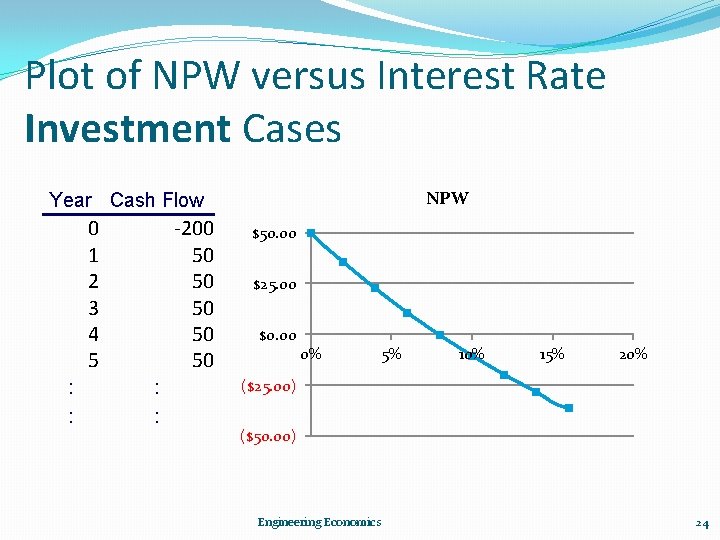

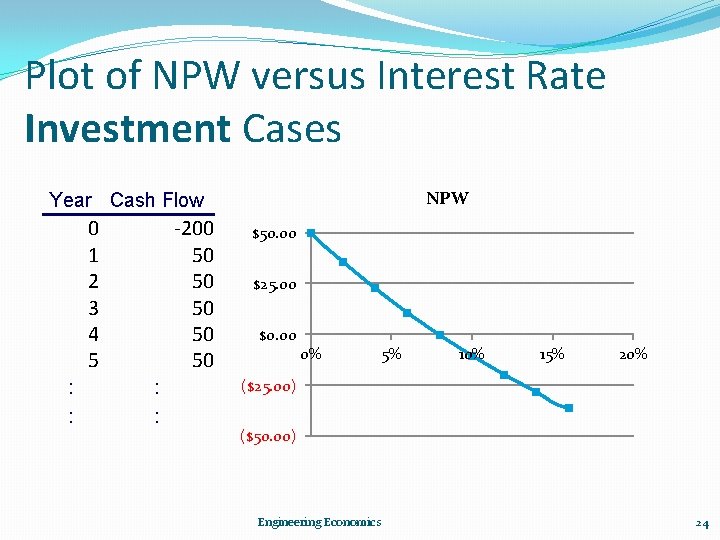

Plot of NPW versus Interest Rate Investment Cases NPW Year Cash Flow 0 1 2 3 4 5 : : -200 50 50 50 : : $50. 00 $25. 00 $0. 00 0% 5% 10% 15% 20% ($25. 00) ($50. 00) Engineering Economics 24

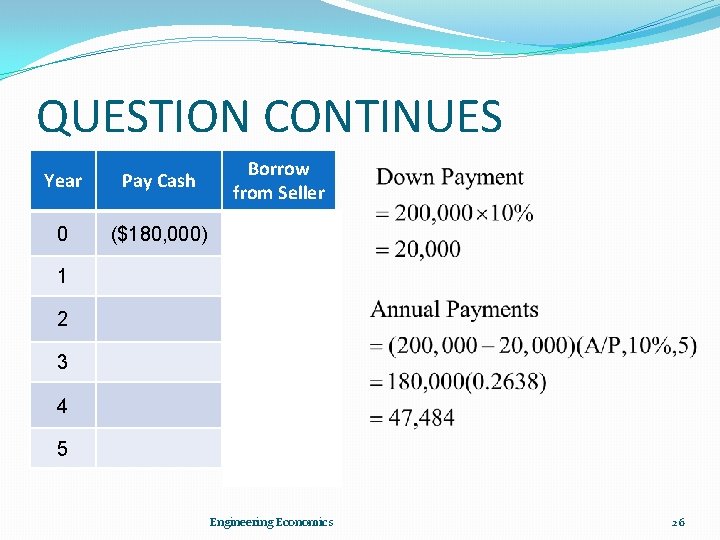

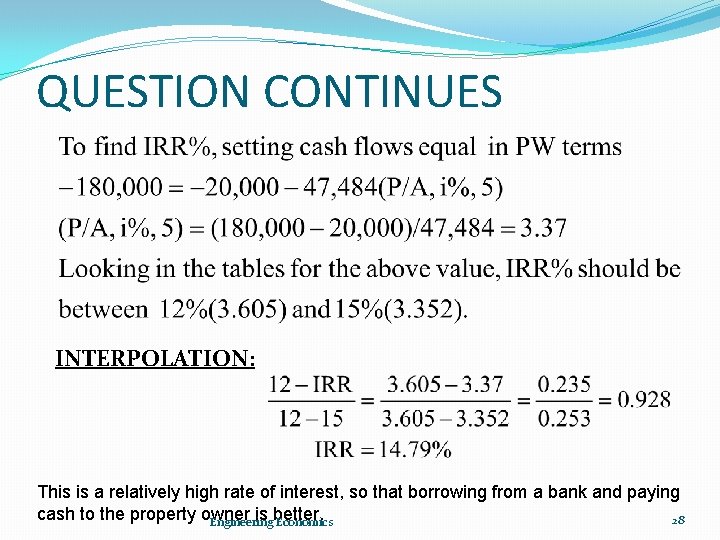

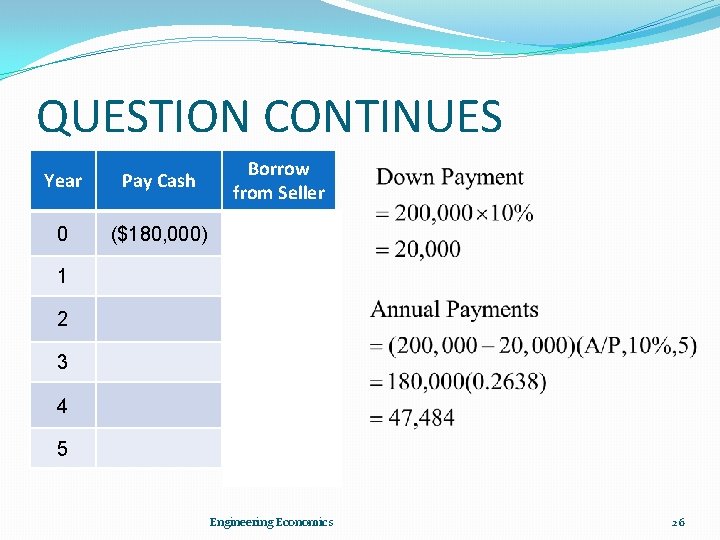

Fees or Discounts Question: Option 1: If a property is financed through a loan provided by a seller, its price is $200, 000 with 10% down payment and five annual payments at 10%. Option 2: If a property is financed through the same seller in cash, the seller will accept 10% less. However, the buyer does not have $180, 000 in cash. What is the IRR for the loan offered by seller? Engineering Economics 25

QUESTION CONTINUES Year Pay Cash Borrow from Seller 0 ($180, 000) ($20, 000) 1 ($47, 484) 2 ($47, 484) 3 ($47, 484) 4 ($47, 484) 5 ($47, 484) Engineering Economics 26

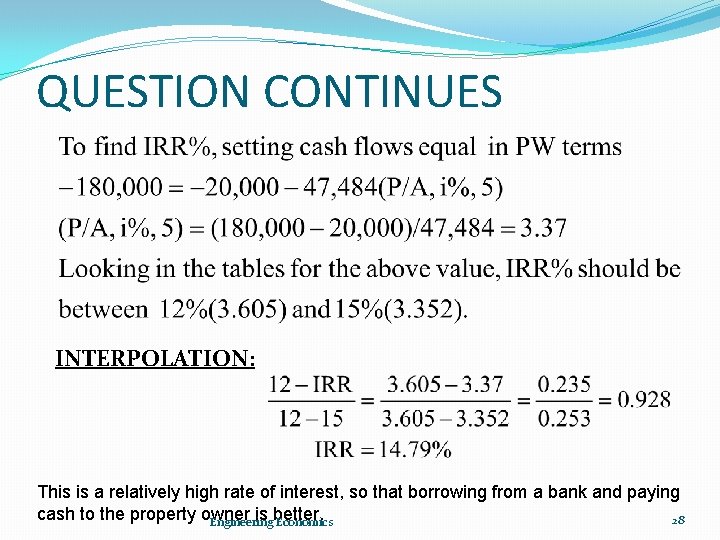

QUESTION CONTINUES INTERPOLATION: Engineering Economics 27

QUESTION CONTINUES INTERPOLATION: This is a relatively high rate of interest, so that borrowing from a bank and paying cash to the property owner is better. 28 Engineering Economics

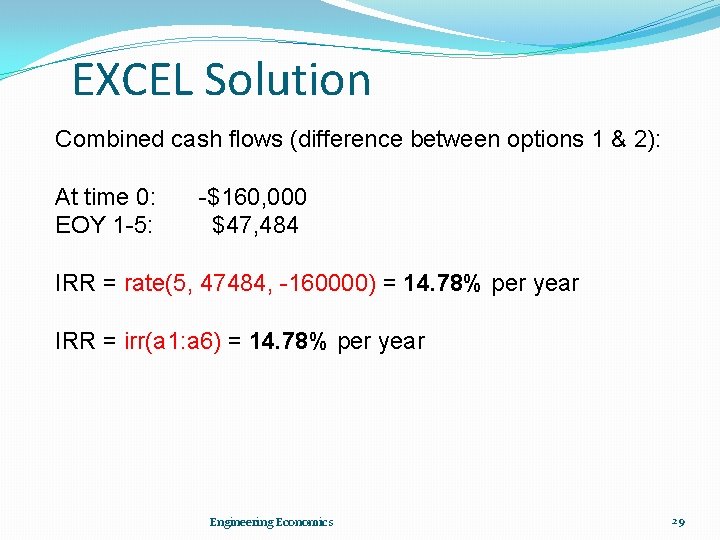

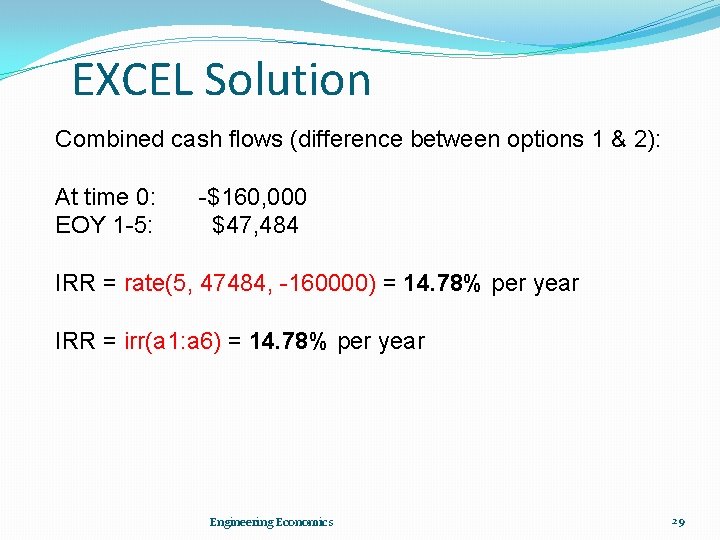

EXCEL Solution Combined cash flows (difference between options 1 & 2): At time 0: EOY 1 -5: -$160, 000 $47, 484 IRR = rate(5, 47484, -160000) = 14. 78% per year IRR = irr(a 1: a 6) = 14. 78% per year Engineering Economics 29

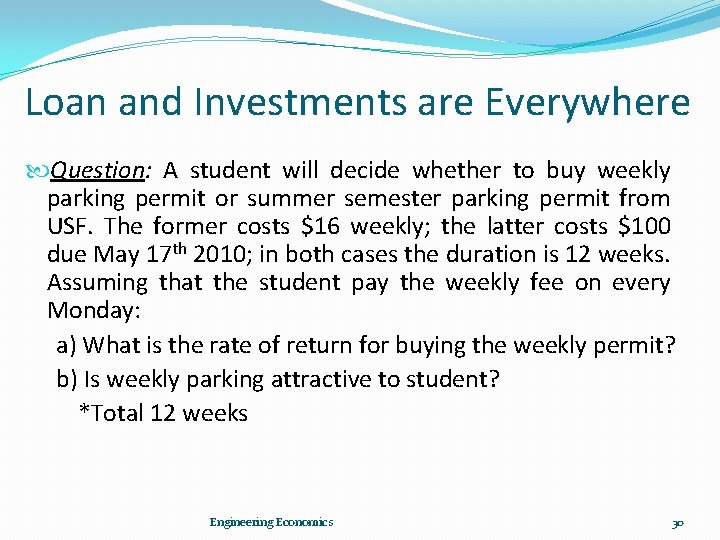

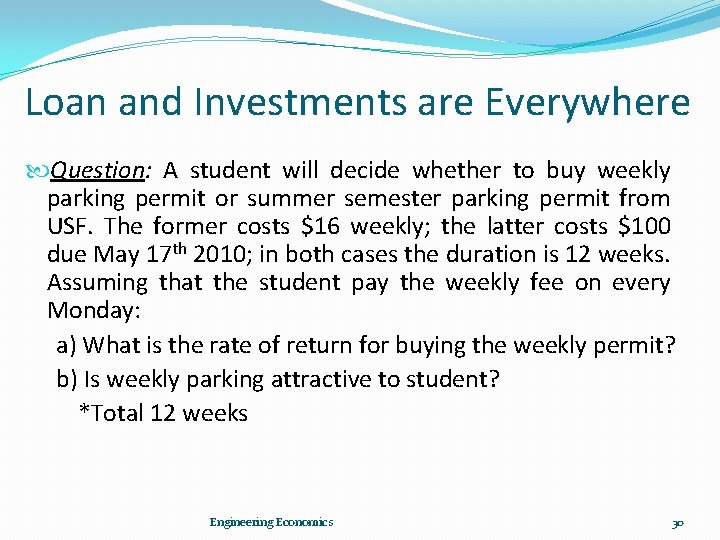

Loan and Investments are Everywhere Question: A student will decide whether to buy weekly parking permit or summer semester parking permit from USF. The former costs $16 weekly; the latter costs $100 due May 17 th 2010; in both cases the duration is 12 weeks. Assuming that the student pay the weekly fee on every Monday: a) What is the rate of return for buying the weekly permit? b) Is weekly parking attractive to student? *Total 12 weeks Engineering Economics 30

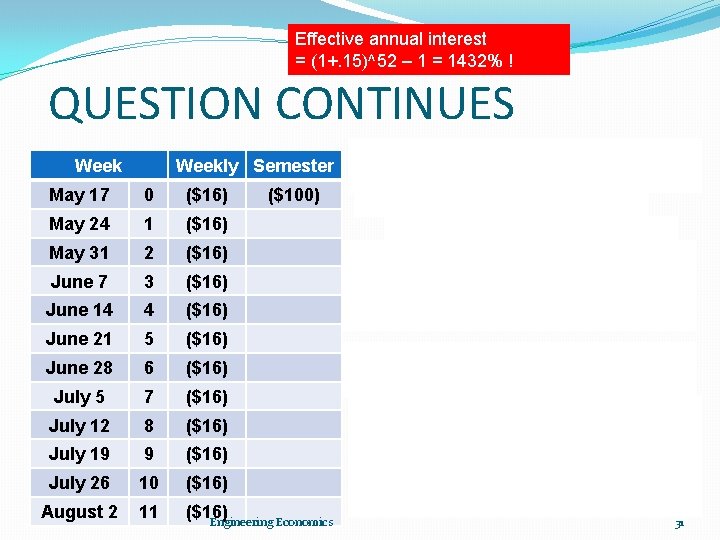

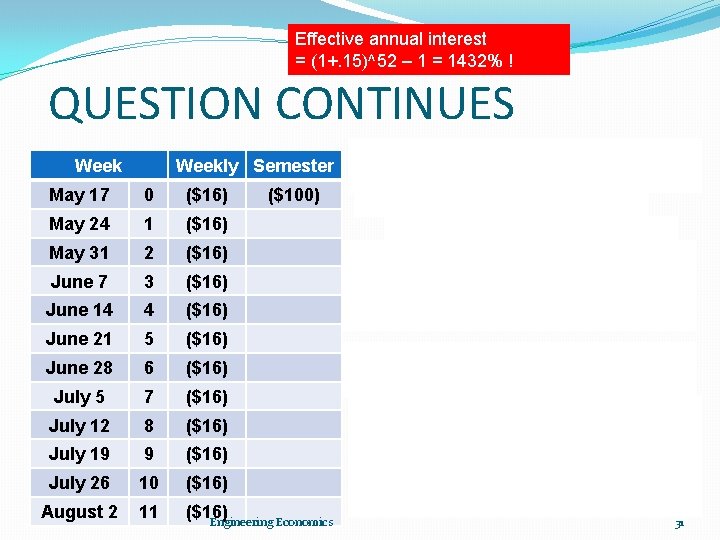

Effective annual interest = (1+. 15)^52 – 1 = 1432% ! QUESTION CONTINUES Weekly Semester May 17 0 ($16) ($100) May 24 1 ($16) May 31 2 ($16) June 7 3 ($16) June 14 4 ($16) June 21 5 ($16) June 28 6 ($16) July 5 7 ($16) July 12 8 ($16) July 19 9 ($16) July 26 10 ($16) August 2 11 ($16) Engineering Economics a) To find IRR%, set cash flows equal in PW terms – 100 = – 16 (P/A, i%, 11) = (100 - 16) / 16 (P/A, i%, 11) = 5. 25 Looking in the table for the above value: IRR = 15% b) Nominal interest rate for 52 weeks IRR ≈ 15%/week or 15*52 = 780%/yr Since the rate is high, paying the semester fee looks like a good choice. 31

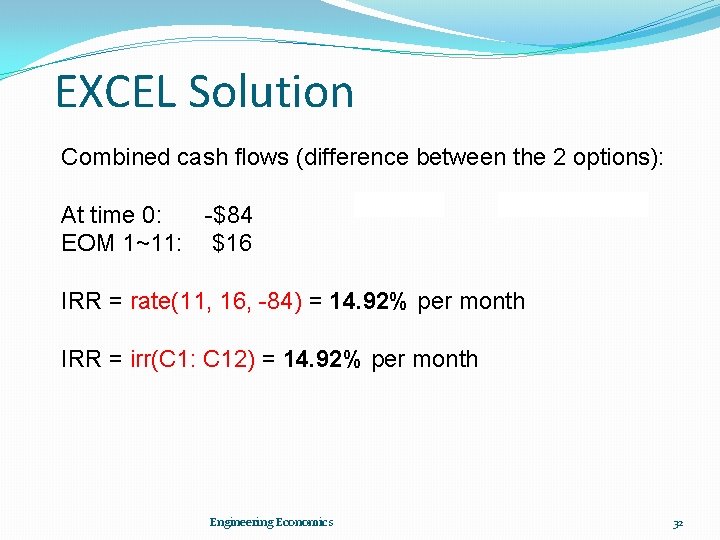

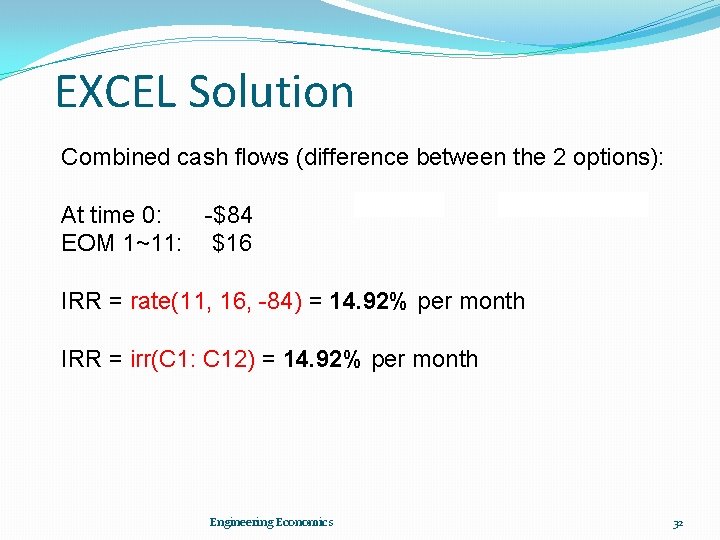

EXCEL Solution Combined cash flows (difference between the 2 options): At time 0: -$84 EOM 1~11: $16 IRR = rate(11, 16, -84) = 14. 92% per month IRR = irr(C 1: C 12) = 14. 92% per month Engineering Economics 32

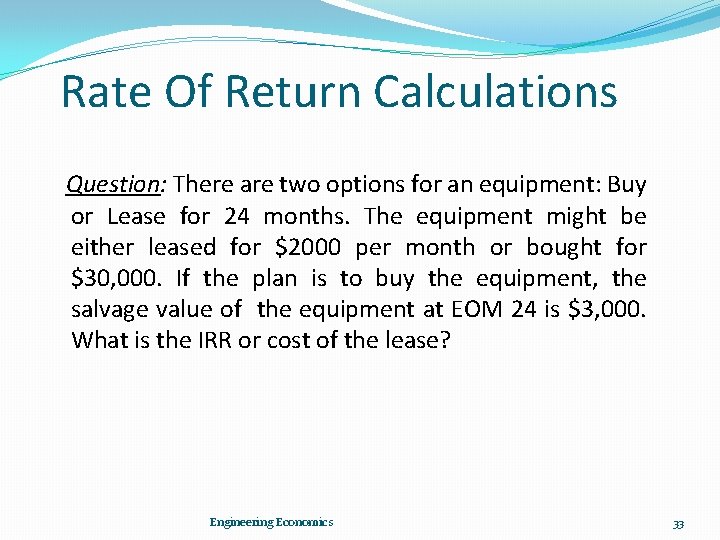

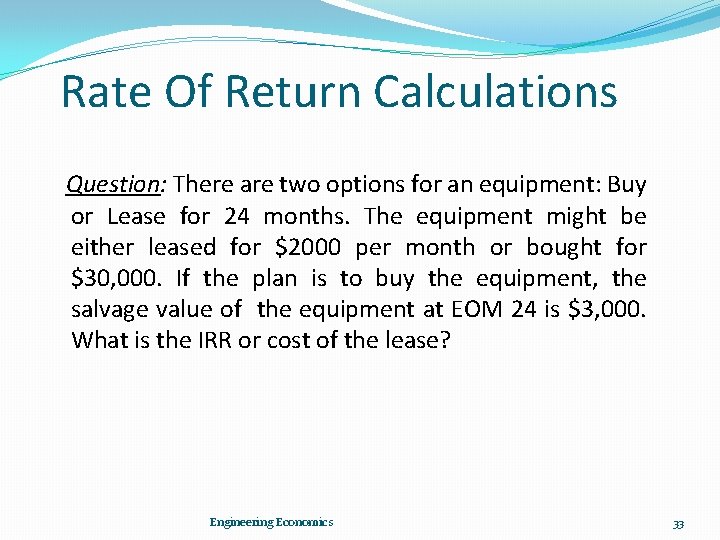

Rate Of Return Calculations Question: There are two options for an equipment: Buy or Lease for 24 months. The equipment might be either leased for $2000 per month or bought for $30, 000. If the plan is to buy the equipment, the salvage value of the equipment at EOM 24 is $3, 000. What is the IRR or cost of the lease? Engineering Economics 33

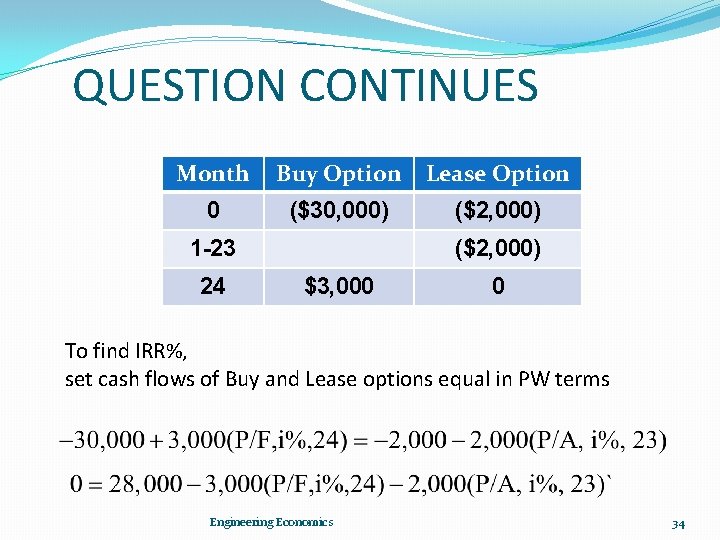

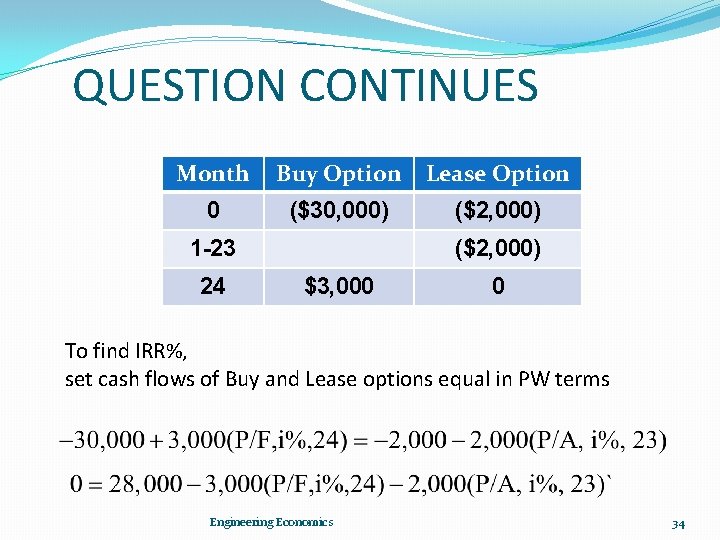

QUESTION CONTINUES Month Buy Option Lease Option 0 ($30, 000) ($2, 000) 1 -23 24 ($2, 000) $3, 000 0 To find IRR%, set cash flows of Buy and Lease options equal in PW terms Engineering Economics 34

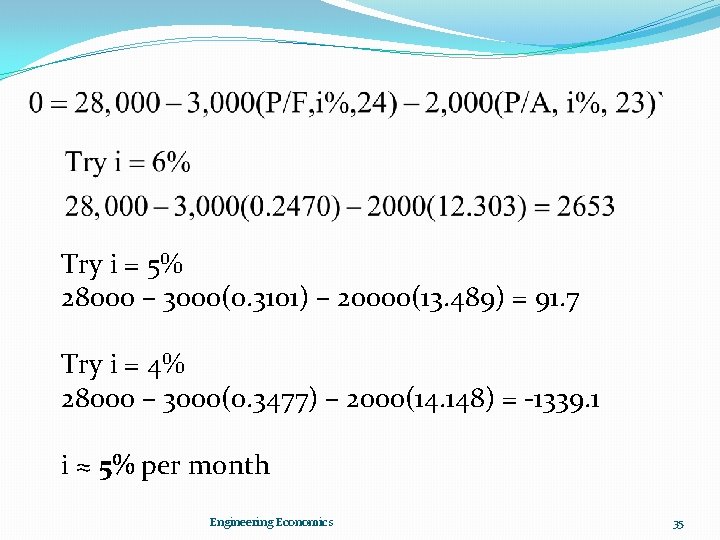

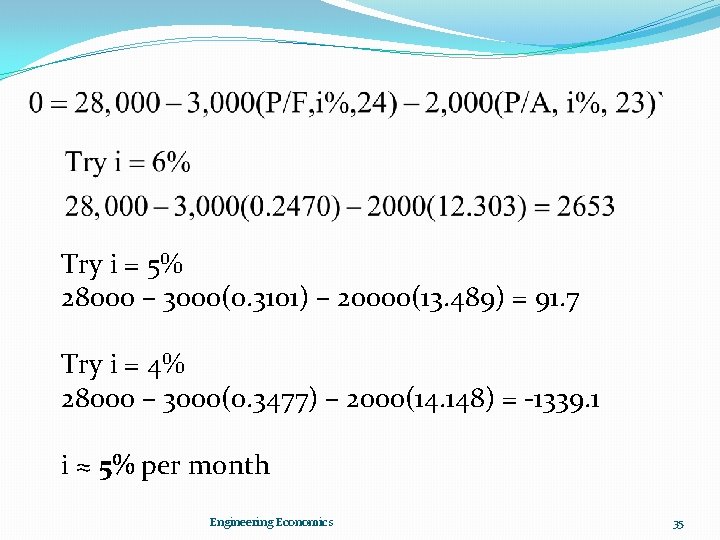

Try i = 5% 28000 – 3000(0. 3101) – 20000(13. 489) = 91. 7 Try i = 4% 28000 – 3000(0. 3477) – 2000(14. 148) = -1339. 1 i ≈ 5% per month Engineering Economics 35

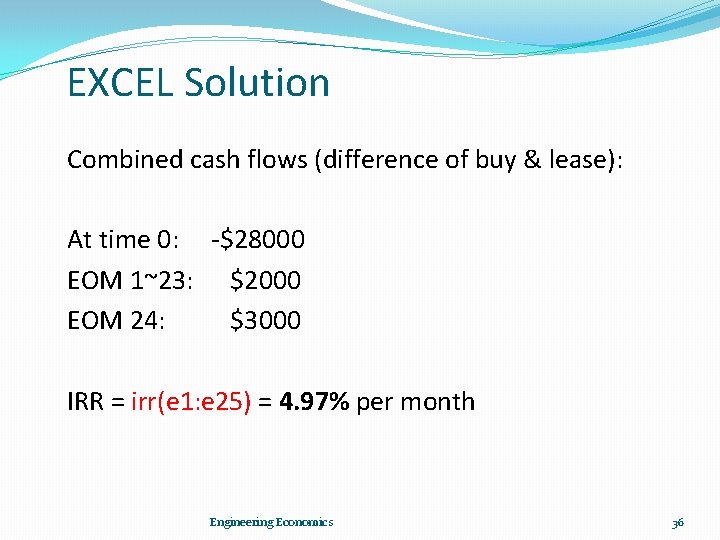

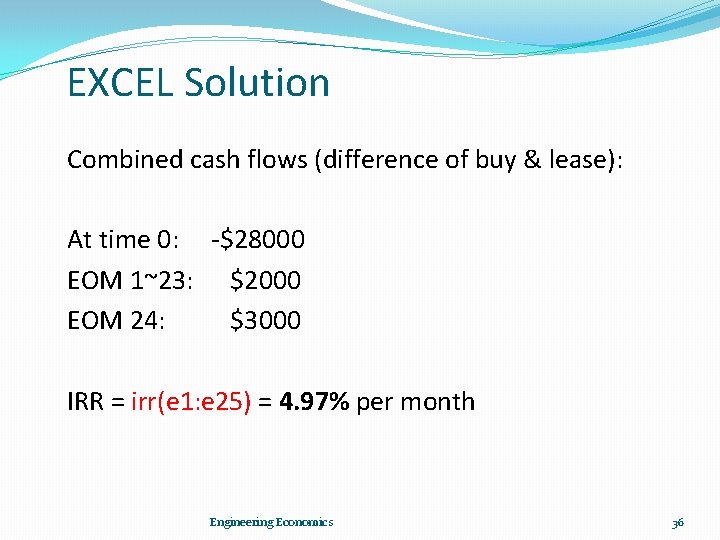

EXCEL Solution Combined cash flows (difference of buy & lease): At time 0: -$28000 EOM 1~23: $2000 EOM 24: $3000 IRR = irr(e 1: e 25) = 4. 97% per month Engineering Economics 36

Incremental Analysis When there are two alternatives, rate of return analysis is often performed by computing the incremental rate of return, ΔIRR, on the difference between the two alternatives. Engineering Economics 37

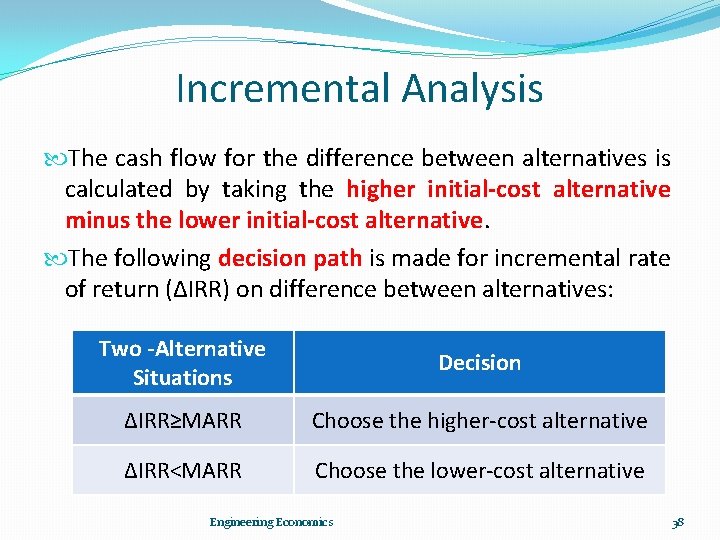

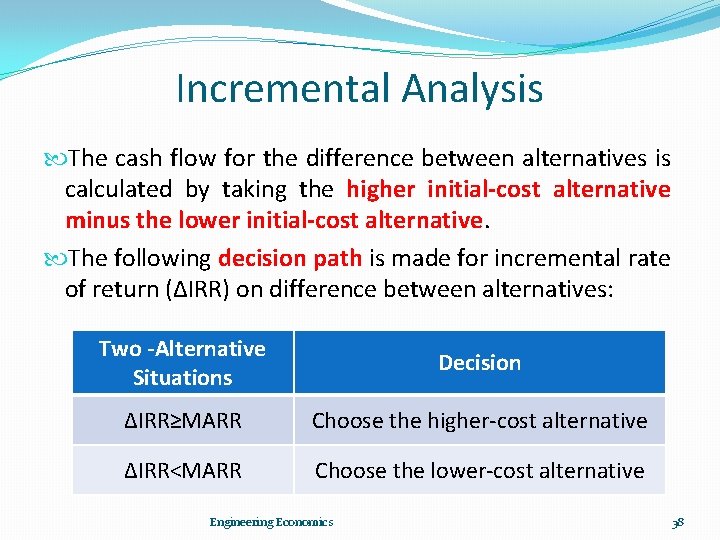

Incremental Analysis The cash flow for the difference between alternatives is calculated by taking the higher initial-cost alternative minus the lower initial-cost alternative. The following decision path is made for incremental rate of return (ΔIRR) on difference between alternatives: Two -Alternative Situations Decision ΔIRR≥MARR Choose the higher-cost alternative ΔIRR<MARR Choose the lower-cost alternative Engineering Economics 38

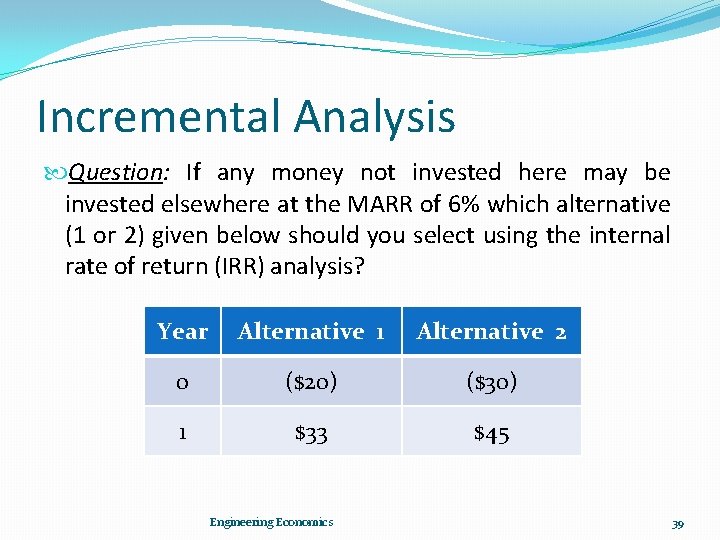

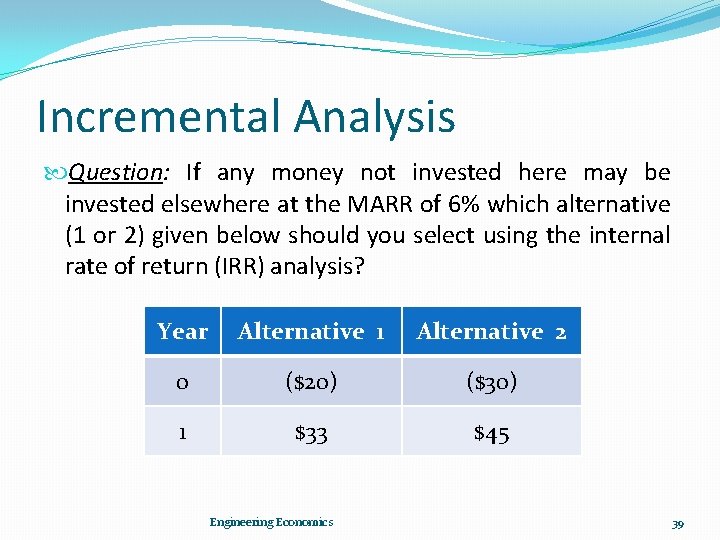

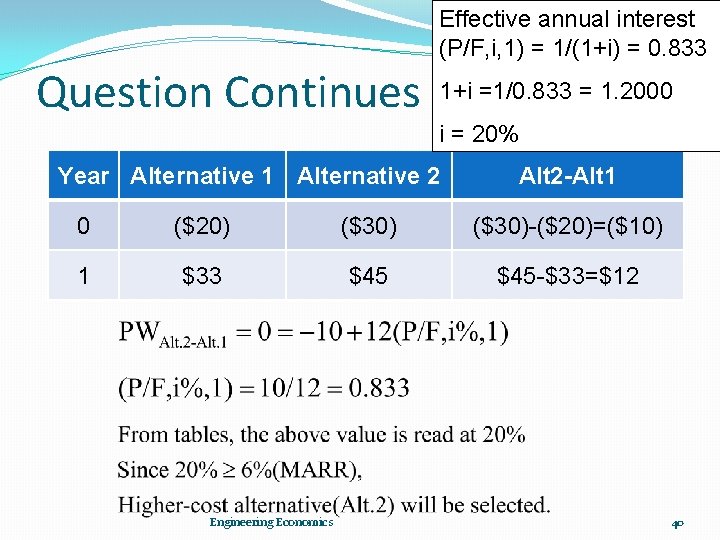

Incremental Analysis Question: If any money not invested here may be invested elsewhere at the MARR of 6% which alternative (1 or 2) given below should you select using the internal rate of return (IRR) analysis? Year Alternative 1 Alternative 2 0 ($20) ($30) 1 $33 $45 Engineering Economics 39

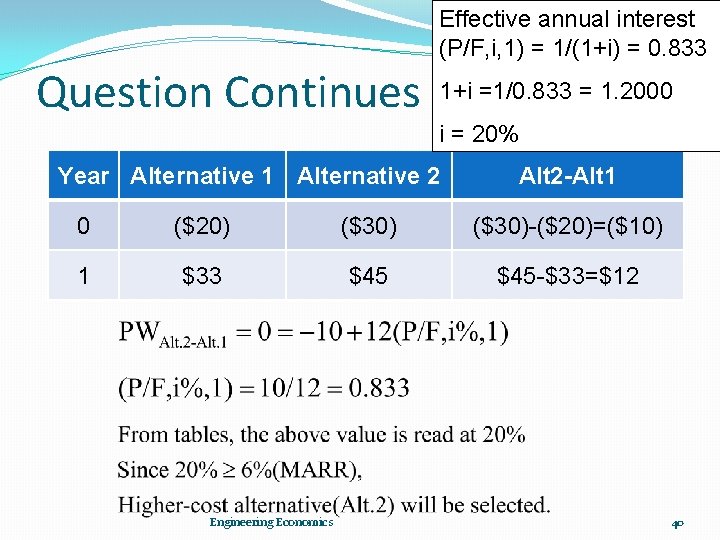

Effective annual interest (P/F, i, 1) = 1/(1+i) = 0. 833 Question Continues 1+i =1/0. 833 = 1. 2000 i = 20% Year Alternative 1 Alternative 2 Alt 2 -Alt 1 0 ($20) ($30)-($20)=($10) 1 $33 $45 -$33=$12 Engineering Economics 40

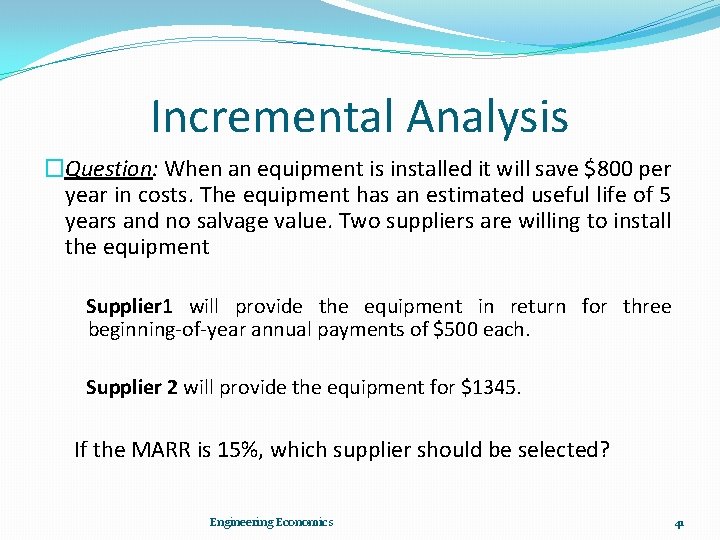

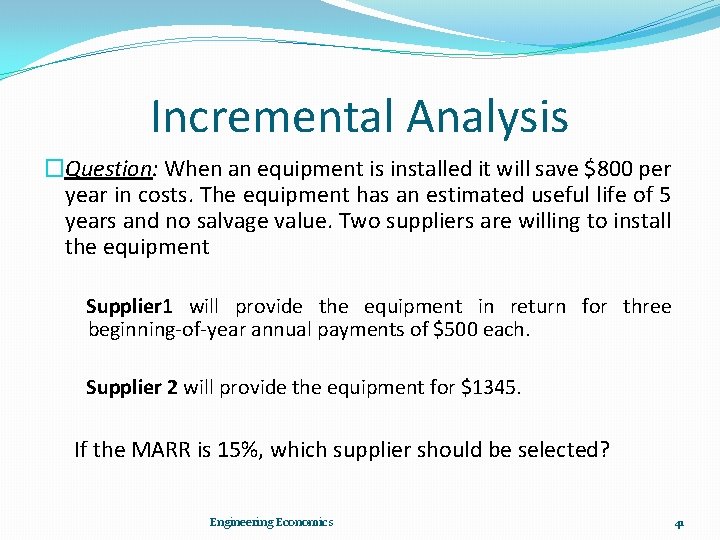

Incremental Analysis �Question: When an equipment is installed it will save $800 per year in costs. The equipment has an estimated useful life of 5 years and no salvage value. Two suppliers are willing to install the equipment Supplier 1 will provide the equipment in return for three beginning-of-year annual payments of $500 each. Supplier 2 will provide the equipment for $1345. If the MARR is 15%, which supplier should be selected? Engineering Economics 41

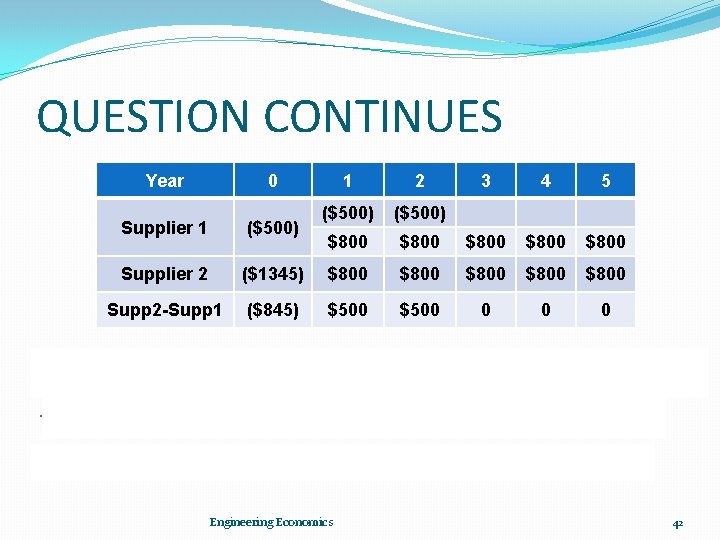

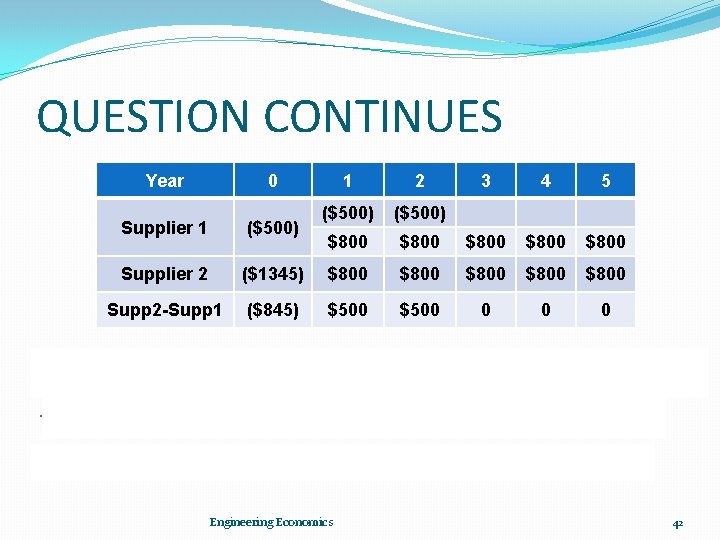

QUESTION CONTINUES Year 0 1 2 3 4 5 ($500) $800 $800 Supplier 1 ($500) Supplier 2 ($1345) $800 $800 Supp 2 -Supp 1 ($845) $500 0 0 0 Engineering Economics 42

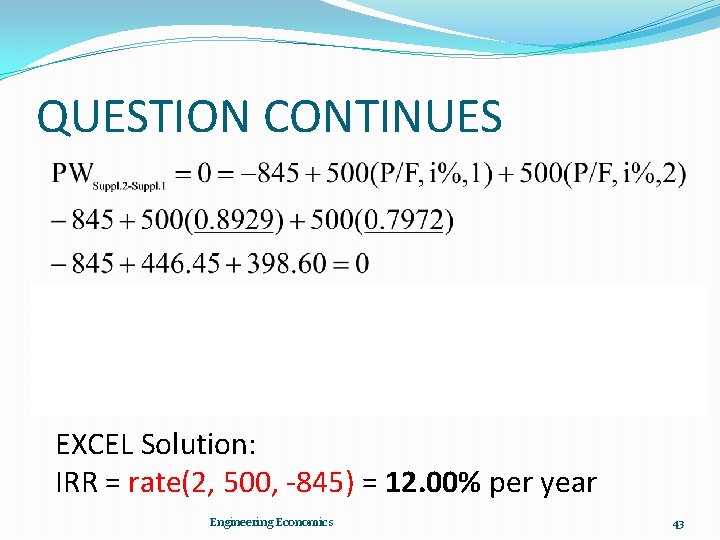

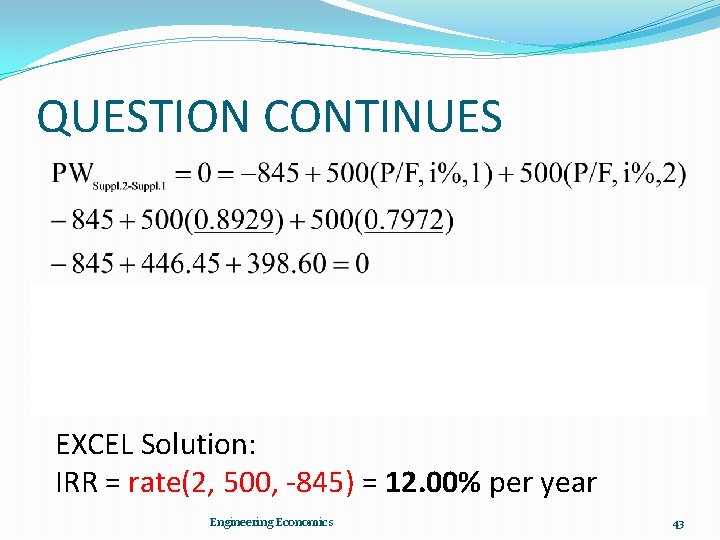

QUESTION CONTINUES EXCEL Solution: IRR = rate(2, 500, -845) = 12. 00% per year Engineering Economics 43

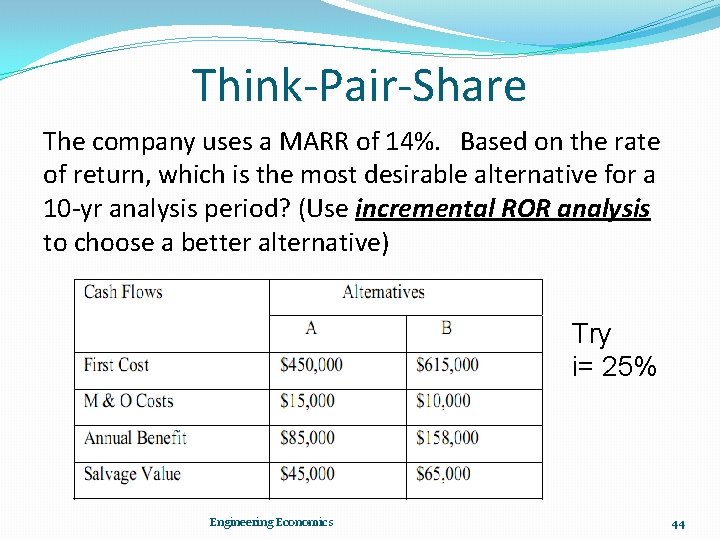

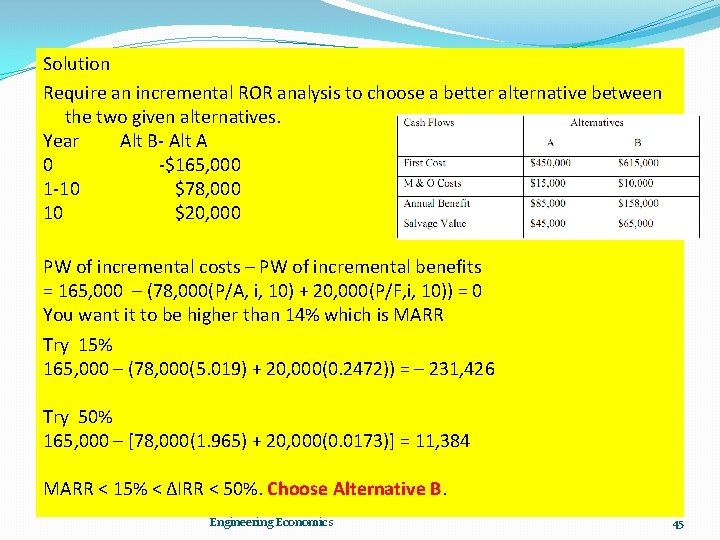

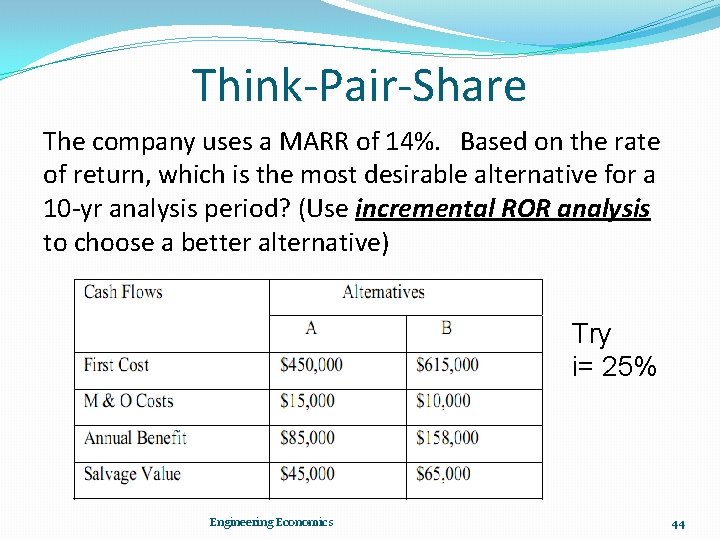

Think-Pair-Share The company uses a MARR of 14%. Based on the rate of return, which is the most desirable alternative for a 10 -yr analysis period? (Use incremental ROR analysis to choose a better alternative) Try i= 25% Engineering Economics 44

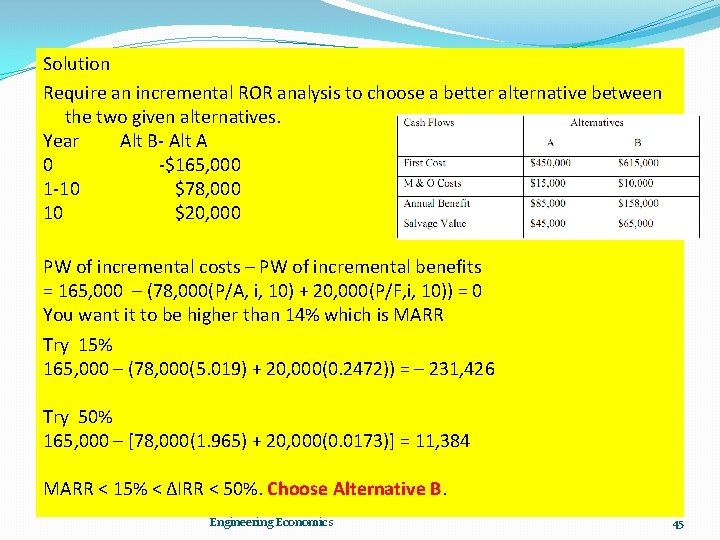

Solution Require an incremental ROR analysis to choose a better alternative between the two given alternatives. Year Alt B- Alt A 0 -$165, 000 1 -10 $78, 000 10 $20, 000 PW of incremental costs – PW of incremental benefits = 165, 000 – (78, 000(P/A, i, 10) + 20, 000(P/F, i, 10)) = 0 You want it to be higher than 14% which is MARR Try 15% 165, 000 – (78, 000(5. 019) + 20, 000(0. 2472)) = – 231, 426 Try 50% 165, 000 – [78, 000(1. 965) + 20, 000(0. 0173)] = 11, 384 MARR < 15% < ΔIRR < 50%. Choose Alternative B. Engineering Economics 45

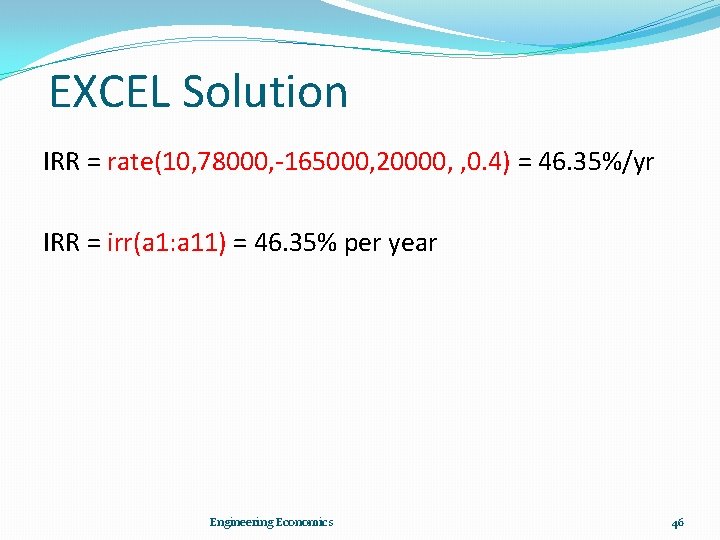

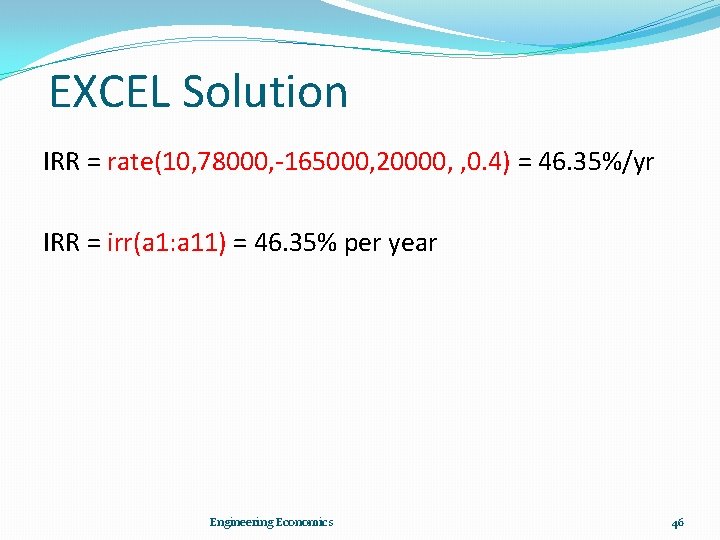

EXCEL Solution IRR = rate(10, 78000, -165000, 20000, , 0. 4) = 46. 35%/yr IRR = irr(a 1: a 11) = 46. 35% per year Engineering Economics 46

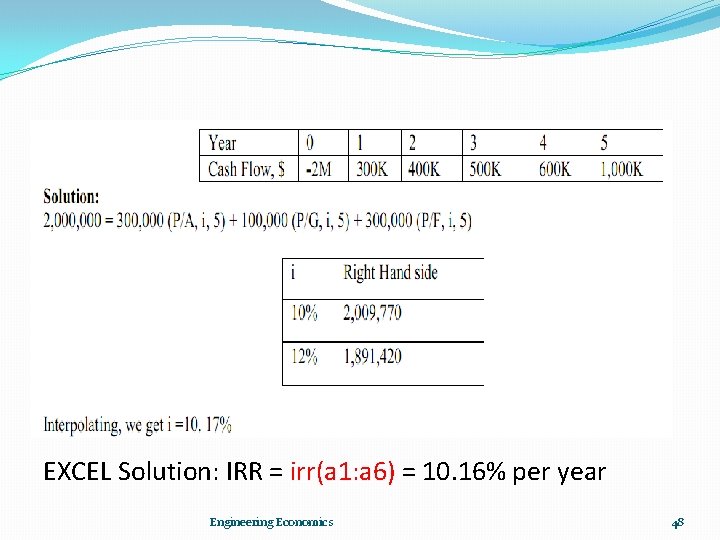

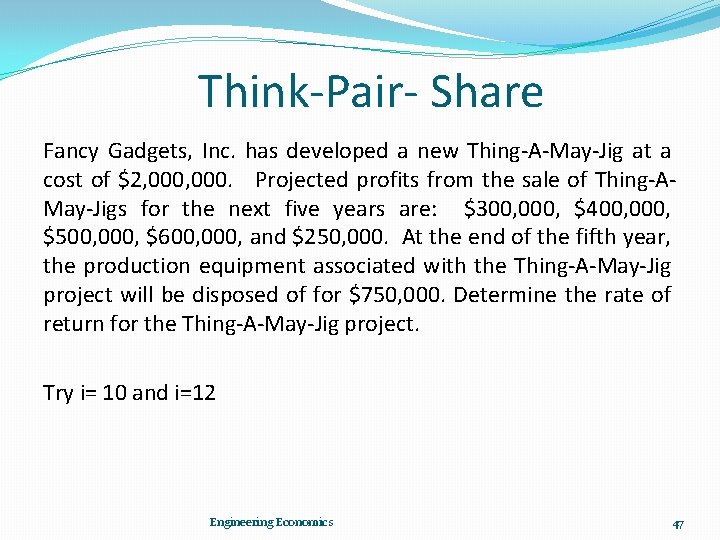

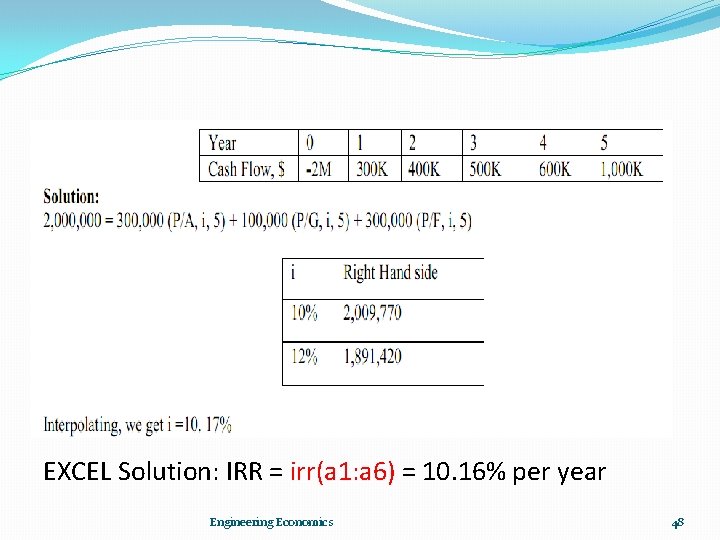

Think-Pair- Share Fancy Gadgets, Inc. has developed a new Thing-A-May-Jig at a cost of $2, 000. Projected profits from the sale of Thing-AMay-Jigs for the next five years are: $300, 000, $400, 000, $500, 000, $600, 000, and $250, 000. At the end of the fifth year, the production equipment associated with the Thing-A-May-Jig project will be disposed of for $750, 000. Determine the rate of return for the Thing-A-May-Jig project. Try i= 10 and i=12 Engineering Economics 47

EXCEL Solution: IRR = irr(a 1: a 6) = 10. 16% per year Engineering Economics 48

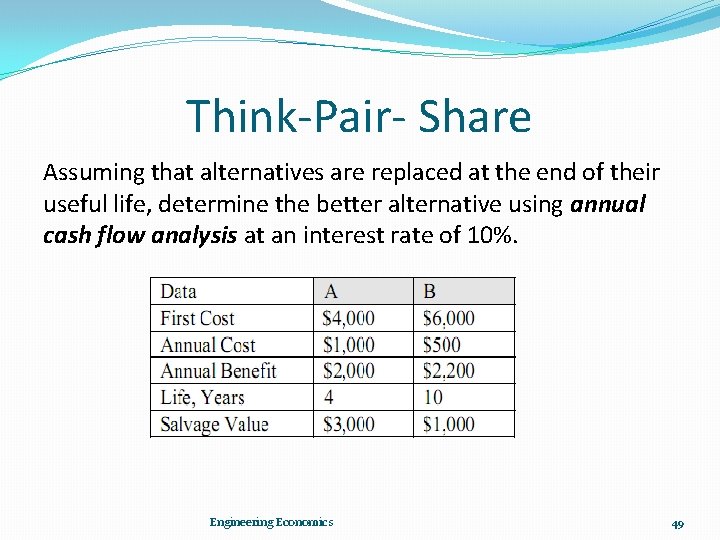

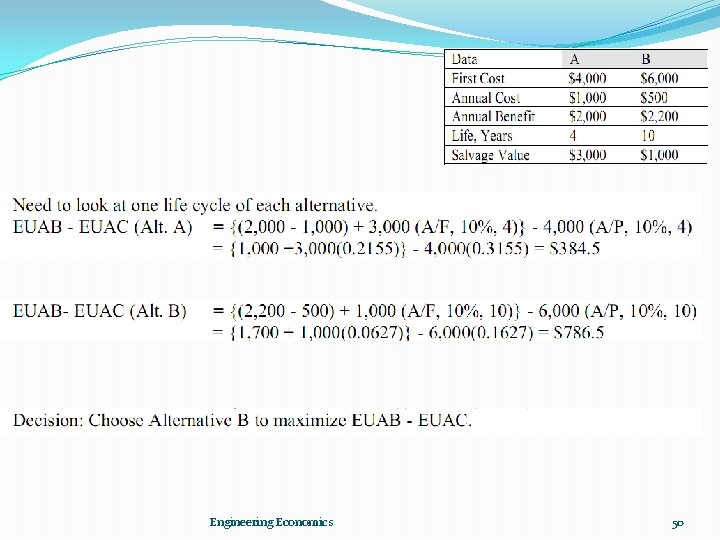

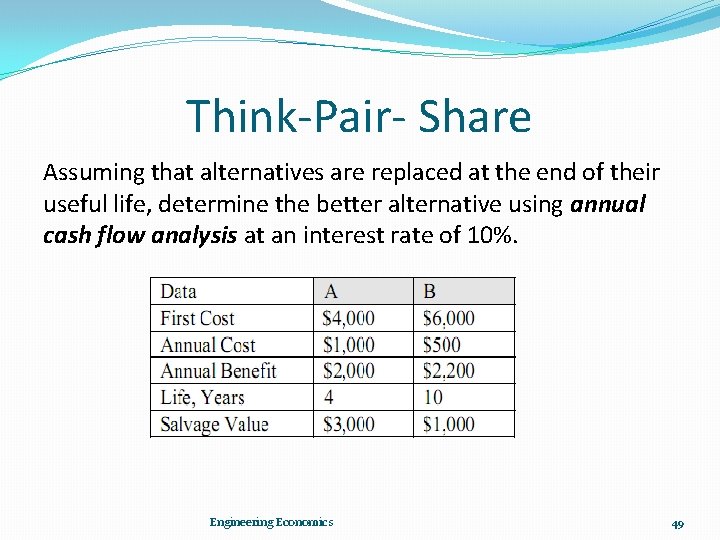

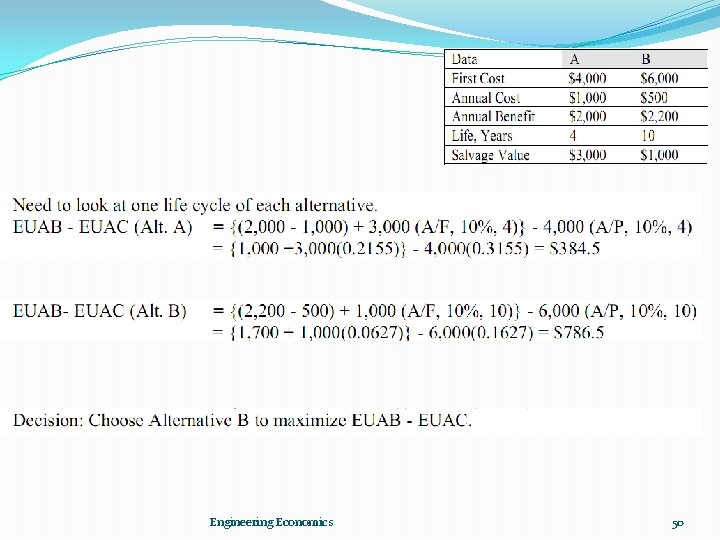

Think-Pair- Share Assuming that alternatives are replaced at the end of their useful life, determine the better alternative using annual cash flow analysis at an interest rate of 10%. Engineering Economics 49

Engineering Economics 50

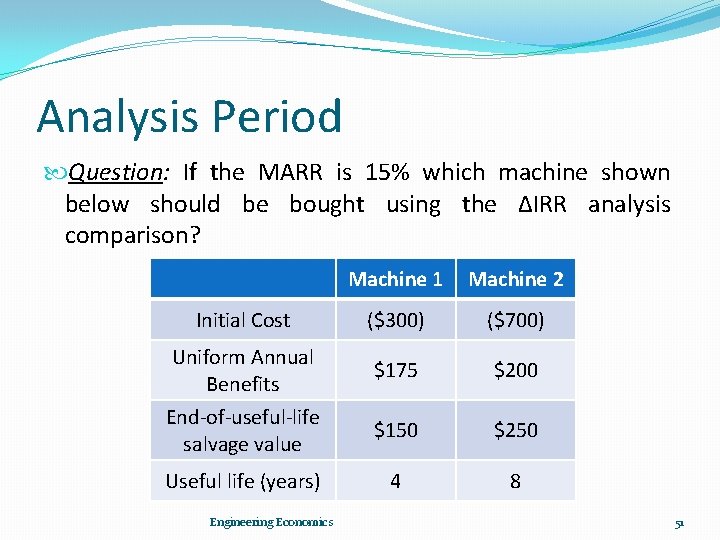

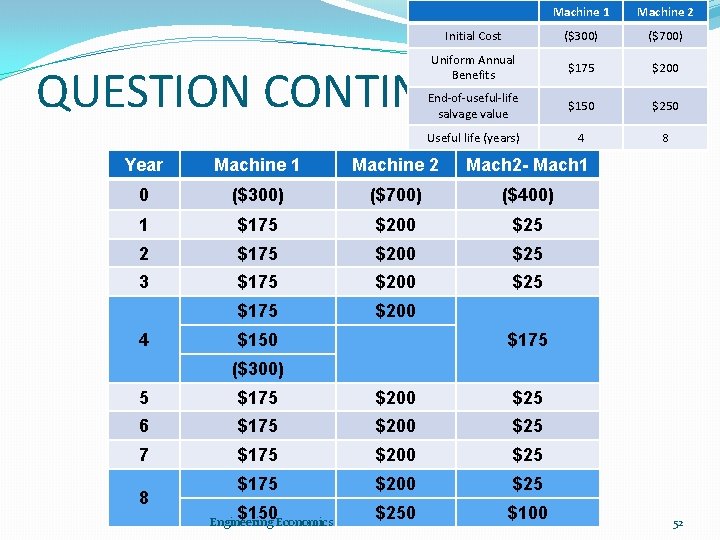

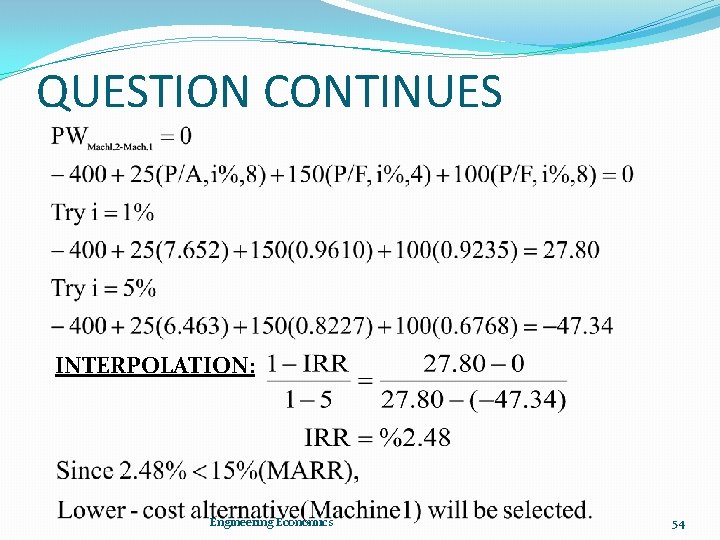

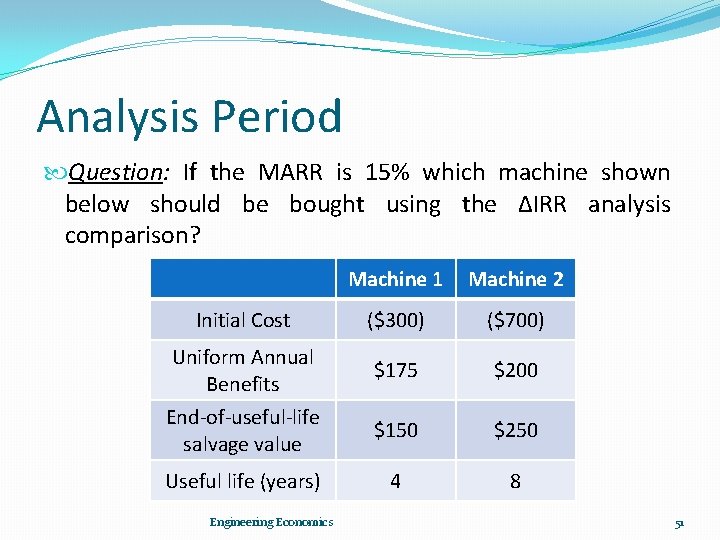

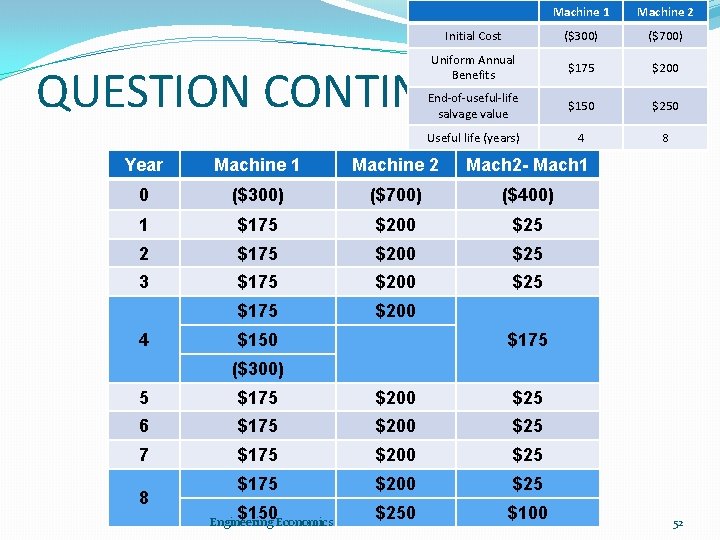

Analysis Period Question: If the MARR is 15% which machine shown below should be bought using the ΔIRR analysis comparison? Machine 1 Machine 2 Initial Cost ($300) ($700) Uniform Annual Benefits $175 $200 End-of-useful-life salvage value $150 $250 Useful life (years) 4 8 Engineering Economics 51

Machine 1 Machine 2 Initial Cost ($300) ($700) Uniform Annual Benefits $175 $200 End-of-useful-life salvage value $150 $250 Useful life (years) 4 8 QUESTION CONTINUES Year Machine 1 Machine 2 Mach 2 - Mach 1 0 ($300) ($700) ($400) 1 $175 $200 $25 2 $175 $200 $25 3 $175 $200 $25 $175 $200 4 $175 $150 ($300) 5 $175 $200 $25 6 $175 $200 $25 7 $175 $200 $25 $150 $250 $100 8 Engineering Economics 52

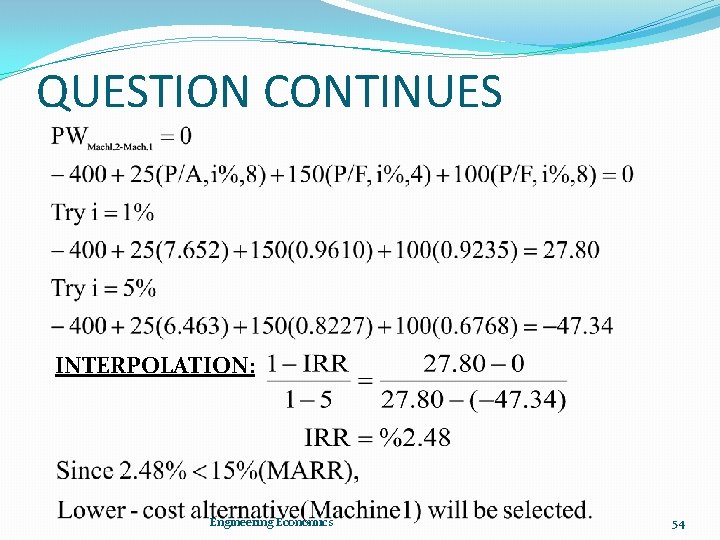

QUESTION CONTINUES INTERPOLATION: Engineering Economics 53

QUESTION CONTINUES INTERPOLATION: Engineering Economics 54

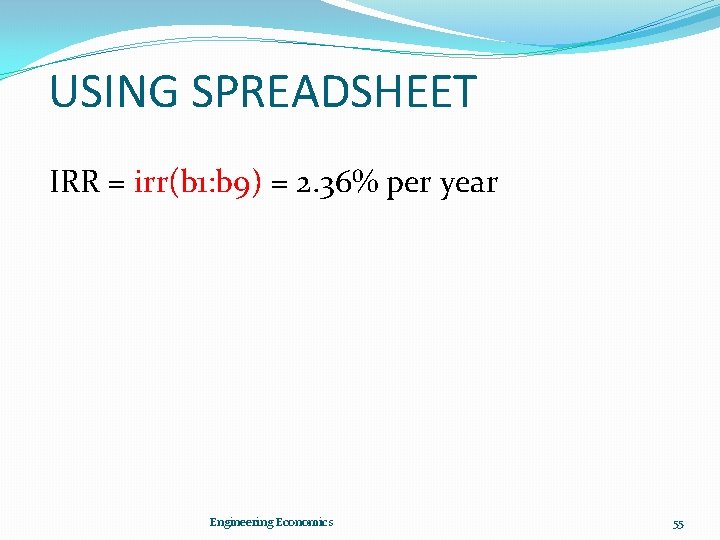

USING SPREADSHEET IRR = irr(b 1: b 9) = 2. 36% per year Engineering Economics 55

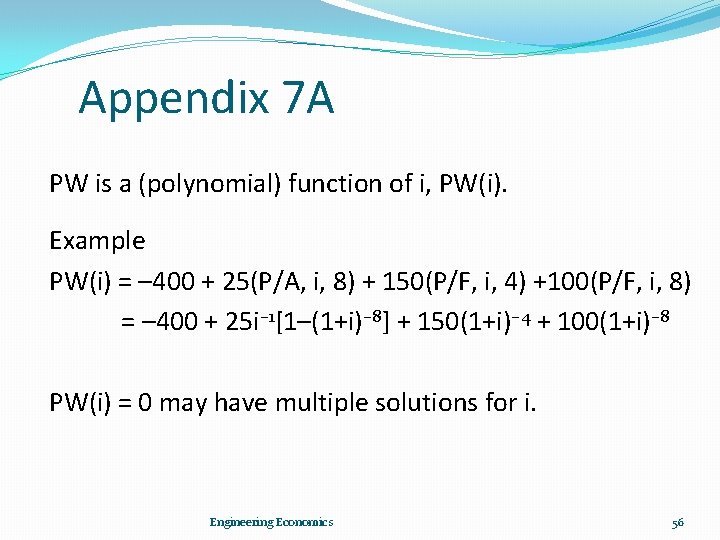

Appendix 7 A PW is a (polynomial) function of i, PW(i). Example PW(i) = – 400 + 25(P/A, i, 8) + 150(P/F, i, 4) +100(P/F, i, 8) = – 400 + 25 i– 1[1–(1+i)– 8] + 150(1+i)– 4 + 100(1+i)– 8 PW(i) = 0 may have multiple solutions for i. Engineering Economics 56

End of Chapter 7 Engineering Economics 57