Understanding Interest Rates Chapter 3 Present Value Discounting

- Slides: 59

Understanding Interest Rates Chapter 3

Present Value: Discounting the Future • A dollar paid to you one year from now is less valuable than a dollar paid to you today. • WHY?

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 3 -3

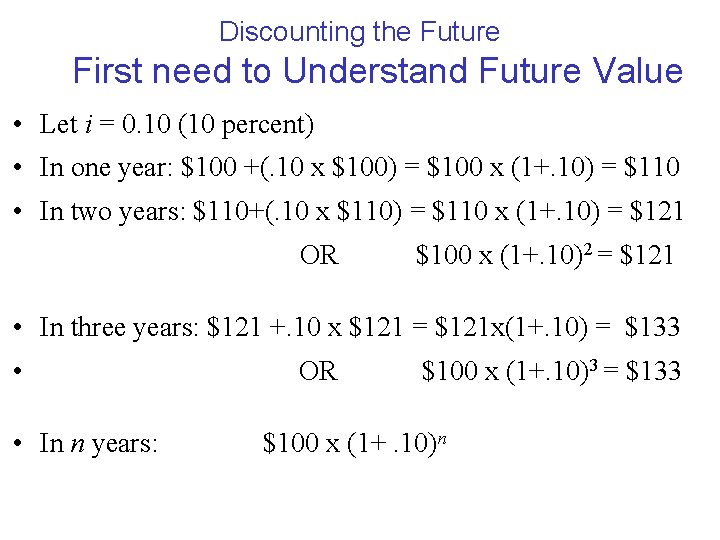

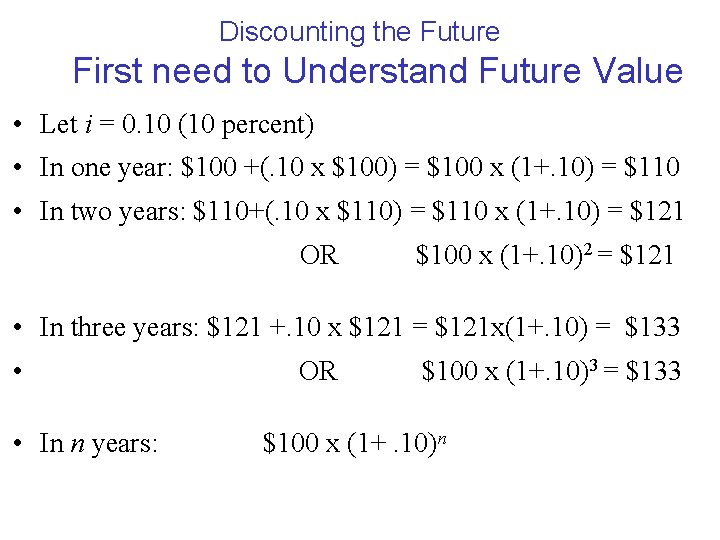

Discounting the Future First need to Understand Future Value • Let i = 0. 10 (10 percent) • In one year: $100 +(. 10 x $100) = $100 x (1+. 10) = $110 • In two years: $110+(. 10 x $110) = $110 x (1+. 10) = $121 OR $100 x (1+. 10)2 = $121 • In three years: $121 +. 10 x $121 = $121 x(1+. 10) = $133 • OR $100 x (1+. 10)3 = $133 • In n years: $100 x (1+. 10)n

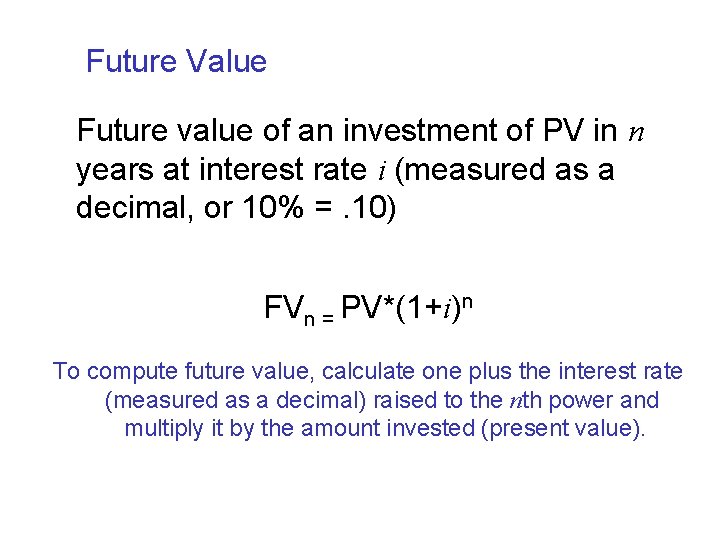

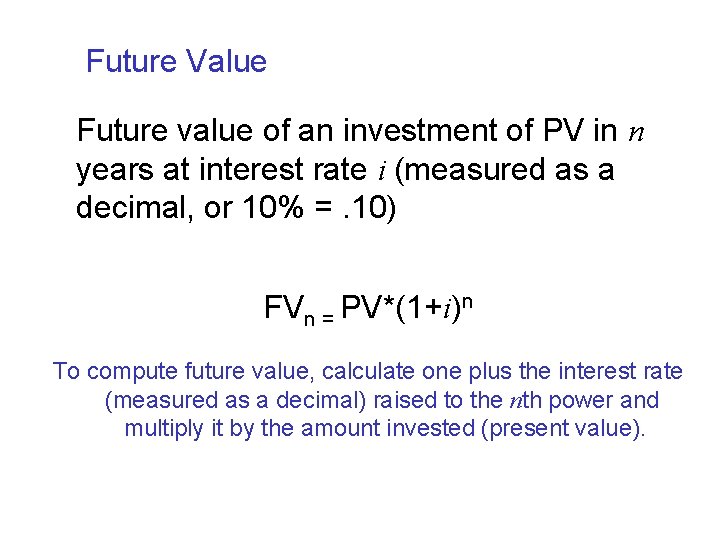

Future Value Future value of an investment of PV in n years at interest rate i (measured as a decimal, or 10% =. 10) FVn = PV*(1+i)n To compute future value, calculate one plus the interest rate (measured as a decimal) raised to the nth power and multiply it by the amount invested (present value).

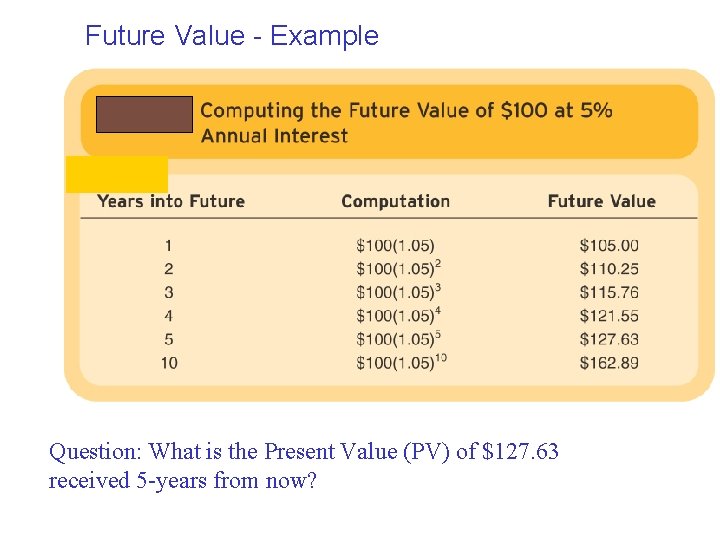

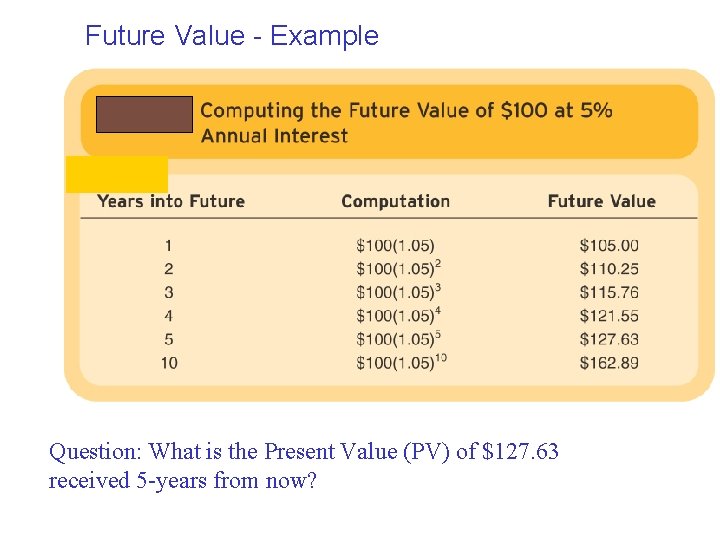

Future Value - Example Computing Future Value at 5% Annual Interest Question: What is the Present Value (PV) of $127. 63 received 5 -years from now?

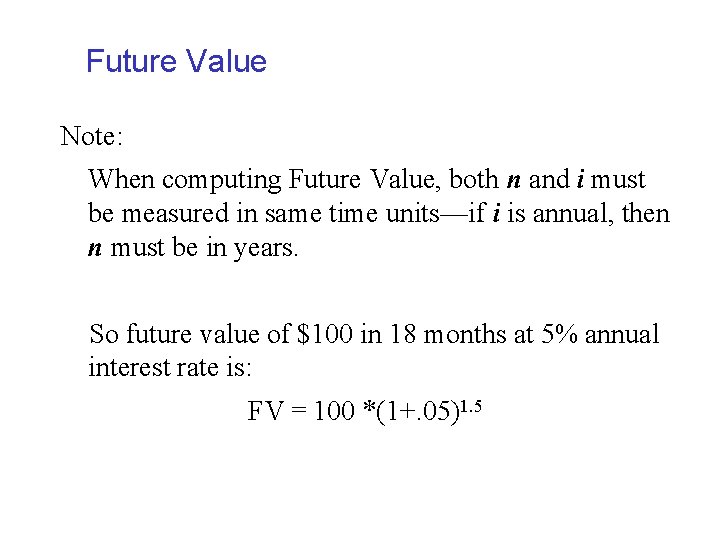

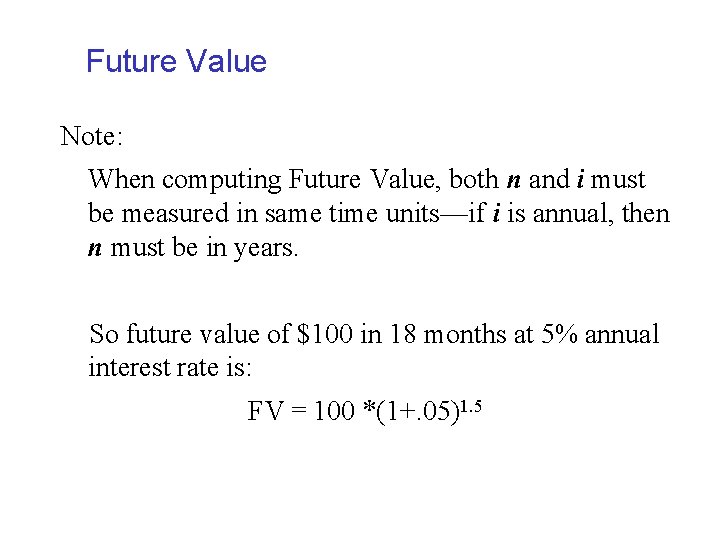

Future Value Note: When computing Future Value, both n and i must be measured in same time units—if i is annual, then n must be in years. So future value of $100 in 18 months at 5% annual interest rate is: FV = 100 *(1+. 05)1. 5

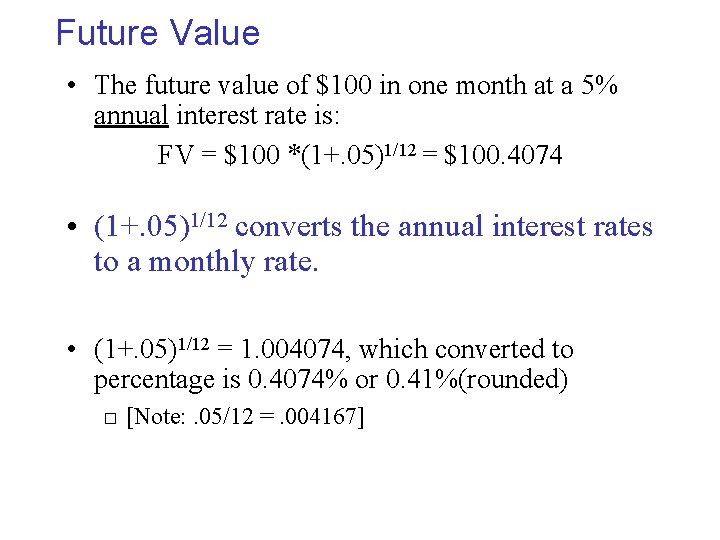

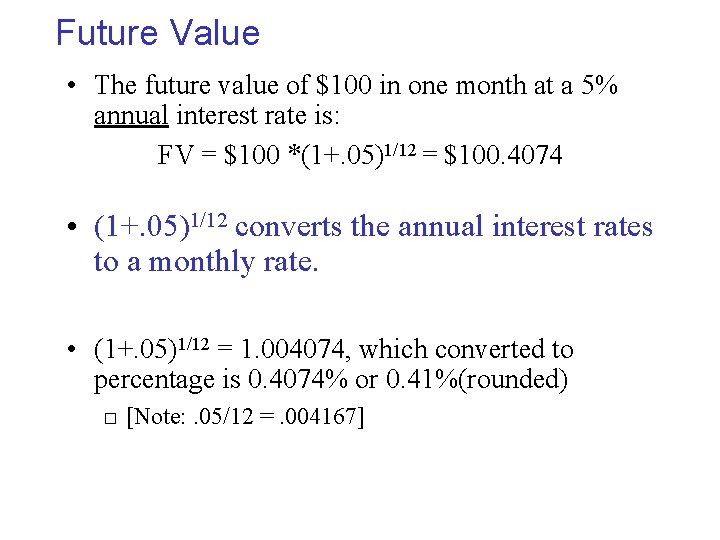

Future Value • The future value of $100 in one month at a 5% annual interest rate is: FV = $100 *(1+. 05)1/12 = $100. 4074 • (1+. 05)1/12 converts the annual interest rates to a monthly rate. • (1+. 05)1/12 = 1. 004074, which converted to percentage is 0. 4074% or 0. 41%(rounded) � [Note: . 05/12 =. 004167]

Basis Point • Faction of a percentage point is called basis point. • A basis point is one-one hundredth of a percentage point • One basis point (bp) = 0. 01 percent.

Present Value (PV) is the value today of a payment that is promised to be made in the future.

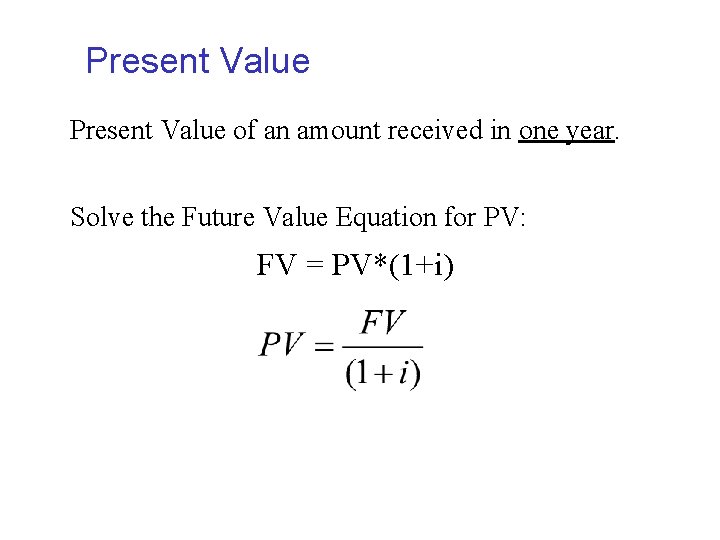

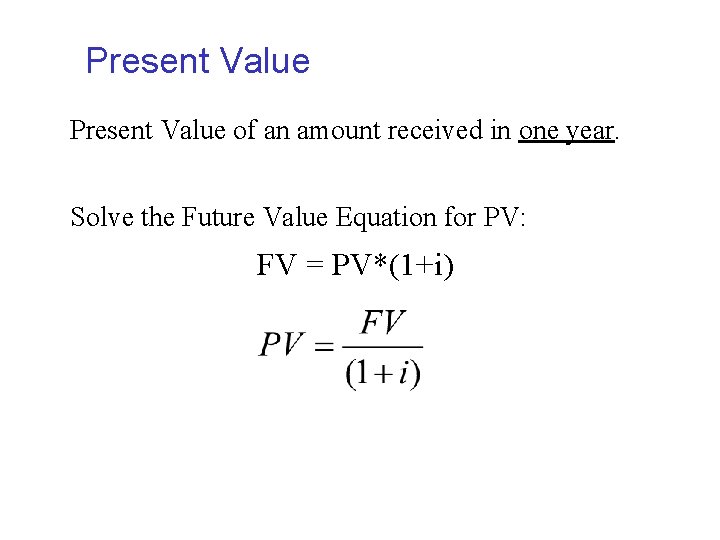

Present Value of an amount received in one year. Solve the Future Value Equation for PV: FV = PV*(1+i)

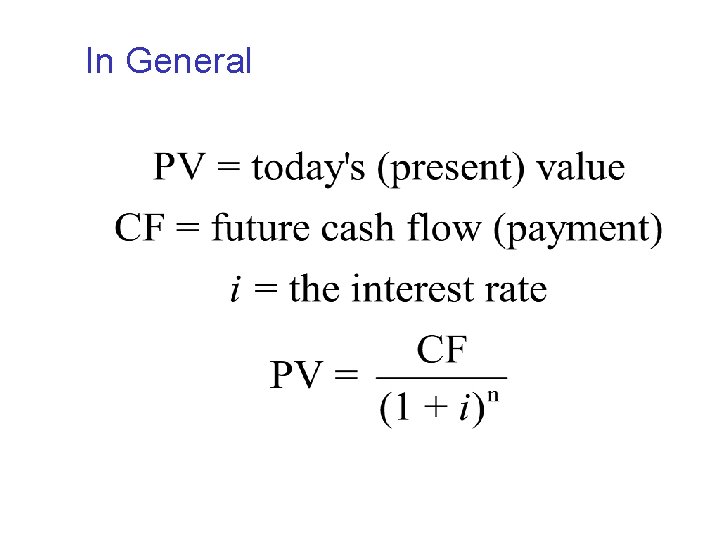

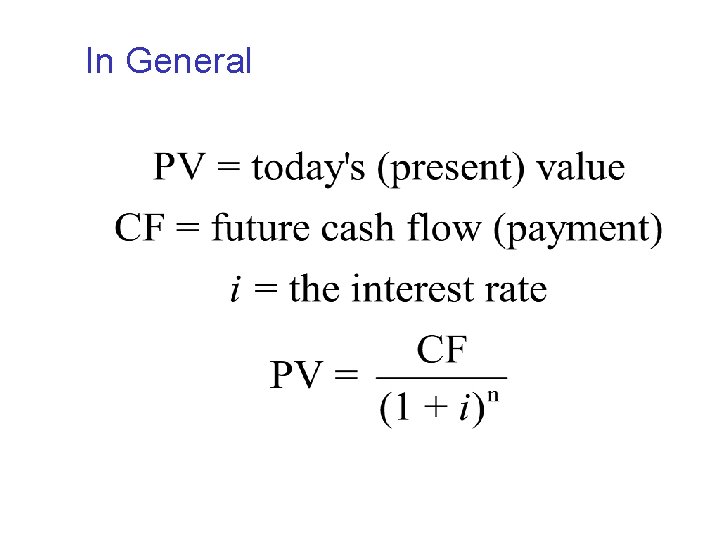

In General

Present Value Example: PV of $100 received in one year at i =5% PV=$100/(1+. 05) = $95. 24

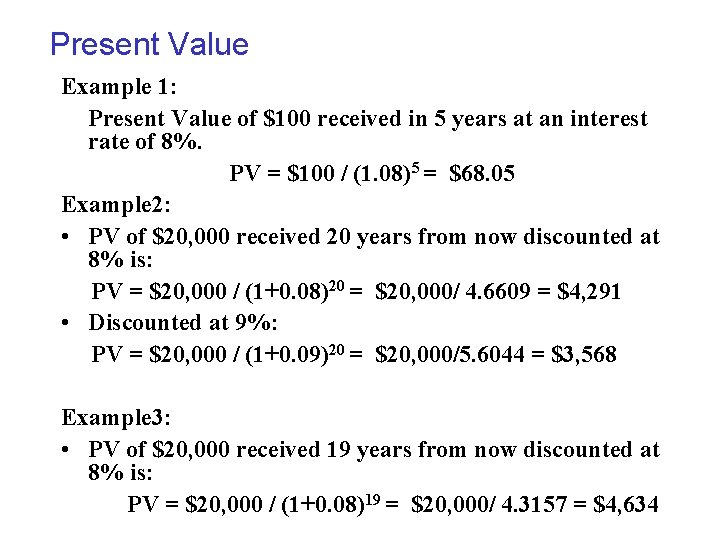

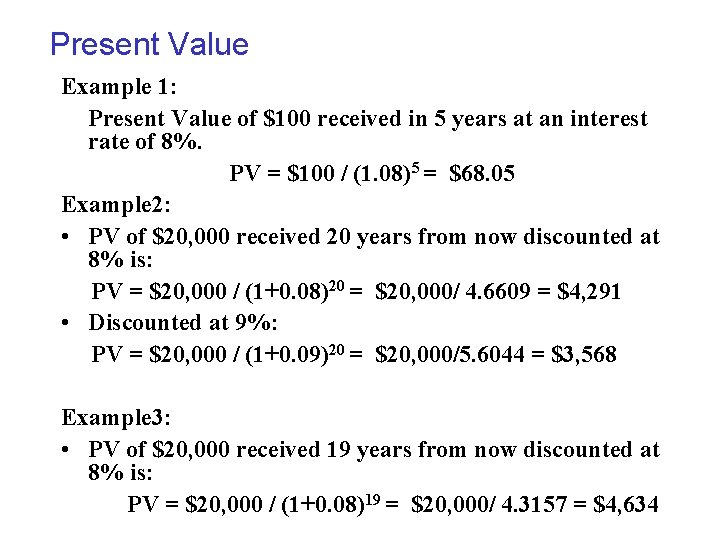

Present Value Example 1: Present Value of $100 received in 5 years at an interest rate of 8%. PV = $100 / (1. 08)5 = $68. 05 Example 2: • PV of $20, 000 received 20 years from now discounted at 8% is: PV = $20, 000 / (1+0. 08)20 = $20, 000/ 4. 6609 = $4, 291 • Discounted at 9%: PV = $20, 000 / (1+0. 09)20 = $20, 000/5. 6044 = $3, 568 Example 3: • PV of $20, 000 received 19 years from now discounted at 8% is: PV = $20, 000 / (1+0. 08)19 = $20, 000/ 4. 3157 = $4, 634

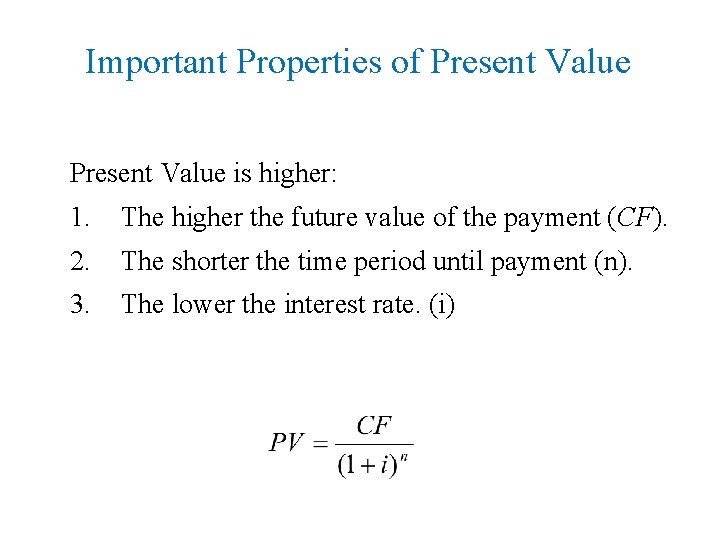

Important Properties of Present Value is higher: 1. The higher the future value of the payment (CF). 2. The shorter the time period until payment (n). 3. The lower the interest rate. (i)

Mishkin in Chapter 4 Discusses Four Types of Credit Market Instruments • Simple Loan • Fixed Payment Loan (I will just mention this) • Coupon Bond - Special case: consol bond • Discount Bond

We will focus on Bonds and look at three types of bonds • Coupon Bonds: which make periodic interest payments and repay the principal at maturity. • U. S. Treasury Bonds and most corporate bonds are coupon bonds. • Discount or Zero-coupon bonds: which promise a single future payment, such as a U. S. Treasury Bill. • Consols: which make periodic interest payments forever, never repaying the principal that was borrowed. (There aren’t many examples of these. )

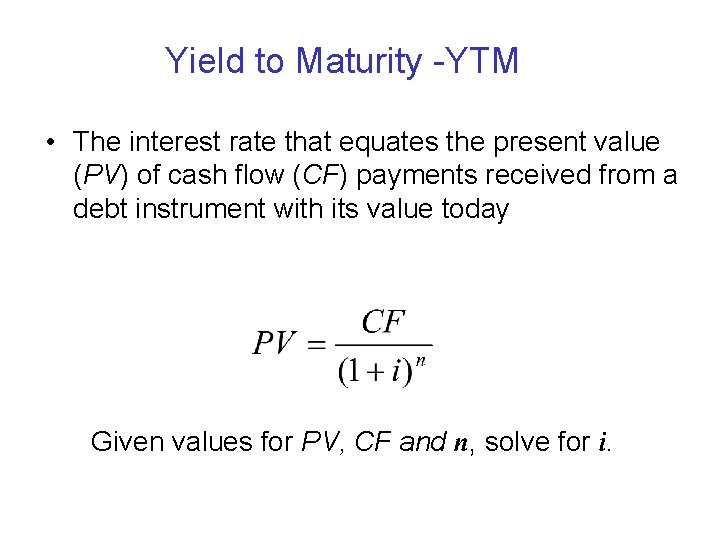

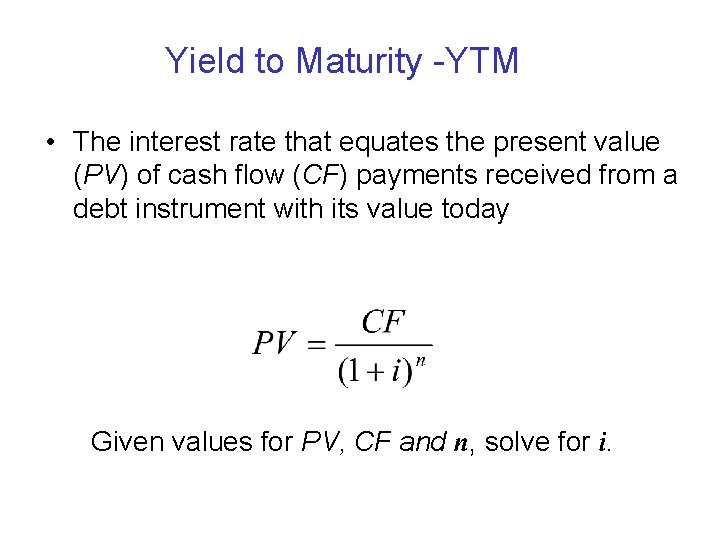

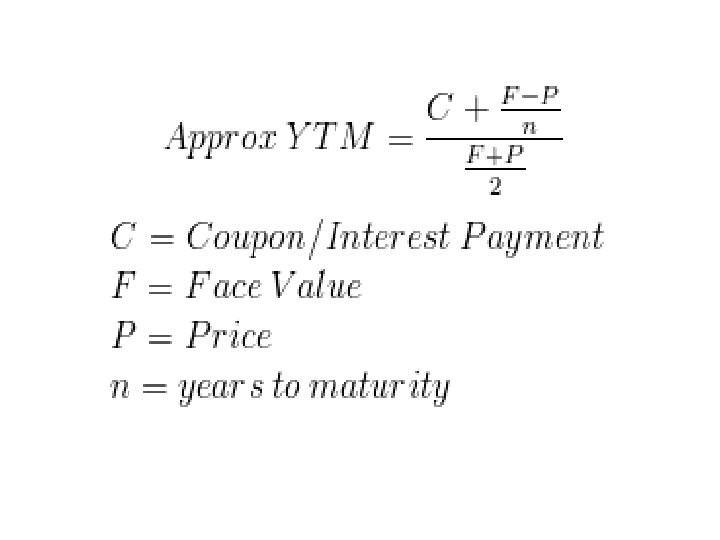

Yield to Maturity -YTM • The interest rate that equates the present value (PV) of cash flow (CF) payments received from a debt instrument with its value today Given values for PV, CF and n, solve for i.

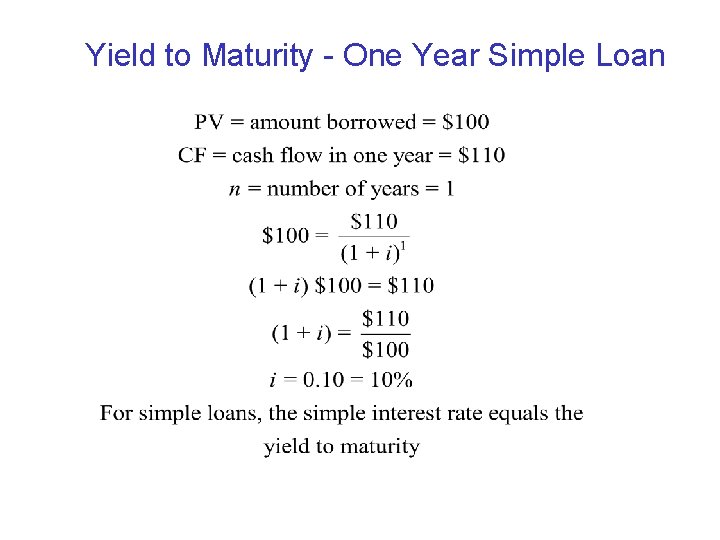

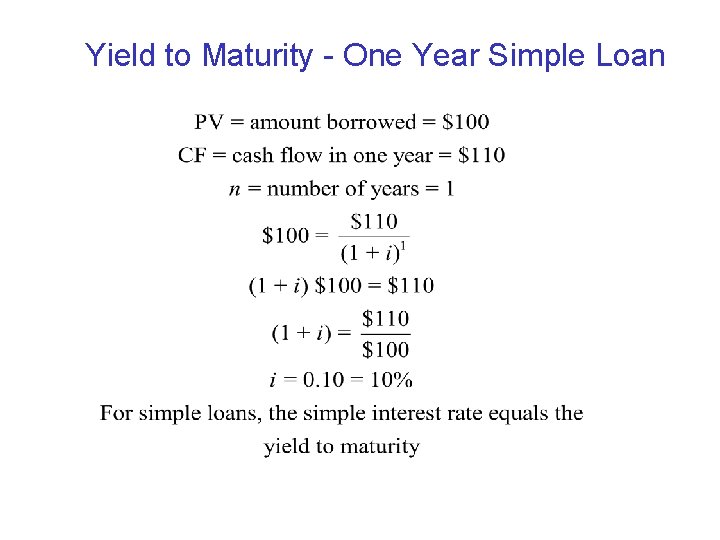

Yield to Maturity - One Year Simple Loan

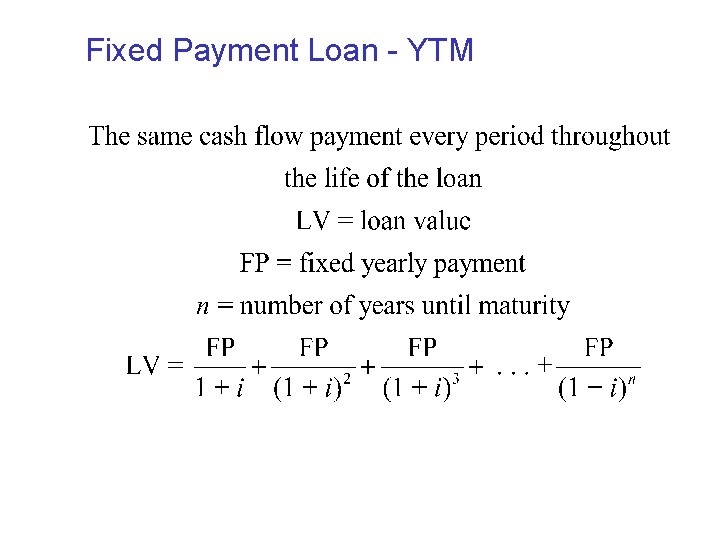

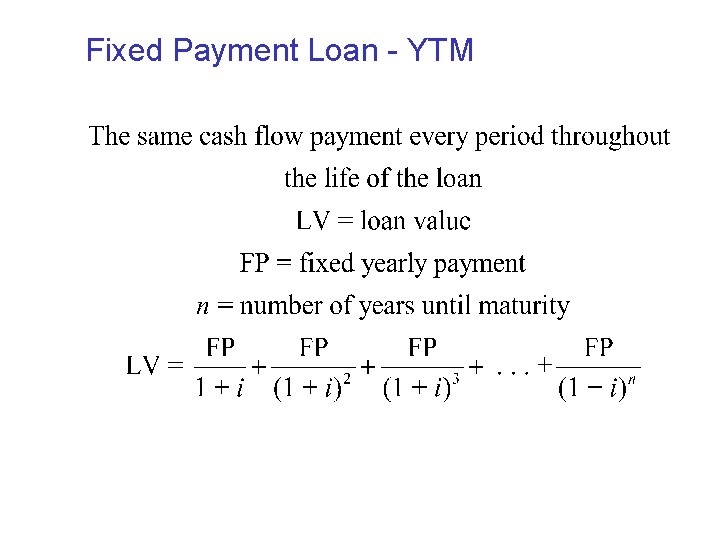

Fixed Payment Loan - YTM

Bonds - Our Objectives • Understand the relationship between bond prices and interest rates. � Bond price is a present value calculation � YTM is the interest rate • Supply and Demand determine the price of bonds. - We will also discuss loanable funds and money supply/money demand. • Why bonds are risky.

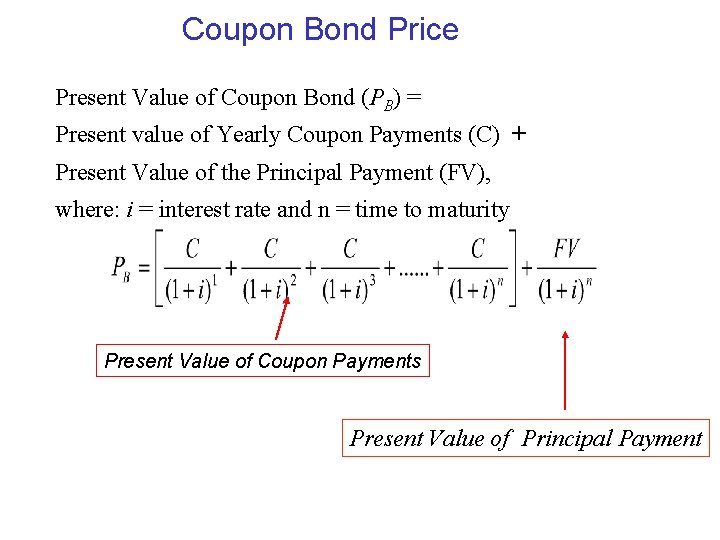

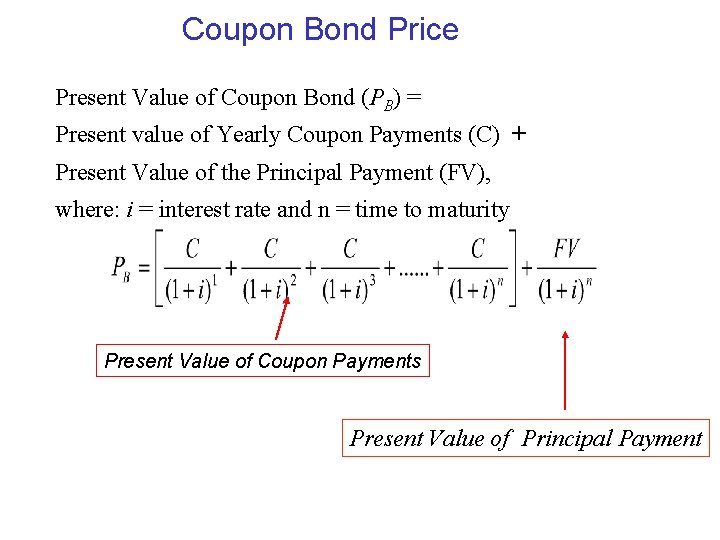

Coupon Bond Price Present Value of Coupon Bond (PB) = Present value of Yearly Coupon Payments (C) + Present Value of the Principal Payment (FV), where: i = interest rate and n = time to maturity Present Value of Coupon Payments Present Value of Principal Payment

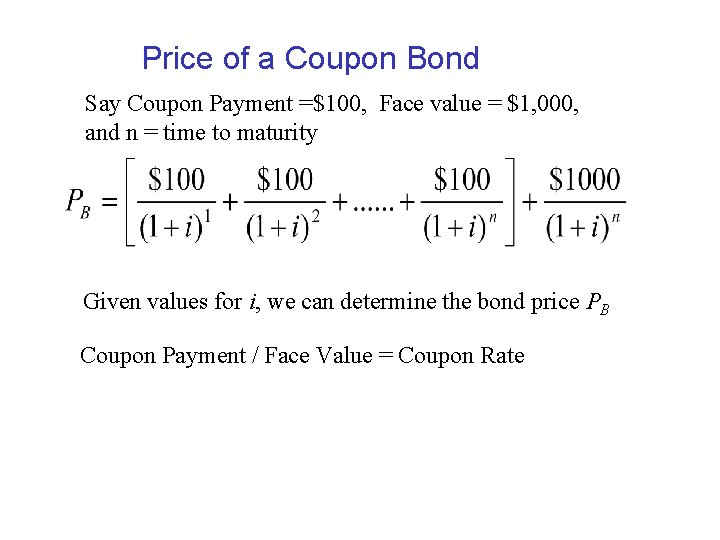

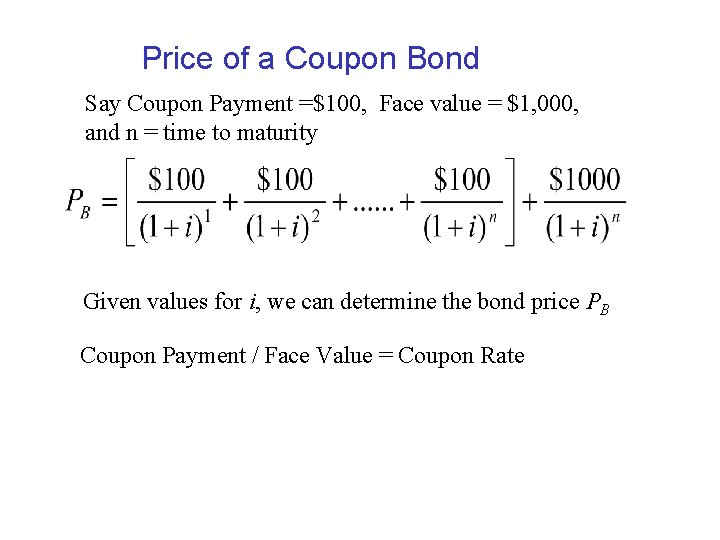

Price of a Coupon Bond Say Coupon Payment =$100, Face value = $1, 000, and n = time to maturity Given values for i, we can determine the bond price PB Coupon Payment / Face Value = Coupon Rate

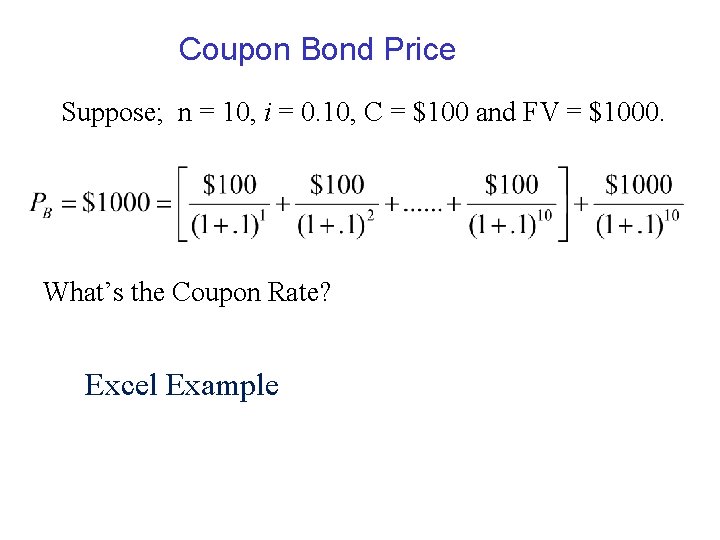

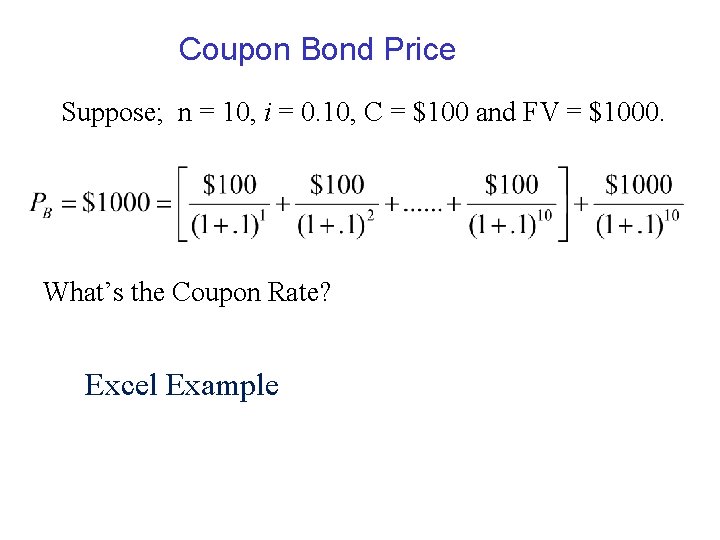

Coupon Bond Price Suppose; n = 10, i = 0. 10, C = $100 and FV = $1000. What’s the Coupon Rate? Excel Example

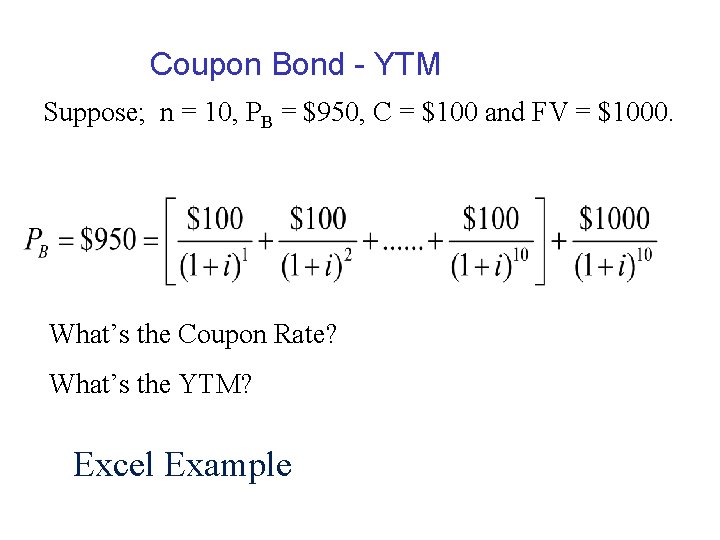

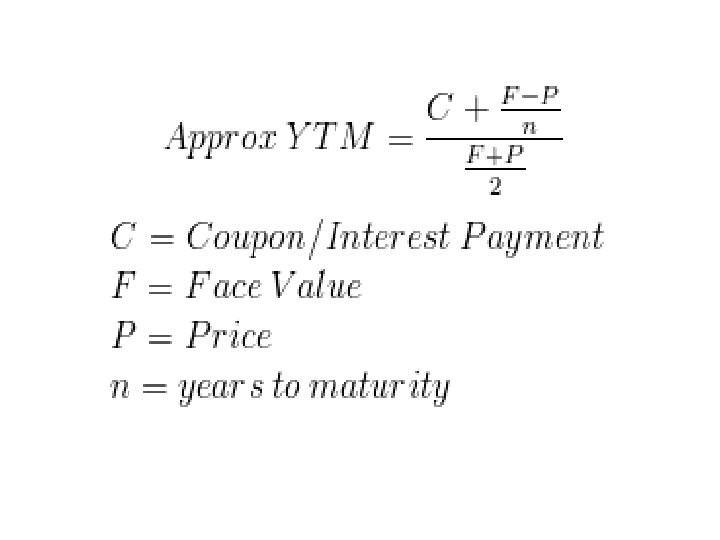

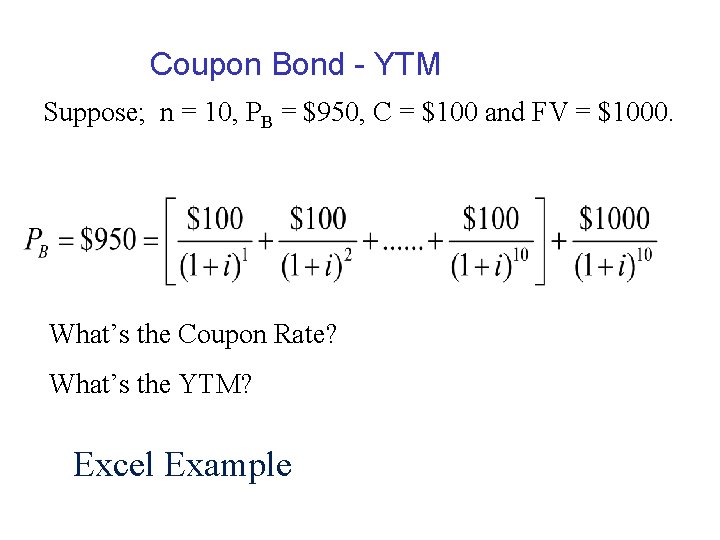

Coupon Bond - YTM Suppose; n = 10, PB = $950, C = $100 and FV = $1000. What’s the Coupon Rate? What’s the YTM? Excel Example

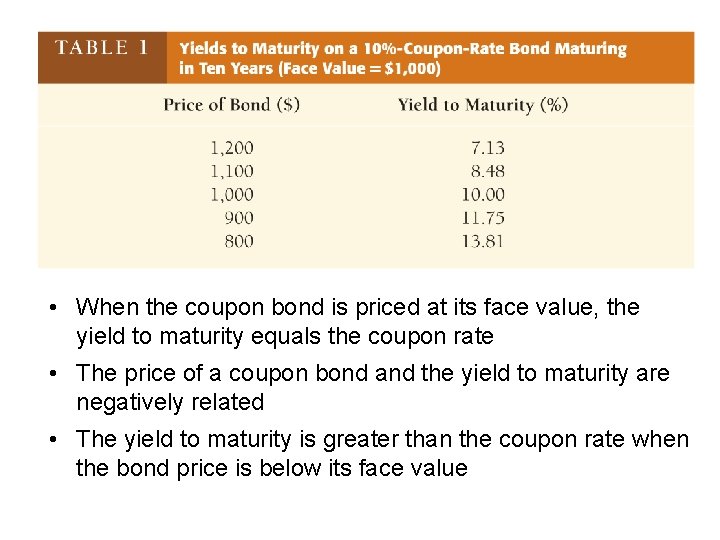

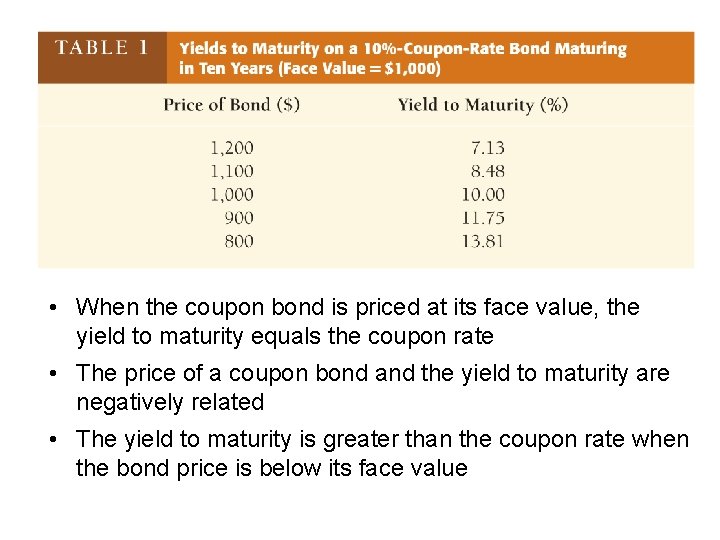

• When the coupon bond is priced at its face value, the yield to maturity equals the coupon rate • The price of a coupon bond and the yield to maturity are negatively related • The yield to maturity is greater than the coupon rate when the bond price is below its face value

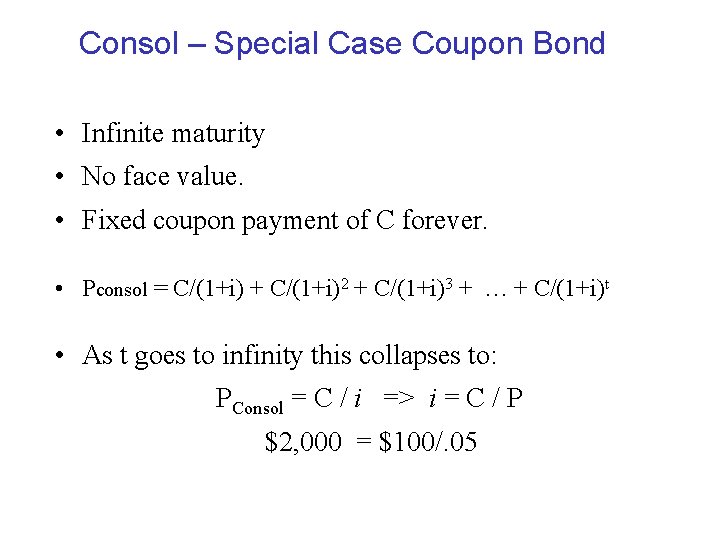

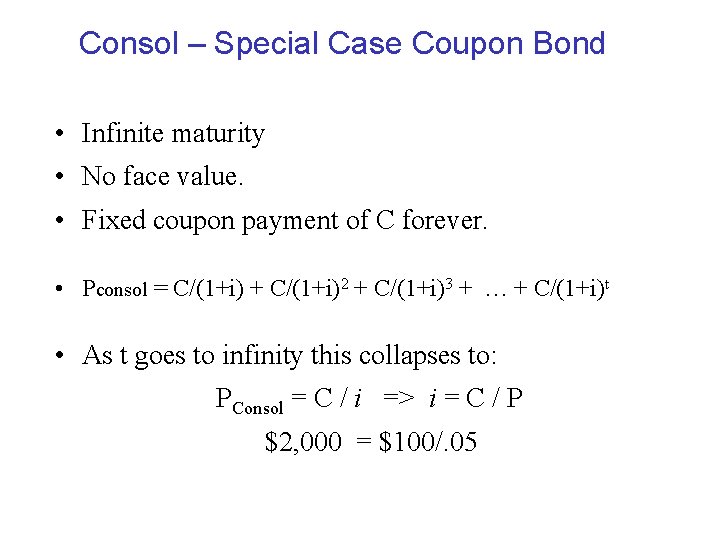

Consol – Special Case Coupon Bond • Infinite maturity • No face value. • Fixed coupon payment of C forever. • Pconsol = C/(1+i) + C/(1+i)2 + C/(1+i)3 + … + C/(1+i)t • As t goes to infinity this collapses to: PConsol = C / i => i = C / P $2, 000 = $100/. 05

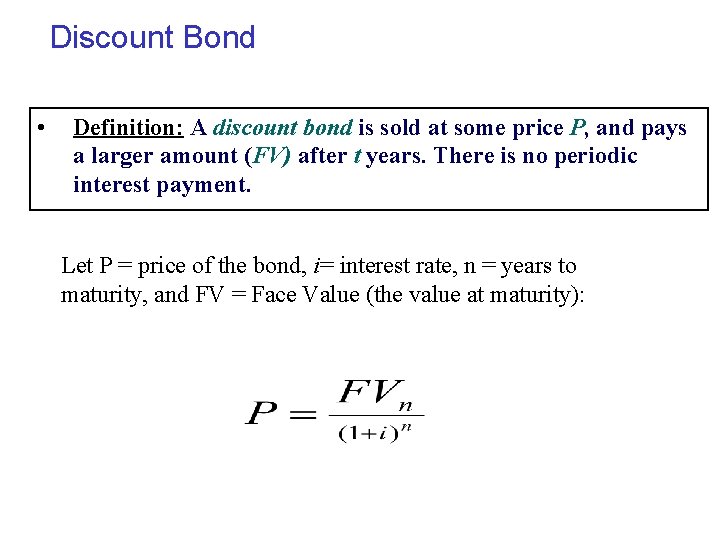

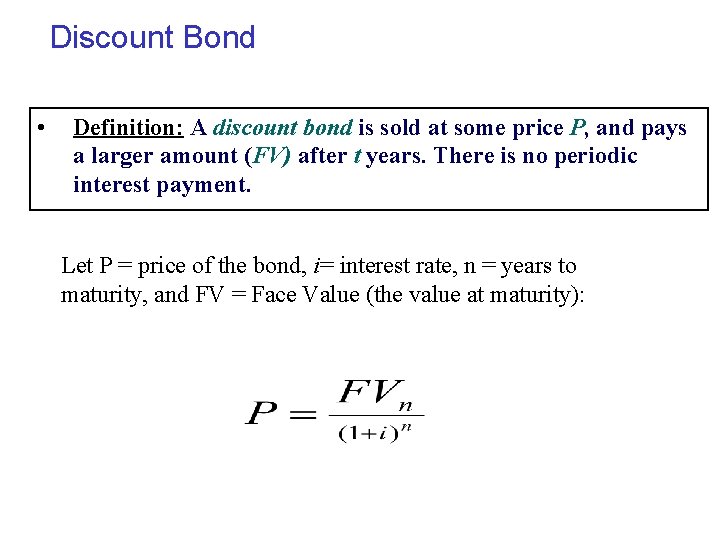

Discount Bond • Definition: A discount bond is sold at some price P, and pays a larger amount (FV) after t years. There is no periodic interest payment. Let P = price of the bond, i= interest rate, n = years to maturity, and FV = Face Value (the value at maturity):

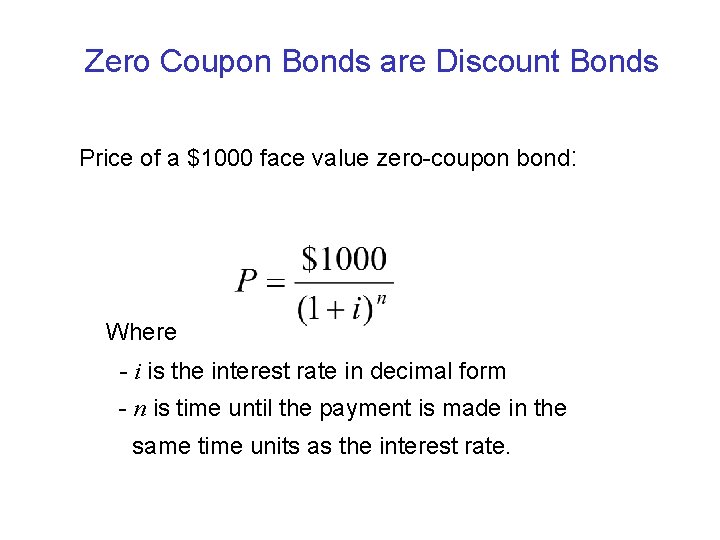

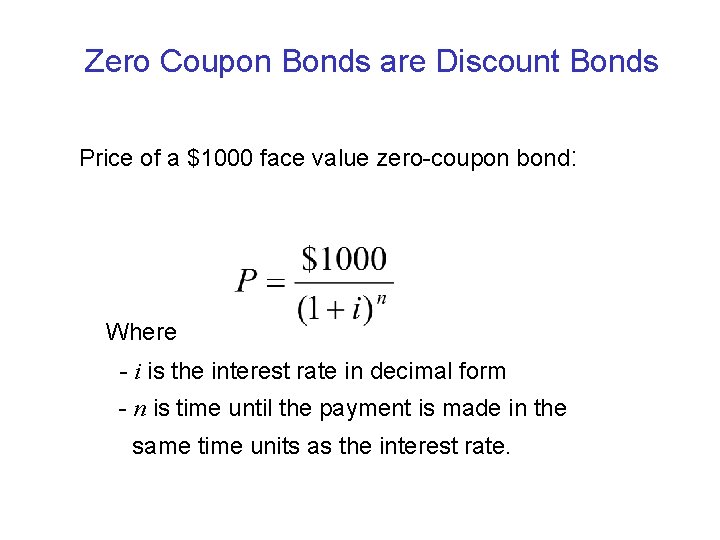

Zero Coupon Bonds are Discount Bonds Price of a $1000 face value zero-coupon bond: Where - i is the interest rate in decimal form - n is time until the payment is made in the same time units as the interest rate.

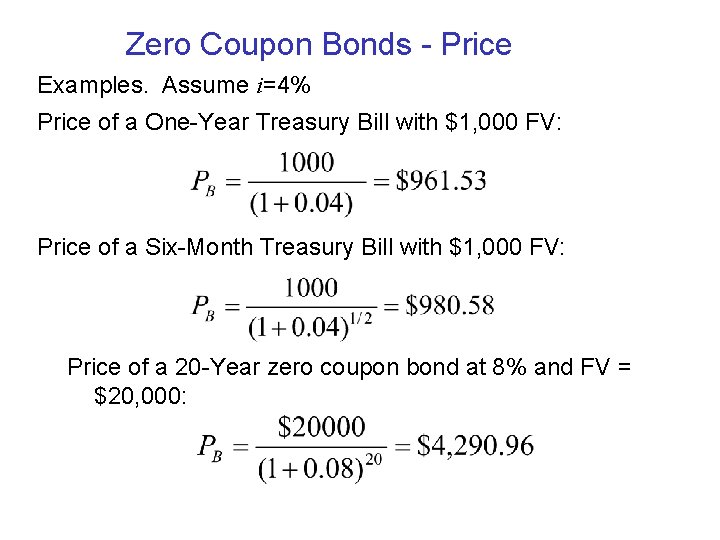

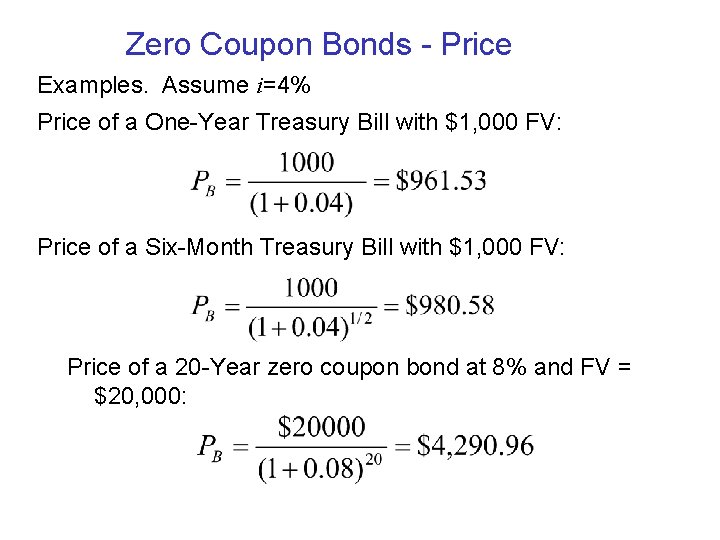

Zero Coupon Bonds - Price Examples. Assume i=4% Price of a One-Year Treasury Bill with $1, 000 FV: Price of a Six-Month Treasury Bill with $1, 000 FV: Price of a 20 -Year zero coupon bond at 8% and FV = $20, 000:

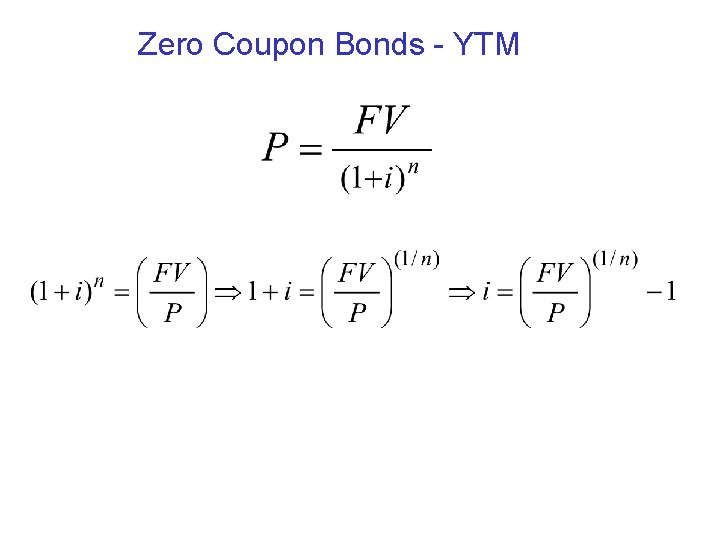

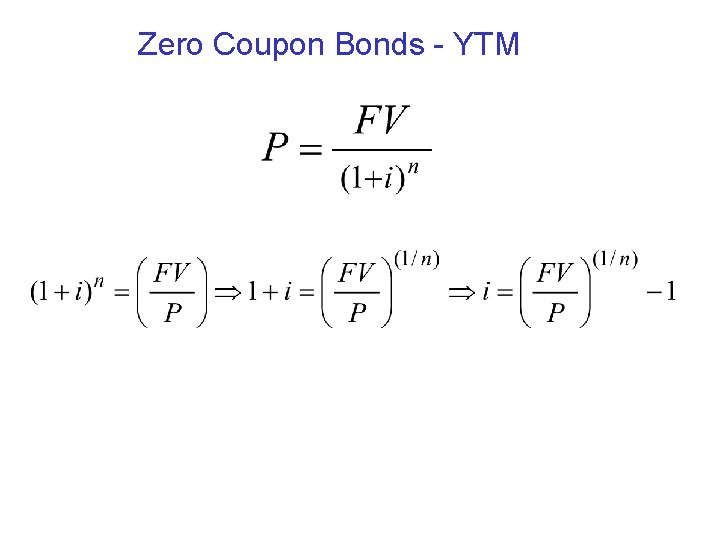

Zero Coupon Bonds - YTM

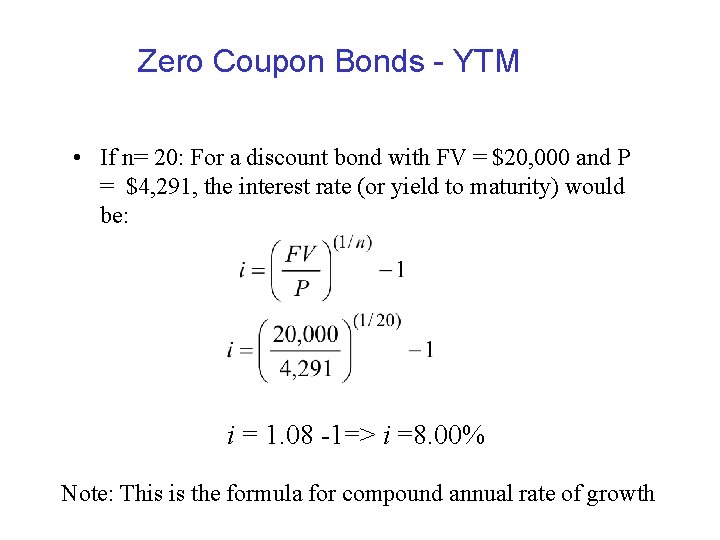

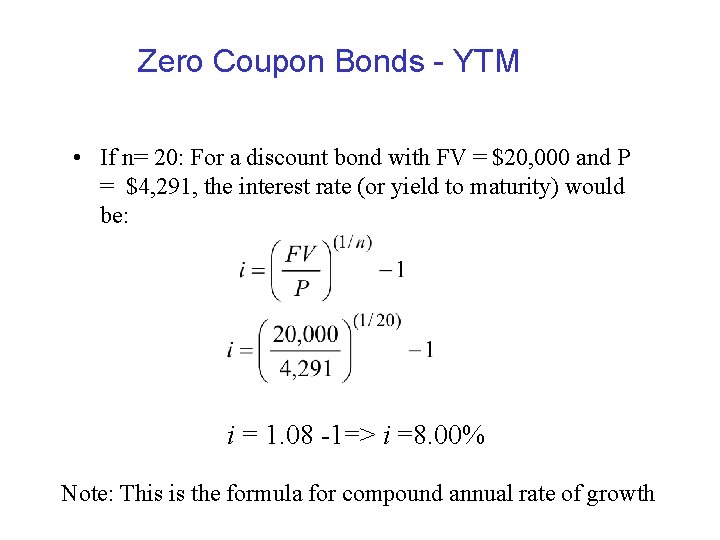

Zero Coupon Bonds - YTM • If n= 20: For a discount bond with FV = $20, 000 and P = $4, 291, the interest rate (or yield to maturity) would be: i = 1. 08 -1=> i =8. 00% Note: This is the formula for compound annual rate of growth

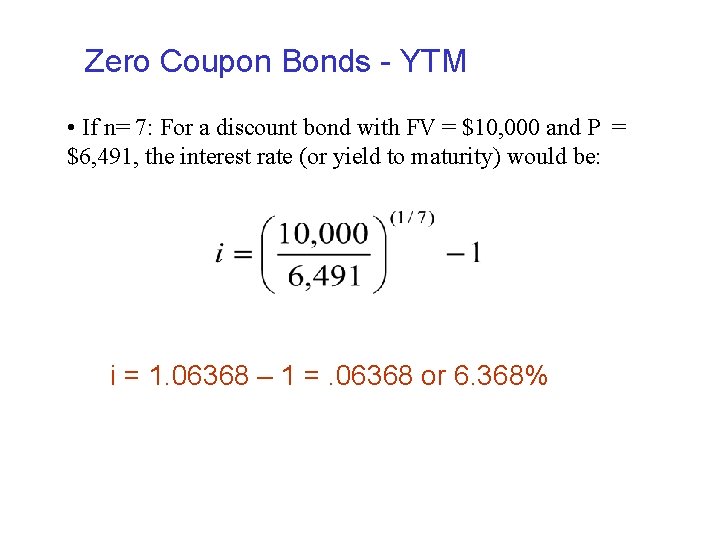

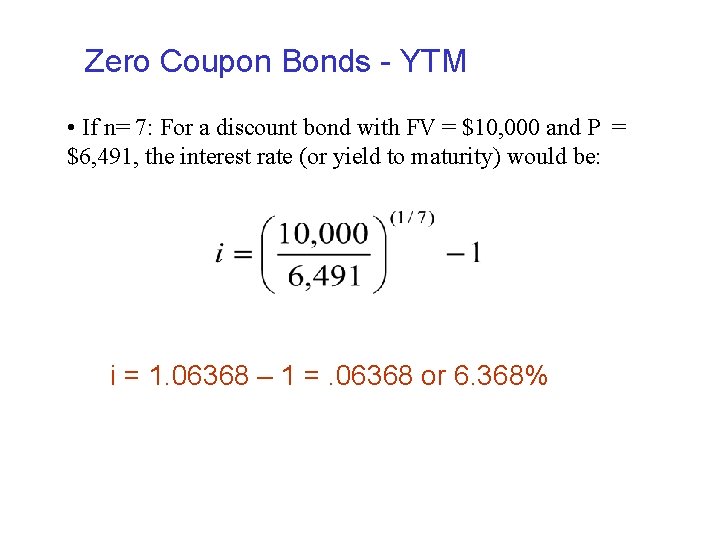

Zero Coupon Bonds - YTM • If n= 7: For a discount bond with FV = $10, 000 and P = $6, 491, the interest rate (or yield to maturity) would be: i = 1. 06368 – 1 =. 06368 or 6. 368%

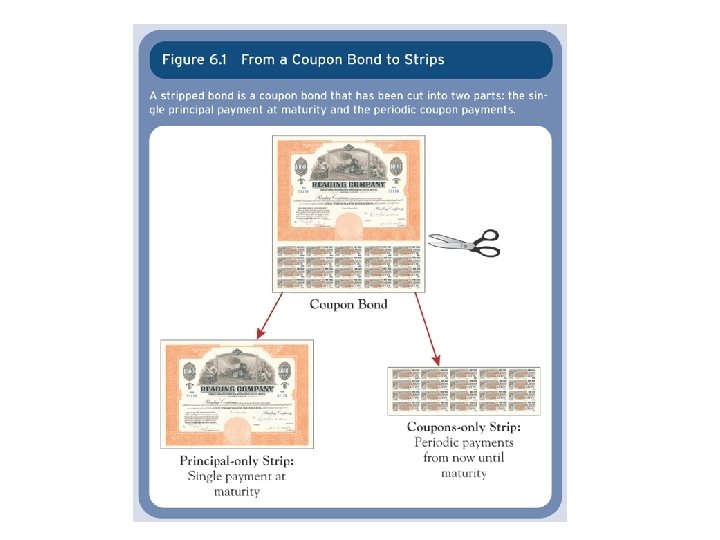

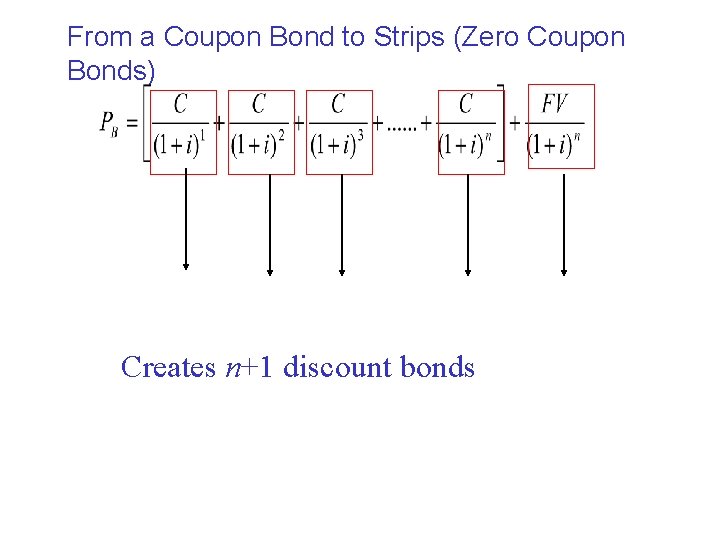

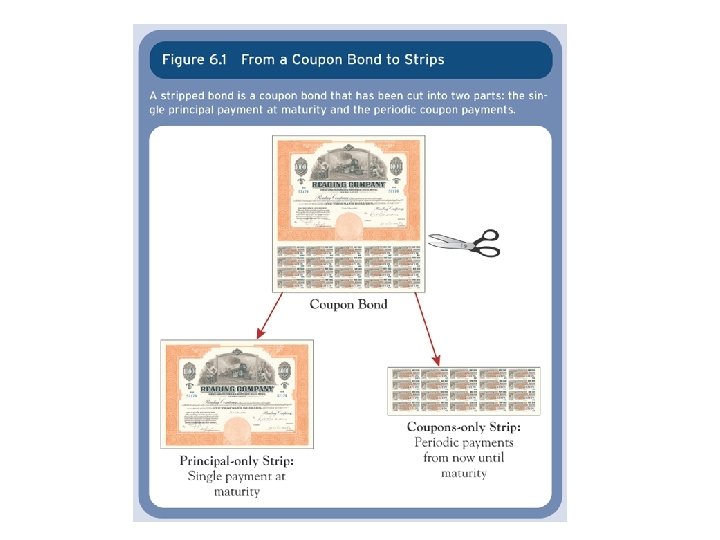

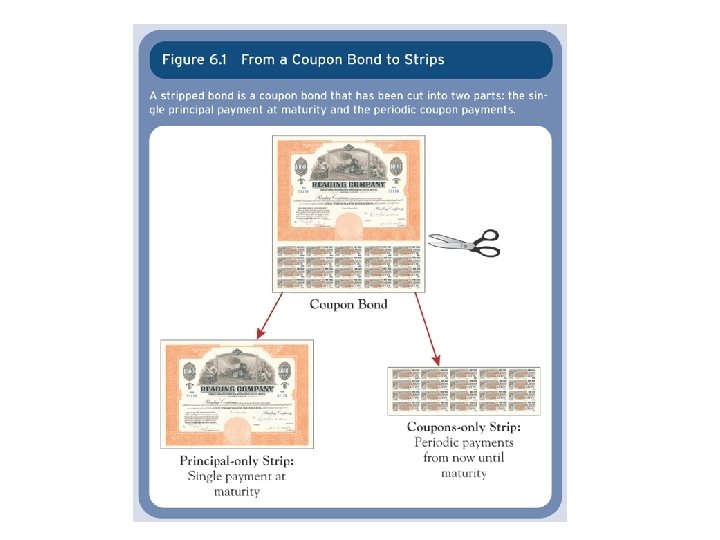

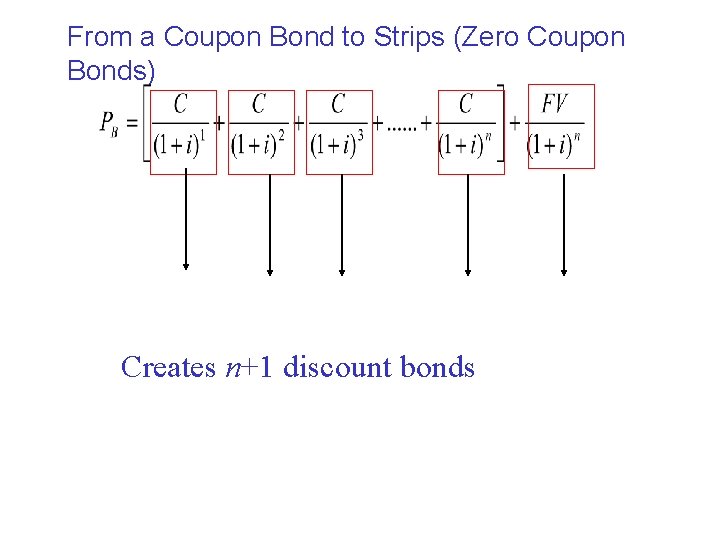

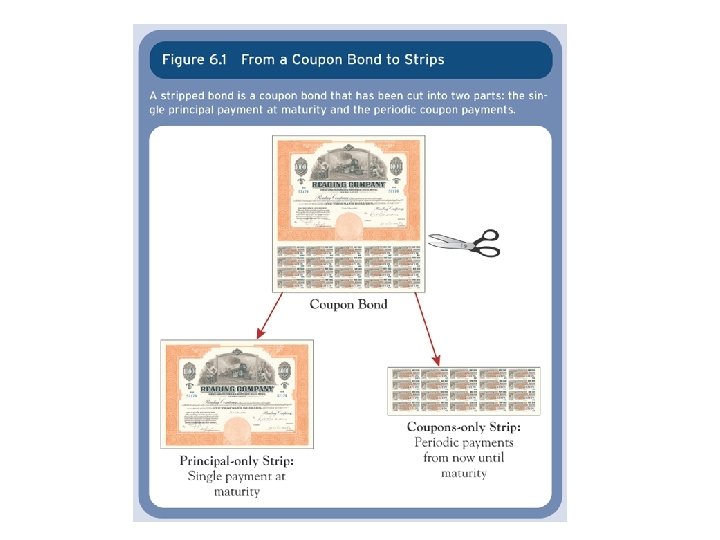

From a Coupon Bond to Strips (Zero Coupon Bonds) Creates n+1 discount bonds

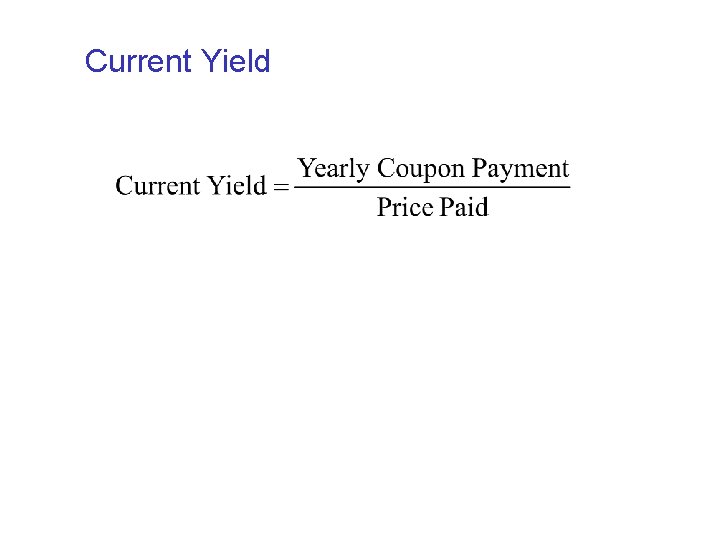

Current Yield

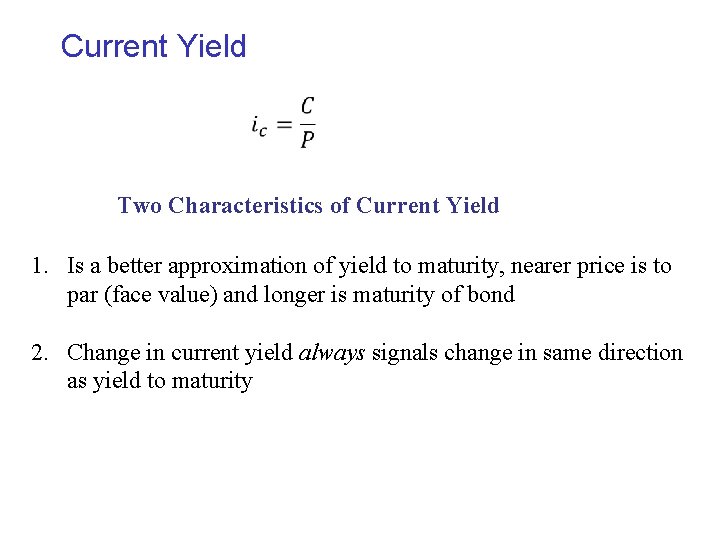

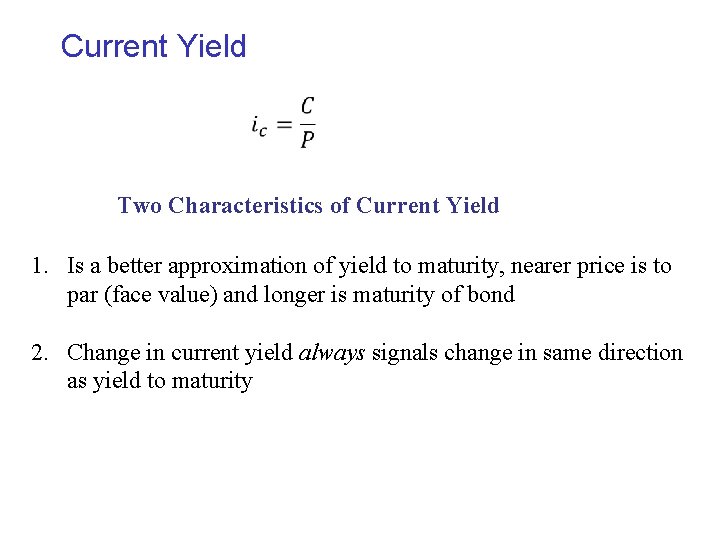

Current Yield Two Characteristics of Current Yield 1. Is a better approximation of yield to maturity, nearer price is to par (face value) and longer is maturity of bond 2. Change in current yield always signals change in same direction as yield to maturity

Yield on a Discount Basis SKIP

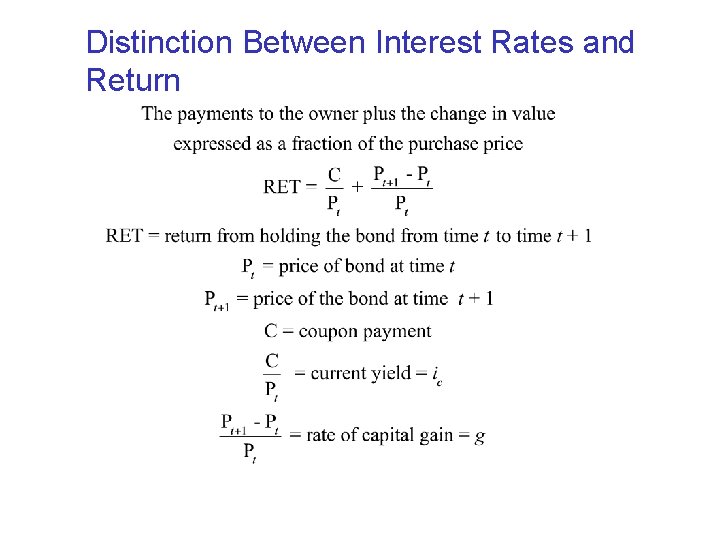

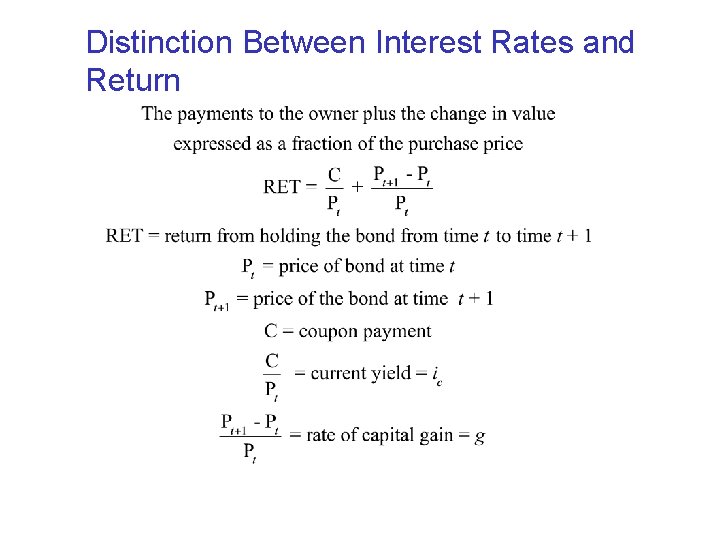

Distinction Between Interest Rates and Return

Holding Period Return • the return from holding a bond and selling it before maturity. • the holding period return can differ from the yield to maturity.

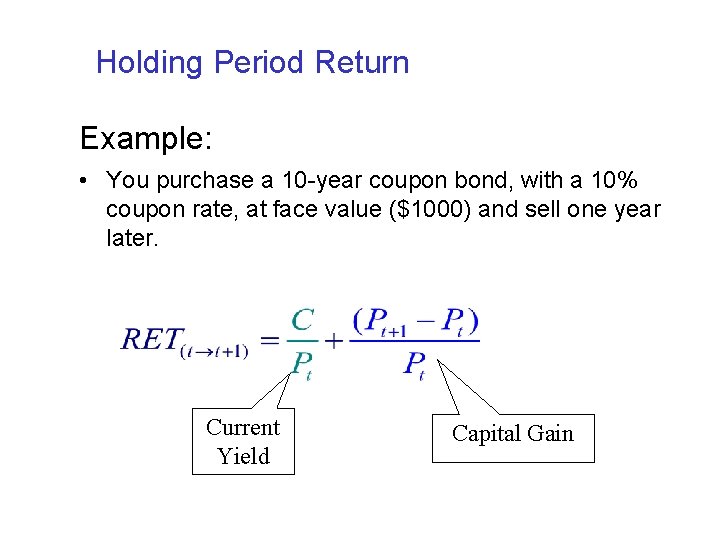

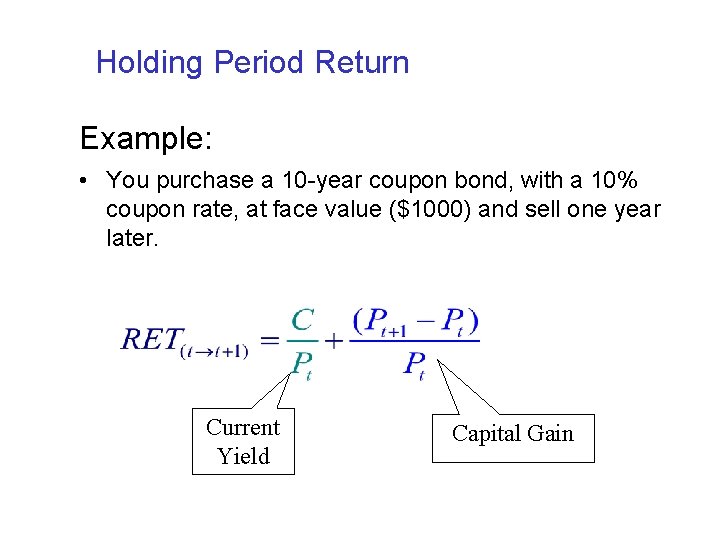

Holding Period Return Example: • You purchase a 10 -year coupon bond, with a 10% coupon rate, at face value ($1000) and sell one year later. Current Yield Capital Gain

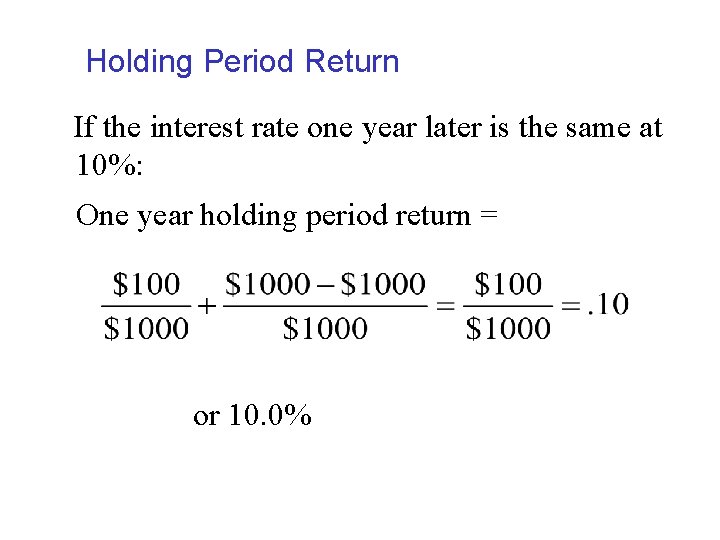

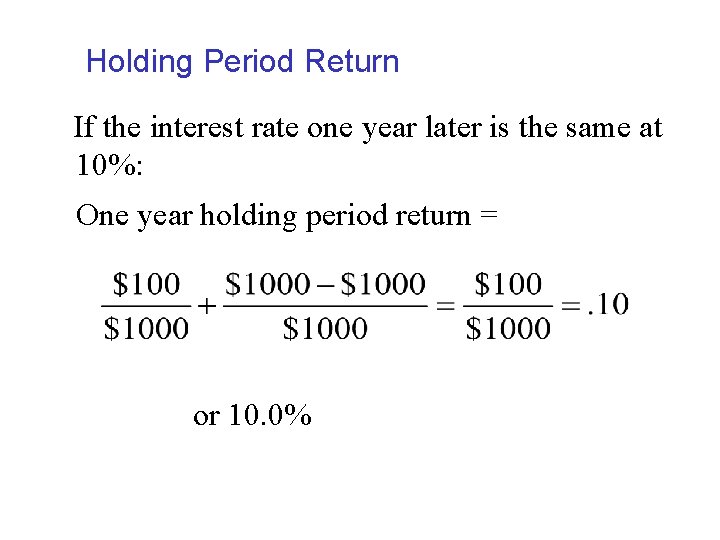

Holding Period Return If the interest rate one year later is the same at 10%: One year holding period return = or 10. 0%

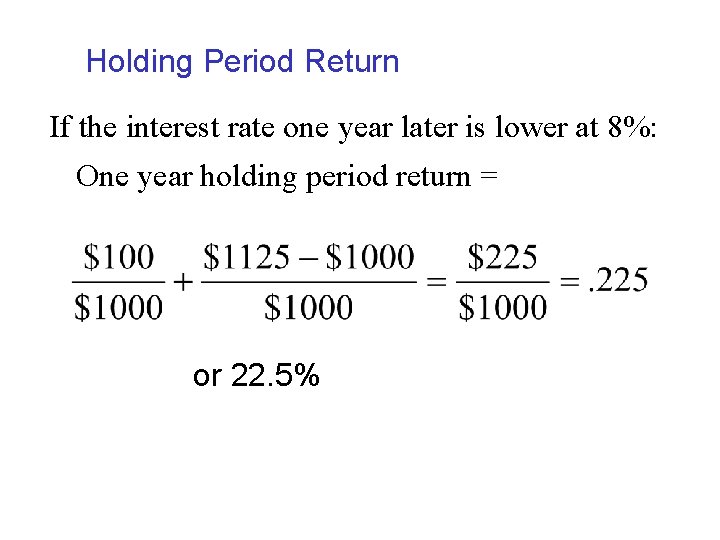

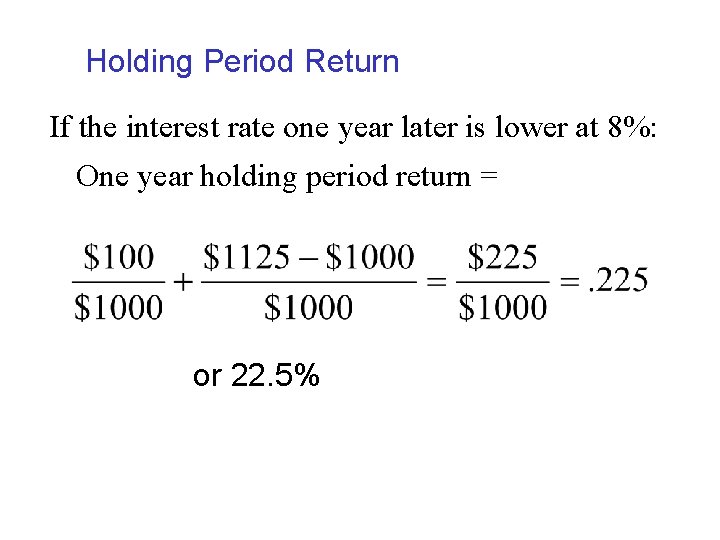

Holding Period Return If the interest rate one year later is lower at 8%: One year holding period return = or 22. 5%

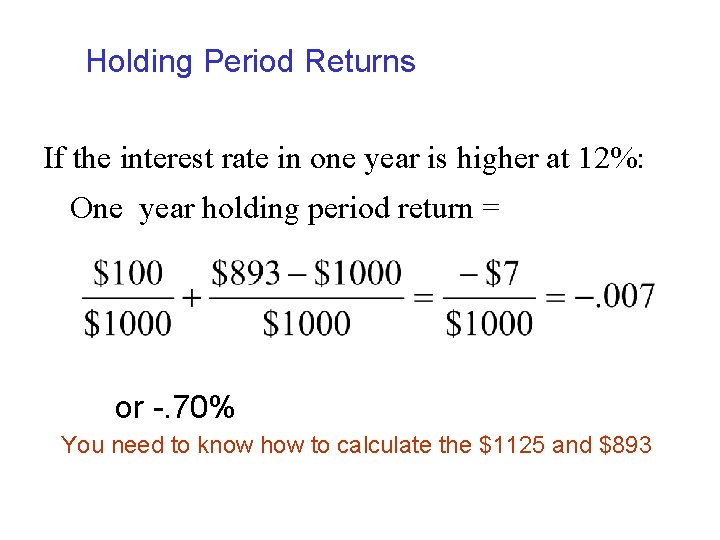

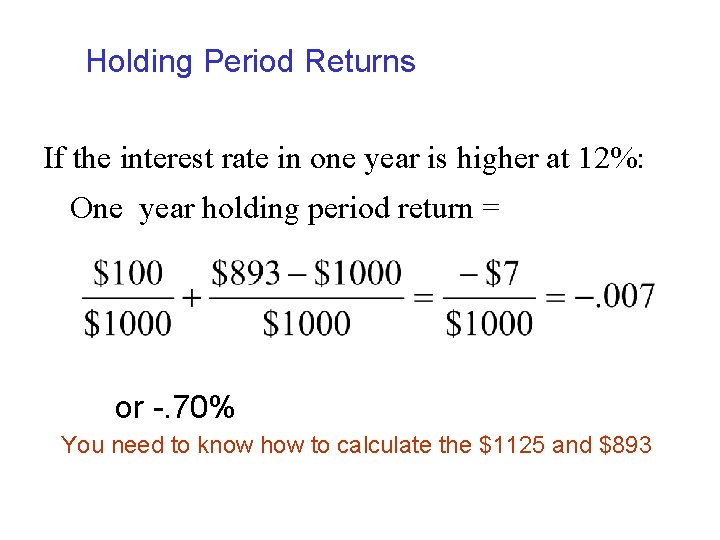

Holding Period Returns If the interest rate in one year is higher at 12%: One year holding period return = or -. 70% You need to know how to calculate the $1125 and $893

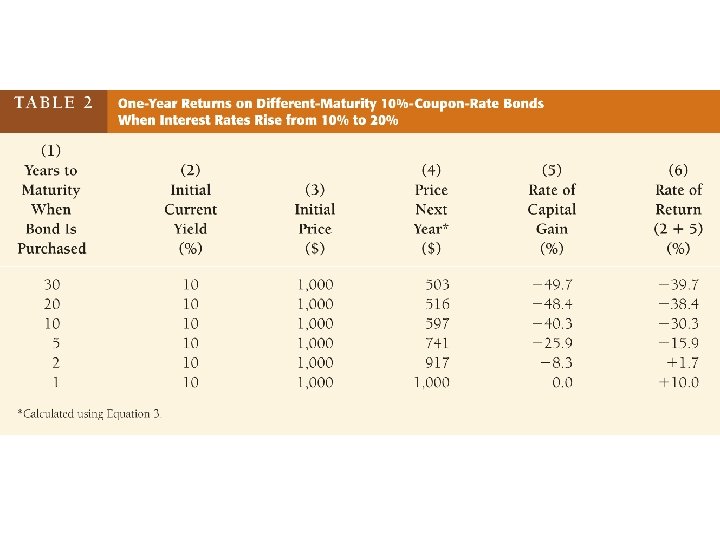

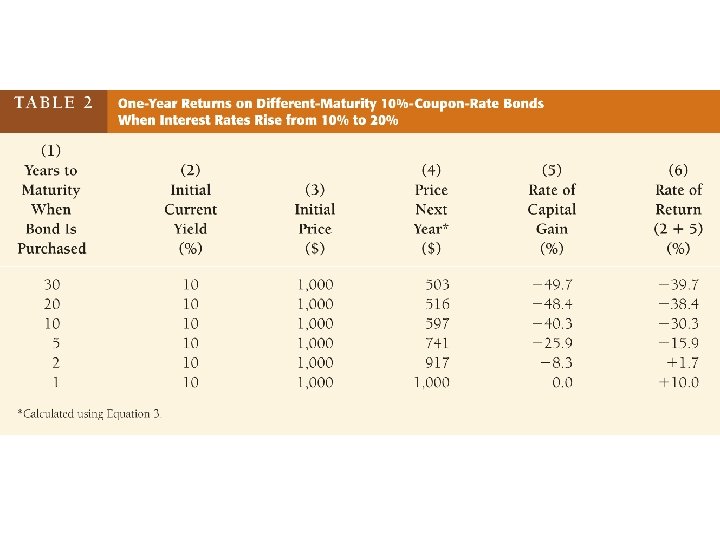

Key Conclusions From Table 2 • The return equals the yield to maturity (YTM) only if the holding period equals the time to maturity • A rise in interest rates is associated with a fall in bond prices, resulting in a capital loss if time to maturity is longer than the holding period • The more distant a bond’s maturity, the greater the size of the percentage price change associated with an interest-rate change

Key Conclusions From Table 2 • The more distant a bond’s maturity, the lower the rate of return that occurs as a result of an increase in the interest rate • Even if a bond has a substantial initial interest rate, its return can be negative if interest rates rise

Interest-Rate Risk • Change in bond price due to change in interest rate • Prices and returns for long-term bonds are more volatile than those for shorter-term bonds • There is no interest-rate risk for a bond whose time to maturity matches the holding period

Reinvestment (interest rate) Risk • If investor’s holding period exceeds the term to maturity proceeds from sale of bond are reinvested at new interest rate the investor is exposed to reinvestment risk • The investor benefits from rising interest rates, and suffers from falling interest rates

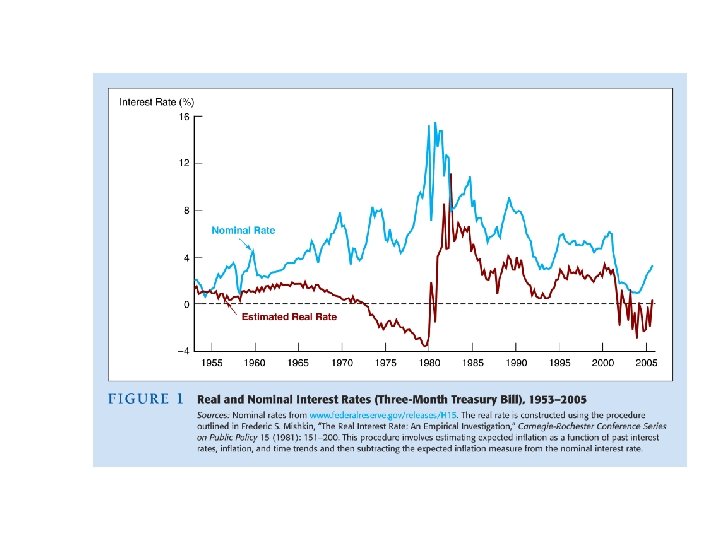

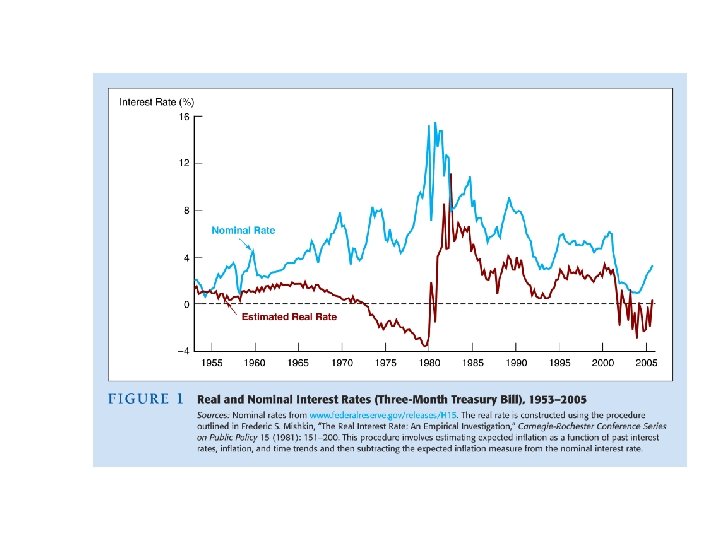

Real and Nominal Interest Rates • Nominal interest rate makes no allowance for inflation • Real interest rate is adjusted for changes in price level so it more accurately reflects the cost of borrowing • Ex ante real interest rate is adjusted for expected changes in the price level • Ex post real interest rate is adjusted for actual changes in the price level

Real and Nominal Interest Rates (i) Interest Rates expressed in current dollar terms. Real Interest Rates (r) Nominal Interest Rate adjusted for inflation.

Real and Nominal Interest Rates Fisher Equation: i = r + πe From this we get r = i - πe

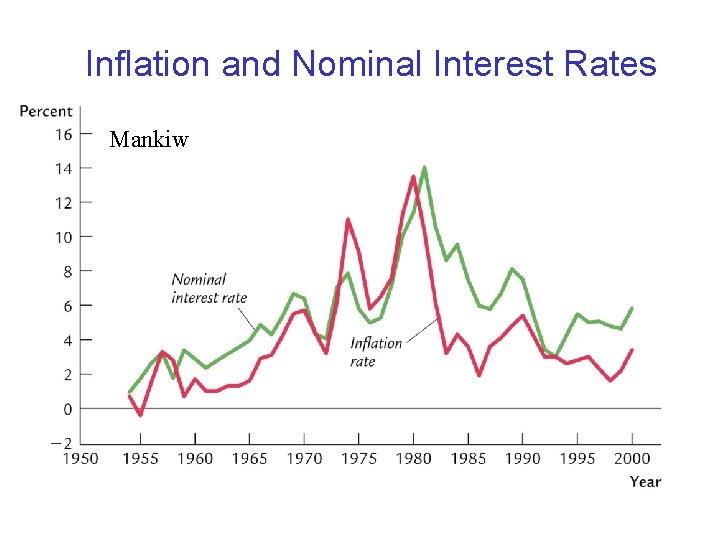

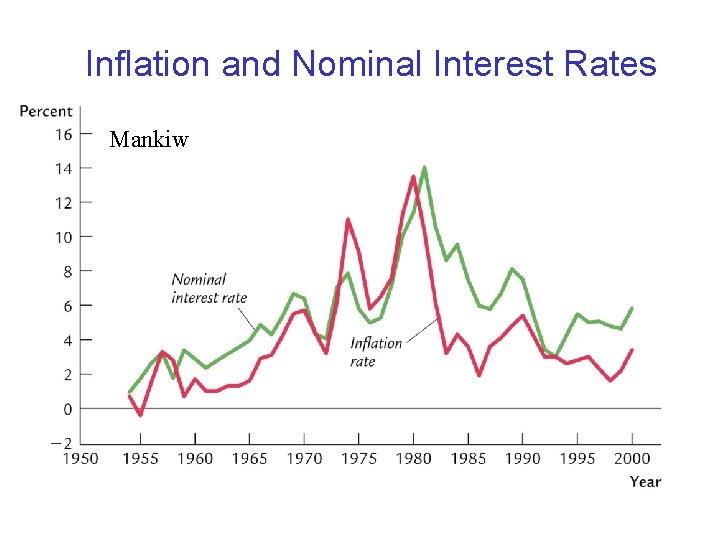

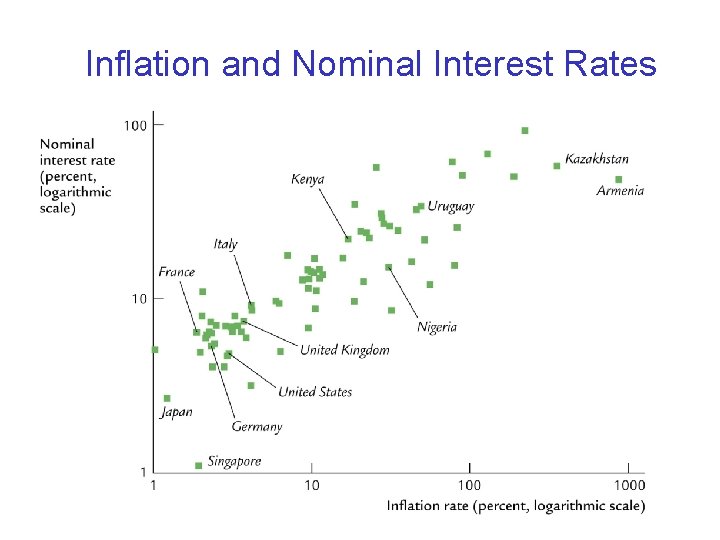

Inflation and Nominal Interest Rates Mankiw

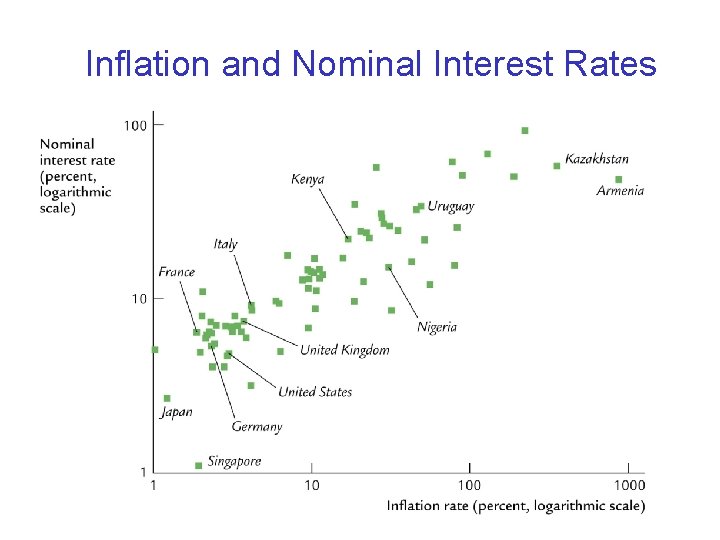

Inflation and Nominal Interest Rates

Real and Nominal Interest Rates Real Interest Rate: Interest rate that is adjusted for expected changes in the price level r = i – πe 1. 2. Real interest rate more accurately reflects true cost of borrowing When real rate is low, greater incentives to borrow and less to lend. if i = 5% and πe = 3% then: r = 5% – 3% = 2% if i = 8% and πe = 10% then r = 8% – 10% = – 2%

A measure in inflationary expectations • http: //www. bloomberg. com/ i = r + πe i - r = πe