WITHHOLDING TAX ON COMPENSATION Revenue Regulations No 2

- Slides: 94

WITHHOLDING TAX ON COMPENSATION (Revenue Regulations No. 2 -98, as amended) Presented by: MS. LILYBETH A. GANER, CPA, MBA Revenue Officer Assessment Division

Compensation Income Defined Compensation means all remuneration for services performed by an employee for his employer under an employee-employer relationship unless exempted by the Code.

Exemptions (cont…) 1. Remunerations received as an incident of employment, as follows: (a) Retirement benefits received under RA No. 7461 and under a reasonable private benefit plan (b) Benefits received due to death, sickness or other physical disability or for any cause beyond the control of the said official or employee

Exemptions (cont…) (c) Social security benefits, retirement gratuities, pensions and other similar benefits received by residents, non-resident citizens and resident aliens

Exemptions (cont…) (d) Payments of benefits due or to become due to any person residing in the Philippines under the law of the United States administered by the United States Veterans Administration; (e) Payments of benefits made under the Social Security System Act of 1945, as amended; and (f) Benefits received from the GSIS Act of 1937, as amended, and the retirement gratuity received by government officials and employees.

Exemptions (cont…) 2. Remuneration paid for agricultural labor. 3. Remuneration for casual labor not in the course of an employer’s trade or business. 4. Compensation for services by a citizen or resident of the Philippines for a foreign government or an international organization.

Exemptions (cont…) 5. Damages 6. Life insurance 7. Amount received by the insured as a return of premium 8. Compensation for injuries or sickness 9. Income exempt under treaty

Exemptions (cont…) 10. Remuneration for domestic services 11. GSIS, SSS, Medicare and other contributions (HDMF and Union Dues)

Exemptions (cont…) 12. Thirteenth(13 th) Month Pay and Other Benefits not exceeding P 30, 000 Other Benefits such as ² Christmas bonus ² Productivity ² Loyalty Award ² Gifts in cash or in kind ² Other benefits of similar nature ² Excess over the prescribed ceiling of the “de minimis benefits”

Exemptions (cont…) 13. Compensation income of MWEs who work in the private sector and being paid the Statutory Minimum Wage applicable to the place where he is assigned.

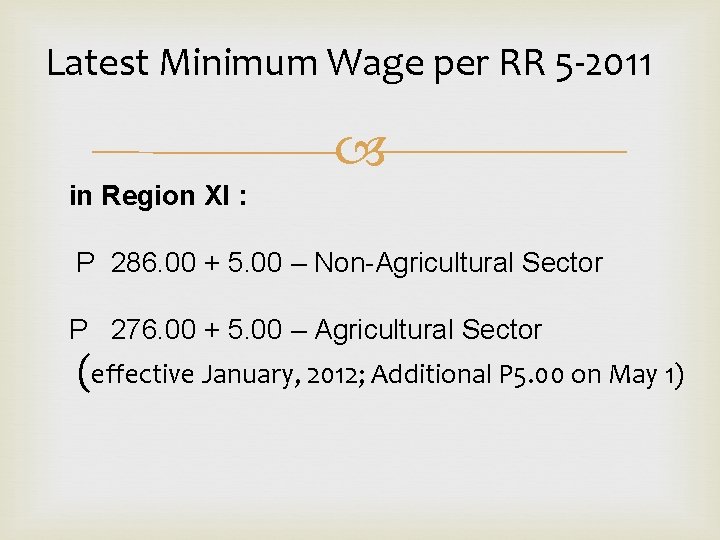

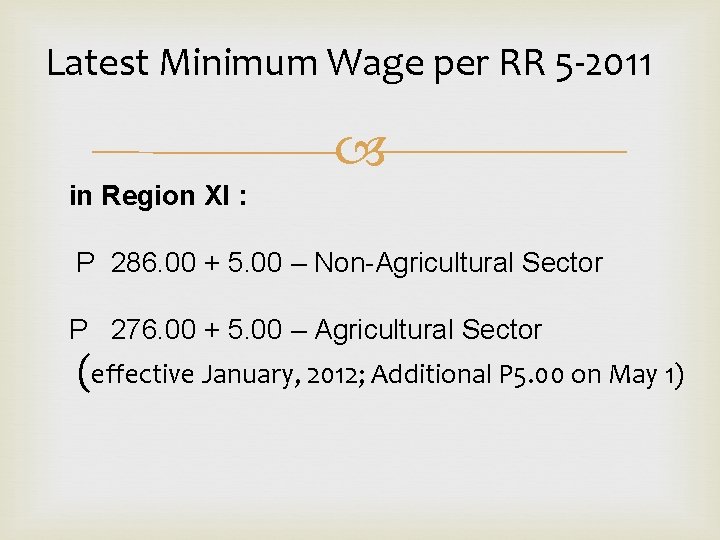

Latest Minimum Wage per RR 5 -2011 in Region XI : P 286. 00 + 5. 00 – Non-Agricultural Sector P 276. 00 + 5. 00 – Agricultural Sector (effective January, 2012; Additional P 5. 00 on May 1)

The following compensation received by minimum wage earners shall likewise be exempt from income tax: ü holiday pay ü overtime pay ü night shift differential pay ü hazard pay

Exemptions (cont…) (14) Compensation income of employees in the public sector with compensation income of not more than the SMW in the non-agricultural sector, as fixed by RTWPB/NWPC, applicable to the place where he is assigned.

Take note! who An employee receives additional compensation other than SMW, holiday pay, overtime, hazard pay, and night shift differential pay such as: Commissions Honoraria Fringe benefits Taxable allowances And other taxable income shall not enjoy the privilege of being a MWE.

Hazard Pay the amount paid by the employer to MWEs Actually assigned to danger or strife-torn areas Disease-infested places Distressed or isolated stations and camps which exposed them to great danger or contagion or peril to life Any hazard pay paid to MWEs which does not satisfy the above criteria is deemed subject to IT and consequently to WT.

DE MINIMIS BENEFITS (As amended by RR 5 -2011) a. ) Monetized unused vacation leave credits of private employees not exceeding 10 days during the year; b. ) Monetized value of vacation and sick leave credits paid to government officials and employees; c. ) Medical cash allowance to dependents of employees, not exceeding p 750 per employee per semester or P 125/month

DE MINIMIS BENEFITS d) Rice subsidy of P 1, 500 or 1 sack of 50 kg rice per month amounting to not more than P 1, 500; e. ) Uniform and clothing allowance not exceeding P 4, 000/ annum; f. ) Actual medical assistance, e. g. medical allowance to cover medical and healthcare needs, annual medical/executive check-up, maternity assistance, and routine consultations, not exceeding P 10, 000 per annum;

DE MINIMIS BENEFITS g. ) Laundry allowance not exceeding P 300 per month h. ) Employees achievement awards, e. g. , for length of service or safety achievement, which must be in the form of tangible personal property other than cash or gift certificate, with an annual monetary value not exceeding P 10, 000 received by the employee under an established written plan which does not discriminate in favor of highly paid employees;

DE MINIMIS BENEFITS i. ) Gifts given during Christmas and major anniversary celebrations not exceeding P 5, 000 per employee per annum; j. ) Daily meal allowance for overtime work and night/graveyard shift not exceeding 25% of basic minimum wage on a per region basis.

DE MINIMIS Rules q “DE MINIMIS BENEFITS” conforming to the ceiling shall not be considered in determining the P 30, 000 q the excess over the respective ceilings shall be considered as part of the “other benefits” and the employee receiving it will be subject to tax only on the excess over the P 30, 000.

Sec. 4. Sec 2. 79. 1 Application for individuals Earning Compensation Income (Form 1902) v the application for registration should be accomplished by both employer and employee relating to the following:

(A)Employee: Name/TIN, address & more as indicated in form 1902 Status– single, married, others If married: v Status of spouse - name/TIN - employed, abroad, ETB, unemployed Qualified dependents v Name, date of birth of QDC

Claimant of exemption for QDC v Husband, wife if Husband is unemployed NRC, income from foreign sources WAIVES HIS RIG HT TO CLAIM EXEMPTION for all children and attach the sworn declaration to his 1902 and that of his wife’s

Required forms and attachments: v birth certificate v marriage contract if married v birth certificate of QDC certified by Local Civil Registry/ NSO ( if not applicable, any doc. issued by a gov’t office) v certificate of employment if Husband works abroad

vsworn declaration and waiver of right to claim exemptions of QDC ( Annex “F” ) v medical cert of QDC, if incapacitated v court decision of legally adopted children v death certificate v other documentary evidence

Concurrent multiple employments: v Shall file 1902 to his primary employer and furnish copy to his secondary employer/s Successive multiple employment: v furnish his new employer with form 2305 (Cert. of Update of Exemption and of Employer’s and Employee’s Information) previous employer’s name, address, TIN And date of separation attach form 2316 (Cert. of compensation payment/ tax withheld) for compensation payment with or without w/holding tax for the CY issued by prev. employers.

Mixed Income v Individual with mixed income shall first deduct the allowable personal and add’l exemptions from compensation income, only the excess there from can be deducted from business/prof. income (B) EMPLOYER: accepts the 1902 filed by the new hired, indicate the date of receipt, accomplish part V (employer’s name, add, TIN, and other relevant infos. )

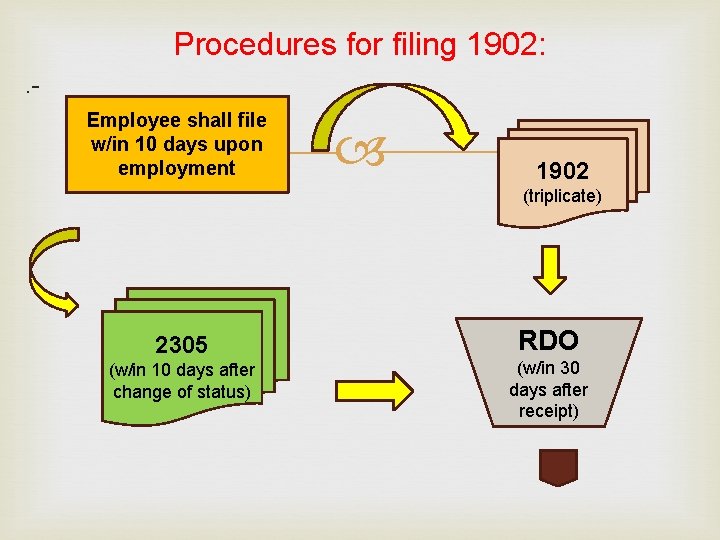

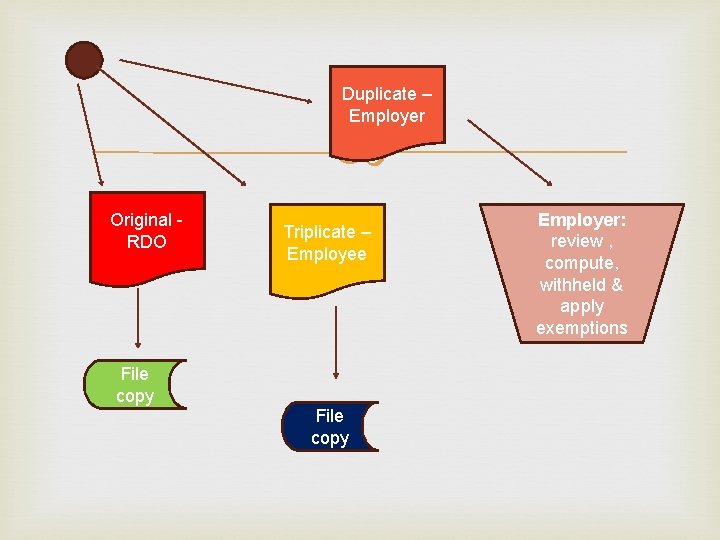

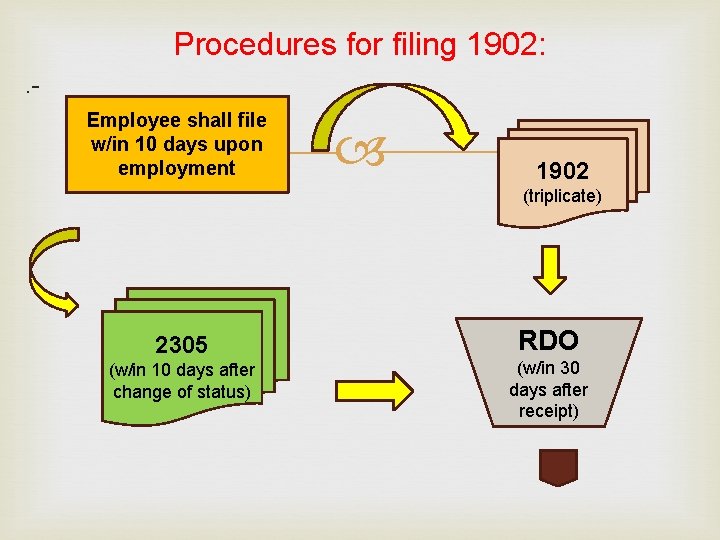

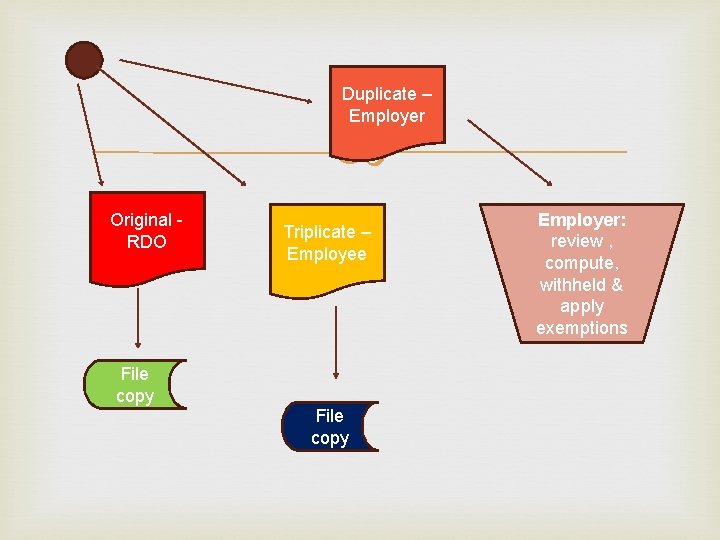

Procedures for filing 1902: . Employee shall file w/in 10 days upon employment 1902 (triplicate) 2305 (w/in 10 days after change of status) RDO (w/in 30 days after receipt)

Duplicate – Employer Original - RDO Triplicate – Employee File copy Employer: review , compute, withheld & apply exemptions

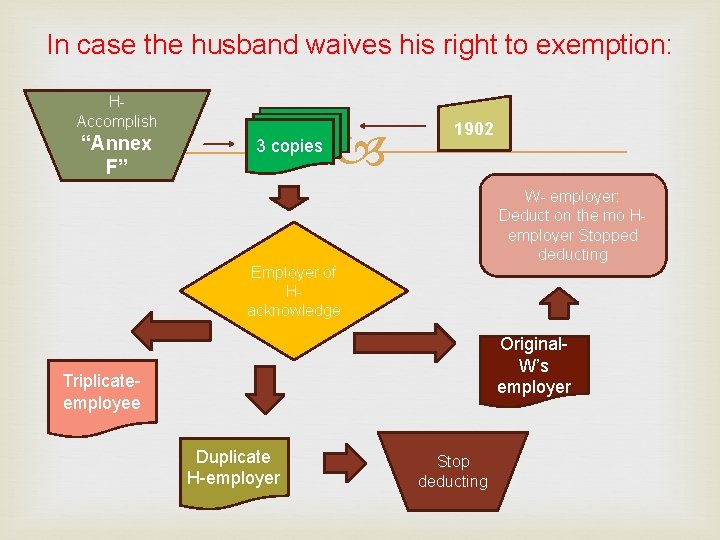

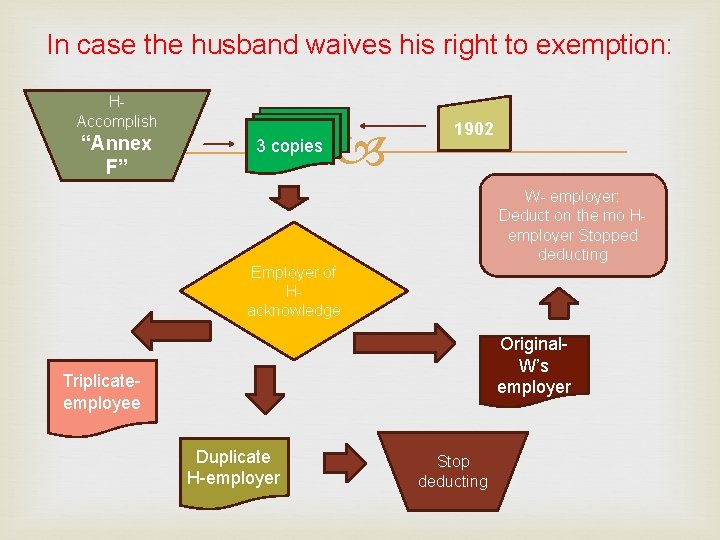

In case the husband waives his right to exemption: HAccomplish “Annex F” 3 copies 1902 W- employer: Deduct on the mo H- employer Stopped deducting Employer of H- acknowledge Original- W’s employer Triplicateemployee Duplicate H-employer Stop deducting

Failure to file 1902: Ø Zero exemption shall be applied based on the revised withholding tax table Failure to file 2305: Ø employer shall withhold based on reported personal exemptions existing prior to change

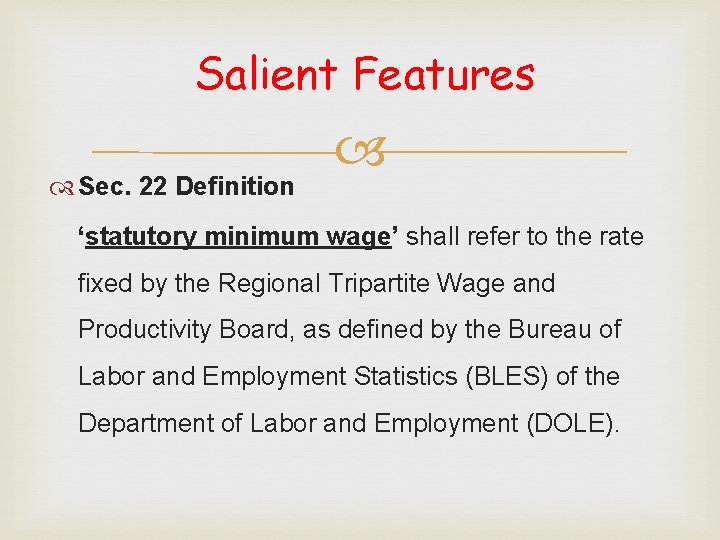

Salient Features Sec. 22 Definition ‘statutory minimum wage’ shall refer to the rate fixed by the Regional Tripartite Wage and Productivity Board, as defined by the Bureau of Labor and Employment Statistics (BLES) of the Department of Labor and Employment (DOLE).

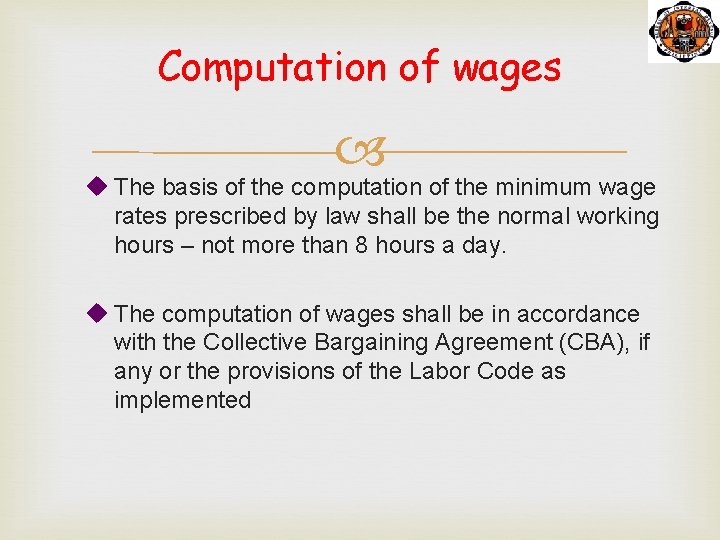

Computation of wages u The basis of the computation of the minimum wage rates prescribed by law shall be the normal working hours – not more than 8 hours a day. u The computation of wages shall be in accordance with the Collective Bargaining Agreement (CBA), if any or the provisions of the Labor Code as implemented

FACTOR OR NUMBER OF WORKING/PAID DAYS IN A YEAR

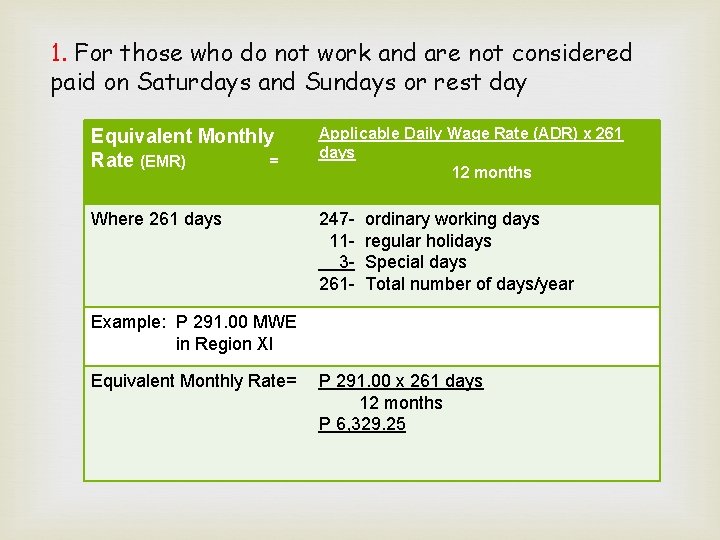

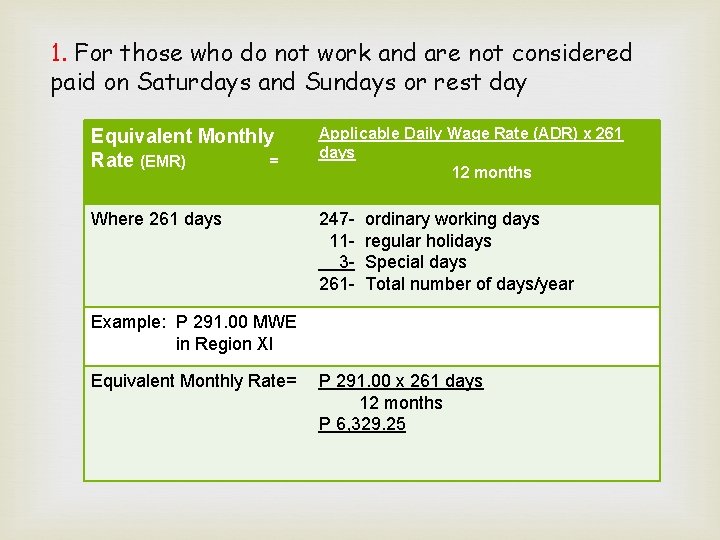

1. For those who do not work and are not considered paid on Saturdays and Sundays or rest day Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 261 days 12 months Where 261 days 247 - ordinary working days 11 - regular holidays 3 - Special days 261 - Total number of days/year Example: P 291. 00 MWE in Region XI Equivalent Monthly Rate= P 291. 00 x 261 days 12 months P 6, 329. 25

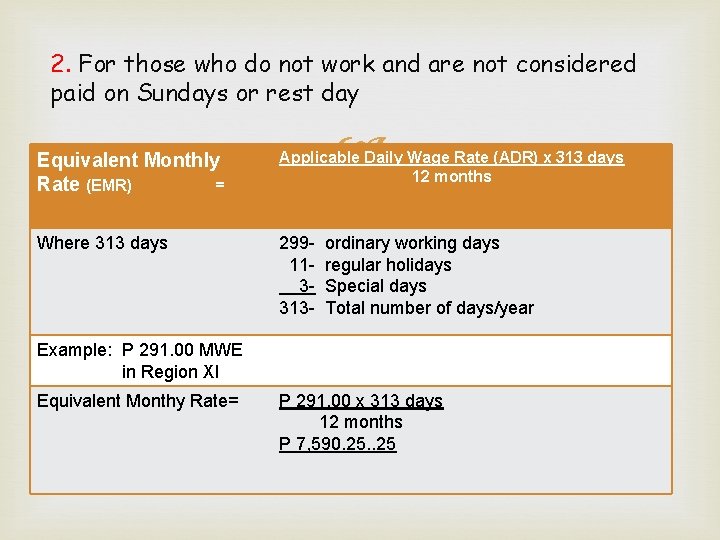

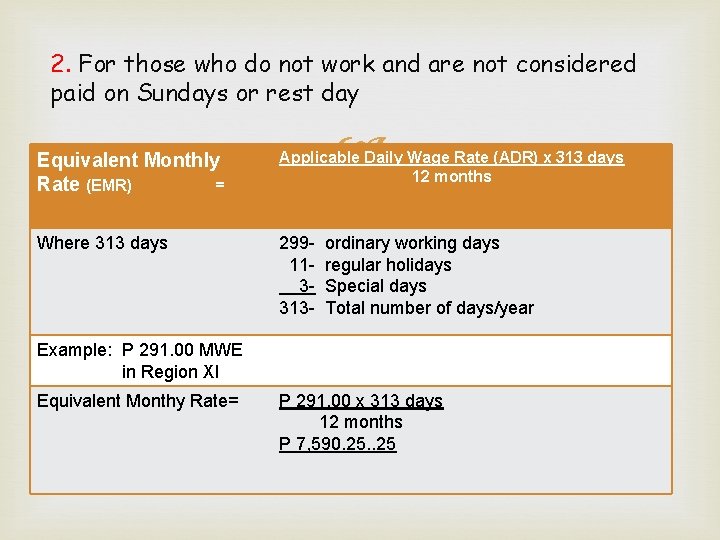

2. For those who do not work and are not considered paid on Sundays or rest day Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 313 days 12 months Where 313 days 299 - ordinary working days 11 - regular holidays 3 - Special days 313 - Total number of days/year Example: P 291. 00 MWE in Region XI Equivalent Monthy Rate= P 291. 00 x 313 days 12 months P 7, 590. 25

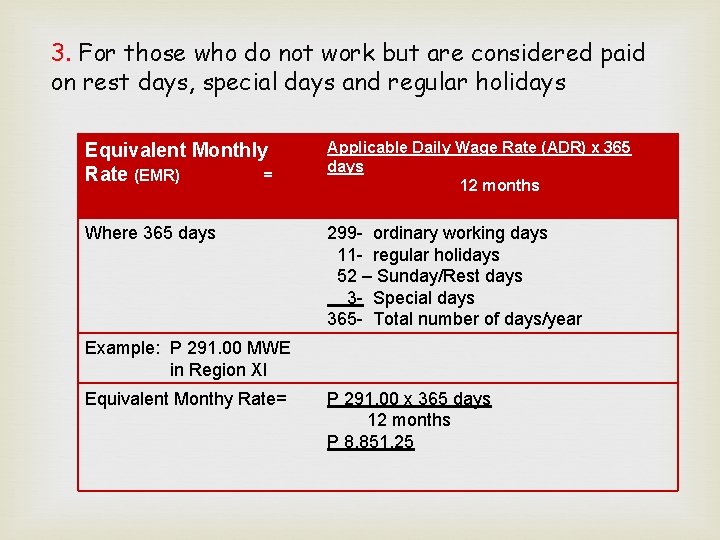

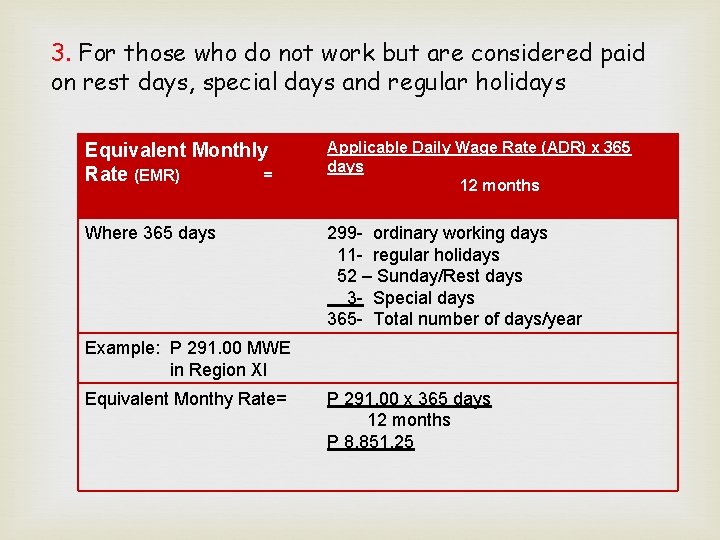

3. For those who do not work but are considered paid on rest days, special days and regular holidays Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 365 days 12 months Where 365 days 299 - ordinary working days 11 - regular holidays 52 – Sunday/Rest days 3 - Special days 365 - Total number of days/year Example: P 291. 00 MWE in Region XI Equivalent Monthy Rate= P 291. 00 x 365 days 12 months P 8, 851. 25

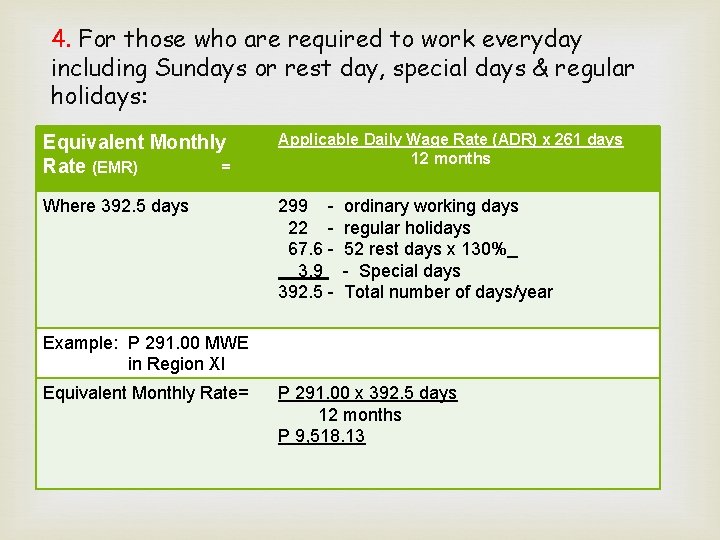

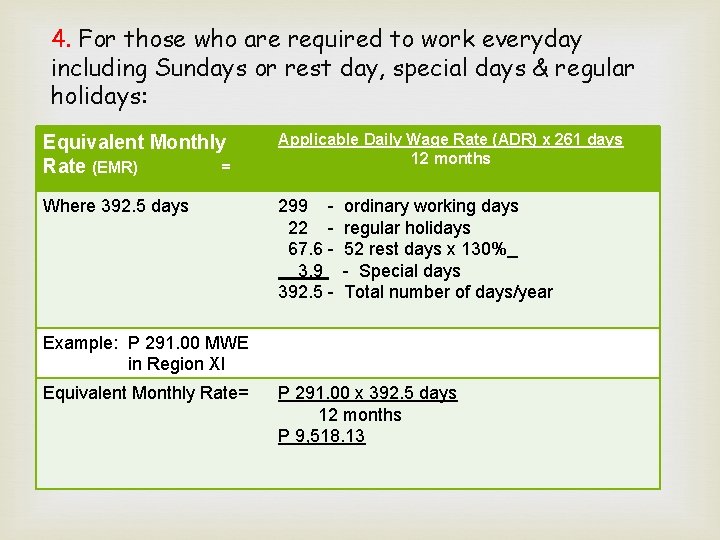

4. For those who are required to work everyday including Sundays or rest day, special days & regular holidays: Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 261 days 12 months Where 392. 5 days 299 - ordinary working days 22 - regular holidays 67. 6 - 52 rest days x 130% 3. 9 - Special days 392. 5 - Total number of days/year Example: P 291. 00 MWE in Region XI Equivalent Monthly Rate= P 291. 00 x 392. 5 days 12 months P 9, 518. 13

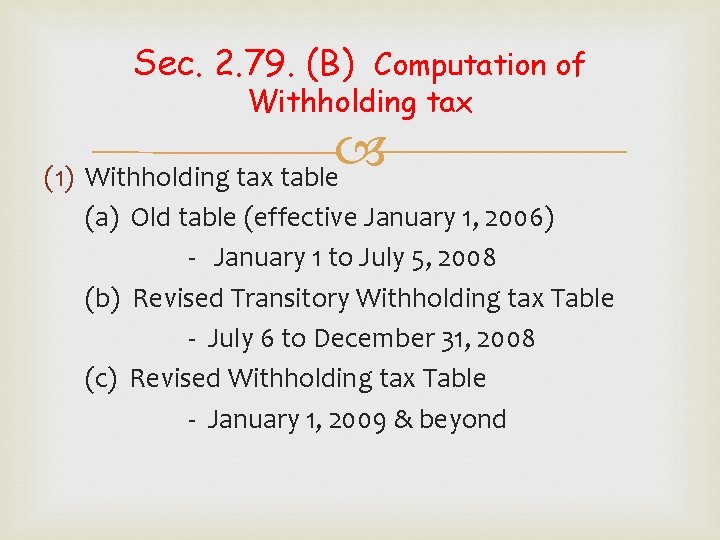

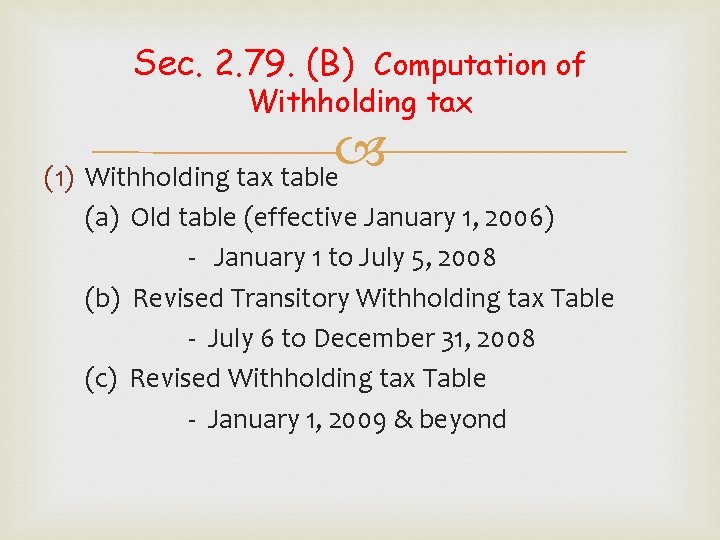

Sec. 2. 79. (B) Computation of Withholding tax (1) Withholding tax table (a) Old table (effective January 1, 2006) - January 1 to July 5, 2008 (b) Revised Transitory Withholding tax Table - July 6 to December 31, 2008 (c) Revised Withholding tax Table - January 1, 2009 & beyond

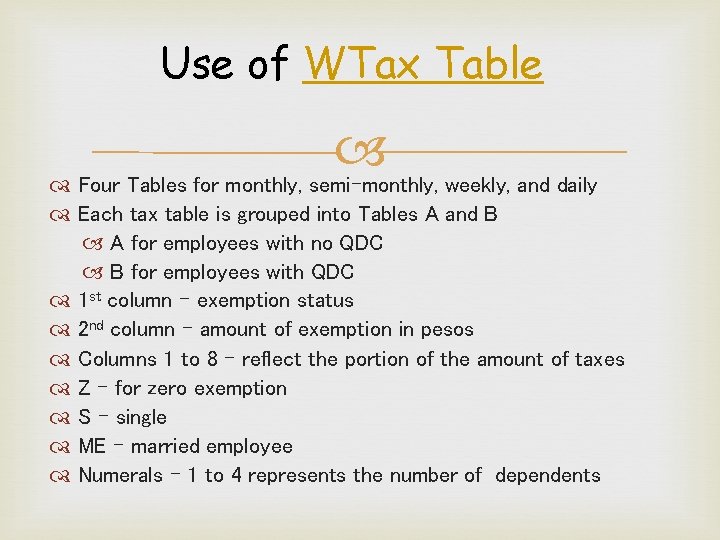

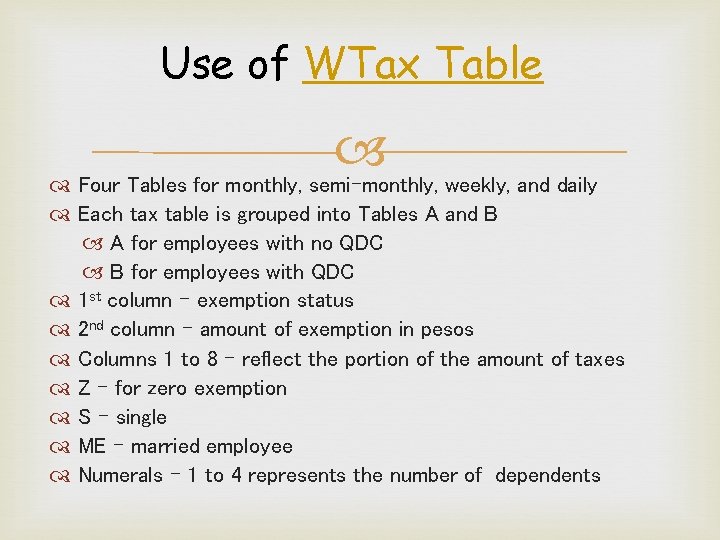

Use of WTax Table Four Tables for monthly, semi-monthly, weekly, and daily Each tax table is grouped into Tables A and B A for employees with no QDC B for employees with QDC 1 st column – exemption status 2 nd column – amount of exemption in pesos Columns 1 to 8 – reflect the portion of the amount of taxes Z – for zero exemption S – single ME – married employee Numerals – 1 to 4 represents the number of dependents

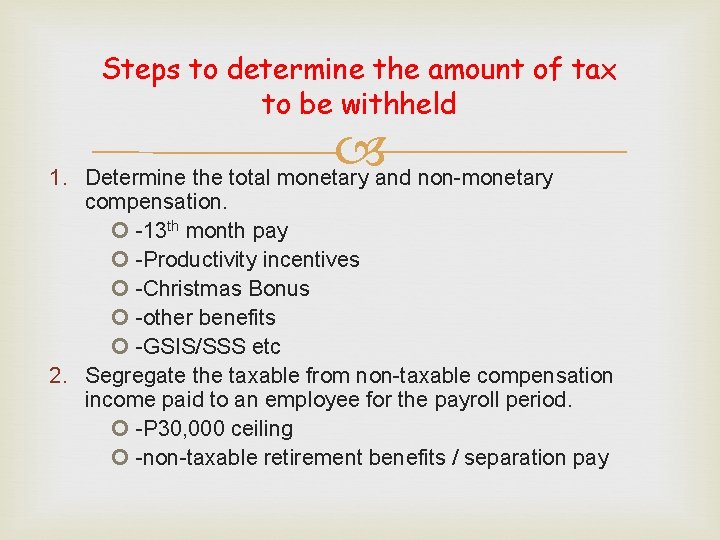

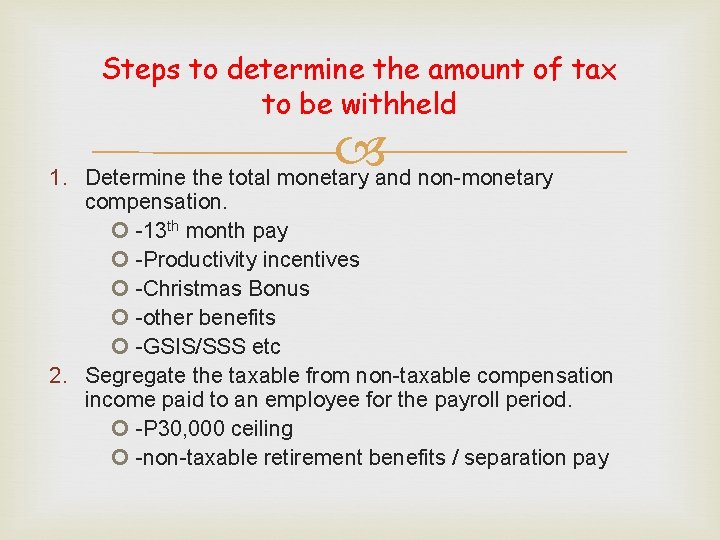

Steps to determine the amount of tax to be withheld 1. Determine the total monetary and non-monetary compensation. -13 th month pay -Productivity incentives -Christmas Bonus -other benefits -GSIS/SSS etc 2. Segregate the taxable from non-taxable compensation income paid to an employee for the payroll period. -P 30, 000 ceiling -non-taxable retirement benefits / separation pay

Steps to determine the amount of tax to be withheld (3. )Segregate the taxable compensation income determined in step 2 into regular taxable compensation income and supplementary compensation. Regular compensation – basic salary, fixed allowances for representation, transportation and other allowances Supplementary compensation – commission, overtime pay, taxable retirement pay, taxable bonus and other taxable benefits

Steps……. . (4) Use the appropriate tables (5) Fix the compensation level using the regular compensation income. (6) Compute the withholding tax due.

Right to claim WT exemption An employee receiving compensation income shall be entitled to w/tax exemptions, provided he/she must file 1902 – Application for registration 2305 – Cert. of Update of Exemption and of Employer’s and Employee’s Information

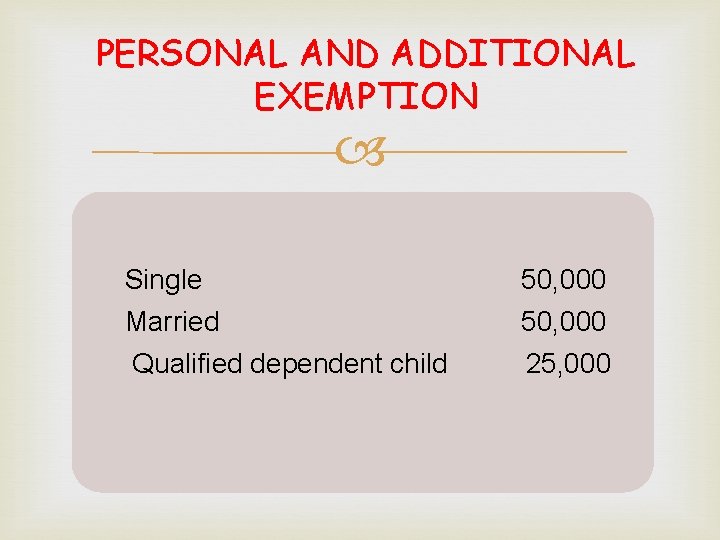

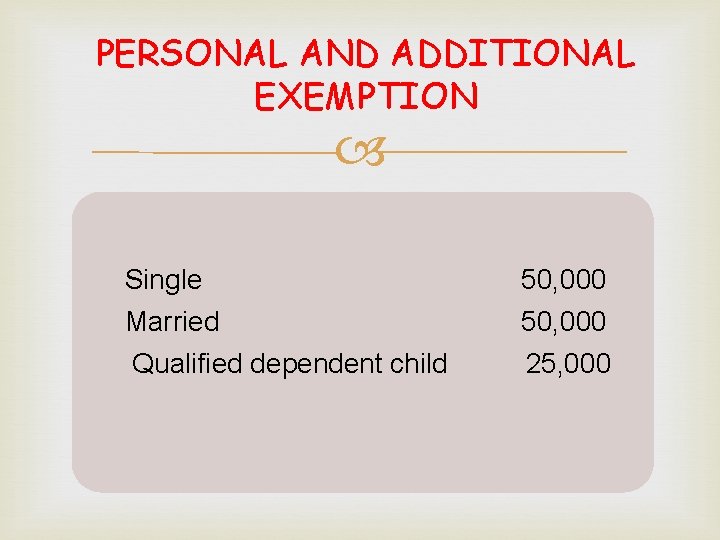

PERSONAL AND ADDITIONAL EXEMPTION Single 50, 000 Married 50, 000 Qualified dependent child 25, 000

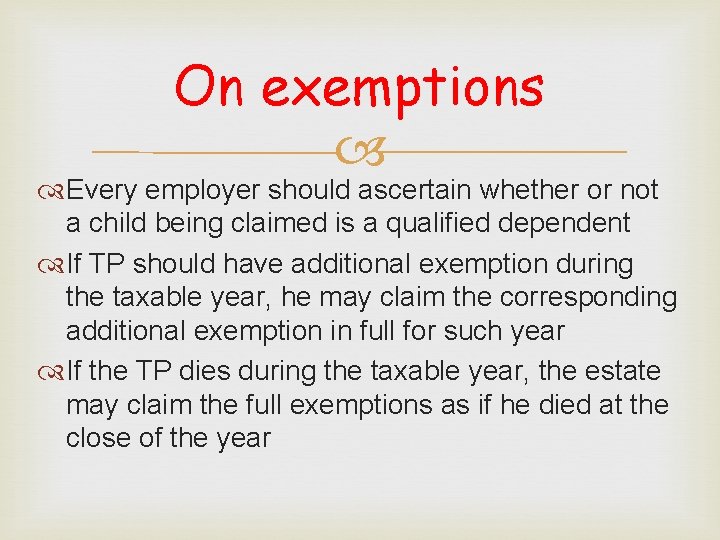

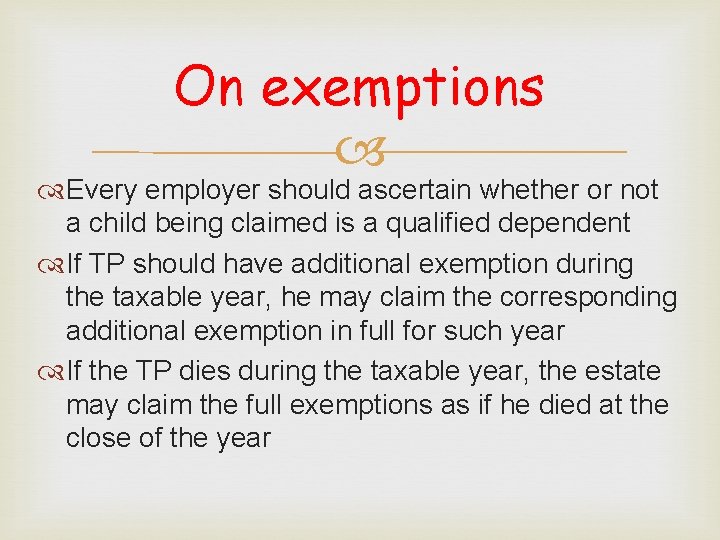

On exemptions Every employer should ascertain whether or not a child being claimed is a qualified dependent If TP should have additional exemption during the taxable year, he may claim the corresponding additional exemption in full for such year If the TP dies during the taxable year, the estate may claim the full exemptions as if he died at the close of the year

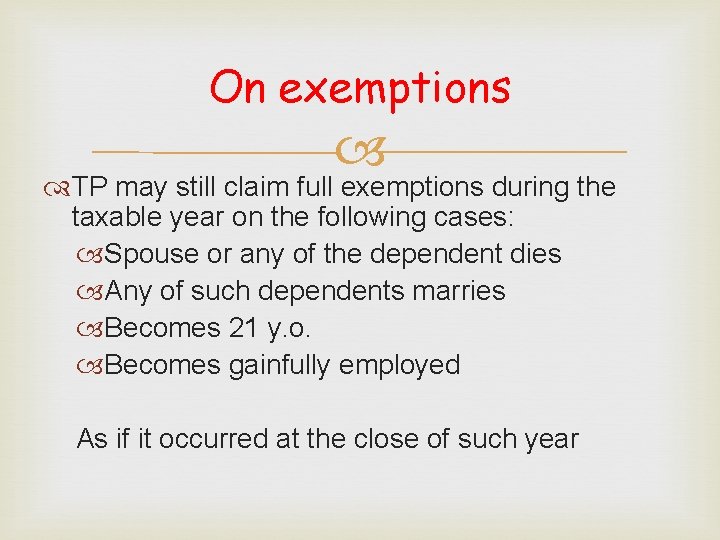

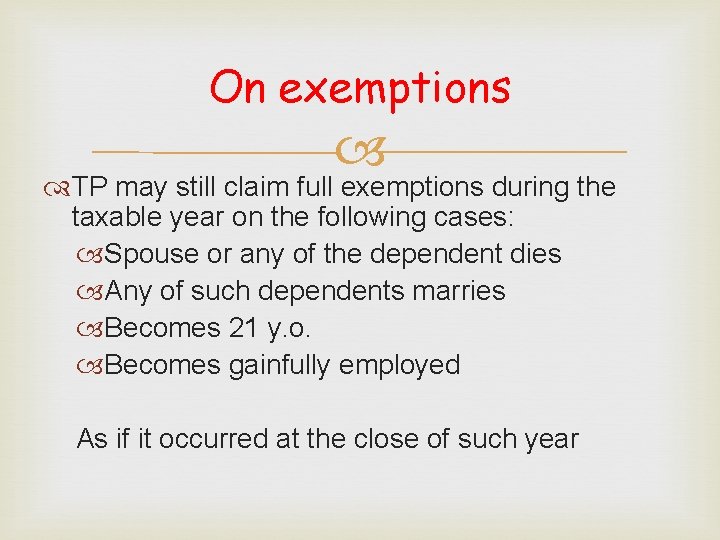

On exemptions TP may still claim full exemptions during the taxable year on the following cases: Spouse or any of the dependent dies Any of such dependents marries Becomes 21 y. o. Becomes gainfully employed As if it occurred at the close of such year

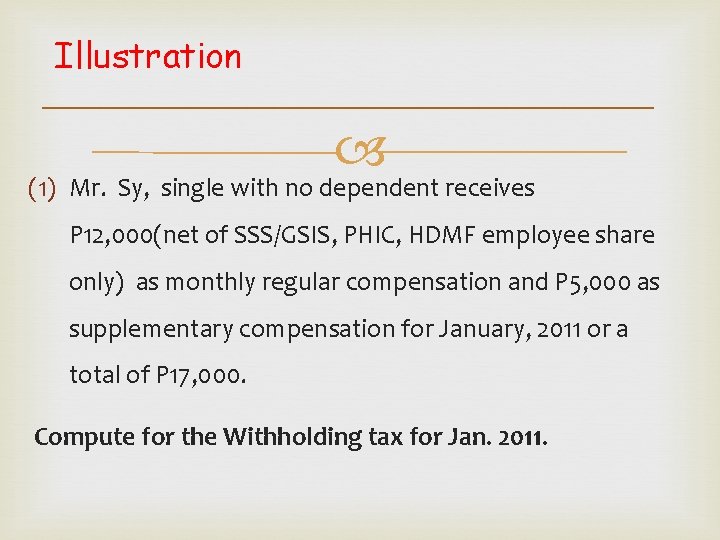

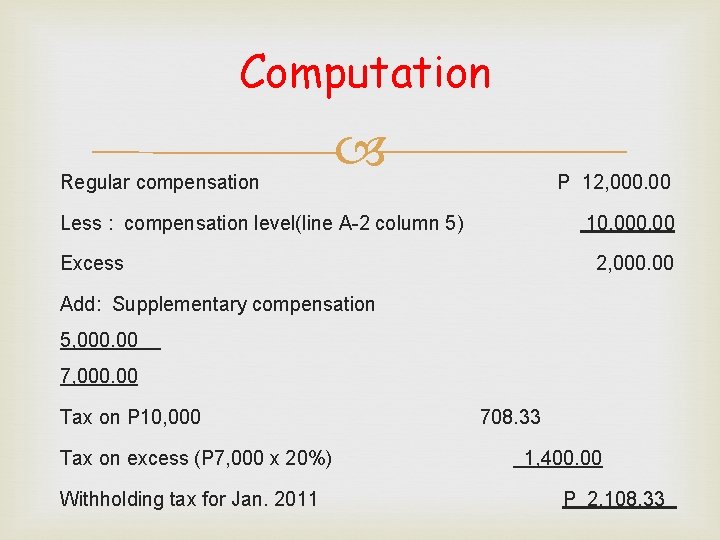

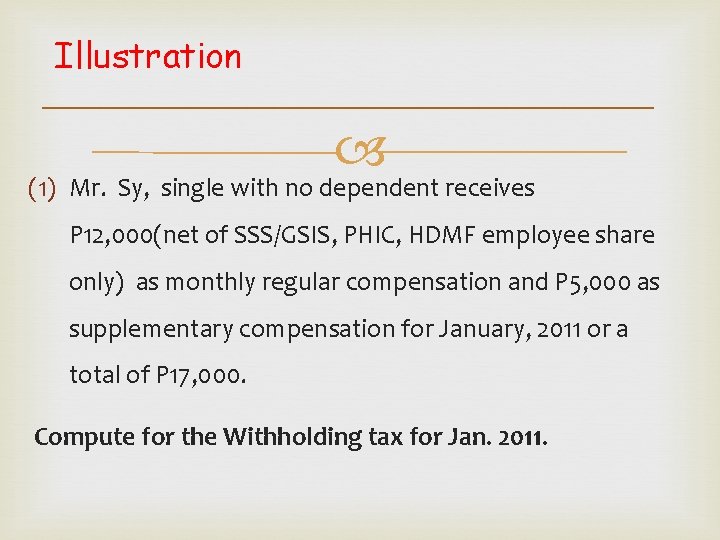

Illustration (1) Mr. Sy, single with no dependent receives P 12, 000(net of SSS/GSIS, PHIC, HDMF employee share only) as monthly regular compensation and P 5, 000 as supplementary compensation for January, 2011 or a total of P 17, 000. Compute for the Withholding tax for Jan. 2011.

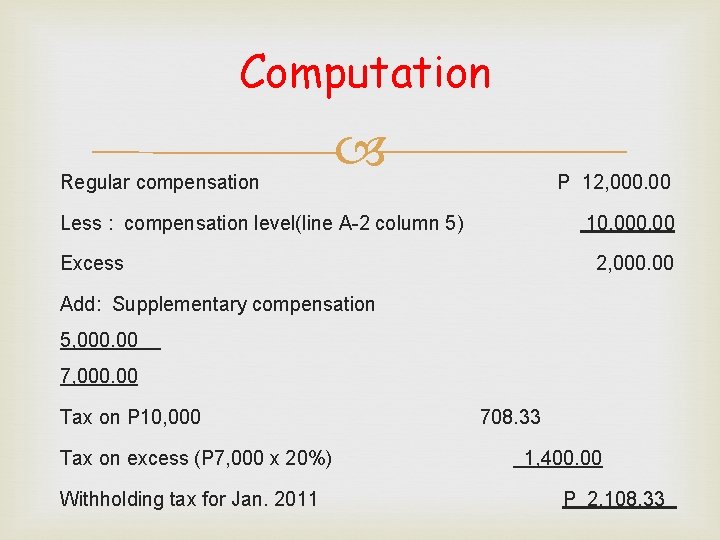

Computation Regular compensation P 12, 000. 00 Less : compensation level(line A-2 column 5) 10, 000. 00 Excess 2, 000. 00 Add: Supplementary compensation 5, 000. 00 7, 000. 00 Tax on P 10, 000 708. 33 Tax on excess (P 7, 000 x 20%) 1, 400. 00 Withholding tax for Jan. 2011 P 2, 108. 33

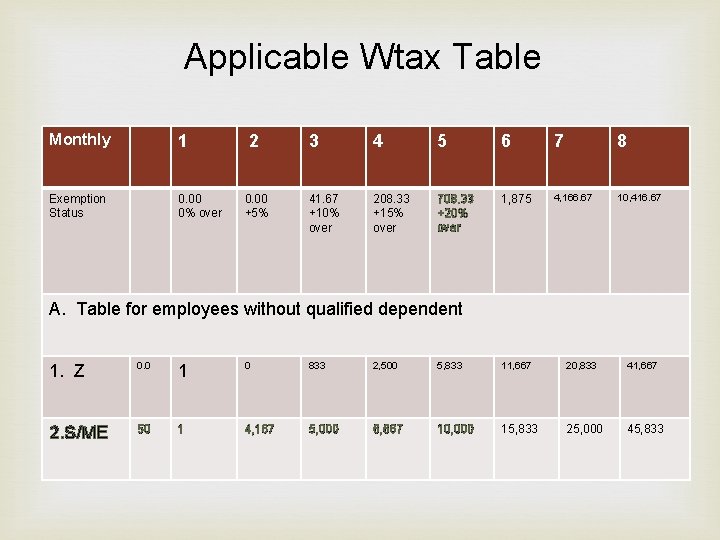

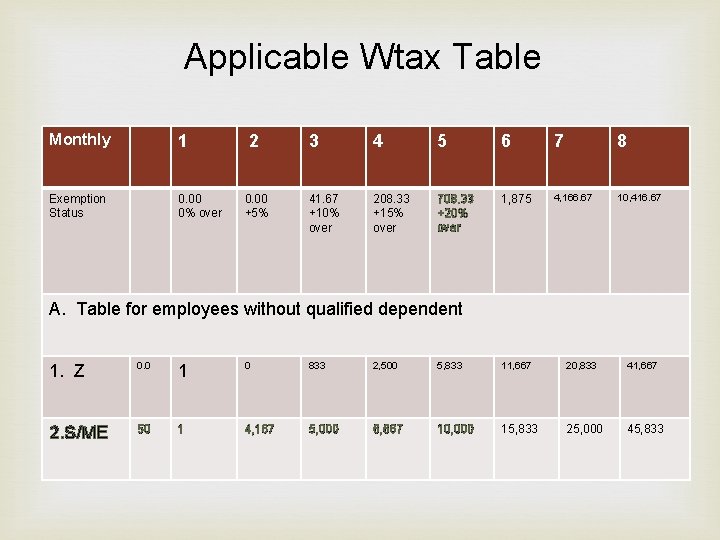

Applicable Wtax Table Monthly 1 Exemption Status 0. 00 0% over 2 0. 00 +5% 3 41. 67 +10% over 4 5 6 7 8 208. 33 +15% over 708. 33 +20% over 1, 875 4, 166. 67 10, 416. 67 A. Table for employees without qualified dependent 1. Z 0. 0 1 0 833 2, 500 5, 833 11, 667 20, 833 41, 667 2. S/ME 50 1 4, 167 5, 000 6, 667 10, 000 15, 833 25, 000 45, 833

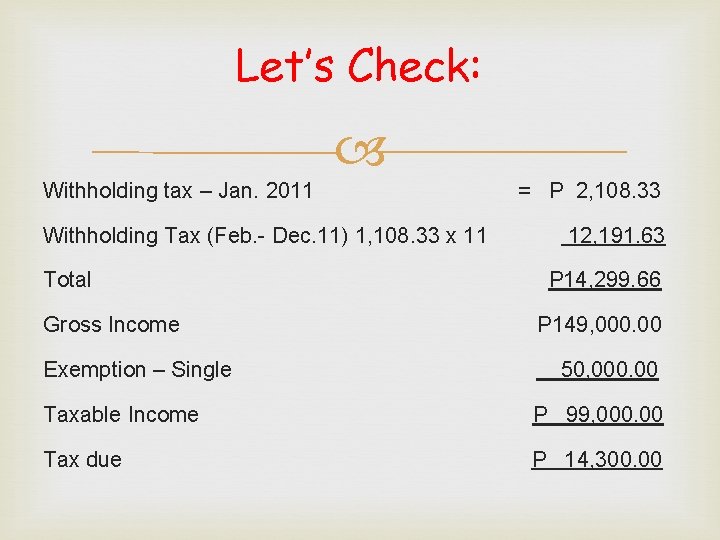

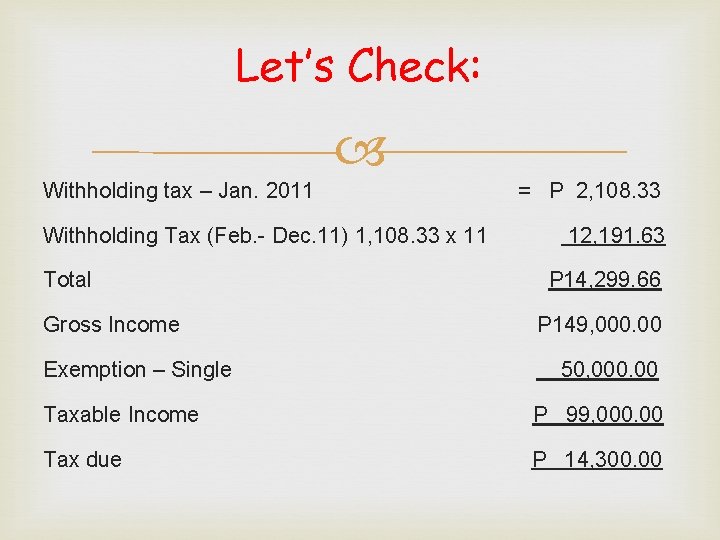

Let’s Check: Withholding tax – Jan. 2011 = P 2, 108. 33 Withholding Tax (Feb. - Dec. 11) 1, 108. 33 x 11 12, 191. 63 Total P 14, 299. 66 Gross Income P 149, 000. 00 Exemption – Single 50, 000. 00 Taxable Income Tax due P 99, 000. 00 P 14, 300. 00

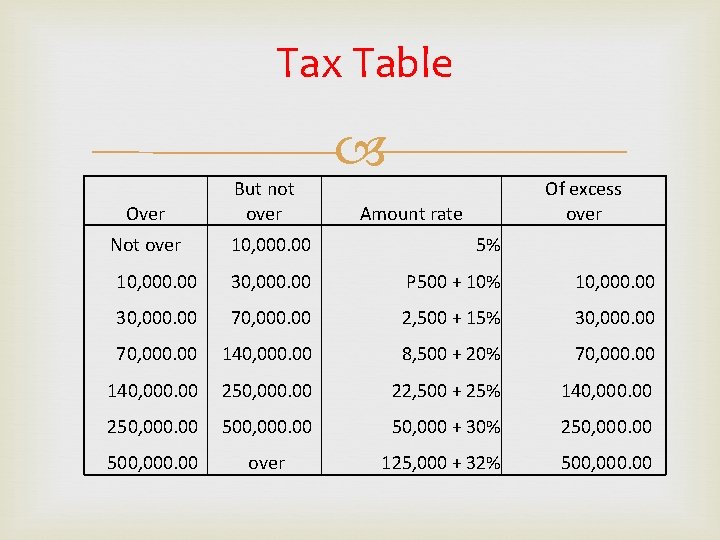

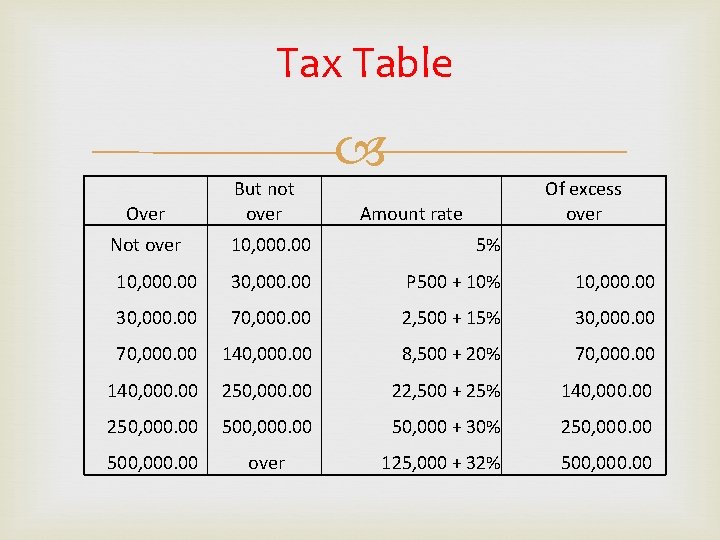

Tax Table Over But not over Not over 10, 000. 00 Amount rate Of excess over 5% 10, 000. 00 30, 000. 00 P 500 + 10% 10, 000. 00 30, 000. 00 70, 000. 00 2, 500 + 15% 30, 000. 00 70, 000. 00 140, 000. 00 8, 500 + 20% 70, 000. 00 140, 000. 00 250, 000. 00 22, 500 + 25% 140, 000. 00 250, 000. 00 500, 000. 00 50, 000 + 30% 250, 000. 00 500, 000. 00 over 125, 000 + 32% 500, 000. 00

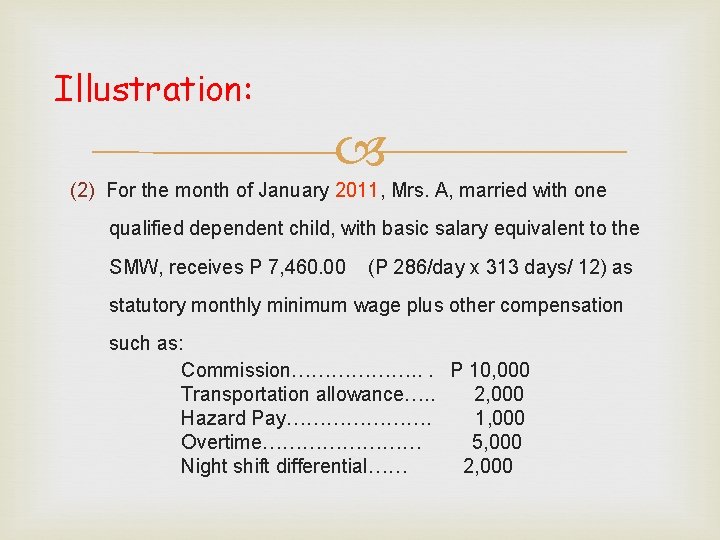

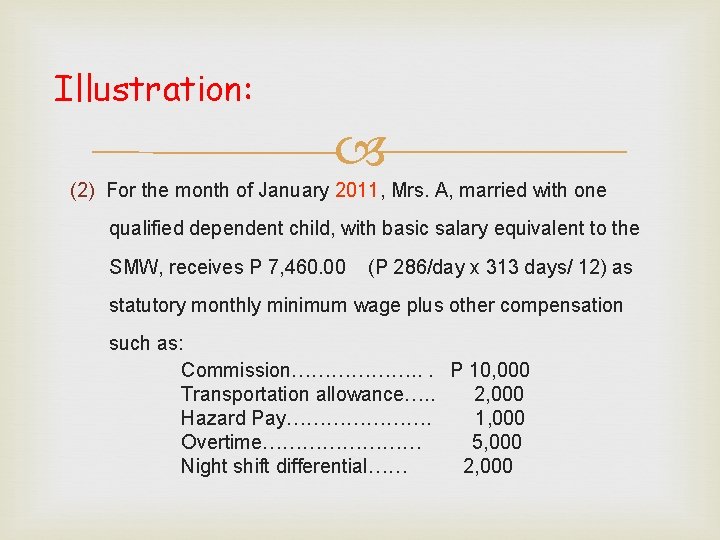

Illustration: (2) For the month of January 2011, Mrs. A, married with one qualified dependent child, with basic salary equivalent to the SMW, receives P 7, 460. 00 (P 286/day x 313 days/ 12) as statutory monthly minimum wage plus other compensation such as: Commission………………. . . P 10, 000 Transportation allowance…. . 2, 000 Hazard Pay…………………. 1, 000 Overtime………… 5, 000 Night shift differential…… 2, 000

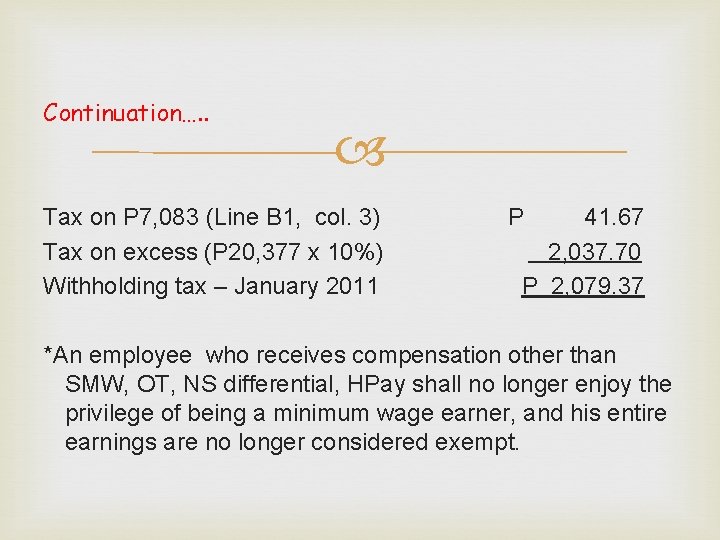

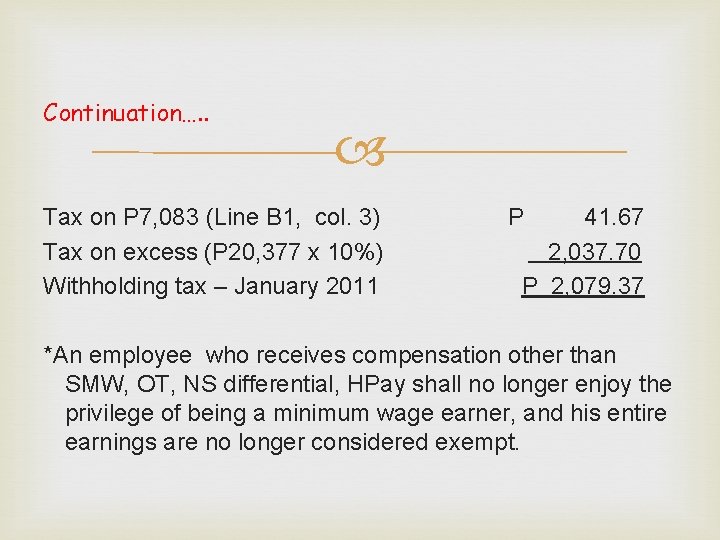

Computation: Statutory Minimum Wage P 7, 460. 00 Gross Benefits Hazard pay P 1, 000. 00 Overtime 5, 000. 00 Night Shift Differential 2, 000. 00 8, 000. 00 Sub-total P 15, 460. 00 Taxable compensation commission* P 10, 000. 00 Transportation* 2, 000. 00 12, 000. 00 Total Taxable Compensation Income P 27, 460. 00 Regular compensation P 7, 460. 00 Less: Compensation Level (B-1 col 3) 7, 083. 00 Excess P 377. 00 Add: Supplementary compensation(8, 000+12, 000) 20, 000. 00 Total P 20, 377. 00

Continuation…. . Tax on P 7, 083 (Line B 1, col. 3) Tax on excess (P 20, 377 x 10%) Withholding tax – January 2011 P 41. 67 2, 037. 70 P 2, 079. 37 *An employee who receives compensation other than SMW, OT, NS differential, HPay shall no longer enjoy the privilege of being a minimum wage earner, and his entire earnings are no longer considered exempt.

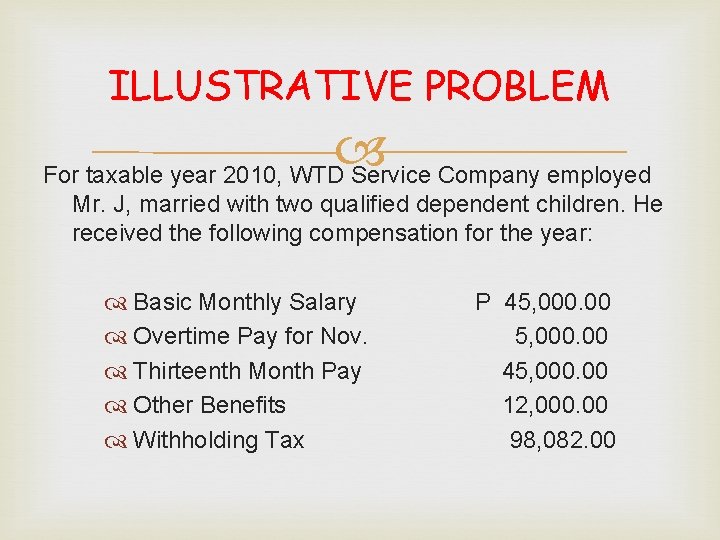

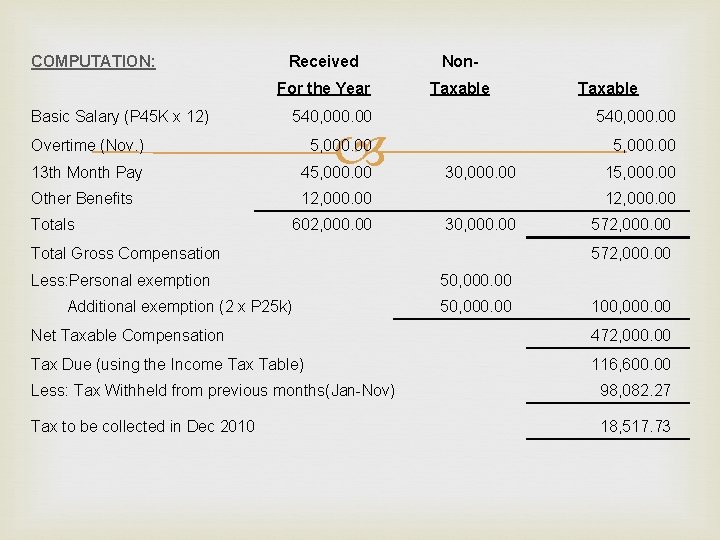

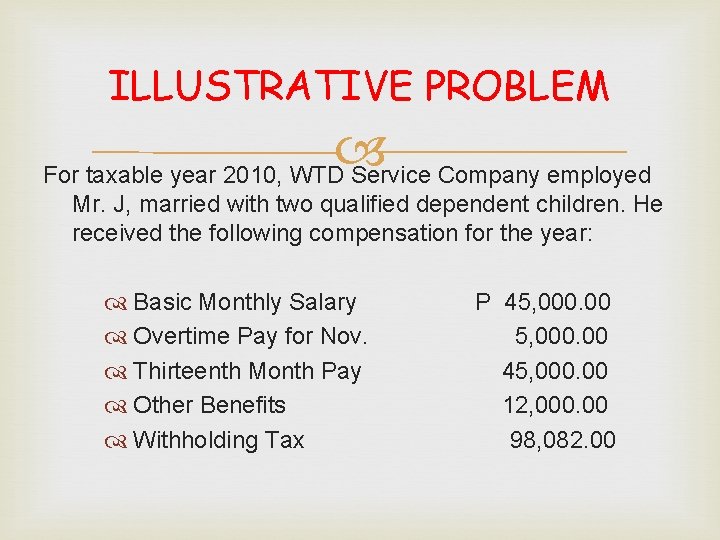

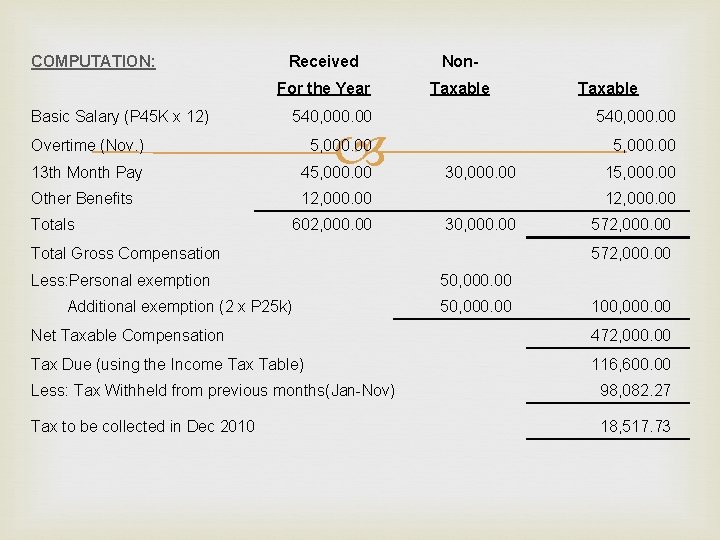

ILLUSTRATIVE PROBLEM For taxable year 2010, WTD Service Company employed Mr. J, married with two qualified dependent children. He received the following compensation for the year: Basic Monthly Salary Overtime Pay for Nov. Thirteenth Month Pay Other Benefits Withholding Tax P 45, 000. 00 45, 000. 00 12, 000. 00 98, 082. 00

COMPUTATION: Received Non- For the Year Taxable Basic Salary (P 45 K x 12) 540, 000. 00 Overtime (Nov. ) 5, 000. 00 13 th Month Pay 45, 000. 00 30, 000. 00 15, 000. 00 Other Benefits 12, 000. 00 Totals 602, 000. 00 30, 000. 00 572, 000. 00 Total Gross Compensation 12, 000. 00 572, 000. 00 Less: Personal exemption 50, 000. 00 Additional exemption (2 x P 25 k) 50, 000. 00 100, 000. 00 Net Taxable Compensation 472, 000. 00 Tax Due (using the Income Tax Table) 116, 600. 00 Less: Tax Withheld from previous months(Jan-Nov) 98, 082. 27 Tax to be collected in Dec 2010 18, 517. 73

Liability for Tax Employer Responsible for withholding and remittance of correct amount of tax Employee Responsible for submission of 1902 / 2305

Statements and Returns �BIR Form 2316 Employer shall furnish the employees NLT Jan. 31 Failure to furnish shall be a ground for mandatory audit upon verified complaint of the payee It shall include the fringe benefits given to rank & file employees Employers of MWEs are still required to issue BIR Form 2316 (June 2008 Encs version) It shall indicate the health &/or hosp. insurance, if any The amount of SMW, OT, Holiday pay, Night diff, and hazard pay shall be indicated Among others

Statements and Returns Form 2316 cont…. It shall be signed by both the employer’s authorized representative and the employee Shall contain a written declaration that it is made under the penalties of perjury Shall contain a certification that the employer’s filing of BIR Form 1604 -CF shall be considered as substituted filing The employer shall retain the duly signed 2316 for a period of three (3) years.

Statements and Returns Form 2316 continued… The applicable box for MWEs shall be indicated (under the enhanced form). This serves as proof of financial capacity for purposes of loans, etc… In case of successive employment during the taxable year, an extra copy of BIR Form 2316 shall be furnished to his new employer

Year-End Adjustment PURPOSE: TAX DUE = TAX WITHHELD WHEN: On or before the end of the calendar year, prior to the payment of compensation for the last payroll. If terminated, on the day on which the last payment of compensation is made.

YEA-Annualized Method STEP 1 - Determine the taxable regular and supplementary compensation paid to the employee for the entire calendar year; STEP 2 - If the employee has previous employment/s within the year, add the amount of taxable compensation paid to the employee by the previous employer.

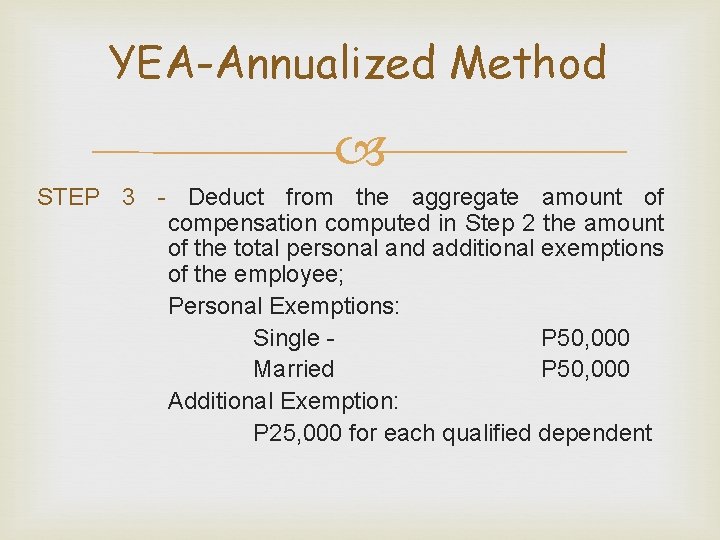

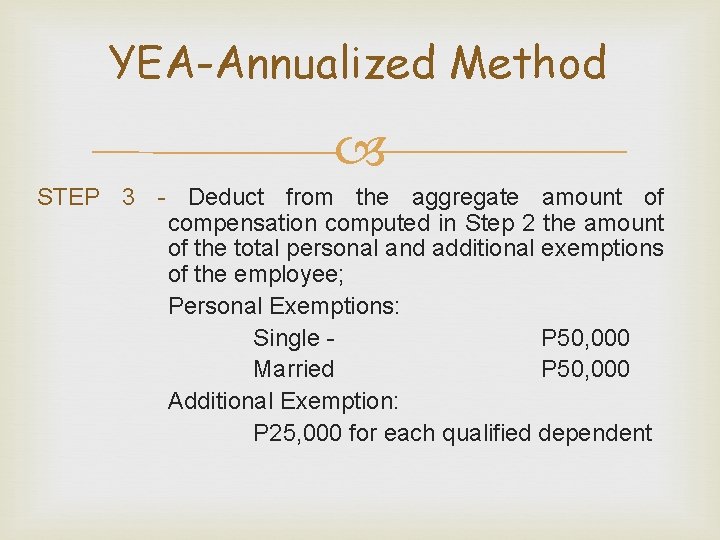

YEA-Annualized Method STEP 3 - Deduct from the aggregate amount of compensation computed in Step 2 the amount of the total personal and additional exemptions of the employee; Personal Exemptions: Single P 50, 000 Married P 50, 000 Additional Exemption: P 25, 000 for each qualified dependent

YEA-Annualized Method STEP 4 - Deduct the amount of premium payments on Health and/or Hospitalization Insurance of employees who have presented evidence that they have paid the same during the taxable year. Note: The deductible amount shall not exceed P 2, 400/annum or P 200/month whichever is lower and total family gross income does not exceed P 250, 000 for the calendar year.

YEA-Annualized Method STEP 6 - Determine the deficiency or excess, if any, of the tax computed in Step 5 over the cumulative tax already deducted and withheld since the beginning of the current calendar year.

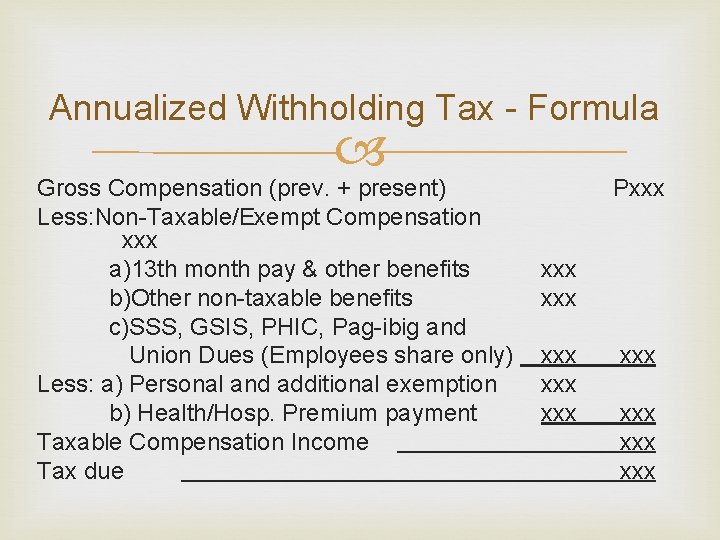

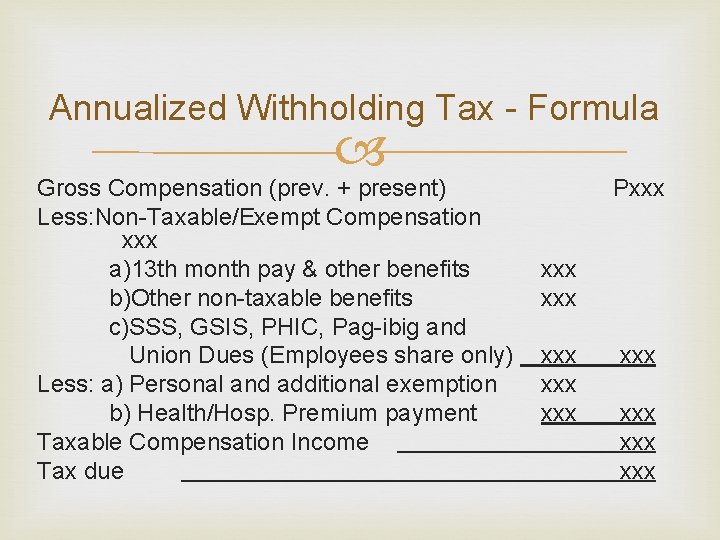

Annualized Withholding Tax - Formula Gross Compensation (prev. + present) Less: Non-Taxable/Exempt Compensation xxx a)13 th month pay & other benefits b)Other non-taxable benefits c)SSS, GSIS, PHIC, Pag-ibig and Union Dues (Employees share only) Less: a) Personal and additional exemption b) Health/Hosp. Premium payment Taxable Compensation Income Tax due Pxxx xxx xxx

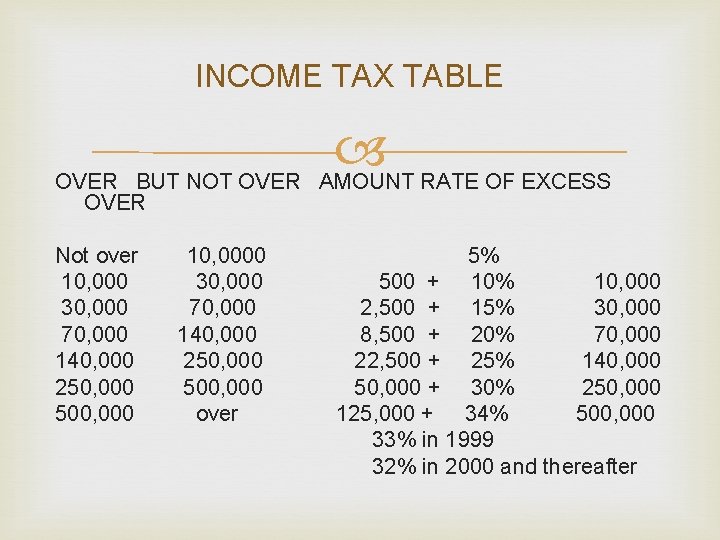

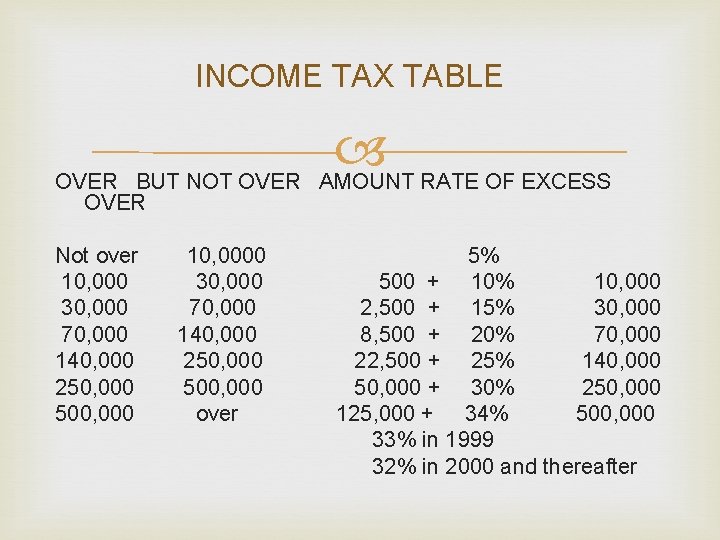

INCOME TAX TABLE OVER BUT NOT OVER AMOUNT RATE OF EXCESS OVER Not over 10, 0000 5% 10, 000 30, 000 500 + 10% 10, 000 30, 000 70, 000 2, 500 + 15% 30, 000 70, 000 140, 000 8, 500 + 20% 70, 000 140, 000 250, 000 22, 500 + 25% 140, 000 250, 000 500, 000 50, 000 + 30% 250, 000 500, 000 over 125, 000 + 34% 500, 000 33% in 1999 32% in 2000 and thereafter

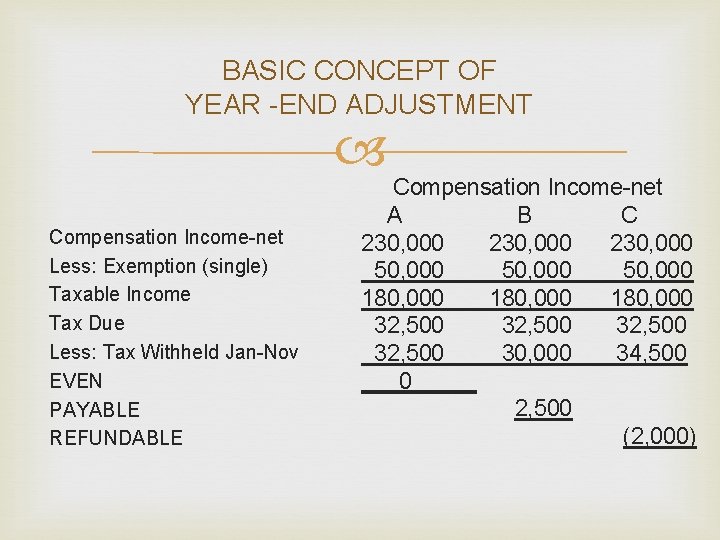

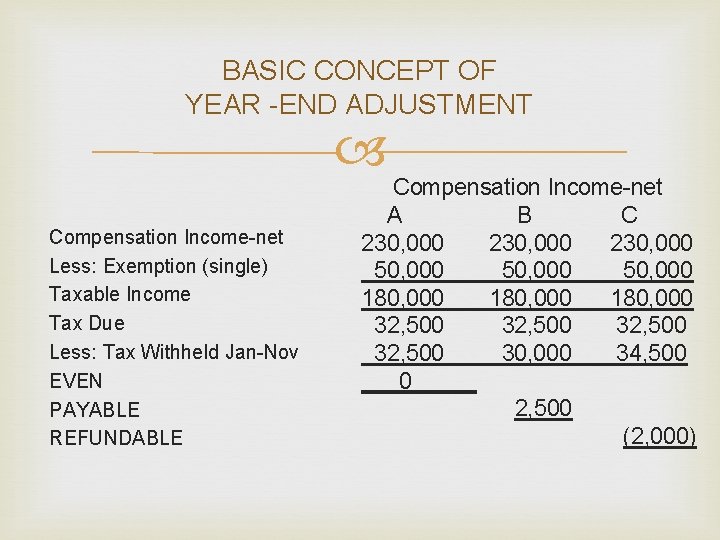

BASIC CONCEPT OF YEAR -END ADJUSTMENT Compensation Income-net Less: Exemption (single) Taxable Income Tax Due Less: Tax Withheld Jan-Nov EVEN PAYABLE REFUNDABLE Compensation Income-net A B C 230, 000 50, 000 180, 000 32, 500 30, 000 34, 500 0__ 2, 500 (2, 000)

Sample Problem 1 Mr. Dexter, head of the family with a qualified dependent brother receives P 12, 166. 67 (net of SSS, Philhealth, HDMF) as monthly regular compensation starting January 1, 2011, he filed his resignation effective June 30, 2011. The tax withheld from January to May was P 2, 900.

Computation: Total compensation (Jan. - June) Less: Personal Exemption 50, 000. 00 Net Taxable Compensation P 73, 000. 00 P 23, 000. 00 Tax Due P 1, 800. 00 Tax Withheld from Jan. to May 2, 900. 00 To be refunded on or before 6/30/02 (P 1, 100. 00)

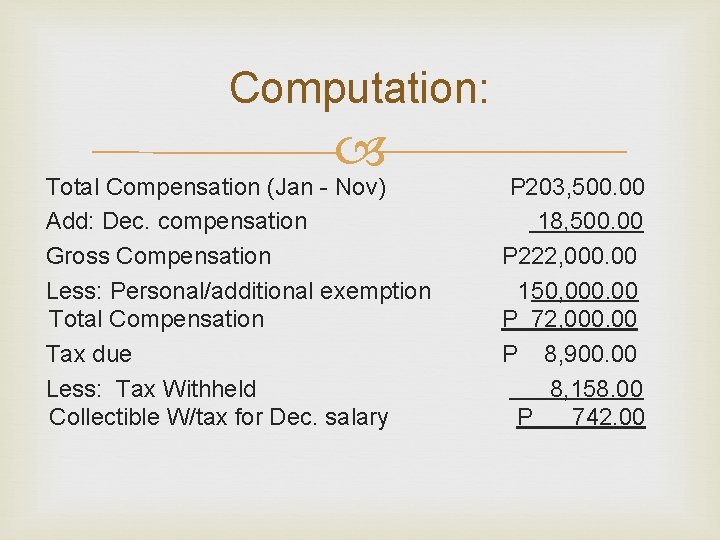

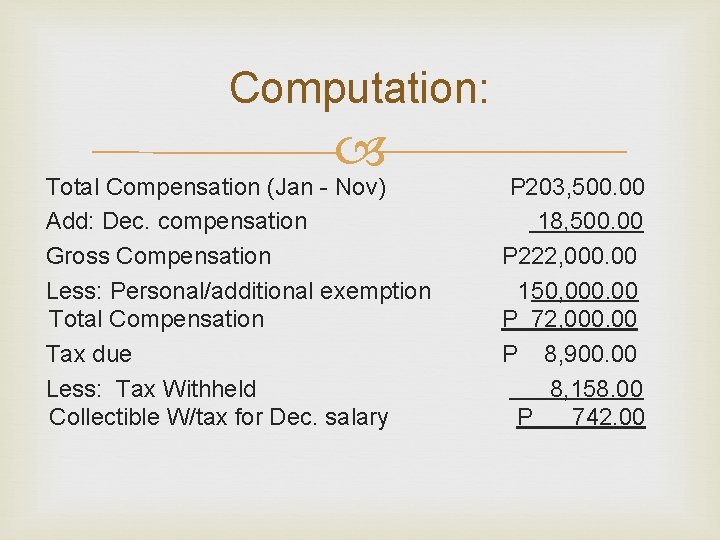

Sample Problem 2 Mr. Jacob, married with 2 qualified dependent children received P 18, 500 monthly compensation (net of SSS, Philhealth, HDMF employees contributions). Taxes withheld from Jan. to Nov. were P 8, 158. 00.

Computation: Total Compensation (Jan - Nov) P 203, 500. 00 Add: Dec. compensation 18, 500. 00 Gross Compensation P 222, 000. 00 Less: Personal/additional exemption 150, 000. 00 Total Compensation P 72, 000. 00 Tax due P 8, 900. 00 Less: Tax Withheld 8, 158. 00 Collectible W/tax for Dec. salary P 742. 00

Annual Information Return J Manual Submission - 3 copies of 1604 CF/1604 E Including the alphalist of employees and income payees. J Diskette/CD & email Submission thru esubmission@bir. gov. ph

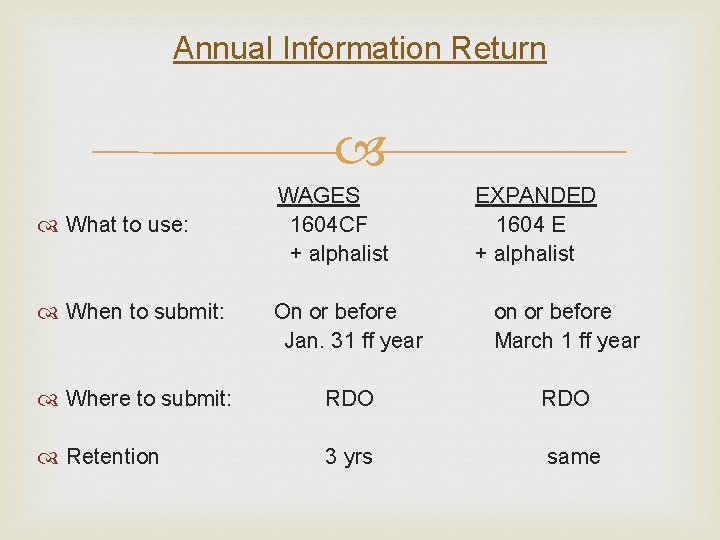

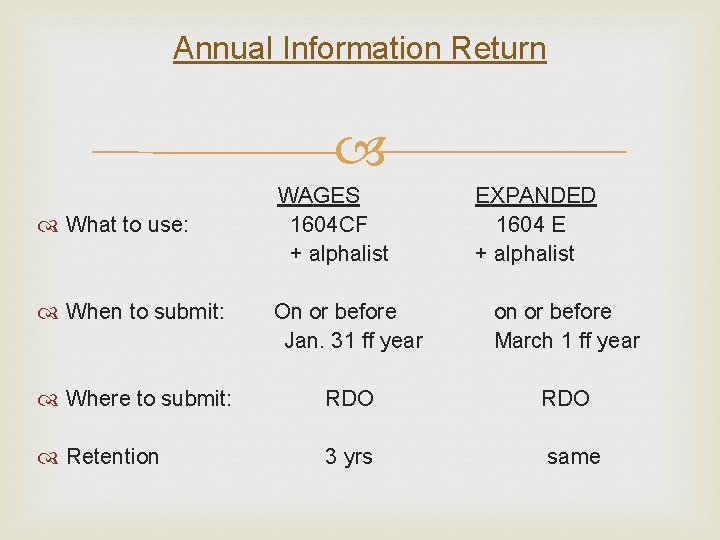

Annual Information Return What to use: WAGES EXPANDED 1604 CF 1604 E + alphalist When to submit: On or before Jan. 31 ff year on or before March 1 ff year Where to submit: RDO Retention 3 yrs same

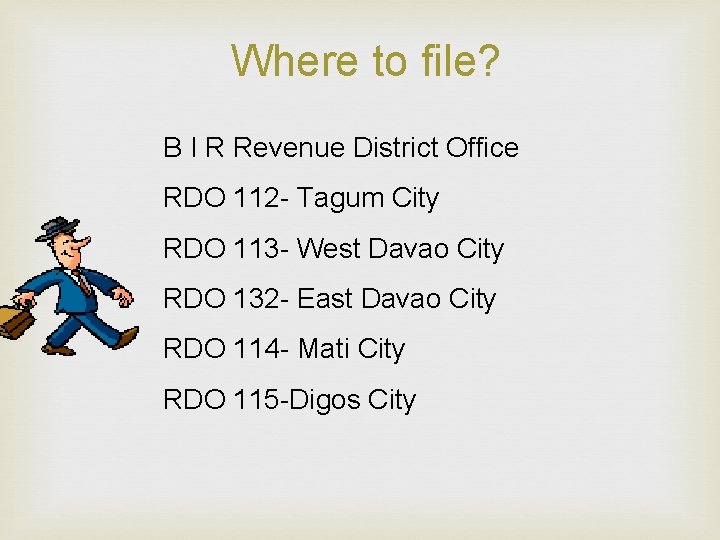

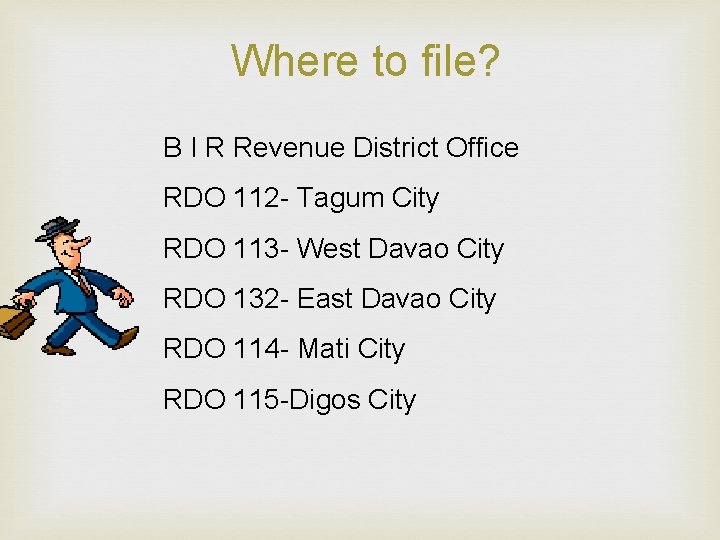

Where to file? B I R Revenue District Office RDO 112 - Tagum City RDO 113 - West Davao City RDO 132 - East Davao City RDO 114 - Mati City RDO 115 -Digos City

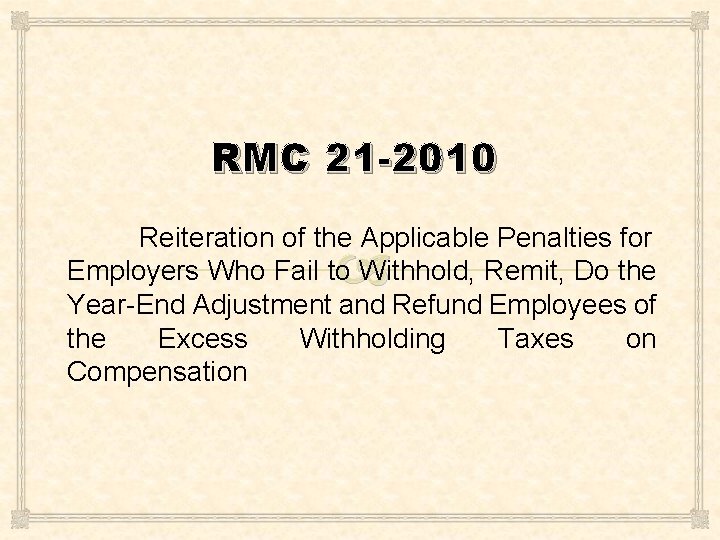

RMC 21 -2010 Reiteration of the Applicable Penalties for Employers Who Fail to Withhold, Remit, Do the Year-End Adjustment and Refund Employees of the Excess Withholding Taxes on Compensation

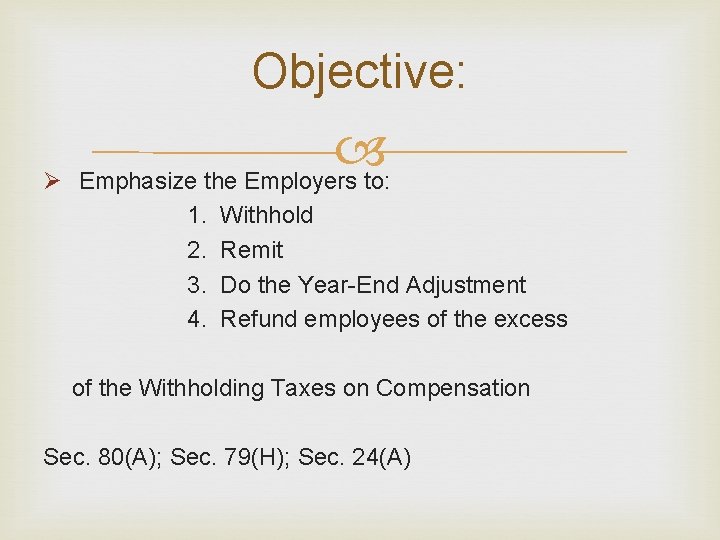

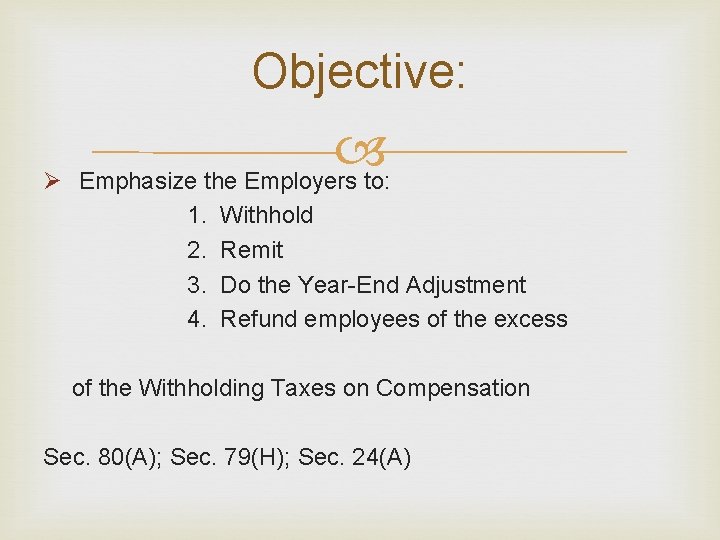

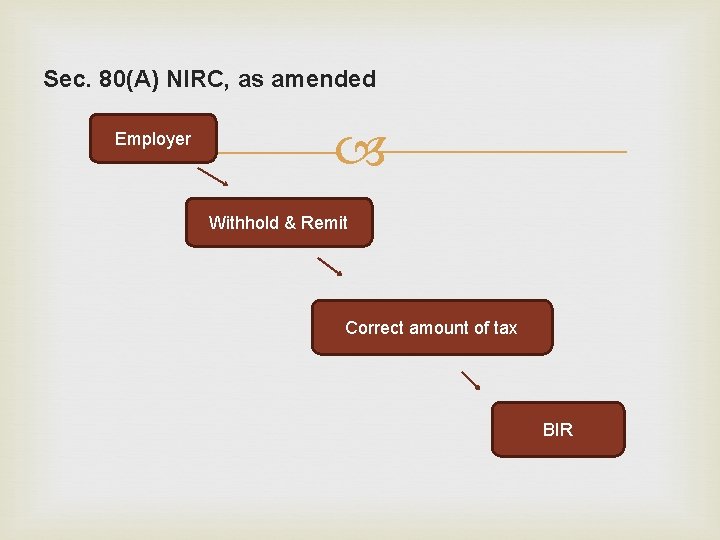

Objective: Ø Emphasize the Employers to: 1. Withhold 2. Remit 3. Do the Year-End Adjustment 4. Refund employees of the excess of the Withholding Taxes on Compensation Sec. 80(A); Sec. 79(H); Sec. 24(A)

Sec. 80(A) NIRC, as amended Employer Withhold & Remit Correct amount of tax BIR

Sec. 79(H) * On or before year end but prior to payment of the compensation for the last payroll period, the employer shall determine the tax due from each employee on taxable compensation income for the entire taxable year - Sec. 24(A). *The difference of the tax due and tax withheld will either be withheld on Dec. or refunded to the employee not later Jan. 25, following year.

FORMS TO BE USED For Monthly Remittance: COMPENSATION ==> BIR Form 1601 C For Annual Information Return: COMPENSATION & FINAL ===> BIR Form 1604 CF For Certificate of Taxes Withheld: COMPENSATION ===> BIR Form 2316

Due Dates: January to November– On or before the 10 th day of the following the month, whether W/A is LT or Non-LT (RR 6 -01) December - On or before Jan. 15 of the following year, whether W/A is LT or Non-LT (RR 6 -01) Annually - On or before Jan. 31 of the following year (RR 3 -02)

Attachments Required: 1. Alphalist of Employees as of Dec. 31 with No 2. 3. 4. 5. Previous Employer within the Year; Alphalist of Employees as of Dec. 31 with Previous Employer(s) within the year; Alphalist of Employees Terminated before Dec. 31; Alphalist of Employees Whose Compensation Income are Exempt from Withholding Tax but Subject to Withholding Tax Alphalist of Employees other than Rank & File Who Were Given Fringe Benefits During the Year

Effectivity of Substituted Filing * Optional for taxable year 2001 * Mandatory effective taxable year 2002

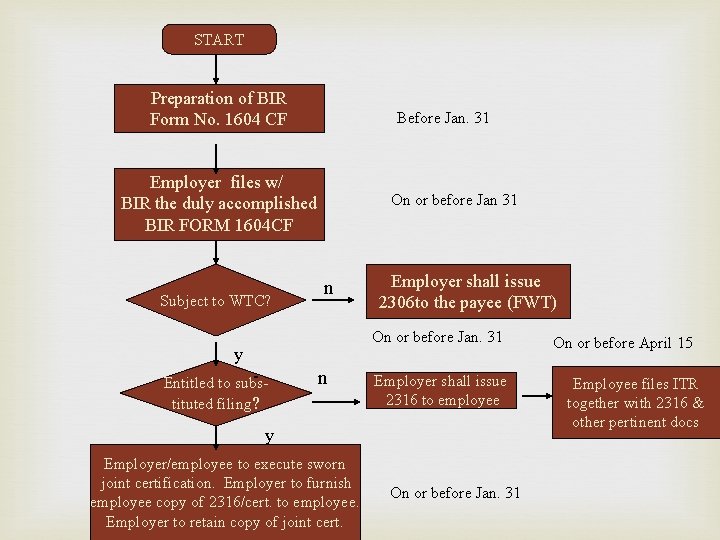

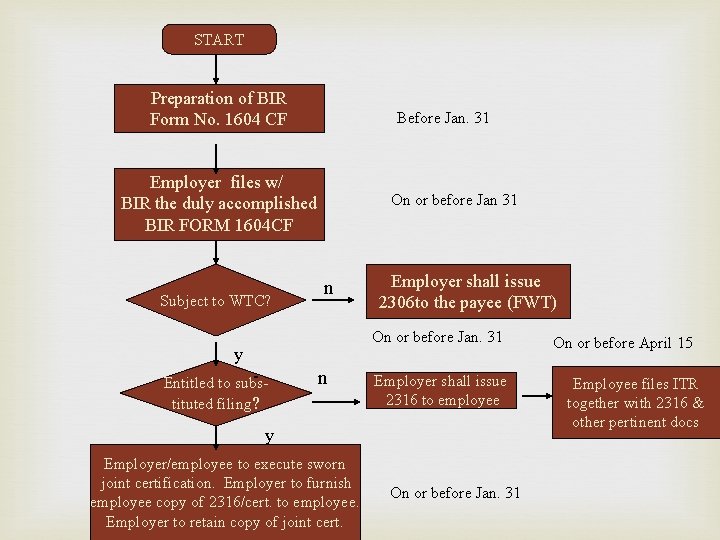

START Preparation of BIR Form No. 1604 CF Before Jan. 31 Employer files w/ BIR the duly accomplished BIR FORM 1604 CF Subject to WTC? On or before Jan 31 n Employer shall issue 2306 to the payee (FWT) On or before Jan. 31 y Entitled to substituted filing? n Employer shall issue 2316 to employee y Employer/employee to execute sworn joint certification. Employer to furnish employee copy of 2316/cert. to employee. Employer to retain copy of joint cert. On or before Jan. 31 On or before April 15 Employee files ITR together with 2316 & other pertinent docs

Note: An illustrative example on the year-end adjustment is shown under Sec. 2. 79(B)(5)(b) of Revenue Regulations (RR) No. 2 -98, as amended.

Failure to Comply 1. Non-withholding of tax - Employer fails to withhold the tax 2. Underwithholding - Employer fails to correctly withhold the tax 3. Non-remittance -Employer fails to remit total amount withhled

4. Underremittance -Employer’s remittance is less than total amount withheld 5. Late remittance -Employer remits correct amount withheld beyond the due date 6. Failure to refund excess taxes withheld -Employer ails to refund excess taxes withheld to its employees

Penalties for Non-Compliance: 1. Additions to the tax: a. Sec. 248 – 25% of the amount due (failure) 50% of the amount due (fraud) b. Sec. 249 – 20% interest per annum c. Sec. 251 – other penalties + total tax not withheld d. Sec. 252 - penalties + refundable amount

2. Criminal Liabilities: (upon Conviction) a. Sec. 255 – other penalties + P 10, 000 + imprisonment of 1 yr to 10 yrs b. Sec. 256 – (Corp. ) penalties + fine of P 50, 000 to P 100, 000 c. Sec. 272 – (Public Officers) penalties + fine of P 5000 to P 50, 000 or imprisonment of 6 mos. to 2 yrs, or both d. Sec. 275 – (no specific penalty) fine of <P 1, 000 or imprisonment of < 6 mos. Or both

Note: In certain instances as provided under Revenue Memorandum Order No. 19 -2007, a compromise penalty in lieu of criminal liability may be imposed and collected.

The end

Compensation computation

Compensation computation Expanded withholding tax computation

Expanded withholding tax computation South carolina state tax withholding form

South carolina state tax withholding form Form 2306

Form 2306 Withholding tax contractors

Withholding tax contractors Expanded withholding tax computation

Expanded withholding tax computation Withholding tax for commission

Withholding tax for commission Expanded withholding tax computation

Expanded withholding tax computation Noncompensation

Noncompensation Average

Average Tax revenue and deadweight loss graph

Tax revenue and deadweight loss graph How to find the tax revenue

How to find the tax revenue Withholding reinforcement for a target response

Withholding reinforcement for a target response 165 withholding statement excel file

165 withholding statement excel file Gst percentage in india

Gst percentage in india Roland purcell a technical writer

Roland purcell a technical writer Partial asset disposition

Partial asset disposition Civil air patrol uniforms

Civil air patrol uniforms Cold ironing regulations

Cold ironing regulations Chapter 4 safe driving rules and regulations

Chapter 4 safe driving rules and regulations Army motor pool safety regulations

Army motor pool safety regulations Foreign trade division

Foreign trade division Tsbde rules and regulations chapter 110

Tsbde rules and regulations chapter 110 Importance of building regulations

Importance of building regulations Animal quarantine department

Animal quarantine department Boiler safety valve regulations

Boiler safety valve regulations In location planning environmental regulations

In location planning environmental regulations Routed export transaction

Routed export transaction Wiaa softball bat regulations

Wiaa softball bat regulations Natural health products regulations

Natural health products regulations Child care facility rules and regulations exam

Child care facility rules and regulations exam Part 21 g et j

Part 21 g et j Dbhds sponsored residential regulations

Dbhds sponsored residential regulations Dietsmann wikipedia

Dietsmann wikipedia Acecqa regulations

Acecqa regulations Radial circuits

Radial circuits Rto rules and regulations

Rto rules and regulations Collective investment scheme regulations

Collective investment scheme regulations 10 sen

10 sen Dbhds office of human rights

Dbhds office of human rights Chapter 4 safe driving rules and regulations

Chapter 4 safe driving rules and regulations Regional factors for location planning

Regional factors for location planning Njdep ust registration form

Njdep ust registration form Easa ftl regulations combined document

Easa ftl regulations combined document Alabama oversize regulations

Alabama oversize regulations Mossel bay municipality organogram

Mossel bay municipality organogram Pocamla regulations

Pocamla regulations Automotive regulations and standards

Automotive regulations and standards Preventive maintenance in computer laboratory

Preventive maintenance in computer laboratory Marine corps league red jacket

Marine corps league red jacket Birdcage scaffold tg20

Birdcage scaffold tg20 Osha hand tool safety

Osha hand tool safety Six pack health and safety regulations

Six pack health and safety regulations Ihss parent provider regulations 2020

Ihss parent provider regulations 2020 Six pack regulations

Six pack regulations Advantages of parliamentary law making

Advantages of parliamentary law making Sasra regulations

Sasra regulations Georgia child care licensing regulations

Georgia child care licensing regulations Food safety regulations and standards

Food safety regulations and standards Telecom regulations dominican republic

Telecom regulations dominican republic Btec sport unit 2

Btec sport unit 2 Cimah regulations 1996

Cimah regulations 1996 Wiaa football rules

Wiaa football rules Nyc chancellor's regulations

Nyc chancellor's regulations Ohio revised code reckless operation

Ohio revised code reckless operation Usp regulations mcmc

Usp regulations mcmc Pfa standards for food

Pfa standards for food Esc law regulations

Esc law regulations Health and safety regulations in engineering

Health and safety regulations in engineering Chapter 4 safe driving rules and regulations

Chapter 4 safe driving rules and regulations New canaan zoning regulations

New canaan zoning regulations Difference between beftn and npsb

Difference between beftn and npsb Church accounting principles

Church accounting principles Loler 1998 legislation

Loler 1998 legislation Blood safety and quality regulations

Blood safety and quality regulations Warehouse health and safety

Warehouse health and safety Bwca rules and regulations

Bwca rules and regulations Kosha regulation

Kosha regulation Bell archiving

Bell archiving R117-02

R117-02 Eu tattoo products regulation

Eu tattoo products regulation Airbnb stayz

Airbnb stayz Niaho

Niaho Telecom regulations lithuania

Telecom regulations lithuania Why do we have hunting laws

Why do we have hunting laws Fire extinguisher rules osha

Fire extinguisher rules osha Badminton regulations btec sport

Badminton regulations btec sport Georgia child care licensing regulations

Georgia child care licensing regulations Pppfa regulations 2017

Pppfa regulations 2017 Bmsma regulations

Bmsma regulations No food or drink near computers

No food or drink near computers Fmc rate filing

Fmc rate filing Copyright regulations 1969

Copyright regulations 1969 Class rules and regulations

Class rules and regulations Cidb regulations

Cidb regulations