WITHHOLDING TAX AT SOURCE Revenue Regulations No 2

- Slides: 152

WITHHOLDING TAX AT SOURCE (Revenue Regulations No. 2 -98, as amended) Presented by: Ms. Susan D. Tusoy, cpa, mps Asst. Chief, Assessment Division RR 19 - Davao City

Importance of Withholding Tax System It is an effective tool in the collection of taxes for the following reasons: • It encourages voluntary compliance; • It reduces cost of collection effort; • It prevents delinquencies and revenue loss; and • It prevents dry spells in the fiscal condition of the government by providing revenues throughout the taxable year.

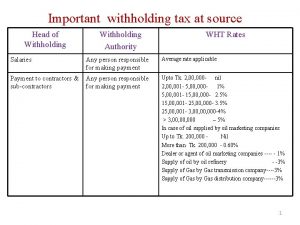

Types of Withholding Taxes • Withholding Tax on Compensation • Expanded Withholding Tax • Final Withholding Tax; and • Withholding Tax on Government Money Payment

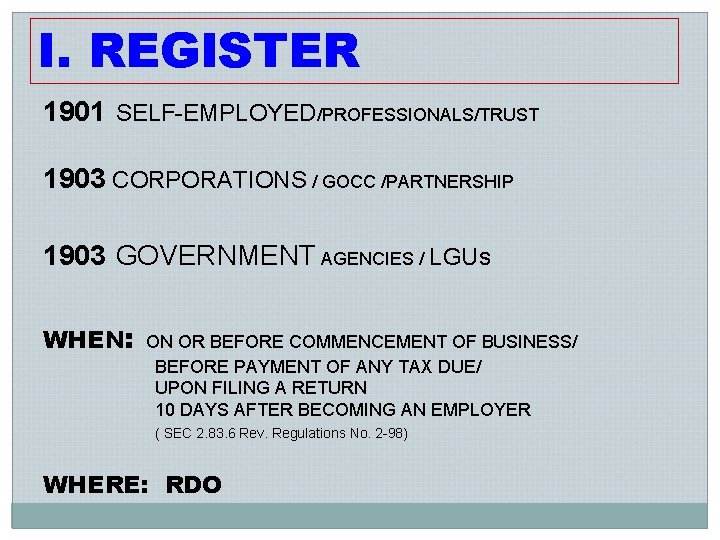

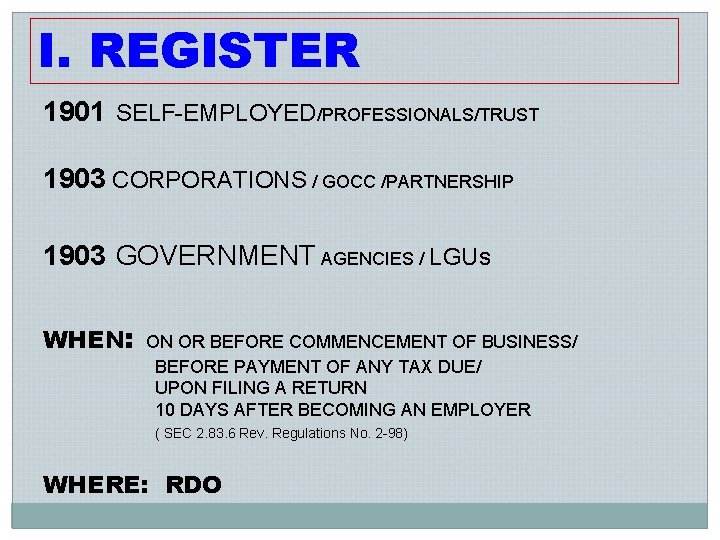

I. REGISTER 1901 SELF-EMPLOYED/PROFESSIONALS/TRUST 1903 CORPORATIONS / GOCC /PARTNERSHIP 1903 GOVERNMENT AGENCIES / LGUs WHEN: ON OR BEFORE COMMENCEMENT OF BUSINESS/ BEFORE PAYMENT OF ANY TAX DUE/ UPON FILING A RETURN 10 DAYS AFTER BECOMING AN EMPLOYER ( SEC 2. 83. 6 Rev. Regulations No. 2 -98) WHERE: RDO

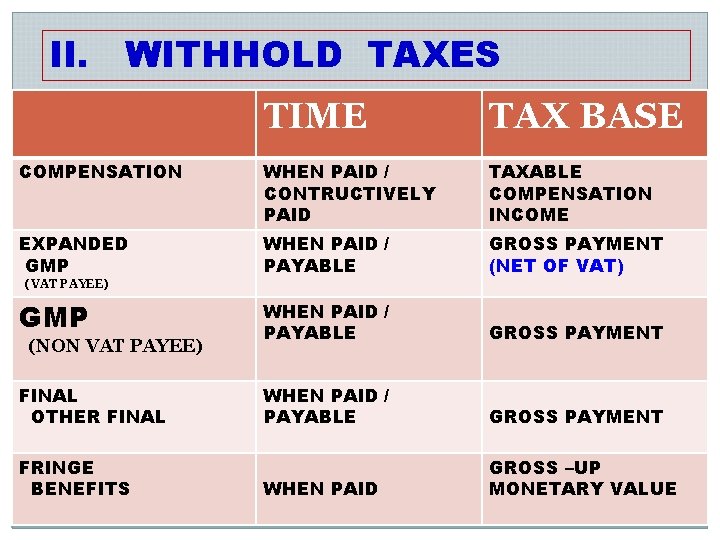

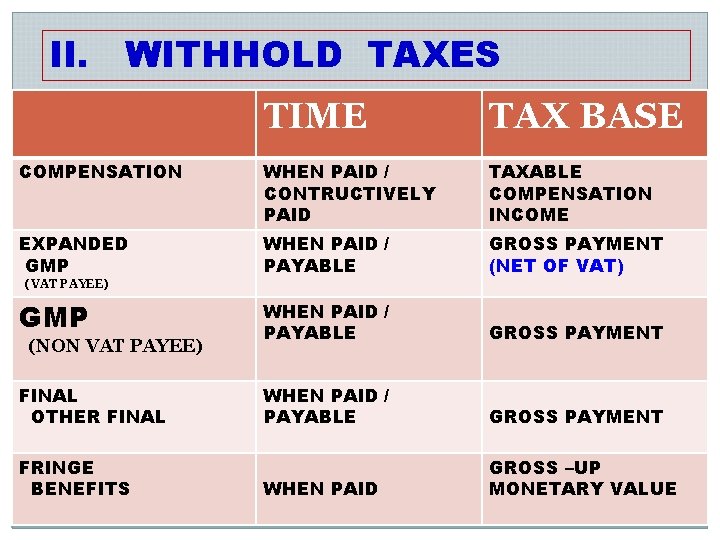

II. WITHHOLD TAXES TIME TAX BASE COMPENSATION WHEN PAID / CONTRUCTIVELY PAID TAXABLE COMPENSATION INCOME EXPANDED GMP WHEN PAID / PAYABLE GROSS PAYMENT (NET OF VAT) GMP WHEN PAID / PAYABLE GROSS PAYMENT FINAL OTHER FINAL WHEN PAID / PAYABLE GROSS PAYMENT WHEN PAID GROSS –UP MONETARY VALUE (VAT PAYEE) (NON VAT PAYEE) FRINGE BENEFITS

III. WITHHOLING TAX REMITTANCE TYPES FORM COMPENSATION 1601 -C EXPANDED 1601 -E BANKS 1602 1606 Real Property (Ordinary Asset) MANUAL FILING/ PAYMENT EFPS FILING EFPS PAYMENT 10 th day of the ff month except for the month of December which is due Staggered Filing on the Jan. 15 (RR 26 -2002) 15 th day of the ff month except for the month of December which is due on the Jan. 20 10 th day of the ff month Not applicable FINAL OTHER FINAL 1601 -F 10 th day of the ff month Staggered Filing (RR 26 -2002) 15 th day of the ff month W/TAX ON VAT & PERCENTAGE 1600 (ALPH ALIST) 10 th day of the ff month FRINGE BENEFITS 1603 10 th day of the month following the end of the qtr. 15 th day of the month ff the end of the quarter

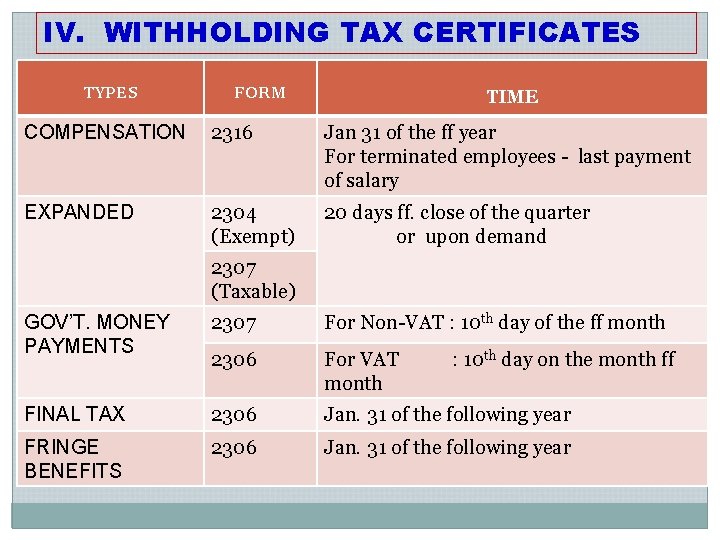

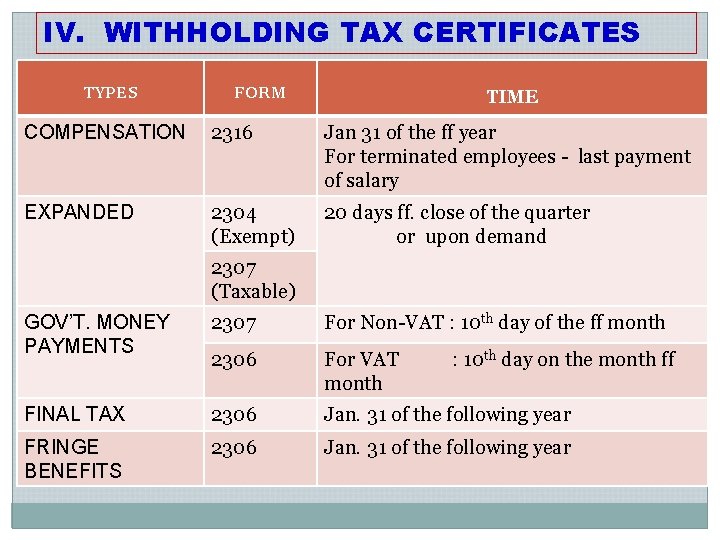

IV. WITHHOLDING TAX CERTIFICATES TYPES FORM TIME COMPENSATION 2316 Jan 31 of the ff year For terminated employees - last payment of salary EXPANDED 2304 (Exempt) 20 days ff. close of the quarter or upon demand 2307 (Taxable) GOV’T. MONEY PAYMENTS 2307 For Non-VAT : 10 th day of the ff month 2306 For VAT month FINAL TAX 2306 Jan. 31 of the following year FRINGE BENEFITS 2306 Jan. 31 of the following year : 10 th day on the month ff

V. ANNUAL RETURNS TYPE COMPENSATION FORM 1604 CF DESCRIPTION Alphalist of employees TIME Jan. 31 of the ff year Less than 10 employees – manual filing 10 employees or more - softcopy e. FPS Filer - e-attach EXPANDED 1604 E Alphalist of payees Less than 10 payees or more e. FPS Filer – manual filing - softcopy - e-attach March 1 of the ff year

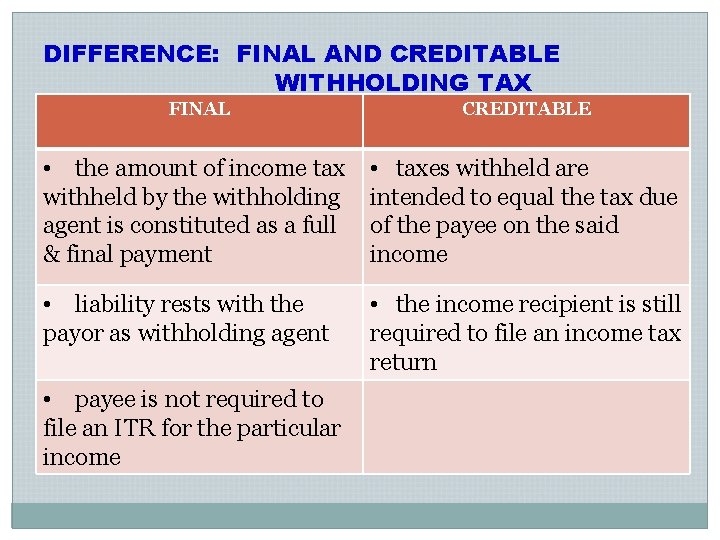

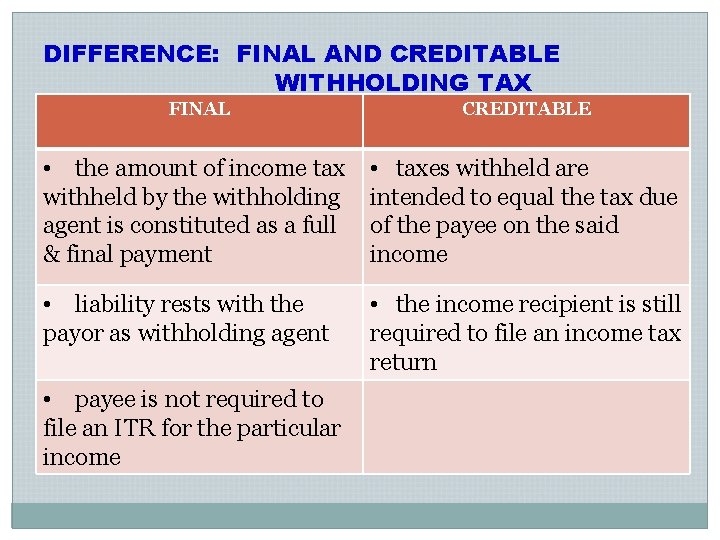

DIFFERENCE: FINAL AND CREDITABLE WITHHOLDING TAX FINAL CREDITABLE • the amount of income tax withheld by the withholding agent is constituted as a full & final payment • taxes withheld are intended to equal the tax due of the payee on the said income • liability rests with the payor as withholding agent • the income recipient is still required to file an income tax return • payee is not required to file an ITR for the particular income

EXPANDED WITHHOLDING TAX

Persons Required to Deduct & withhold Juridical persons, whether or not engaged in trade or business; Individuals in connection with his trade or business, however, individual buyers of real properties are also constituted as withholding agents; All government offices.

INCOME PAYMENTS SUBJEC TO EWT A. Professional fees, talent fees, etc. , for services rendered by individuals DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered. 1)Those engaged in the practice of profession 2)Professional entertainers 3)Professional athletes 4)Directors and producers of movies, stage, etc. 5)Insurance agents and adjusters 6)Management and technical consultants 7)Bookkeeping agents and agencies 8)Other recipients of talent fees 9)Fees of directors who are not employees of the company.

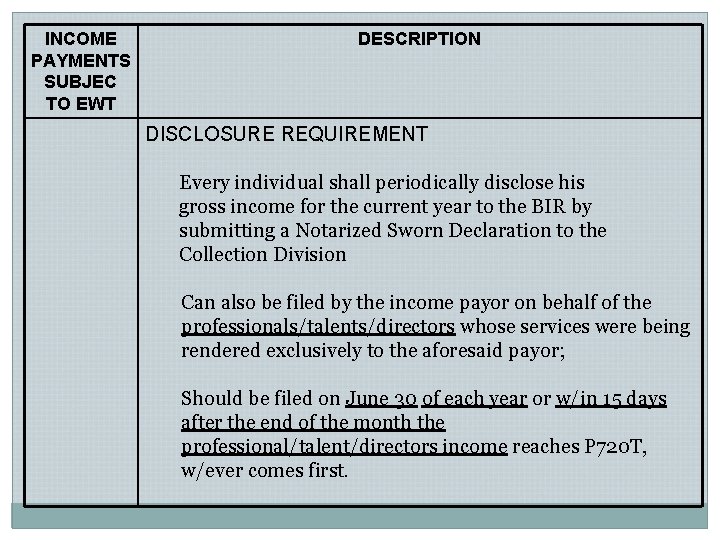

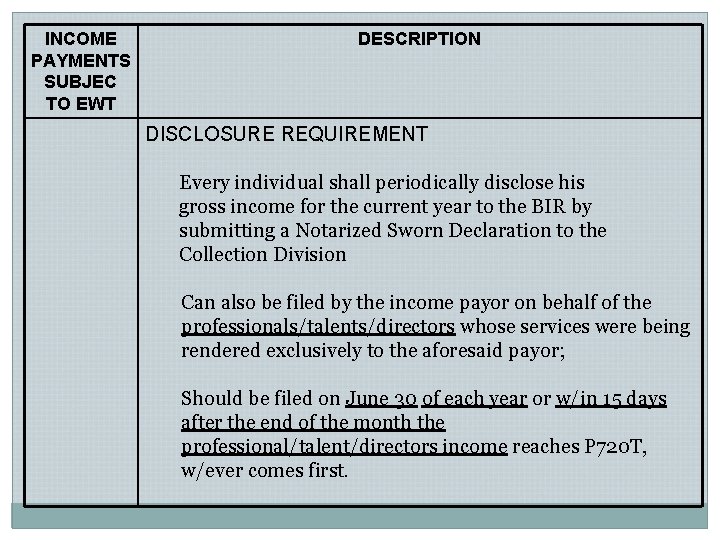

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION DISCLOSURE REQUIREMENT Every individual shall periodically disclose his gross income for the current year to the BIR by submitting a Notarized Sworn Declaration to the Collection Division Can also be filed by the income payor on behalf of the professionals/talents/directors whose services were being rendered exclusively to the aforesaid payor; Should be filed on June 30 of each year or w/in 15 days after the end of the month the professional/talent/directors income reaches P 720 T, w/ever comes first.

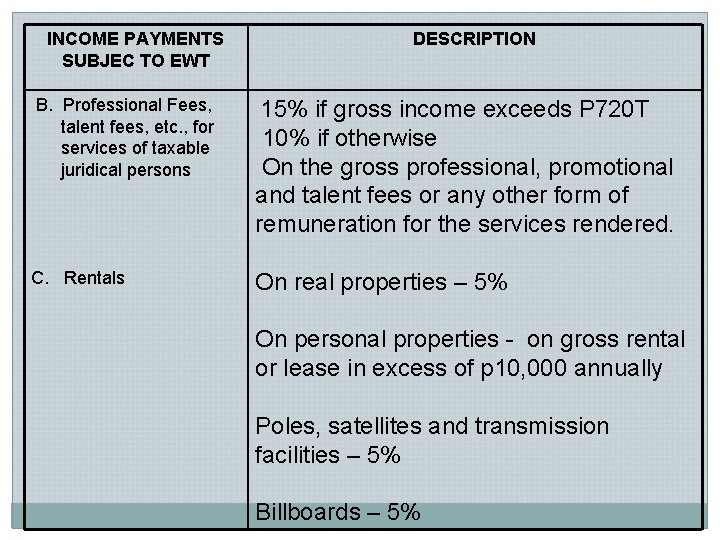

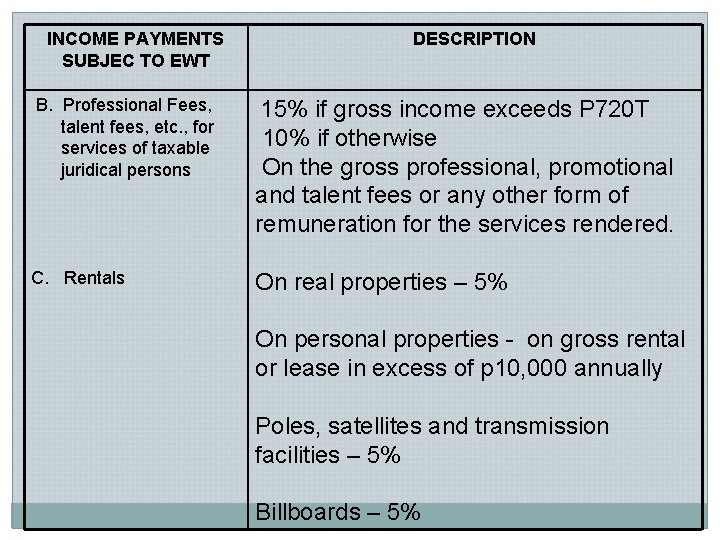

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION B. Professional Fees, talent fees, etc. , for services of taxable juridical persons 15% if gross income exceeds P 720 T 10% if otherwise On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered. C. Rentals On real properties – 5% On personal properties - on gross rental or lease in excess of p 10, 000 annually Poles, satellites and transmission facilities – 5% Billboards – 5%

INCOME PAYMENTS SUBJEC TO EWT D. Cinematographic film rental and other payments E. Income Payments to certain contractors DESCRIPTION 5% on gross payment 2% on gross payments of the ff: - General engineering contractors General building contractors Specialty contractors other contractors F. Income distribution to the beneficiaries 15% on the income distributed to the beneficiaries of estates and trusts

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION G. Gross payments to certain brokers and agents 10% on gross commissions or service fees H. Income payments to partners of general professional partnerships On income payments made to partners such as drawings, advances, sharings, allowances and stipends 15% if gross income exceeds P 720 T 10% if otherwise

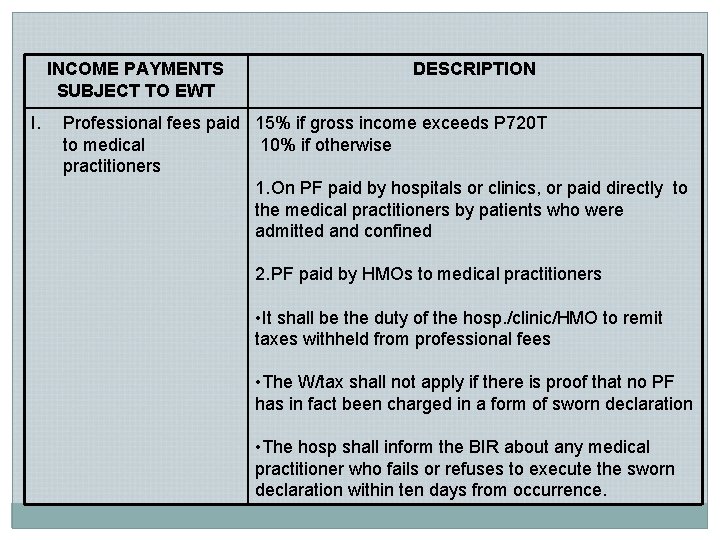

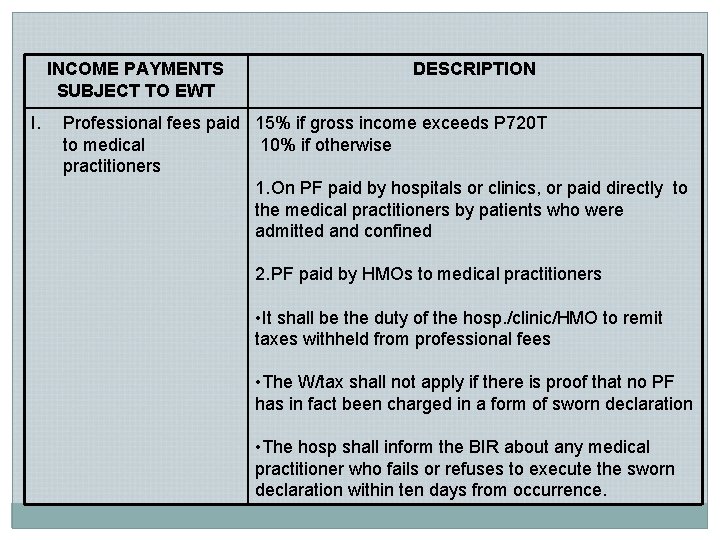

INCOME PAYMENTS SUBJECT TO EWT I. DESCRIPTION Professional fees paid 15% if gross income exceeds P 720 T to medical 10% if otherwise practitioners 1. On PF paid by hospitals or clinics, or paid directly to the medical practitioners by patients who were admitted and confined 2. PF paid by HMOs to medical practitioners • It shall be the duty of the hosp. /clinic/HMO to remit taxes withheld from professional fees • The W/tax shall not apply if there is proof that no PF has in fact been charged in a form of sworn declaration • The hosp shall inform the BIR about any medical practitioner who fails or refuses to execute the sworn declaration within ten days from occurrence.

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION • Hospitals and clinics shall submit the names and address of medical practitioners every 15 th day after end of each quarter • The hospitals and clinics shall be responsible for the accurate computation, timely remittance and issuance of withholding tax certificates J. Gross selling price or total amount of consideration or its equivalent paid to seller/owner for the sale, exchange, or transfer of real property classified ad ordinary asset Seller/transferor is exempt from CWT in accordance with Sec. 2. 57. 5 of the regulation Seller/transferor is habitually engaged in the real estate business: Selling price is P 500 k of less - 1. 5% SP <P 500 K but => P 2 M - 3. 0% SP <P 2 M - 5. 0% Seller/transferor is not habitually engaged in the real estate business - 6. 0%

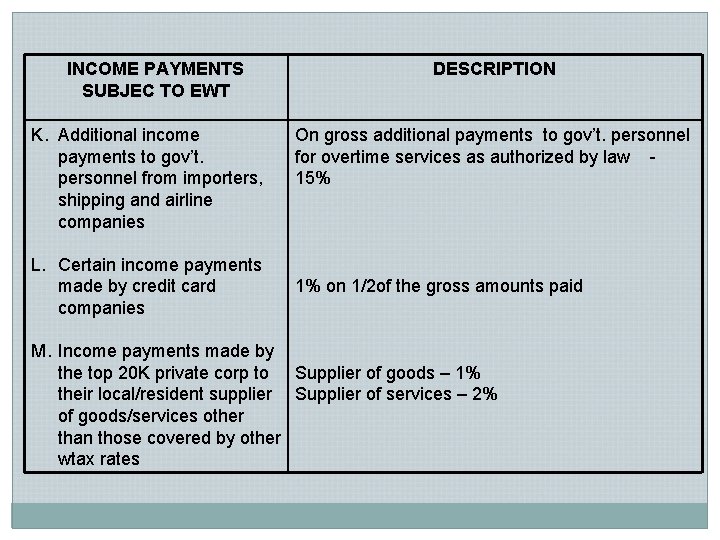

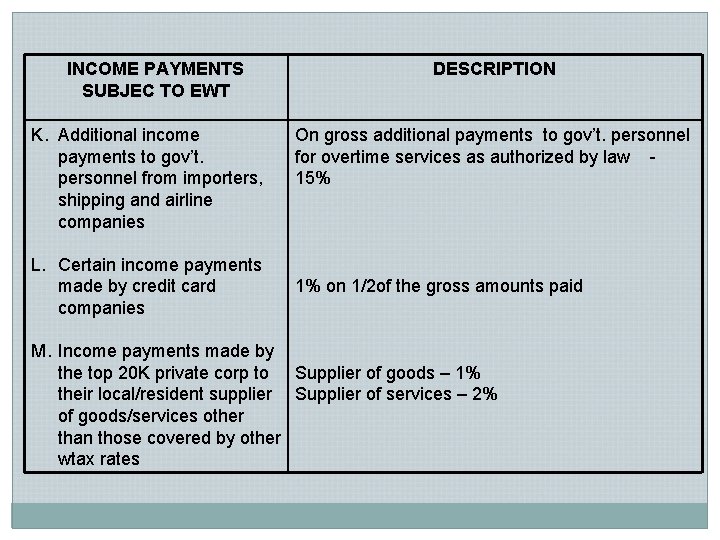

INCOME PAYMENTS SUBJEC TO EWT K. Additional income payments to gov’t. personnel from importers, shipping and airline companies L. Certain income payments made by credit card companies DESCRIPTION On gross additional payments to gov’t. personnel for overtime services as authorized by law 15% 1% on 1/2 of the gross amounts paid M. Income payments made by the top 20 K private corp to Supplier of goods – 1% their local/resident supplier Supplier of services – 2% of goods/services other than those covered by other wtax rates

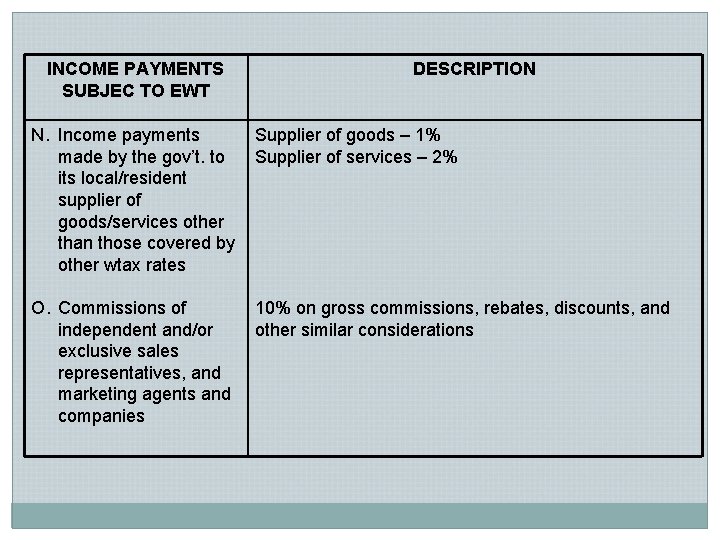

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION N. Income payments made by the gov’t. to its local/resident supplier of goods/services other than those covered by other wtax rates Supplier of goods – 1% Supplier of services – 2% O. Commissions of independent and/or exclusive sales representatives, and marketing agents and companies 10% on gross commissions, rebates, discounts, and other similar considerations

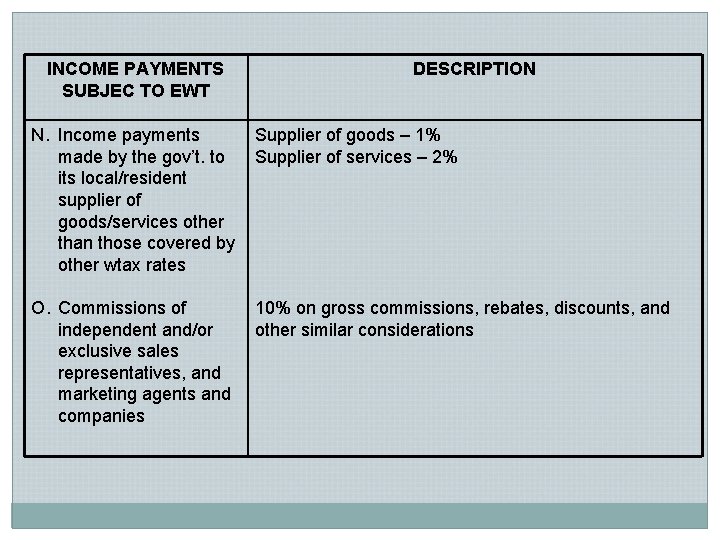

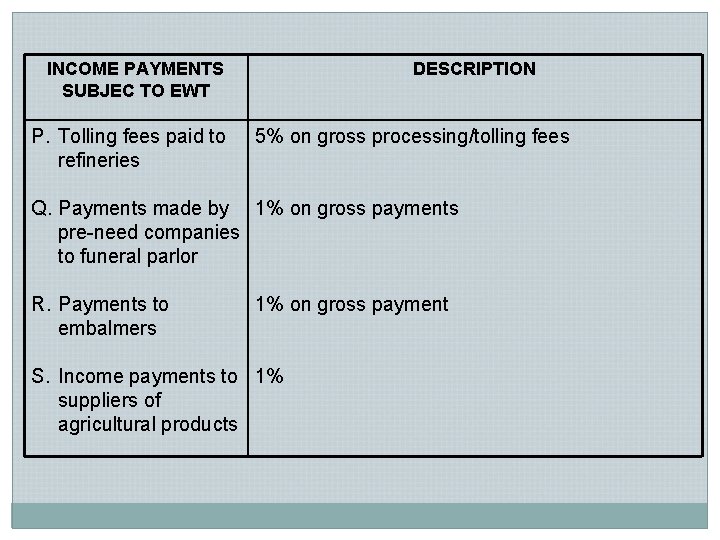

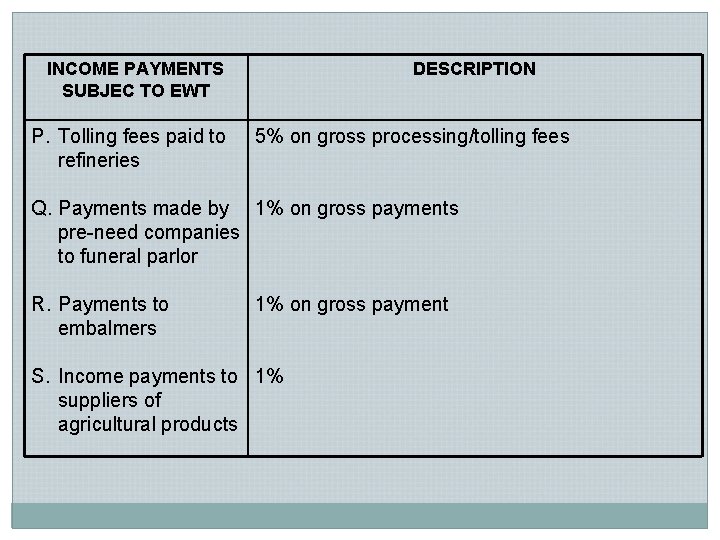

INCOME PAYMENTS SUBJEC TO EWT P. Tolling fees paid to refineries DESCRIPTION 5% on gross processing/tolling fees Q. Payments made by 1% on gross payments pre-need companies to funeral parlor R. Payments to embalmers 1% on gross payment S. Income payments to 1% suppliers of agricultural products

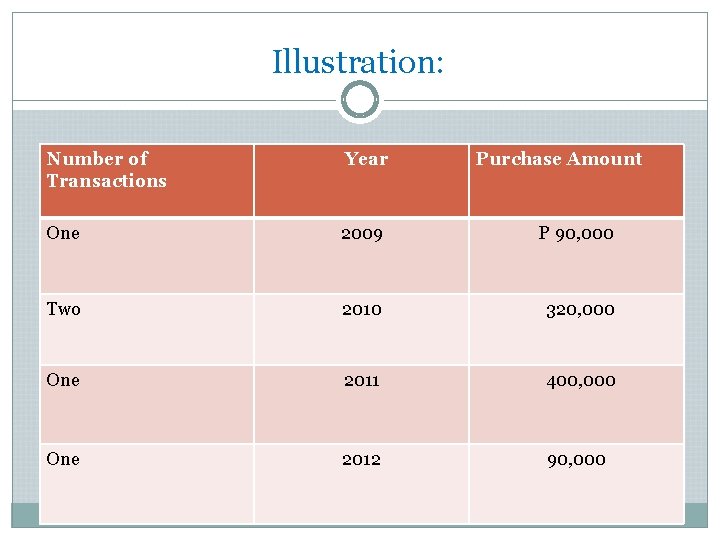

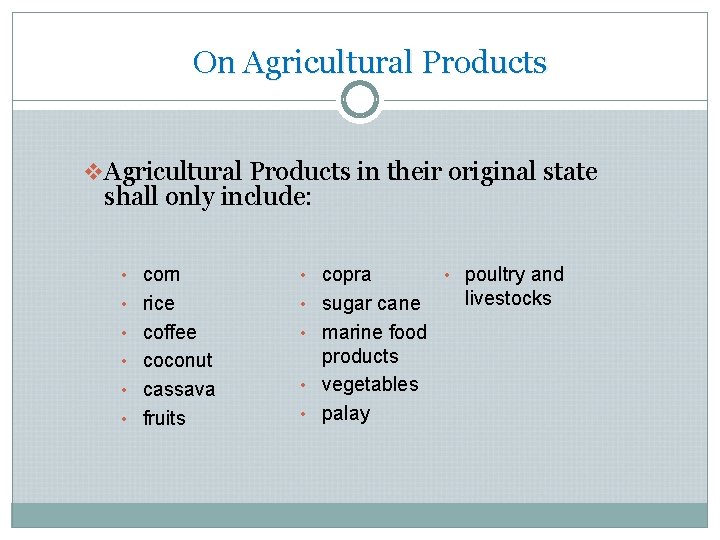

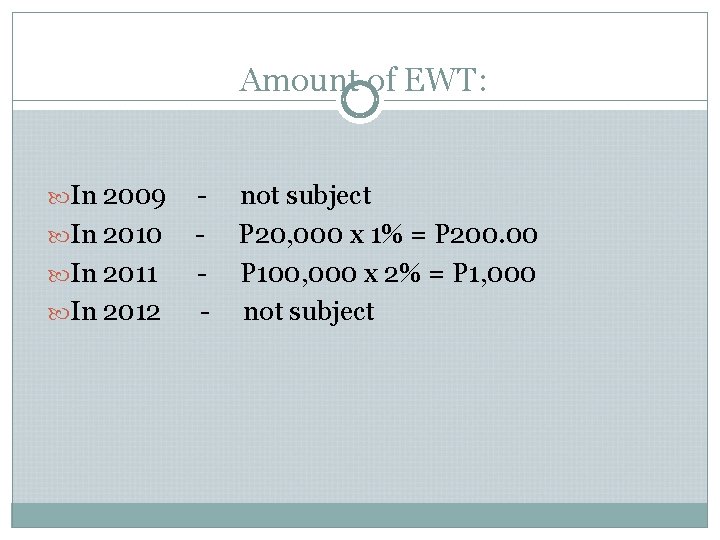

On Agricultural Products 23 v. For purchases involving agricultural products in their original state, the tax required to be withheld shall only apply to purchases in excess of the cumulative amount of P 300, 000. 00 within the same taxable year.

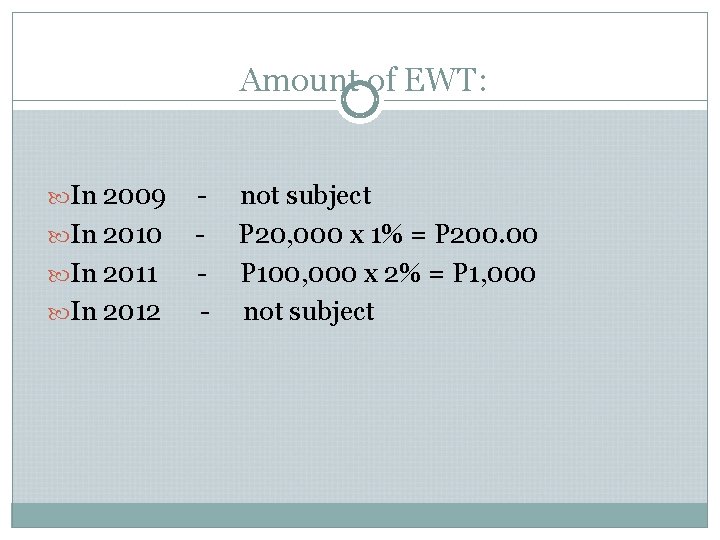

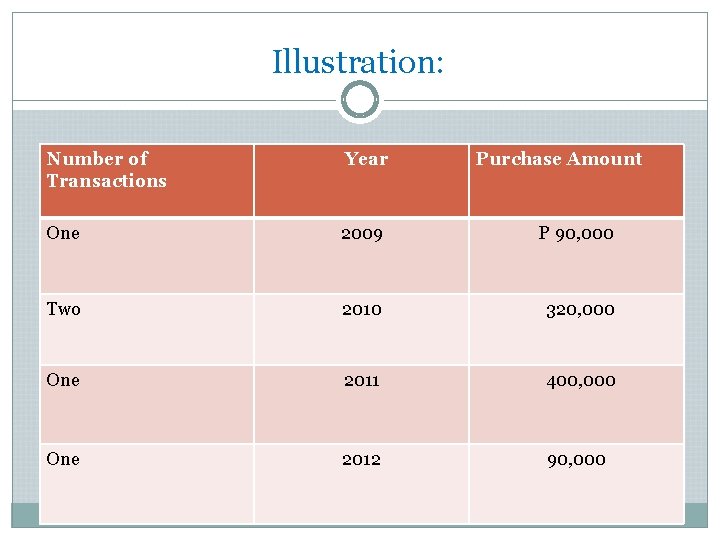

Illustration: Number of Transactions Year Purchase Amount One 2009 P 90, 000 Two 2010 320, 000 One 2011 400, 000 One 2012 90, 000

Amount of EWT: In 2009 In 2010 In 2011 In 2012 - not subject P 20, 000 x 1% = P 200. 00 P 100, 000 x 2% = P 1, 000 not subject

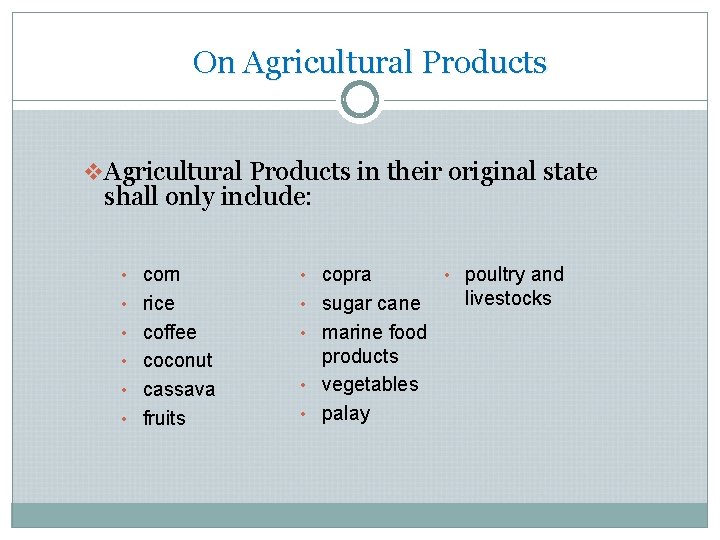

On Agricultural Products v Agricultural Products in their original state shall only include: • corn • copra • rice • sugar cane • coffee • marine food • coconut products • vegetables • palay • cassava • fruits • poultry and livestocks

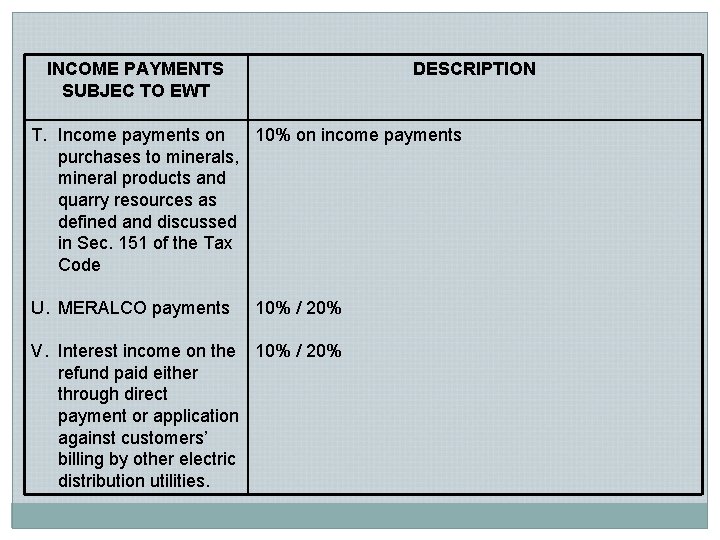

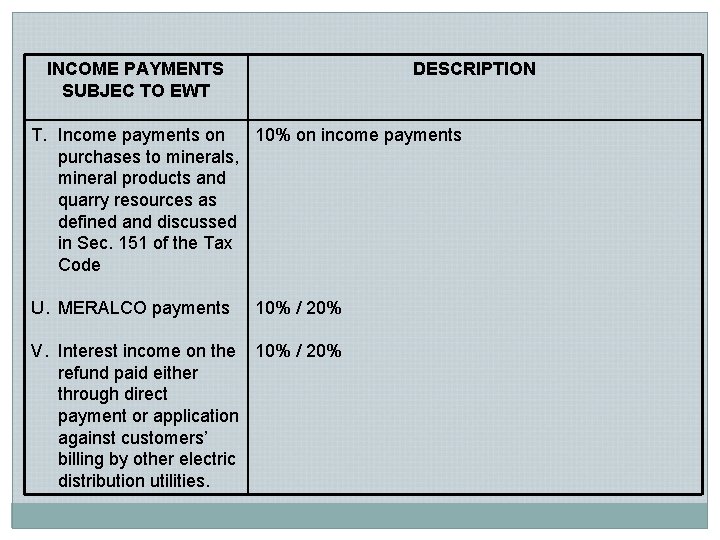

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION T. Income payments on 10% on income payments purchases to minerals, mineral products and quarry resources as defined and discussed in Sec. 151 of the Tax Code U. MERALCO payments 10% / 20% V. Interest income on the 10% / 20% refund paid either through direct payment or application against customers’ billing by other electric distribution utilities.

FINAL WITHHOLDING TAX

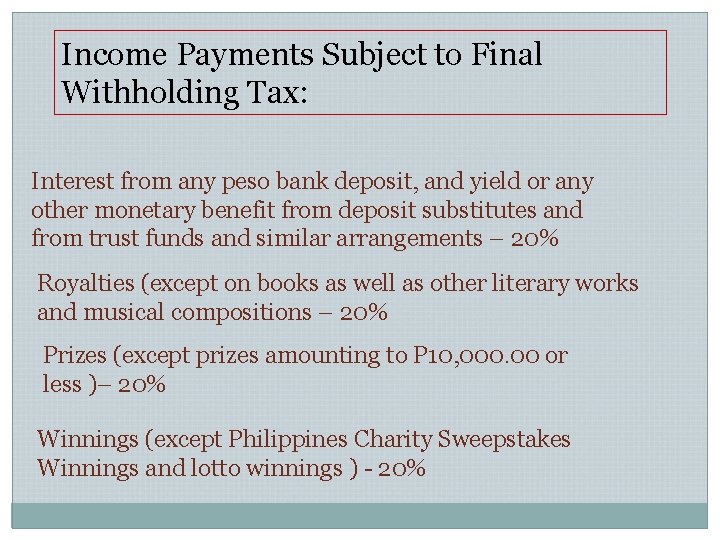

Income Payments Subject to Final Withholding Tax: Interest from any peso bank deposit, and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements – 20% Royalties (except on books as well as other literary works and musical compositions – 20% Prizes (except prizes amounting to P 10, 000. 00 or less )– 20% Winnings (except Philippines Charity Sweepstakes Winnings and lotto winnings ) - 20%

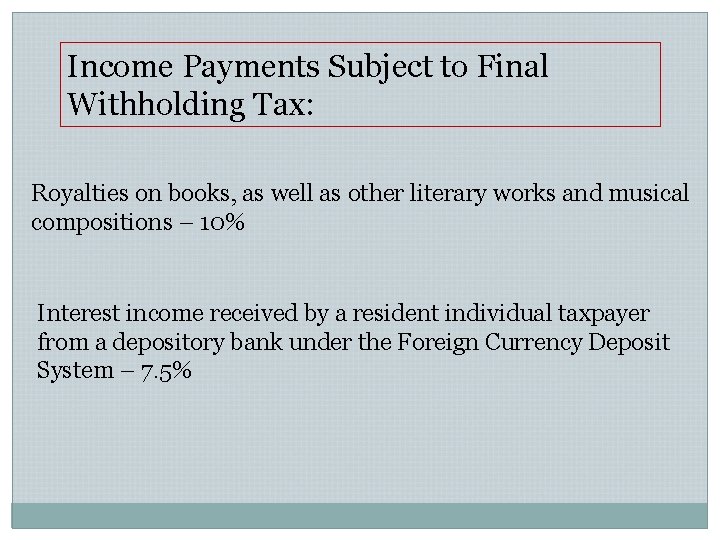

Income Payments Subject to Final Withholding Tax: Royalties on books, as well as other literary works and musical compositions – 10% Interest income received by a resident individual taxpayer from a depository bank under the Foreign Currency Deposit System – 7. 5%

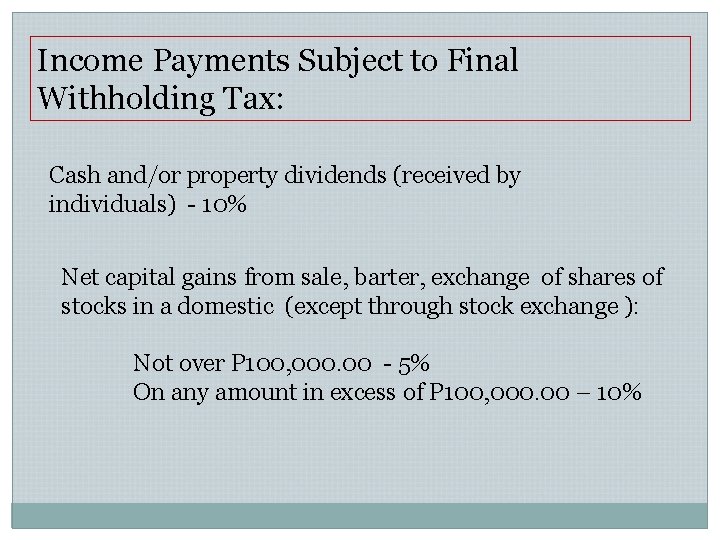

Income Payments Subject to Final Withholding Tax: Cash and/or property dividends (received by individuals) - 10% Net capital gains from sale, barter, exchange of shares of stocks in a domestic (except through stock exchange ): Not over P 100, 000. 00 - 5% On any amount in excess of P 100, 000. 00 – 10%

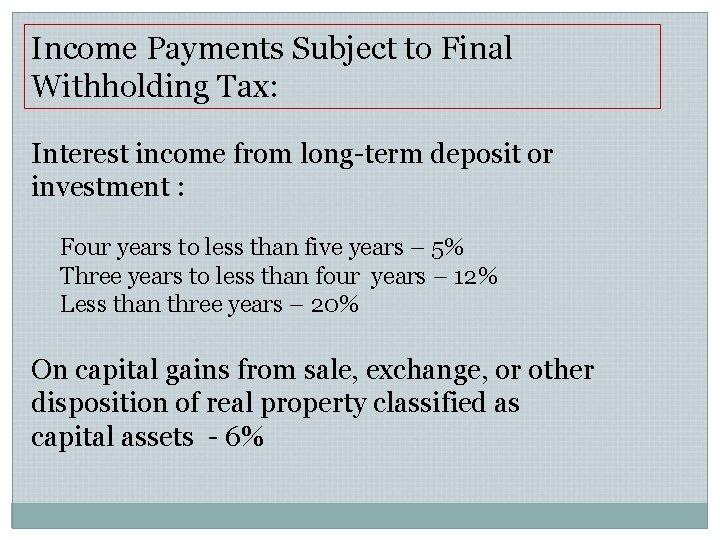

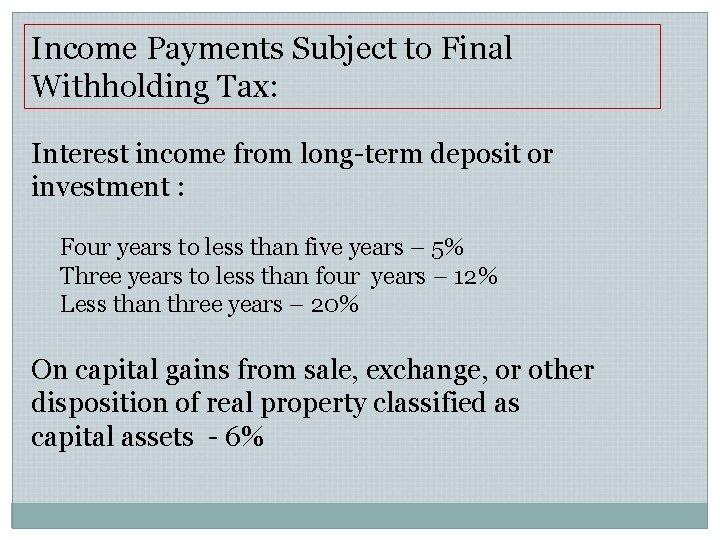

Income Payments Subject to Final Withholding Tax: Interest income from long-term deposit or investment : Four years to less than five years – 5% Three years to less than four years – 12% Less than three years – 20% On capital gains from sale, exchange, or other disposition of real property classified as capital assets - 6%

ON GOVERNMENT MONEY PAYMENTS RMC 56 -2009

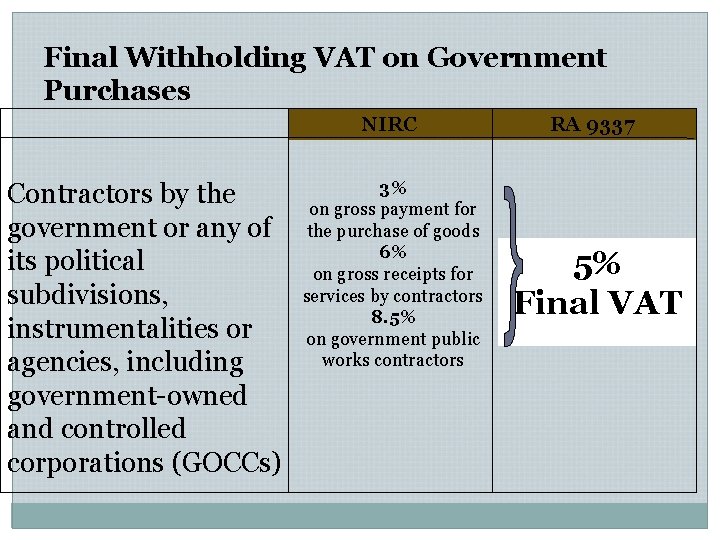

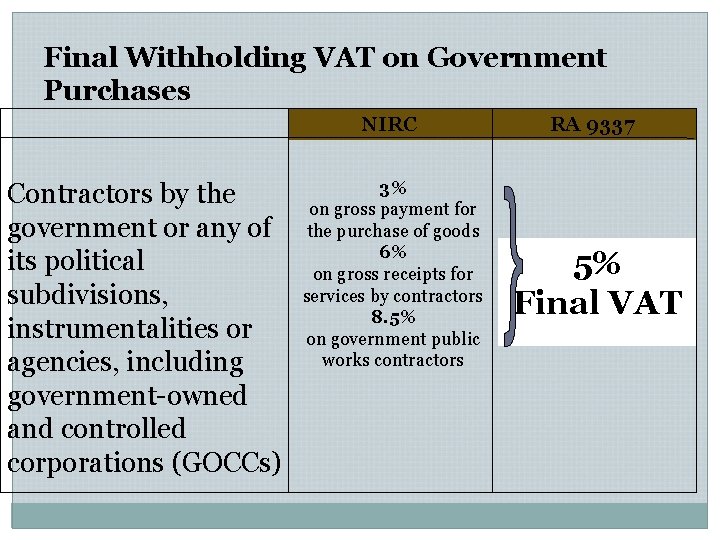

Final Withholding VAT on Government Purchases Contractors by the government or any of its political subdivisions, instrumentalities or agencies, including government-owned and controlled corporations (GOCCs) NIRC RA 9337 3% on gross payment for the purchase of goods 6% on gross receipts for services by contractors 8. 5% on government public works contractors 5% Final VAT

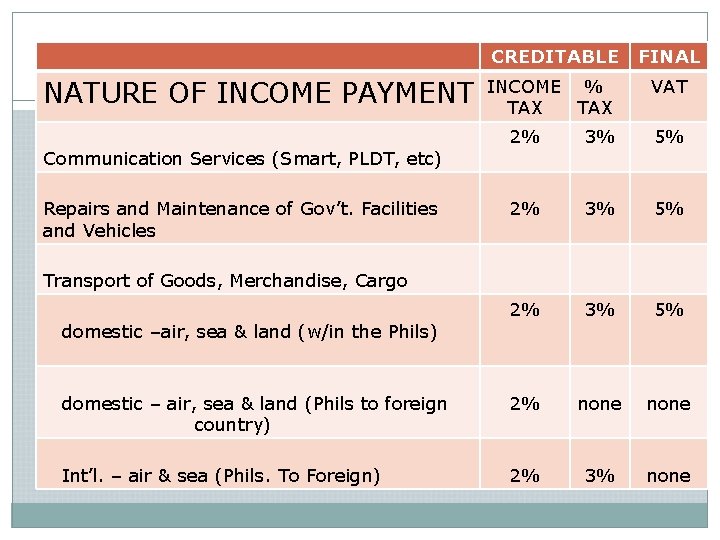

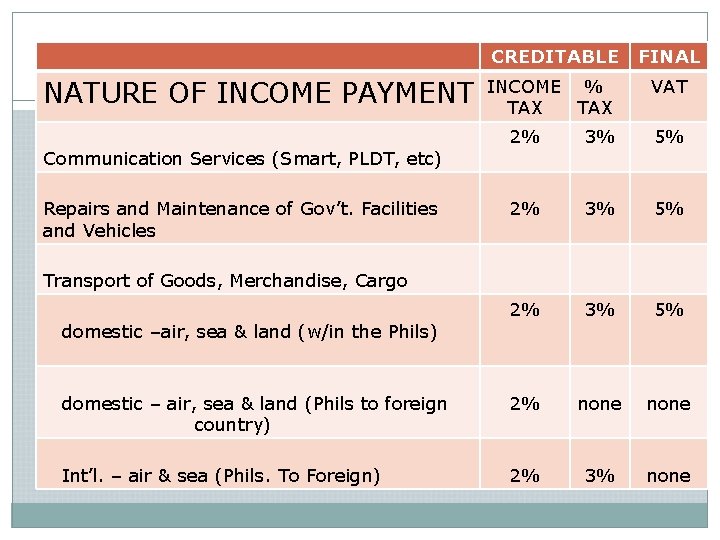

NATURE OF INCOME PAYMENT CREDITABLE FINAL INCOME % TAX VAT 2% 3% 5% domestic – air, sea & land (Phils to foreign country) 2% none Int’l. – air & sea (Phils. To Foreign) 2% 3% none Communication Services (Smart, PLDT, etc) Repairs and Maintenance of Gov’t. Facilities and Vehicles Transport of Goods, Merchandise, Cargo domestic –air, sea & land (w/in the Phils)

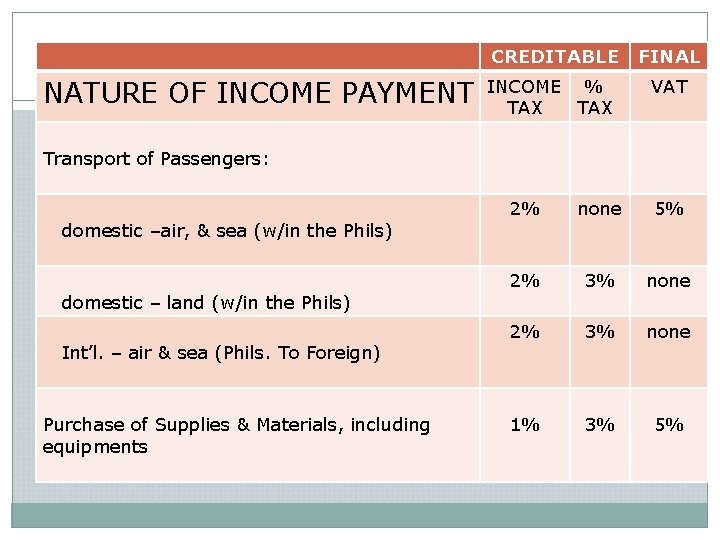

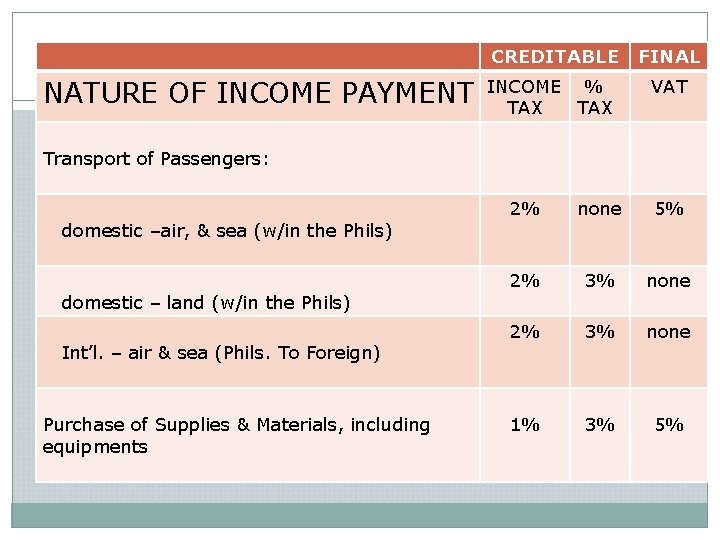

NATURE OF INCOME PAYMENT CREDITABLE FINAL INCOME % TAX VAT Transport of Passengers: domestic –air, & sea (w/in the Phils) domestic – land (w/in the Phils) Int’l. – air & sea (Phils. To Foreign) Purchase of Supplies & Materials, including equipments 2% none 5% 2% 3% none 1% 3% 5%

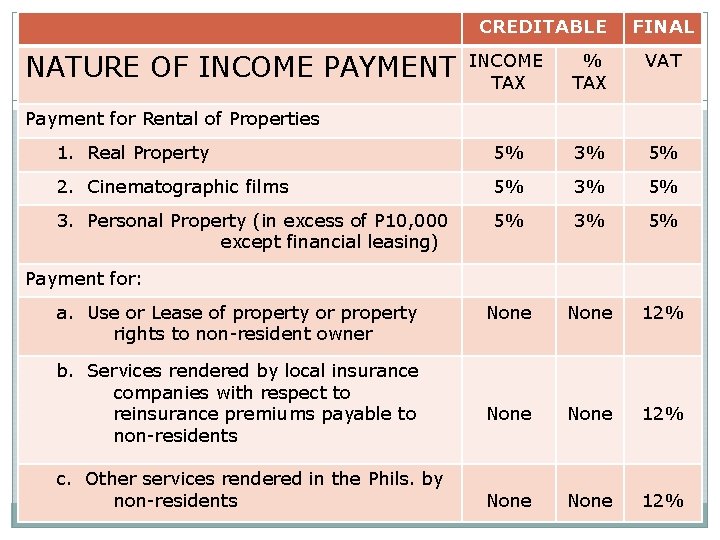

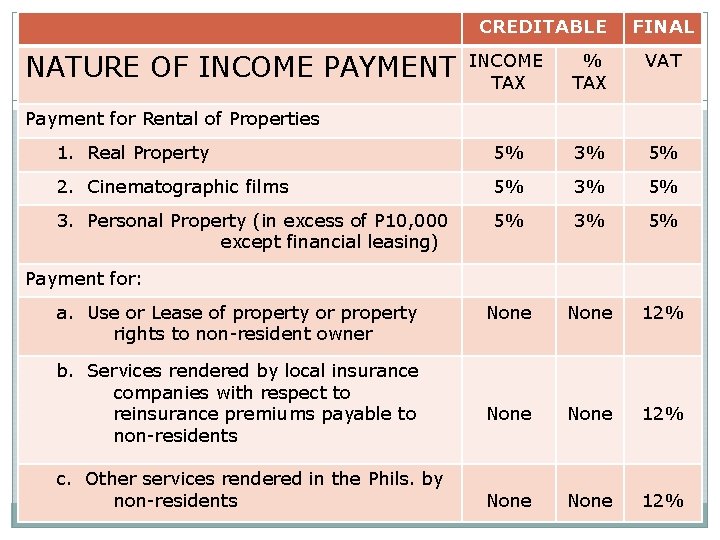

CREDITABLE NATURE OF INCOME PAYMENT FINAL INCOME TAX % TAX VAT 1. Real Property 5% 3% 5% 2. Cinematographic films 5% 3% 5% 3. Personal Property (in excess of P 10, 000 except financial leasing) 5% 3% 5% None 12% None 12% Payment for Rental of Properties Payment for: a. Use or Lease of property or property rights to non-resident owner b. Services rendered by local insurance companies with respect to reinsurance premiums payable to non-residents c. Other services rendered in the Phils. by non-residents

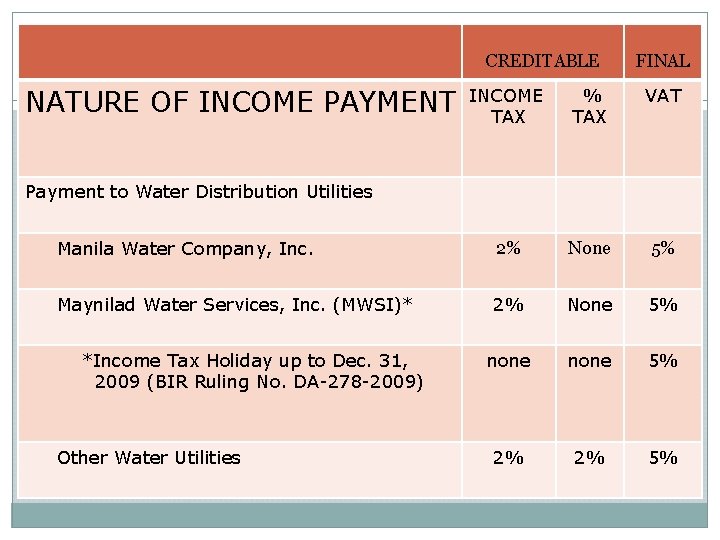

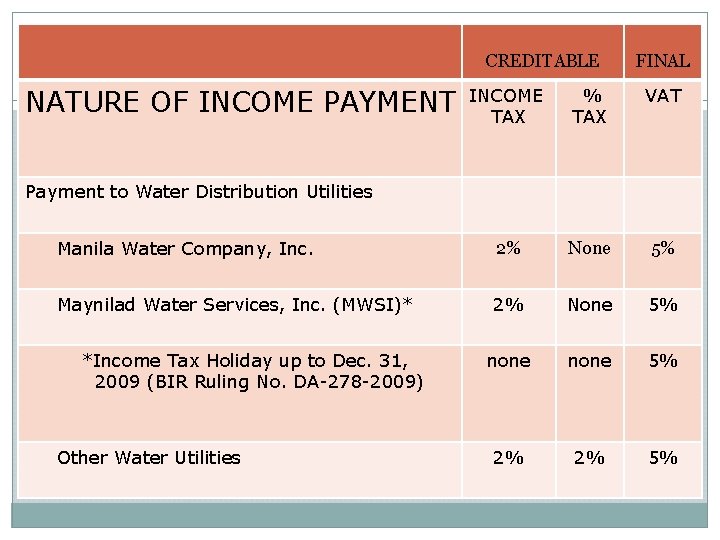

CREDITABLE NATURE OF INCOME PAYMENT FINAL INCOME TAX % TAX VAT Manila Water Company, Inc. 2% None 5% Maynilad Water Services, Inc. (MWSI)* 2% None 5% none 5% 2% 2% 5% Payment to Water Distribution Utilities *Income Tax Holiday up to Dec. 31, 2009 (BIR Ruling No. DA-278 -2009) Other Water Utilities

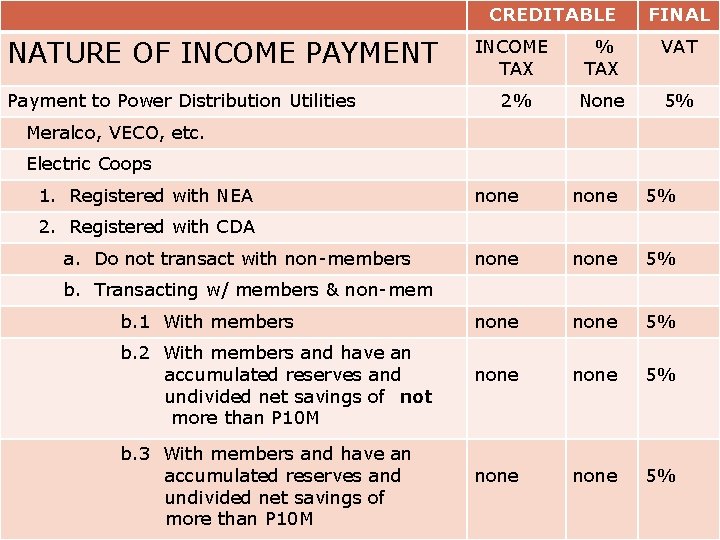

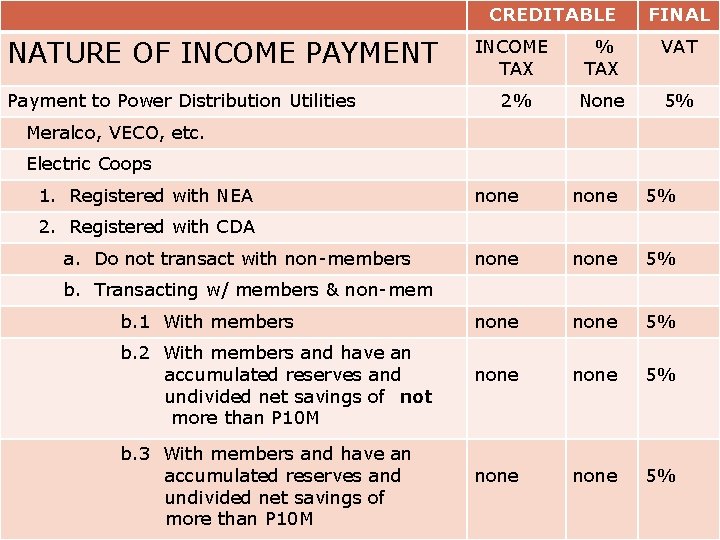

CREDITABLE NATURE OF INCOME PAYMENT Payment to Power Distribution Utilities FINAL INCOME TAX % TAX VAT 2% None 5% Meralco, VECO, etc. Electric Coops 1. Registered with NEA none none 5% none 5% 2. Registered with CDA a. Do not transact with non-members b. Transacting w/ members & non-mem b. 1 With members b. 2 With members and have an accumulated reserves and undivided net savings of not more than P 10 M b. 3 With members and have an accumulated reserves and undivided net savings of more than P 10 M

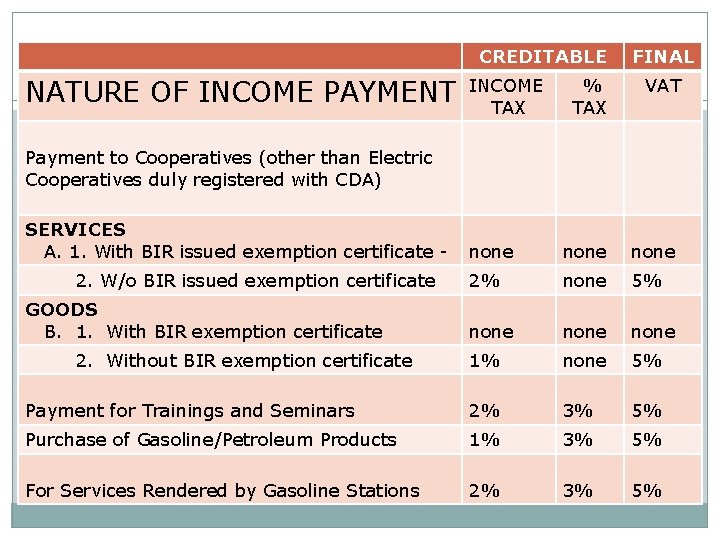

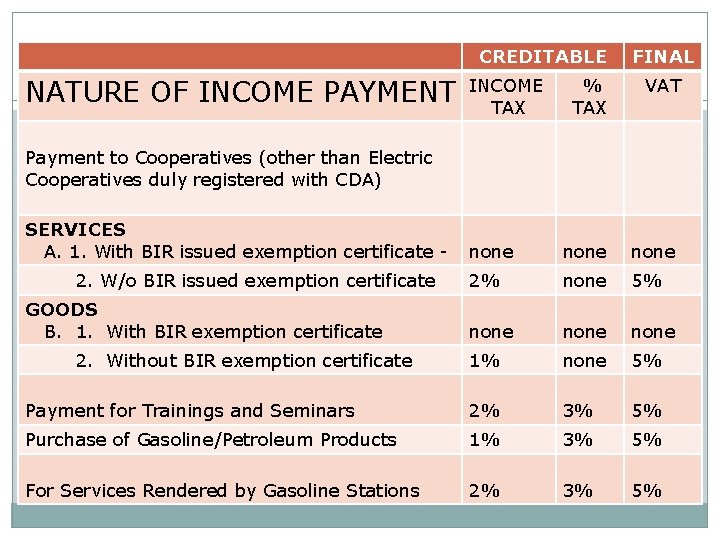

CREDITABLE NATURE OF INCOME PAYMENT INCOME TAX FINAL % TAX VAT none 2% none 5% none 1% none 5% Payment for Trainings and Seminars 2% 3% 5% Purchase of Gasoline/Petroleum Products 1% 3% 5% For Services Rendered by Gasoline Stations 2% 3% 5% Payment to Cooperatives (other than Electric Cooperatives duly registered with CDA) SERVICES A. 1. With BIR issued exemption certificate 2. W/o BIR issued exemption certificate GOODS B. 1. With BIR exemption certificate 2. Without BIR exemption certificate

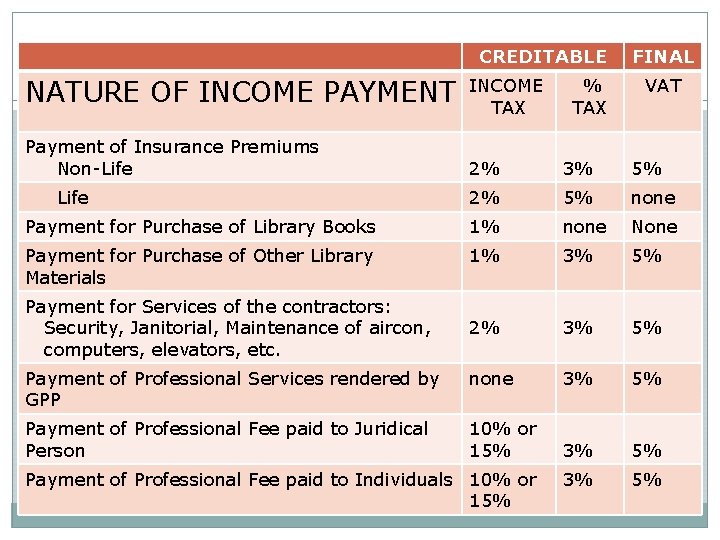

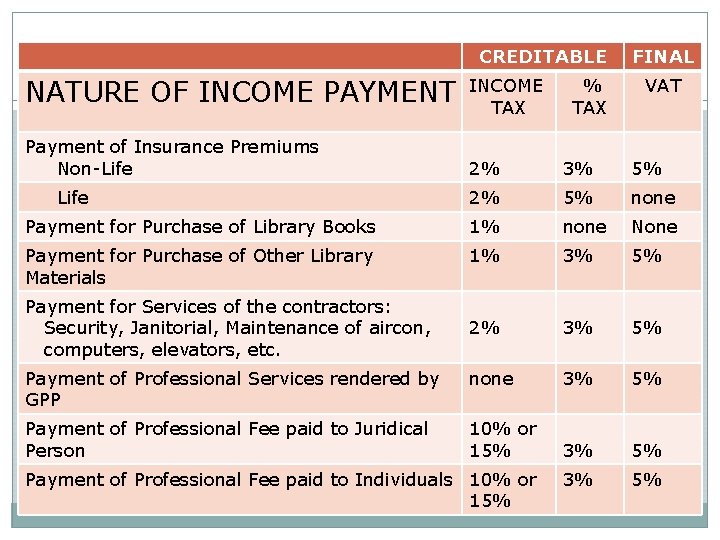

CREDITABLE NATURE OF INCOME PAYMENT Payment of Insurance Premiums Non-Life INCOME TAX % TAX FINAL VAT 2% 3% 5% 2% 5% none Payment for Purchase of Library Books 1% none None Payment for Purchase of Other Library Materials 1% 3% 5% 2% 3% 5% Payment of Professional Services rendered by GPP none 3% 5% Payment of Professional Fee paid to Juridical Person 10% or 15% 3% 5% Life Payment for Services of the contractors: Security, Janitorial, Maintenance of aircon, computers, elevators, etc. Payment of Professional Fee paid to Individuals 10% or 15%

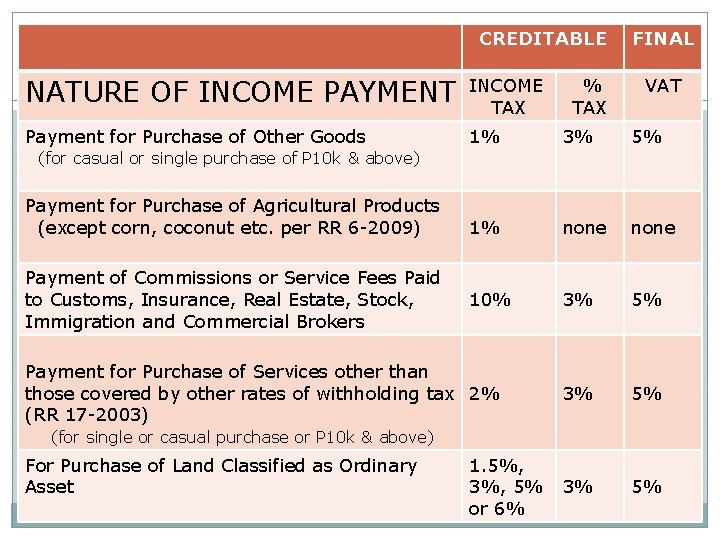

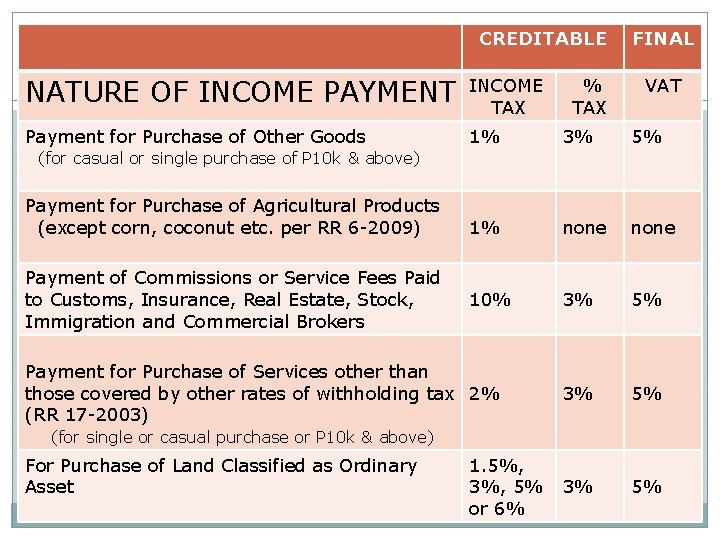

CREDITABLE FINAL NATURE OF INCOME PAYMENT INCOME TAX Payment for Purchase of Other Goods 1% 3% 5% 1% none 10% 3% 5% % TAX VAT (for casual or single purchase of P 10 k & above) Payment for Purchase of Agricultural Products (except corn, coconut etc. per RR 6 -2009) Payment of Commissions or Service Fees Paid to Customs, Insurance, Real Estate, Stock, Immigration and Commercial Brokers Payment for Purchase of Services other than those covered by other rates of withholding tax 2% (RR 17 -2003) (for single or casual purchase or P 10 k & above) For Purchase of Land Classified as Ordinary Asset 1. 5%, 3%, 5% or 6%

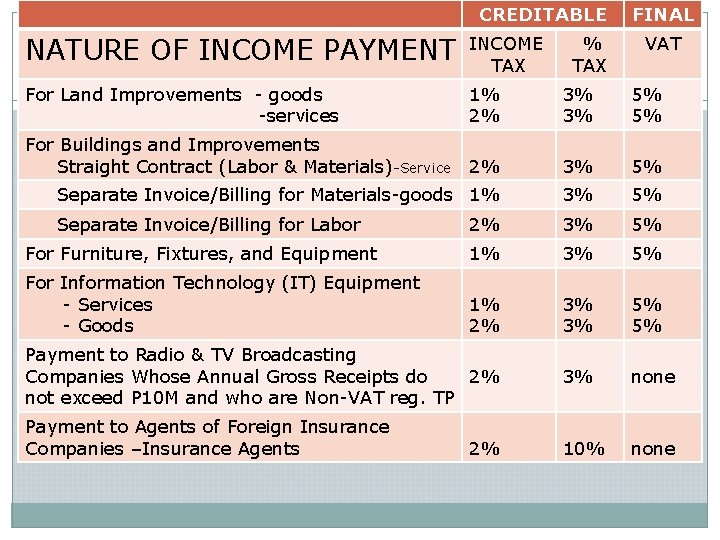

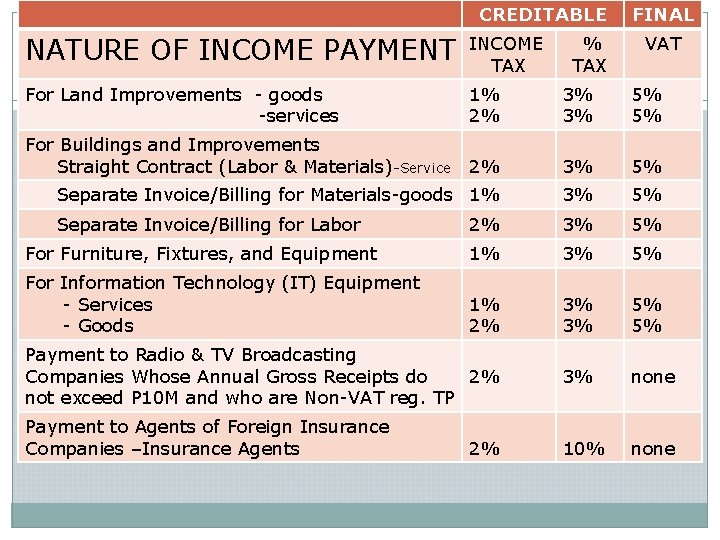

CREDITABLE FINAL NATURE OF INCOME PAYMENT INCOME TAX For Land Improvements - goods -services 1% 2% 3% 3% 5% 5% For Buildings and Improvements Straight Contract (Labor & Materials)-Service 2% 3% 5% Separate Invoice/Billing for Materials-goods 1% 3% 5% Separate Invoice/Billing for Labor 2% 3% 5% For Furniture, Fixtures, and Equipment 1% 3% 5% For Information Technology (IT) Equipment - Services - Goods 1% 2% 3% 3% 5% 5% Payment to Radio & TV Broadcasting Companies Whose Annual Gross Receipts do 2% not exceed P 10 M and who are Non-VAT reg. TP 3% none 10% none Payment to Agents of Foreign Insurance Companies –Insurance Agents 2% % TAX VAT

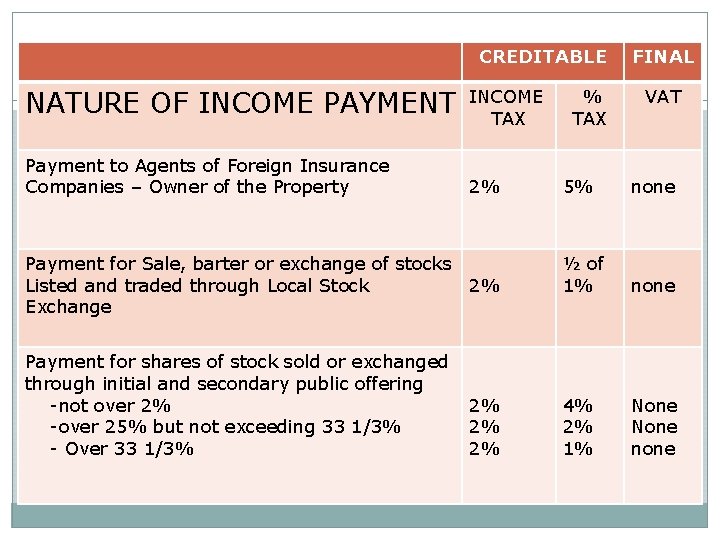

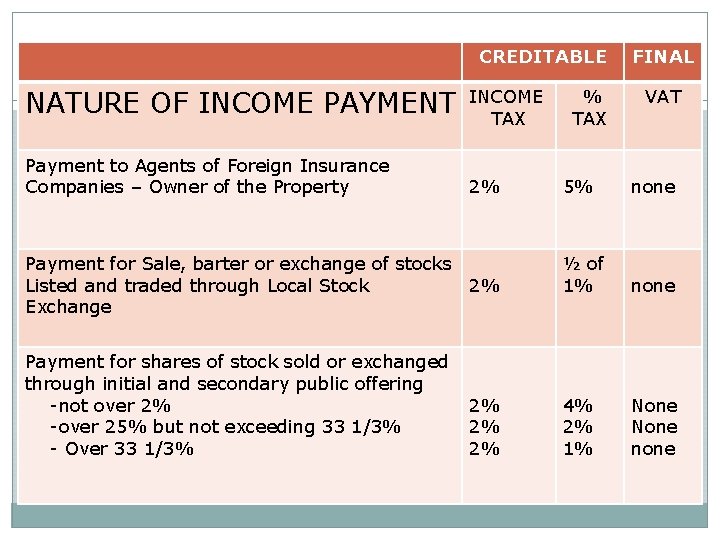

CREDITABLE NATURE OF INCOME PAYMENT Payment to Agents of Foreign Insurance Companies – Owner of the Property INCOME TAX 2% Payment for Sale, barter or exchange of stocks Listed and traded through Local Stock 2% Exchange Payment for shares of stock sold or exchanged through initial and secondary public offering -not over 2% -over 25% but not exceeding 33 1/3% - Over 33 1/3% 2% 2% 2% % TAX FINAL VAT 5% none ½ of 1% none 4% 2% 1% None none

CREDITABLE NATURE OF INCOME PAYMENT INCOME TAX % TAX FINAL VAT Payment to Banks and Non-Bank Financial Intermediaries performing quasi-banking functions (Sec. 121 of RA 8424 as amended by RA 9337) 1. On interests, commissions and discounts from lending activities as well as income from financial leasing, on the basis of remaining maturities of instruments from which such receipts are derived: - Maturity period is 5 years or less - Maturity period is more than 5 years 2. On dividends and equity shares and net income of subsidiaries 2% 5% None 2% 2% 5% 1% none None 2% 0% none

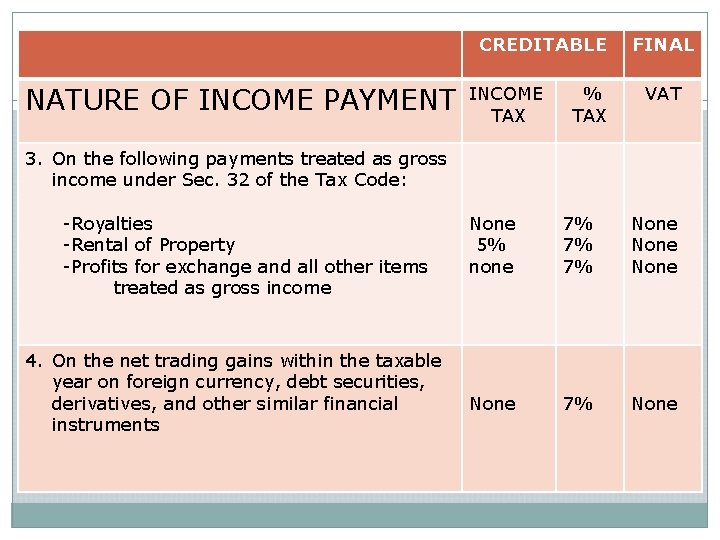

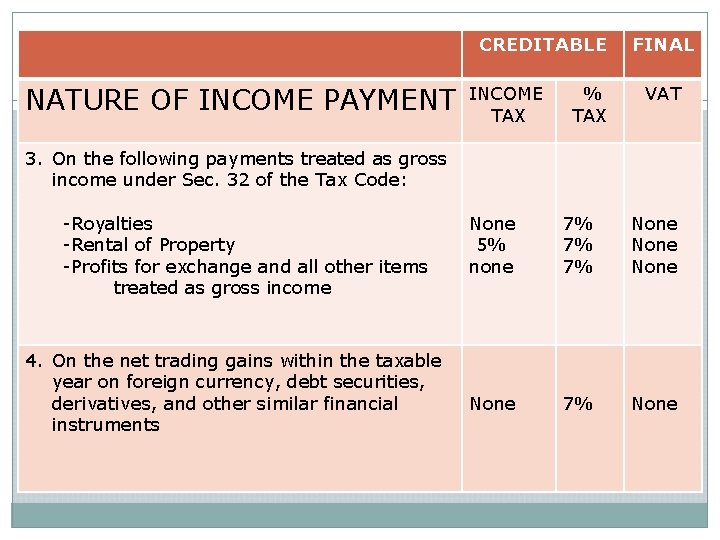

CREDITABLE NATURE OF INCOME PAYMENT INCOME TAX % TAX FINAL VAT 3. On the following payments treated as gross income under Sec. 32 of the Tax Code: -Royalties -Rental of Property -Profits for exchange and all other items treated as gross income 4. On the net trading gains within the taxable year on foreign currency, debt securities, derivatives, and other similar financial instruments None 5% none 7% 7% 7% None 7% None

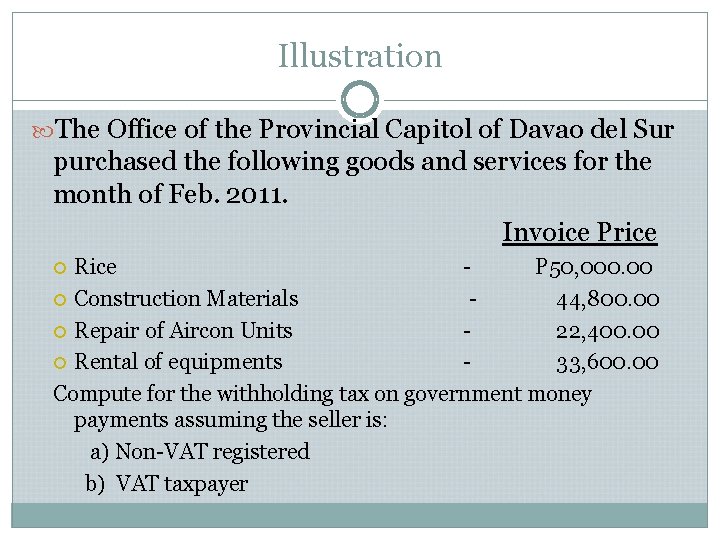

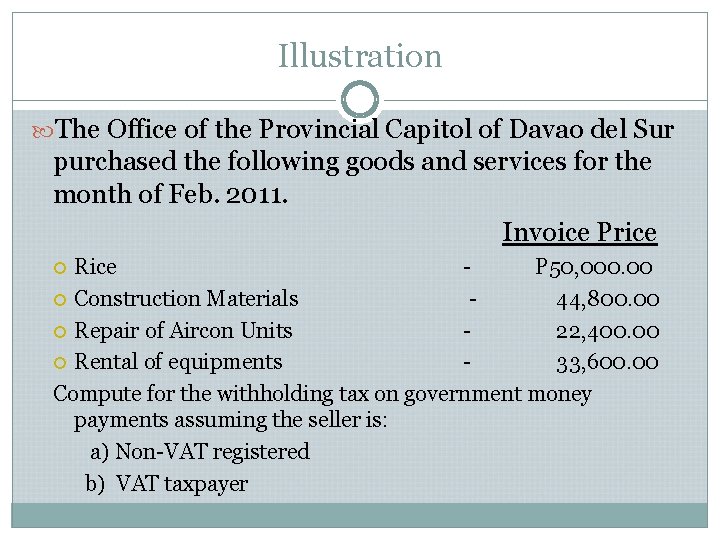

Illustration The Office of the Provincial Capitol of Davao del Sur purchased the following goods and services for the month of Feb. 2011. Invoice Price Rice P 50, 000. 00 Construction Materials 44, 800. 00 Repair of Aircon Units 22, 400. 00 Rental of equipments 33, 600. 00 Compute for the withholding tax on government money payments assuming the seller is: a) Non-VAT registered b) VAT taxpayer

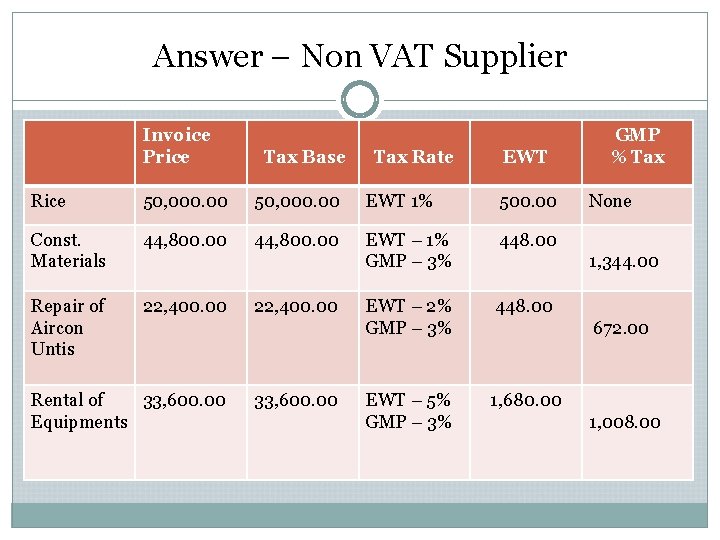

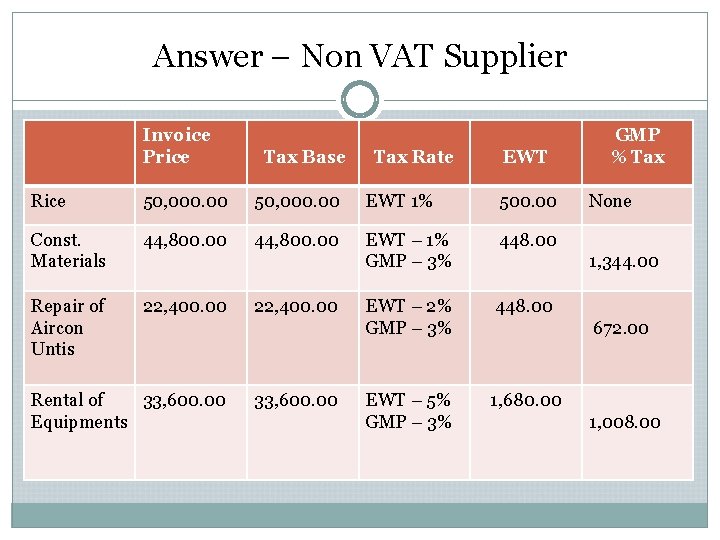

Answer – Non VAT Supplier Invoice Price Tax Base Tax Rate EWT Rice 50, 000. 00 EWT 1% 500. 00 Const. Materials 44, 800. 00 EWT – 1% GMP – 3% 448. 00 Repair of Aircon Untis 22, 400. 00 EWT – 2% GMP – 3% 448. 00 EWT – 5% GMP – 3% 1, 680. 00 Rental of 33, 600. 00 Equipments 22, 400. 00 33, 600. 00 GMP % Tax None 1, 344. 00 672. 00 1, 008. 00

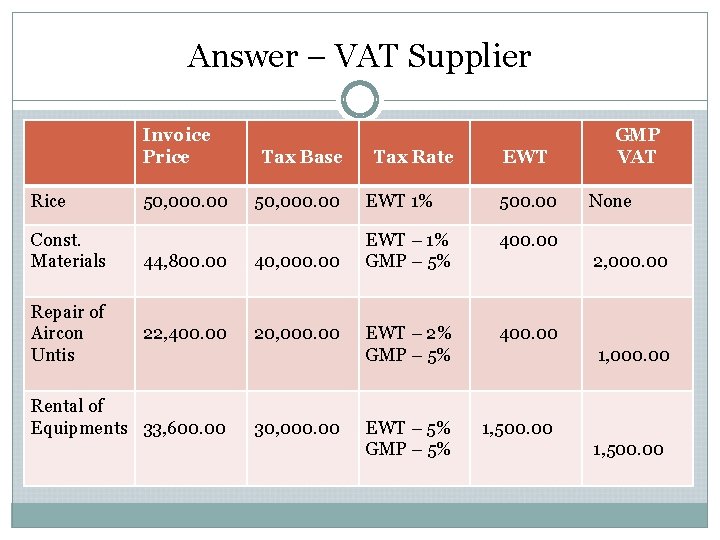

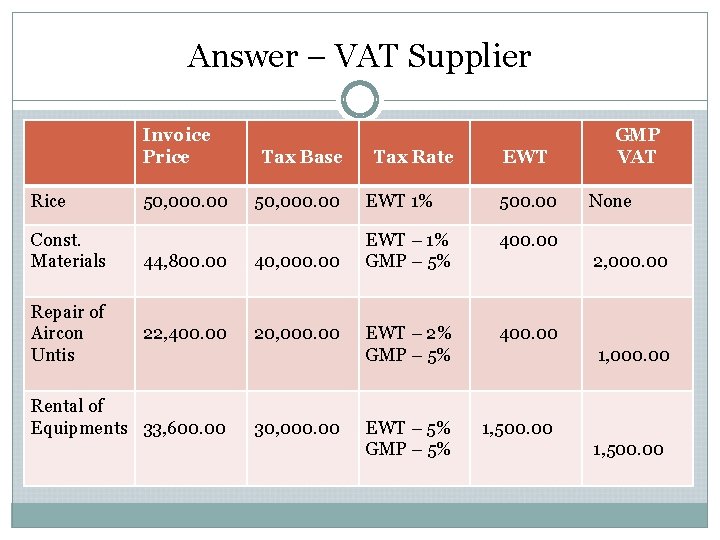

Answer – VAT Supplier Invoice Price Rice Const. Materials Repair of Aircon Untis 50, 000. 00 Tax Base Tax Rate EWT 50, 000. 00 EWT 1% 500. 00 44, 800. 00 40, 000. 00 EWT – 1% GMP – 5% 22, 400. 00 20, 000. 00 EWT – 2% GMP – 5% 400. 00 Rental of Equipments 33, 600. 00 30, 000. 00 EWT – 5% GMP VAT None 2, 000. 00 1, 500. 00

FRINGE BENEFITS TAX (FBT)

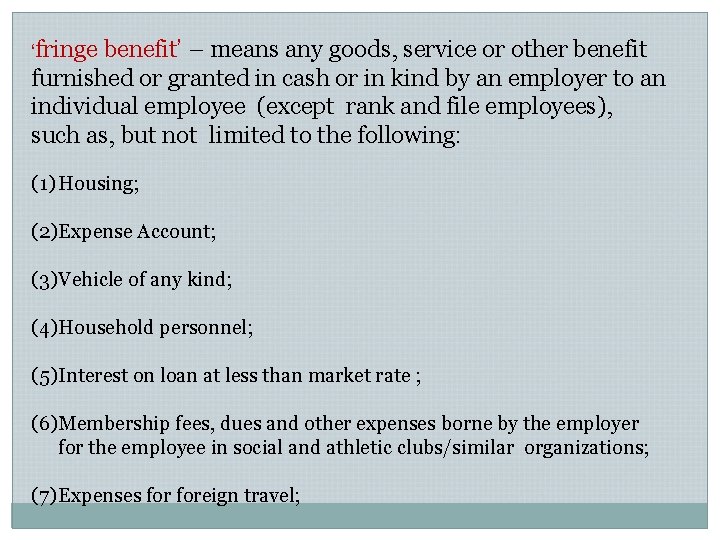

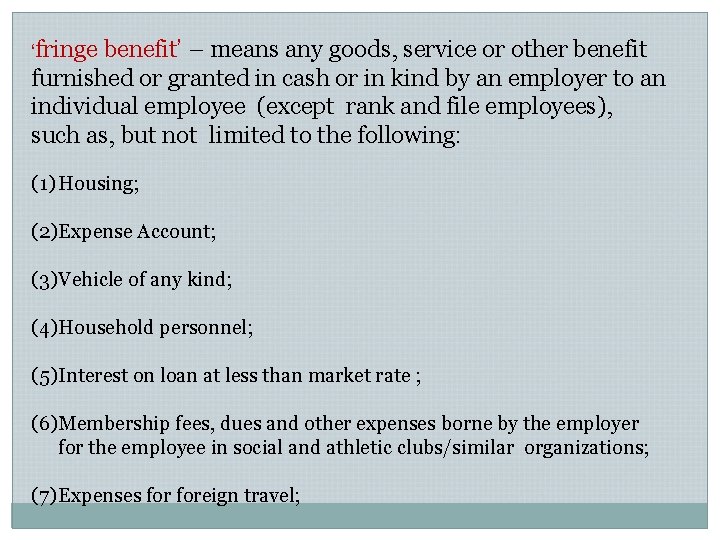

‘fringe benefit’ – means any goods, service or other benefit furnished or granted in cash or in kind by an employer to an individual employee (except rank and file employees), such as, but not limited to the following: (1) Housing; (2)Expense Account; (3)Vehicle of any kind; (4)Household personnel; (5) Interest on loan at less than market rate ; (6)Membership fees, dues and other expenses borne by the employer for the employee in social and athletic clubs/similar organizations; (7) Expenses foreign travel;

Fringe Benefit (Cont. ) (8) Holiday and vacation expenses; (9) Educational assistance to the employee or his dependents; (10) Life or health insurance and other non-life insurance premiums

Fringe Benefits Granted to the Employee (Except Rank and File Employee) – 32% on the grossed-up monetary value of fringe benefits granted or furnished by the employer to his employees.

Exception: if the fringe benefits are required by the nature of or necessary to the trade, business or profession of the employer, or where such fringe benefit is for the convenience and advantage of the employer shall not be subject to the fringe benefits tax.

WITHHOLDING TAX ON COMPENSATION (Revenue Regulations No. 2 -98, as amended) Presented by: Sheila Joy C. Benedicto Revenue Officer RDO 113 -West Davao

Compensation Income Defined Compensation means all remuneration for services performed by an employee for his employer under an employeeemployer relationship unless exempted by the Code.

Exemptions from withholding tax on compensation 1. Remunerations received as an incident of employment (retirement/separation) 2. Remuneration paid for agricultural labor 3. Remuneration for domestic services 4. Remuneration for casual labor not in the course of an employer’s trade or business

Exemptions (cont…) 5. Compensation for services by a citizen or resident of the Philippines to a Foreign Government or an International Organization; 6. Damages 7. Life Insurance 8. Amount Received by the Insured as a Return of Premium

Exemptions (cont…) 9. Compensation for Injuries or sickness 10. Income Exempt Under Treaty 11. GSIS, SSS, Medicare and other contributions (HDMF and Union Dues)

Exemptions (cont…) 12. Thirteenth(13 th) Month Pay and Other Benefits not exceeding P 30, 000 Other Benefits such as ² Christmas bonus ² Productivity ² Loyalty Award ² Gifts in cash or in kind ² Other benefits of similar nature ² Excess over the prescribed ceiling of the “de minimis benefits”

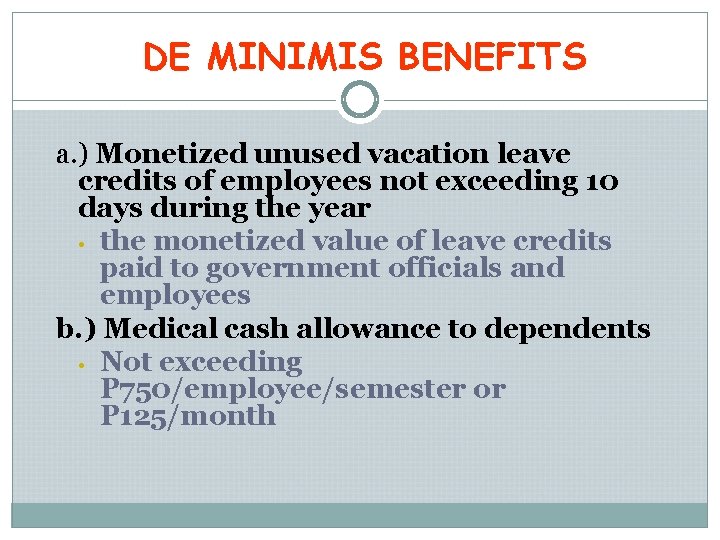

DE MINIMIS BENEFITS a. ) Monetized unused vacation leave credits of employees not exceeding 10 days during the year • the monetized value of leave credits paid to government officials and employees b. ) Medical cash allowance to dependents • Not exceeding P 750/employee/semester or P 125/month

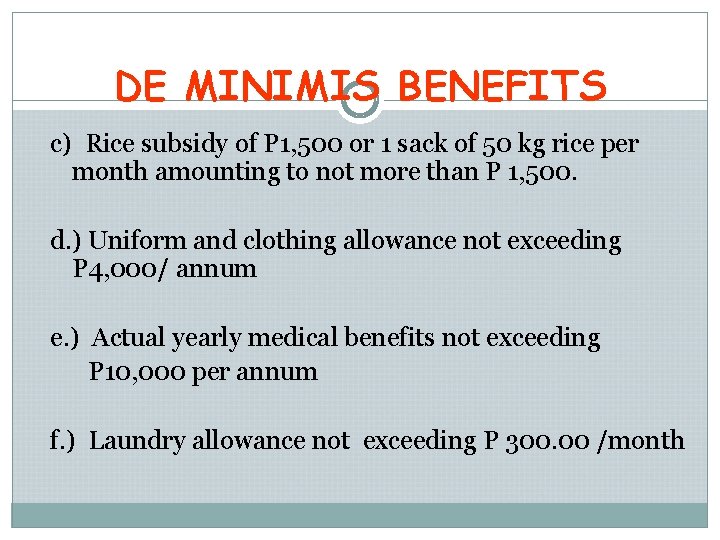

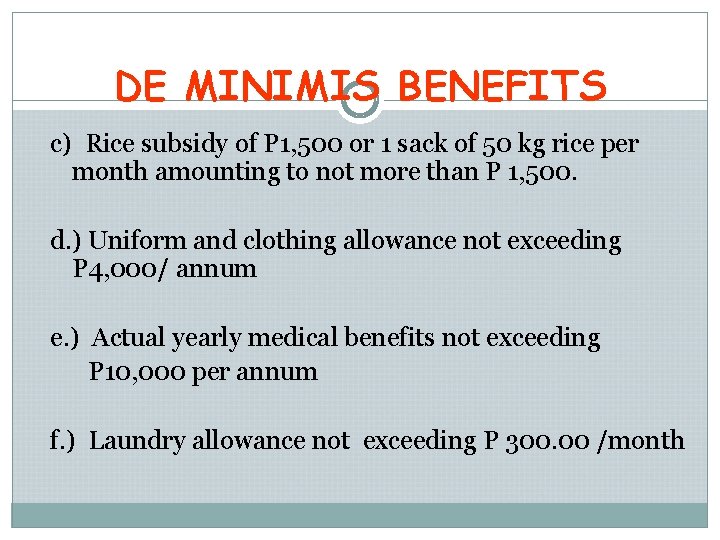

DE MINIMIS BENEFITS c) Rice subsidy of P 1, 500 or 1 sack of 50 kg rice per month amounting to not more than P 1, 500. d. ) Uniform and clothing allowance not exceeding P 4, 000/ annum e. ) Actual yearly medical benefits not exceeding P 10, 000 per annum f. ) Laundry allowance not exceeding P 300. 00 /month

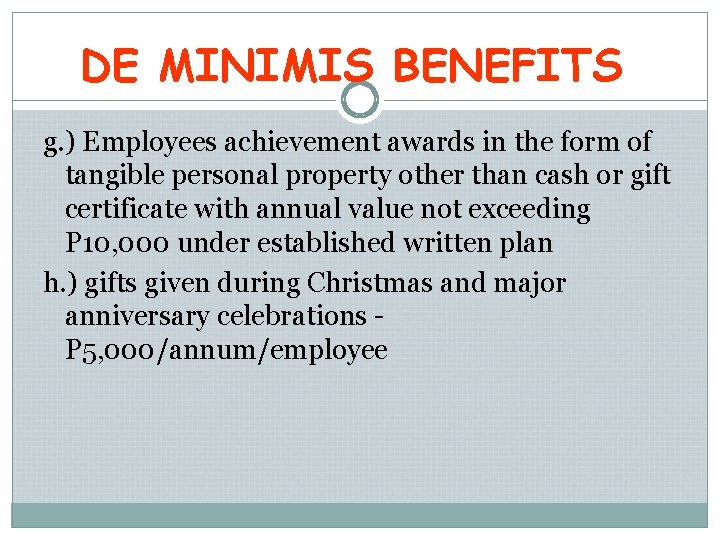

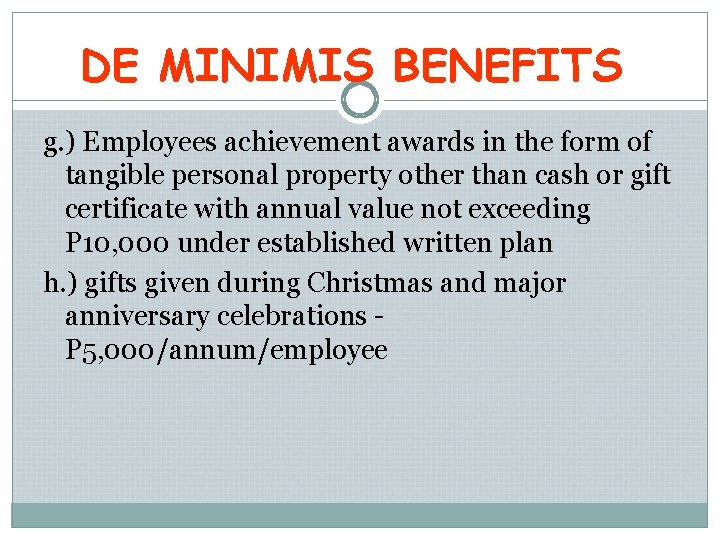

DE MINIMIS BENEFITS g. ) Employees achievement awards in the form of tangible personal property other than cash or gift certificate with annual value not exceeding P 10, 000 under established written plan h. ) gifts given during Christmas and major anniversary celebrations P 5, 000/annum/employee

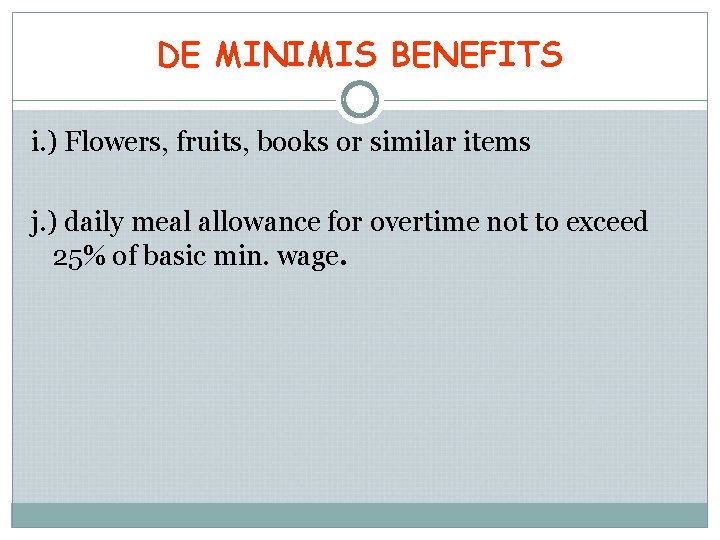

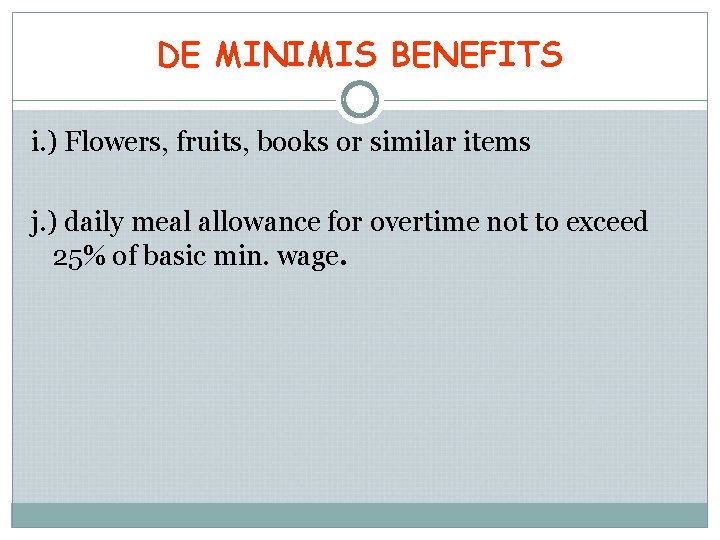

DE MINIMIS BENEFITS i. ) Flowers, fruits, books or similar items j. ) daily meal allowance for overtime not to exceed 25% of basic min. wage.

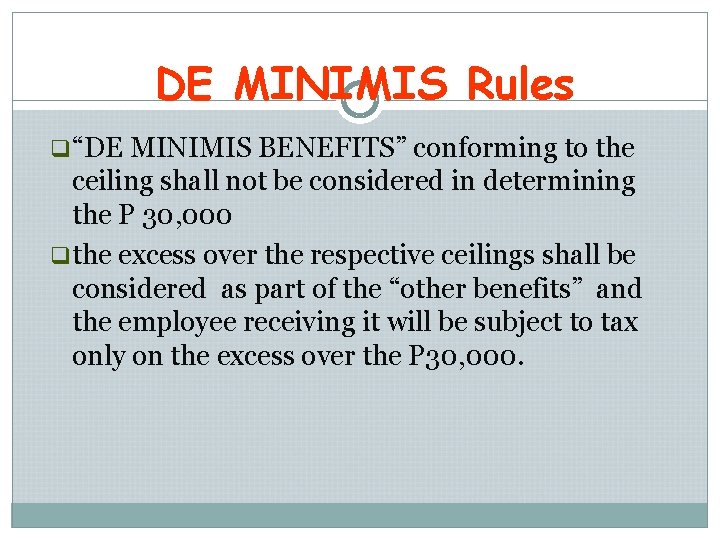

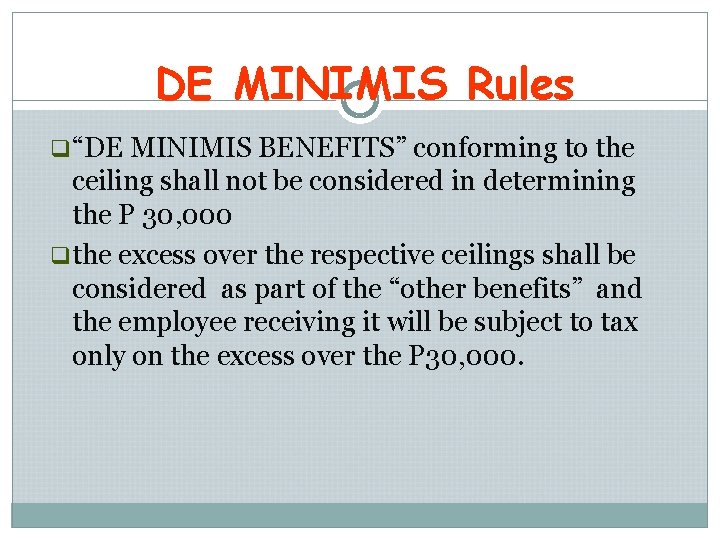

DE MINIMIS Rules q“DE MINIMIS BENEFITS” conforming to the ceiling shall not be considered in determining the P 30, 000 qthe excess over the respective ceilings shall be considered as part of the “other benefits” and the employee receiving it will be subject to tax only on the excess over the P 30, 000.

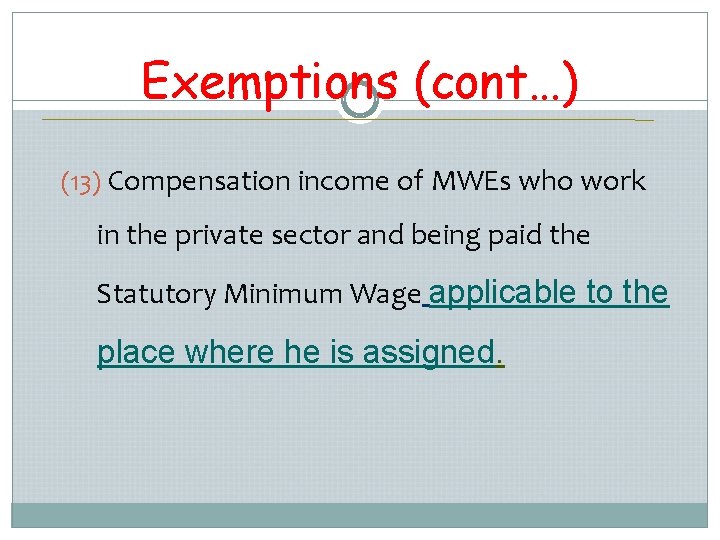

Exemptions (cont…) (13) Compensation income of MWEs who work in the private sector and being paid the Statutory Minimum Wage applicable to the place where he is assigned.

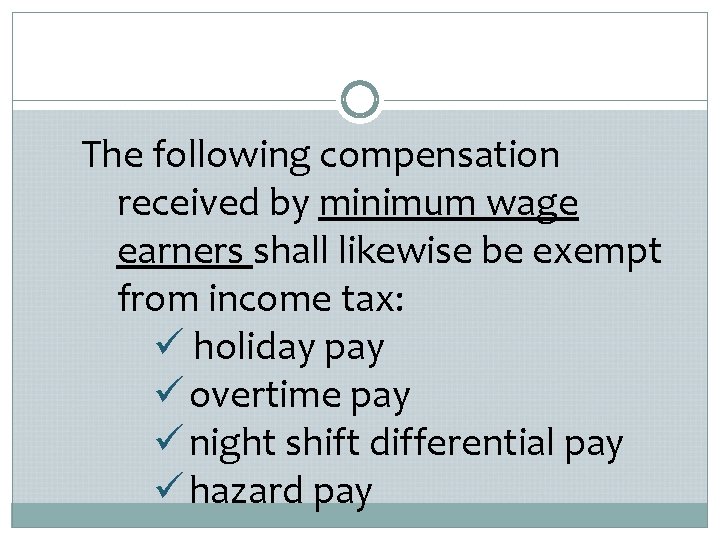

The following compensation received by minimum wage earners shall likewise be exempt from income tax: ü holiday pay ü overtime pay ü night shift differential pay ü hazard pay

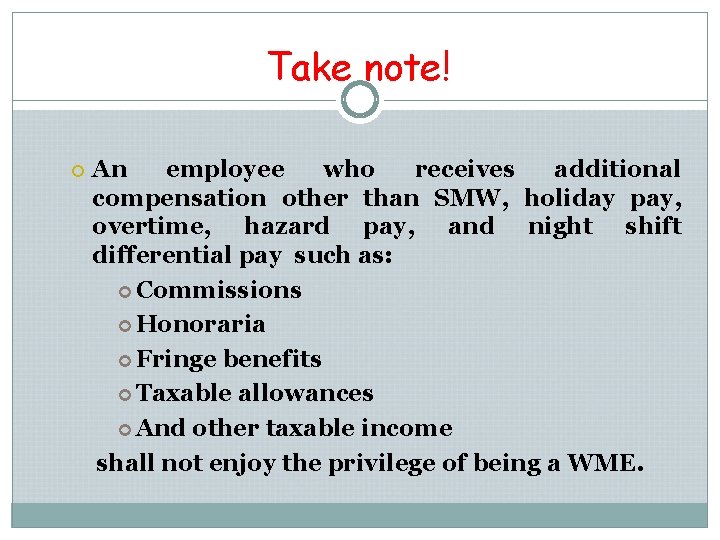

Take note! An employee who receives additional compensation other than SMW, holiday pay, overtime, hazard pay, and night shift differential pay such as: Commissions Honoraria Fringe benefits Taxable allowances And other taxable income shall not enjoy the privilege of being a WME.

Take Note! MWEs receiving other income from business or practice of profession, except income subject to Final Tax, shall be subject to Income Tax on their entire income SMW, Holiday pay, overtime pay, night shift differential pay, and hazard pay shall still be exempt from WT

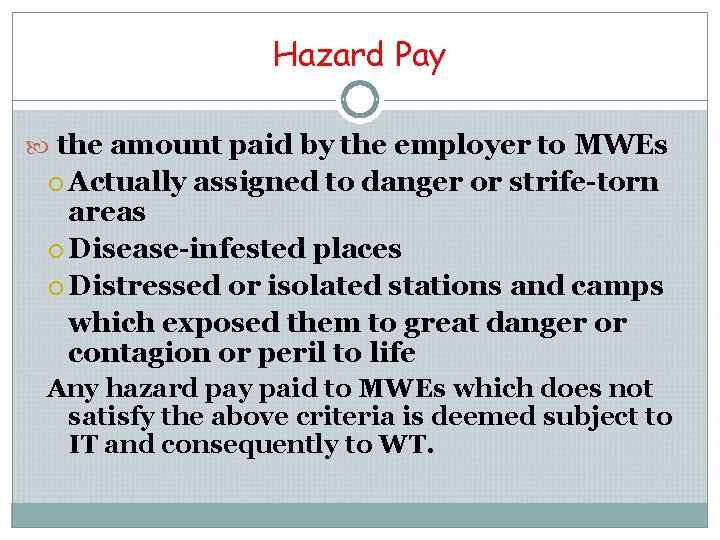

Hazard Pay the amount paid by the employer to MWEs Actually assigned to danger or strife-torn areas Disease-infested places Distressed or isolated stations and camps which exposed them to great danger or contagion or peril to life Any hazard pay paid to MWEs which does not satisfy the above criteria is deemed subject to IT and consequently to WT.

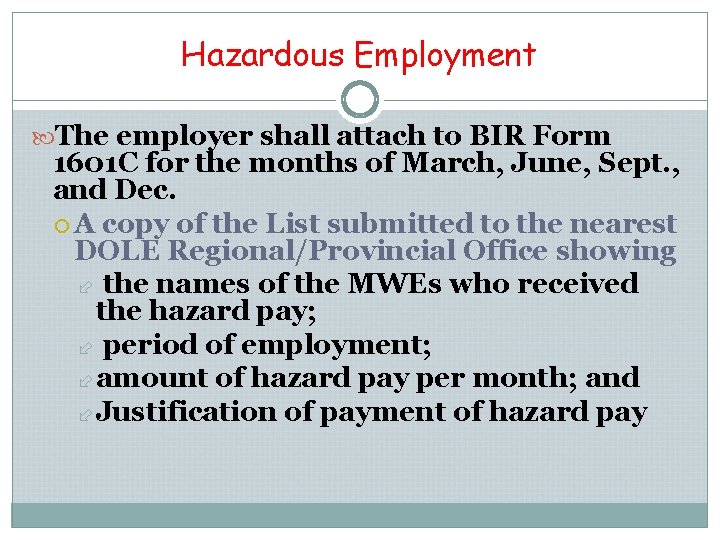

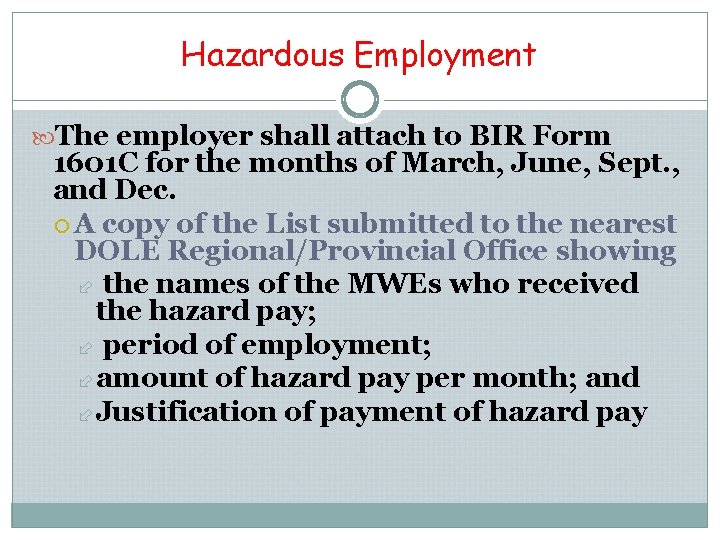

Hazardous Employment The employer shall attach to BIR Form 1601 C for the months of March, June, Sept. , and Dec. A copy of the List submitted to the nearest DOLE Regional/Provincial Office showing the names of the MWEs who received the hazard pay; period of employment; amount of hazard pay per month; and Justification of payment of hazard pay

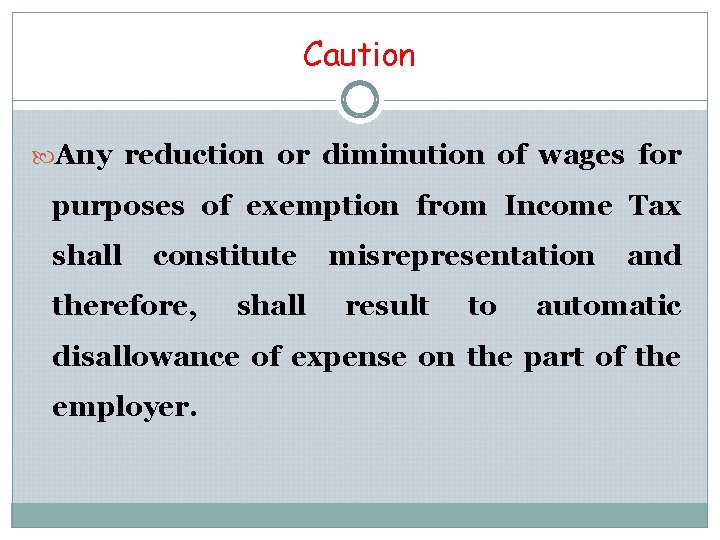

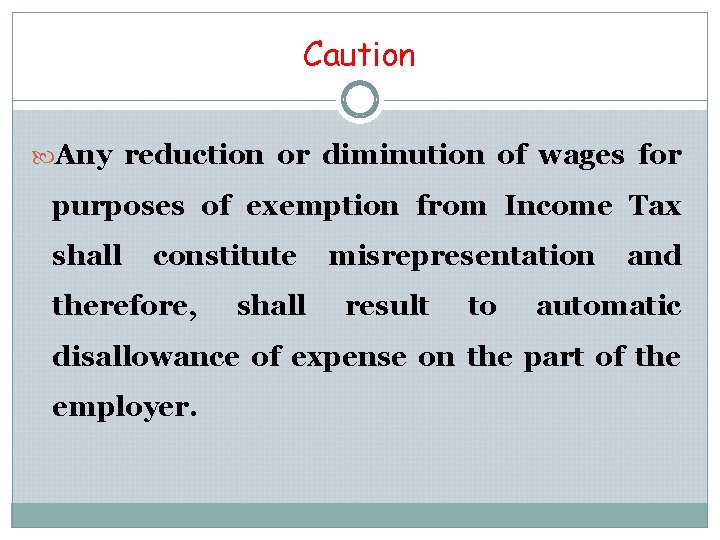

Caution Any reduction or diminution of wages for purposes of exemption from Income Tax shall constitute therefore, shall misrepresentation result to and automatic disallowance of expense on the part of the employer.

Exemptions (cont…) (14) Compensation income of employees in the public sector with compensation income of not more than the SMW in the non-agricultural sector, as fixed by RTWPB/NWPC, applicable to the place where he is assigned.

SMW in the public sector The determination of the SMW in the public sector shall likewise adopt the same procedures and consideration as those of the private sector, except: In case of hazardous employment the employer shall attach to BIR Form 1601 C for the months of March, June, Sept. , and Dec. a copy of DBM Circular/s, or equivalent, as to who are allowed to receive hazard pay.

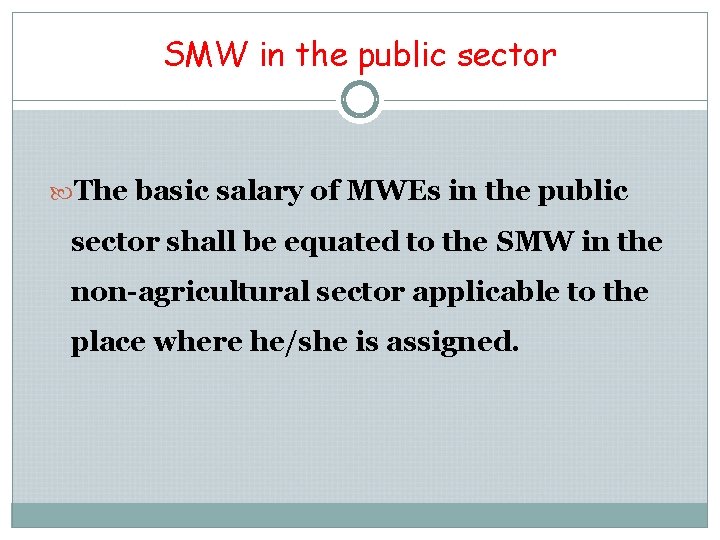

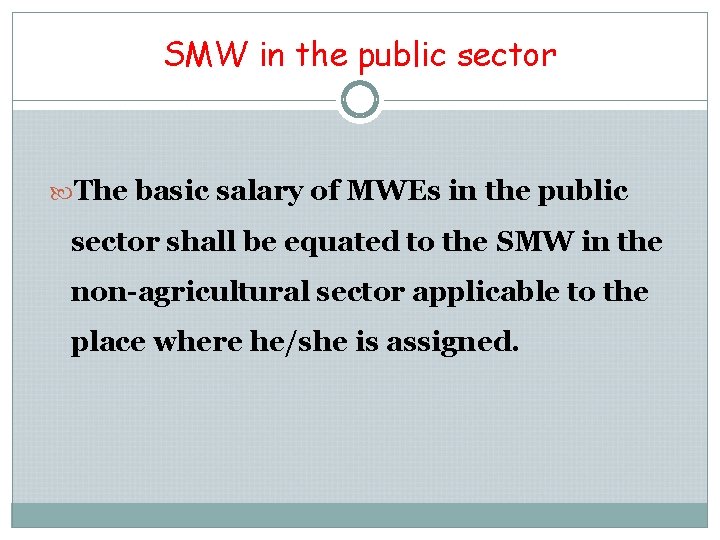

SMW in the public sector The basic salary of MWEs in the public sector shall be equated to the SMW in the non-agricultural sector applicable to the place where he/she is assigned.

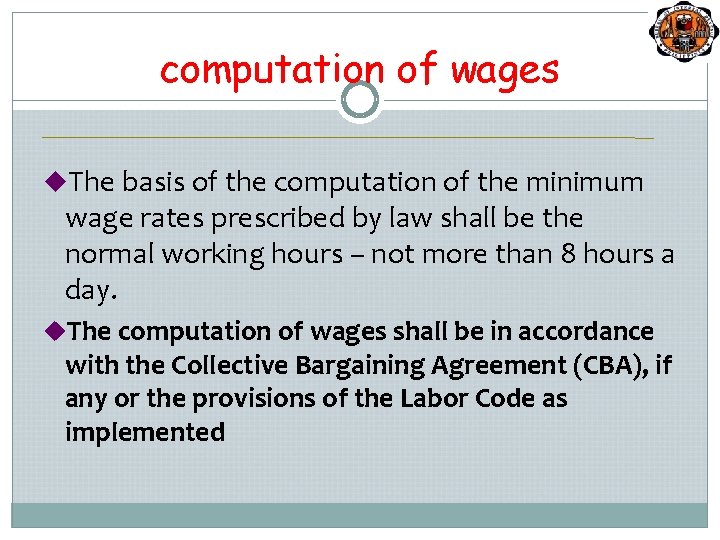

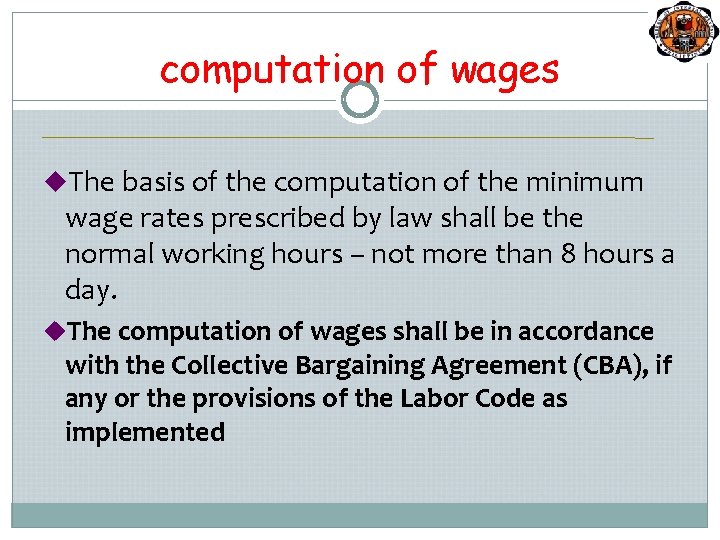

computation of wages u. The basis of the computation of the minimum wage rates prescribed by law shall be the normal working hours – not more than 8 hours a day. u. The computation of wages shall be in accordance with the Collective Bargaining Agreement (CBA), if any or the provisions of the Labor Code as implemented

FACTOR OR NUMBER OF WORKING/PAID DAYS IN A YEAR

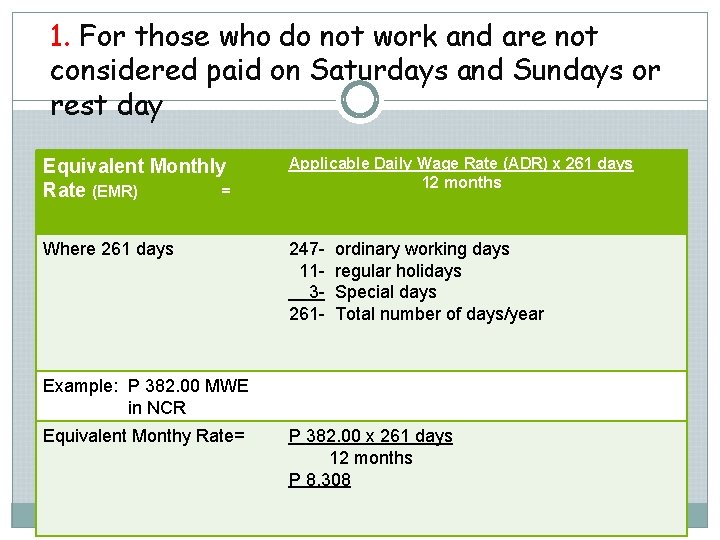

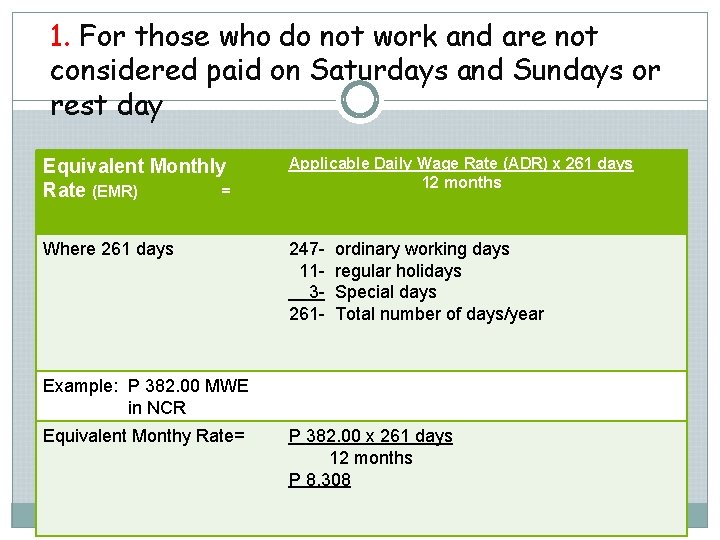

1. For those who do not work and are not considered paid on Saturdays and Sundays or rest day Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 261 days 12 months Where 261 days 247113261 - ordinary working days regular holidays Special days Total number of days/year Example: P 382. 00 MWE in NCR Equivalent Monthy Rate= P 382. 00 x 261 days 12 months P 8, 308

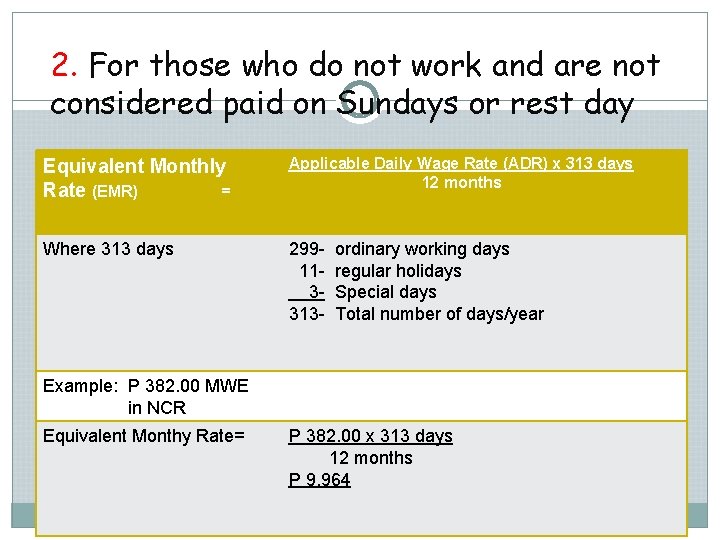

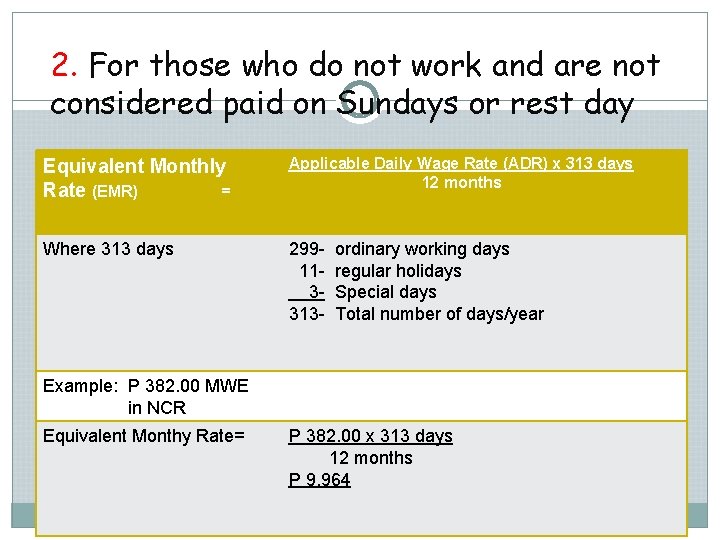

2. For those who do not work and are not considered paid on Sundays or rest day Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 313 days 12 months Where 313 days 299113313 - ordinary working days regular holidays Special days Total number of days/year Example: P 382. 00 MWE in NCR Equivalent Monthy Rate= P 382. 00 x 313 days 12 months P 9, 964

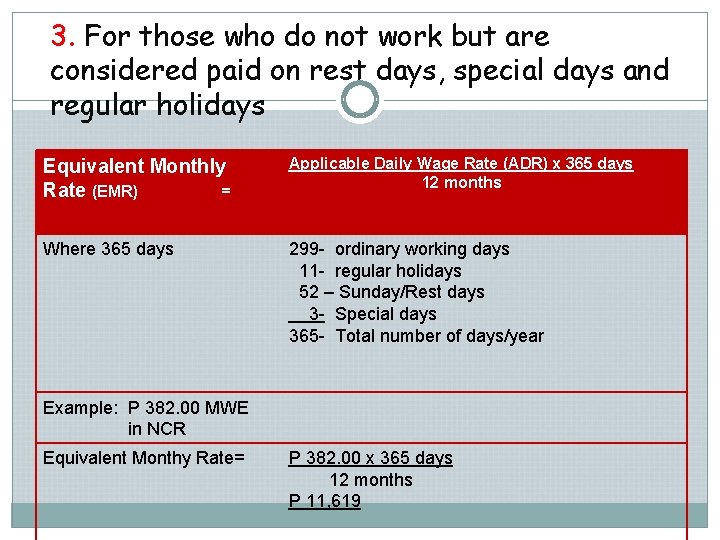

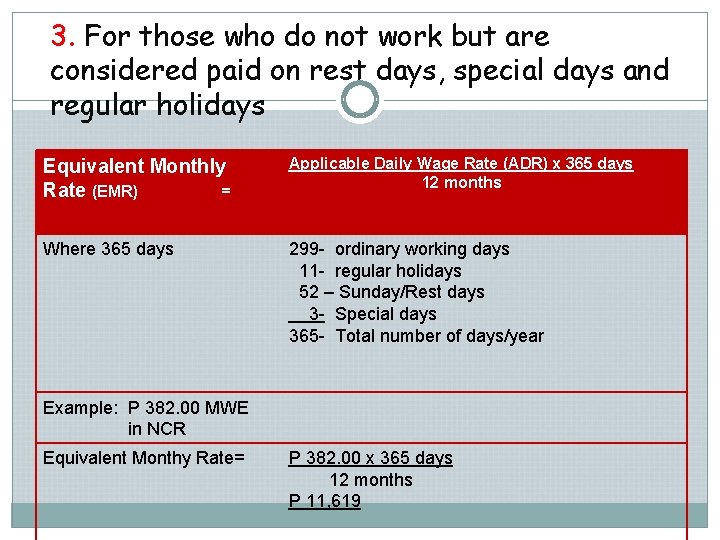

3. For those who do not work but are considered paid on rest days, special days and regular holidays Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 365 days 12 months Where 365 days 299 - ordinary working days 11 - regular holidays 52 – Sunday/Rest days 3 - Special days 365 - Total number of days/year Example: P 382. 00 MWE in NCR Equivalent Monthy Rate= P 382. 00 x 365 days 12 months P 11, 619

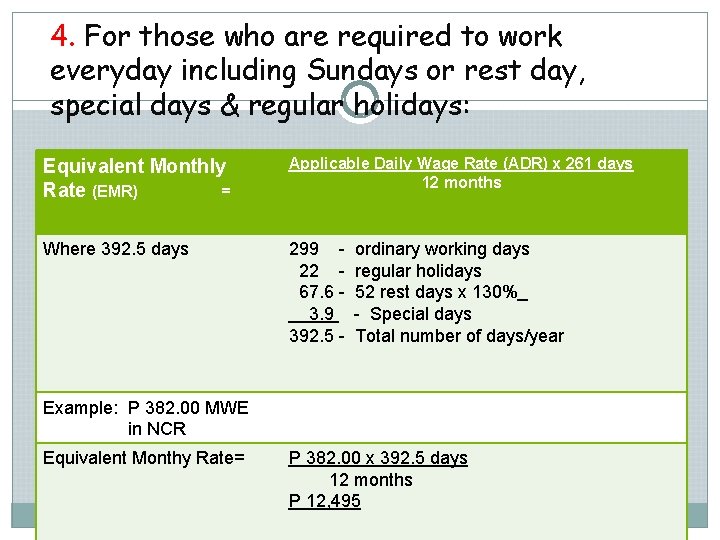

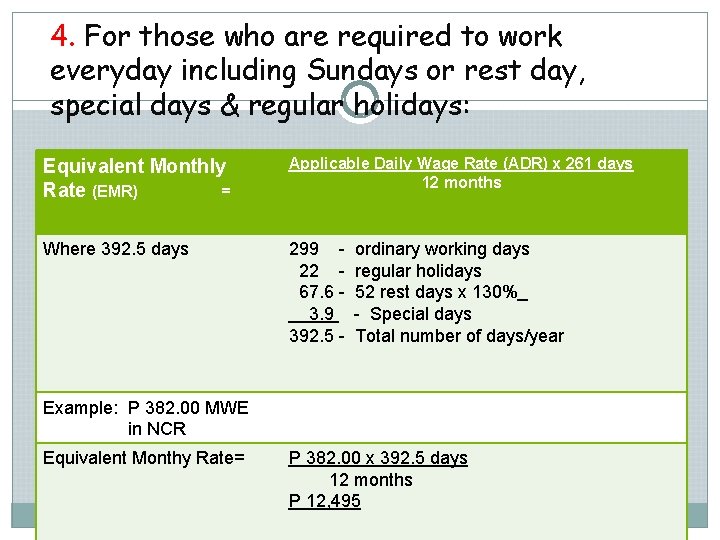

4. For those who are required to work everyday including Sundays or rest day, special days & regular holidays: Equivalent Monthly Rate (EMR) = Applicable Daily Wage Rate (ADR) x 261 days 12 months Where 392. 5 days 299 22 67. 6 3. 9 392. 5 - ordinary working days regular holidays 52 rest days x 130% - Special days Total number of days/year Example: P 382. 00 MWE in NCR Equivalent Monthy Rate= P 382. 00 x 392. 5 days 12 months P 12, 495

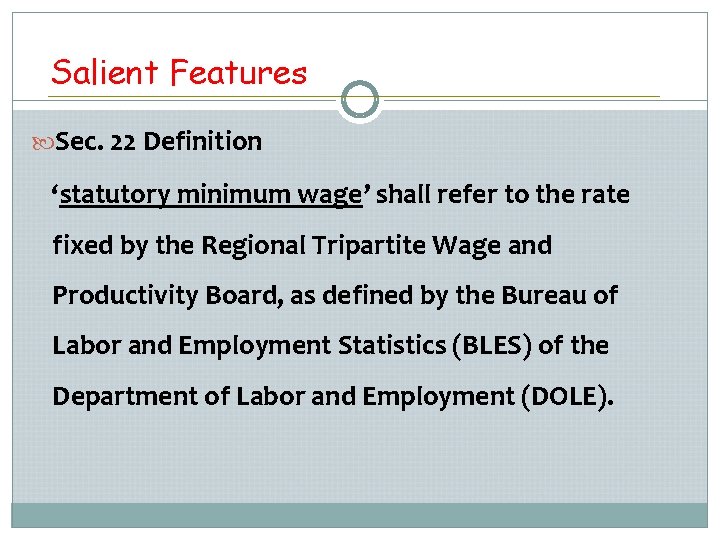

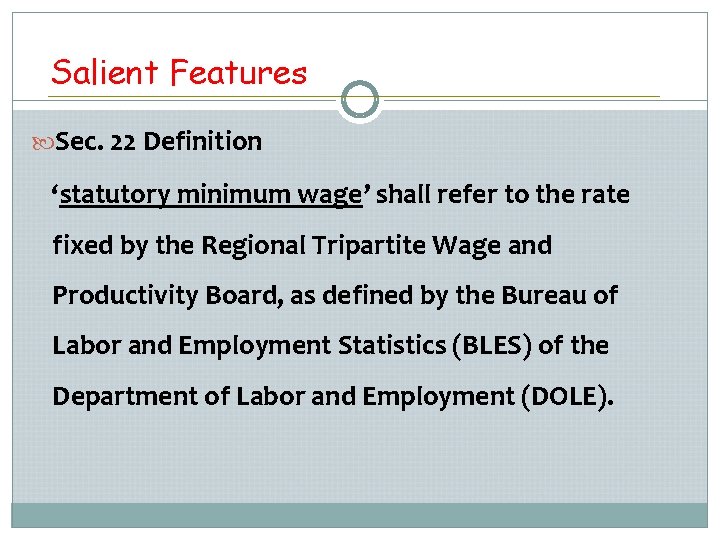

Salient Features Sec. 22 Definition ‘statutory minimum wage’ shall refer to the rate fixed by the Regional Tripartite Wage and Productivity Board, as defined by the Bureau of Labor and Employment Statistics (BLES) of the Department of Labor and Employment (DOLE).

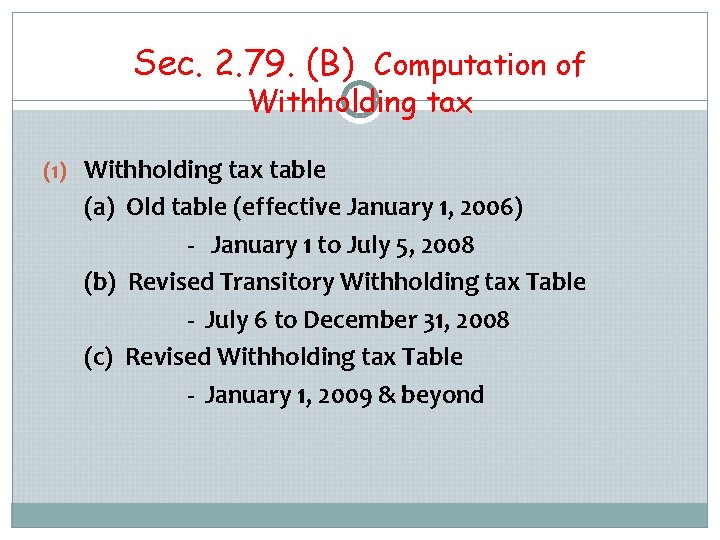

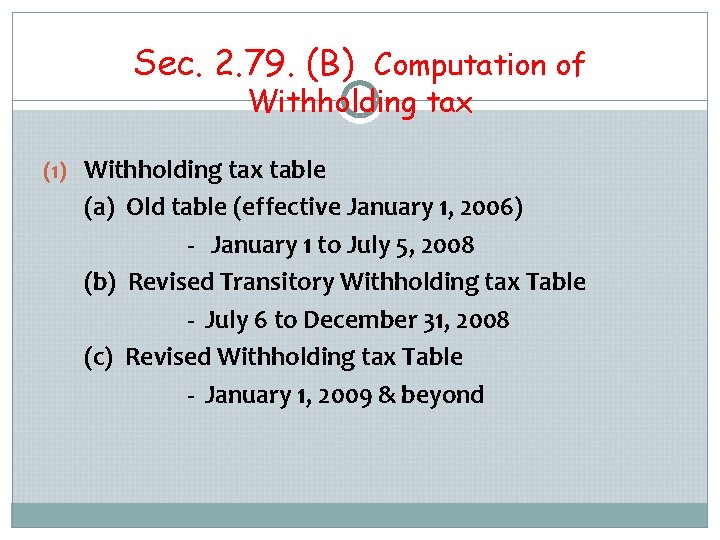

Sec. 2. 79. (B) Computation of Withholding tax (1) Withholding tax table (a) Old table (effective January 1, 2006) - January 1 to July 5, 2008 (b) Revised Transitory Withholding tax Table - July 6 to December 31, 2008 (c) Revised Withholding tax Table - January 1, 2009 & beyond

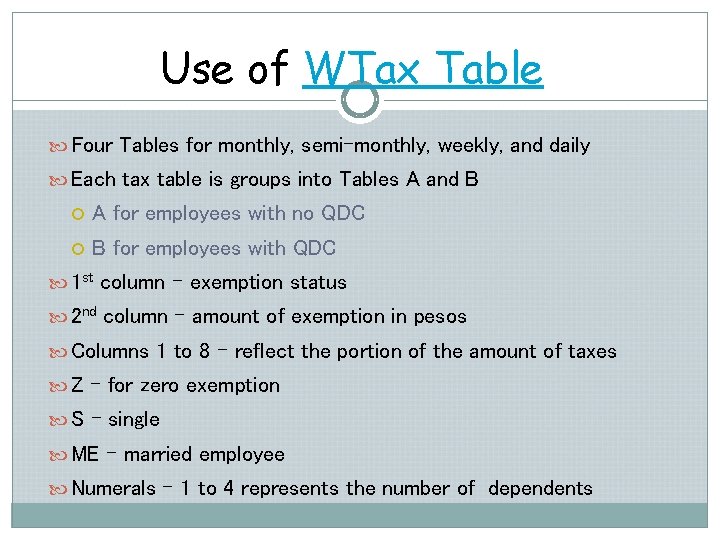

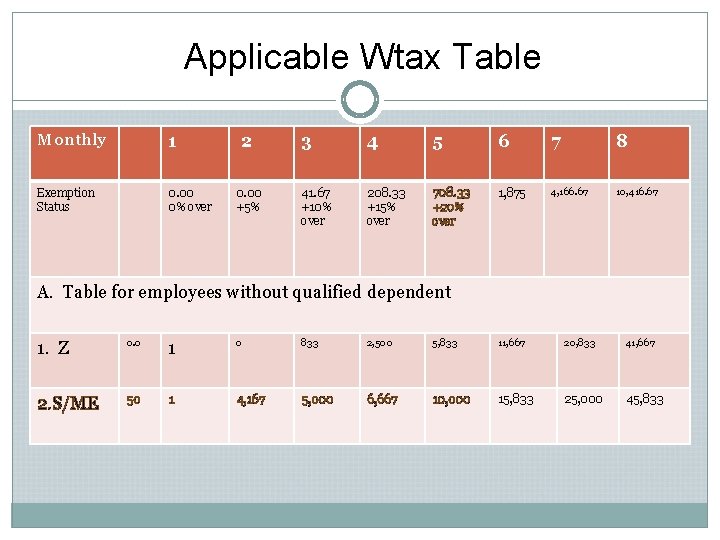

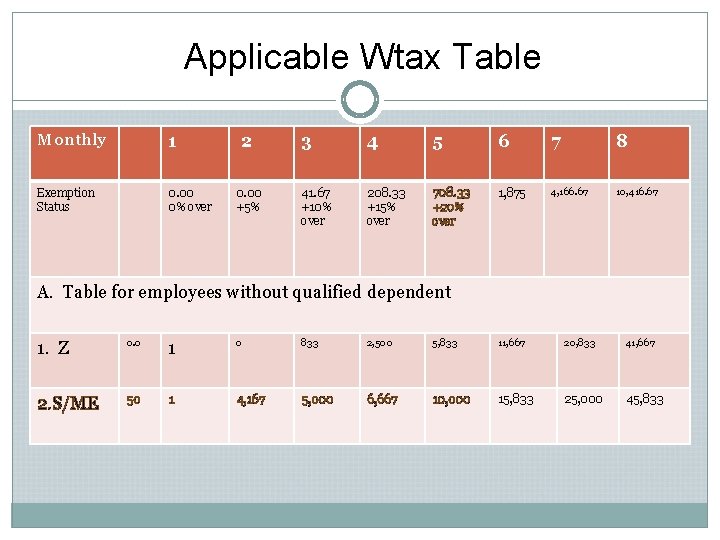

Use of WTax Table Four Tables for monthly, semi-monthly, weekly, and daily Each tax table is groups into Tables A and B A for employees with no QDC B for employees with QDC 1 st column – exemption status 2 nd column – amount of exemption in pesos Columns 1 to 8 – reflect the portion of the amount of taxes Z – for zero exemption S – single ME – married employee Numerals – 1 to 4 represents the number of dependents

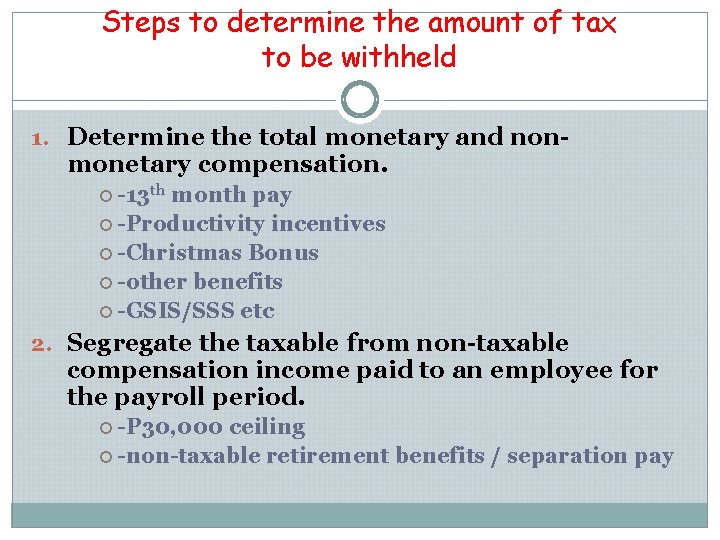

Steps to determine the amount of tax to be withheld 1. Determine the total monetary and non- monetary compensation. -13 th month pay -Productivity incentives -Christmas Bonus -other benefits -GSIS/SSS etc 2. Segregate the taxable from non-taxable compensation income paid to an employee for the payroll period. -P 30, 000 ceiling -non-taxable retirement benefits / separation pay

Steps to determine the amount of tax to be withheld (3. )Segregate the taxable compensation income determined in step 3 into regular taxable compensation income and supplementary compensation. Regular compensation – basic salary, fixed allowances for representation, transportation and other allowances Supplementary compensation – commission, overtime pay, taxable retirement pay, taxable bonus and other taxable benefits

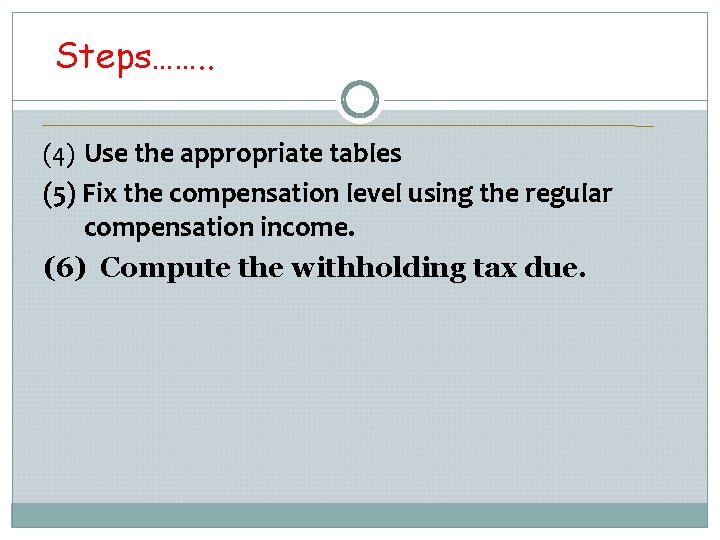

Steps……. . (4) Use the appropriate tables (5) Fix the compensation level using the regular compensation income. (6) Compute the withholding tax due.

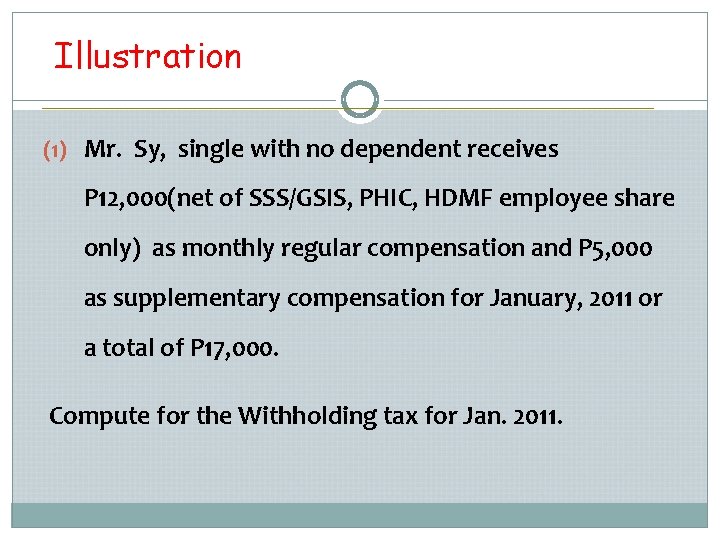

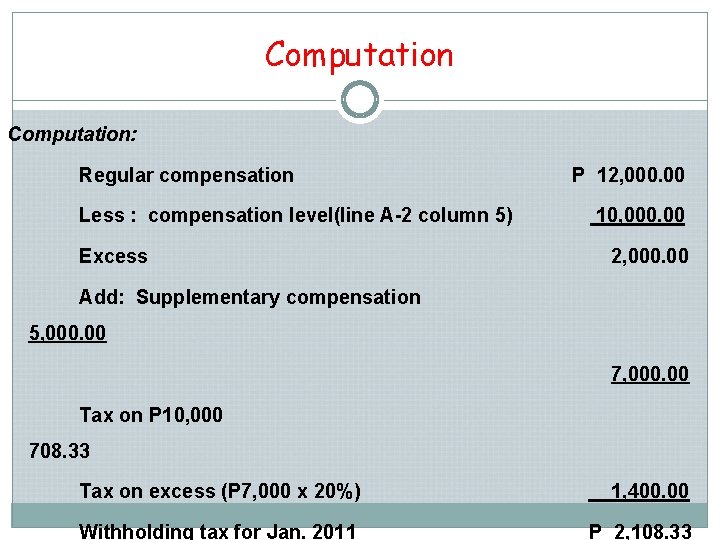

Illustration (1) Mr. Sy, single with no dependent receives P 12, 000(net of SSS/GSIS, PHIC, HDMF employee share only) as monthly regular compensation and P 5, 000 as supplementary compensation for January, 2011 or a total of P 17, 000. Compute for the Withholding tax for Jan. 2011.

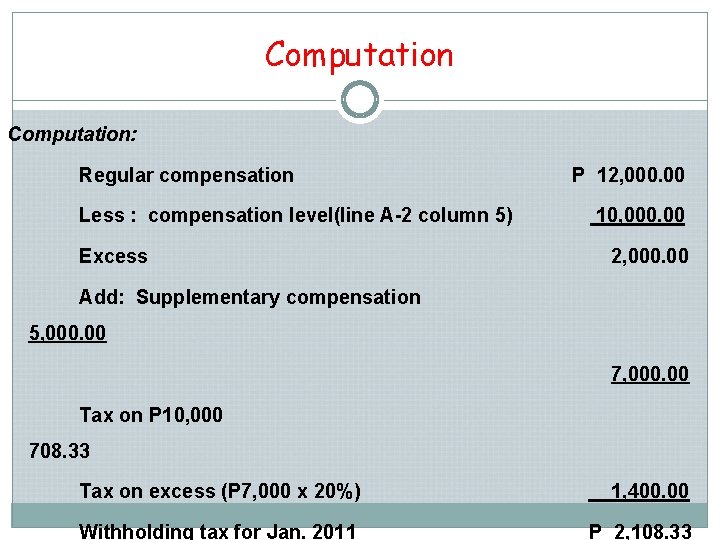

Computation: Regular compensation Less : compensation level(line A-2 column 5) Excess P 12, 000. 00 10, 000. 00 2, 000. 00 Add: Supplementary compensation 5, 000. 00 7, 000. 00 Tax on P 10, 000 708. 33 Tax on excess (P 7, 000 x 20%) 1, 400. 00 Withholding tax for Jan. 2011 P 2, 108. 33

Applicable Wtax Table Monthly 1 Exemption Status 0. 00 0% over 2 0. 00 +5% 3 4 5 6 7 8 41. 67 +10% over 208. 33 +15% over 708. 33 +20% over 1, 875 4, 166. 67 10, 416. 67 A. Table for employees without qualified dependent 1. Z 0. 0 1 0 833 2, 500 5, 833 11, 667 20, 833 41, 667 2. S/ME 50 1 4, 167 5, 000 6, 667 10, 000 15, 833 25, 000 45, 833

Let’s Check: Withholding tax – Jan. 2011 = P 2, 108. 33 Withholding Tax (Feb. - Dec. 11) 1, 108. 33 x 11 12, 191. 63 Total P 14, 299. 66 Gross Income P 149, 000. 00 Exemption – Single 50, 000. 00 Taxable Income P 99, 000. 00 Tax due P 14, 300. 00

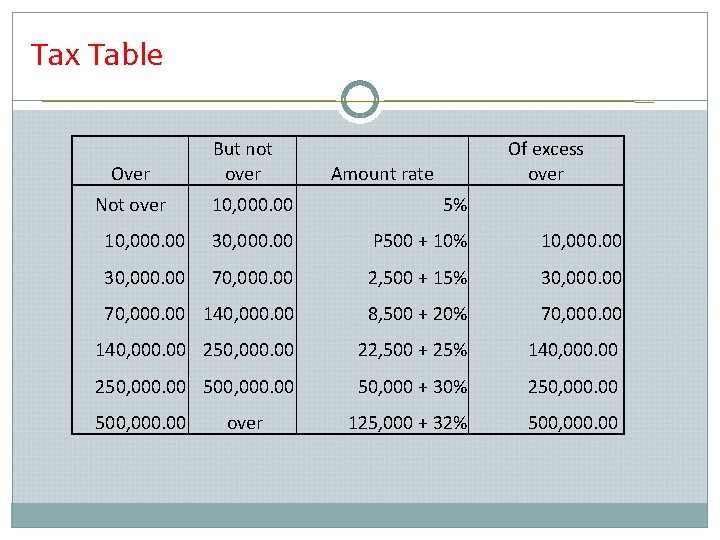

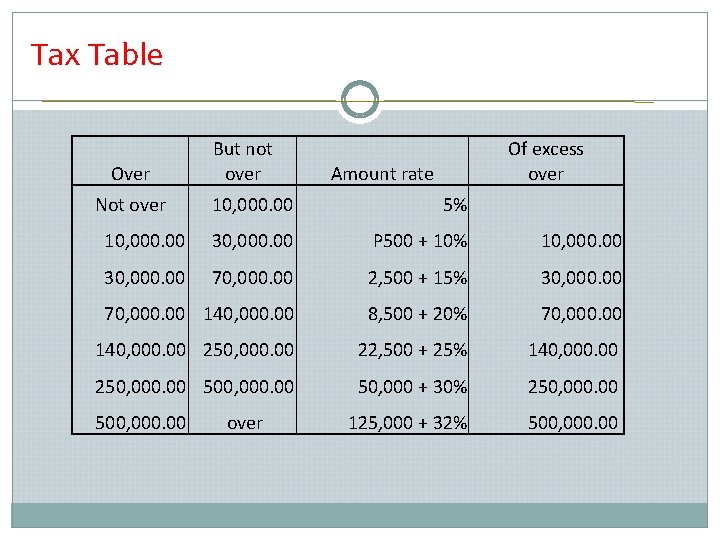

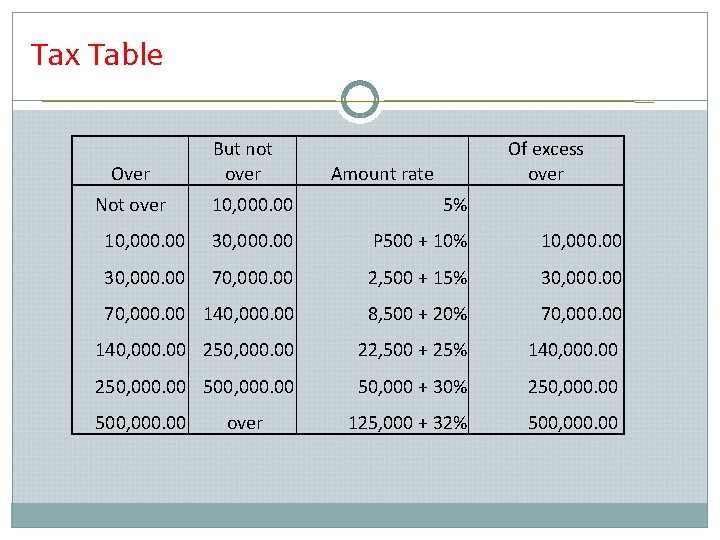

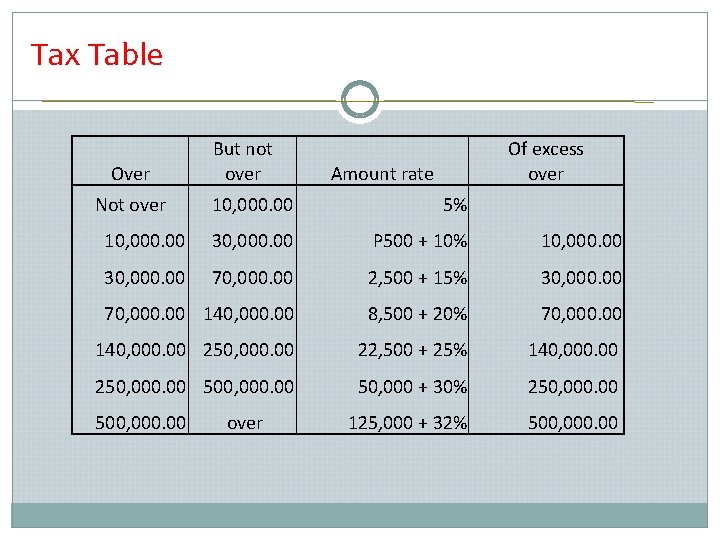

Tax Table Over Not over But not over Of excess over Amount rate 10, 000. 00 5% 10, 000. 00 30, 000. 00 P 500 + 10% 10, 000. 00 30, 000. 00 70, 000. 00 2, 500 + 15% 30, 000. 00 70, 000. 00 140, 000. 00 8, 500 + 20% 70, 000. 00 140, 000. 00 250, 000. 00 22, 500 + 25% 140, 000. 00 250, 000. 00 50, 000 + 30% 250, 000. 00 125, 000 + 32% 500, 000. 00 over

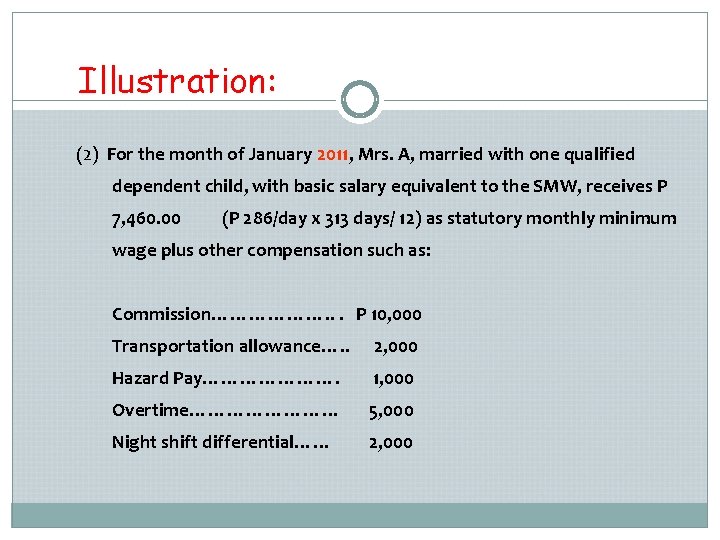

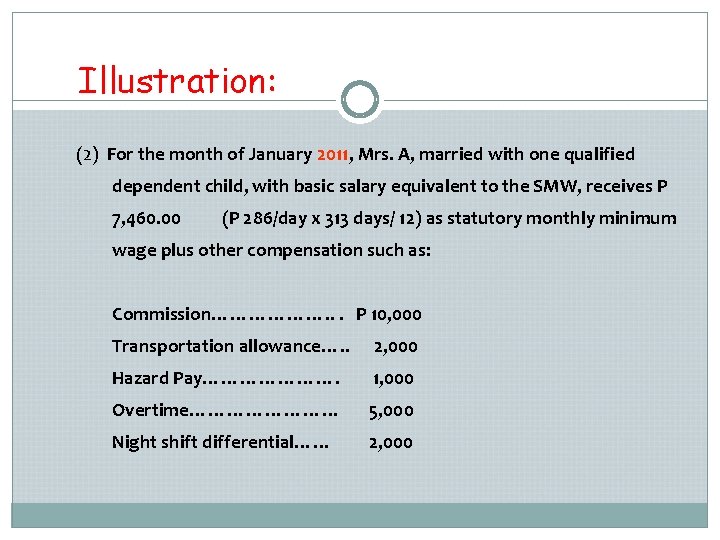

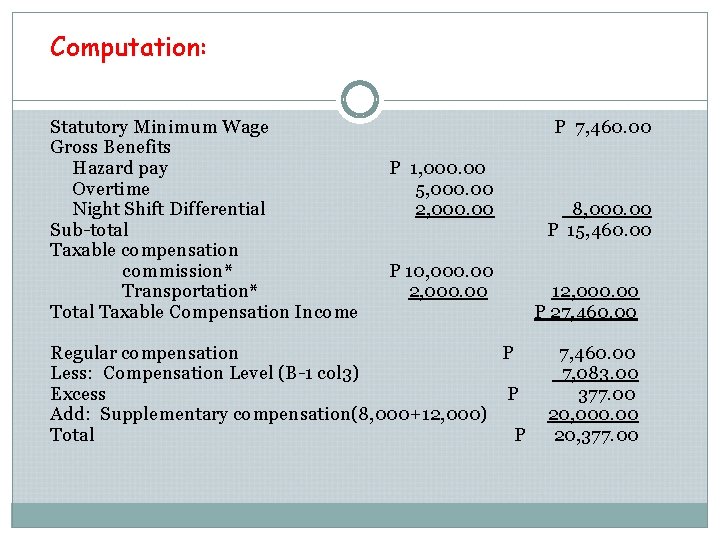

Illustration: (2) For the month of January 2011, Mrs. A, married with one qualified dependent child, with basic salary equivalent to the SMW, receives P 7, 460. 00 (P 286/day x 313 days/ 12) as statutory monthly minimum wage plus other compensation such as: Commission………………. . . P 10, 000 Transportation allowance…. . 2, 000 Hazard Pay…………………. 1, 000 Overtime………… 5, 000 Night shift differential…… 2, 000

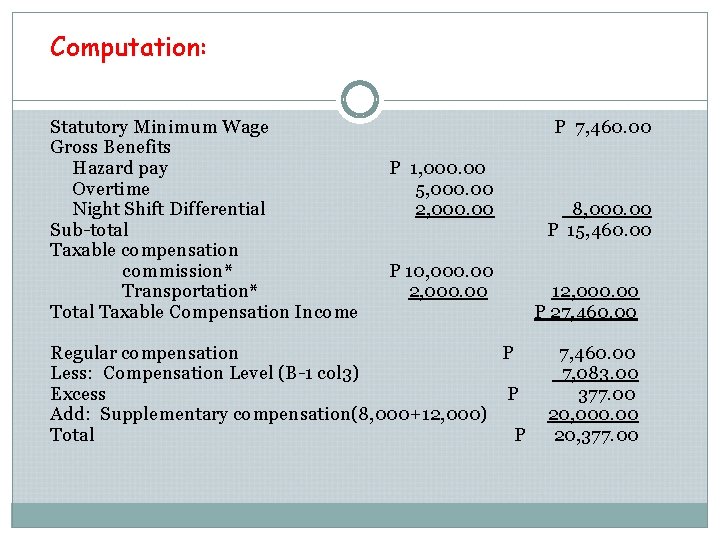

Computation: Statutory Minimum Wage Gross Benefits Hazard pay Overtime Night Shift Differential Sub-total Taxable compensation commission* Transportation* Total Taxable Compensation Income P 7, 460. 00 P 1, 000. 00 5, 000. 00 2, 000. 00 P 10, 000. 00 2, 000. 00 Regular compensation P Less: Compensation Level (B-1 col 3) Excess P Add: Supplementary compensation(8, 000+12, 000) Total P 8, 000. 00 P 15, 460. 00 12, 000. 00 P 27, 460. 00 7, 083. 00 377. 00 20, 000. 00 20, 377. 00

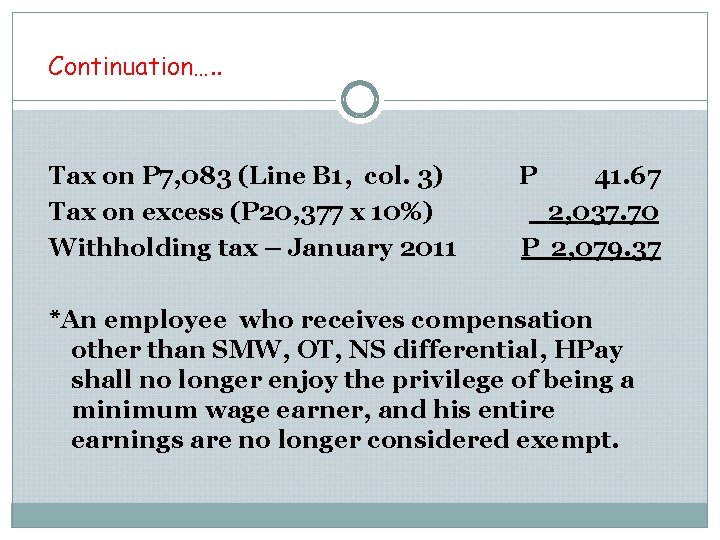

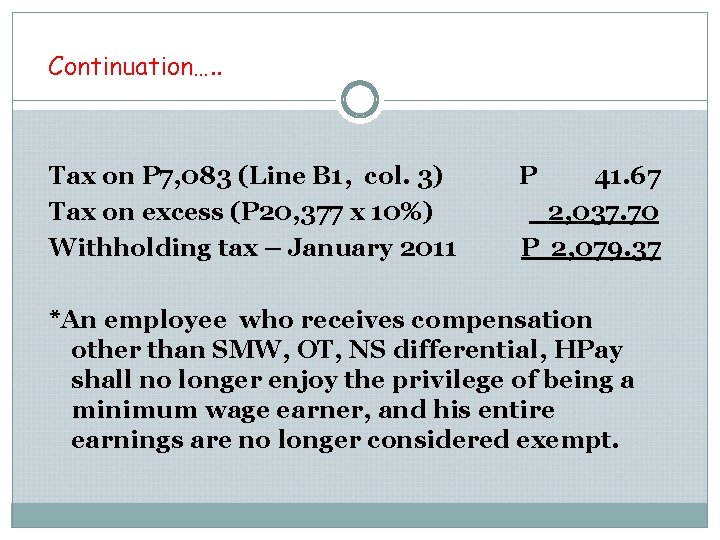

Continuation…. . Tax on P 7, 083 (Line B 1, col. 3) Tax on excess (P 20, 377 x 10%) Withholding tax – January 2011 P 41. 67 2, 037. 70 P 2, 079. 37 *An employee who receives compensation other than SMW, OT, NS differential, HPay shall no longer enjoy the privilege of being a minimum wage earner, and his entire earnings are no longer considered exempt.

Tax Table Over Not over But not over Of excess over Amount rate 10, 000. 00 5% 10, 000. 00 30, 000. 00 P 500 + 10% 10, 000. 00 30, 000. 00 70, 000. 00 2, 500 + 15% 30, 000. 00 70, 000. 00 140, 000. 00 8, 500 + 20% 70, 000. 00 140, 000. 00 250, 000. 00 22, 500 + 25% 140, 000. 00 250, 000. 00 50, 000 + 30% 250, 000. 00 125, 000 + 32% 500, 000. 00 over

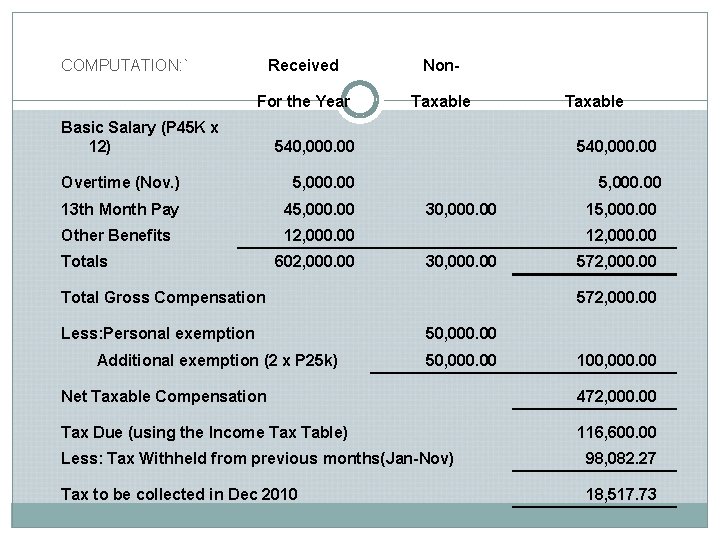

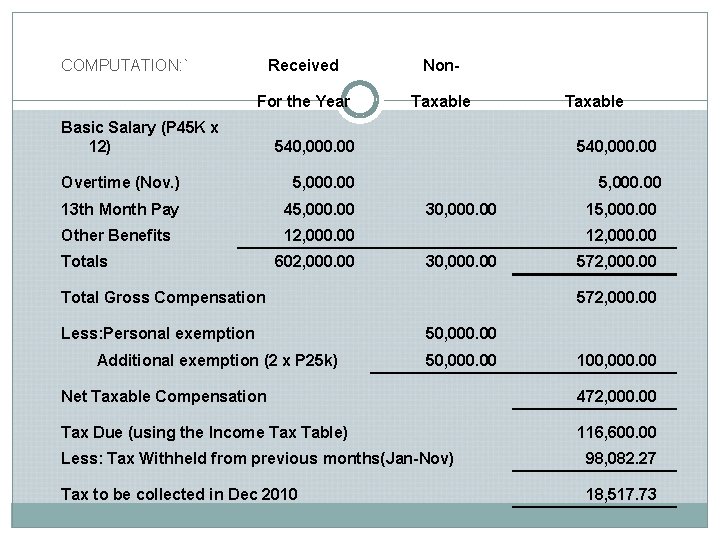

ILLUSTRATIVE PROBLEM For taxable year 2010, WTD Service Company employed Mr. J, married with two qualified dependent children. He received the following compensation for the year: Basic Monthly Salary Overtime Pay for Nov. Thirteenth Month Pay Other Benefits Withholding Tax P 45, 000. 00 12, 000. 00 98, 082. 00

COMPUTATION: ` Received Non- For the Year Taxable Basic Salary (P 45 K x 12) Taxable 540, 000. 00 Overtime (Nov. ) 5, 000. 00 13 th Month Pay 45, 000. 00 Other Benefits 12, 000. 00 Totals 602, 000. 00 30, 000. 00 12, 000. 00 30, 000. 00 Total Gross Compensation Less: Personal exemption Additional exemption (2 x P 25 k) 15, 000. 00 572, 000. 00 50, 000. 00 100, 000. 00 Net Taxable Compensation 472, 000. 00 Tax Due (using the Income Tax Table) 116, 600. 00 Less: Tax Withheld from previous months(Jan-Nov) 98, 082. 27 Tax to be collected in Dec 2010 18, 517. 73

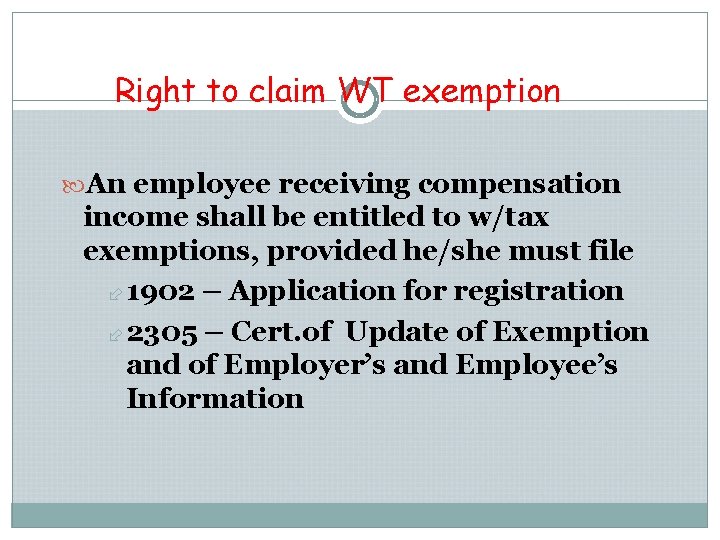

Right to claim WT exemption An employee receiving compensation income shall be entitled to w/tax exemptions, provided he/she must file 1902 – Application for registration 2305 – Cert. of Update of Exemption and of Employer’s and Employee’s Information

PERSONAL AND ADDITIONAL EXEMPTION Single

On exemptions Every employer should ascertain whether or not a child being claimed is a qualified dependent If TP should have additional exemption during the taxable year, he may claim the corresponding additional exemption in full for such year If the TP dies during the taxable year, the estate may claim the full exemptions as if he died at the close of the year

On exemptions TP may still claim full exemptions during the taxable year on the following cases: Spouse or any of the dependent dies Any of such dependents marries Becomes 21 y. o. Becomes gainfully employed As if it occurred at the close of such year

Requirement for deductibility Compensation where no income taxes were withheld shall be allowed as deduction when form 2316 is issued to the employees; Alphabetical list of employees whose compensation are exempt from withholding tax but subject to income tax shall be submitted together with the form 1604 -CF; If with previous/successive employers – BIR form 2316 and/or ITR filed

Registration Use BIR Form 1902 for new employees Submit to the employer within 10 days from date of employment Use BIR Form 2305 in case of change/s of information data in previously submitted 1902 Submit to the employer within 10 days after the following changes Status Personal and additional exemption Employment or working status of the spouse Multiple employment status Amount of compensation income

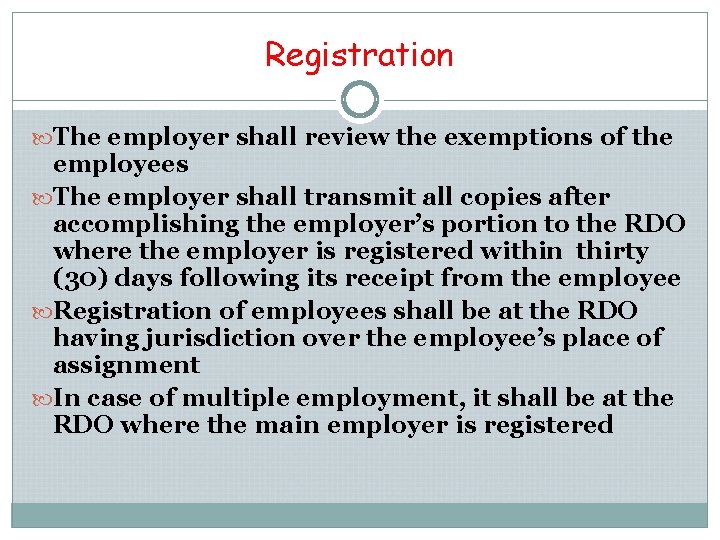

Registration The employer shall review the exemptions of the employees The employer shall transmit all copies after accomplishing the employer’s portion to the RDO where the employer is registered within thirty (30) days following its receipt from the employee Registration of employees shall be at the RDO having jurisdiction over the employee’s place of assignment In case of multiple employment, it shall be at the RDO where the main employer is registered

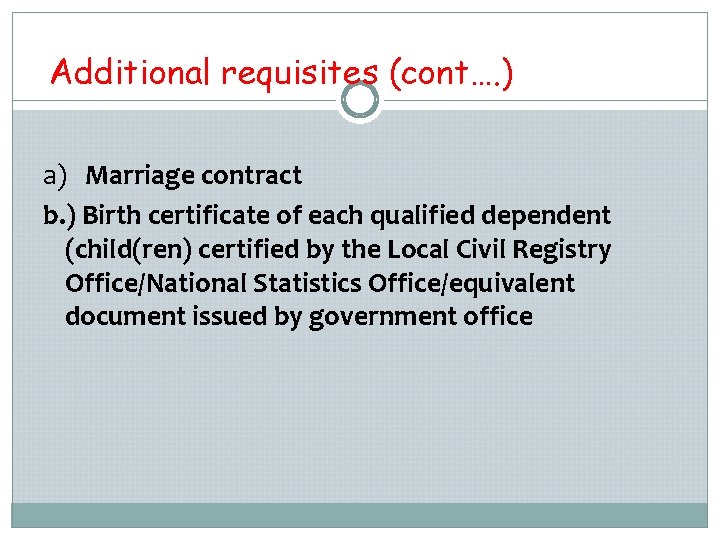

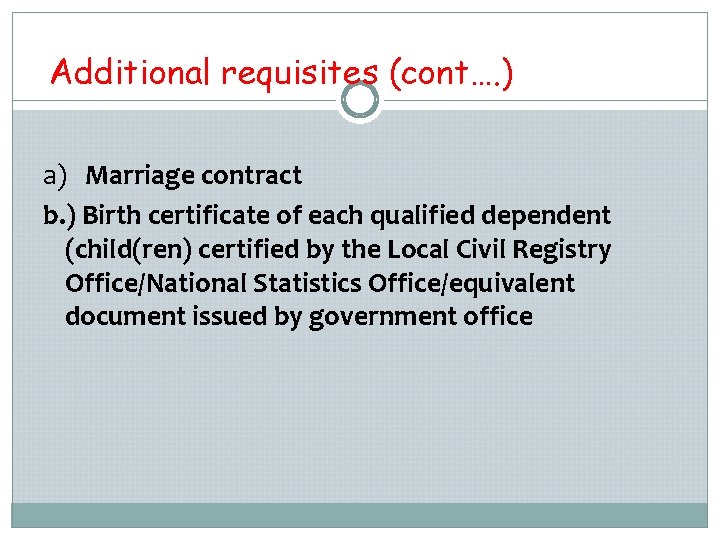

Additional requisites (cont…. ) a) Marriage contract b. ) Birth certificate of each qualified dependent (child(ren) certified by the Local Civil Registry Office/National Statistics Office/equivalent document issued by government office

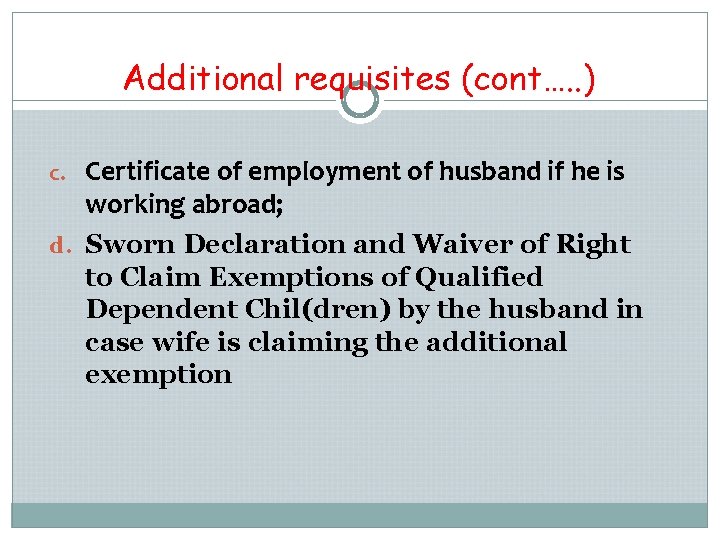

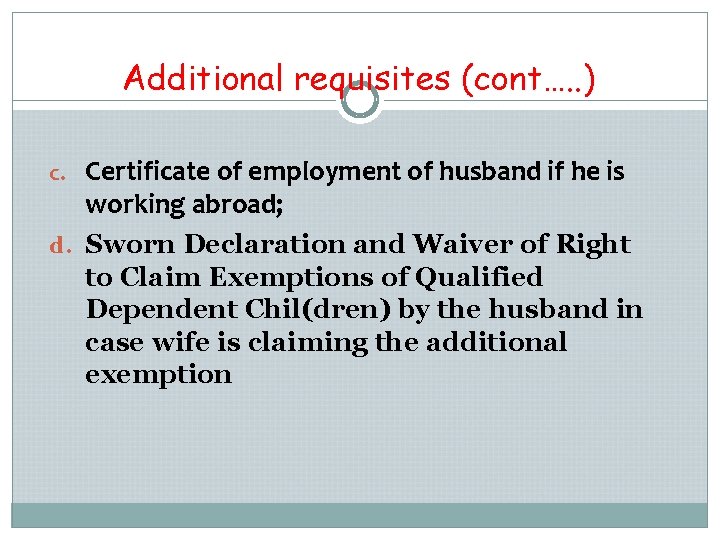

Additional requisites (cont…. . ) c. Certificate of employment of husband if he is working abroad; d. Sworn Declaration and Waiver of Right to Claim Exemptions of Qualified Dependent Chil(dren) by the husband in case wife is claiming the additional exemption

Additional requisites (cont…. ) e. ) Medical Certificate of qualified dependent child, if physically/mentally incapacitated; f. ) Court decision of legal adoption of children g. ) Death certificate

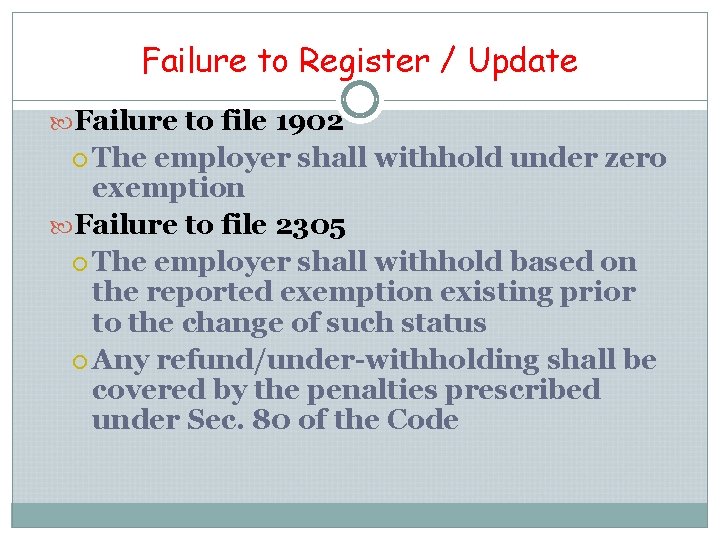

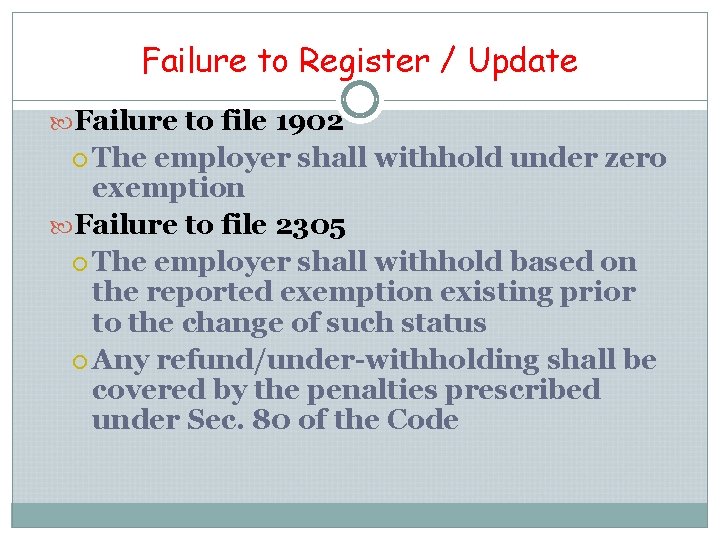

Failure to Register / Update Failure to file 1902 The employer shall withhold under zero exemption Failure to file 2305 The employer shall withhold based on the reported exemption existing prior to the change of such status Any refund/under-withholding shall be covered by the penalties prescribed under Sec. 80 of the Code

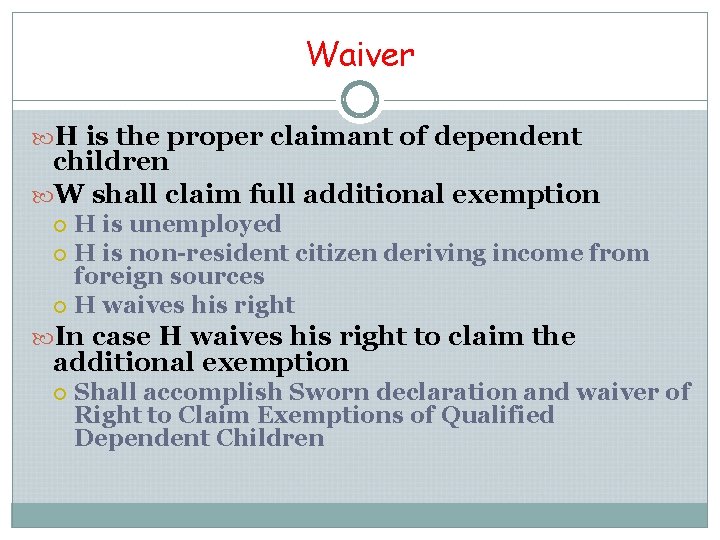

Waiver H is the proper claimant of dependent children W shall claim full additional exemption H is unemployed H is non-resident citizen deriving income from foreign sources H waives his right In case H waives his right to claim the additional exemption Shall accomplish Sworn declaration and waiver of Right to Claim Exemptions of Qualified Dependent Children

Liability for Tax Employer Responsible for withholding and remittance of correct amount of tax Employee Responsible for submission of 1902 / 2305

Statements and Returns BIR Form 2316 Employer shall furnish the employees NLT Jan. 31 Failure to furnish shall be a ground for mandatory audit upon verified complaint of the payee It shall include the fringe benefits given to rank & file employees Employers of MWEs are still required to issue BIR Form 2316 (June 2008 Encs version) It shall indicate the health &/or hosp. insurance, if any The amount of SMW, OT, Holiday pay, Night diff, and hazard pay shall be indicated Among others

Statements and Returns Form 2316 cont…. It shall be signed by both the employer’s authorized representative and the employee Shall contain a written declaration that it is made under the penalties of perjury Shall contain a certification that the employer’s filing of BIR Form 1604 -CF shall be considered as substituted filing The employer shall retain the duly signed 2316 for a period of three (3) years.

Statements and Returns Form 2316 continued… The applicable box for MWEs shall be indicated (under the enhanced form). This serves as proof of financial capacity for purposes of loans, etc… In case of successive employment during the taxable year, an extra copy of BIR Form 2316 shall be furnished to his new employer

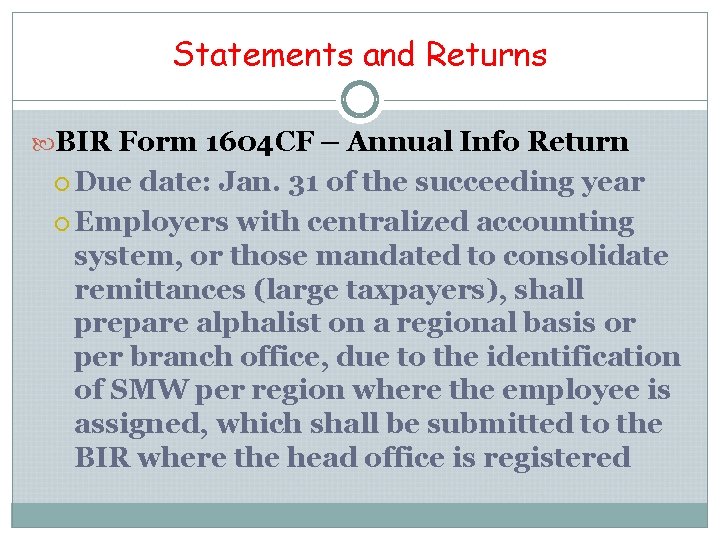

Statements and Returns BIR Form 1604 CF – Annual Info Return Due date: Jan. 31 of the succeeding year Employers with centralized accounting system, or those mandated to consolidate remittances (large taxpayers), shall prepare alphalist on a regional basis or per branch office, due to the identification of SMW per region where the employee is assigned, which shall be submitted to the BIR where the head office is registered

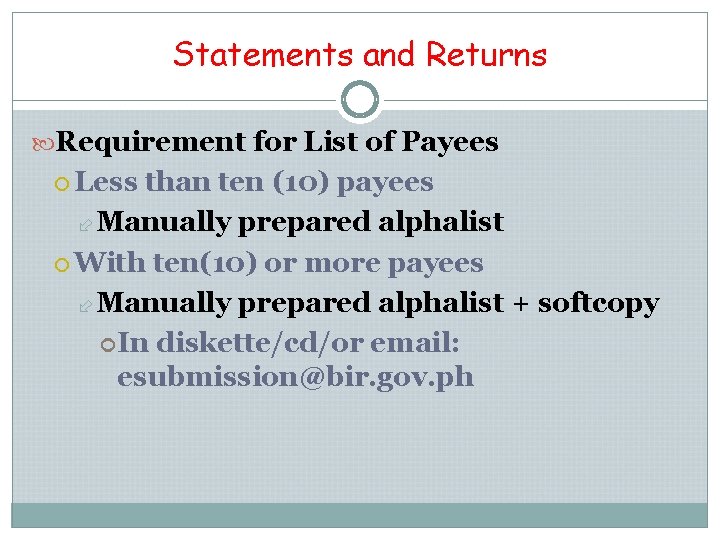

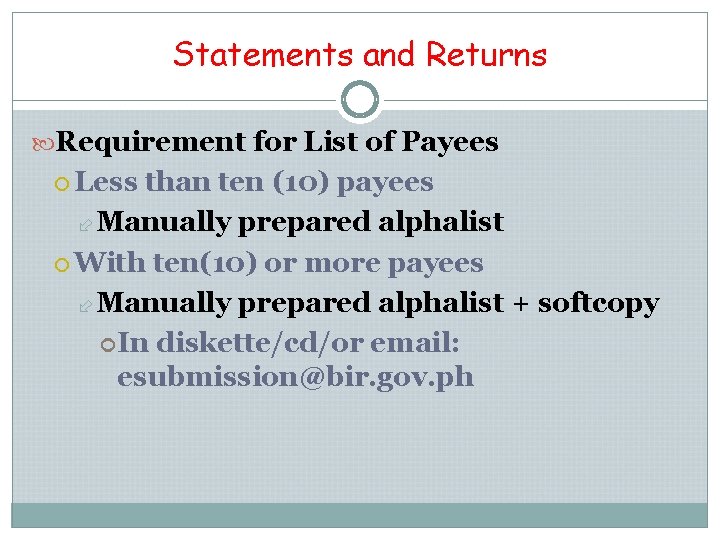

Statements and Returns Requirement for List of Payees Less than ten (10) payees Manually prepared alphalist With ten(10) or more payees Manually prepared alphalist + softcopy In diskette/cd/or email: esubmission@bir. gov. ph

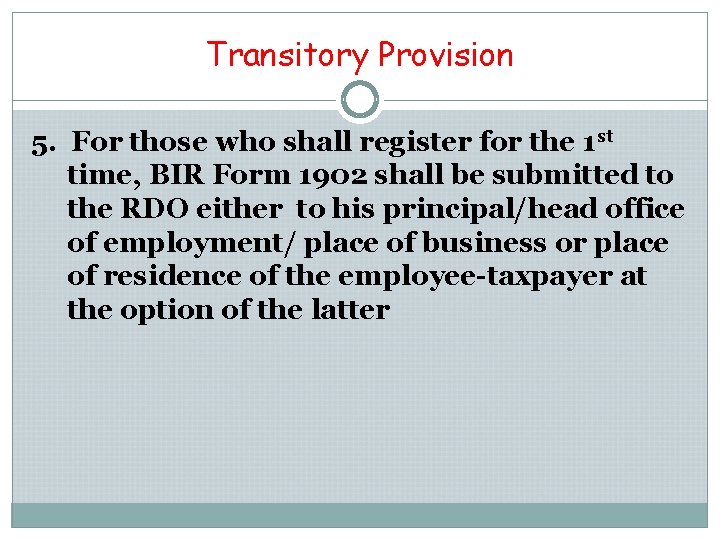

Transitory Provision 5. For those who shall register for the 1 st time, BIR Form 1902 shall be submitted to the RDO either to his principal/head office of employment/ place of business or place of residence of the employee-taxpayer at the option of the latter

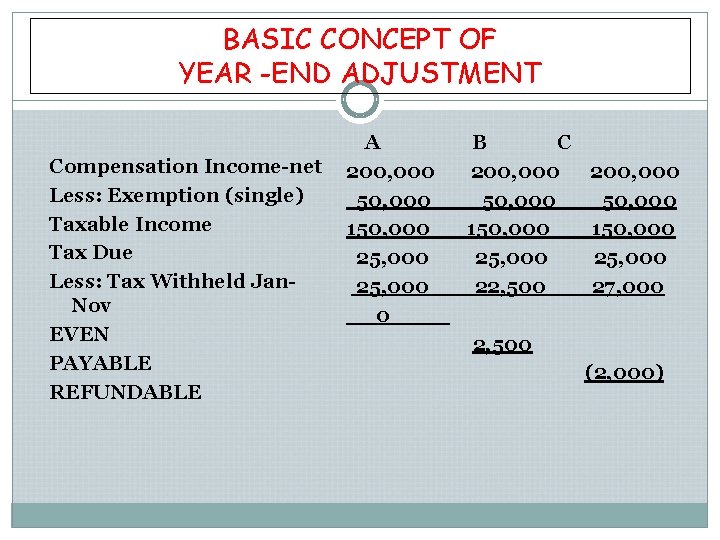

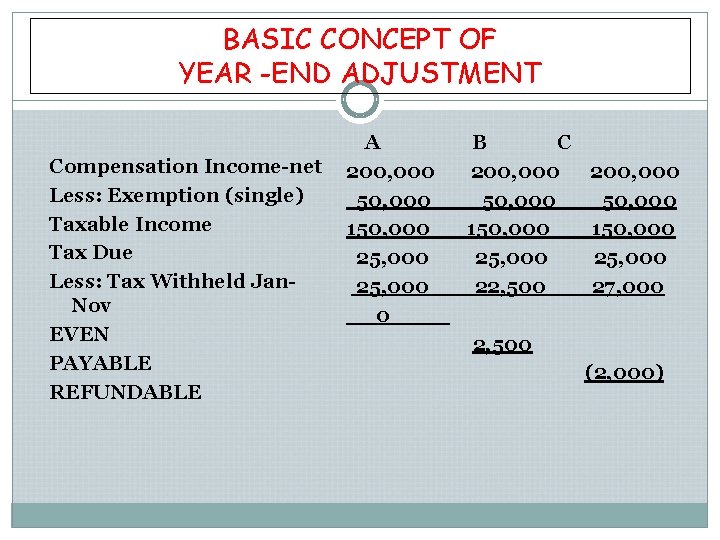

BASIC CONCEPT OF YEAR -END ADJUSTMENT Compensation Income-net Less: Exemption (single) Taxable Income Tax Due Less: Tax Withheld Jan. Nov EVEN PAYABLE REFUNDABLE A 200, 000 50, 000 150, 000 25, 000 0__ B C 200, 000 50, 000 150, 000 25, 000 22, 500 27, 000 2, 500 (2, 000)

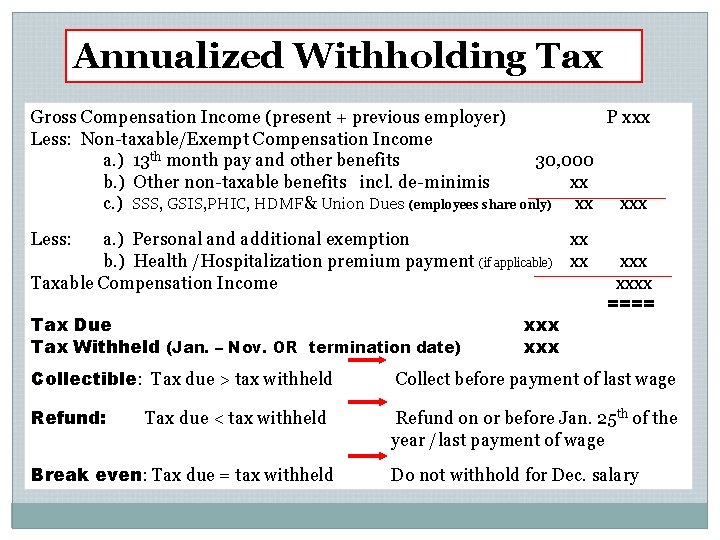

Annualized Computation To be used when the employer- employee relationship is terminated before the end of the calendar year; When computing for the year-end adjustment

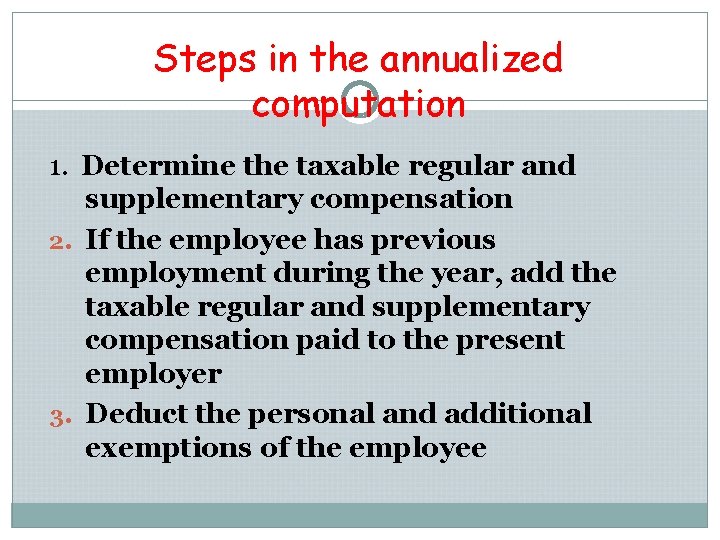

Steps in the annualized computation 1. Determine the taxable regular and supplementary compensation 2. If the employee has previous employment during the year, add the taxable regular and supplementary compensation paid to the present employer 3. Deduct the personal and additional exemptions of the employee

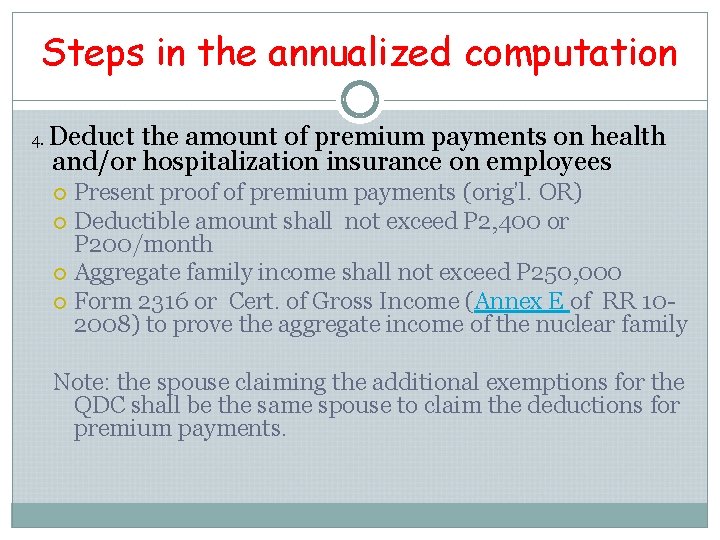

Steps in the annualized computation 4. Deduct the amount of premium payments on health and/or hospitalization insurance on employees Present proof of premium payments (orig’l. OR) Deductible amount shall not exceed P 2, 400 or P 200/month Aggregate family income shall not exceed P 250, 000 Form 2316 or Cert. of Gross Income (Annex E of RR 102008) to prove the aggregate income of the nuclear family Note: the spouse claiming the additional exemptions for the QDC shall be the same spouse to claim the deductions for premium payments.

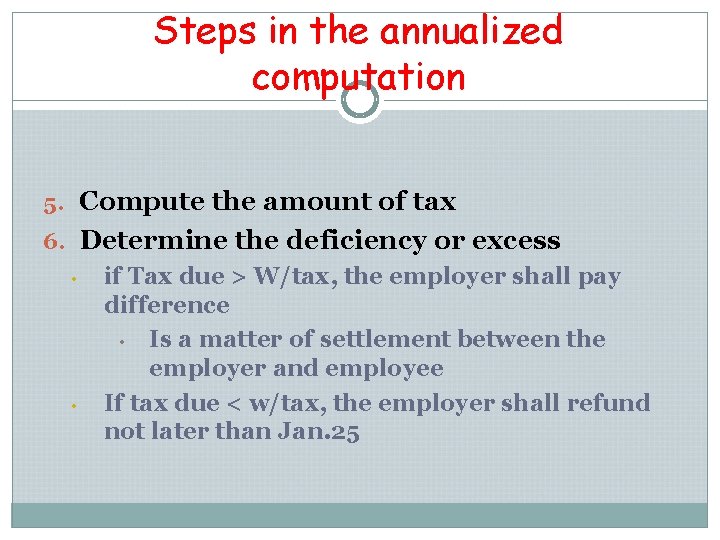

Steps in the annualized computation 5. Compute the amount of tax 6. Determine the deficiency or excess • • if Tax due > W/tax, the employer shall pay difference • Is a matter of settlement between the employer and employee If tax due < w/tax, the employer shall refund not later than Jan. 25

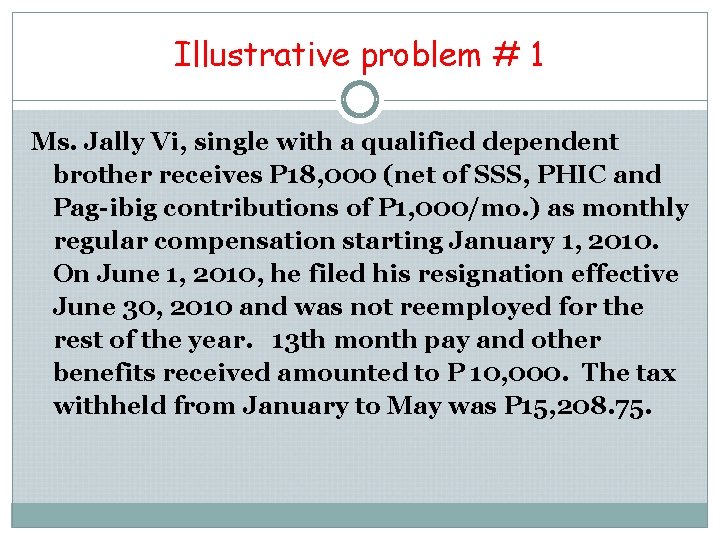

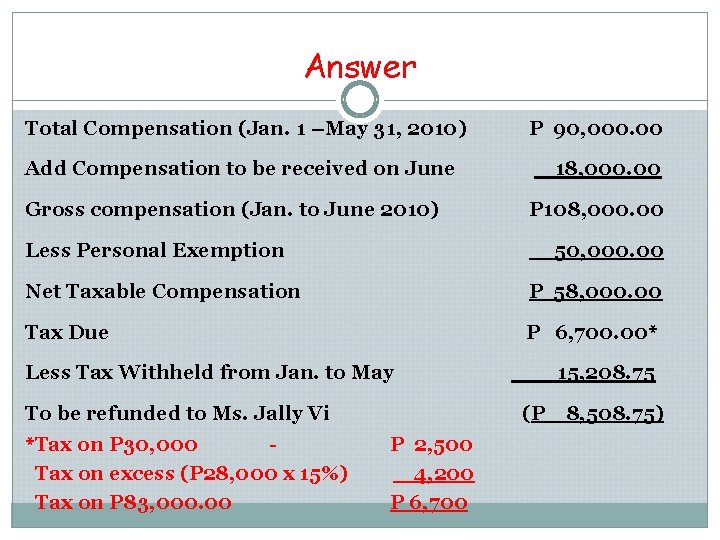

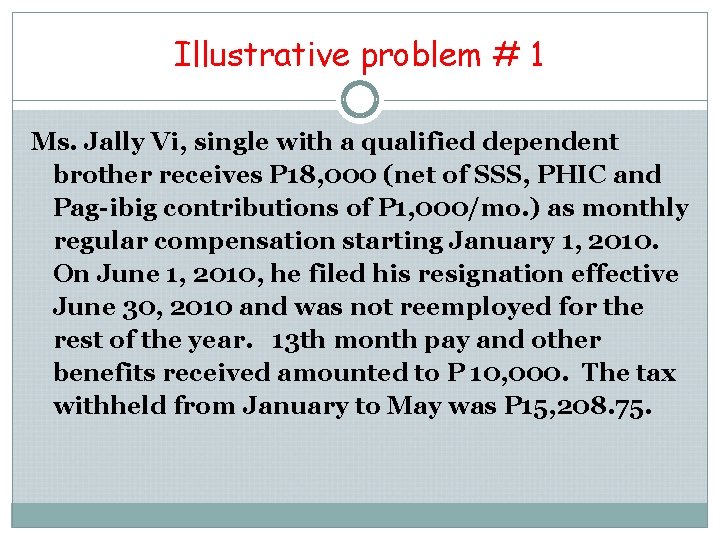

Illustrative problem # 1 Ms. Jally Vi, single with a qualified dependent brother receives P 18, 000 (net of SSS, PHIC and Pag-ibig contributions of P 1, 000/mo. ) as monthly regular compensation starting January 1, 2010. On June 1, 2010, he filed his resignation effective June 30, 2010 and was not reemployed for the rest of the year. 13 th month pay and other benefits received amounted to P 10, 000. The tax withheld from January to May was P 15, 208. 75.

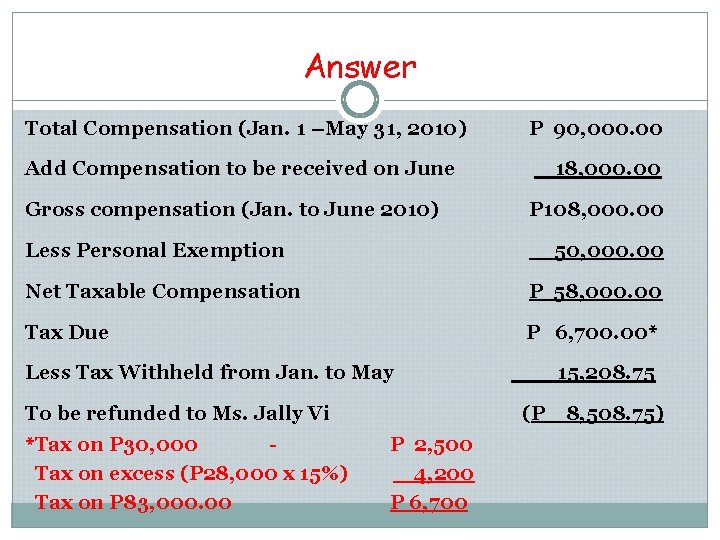

Answer Total Compensation (Jan. 1 –May 31, 2010) P 90, 000. 00 Add Compensation to be received on June Gross compensation (Jan. to June 2010) 18, 000. 00 P 108, 000. 00 Less Personal Exemption 50, 000. 00 Net Taxable Compensation P 58, 000. 00 Tax Due P 6, 700. 00* Less Tax Withheld from Jan. to May To be refunded to Ms. Jally Vi *Tax on P 30, 000 Tax on excess (P 28, 000 x 15%) Tax on P 83, 000. 00 15, 208. 75 (P P 2, 500 4, 200 P 6, 700 8, 508. 75)

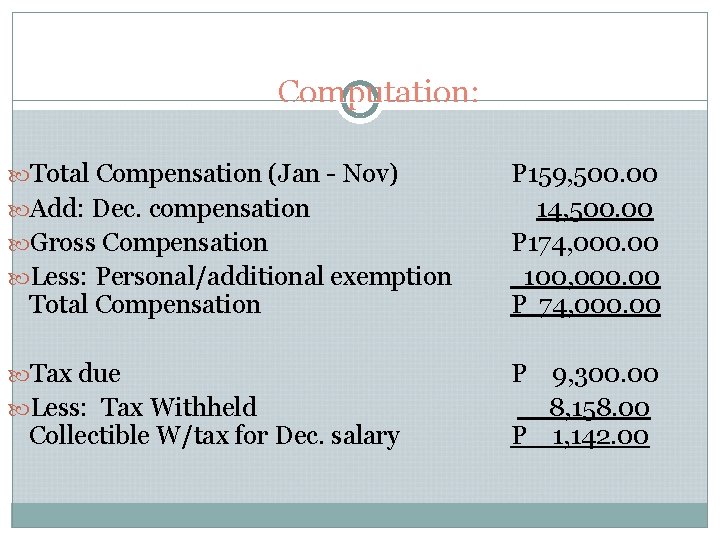

Illustrative Problem # 2 Mr. Jacob, married with 2 qualified dependent children received P 14, 500 monthly compensation (net of SSS, Philhealth, HDMF employees contributions). Taxes withheld from Jan. to Nov. were P 8, 158. 00.

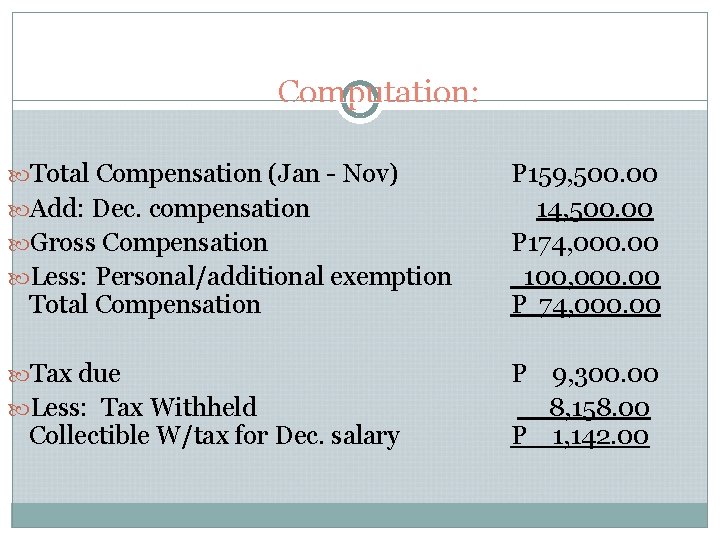

Computation: Total Compensation (Jan - Nov) Add: Dec. compensation Gross Compensation Less: Personal/additional exemption Total Compensation Tax due Less: Tax Withheld Collectible W/tax for Dec. salary P 159, 500. 00 14, 500. 00 P 174, 000. 00 100, 000. 00 P 74, 000. 00 P 9, 300. 00 8, 158. 00 P 1, 142. 00

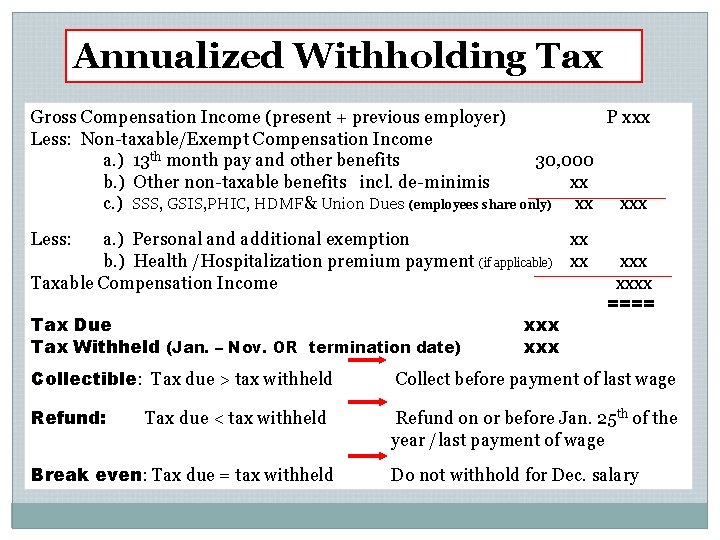

Annualized Withholding Tax Gross Compensation Income (present + previous employer) P xxx Less: Non-taxable/Exempt Compensation Income a. ) 13 th month pay and other benefits 30, 000 b. ) Other non-taxable benefits incl. de-minimis xx c. ) SSS, GSIS, PHIC, HDMF& Union Dues (employees share only) xx xxx Less: a. ) Personal and additional exemption xx b. ) Health /Hospitalization premium payment (if applicable) xx Taxable Compensation Income Tax Due Tax Withheld (Jan. – Nov. OR termination date) xxx xxxx ==== Collectible: Tax due > tax withheld Collect before payment of last wage Refund: Refund on or before Jan. 25 th of the year /last payment of wage Tax due < tax withheld Break even: Tax due = tax withheld Do not withhold for Dec. salary

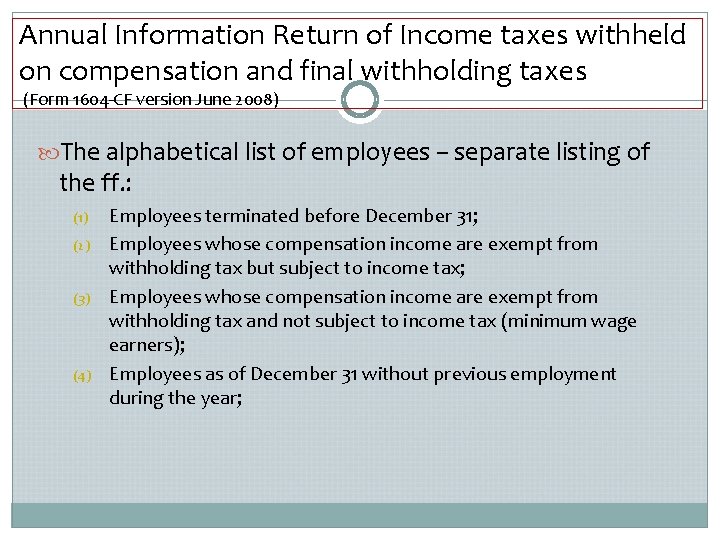

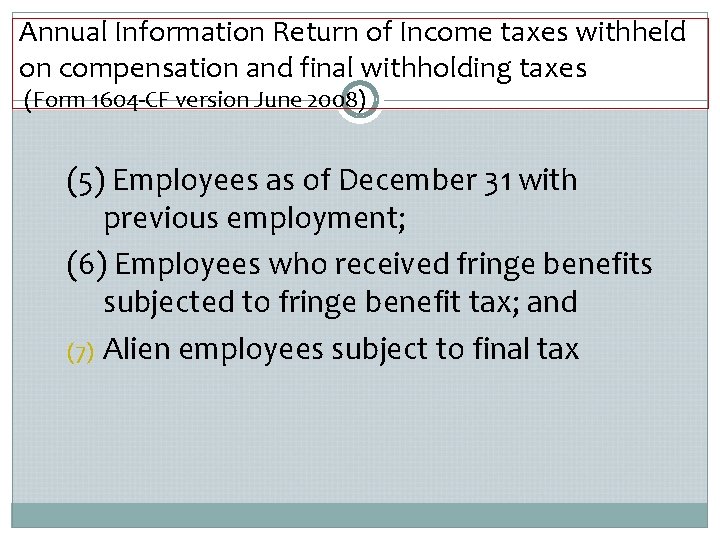

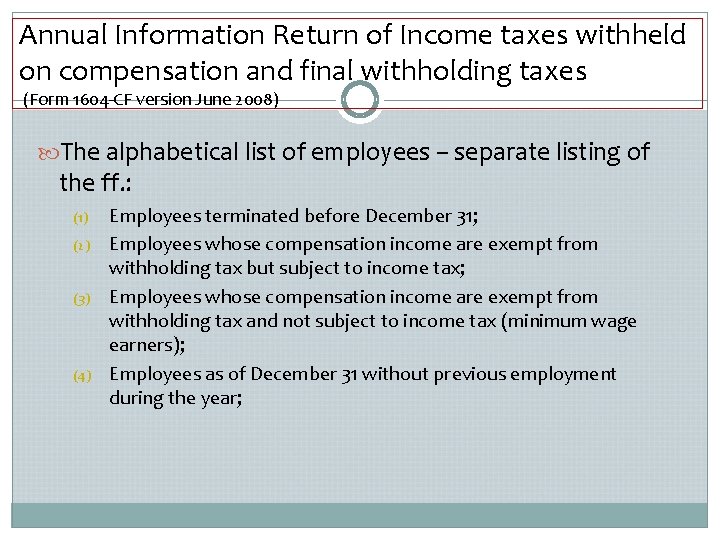

Annual Information Return of Income taxes withheld on compensation and final withholding taxes (Form 1604 -CF version June 2008) The alphabetical list of employees – separate listing of the ff. : (1) (2) (3) (4) Employees terminated before December 31; Employees whose compensation income are exempt from withholding tax but subject to income tax; Employees whose compensation income are exempt from withholding tax and not subject to income tax (minimum wage earners); Employees as of December 31 without previous employment during the year;

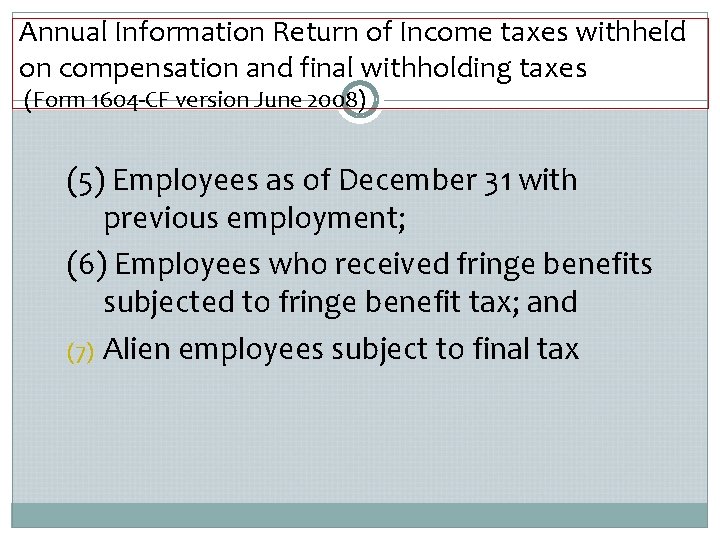

Annual Information Return of Income taxes withheld on compensation and final withholding taxes (Form 1604 -CF version June 2008) (5) Employees as of December 31 with previous employment; (6) Employees who received fringe benefits subjected to fringe benefit tax; and (7) Alien employees subject to final tax

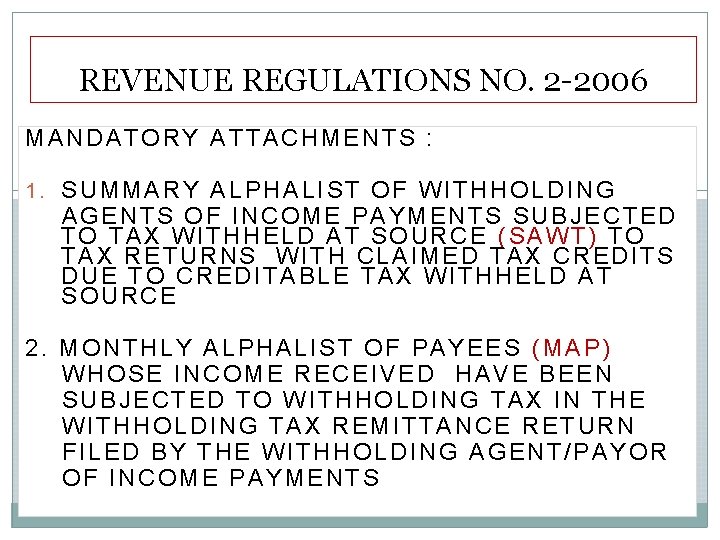

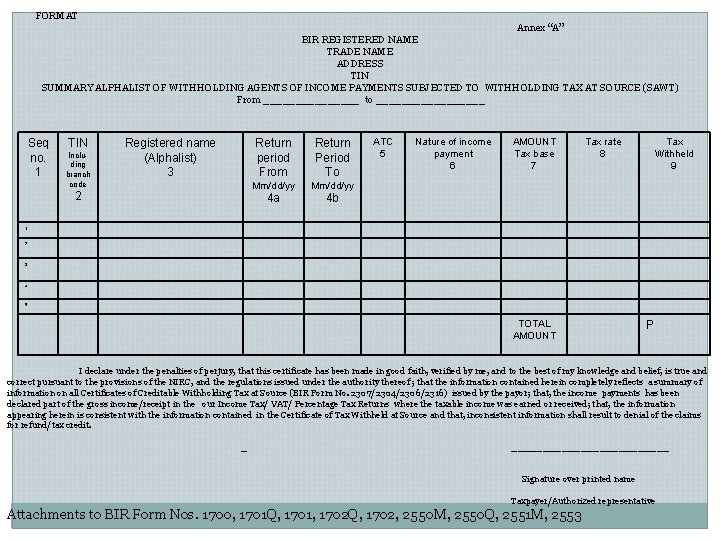

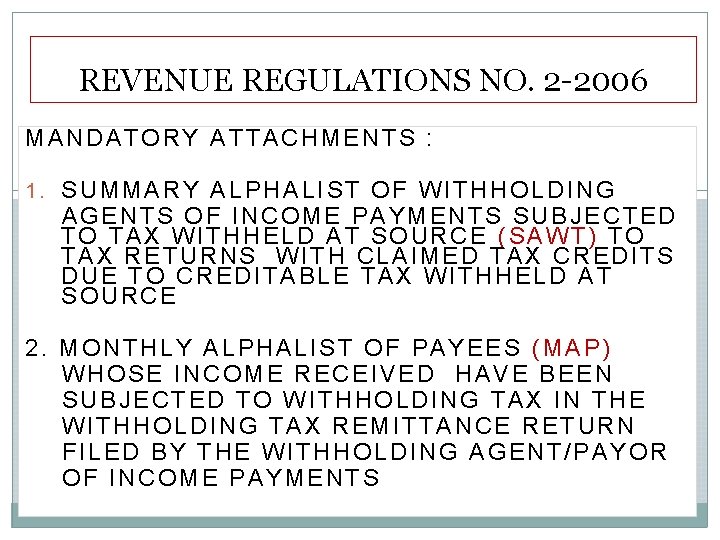

REVENUE REGULATIONS NO. 2 -2006 MANDATORY ATTACHMENTS : 1. SUMMARY ALPHALIST OF WITHHOLDING AGENTS OF INCOME PAYMENTS SUBJECTED TO TAX WITHHELD AT SOURCE (SAWT) TO TAX RETURNS WITH CLAIMED TAX CREDITS DUE TO CREDITABLE TAX WITHHELD AT SOURCE 2. MONTHLY ALPHALIST OF PAYEES (MAP) WHOSE INCOME RECEIVED HAVE BEEN SUBJECTED TO WITHHOLDING TAX IN THE WITHHOLDING TAX REMITTANCE RETURN FILED BY THE WITHHOLDING AGENT/PAYOR OF INCOME PAYMENTS

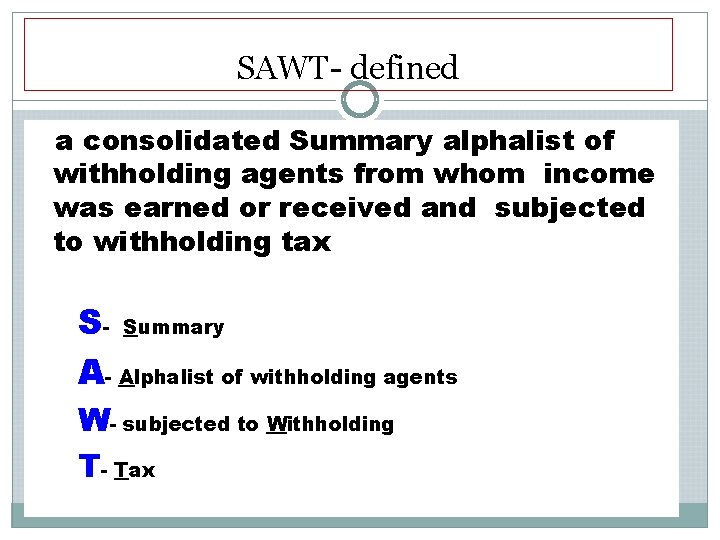

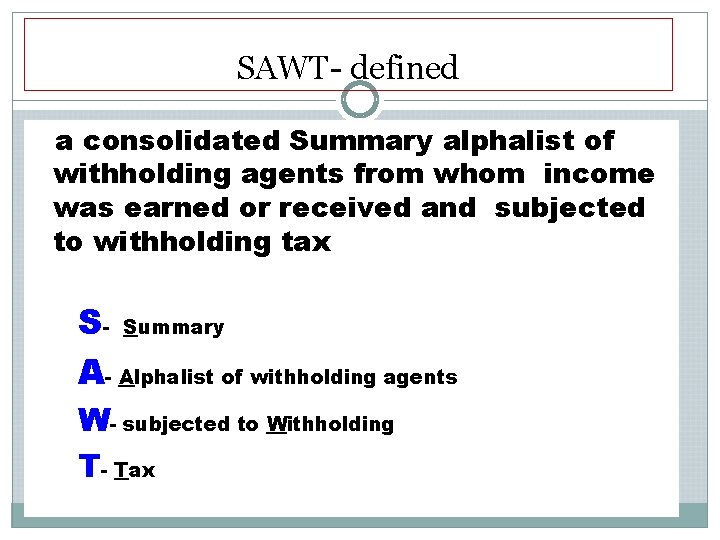

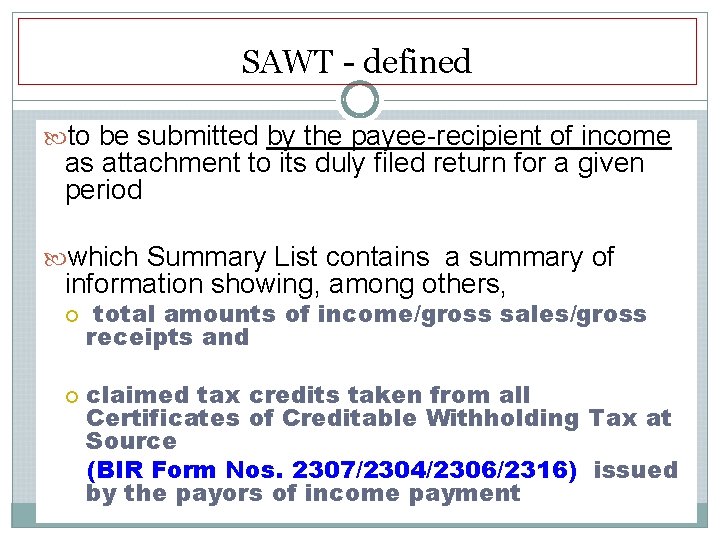

SAWT- defined a consolidated Summary alphalist of withholding agents from whom income was earned or received and subjected to withholding tax S- Summary A- Alphalist of withholding agents W- subjected to Withholding T- Tax

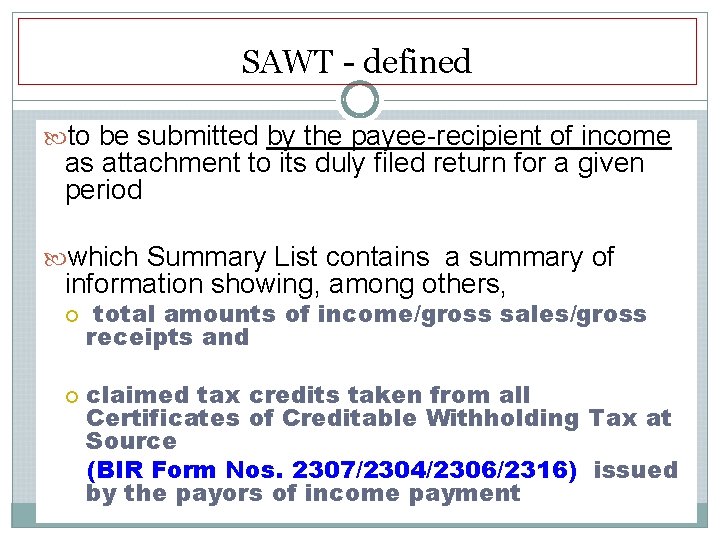

SAWT - defined to be submitted by the payee-recipient of income as attachment to its duly filed return for a given period which Summary List contains a summary of information showing, among others, total amounts of income/gross sales/gross receipts and claimed tax credits taken from all Certificates of Creditable Withholding Tax at Source (BIR Form Nos. 2307/2304/2306/2316) issued by the payors of income payment

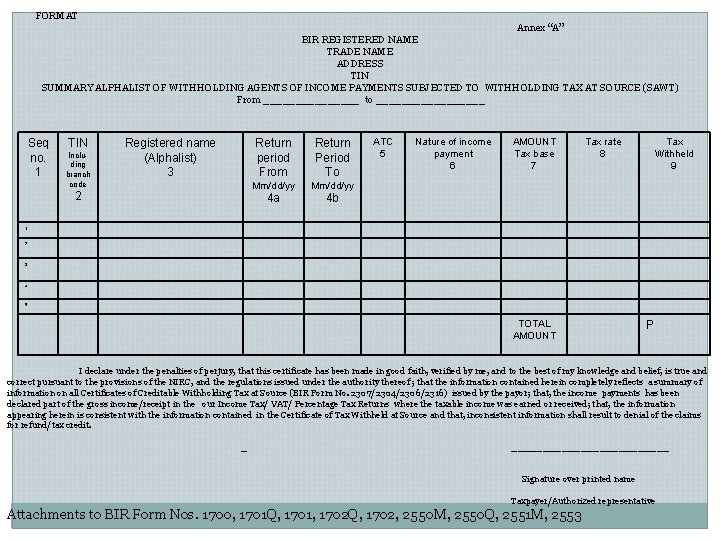

FORMAT Annex “A” BIR REGISTERED NAME TRADE NAME ADDRESS TIN SUMMARY ALPHALIST OF WITHHOLDING AGENTS OF INCOME PAYMENTS SUBJECTED TO WITHHOLDING TAX AT SOURCE (SAWT) From ________ to _________ Seq no. 1 TIN Including branch code Registered name (Alphalist) 3 2 Return period From Return Period To Mm/dd/yy 4 a 4 b ATC 5 Nature of income payment 6 AMOUNT Tax base 7 Tax rate 8 Tax Withheld 9 1 2 3 4 5 TOTAL AMOUNT P I declare under the penalties of perjury, that this certificate has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct pursuant to the provisions of the NIRC, and the regulations issued under the authority thereof ; that the information contained herein completely reflects a summary of information on all Certificates of Creditable Withholding Tax at Source (BIR Form No. 2307/2304/2306/2316) issued by the payor; that, the income payments has been declared part of the gross income/receipt in the our Income Tax/ VAT/ Percentage Tax Returns where the taxable income was earned or received; that, the information appearing herein is consistent with the information contained in the Certificate of Tax Withheld at Source and that, inconsistent information shall result to denial of the claims for refund/tax credit. _ _____________ Signature over printed name Taxpayer/Authorized representative Attachments to BIR Form Nos. 1700, 1701 Q, 1701, 1702 Q, 1702, 2550 M, 2550 Q, 2551 M, 2553

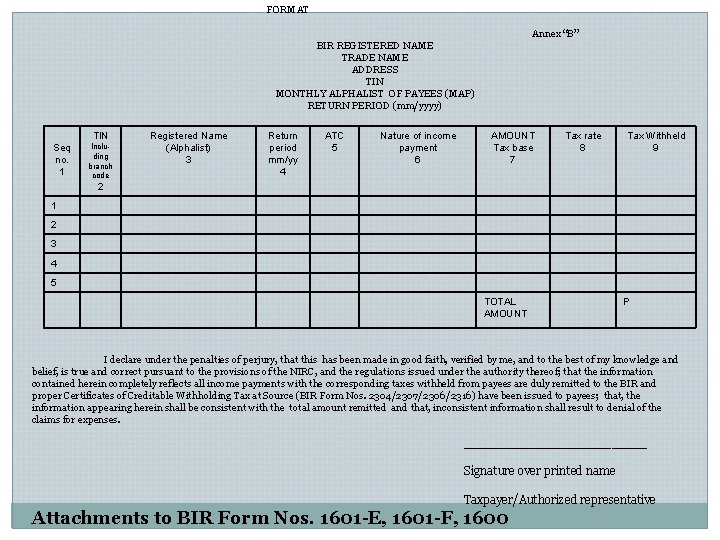

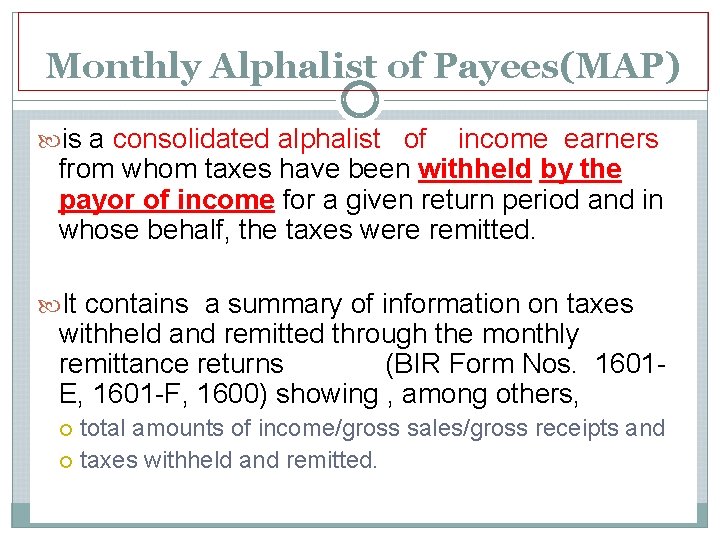

Monthly Alphalist of Payees(MAP) is a consolidated alphalist of income earners from whom taxes have been withheld by the payor of income for a given return period and in whose behalf, the taxes were remitted. It contains a summary of information on taxes withheld and remitted through the monthly remittance returns (BIR Form Nos. 1601 E, 1601 -F, 1600) showing , among others, total amounts of income/gross sales/gross receipts and taxes withheld and remitted.

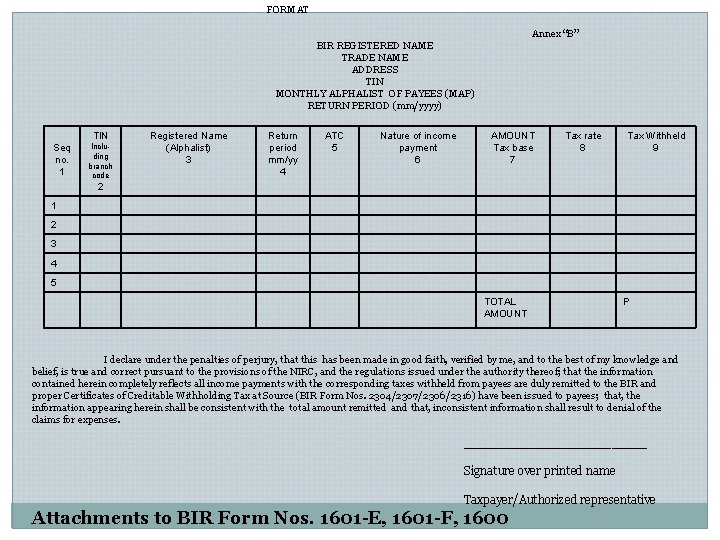

FORMAT Annex “B” BIR REGISTERED NAME TRADE NAME ADDRESS TIN MONTHLY ALPHALIST OF PAYEES (MAP) RETURN PERIOD (mm/yyyy) TIN Seq no. 1 Including branch code Registered Name (Alphalist) 3 Return period mm/yy 4 ATC 5 Nature of income payment 6 AMOUNT Tax base 7 Tax rate 8 Tax Withheld 9 2 1 2 3 4 5 TOTAL AMOUNT P I declare under the penalties of perjury, that this has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct pursuant to the provisions of the NIRC, and the regulations issued under the authority thereof; that the information contained herein completely reflects all income payments with the corresponding taxes withheld from payees are duly remitted to the BIR and proper Certificates of Creditable Withholding Tax at Source (BIR Form Nos. 2304/2307/2306/2316) have been issued to payees; that, the information appearing herein shall be consistent with the total amount remitted and that, inconsistent information shall result to denial of the claims for expenses. _____________ Signature over printed name Taxpayer/Authorized representative Attachments to BIR Form Nos. 1601 -E, 1601 -F, 1600

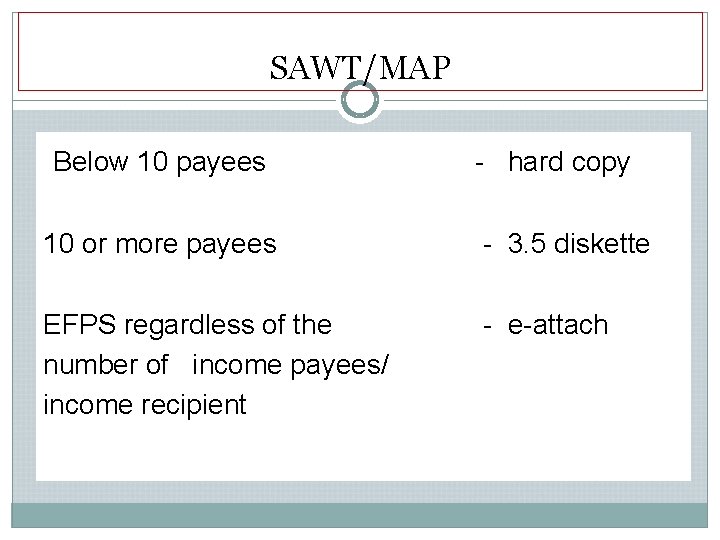

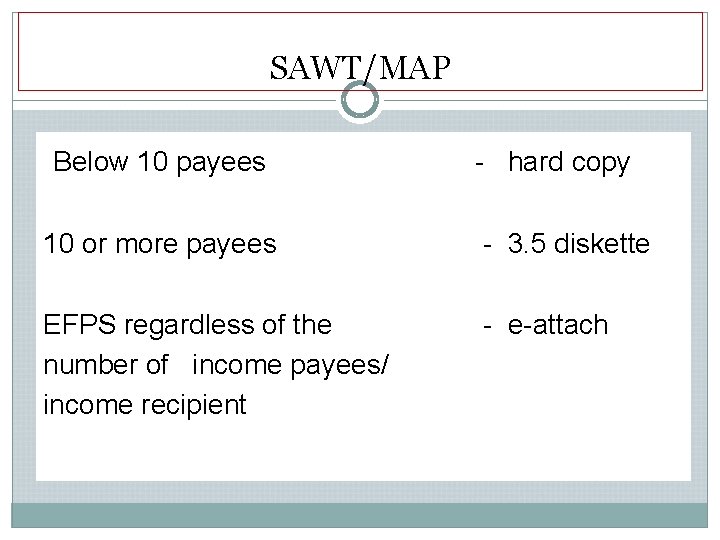

SAWT/MAP Below 10 payees - hard copy 10 or more payees - 3. 5 diskette EFPS regardless of the number of income payees/ income recipient - e-attach

Returns required to be filed with SAWT & Certificate of Creditable Tax Withheld at Source BIR Form No. 1701 Q BIR Form No. 1701 BIR Form No. 1700 BIR Form No. 1702 Q BIR Form No. 1702 BIR Form No. 2550 Q BIR Form No. 2550 M BIR Form No. 2551 M BIR Form No. 2553

1700 1701/Q INCOME 1702/Q RECIPIENTS 2316 SAWT 2307/2316 SAWT 2307 SAWT (PAYEES) 2550 M/Q 2551 M/2553 BIR 2307 SAWT Note: Transactions beg. Jan. 1, 2006 – 1702 Q/1701 Q – WITH SAWT 2005 Annual ITR (calendar Jan-Dec) DUE APRIL 15, 2006 –NO SAWT

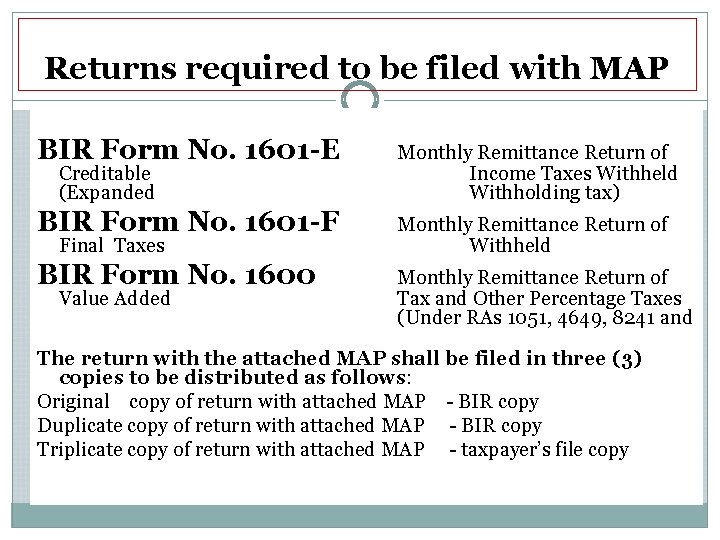

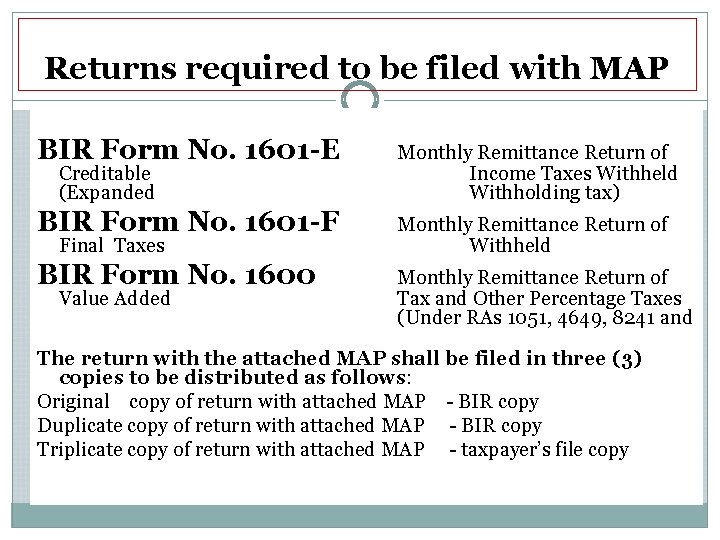

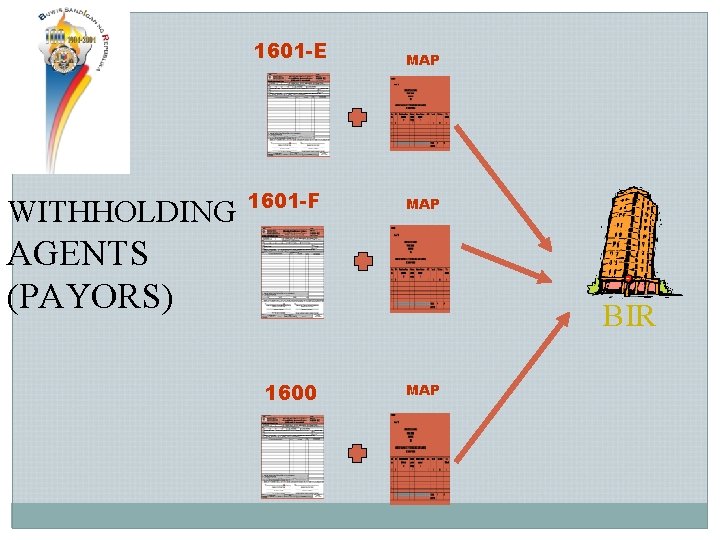

Returns required to be filed with MAP BIR Form No. 1601 -E Monthly Remittance Return of Income Taxes Withheld Withholding tax) BIR Form No. 1601 -F Monthly Remittance Return of Withheld BIR Form No. 1600 Monthly Remittance Return of Tax and Other Percentage Taxes (Under RAs 1051, 4649, 8241 and Creditable (Expanded Final Taxes Value Added The return with the attached MAP shall be filed in three (3) copies to be distributed as follows: Original copy of return with attached MAP - BIR copy Duplicate copy of return with attached MAP - BIR copy Triplicate copy of return with attached MAP - taxpayer’s file copy

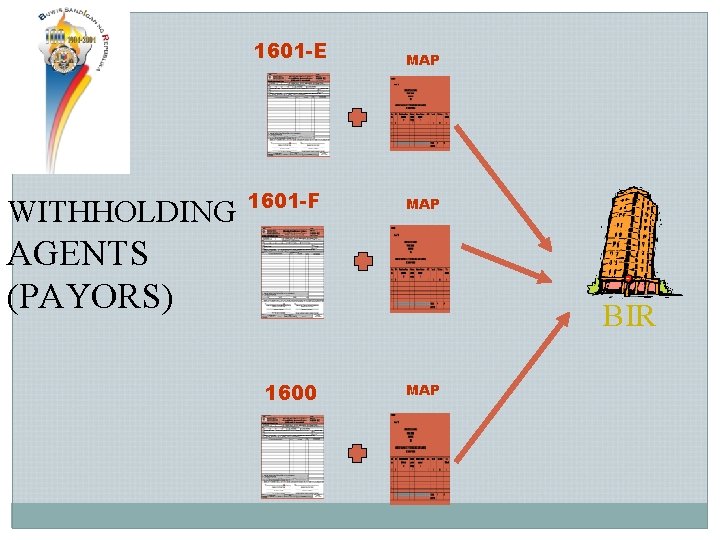

1601 -E WITHHOLDING 1601 -F MAP AGENTS (PAYORS) BIR 1600 MAP

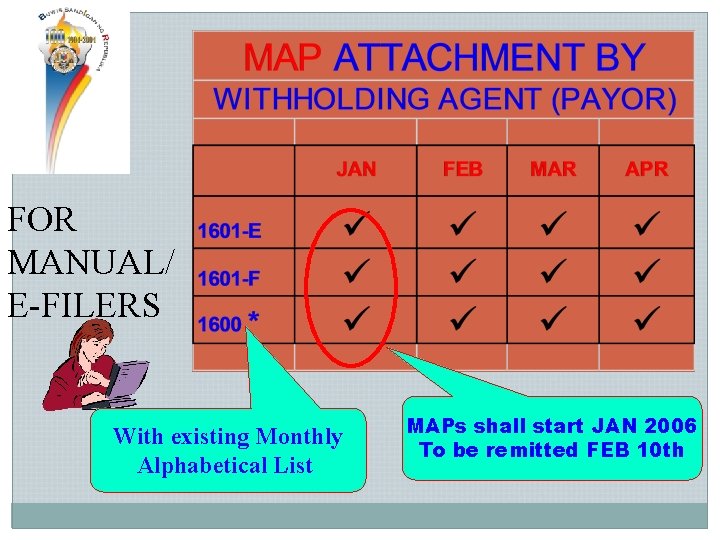

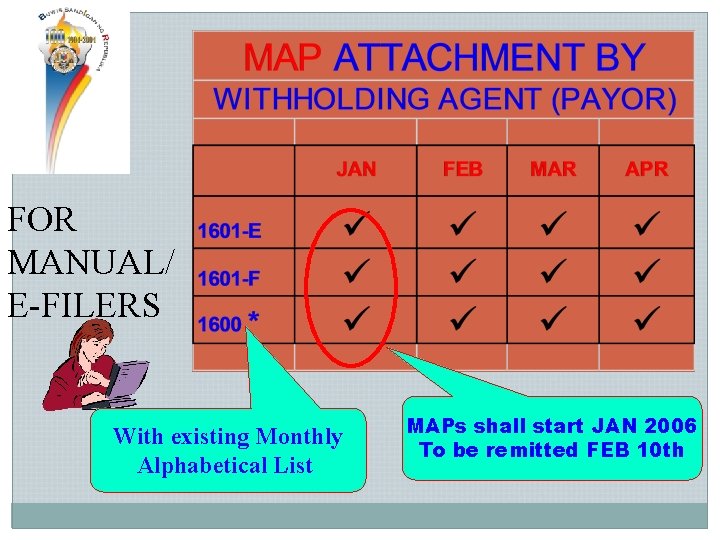

FOR MANUAL/ E-FILERS With existing Monthly Alphabetical List MAPs shall start JAN 2006 To be remitted FEB 10 th

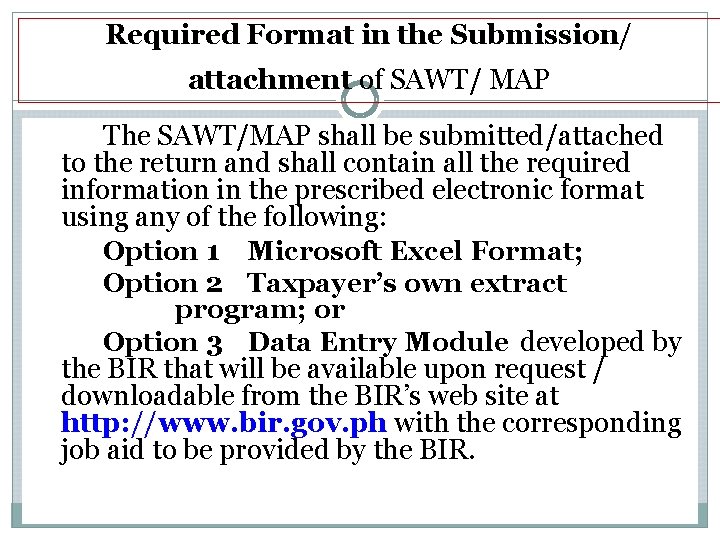

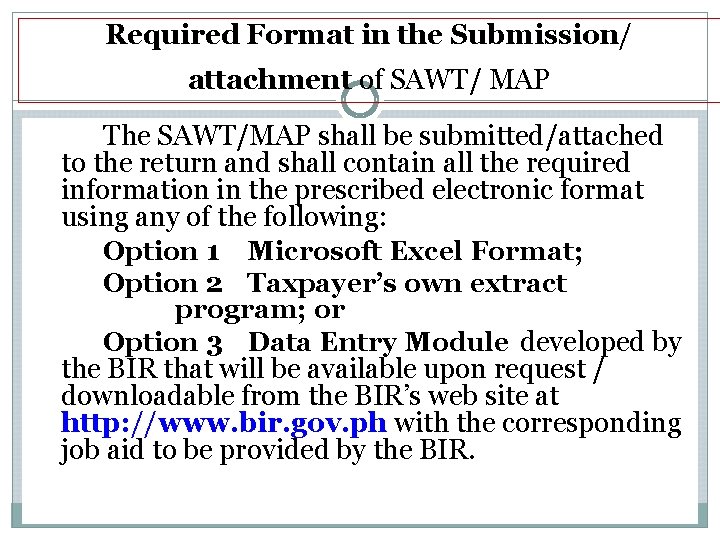

Required Format in the Submission/ attachment of SAWT/ MAP The SAWT/MAP shall be submitted/attached to the return and shall contain all the required information in the prescribed electronic format using any of the following: Option 1 Microsoft Excel Format; Option 2 Taxpayer’s own extract program; or Option 3 Data Entry Module developed by the BIR that will be available upon request / downloadable from the BIR’s web site at http: //www. bir. gov. ph with the corresponding job aid to be provided by the BIR.

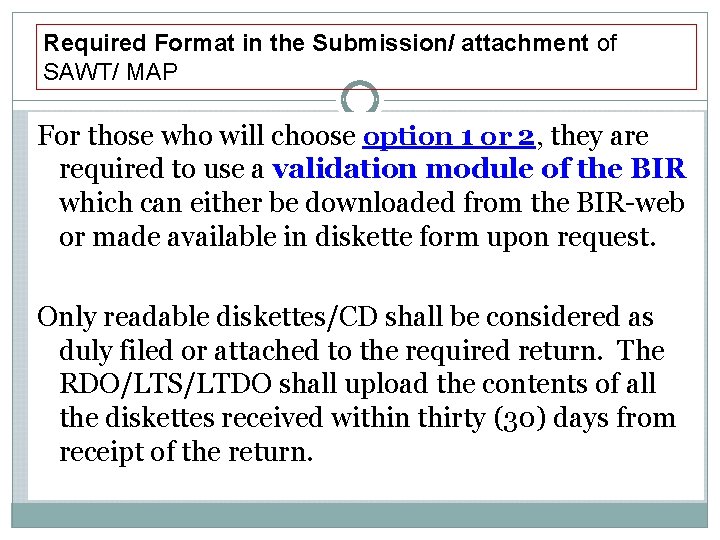

Required Format in the Submission/ attachment of SAWT/ MAP For those who will choose option 1 or 2, they are required to use a validation module of the BIR which can either be downloaded from the BIR-web or made available in diskette form upon request. Only readable diskettes/CD shall be considered as duly filed or attached to the required return. The RDO/LTS/LTDO shall upload the contents of all the diskettes received within thirty (30) days from receipt of the return.

RETENTION OF THE HARD COPY OF THE CERTIFICATES OF TAX WITHHELD It shall always be retained within the period prescribed in the law for the preservation of books of accounts and accounting records and presentation of said hard copy may be requested during audit to prove the tax credits arising from withholding taxes which are being claimed in the tax returns filed.

PENALTY PROVISION a person who fails to file, keep or supply a statement, list, or information required herein on the date prescribed therefor shall pay, upon notice and demand by the CIR, an administrative penalty of One Thousand Pesos (P 1, 000) for each such failure, unless it is satisfactorily shown that such failure is due to reasonable causes and not due to willful neglect. For this purpose, the failure to supply the required information shall constitute a single act or omission punishable thereof. However, the aggregate amount to be imposed for all such failures during the year shall not exceed Twenty Five Thousand Pesos (P 25, 000).

PENALTY PROVISION In addition to the imposition of administrative penalty, willful failure by such person to keep any record and to supply the correct and accurate information at the time required herein, shall be subject to the criminal penalty under the relevant provisions of the Tax Code of 1997, upon conviction of the offender. The imposition of any of the penalties under the Tax Code of 1997 and the compromise of the criminal penalty on such violations, notwithstanding, shall not in any manner relieve the violating taxpayer from the obligation to submit the required documents

PENALTY PROVISION Finally, the corresponding administrative penalty shall be imposed on every violation of the provisions of these Regulations, upon due notice and demand by the CIR. second offense - A subpoena duces tecum for the submission of the required documents shall be issued on the. third offense shall set the motion for a criminal prosecution of the offender. In cases where a violation hereof is allowed to be compromised, the submission of the unsubmitted lists should always form part of the obligation of the taxpayer to be embodied in the compromise agreement.

The end

Withholding tax form 2307

Withholding tax form 2307 Expanded withholding tax computation

Expanded withholding tax computation Withholding tax for commission

Withholding tax for commission Expanded withholding tax computation

Expanded withholding tax computation Expanded withholding tax computation

Expanded withholding tax computation Form 2306

Form 2306 Sc wh 1605

Sc wh 1605 Job order tax

Job order tax Average revenue vs marginal revenue

Average revenue vs marginal revenue How to find the tax revenue

How to find the tax revenue Deadweight loss tax

Deadweight loss tax 165 withholding statement excel file

165 withholding statement excel file Response blocking vs extinction

Response blocking vs extinction Gst conclusion

Gst conclusion Roland purcell a technical writer

Roland purcell a technical writer Federal government primary source of revenue

Federal government primary source of revenue Certificate of creditable tax withheld at source 2307 form

Certificate of creditable tax withheld at source 2307 form Chapter 4 safe driving rules and regulations

Chapter 4 safe driving rules and regulations Army motor pool regulations

Army motor pool regulations Foreign trade division

Foreign trade division Navy stencil regulations

Navy stencil regulations Tsbde rules and regulations chapter 110

Tsbde rules and regulations chapter 110 Importance of building regulations

Importance of building regulations List of food laws in pakistan

List of food laws in pakistan Boiler safety valve regulations

Boiler safety valve regulations In location planning environmental regulations

In location planning environmental regulations Foreign trade statistics regulations

Foreign trade statistics regulations Wiaa fastpitch rules

Wiaa fastpitch rules Natural health product regulations canada

Natural health product regulations canada Child care facility rules and regulations exam

Child care facility rules and regulations exam Irs repair regulations flowchart

Irs repair regulations flowchart Part 21 g et j

Part 21 g et j Dbhds sponsored residential regulations

Dbhds sponsored residential regulations Maintenance rules and regulations

Maintenance rules and regulations Acecqa regulations

Acecqa regulations Ckt motor perlis

Ckt motor perlis Rto rules and regulations

Rto rules and regulations Collective investment scheme regulations

Collective investment scheme regulations Graduated approach

Graduated approach Dbhds licensing regulations

Dbhds licensing regulations Chapter 4 safe driving rules and regulations

Chapter 4 safe driving rules and regulations Njdep ust registration form

Njdep ust registration form Easa ftl regulations combined document

Easa ftl regulations combined document Alabama oversize regulations

Alabama oversize regulations Mossel bay municipality building plans

Mossel bay municipality building plans Pocamla

Pocamla Automotive regulations and standards

Automotive regulations and standards Preventive maintenance in computer laboratory

Preventive maintenance in computer laboratory Mcl uniform

Mcl uniform Tg 20:13

Tg 20:13 Osha hand tools

Osha hand tools Six pack health and safety regulations

Six pack health and safety regulations Ihss parent provider regulations 2020

Ihss parent provider regulations 2020 Sacco societies regulatory authority

Sacco societies regulatory authority 6 pack regulations

6 pack regulations Georgia child care licensing regulations

Georgia child care licensing regulations Food safety regulations and standards

Food safety regulations and standards Chapter 8 location planning and analysis

Chapter 8 location planning and analysis Telecom regulations dominican republic

Telecom regulations dominican republic Unit 2 btec sport level 3

Unit 2 btec sport level 3 Cimah

Cimah Wiaa tennis rules

Wiaa tennis rules Nyc doe

Nyc doe Ohio revised code towing regulations

Ohio revised code towing regulations Usp regulations mcmc

Usp regulations mcmc Fpo standards

Fpo standards Esc law regulations

Esc law regulations Health and safety regulations in engineering

Health and safety regulations in engineering Chapter 4 safe driving rules and regulations

Chapter 4 safe driving rules and regulations Advantages of acts of parliament

Advantages of acts of parliament New canaan zoning regulations

New canaan zoning regulations Rtgs bd

Rtgs bd Church accounting regulations

Church accounting regulations Loler regulations 2018

Loler regulations 2018 Blood safety and quality regulations

Blood safety and quality regulations Warehouse objectives

Warehouse objectives Bwca rules and regulations

Bwca rules and regulations Korea work safety

Korea work safety Venolive

Venolive Eu tattoo ink

Eu tattoo ink Airbnb stayz

Airbnb stayz Dnv vs joint commission

Dnv vs joint commission Telecom regulations lithuania

Telecom regulations lithuania Why do we have hunting laws and regulations

Why do we have hunting laws and regulations Osha standard for fire extinguishers

Osha standard for fire extinguishers Badminton regulations btec sport

Badminton regulations btec sport Preferential procurement regulations 2017

Preferential procurement regulations 2017 Bmsma regulations

Bmsma regulations Eating in computer lab

Eating in computer lab Georgia child care licensing regulations

Georgia child care licensing regulations Fmc rate filing

Fmc rate filing Class rules and regulations

Class rules and regulations Cidb regulations

Cidb regulations Business text archiving

Business text archiving Legal regulations compliance and investigation

Legal regulations compliance and investigation Navy male hair regulations

Navy male hair regulations Canada motor vehicle safety act

Canada motor vehicle safety act Work health and safety regulations 2012 sa

Work health and safety regulations 2012 sa Gso standards

Gso standards Icao maintenance regulations

Icao maintenance regulations Alberta occupant restraint program

Alberta occupant restraint program Pesticide warning signs ontario

Pesticide warning signs ontario Easa ftl

Easa ftl Gmp adalah

Gmp adalah Bucs tennis regulations

Bucs tennis regulations Copyright regulations 1969

Copyright regulations 1969 Mining regulations

Mining regulations Environmental permitting regulations 2007

Environmental permitting regulations 2007 Badminton referee rules

Badminton referee rules A motorist should know that he she is entering

A motorist should know that he she is entering Customs union technical regulations

Customs union technical regulations The provision and use of work equipment regulations

The provision and use of work equipment regulations Fifa regulations on working with intermediaries

Fifa regulations on working with intermediaries Irda (insurance brokers) regulations 2018

Irda (insurance brokers) regulations 2018 Civil air patrol patch placement

Civil air patrol patch placement Cold ironing regulations

Cold ironing regulations Hsmai revenue management certification

Hsmai revenue management certification Incoterms and revenue recognition us gaap

Incoterms and revenue recognition us gaap Breakeven volume

Breakeven volume Importance of forecasting in front office management

Importance of forecasting in front office management Role of pricing and revenue management in a supply chain

Role of pricing and revenue management in a supply chain Warren buffet network marketing

Warren buffet network marketing Asus revenue

Asus revenue Midaxo pricing

Midaxo pricing Eastman kodak revenue

Eastman kodak revenue Capital and revenue

Capital and revenue Les types de revenus

Les types de revenus Revenue equivalence theorem

Revenue equivalence theorem Contoh revenue center

Contoh revenue center Break even diagram labelled

Break even diagram labelled Revenue management and pricing

Revenue management and pricing Accrual and deferral

Accrual and deferral Factors affecting transportation decisions

Factors affecting transportation decisions Revpar adalah

Revpar adalah Revenue allocation methods

Revenue allocation methods Setting prices and implementing revenue management

Setting prices and implementing revenue management Sales revenue maximisation theory

Sales revenue maximisation theory Pengertian tax amnesty

Pengertian tax amnesty Drawing is dr or cr

Drawing is dr or cr Revenue cycle sales to cash collections

Revenue cycle sales to cash collections Advertising-subscription mixed revenue model

Advertising-subscription mixed revenue model Define revenue leakage

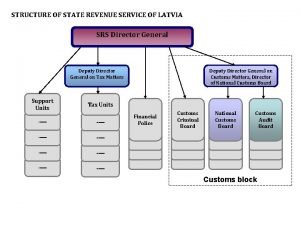

Define revenue leakage Srs latvia

Srs latvia Pricing and revenue management in supply chain

Pricing and revenue management in supply chain Revenue recognition pwc

Revenue recognition pwc Lego revenue streams

Lego revenue streams Iso-revenue line

Iso-revenue line How to calculate break even sales

How to calculate break even sales Mike gamble alabama department of revenue

Mike gamble alabama department of revenue Revenue cycle sales to cash collections

Revenue cycle sales to cash collections Ipsas 23 revenue from non-exchange transactions

Ipsas 23 revenue from non-exchange transactions Adnan shoaib

Adnan shoaib Role of pricing and revenue management in a supply chain

Role of pricing and revenue management in a supply chain