The six fundamental indicators every investor must use

- Slides: 41

The six fundamental indicators every investor must use

Definition Fundamental analysis – the study of a company’s capital value (on the balance sheet) and profit or loss (on the income statement) to determine its overall viability as an investment; to identify financial trends; and to decide whether the current price is reasonable based on trends in revenue and profit. Fundamental analysis includes the study of: - the balance sheet, the value of assets, liabilities and net worth as of the end of the quarter or year. - the income statement, a summary of revenues, costs, expenses and profits during a quarter or full year. - other financial attributes including the earnings per share, competitive position within the industry, and dividend history.

The six indicators An investor may use any number of fundamental indicators, but six are essential for everyone. These are: 1. growth in revenues 2. growth in earnings 3. price/earnings ratio (P/E) 4. dividend yield 5. dividend growth 6. debt ratio

1. growth in revenues

The nature of revenue growth What should you expect to see? The trend and how it changes The tendency for trends to level out Revenues are tied to earnings Revenue dollar values should grow Earnings percentage should be consistent

Problems with revenue Revenues trend erratically Revenues grow while earnings do not Revenues remain level or begin to slide

2. growth in earnings

How earnings grow Net return should remain consistent or rise The net dollar value should grow as well Seek consistent earnings trends

Problems with earnings The net return declines even if dollar amount grows Revenues outpace the net return Revenues grow while earnings move to negative

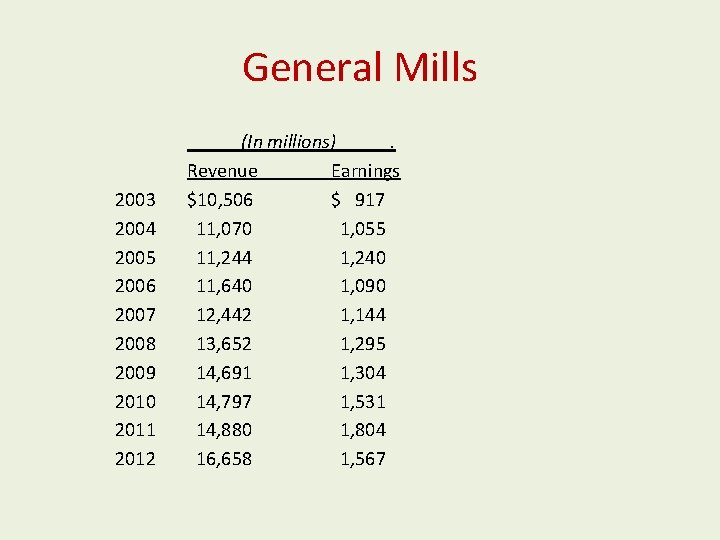

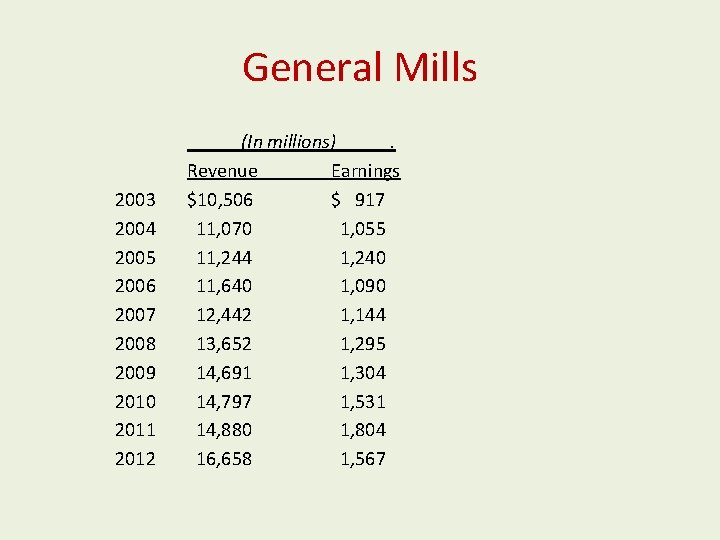

Revenue and earnings examples You can only tell how a trend is evolving by studying a long-term trend A 10 -year trend is excellent because it reveals how trends move through time Track revenues and earnings together to get the full picture

General Mills 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 (In millions). Revenue Earnings $10, 506 $ 917 11, 070 1, 055 11, 244 1, 240 11, 640 1, 090 12, 442 1, 144 13, 652 1, 295 14, 691 1, 304 14, 797 1, 531 14, 880 1, 804 16, 658 1, 567

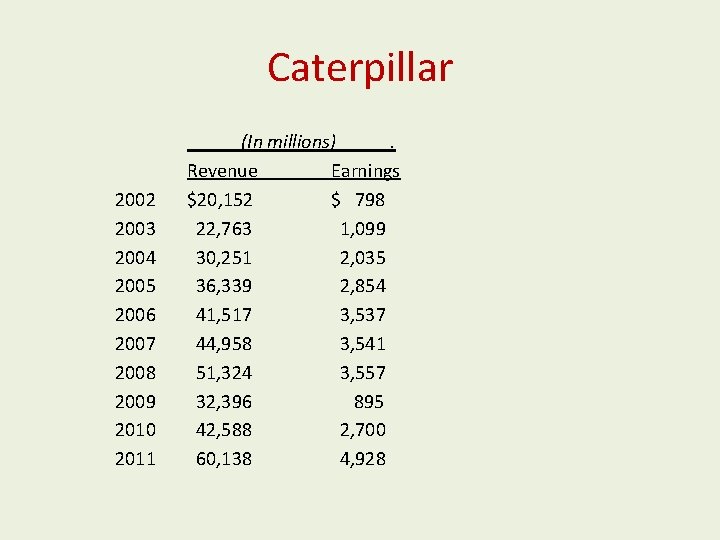

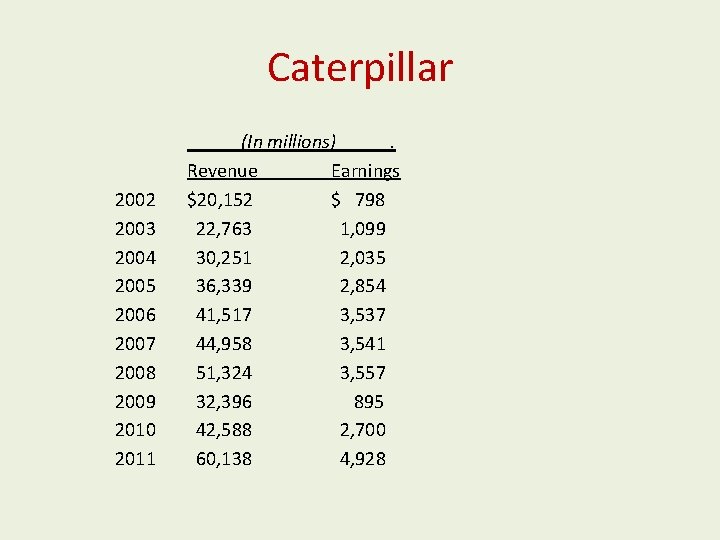

Caterpillar 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 (In millions). Revenue Earnings $20, 152 $ 798 22, 763 1, 099 30, 251 2, 035 36, 339 2, 854 41, 517 3, 537 44, 958 3, 541 51, 324 3, 557 32, 396 895 42, 588 2, 700 60, 138 4, 928

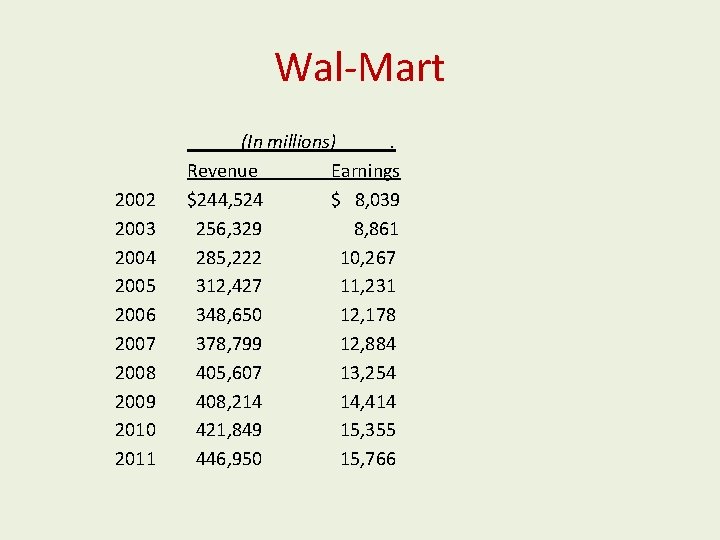

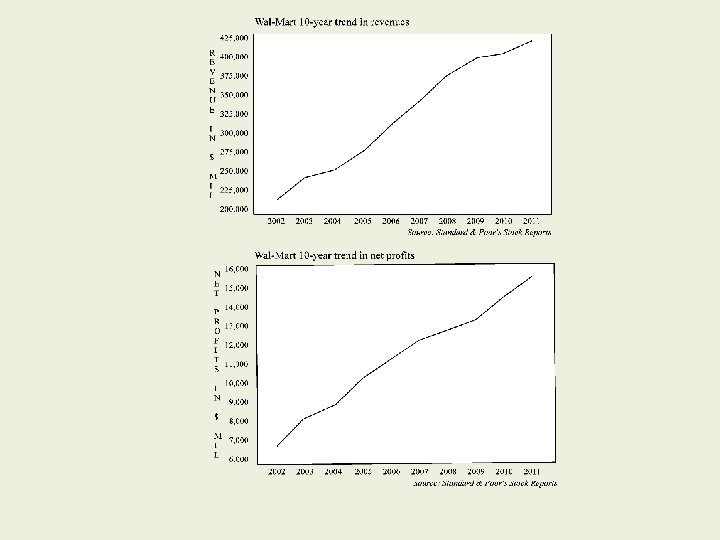

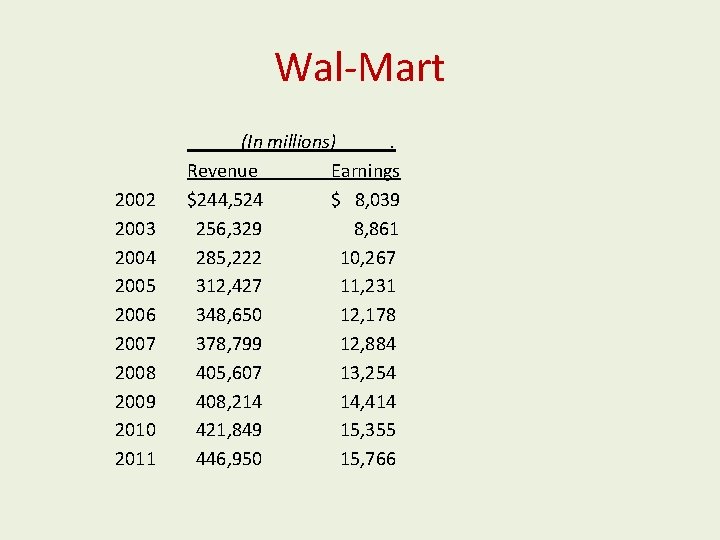

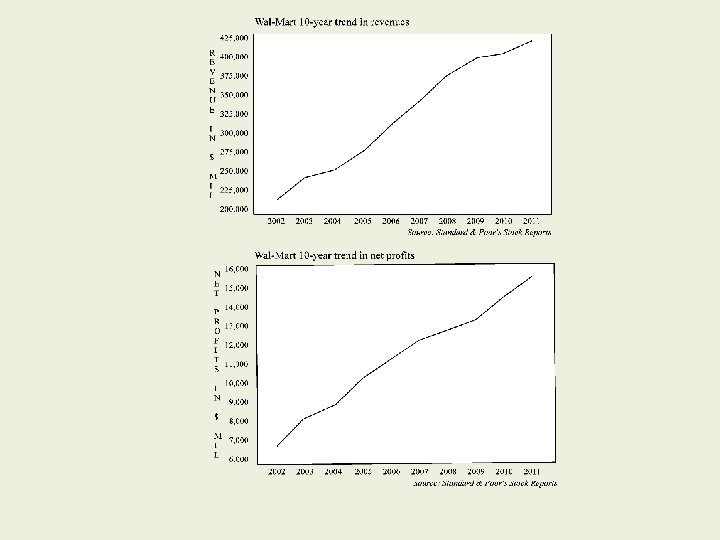

Wal-Mart 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 (In millions). Revenue Earnings $244, 524 $ 8, 039 256, 329 8, 861 285, 222 10, 267 312, 427 11, 231 348, 650 12, 178 378, 799 12, 884 405, 607 13, 254 408, 214 14, 414 421, 849 15, 355 446, 950 15, 766

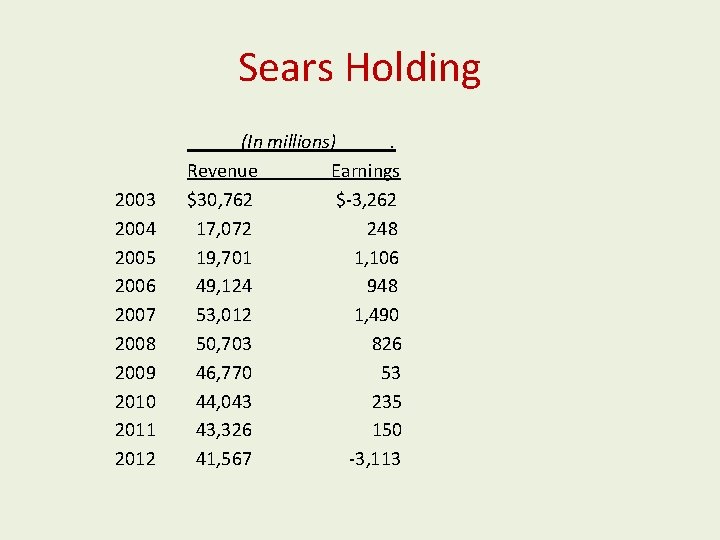

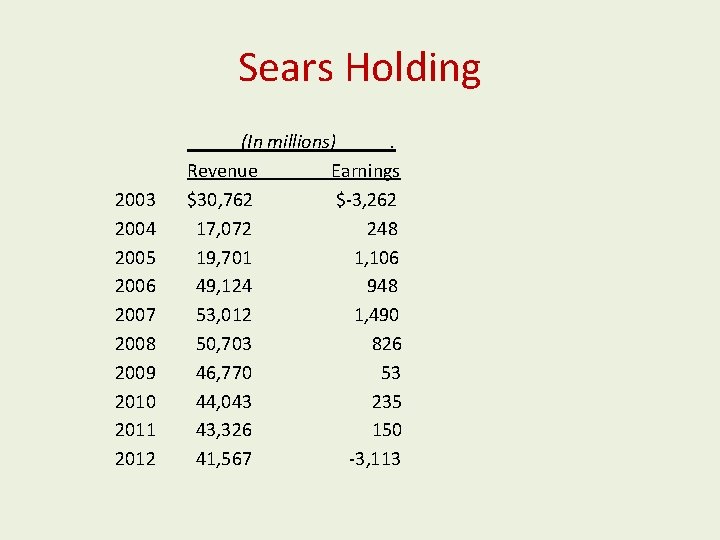

Sears Holding 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 (In millions). Revenue Earnings $30, 762 $-3, 262 17, 072 248 19, 701 1, 106 49, 124 948 53, 012 1, 490 50, 703 826 46, 770 53 44, 043 235 43, 326 150 41, 567 -3, 113

3. price/earnings ratio (P/E)

How the P/E works The price/earnings ratio (P/E) is a summary of the relationship between the current price per share, and latest reported earnings per share (EPS) To compute, divide price per share by earnings per share.

Problems with the P/E The P/E compares a current technical indicator (price) to an outdated fundamental indicator (earnings). The P/E multiplier is a reflection of how many years' earnings are in the current price. The higher the P/E, the more expensive the stock

Solutions to the P/E problem The P/E cannot be reliably used as a singular value at the moment. However, volatility of the stock can be judged by a review of the range of annual P/E and its trend. A consistent level of P/E in a narrow range is a positive indicator. For example, General Mills has reported a narrow P/E over many years.

P/E rules of thumb Generally, a P/E between 10 and 25 is a positive signal. However, the trend is as important as where P/E is today. Irregular and volatile P/E is a sign of volatility in the stock and in the fundamentals. For example, Caterpillar has reported very erratic P/E range over recent years.

4. dividend yield

Definition Dividend yield – the percentage yield based on dividend declared and paid per share. To determine, dividend per share, by the current price per share. Example: a company currently pays $0. 44 (fortyfour cents) per share. The price per share is $20. 00. Dividend yield is: 0. 44 ÷ 20. 00 = 2. 2% The meaning of dividend yield Price is changing constantly, but the dividend declared per share does not change. As a result, dividend yield changes every day. The lower the price, the higher the yield. Examples: 0. 44 ÷ 20. 00 = 2. 2% 0. 44 ÷ 18. 00 = 2. 4% 0. 44 ÷ 16. 00 = 2. 8%

The meaning of dividend yield To evaluate dividend yield, remember: - Your dividend yield is always based on the price you paid per share. - To judge a company’s value, review dividend yield over many years, and not just what is paid today.

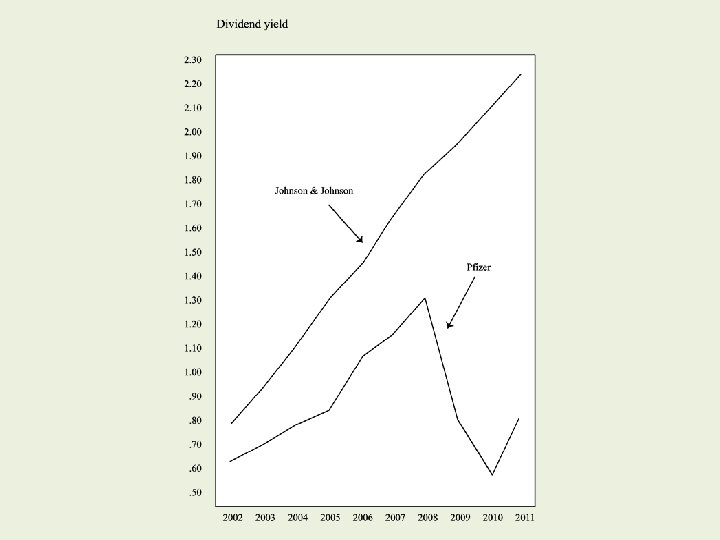

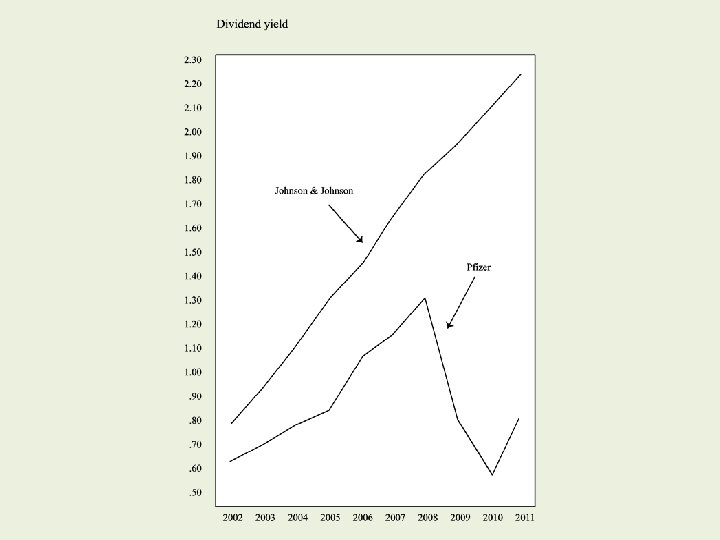

The meaning of dividend yield Compare two companies to see how dividend yield works. Both yielded 3. 43% as of December 11, 2012: Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 dividend per share Johnson Pfizer & Johnson 0. 52 0. 80 0. 60 0. 93 0. 68 1. 10 0. 76 1. 28 0. 96 1. 46 1. 16 1. 62 1. 28 1. 80 0. 80 1. 93 0. 54 2. 11 0. 80 2. 25

The meaning of dividend yield In this comparison, Pfizer’s dividend over 10 years was lower than Johnson & Johnson’s. More significantly, Pfizer reduced its dividend per share over several year, while JNJ increased its payment every year.

5. dividend growth

Definition Dividend growth – the percentage of increase each year in dividends per share, over payments in the previous year. Dividend growth may be more revealing than dividend yield. The rate of growth is a significant factor as a long-term trend. The meaning of dividend growth The change from year to year in the dividend per share is a significant factor. Although a company may increase its annual dividend per share, if growth is declining, that has to be taken into account as well. Evaluating dividends should be a combination of dividend yield and dividend growth.

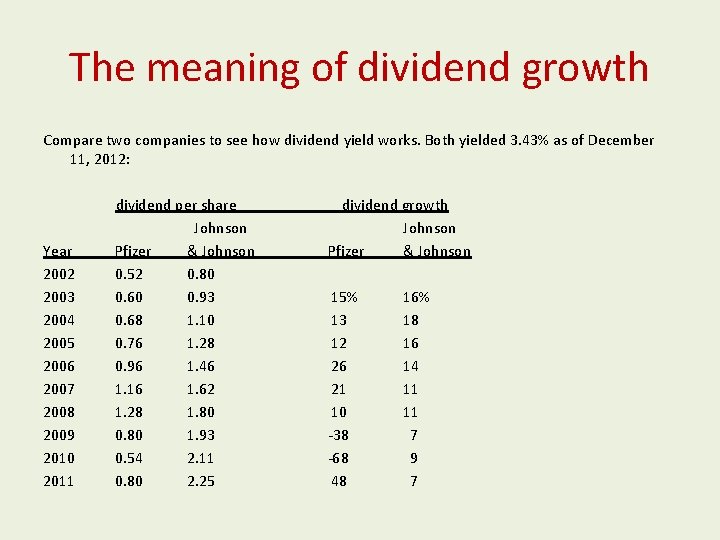

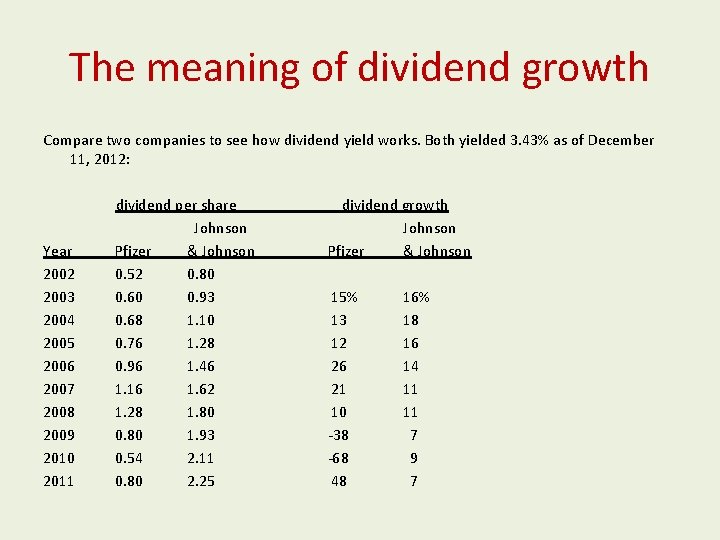

The meaning of dividend growth Compare two companies to see how dividend yield works. Both yielded 3. 43% as of December 11, 2012: Year 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 dividend per share Johnson Pfizer & Johnson 0. 52 0. 80 0. 60 0. 93 0. 68 1. 10 0. 76 1. 28 0. 96 1. 46 1. 16 1. 62 1. 28 1. 80 0. 80 1. 93 0. 54 2. 11 0. 80 2. 25 dividend growth Johnson Pfizer & Johnson 15% 13 12 26 21 10 -38 -68 48 16% 18 16 14 11 11 7 9 7

The meaning of dividend growth These results tell the story of dividend growth. Although Pfizer’s yield was erratic, the growth during positive years was impressive In comparison, Johnson & Johnson increased its dividend yield each year, but growth diminished.

6. debt ratio

Debt Ratio The debt ratio is a test of how well management plans and controls its cash flow. The debt ratio is the percentage of total capitalization represented by long-term debt. “Total capitalization” is the combination of longterm debt and stockholders’ equity.

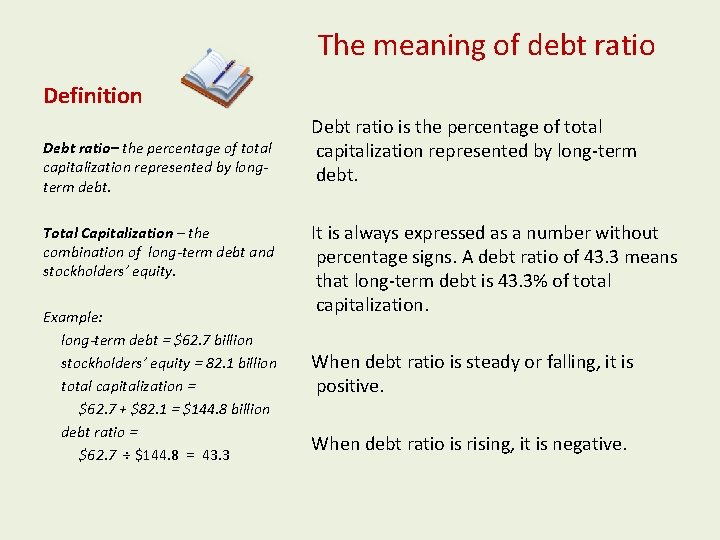

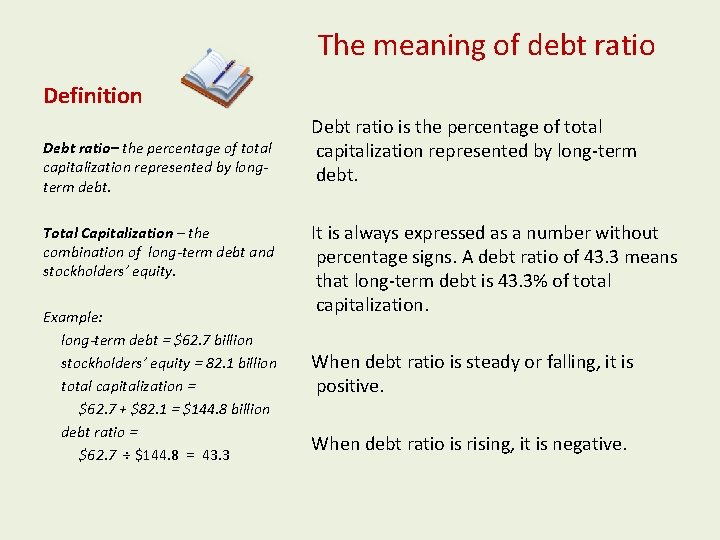

The meaning of debt ratio Definition Debt ratio– the percentage of total capitalization represented by longterm debt. Total Capitalization – the combination of long-term debt and stockholders’ equity. Example: long-term debt = $62. 7 billion stockholders’ equity = 82. 1 billion total capitalization = $62. 7 + $82. 1 = $144. 8 billion debt ratio = $62. 7 ÷ $144. 8 = 43. 3 Debt ratio is the percentage of total capitalization represented by long-term debt. It is always expressed as a number without percentage signs. A debt ratio of 43. 3 means that long-term debt is 43. 3% of total capitalization. When debt ratio is steady or falling, it is positive. When debt ratio is rising, it is negative.

The meaning of debt ratio For example, Eastman Kodak was for many years considered one of the strongest and best capitalized blue chip companies in the market. However, EK did not keep up with changing markets and when the digital camera boom arrived, they lost market share. In 2007, EK’s debt ratio was about 30 – but by the end of 2010, it was above 160. When debt ratio is over 100, it means debt has entirely absorbed equity. The company’s stock is worthless.

Conclusion Fundamental analysis is nothing more than the study of financial conditions and trends. It is imperative to analyze trend direction and strength over time. The fundamentals identify the value of companies and levels of competitive strength.

Fundamental indicators

Fundamental indicators Every nation and every country

Every nation and every country Microsoft mission and vision

Microsoft mission and vision Every knee shall bow every tongue confess

Every knee shall bow every tongue confess Every rotarian every year

Every rotarian every year Every nation and every country

Every nation and every country Every picture has a story and every story has a moment

Every picture has a story and every story has a moment Every child every day

Every child every day Every living plants and animals must have

Every living plants and animals must have Ctip clause that must be included in every contract

Ctip clause that must be included in every contract Lang stair & rail inc

Lang stair & rail inc Every society must answer the question of

Every society must answer the question of Venn diagram series and parallel circuits

Venn diagram series and parallel circuits Every flight of stairs with four or more risers must have

Every flight of stairs with four or more risers must have A complete sentence must have

A complete sentence must have Every society must develop a system

Every society must develop a system Every child ready to read six skills

Every child ready to read six skills Fletcher's situation ethics

Fletcher's situation ethics Six fundamental values of academic integrity

Six fundamental values of academic integrity Drug use indicators definition

Drug use indicators definition I must become less

I must become less Classify each polygon

Classify each polygon Figurative writing that paints pictures

Figurative writing that paints pictures Tree diagram outcomes

Tree diagram outcomes Simplify trig identities calculator

Simplify trig identities calculator Impulse momentum bar chart

Impulse momentum bar chart Should to

Should to Libros definite article

Libros definite article Use of must and have to

Use of must and have to Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Slidetodoc

Slidetodoc Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Voi kéo gỗ như thế nào

Voi kéo gỗ như thế nào Chụp tư thế worms-breton

Chụp tư thế worms-breton Hát lên người ơi alleluia

Hát lên người ơi alleluia Môn thể thao bắt đầu bằng từ đua

Môn thể thao bắt đầu bằng từ đua Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

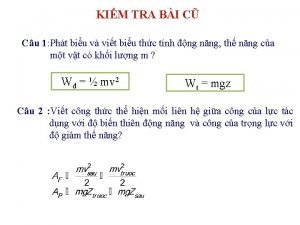

Các châu lục và đại dương trên thế giới Công thức tính thế năng

Công thức tính thế năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Mật thư anh em như thể tay chân

Mật thư anh em như thể tay chân