PORTFOLIO RISK AND RETURN Measuring Returns Converting Dollar

![Measuring Risk Ex post Standard Deviation [8 -7] 8 - 24 Measuring Risk Ex post Standard Deviation [8 -7] 8 - 24](https://slidetodoc.com/presentation_image_h/9bb5d4ff59aa42e84c2307ee16751ae6/image-24.jpg)

- Slides: 38

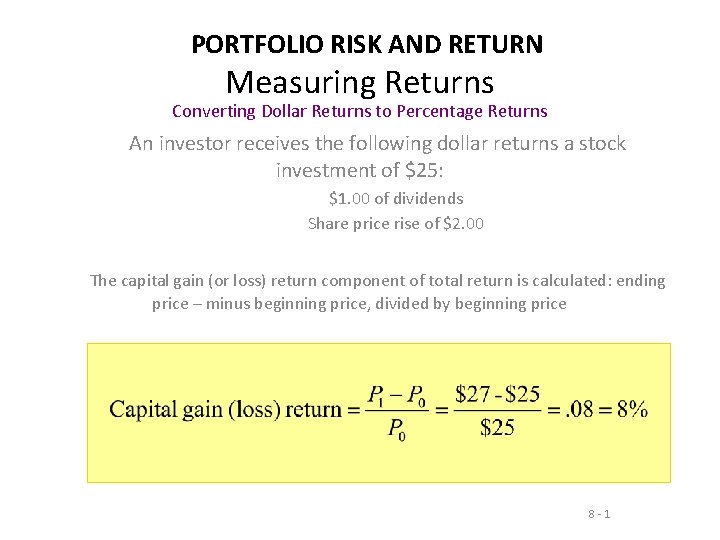

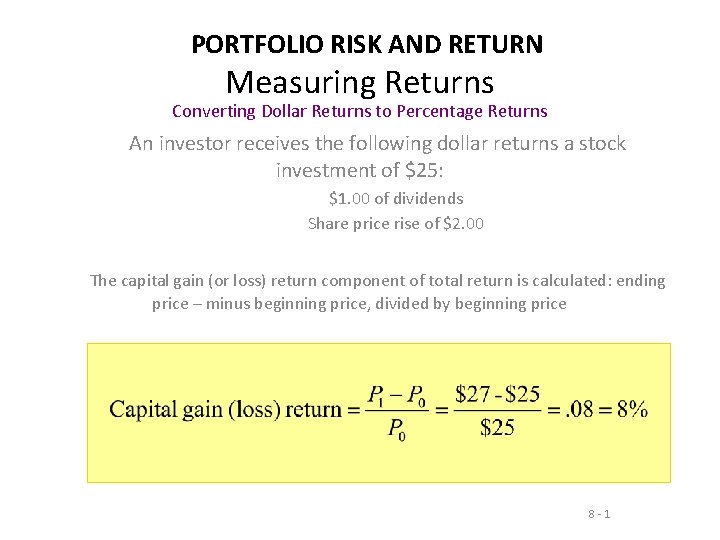

PORTFOLIO RISK AND RETURN Measuring Returns Converting Dollar Returns to Percentage Returns An investor receives the following dollar returns a stock investment of $25: $1. 00 of dividends Share price rise of $2. 00 The capital gain (or loss) return component of total return is calculated: ending price – minus beginning price, divided by beginning price [8 -2] 8 -1

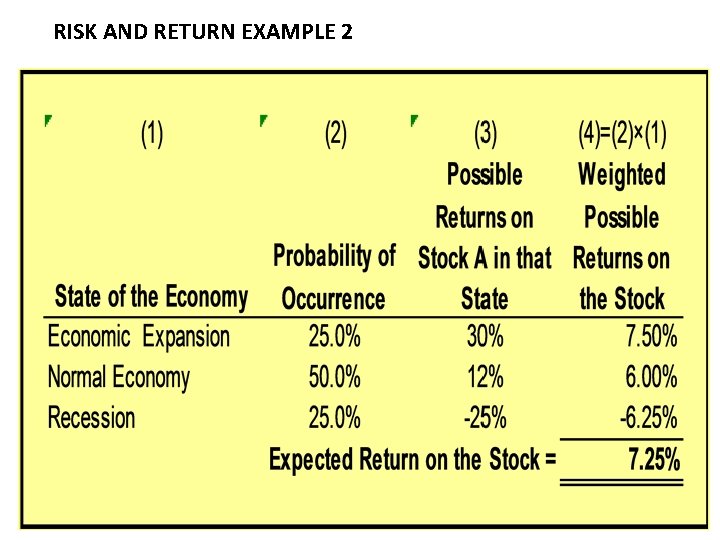

Portfolio’s Risk and Return 2 The future is uncertain. Investors do not know with certainty whether the economy will be growing rapidly or be in recession. Investors do not know what rate of return their investments will yield. Therefore, they base their decisions on their expectations concerning the future. The expected rate of return on a stock represents the mean of a probability distribution of possible future returns on the stock.

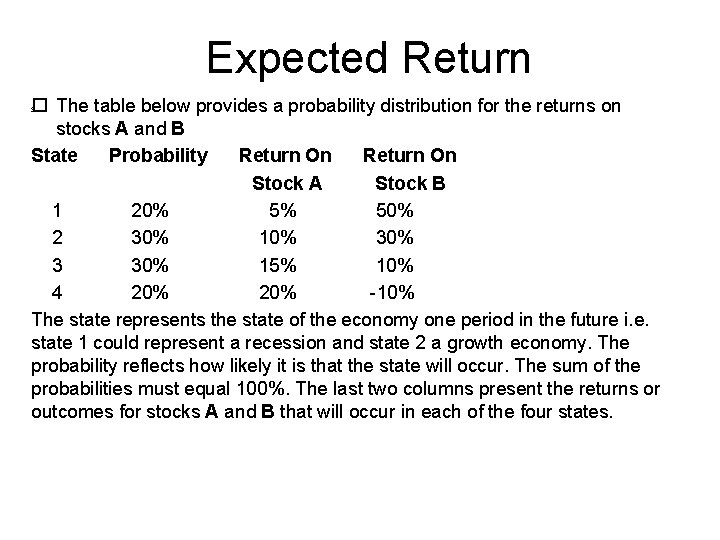

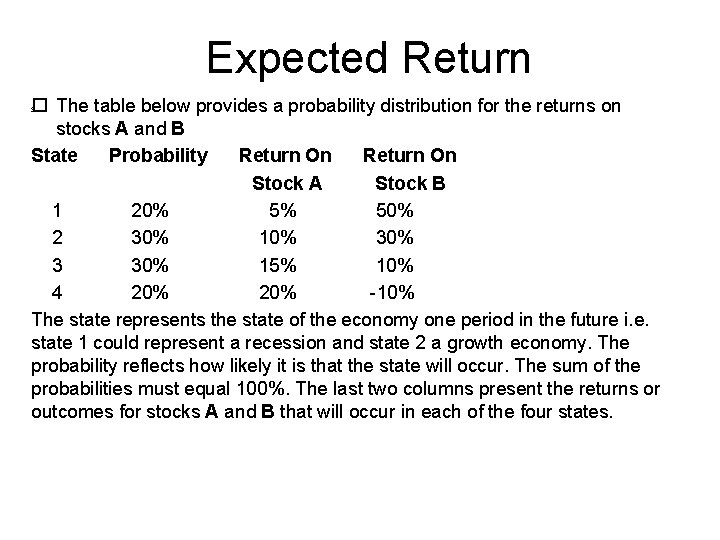

Expected Return The table below provides a probability distribution for the returns on stocks A and B State Probability Return On Stock A Stock B 1 20% 50% 2 30% 10% 30% 3 30% 15% 10% 4 20% -10% The state represents the state of the economy one period in the future i. e. state 1 could represent a recession and state 2 a growth economy. The probability reflects how likely it is that the state will occur. The sum of the probabilities must equal 100%. The last two columns present the returns or outcomes for stocks A and B that will occur in each of the four states. 3

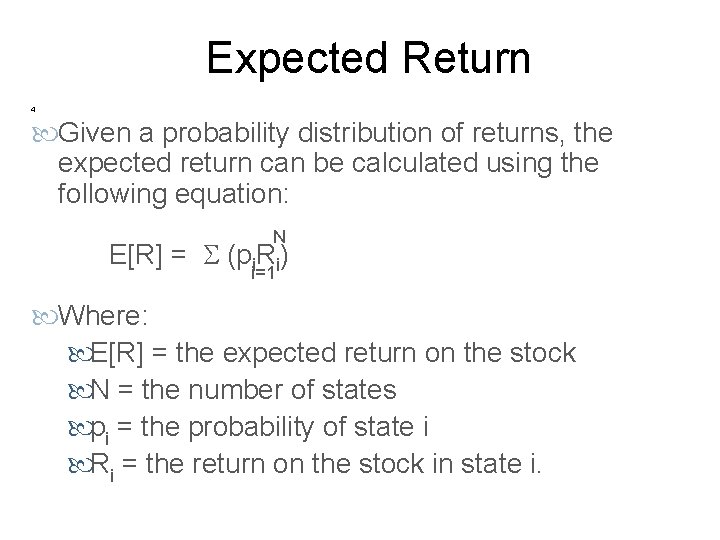

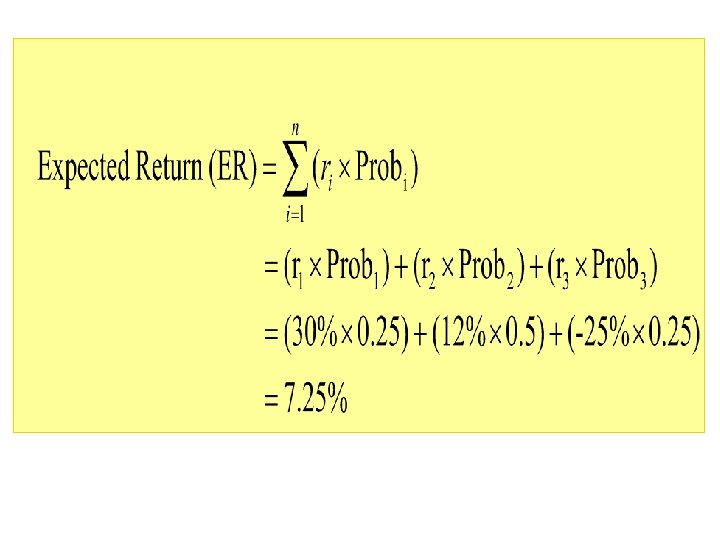

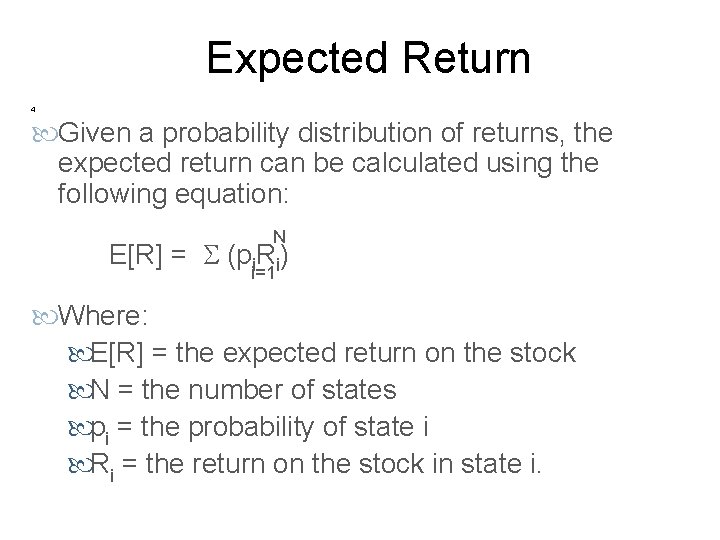

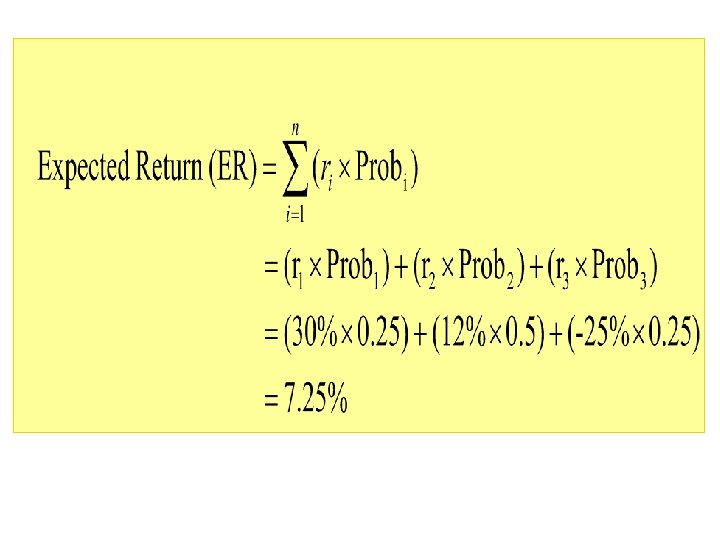

Expected Return 4 Given a probability distribution of returns, the expected return can be calculated using the following equation: N E[R] = S (pi. Ri) i=1 Where: E[R] = the expected return on the stock N = the number of states pi = the probability of state i Ri = the return on the stock in state i.

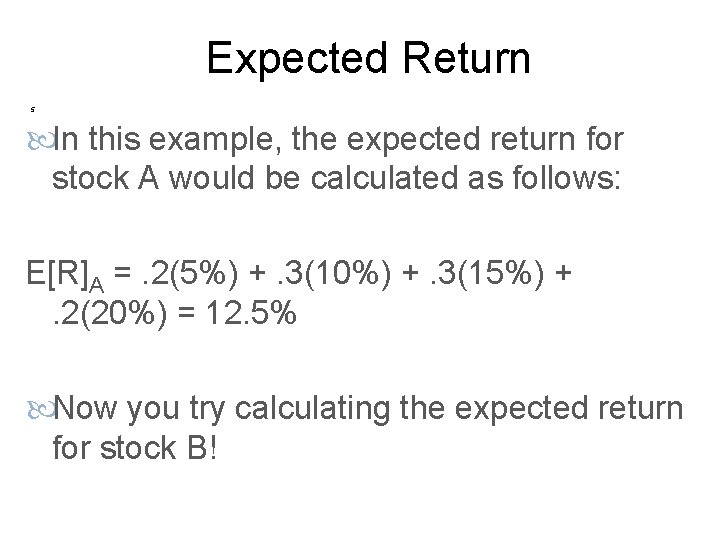

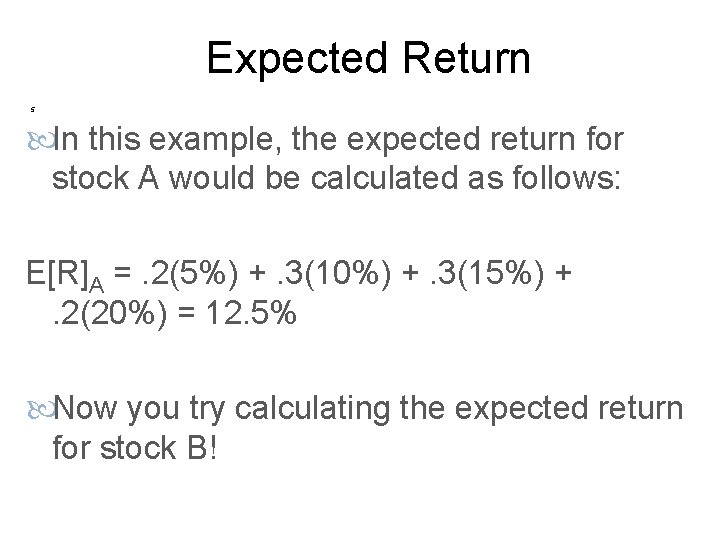

Expected Return 5 In this example, the expected return for stock A would be calculated as follows: E[R]A =. 2(5%) +. 3(10%) +. 3(15%) + . 2(20%) = 12. 5% Now you try calculating the expected return for stock B!

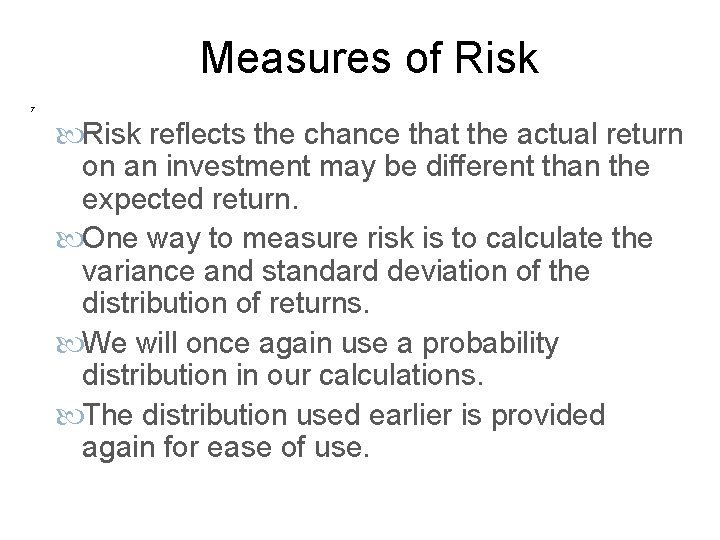

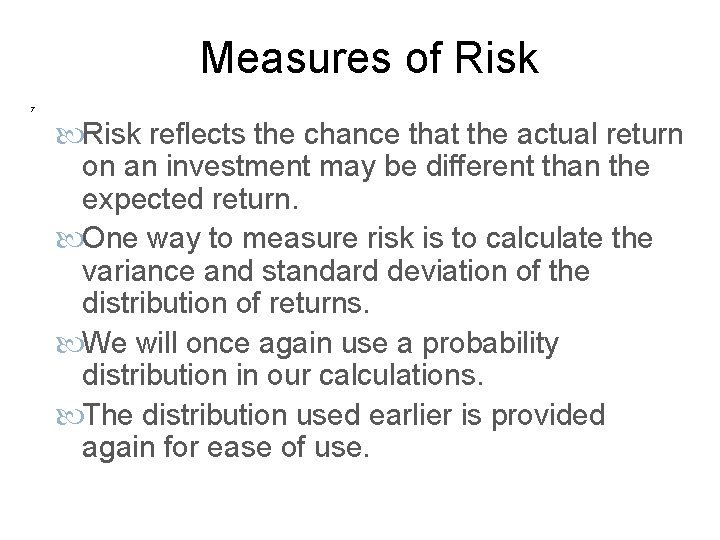

Expected Return 6 Did you get 20%? If so, you are correct. If not, here is how to get the correct answer: E[R]B =. 2(50%) +. 3(30%) +. 3(10%) +. 2(-10%) = 20% So we see that Stock B offers a higher expected return than Stock A. However, that is only part of the story; we haven't considered risk.

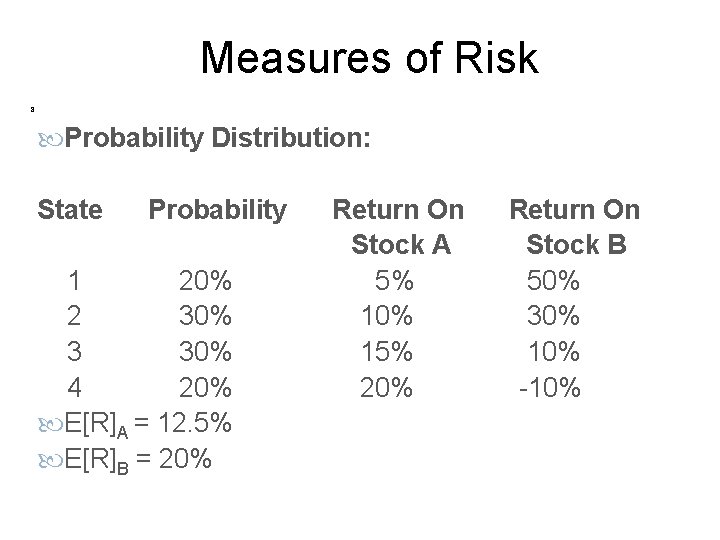

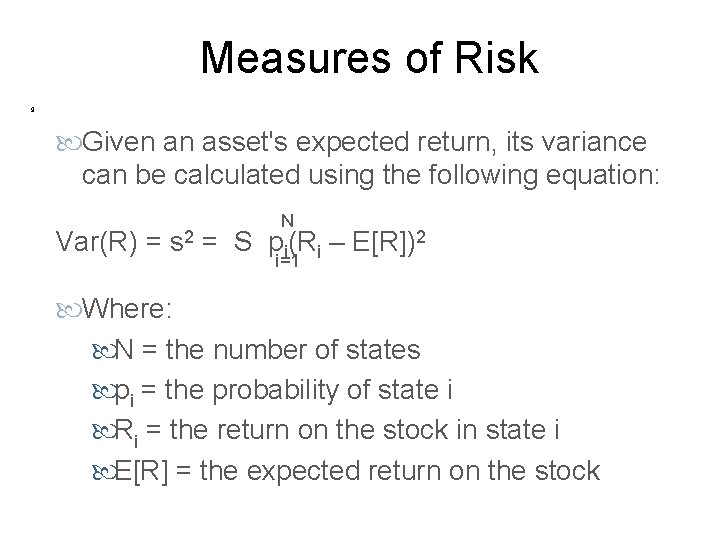

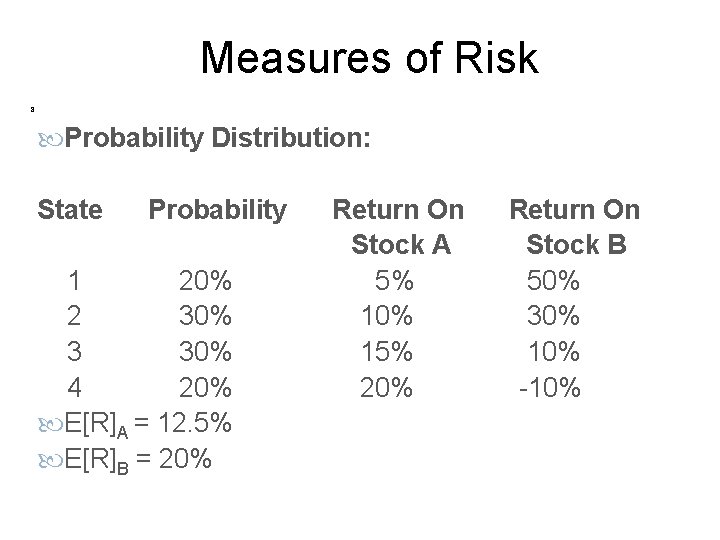

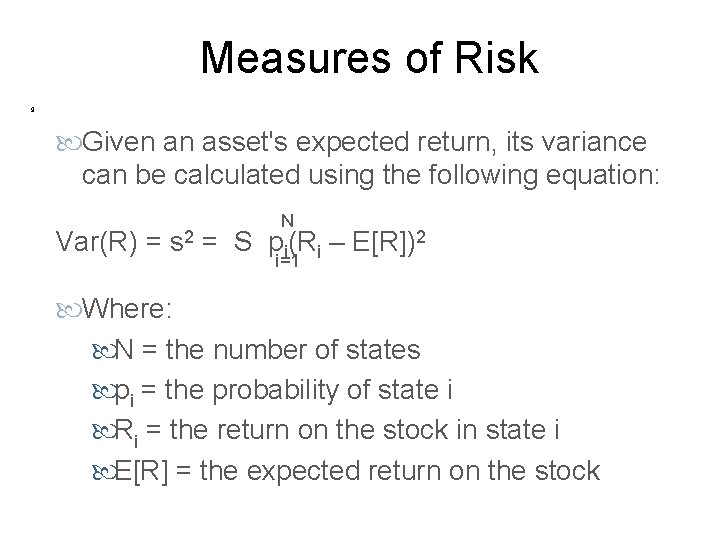

Measures of Risk 7 Risk reflects the chance that the actual return on an investment may be different than the expected return. One way to measure risk is to calculate the variance and standard deviation of the distribution of returns. We will once again use a probability distribution in our calculations. The distribution used earlier is provided again for ease of use.

Measures of Risk 8 Probability Distribution: State Probability Return On Stock A Stock B 1 20% 50% 2 30% 10% 30% 3 30% 15% 10% 4 20% -10% E[R]A = 12. 5% E[R]B = 20%

Measures of Risk 9 Given an asset's expected return, its variance can be calculated using the following equation: N Var(R) = s 2 = S pi(Ri – E[R])2 i=1 Where: N = the number of states pi = the probability of state i Ri = the return on the stock in state i E[R] = the expected return on the stock

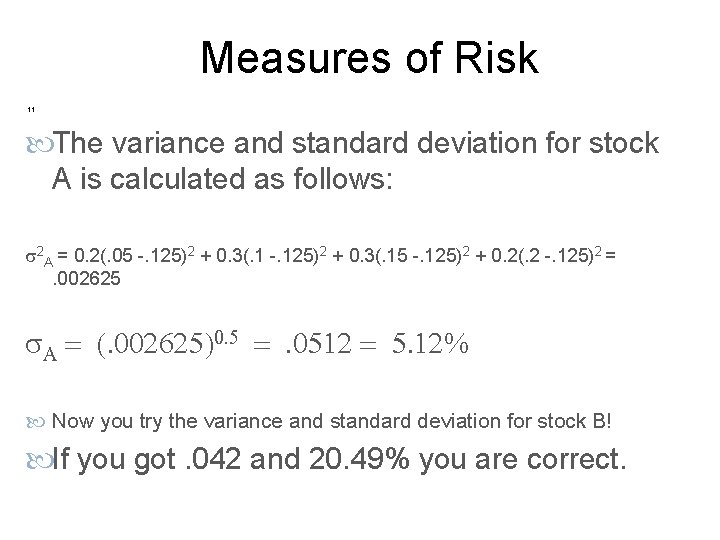

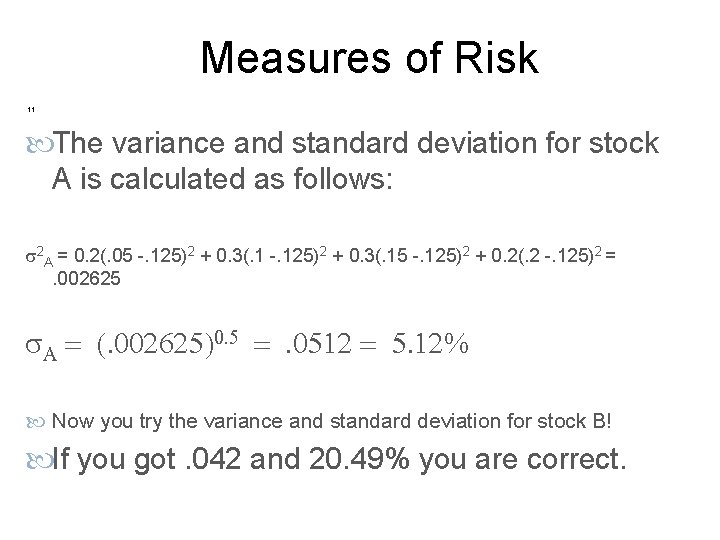

Measures of Risk 10 • The standard deviation is calculated as the positive square root of the variance: SD(R) = s = s 2 = (s 2)1/2 = (s 2)0. 5

Measures of Risk 11 The variance and standard deviation for stock A is calculated as follows: s 2 A = 0. 2(. 05 -. 125)2 + 0. 3(. 15 -. 125)2 + 0. 2(. 2 -. 125)2 = . 002625 s. A = (. 002625)0. 5 =. 0512 = 5. 12% Now you try the variance and standard deviation for stock B! If you got. 042 and 20. 49% you are correct.

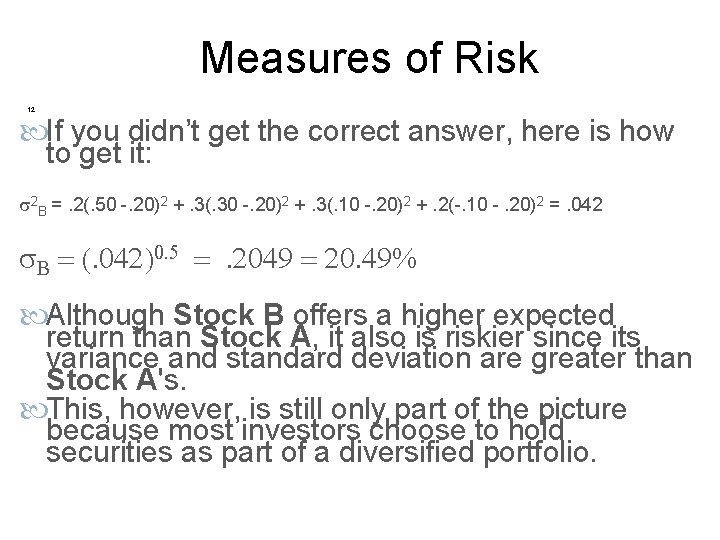

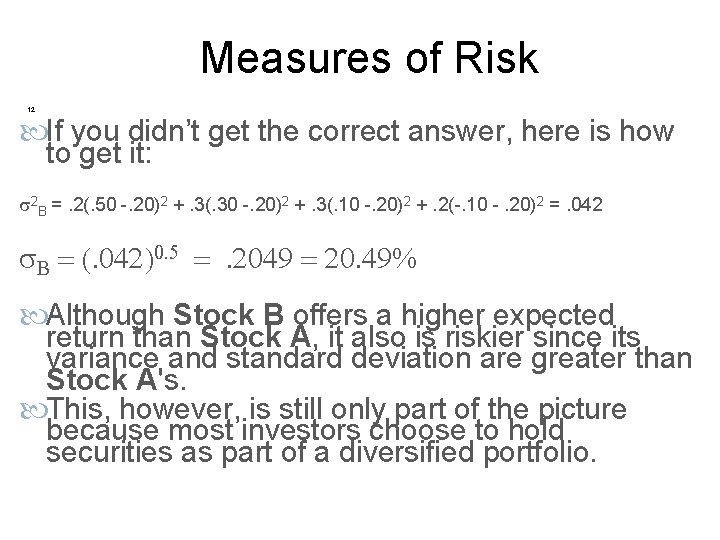

Measures of Risk 12 If you didn’t get the correct answer, here is how to get it: s 2 B =. 2(. 50 -. 20)2 +. 3(. 30 -. 20)2 +. 3(. 10 -. 20)2 +. 2(-. 10 -. 20)2 =. 042 s. B = (. 042)0. 5 =. 2049 = 20. 49% Although Stock B offers a higher expected return than Stock A, it also is riskier since its variance and standard deviation are greater than Stock A's. This, however, is still only part of the picture because most investors choose to hold securities as part of a diversified portfolio.

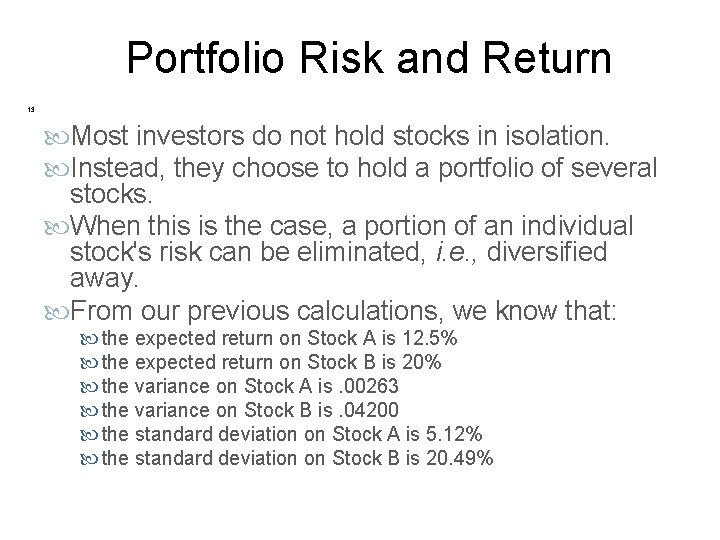

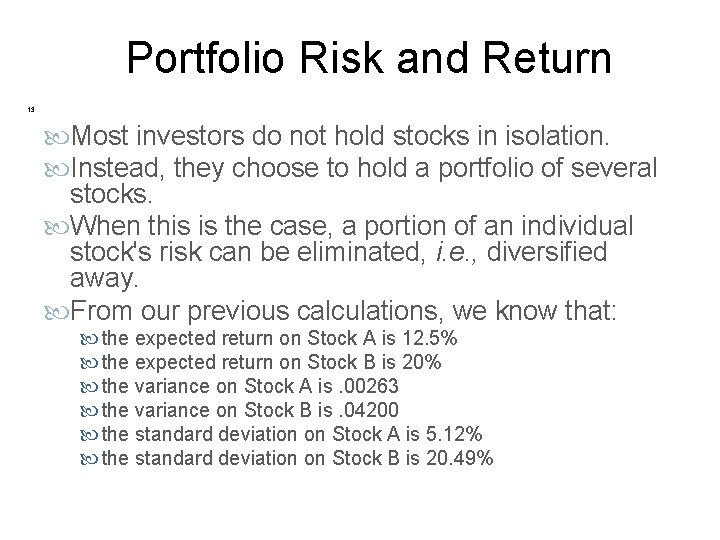

Portfolio Risk and Return 13 Most investors do not hold stocks in isolation. Instead, they choose to hold a portfolio of several stocks. When this is the case, a portion of an individual stock's risk can be eliminated, i. e. , diversified away. From our previous calculations, we know that: the expected return on Stock A is 12. 5% the expected return on Stock B is 20% the variance on Stock A is. 00263 the variance on Stock B is. 04200 the standard deviation on Stock A is 5. 12% the standard deviation on Stock B is 20. 49%

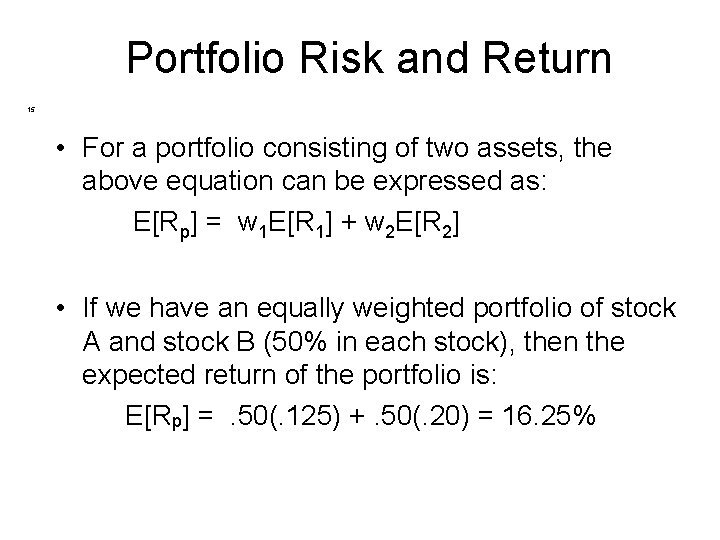

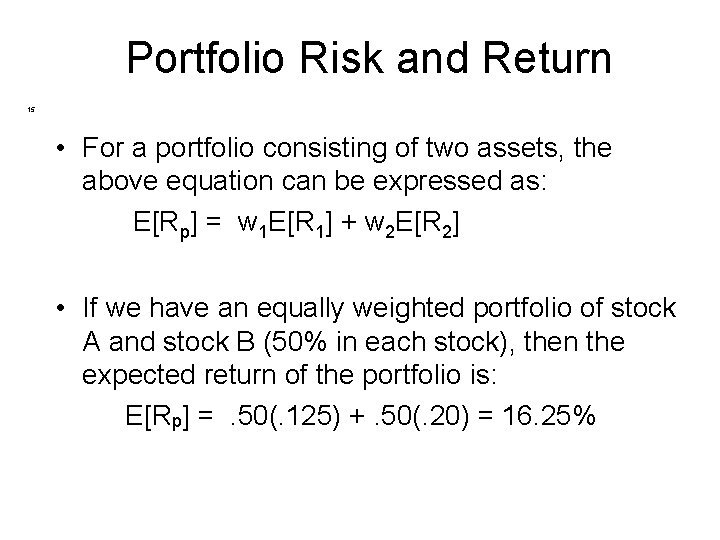

Portfolio Risk and Return 14 The Expected Return on a Portfolio is computed as the weighted average of the expected returns on the stocks which comprise the portfolio. The weights reflect the proportion of the portfolio invested in the stocks. This can be expressed as follows: E[Rp] = S wi. E[Ri] Where: N i=1 � E[Rp] = the expected return on the portfolio � N = the number of stocks in the portfolio � wi = the proportion of the portfolio invested in stock i � E[Ri] = the expected return on stock i

Portfolio Risk and Return 15 • For a portfolio consisting of two assets, the above equation can be expressed as: E[Rp] = w 1 E[R 1] + w 2 E[R 2] • If we have an equally weighted portfolio of stock A and stock B (50% in each stock), then the expected return of the portfolio is: E[Rp] = . 50(. 125) +. 50(. 20) = 16. 25%

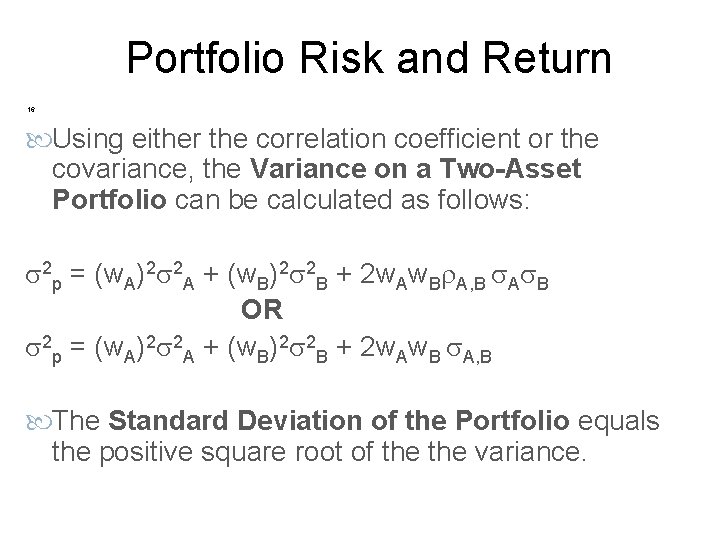

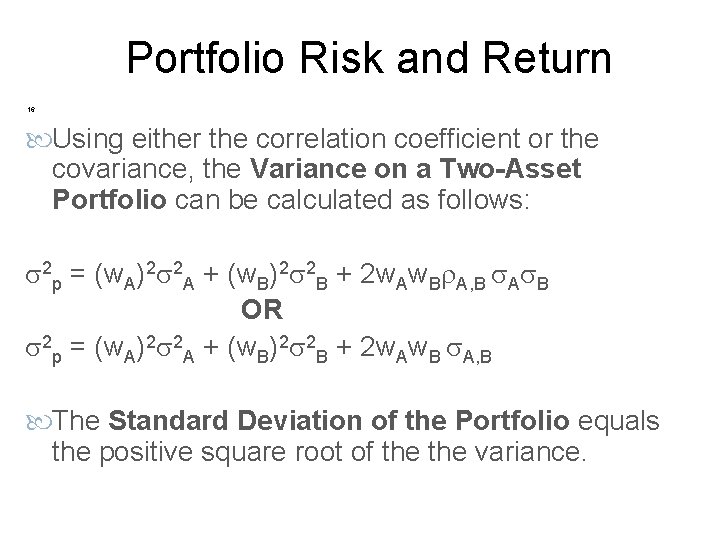

Portfolio Risk and Return 16 Using either the correlation coefficient or the covariance, the Variance on a Two-Asset Portfolio can be calculated as follows: s 2 p = (w. A)2 s 2 A + (w. B)2 s 2 B + 2 w. Aw. Br. A, B s. As. B OR s 2 p = (w. A)2 s 2 A + (w. B)2 s 2 B + 2 w. Aw. B s. A, B The Standard Deviation of the Portfolio equals the positive square root of the variance.

Portfolio Risk and Return 17 The Covariance between the returns on two stocks can be calculated as follows: N Cov(R , R ) = s = S p (R - E[R ]) A B A, B i Ai A Bi B i=1 Where: s. A, B = the covariance between the returns on stocks A and B N = the number of states pi = the probability of state i RAi = the return on stock A in state i E[RA] = the expected return on stock A RBi = the return on stock B in state i E[RB] = the expected return on stock B

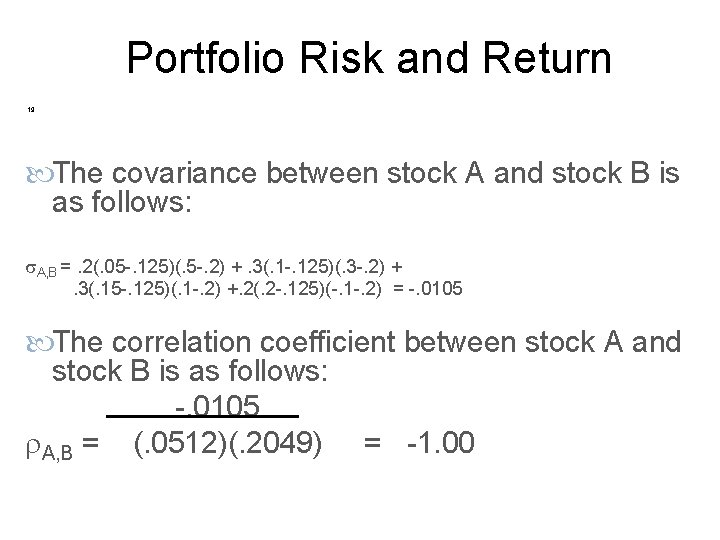

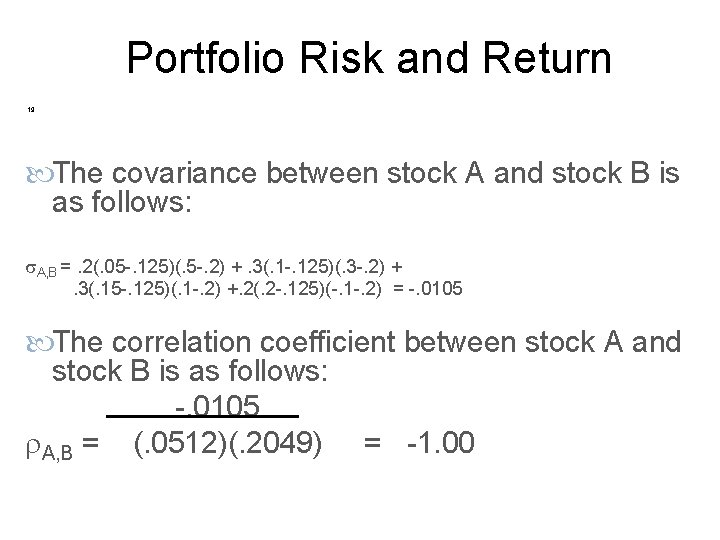

Portfolio Risk and Return 18 The Correlation Coefficient between the returns on two stocks can be calculated as follows: Cov(RA, RB)/s. A, B Corr(RA, RB) = r. A, B = s. As. B = SD(RA)SD(RB) Where: r. A, B=the correlation coefficient between the returns on stocks A and B s. A, B=the covariance between the returns on stocks A and B, s. A=the standard deviation on stock A, and s. B=the standard deviation on stock B

Portfolio Risk and Return 19 The covariance between stock A and stock B is as follows: s. A, B =. 2(. 05 -. 125)(. 5 -. 2) +. 3(. 1 -. 125)(. 3 -. 2) + . 3(. 15 -. 125)(. 1 -. 2) +. 2(. 2 -. 125)(-. 1 -. 2) = -. 0105 The correlation coefficient between stock A and stock B is as follows: -. 0105 r. A, B = (. 0512)(. 2049) = -1. 00

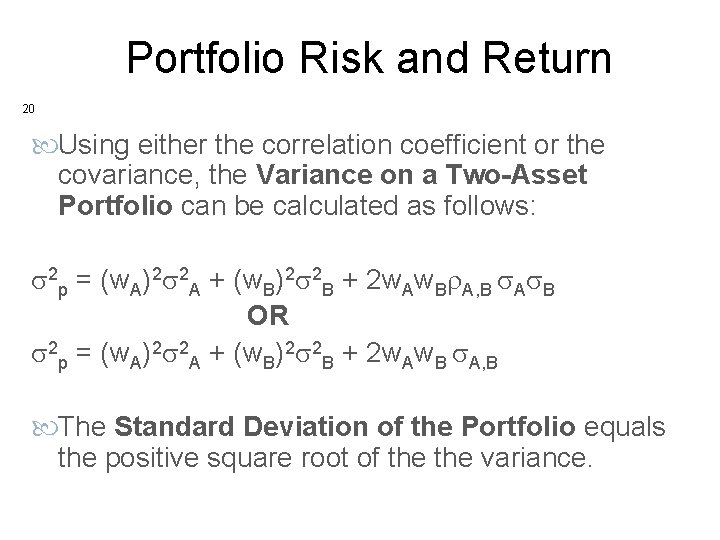

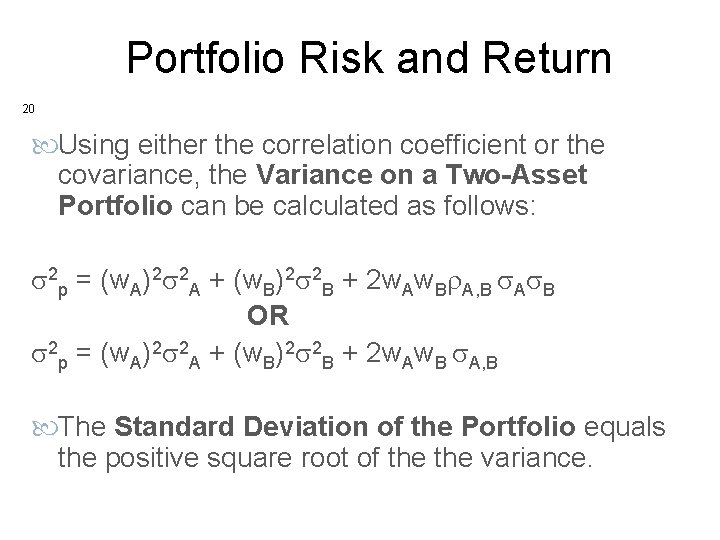

Portfolio Risk and Return 20 Using either the correlation coefficient or the covariance, the Variance on a Two-Asset Portfolio can be calculated as follows: s 2 p = (w. A)2 s 2 A + (w. B)2 s 2 B + 2 w. Aw. Br. A, B s. As. B OR s 2 p = (w. A)2 s 2 A + (w. B)2 s 2 B + 2 w. Aw. B s. A, B The Standard Deviation of the Portfolio equals the positive square root of the variance.

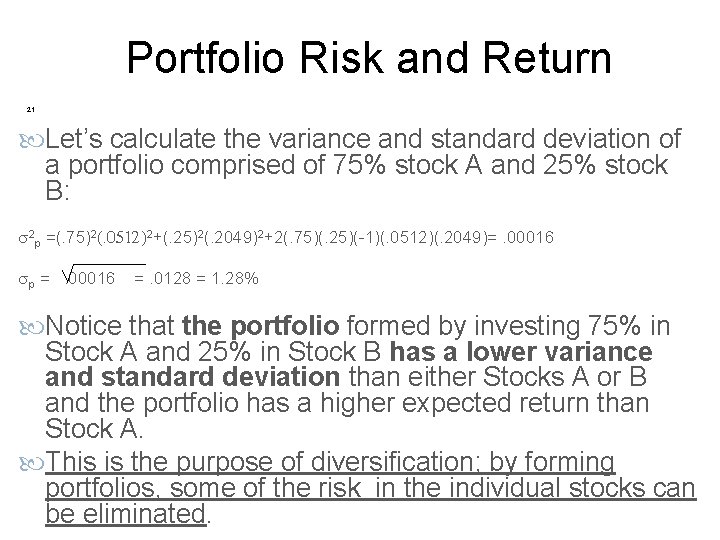

Portfolio Risk and Return 21 Let’s calculate the variance and standard deviation of a portfolio comprised of 75% stock A and 25% stock B: s 2 p =(. 75)2(. 0512)2+(. 25)2(. 2049)2+2(. 75)(. 25)(-1)(. 0512)(. 2049)=. 00016 sp = . 00016 =. 0128 = 1. 28% Notice that the portfolio formed by investing 75% in Stock A and 25% in Stock B has a lower variance and standard deviation than either Stocks A or B and the portfolio has a higher expected return than Stock A. This is the purpose of diversification; by forming portfolios, some of the risk in the individual stocks can be eliminated.

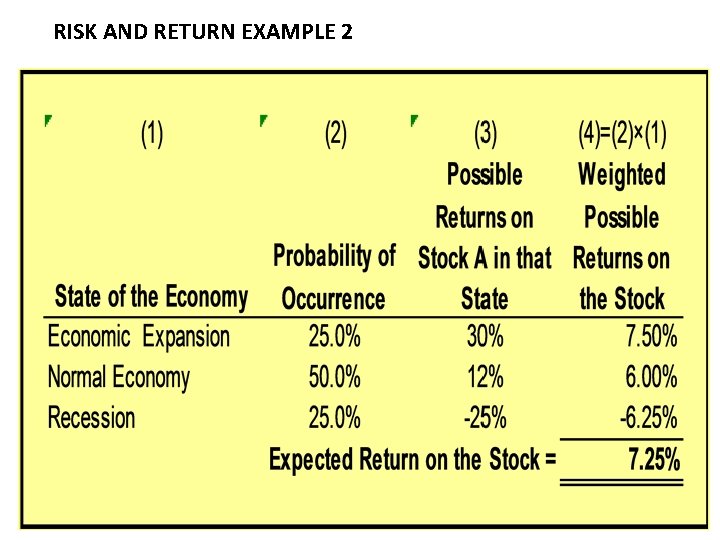

RISK AND RETURN EXAMPLE 2

![Measuring Risk Ex post Standard Deviation 8 7 8 24 Measuring Risk Ex post Standard Deviation [8 -7] 8 - 24](https://slidetodoc.com/presentation_image_h/9bb5d4ff59aa42e84c2307ee16751ae6/image-24.jpg)

Measuring Risk Ex post Standard Deviation [8 -7] 8 - 24

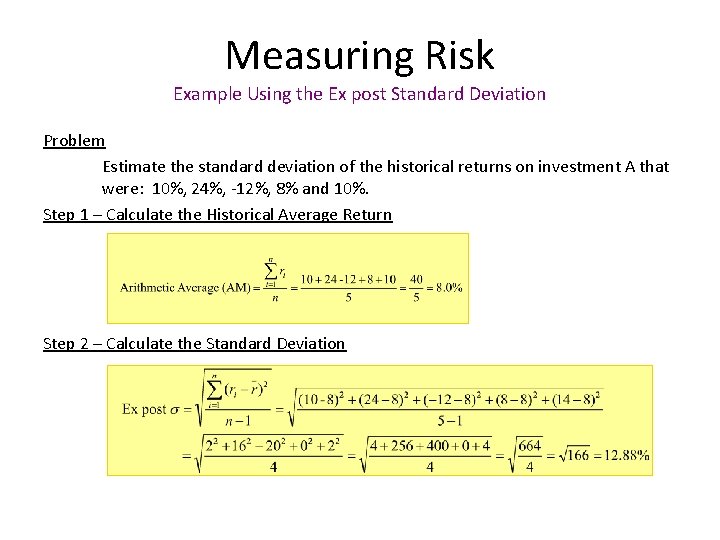

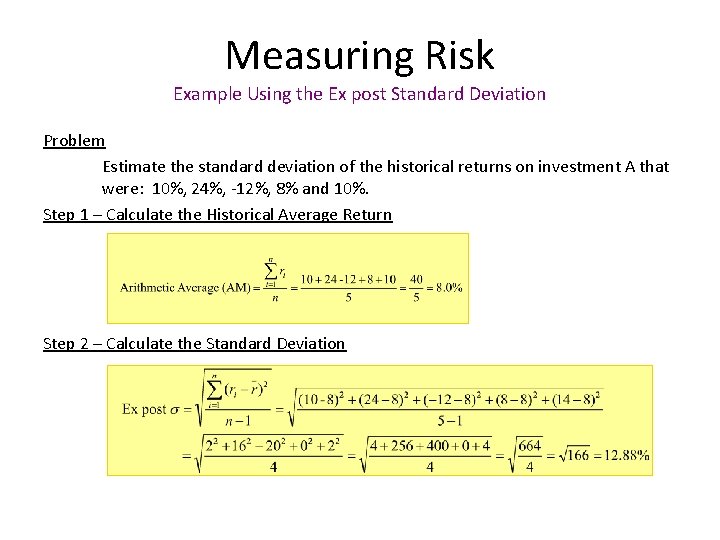

Measuring Risk Example Using the Ex post Standard Deviation Problem Estimate the standard deviation of the historical returns on investment A that were: 10%, 24%, -12%, 8% and 10%. Step 1 – Calculate the Historical Average Return Step 2 – Calculate the Standard Deviation

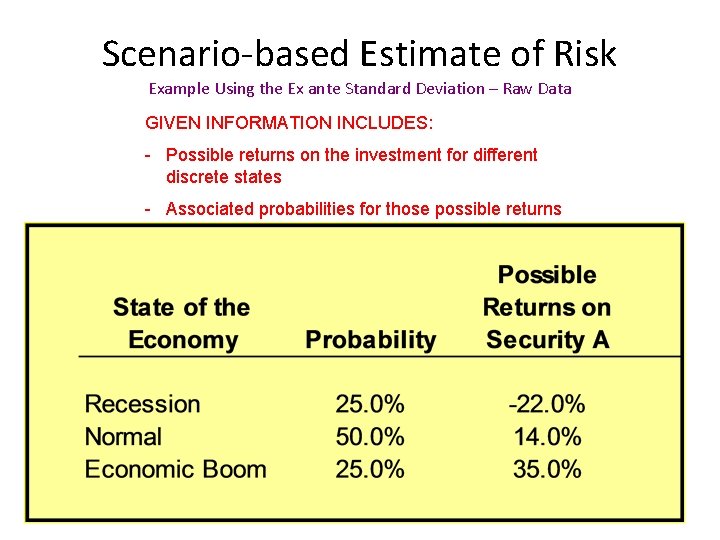

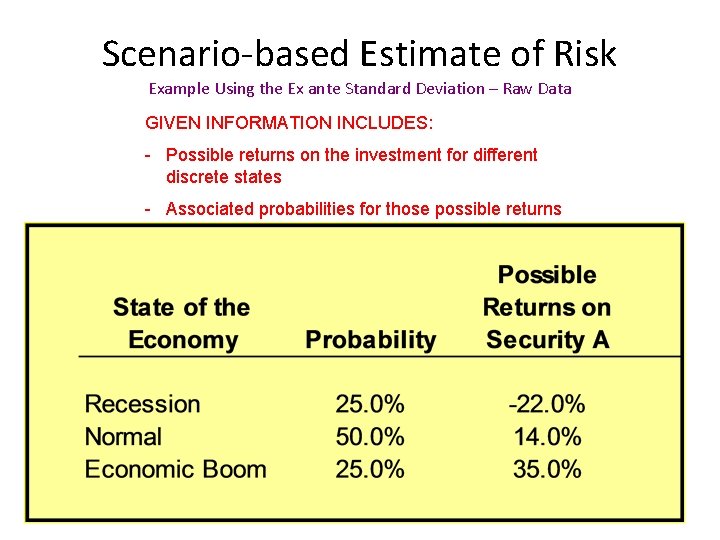

Scenario-based Estimate of Risk Example Using the Ex ante Standard Deviation – Raw Data GIVEN INFORMATION INCLUDES: - Possible returns on the investment for different discrete states - Associated probabilities for those possible returns

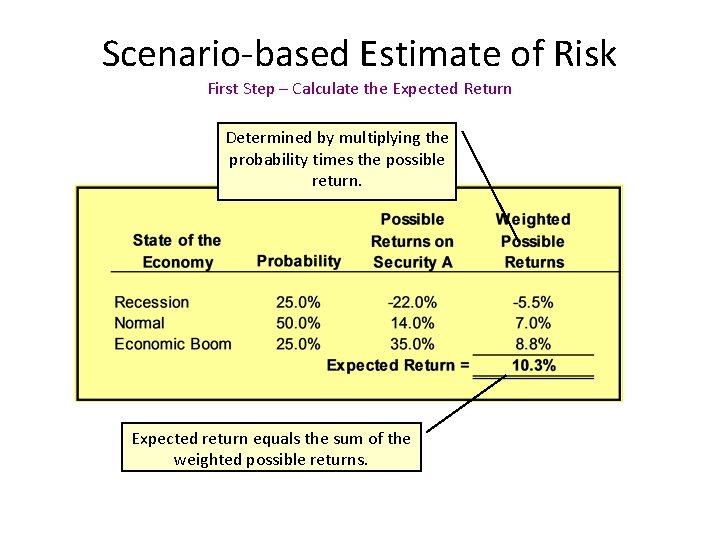

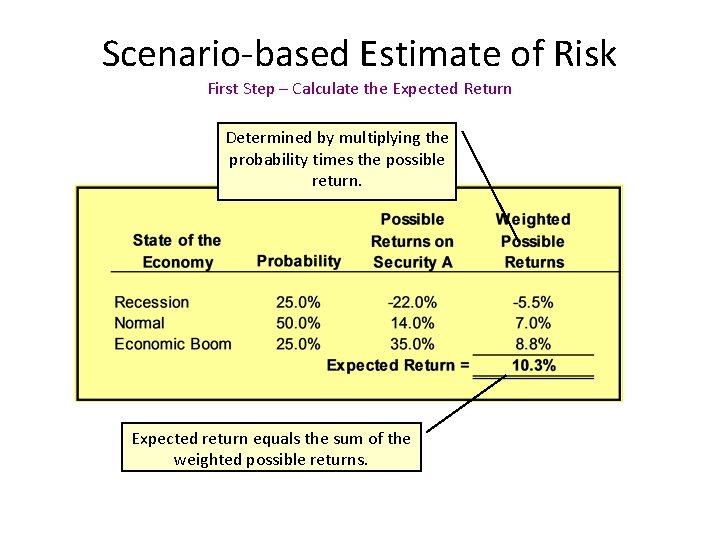

Scenario-based Estimate of Risk First Step – Calculate the Expected Return Determined by multiplying the probability times the possible return. Expected return equals the sum of the weighted possible returns.

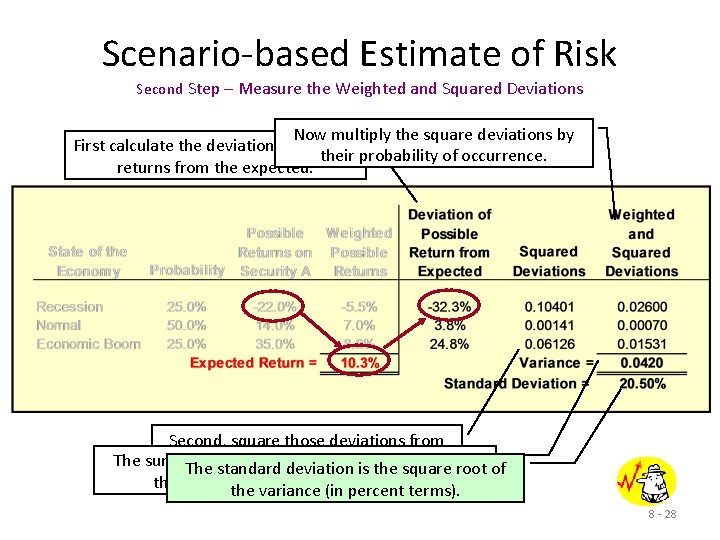

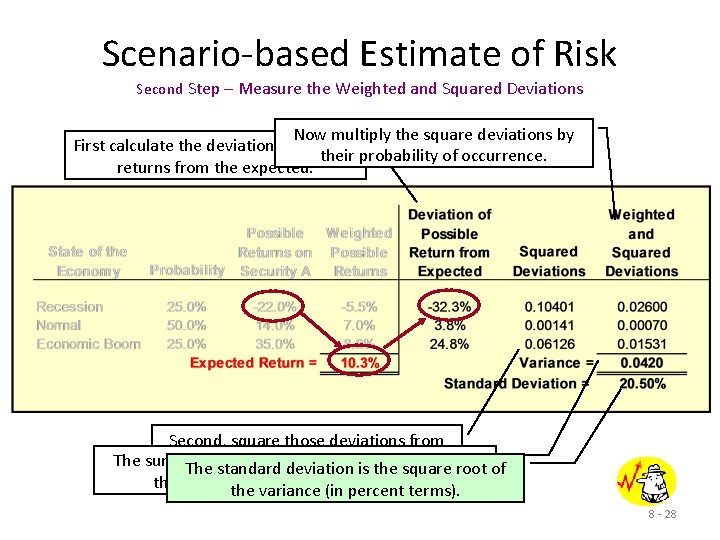

Scenario-based Estimate of Risk Second Step – Measure the Weighted and Squared Deviations Now multiply the square deviations by First calculate the deviation of possible their probability of occurrence. returns from the expected. Second, square those deviations from The sum of thestandard weighted and square deviations is of thedeviation mean. The is the square root the variance percent (in squared terms. theinvariance percent terms). 8 - 28

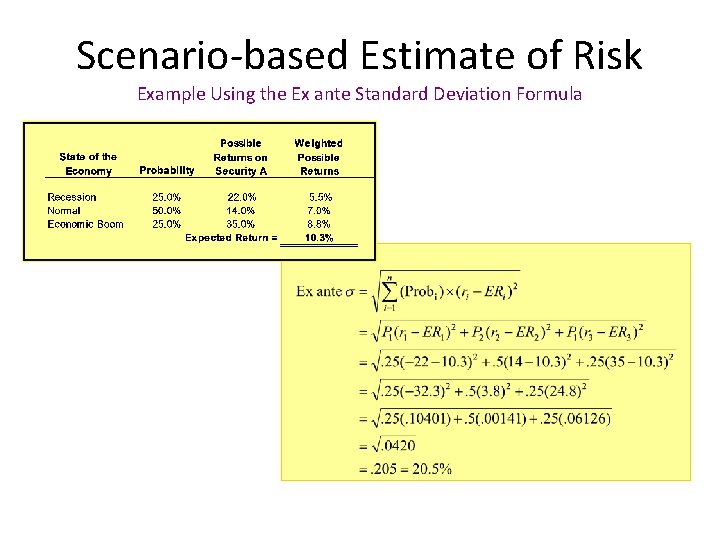

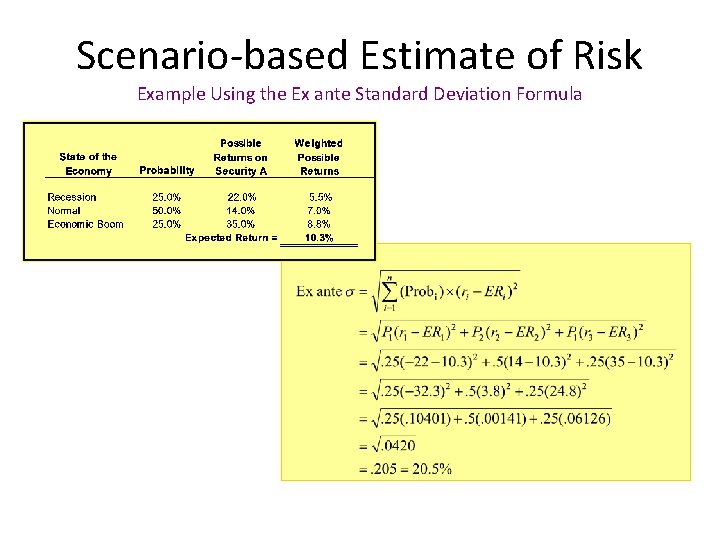

Scenario-based Estimate of Risk Example Using the Ex ante Standard Deviation Formula

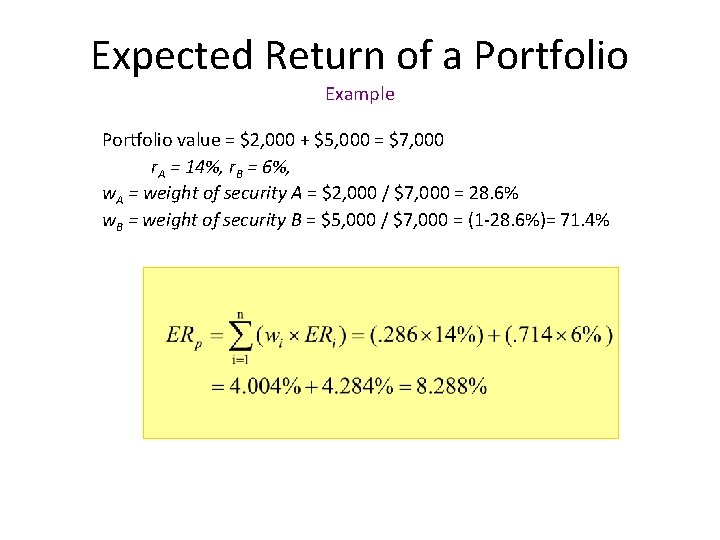

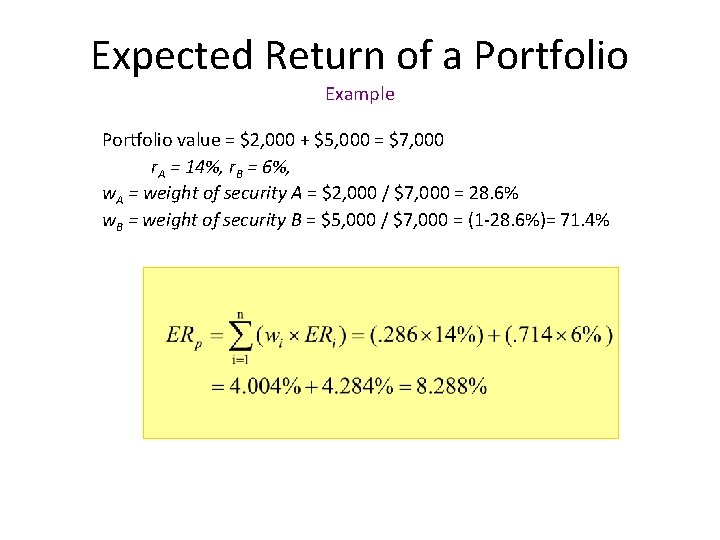

Expected Return of a Portfolio Example Portfolio value = $2, 000 + $5, 000 = $7, 000 r. A = 14%, r. B = 6%, w. A = weight of security A = $2, 000 / $7, 000 = 28. 6% w. B = weight of security B = $5, 000 / $7, 000 = (1 -28. 6%)= 71. 4%

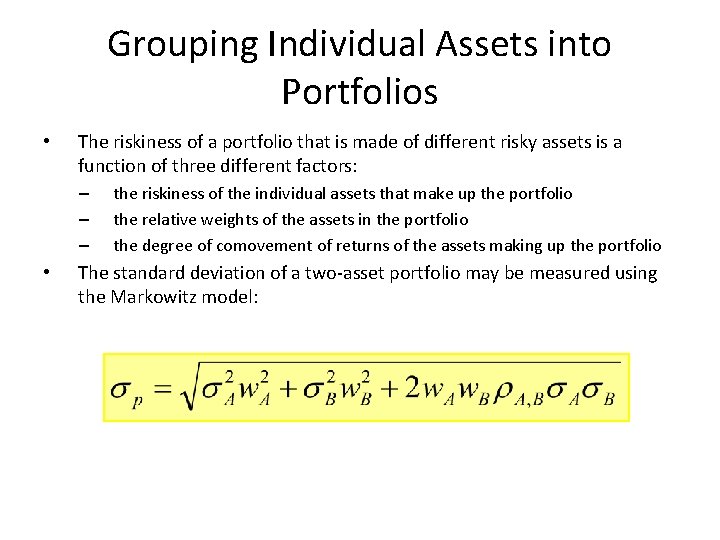

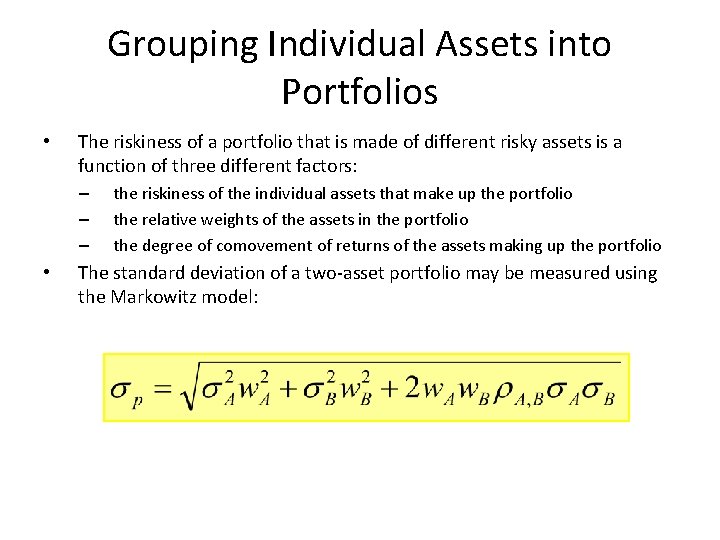

Expected Return and Risk For Portfolios Standard Deviation of a Two-Asset Portfolio using Covariance [8 -11] Risk of Asset A adjusted for weight in the portfolio CHAPTER 8 – Risk, Return and Portfolio Theory Risk of Asset B adjusted for weight in the portfolio 8 - 31 Factor to take into account comovement of returns. This factor can be negative.

Grouping Individual Assets into Portfolios • The riskiness of a portfolio that is made of different risky assets is a function of three different factors: – – – • the riskiness of the individual assets that make up the portfolio the relative weights of the assets in the portfolio the degree of comovement of returns of the assets making up the portfolio The standard deviation of a two-asset portfolio may be measured using the Markowitz model:

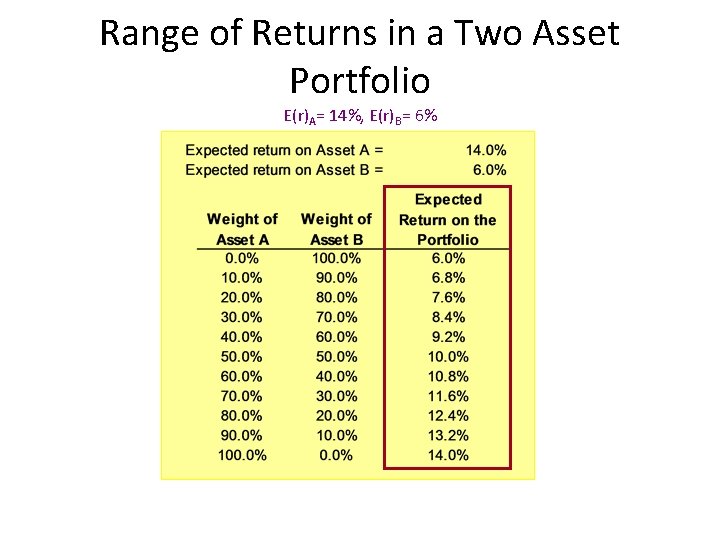

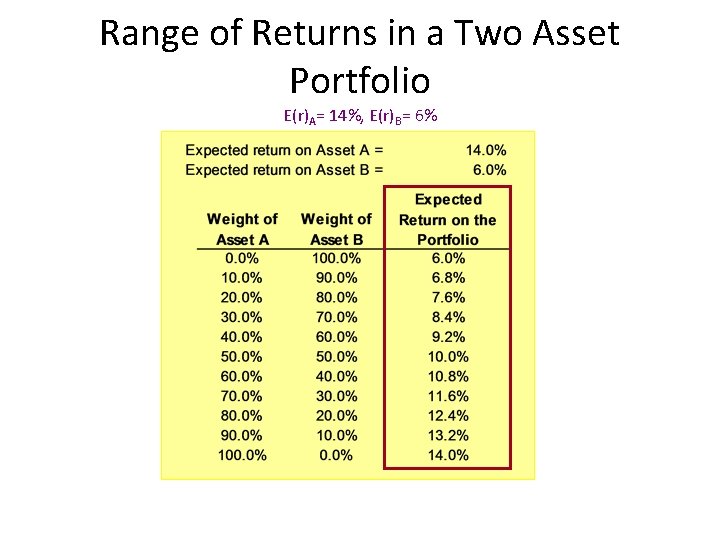

Range of Returns in a Two Asset Portfolio E(r)A= 14%, E(r)B= 6% A graph of this relationship is found on the following slide.

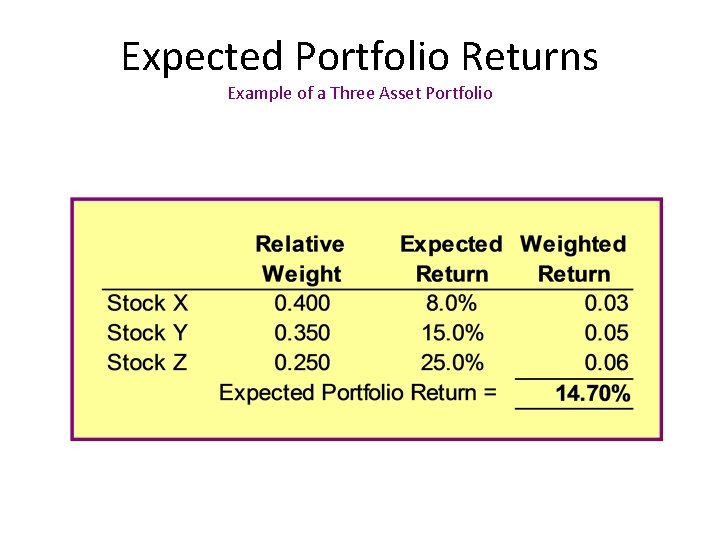

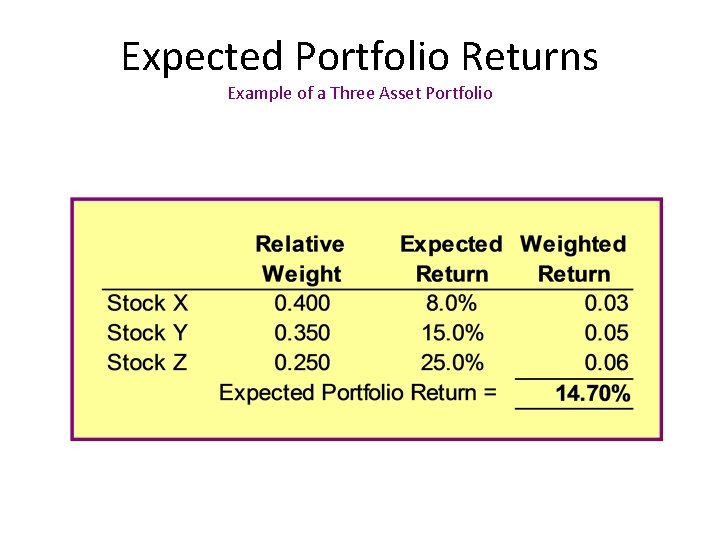

Expected Portfolio Returns Example of a Three Asset Portfolio

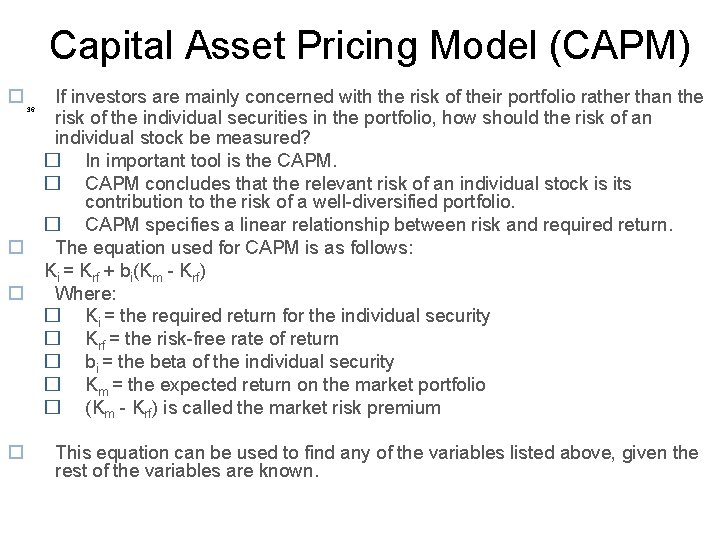

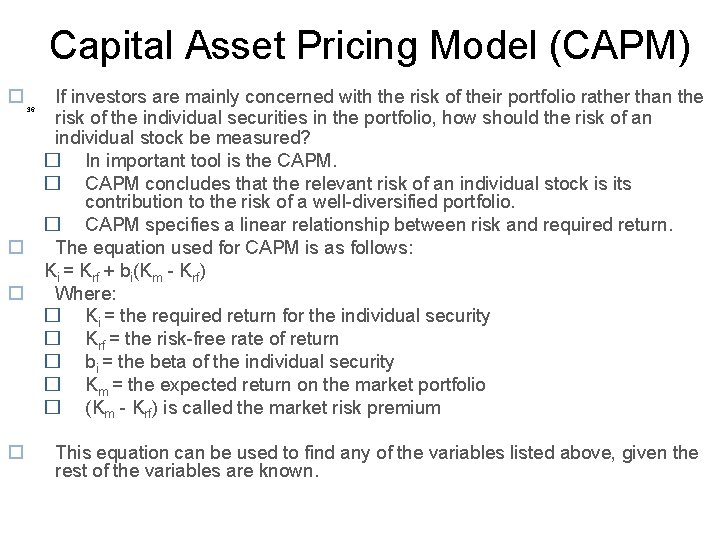

Correlation • The degree to which the returns of two stocks co-move is measured by the correlation coefficient (ρ). • The correlation coefficient (ρ) between the returns on two securities will lie in the range of +1 through - 1. +1 is perfect positive correlation -1 is perfect negative correlation [8 -13]

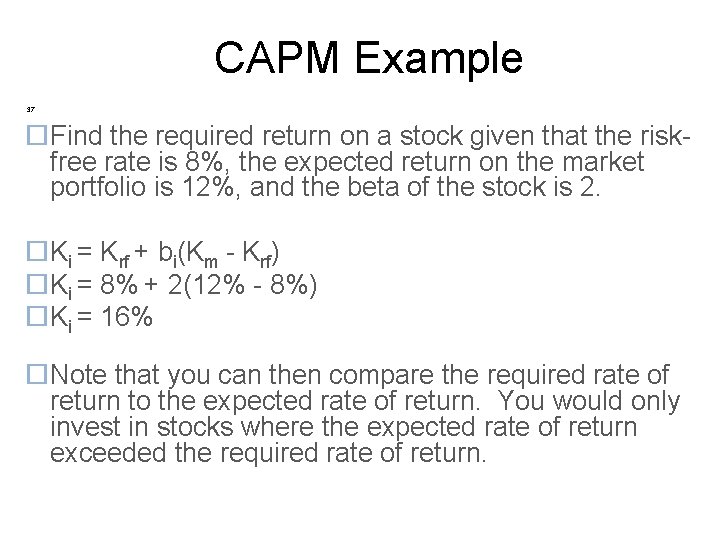

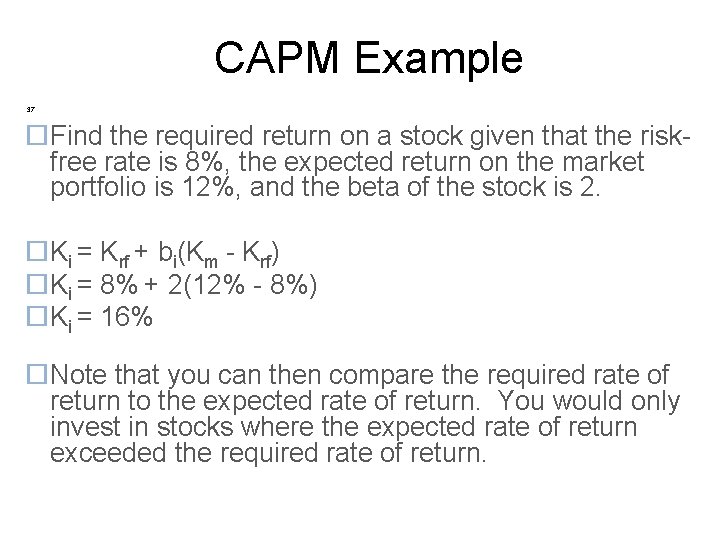

Capital Asset Pricing Model (CAPM) If investors are mainly concerned with the risk of their portfolio rather than the risk of the individual securities in the portfolio, how should the risk of an individual stock be measured? � In important tool is the CAPM. � CAPM concludes that the relevant risk of an individual stock is its contribution to the risk of a well-diversified portfolio. � CAPM specifies a linear relationship between risk and required return. The equation used for CAPM is as follows: Ki = Krf + bi(Km - Krf) Where: � Ki = the required return for the individual security � Krf = the risk-free rate of return � bi = the beta of the individual security � Km = the expected return on the market portfolio � (Km - Krf) is called the market risk premium 36 This equation can be used to find any of the variables listed above, given the rest of the variables are known.

CAPM Example 37 Find the required return on a stock given that the riskfree rate is 8%, the expected return on the market portfolio is 12%, and the beta of the stock is 2. Ki = Krf + bi(Km - Krf) Ki = 8% + 2(12% - 8%) Ki = 16% Note that you can then compare the required rate of return to the expected rate of return. You would only invest in stocks where the expected rate of return exceeded the required rate of return.

Another CAPM Example 38 Find the beta on a stock given that its expected return is 12%, the risk-free rate is 4%, and the expected return on the market portfolio is 10%. 12% = 4% + bi(10% - 4%) bi = 12% - 4% 10% - 4% bi = 1. 33 Note that beta measures the stock’s volatility (or risk) relative to the market.