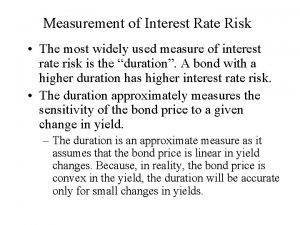

Measurement of Interest Rate Risk The most widely

- Slides: 9

Measurement of Interest Rate Risk • The most widely used measure of interest rate risk is the “duration”. A bond with a higher duration has higher interest rate risk. • The duration approximately measures the sensitivity of the bond price to a given change in yield. – The duration is an approximate measure as it assumes that the bond price is linear in yield changes. Because, in reality, the bond price is convex in the yield, the duration will be accurate only for small changes in yields.

Definition of Duration • We will define the duration as the percentage change in the bond price for a given change in yield. • Let D = Duration, then: • D = (% change in bond price)/ change in yield

Mathematical Derivation of Duration for Zero Coupon Bond (1/2) • We can easily derive the duration from the bond price formula by differentiating it. • Consider a zero coupon bond with face value equal to 100. • Let B = bond price, y = yield to maturity, and T=maturity of bond. • Then, assuming semi-annual compounding, we get the bond price as: B = 100/(1 + y/2)2 T

Mathematical Derivation of Duration for Zero Coupon Bond (2/2) • Differentiating the bond price with respect to y, we get: • d. B/dy = (-T) B/(1 + y/2) • Therefore, from the definition of D, • D = (d. B/B)/dy = -T/(1+y/2) • We normally express the duration as a positive number, and the negative sensitivity of the bond to the change in yield is assumed. • Notes: This measure of duration is also called the “modified duration” to differentiate it from the “Macaulay duration”. The Macaulay duration for the zero coupon bond is simply equal to (T).

Duration and the Maturity of the Bond • Thus, the duration of the zero coupon bond (except for the adjustment in the denominator of (1+y/2)) is almost exactly equal to the maturity of the bond. – In other words, a bond of maturity 10 years will be twice as risky as a bond of maturity 5 years, all else equal. – The above statement will be approximately true even if bonds have different yields and coupons (although this may not be true if bonds have embedded options).

Duration for Coupon Bonds • We can extend the analysis to coupon bonds by considering each cash flow of the bond as a separate zero coupon bond. • Thus, viewing a coupon bond as a portfolio of zero coupon bonds, the duration will be the weighted average of the individual durations of each of the cash flows. – The weights will be equal to [PV(cash flow)/Total Value of Bond] • The spreadsheet provides a detailed example of the computations involved.

Example of Use of Duration • We can now use the duration to estimate the impact of a change in yield on the bond price. • Consider a bond of maturity of exactly 2 years, coupon and yield equal to 5%. The price of this bond is 100. • What would be the new bond price if the yield increases by 6%? • This bond has a (modified) duration of 1. 869. Thus: the % change in bond price is equal to D x increase in yield = -1. 869 x 1% = -1. 869%. • If the yield increases from 5% to 6%, we expect the bond price to decline by 1. 869% to 98. 13. – The exact bond price for a yield of 6% is 98. 14, so the duration gave us a reasonable answer.

Convexity (1/2) • As noted earlier, the duration is an approximate measure of the actual % change bond change for a given change in yield. • To get a more accurate measure of the price change, we can use the second risk measure called the “convexity” of the bond. • The convexity measure the curvature of the bond, and when used along with the duration, allows for a more accurate measurement of bond interest rate risk. This is done as follows (denote convexity = C): • % change in bond price = -D x (increase in yield) + 0. 5 x C x (increase in yield)^2.

Convexity (2/2) • Using the spreadsheet, the bond used in our earlier example has a convexity of 2. 2656. • Thus, the impact of the convexity on the bond price is equal to 0. 5 x 2. 2545 x (change in yield)^2. • For an increase in yield of 1%, this works out to 0. 011%. • Thus (combining both the duration and convexity), for an increase in yield of 1%, we expect the % price change to be = -1% x (D=1. 869%) + 0. 5 x 2. 2545 x (1%)^2 = -1. 869% + 0. 011% = -1. 858%. • Thus, if interest rates increase from 5% to 6%, we expect the bond price to decrease to 98. 14.

Nominal v. real interest rates

Nominal v. real interest rates How is interest rate risk measured

How is interest rate risk measured The biomedical treatment most widely used today is

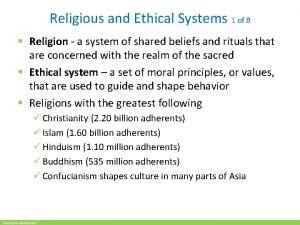

The biomedical treatment most widely used today is Most widely practiced religion

Most widely practiced religion Culture and the workplace

Culture and the workplace Types of self secured joints

Types of self secured joints The most widely used agile process, originally proposed by

The most widely used agile process, originally proposed by Simple distillation theory

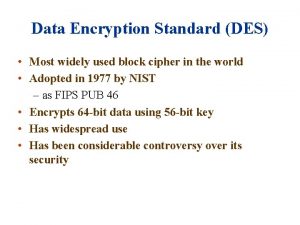

Simple distillation theory The most widely used encryption standard is

The most widely used encryption standard is Cap rate interest rate relationship

Cap rate interest rate relationship