Risk and Return Portfolio Theory and Assets Pricing

- Slides: 43

Risk and Return: Portfolio Theory and Assets Pricing Models

Chapter Objectives • Discuss the concepts of portfolio risk and return. • Determine the relationship between risk and return of portfolios. • Highlight the difference between systematic and unsystematic risks. • Examine the logic of portfolio theory. • Show the use of capital asset pricing model (CAPM) in the valuation of securities.

Introduction • A portfolio is a bundle or a combination of individual assets or securities. • The portfolio theory provides a normative approach to investors to make decisions to invest their wealth in assets or securities under risk. – It is based on the assumption that investors are risk-averse. – An investor may want to maximize the returns from his investments for a given level of risk. – The third assumption of the portfolio theory is that the returns of assets are normally distributed.

Markowitz Portfolio Theory • The basic portfolio model was developed by Harry Markowitz, who derived the expected rate of return for a portfolio of assets and an expected risk measure. The Markowitz model is based on several assumptions regarding investor behavior: 1. Investors consider each investment alternative as being represented by a probability distribution of expected returns over some holding period. 2. Investors maximize one-period expected utility, and their utility curves demonstrate diminishing marginal utility of wealth

Markowitz Portfolio Theory Investors estimate the risk of the portfolio on the basis of the variability of expected returns. 4. Investors base decisions solely on expected return and risk, so their utility curves are a function of expected return and the expected variance (or standard deviation) of returns only. 5. For a given risk level, investors prefer higher returns to lower returns. Similarly, for a given level of expected return, investors prefer less risk to more risk

Markowitz Portfolio Theory • Under these assumptions, a single asset or portfolio of assets is considered to be efficient if no other asset or portfolio of assets offers higher expected return with the same (or lower) risk, or lower risk with the same (or higher) expected return

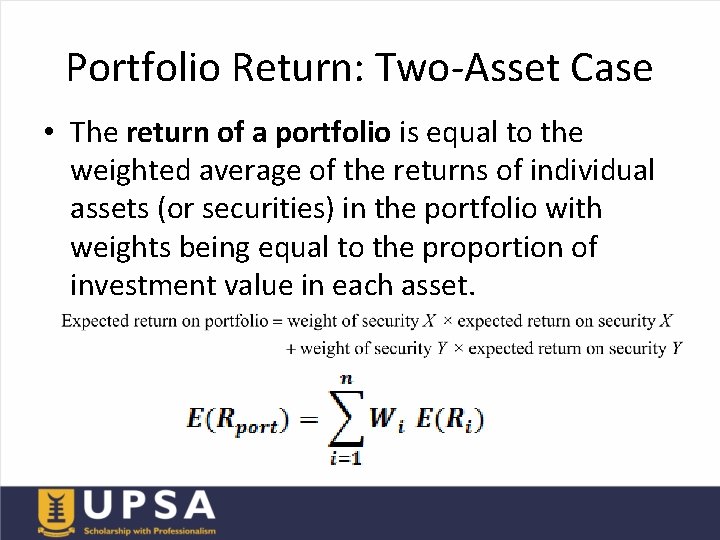

Portfolio Return: Two-Asset Case • The return of a portfolio is equal to the weighted average of the returns of individual assets (or securities) in the portfolio with weights being equal to the proportion of investment value in each asset.

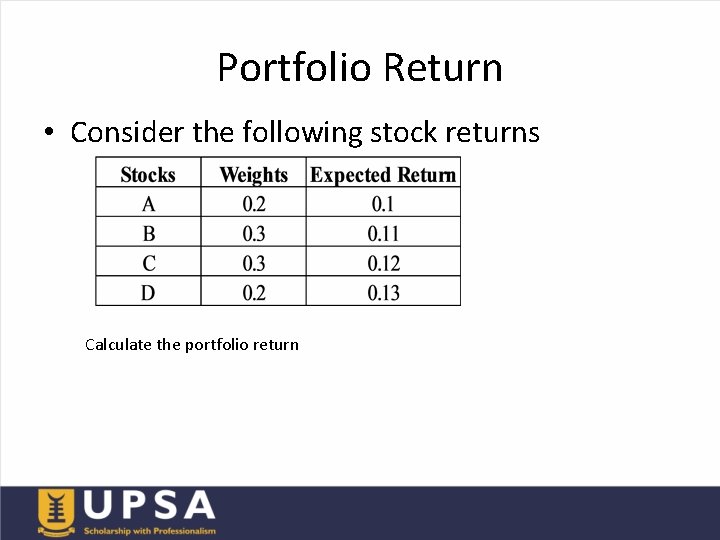

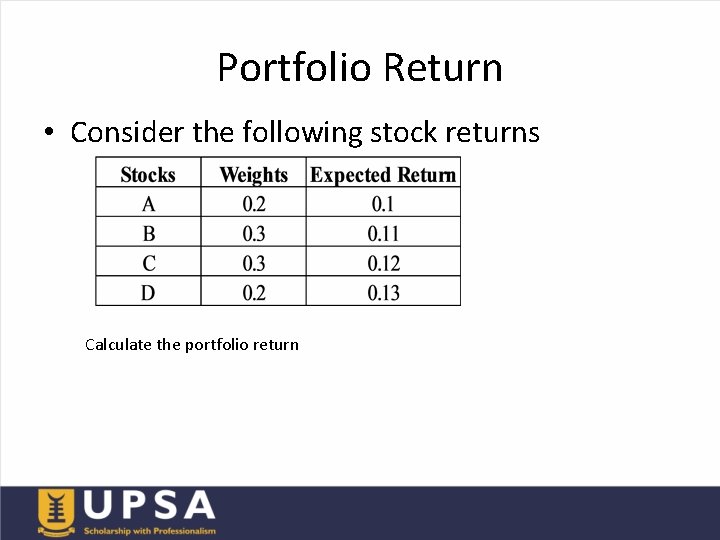

Portfolio Return • Consider the following stock returns Calculate the portfolio return

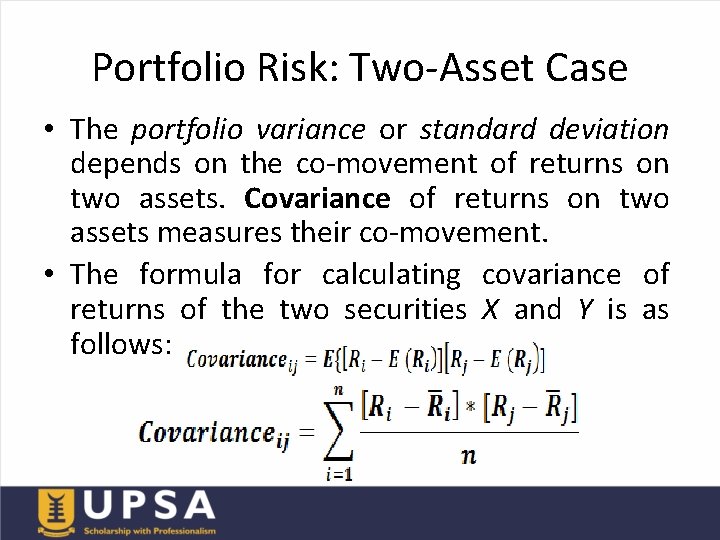

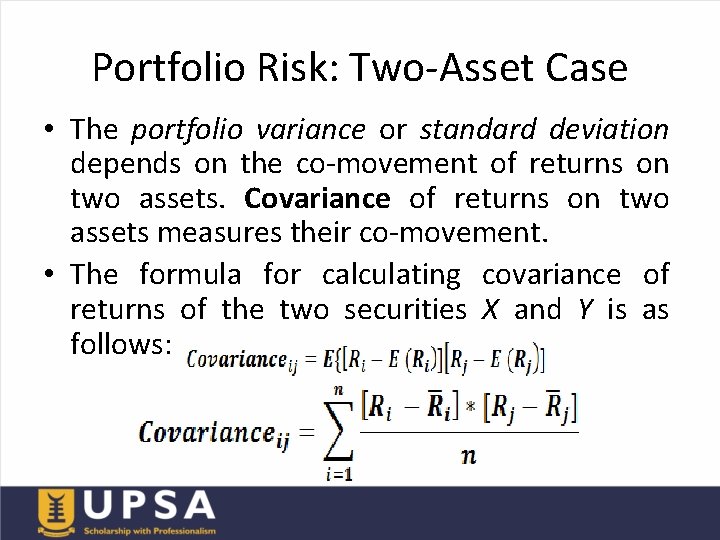

Portfolio Risk: Two-Asset Case • The portfolio variance or standard deviation depends on the co-movement of returns on two assets. Covariance of returns on two assets measures their co-movement. • The formula for calculating covariance of returns of the two securities X and Y is as follows:

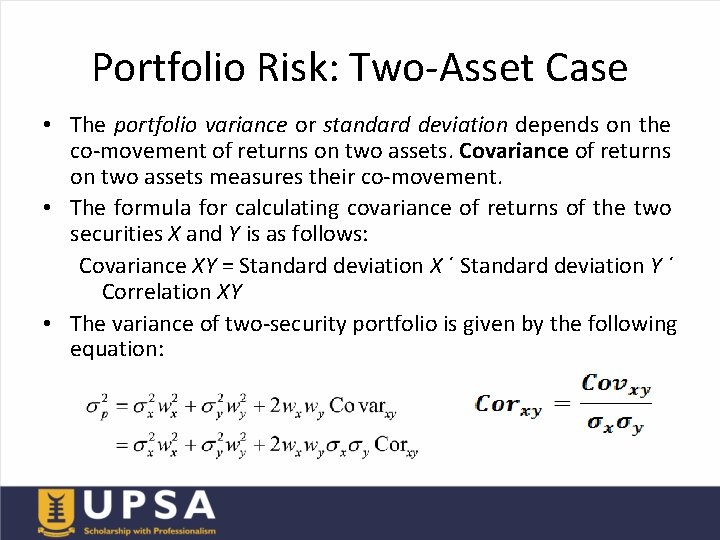

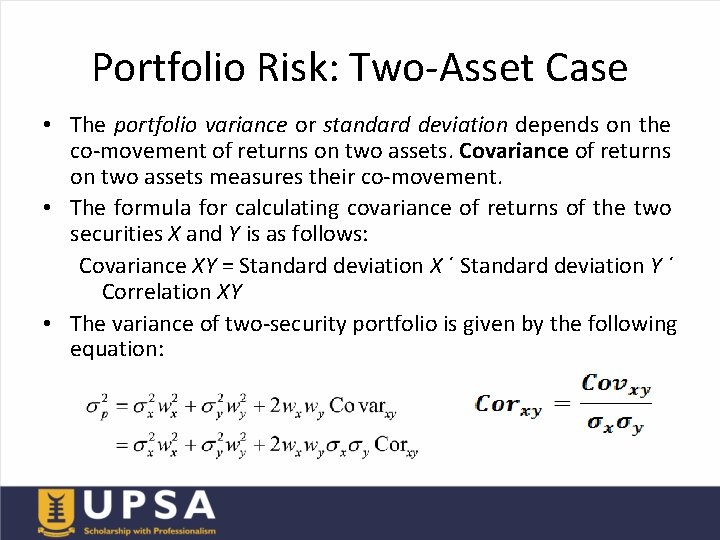

Portfolio Risk: Two-Asset Case • The portfolio variance or standard deviation depends on the co-movement of returns on two assets. Covariance of returns on two assets measures their co-movement. • The formula for calculating covariance of returns of the two securities X and Y is as follows: Covariance XY = Standard deviation X ´ Standard deviation Y ´ Correlation XY • The variance of two-security portfolio is given by the following equation:

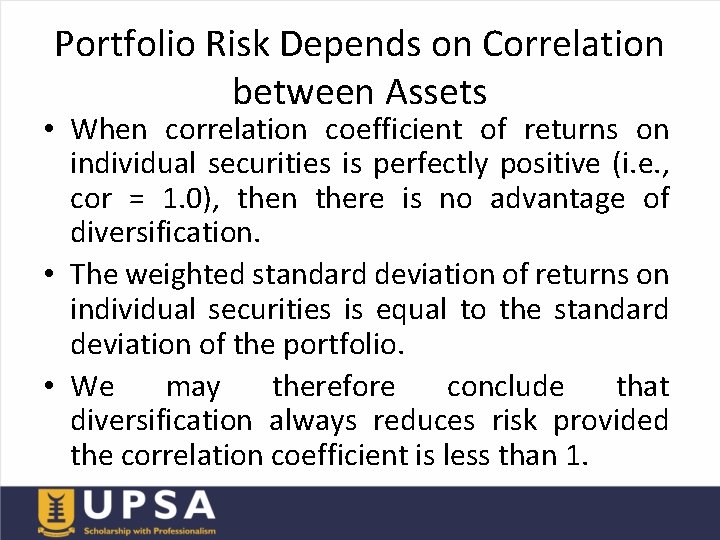

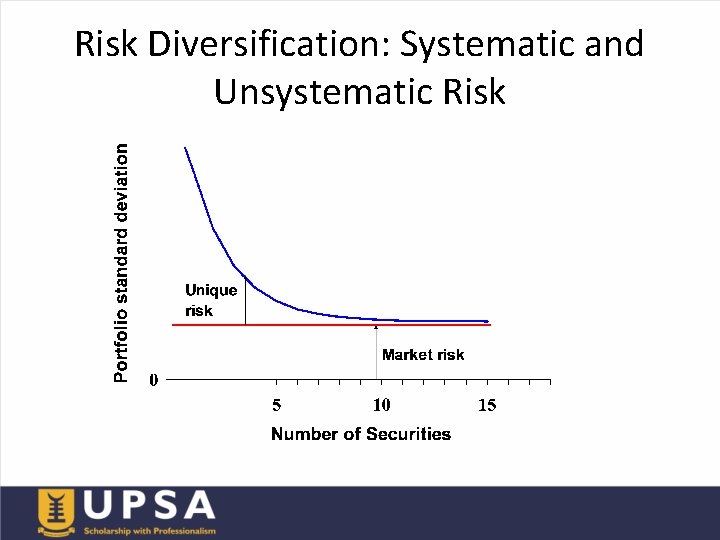

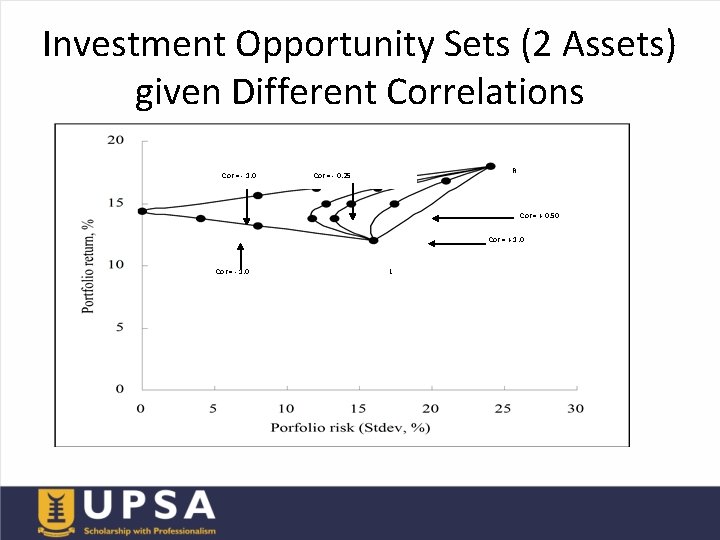

Portfolio Risk Depends on Correlation between Assets • When correlation coefficient of returns on individual securities is perfectly positive (i. e. , cor = 1. 0), then there is no advantage of diversification. • The weighted standard deviation of returns on individual securities is equal to the standard deviation of the portfolio. • We may therefore conclude that diversification always reduces risk provided the correlation coefficient is less than 1.

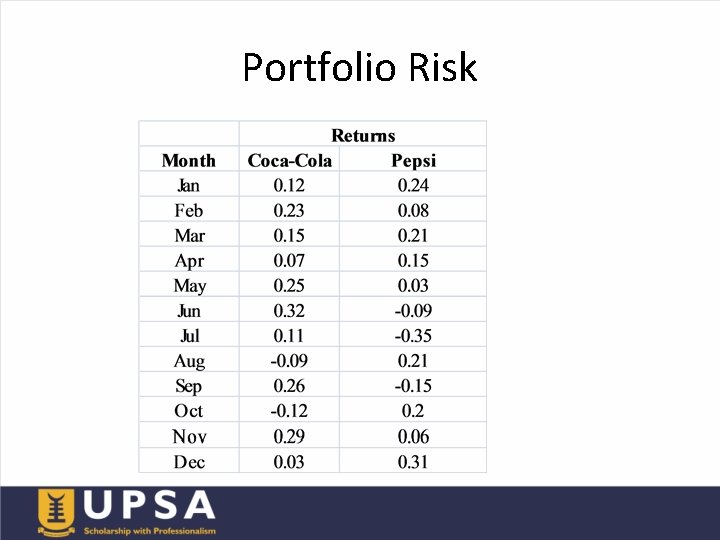

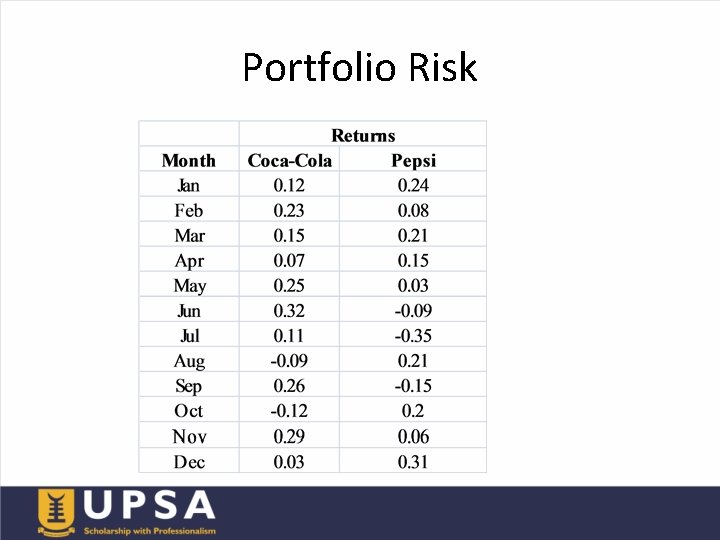

Portfolio Risk

Portfolio Risk • Calculate the covariance between the two assets • Calculate the portfolio risk and return assuming the assets are equally weighted in the portfolio

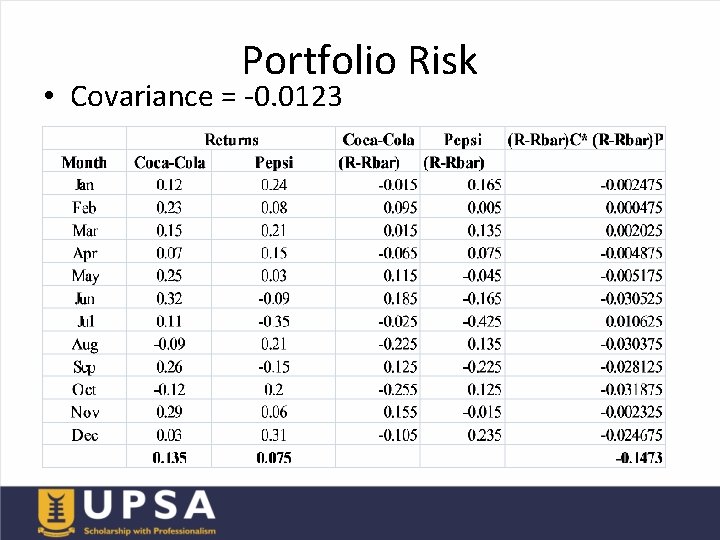

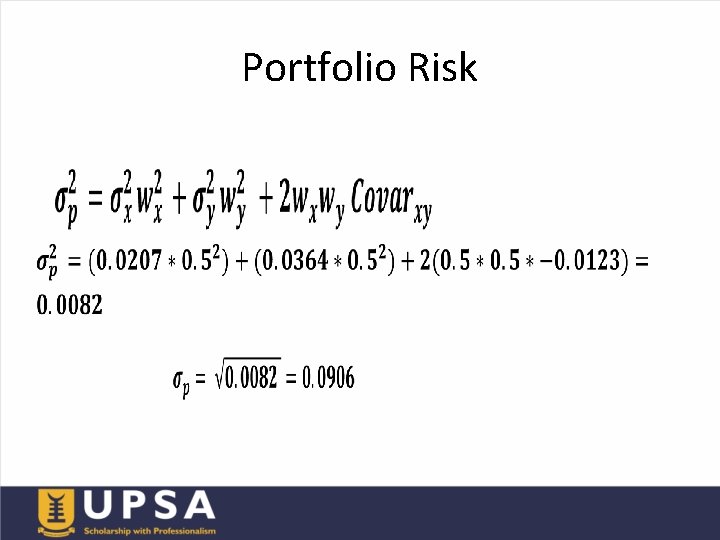

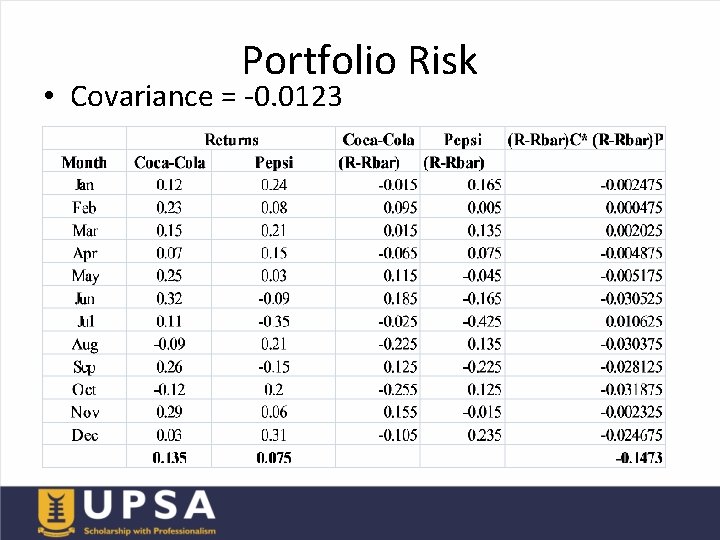

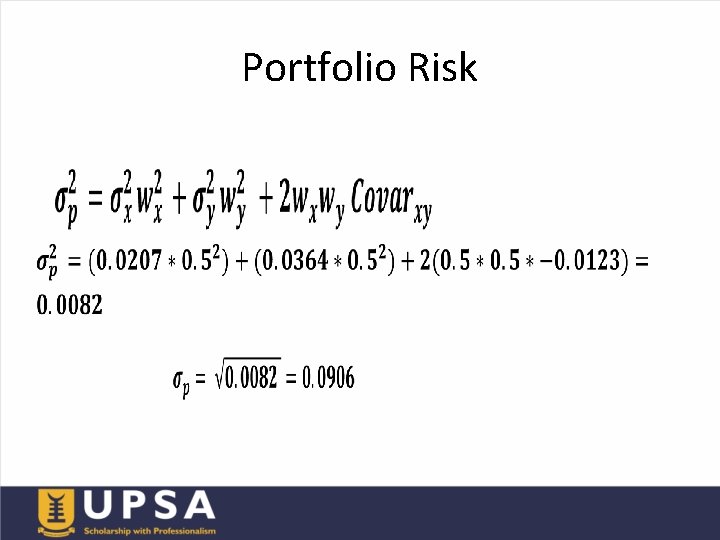

Portfolio Risk • Covariance = -0. 0123

Portfolio Risk • Portfolio return = (0. 5*0. 135) + (0. 5*0. 075) =0. 105

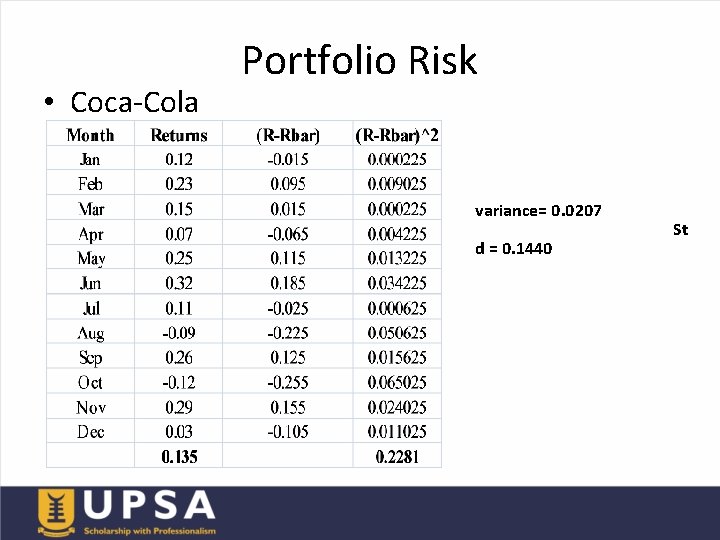

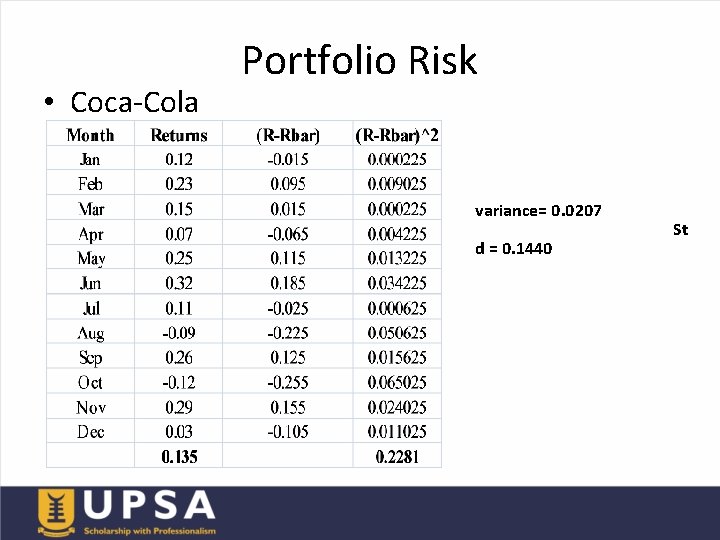

• Coca-Cola Portfolio Risk variance= 0. 0207 d = 0. 1440 St

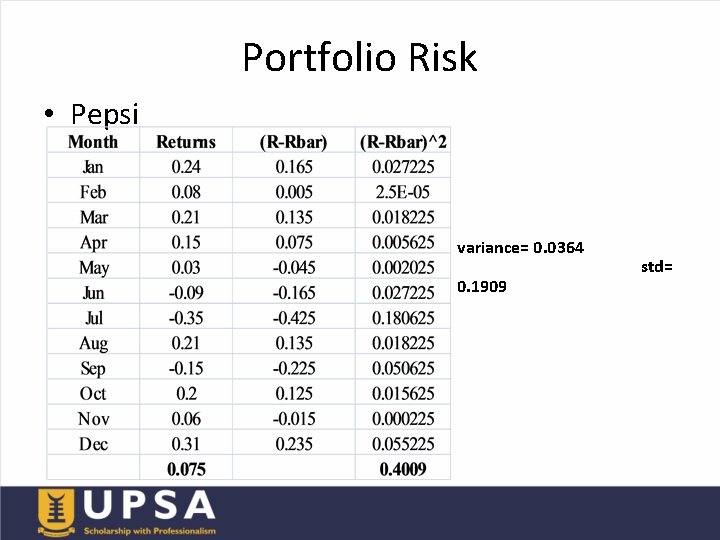

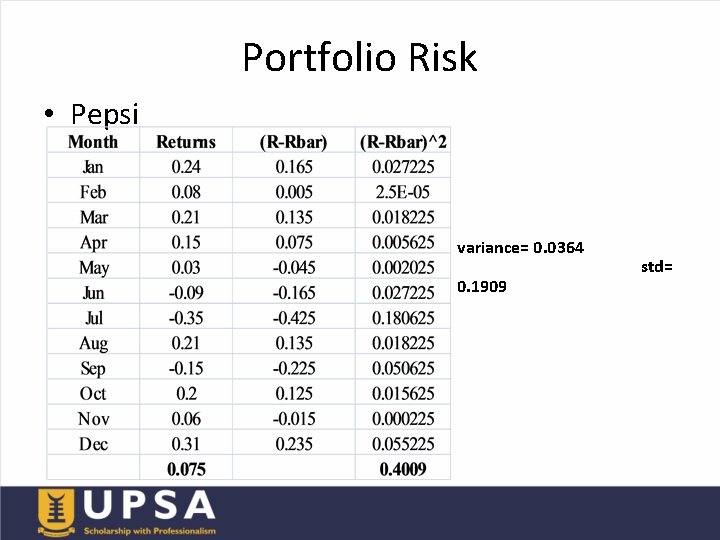

Portfolio Risk • Pepsi variance= 0. 0364 0. 1909 std=

Portfolio Risk

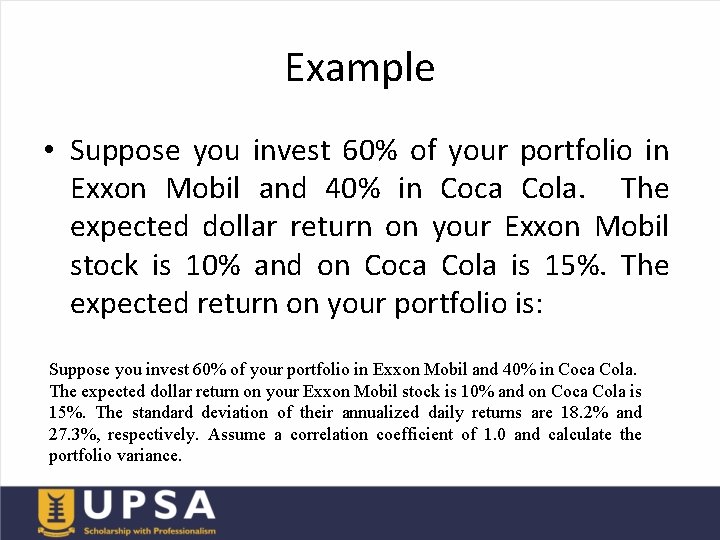

Example • Suppose you invest 60% of your portfolio in Exxon Mobil and 40% in Coca Cola. The expected dollar return on your Exxon Mobil stock is 10% and on Coca Cola is 15%. The expected return on your portfolio is: Suppose you invest 60% of your portfolio in Exxon Mobil and 40% in Coca Cola. The expected dollar return on your Exxon Mobil stock is 10% and on Coca Cola is 15%. The standard deviation of their annualized daily returns are 18. 2% and 27. 3%, respectively. Assume a correlation coefficient of 1. 0 and calculate the portfolio variance.

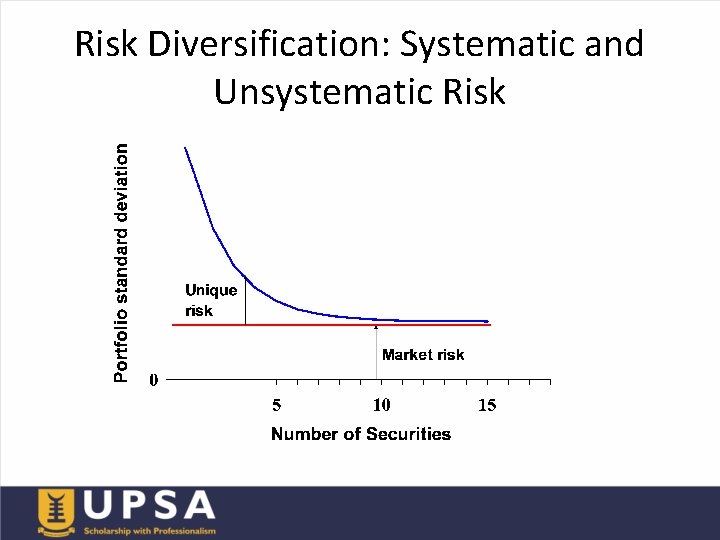

Risk Diversification: Systematic and Unsystematic Risk

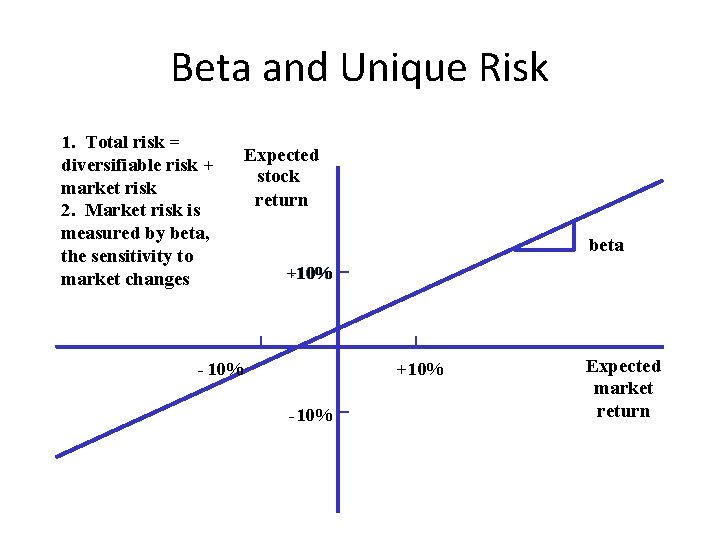

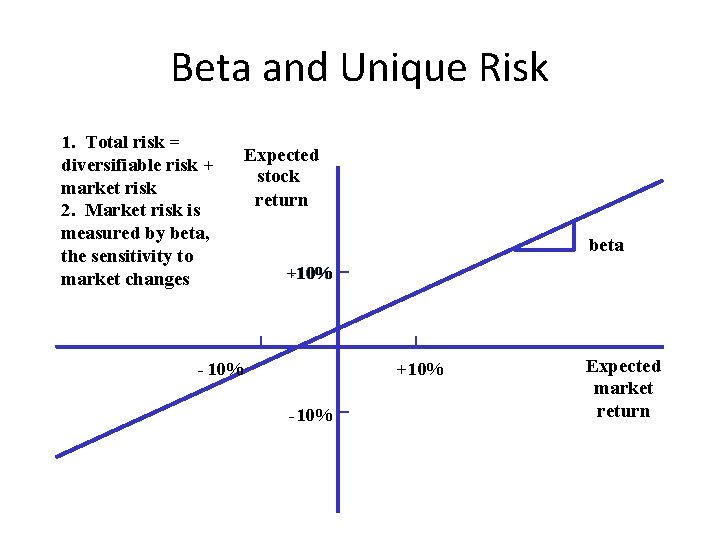

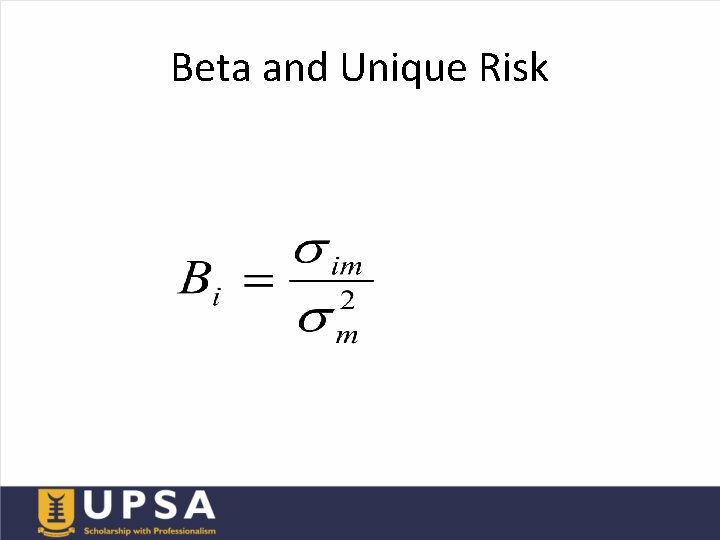

Beta and Unique Risk 1. Total risk = diversifiable risk + market risk 2. Market risk is measured by beta, the sensitivity to market changes Expected stock return beta +10% - 10% +10% -10% Expected market return

Beta and Unique Risk • Market Portfolio - Portfolio of all assets in the economy. In practice a broad stock market index, such as the GSE All Share Index, S&P Composite are used to represent the market. • Beta - Sensitivity of a stock’s return to the return on the market portfolio.

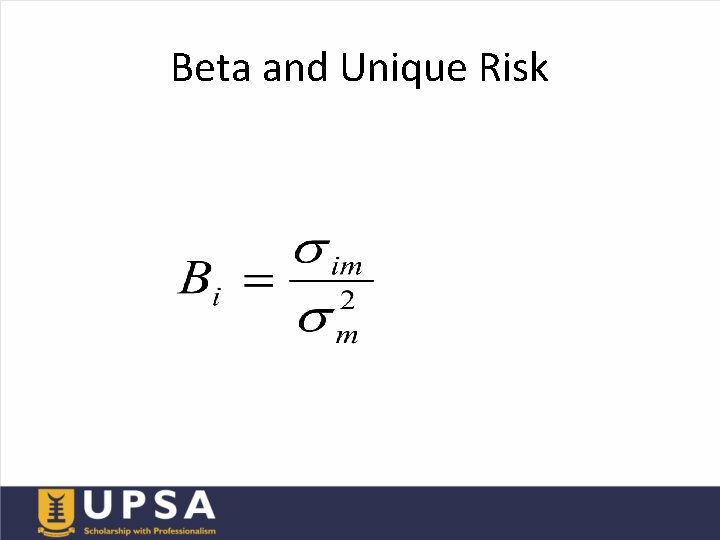

Beta and Unique Risk

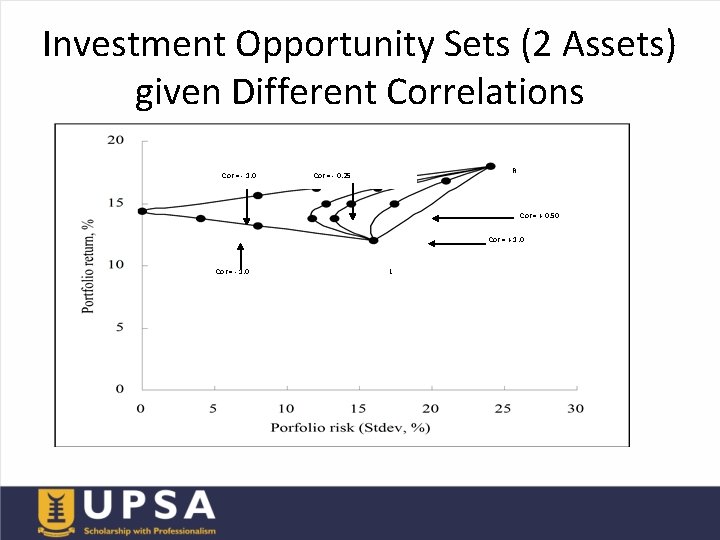

Investment Opportunity Sets (2 Assets) given Different Correlations Cor = - 1. 0 R Cor = - 0. 25 Cor = + 0. 50 Cor = + 1. 0 Cor = - 1. 0 L

Mean-Variance Criterion • A risk-averse investor will prefer a portfolio with the highest expected return for a given level of risk or prefer a portfolio with the lowest level of risk for a given level of expected return. In portfolio theory, this is referred to as the principle of dominance

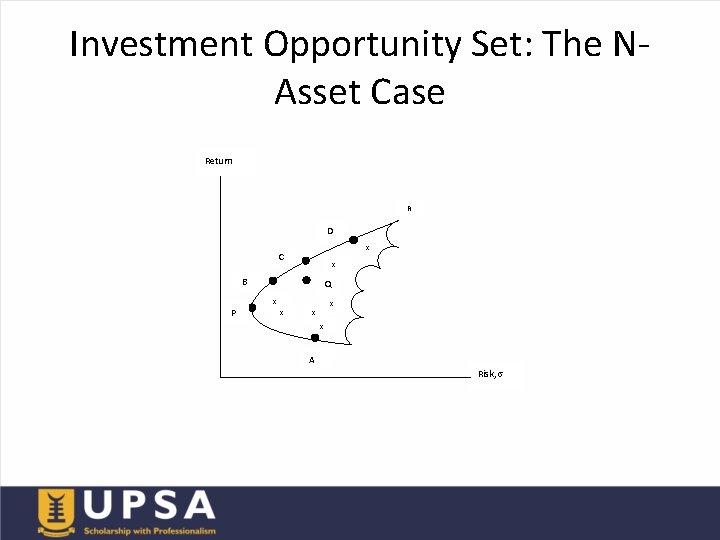

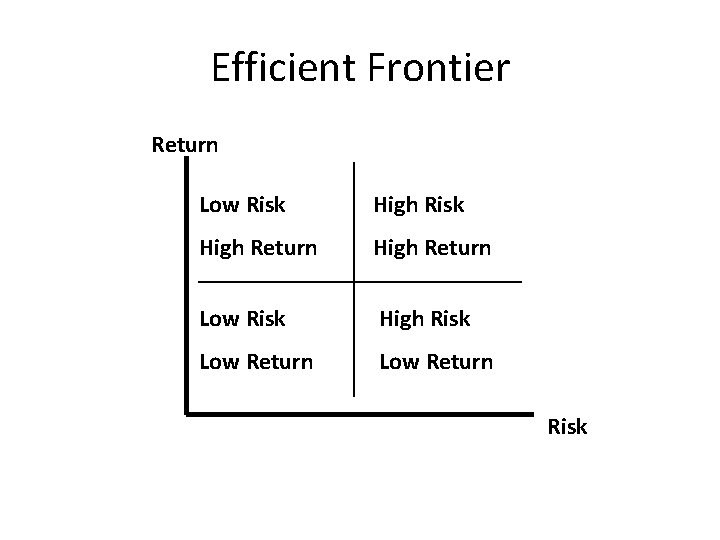

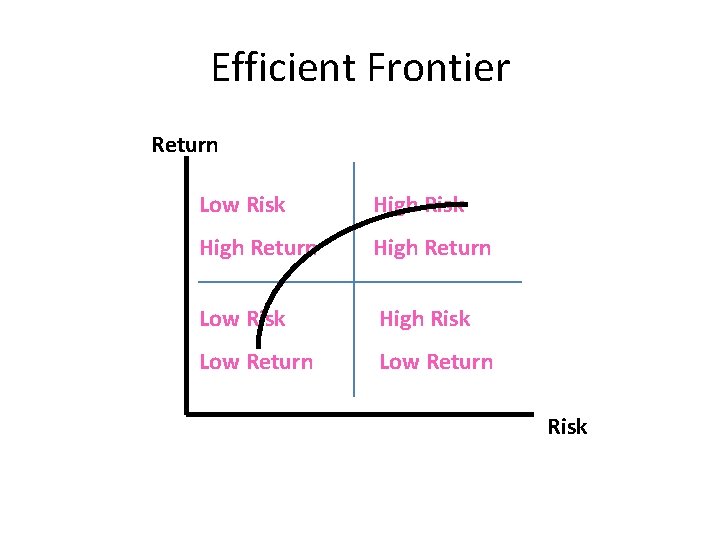

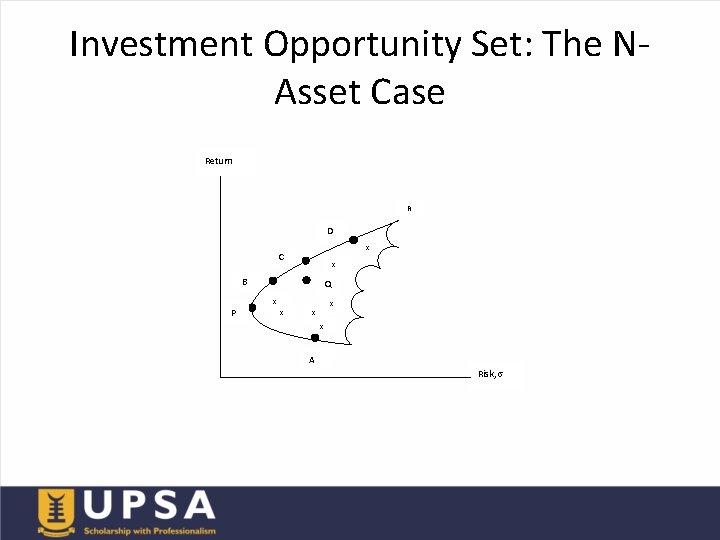

Investment Opportunity Set: The NAsset Case • An efficient portfolio is one that has the highest expected returns for a given level of risk. The efficient frontier is the frontier formed by the set of efficient portfolios. All other portfolios, which lie outside the efficient frontier, are inefficient portfolios.

Investment Opportunity Set: The NAsset Case Return R D x C x B P Q x x x A Risk,

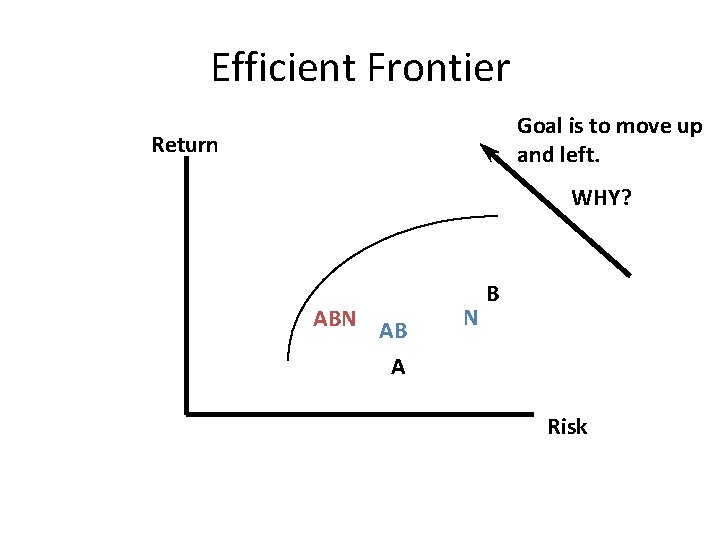

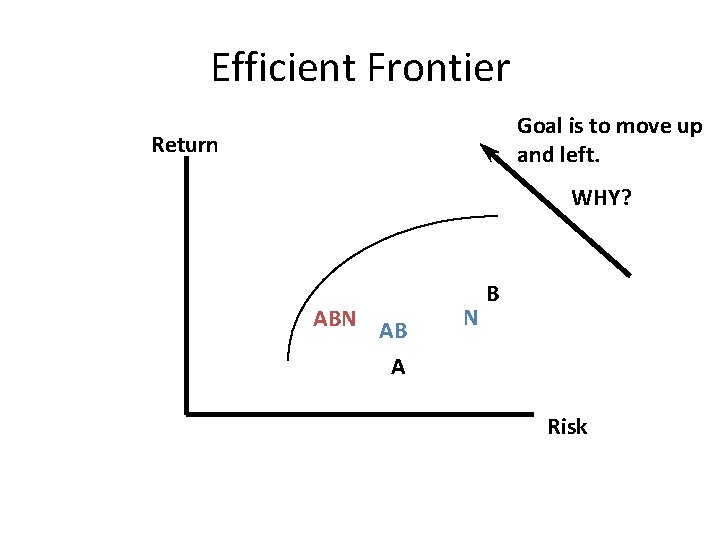

Efficient Frontier Goal is to move up and left. Return WHY? ABN AB A N B Risk

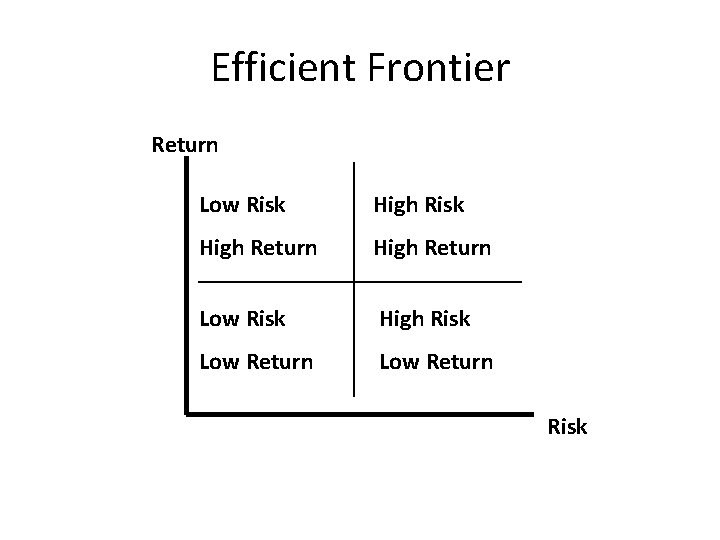

Efficient Frontier Return Low Risk High Return Low Risk High Risk Low Return Risk

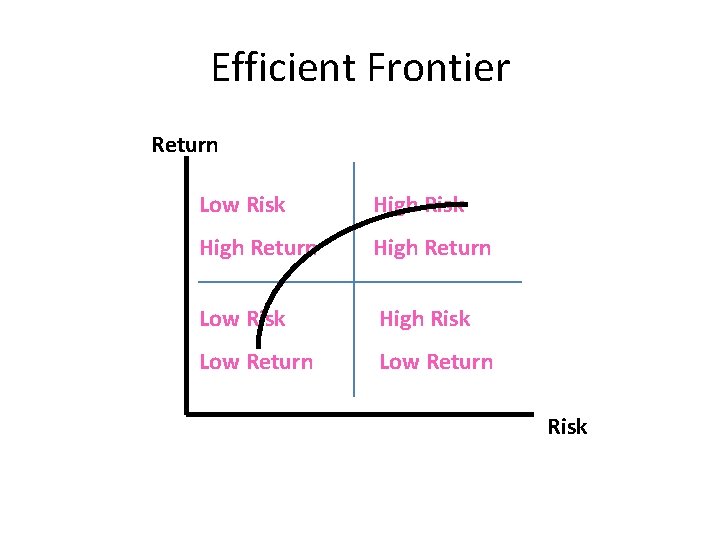

Efficient Frontier Return Low Risk High Return Low Risk High Risk Low Return Risk

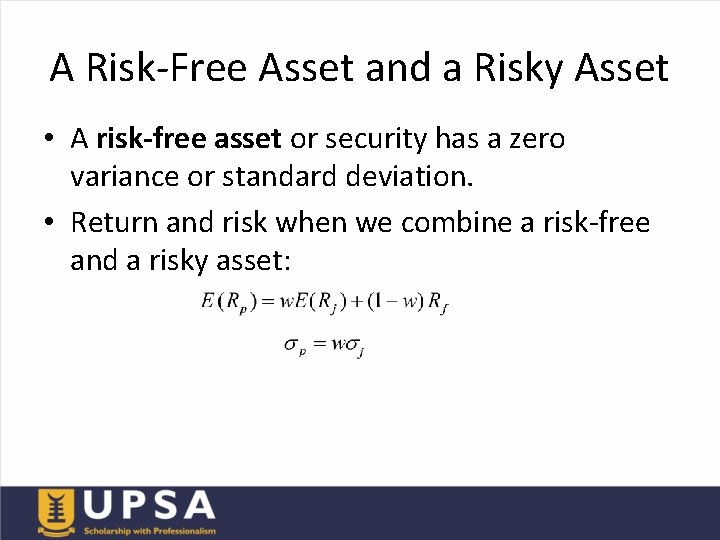

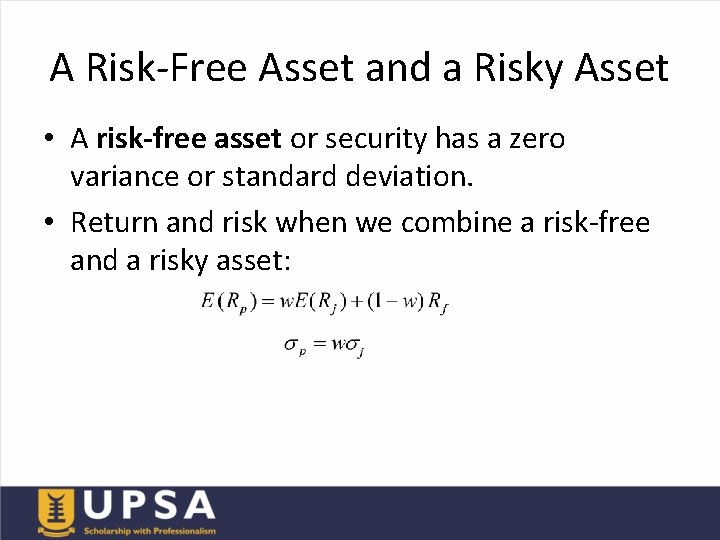

A Risk-Free Asset and a Risky Asset • A risk-free asset or security has a zero variance or standard deviation. • Return and risk when we combine a risk-free and a risky asset:

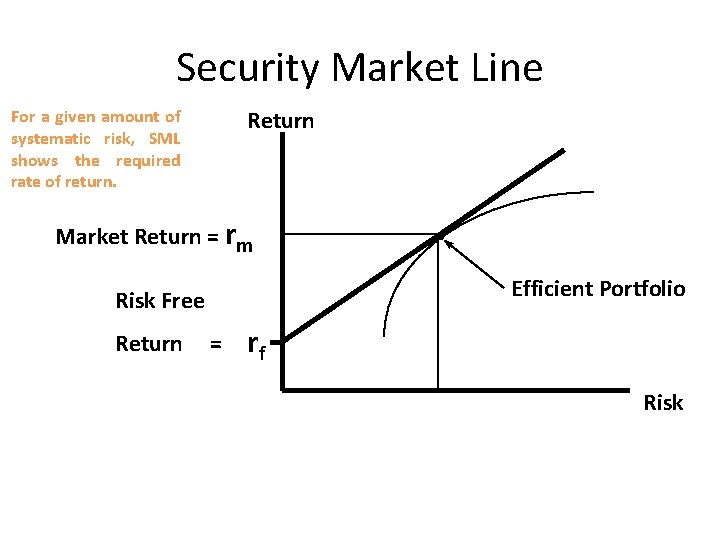

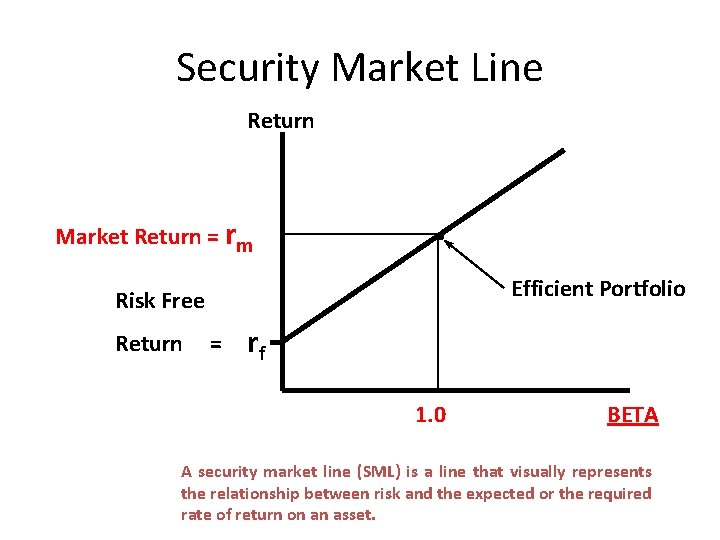

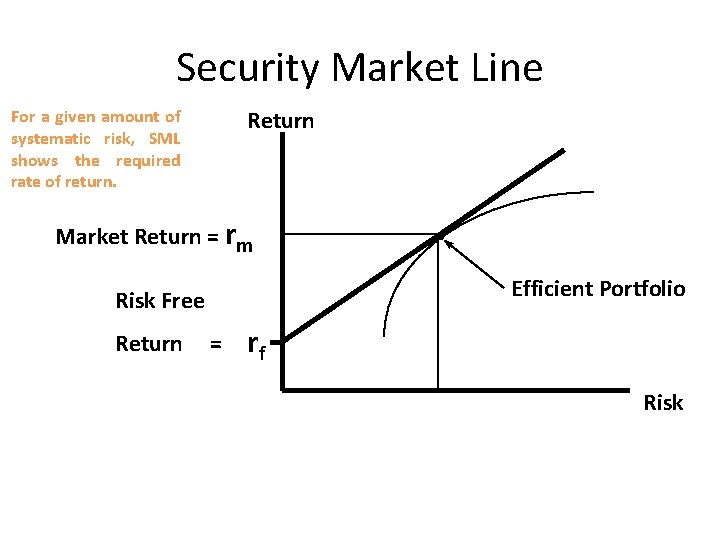

Security Market Line Return For a given amount of systematic risk, SML shows the required rate of return. Market Return = rm Efficient Portfolio Risk Free Return . = rf Risk

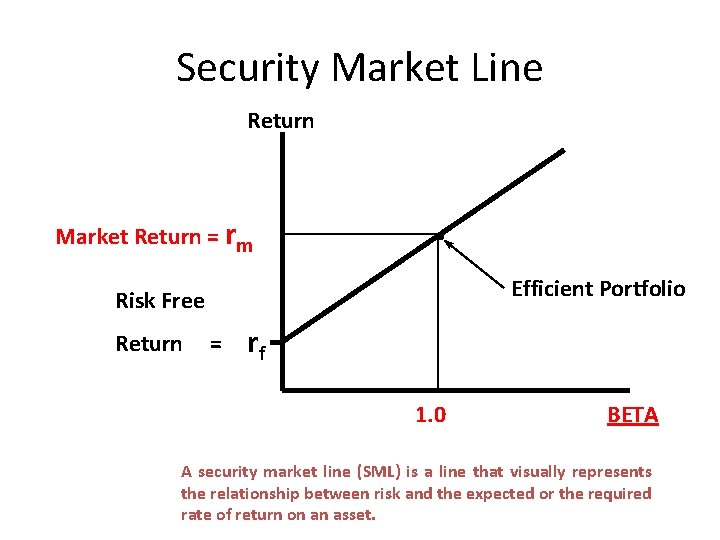

Security Market Line Return Market Return = rm . Efficient Portfolio Risk Free Return = rf 1. 0 BETA A security market line (SML) is a line that visually represents the relationship between risk and the expected or the required rate of return on an asset.

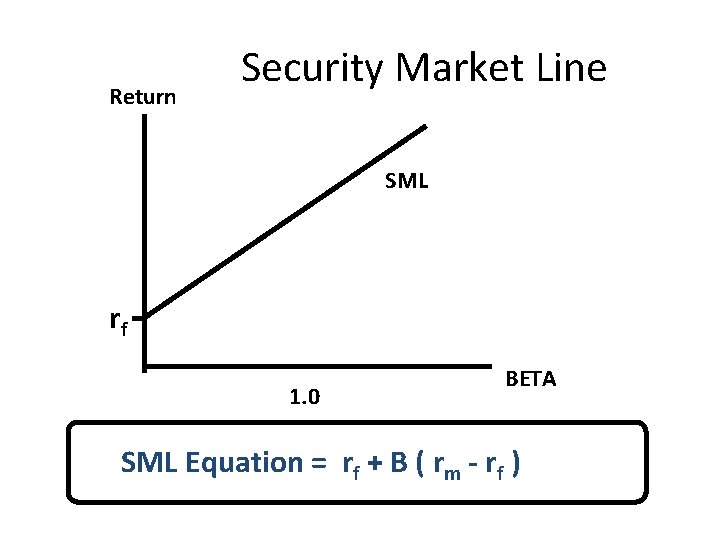

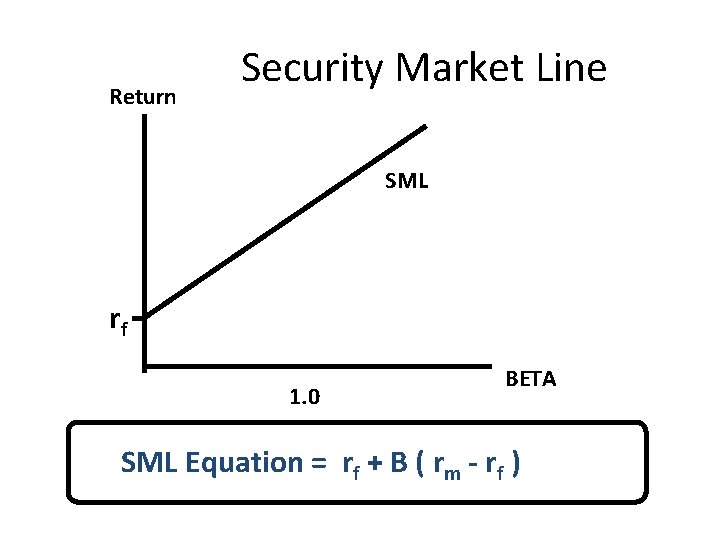

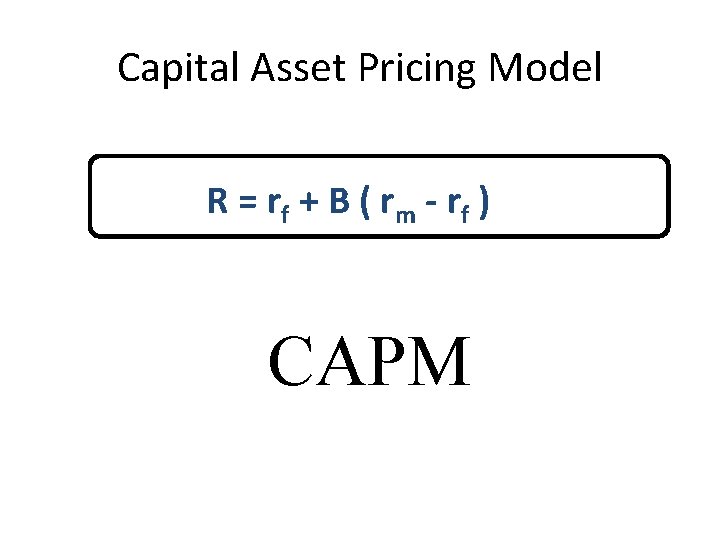

Security Market Line Return SML rf 1. 0 BETA SML Equation = rf + B ( rm - rf )

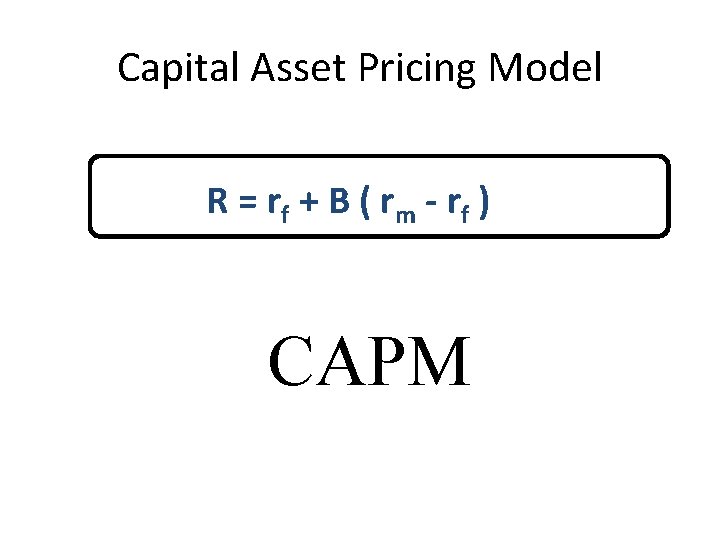

Capital Asset Pricing Model R = r f + B ( r m - rf ) CAPM

Capital Asset Pricing Model Given beta of 2. 5 and risk premium on the market as 5%, if the risk free rate is 19%, use the CAPM to find the opportunity cost.

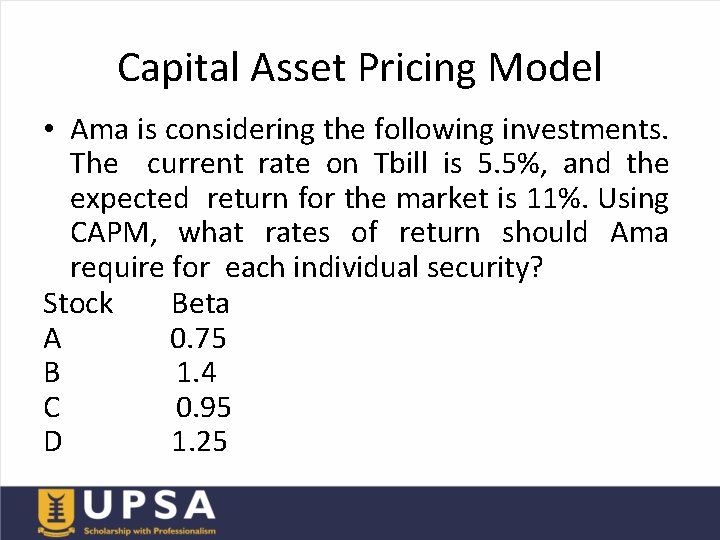

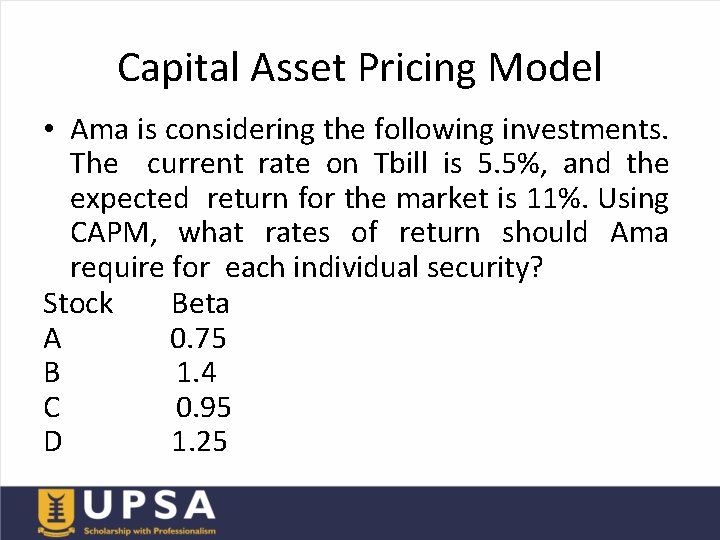

Capital Asset Pricing Model • Ama is considering the following investments. The current rate on Tbill is 5. 5%, and the expected return for the market is 11%. Using CAPM, what rates of return should Ama require for each individual security? Stock Beta A 0. 75 B 1. 4 C 0. 95 D 1. 25

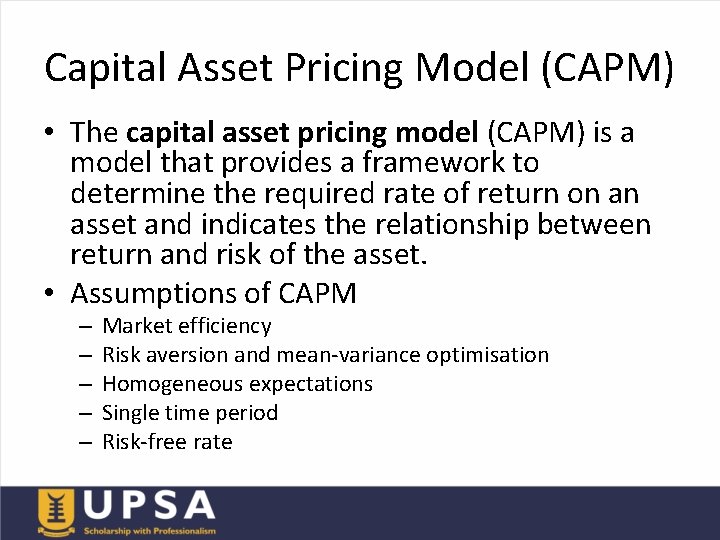

Capital Asset Pricing Model (CAPM) • The capital asset pricing model (CAPM) is a model that provides a framework to determine the required rate of return on an asset and indicates the relationship between return and risk of the asset. • Assumptions of CAPM – – – Market efficiency Risk aversion and mean-variance optimisation Homogeneous expectations Single time period Risk-free rate

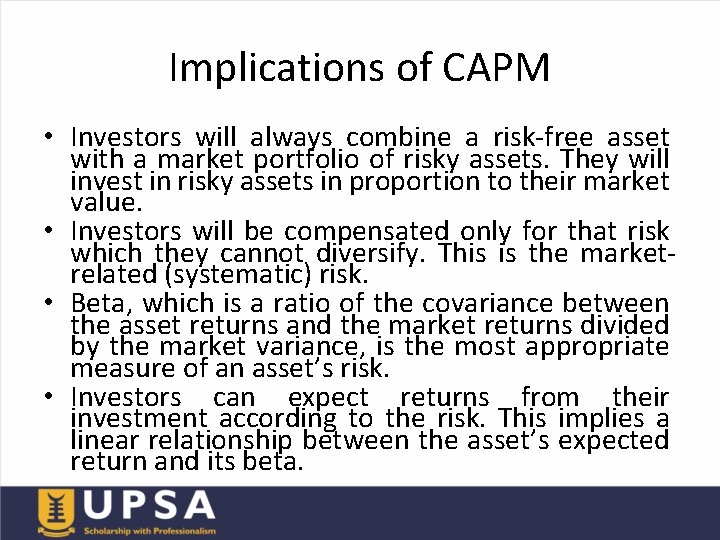

Implications of CAPM • Investors will always combine a risk-free asset with a market portfolio of risky assets. They will invest in risky assets in proportion to their market value. • Investors will be compensated only for that risk which they cannot diversify. This is the marketrelated (systematic) risk. • Beta, which is a ratio of the covariance between the asset returns and the market returns divided by the market variance, is the most appropriate measure of an asset’s risk. • Investors can expect returns from their investment according to the risk. This implies a linear relationship between the asset’s expected return and its beta.

Limitations of CAPM • It is based on unrealistic assumptions. • It is difficult to test the validity of CAPM. • Betas do not remain stable over time.

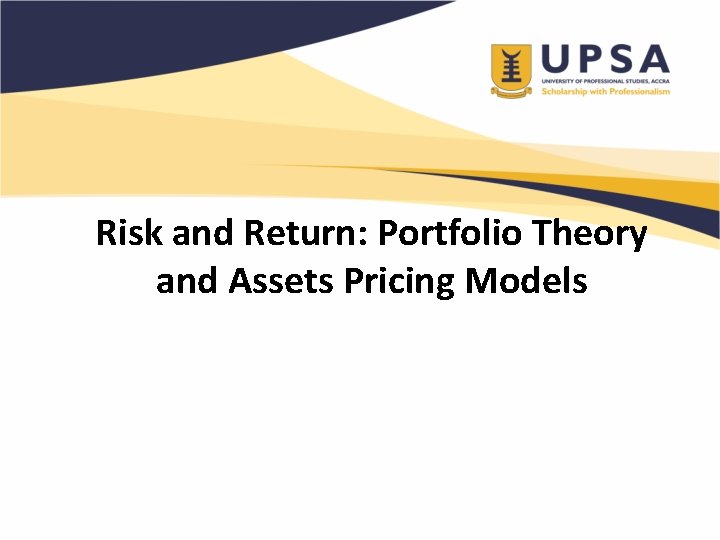

The Arbitrage Pricing Theory (APT) • In APT, the return of an asset is assumed to have two components: predictable (expected) and unpredictable (uncertain) return. Thus, return on asset j will be: where Rf is the predictable return (risk-free return on a zero-beta asset) and UR is the unanticipated part of the return. The uncertain return may come from the firm specific information and the market related information:

Steps in Calculating Expected Return under APT • Factors: – – – industrial production changes in default premium changes in the structure of interest rates inflation rate changes in the real rate of return • Risk premium • Factor beta