Office of the State Auditor Overview State Government

- Slides: 26

Office of the State Auditor Overview State Government Finance and Policy and Elections Committee February 28, 2017 Rebecca Otto State Auditor 1

Office of the State Auditor The Office of the State Auditor (OSA) generally oversees over $20 billion in spending per year by local governments 2

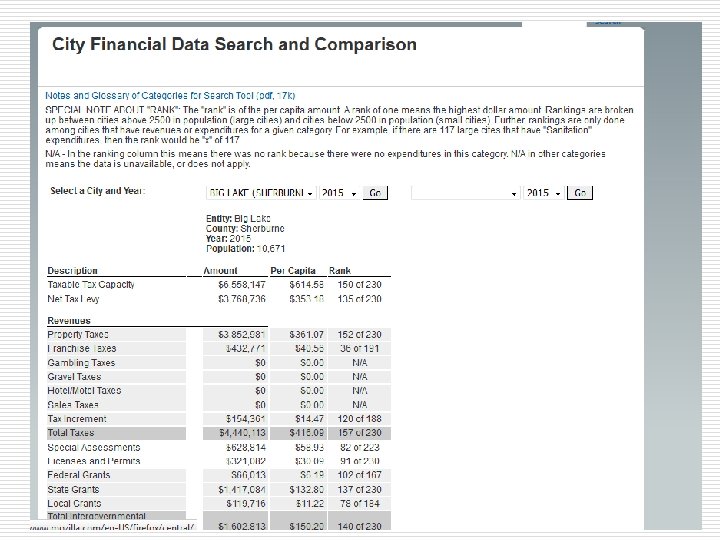

Follow the Money: Transparency Ø OSA is the only entity that collects, reviews, publishes & maintains longterm comparable financial data on all local governments (except schools) Ø Used by taxpayers, legislature, governor, media, researchers, State agencies, and more Ø Transparency & accountability for taxpayers 3

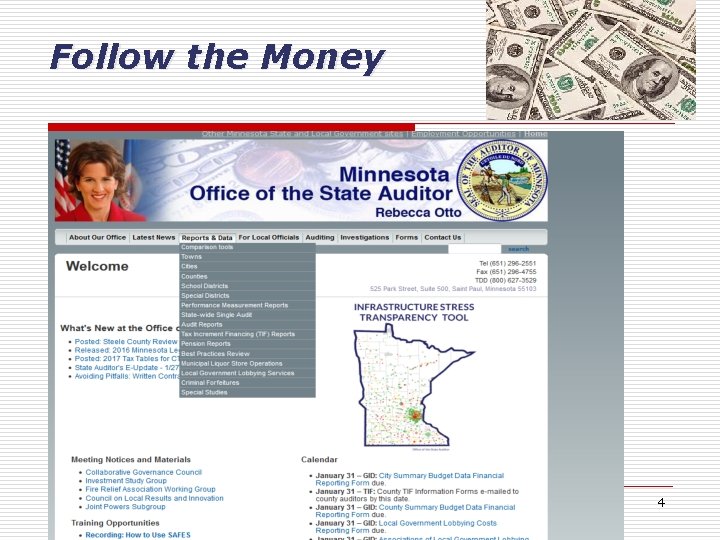

Follow the Money 4

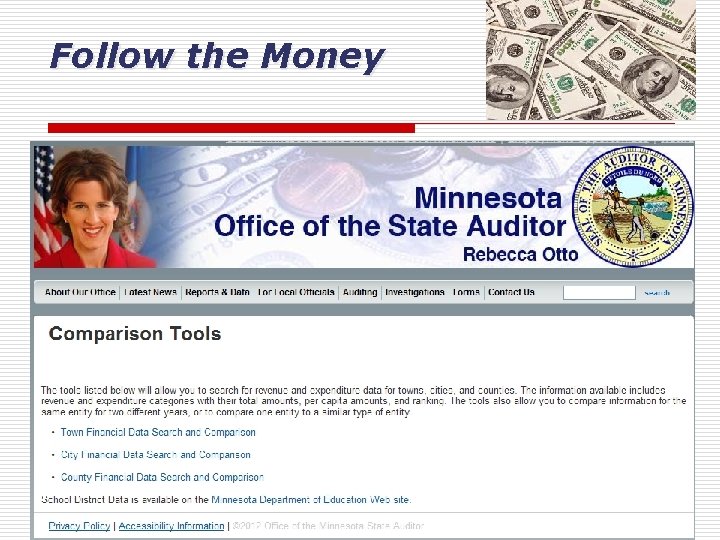

Follow the Money 5

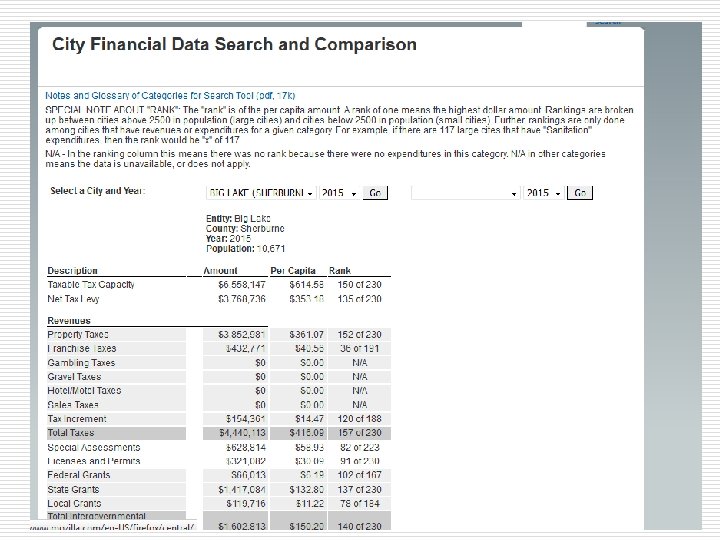

6

Follow the Money: Accountability Ø We receive mandatory reports on alleged misuse/theft of public funds/assets: Ø Ø 609. 456 reporting Local officials must report evidence of theft or misuse of public funds Ø Ø 6. 67 reporting Private CPA firms are required to report evidence of theft or misuse of public funds Ø Taxpayers report concerns and make inquiries 7

Follow the Money: Accountability Ø OSA serves as the deterrent: Ø Conducts investigations Ø Assists law enforcement/others with investigations Ø Trains/educates local officials to prevent/detect fraud Ø Refers cases to County Attorneys for possible criminal proceedings 8

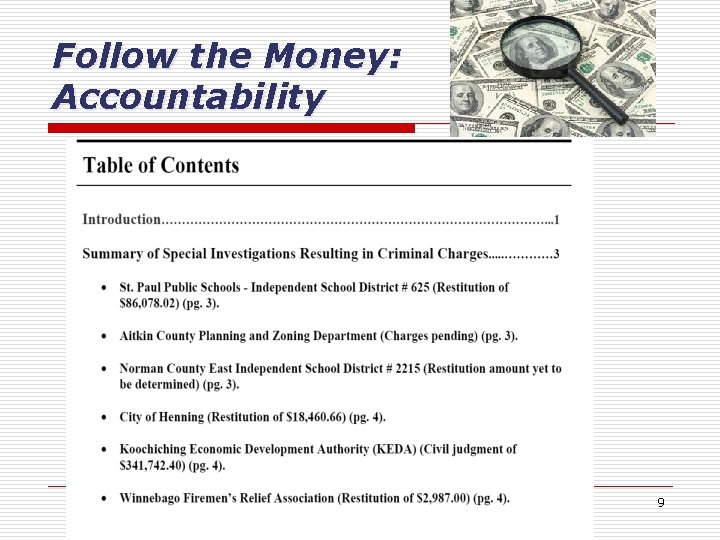

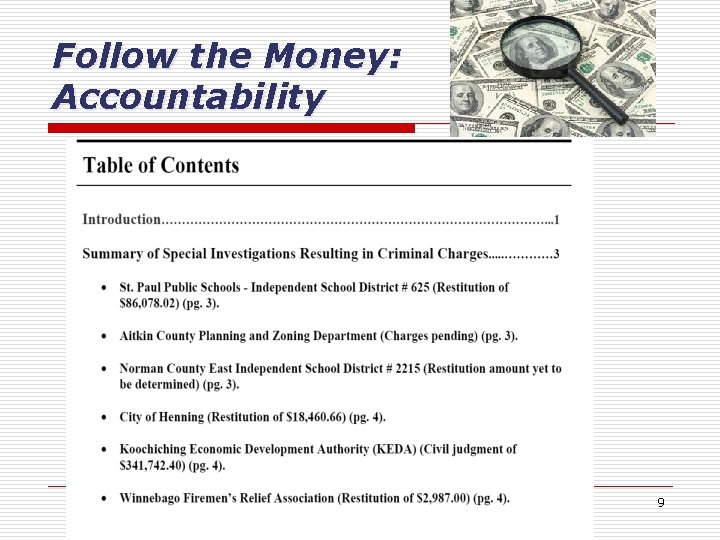

Follow the Money: Accountability 9

Follow the Money: Accountability Ø Certify cities to receive local government aid from DOR ($519 million LGA available for 2017) Ø Accountability: aid received if requirements are met Ø Annual audit Ø Fulfill annual reporting requirement Ø Important source of revenue for many cities 10

Follow the Money: Accountability Ø Certify Volunteer Fire Relief Associations for fire state aid ($34 million aid in 2016) Ø Accountability: aid received if requirements are met Ø Audit or AUP Engagement Ø Annual reporting requirement, compliance Ø Safeguard pensions, provide transparency Ø Support our cost-effective statewide volunteer firefighting system 11

Follow the Money: Accountability Ø Tax Increment Financing (TIF) is an economic development tool Ø Housing, economic development, redevelopment, and more Ø Oversee the use of TIF to help ensure that: Ø Used in compliance with state law Ø TIF Districts are decertified in a timely manner Ø Any excess tax increments collected are returned to property tax stream for redistribution 12

Follow the Money: Accountability Ø In 2015: Ø Approximately $194 million in tax increment was generated Ø Development authorities returned approximately $25 million in tax increment revenue to county auditors for redistribution as property taxes to cities, counties, and school districts Ø About 64 percent of TIF Districts are located in Greater Minnesota 13

Follow the Money: Accountability Ø We conduct annual financial & compliance audits, including the Single Audit Ø Audited financial statements are used by taxpayers, bondholders, rating agencies, governing bodies, and more Ø Single Audits are used by federal/ State departments for consideration when awarding grants & funds to local governments 14

Budget 15

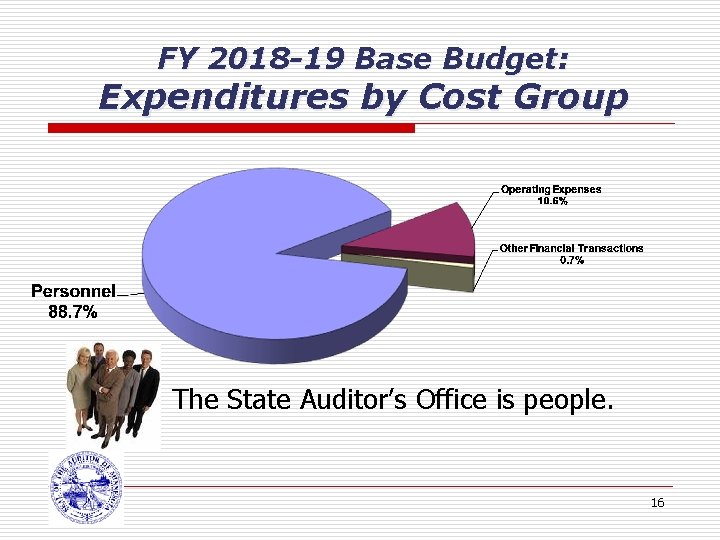

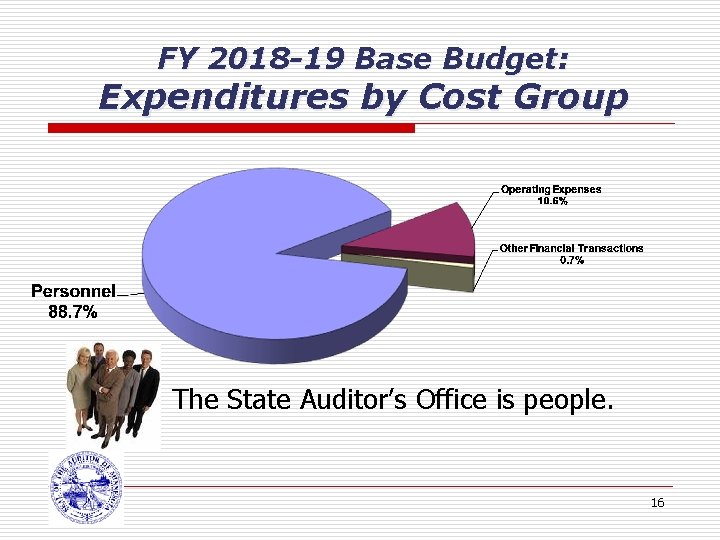

FY 2018 -19 Base Budget: Expenditures by Cost Group The State Auditor’s Office is people. 16

FY 2018 -19 Base Budget: Expenditures by Cost Group • OSA overhead expense as a % of revenues at 13. 5%; Average for private firms is 20 -25% • OSA administrative personnel as a % of total headcount at 6%; 20% considered good number for private firms • OSA overhead expenses person at $6, 643; $35, 000 to $40, 000 considered good number for private firms • OSA is very efficient at serving taxpayers! • *CPA Practice Advisor, Mark Rosenberg, CPA 17

FY 2018 -19 Base Budget: Where the money goes 18

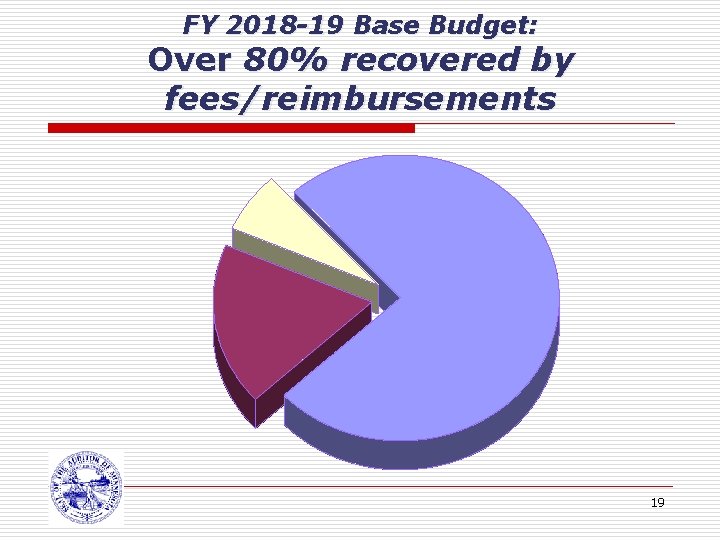

FY 2018 -19 Base Budget: Over 80% recovered by fees/reimbursements 19

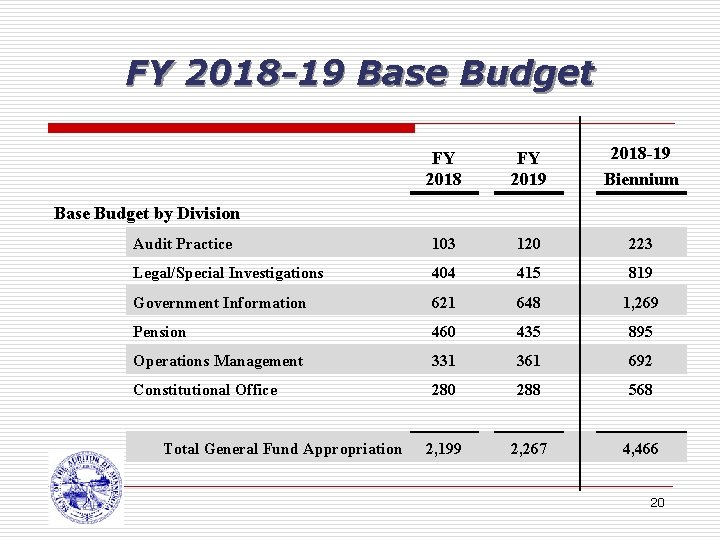

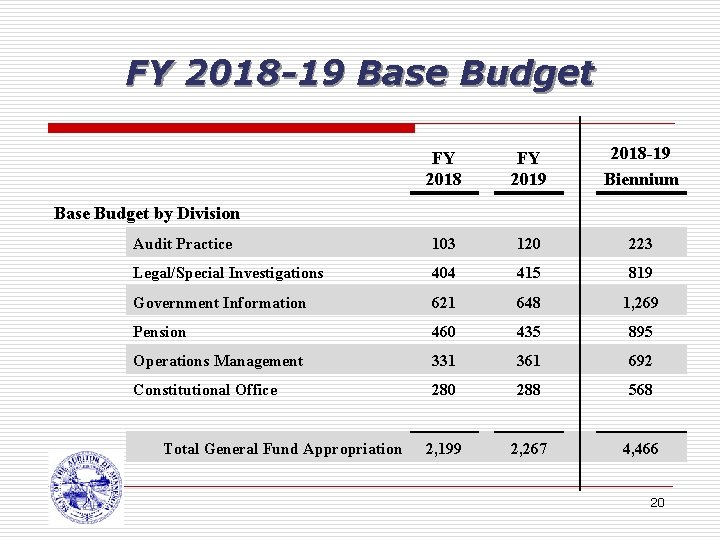

FY 2018 -19 Base Budget FY 2018 FY 2019 2018 -19 Biennium Audit Practice 103 120 223 Legal/Special Investigations 404 415 819 Government Information 621 648 1, 269 Pension 460 435 895 Operations Management 331 361 692 Constitutional Office 280 288 568 2, 199 2, 267 4, 466 Base Budget by Division Total General Fund Appropriation 20

Proposed FY 2018 -19 Change Items Ø Staff Retention Ø Technology Staffing 21

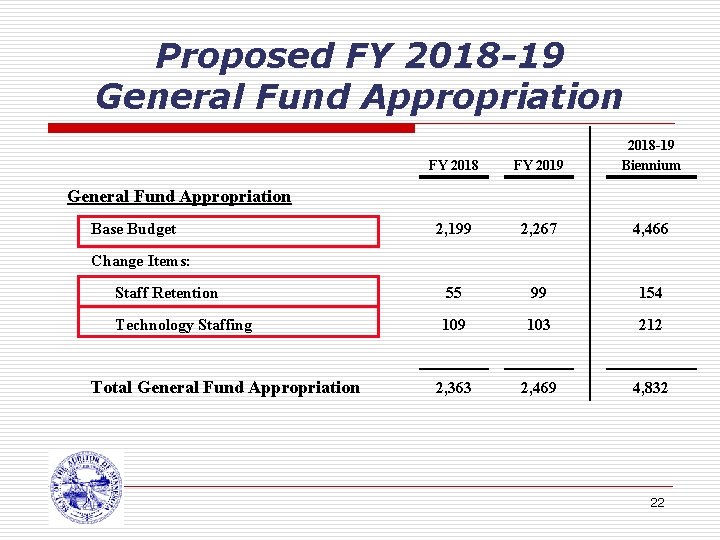

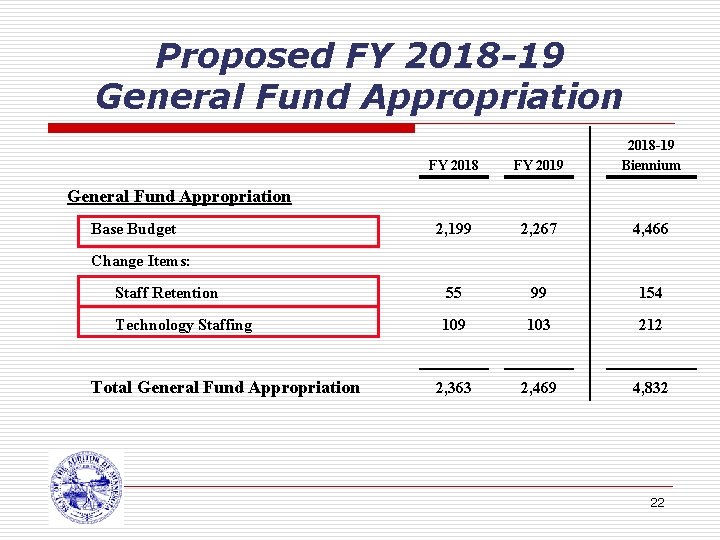

Proposed FY 2018 -19 General Fund Appropriation FY 2018 FY 2019 2018 -19 Biennium 2, 199 2, 267 4, 466 Staff Retention 55 99 154 Technology Staffing 109 103 212 2, 363 2, 469 4, 832 General Fund Appropriation Base Budget Change Items: Total General Fund Appropriation 22

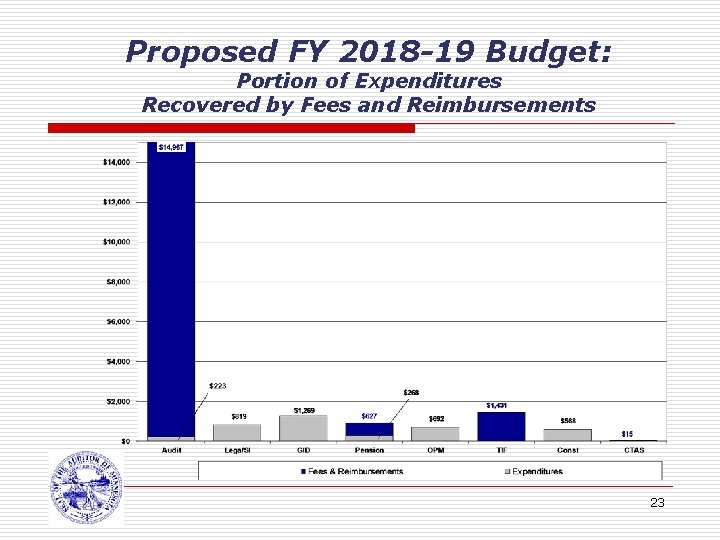

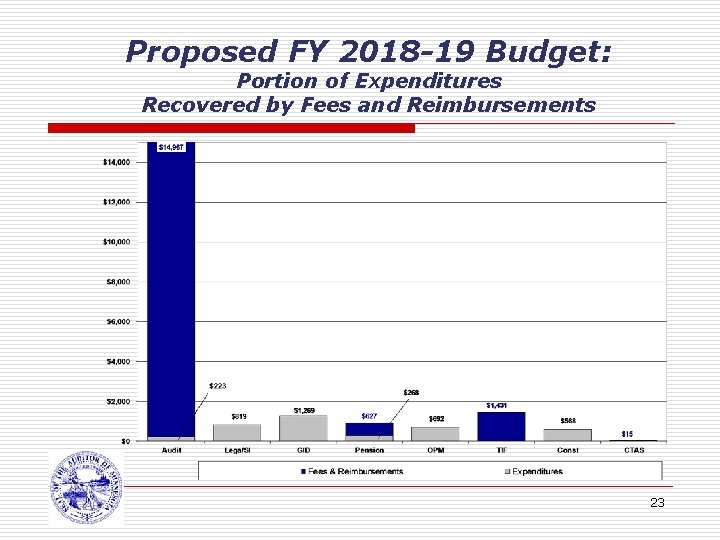

Proposed FY 2018 -19 Budget: Portion of Expenditures Recovered by Fees and Reimbursements 23

Proposed FY 2018 -19 Budget: Change Item: Staff Retention Ø The OSA has highly-trained, sought-after specialized staff Ø The change item allows OSA to maintain current staff 24

Proposed FY 2018 -19 Budget: Change Item: Tech Staff Ø Improve processes and systems used to report to the OSA Ø Simplify reporting forms for over 4, 000 local governments reporting to OSA Ø Increase efficiency for OSA staff by building in some automated data analysis Ø Improve transparency by updating website 25

Questions? Contact Us: State. Auditor@osa. state. mn. us 651 -296 -2551 www. auditor. state. mn. us 26

Office of auditor general of nepal

Office of auditor general of nepal Office of the auditor general of norway

Office of the auditor general of norway Vermont state auditor

Vermont state auditor Overview of government accounting

Overview of government accounting Connecticut comptroller

Connecticut comptroller State and federal constitutions

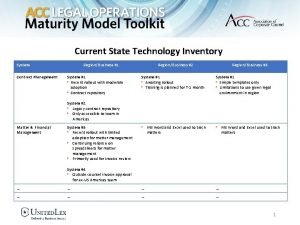

State and federal constitutions Overview of the current state of technology

Overview of the current state of technology Office of the government chief information officer

Office of the government chief information officer Gsa office of governmentwide policy

Gsa office of governmentwide policy Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Ng-html

Ng-html Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Chó sói

Chó sói Tư thế worms-breton

Tư thế worms-breton Bài hát chúa yêu trần thế alleluia

Bài hát chúa yêu trần thế alleluia Môn thể thao bắt đầu bằng chữ f

Môn thể thao bắt đầu bằng chữ f Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Công thức tính thế năng

Công thức tính thế năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Cách giải mật thư tọa độ

Cách giải mật thư tọa độ Phép trừ bù

Phép trừ bù Phản ứng thế ankan

Phản ứng thế ankan Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra