Getting Ready to Enroll for 2017 Annual Enrollment

- Slides: 33

Getting Ready to Enroll for 2017 Annual Enrollment December 12 th December 16 th

LBG Advisors Disclaimer Braun NW| 2017 Benefits Enrollment | 2 This Power. Point is not a legal document and is provided for employees of the company only. Information contained in this guide is only a summary of benefits. Official plan and insurance documents actually govern your rights and benefits under each plan. If any discrepancy exists between this document and any of the official documents, the official documents will prevail. Please consult your plan document for details relating to your coverage. This Power. Point does not guarantee coverage. This information is produced by LBG Advisors for the sole use of its clients and their representatives. Certain information included herein may be considered proprietary and confidential.

Annual Enrollment December 12 th -16 th Braun NW| 2017 Benefits Enrollment | 3 12 December 16 December

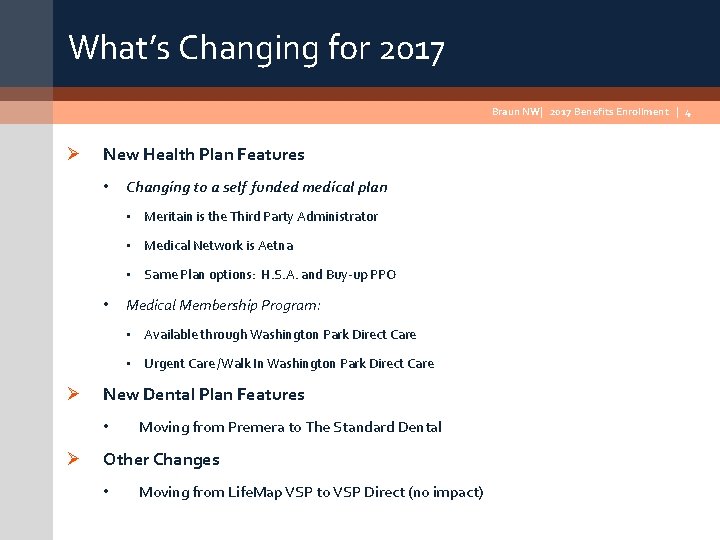

What’s Changing for 2017 Braun NW| 2017 Benefits Enrollment | 4 Ø New Health Plan Features • Changing to a self funded medical plan • Meritain is the Third Party Administrator • Medical Network is Aetna • Same Plan options: H. S. A. and Buy-up PPO • Medical Membership Program: • Available through Washington Park Direct Care • Urgent Care /Walk In Washington Park Direct Care Ø New Dental Plan Features • Ø Moving from Premera to The Standard Dental Other Changes • Moving from Life. Map VSP to VSP Direct (no impact)

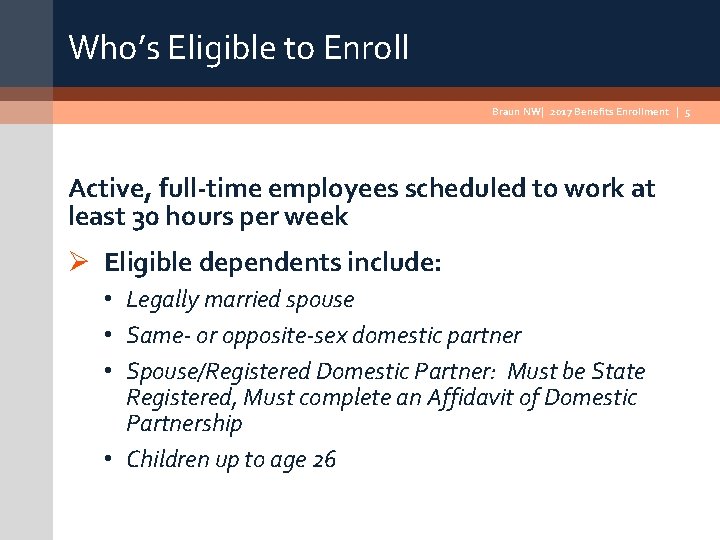

Who’s Eligible to Enroll Braun NW| 2017 Benefits Enrollment | 5 Active, full time employees scheduled to work at least 30 hours per week Ø Eligible dependents include: • Legally married spouse • Same- or opposite-sex domestic partner • Spouse/Registered Domestic Partner: Must be State Registered, Must complete an Affidavit of Domestic Partnership • Children up to age 26

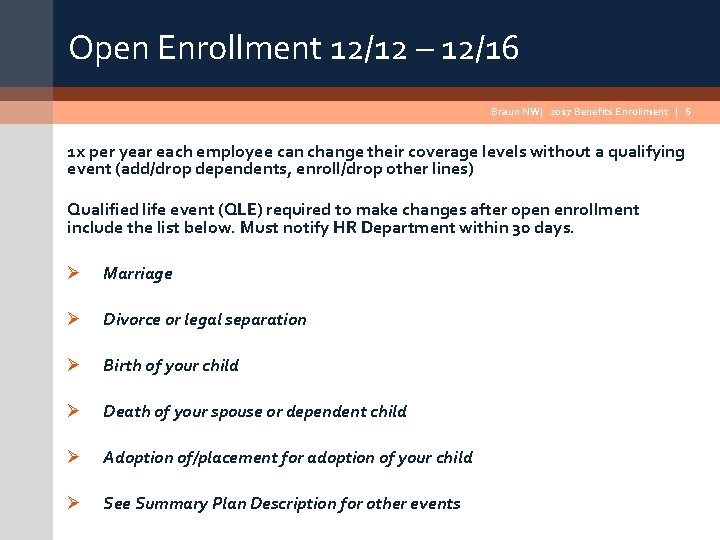

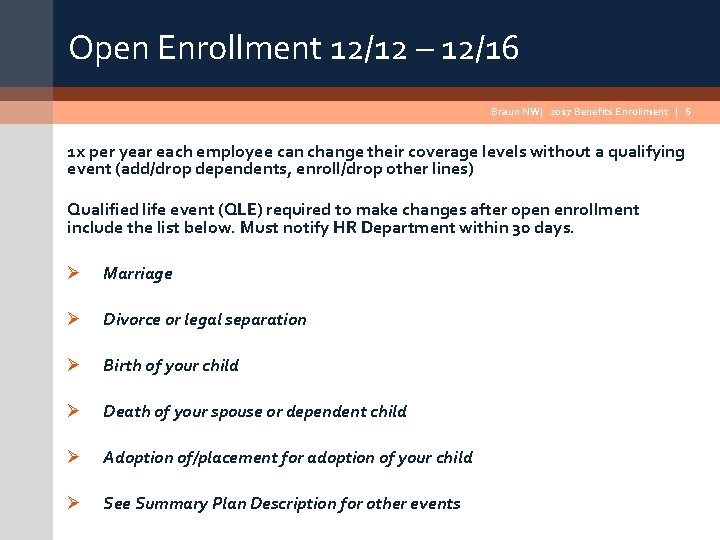

Open Enrollment 12/12 – 12/16 Braun NW| 2017 Benefits Enrollment | 6 1 x per year each employee can change their coverage levels without a qualifying event (add/drop dependents, enroll/drop other lines) Qualified life event (QLE) required to make changes after open enrollment include the list below. Must notify HR Department within 30 days. Ø Marriage Ø Divorce or legal separation Ø Birth of your child Ø Death of your spouse or dependent child Ø Adoption of/placement for adoption of your child Ø See Summary Plan Description for other events

Braun NW| 2017 Benefits Enrollment | 7 Medical and Rx plan: Medical Claims Administrator Network Prescription Drug

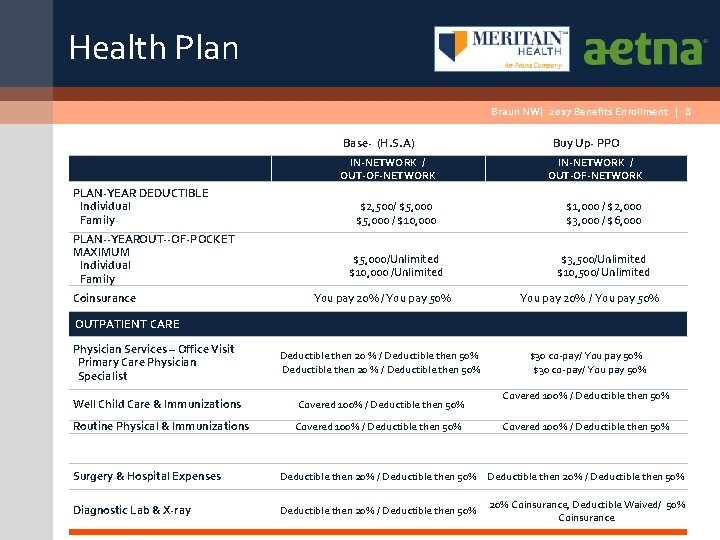

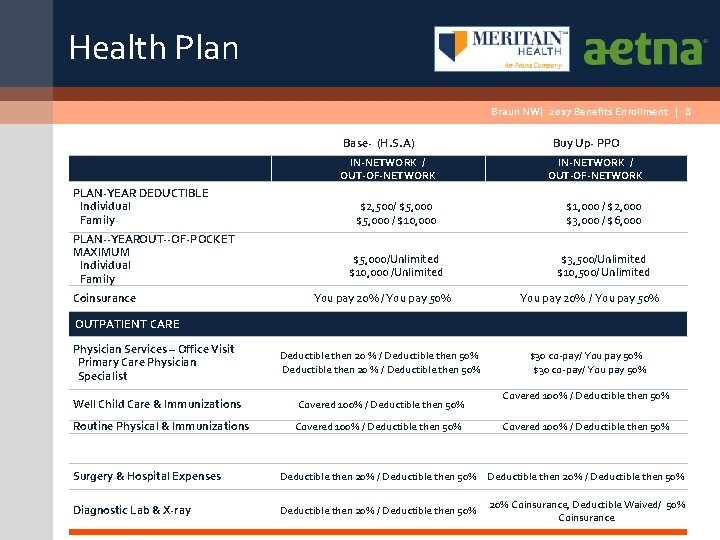

Health Plan Braun NW| 2017 Benefits Enrollment | 8 Base (H. S. A) PLAN YEAR DEDUCTIBLE Individual Family PLAN YEAROUT OF POCKET MAXIMUM Individual Family Coinsurance Buy Up PPO IN NETWORK / OUT OF NETWORK $2, 500/ $5, 000 / $10, 000 $1, 000 / $2, 000 $3, 000 / $6, 000 $5, 000/Unlimited $10, 000 /Unlimited $3, 500/Unlimited $10, 500/ Unlimited You pay 20% / You pay 50% Deductible then 20 % / Deductible then 50% $30 co-pay/ You pay 50% OUTPATIENT CARE Physician Services – Office Visit Primary Care Physician Specialist Well Child Care & Immunizations Covered 100% / Deductible then 50% Routine Physical & Immunizations Covered 100% / Deductible then 50% Surgery & Hospital Expenses Deductible then 20% / Deductible then 50% Diagnostic Lab & X ray Deductible then 20% / Deductible then 50% 20% Coinsurance, Deductible Waived/ 50% Coinsurance

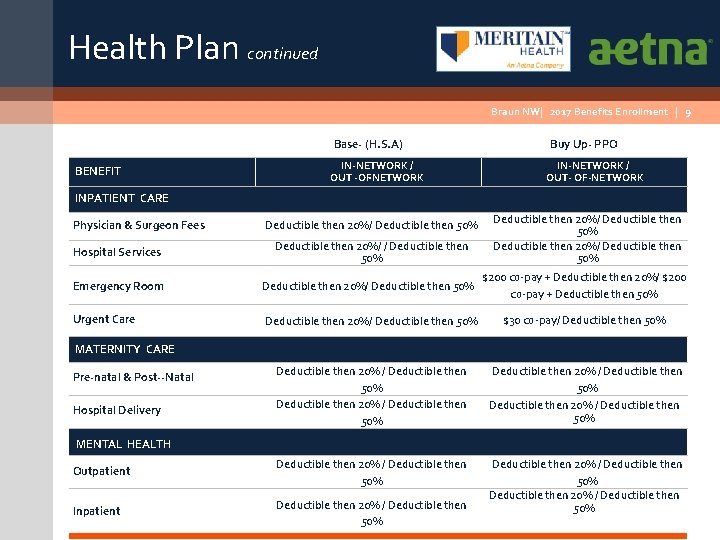

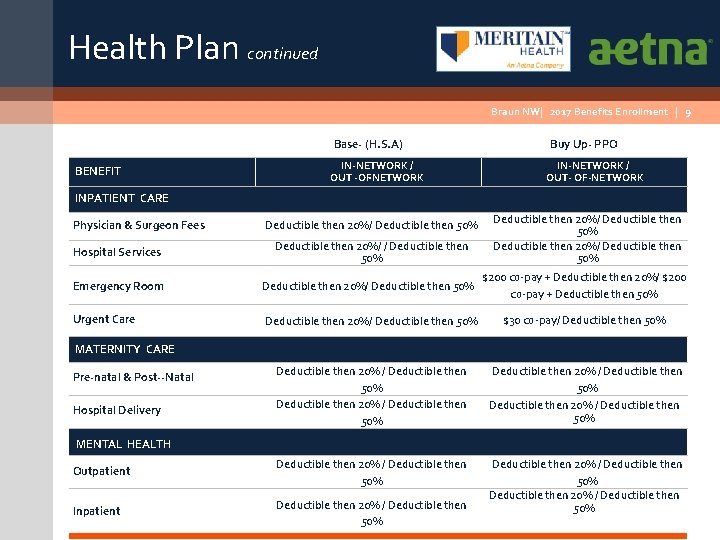

Health Plan continued Braun NW| 2017 Benefits Enrollment | 9 Base (H. S. A) BENEFIT IN NETWORK / OUT OF NETWORK Buy Up PPO IN NETWORK / OUT OF NETWORK INPATIENT CARE Physician & Surgeon Fees Deductible then 20%/ Deductible then 50% Hospital Services Deductible then 20%/ / Deductible then 50% Emergency Room Deductible then 20%/ Deductible then 50% $200 co-pay + Deductible then 20%/ $200 co-pay + Deductible then 50% Urgent Care Deductible then 20%/ Deductible then 50% $30 co-pay/ Deductible then 50% Deductible then 20% / Deductible then 50% Outpatient Deductible then 20% / Deductible then 50% Inpatient Deductible then 20% / Deductible then 50% MATERNITY CARE Pre natal & Post Natal Hospital Delivery MENTAL HEALTH

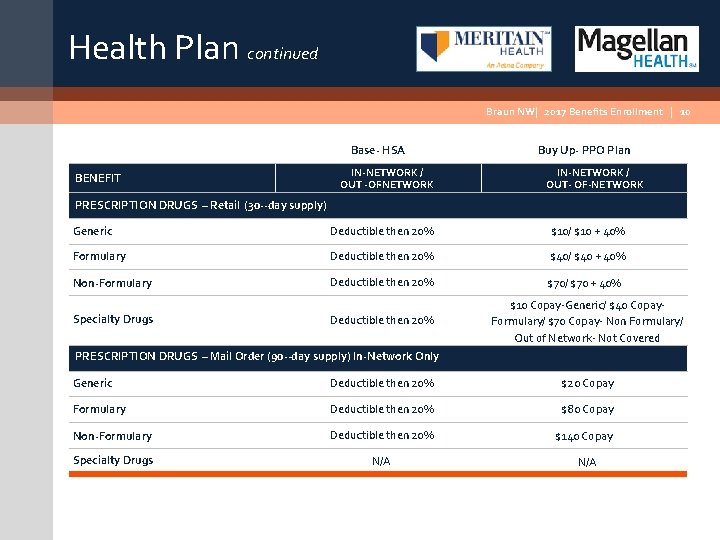

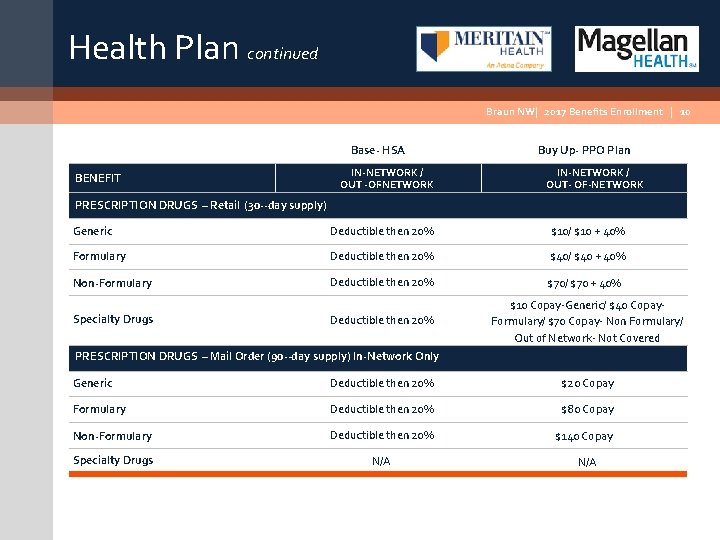

Health Plan continued Braun NW| 2017 Benefits Enrollment | 10 Base HSA BENEFIT IN NETWORK / OUT OF NETWORK Buy Up PPO Plan IN NETWORK / OUT OF NETWORK PRESCRIPTION DRUGS – Retail (30 day supply) Generic Deductible then 20% $10/ $10 + 40% Formulary Deductible then 20% $40/ $40 + 40% Non Formulary Deductible then 20% $70/ $70 + 40% Specialty Drugs Deductible then 20% $10 Copay-Generic/ $40 Copay. Formulary/ $70 Copay- Non Formulary/ Out of Network- Not Covered PRESCRIPTION DRUGS – Mail Order (90 day supply) In Network Only Generic Deductible then 20% $20 Copay Formulary Deductible then 20% $80 Copay Non Formulary Deductible then 20% $140 Copay Specialty Drugs N/A

Braun NW| 2017 Benefits Enrollment | 11 Health Savings Account

What is an H. S. A / HDHP? Braun NW| 2017 Benefits Enrollment | 12 An HSA PLAN is made up of two parts: Ø High Deductible Health Plan Ø Health Savings Account A Health Savings Account (HSA): • Set aside a portion of your paycheck before taxes into an account (reduces taxable income) • Rolls from year to year • It is your account – even if you leave Braun NW • Help you pay for qualified medical expenses for you and your dependents! • It can also help you plan for future medical expenses • Funds may be invested in mutual funds yielding tax free earnings* • Can use funds for dependent expenses even if they are not your health plan *LBG Advisors are not tax advisors. Please consult your tax advisor for details.

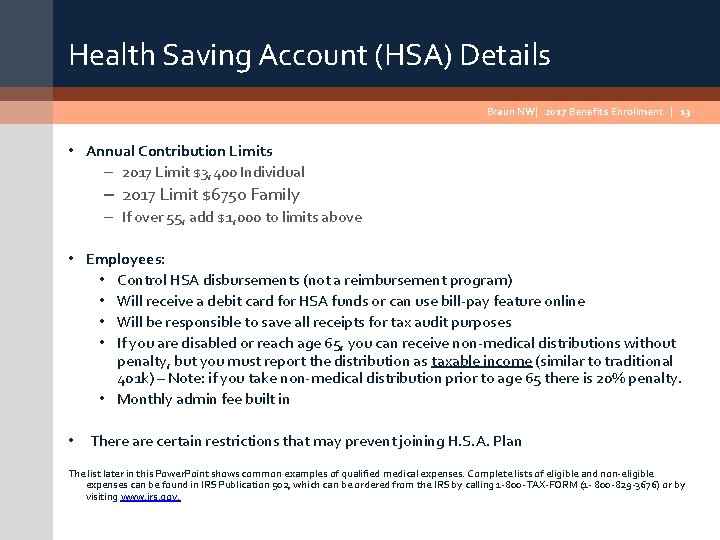

Health Saving Account (HSA) Details Braun NW| 2017 Benefits Enrollment | 13 • Annual Contribution Limits – 2017 Limit $3, 400 Individual – 2017 Limit $6750 Family – If over 55, add $1, 000 to limits above • Employees: • Control HSA disbursements (not a reimbursement program) • Will receive a debit card for HSA funds or can use bill-pay feature online • Will be responsible to save all receipts for tax audit purposes • If you are disabled or reach age 65, you can receive non-medical distributions without penalty, but you must report the distribution as taxable income (similar to traditional 401 k) – Note: if you take non-medical distribution prior to age 65 there is 20% penalty. • Monthly admin fee built in • There are certain restrictions that may prevent joining H. S. A. Plan The list later in this Power. Point shows common examples of qualified medical expenses. Complete lists of eligible and non-eligible expenses can be found in IRS Publication 502, which can be ordered from the IRS by calling 1 -800 -TAX-FORM (1 - 800 -829 -3676) or by visiting www. irs. gov.

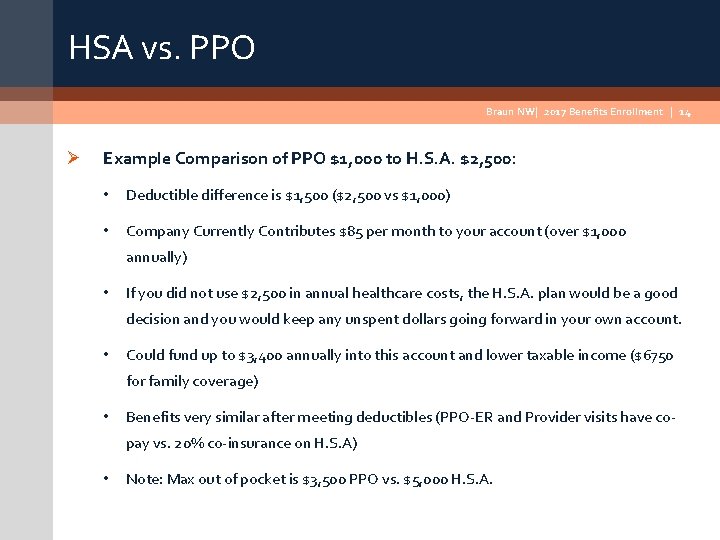

HSA vs. PPO Braun NW| 2017 Benefits Enrollment | 14 Ø Example Comparison of PPO $1, 000 to H. S. A. $2, 500: • Deductible difference is $1, 500 ($2, 500 vs $1, 000) • Company Currently Contributes $85 per month to your account (over $1, 000 annually) • If you did not use $2, 500 in annual healthcare costs, the H. S. A. plan would be a good decision and you would keep any unspent dollars going forward in your own account. • Could fund up to $3, 400 annually into this account and lower taxable income ($6750 for family coverage) • Benefits very similar after meeting deductibles (PPO-ER and Provider visits have copay vs. 20% co-insurance on H. S. A) • Note: Max out of pocket is $3, 500 PPO vs. $5, 000 H. S. A.

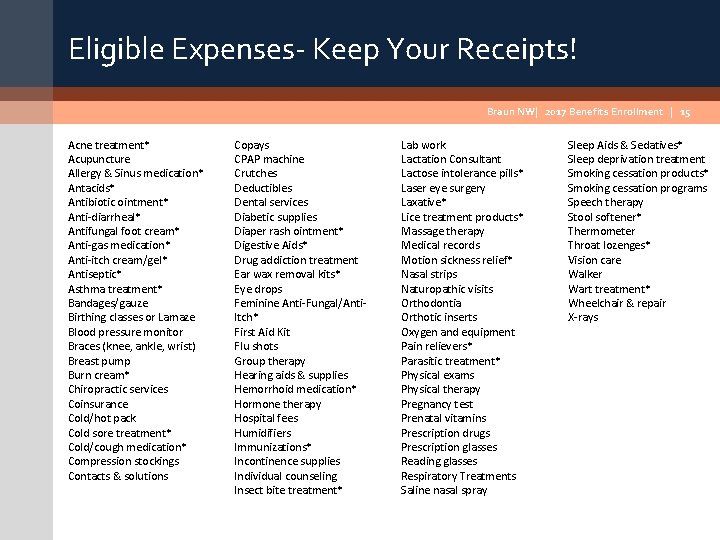

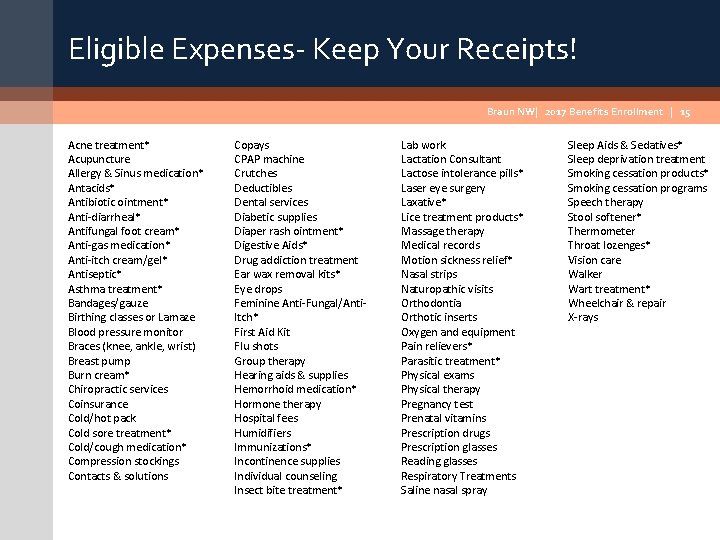

Eligible Expenses- Keep Your Receipts! Braun NW| 2017 Benefits Enrollment | 15 Acne treatment* Acupuncture Allergy & Sinus medication* Antacids* Antibiotic ointment* Anti-diarrheal* Antifungal foot cream* Anti-gas medication* Anti-itch cream/gel* Antiseptic* Asthma treatment* Bandages/gauze Birthing classes or Lamaze Blood pressure monitor Braces (knee, ankle, wrist) Breast pump Burn cream* Chiropractic services Coinsurance Cold/hot pack Cold sore treatment* Cold/cough medication* Compression stockings Contacts & solutions Copays CPAP machine Crutches Deductibles Dental services Diabetic supplies Diaper rash ointment* Digestive Aids* Drug addiction treatment Ear wax removal kits* Eye drops Feminine Anti-Fungal/Anti. Itch* First Aid Kit Flu shots Group therapy Hearing aids & supplies Hemorrhoid medication* Hormone therapy Hospital fees Humidifiers Immunizations* Incontinence supplies Individual counseling Insect bite treatment* Lab work Lactation Consultant Lactose intolerance pills* Laser eye surgery Laxative* Lice treatment products* Massage therapy Medical records Motion sickness relief* Nasal strips Naturopathic visits Orthodontia Orthotic inserts Oxygen and equipment Pain relievers* Parasitic treatment* Physical exams Physical therapy Pregnancy test Prenatal vitamins Prescription drugs Prescription glasses Reading glasses Respiratory Treatments Saline nasal spray Sleep Aids & Sedatives* Sleep deprivation treatment Smoking cessation products* Smoking cessation programs Speech therapy Stool softener* Thermometer Throat lozenges* Vision care Walker Wart treatment* Wheelchair & repair X-rays

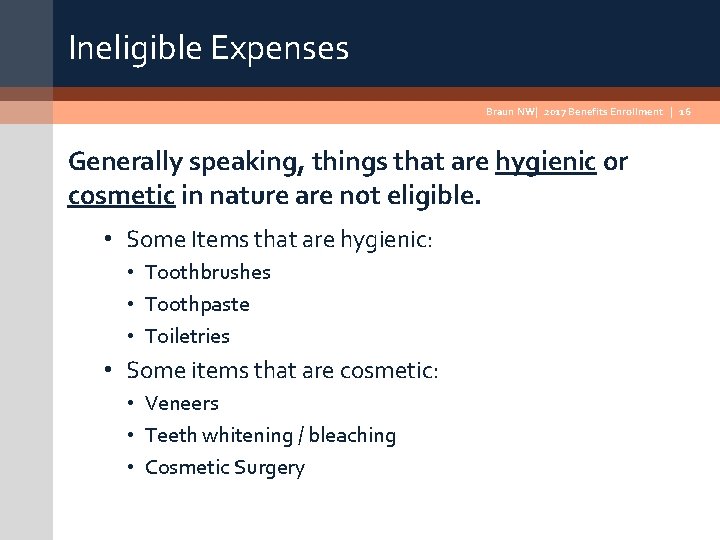

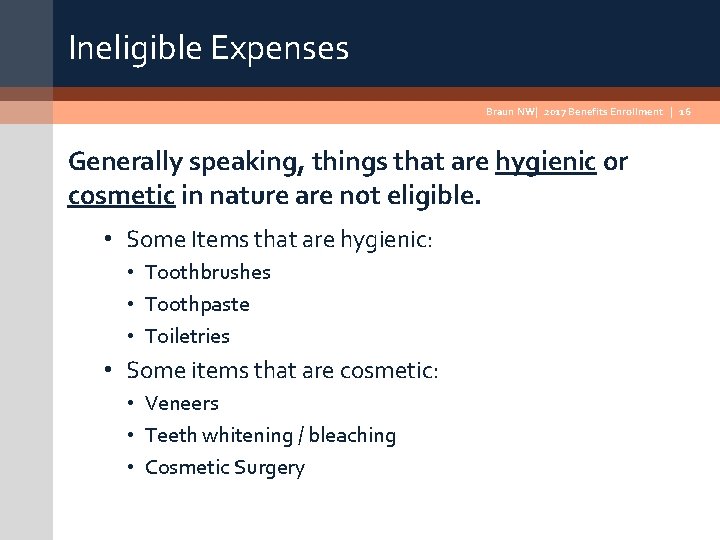

Ineligible Expenses Braun NW| 2017 Benefits Enrollment | 16 Generally speaking, things that are hygienic or cosmetic in nature are not eligible. • Some Items that are hygienic: • Toothbrushes • Toothpaste • Toiletries • Some items that are cosmetic: • Veneers • Teeth whitening / bleaching • Cosmetic Surgery

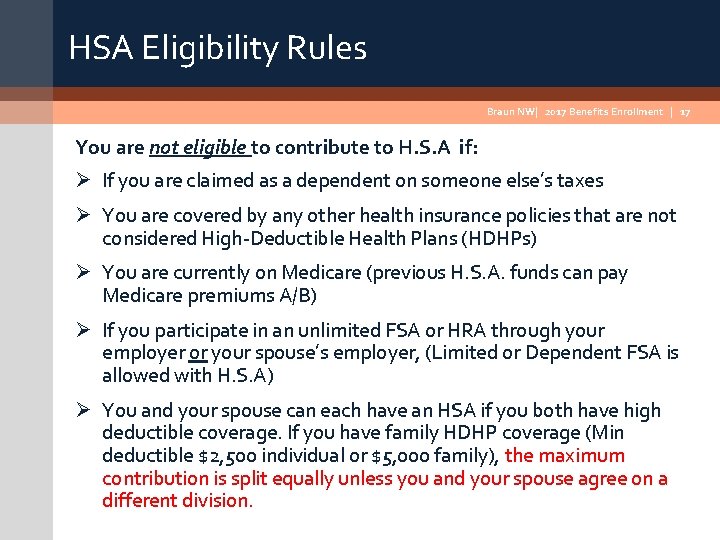

HSA Eligibility Rules Braun NW| 2017 Benefits Enrollment | 17 You are not eligible to contribute to H. S. A if: Ø If you are claimed as a dependent on someone else’s taxes Ø You are covered by any other health insurance policies that are not considered High-Deductible Health Plans (HDHPs) Ø You are currently on Medicare (previous H. S. A. funds can pay Medicare premiums A/B) Ø If you participate in an unlimited FSA or HRA through your employer or your spouse’s employer, (Limited or Dependent FSA is allowed with H. S. A) Ø You and your spouse can each have an HSA if you both have high deductible coverage. If you have family HDHP coverage (Min deductible $2, 500 individual or $5, 000 family), the maximum contribution is split equally unless you and your spouse agree on a different division.

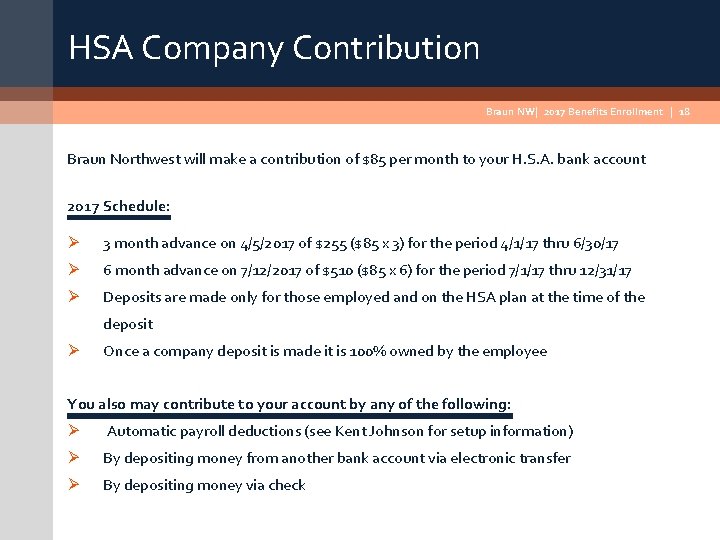

HSA Company Contribution Braun NW| 2017 Benefits Enrollment | 18 Braun Northwest will make a contribution of $85 per month to your H. S. A. bank account 2017 Schedule: Ø 3 month advance on 4/5/2017 of $255 ($85 x 3) for the period 4/1/17 thru 6/30/17 Ø 6 month advance on 7/12/2017 of $510 ($85 x 6) for the period 7/1/17 thru 12/31/17 Ø Deposits are made only for those employed and on the HSA plan at the time of the deposit Ø Once a company deposit is made it is 100% owned by the employee You also may contribute to your account by any of the following: Ø Automatic payroll deductions (see Kent Johnson for setup information) Ø By depositing money from another bank account via electronic transfer Ø By depositing money via check

2017 Rate Overview Braun NW| 2017 Benefits Enrollment | 19 Ø Please Reference Rate Sheet in Hand outs Ø Also posted on website www. Braun. Northwest. Benefits. com Ø Kent Johnson / Rate Overview

Braun NW| 2017 Benefits Enrollment | 20 Provider Network:

Aetna Provider Network Braun NW| 2017 Benefits Enrollment | 21 Ø Strong In Network Coverage Compared to Premera Ø Remind Your Provider to Update Billing Information Effective 1/1/17 Aetna In Network Search Instructions: Ø Go Braun Benefits Web page Ø Click on Provider lookup tab: Ø www. Braun. Northwest. Benefits. com Plan Co insurance levels: Ø In Network co insurance 80%, Ø Out of Network co insurance 50%

Braun NW| 2017 Benefits Enrollment | 22 New: Medical Membership Program

Medical Membership Program Braun NW| 2017 Benefits Enrollment | 23 Ø Braun NW is working with Washington Park Direct Care to provide a “Membership Medical Program” in addition to the standard medical plan offering. Ø Employees will still have their traditional premium share Ø Braun NW is paying half of the “Membership” cost. The employee cost will be an additional $25 per month Ø Services provided by Washington Park Direct Care will be routine office visits on an as needed basis Ø Some services are not included in the basic Membership such as: lab tests, x-rays, RX. etc

Washington Park Urgent Care/Direct Care Braun NW| 2017 Benefits Enrollment | 24 Ø Washington Park Direct Care also offers an Urgent Care and Walk-in clinic There will be a brief meeting after the presentation to answer any questions regarding the programs with Washington Park Direct Care

Braun NW| 2017 Benefits Enrollment | 25 Dental:

Dental Plan continued Braun NW| 2017 Benefits Enrollment | 26 Ø New Standard Dental Plan Begins 1/1/17 Ø New Cards to be distributed by HR Dept. Group number and phone number on new website if needed. Ø Online In Network Search: http: //ameritas dental. prismisp. com/ Ø Three types of coverage: • Preventive and Diagnostic • Basic services • Major services *Reference www. Braun. Northwest. Benefits. com for specific coverage details under “Dental” tab

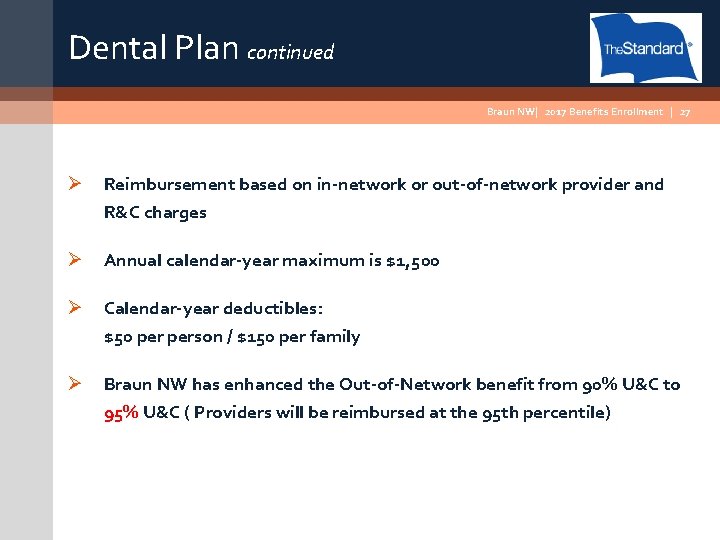

Dental Plan continued Braun NW| 2017 Benefits Enrollment | 27 Ø Reimbursement based on in network or out of network provider and R&C charges Ø Annual calendar year maximum is $1, 500 Ø Calendar year deductibles: $50 person / $150 per family Ø Braun NW has enhanced the Out of Network benefit from 90% U&C to 95% U&C ( Providers will be reimbursed at the 95 th percentile)

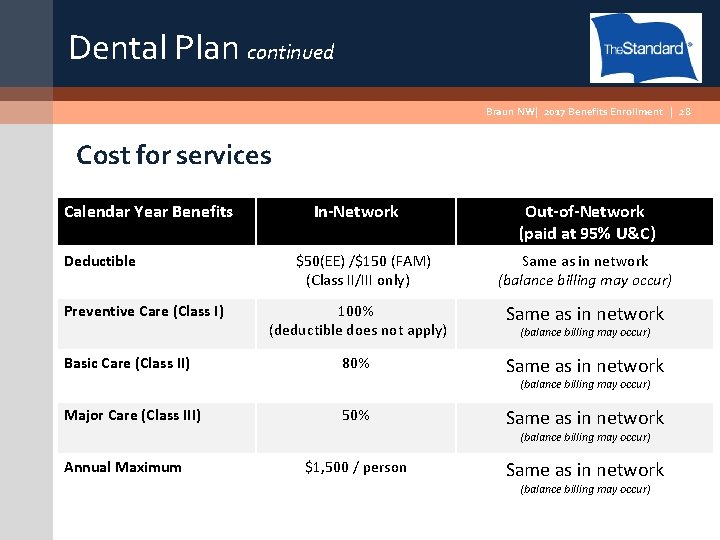

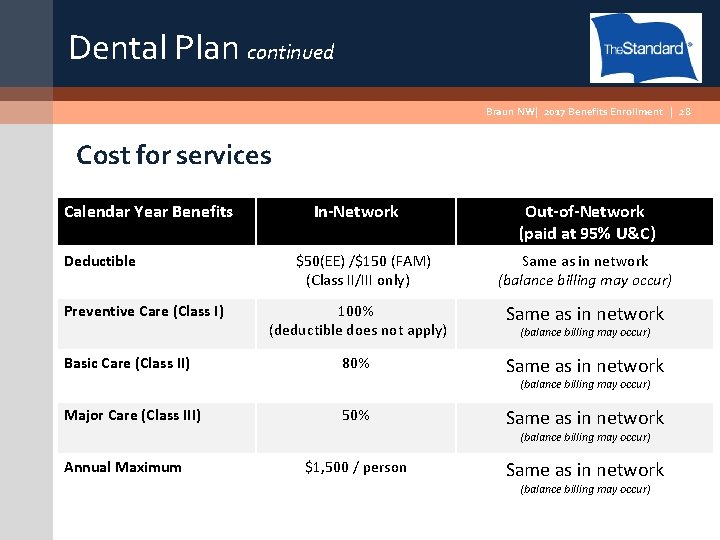

Dental Plan continued Braun NW| 2017 Benefits Enrollment | 28 Cost for services Calendar Year Benefits Deductible Preventive Care (Class I) Basic Care (Class II) In-Network $50(EE) /$150 (FAM) (Class II/III only) Out-of-Network (paid at 95% U&C) Same as in network (balance billing may occur) 100% (deductible does not apply) Same as in network 80% Same as in network (balance billing may occur) Major Care (Class III) 50% Same as in network (balance billing may occur) Annual Maximum $1, 500 / person Same as in network (balance billing may occur)

Vision Plan Provided by VSP Vision Services Braun NW| 2017 Benefits Enrollment | 29 Ø Large U. S. network of providers Ø Private practitioners and major retail centers Ø Eye exams, frames, lenses, and contacts

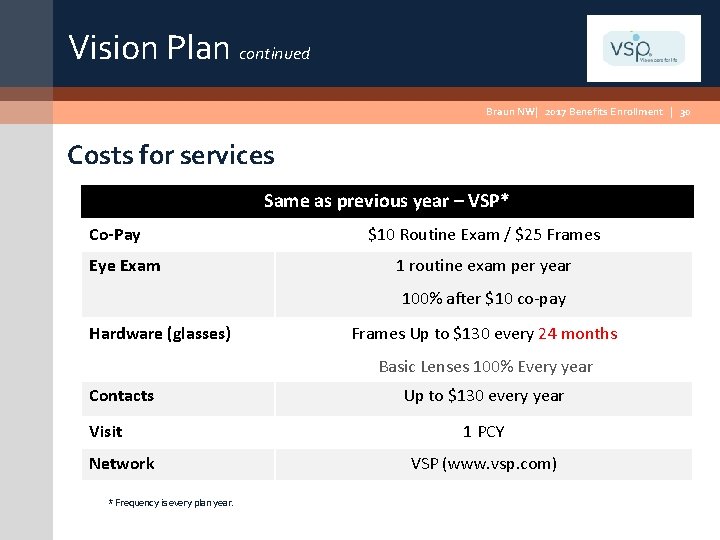

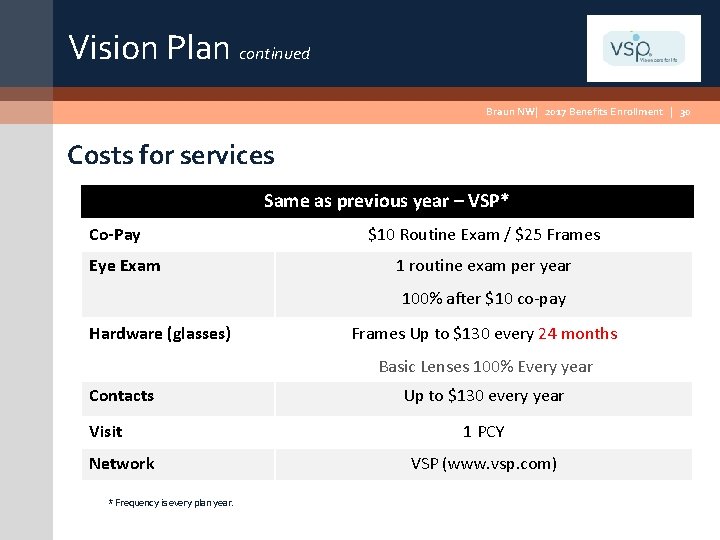

Vision Plan continued Braun NW| 2017 Benefits Enrollment | 30 Costs for services Same as previous year – VSP* Co-Pay Eye Exam $10 Routine Exam / $25 Frames 1 routine exam per year 100% after $10 co-pay Hardware (glasses) Frames Up to $130 every 24 months Basic Lenses 100% Every year Contacts Visit Network * Frequency is every plan year. Up to $130 every year 1 PCY VSP (www. vsp. com)

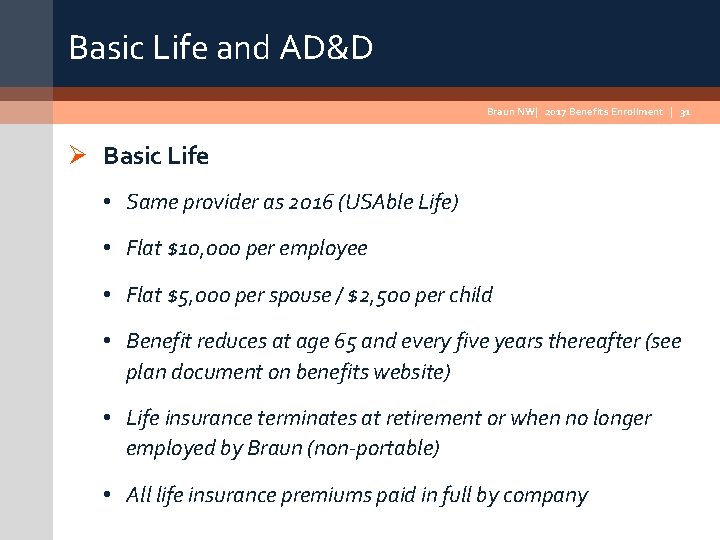

Basic Life and AD&D Braun NW| 2017 Benefits Enrollment | 31 Ø Basic Life • Same provider as 2016 (USAble Life) • Flat $10, 000 per employee • Flat $5, 000 per spouse / $2, 500 per child • Benefit reduces at age 65 and every five years thereafter (see plan document on benefits website) • Life insurance terminates at retirement or when no longer employed by Braun (non-portable) • All life insurance premiums paid in full by company

Next Steps Braun NW| 2017 Benefits Enrollment | 32 Ø Everyone must complete new enrollment forms for all coverages including waiver form if applicable. Ø Forms located at: www. Braun. Northwest. Benefits. com Ø All forms are due no later than 5 pm on Friday 12/16/2016 Ø If you select H. S. A. option, please see Kent Johnson to complete Optum Bank Account Setup and any payroll deduction elections Ø Fill any “Maintenance” Drugs before 12/31 Ø New Medical & Dental Cards Available from HR Dept. by 12/23/16 – Temporary Card information including group numbers to be posted on benefits website.

Contact Information Braun NW| 2017 Benefits Enrollment | 33 Ø Your HR Dept. • Ø Reference benefit website at www. Braun. Northwest. Benefits. com • Ø Ø For general questions about enrollment and benefit coverages Contact Each Carrier’s Customer Service # • For all lines of coverage (Medical, Dental, Vision, H. S. A. , etc. ) there a team of specialists who are available to help answer your questions with information readily available. • Typically this will be your fastest response Please reach out to your LBG Advisors support service team • 877 -485 -2120 (Stacie, Kris, Matt, Scott) • Stacie@lbgadvisors. com, kris@lbgadvisors. com, matt@lbgadvisors. com, scott@lbgadvisors. com