Competitive strategies for Swiss industries Philip Mosimann CEO

- Slides: 27

Competitive strategies for Swiss industries Philip Mosimann, CEO Präsentationstitel 1. Monat 2005 Page 1

Contents 1. Brief portrait of Bucher Industries 2. Pre-conditions in Switzerland 3. Examples of competitive strategies 4. Some personal considerations 5. Discussion WTO 27 March 2012 Page 2

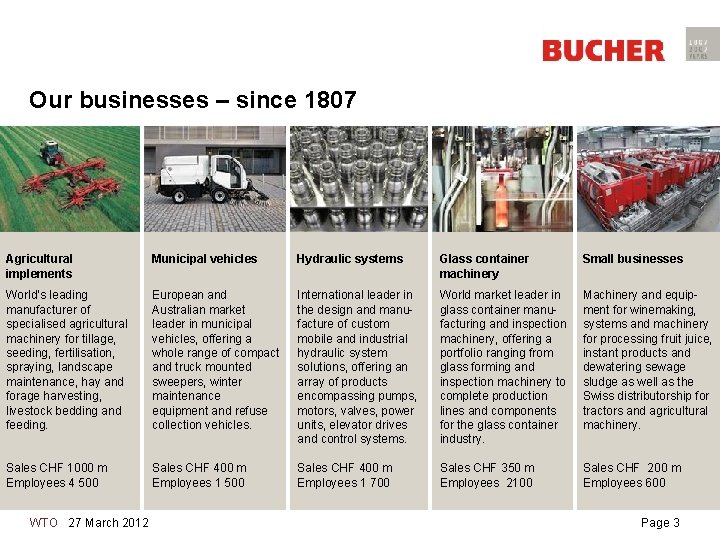

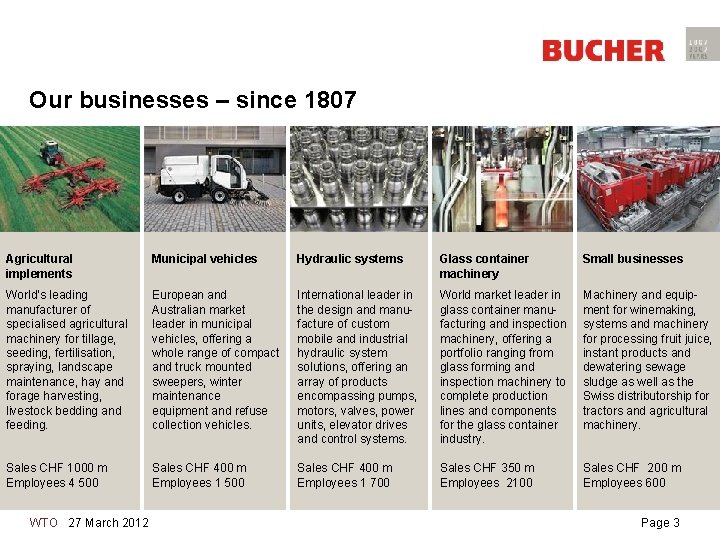

Our businesses – since 1807 Agricultural implements Municipal vehicles Hydraulic systems Glass container machinery Small businesses World’s leading manufacturer of specialised agricultural machinery for tillage, seeding, fertilisation, spraying, landscape maintenance, hay and forage harvesting, livestock bedding and feeding. European and Australian market leader in municipal vehicles, offering a whole range of compact and truck mounted sweepers, winter maintenance equipment and refuse collection vehicles. International leader in the design and manufacture of custom mobile and industrial hydraulic system solutions, offering an array of products encompassing pumps, motors, valves, power units, elevator drives and control systems. World market leader in glass container manufacturing and inspection machinery, offering a portfolio ranging from glass forming and inspection machinery to complete production lines and components for the glass container industry. Machinery and equipment for winemaking, systems and machinery for processing fruit juice, instant products and dewatering sewage sludge as well as the Swiss distributorship for tractors and agricultural machinery. Sales CHF 1000 m Employees 4 500 Sales CHF 400 m Employees 1 700 Sales CHF 350 m Employees 2100 Sales CHF 200 m Employees 600 WTO 27 March 2012 Page 3

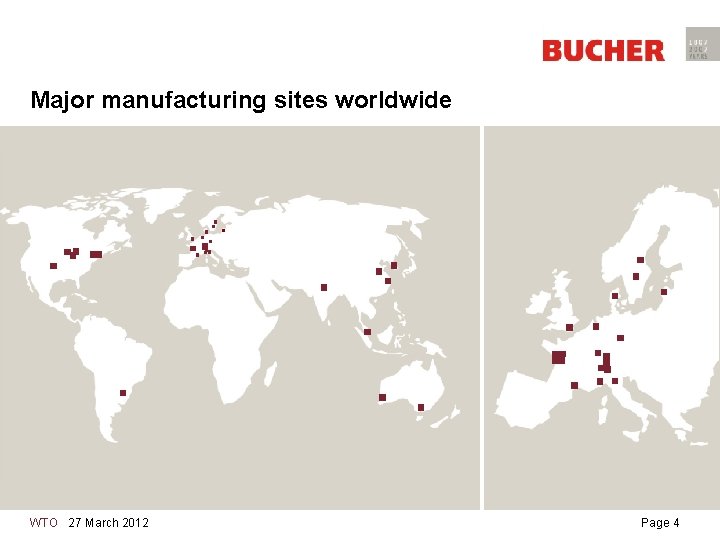

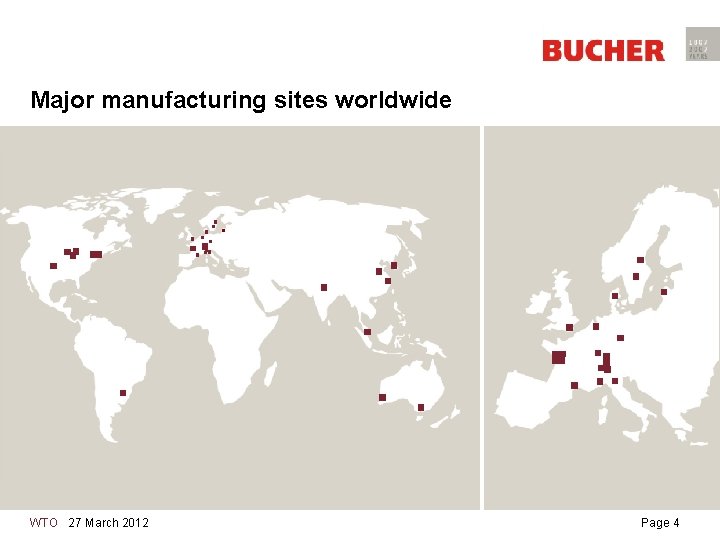

Major manufacturing sites worldwide WTO 27 March 2012 Page 4

Bucher group strategy (1) Principles • “Stakeholder approach” with long term, industrial view • Increase of enterprise value (RONOA>>WACC) • Businesses with worldwide technology and market leadership with #1 to #3 market positions • Profitable growth, where profit growth is prioritised • Focus on organic growth enhanced with specific targeted acquisitions strengthening existing businesses • Strong balance sheet with high liquid funds for independance from banks and stock exchange WTO 27 March 2012 Page 5

Bucher group strategy (2) Implementation of principles: • Do what we understand: machinery and vehicles • Do what we can best: “Best owner” of our businesses • Do what we can handle: number of businesses 4 to 6 • Do what we can finance: Cash-flow and growth • Do what creates value: Innovation and profitable growth Consequences in group management • Lean and decentralised management structure • Lived entrepreneurial attitude with common methodologies • Balance of trust and reasonable controls WTO 27 March 2012 Page 6

Pre-conditions in Switzerland • Generell environment - Excellent infrastructure for business, living, and leisure - High security level politically, socially, financially - Internationally open society, entrepreneurial freedom, competitive tax systems both in business as well as in private - High cost country with strong currency • Education and innovation - Universities, technical high schools, dual education system - Established knowledge transfer fro universities to businesses • Swiss businesses - No or very small home market - Quality, reliability, innovation, automisation, work ethics - World champion in exports per capita WTO 27 March 2012 Page 7

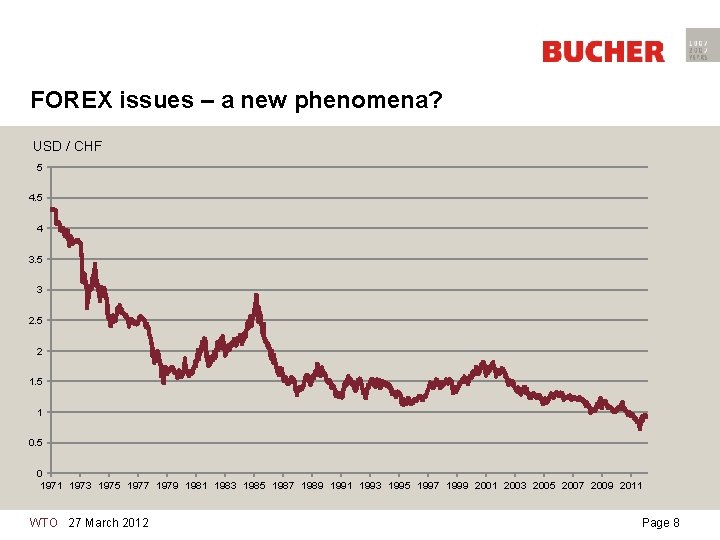

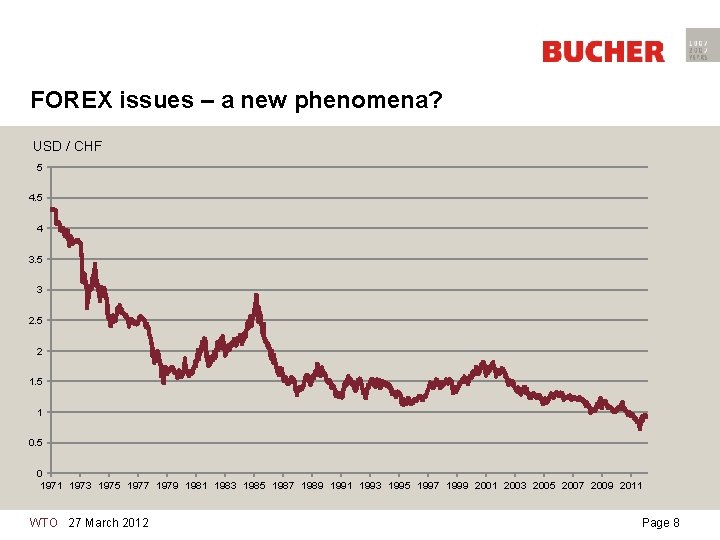

FOREX issues – a new phenomena? USD / CHF 5 4 3. 5 3 2. 5 2 1. 5 1 0. 5 0 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 WTO 27 March 2012 Page 8

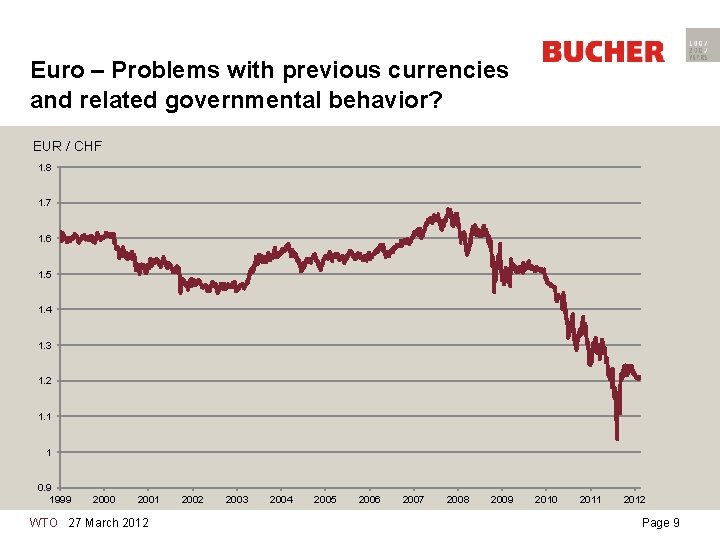

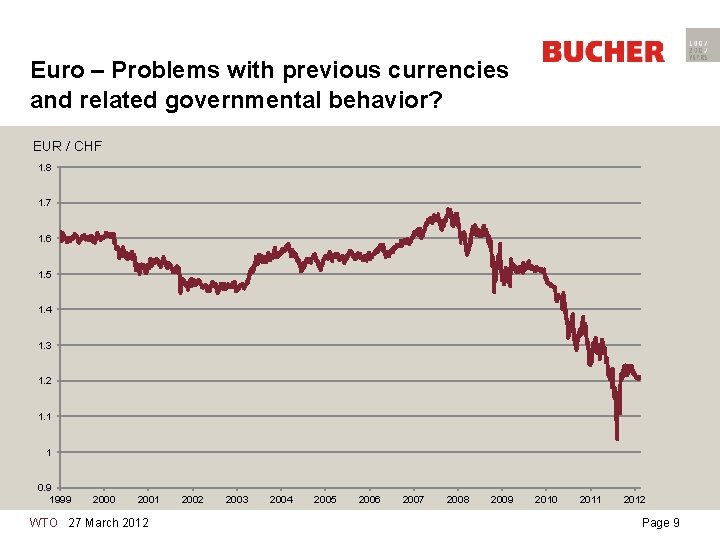

Euro – Problems with previous currencies and related governmental behavior? EUR / CHF 1. 8 1. 7 1. 6 1. 5 1. 4 1. 3 1. 2 1. 1 1 0. 9 1999 2000 2001 WTO 27 March 2012 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Page 9

Competitive strategies Topics on any board agenda • Access to main markets which are outside Switzerland - Manufacturing at one place, export worldwide - Split of value & supply chain: why, how? - Protectionism today and tomorrow • Which technologies for which markets • What can we do better here than elsewhere? Why, how? • What exactly means “better” – customers decide! • For which technologies, products, applications is “Swiss made” the best solution? For which ones not? WTO 27 March 2012 Page 10

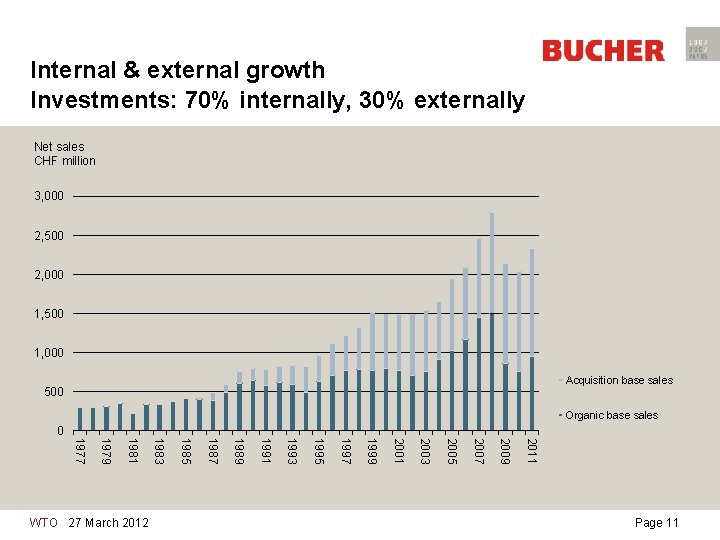

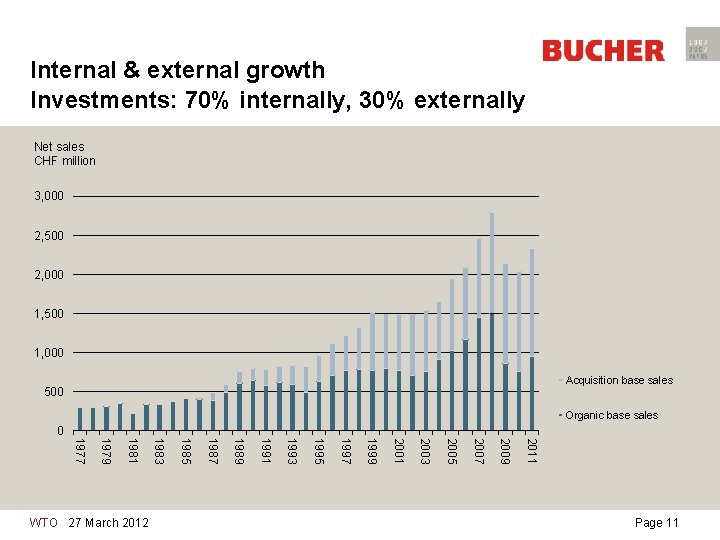

Internal & external growth Investments: 70% internally, 30% externally Net sales CHF million 3, 000 2, 500 2, 000 1, 500 1, 000 Acquisition base sales 500 Organic base sales 0 2011 2009 2007 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 WTO 27 March 2012 Page 11

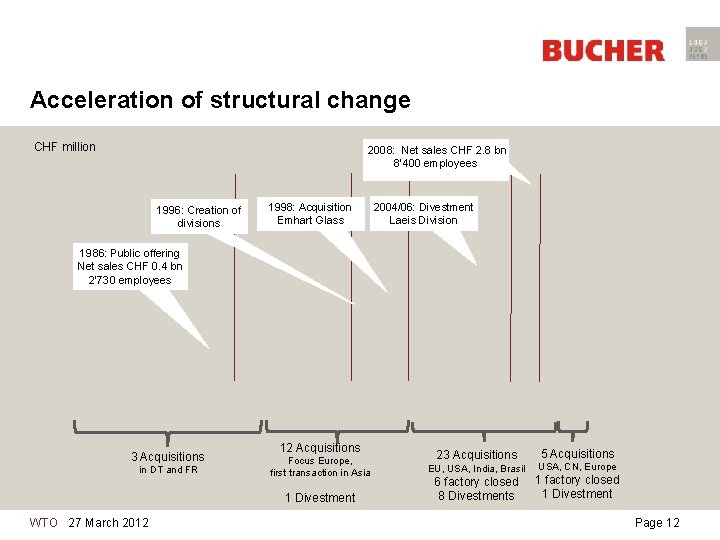

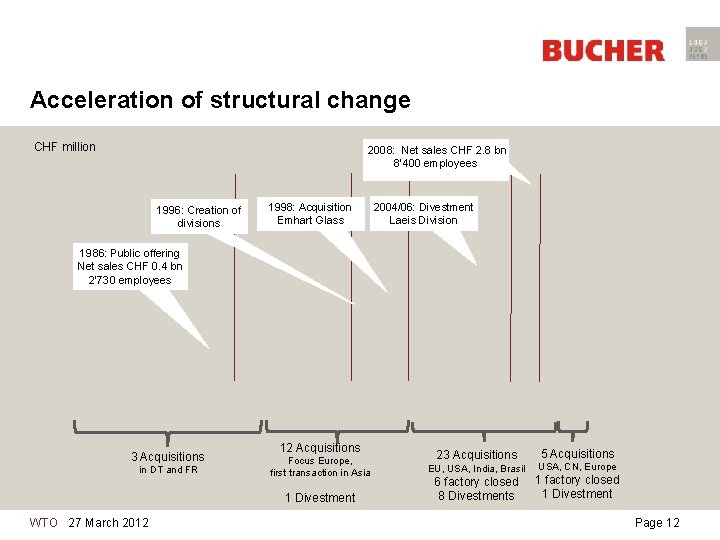

Acceleration of structural change CHF million 2008: Net sales CHF 2. 8 bn 8‘ 400 employees 1996: Creation of divisions 1998: Acquisition Emhart Glass 2004/06: Divestment Laeis Division 1986: Public offering Net sales CHF 0. 4 bn 2‘ 730 employees 3 Acquisitions in DT and FR 12 Acquisitions Focus Europe, first transaction in Asia 1 Divestment WTO 27 March 2012 23 Acquisitions EU, USA, India, Brasil 6 factory closed 8 Divestments 5 Acquisitions USA, CN, Europe 1 factory closed 1 Divestment Page 12

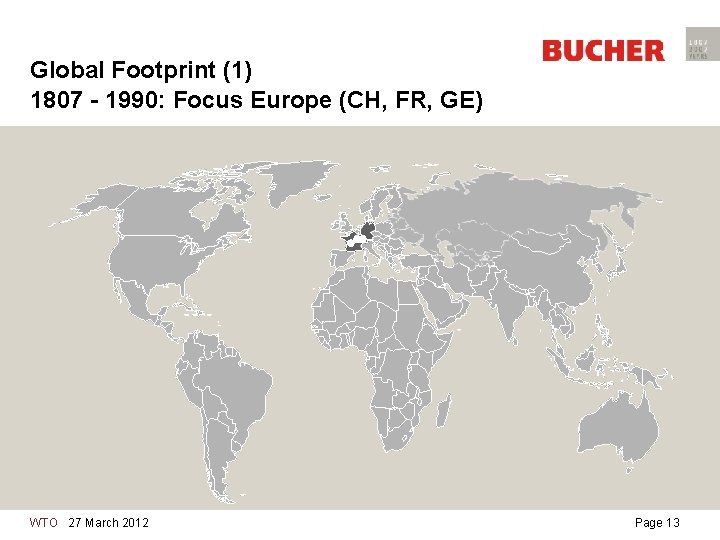

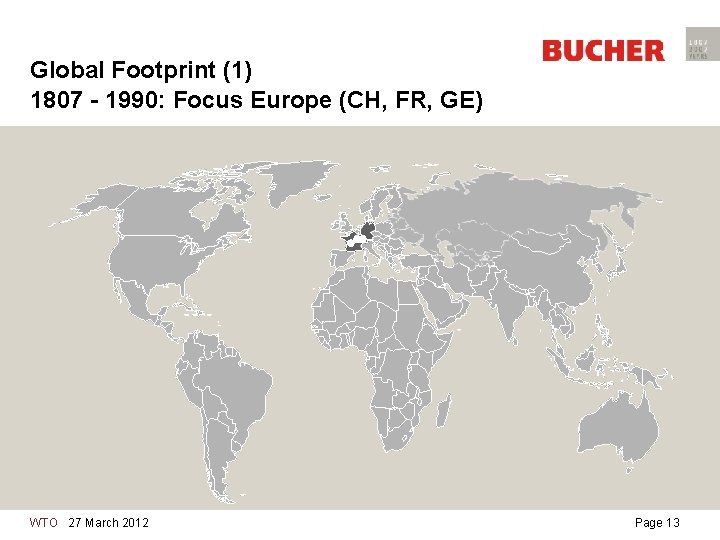

Global Footprint (1) 1807 - 1990: Focus Europe (CH, FR, GE) WTO 27 March 2012 Page 13

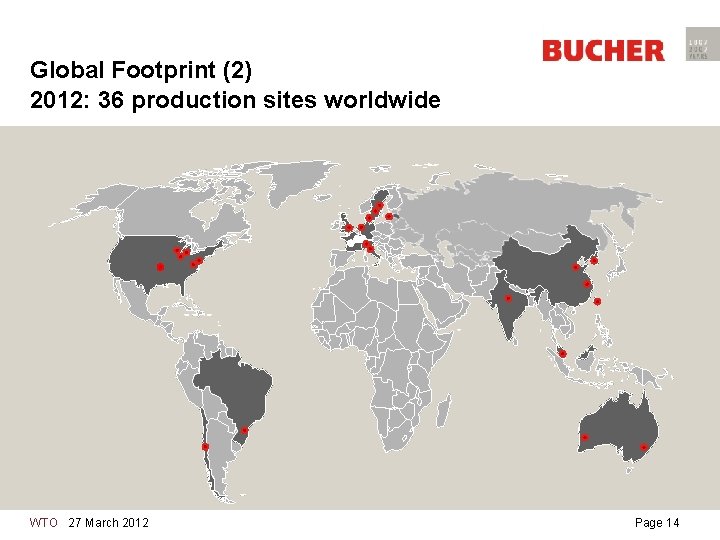

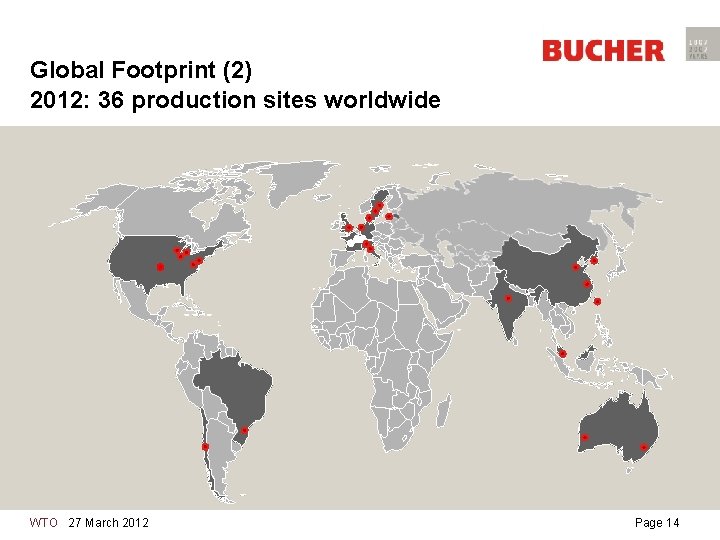

Global Footprint (2) 2012: 36 production sites worldwide WTO 27 March 2012 Page 14

Acquisition… 2002 Knight Manufacturing, Brodhead, USA WTO 27 March 2012 Page 15

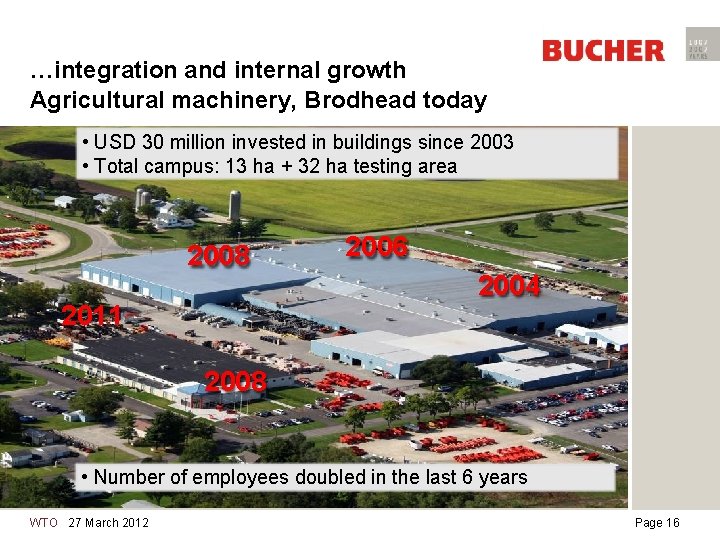

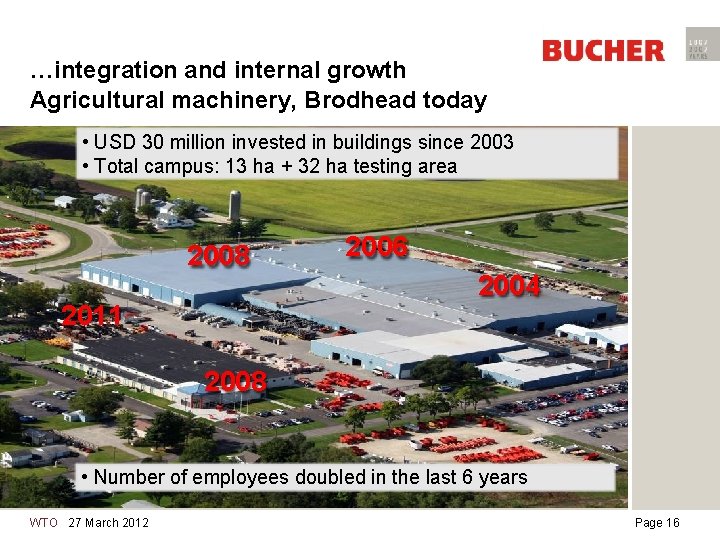

…integration and internal growth Agricultural machinery, Brodhead today • USD 30 million invested in buildings since 2003 • Total campus: 13 ha + 32 ha testing area 2008 2011 2006 2004 2008 • Number of employees doubled in the last 6 years WTO 27 March 2012 Page 16

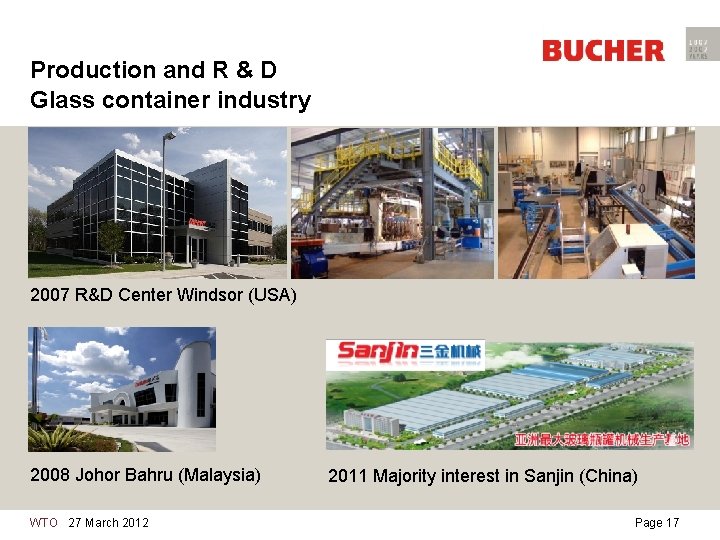

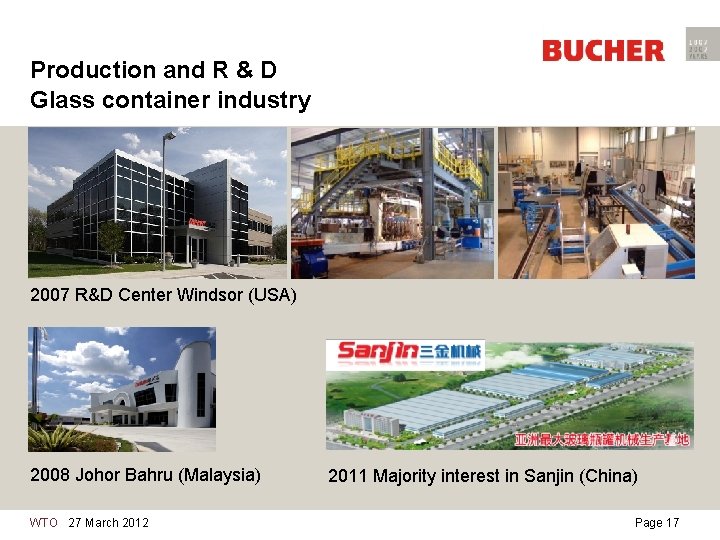

Production and R & D Glass container industry 2007 R&D Center Windsor (USA) 2008 Johor Bahru (Malaysia) WTO 27 March 2012 2011 Majority interest in Sanjin (China) Page 17

Swiss success story (1) Hydraulic systems, Frutigen 1974 – 1993 Bei der Übernahme 1997 2000 Heute WTO 27 March 2012 Page 18

Swiss success story (2) Hydraulic systems, Neuheim • Bilder folgen WTO 27 March 2012 Page 19

Swiss success story (3) Municipal vehicles, Ventspils, Latvia WTO 27 March 2012 Page 20

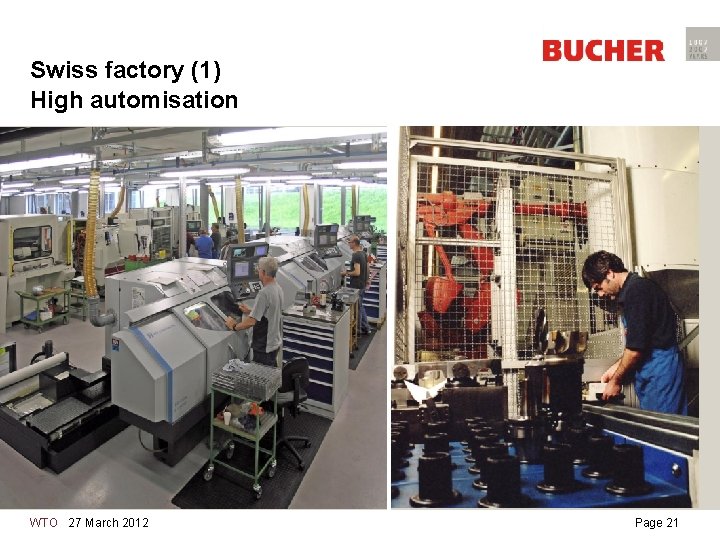

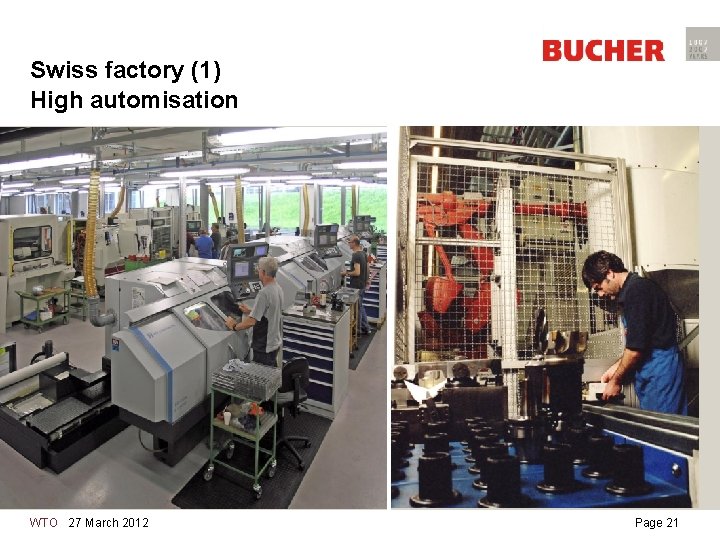

Swiss factory (1) High automisation WTO 27 March 2012 Page 21

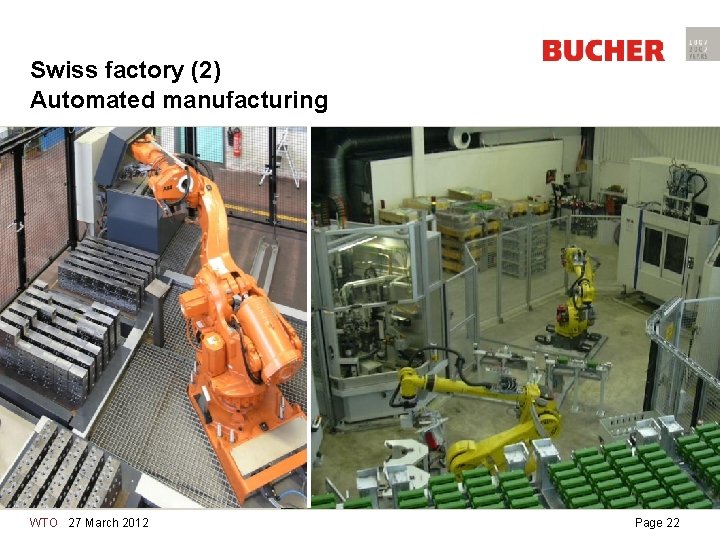

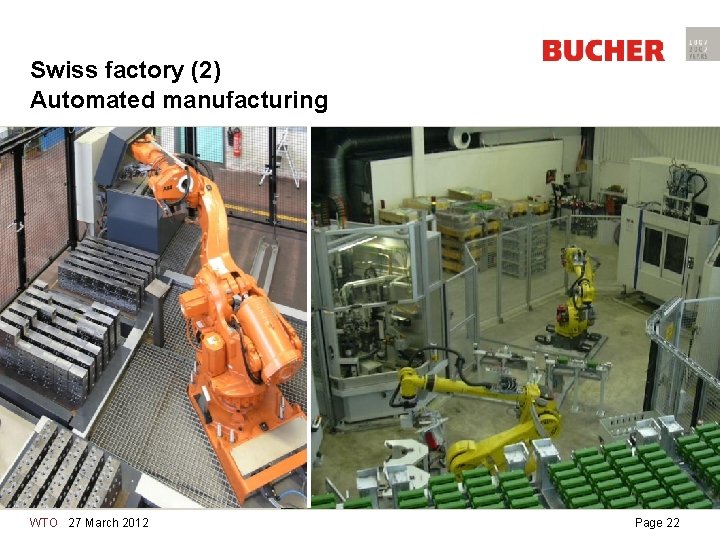

Swiss factory (2) Automated manufacturing WTO 27 March 2012 Page 22

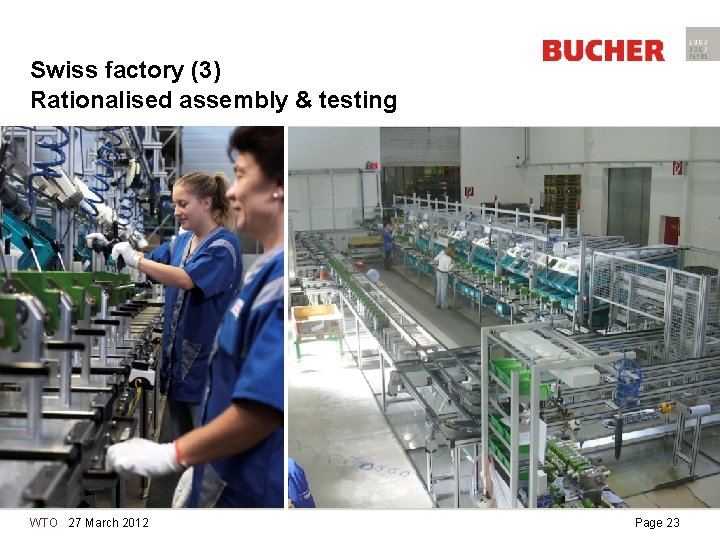

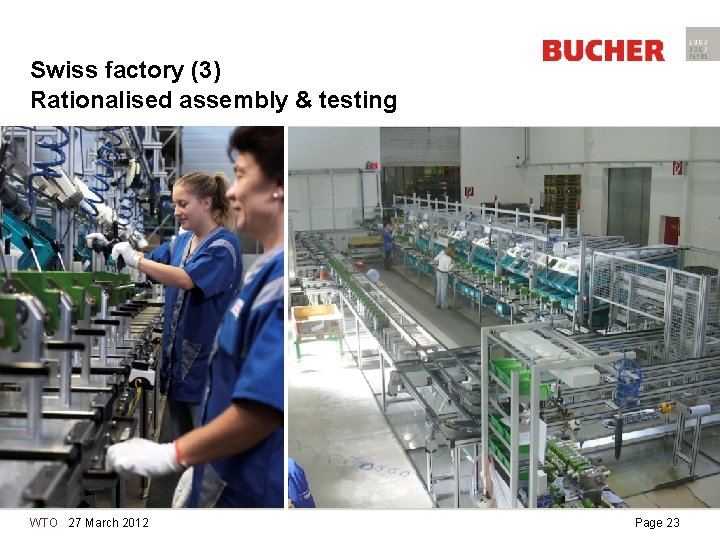

Swiss factory (3) Rationalised assembly & testing WTO 27 March 2012 Page 23

Swiss owned & run factory (4) Manufacturing and assembly WTO 27 March 2012 Page 24

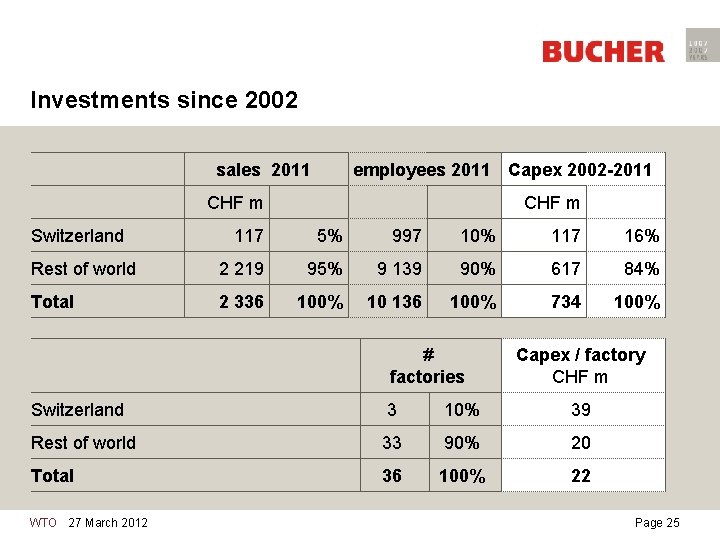

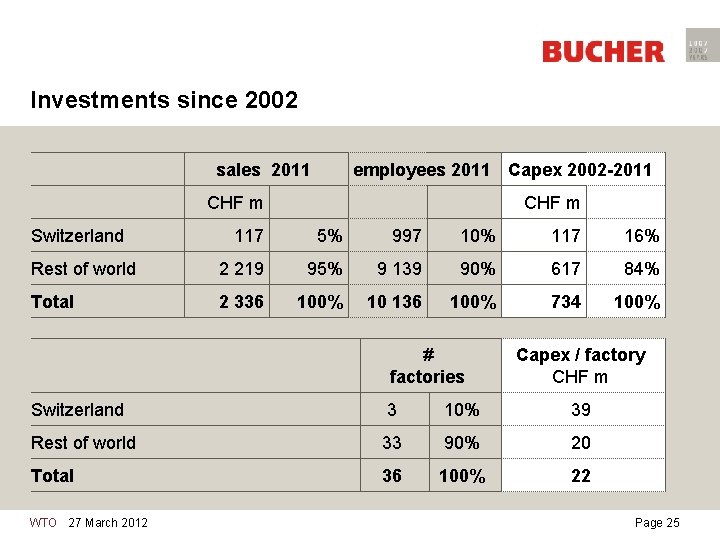

Investments since 2002 sales 2011 employees 2011 Capex 2002 -2011 CHF m Switzerland CHF m 117 5% 997 10% 117 16% Rest of world 2 219 95% 9 139 90% 617 84% Total 2 336 100% 10 136 100% 734 100% # factories Capex / factory CHF m Switzerland 3 10% 39 Rest of world 33 90% 20 Total 36 100% 22 WTO 27 March 2012 Page 25

Personal considerations Cometitiveness in Switzerland 1. Expand excellent pre-conditions in Switzerland 2. Intensify co-operation with universities 3. Innovation and R&D: Continuity as success factor 4. Make structural changes fast; position company in major markets 5. Adapt supplier base to major markets 6. Permanent modernisation and automisation of factories 7. Create culture of continued improvement „Kaizen“ 8. Secure strong balance sheet and financing in good times 9. Understand FOREX hedging as buying of time 10. Build dedicated, competent and creative work force WTO 27 March 2012 Page 26

Thank you for your kind attention Präsentationstitel 1. Monat 2005 Page 27

Philip mosimann

Philip mosimann Bulk-gaining industry definition

Bulk-gaining industry definition Mature industries

Mature industries Competitive advantage in mature industries

Competitive advantage in mature industries Market commonality and resource similarity examples

Market commonality and resource similarity examples The two least common competitive structures are

The two least common competitive structures are Therapeutic index

Therapeutic index Most embryonic industries emerge from:

Most embryonic industries emerge from: Mintzberg generic competitive strategies

Mintzberg generic competitive strategies Kotler competitive strategies

Kotler competitive strategies What are the five generic competitive strategies

What are the five generic competitive strategies Integrated cost leadership/differentiation strategy

Integrated cost leadership/differentiation strategy Five generic competitive strategies examples

Five generic competitive strategies examples What are porter's four competitive strategies?

What are porter's four competitive strategies? Fredsgudinnan

Fredsgudinnan Tidbok yrkesförare

Tidbok yrkesförare Handledning reflektionsmodellen

Handledning reflektionsmodellen Orubbliga rättigheter

Orubbliga rättigheter Big brother rösta

Big brother rösta Verktyg för automatisering av utbetalningar

Verktyg för automatisering av utbetalningar Ministerstyre för och nackdelar

Ministerstyre för och nackdelar Tillitsbaserad ledning

Tillitsbaserad ledning Plats för toran ark

Plats för toran ark Omprov cellprov

Omprov cellprov Stig kerman

Stig kerman Sju för caesar

Sju för caesar Shingelfrisyren

Shingelfrisyren Vad är verksamhetsanalys

Vad är verksamhetsanalys