Competitive Advantage in Mature Industries OUTLINE Key success

- Slides: 9

Competitive Advantage in Mature Industries OUTLINE • Key success factors in mature industries • Strategic Implementation: Structure, Systems, Style • Strategies for declining industries

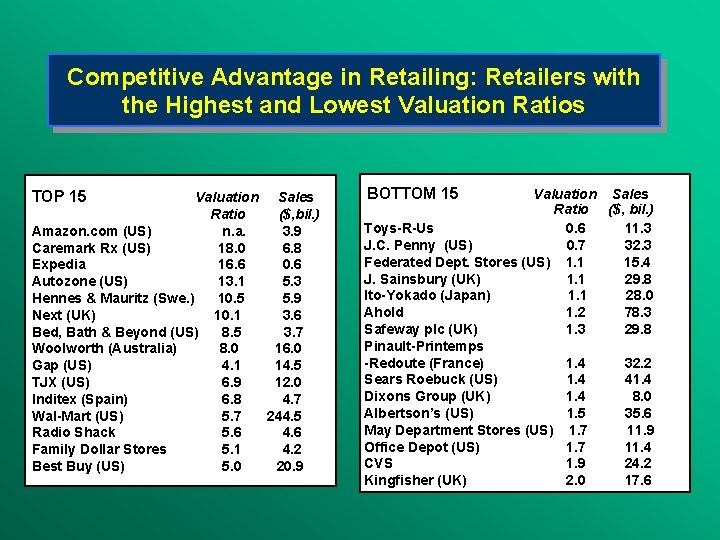

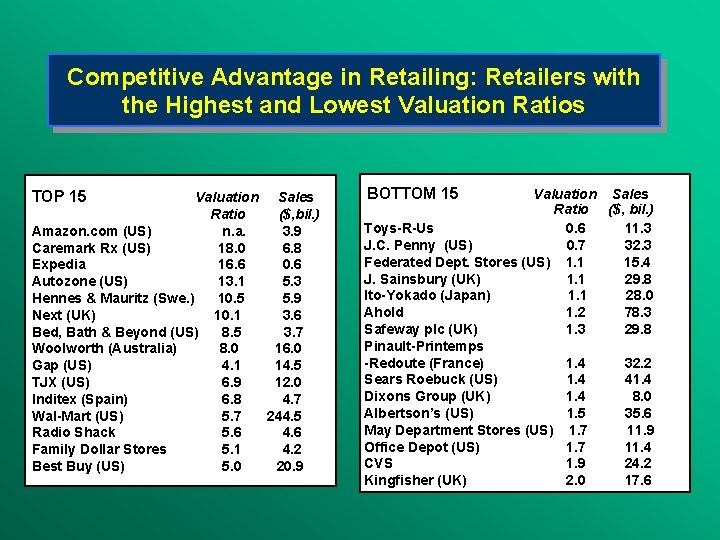

Competitive Advantage in Retailing: Retailers with the Highest and Lowest Valuation Ratios TOP 15 Valuation Sales Ratio ($, bil. ) Amazon. com (US) n. a. 3. 9 Caremark Rx (US) 18. 0 6. 8 Expedia 16. 6 0. 6 Autozone (US) 13. 1 5. 3 Hennes & Mauritz (Swe. ) 10. 5 5. 9 Next (UK) 10. 1 3. 6 Bed, Bath & Beyond (US) 8. 5 3. 7 Woolworth (Australia) 8. 0 16. 0 Gap (US) 4. 1 14. 5 TJX (US) 6. 9 12. 0 Inditex (Spain) 6. 8 4. 7 Wal-Mart (US) 5. 7 244. 5 Radio Shack 5. 6 4. 6 Family Dollar Stores 5. 1 4. 2 Best Buy (US) 5. 0 20. 9 BOTTOM 15 Valuation Sales Ratio ($, bil. ) Toys-R-Us 0. 6 11. 3 J. C. Penny (US) 0. 7 32. 3 Federated Dept. Stores (US) 1. 1 15. 4 J. Sainsbury (UK) 1. 1 29. 8 Ito-Yokado (Japan) 1. 1 28. 0 Ahold 1. 2 78. 3 Safeway plc (UK) 1. 3 29. 8 Pinault-Printemps -Redoute (France) 1. 4 32. 2 Sears Roebuck (US) 1. 4 41. 4 Dixons Group (UK) 1. 4 8. 0 Albertson’s (US) 1. 5 35. 6 May Department Stores (US) 1. 7 11. 9 Office Depot (US) 1. 7 11. 4 CVS 1. 9 24. 2 Kingfisher (UK) 2. 0 17. 6

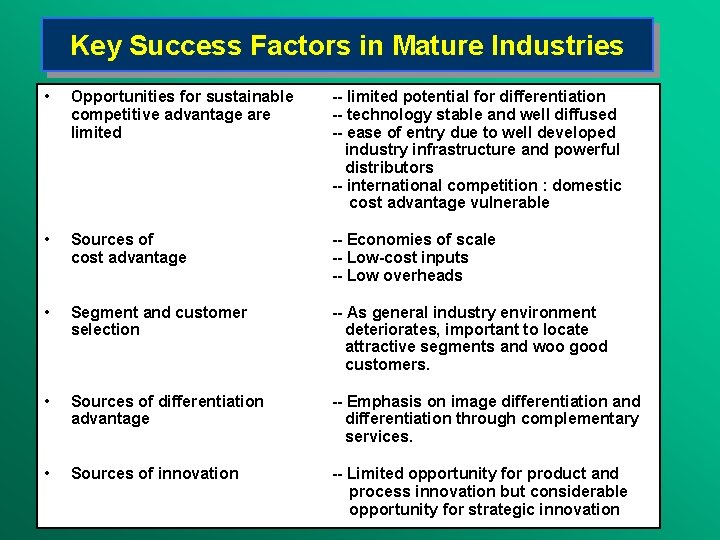

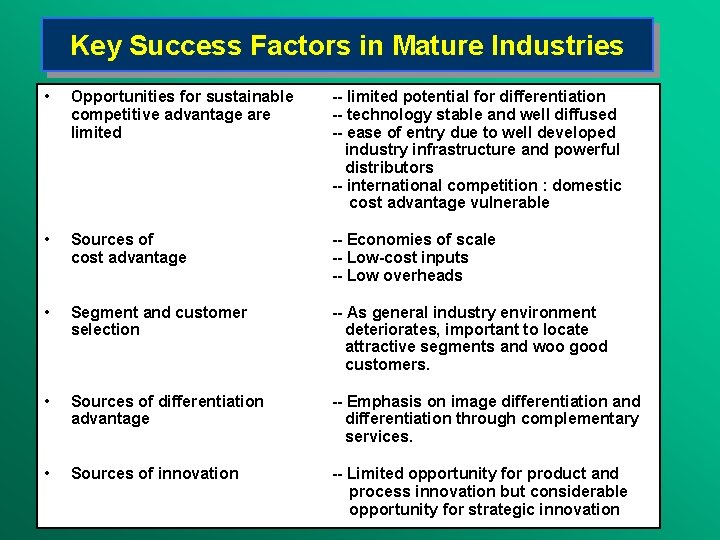

Key Success Factors in Mature Industries • Opportunities for sustainable competitive advantage are limited -- limited potential for differentiation -- technology stable and well diffused -- ease of entry due to well developed industry infrastructure and powerful distributors -- international competition : domestic cost advantage vulnerable • Sources of cost advantage -- Economies of scale -- Low-cost inputs -- Low overheads • Segment and customer selection -- As general industry environment deteriorates, important to locate attractive segments and woo good customers. • Sources of differentiation advantage -- Emphasis on image differentiation and differentiation through complementary services. • Sources of innovation -- Limited opportunity for product and process innovation but considerable opportunity for strategic innovation

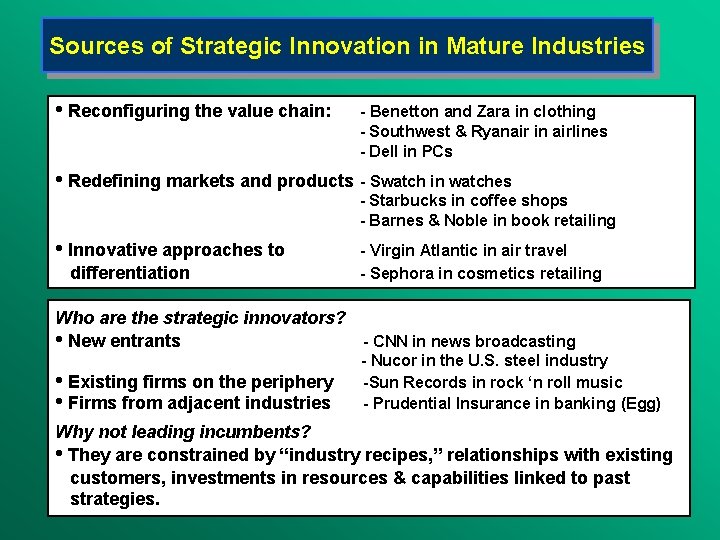

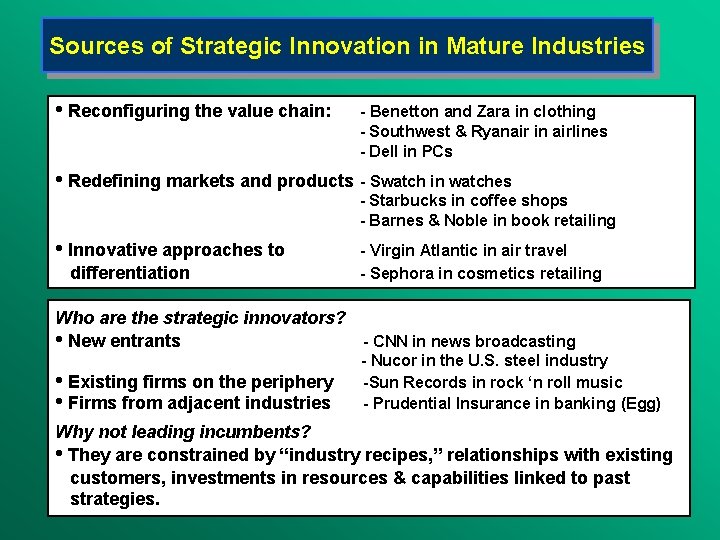

Sources of Strategic Innovation in Mature Industries • Reconfiguring the value chain: - Benetton and Zara in clothing - Southwest & Ryanair in airlines - Dell in PCs • Redefining markets and products - Swatch in watches - Starbucks in coffee shops - Barnes & Noble in book retailing • Innovative approaches to differentiation - Virgin Atlantic in air travel - Sephora in cosmetics retailing Who are the strategic innovators? • New entrants - CNN in news broadcasting • Existing firms on the periphery • Firms from adjacent industries - Nucor in the U. S. steel industry -Sun Records in rock ‘n roll music - Prudential Insurance in banking (Egg) Why not leading incumbents? • They are constrained by “industry recipes, ” relationships with existing customers, investments in resources & capabilities linked to past strategies.

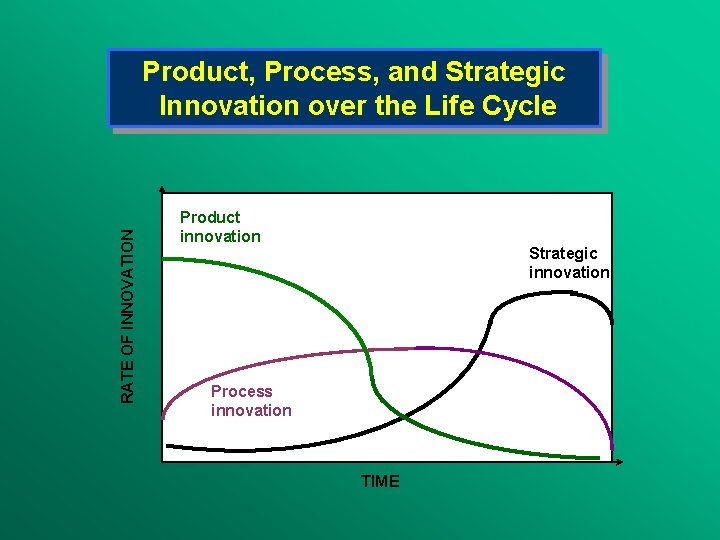

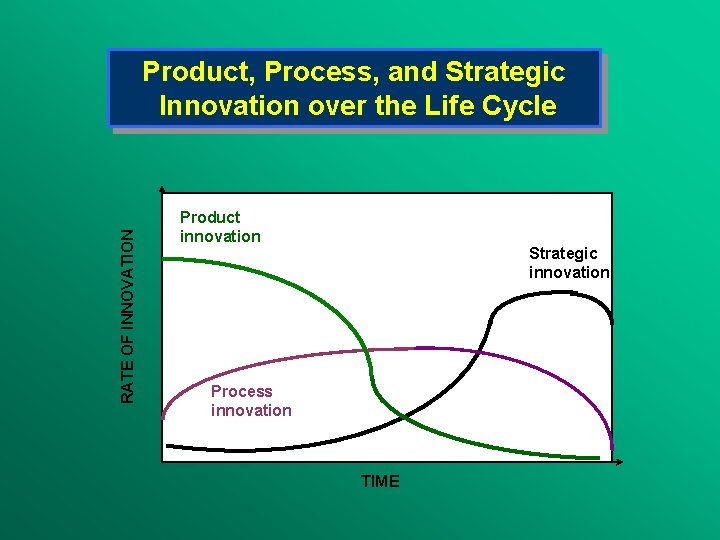

RATE OF INNOVATION Product, Process, and Strategic Innovation over the Life Cycle Product innovation Strategic innovation Process innovation TIME

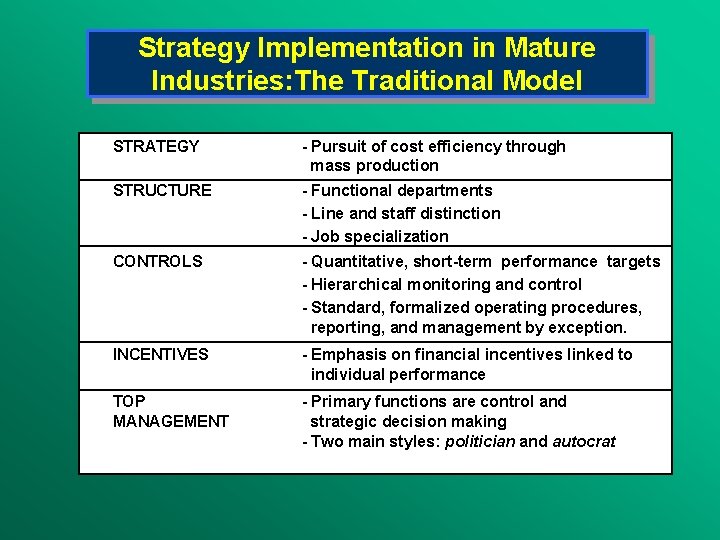

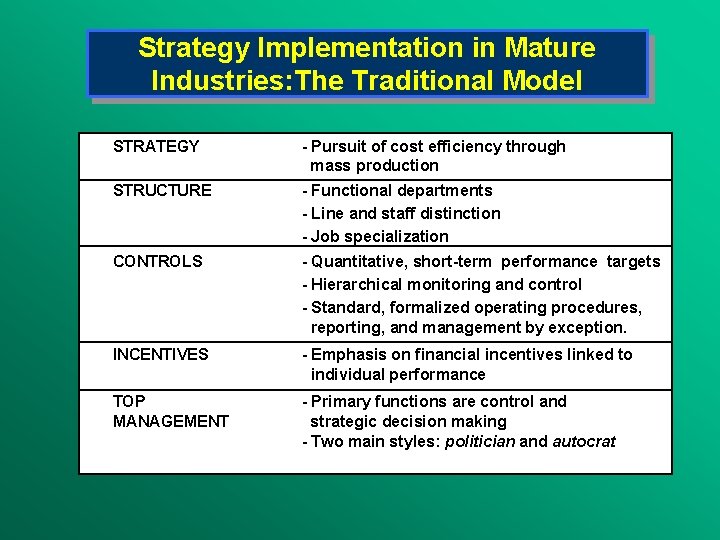

Strategy Implementation in Mature Industries: The Traditional Model STRATEGY - Pursuit of cost efficiency through mass production STRUCTURE - Functional departments - Line and staff distinction - Job specialization CONTROLS - Quantitative, short-term performance targets - Hierarchical monitoring and control - Standard, formalized operating procedures, reporting, and management by exception. INCENTIVES - Emphasis on financial incentives linked to individual performance TOP MANAGEMENT - Primary functions are control and strategic decision making - Two main styles: politician and autocrat

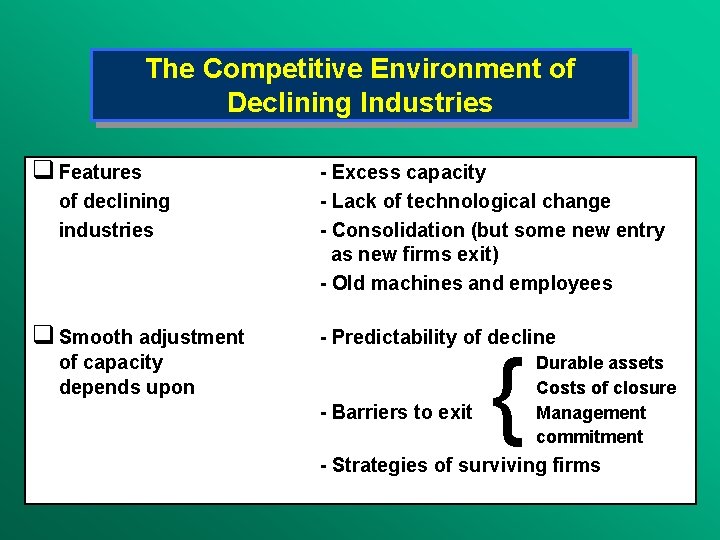

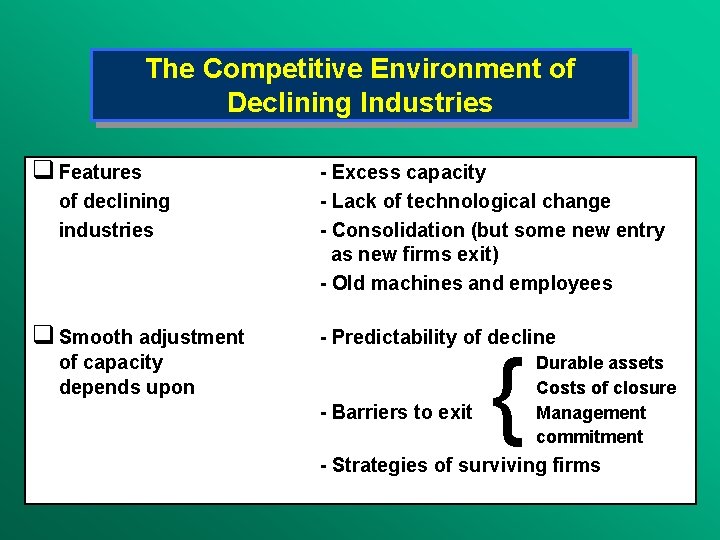

The Competitive Environment of Declining Industries q Features of declining industries q Smooth adjustment - Excess capacity - Lack of technological change - Consolidation (but some new entry as new firms exit) - Old machines and employees - Predictability of decline of capacity depends upon - Barriers to exit { Durable assets Costs of closure Management commitment - Strategies of surviving firms

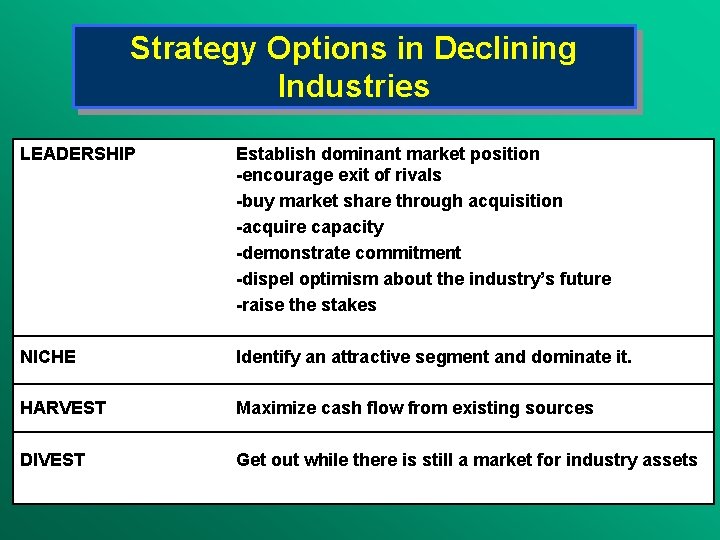

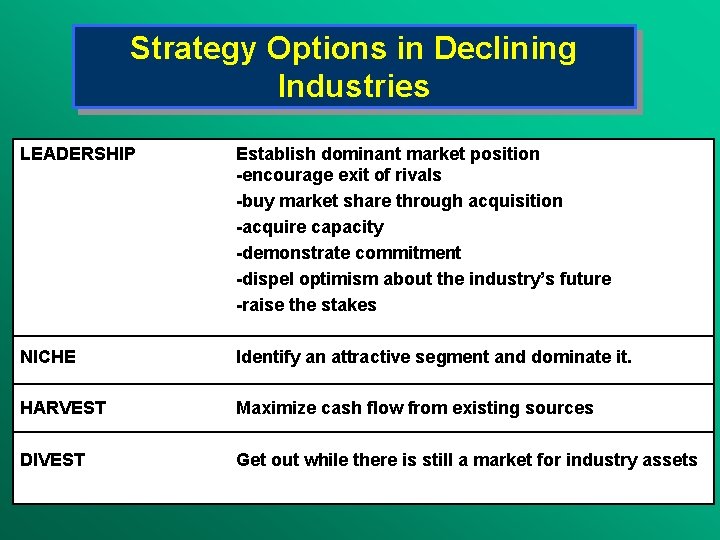

Strategy Options in Declining Industries LEADERSHIP Establish dominant market position -encourage exit of rivals -buy market share through acquisition -acquire capacity -demonstrate commitment -dispel optimism about the industry’s future -raise the stakes NICHE Identify an attractive segment and dominate it. HARVEST Maximize cash flow from existing sources DIVEST Get out while there is still a market for industry assets

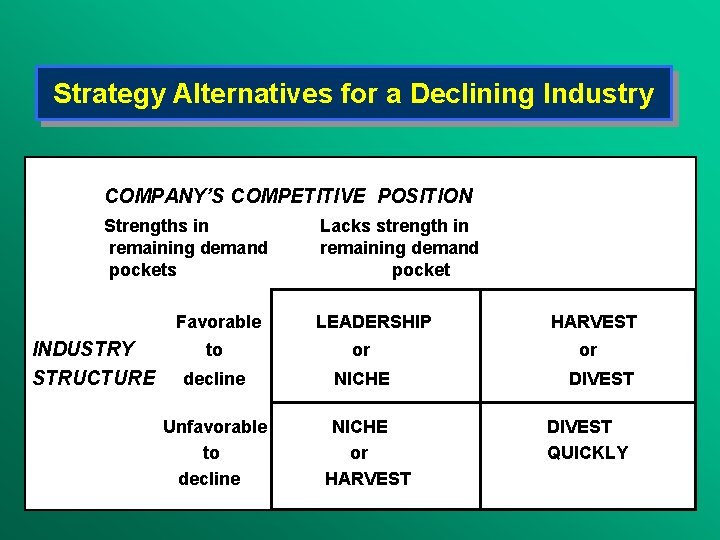

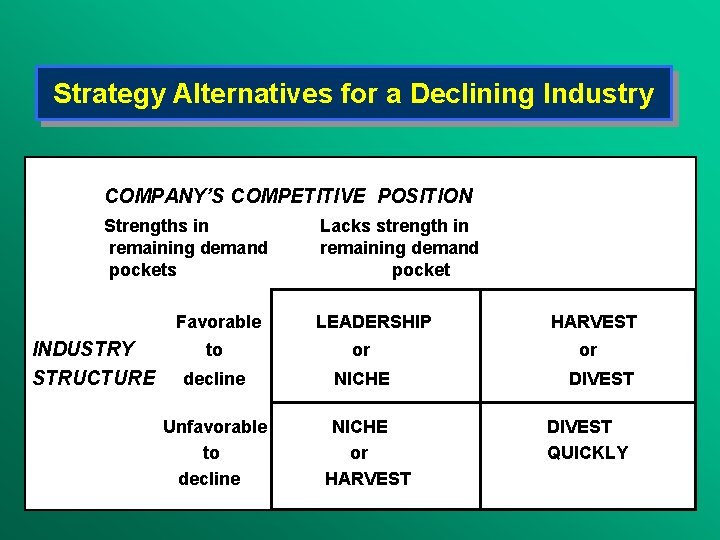

Strategy Alternatives for a Declining Industry COMPANY’S COMPETITIVE POSITION Strengths in remaining demand pockets Favorable INDUSTRY STRUCTURE Lacks strength in remaining demand pocket LEADERSHIP to or decline NICHE Unfavorable to decline NICHE or HARVEST or DIVEST QUICKLY

Mature industries

Mature industries Competitive advantage in mature industries

Competitive advantage in mature industries An embryonic industry is one that

An embryonic industry is one that What is a bulk reducing industry

What is a bulk reducing industry What is the least competitive market structure

What is the least competitive market structure Pharmacology introduction

Pharmacology introduction Standard cycle market example

Standard cycle market example Value creation strategy

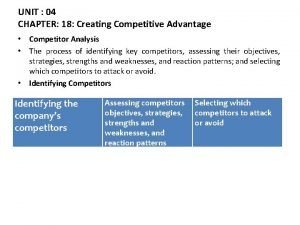

Value creation strategy Chapter 18 creating competitive advantage

Chapter 18 creating competitive advantage Vrio jay barney

Vrio jay barney