Chapter 22 Decision Analysis Copyright 2009 Cengage Learning

- Slides: 39

Chapter 22 Decision Analysis Copyright © 2009 Cengage Learning 22. 1

Decision Analysis… In decision analysis: • We deal with the problem of selecting one alternative from a list of several possible decisions. • There may be no statistical data, or if there are data, the decision may depend only partly on them, and • Profits and losses are directly involved. We will draw upon concepts from probability theory, Bayes’ Law, and expected value. Copyright © 2009 Cengage Learning 22. 2

Decision Problem – Terminology… Choices, decisions, possibilities, alternative courses of action, decision alternatives… these are referred to as acts (ai). E. g. : a 1: Invest in a GIC, or a 2: Invest in the stock market. Acts are controllable; they reflect our choices. Copyright © 2009 Cengage Learning 22. 3

Decision Problem – Terminology… What actually comes to pass in the future, an outcome, is referred to as a state of nature (si): E. g. : s 1: Interest rates increase, or s 2: Interest rates stay steady or decline. States of nature are uncontrollable. When enumerating states of nature, we should define all possible outcomes, (i. e. the list should be mutually exclusive and collectively exhaustive) Copyright © 2009 Cengage Learning 22. 4

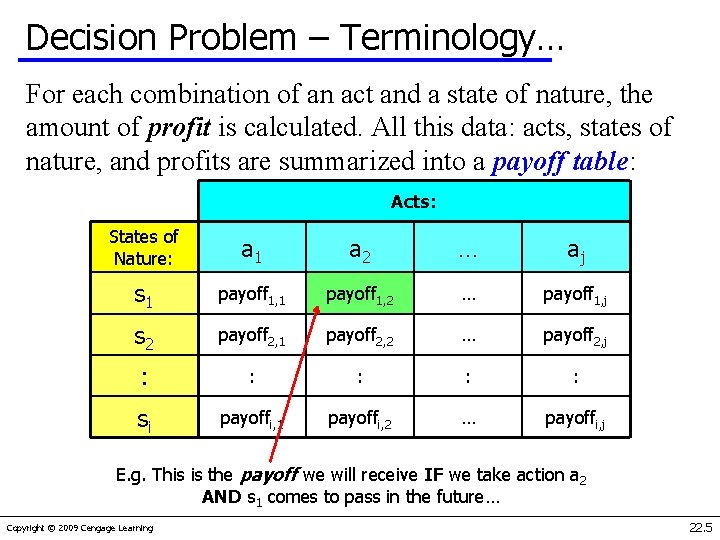

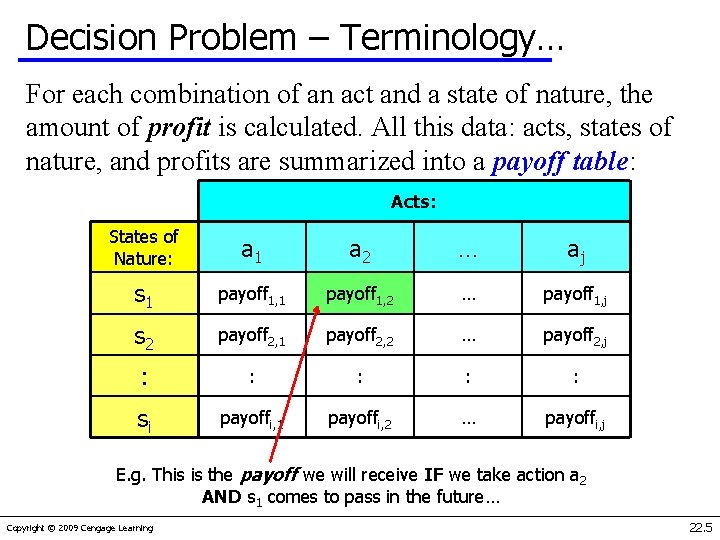

Decision Problem – Terminology… For each combination of an act and a state of nature, the amount of profit is calculated. All this data: acts, states of nature, and profits are summarized into a payoff table: Acts: States of Nature: a 1 a 2 … aj s 1 payoff 1, 2 … payoff 1, j s 2 payoff 2, 1 payoff 2, 2 … payoff 2, j : : : si payoffi, 1 payoffi, 2 … payoffi, j E. g. This is the payoff we will receive IF we take action a 2 AND s 1 comes to pass in the future… Copyright © 2009 Cengage Learning 22. 5

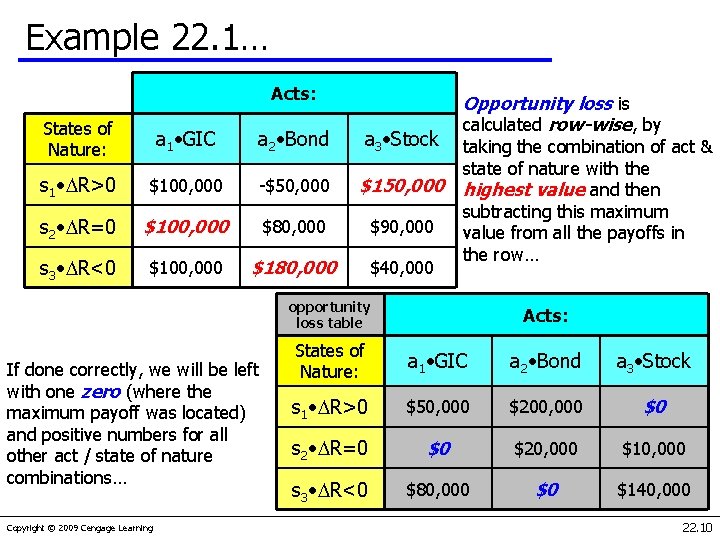

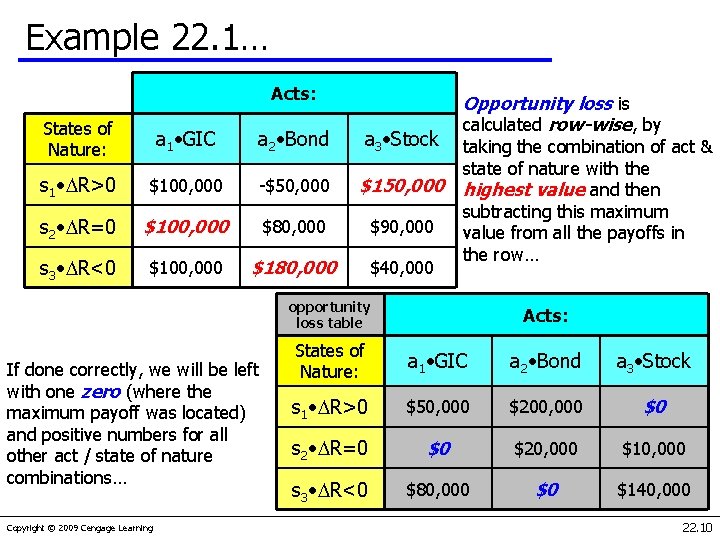

Decision Problem – Terminology… An opportunity loss is the difference between what the decision maker’s profit for an act is and what the profit could have been had the best decision been made. Opportunity loss is calculated row-wise, by taking the combination of act & state of nature with the highest value and then subtracting this maximum value from all the payoffs in the row. If done correctly, we will be left with one zero (where the maximum payoff was located) and positive numbers for all other act / state of nature combinations. Copyright © 2009 Cengage Learning 22. 6

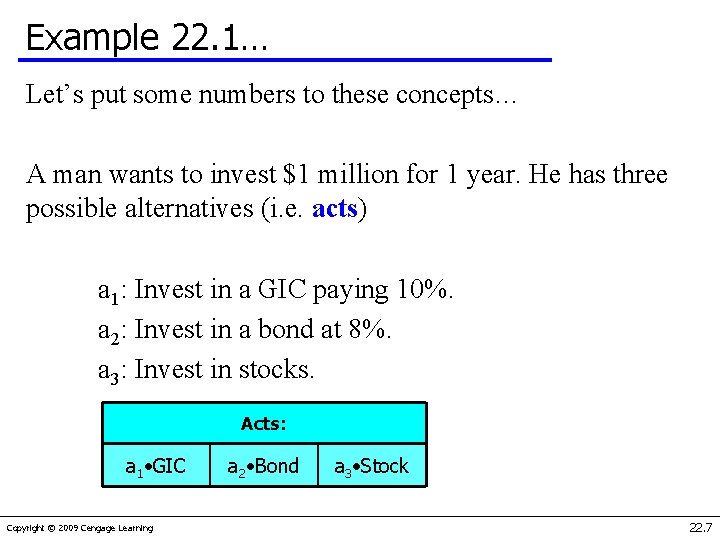

Example 22. 1… Let’s put some numbers to these concepts… A man wants to invest $1 million for 1 year. He has three possible alternatives (i. e. acts) a 1: Invest in a GIC paying 10%. a 2: Invest in a bond at 8%. a 3: Invest in stocks. Acts: a 1 • GIC Copyright © 2009 Cengage Learning a 2 • Bond a 3 • Stock 22. 7

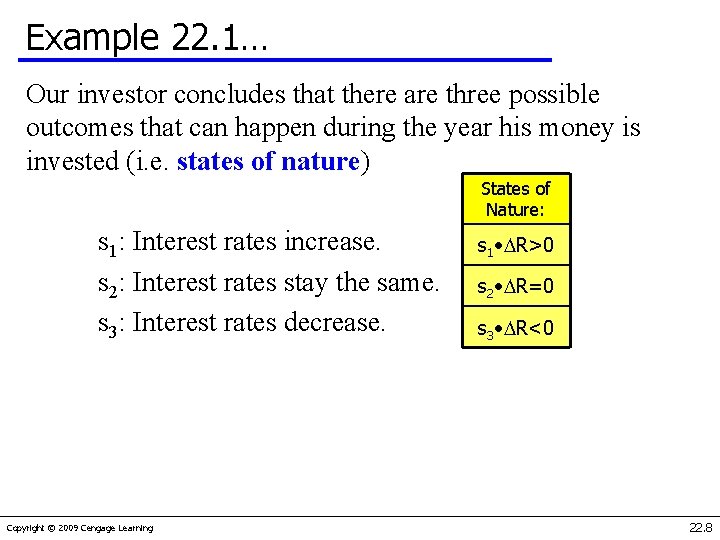

Example 22. 1… Our investor concludes that there are three possible outcomes that can happen during the year his money is invested (i. e. states of nature) States of Nature: s 1: Interest rates increase. s 2: Interest rates stay the same. s 3: Interest rates decrease. Copyright © 2009 Cengage Learning s 1 • R>0 s 2 • R=0 s 3 • R<0 22. 8

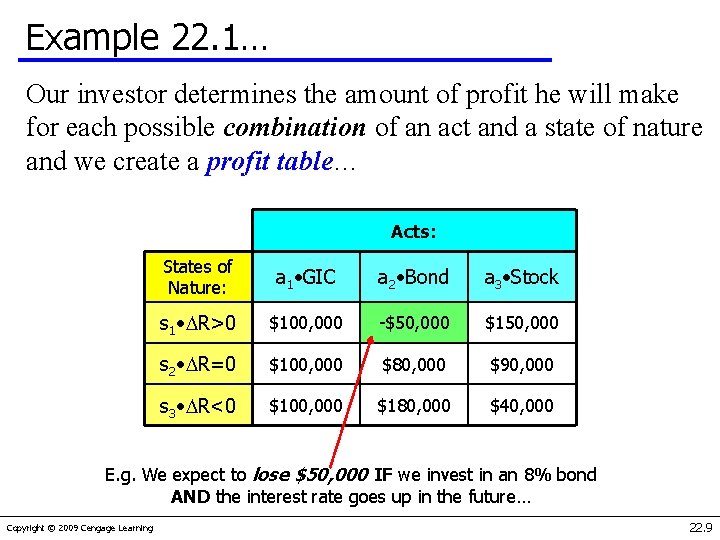

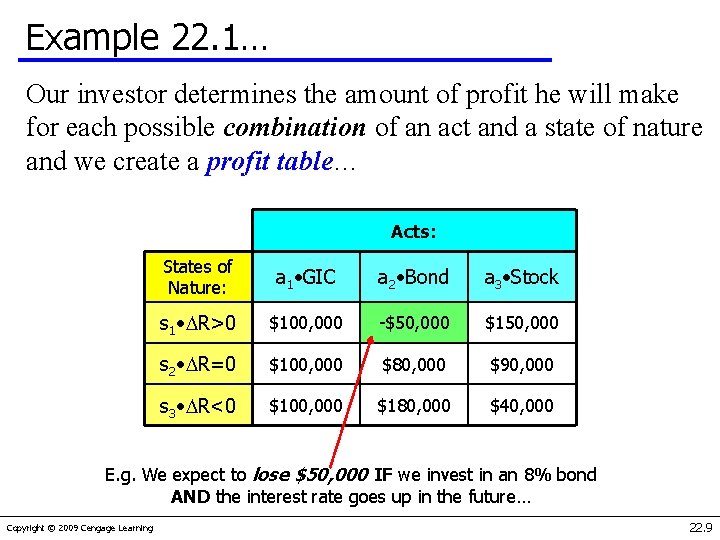

Example 22. 1… Our investor determines the amount of profit he will make for each possible combination of an act and a state of nature and we create a profit table… Acts: States of Nature: a 1 • GIC a 2 • Bond a 3 • Stock s 1 • R>0 $100, 000 -$50, 000 $150, 000 s 2 • R=0 $100, 000 $80, 000 $90, 000 s 3 • R<0 $100, 000 $180, 000 $40, 000 E. g. We expect to lose $50, 000 IF we invest in an 8% bond AND the interest rate goes up in the future… Copyright © 2009 Cengage Learning 22. 9

Example 22. 1… Acts: States of Nature: a 1 • GIC a 2 • Bond a 3 • Stock s 1 • R>0 $100, 000 -$50, 000 $150, 000 s 2 • R=0 $100, 000 $80, 000 $90, 000 s 3 • R<0 $100, 000 $180, 000 $40, 000 Opportunity loss is calculated row-wise, by taking the combination of act & state of nature with the highest value and then subtracting this maximum value from all the payoffs in the row… opportunity loss table If done correctly, we will be left with one zero (where the maximum payoff was located) and positive numbers for all other act / state of nature combinations… Copyright © 2009 Cengage Learning Acts: States of Nature: a 1 • GIC a 2 • Bond a 3 • Stock s 1 • R>0 $50, 000 $200, 000 $0 s 2 • R=0 $0 $20, 000 $10, 000 s 3 • R<0 $80, 000 $0 $140, 000 22. 10

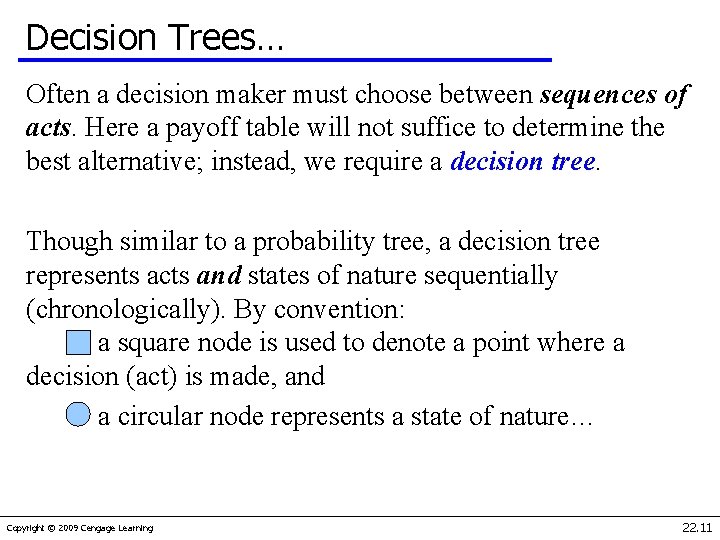

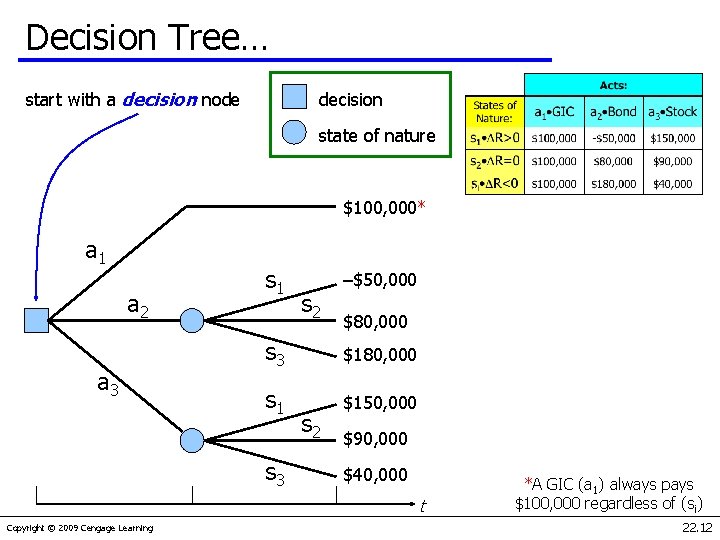

Decision Trees… Often a decision maker must choose between sequences of acts. Here a payoff table will not suffice to determine the best alternative; instead, we require a decision tree. Though similar to a probability tree, a decision tree represents acts and states of nature sequentially (chronologically). By convention: a square node is used to denote a point where a decision (act) is made, and a circular node represents a state of nature… Copyright © 2009 Cengage Learning 22. 11

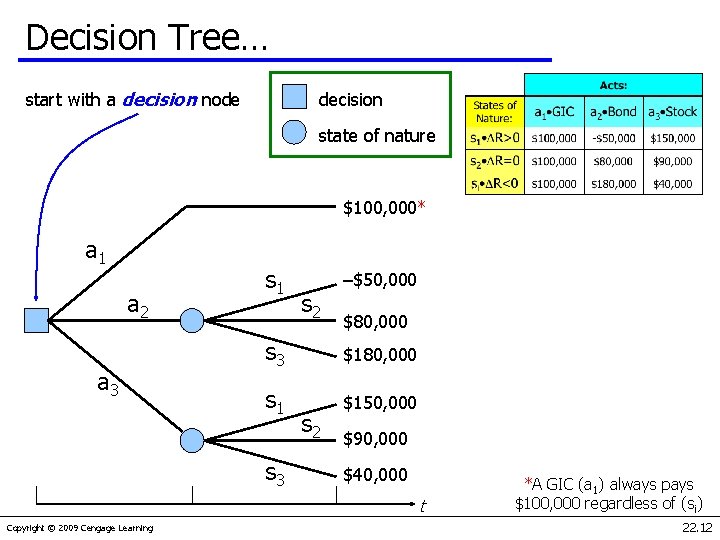

Decision Tree… start with a decision node decision state of nature $100, 000* a 1 a 2 a 3 s 1 s 2 –$50, 000 $80, 000 s 3 $180, 000 s 1 $150, 000 s 3 s 2 $90, 000 $40, 000 t Copyright © 2009 Cengage Learning *A GIC (a 1) always pays $100, 000 regardless of (si) 22. 12

Expected Monetary Value Decision… Often it is possible to assign probabilities to the states of nature, that is some values P(si). Our investor believes that future interest rates are most likely to remain essentially the same as they are today and that (of the remaining two states of nature) rates are more likely to decrease than to increase. His probabilities might be: P(s 1) =. 2 P(s 2) =. 5 P(s 3) =. 3 Copyright © 2009 Cengage Learning 22. 13

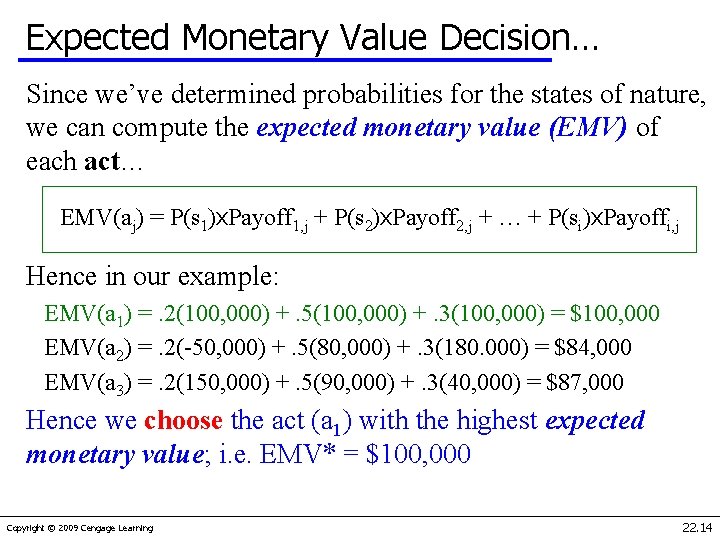

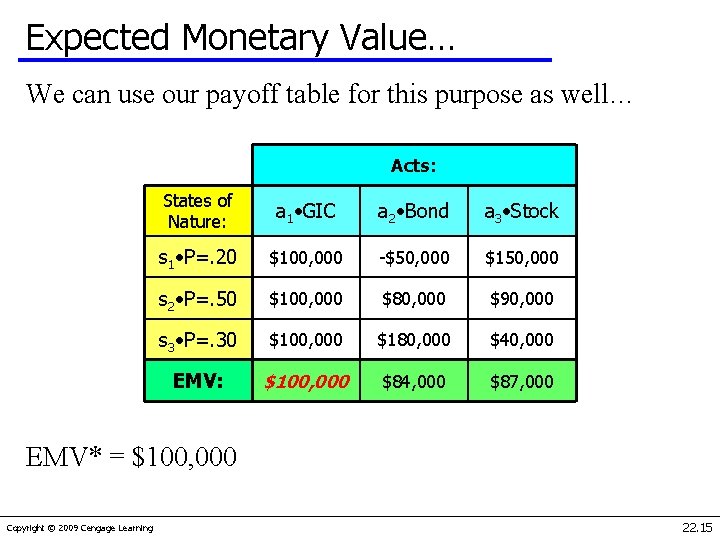

Expected Monetary Value Decision… Since we’ve determined probabilities for the states of nature, we can compute the expected monetary value (EMV) of each act… EMV(aj) = P(s 1)x. Payoff 1, j + P(s 2)x. Payoff 2, j + … + P(si)x. Payoffi, j Hence in our example: EMV(a 1) =. 2(100, 000) +. 5(100, 000) +. 3(100, 000) = $100, 000 EMV(a 2) =. 2(-50, 000) +. 5(80, 000) +. 3(180. 000) = $84, 000 EMV(a 3) =. 2(150, 000) +. 5(90, 000) +. 3(40, 000) = $87, 000 Hence we choose the act (a 1) with the highest expected monetary value; i. e. EMV* = $100, 000 Copyright © 2009 Cengage Learning 22. 14

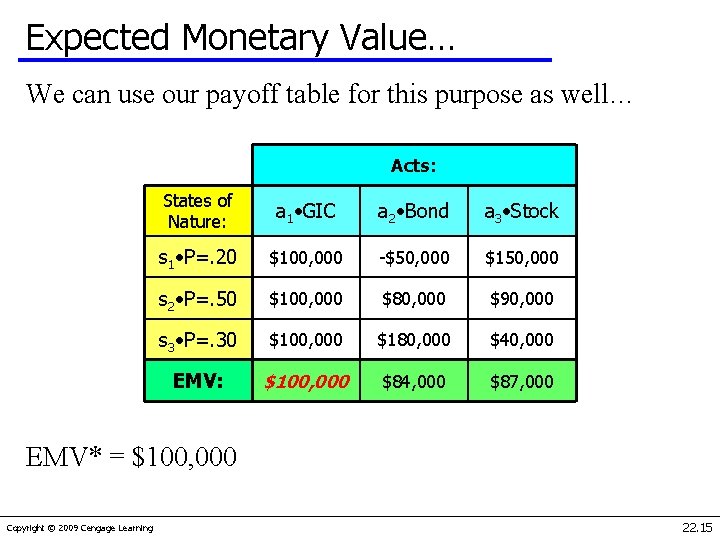

Expected Monetary Value… We can use our payoff table for this purpose as well… Acts: States of Nature: a 1 • GIC a 2 • Bond a 3 • Stock s 1 • P=. 20 $100, 000 -$50, 000 $150, 000 s 2 • P=. 50 $100, 000 $80, 000 $90, 000 s 3 • P=. 30 $100, 000 $180, 000 $40, 000 EMV: $100, 000 $84, 000 $87, 000 EMV* = $100, 000 Copyright © 2009 Cengage Learning 22. 15

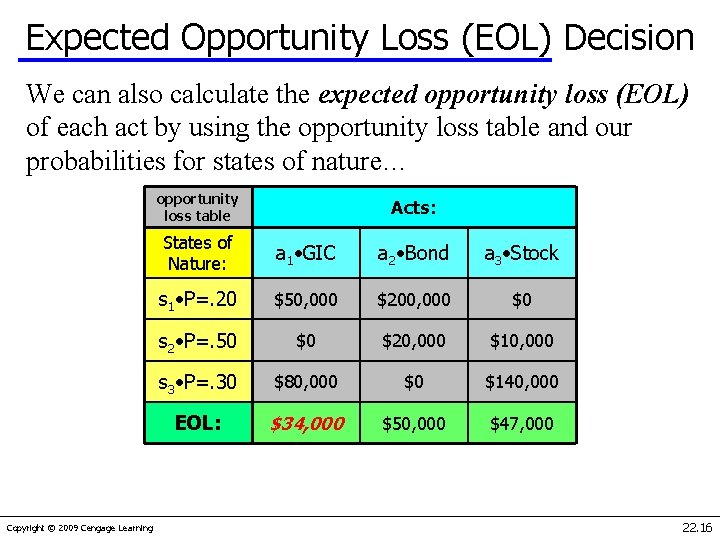

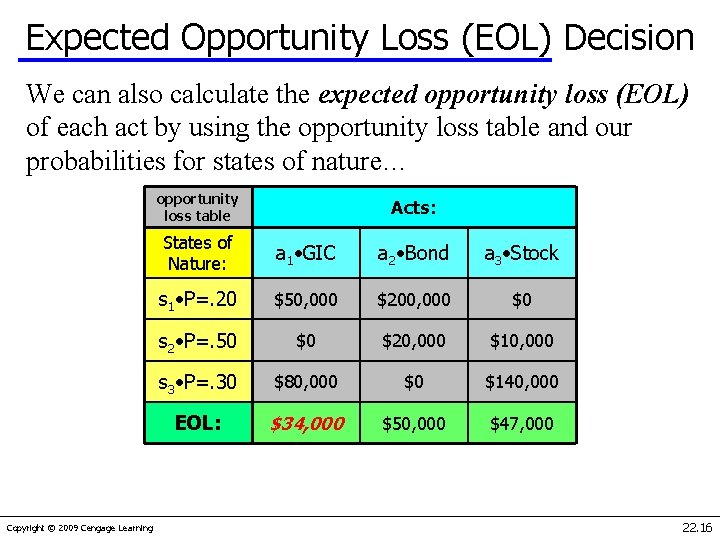

Expected Opportunity Loss (EOL) Decision We can also calculate the expected opportunity loss (EOL) of each act by using the opportunity loss table and our probabilities for states of nature… opportunity loss table Copyright © 2009 Cengage Learning Acts: States of Nature: a 1 • GIC a 2 • Bond a 3 • Stock s 1 • P=. 20 $50, 000 $200, 000 $0 s 2 • P=. 50 $0 $20, 000 $10, 000 s 3 • P=. 30 $80, 000 $0 $140, 000 EOL: $34, 000 $50, 000 $47, 000 22. 16

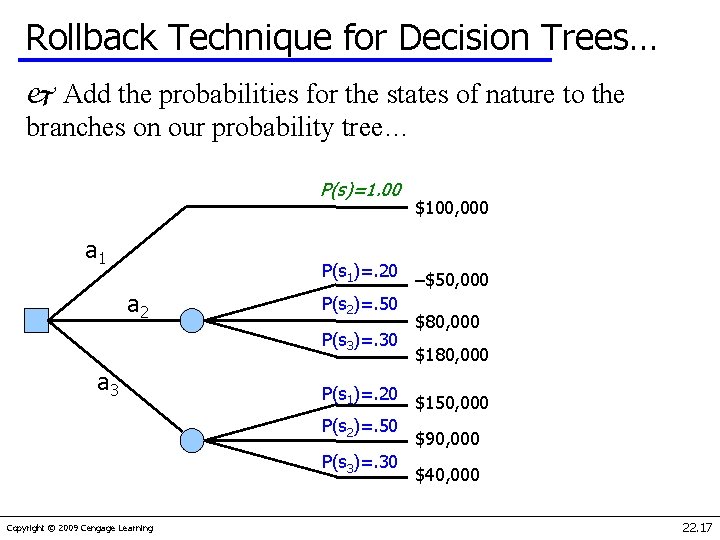

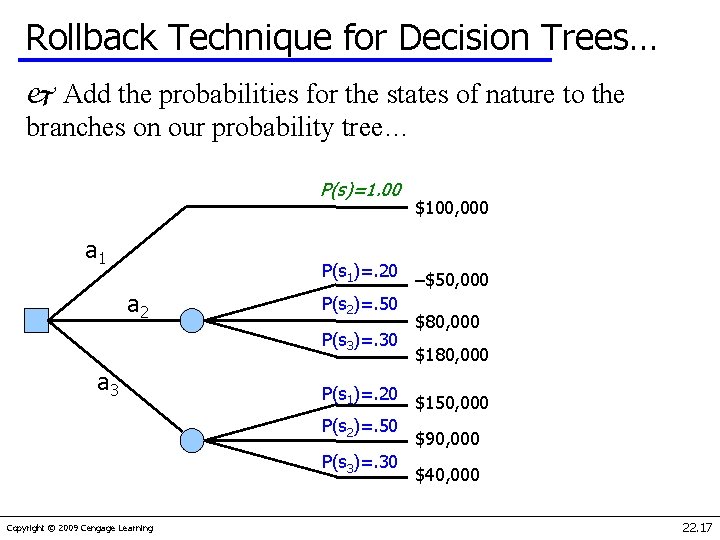

Rollback Technique for Decision Trees… j Add the probabilities for the states of nature to the branches on our probability tree… P(s)=1. 00 a 1 a 2 a 3 P(s 1)=. 20 –$50, 000 P(s 2)=. 50 $80, 000 P(s 3)=. 30 $180, 000 P(s 1)=. 20 P(s 2)=. 50 P(s 3)=. 30 Copyright © 2009 Cengage Learning $100, 000 $150, 000 $90, 000 $40, 000 22. 17

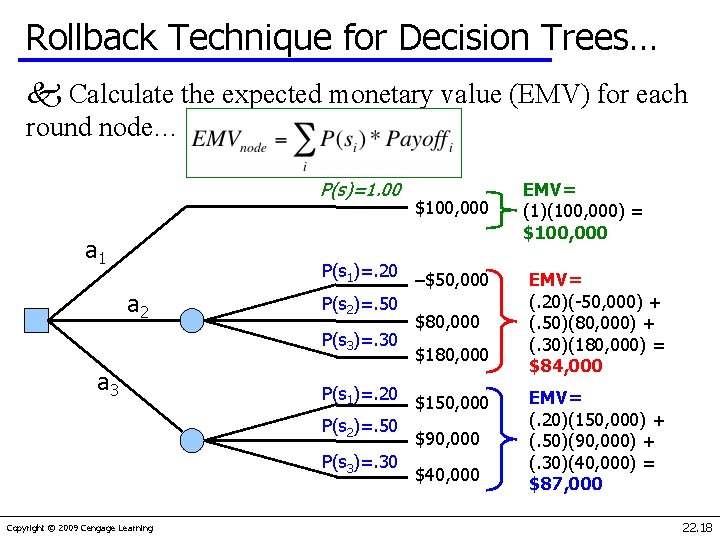

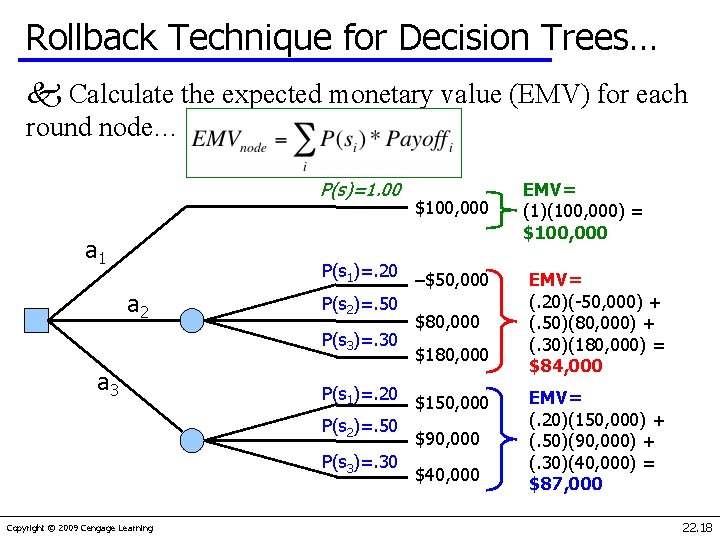

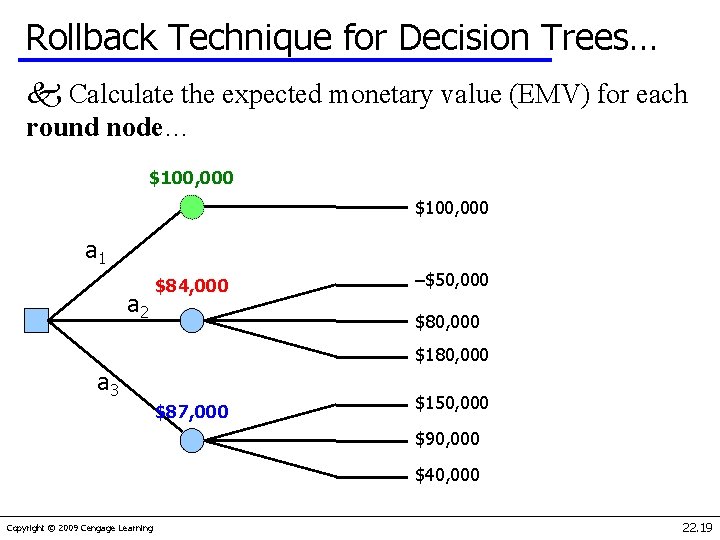

Rollback Technique for Decision Trees… k Calculate the expected monetary value (EMV) for each round node… P(s)=1. 00 a 1 a 2 a 3 P(s 1)=. 20 –$50, 000 P(s 2)=. 50 $80, 000 P(s 3)=. 30 $180, 000 EMV= (. 20)(-50, 000) + (. 50)(80, 000) + (. 30)(180, 000) = $84, 000 P(s 1)=. 20 EMV= (. 20)(150, 000) + (. 50)(90, 000) + (. 30)(40, 000) = $87, 000 P(s 2)=. 50 P(s 3)=. 30 Copyright © 2009 Cengage Learning $100, 000 EMV= (1)(100, 000) = $100, 000 $150, 000 $90, 000 $40, 000 22. 18

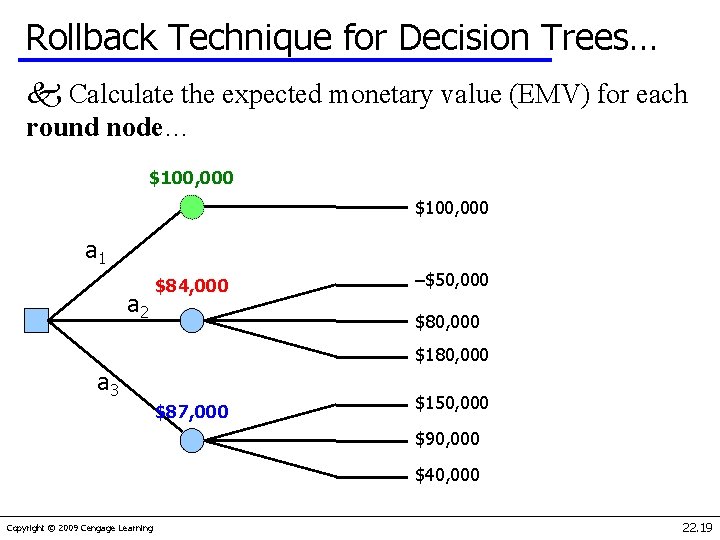

Rollback Technique for Decision Trees… k Calculate the expected monetary value (EMV) for each round node… $100, 000 a 1 a 2 $84, 000 –$50, 000 $80, 000 $180, 000 a 3 $87, 000 $150, 000 $90, 000 $40, 000 Copyright © 2009 Cengage Learning 22. 19

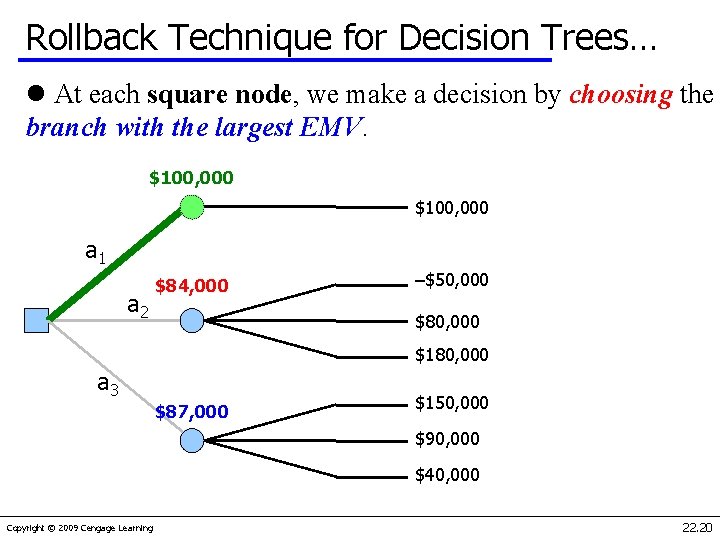

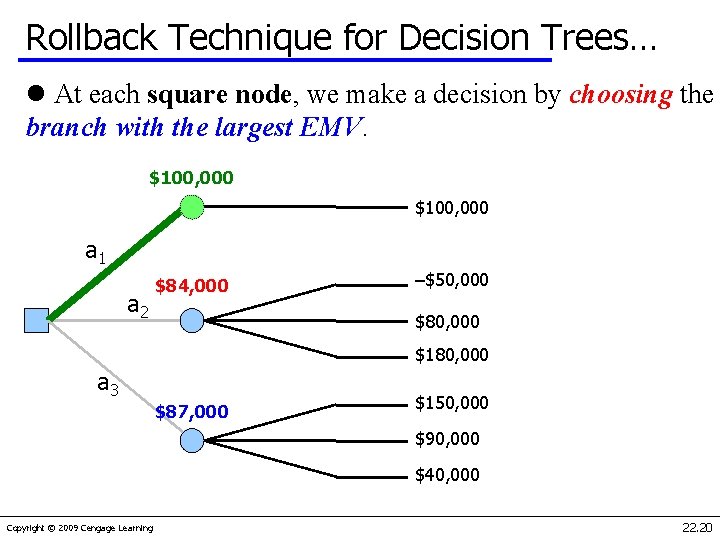

Rollback Technique for Decision Trees… l At each square node, we make a decision by choosing the branch with the largest EMV. $100, 000 a 1 a 2 $84, 000 –$50, 000 $80, 000 $180, 000 a 3 $87, 000 $150, 000 $90, 000 $40, 000 Copyright © 2009 Cengage Learning 22. 20

Additional Information… We can acquire useful information from consultants, surveys, or other experiments in an effort to improve our decision process, but this additional information comes at a cost to us. What’s the maximum price we’d be willing to pay for such a survey? This leads us to the concept of expected payoff with perfect information (EPPI). Copyright © 2009 Cengage Learning 22. 21

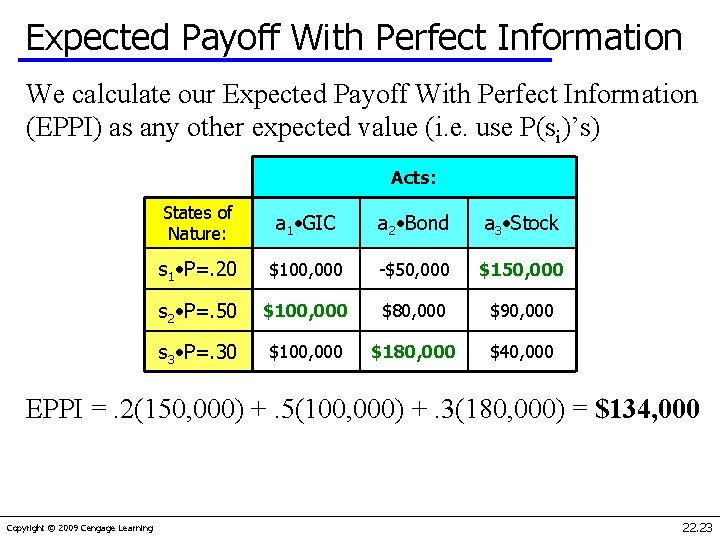

Expected Payoff With Perfect Information If we knew with certainty which state of nature would come to pass, we would make our decisions accordingly. If our investor knew for sure that state of nature #1 (s 1 – interest rates rising) were to come to pass, he would invest in stocks in order to earn $150, 000 (instead of investing in GICs [return = $100, 000] which we calculated when we didn’t have perfect information). Back to our payoff table – what is the highest payoff for each state of nature (each row)? Copyright © 2009 Cengage Learning 22. 22

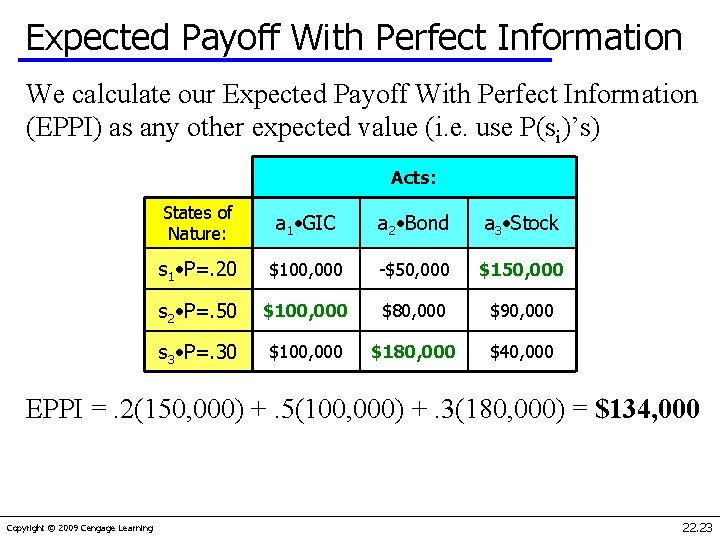

Expected Payoff With Perfect Information We calculate our Expected Payoff With Perfect Information (EPPI) as any other expected value (i. e. use P(si)’s) Acts: States of Nature: a 1 • GIC a 2 • Bond a 3 • Stock s 1 • P=. 20 $100, 000 -$50, 000 $150, 000 s 2 • P=. 50 $100, 000 $80, 000 $90, 000 s 3 • P=. 30 $100, 000 $180, 000 $40, 000 EPPI =. 2(150, 000) +. 5(100, 000) +. 3(180, 000) = $134, 000 Copyright © 2009 Cengage Learning 22. 23

Expected Value of Perfect Information… Without perfect information, our investor could put his money into a GIC and earn EMV* = $100, 000 expected profit. Subtracting EMV* from EPPI leaves us with a quantity known as EVPI: the Expected Value of Perfect Information EVPI = EPPI – EMV* = $134, 000 – $100, 000 = $34, 000 Copyright © 2009 Cengage Learning 22. 24

Expected Value of Perfect Information… Expected Value of Perfect Information EVPI = EPPI – EMV* = $134, 000 – $100, 000 = $34, 000 The expected value of perfect information is $34, 000 more than what our investor could earn without perfect information. Thus EVPI provides an upper bound for survey costs to improve the decision making information on hand. Copyright © 2009 Cengage Learning 22. 25

Decision Making w/ Additional Information Suppose our investor wants to improve his decision-making capabilities by hiring a consultant. IMC (the consultant), will, for a $5, 000 fee, analyze the economic conditions and forecast the behavior of interest rates over the next 12 months. IMC details of their past successes forecasting interest rates. These are stated as conditional probabilities (also known as likelihood probabilities). Should we pay the $5, 000 fee? Is it worth it to buy this data? Copyright © 2009 Cengage Learning 22. 26

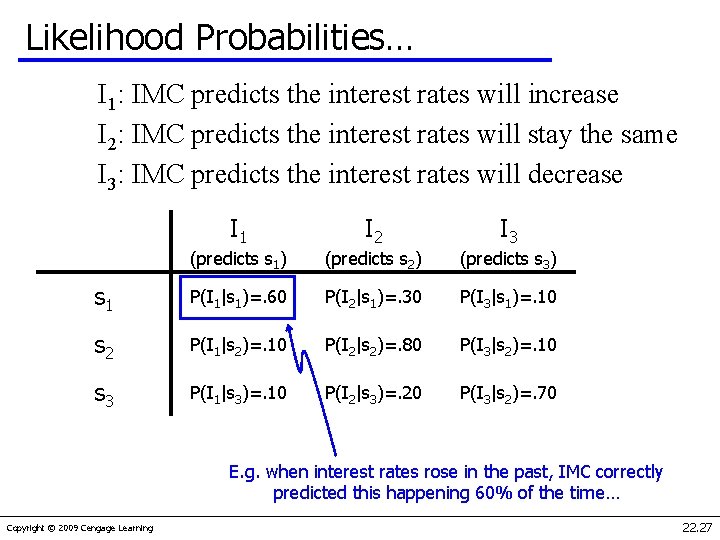

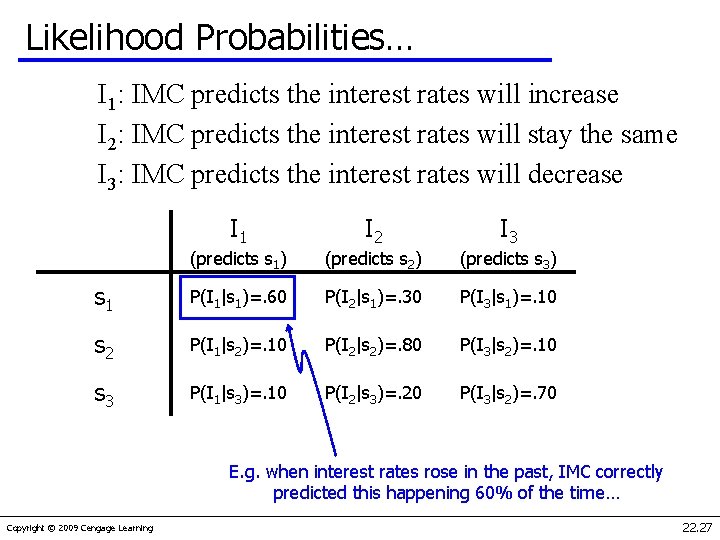

Likelihood Probabilities… I 1: IMC predicts the interest rates will increase I 2: IMC predicts the interest rates will stay the same I 3: IMC predicts the interest rates will decrease I 1 I 2 I 3 (predicts s 1) (predicts s 2) (predicts s 3) s 1 P(I 1|s 1)=. 60 P(I 2|s 1)=. 30 P(I 3|s 1)=. 10 s 2 P(I 1|s 2)=. 10 P(I 2|s 2)=. 80 P(I 3|s 2)=. 10 s 3 P(I 1|s 3)=. 10 P(I 2|s 3)=. 20 P(I 3|s 2)=. 70 E. g. when interest rates rose in the past, IMC correctly predicted this happening 60% of the time… Copyright © 2009 Cengage Learning 22. 27

Likelihood Probabilities… P(I 1|s 1) =. 60 When the interest rates actually increased (s 1) in the past, IMC correctly predicted this happening 60% of the time. That means 40% of the time they were wrong. 30% of the time they predicted stable rates and 10% of the time they predicted falling rates, hence the other likelihood probabilities: P(I 3|s 1) =. 10 (say) We refer to Ii as an “indicator variable”. Copyright © 2009 Cengage Learning 22. 28

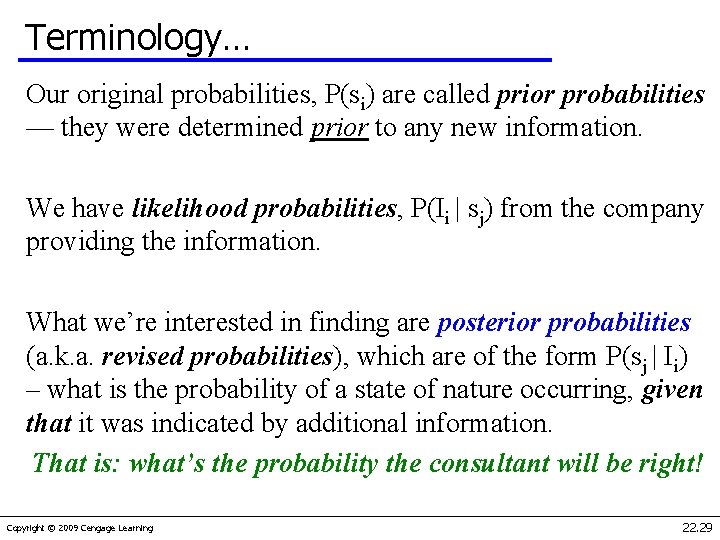

Terminology… Our original probabilities, P(si) are called prior probabilities — they were determined prior to any new information. We have likelihood probabilities, P(Ii | sj) from the company providing the information. What we’re interested in finding are posterior probabilities (a. k. a. revised probabilities), which are of the form P(sj | Ii) – what is the probability of a state of nature occurring, given that it was indicated by additional information. That is: what’s the probability the consultant will be right! Copyright © 2009 Cengage Learning 22. 29

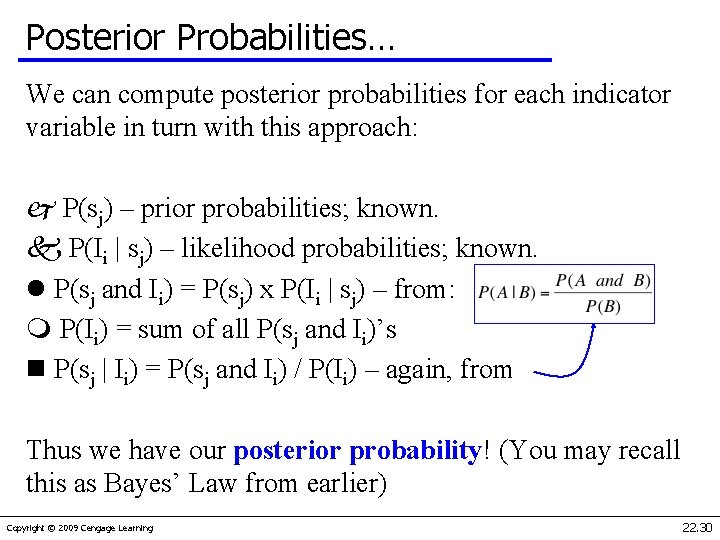

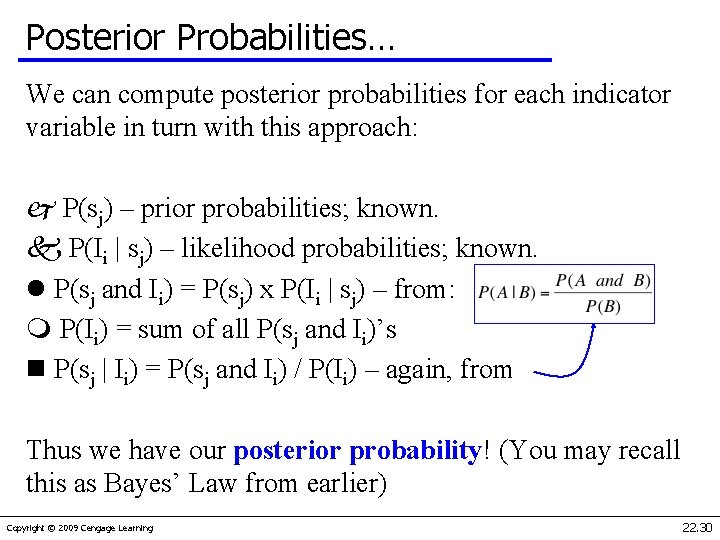

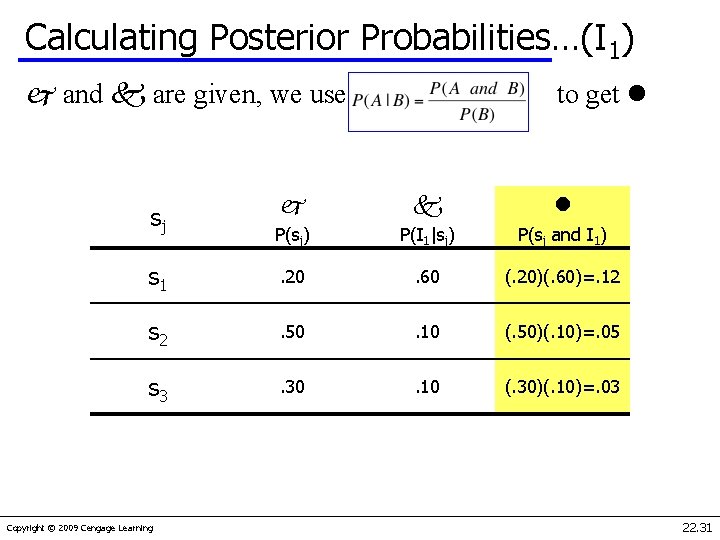

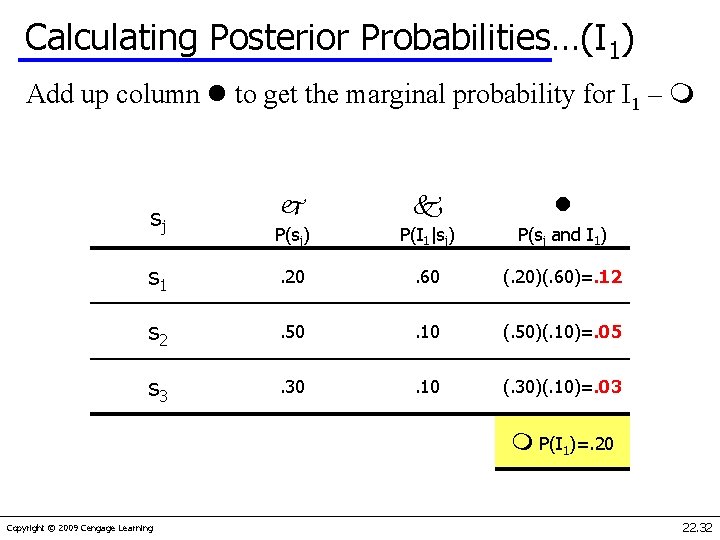

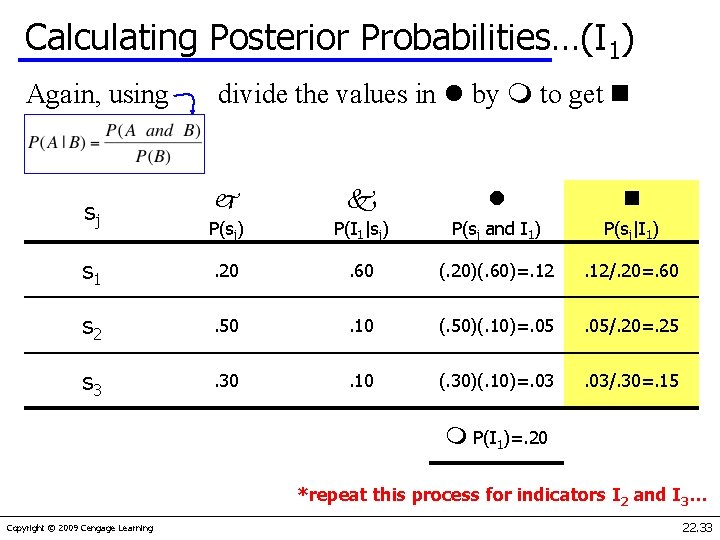

Posterior Probabilities… We can compute posterior probabilities for each indicator variable in turn with this approach: j P(sj) – prior probabilities; known. k P(Ii | sj) – likelihood probabilities; known. l P(sj and Ii) = P(sj) x P(Ii | sj) – from: m P(Ii) = sum of all P(sj and Ii)’s n P(sj | Ii) = P(sj and Ii) / P(Ii) – again, from Thus we have our posterior probability! (You may recall this as Bayes’ Law from earlier) Copyright © 2009 Cengage Learning 22. 30

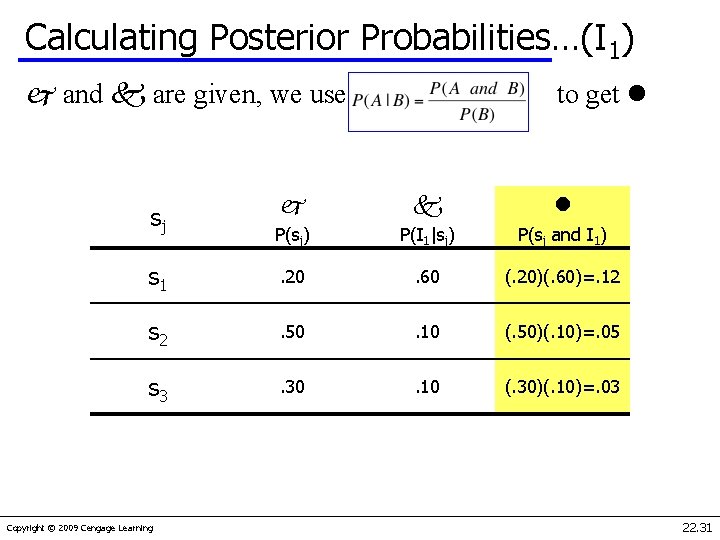

Calculating Posterior Probabilities…(I 1) j and k are given, we use to get l j k l P(sj) P(I 1|sj) P(sj and I 1) s 1 . 20 . 60 (. 20)(. 60)=. 12 s 2 . 50 . 10 (. 50)(. 10)=. 05 s 3 . 30 . 10 (. 30)(. 10)=. 03 sj Copyright © 2009 Cengage Learning 22. 31

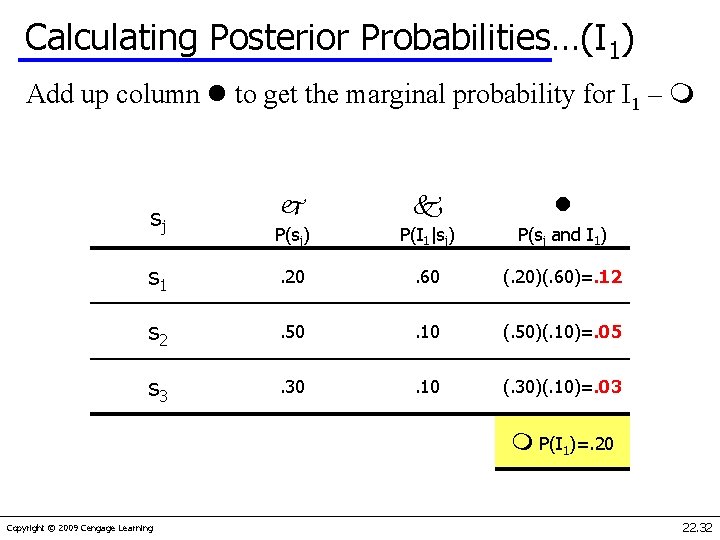

Calculating Posterior Probabilities…(I 1) Add up column l to get the marginal probability for I 1 – m j k l P(sj) P(I 1|sj) P(sj and I 1) s 1 . 20 . 60 (. 20)(. 60)=. 12 s 2 . 50 . 10 (. 50)(. 10)=. 05 s 3 . 30 . 10 (. 30)(. 10)=. 03 sj m P(I 1)=. 20 Copyright © 2009 Cengage Learning 22. 32

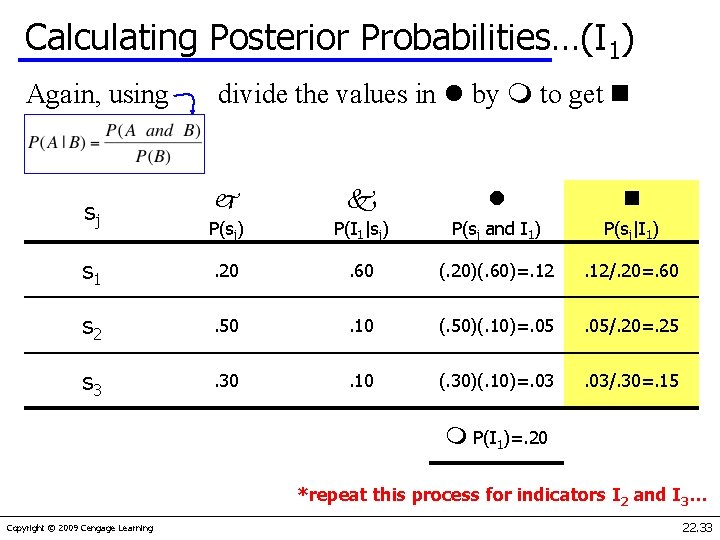

Calculating Posterior Probabilities…(I 1) Again, using divide the values in l by m to get n j k l n P(sj) P(I 1|sj) P(sj and I 1) P(sj|I 1) s 1 . 20 . 60 (. 20)(. 60)=. 12/. 20=. 60 s 2 . 50 . 10 (. 50)(. 10)=. 05/. 20=. 25 s 3 . 30 . 10 (. 30)(. 10)=. 03/. 30=. 15 sj m P(I 1)=. 20 *repeat this process for indicators I 2 and I 3… Copyright © 2009 Cengage Learning 22. 33

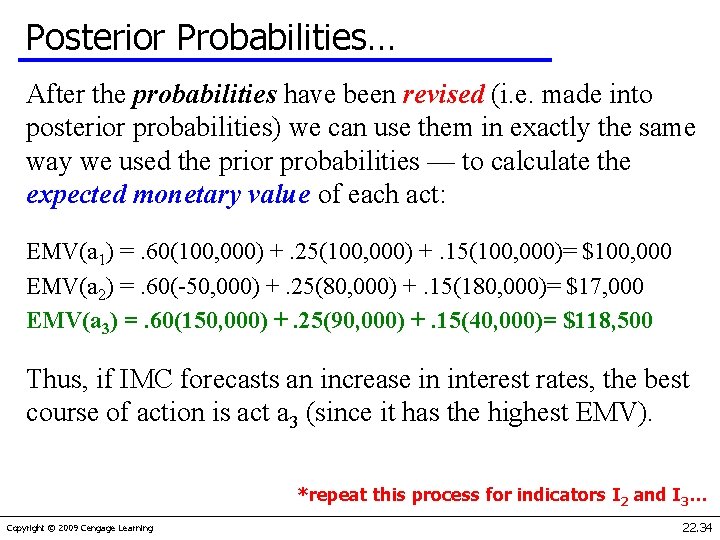

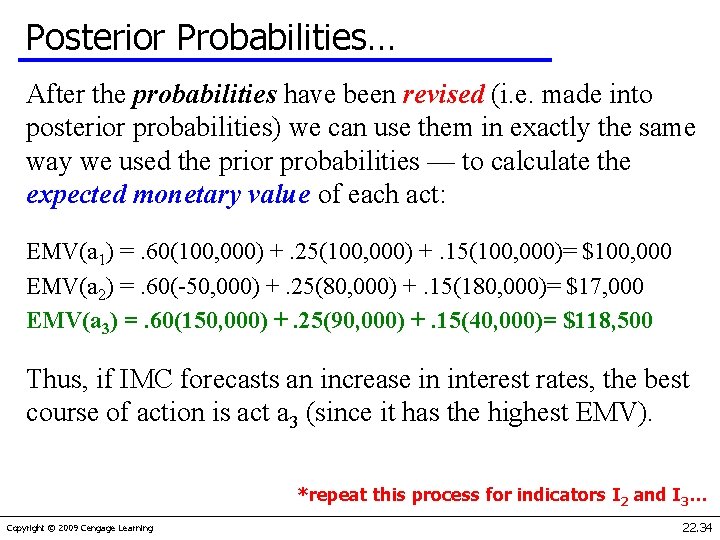

Posterior Probabilities… After the probabilities have been revised (i. e. made into posterior probabilities) we can use them in exactly the same way we used the prior probabilities — to calculate the expected monetary value of each act: EMV(a 1) =. 60(100, 000) +. 25(100, 000) +. 15(100, 000)= $100, 000 EMV(a 2) =. 60(-50, 000) +. 25(80, 000) +. 15(180, 000)= $17, 000 EMV(a 3) =. 60(150, 000) +. 25(90, 000) +. 15(40, 000)= $118, 500 Thus, if IMC forecasts an increase in interest rates, the best course of action is act a 3 (since it has the highest EMV). *repeat this process for indicators I 2 and I 3… Copyright © 2009 Cengage Learning 22. 34

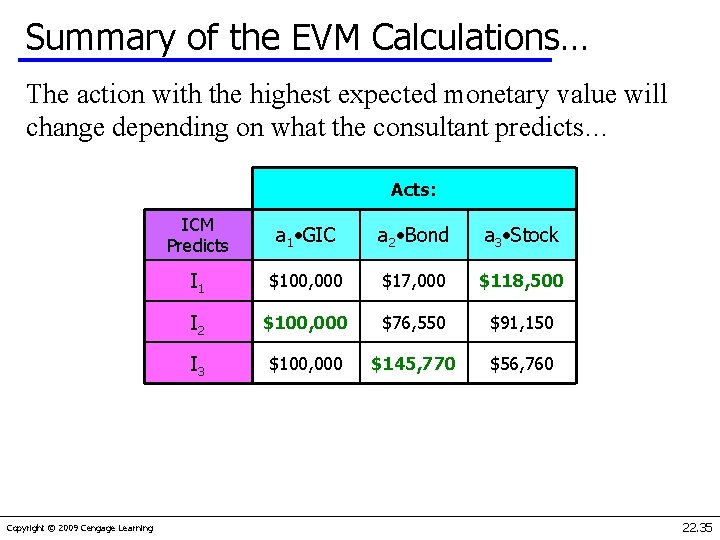

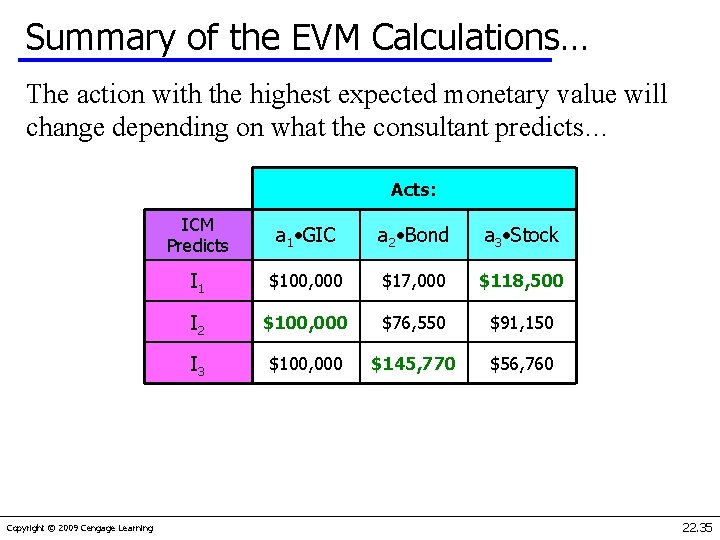

Summary of the EVM Calculations… The action with the highest expected monetary value will change depending on what the consultant predicts… Acts: Copyright © 2009 Cengage Learning ICM Predicts a 1 • GIC a 2 • Bond a 3 • Stock I 1 $100, 000 $17, 000 $118, 500 I 2 $100, 000 $76, 550 $91, 150 I 3 $100, 000 $145, 770 $56, 760 22. 35

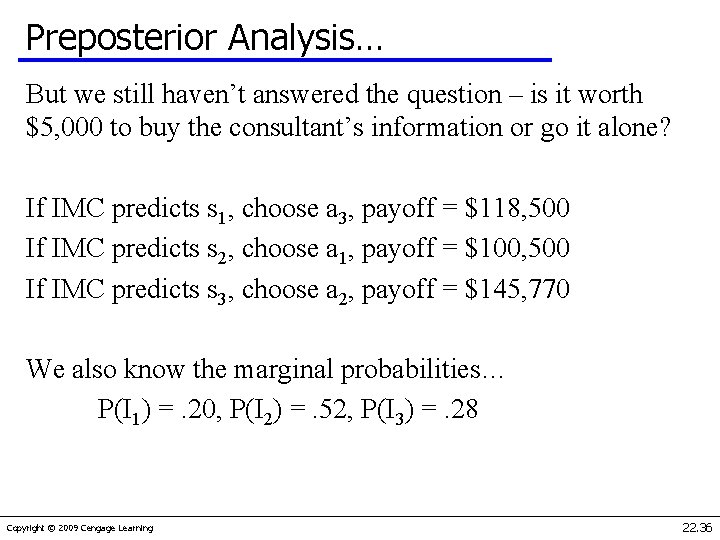

Preposterior Analysis… But we still haven’t answered the question – is it worth $5, 000 to buy the consultant’s information or go it alone? If IMC predicts s 1, choose a 3, payoff = $118, 500 If IMC predicts s 2, choose a 1, payoff = $100, 500 If IMC predicts s 3, choose a 2, payoff = $145, 770 We also know the marginal probabilities… P(I 1) =. 20, P(I 2) =. 52, P(I 3) =. 28 Copyright © 2009 Cengage Learning 22. 36

Expected Monetary Value… We can calculate an expected monetary value with additional information as the weighted average of: the expected monetary values, and P(I 1), P(I 2), and P(I 3) as weights. Hence: EMV' =. 20(118, 500) +. 52(100, 000) +. 28(145, 770)= $116, 516 Copyright © 2009 Cengage Learning 22. 37

Expected Monetary Value… The value of the consultant’s forecast is the delta between the expected monetary value with additional information (EMV') and the expected monetary value without additional information (EMV*). This difference is called the expected value of sample information and is denoted EVSI. Thus, EVSI = EMV' - EMV* = $116, 516 - $100, 000 = $16, 516 Copyright © 2009 Cengage Learning 22. 38

Expected Value of Sample Information Since the expected value of sample information is greater than the cost of obtaining the information… $16, 516 > $5, 000 …we should advise our investor to hire IMC consultants and obtain an interest rate forecast before investing. Copyright © 2009 Cengage Learning 22. 39