Chapter 3 The Measurement Fundamentals of Financial Accounting

- Slides: 30

Chapter 3: The Measurement Fundamentals of Financial Accounting 1

Basic Assumptions l Basic assumptions are foundations of financial accounting measurements l The basic assumptions are – Economic entity – Fiscal period – Going concern – Stable dollar 2

Economic Entity l. A company is assumed to be a separate economic entity that can be identified and measured. l This concept helps determine the scope of financial statements. l Examples — Disney and ABC, General Electric and NBC. 3

Fiscal Period (Periodicity) l It is assumed that the life of an economic entity can be broken down into accounting periods. l The result is a trade-off between objectivity and timeliness. l Alternative accounting periods include the calendar or fiscal year. 4

Going Concern l The life of an economic entity is assumed to be indefinite. l Assets, defined as having future economic benefit, require this assumption. l Allocation of costs to future periods is supported by the going concern assumption. 5

Stable Dollar (Monetary Unit) l The value of the monetary unit used to measure an economic entity’s performance and position is assumed stable. l If true, the monetary unit must maintain constant purchasing power. l Inflation, however, changes the monetary unit’s purchasing power. l If inflation is material, the stable dollar assumption is invalid. 6

Valuations on the Balance Sheet l There a number of ways to value assets and liabilities on the balance sheet: – Input market: cost to purchase materials, labor, overhead – Output market: value received from sales of services or inventories 7

Valuation on the Balance Sheet l Alternative valuation bases – Present value – Fair market value – Replacement cost – Original (historical) cost 8

Present Value as a Valuation Base l Discounted future cash inflows and outflows l For example, the present value of a notes receivable is calculated by determining the amount and timing of its future cash inflows and adjusting the dollar amounts for the time value of money. 9

Fair Market Value as a Valuation Base l Fair market value is measured by the sales price or the value of goods and services in the output market. l For example, accounts receivable are valued at net realizable value which approximates fair market value. 10

Replacement Cost as a Valuation Base l Replacement cost is the current cost or the current price paid in the input market. l For example, inventories are valued at original cost or replacement cost, whichever is lower. 11

Historical Cost as a Valuation Base l Historical cost is the input price paid when asset originally purchased. l For example, land property used in a company’s operations are all valued at original cost. l “Cash equivalent price” is used to calculate historical cost when cash is not paid (as in the issue of a liability to purchase the asset) 12

DEPARTURE FROM HISTORIC COST l Under IFRS, certain companies are allowed to value property, plant, and equipment at fair market value. 13

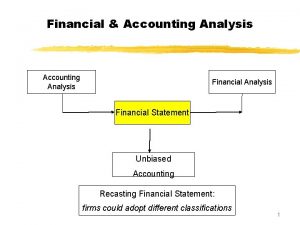

Principles of Financial Accounting Measurement l When transactions occur, we must decide when to recognize the transactions in the financial statements, and how to measure the transactions. 14

Accounting Principles l. The principles of recognition and measurement are: – Objectivity – Revenue recognition – Matching – Consistency 15

The Objectivity Principle l This principle requires that the values of transactions and the assets and liabilities created by them be verifiable and backed by documentation. 16

The Revenue Recognition Principle l This principle determines when revenues can be recognized. l The most common point of revenue recognition is when goods or services are transferred or provided to the buyer (at delivery). 17

Exercise 3 -7 Cascades Enterprises ordered 4, 000 brackets from Mc. Key and Company on December 1, 2011, for a contracted price of $40, 000. Dec 1, 20011: Cascades orders brackets Jan 17, 2012: Mc. Key completed manufacturing Feb 9, 2012: Mc. Key delivered the brackets Mar 14, 2012: Mc. Key received a check for $40, 000

§ • a. Assume that Mc. Key prepares monthly income statements. In which month should it recognize the $40, 000 revenue? The most common point at which a company would recognize revenue is at the time of delivery. So in this case Mc. Key and Company would recognize revenue in February.

§ b. What are the four revenue recognition criteria? §The four criteria for recognizing revenue are (1) the company has completed a significant portion of the production and sales effort, (2) the amount of revenue can be objectively measured, (3) the company has incurred the majority of costs, and remaining costs can be reasonably estimated, and (4) cash collection is reasonably assured.

§ c. Are there conditions under which the revenue could be recognized in a month different from the one chosen in (a)? §Revenue could be recognized (1) during production, (2) at the completion of production, (3) at the point of delivery, or (4) when the cash is collected. Since the production and sales effort was not really complete until Mc. Key shipped the brackets on February 9, February 9 appears to be the appropriate date to recognize the revenue.

§ d. Why is the timing of revenue recognition important? §Mc. Key's managers could be interested in the timing of revenue recognition due to incentives provided by contracts. For example, the managers may be paid a bonus based upon accounting income.

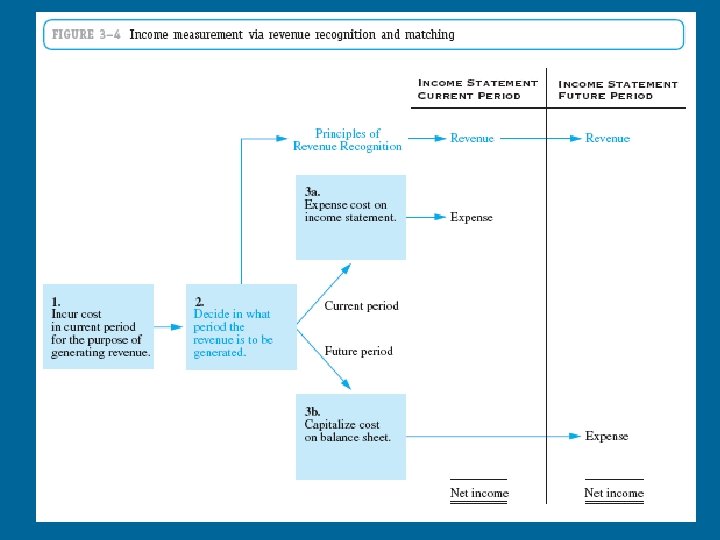

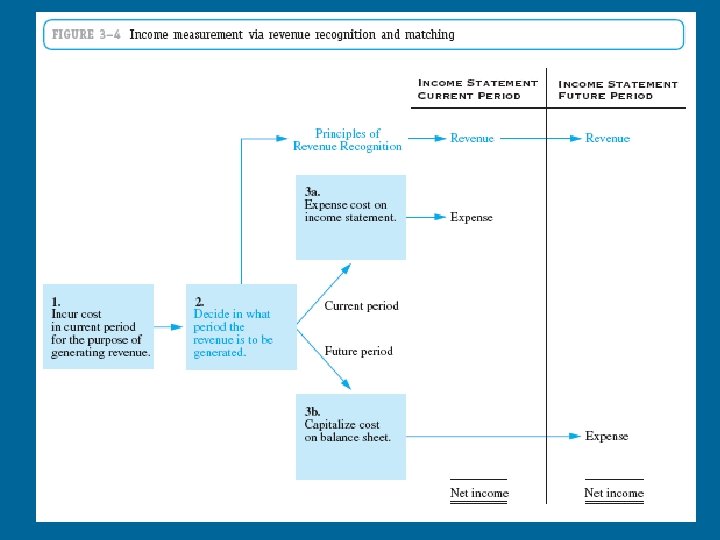

The Matching Principle Matching focuses on the timing of recognition of expenses after revenue recognition has been determined. l This principle states that the efforts of a given period (expenses) should be matched against the benefits (revenues) they generate. l For example, the cost of inventory is initially capitalized as an asset on the balance sheet; it is not recorded in Cost of Goods Sold (expense) until the sale is recognized. l 23

24

The Consistency Principle Generally accepted accounting principles allow a number of different, acceptable methods of accounting. l This principle states that companies should choose a set of methods and use them from one period to the next. l For example, a change in the method of accounting for inventory would violate the consistency principle. l However, certain changes are permitted with sufficient disclosure regarding the change. l 25

Exceptions (Constraints) to the Basic Principles l These exceptions contradict the basic principles, in certain circumstances. l They are: – Materiality – Conservatism 26

Materiality l Materiality (the immateriality constraint) – Only transactions with amounts large enough to make a difference are considered material. – Nonmaterial transactions can be given alternative treatments l For example, a trash can might have a five year life, but the materiality constraint allows a company to expense the item in the year purchased. 27

Conservatism The conservatism constraint permits the choice of the more conservative alternative in certain situations where two alternatives exist regarding the valuation of a transaction. l Conservatism - When in doubt: – Avoid overstatement of assets – Avoid understatement of liabilities – Accelerate recognition of losses – Delay recognition of gains l For example, “lower of cost or market” is used to value inventory. l Problem: Some managers have abused the conservatism constraint in earnings management. l 28

International Perspective l Conservatism is pervasive in foreign financial statements. l In Japan and most of western Europe, where creditors provide large amounts of capital, companies prepare reports that contain intentional understatement of assets and overstatement of liabilities. l Such practices are more difficult under IFRS, but many believe that the additional discretion available to management under IFRS is still used to reduce reported earnings. 29

Fundamental Differences – US GAAP and IFRS l IFRS is “principles-based” while US GAAP is “rules-based” l IFRS leaves more discretion to management l US GAAP generally does not allow the use of fair market values unless they can be objectively determined. l IFRS allows adjustments to the balance sheet values for changes in market value. 30

Financial accounting and accounting standards chapter 1

Financial accounting and accounting standards chapter 1 Responsibility centers in management accounting

Responsibility centers in management accounting Process instrumentation ppt

Process instrumentation ppt Financial accounting chapter 2 solutions

Financial accounting chapter 2 solutions Financial accounting chapter 13

Financial accounting chapter 13 Accounting chapter 6

Accounting chapter 6 Financial accounting chapter 9

Financial accounting chapter 9 Financial accounting chapter 7

Financial accounting chapter 7 Financial accounting ifrs 4th edition chapter 12

Financial accounting ifrs 4th edition chapter 12 Financial accounting chapter 3

Financial accounting chapter 3 Accounting chapter 2

Accounting chapter 2 Hospitality accounting basics

Hospitality accounting basics Financial accounting chapter 5

Financial accounting chapter 5 Measurement theory in accounting

Measurement theory in accounting Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Frameset trong html5

Frameset trong html5 Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Voi kéo gỗ như thế nào

Voi kéo gỗ như thế nào Chụp tư thế worms-breton

Chụp tư thế worms-breton Chúa yêu trần thế alleluia

Chúa yêu trần thế alleluia Các môn thể thao bắt đầu bằng tiếng nhảy

Các môn thể thao bắt đầu bằng tiếng nhảy Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

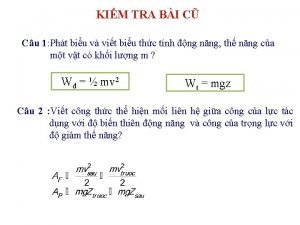

Các châu lục và đại dương trên thế giới Công thức tính thế năng

Công thức tính thế năng Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Mật thư anh em như thể tay chân

Mật thư anh em như thể tay chân 101012 bằng

101012 bằng Phản ứng thế ankan

Phản ứng thế ankan Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật