201011 201213 Industrial Policy Action Plan IPAP Economic

- Slides: 66

2010/11 – 2012/13 Industrial Policy Action Plan (IPAP) Economic Sectors and Employment Cluster Portfolio Committee 23 February 2010 1

The National Industrial Policy Framework • • • The NIPF adopted by Cabinet in 2007 sets out the broad approach to Industrial Policy as; Long term industrialisation Facilitate diversification beyond traditional commodities Increased value addition in tradable goods and services Promotion of labour absorbing economic development Industrialisation that ensures increased participation (BBBBEE) and marginalised regions Contributes to building industrial development on African continent 2

Progress • Flowing from NIPF, Cabinet approved the 2007/8 IPAP in which significant progress has been made: – Strengthening of competition legislation and practice – Revised auto programme for 2013 -2020: Automotive Production and Development Programme (APDP) – Development of new architecture for Clothing / Textiles: Clothing Textiles Competitiveness Programme (CTCP) – Removal / lowering of tariffs on key input industries such as on primary chemicals, aluminium, and machinery and textiles not produced in SA – Significant investment and job creation in Business Process Services (Outsourcing) – Strengthened energy efficiency standards in the light of the electricity crisis • 2007/8 IPAP reflected chiefly ‘easy-to-do’ actions / low-hanging fruit versus ‘need-to-do’ actions to achieve structural change • 2010/11 – 12/13 IPAP is a product of the Economic Sectors and Employment Cluster. Responds to the demand of the new administration for strategic higher impact industrial policy interventions. Movement to three year rolling IPAP with iterative scaling up and continuous improvement 3

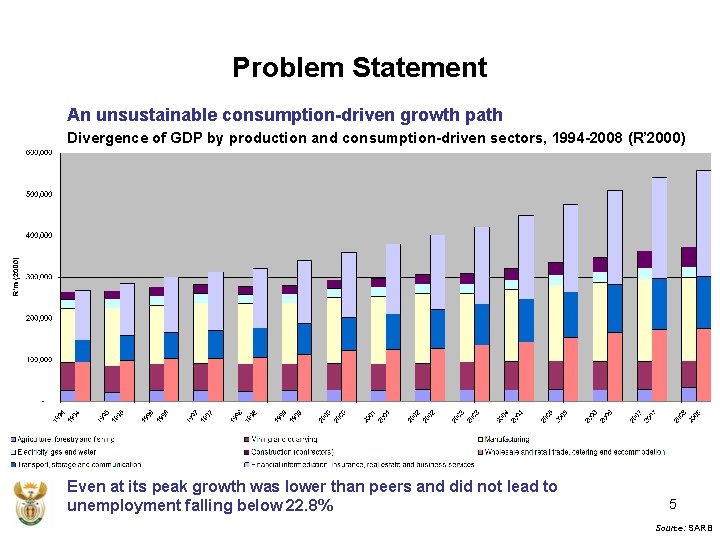

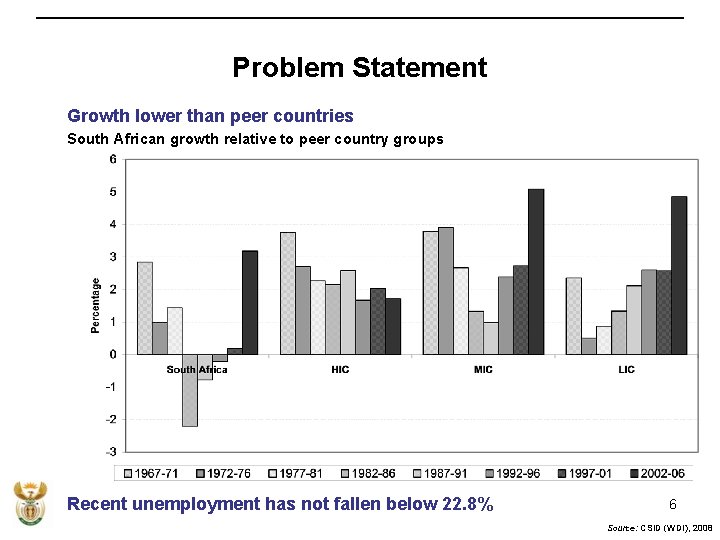

Problem statement • Prior to global crisis SA achieved relatively high growth rates but this masks key structural problems • SA growth rates lower than peers • Growth driven by unsustainable increases in credit extension and consumption (financial intermediation, insurance, real estate, transport, storage, communication, wholesale and retail, catering, accommodation) grew 7. 7% annually, • Production sectors, (agriculture, mining, manufacturing, electricity, water and construction) only grew 2, 9% annually. • Contributed to range of imbalances in economy including current account deficit • Employment has remained unacceptably high – never below 22. 8% 4

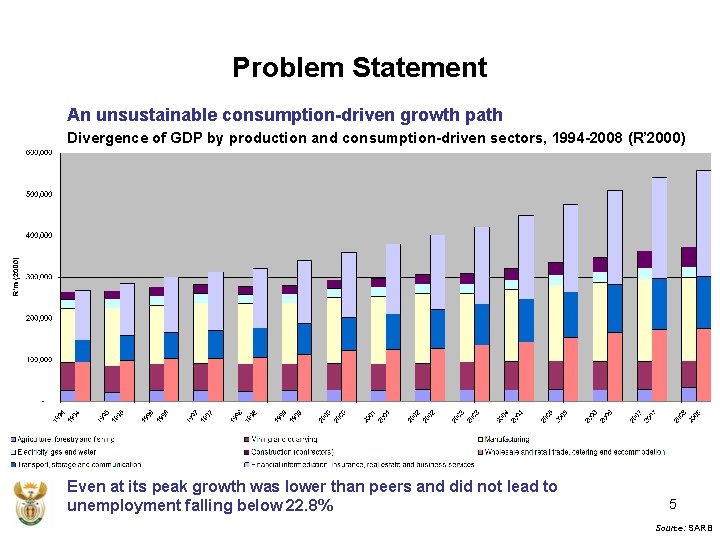

Problem Statement An unsustainable consumption-driven growth path Divergence of GDP by production and consumption-driven sectors, 1994 -2008 (R’ 2000) Even at its peak growth was lower than peers and did not lead to unemployment falling below 22. 8% 5 Source: SARB

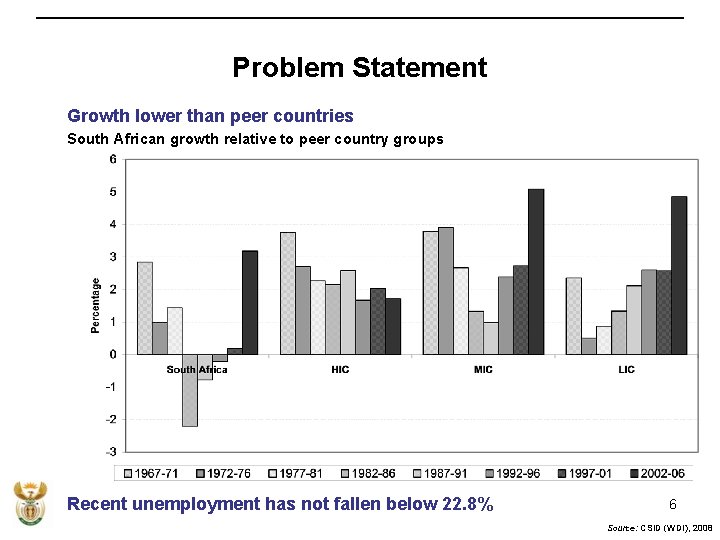

Problem Statement Growth lower than peer countries South African growth relative to peer country groups Recent unemployment has not fallen below 22. 8% 6 Source: CSID (WDI), 2008

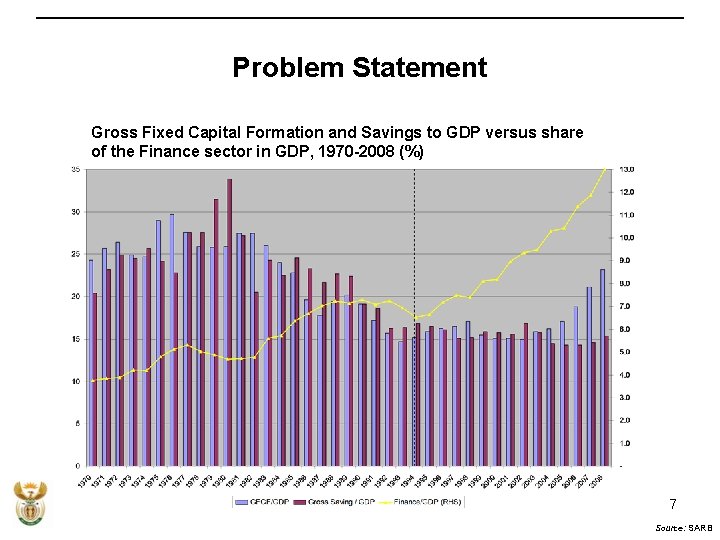

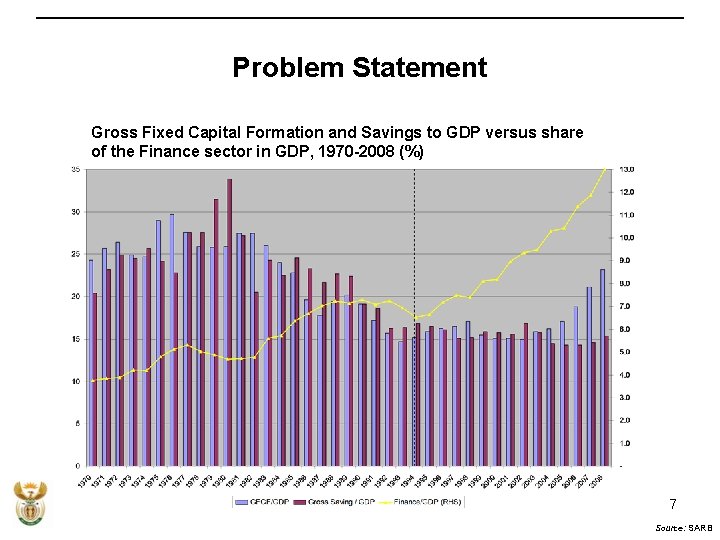

Problem Statement Gross Fixed Capital Formation and Savings to GDP versus share of the Finance sector in GDP, 1970 -2008 (%) 7 Source: SARB

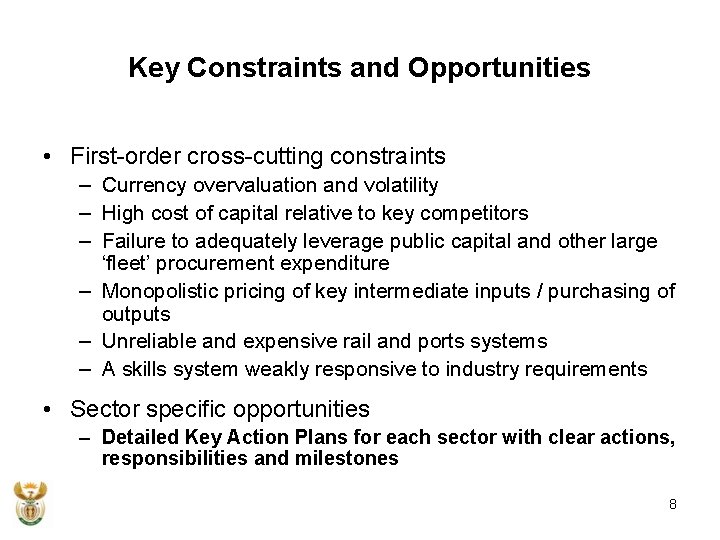

Key Constraints and Opportunities • First-order cross-cutting constraints – Currency overvaluation and volatility – High cost of capital relative to key competitors – Failure to adequately leverage public capital and other large ‘fleet’ procurement expenditure – Monopolistic pricing of key intermediate inputs / purchasing of outputs – Unreliable and expensive rail and ports systems – A skills system weakly responsive to industry requirements • Sector specific opportunities – Detailed Key Action Plans for each sector with clear actions, responsibilities and milestones 8

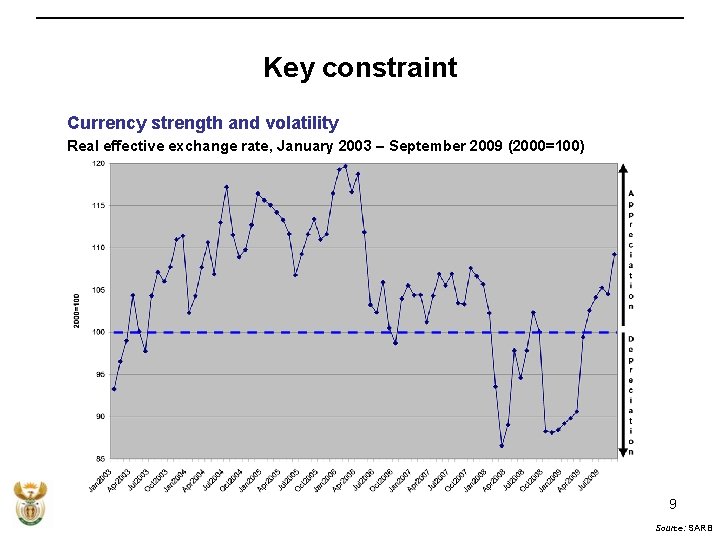

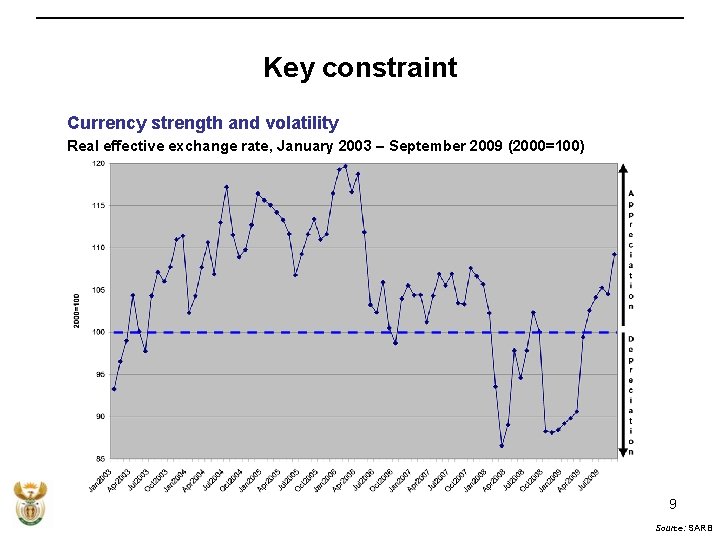

Key constraint Currency strength and volatility Real effective exchange rate, January 2003 – September 2009 (2000=100) 9 Source: SARB

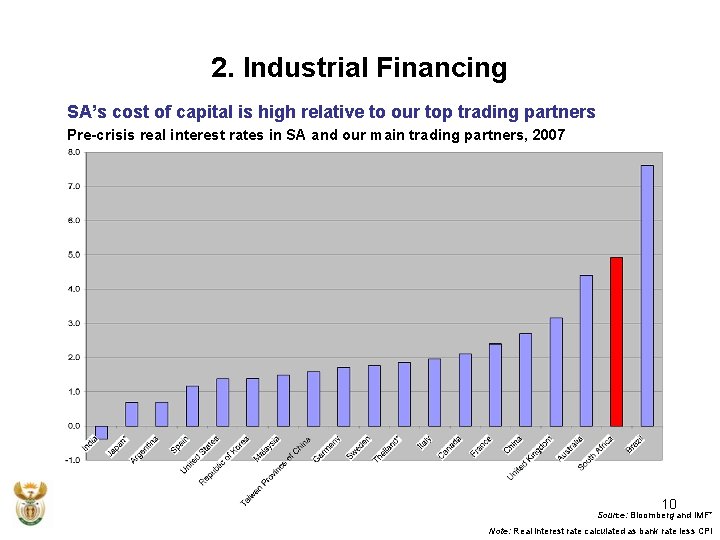

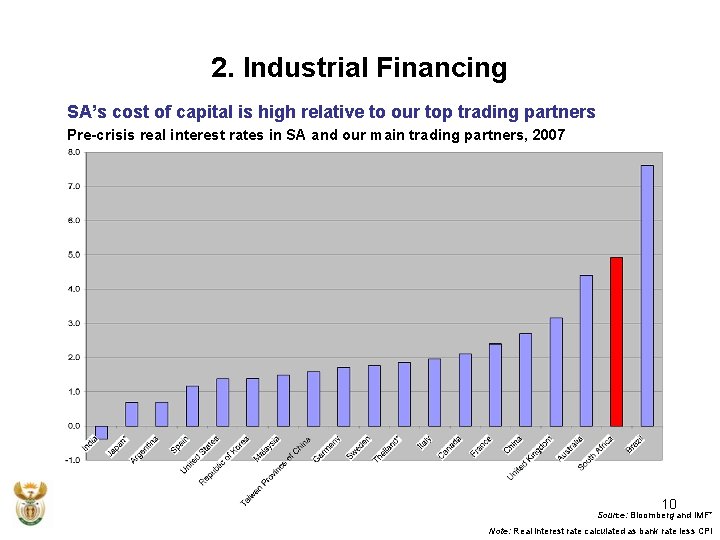

2. Industrial Financing SA’s cost of capital is high relative to our top trading partners Pre-crisis real interest rates in SA and our main trading partners, 2007 10 Source: Bloomberg and IMF* Note: Real interest rate calculated as bank rate less CPI

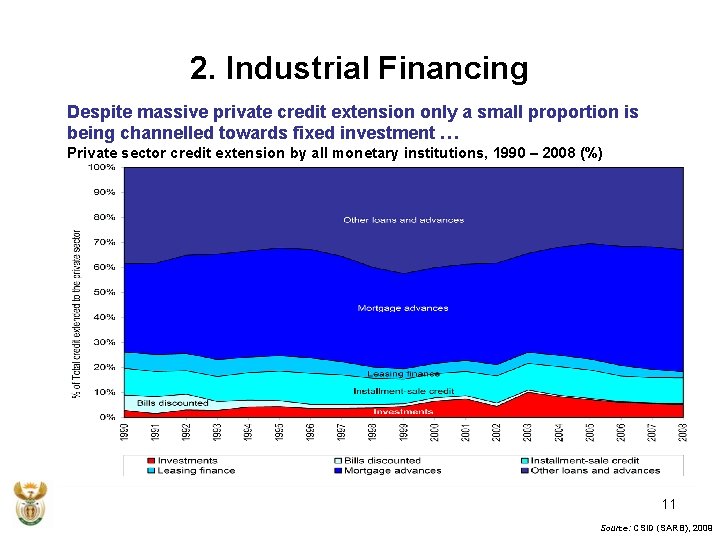

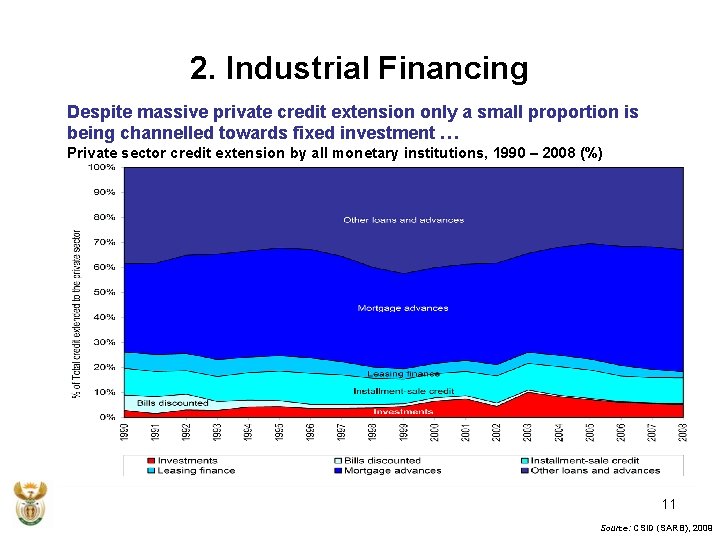

2. Industrial Financing Despite massive private credit extension only a small proportion is being channelled towards fixed investment … Private sector credit extension by all monetary institutions, 1990 – 2008 (%) 11 Source: CSID (SARB), 2009

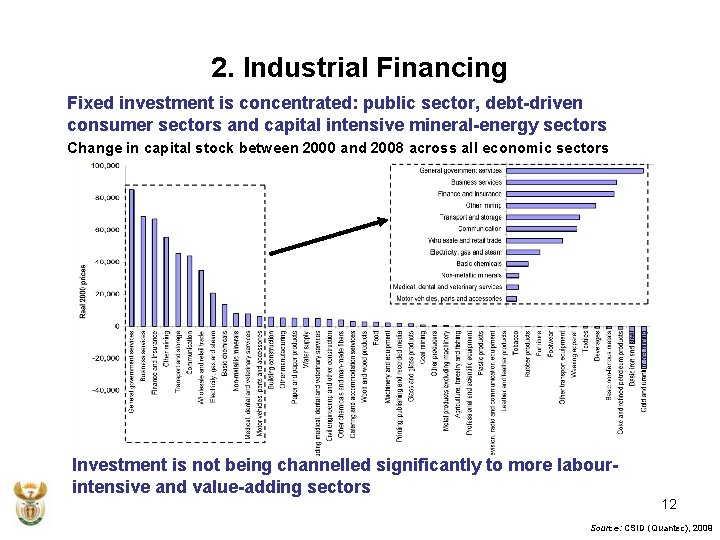

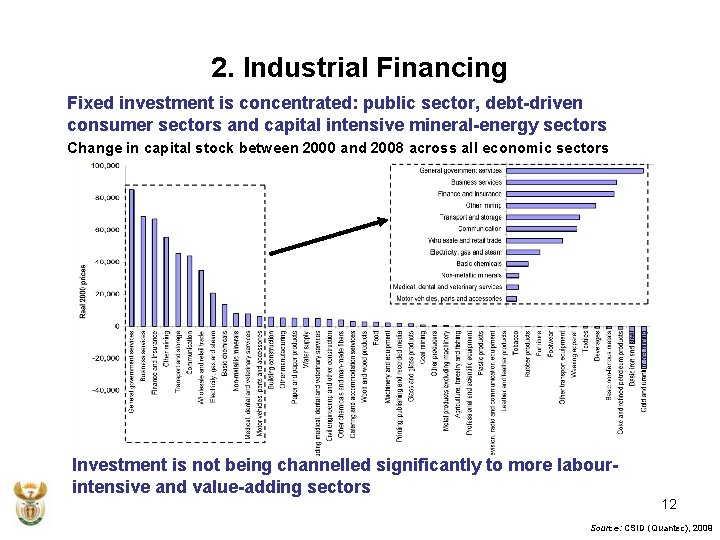

2. Industrial Financing Fixed investment is concentrated: public sector, debt-driven consumer sectors and capital intensive mineral-energy sectors Change in capital stock between 2000 and 2008 across all economic sectors Investment is not being channelled significantly to more labourintensive and value-adding sectors 12 Source: CSID (Quantec), 2009

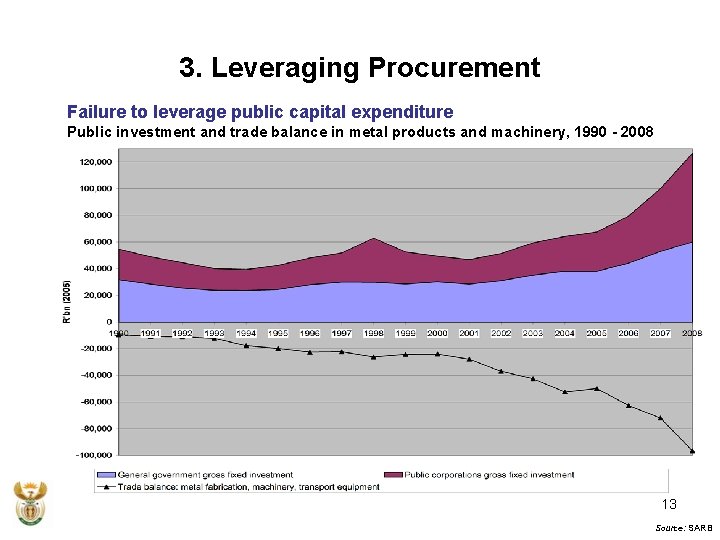

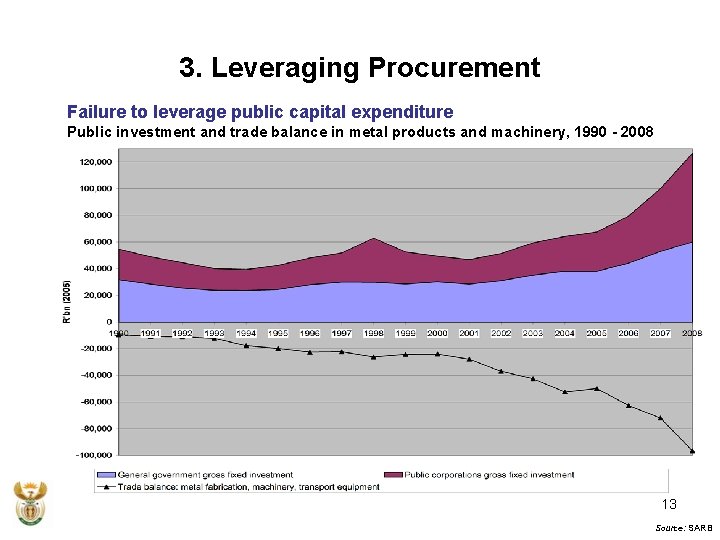

3. Leveraging Procurement Failure to leverage public capital expenditure Public investment and trade balance in metal products and machinery, 1990 - 2008 13 Source: SARB

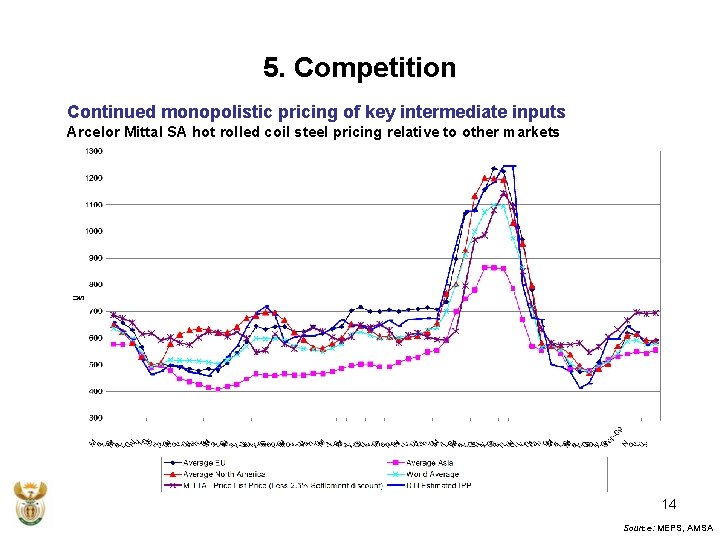

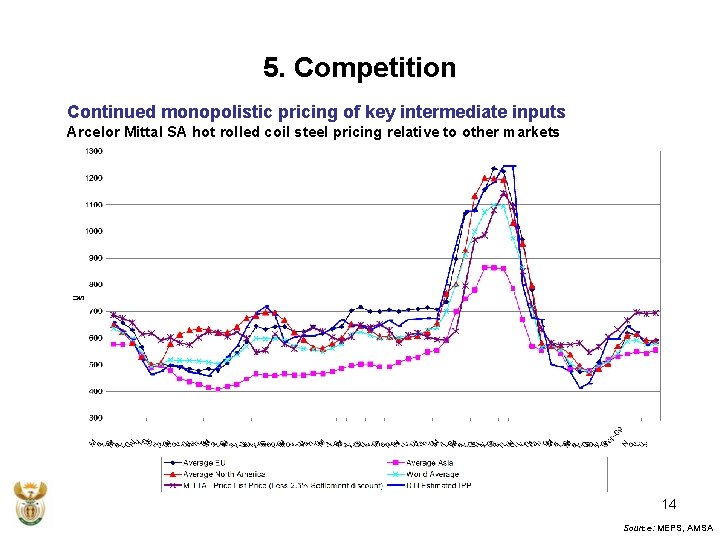

5. Competition Continued monopolistic pricing of key intermediate inputs Arcelor Mittal SA hot rolled coil steel pricing relative to other markets Graph from Bianca 14 Source: MEPS, AMSA

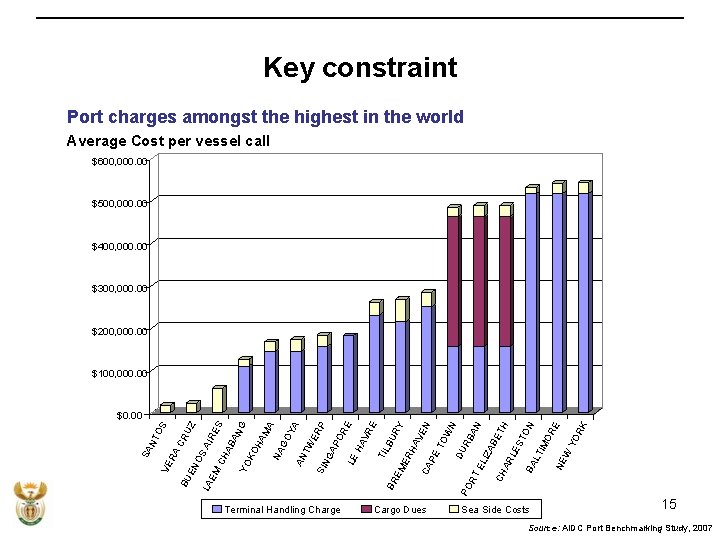

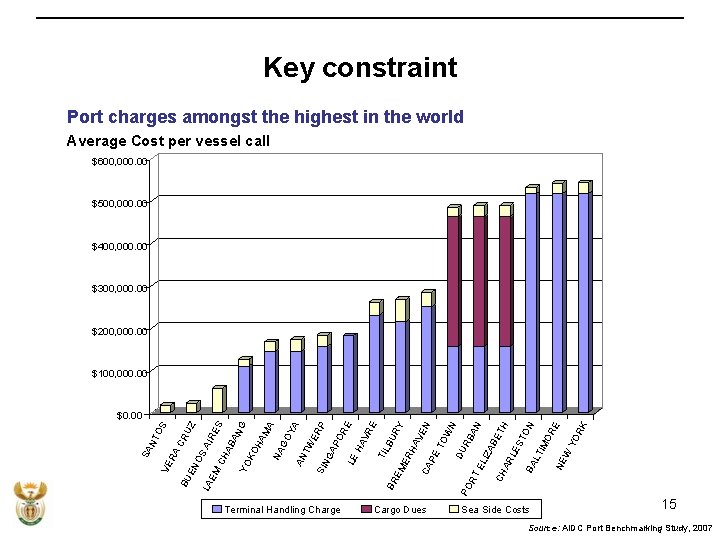

Key constraint Port charges amongst the highest in the world Average Cost per vessel call $600, 000. 00 $500, 000. 00 $400, 000. 00 $300, 000. 00 $200, 000. 00 $100, 000. 00 TW ER P GA PO RE LE HA VR E TIL BU BR RY EM ER HA VE CA N PE TO WN DU PO RB RT AN EL IZA BE CH TH AR LE ST ON BA LT IM OR E NE W YO RK SIN YA AN GO NA HA MA G KO AN YO ES AB AIR LA EM CH UZ OS CR BU EN RA VE SA NT OS $0. 00 Terminal Handling Charge Cargo Dues Sea Side Costs 15 Source: AIDC Port Benchmarking Study, 2007

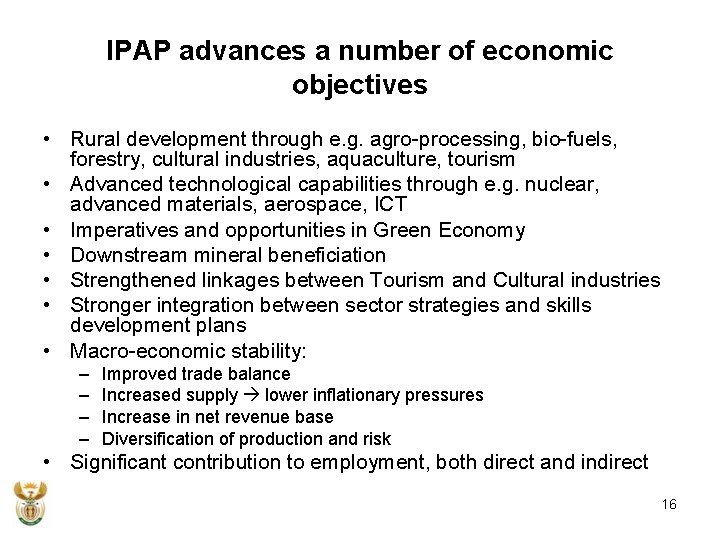

IPAP advances a number of economic objectives • Rural development through e. g. agro-processing, bio-fuels, forestry, cultural industries, aquaculture, tourism • Advanced technological capabilities through e. g. nuclear, advanced materials, aerospace, ICT • Imperatives and opportunities in Green Economy • Downstream mineral beneficiation • Strengthened linkages between Tourism and Cultural industries • Stronger integration between sector strategies and skills development plans • Macro-economic stability: – – Improved trade balance Increased supply lower inflationary pressures Increase in net revenue base Diversification of production and risk • Significant contribution to employment, both direct and indirect 16

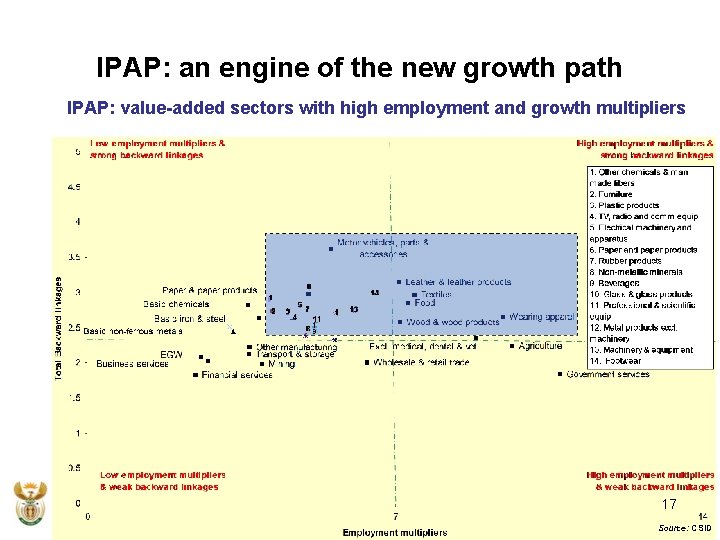

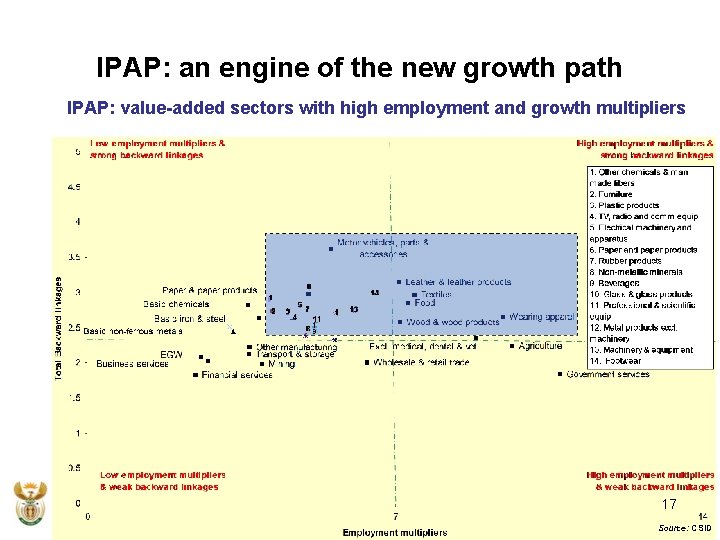

IPAP: an engine of the new growth path IPAP: value-added sectors with high employment and growth multipliers 17 Source: CSID

New Growth Path A process is required to further elaborate other economic policies and integrate inter-related policies and key departments and agencies into the New Growth Path – led by EDD: – Framework Response to the International Economic Crisis – Stable pro-employment macroeconomic environment – Public sector – Labour market policies – Industrial policy and action plans – Knowledge economy – Green economy – Rural economic development – Tourism development – Enterprise development – Informal economy – Social economy – Work on skills for the economy – Provision of economic infrastructure which excludes bulk infrastructure – Regional integration 18

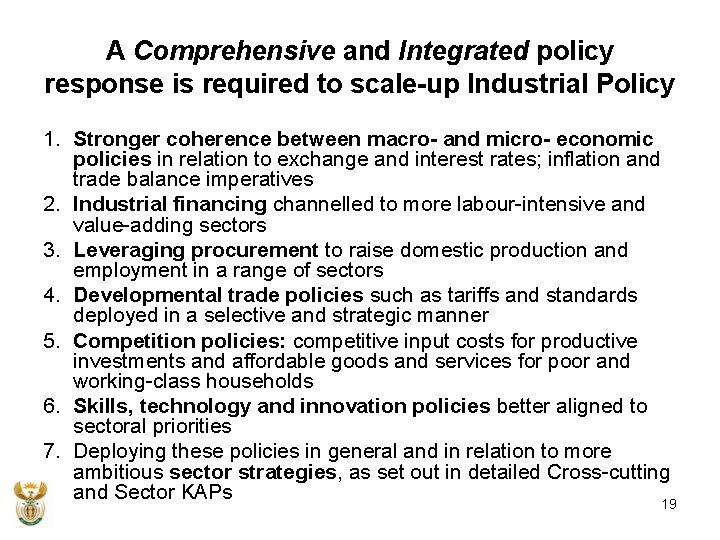

A Comprehensive and Integrated policy response is required to scale-up Industrial Policy 1. Stronger coherence between macro- and micro- economic policies in relation to exchange and interest rates; inflation and trade balance imperatives 2. Industrial financing channelled to more labour-intensive and value-adding sectors 3. Leveraging procurement to raise domestic production and employment in a range of sectors 4. Developmental trade policies such as tariffs and standards deployed in a selective and strategic manner 5. Competition policies: competitive input costs for productive investments and affordable goods and services for poor and working-class households 6. Skills, technology and innovation policies better aligned to sectoral priorities 7. Deploying these policies in general and in relation to more ambitious sector strategies, as set out in detailed Cross-cutting and Sector KAPs 19

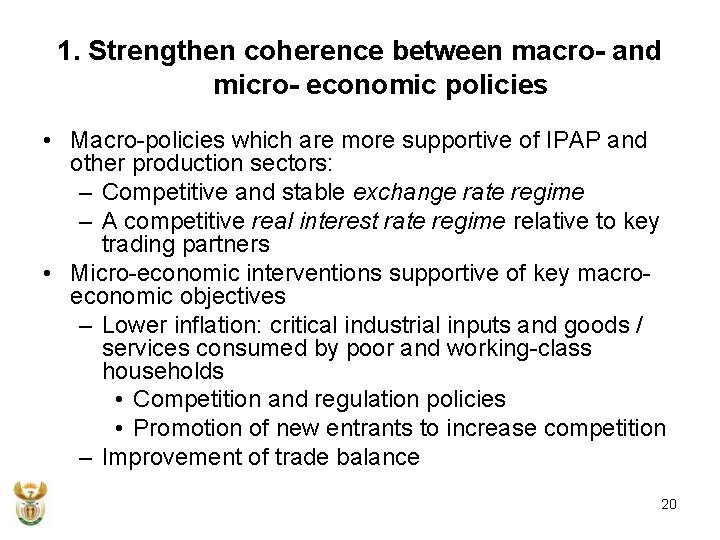

1. Strengthen coherence between macro- and micro- economic policies • Macro-policies which are more supportive of IPAP and other production sectors: – Competitive and stable exchange rate regime – A competitive real interest rate regime relative to key trading partners • Micro-economic interventions supportive of key macroeconomic objectives – Lower inflation: critical industrial inputs and goods / services consumed by poor and working-class households • Competition and regulation policies • Promotion of new entrants to increase competition – Improvement of trade balance 20

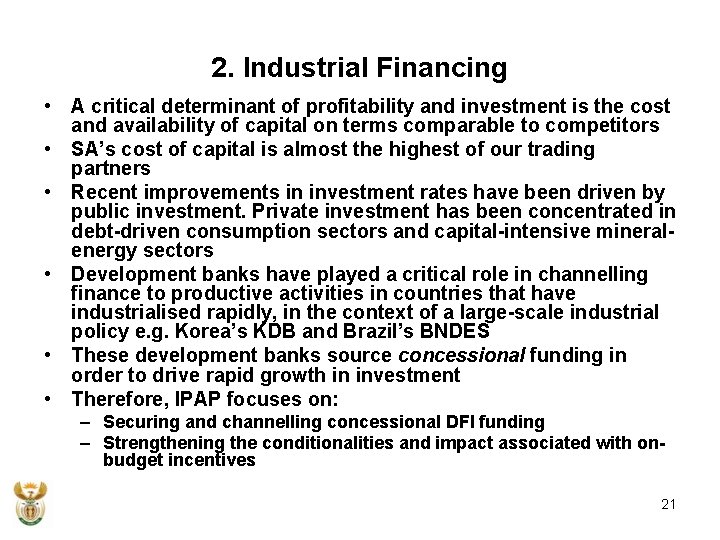

2. Industrial Financing • A critical determinant of profitability and investment is the cost and availability of capital on terms comparable to competitors • SA’s cost of capital is almost the highest of our trading partners • Recent improvements in investment rates have been driven by public investment. Private investment has been concentrated in debt-driven consumption sectors and capital-intensive mineralenergy sectors • Development banks have played a critical role in channelling finance to productive activities in countries that have industrialised rapidly, in the context of a large-scale industrial policy e. g. Korea’s KDB and Brazil’s BNDES • These development banks source concessional funding in order to drive rapid growth in investment • Therefore, IPAP focuses on: – Securing and channelling concessional DFI funding – Strengthening the conditionalities and impact associated with onbudget incentives 21

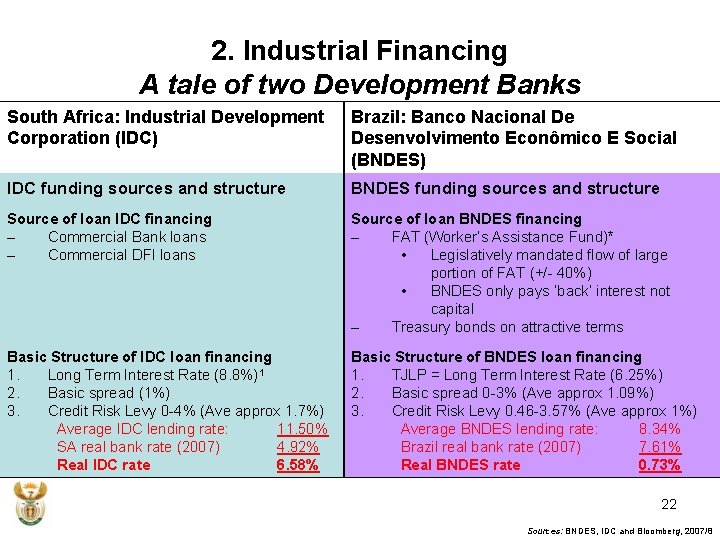

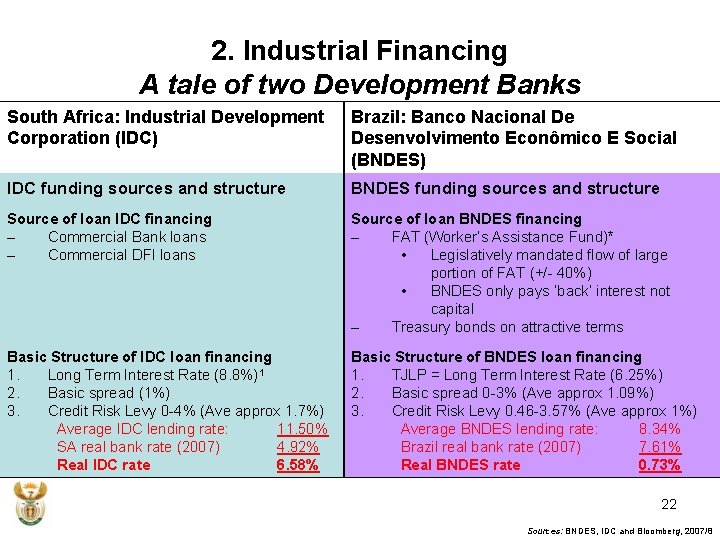

2. Industrial Financing A tale of two Development Banks South Africa: Industrial Development Corporation (IDC) Brazil: Banco Nacional De Desenvolvimento Econômico E Social (BNDES) IDC funding sources and structure BNDES funding sources and structure Source of loan IDC financing – Commercial Bank loans – Commercial DFI loans Source of loan BNDES financing – FAT (Worker’s Assistance Fund)* • Legislatively mandated flow of large portion of FAT (+/- 40%) • BNDES only pays ‘back’ interest not capital – Treasury bonds on attractive terms Basic Structure of IDC loan financing 1. Long Term Interest Rate (8. 8%)1 2. Basic spread (1%) 3. Credit Risk Levy 0 -4% (Ave approx 1. 7%) Average IDC lending rate: 11. 50% SA real bank rate (2007) 4. 92% Real IDC rate 6. 58% Basic Structure of BNDES loan financing 1. TJLP = Long Term Interest Rate (6. 25%) 2. Basic spread 0 -3% (Ave approx 1. 09%) 3. Credit Risk Levy 0. 46 -3. 57% (Ave approx 1%) Average BNDES lending rate: 8. 34% Brazil real bank rate (2007) 7. 61% Real BNDES rate 0. 73% 22 Sources: BNDES, IDC and Bloomberg, 2007/8

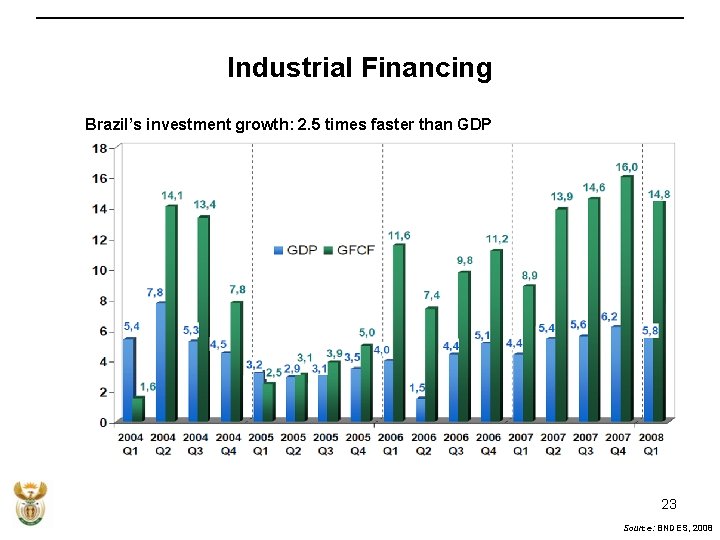

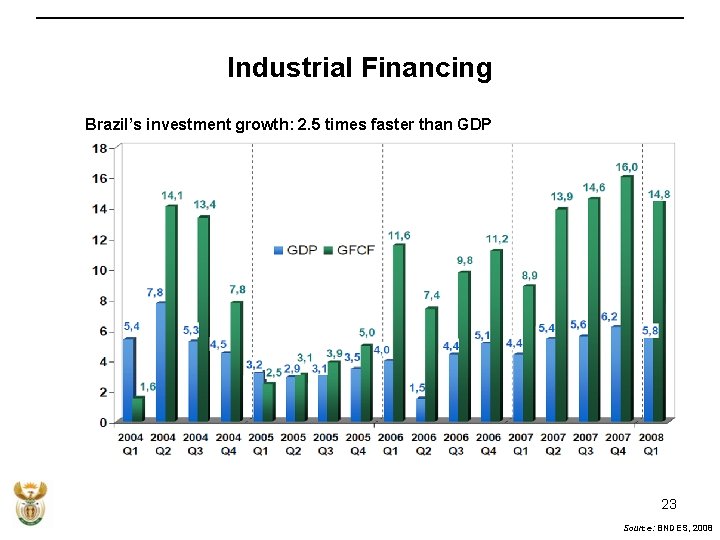

Industrial Financing Brazil’s investment growth: 2. 5 times faster than GDP 23 Source: BNDES, 2008

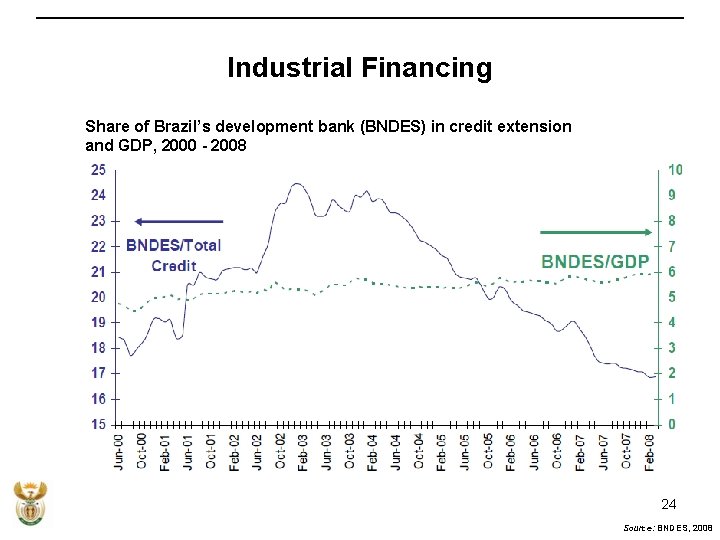

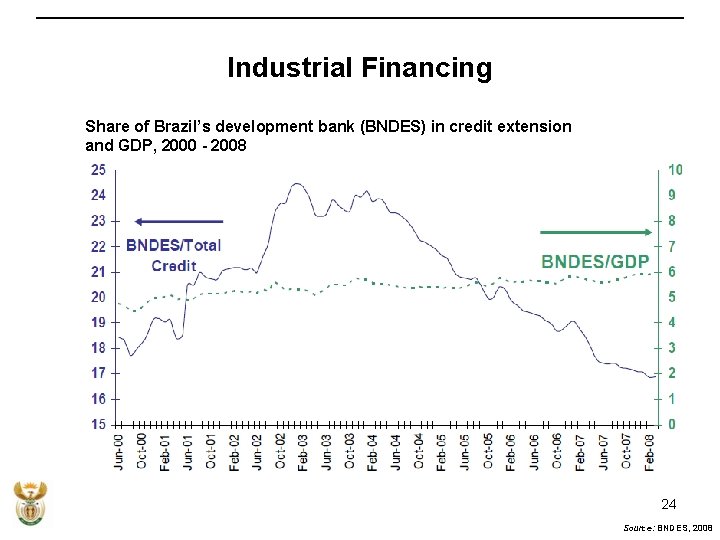

Industrial Financing Share of Brazil’s development bank (BNDES) in credit extension and GDP, 2000 - 2008 24 Source: BNDES, 2008

2. Industrial Financing KEY ACTION PLANS IDC funding source 1. Review IDC business model to free up capital for IPAP, other value -adding and more labour-intensive sectors 2. Intra-governmental process to identify and create long-term ongoing source of concessional funding for IDC Strengthen impact: incentives and support measures 3. Strengthen conditionalities in relation to: - Employment intensity - Market behaviour - Localisation of supply chains - Much stronger scrutiny and conditionalities for further ‘megaprojects’ 25

3. Leveraging Procurement • Large public procurement is currently conducted more on an ‘ad-hoc’ than ‘strategic’ basis – No medium- and long-term procurement plans – Little or no price advantage – Limited leveraging of domestic production • Many sectors in the IPAP will depend on leveraging public expenditure • Strengthen procurement to deliver greater industrial development and net economic benefits • Overhaul procurement policy, legislation and practice to: – Identify 8 -10 large strategic ‘fleet’ procurements for the development of long-term procurement plans that set out what will be manufactured domestically – Incentivise local production and B-BBEE on routine purchases, while ensuring value-for-money for the state 26

3. Leveraging Procurement KEY ACTION PLANS 1. Identification of 8 -10 strategic procurement ‘fleets’ for the explicit development of longterm procurement plans that incorporate local production and supplier development requirements: – Locomotives / wagons / coaches for freight and commuter rail – Key elements of the coal-fired electricity build programme – Key elements of the nuclear electricity build programme – Buses procured by Metros – Components / materials in relation to SAA / Defence Aerospace procurement – Appropriate sequencing of inclusion of pharmaceuticals especially ARVs – Set-top-boxes produced for digital migration process 2. Overhaul of Preferential Procurement Policy Framework Act (PPPFA) – Align discretionary points with B-BBEE Codes and local procurement – Eliminate ‘import fronting’ – Designation of fleets and other ‘critical industries’ for domestic production – Allow price-matching by domestic producers 27

3. Leveraging Procurement KEY ACTION PLANS 3. Revise National Industrial Participation Programme (NIPP) and integrate Competitive Supplier Development Programme (CSDP) – – – More strategic pre-tender process applying to public procurements over a particular threshold and in relation to strategic sectors Gap analysis comparing demand requirements and domestic supply capacity Up-front identification in NIPP tenders of domestic production / supplier development requirements 4. Align B-BBEE and Industrial Policy – Review B-BBEE policy with a view to strengthening the linkages between B-BBEE and industrial policy 5. Strengthen role of DFI’s in locking-in domestic and regional procurement – DFI’s to include local production conditionalities in their lending conditions 6. Revamped Proudly South Africa – – PSA with SANAS to verify local content Higher profile campaigns 28

4. Developmental Trade Policies • • NIPF identifies tariffs as industrial policy instruments More strategic and focussed deployment of trade policy instruments – Tariff-setting informed by sector strategies and properly enforced – Standards • • Developed and Advanced Developing countries are increasingly erecting standards-based barriers to trade Standards in relation to climate change and energy efficiency 29

4. Developmental Trade Policies KEY ACTION PLANS 1. Ongoing Developmental Tariff Reform – Scope to increases tariffs on products with scope for significant potential creation / retention of decent jobs and import replacement – Scope for further decreases in tariffs on intermediate inputs into manufacturing – Explore stronger conditionalities on tariff increases 2. Clampdown on Customs Fraud – Indicative reference pricing system – Dedicated capacity to deal with fraudulent and illegal imports – Dedicated ports of entry for sensitive products – Criminalisation of customs fraud and increasing fines 3. Review trade valuation methodology to align with major trading partners 30

4. Developmental Trade Policies KEY ACTION PLANS 4. Strengthen market standards – Pre-import enforcement of standards – Additional mandatory standards in areas such as building energy and water efficiency, electrical products, electric motor vehicle batteries, processed meat – Develop additional standards in areas such as solar water heaters, wind energy turbines, diesel particulate filters, motor vehicles electronics, interiors and exteriors, bio-diesel, furniture – Accreditation of local production in conjunction with Proudly South Africa (SANAS) 31

5. Competition • • Continued challenges with respect to monopolistic provision of strategic goods and services and low levels of effective competition. Returns derived not from effort and innovation but from historical position Existing regulation and enforcement backed up by IPAP focus on greater strategic role of competition authorities including by ensuring that strategies for those that receive state support are based on long term capacity building investment. Three areas of problematic activity; – Private inputs into manufacturing and other productive processes, e. g. steel, chemicals – Public inputs into manufacturing and other productive processes, e. g. electricity and telecommunications – Wage goods and other products purchased largely by poor and working- class households, particularly food 32

5. Competition KEY ACTION PLANS 1. Focus of Competition Authorities on: – Intermediate industrial products such as Steel, Chemicals and Cement – Infrastructure and Construction – Airfares – Food – Banking – Stronger focus on economic impacts such as: • Follow up on anti-cartel findings • Policy advocacy with government 33

6. Sectors Cluster 1: Qualitatively new areas of focus – – – Metals fabrication, capital and transport equipment sectors: leverage Capex programme, rebuild and position as future exporters Green and energy saving industries: solar water heating, concentrated solar power, wind power, energy efficiency Agro-processing linked to food security and food pricing imperatives Cluster 2: Scale up / broaden interventions in existing IPAP sectors – – Automotives, Components, Medium and Heavy Commercial Vehicles: raise economies of scale and localisation of components Downstream Mineral Beneficiation: based on establishing minimum beneficiation levels Plastics, Pharmaceuticals and Chemicals: focused on plastics and value -adding pharmaceuticals Clothing, Textiles, Footwear, Leather: recapture domestic market share through competitiveness upgrading and tackling illegal imports 34

6. Sectors Cluster 2: Scale up / broaden interventions in existing IPAP sectors – – Biofuels: establish regulatory framework and support agricultural and refining investment Forestry, Paper & Pulp, Furniture: unblock water licences and promote further processing Strengthening linkages between Cultural Industries and Tourism Business Process Outsourcing: broaden and deepen SA’s product offerings Cluster 3: Sectors to develop long-term advanced capabilities – – – Nuclear: leveraging local production and technology transfer Advanced Materials: feeding into new growth industries such as aerospace, solar and nuclear Aerospace: strengthening integration into supply chains Detailed Sector Key Action Plans: Appendix A 35

Impact of revised IPAP • Employment – 825, 706 direct decent jobs over ten years – 2, 477, 118 total (direct + indirect) decent jobs over ten years • Trade balance – Significant improvement in trade balance – Mitigate Balance-of-Payments threat to sustainability of public Capex programme – Diversify and grow exports in areas such as capital equipment, automotive components, agro-processing • Industrial capabilities – Build long term industrial capabilities and increasing returns through investment, skills development, upward movement in value chains and support for commercialisation and growth of domestic technologies 36

Appendix A Metal Fabrication, Capital and Transport Equipment • Most promising set of ‘sunrise industries’ which have benefited somewhat from recent public and private investment • Complimentarity between investment and employment • However, the potential of these sectors has not been fully realised • Opportunity to resuscitate the industry domestically in the short- and medium-term and develop into a competitive exporting industry • Key Opportunities – Eskom and Transnet capital expenditure programmes – Mining industry capital expenditure programme – African market • Potential to create 145, 478 direct jobs over next ten years, substantially reduce trade deficit and increase long term exports 37

Appendix A Metal Fabrication, Capital and Transport Equipment Key Actions 1. 2. 3. 4. 5. ‘Designation’ of long-term procurement fleets - Transnet and PRASA: locomotives / coaches - Key elements of Eskom’s coal-fired power stations Competitive Financing Programme for Suppliers to CAPEX Programme - Finance scheme to assist domestic suppliers to public CAPEX Programme - Administered by IDC Competitiveness benchmarking and matchmaking - UNIDO SPX programme to benchmark capabilities of suppliers and matching to Transnet’s demand requirements Skills Development - Tooling and Foundry initiatives - Resuscitation of skills facilities in specific industrial clusters - Annual Skills Development Plan in conjunction with DHE&T / SETA / NSF Finalise White Goods strategy and Action Plan Key departments / agencies: DTI, EDD IDC, NT, Transnet, Eskom, PRASA , DPE, Do. T, UNIDO, DST, DMR, NTI, NFTN 38

Appendix A Green Industries and energy efficiency • Environmental and climate change concerns have become a commercial reality • Increasing energy costs will be a major threat to manufacturing • Increasing ‘eco-protectionism’ in advanced economies • Opportunities to develop new industries and substantially increase energy efficiencies • Key opportunities – Solar Water Heating – Concentrated Solar Power – Wind – Biomass – Automotives – Substantial improvements in industrial energy efficiency • Potential to create thousands of direct jobs but requires more scoping 39

Appendix A Green Industries and energy efficiency Key Actions 1. Solar Water Heating – Establish mandatory requirement that all new houses from March 2011 must have solar water heating – Upscale domestic manufacturing – Financial model developed by Do. E – Training programme for installers 2. Concentrated Solar Power – Pilot plant financed by IDC – Leverage NERSA Refit tariff – Identify domestic manufacturing opportunities – Expedite process for signing of PPAs 3. Technology – Strengthen technological drive e. g. electric car 40

Appendix A Green Industries and energy efficiency Key Actions 4. 5. 6. Industrial energy efficiency programme – Explore fiscal incentives e. g. accelerated depreciation for energy efficient industrial motors – Scale up Cleaner Production Centre Water efficiency – SABS to develop standards for building water efficiency – Identify industrial opportunities e. g. rain-water tanks Further work required around: – Wind – Biomass – Recycling Key departments / agencies: DTI, EDD, Do. E, Municipal / Provincial Government, SABS 41

Appendix A Agro-processing • • Largest set of manufacturing sectors Some initial scoping work has been completed but requires more dedicated strategies for specific sub-sectors Key opportunities – Mariculture / Aquaculture – High-value agriculture – Organics – Small scale maize milling – Strengthen food safety controls and accreditation for domestic market and export access Potential to create 128, 000 direct jobs, retain 216, 000 jobs over next ten years and improve trade balance 42

Appendix A Agro-processing Key Actions 1. Implement Food Control Agency – Strengthen consumer safety and promote recapture of domestic market – Address increasing food safety requirements for export markets 2. Aquaculture / Mariculture – Legislative changes to improve enabling environment – Develop marine Aquaculture Zones – Establish aquaculture hatcheries – Financing and Technology support 3. Organics – Organic produce strategy and action plan – Develop organic food standards – Development of niche markets, e. g. organic cotton 43

Appendix A Agro-processing Key Actions 4. Small scale milling – Support small scale milling sector to create competition, support small businesses and lower bread prices – Develop financing and technology package 5. Fruit and vegetable canning industry – Raise competitiveness for long term sustainability 6. Rooibos and Honeybush Tea – Develop domestic packaging capacity 7. Skills Development plan in conjunction with DHE&T / SETA / NSF Key departments / agencies: DTI, EDD, Do. H, DAFF, DWA, DEA, Provincial / Municipal Government 44

Appendix A • • Automotives, Components, Medium and Heavy Commercial Vehicles Doubling of automotive production and tenfold growth in exports since 1995 with moderate employment growth However, a number of challenges persist: – High import penetration – Insufficient local content linked to inadequate breadth and depth of the components sector – Medium and heavy vehicles – including buses – were excluded Key opportunities: – Raise economies of scale and production to 1. 2 m vehicles by 2020 – Substantially increase local content through broadening and deepening component sector – Commercialise SA electric car – Resuscitate Bus sector – Grow “Yellow Metals” sector Potential to create 160, 000 direct jobs over ten years and increase exports 45

Appendix A Automotives, Components, Medium and Heavy Commercial Vehicles Key Actions 1. Raise economies of scale and production to 1. 2 million vehicles by 2020 - Leverage Automotive Production and Development Programme (APDP) - Ongoing increases in minimum volume threshold 2. Broaden and deepen component manufacturing – Localisation strategy - Electrical / Electronics - Exteriors - Interiors - Body - Chassis and Drive-train – Catalytic converters: move into Diesel Particulate Filters 3. Commercialise SA electric car - Leverage APDP and other support mechanisms 46

Appendix A Automotives, Components, Medium and Heavy Commercial Vehicles Key Actions 4. Resuscitate Bus Sector - ‘Designate’ Bus sector as long term procurement fleet - Incorporate Bus sector into APDP 5. Scale up domestic “Yellow Metal” manufacturers - (Re)incorporation into MIDP / APDP 6. Skills Development plan in conjunction with DHE&T / SETA / NSF Key departments / agencies: DTI, Do. T, DST, Provincial Government, Metros, AIDC 47

Appendix A Downstream Mineral Beneficiation • Minerals are a non-renewable ‘wasting asset’ which need to be leveraged during their lifespan to build a more diversified, labourintensive and value-adding economy Key Actions • Setting minimum beneficiation levels for key commodity chains • Identification of beneficiation offsets • Gold loan scheme Key departments / agencies: DTI, DMR, IDC 48

Appendix A Plastics, Pharmaceuticals and Chemicals • • • The upstream chemical sectors have performed well, with the more labourintensive and value-adding plastics and pharmaceuticals sectors lagging. Pharmaceuticals imports are 5 th largest contributor to our trade deficit There is significant scope to grow plastics and pharmaceuticals sectors Key opportunities – Grow plastics fabrication, in applications such as automotives, building and packaging – Leverage public procurement to increase pharmaceutical production and API’s – Selected opportunities for downstream beneficiation of chemicals Potential to create 22, 754 direct jobs over next ten years and significantly reduce trade deficit Key departments / agencies: DTI, DST, Do. E, Do. H, NT, IDC, CSIR 49

Appendix A Plastics, Pharmaceuticals and Chemicals Key Actions 1. 2. 3. Plastics – Leverage more competitive polymers price – Key opportunities in automotive, building and packaging sectors – Grow medical and electrical applications – Skills Development plan in conjunction with DHE&T / SETA / NSF Pharmaceuticals – Leverage public procurement: ARVs, reagents for AIDS / HIV diagnostics, vaccines – Attract Active Pharmaceutical Ingredient (API) investments for key ARVs – Improve regulatory environment for pharmaceutical production and clinical research – Subject to agreement with Department of Health Chemicals – Investigate opportunities for strategic downstream beneficiation e. g. fluorspar – Investigate costs / benefits of proposed new liquid fuels projects Key departments / agencies: DTI, DST, Do. E, Do. H, NT, IDC, CSIR 50

Appendix A Clothing, Textiles, Footwear, Leather • Sectors have experienced substantial decline due to rand strength and volatility, illegal imports and insufficient competitiveness • DCCS has not worked: only applicable to small pool of exporters and promoted imports through duty credits • Substantial strategy work has been done and most interventions required have been identified • Key opportunities – Recapture significant portion of domestic market through: • Firm and value-chain competitiveness upgrading • Clamp down on illegal imports and non-compliance with country of origin labelling – Develop / strengthen niche technology / export capabilities • Potential to retain 100, 000 jobs, possible creation of net new jobs and significantly reverse negative trade balance over the next 10 years 51

Appendix A Clothing, Textiles, Footwear, Leather Key Actions 1. Clothing Textiles Competitiveness Programme (CTCP) and Production Incentive (PI) – Rollout CTCP – Finalise and rollout PI – Extend CTCP and PI to Footwear, parts of Leather 2. Illegal Imports and related non-compliance – SARS clampdown on illegal imports – Scale up policing of country of origin labelling 3. Skills Upgrading Programme – Finalise funding arrangements with NSF – Roll-out via CTFL SETA and related institutions 4. Audit of Textiles Capabilities – Audit Textiles capabilities – Explore industry consolidation to achieve sustainability and competitive focus – Adapt tariff regime 52

Appendix A Clothing, Textiles, Footwear, Leather Key Actions 5. Innovation / Technology – Identify distinct technological capabilities – Explore commercialisation opportunities 6. BB-BEE – Explore leveraging BB-BEE obligations at retail level to promote: • Domestic manufacturing • Sustainable black ownership / management / succession planning Key departments / agencies: DTI, DHE&T, ITAC, SARS, IDC, DHE, CTFL SETA 53

Appendix A Biofuels • • Biofuels has substantial opportunity to generate employment and valueadded across primary (farming), manufacturing (refining) and tertiary (distribution) sectors and contribute to rural development Impetus around Biofuels has slowed due to debates about food security and appropriate crops to include. • Key opportunity – Fast-track regulatory processes to produce ‘quick win’ around employment and rural development progress – Scale up biofuels to 10% of fuel supply • Potential to create 125, 000 direct jobs over next ten years, mostly in rural areas, and lower oil imports 54

Appendix A Biofuels Key Actions 1. Biofuels – Ensure mandatory uplift of 2% of bio-ethanol into fuel supply at minimum price, rising to 10% over the next 10 years – IDC investment to support investment in projects (currently invested in 4 plants) – Skills development support Key departments / agencies: Do. E, DTI, EDD, DAFF, IDC, NEF 55

Appendix A Forestry, Paper & Pulp, Furniture • Forestry has the potential to create large number of jobs in rural areas with opportunities for further processing • The key constraint has been slowness in processes related to issuing of water licences, particularly in Eastern Cape • Requires an expedited process / dedicated task team to work through licensing backlog • Key opportunities – Create thousands of jobs in rural areas if regulatory processes can be expedited – Opportunity and need to improve the quality of work through revisiting outsourcing arrangements and stronger enforcement of labour legislation – Downstream beneficiation possibilities in sawmilling and furniture • Potential to create 42, 941 direct jobs over next ten years, mostly in rural areas, with downstream beneficiation opportunities 56

Appendix A Forestry, Paper & Pulp, Furniture Key Actions 1. 2. 3. Forestry – Establish expedited process / dedicated task team to fast-track issuing of water licences for 50, 000 hectares over next ten years – Revisit outsourcing model and strengthen enforcement of labour legislation in order to improve the quality of work in forestry – Accelerate PPA process for issuing of co-generation licenses to improve viability of existing sawmillers Furniture – Establishment of clusters for small furniture manufacturers (SMME) in KZN, WC and Gauteng – Establish furniture centre of competence Charcoal manufacturing – Establish charcoal plants in EC and KZN using mainly jungle wattle (alien species) as input Key departments / agencies: DAFF, DWEA, DTI, EDD, Provincial / Municipal Government, ASGISA-EC, Land Bank, SEDA 57

Appendix A Cultural Industries and Tourism • Closer integration between Cultural Industries and Tourism work • Key opportunities – Strengthen linkages between cultural industries and tourism to bolster both – Broaden cultural industries response 58

Appendix A Cultural Industries and Tourism Key Actions 1. Cultural industries – Rollout Craft Hubs to more provinces – Build on Film Rebate, IDC Funding and significant international and domestic successes – Develop a music industry strategy 2. Tourism – Research airline cost structures such as fuel levies – Identification of niche tourism development opportunities – Identification and promotion of cultural industry events that can bolster SA’s tourist offering e. g. music, literature Key departments / agencies: DTI, DAC, EDD, DST, DOT, Provincial Government, Metros, IDC, NFVF 59

Appendix A Business Processing Services • Build on successes of BPS incentives • Further research and strategy related to tradable and non-tradable services that can create decent jobs and generate foreign exchange • Key opportunities – Grow BPS programme • Potential to create 56, 000 direct decent jobs over ten years in BPS Key Actions 1. BPS – Continue to rollout BPS incentive – Continue Monyetla skills programme – Leverage lower telecomms costs – Promotion of SA as BPS destination Key departments and agencies: DTI, NT, Do. HE, DHE&T, Training institutions and private investors 60

Appendix A Advanced Manufacturing • • Advanced manufacturing is extremely broad area of work. Involves the commercialisation of advanced technologies and integration into high-value production systems Key opportunities: – Nuclear – Advanced Materials – Aerospace Raise long-term manufacturing and growth capabilities Potential to create 67, 500 direct jobs in nuclear over next ten years with significant positive impact on trade balance 61

Appendix A Advanced Manufacturing Key Actions 1. Nuclear – Leverage procurement of the Nuclear build programme for localisation and participation in global nuclear value chains – Conformity Assessment Framework for SA nuclear industry – Skills development support 2. Advanced Materials – Targeted development of metals / materials linked to downstream beneficiation opportunities such as Titanium – Nano-materials – Commercialisation of natural fibre composites (Kenaf, flax, sisal, hemp) – Composites 3. Aerospace – Deepen and broaden supply into global aerospace value chains – Leverage public purchase of aircraft 62

Appendix A Advanced Manufacturing Key Actions 4. Electronics – Leverage digital migration process in relation to set-top-boxes and digital televisions Key departments / agencies: DTI, Do. E, DPE, NT, DHE&T, Do. H, DAFF, CSIR, Eskom, NNR, NECSA 63

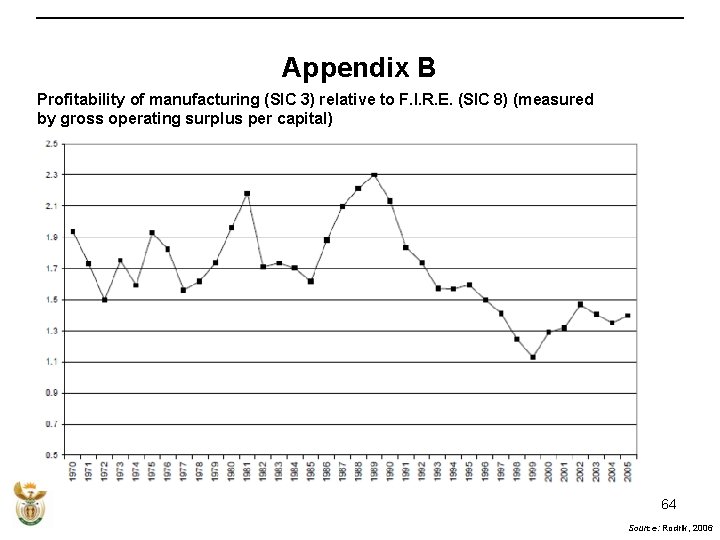

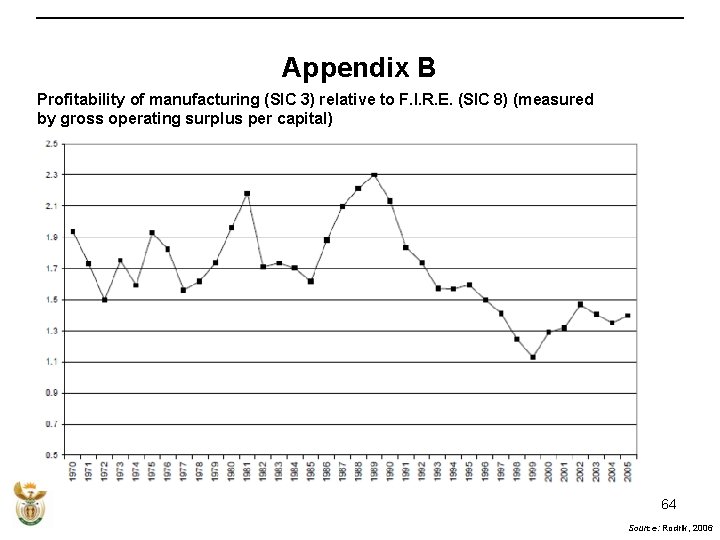

Appendix B Profitability of manufacturing (SIC 3) relative to F. I. R. E. (SIC 8) (measured by gross operating surplus per capital) 64 Source: Rodrik, 2006

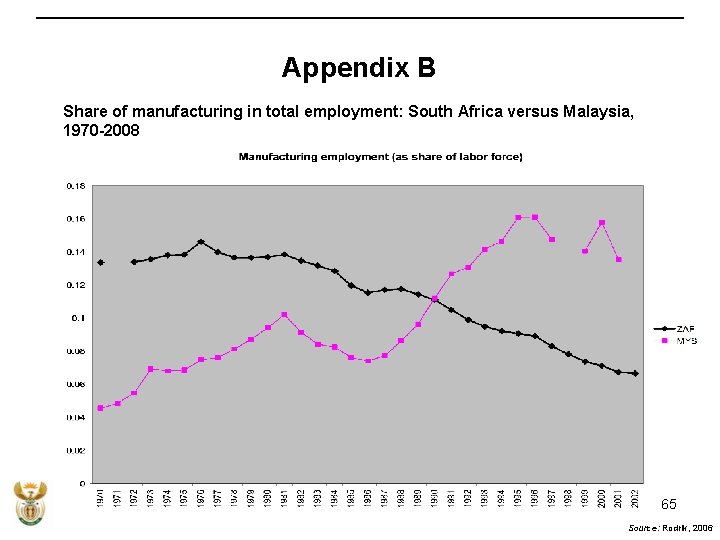

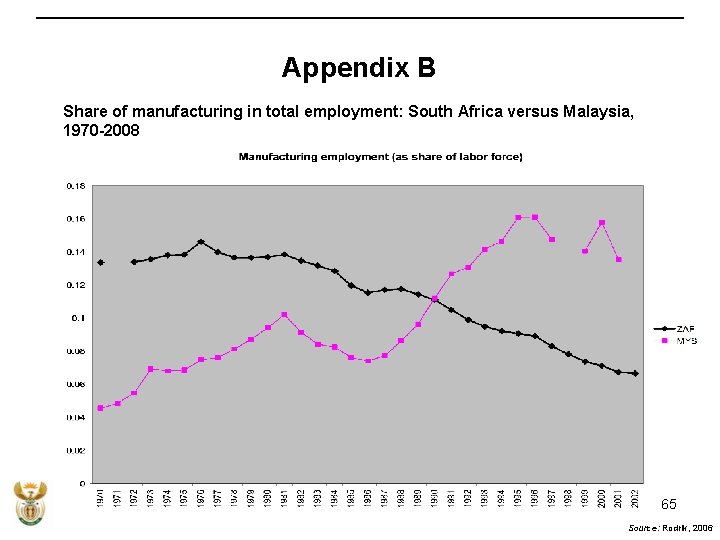

Appendix B Share of manufacturing in total employment: South Africa versus Malaysia, 1970 -2008 65 Source: Rodrik, 2006

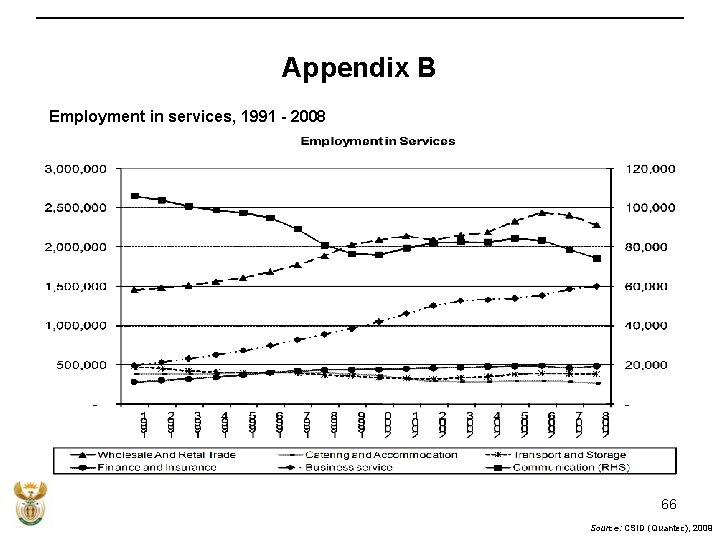

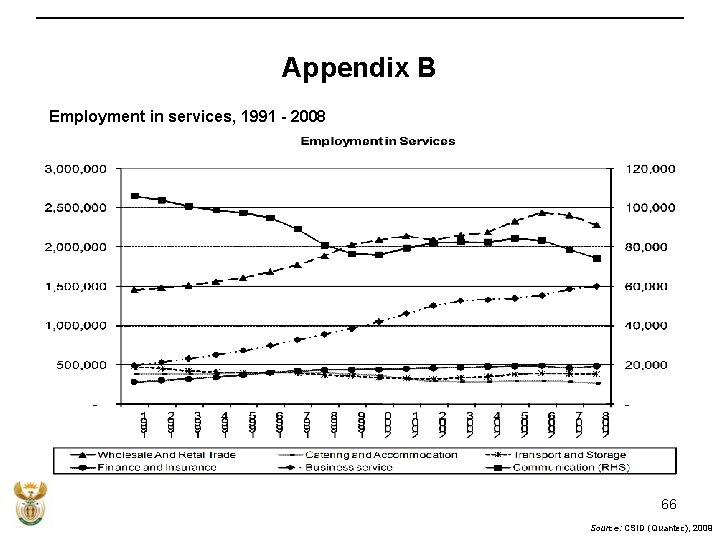

Appendix B Employment in services, 1991 - 2008 66 Source: CSID (Quantec), 2009

Ipap chaco

Ipap chaco Karl marx definition

Karl marx definition Hitlers economic policy

Hitlers economic policy Economic policy

Economic policy What does holodomor mean

What does holodomor mean Economic growth vs economic development

Economic growth vs economic development Economic growth and development

Economic growth and development Economic systems lesson 2 our economic choices

Economic systems lesson 2 our economic choices Industrial policy 1991

Industrial policy 1991 Industrial policy resolution in india

Industrial policy resolution in india Industrial policy of 1991 approved

Industrial policy of 1991 approved The plot sequence

The plot sequence Hatchet plot diagram answer key

Hatchet plot diagram answer key 5 stages of the plot

5 stages of the plot The black cat exposition

The black cat exposition Suit the action to the word the word to the action meaning

Suit the action to the word the word to the action meaning Lic endowment plan table 814

Lic endowment plan table 814 Lic samridhi plus 804 maturity calculator

Lic samridhi plus 804 maturity calculator Economic recovery plan

Economic recovery plan Industrial park master plan pdf

Industrial park master plan pdf Sorbent tubes

Sorbent tubes Plan de estudios ingenieria industrial javeriana

Plan de estudios ingenieria industrial javeriana Gender action plan world bank

Gender action plan world bank Gender action plan world bank

Gender action plan world bank Wellness recovery action plan examples

Wellness recovery action plan examples Counselling action plan

Counselling action plan 19 activities under swachhta action plan

19 activities under swachhta action plan Remarks in action plan

Remarks in action plan Madagascar action plan

Madagascar action plan Leadership action plan sample

Leadership action plan sample Trgpol

Trgpol Wellness recovery action plan examples

Wellness recovery action plan examples Is the component of agricultural renewal action plan

Is the component of agricultural renewal action plan Action plan for senior citizens

Action plan for senior citizens Wellness recovery action plan examples

Wellness recovery action plan examples Karnataka state action plan on climate change

Karnataka state action plan on climate change Iec plan

Iec plan Synergy action plan

Synergy action plan Cpuc esj action plan

Cpuc esj action plan Lcvp enterprise action plan

Lcvp enterprise action plan Dei action plan template

Dei action plan template Community action plan

Community action plan Chapter 4 action research sample

Chapter 4 action research sample Strategic retail planning

Strategic retail planning Cbrn national action plan philippines

Cbrn national action plan philippines Sample library action plan

Sample library action plan Appendix writing

Appendix writing Action plan on urban mobility

Action plan on urban mobility Tentative plan example

Tentative plan example Algee action steps

Algee action steps Strategic action plan

Strategic action plan Employee engagement survey results and action plan ppt

Employee engagement survey results and action plan ppt Wipo

Wipo Spatres matrix

Spatres matrix Action plan for sports coordinator

Action plan for sports coordinator Employee engagement plan template

Employee engagement plan template Data wise meeting norms

Data wise meeting norms Copd national action plan

Copd national action plan Ac61-98 plan of action

Ac61-98 plan of action Affirmative action plan components

Affirmative action plan components Action plan for active listening

Action plan for active listening My health plan of action

My health plan of action Cqi action plan template

Cqi action plan template Health action plan template

Health action plan template Sample activities in brigada eskwela

Sample activities in brigada eskwela Emergency action plan swimming pool

Emergency action plan swimming pool Global plan decade of action for road safety

Global plan decade of action for road safety