Simple Keynesian Model National Income Determination ThreeSector National

![Consumption Function C = C’ + c [Y - (T’ + t. Y)] Y-intercept Consumption Function C = C’ + c [Y - (T’ + t. Y)] Y-intercept](https://slidetodoc.com/presentation_image/1d7c93110f886965a0c0607ddefe156c/image-17.jpg)

- Slides: 72

Simple Keynesian Model National Income Determination Three-Sector National Income Model 1

Outline n n n Three-Sector Model Tax Function T = f (Y) Consumption Function C = f (Yd) Government Expenditure Function G=f(Y) Aggregate Expenditure Function E = f(Y) Output-Expenditure Approach: Equilibrium National Income Ye 2

Outline n n n Factors affecting Ye Expenditure Multipliers k E Tax Multipliers k T Balanced-Budget Multipliers k B Injection-Withdrawal Approach: Equilibrium National Income Ye 3

Outline n n n Fiscal Policy (v. s. Monetary Policy) Recessionary Gap Yf - Ye Inflationary Gap Ye - Yf Financing the Government Budget Automatic Built-in Stabilizers 4

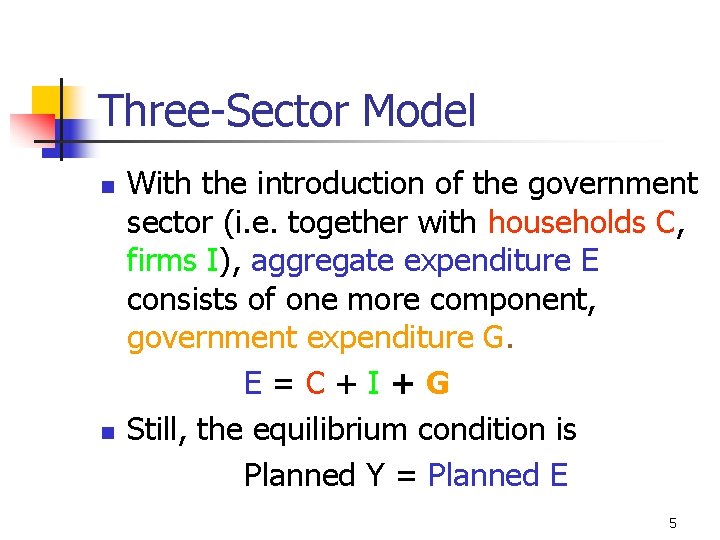

Three-Sector Model n n With the introduction of the government sector (i. e. together with households C, firms I), aggregate expenditure E consists of one more component, government expenditure G. E=C+I+G Still, the equilibrium condition is Planned Y = Planned E 5

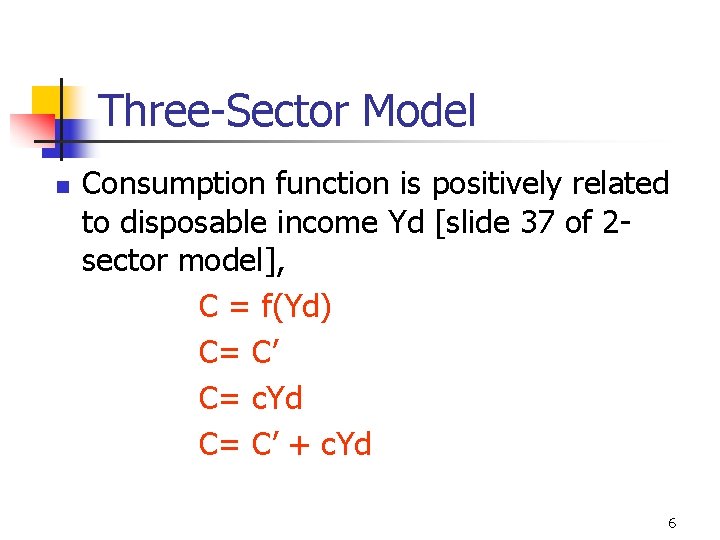

Three-Sector Model n Consumption function is positively related to disposable income Yd [slide 37 of 2 sector model], C = f(Yd) C= C’ C= c. Yd C= C’ + c. Yd 6

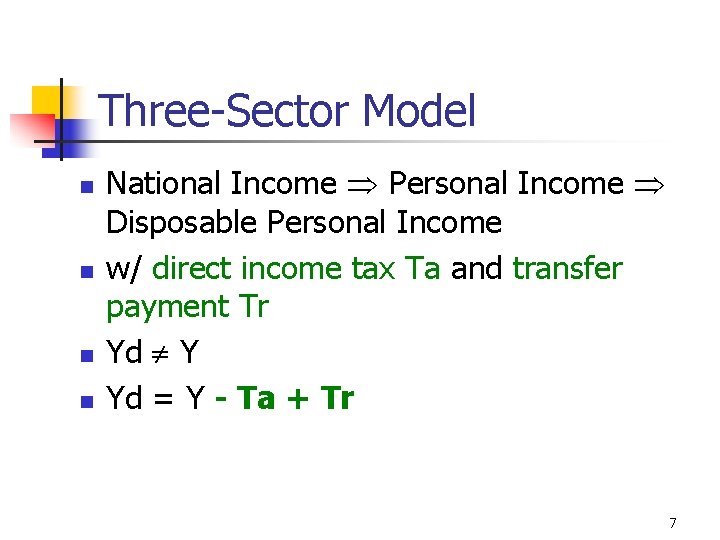

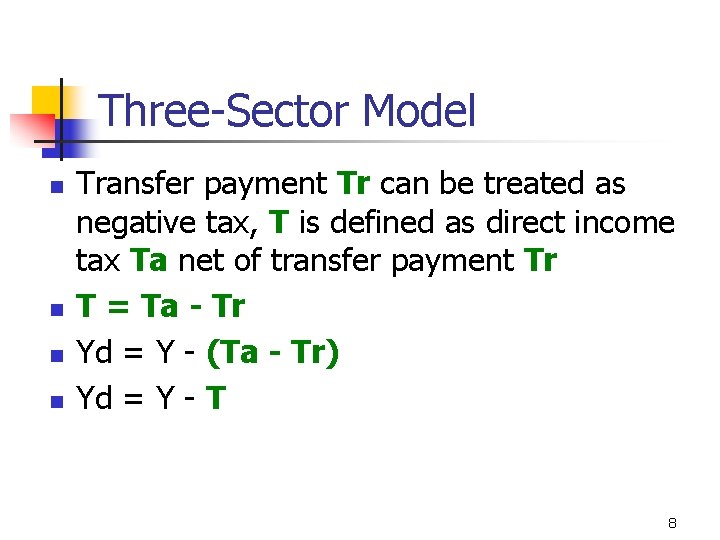

Three-Sector Model n n National Income Personal Income Disposable Personal Income w/ direct income tax Ta and transfer payment Tr Yd Y Yd = Y - Ta + Tr 7

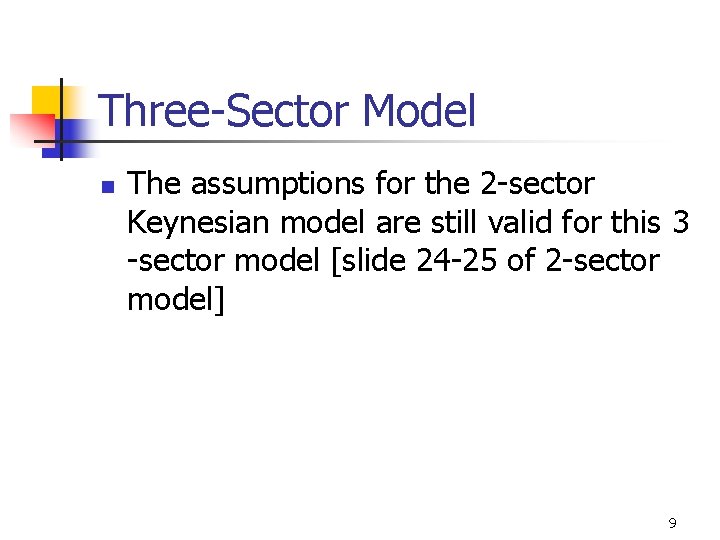

Three-Sector Model n n Transfer payment Tr can be treated as negative tax, T is defined as direct income tax Ta net of transfer payment Tr T = Ta - Tr Yd = Y - (Ta - Tr) Yd = Y - T 8

Three-Sector Model n The assumptions for the 2 -sector Keynesian model are still valid for this 3 -sector model [slide 24 -25 of 2 -sector model] 9

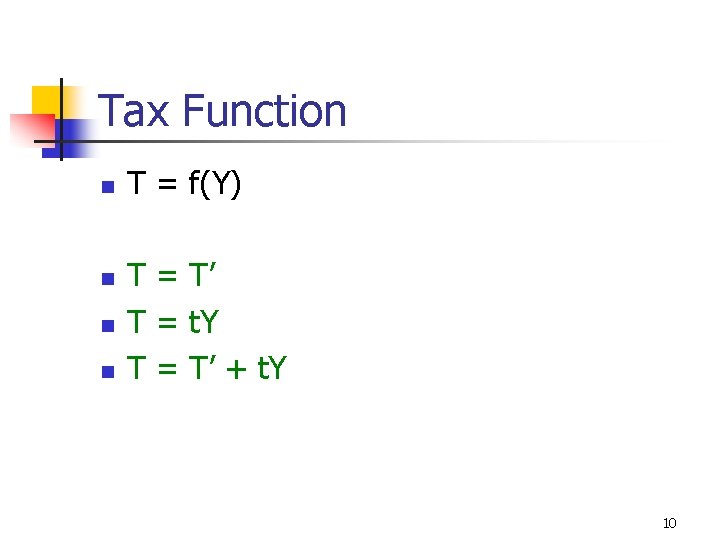

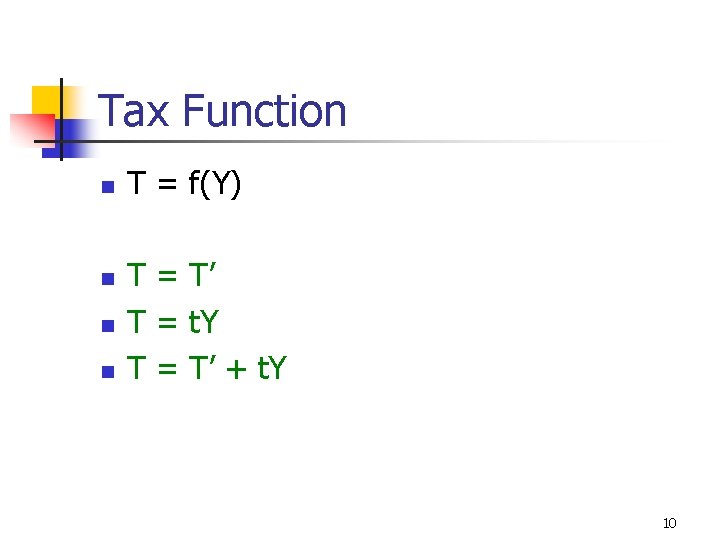

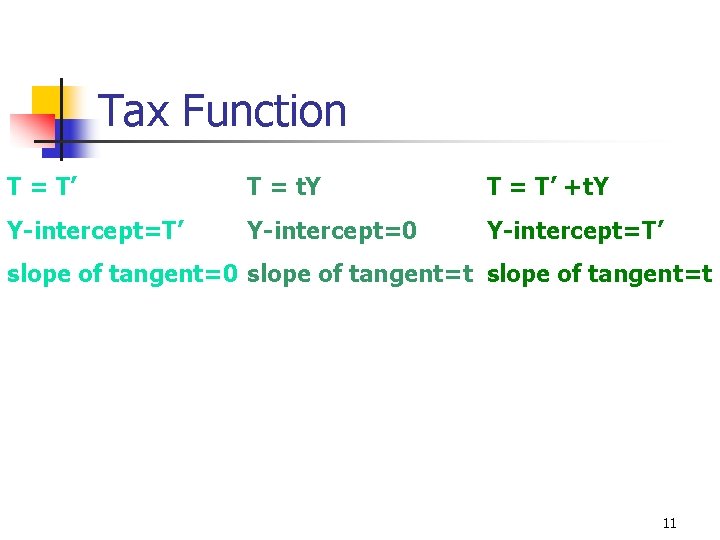

Tax Function n n T = f(Y) T = T’ T = t. Y T = T’ + t. Y 10

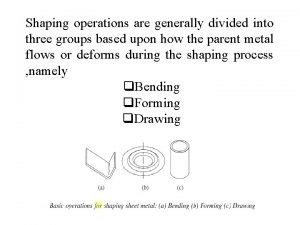

Tax Function T = T’ T = t. Y T = T’ +t. Y Y-intercept=T’ Y-intercept=0 Y-intercept=T’ slope of tangent=0 slope of tangent=t 11

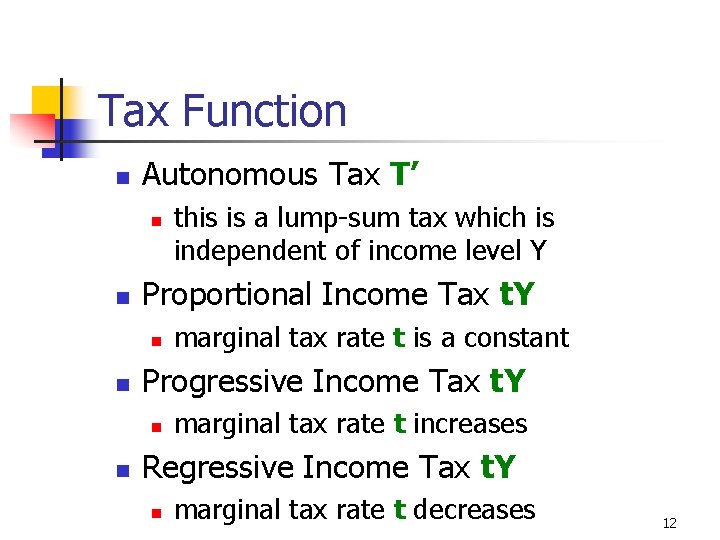

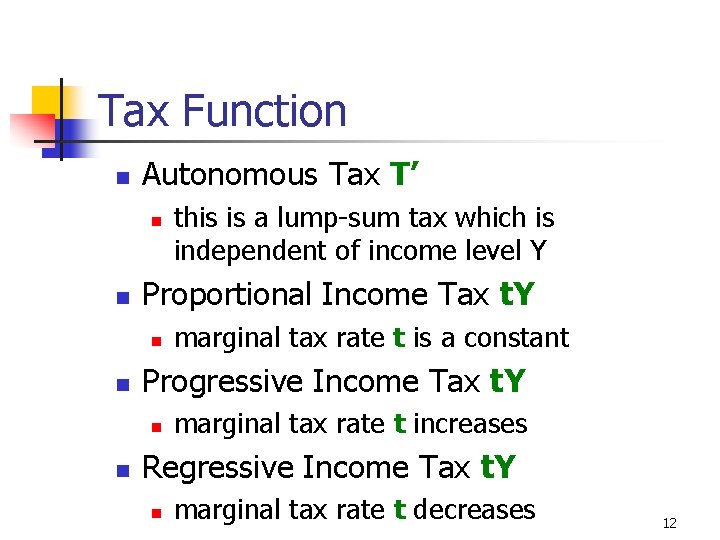

Tax Function n Autonomous Tax T’ n n Proportional Income Tax t. Y n n marginal tax rate t is a constant Progressive Income Tax t. Y n n this is a lump-sum tax which is independent of income level Y marginal tax rate t increases Regressive Income Tax t. Y n marginal tax rate t decreases 12

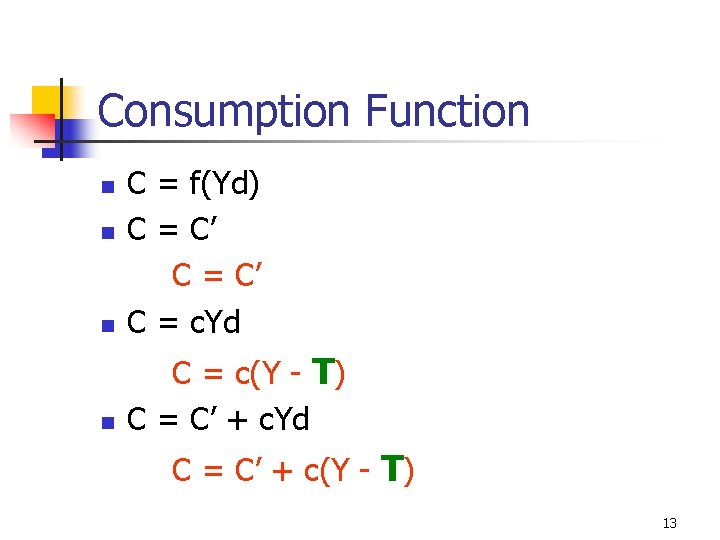

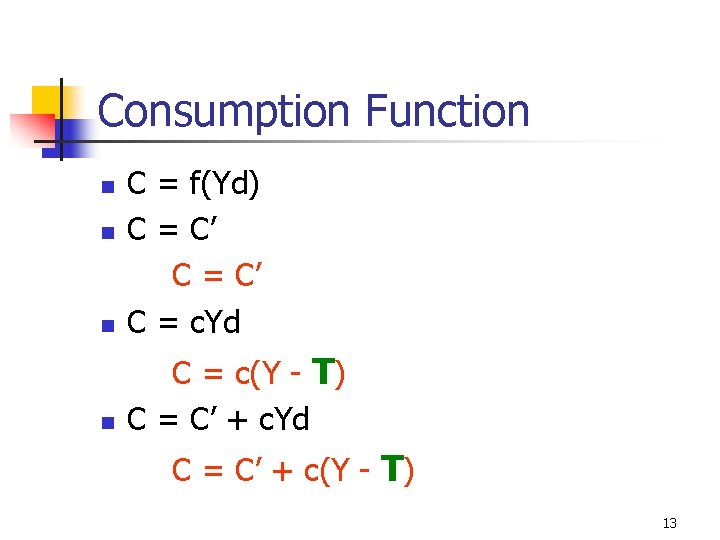

Consumption Function n C = f(Yd) C = C’ C = c. Yd n C = c(Y - T) C = C’ + c. Yd n n C = C’ + c(Y - T) 13

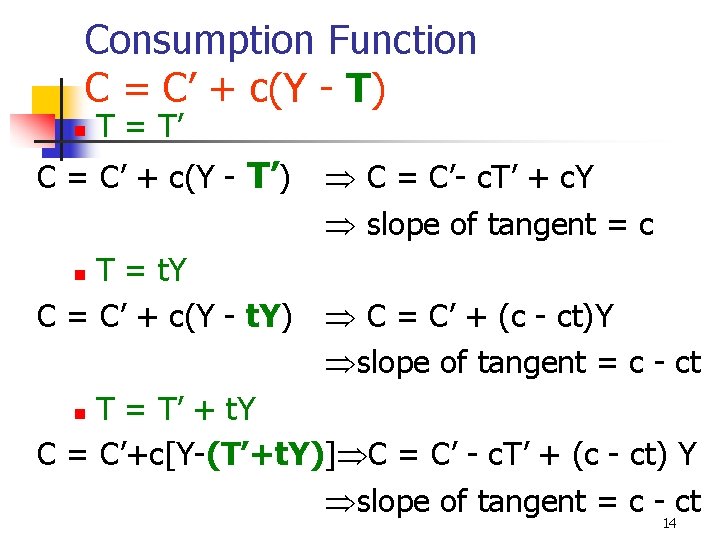

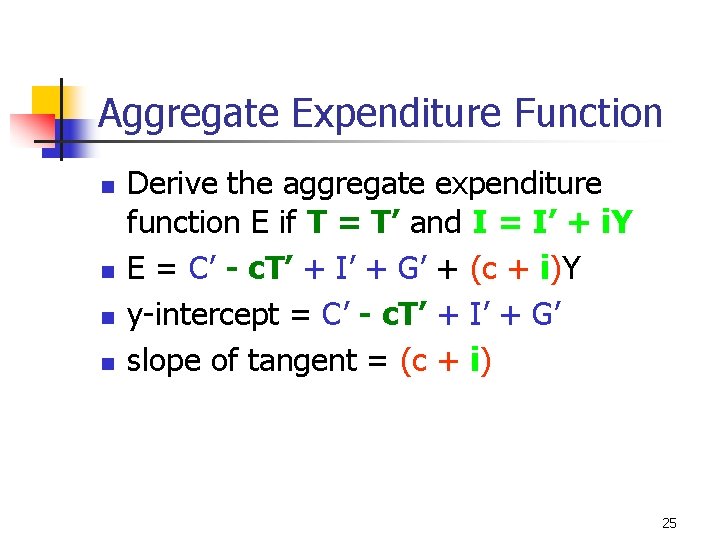

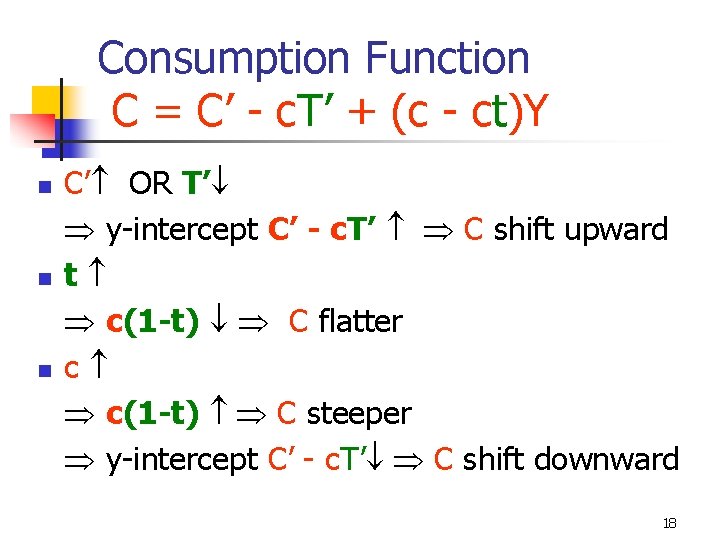

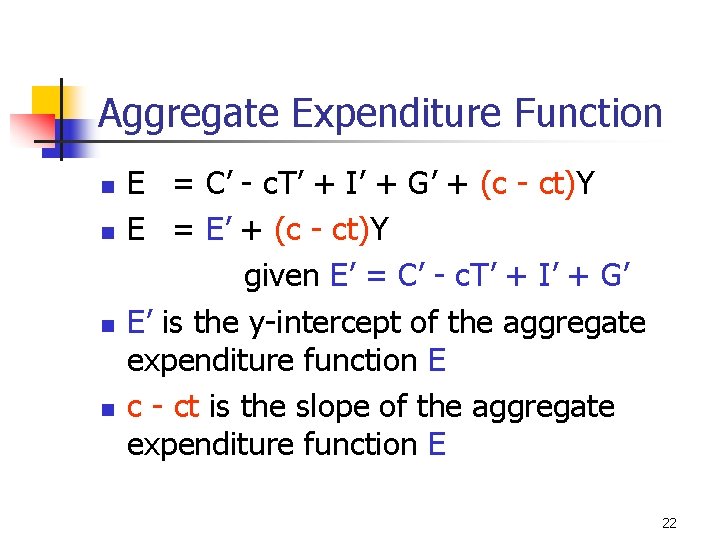

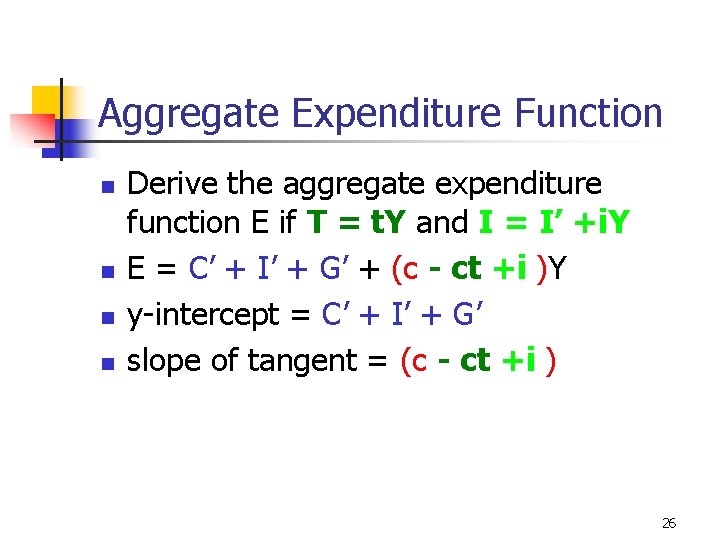

Consumption Function C = C’ + c(Y - T) n T = T’ C = C’ + c(Y - T’) T = t. Y C = C’ + c(Y - t. Y) C = C’- c. T’ + c. Y slope of tangent = c n C = C’ + (c - ct)Y slope of tangent = c - ct T = T’ + t. Y C = C’+c[Y-(T’+t. Y)] C = C’ - c. T’ + (c - ct) Y slope of tangent = c - ct n 14

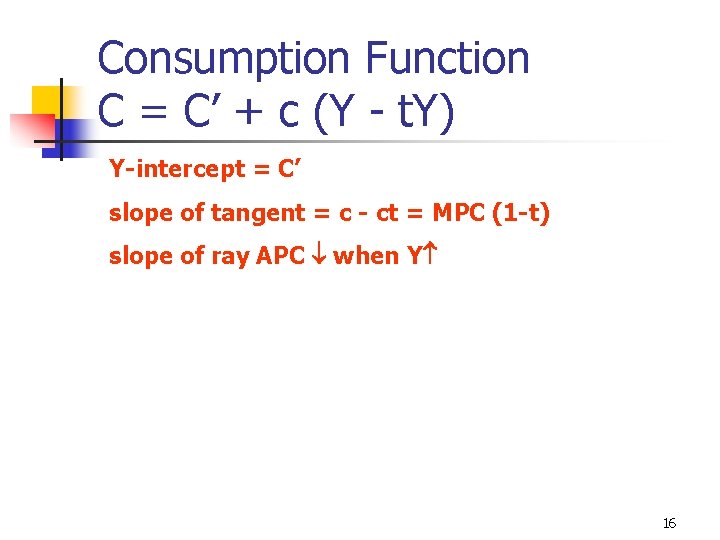

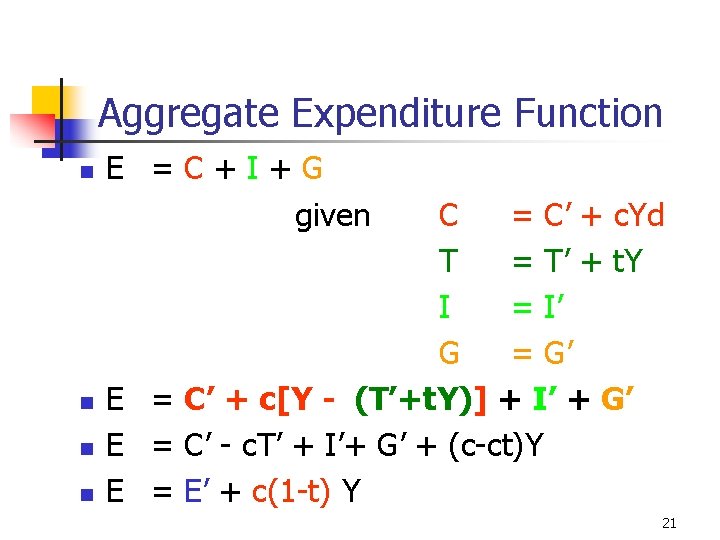

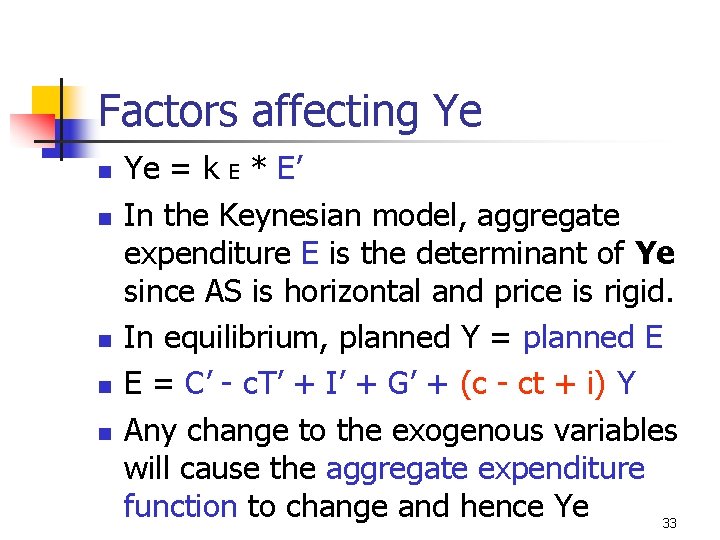

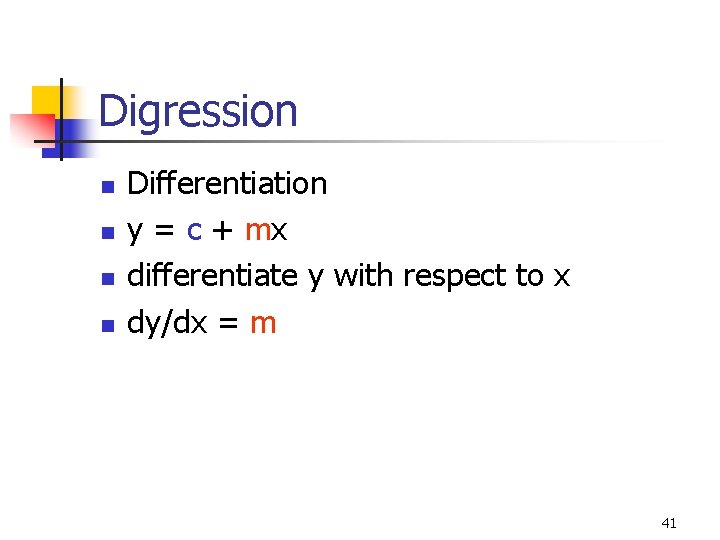

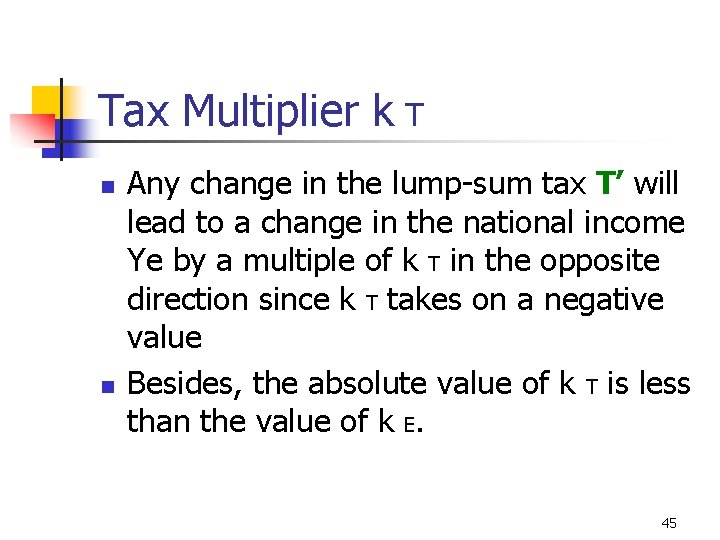

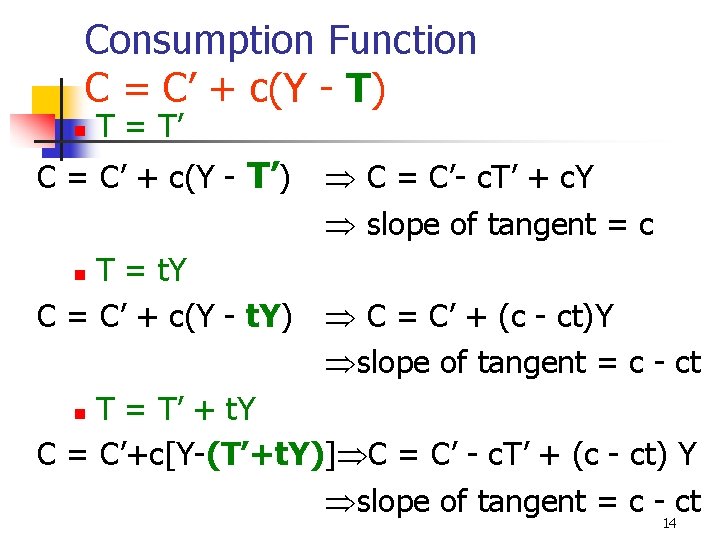

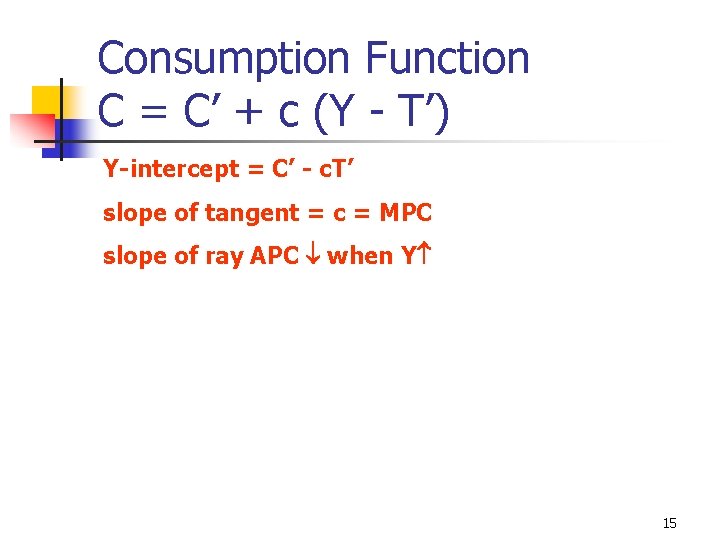

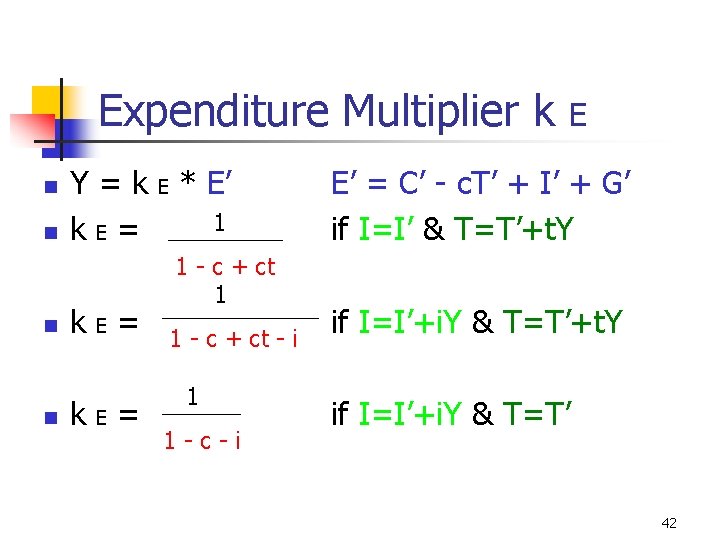

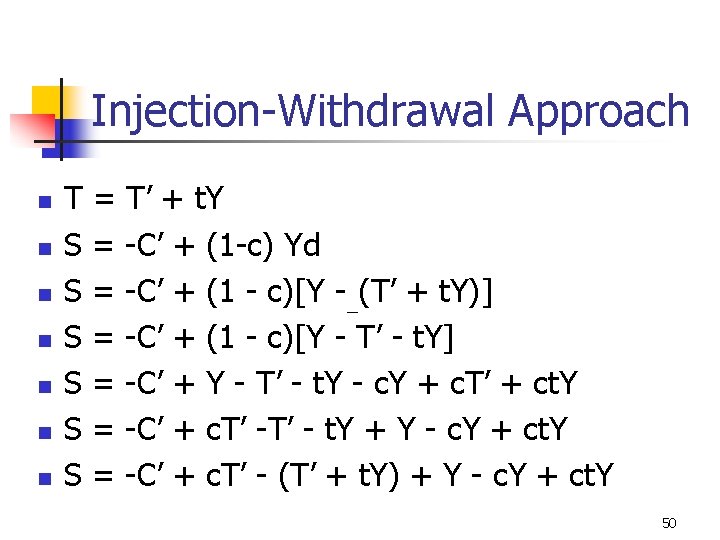

Consumption Function C = C’ + c (Y - T’) Y-intercept = C’ - c. T’ slope of tangent = c = MPC slope of ray APC when Y 15

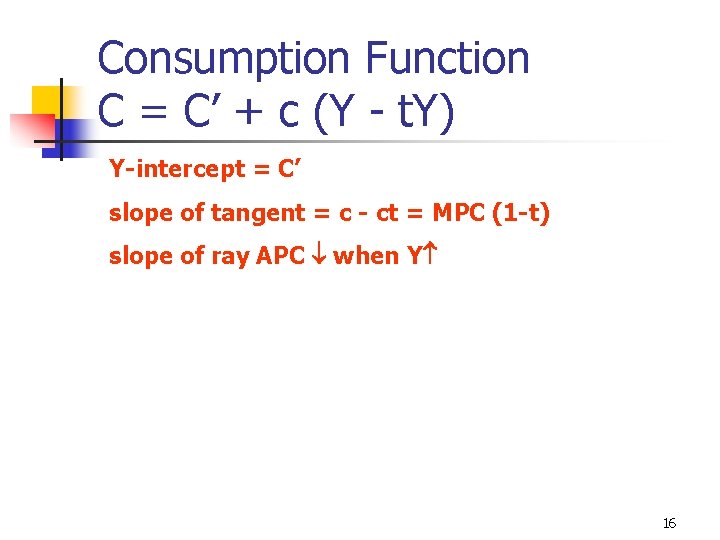

Consumption Function C = C’ + c (Y - t. Y) Y-intercept = C’ slope of tangent = c - ct = MPC (1 -t) slope of ray APC when Y 16

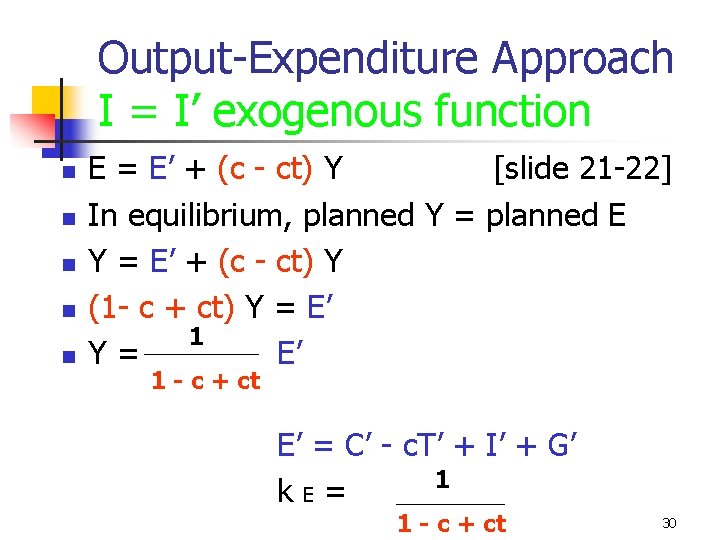

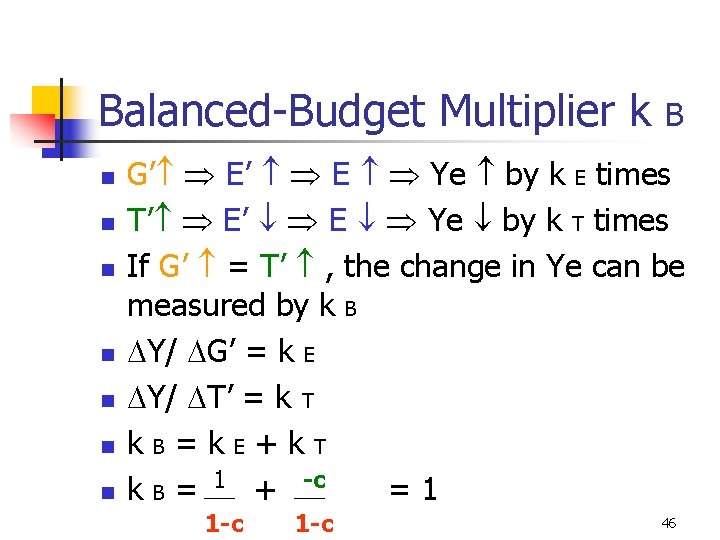

![Consumption Function C C c Y T t Y Yintercept Consumption Function C = C’ + c [Y - (T’ + t. Y)] Y-intercept](https://slidetodoc.com/presentation_image/1d7c93110f886965a0c0607ddefe156c/image-17.jpg)

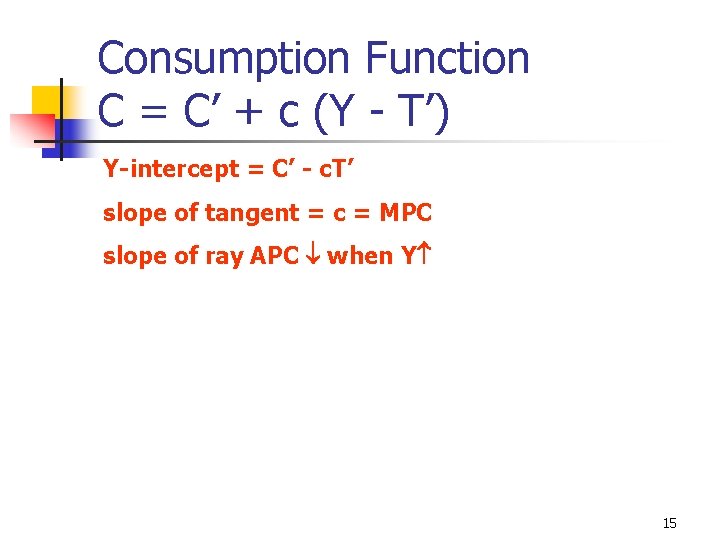

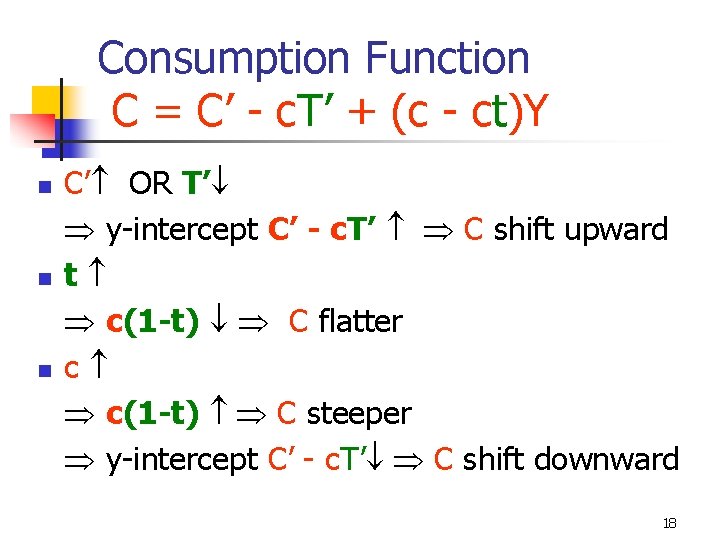

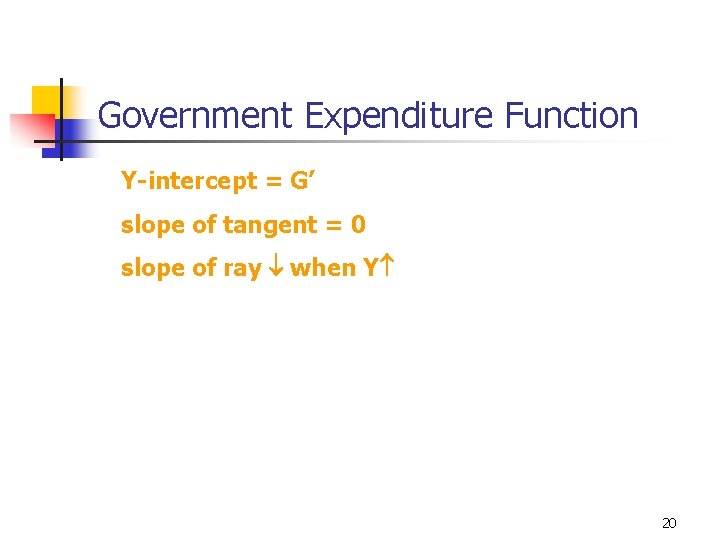

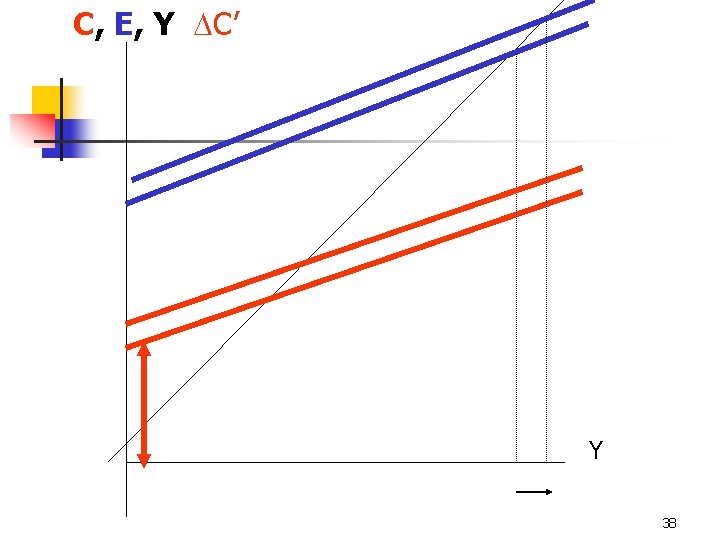

Consumption Function C = C’ + c [Y - (T’ + t. Y)] Y-intercept = C’ -c. T’ slope of tangent = c - ct = MPC (1 -t) slope of ray APC when Y 17

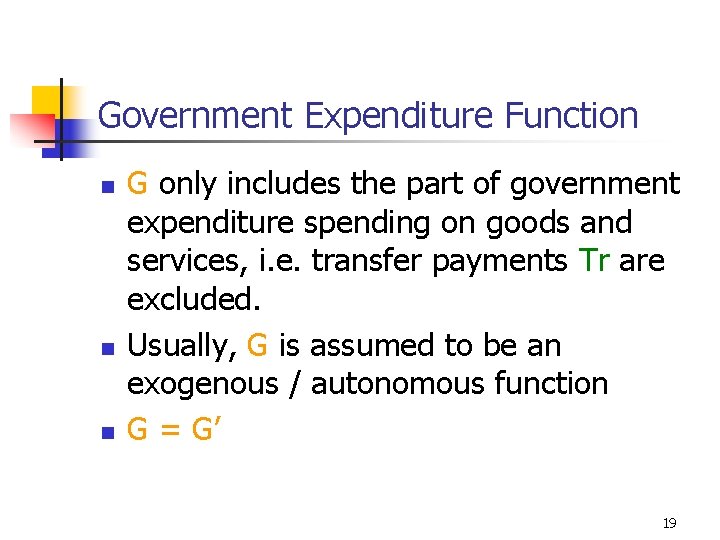

Consumption Function C = C’ - c. T’ + (c - ct)Y n n n C’ OR T’ y-intercept C’ - c. T’ C shift upward t c(1 -t) C flatter c c(1 -t) C steeper y-intercept C’ - c. T’ C shift downward 18

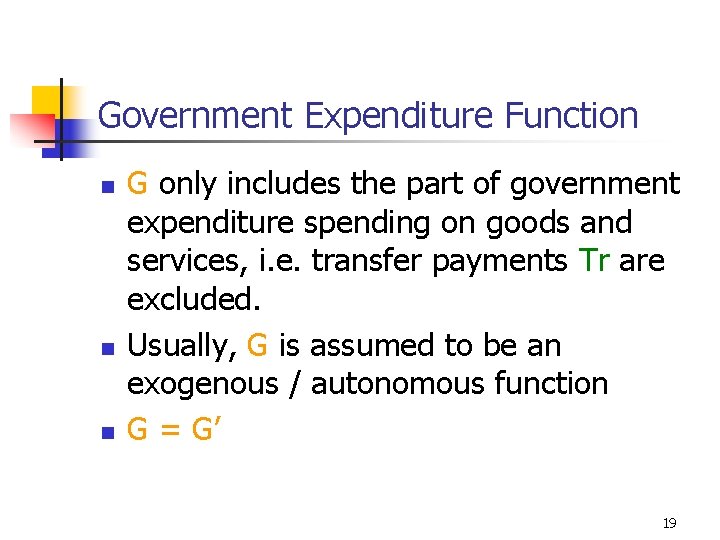

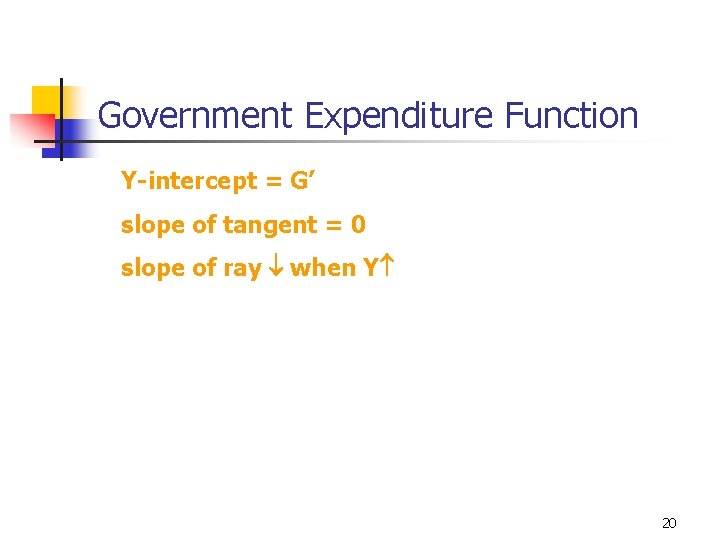

Government Expenditure Function n G only includes the part of government expenditure spending on goods and services, i. e. transfer payments Tr are excluded. Usually, G is assumed to be an exogenous / autonomous function G = G’ 19

Government Expenditure Function Y-intercept = G’ slope of tangent = 0 slope of ray when Y 20

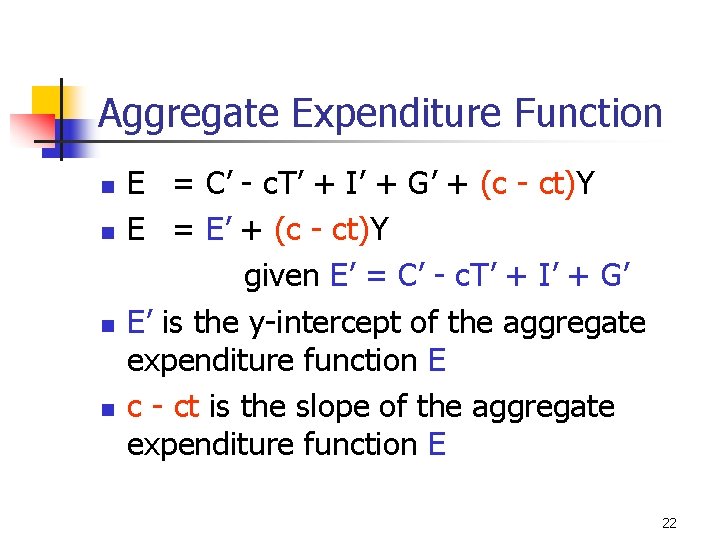

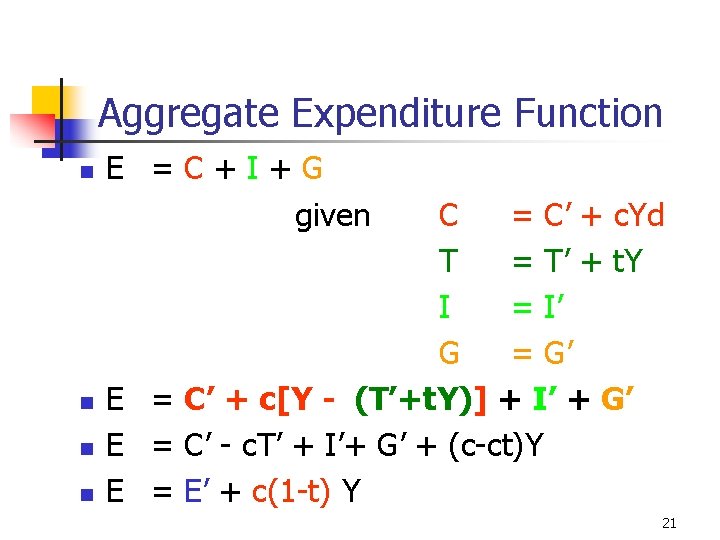

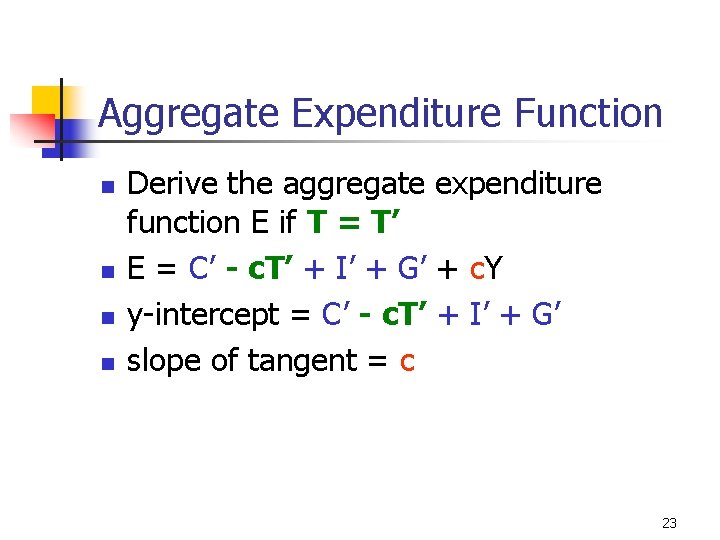

Aggregate Expenditure Function n n E =C+I+G given C = C’ + c. Yd T = T’ + t. Y I = I’ G = G’ E = C’ + c[Y - (T’+t. Y)] + I’ + G’ E = C’ - c. T’ + I’+ G’ + (c-ct)Y E = E’ + c(1 -t) Y 21

Aggregate Expenditure Function n n E = C’ - c. T’ + I’ + G’ + (c - ct)Y E = E’ + (c - ct)Y given E’ = C’ - c. T’ + I’ + G’ E’ is the y-intercept of the aggregate expenditure function E c - ct is the slope of the aggregate expenditure function E 22

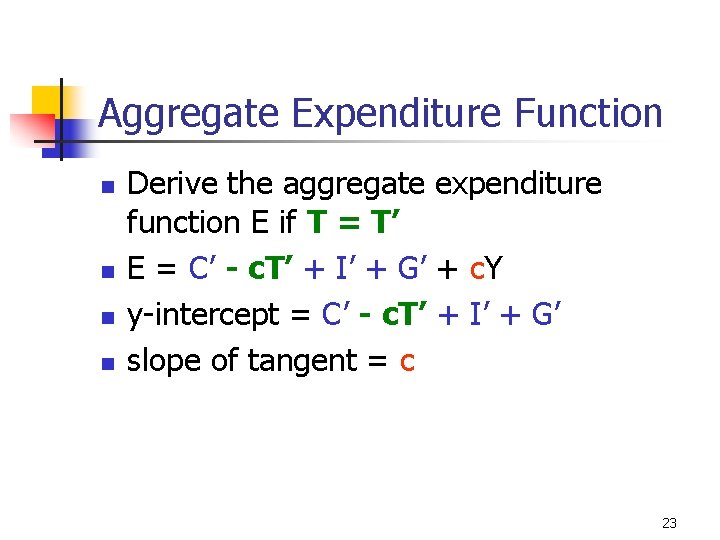

Aggregate Expenditure Function n n Derive the aggregate expenditure function E if T = T’ E = C’ - c. T’ + I’ + G’ + c. Y y-intercept = C’ - c. T’ + I’ + G’ slope of tangent = c 23

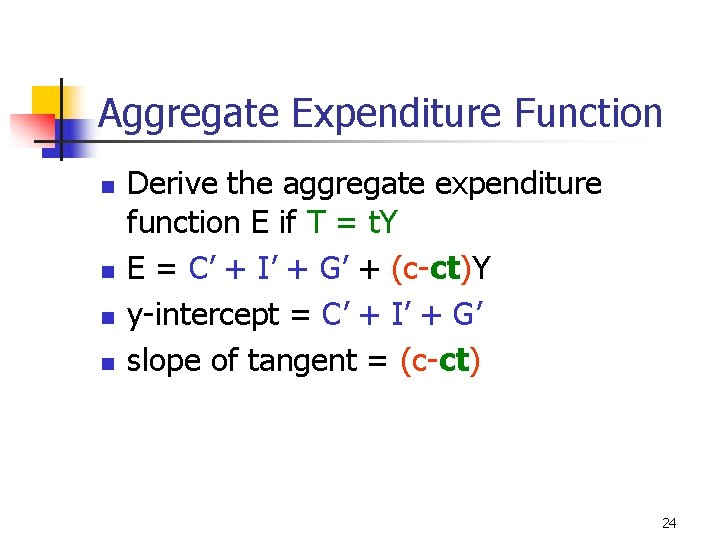

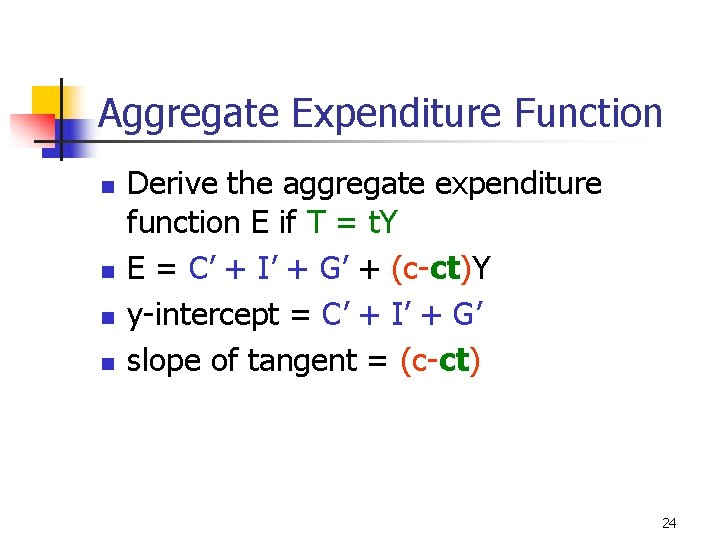

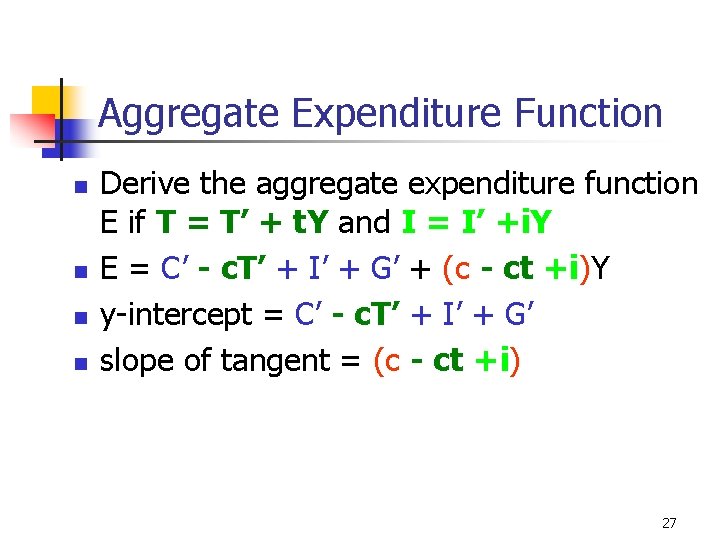

Aggregate Expenditure Function n n Derive the aggregate expenditure function E if T = t. Y E = C’ + I’ + G’ + (c-ct)Y y-intercept = C’ + I’ + G’ slope of tangent = (c-ct) 24

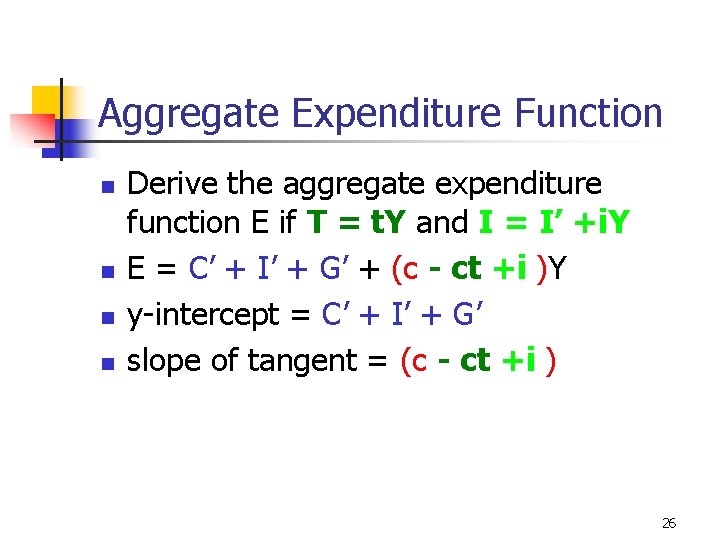

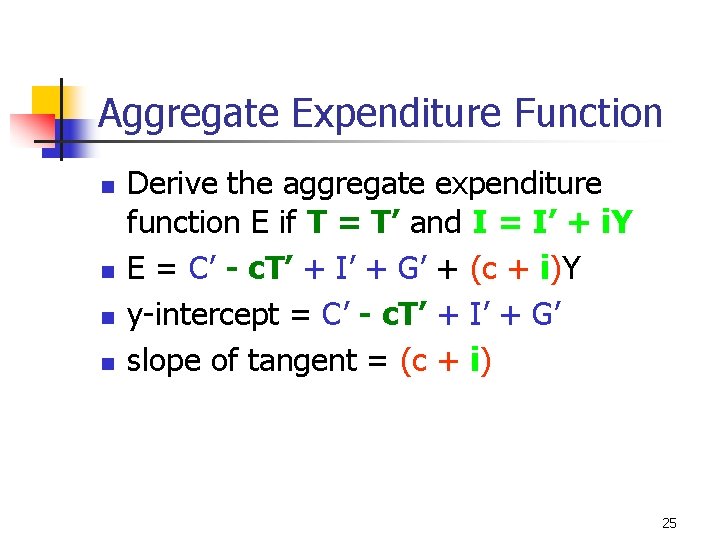

Aggregate Expenditure Function n n Derive the aggregate expenditure function E if T = T’ and I = I’ + i. Y E = C’ - c. T’ + I’ + G’ + (c + i)Y y-intercept = C’ - c. T’ + I’ + G’ slope of tangent = (c + i) 25

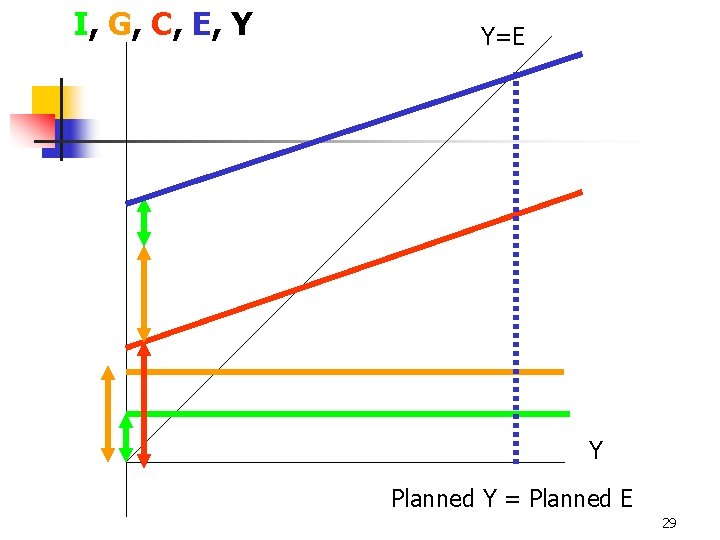

Aggregate Expenditure Function n n Derive the aggregate expenditure function E if T = t. Y and I = I’ +i. Y E = C’ + I’ + G’ + (c - ct +i )Y y-intercept = C’ + I’ + G’ slope of tangent = (c - ct +i ) 26

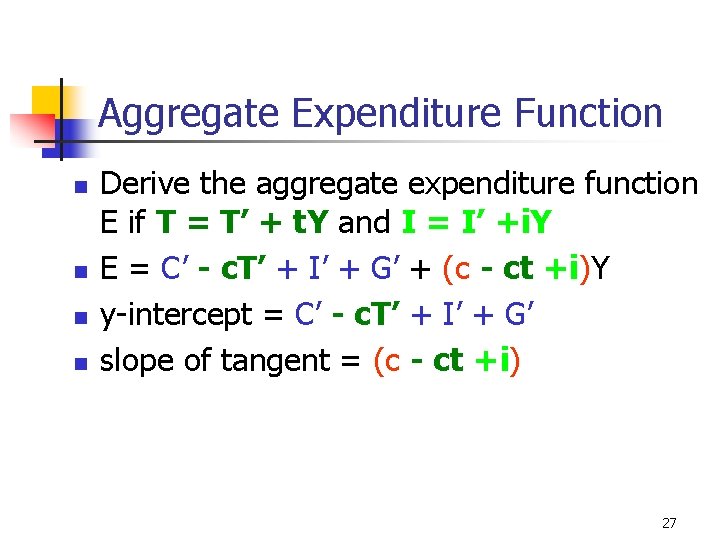

Aggregate Expenditure Function n n Derive the aggregate expenditure function E if T = T’ + t. Y and I = I’ +i. Y E = C’ - c. T’ + I’ + G’ + (c - ct +i)Y y-intercept = C’ - c. T’ + I’ + G’ slope of tangent = (c - ct +i) 27

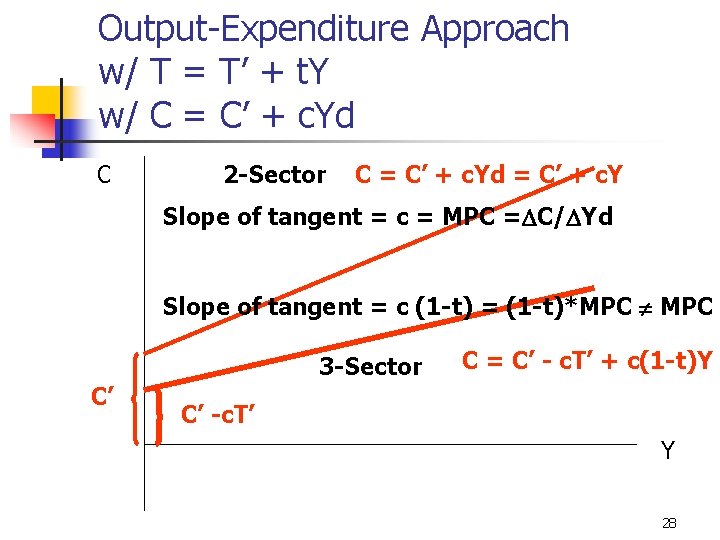

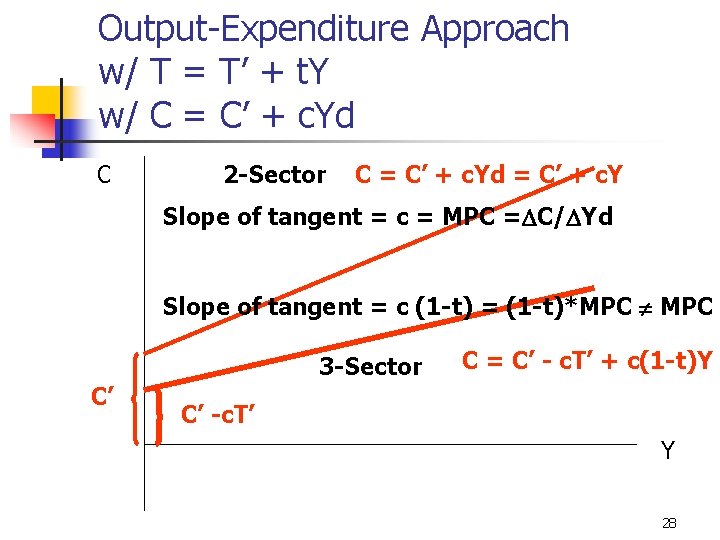

Output-Expenditure Approach w/ T = T’ + t. Y w/ C = C’ + c. Yd C 2 -Sector C = C’ + c. Yd = C’ + c. Y Slope of tangent = c = MPC = C/ Yd Slope of tangent = c (1 -t) = (1 -t)*MPC 3 -Sector C’ C = C’ - c. T’ + c(1 -t)Y C’ -c. T’ Y 28

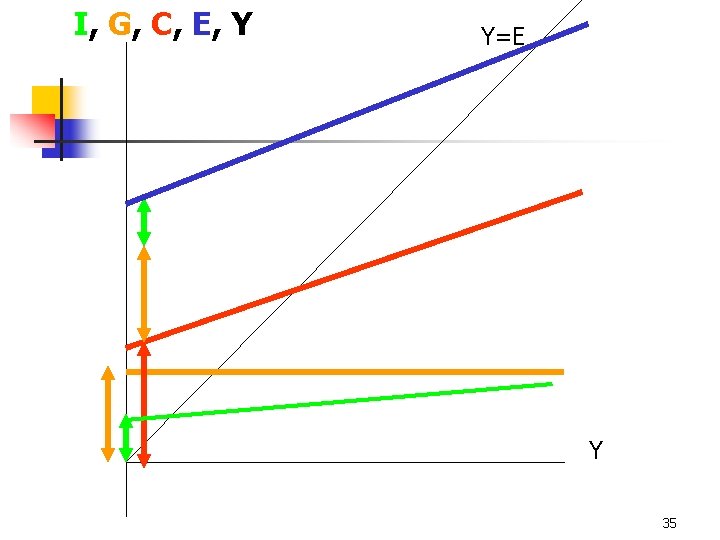

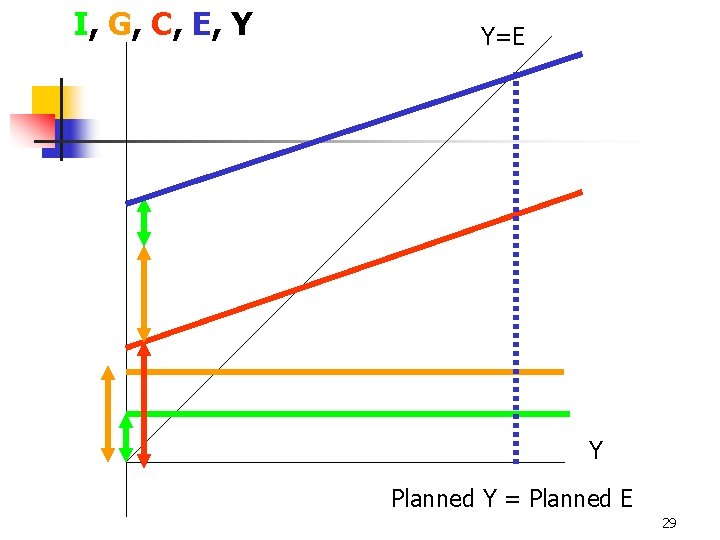

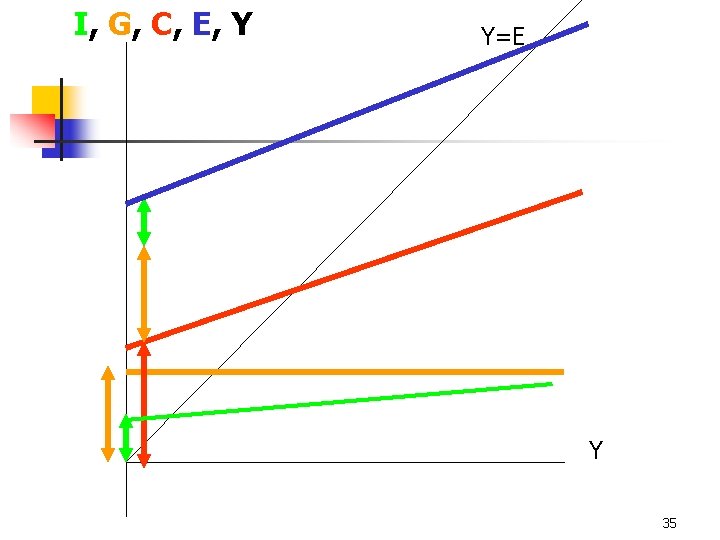

I, G, C, E, Y Y=E Y Planned Y = Planned E 29

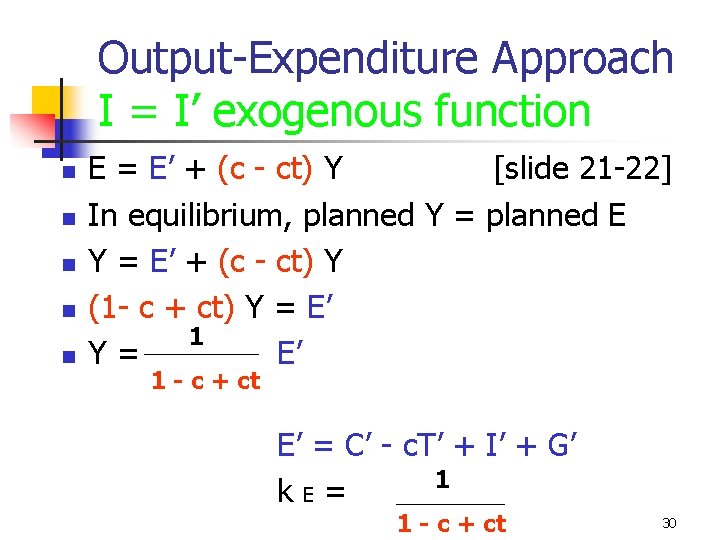

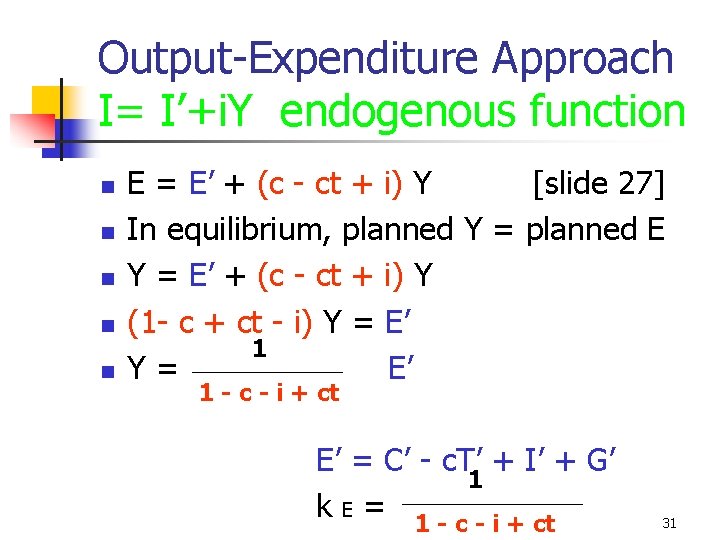

Output-Expenditure Approach I = I’ exogenous function n n E = E’ + (c - ct) Y [slide 21 -22] In equilibrium, planned Y = planned E Y = E’ + (c - ct) Y (1 - c + ct) Y = E’ 1 Y= E’ 1 - c + ct E’ = C’ - c. T’ + I’ + G’ 1 k. E= 1 - c + ct 30

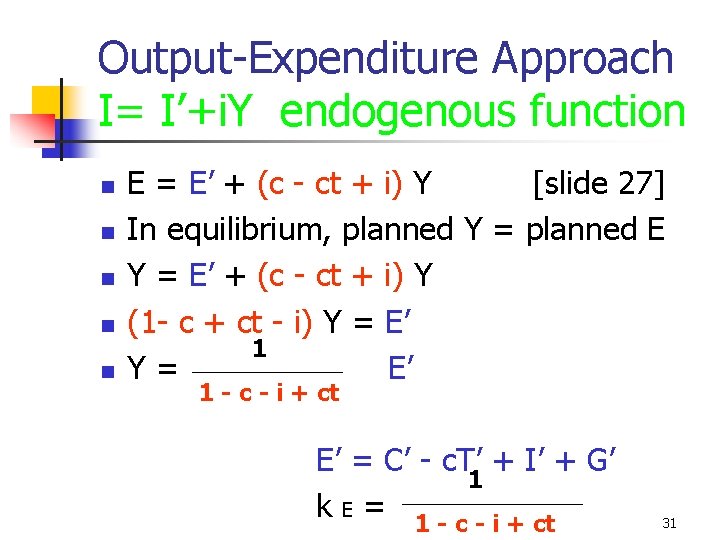

Output-Expenditure Approach I= I’+i. Y endogenous function n n E = E’ + (c - ct + i) Y [slide 27] In equilibrium, planned Y = planned E Y = E’ + (c - ct + i) Y (1 - c + ct - i) Y = E’ 1 Y= E’ 1 - c - i + ct E’ = C’ - c. T’ + I’ + G’ 1 k E = 1 - c - i + ct 31

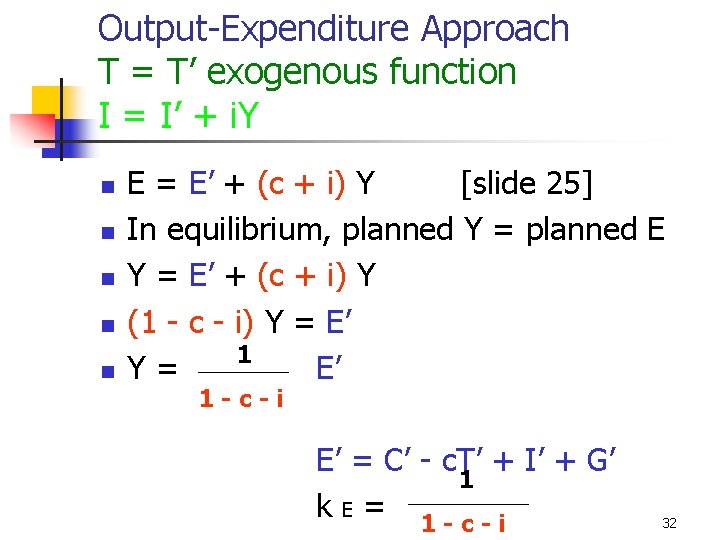

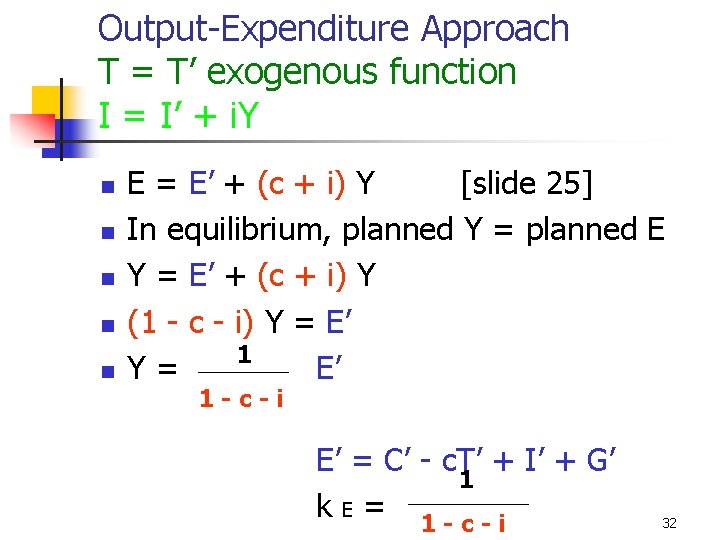

Output-Expenditure Approach T = T’ exogenous function I = I’ + i. Y n n n E = E’ + (c + i) Y [slide 25] In equilibrium, planned Y = planned E Y = E’ + (c + i) Y (1 - c - i) Y = E’ 1 Y= E’ 1 -c-i E’ = C’ - c. T’ + I’ + G’ 1 k E = 1 -c-i 32

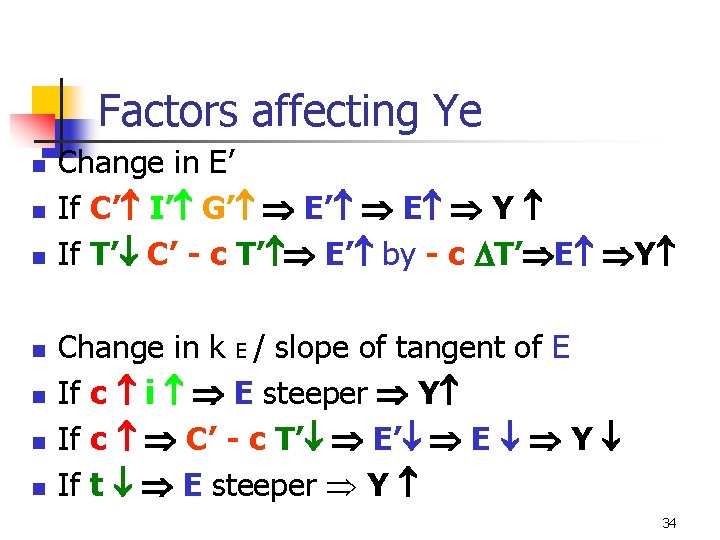

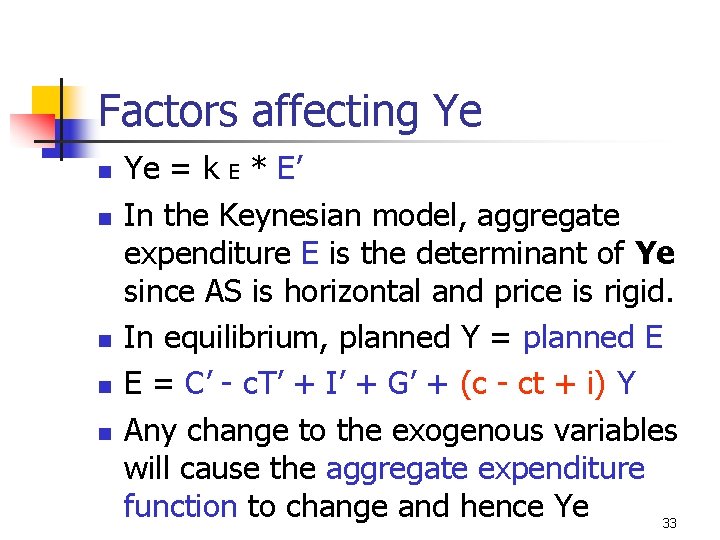

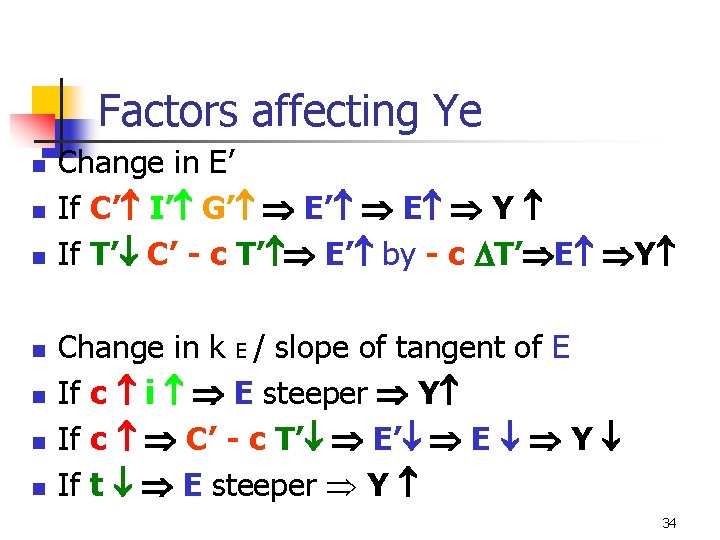

Factors affecting Ye n n n Ye = k E * E’ In the Keynesian model, aggregate expenditure E is the determinant of Ye since AS is horizontal and price is rigid. In equilibrium, planned Y = planned E E = C’ - c. T’ + I’ + G’ + (c - ct + i) Y Any change to the exogenous variables will cause the aggregate expenditure function to change and hence Ye 33

Factors affecting Ye n n n n Change in E’ If C’ I’ G’ E Y If T’ C’ - c T’ E’ by - c T’ E Y Change in k E / slope of tangent of E If c i E steeper Y If c C’ - c T’ E Y If t E steeper Y 34

I, G, C, E, Y Y=E Y 35

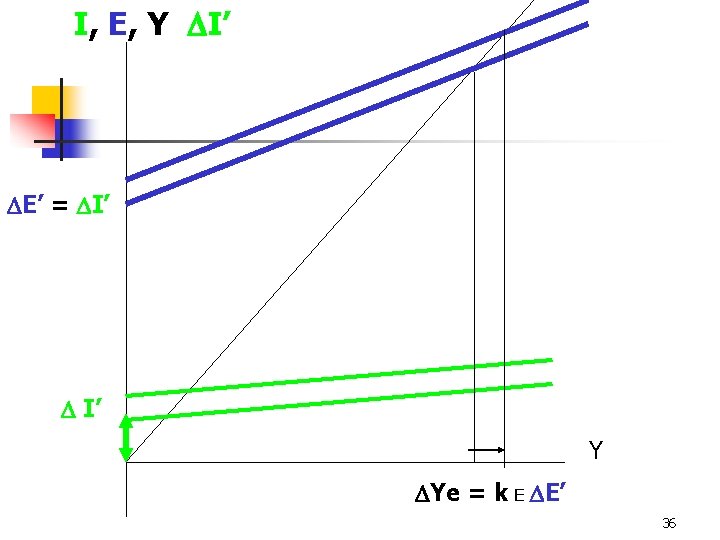

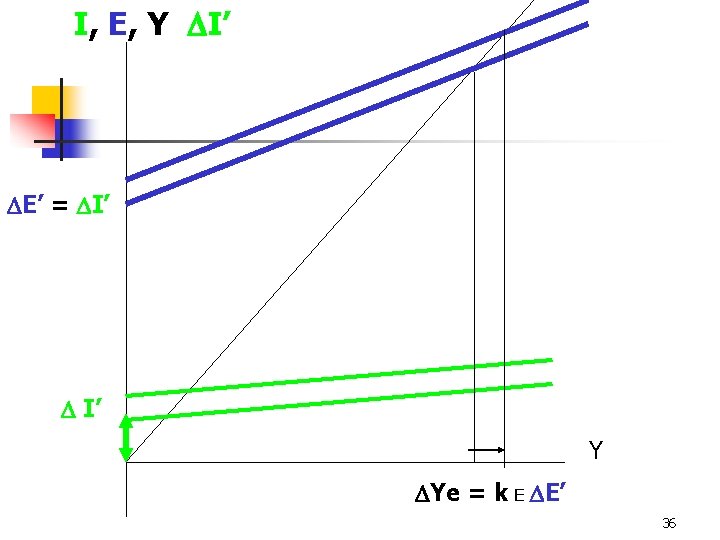

I, E, Y I’ E’ = I’ Y Ye = k E E’ 36

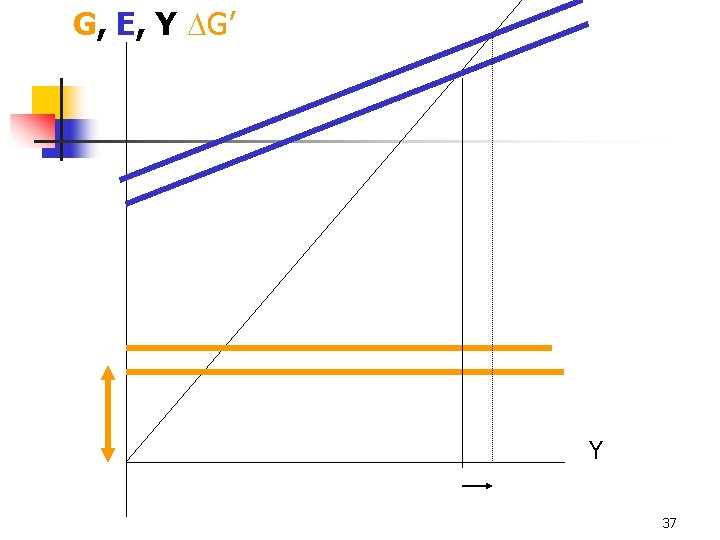

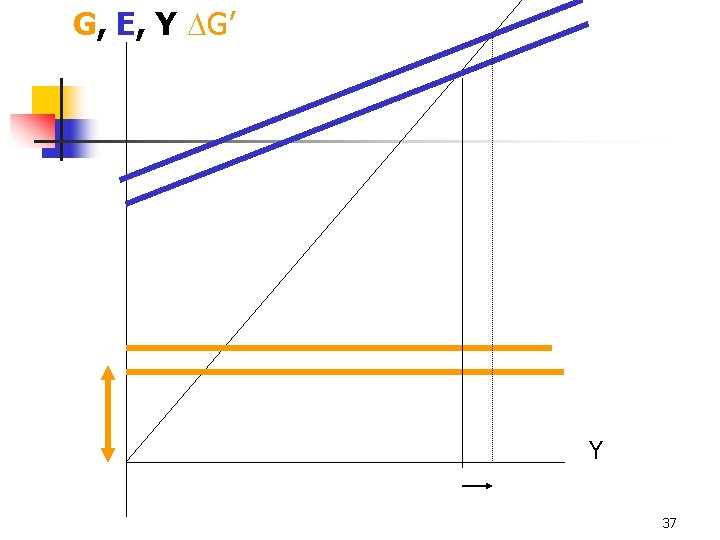

G, E, Y G’ Y 37

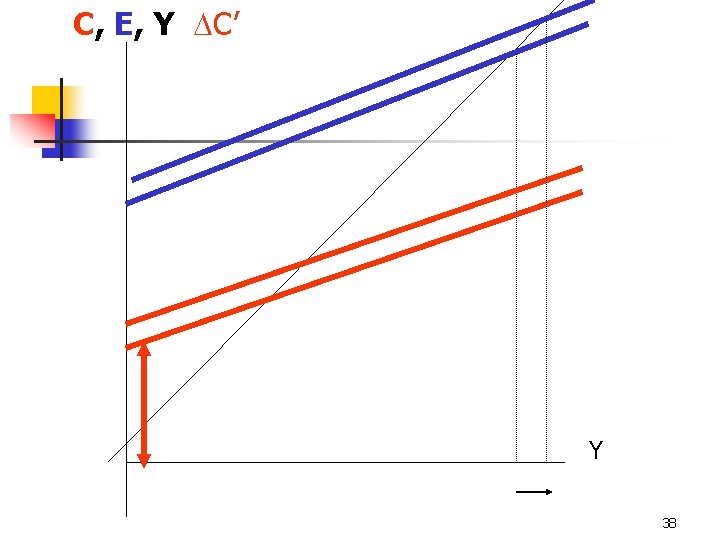

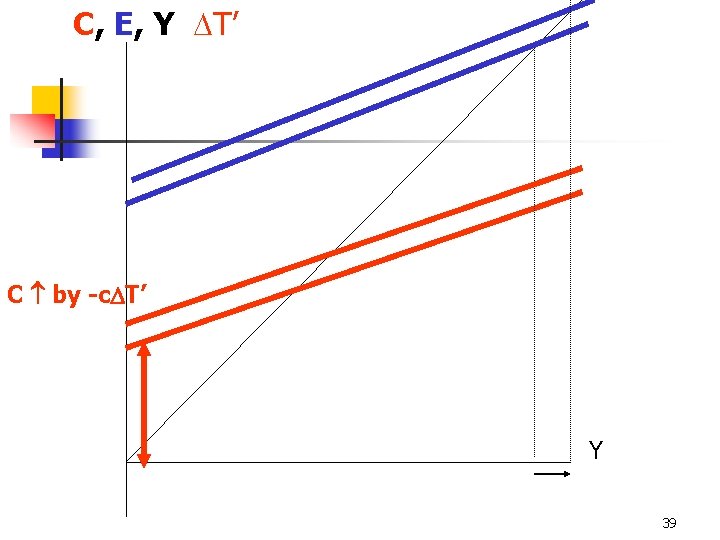

C, E, Y C’ Y 38

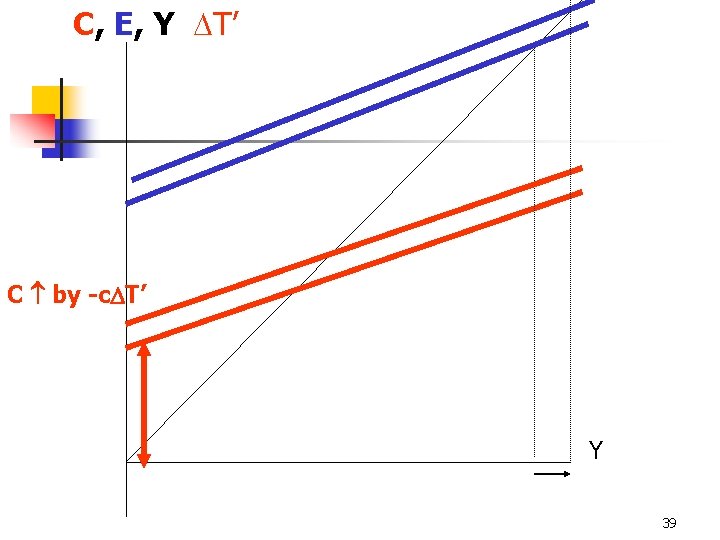

C, E, Y T’ C by -c T’ Y 39

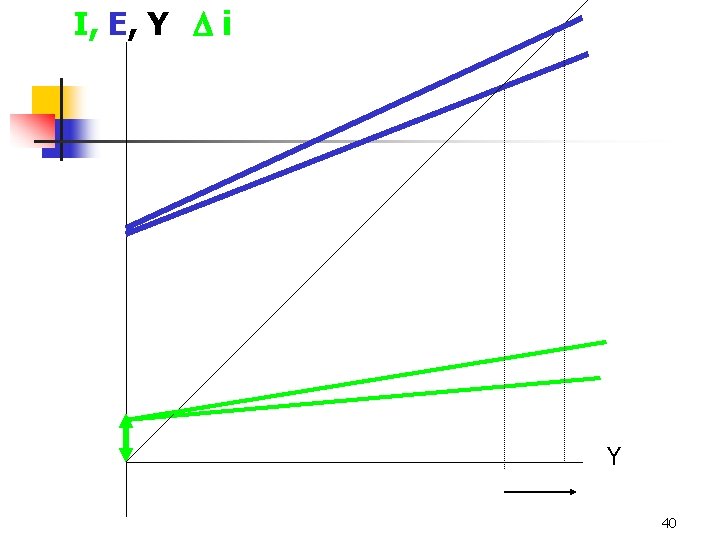

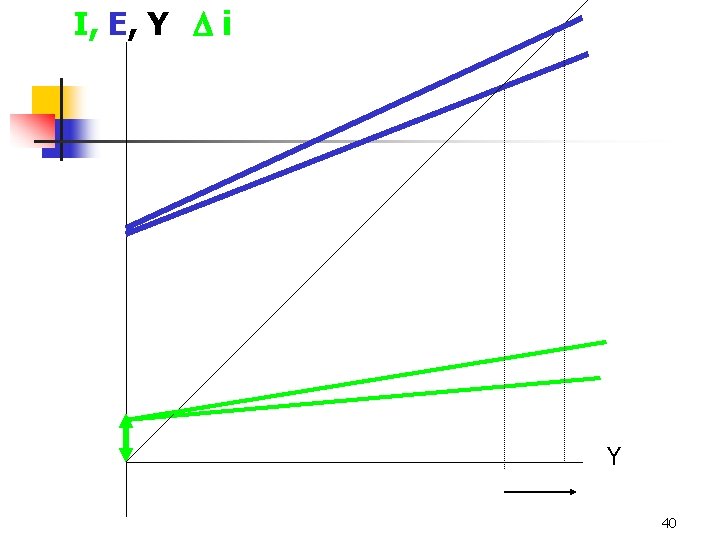

I, E, Y i Y 40

Digression n n Differentiation y = c + mx differentiate y with respect to x dy/dx = m 41

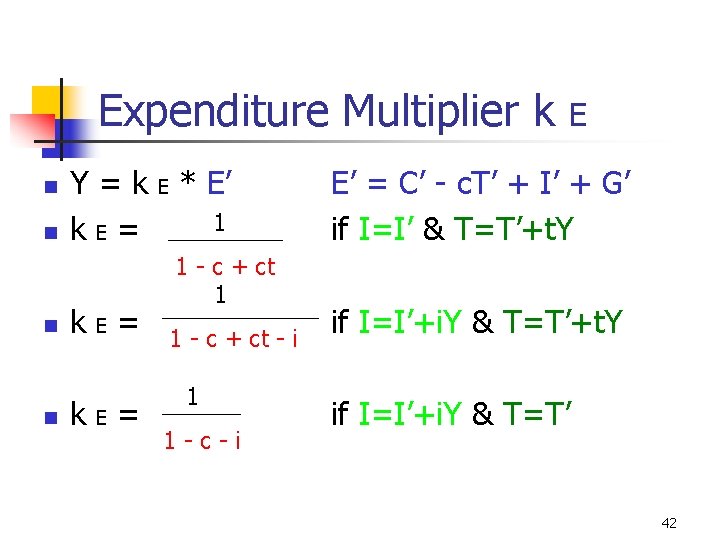

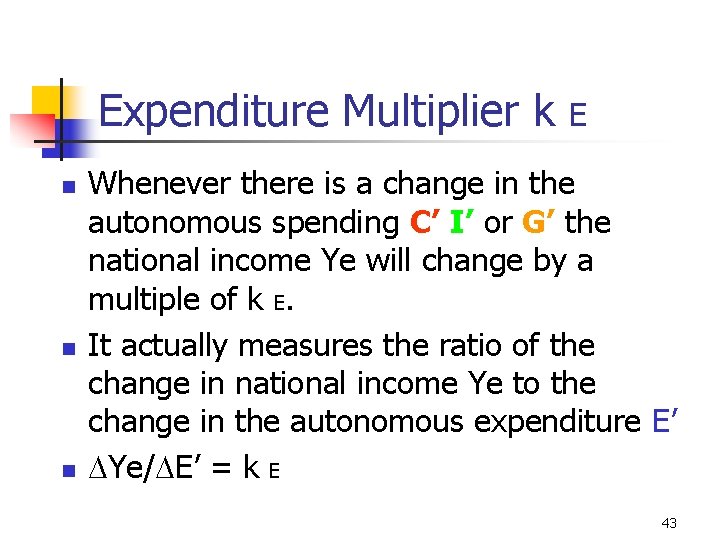

Expenditure Multiplier k n n Y = k E * E’ 1 k. E= 1 - c + ct 1 1 - c + ct - i 1 1 -c-i E E’ = C’ - c. T’ + I’ + G’ if I=I’ & T=T’+t. Y if I=I’+i. Y & T=T’ 42

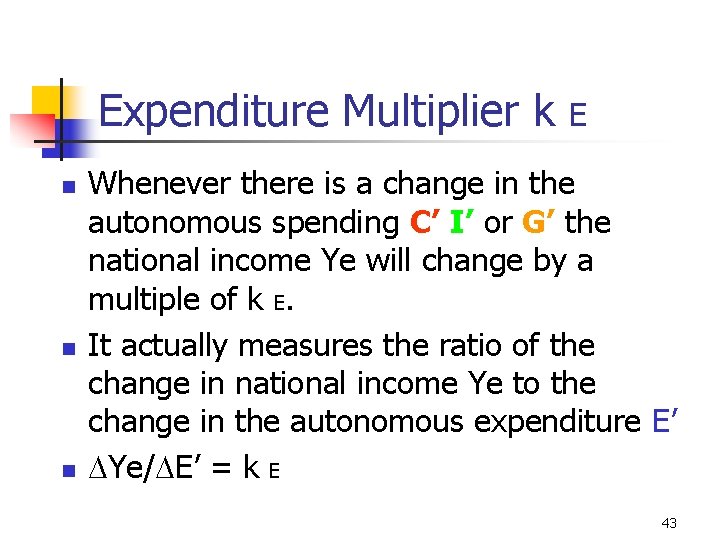

Expenditure Multiplier k n n n E Whenever there is a change in the autonomous spending C’ I’ or G’ the national income Ye will change by a multiple of k E. It actually measures the ratio of the change in national income Ye to the change in the autonomous expenditure E’ Ye/ E’ = k E 43

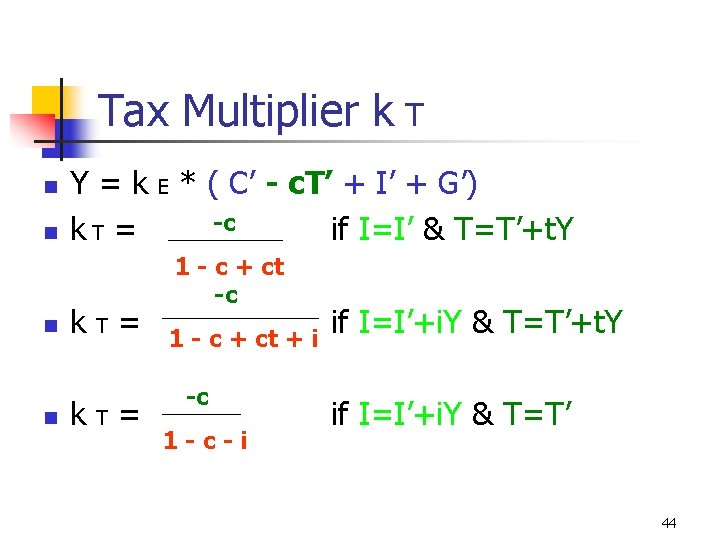

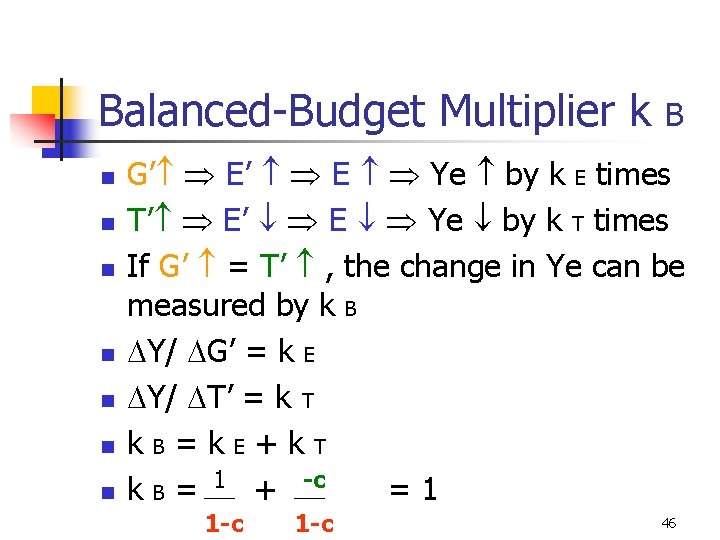

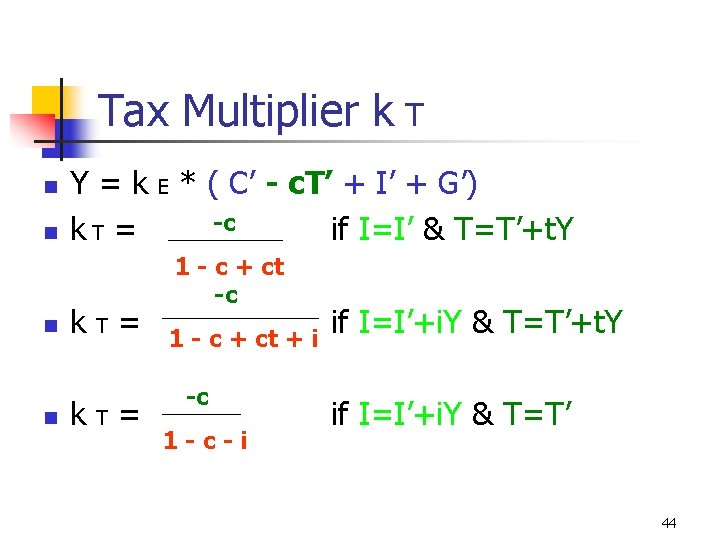

Tax Multiplier k T n n Y = k E * ( C’ - c. T’ + I’ + G’) -c k. T = if I=I’ & T=T’+t. Y k. T= 1 - c + ct -c 1 - c + ct + i -c 1 -c-i if I=I’+i. Y & T=T’+t. Y if I=I’+i. Y & T=T’ 44

Tax Multiplier k T n n Any change in the lump-sum tax T’ will lead to a change in the national income Ye by a multiple of k T in the opposite direction since k T takes on a negative value Besides, the absolute value of k T is less than the value of k E. 45

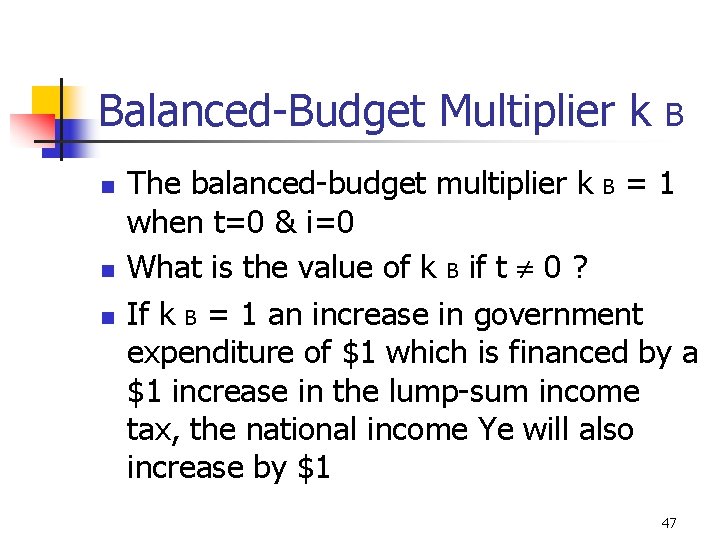

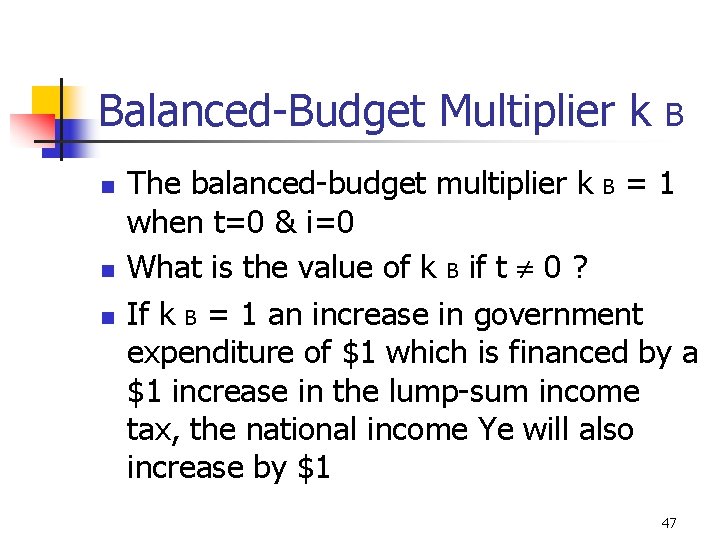

Balanced-Budget Multiplier k n n n n B G’ E’ E Ye by k E times T’ E’ E Ye by k T times If G’ = T’ , the change in Ye can be measured by k B Y/ G’ = k E Y/ T’ = k T k. B=k. E+k. T k B = 1 + -c =1 1 -c 46

Balanced-Budget Multiplier k n n n B The balanced-budget multiplier k B = 1 when t=0 & i=0 What is the value of k B if t 0 ? If k B = 1 an increase in government expenditure of $1 which is financed by a $1 increase in the lump-sum income tax, the national income Ye will also increase by $1 47

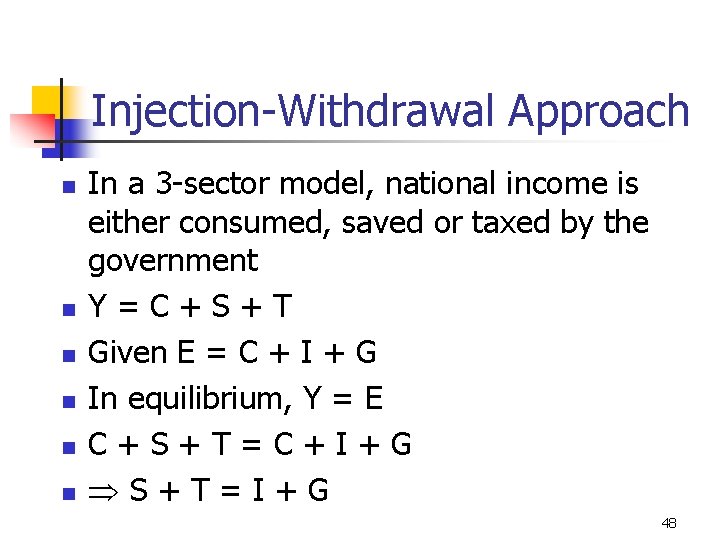

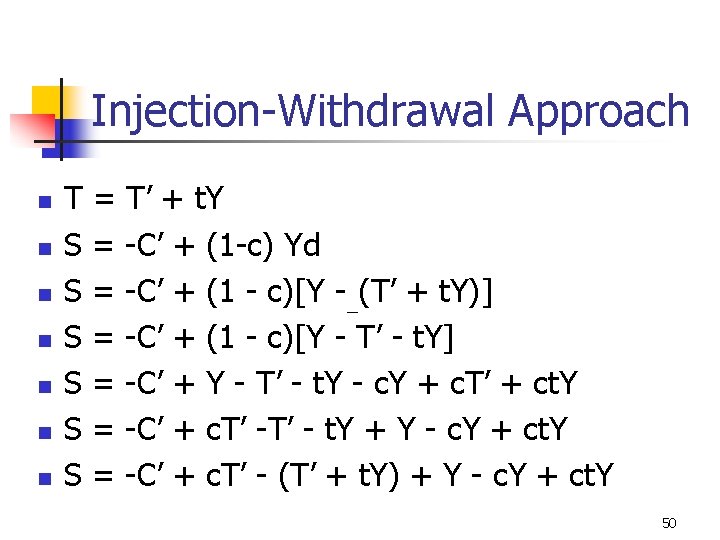

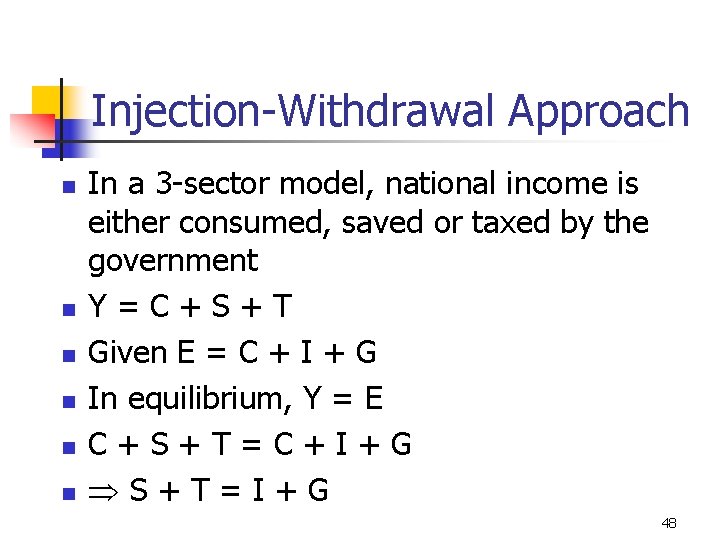

Injection-Withdrawal Approach n n n In a 3 -sector model, national income is either consumed, saved or taxed by the government Y=C+S+T Given E = C + I + G In equilibrium, Y = E C+S+T=C+I+G S+T=I+G 48

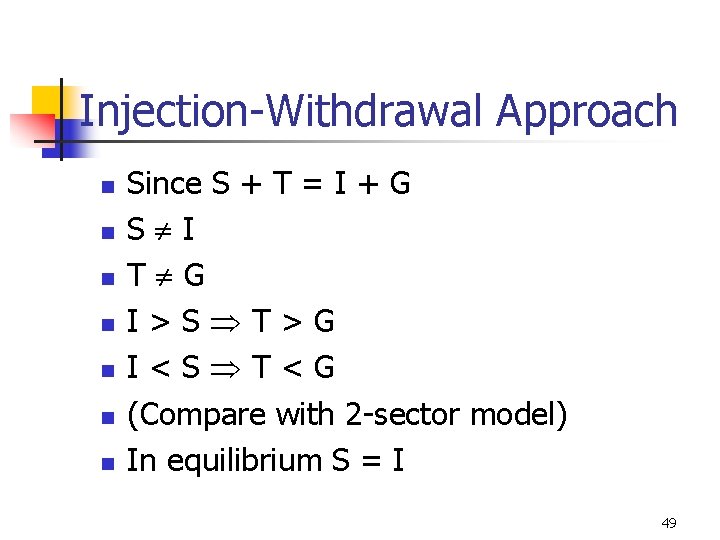

Injection-Withdrawal Approach n n n n Since S + T = I + G S I T G I>S T>G I<S T<G (Compare with 2 -sector model) In equilibrium S = I 49

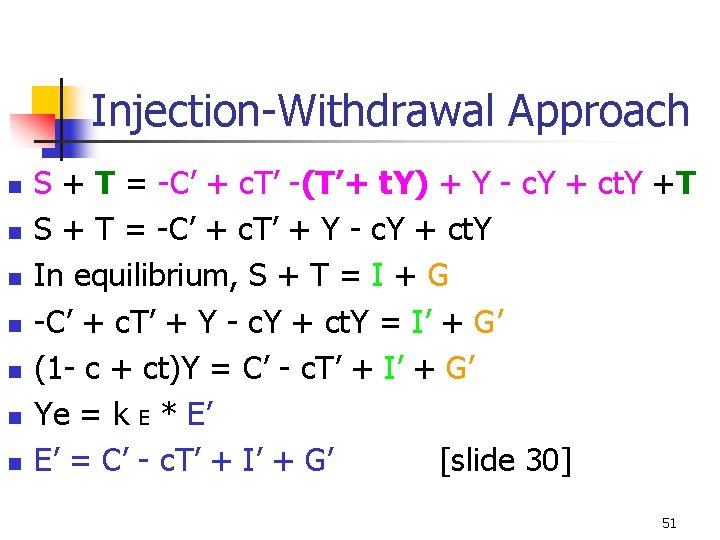

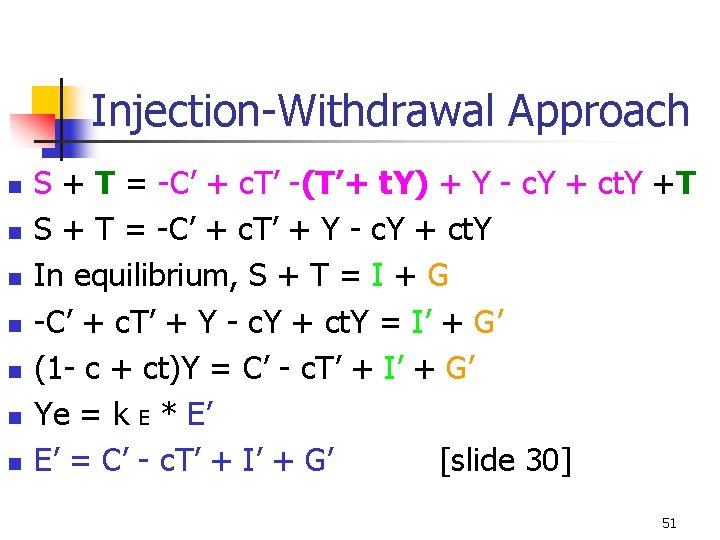

Injection-Withdrawal Approach n n n n T = T’ + t. Y S = -C’ + (1 -c) Yd S = -C’ + (1 - c)[Y -_(T’ + t. Y)] S = -C’ + (1 - c)[Y - T’ - t. Y] S = -C’ + Y - T’ - t. Y - c. Y + c. T’ + ct. Y S = -C’ + c. T’ - t. Y + Y - c. Y + ct. Y S = -C’ + c. T’ - (T’ + t. Y) + Y - c. Y + ct. Y 50

Injection-Withdrawal Approach n n n n S + T = -C’ + c. T’ -(T’+ t. Y) + Y - c. Y + ct. Y +T S + T = -C’ + c. T’ + Y - c. Y + ct. Y In equilibrium, S + T = I + G -C’ + c. T’ + Y - c. Y + ct. Y = I’ + G’ (1 - c + ct)Y = C’ - c. T’ + I’ + G’ Ye = k E * E’ E’ = C’ - c. T’ + I’ + G’ [slide 30] 51

Use the Injection-Withdrawal Approach to solve for Ye if T=T’ 52

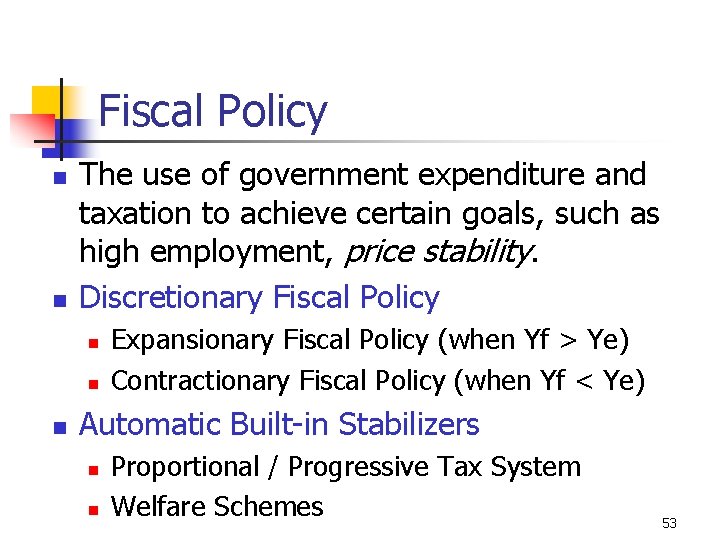

Fiscal Policy n n The use of government expenditure and taxation to achieve certain goals, such as high employment, price stability. Discretionary Fiscal Policy n n n Expansionary Fiscal Policy (when Yf > Ye) Contractionary Fiscal Policy (when Yf < Ye) Automatic Built-in Stabilizers n n Proportional / Progressive Tax System Welfare Schemes 53

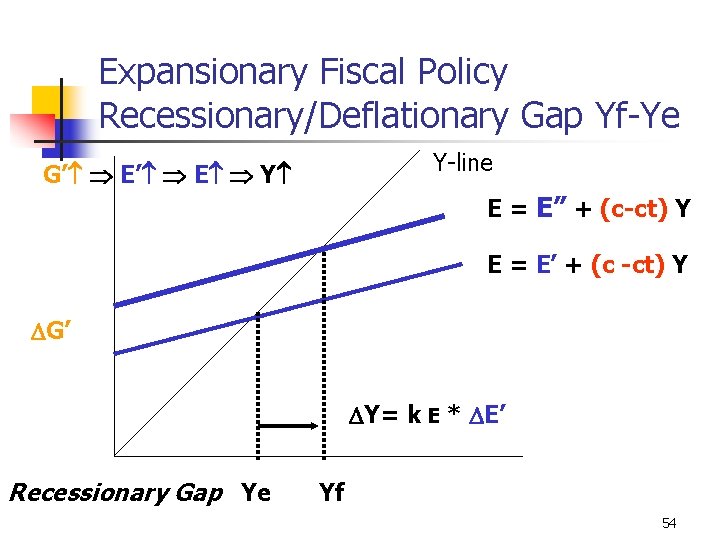

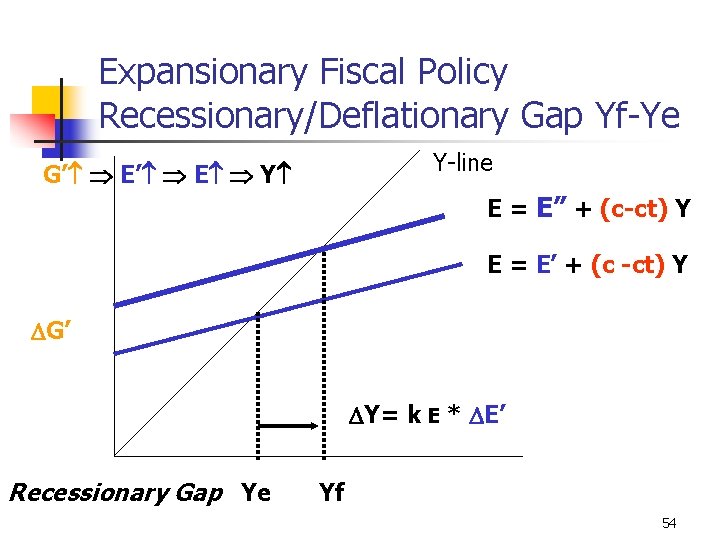

Expansionary Fiscal Policy Recessionary/Deflationary Gap Yf-Ye Y-line G’ E Y E = E” + (c-ct) Y E = E’ + (c -ct) Y G’ Y= k E * E’ Recessionary Gap Ye Yf 54

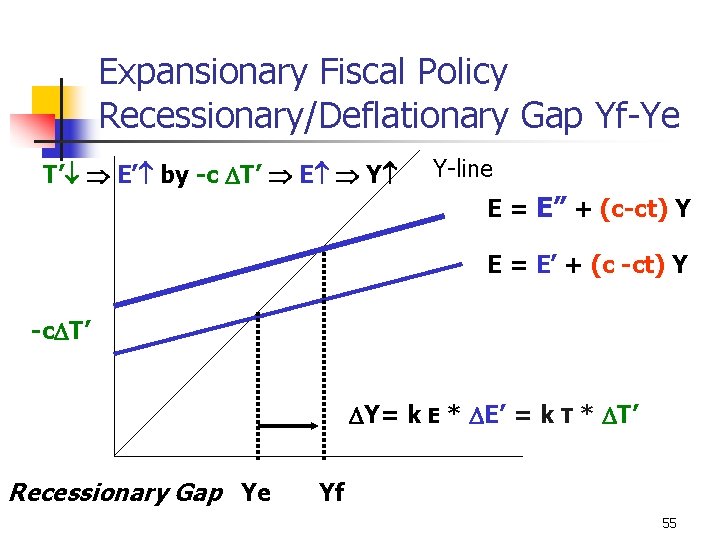

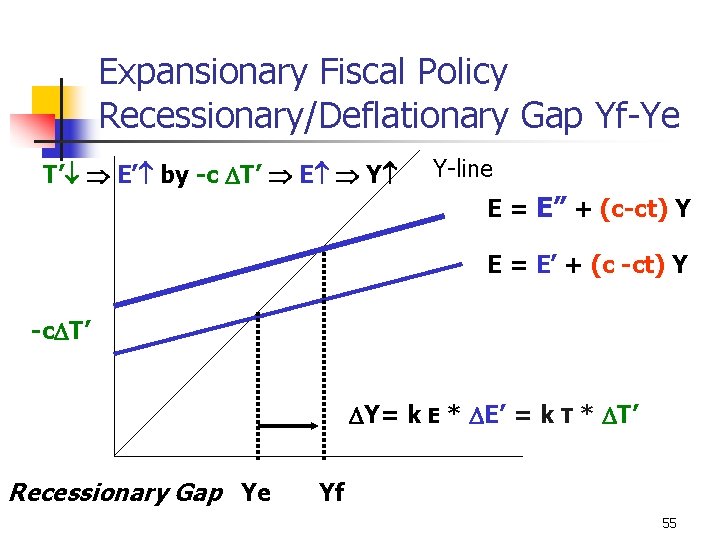

Expansionary Fiscal Policy Recessionary/Deflationary Gap Yf-Ye T’ E’ by -c T’ E Y Y-line E = E” + (c-ct) Y E = E’ + (c -ct) Y -c T’ Y= k E * E’ = k T * T’ Recessionary Gap Ye Yf 55

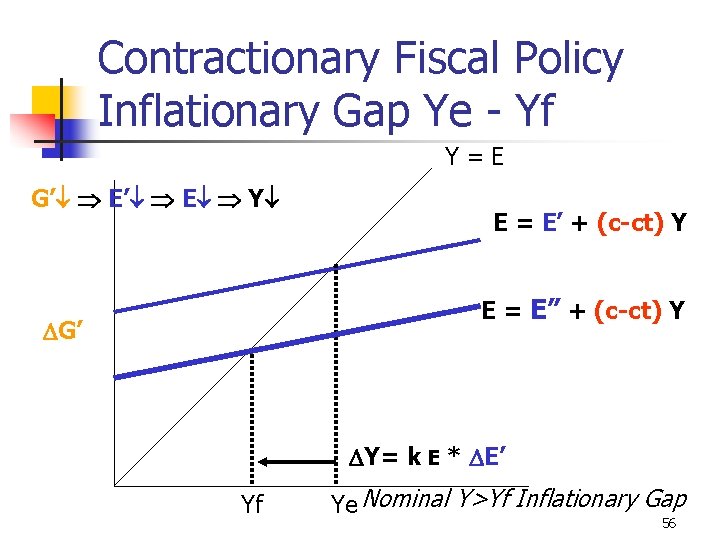

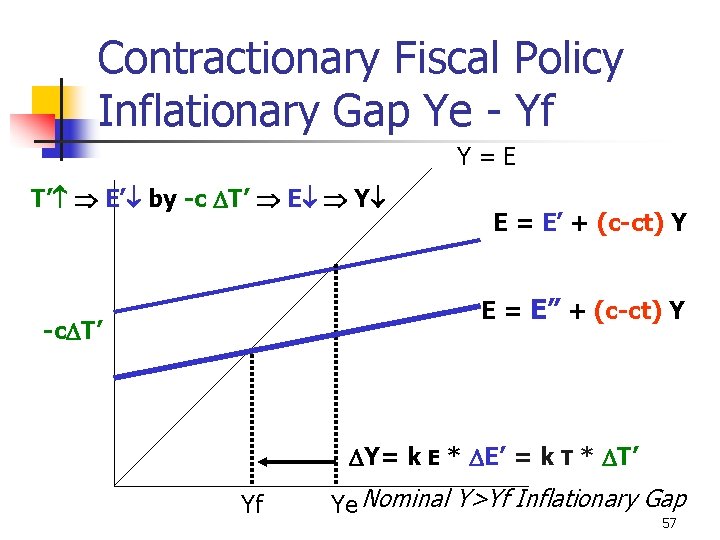

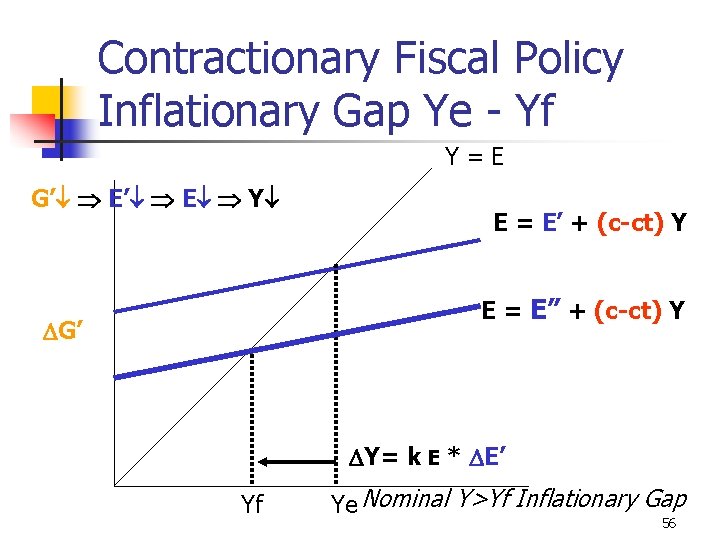

Contractionary Fiscal Policy Inflationary Gap Ye - Yf Y=E G’ E Y E = E’ + (c-ct) Y E = E” + (c-ct) Y G’ Y= k E * E’ Yf Ye Nominal Y>Yf Inflationary Gap 56

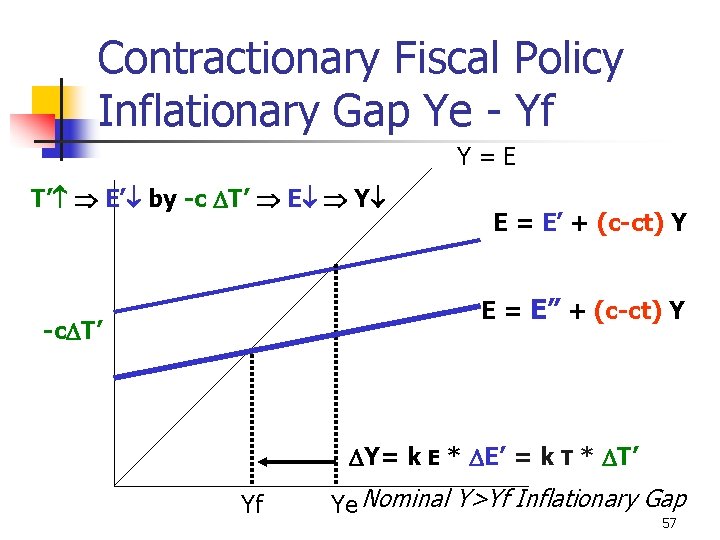

Contractionary Fiscal Policy Inflationary Gap Ye - Yf Y=E T’ E’ by -c T’ E Y E = E’ + (c-ct) Y E = E” + (c-ct) Y -c T’ Y= k E * E’ = k T * T’ Yf Ye Nominal Y>Yf Inflationary Gap 57

Automatic Built-in Stabilizers n Proportional /Progressive Tax System n n Recession: government’s tax revenue Boom: government’s tax revenue The more progressive the tax system, the greater is its stabilizing effect. But there will be greater dis-incentives to earn income With t, k E With proportional tax, the multiplying effect of a discretionary change in government expenditure G’ reduces 58

Automatic Built-in Stabilizers n n Welfare Schemes Unemployment benefits, public assistance allowances, agricultural support schemes n n n Recession: government’s expenditure Boom: government’s expenditure Again, if the welfare schemes are generous, the incentives to work will be weakened. 59

Discretionary Fiscal Policy v. s. Automatic Built-in Stabilizers n n If the economy is close to Yf, built-in stabilizers are useful as they can stabilize the economy around Yf or potential income level. However, if the economy is far below Yf, discretionary fiscal policy is still necessary (Simple Keynesian model). Another drawback of the built-in stabilizers is they may reduce the speed of recovery as k E Y = k E * E’ 60

Discretionary Fiscal Policy n n Government expenditure G’ ? Tax T’ ? Location of effects If a recession is localized in a particular industry G’ Tax cut will have its impact on the entire economy 61

Discretionary Fiscal Policy n n Government expenditure G’ ? Tax T’ ? Duration of the time lag n n Decision lag : time involved to assess a situation & decide what corrective actions should be taken Executive lag : time involved to initiate corrective policies & for their full impact to be felt tax cut has a much shorter executive lag 62

Discretionary Fiscal Policy n n Government expenditure G’ ? Tax T’ ? Reversibility of the fiscal policy n n Government expenditure can easily be increased but are not so easy to cut as the civil servants who have vested interests in the present allocation of government expenditure will resist Tax is easier to be changed as the civil servants who administer income tax is independent of the rate being levied. Of course, voter resistance should also be considered. 63

Discretionary Fiscal Policy n n n Government expenditure G’ ? Tax T’ ? Public reaction to short-term changes A temporary tax cut raises Yd. Households, recognizing this situation, may not revise their current consumption. Instead, they save a large part of the tax cut. 64

Financing the Government Budget Increasing Taxes n n By increasing taxes, the government transfers purchasing power from current taxpayers to itself Current taxpayers bear the cost If the revenue is spent on some investment project, (current / future) taxpayers may benefit when the project is completed. How about the revenue is spent on transfer payment? 65

Financing the Government Budget Printing more Money n n n This will create inflationary pressure. Households and firms will be able to buy less with each unit of money. Fewer resources are available for private consumption and investment. Those whose incomes respond slowly to changes in price levels will bear most of the cost of the government activity 66

Financing the Government Budget Internal Debt n n n The government can transfer purchasing power from any willing lenders to itself in return for the promise to repay equivalent purchasing power plus interest in future. Since, repayment of the debt are made from tax revenue, future taxpayers will suffer. However, if the debt raised today is spent on creating capital assets, the burden on future generation will be lighter. 67

Financing the Government Budget External Debt n n Borrowing from abroad transfers purchasing power from foreigners to the government. The burden on future generations will once again depend on how the debt raised is used (investment project / transfer payment) 68

The Problems of the Simple Keynesian Multiplier k E n n Y = k E * G’ There are several problems with this method of analysis, i. e. , Y may be less n n n Sources of financing G’ Effects on private investment I’ Productivity of government projects 69

The Problems of the Simple Keynesian Multiplier k E n n Sources of financing G’ Increasing Tax n n Increasing Money Supply n n will exert a contractionary effect on the economy will generate an inflationary pressure Increasing Debt n will increase the demand for loanable fund as well as interest rate affect private investment 70

The Problems of the Simple Keynesian Multiplier k E n n Effects on Private Investment I’ Private investment may be crowded out when government increases its expenditure It is questionable that the government can really produce something which is desired by the consumers Besides, government investment projects are usually less productive than private investment projects 71

The Problems of the Simple Keynesian Multiplier k E n n Productivity of Government Projects Government projects may not yield a rate of return (MEC / MEI) exceeding the market interest rate. 72

Calculate real gdp per capita

Calculate real gdp per capita Income determination

Income determination Keynesian model

Keynesian model Keynesian model

Keynesian model Keynesian cross model

Keynesian cross model Model islm

Model islm Tax payable

Tax payable Partnership income statement format

Partnership income statement format Chapter 16 accounting for income taxes

Chapter 16 accounting for income taxes Linear algebra

Linear algebra Keynesian cross

Keynesian cross Supply vs demand side economics

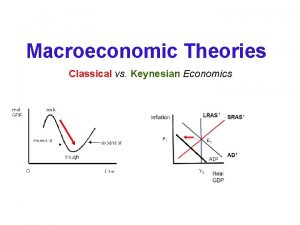

Supply vs demand side economics Classical keynesian and monetarist

Classical keynesian and monetarist Keynesian vs classical vs monetarist

Keynesian vs classical vs monetarist Classical economics vs keynesian

Classical economics vs keynesian Classical economics vs keynesian

Classical economics vs keynesian Keynesian vs classical vs monetarist

Keynesian vs classical vs monetarist Explain the keynesian theory of employment

Explain the keynesian theory of employment Classical theory vs keynesian theory

Classical theory vs keynesian theory Keynesian policy

Keynesian policy Keynesian consumption function

Keynesian consumption function Keynesian economics policy

Keynesian economics policy Keynesian vs classical vs monetarist

Keynesian vs classical vs monetarist Keynesian consumption function

Keynesian consumption function Classical economics vs keynesian

Classical economics vs keynesian New classical macroeconomics

New classical macroeconomics Austrian economics vs keynesian

Austrian economics vs keynesian New classical and new keynesian macroeconomics

New classical and new keynesian macroeconomics Subnetting worksheet

Subnetting worksheet Tatlong paraan ng national income accounting

Tatlong paraan ng national income accounting Nnp calculation formula

Nnp calculation formula The national income and product accounts

The national income and product accounts Lesson plan on national income

Lesson plan on national income National income formula

National income formula Lgutef

Lgutef Measuring domestic output and national income

Measuring domestic output and national income National income data

National income data What is national income

What is national income National income accounting equation

National income accounting equation Outputs

Outputs Measuring domestic output and national income

Measuring domestic output and national income Measuring domestic output and national income

Measuring domestic output and national income Allianz simple income iii rider

Allianz simple income iii rider Past simple for future

Past simple for future Present simple past simple future simple

Present simple past simple future simple Past simple future

Past simple future Present simple past simple future simple present continuous

Present simple past simple future simple present continuous Simple present simple past and simple future

Simple present simple past and simple future Present continuous present simple exercises

Present continuous present simple exercises Future continuous tense vs future simple

Future continuous tense vs future simple Be present simple

Be present simple Present simple past simple future simple

Present simple past simple future simple Persistence factor

Persistence factor Residual income valuation method

Residual income valuation method Residual income model valuation

Residual income model valuation X-ray structure determination

X-ray structure determination Coefficient of determination formula in regression

Coefficient of determination formula in regression Blank determination example

Blank determination example X-linked punnett square

X-linked punnett square Brainpop sex ed

Brainpop sex ed Sex linkage

Sex linkage Self-advocacy worksheets for adults

Self-advocacy worksheets for adults Sample size calculation example

Sample size calculation example Shipping point determination

Shipping point determination Shipping point determination sap

Shipping point determination sap R squared interpretation

R squared interpretation Requirement determination

Requirement determination Correlation stufy

Correlation stufy Quality determination

Quality determination Bicinchoninic acid

Bicinchoninic acid Determination in sanskrit

Determination in sanskrit Price and output determination under monopoly

Price and output determination under monopoly Author tone

Author tone