Recent Judgements in Incometax Act 1961 CA Nihar

![Computation under MAT Milan Intermediates v. ITO – Ahmedabad ITAT [2018] 96 taxmann. com Computation under MAT Milan Intermediates v. ITO – Ahmedabad ITAT [2018] 96 taxmann. com](https://slidetodoc.com/presentation_image_h/e8fc9562695c38a19f26fff8c80bb7ec/image-48.jpg)

- Slides: 57

Recent Judgements in Income-tax Act, 1961 - CA Nihar Jambusaria

Sr. No. Particulars Sl. No. Recent Judgements 1. CIT Vs. M/s Shree Rama Multi Tech Ltd 3 -7 2. CIT Vs. Hindustan Petroleum Corporation Ltd. 8 -12 3. Maxopp Investment Ltd. Vs. CIT 13 -19 4. Flipkart India Pvt. Vs. . ACIT 20 -24 5. CIT Vs. HCL Technologies 25 -31 6. CIT Vs. Mahindra and Mahindra Ltd 32 -38 7. Oriental Bank of Commerce Vs. ACIT 39 -42 8. Rameshwaram Strong Glass v ITPO 43 -47 9. Milan Intermediates v. ITO 48 -52 10. Google India (P. ) Ltd. v. JDIT (International Taxation) 52 -56 2

Interest on Share Application money kept in FD as statutorily required – Taxable as IOS or can be deducted from share issue expenses? The Commissioner of Income Tax IV Ahmedabad Vs M/s Shree Rama Multi Tech Ltd [TS-199 -SC-2018] Issue Interest accrued on account of deposit of share application money whether taxable as IOS or can be deducted from share Issue expenses? 3

Facts: v A company had come out with IPO during the year under consideration and the amount of share application money received was deposited with banks on which interest was earned which was shown in the return of income originally filed as income from other source. v Assessee was statutorily required to keep share application money in separate account till the allotment of shares was completed v Later on assessee filed an additional ground before ITAT to allow set off of such interest against public issue expenses. 4

Held: Taking common rationale from both these judgments, SC held that "if there is any surplus money which is lying idle and it has been deposited in the bank for the purpose of earning interest then it is liable to be taxed as income from other sources but if the income accrued is merely incidental and not the prime purpose of doing the act in question which resulted into accrual of some additional income then the income is not liable to be assessed and is eligible to be claimed as deduction“ v The issue of shares relates to capital structure of the company and purpose of such deposit is not to make some additional income but to comply with statutory requirements, thus interest accrued on such deposit is merely incidental. v Interest income from share application money is inextricably linked with requirement of company to raise share capital and, thus, liable to be set off 5 against public issue expenses v

Case References: Commissioner of Income Tax v. Bokaro Steel Ltd (1999) 102 taxman 94 (SC), wherein the company was set up to produce steel. When the construction of plant was yet not completed, company earned following income: v v Interest on advances to contractor Rent from quarters let out to employees of the contractor Hire charges on plant and machinery let out to contractor Royalty on stones removed from its land In above judgment SC has held that all the above amounts were directly connected to and incidental to construction of plant by the asseesee thus all the amounts were capital receipts and not income from any independent source. It was held that all these receipts are intrinsically connected with construction of its steel plant. 6

Case References: Commissioner of Income Tax v. Karnal Co-operative Sugar Mills Ltd (2000) 243 ITR 2 (SC) wherein the assessee has deposited certain amount with bank to open letter of credit for purchase of machinery for setting up plant. It earned interest on such deposit. In above judgment SC has held that this was not a case where any surplus money was lying idle which was deposited in the bank for the purpose of earning interest. Hence, any income earned on such deposit was incidental to the acquisition of assets for the setting up of the plant and machinery. Thus, the interest was a capital receipt which would go to reduce the cost of asset. 7

Process of bottling of gas into cylinders for domestic use amounts to production or manufacture of gas cylinders The Commissioner of Income Tax 1 Mum Vs Hindustan Petroleum Corpn. Ltd. [2017] 84 taxmann. com 215 (SC) Issue Whether bottling of LPG, is a process which amounts to ‘production’ or ‘manufacture’ for the purpose of deductions of profits and gains from industrial undertakings etc for section 80 HH, 80 -I and 80 -IA of the Act? 8

Facts: v The assessees are engaged in the production of bottling liquefied petroleum Gas (LPG) cylinders meant for domestic use. v They are claiming benefit of sections 80 HH, 80 -I and 80 -IA of the Income Tax Act, 1961. 80 HH Deduction in respect of profits and gains from newly established industrial undertakings or hotel business in backward areas. Ø 80 -I Deduction in respect of profits and gains from industrial undertakings after certain date, etc. Ø 80 -IA Deduction in respect of profits and gains from industrial undertakings or enterprises engaged in infrastructure development, etc. Ø v The Assessing officer (AO) had disallowed the deduction claimed by the assesse holding that they did not engage in the production or manufacturing activity because LPG was produced and manufactured in refineries and thereafter there was no change in the chemical composition of the gas in the activity of filling the cylinder. 9

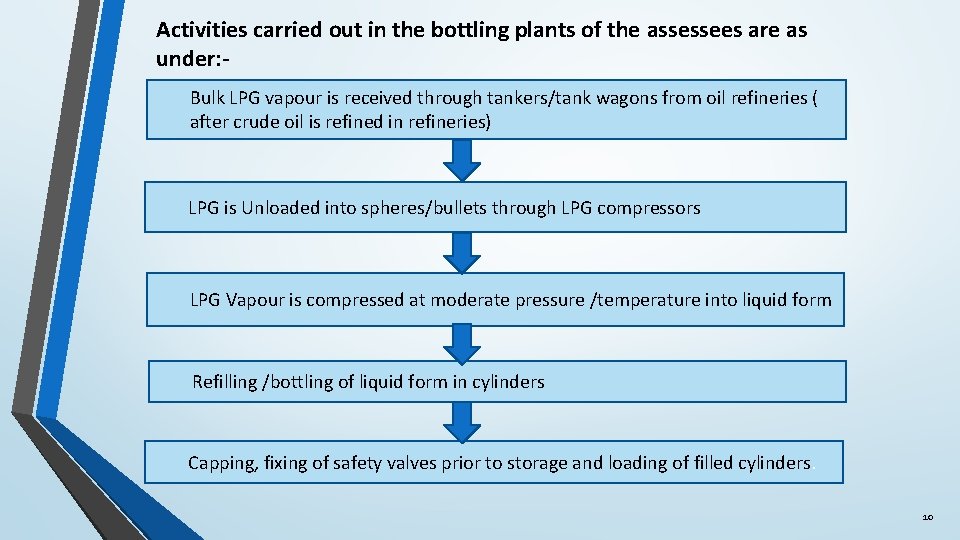

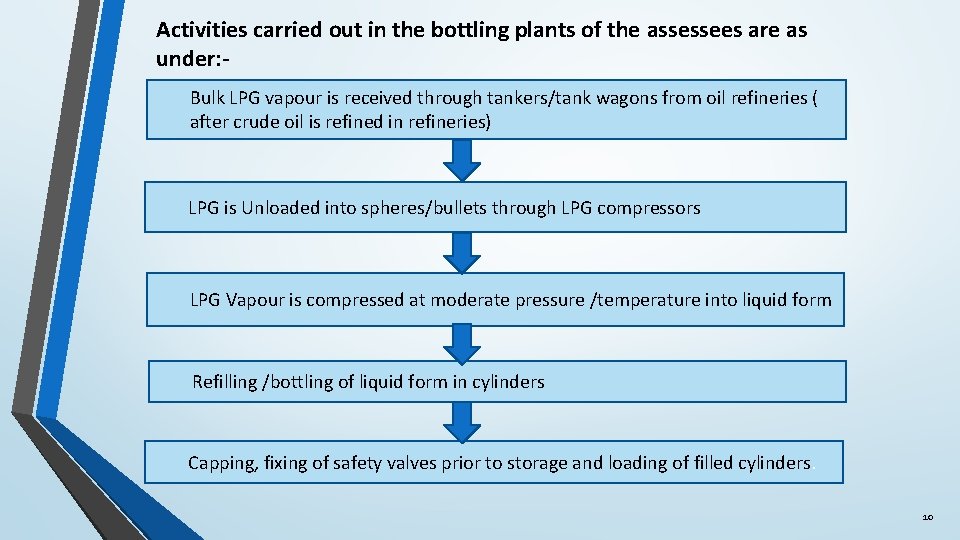

Activities carried out in the bottling plants of the assessees are as under: Bulk LPG vapour is received through tankers/tank wagons from oil refineries ( after crude oil is refined in refineries) LPG is Unloaded into spheres/bullets through LPG compressors LPG Vapour is compressed at moderate pressure /temperature into liquid form Refilling /bottling of liquid form in cylinders Capping, fixing of safety valves prior to storage and loading of filled cylinders. 10

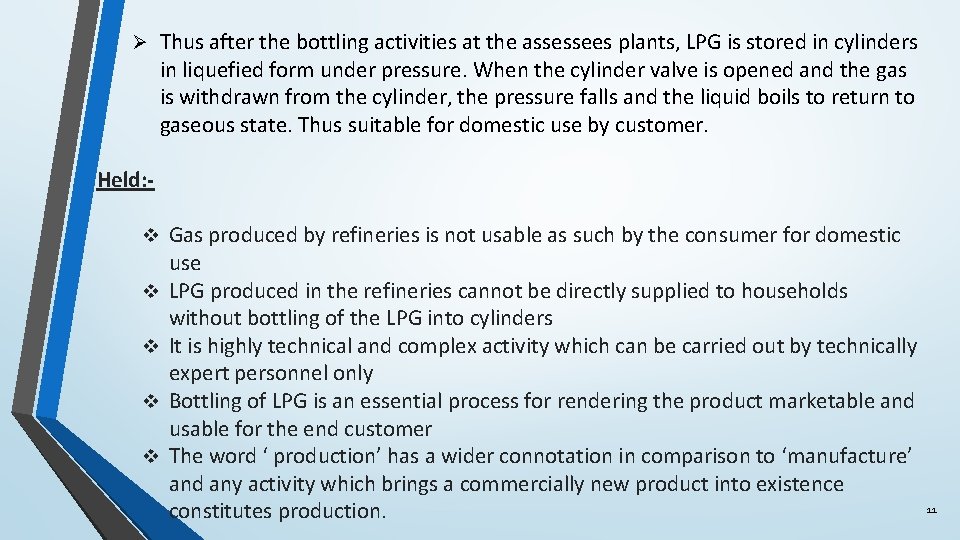

Ø Thus after the bottling activities at the assessees plants, LPG is stored in cylinders in liquefied form under pressure. When the cylinder valve is opened and the gas is withdrawn from the cylinder, the pressure falls and the liquid boils to return to gaseous state. Thus suitable for domestic use by customer. Held: v v v Gas produced by refineries is not usable as such by the consumer for domestic use LPG produced in the refineries cannot be directly supplied to households without bottling of the LPG into cylinders It is highly technical and complex activity which can be carried out by technically expert personnel only Bottling of LPG is an essential process for rendering the product marketable and usable for the end customer The word ‘ production’ has a wider connotation in comparison to ‘manufacture’ and any activity which brings a commercially new product into existence 11 constitutes production.

The provisions with which we are concerned in the instant case use the words ‘manufacture or production’ and are not limited to ‘manufacture’ alone v The aforesaid activity would definitely fall within the expression ‘production’, therefore, claim of deduction u/s 80 HH, 80 -I and 80 -IA will be allowed. v Case Reference: Income Tax officer, Udaipur v. Arihant Tiles and Marbles P. Ltd (2010) 186 Taxman 439 (SC) v Commissioner of Income Tax, Goa v. Sesa Goa Ltd (2004) 271 ITR 331 (SC) In both the above cases it was held that the word “production” is wider in ambit and it has a wider connotation than the word “ manufacture”. Further it was held that while every manufacture can constitute production, every production did not amount to manufacture. v v Commissioner of Income Tax, Madras v. Vinbros and Company [2015] 14 SCC 483 In the above case, it was held that the bottling and blending of alcohol is manufacture or production for the purpose of section 80 -IB of the Act. 12

Maxopp Investment Ltd. Vs. CIT – 91 taxmann. com 154 (SC) Issue Disallowance of expenditure under section 14 A in relation to exempt dividend income from shares held as ‘strategic investment’ and ‘stock in trade’. 13

Facts: v Assessee was engaged in the business of finance, investment and dealing in shares and securities. v It held shares in 2 portfolios – v Investment on Capital account v Trading assets for the purpose of acquiring and retaining control over investee group companies, particularly MAX India Ltd. v Profit / loss on account of transfer of shares held as ‘investment’ was offered under ‘Capital Gains’ and shares held as ‘trading assets’ (i. e. held with the intention of acquiring, exercising and retaining control over investee companies) was offered under ‘Profit and gains of business or profession’. v Assessee did not disallow the interest expenditure to the extent relatable to exempt income under section 14 A. v According to the assessee, the dominant purpose/ intention of investment in shares of Max India Ltd was to acquire/exercise and retain control and not earn dividend income. 14

Assessing Officer: v The Assessing Officer worked out disallowance under section 14 A by apportioning the total interest expenditure in the ratio of investment in shares of Max India Ltd. (on which dividend was received) to the total amount of unsecured loan. However, AO restricted the disallowance under section 14 A to the amount of dividend received and claimed exempt income. CIT(A) v The CIT (A) upheld the AO order. ITAT v The Special Bench held that the investment in shares representing controlling interest did not amount to carrying on of business and, therefore, interest expenditure incurred for acquiring shares in group companies was hit by the provisions of section 14 A. 15

High Court v HC held that the expression 'in relation to' appearing in section 14 A is synonymous with 'in connection with' or 'pertaining to', and, that the provisions of section 14 A apply regardless of the intention/ motive behind making the investment Issues before Supreme Court – Whether disallowance under the Section 14 A is attracted in a case where exempt dividend income is earned from - 1. shares held as “trading assets” or where the predominant intent of investing in shares is not to earn exempt dividend income, but to either retain controlling interest over the investee company or 2. “stock-in-trade” where the intention is to earn profit from trading in shares. v 16

Issue 1: Shares held as “trading assets” v As per the section, expenditure incurred “in relation to” exempt income is not allowed as deduction. If an expenditure incurred has no casual connection with the exempt income, then such an expenditure would be allowed as business expenditure. There is no judicial divergence on this aspect. v Controversy arises on interpretation to be given to the words “in relation to” in a case wherein the exempt dividend income is earned, but the dominant purpose of investing in shares is not to earn exempt dividend (dominant purpose test) v Prior to introduction of section 14 A, the law was that when an assessee had a composite and indivisible business which had elements of both taxable and nontaxable income, the entire expenditure in respect of the said business was deductible. The principle of apportionment was made available only where the business was divisible. v The Legislature perceived this as resulting in a double benefit to taxpayers 17

v As held by the SC in the case of CIT v. Walfort Share and Stock Pvt. Ltd (326 ITR 1), the Section incorporates the principle of apportionment of expenditure between exempt income and taxable income. v Keeping in mind the object of the Section, if the expenditure is incurred on earning the dividend income, pro rata expenditure attributable to the dividend income has to be disallowed. v The dominant purpose test is not relevant to trigger the Section. The dominant purpose for which the investment is made by the Taxpayer is not relevant. The fact remains that dividend received is exempt from tax and therefore the provisions of section 14 A would apply. v The SC affirmed the view of the HC and held that if dividend income received is exempt, the disallowance under the Section is triggered in all cases, even where the investment in shares is not with the main object of earning dividend income 18

Issue 2: Shares held as “Stock in trade” v In cases where shares are held as stock-in-trade, the main purpose is to trade in those shares and earn profits therefrom. When the shares are held as 'stock-intrade', certain dividend is also earned which is also an exempt income not to be included in the total income. v This triggers the applicability of Section 14 A of the Act which is based on theory of apportionment of expenditure between taxable and non-taxable income as held in Walfort Share & Stock Brokers (P. ) Ltd. (supra) case. Therefore, to that extent, depending upon the facts of each case, the expenditure incurred in acquiring those shares will have to be apportioned. 19

Flipkart India Pvt. Vs. ACIT – Bangalore ITAT ( ITA No. 693/Bang/2018) Issue Re-characterization of discounts as ‘Capital Expenditure’ 20

Facts: - v Assessee is engaged in the wholesale trading business. Assessee acquired goods from various unrelated persons and immediately sold them to third party retail sellers who, subsequently, sold such goods through electronic form (e-commerce) on an internet platform under the name “flipkart. com”, owned by the Taxpayer’s group entity. v During the year, the assessee purchased goods (say, at INR 100) and, subsequently, sold them to retailers at a lower value (say, INR 80). Consequently, the assessee incurred substantial losses during the year, amounting to approximately 2. 52% of the cost of the purchase value. AO held that - v The pricing strategy was not in line with comparable wholesale trading businesses which typically earn a profit margin of 16. 95%. The Taxpayer’s business model incurring loss at gross level is not normal, but exceptional 21

v The assessee indulged in a strategy of “predatory pricing” of selling goods at lower than cost price to establish customer goodwill and brand value in the long run and reap benefits in the future. Therefore, loss incurred by the assessee was to create marketing intangibles and such loss created due to predatory pricing was disallowed, holding it as a capital expenditure. Since marketing intangibles so created are used for business purposes, depreciation at the rate of 25% was allowed as deduction. v The difference in price between the sale proceeds of any normal wholesaler in the market and the sale proceeds of the assessee in the same market was considered as the cost incurred on the marketing intangibles. v Further, shares of the assessee were purchased by venture capitalist at a very high premium. This was justified only because of the asset base created by the assessee in the form of brand value v CIT(A) upheld the AO order. CIT(A) further enhanced the assessed income by denying depreciation on the marketing intangible on the ground that the owner of such 22 intangible asset was the assessee’s group entity, and not the assessee itself.

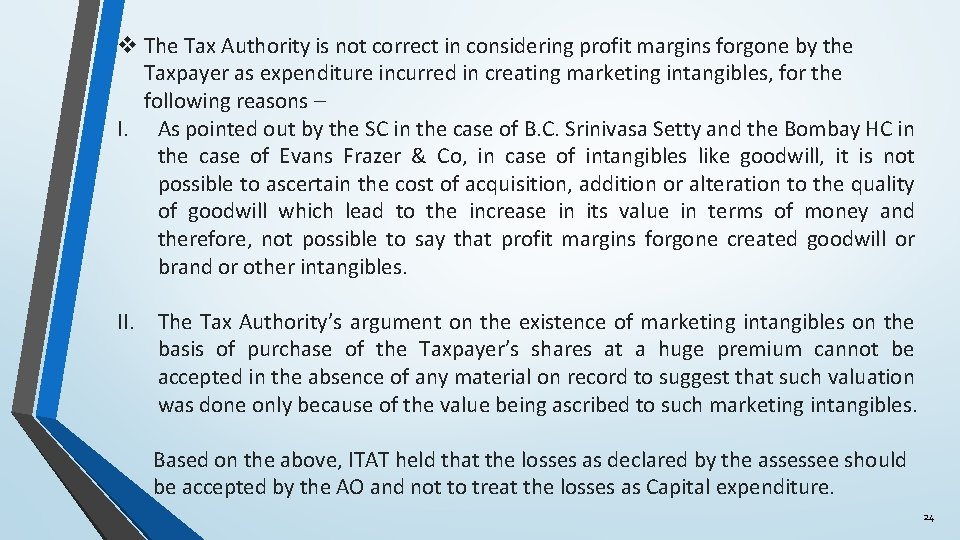

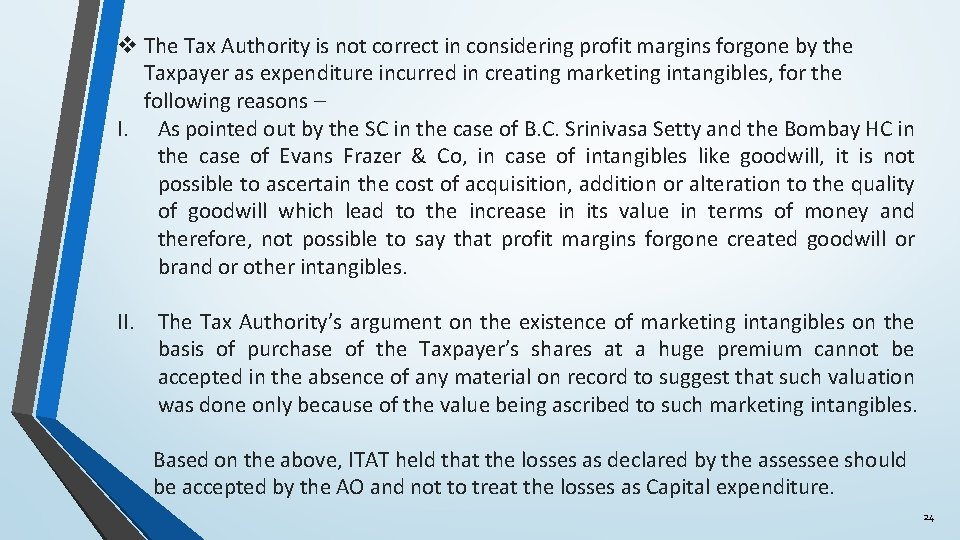

ITAT held that - v The starting point of computing income from business is the profit or loss as per the P&L account of the assessee. The Tax Authority cannot go beyond the books of account to disregard the assessee’s computation, unless it is dissatisfied about the correctness or completeness of the same as per section 145(3) of the Act, which is not the case. v There should be income and its receipt or accrual that can be subject to tax. In the present case, there is nothing to show accrual/receipt of any income beyond what is realized by the assesse in normal trading business. v There is no provision in the Act by which the Tax Authority can ignore and enhance the sale price declared by a taxpayer, unless there is evidence to suggest that the transaction is not bona fide or if the transaction is subject to transfer pricing provisions (section 40 A(2))or unless there is a provision which permits notional taxation ( section 43 CA or section 50 C). v The present case does not get covered in the transfer pricing provisions as there are no transactions with related parties. 23

v The Tax Authority is not correct in considering profit margins forgone by the Taxpayer as expenditure incurred in creating marketing intangibles, for the following reasons – I. As pointed out by the SC in the case of B. C. Srinivasa Setty and the Bombay HC in the case of Evans Frazer & Co, in case of intangibles like goodwill, it is not possible to ascertain the cost of acquisition, addition or alteration to the quality of goodwill which lead to the increase in its value in terms of money and therefore, not possible to say that profit margins forgone created goodwill or brand or other intangibles. II. The Tax Authority’s argument on the existence of marketing intangibles on the basis of purchase of the Taxpayer’s shares at a huge premium cannot be accepted in the absence of any material on record to suggest that such valuation was done only because of the value being ascribed to such marketing intangibles. Based on the above, ITAT held that the losses as declared by the assessee should be accepted by the AO and not to treat the losses as Capital expenditure. 24

CIT Vs. HCL Technologies – SC ( TS – 218 - SC - 2018) Issue Whether while computing tax holiday benefit under section 10 A, exclusions from export turnover also have to be reduced from total turnover? 25

Background of Section 10 A v Any profits and gains derived by an undertaking from the export of any articles or things or computer software shall be allowed as deduction for a period of 10 consecutive years from the year in which the undertaking begins to manufacture or produce such articles or things or computer software. v Accordingly, the formula for computation of the deduction under Section 10 A of the Act would be as follows: Export Profit = Total Profit of the Business X Export turnover Total Turnover of the undertaking. v Explanation 2(iv) of Section 10 A of the IT Act defines “export turnover” to mean the consideration that has been received for export of articles/things/computer software but does not include freight, telecommunication charges or insurance attributable to the delivery of articles/things/computer software or any expenses incurred in foreign exchange in providing the technical services outside India. 26

Facts: - v Assessee was engaged in the business of development and export of computer softwares and rendering technical services and had claimed deduction under section 10 A. v Further, the assessee had deducted expenses like freight, telecommunication and insurance attributable to the delivery of software outside India from export turnover and also from total turnover, while calculating deduction under section 10 A. The AO disallowed the same. v Further, the AO held that the software development charges, as claimed by the assessee, are nothing but in the nature of expenses incurred for technical services provided outside India and therefore to be excluded only from export turnover while computing deduction. 27

Issues before Supreme Court – 1. Whether certain expenses attributable to the delivery of software outside India or in providing technical services is also required to be deducted from ‘total turnover’? 2. Whether the software development charges are to be excluded while working out the deduction admissible u/s 10 A on the ground that such charges are relatable towards expenses incurred on providing technical services outside India? 28

Supreme Court held as under: Issue 1 v It is an undisputed fact that neither Section 10 A nor Section 2 of the IT Act define the term ‘total turnover’. However, the term ‘total turnover’ is given in clause (ba) of the Explanation to Section 80 HHC. v Now, whether the particular term which has not been defined in any particular section, is allowed to import the meaning of such term from the other provisions of the same Act? v SC held that the definition of total turnover given under Sections 80 HHC and 80 HHE cannot be adopted for the purpose of Section 10 A as “the technical meaning of total turnover, which does not envisage the reduction of any expenses from the total amount, is to be taken into consideration for computing the deduction under Section 10 A. ” 29

v If a term is defined under Section 2, then the definition would be applicable to all the provisions wherein the same term appears. v Therefore, the term ‘total turnover’ as defined in section 80 HHC and 80 HHE would be applicable for the purpose of those sections only. v Further, If denominator includes certain amount of certain type which numerator does not include, it would give rise to inadvertent, unlawful, meaningless and illogical result which would cause grave injustice to the assessee which could have never been the intention of the legislature. v Even in common parlance, when the object of the formula is to arrive at the profit from export business, expenses excluded from export turnover have to be excluded from total turnover also. Any other interpretation makes the formula unworkable and absurd v Export turnover is a component of total turnover. It is clear that any exclusion in the export turnover in the numerator will automatically imply exclusion in the denominator as well because export turnover is always a component of total turnover. 30

Issue 2 v The assessee was engaged in the business of software development for its customers. In the process of customized software development, certain activities were required to be carried out at the sight of customers on site, located outside India. v Further, after delivery of such softwares as per requirement, in order to make it fully functional subsequent to the delivery of softwares, there can be requirement of technical personnel to visit the client on site. v Further, it is not defined in section 10 A as to which activity will be termed as ‘providing technical services outside India’. v Since, the Assessing Officer could not bring any evidence that the assessee was engaged in providing simply technical services independent of software development for the client for which the expenditures were incurred outside India in foreign currency, the SC ruled in favour of the assessee that the expenditure was incurred for software development charges and not for providing simply technical services. 31

Capital asset loan waiver neither perquisite u/s 28(iv) nor cessation of trading liability The Commissioner of Income Tax Vs. Mahindra and Mahindra Ltd [TS-220 -SC 2018] Issue Whether waiver of loan by the creditor is taxable as a perquisite u/s 28(iv) or taxable as a remission of liability u/s 41(1) of the Act? 32

Facts: v v v Assessee entered into an agreement with Kaiser Jeep Corporation (KJC) based in America wherein KJC agreed to sell the dye, welding equipments and dye models to the assesse. The said toolings and other equipments were supplied by the KJC through its subsidiary Kaiser Jeep International Corporation (KJIC). For the procurement of the said toolings and other equipments, the KJC agreed to provide loan to the assesse at the rate of 6% interest repayable after 10 years in installments. Later on American Motor Corporation (AMC) had taken over the KJC and also agreed to waive the principal amount of loan advanced by the KJC to the assesse. Assessee claimed the waiver to be capital receipt and shown the amount as 33 cessation of its liability in its return filed.

Income Tax officer held that with the waiver of the loan amount, the credit represented income and not a liability. v ITAT and HC ruled in favour of assesse. Aggrieved by the decision revenue filed an appeal before SC. v It was contended by the revenue that since an amount is waived off, for which assesse is claiming exemption, it actually amounts to income in the hands of the assesse u/s 28(iv) or alternatively u/s 41(1). v Supreme Court noted the following points while discussion: v The term “Loan” generally refers to borrowing something, especially a sum of cash that is to be paid back along with interest decided mutually by the parties. v Creditor or his successor may exercise his “Right of Waiver” unilaterally to absolve the debtor from his liability to repay. After such exercise , the debtor is deemed to be absolved from the liability of repayment of loan subject to the conditions of waiver v Wavier of loan by the creditor results in the debtor having extra cash in his hand. 34

Applicability of section 28(iv) of the Act Relevant Provision of the Act Section 28 Profits and gains of business or profession- The following income shall be chargeable to Income Tax under the head “Profits and gains of business or profession”………. . (iv) The value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession; ………. Supreme Court held that to invoke the provision of section 28(iv) the benefit which is received has to be in some other form rather than in shape of money. Therefore, the very 1 st condition of section 28(iv) is not satisfied in the present case. 35

Applicability of section 41 (1) of the Act Relevant Provision of the Act Section 41 Profits Chargeable to tax- (1) Where an allowance or deduction has been made in the assessment for any year in respect of loss, expenditure or trading liability incurred by the assessee (hereinafter referred to as the first-mentioned person) and subsequently during any previous year, — (a) the first-mentioned person has obtained, whether in cash or in any other manner whatsoever, any amount in respect of such loss or expenditure or some benefit in respect of such trading liability by way of remission or cessation thereof, the amount obtained by such person or the value of benefit accruing to him shall be deemed to be profits and gains of business or profession and accordingly chargeable to income-tax as the income of that previous year, whether the business or profession in respect of which the allowance or deduction has been made is in existence in that year or not; or 36

Supreme Court held that : v It is a sine qua non that there should be an allowance or deduction claimed by the assesssee in any assessment for any year in respect of loss, expenditure or trading liability incurred by the assesse. Then, subsequently, during any previous year, if the creditor remits or waives the liability, then the assesse is liable to pay tax u/s 41 of the Act. v In the present case, it is undisputed fact that assesse had been paying interest at 6% to the KJC but never claimed deduction for the payment of interest u/s 36(1)(iii) of the Act. v The Purchase from KJC is in respect of capital assets and said purchase amount had not been debited to the trading account or profit and loss account in any assessment years. v There is difference between trading liability and other liability. v Section 41(1) of the Act particularly deals with remission of trading liability. Whereas in the instant case, waiver of loan amounts to cessation of liability other than trading liability. Hence would not fall u/s 41(1) of the Act. 37

v In present case CIT(A) relied upon section 41(1) of the Act and held assesse had received amortization benefit. For this observation of CIT(A), it was held by SC that § it is nothing else than depreciation and depreciation is a reduction in the value of an asset over time , in particular, to wear and tear. § Therefore , the deduction claimed by the respondent in earlier years was due to depreciation and not on the interest paid by it. In brief: SC held that waiver of the relevant loan was not taxable u/s 28(iv) as it was in the nature of cash or money and provision of section 41(1) were not applicable as relevant liability was not trading liability. 38

Oriental Bank of Commerce Vs. ACIT – Delhi HC ( TS – 217 - HC - 2018) Issue Whether expenditure incurred towards software, which results in fine tuning of business operations and enabling to run the business effectively and efficiently, is revenue expenditure or a capital expenditure ? 39

Facts: v The assessee, Oriental Bank of Commerce, had incurred expenditure on acquisition of various categories of software and claimed it as revenue expenditure. v After considering a detailed enquiry as to the nature of the software and the utility of each of them, AO held that these were depreciable assets, for which the rates of depreciation were set out and consequently the expenditure could not be treated as falling in the revenue stream and therefore the AO treated it as a capital expenditure. v CIT(A) and ITAT further ruled in favour of Revenue. Issues before Delhi HC v Whether in the facts and circumstance of the case, the Tribunal was correct in law in holding that software expenses incurred by the Appellant during the assessment year were in the nature of capital expenditure 40

Delhi HC held that - v HC observed that the software acquired were in the nature of licenses. v These copyright licenses are used for a specific duration as specified in an agreement with the licensor/intellectual property owner. v Furthermore, the assessee’s objective is not to carry on software business, rather it uses the computer software as a tool to maximize its performance and streamline its efficiency. v The mere circumstance that depreciation rate is spelt out in the Schedule to the Income-tax Rules in our opinion is not conclusive as to the nature of the expenditure and whether it resulted an enduring advantage to a particular assessee 41

Delhi HC held that - v HC further held that it uses specific customized software, which is specific to its banking activities. v Had it been the license not acquired by the assessee, the assessee would have incurred the expenditure on fees payable to the consultants and special professionals for systems. This would have fallen undoubtedly in the revenue stream. v Based on the above, Delhi HC held that the expenditure incurred on software is revenue in nature. 42

Rameshwaram Strong Glass (P) Ltd. – Jaipur ITAT (96 taxmann. com 542) Issue Valuation under section 56(2)(viib) 43

Facts: v The assessee was a private limited company. There was no business activity during the starting assessment years except purchase of a land. During the year under consideration, the assessee had issued 1, 40, 000 shares having the face value of Rs. 10 each, at the premium of Rs. 60 per share, receiving a total premium of Rs. 84 lakhs over and above the share application money of Rs. 14 lakhs. The assessee had determined Fair Market Value (FMV) on the basis of Discounted Cash Flow Method as per Rule 11 UA(2)(b). v The AO rejects the valuation based on DCF method and adopted the NAV method to determine the value of shares. 44

Facts: v Sec 56(2)(viib) of the Act provides that where a company not being a company in which the public are substantially interested, receives from residents, any consideration for issue of shares that exceeds the face value of such shares, the aggregate consideration received for such shares as exceeds the FMV of the shares is to be taxed as income from other sources. v Further, Rule 11 UA(2)(b) provides that the FMV of unquoted equity shares shall be the value, on the valuation date, of such unquoted equity shares as determined in the following manner under clause (a) or clause (b), at the option of the assessee - Clause (a) – NAV method - Clause (b) – DCF method. v The CIT(A) noted that the DCF Method was used based on the estimated figures and when the DCF Method was applied on actual figures, the discounted cash flow turned negative and upheld AO order and rejected DCF method. 45

ITAT held as under – v ITAT held that the valuation of unquoted shares has been completely left to the discretion of the assessee who can choose between NAV method or to choose DCF Method and the AO cannot adopt method of his own choice. v The legislation has conferred an option upon the assessee to choose a particular method, the valuation of the shares has to be in accordance with such method only i. e. DCF method in the present case and changing the method or adopting a different method would be beyond the powers of the revenue authorities v ITAT explains that the AO can only scrutinize the valuation report and make adjustment for any arithmetical inaccuracy and if he finds the working or the assumptions made by CA/Merchant Banker as erroneous or contradictory, he may suggest the necessary modifications provided they are based on sound reasoning and rational basis. 46

ITAT held as under – v ITAT noted that DCF Method is essentially based on the projections (estimations) only and hence these projections cannot be compared with the actuals to expect the same figures as were projected. ITAT held that the projections are affected by various factors. v Taking example of start-ups, ITAT held that in the case of company where, there is no commencement of production or of the business, it cannot mean that its share cannot command any premium. v Further, the valuation reports were prepared as per the guidelines given by the Institute of Chartered Accountants of India and the Assessing Officer has not found any fault. Thus, there is no rational or sound basis in the order of the authorities below, Assessing Officer was unjustified in rejecting the valuation report submitted by the assessee based on DCF Method 47

![Computation under MAT Milan Intermediates v ITO Ahmedabad ITAT 2018 96 taxmann com Computation under MAT Milan Intermediates v. ITO – Ahmedabad ITAT [2018] 96 taxmann. com](https://slidetodoc.com/presentation_image_h/e8fc9562695c38a19f26fff8c80bb7ec/image-48.jpg)

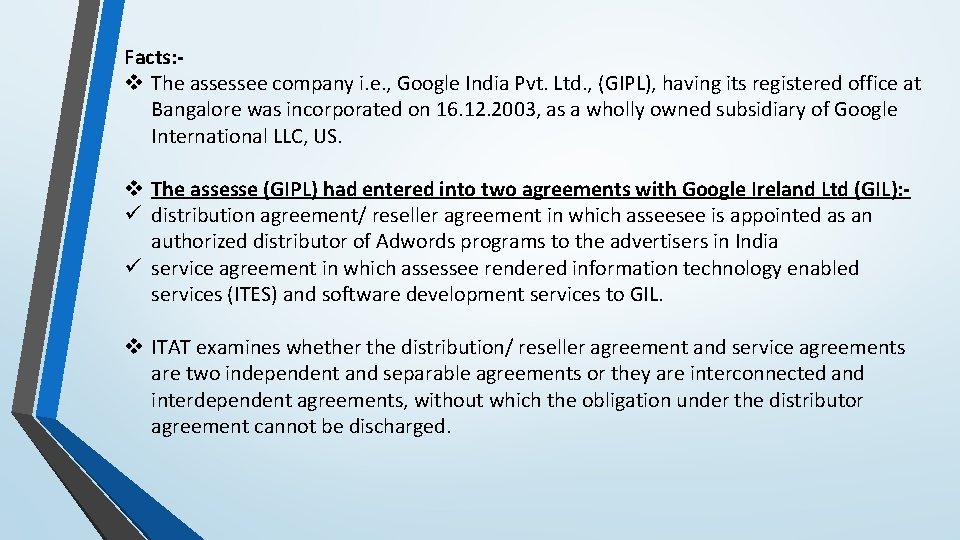

Computation under MAT Milan Intermediates v. ITO – Ahmedabad ITAT [2018] 96 taxmann. com 338 (Ahmd. ITAT) Issue Computation under MAT. 48

Facts: v During AY 2011 -12, in case of Milan Intermediates LLP (assessee-LLP), the methodology towards adjustment and set off of brought forward loss and unabsorbed depreciation while calculating the book profit was disputed by the AO. v AO observed that assessee followed FIFO method for setting off the losses, whereby it first adjusted the loss out of brought forward losses and thereafter out of remaining unabsorbed depreciation against the book profits. v AO was of the view that the assessee wrongly calculated the eligible amount of set off. v CIT(A) upheld AO’s order 49

ITAT Held - v ITAT noted that assessee adopted the methodology of reduction of current years’ profits out of brought forward losses in preference to unabsorbed depreciation (subject to quantification of amount being lower of the two) irrespective of the fact that unabsorbed depreciation was lower than unabsorbed losses. v This can be explained in following illustration B/f Loss – Rs. 75. B/f UAD – Rs. 25. Current Year Profit – Rs. 35 v ITAT explained that the assessee reduced Rs. 25/- (being lower of unabsorbed losses and unabsorbed depreciation) from the book profit and adjusted the same under unabsorbed losses and consequently carried forward unabsorbed loss at Rs. 50 and unabsorbed depreciation at Rs. 25 to the succeeding year 50

ITAT Held - v ITAT noted assessee’s stand that the taxpayer was fully entitled to exercise its discretion in claiming reduction out of unabsorbed losses in preference to unabsorbed depreciation in the absence of any specific suggestion in Explanation to Sec 115 JB. v The benefit of Explanation to Clause (iii) was not available in the event either unabsorbed loss or unabsorbed depreciation becoming NIL. v ITAT held that “The spirit of the clause thus requires to be gauged from this restriction placed statutorily. If the methodology adopted by the assessee is endorsed, it may generally defeat a situation where one of the two i. e. unabsorbed loss and unabsorbed depreciation turning NIL 51

ITAT Held - v ITAT clarified that if the lower of the two happened to be unabsorbed depreciation, reduction to be done from depreciation kitty and not out of unabsorbed loss. ITAT opined that “Doing so would give fair treatment to the language employed and will be in consonance with the object of Clause (iii) for the purposes of set off”. 52

Whether the payment made by the assessee to purchase of advertisement space for resale to the advertisers in India is in the nature of 'Royalty' under the Act and the India-Ireland Double Taxation Avoidance Agreement (`lndia-lreland Treaty') ? [2018] 93 taxmann. com 183 (Bangalore - Trib. ) Google India (P. ) Ltd. v. Joint Director of Income-tax (International Taxation), Bengaluru Main Issue : Whether the payment made by the assessee to Google Ireland Limited in relation to purchase of advertisement space for resale to the advertisers in India under the Google Ad. Words Reseller Agreement ('the Agreement') to be in the nature of 'Royalty' under the Act and the India-Ireland Double Taxation Avoidance Agreement (`lndia-lreland Treaty'). Nature of other issues: Tax Deduction at source, Free Trade Zone u/s 10 A, Transfer Pricing, Reopening , Rejecting books of Accounts etc. 53

Facts: v The assessee company i. e. , Google India Pvt. Ltd. , (GIPL), having its registered office at Bangalore was incorporated on 16. 12. 2003, as a wholly owned subsidiary of Google International LLC, US. v The assesse (GIPL) had entered into two agreements with Google Ireland Ltd (GIL): - ü distribution agreement/ reseller agreement in which asseesee is appointed as an authorized distributor of Adwords programs to the advertisers in India ü service agreement in which assessee rendered information technology enabled services (ITES) and software development services to GIL. v ITAT examines whether the distribution/ reseller agreement and service agreements are two independent and separable agreements or they are interconnected and interdependent agreements, without which the obligation under the distributor agreement cannot be discharged.

v Further observes that the obligation cast upon the assessee under the Google Adword distribution agreement can only be discharged with the help of the ITES division, therefore, the distribution agreement and the service agreement are to be read together as they are Interconnected v Google Ad. Word Program is a complex program or rather it can be called to be a portal or software developed by Google Inc. While discharging its obligation under the Google Ad. Word Programs and Service Agreement the assessee has an access to the trade marks, IPRs, derivative works, brand features and the confidential information of the GIL. v Therefore, it cannot be called that whatever payments were made by the assessee to GIL was simpliciter a payment towards the purchase of Ad. Word space from the GIL for its resale to advertisers. ” but it is a payment of royalty to the GIL in the light of definition of royalty given under the Act and the DTAA. ”

ITAT held: v Thus, holds that payment made by Google India (‘assessee’) to Google Ireland (‘GIL’) for AY 2013 -14 for granting distribution right of ‘Adwords programme’ is taxable as ‘royalty’ in India under the domestic law (i. e. Section 9) as well as provisions of India-Ireland tax treaty, upholds AO’s order u/s. 201(1)/(1 A) for failure to make TDS. v ITAT notes that though the ownership of the intangibles remains with the GIL or the Google Inc. , but the assessee was given the licence to use it in order to provide better service. v ITAT clarifies that “the introduction of equilisation levy would not convert the nature of payment made by the assessee to GIL. ” v Rejects assessee’s bona-fide belief stand for non-deduction of TDS observing that the distribution and service agreements were prepared in such a way to give transaction a different colour; v ITAT observes that the Google Adwords program is owned by Google Inc. USA and it was licensed by Google Inc. to Google Ireland Holdings (GIH) which in turn was further licensed to Google Netherlands Holding BV (GNHBV) and in turn GNHBV licensed it to Google Ireland Ltd. (GIL). v With respect to whether GIL is the beneficial owner of royalty income so as to claim concessional tax rate under DTAA, ITAT restores the matter to the AO to re-adjudicate the issue in the light of the license agreements executed between the parent holdings of GIL