Park Elektrik retim Madencilik Sanayi ve Ticaret A

- Slides: 39

Park Elektrik Üretim Madencilik Sanayi ve Ticaret A. Ş. September 2012 BGC Partners Conference London

Contents I. III. IV. V. VIII. Park Elektrik Overview Ciner Group in Brief Operations Reserves Planned Investments Financial Structure Evaluation of The Latest Financial Tables Corporate Governance Rating Park Elektrik September 2012 3 7 10 13 20 23 32 38 2

I. Park Elektrik Overview September 2012 3

The Company § § § Park Elektrik was established as a textile company in 1994. Initially offered to public in 1997, Park Elektrik is the sole listed company within Ciner Group. Changed its commercial title and main line of activity in 2000. Took over operational rights of copper mine in Siirt in 2004. Commenced copper mining operations in late 2006. Merged with ISE-listed Group company, Ceytas, in May 2009 and added asphaltite mining into its operation line following Ceytas merger. Park Elektrik September 2012 4

Ownership Structure Park Elektrik September 2012 5

Participation, Park Termik § § Park Elektrik has 10% stake in Park Termik Elektrik San. ve Tic. A. S. , a Ciner Group company which is involved in thermal power generation in Çayırhan, Ankara. Park Termik operates Cayirhan Thermal Power Plant which has a total production capacity of 620 MW, in four units. The plant is an integrated power generator which procures coal through its own lignite mines. In June 2012, Park Termik paid TL 5. 2 mn dividends to Park Elektrik & Madencilik. Park Elektrik September 2012 6

II. Park Elektrik Ciner Group in Brief September 2012 7

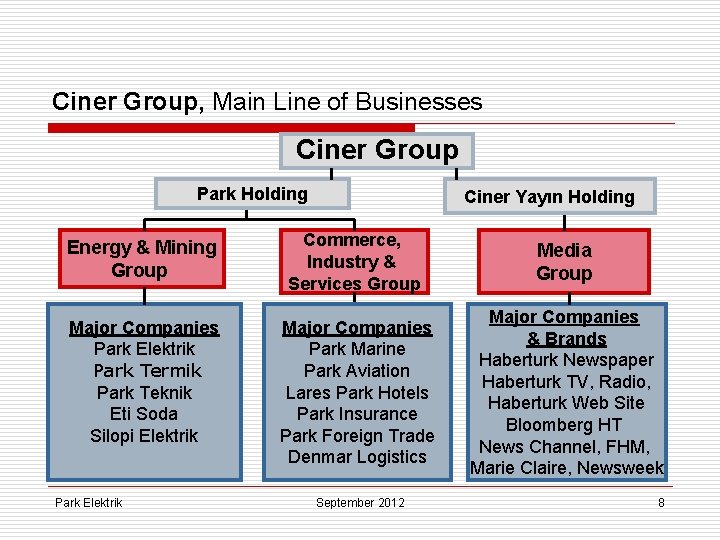

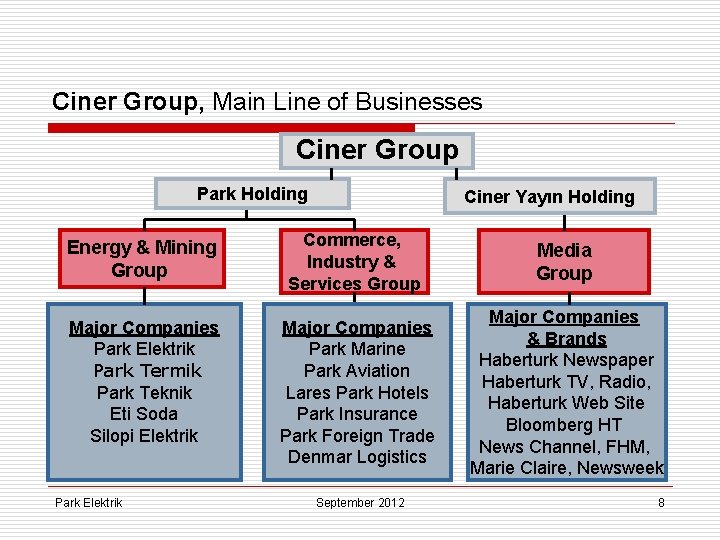

Ciner Group, Main Line of Businesses Ciner Group Park Holding Ciner Yayın Holding Energy & Mining Group Commerce, Industry & Services Group Media Group Major Companies Park Elektrik Park Termik Park Teknik Eti Soda Silopi Elektrik Major Companies Park Marine Park Aviation Lares Park Hotels Park Insurance Park Foreign Trade Denmar Logistics Major Companies & Brands Haberturk Newspaper Haberturk TV, Radio, Haberturk Web Site Bloomberg HT News Channel, FHM, Marie Claire, Newsweek Park Elektrik September 2012 8

Ciner Group, Introduction § Park Holding, the main shareholder of Park Elektrik with 61% share, is solely owned by Mr. Turgay Ciner. § Ranking among the largest Groups of Turkey, Ciner Group’s history goes back to 1978 when it was founded. The Group has a diversified business portfolio including companies in construction, insurance, logistics, media and broadcasting sectors. However, the Group’s main line of businesses are mining and energy in which it has a wide expertise. § Ciner Group is a pioneering actor in energy and mining sector given its new and initial steps since early 1990 s. In line with accelerated privatization efforts in 1990 s, the Group successfully involved in mining and energy sectors which are the underlying sectors of the Group’s fast growth in recent years. § As of year-end 2011, Park Holding has TL 1. 3 bn of consolidated sales and TL 3. 2 bn of total assets. Park Elektrik September 2012 9

III. Park Elektrik Operations September 2012 10

Park Elektrik’s Existing & Planned Facilities Copper Mine Siirt Natural Gas Power Plant Adana Park Elektrik September 2012 HPP Diyarbakır Asphaltite Mine Sırnak 11

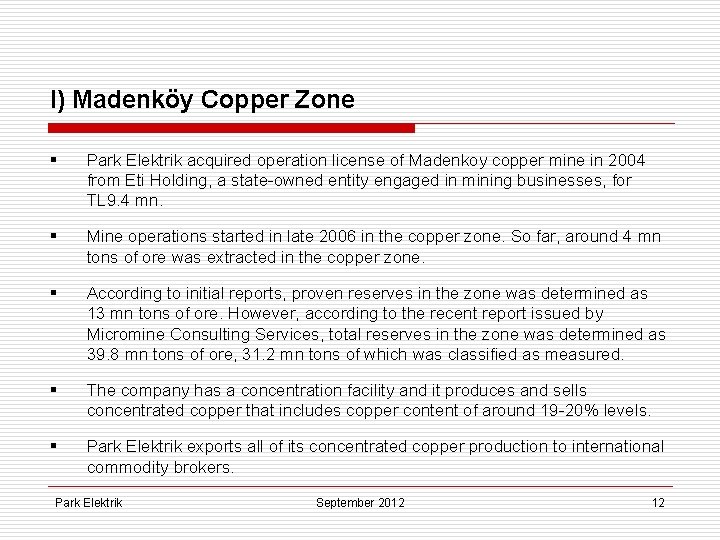

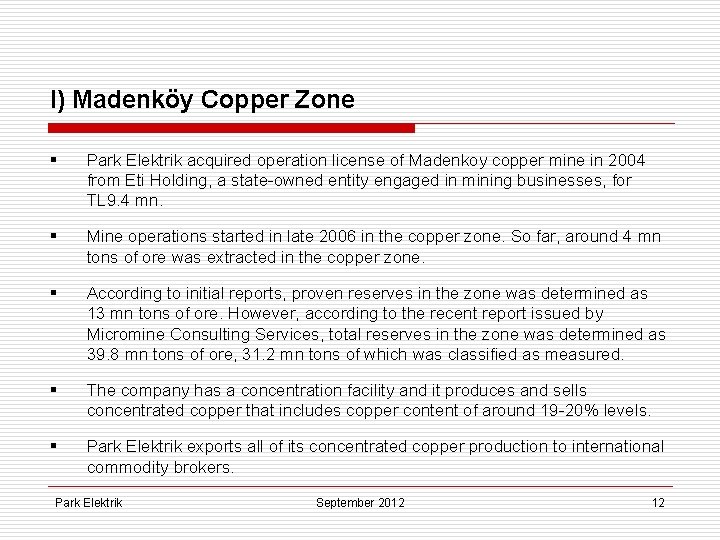

I) Madenköy Copper Zone § Park Elektrik acquired operation license of Madenkoy copper mine in 2004 from Eti Holding, a state-owned entity engaged in mining businesses, for TL 9. 4 mn. § Mine operations started in late 2006 in the copper zone. So far, around 4 mn tons of ore was extracted in the copper zone. § According to initial reports, proven reserves in the zone was determined as 13 mn tons of ore. However, according to the recent report issued by Micromine Consulting Services, total reserves in the zone was determined as 39. 8 mn tons of ore, 31. 2 mn tons of which was classified as measured. § The company has a concentration facility and it produces and sells concentrated copper that includes copper content of around 19 -20% levels. § Park Elektrik exports all of its concentrated copper production to international commodity brokers. Park Elektrik September 2012 12

Micromine Reserve Report Based On JORC § § According to a JORC (Joint Ore Resources Code) compliant reserve report issued by Micromine Consulting Services in October 2011, based on the drilling and sampling works by Eti Holding (1981), Preussag AG Metall (1988) and Park Elektrik, the total reserves of Madenköy project was determined as 39, 821, 000 tons of ore, 31, 182, 000 tons of which was measured. According to the same report, average grade in Madenkoy copper mine is 2. 4% for the whole zone. Current grade in the zone is lower, at 1. 8 -1. 9% levels in average. Source: JORC Resource Estimate Report by Micromine Park Elektrik September 2012 13

Capacity Expansion § § § In parallel with growing reserves in the Madenkoy copper zone, the company increased its concentration facility’s capacity from 750 k to 1. 2 mn tons as of October 2011. Total capex for this investment was Euro 3. 5 mn. Furthermore, Park Elektrik plans to increase its concentration capacity to 1. 8 mn tons in the short term. The company plans to complete this second phase capacity expansion by December 2012 with a planned investment amount of Euro 3. 5 -4 mn. In line with increasing capacity, Park Elektrik revised its production targets for the coming two years. The company expects 90 k production in 2012. For 2013, Park Elektrik expects production volume to be in a band of 130 k-150 k levels, with the assumptions of 1, 8% and 2% grades respectively. * 2012 production targets have been revised as 90 k from 95 k due to an unexpected delay in delivery of new production line equipment in the capacity expansion process. ** Production targets for 2013 have been revised within the context of budget revision and new grade assumptions. Park Elektrik September 2012 14

2012 Production Targets & Realizations by 1 H 12 § § As of 1 H 12, Park Elektrik exceeded its first half production targets by producing 46, 852 wmt of concentrated copper, 9% over its target of 43 k. The company revised its year-end production target from 95 k to 90 k due to an unexpected delay in delivery of new production line equipment. There might also be a few daily production shortages in the second half of the year in line with ongoing capacity expansion process in the current concentration center. Park Elektrik September 2012 15

Current Underground Zone Plan Park Elektrik September 2012 16

Shift To Open Pit Mining in 2013 § § Park Elektrik plans to shift its copper mining operations from underground to open-pit mining by the mid of 2013. Based on projections, production through open pit mining will continue until the end of 2025 for thirteen years in two different phases. Regarding this shift, the company started stripping in the copper zone by assigning two subcontractors. The initial stripping of 13 mn m 3, which will take one year from mid of 2012 to mid of 2013, will cost TL 65 mn with an average stripping cost of TL 5 per m 3. The company plans to excavate 198 mn m 3 soil to produce 19. 75 mn tons of ore in thirteen years period of open pit mining, including initial stripping of 13 mn m 3. The compulsory purchase process which has started in line with Park Elektrik’s shift to open pit mining has completed recently with a total expense of TL 11 mn. Park Elektrik September 2012 17

II) Silopi Asphaltite Zone § Asphaltite is a petroleum-origin hydrocarbon with a thermal value of 5, 500 -5, 800 kcal/kg. § Park Elektrik has the operational rights of Silopi asphaltite mine until 2033. Estimated asphaltite reserve in Silopi is around 35 mn tons based on Turkish Coal Enterprise (TKI) reports. § Operations in the asphaltite zone started in June 2009. The company provides asphaltite to Silopi Elektrik Üretim A. Ş. , a group company which is involved in electricity production in Silopi with fluidized bed technology and has a starting capacity of 135 MW. § Annual production amount in Silopi is around 450, 000 tons and is subject to increase from 2014 onwards in line with capacity expansion of Silopi EUAS from 135 MW to 405 MW. With the expansion, annual asphaltite production of Park Elektrik is also estimated to be tripled. § Based on recently renewed contract by two companies, sale price of asphaltite is determined as “Costs + 15%”. § Asphaltite mine will be open-pit for the first years of operation. Later on, underground mining will be done by the method of “Cut and Fill Block Caving”. Park Elektrik September 2012 18

Open-Pit Mining in Silopi Park Elektrik September 2012 19

IV. Park Elektrik Planned Investments September 2012 20

Diyarbakır HPP § Installed capacity will be 50. 5 MW. § Production license is valid for 49 years. § According to recent feasibility studies, estimated investment amount is US$ 100 mn. Park Elektrik September 2012 21

Ceyhan Natural Gas Power Plant § Park Elektrik applied to Energy Market Regulatory Authority for a license to establish a NGPP in Ceyhan, Adana. § Installed capacity will be 423 MW. § Production license will be valid for 49 years. § Estimated investment amount is Euro 250 mn. Park Elektrik September 2012 22

V. Park Elektrik Financial Structure September 2012 23

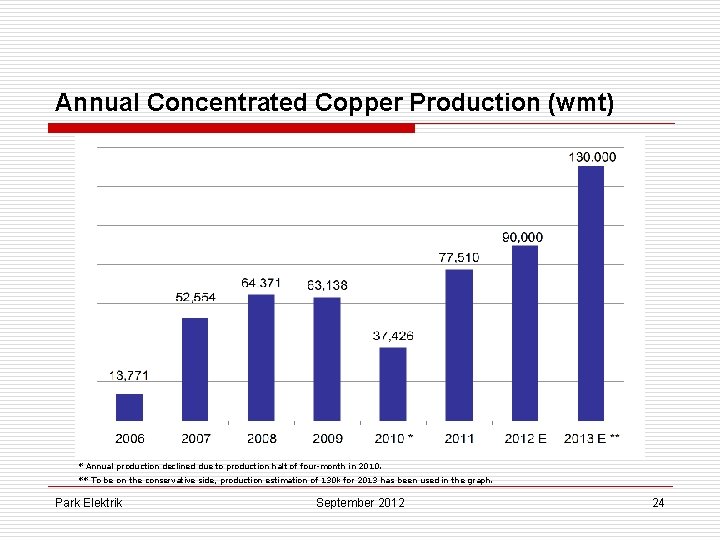

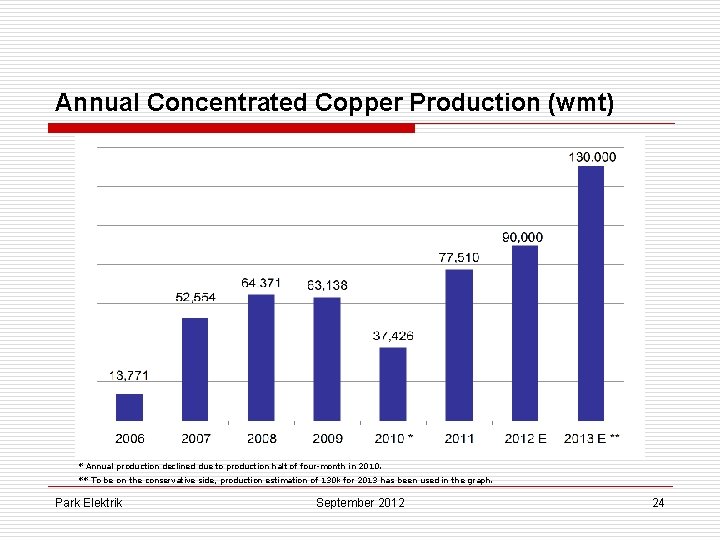

Annual Concentrated Copper Production (wmt) * Annual production declined due to production halt of four-month in 2010. ** To be on the conservative side, production estimation of 130 k for 2013 has been used in the graph. Park Elektrik September 2012 24

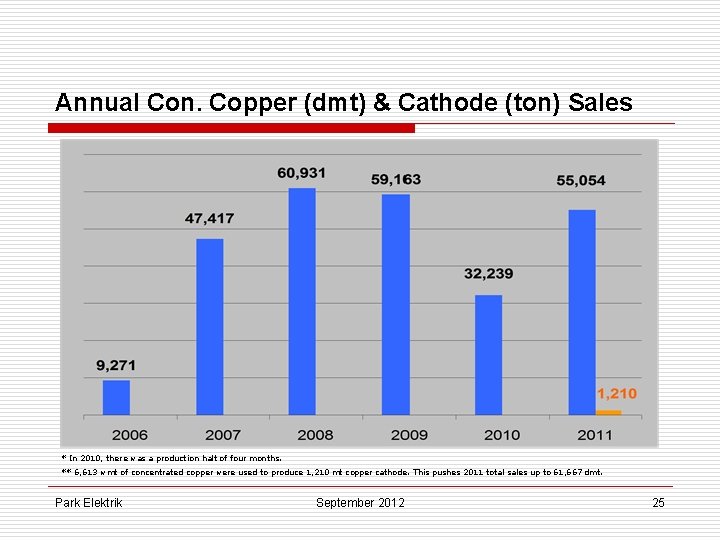

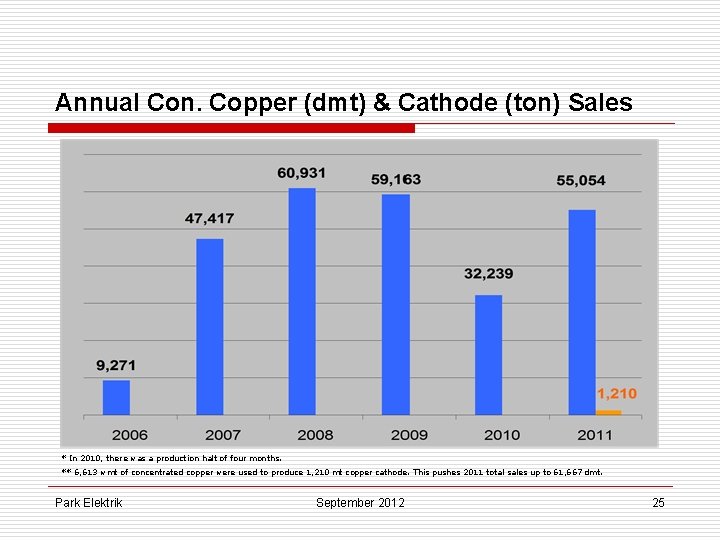

Annual Con. Copper (dmt) & Cathode (ton) Sales * In 2010, there was a production halt of four months. ** 6, 613 wmt of concentrated copper were used to produce 1, 210 mt copper cathode. This pushes 2011 total sales up to 61, 667 dmt. Park Elektrik September 2012 25

Annual Asphaltite Sales (ton) * Asphaltite operations started in mid 2009. Park Elektrik September 2012 26

Total Sales Revenues (TL) * Revenues from other sales is 1, 616, 016. Park Elektrik September 2012 27

Net Earnings (TL mn) Park Elektrik September 2012 28

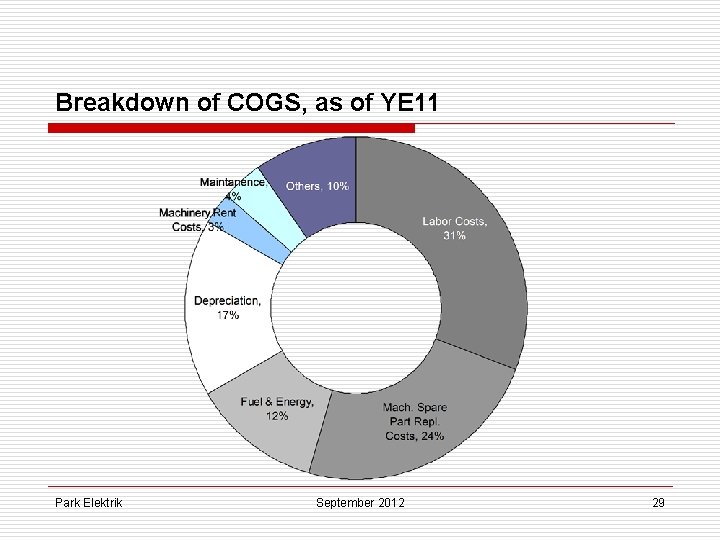

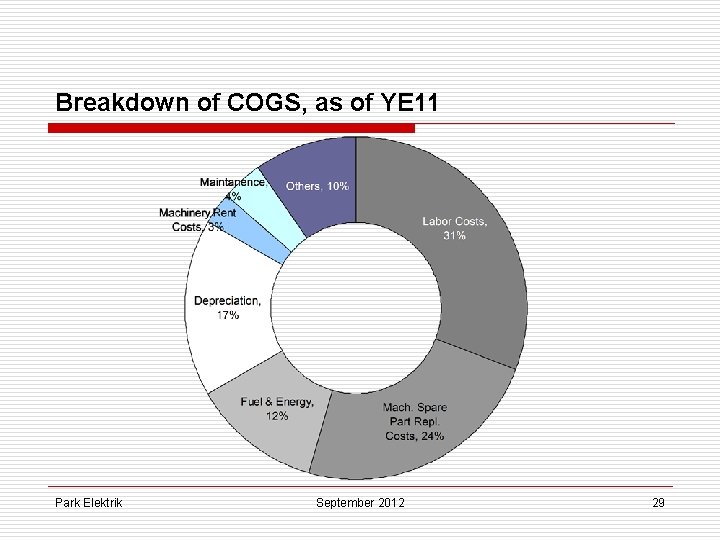

Breakdown of COGS, as of YE 11 Park Elektrik September 2012 29

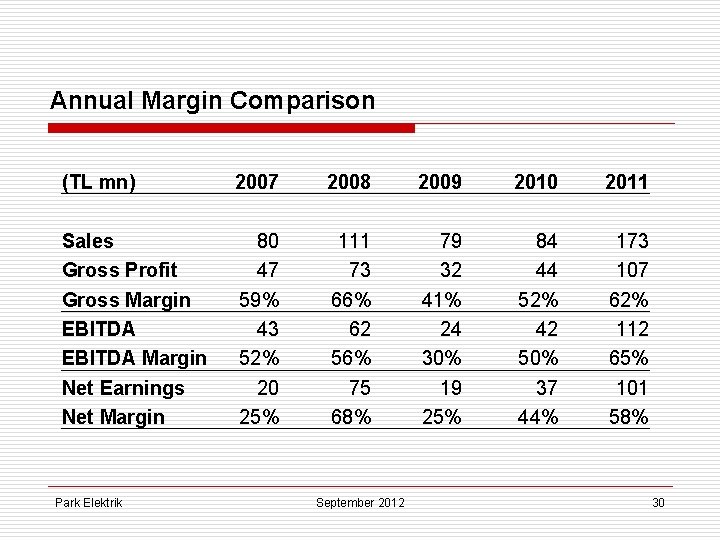

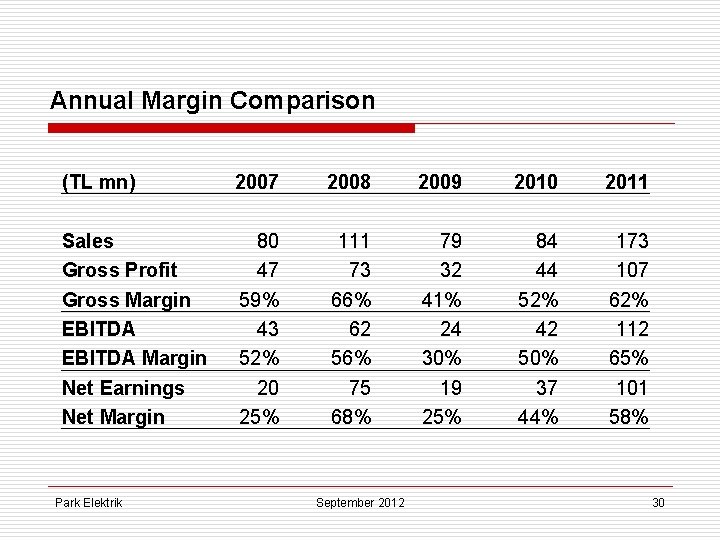

Annual Margin Comparison (TL mn) 2007 2008 2009 2010 2011 Sales Gross Profit Gross Margin EBITDA Margin Net Earnings Net Margin 80 47 59% 43 52% 20 25% 111 73 66% 62 56% 75 68% 79 32 41% 24 30% 19 25% 84 44 52% 42 50% 37 44% 173 107 62% 112 65% 101 58% Park Elektrik September 2012 30

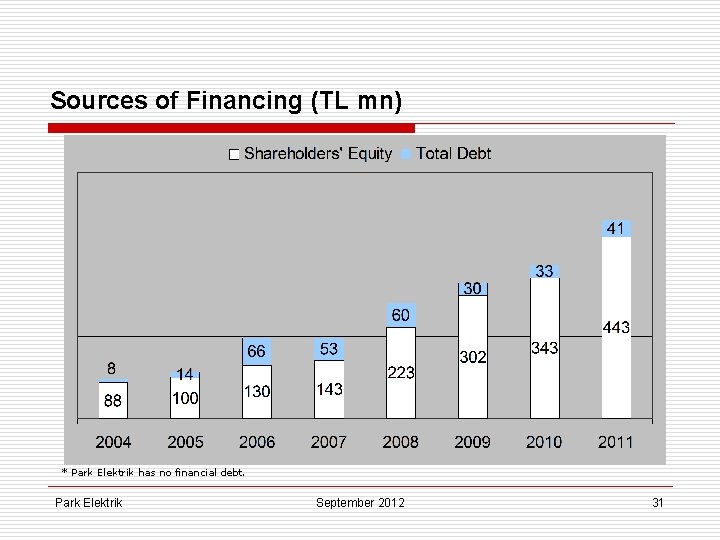

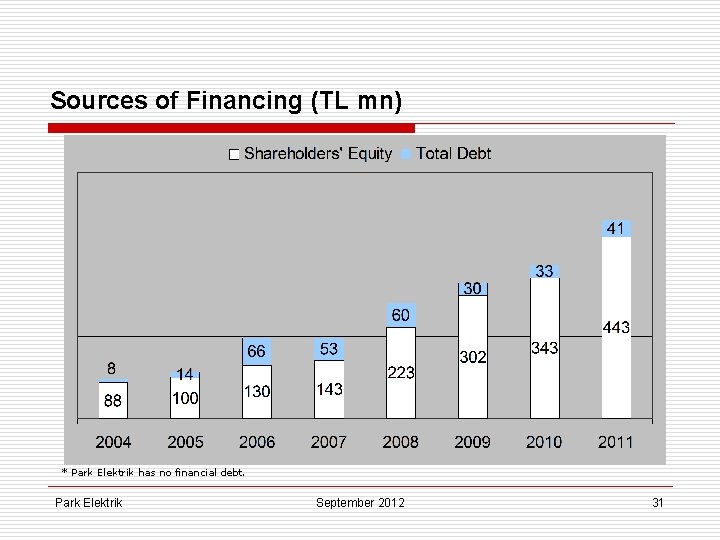

Sources of Financing (TL mn) * Park Elektrik has no financial debt. Park Elektrik September 2012 31

VI. Evaluation of 1 H 12 Financial Results Park Elektrik September 2012 32

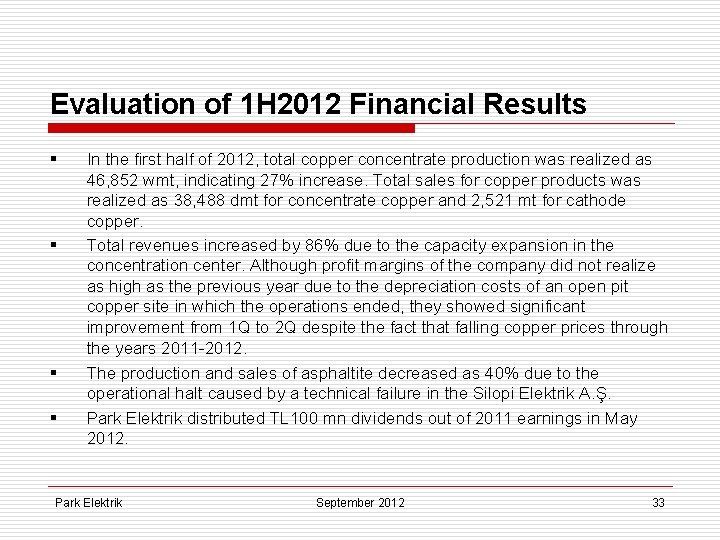

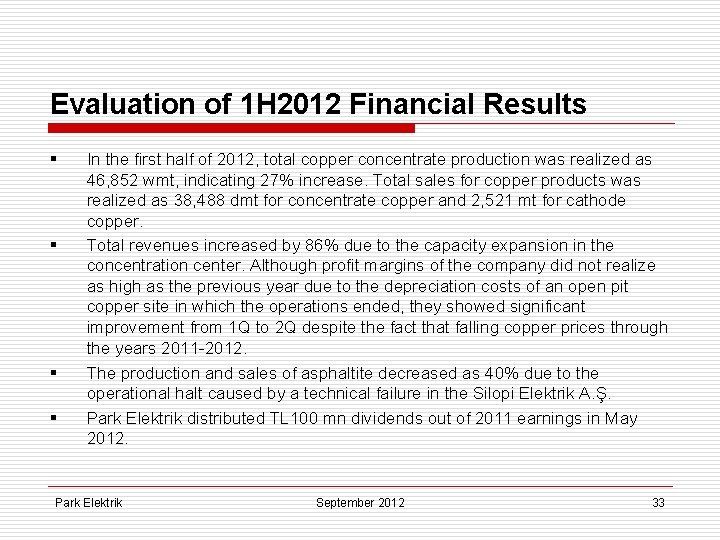

Evaluation of 1 H 2012 Financial Results § § In the first half of 2012, total copper concentrate production was realized as 46, 852 wmt, indicating 27% increase. Total sales for copper products was realized as 38, 488 dmt for concentrate copper and 2, 521 mt for cathode copper. Total revenues increased by 86% due to the capacity expansion in the concentration center. Although profit margins of the company did not realize as high as the previous year due to the depreciation costs of an open pit copper site in which the operations ended, they showed significant improvement from 1 Q to 2 Q despite the fact that falling copper prices through the years 2011 -2012. The production and sales of asphaltite decreased as 40% due to the operational halt caused by a technical failure in the Silopi Elektrik A. Ş. Park Elektrik distributed TL 100 mn dividends out of 2011 earnings in May 2012. Park Elektrik September 2012 33

Production & Sales Amount Production Concentrated Copper (wmt) 1 H 11 1 H 12 % 37, 021 46, 852 27% 852* 902* 6% 204, 069 122, 594 -40% 1 H 11 1 H 12 % 29, 681 38, 488 30% - 2, 521** - 204, 069 122, 594 -40% Cathode Copper (MT) Asphaltite (ton) * 852 mt cathode equals to 5, 015 wmt con. copper. 902 mt cathode equals to 5, 540 wmt of con. copper. Sales Concentrated Copper (dmt) Cathode Copper (MT) Asphaltite (ton) ** 2, 521 mt cathode equals to 14, 032 dmt of con. copper which push up total sales to 52, 520 dmt, with a 77% y-o-y growth. Park Elektrik September 2012 34

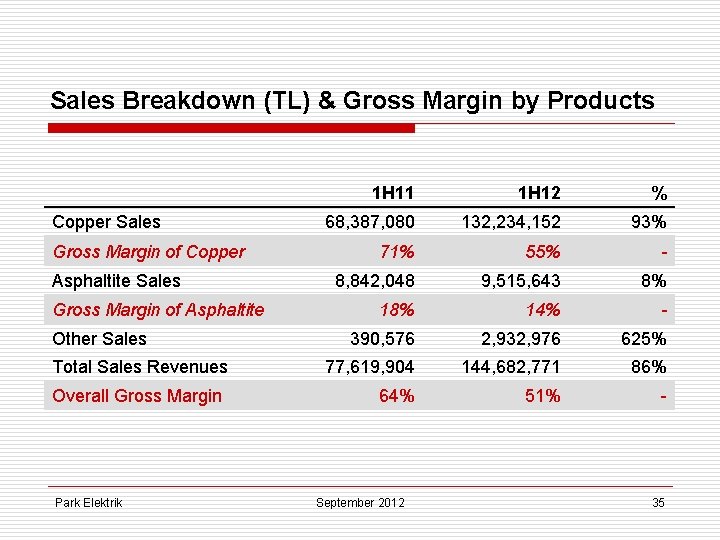

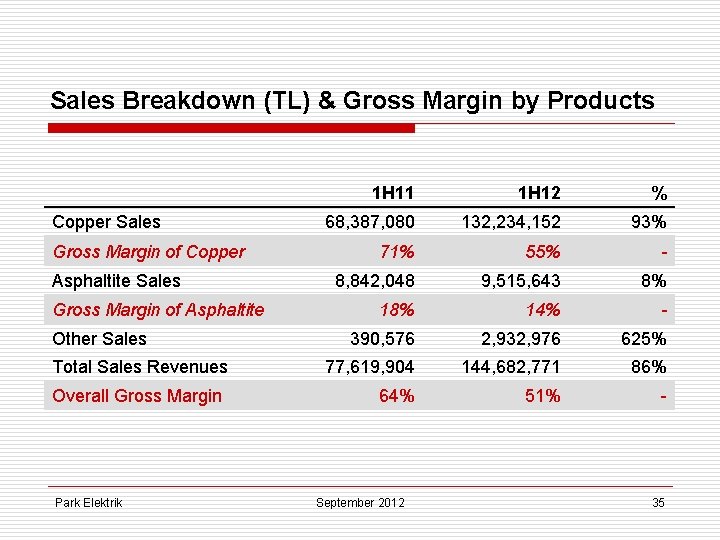

Sales Breakdown (TL) & Gross Margin by Products Copper Sales Gross Margin of Copper Asphaltite Sales Gross Margin of Asphaltite Other Sales Total Sales Revenues Overall Gross Margin Park Elektrik 1 H 11 1 H 12 % 68, 387, 080 132, 234, 152 93% 71% 55% - 8, 842, 048 9, 515, 643 8% 14% - 390, 576 2, 932, 976 625% 77, 619, 904 144, 682, 771 86% 64% 51% - September 2012 35

Income Statement (TL) Sales COGS Gross Profit 1 H 11 1 H 12 % 77, 619, 704 -27, 581, 165 50. 038. 539 144, 682, 771 -70, 931, 733 73, 751, 038 86% 157% 47% 64% 51% - -4, 286, 574 -7, 329, 810 5, 331, 285 -1, 537, 688 42, 215, 752 -6, 447, 206 -7, 810, 182 10, 448, 793 -2, 498, 127 67, 444, 316 50% 7% 96% 62% 60% 54% 47% - 15, 065, 031 -3, 224, 718 54, 056, 065 -10, 632, 392 43, 423, 673 19, 587, 033 -5, 491, 655 81, 539, 694 -14, 880, 193 66, 659, 501 30% 70% 51% 40% 54% 56% 46% - 49, 918, 858 96, 706, 418 94% 67% - Gross Margin Marketing Selling & Dist. Exp. General Adm. Expenses Other Operating Income Other Operating Expenses Operating Income Operating Margin Financial Income Financial Expenses Profit Before Tax Net Profit Net Margin EBITDA Margin Park Elektrik September 2012 36

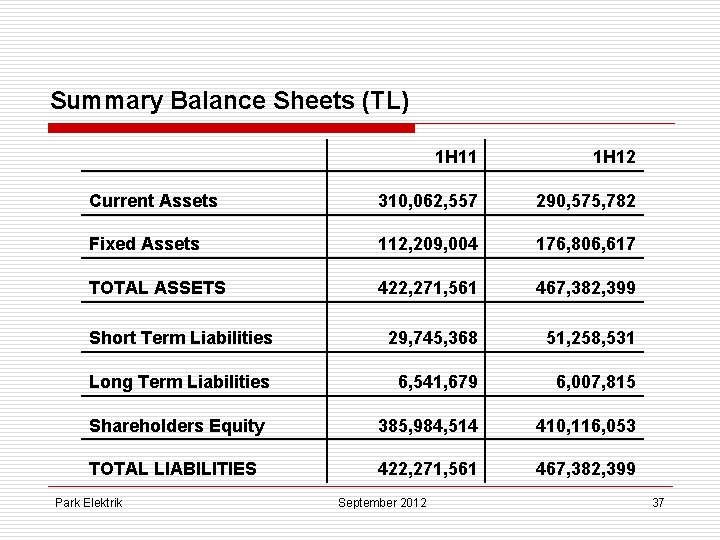

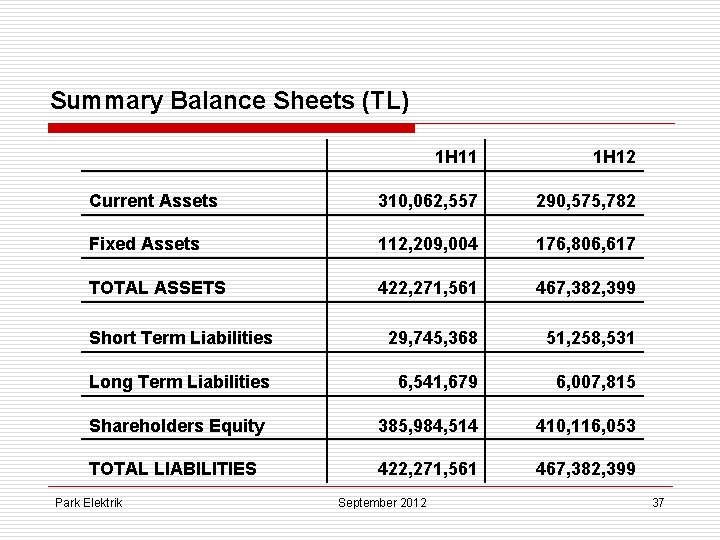

Summary Balance Sheets (TL) 1 H 11 1 H 12 Current Assets 310, 062, 557 290, 575, 782 Fixed Assets 112, 209, 004 176, 806, 617 TOTAL ASSETS 422, 271, 561 467, 382, 399 Short Term Liabilities 29, 745, 368 51, 258, 531 Long Term Liabilities 6, 541, 679 6, 007, 815 Shareholders Equity 385, 984, 514 410, 116, 053 TOTAL LIABILITIES 422, 271, 561 467, 382, 399 Park Elektrik September 2012 37

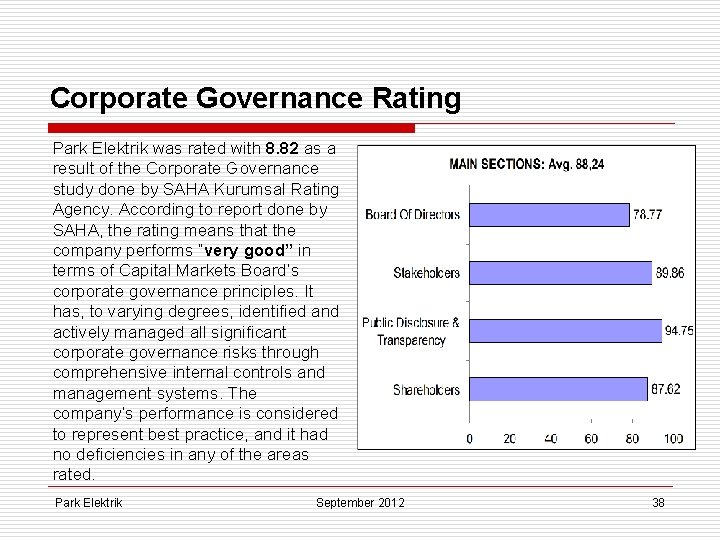

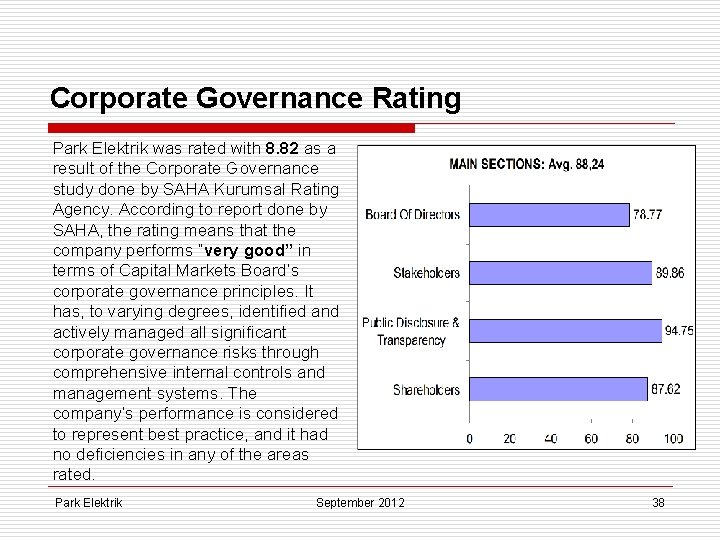

Corporate Governance Rating Park Elektrik was rated with 8. 82 as a result of the Corporate Governance study done by SAHA Kurumsal Rating Agency. According to report done by SAHA, the rating means that the company performs “very good” in terms of Capital Markets Board’s corporate governance principles. It has, to varying degrees, identified and actively managed all significant corporate governance risks through comprehensive internal controls and management systems. The company’s performance is considered to represent best practice, and it had no deficiencies in any of the areas rated. Park Elektrik September 2012 38

T H A N K Y O U. CONTACTS Yesim Bilginturan Selim Erdogan IR Manager Phone: +90 216 531 25 33 +90 216 531 25 35 y. bilginturan@cinergroup. com. tr s. erdogan@cinergroup. com. tr www. parkelektrik. com. tr www. cinergroup. com. tr Park Elektrik September 2012 39

Bpql

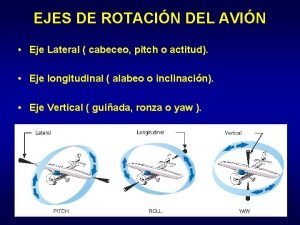

Bpql Cabeceo lateral

Cabeceo lateral Turgay delialioğlu

Turgay delialioğlu Park elektrik

Park elektrik Matematik felsefesi sosyal gruplar

Matematik felsefesi sosyal gruplar Sanayi kolları

Sanayi kolları Donmez debriyaj sanayi

Donmez debriyaj sanayi Sanayi devriminin sanata etkisi

Sanayi devriminin sanata etkisi Yumru yemler

Yumru yemler Sanayi bitkileri

Sanayi bitkileri Etuys.sanayi.gov.tr

Etuys.sanayi.gov.tr Sanayi bitkileri

Sanayi bitkileri Ticaret artırıcı yönlü büyüme

Ticaret artırıcı yönlü büyüme Mehmet ali lahur ticaret meslek lisesi

Mehmet ali lahur ticaret meslek lisesi çorlu hatip ticaret

çorlu hatip ticaret Ticaret unvanı çekirdek kısmı örnekleri

Ticaret unvanı çekirdek kısmı örnekleri Statik

Statik Dış ticaret işlemleri yönetimi yaser gürsoy

Dış ticaret işlemleri yönetimi yaser gürsoy Ticaret edu

Ticaret edu Ticaret merkezi nedir

Ticaret merkezi nedir Ttk da düzenlenen tacir yardımcıları

Ttk da düzenlenen tacir yardımcıları Ticaret unvanı, çekirdek kısmı örnekleri

Ticaret unvanı, çekirdek kısmı örnekleri Neoklasik dış ticaret teorisi nedir

Neoklasik dış ticaret teorisi nedir Azalan maliyet koşulları

Azalan maliyet koşulları Dtrade

Dtrade Doal dış ticaret pazarlama

Doal dış ticaret pazarlama Temnat

Temnat Biyografi nedir özellikleri nelerdir

Biyografi nedir özellikleri nelerdir E ticaret sunum

E ticaret sunum Escrip nedir

Escrip nedir Mutlak üstünlük teorisi

Mutlak üstünlük teorisi Ttk'ya göre tacirin sorumlulukları

Ttk'ya göre tacirin sorumlulukları Ticaret sicilinin olumlu ve olumsuz etkisi

Ticaret sicilinin olumlu ve olumsuz etkisi Brush mountain park orchard park

Brush mountain park orchard park Elektrik birim

Elektrik birim Levhalar arası elektrik alan

Levhalar arası elektrik alan 10 etika penggunaan internet

10 etika penggunaan internet Televizyon kumandasını çalıştıran elektrik kaynağı

Televizyon kumandasını çalıştıran elektrik kaynağı Diqqətinizə görə təşəkkür edirəm

Diqqətinizə görə təşəkkür edirəm Elektrik tesisatları ve dağıtımı dalı

Elektrik tesisatları ve dağıtımı dalı