FTA FEDERAL TRANSIT ADMINISTRATION New Starts Program Assessment

- Slides: 43

FTA FEDERAL TRANSIT ADMINISTRATION New Starts Program Assessment Appendix B: Assessment of Analogous Project Delivery Processes February 12, 2007 Note: This document is intended to be read in conjunction with the New Starts Program Assessment Final Report dated February 12, 2007, and is not intended for independent review.

Contents • Introduction - Approach to Assessing Analogous Project Delivery Processes - Summary of Key Findings • Leading Practices in Funding/Project Approval - Federal Grants Management - Federal Capital Investment - Surety Bond Industry • Public-Private Partnerships • Alternative Project Delivery Methods Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 2

Approach to Assessing Analogous Delivery Processes Introduction The Approach • FTA requested analysis of analogous approaches to project development and delivery to identify relevant leading practices. § FTA directed Deloitte to examine analogous grant/funding decision-making processes to understand their evaluation of project costs and benefits and their approaches to assessing and managing project risk. § FTA also directed the Deloitte team to evaluate the benefits of alternative project delivery methods (such as Design-Build) and the degree to which the New Starts program accommodates or enables alternative delivery methods. • FTA requested that Deloitte perform the following activities during its assessment of analogous project delivery processes: § Reviewed analogous funding/project approval processes, identified relevant leading practices and their applicability and implications for implementation in the New Starts program. – Compared various federal grants management, risk management and other capital investment processes. – Identified applicable leading practices based on Deloitte’s internal experience in the Surety Bonds industry, which shows direct relevance to FTA’s assessment of capital investment projects. – Examined Public-Private Partnership (PPP) approaches, key legislative enablers and the implications for New Starts. § Reviewed various alternative delivery methods to determine possible improvements to the New Starts project development process that may better enable grantees to realize the benefits from such alternative delivery methods. Programs/Approaches Reviewed • Federal Grants and Capital Investment Programs § National Science Foundation: Critical Zone Observatories § Department of Homeland Security: Pre-Disaster Mitigation § Environmental Protection Agency: Watershed Grant § Department of Health and Human Services: General Grants Management § Agency for International Development: Disaster Prevention Relief § World Bank: Conflict Prevention and Reconstruction Fund § Department of Energy: Office of Engineering and Construction Management § Federal Aviation Administration: Airport Improvement Program § U. S. Army Corps of Engineers: Project Prioritization and Approval Processes • Surety Bonds Industry § Deloitte’s best practices in Surety Bond underwriting • PPP Methodologies • Alternative Delivery Methods § Design-Build (DB), CMGC, CM At Risk Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 3

Key Findings From Analogous Processes Introduction Leading practices in federal grants and risk management, surety bond reviews, PPPs, and alternative project delivery methods present a number of opportunities to improve the New Starts Program. Key findings from our assessment include: • Leading agencies conduct some form of customer segmentation, determining additional or reduced monitoring and technical assistance to grantees based on varying levels of project risk and grantee capabilities. • Clear and transparent policies, coupled with effective communication to stakeholders, promote program effectiveness among leading grants management agencies. • Performance measures, such as linking program activities throughout the process to overall program goals, promote overall program effectiveness and help achieve desired program goals. • Several agencies make use of external resources, such as independent or peer review panels, to augment internal expertise with that of industry experts and practitioners. • Immediate review of grantee submissions for fulfillment of minimum requirements and formal notice of acceptance/non -acceptance enables leading agencies to clarify requirements and review timeframes for grantees, and to avoid allocating scarce resources for review of incomplete or inadequate applications. • Leading agencies use case management and web-based application submission systems to help streamline the submission and review processes while increasing program transparency. • Formalized training on management-approved guidelines and procedures enables staff to perform functions more effectively and consistently. • Leading practices in the Surety Bonds industry indicate that clearly defined roles and responsibilities, including lines of authority and approval, facilitate an effective review process. • An “early commitment” mechanism, such as a Project Development Agreement (PDA), can establish an understanding of project development expectations and can enable the early involvement of private partners. • PPPs do not introduce different kinds of risks from traditionally developed public sector projects; however, the implementing agency or authority must adopt a new approach to allocating and managing the project’s risks. FTA can support this by incorporating risk allocation, revenue sharing models, and lessons learned from existing PPPs into periodic training sessions • Project sponsors select project delivery methods based on their experience and resources and the project’s characteristics. Project sponsors select the system that will provide the greatest benefit in terms of cost and schedule and acceptable level of risk for all parties involved. These and other issues are discussed in more detail, along with the associated recommendations for improvement, in the following sections. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 4

Leading Practices in Funding/Project Approval Grants Management Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 5

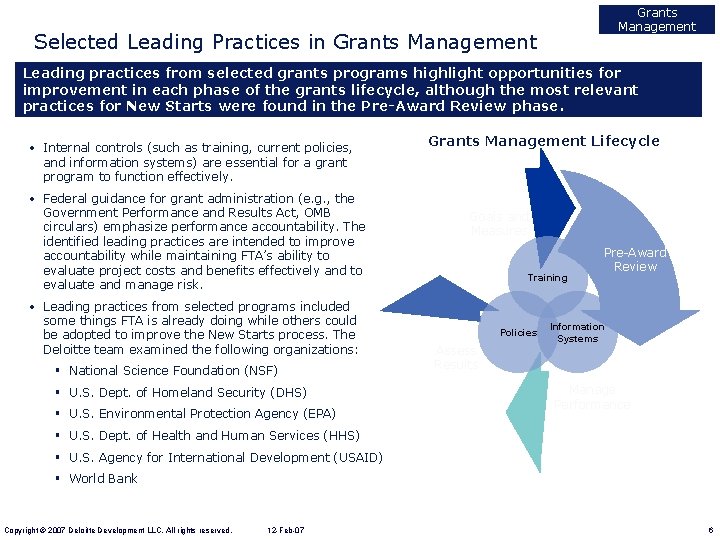

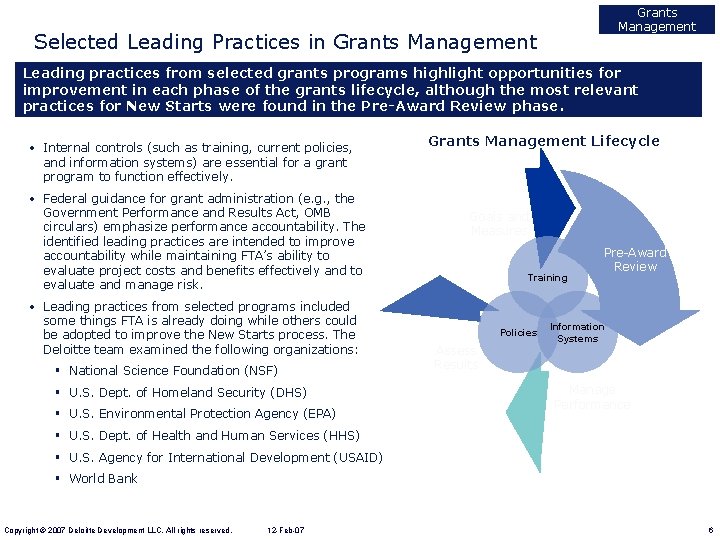

Grants Management Selected Leading Practices in Grants Management Leading practices from selected grants programs highlight opportunities for improvement in each phase of the grants lifecycle, although the most relevant practices for New Starts were found in the Pre-Award Review phase. • Internal controls (such as training, current policies, and information systems) are essential for a grant program to function effectively. • Federal guidance for grant administration (e. g. , the Government Performance and Results Act, OMB circulars) emphasize performance accountability. The identified leading practices are intended to improve accountability while maintaining FTA’s ability to evaluate project costs and benefits effectively and to evaluate and manage risk. • Leading practices from selected programs included some things FTA is already doing while others could be adopted to improve the New Starts process. The Deloitte team examined the following organizations: § National Science Foundation (NSF) § U. S. Dept. of Homeland Security (DHS) § U. S. Environmental Protection Agency (EPA) Grants Management Lifecycle Goals and Measures Training Policies Assess Results Pre-Award Review Information Systems Manage Performance § U. S. Dept. of Health and Human Services (HHS) § U. S. Agency for International Development (USAID) § World Bank Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 6

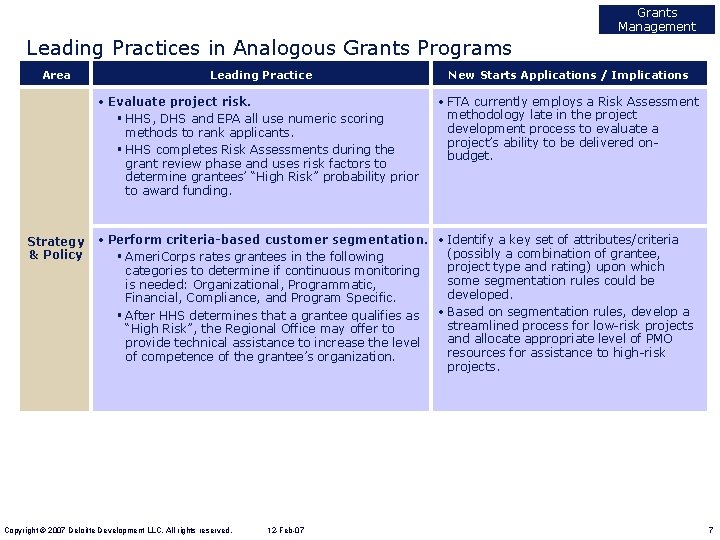

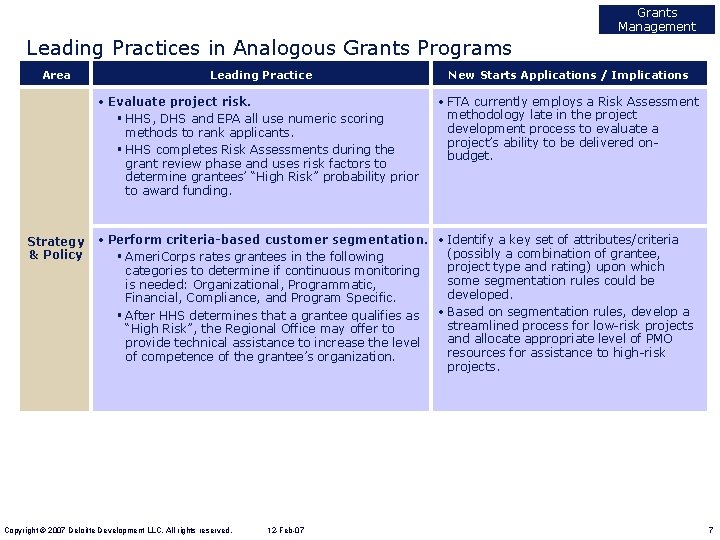

Grants Management Leading Practices in Analogous Grants Programs Area Strategy & Policy Leading Practice New Starts Applications / Implications • Evaluate project risk. § HHS, DHS and EPA all use numeric scoring methods to rank applicants. § HHS completes Risk Assessments during the grant review phase and uses risk factors to determine grantees’ “High Risk” probability prior to award funding. • FTA currently employs a Risk Assessment methodology late in the project development process to evaluate a project’s ability to be delivered onbudget. • Perform criteria-based customer segmentation. • Identify a key set of attributes/criteria (possibly a combination of grantee, § Ameri. Corps rates grantees in the following project type and rating) upon which categories to determine if continuous monitoring some segmentation rules could be is needed: Organizational, Programmatic, developed. Financial, Compliance, and Program Specific. • Based on segmentation rules, develop a § After HHS determines that a grantee qualifies as streamlined process for low-risk projects “High Risk”, the Regional Office may offer to and allocate appropriate level of PMO provide technical assistance to increase the level resources for assistance to high-risk of competence of the grantee’s organization. projects. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 7

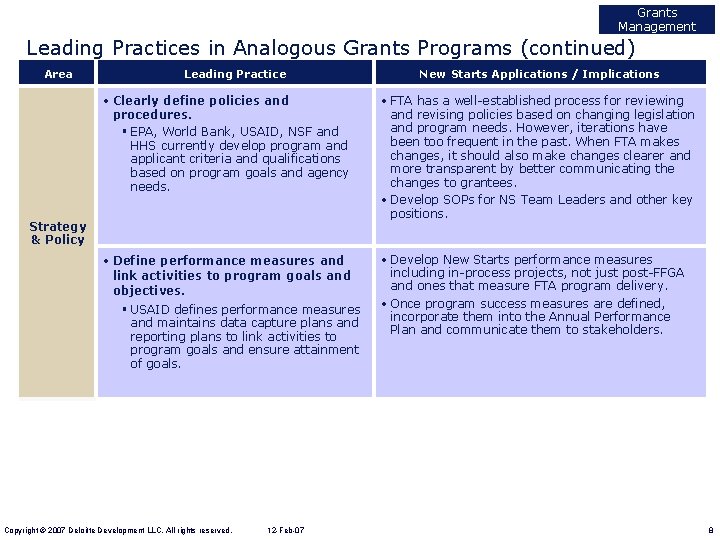

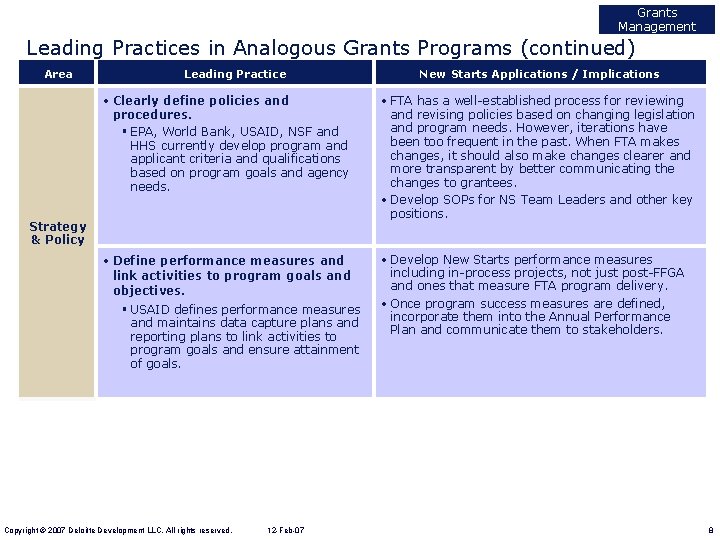

Grants Management Leading Practices in Analogous Grants Programs (continued) Area Leading Practice New Starts Applications / Implications • Clearly define policies and procedures. § EPA, World Bank, USAID, NSF and HHS currently develop program and applicant criteria and qualifications based on program goals and agency needs. • FTA has a well-established process for reviewing and revising policies based on changing legislation and program needs. However, iterations have been too frequent in the past. When FTA makes changes, it should also make changes clearer and more transparent by better communicating the changes to grantees. • Develop SOPs for NS Team Leaders and other key positions. • Define performance measures and link activities to program goals and objectives. • Develop New Starts performance measures including in-process projects, not just post-FFGA and ones that measure FTA program delivery. • Once program success measures are defined, incorporate them into the Annual Performance Plan and communicate them to stakeholders. Strategy & Policy § USAID defines performance measures and maintains data capture plans and reporting plans to link activities to program goals and ensure attainment of goals. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 8

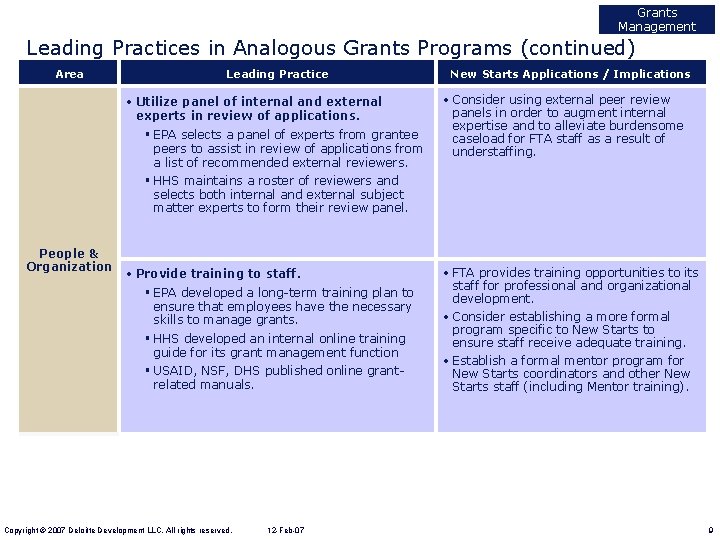

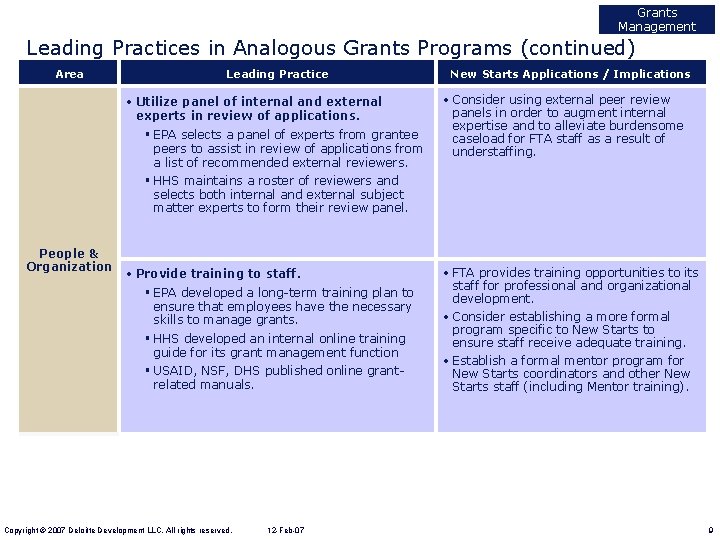

Grants Management Leading Practices in Analogous Grants Programs (continued) Area Leading Practice • Utilize panel of internal and external experts in review of applications. § EPA selects a panel of experts from grantee peers to assist in review of applications from a list of recommended external reviewers. § HHS maintains a roster of reviewers and selects both internal and external subject matter experts to form their review panel. People & Organization • Provide training to staff. § EPA developed a long-term training plan to ensure that employees have the necessary skills to manage grants. § HHS developed an internal online training guide for its grant management function § USAID, NSF, DHS published online grantrelated manuals. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 New Starts Applications / Implications • Consider using external peer review panels in order to augment internal expertise and to alleviate burdensome caseload for FTA staff as a result of understaffing. • FTA provides training opportunities to its staff for professional and organizational development. • Consider establishing a more formal program specific to New Starts to ensure staff receive adequate training. • Establish a formal mentor program for New Starts coordinators and other New Starts staff (including Mentor training). 9

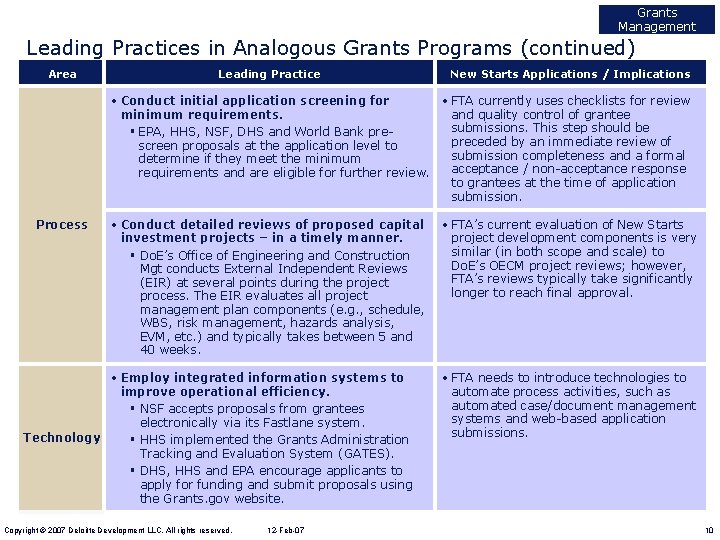

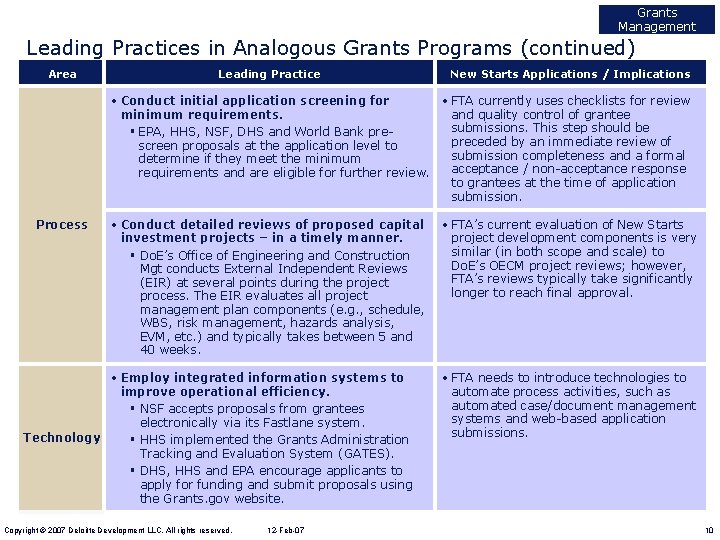

Grants Management Leading Practices in Analogous Grants Programs (continued) Area Leading Practice New Starts Applications / Implications • Conduct initial application screening for • FTA currently uses checklists for review minimum requirements. and quality control of grantee submissions. This step should be § EPA, HHS, NSF, DHS and World Bank prepreceded by an immediate review of screen proposals at the application level to submission completeness and a formal determine if they meet the minimum acceptance / non-acceptance response requirements and are eligible for further review. to grantees at the time of application submission. Process • Conduct detailed reviews of proposed capital investment projects – in a timely manner. § Do. E’s Office of Engineering and Construction Mgt conducts External Independent Reviews (EIR) at several points during the project process. The EIR evaluates all project management plan components (e. g. , schedule, WBS, risk management, hazards analysis, EVM, etc. ) and typically takes between 5 and 40 weeks. • Employ integrated information systems to improve operational efficiency. § NSF accepts proposals from grantees electronically via its Fastlane system. Technology § HHS implemented the Grants Administration Tracking and Evaluation System (GATES). § DHS, HHS and EPA encourage applicants to apply for funding and submit proposals using the Grants. gov website. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 • FTA’s current evaluation of New Starts project development components is very similar (in both scope and scale) to Do. E’s OECM project reviews; however, FTA’s reviews typically take significantly longer to reach final approval. • FTA needs to introduce technologies to automate process activities, such as automated case/document management systems and web-based application submissions. 10

Leading Practices in Funding/Project Approval Capital Investment Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 11

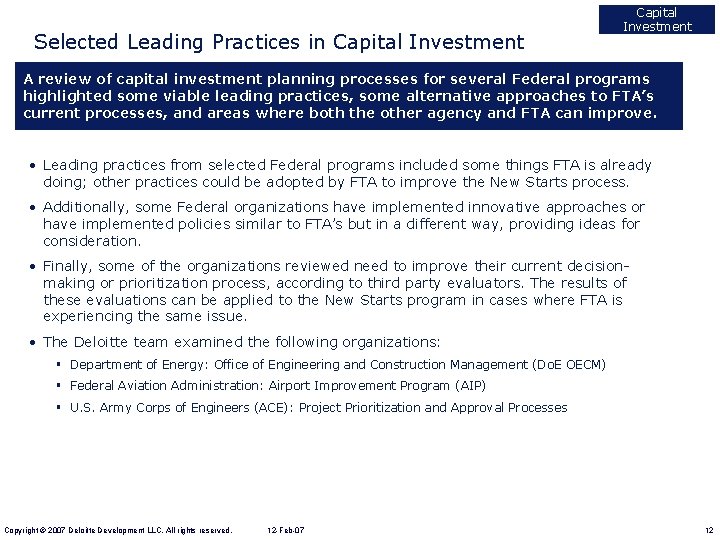

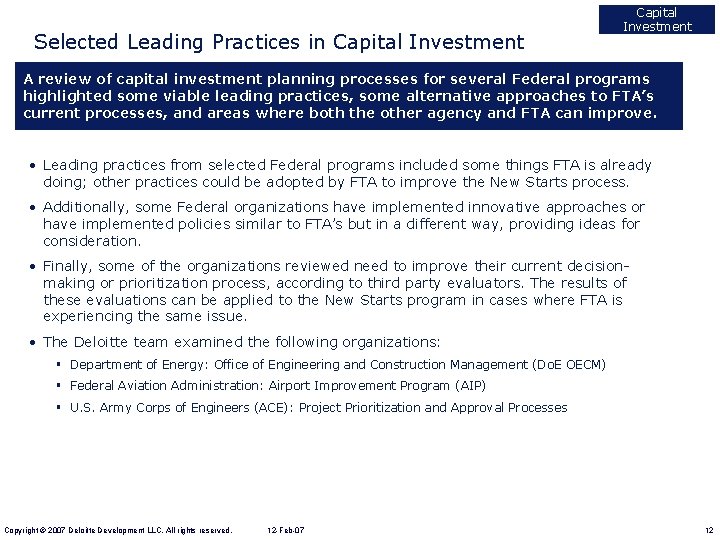

Selected Leading Practices in Capital Investment A review of capital investment planning processes for several Federal programs highlighted some viable leading practices, some alternative approaches to FTA’s current processes, and areas where both the other agency and FTA can improve. • Leading practices from selected Federal programs included some things FTA is already doing; other practices could be adopted by FTA to improve the New Starts process. • Additionally, some Federal organizations have implemented innovative approaches or have implemented policies similar to FTA’s but in a different way, providing ideas for consideration. • Finally, some of the organizations reviewed need to improve their current decisionmaking or prioritization process, according to third party evaluators. The results of these evaluations can be applied to the New Starts program in cases where FTA is experiencing the same issue. • The Deloitte team examined the following organizations: § Department of Energy: Office of Engineering and Construction Management (Do. E OECM) § Federal Aviation Administration: Airport Improvement Program (AIP) § U. S. Army Corps of Engineers (ACE): Project Prioritization and Approval Processes Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 12

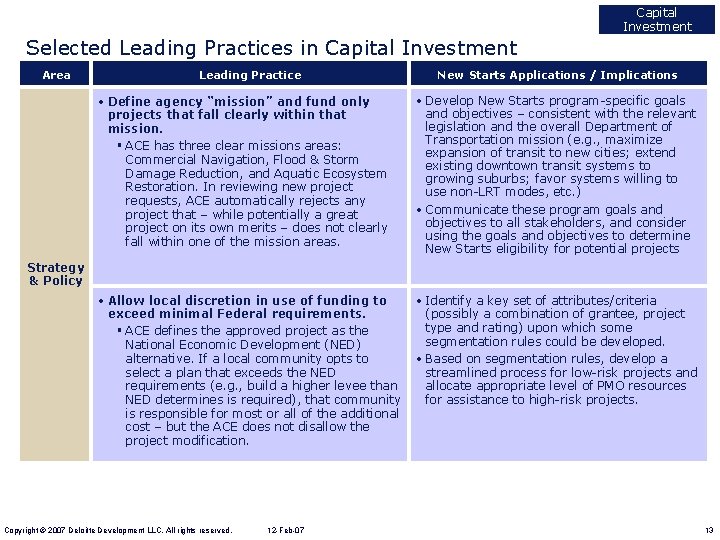

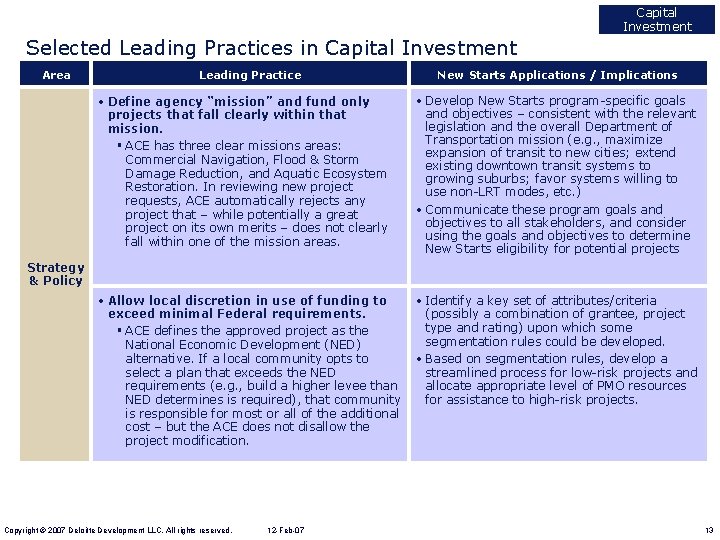

Capital Investment Selected Leading Practices in Capital Investment Area Leading Practice New Starts Applications / Implications • Define agency “mission” and fund only projects that fall clearly within that mission. § ACE has three clear missions areas: Commercial Navigation, Flood & Storm Damage Reduction, and Aquatic Ecosystem Restoration. In reviewing new project requests, ACE automatically rejects any project that – while potentially a great project on its own merits – does not clearly fall within one of the mission areas. • Develop New Starts program-specific goals and objectives – consistent with the relevant legislation and the overall Department of Transportation mission (e. g. , maximize expansion of transit to new cities; extend existing downtown transit systems to growing suburbs; favor systems willing to use non-LRT modes, etc. ) • Communicate these program goals and objectives to all stakeholders, and consider using the goals and objectives to determine New Starts eligibility for potential projects • Allow local discretion in use of funding to exceed minimal Federal requirements. § ACE defines the approved project as the National Economic Development (NED) alternative. If a local community opts to select a plan that exceeds the NED requirements (e. g. , build a higher levee than NED determines is required), that community is responsible for most or all of the additional cost – but the ACE does not disallow the project modification. • Identify a key set of attributes/criteria (possibly a combination of grantee, project type and rating) upon which some segmentation rules could be developed. • Based on segmentation rules, develop a streamlined process for low-risk projects and allocate appropriate level of PMO resources for assistance to high-risk projects. Strategy & Policy Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 13

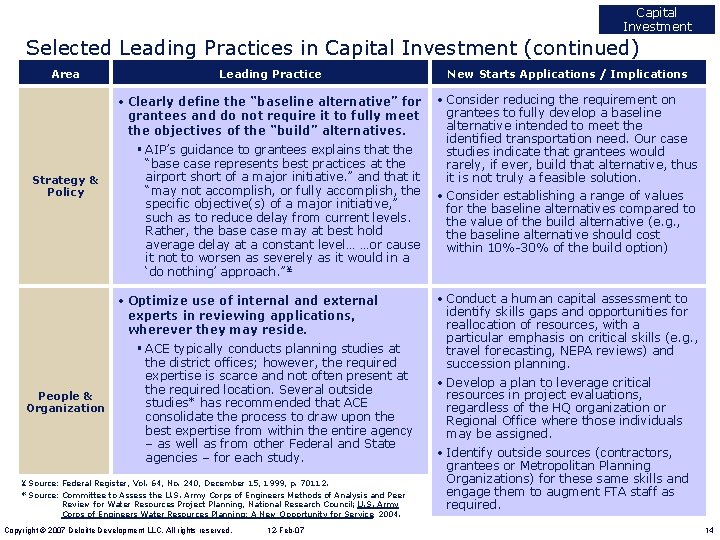

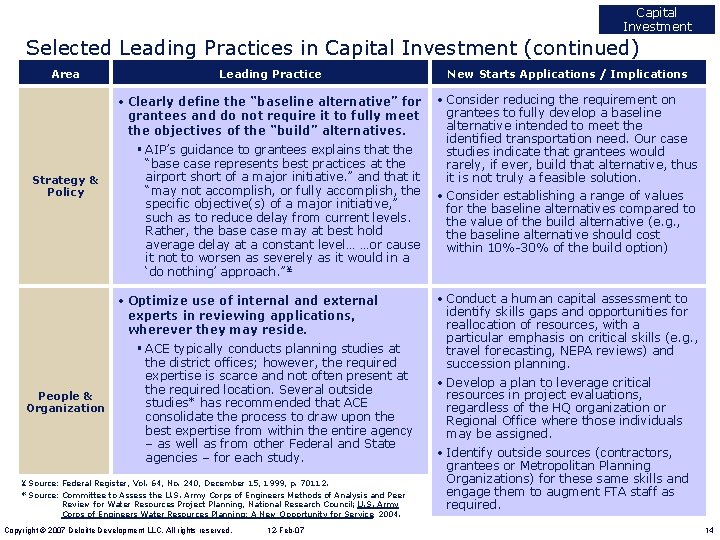

Capital Investment Selected Leading Practices in Capital Investment (continued) Area Strategy & Policy Leading Practice New Starts Applications / Implications • Clearly define the “baseline alternative” for grantees and do not require it to fully meet the objectives of the “build” alternatives. • Consider reducing the requirement on grantees to fully develop a baseline alternative intended to meet the identified transportation need. Our case studies indicate that grantees would rarely, if ever, build that alternative, thus it is not truly a feasible solution. • Consider establishing a range of values for the baseline alternatives compared to the value of the build alternative (e. g. , the baseline alternative should cost within 10%-30% of the build option) § AIP’s guidance to grantees explains that the “base case represents best practices at the airport short of a major initiative. ” and that it “may not accomplish, or fully accomplish, the specific objective(s) of a major initiative, ” such as to reduce delay from current levels. Rather, the base case may at best hold average delay at a constant level… …or cause it not to worsen as severely as it would in a ‘do nothing’ approach. ” ¥ • Optimize use of internal and external experts in reviewing applications, wherever they may reside. People & Organization § ACE typically conducts planning studies at the district offices; however, the required expertise is scarce and not often present at the required location. Several outside studies* has recommended that ACE consolidate the process to draw upon the best expertise from within the entire agency – as well as from other Federal and State agencies – for each study. ¥ Source: Federal Register, Vol. 64, No. 240, December 15, 1999, p. 70112. * Source: Committee to Assess the U. S. Army Corps of Engineers Methods of Analysis and Peer Review for Water Resources Project Planning, National Research Council; U. S. Army Corps of Engineers Water Resources Planning: A New Opportunity for Service, 2004. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 • Conduct a human capital assessment to identify skills gaps and opportunities for reallocation of resources, with a particular emphasis on critical skills (e. g. , travel forecasting, NEPA reviews) and succession planning. • Develop a plan to leverage critical resources in project evaluations, regardless of the HQ organization or Regional Office where those individuals may be assigned. • Identify outside sources (contractors, grantees or Metropolitan Planning Organizations) for these same skills and engage them to augment FTA staff as required. 14

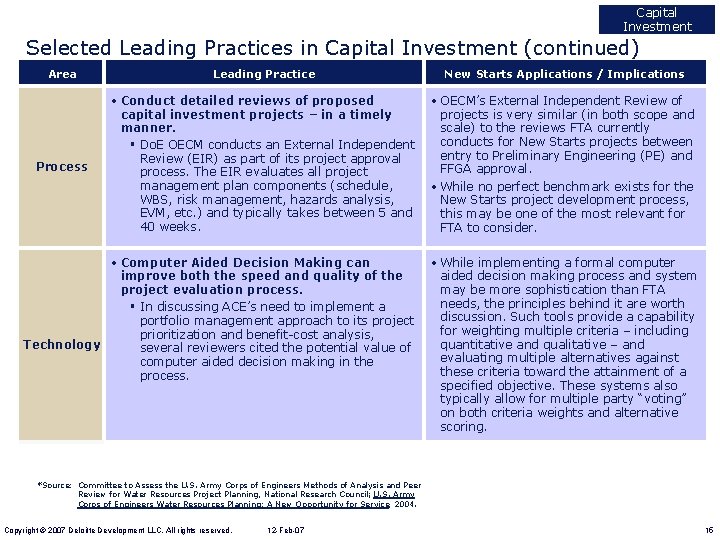

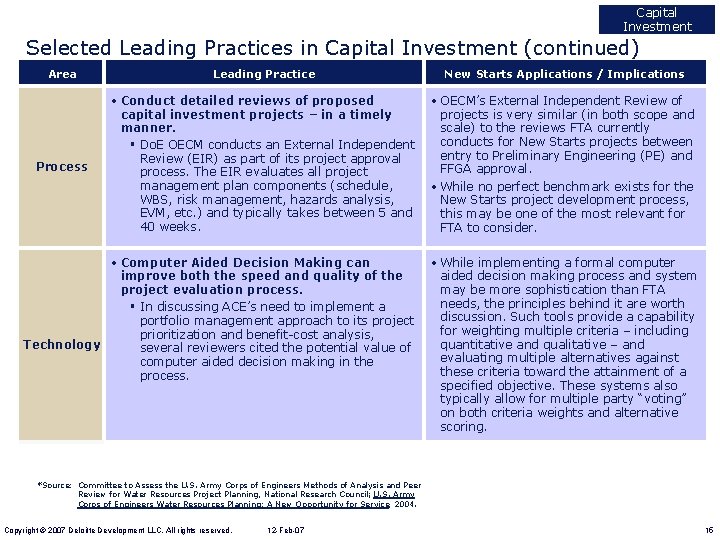

Capital Investment Selected Leading Practices in Capital Investment (continued) Area Leading Practice New Starts Applications / Implications Process • Conduct detailed reviews of proposed capital investment projects – in a timely manner. § Do. E OECM conducts an External Independent Review (EIR) as part of its project approval process. The EIR evaluates all project management plan components (schedule, WBS, risk management, hazards analysis, EVM, etc. ) and typically takes between 5 and 40 weeks. • OECM’s External Independent Review of projects is very similar (in both scope and scale) to the reviews FTA currently conducts for New Starts projects between entry to Preliminary Engineering (PE) and FFGA approval. • While no perfect benchmark exists for the New Starts project development process, this may be one of the most relevant for FTA to consider. • Computer Aided Decision Making can improve both the speed and quality of the project evaluation process. § In discussing ACE’s need to implement a portfolio management approach to its project prioritization and benefit-cost analysis, Technology several reviewers cited the potential value of computer aided decision making in the process. • While implementing a formal computer aided decision making process and system may be more sophistication than FTA needs, the principles behind it are worth discussion. Such tools provide a capability for weighting multiple criteria – including quantitative and qualitative – and evaluating multiple alternatives against these criteria toward the attainment of a specified objective. These systems also typically allow for multiple party “voting” on both criteria weights and alternative scoring. *Source: Committee to Assess the U. S. Army Corps of Engineers Methods of Analysis and Peer Review for Water Resources Project Planning, National Research Council; U. S. Army Corps of Engineers Water Resources Planning: A New Opportunity for Service, 2004. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 15

Leading Practices in Funding/Project Approval Surety Bond Underwriting Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 16

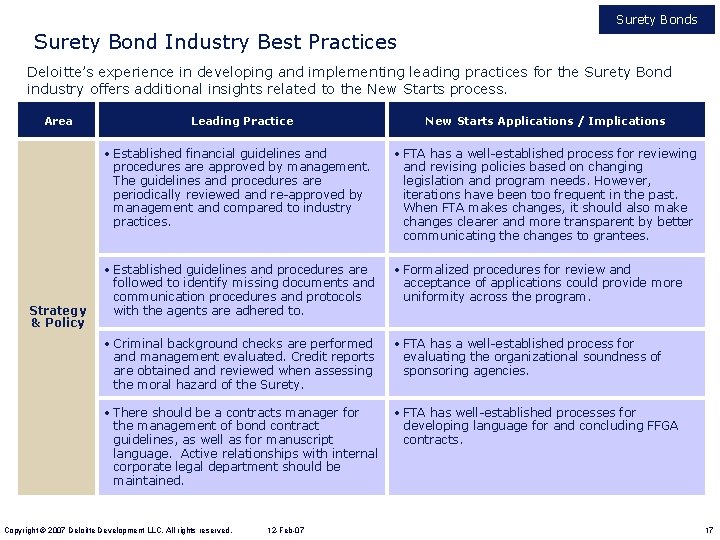

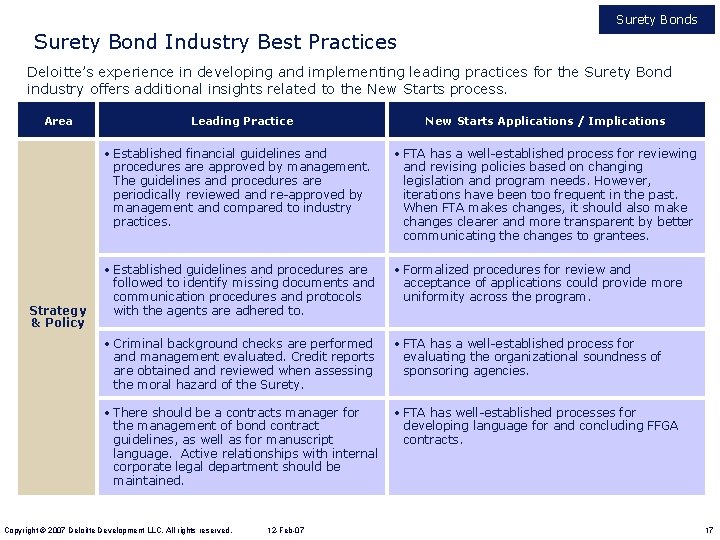

Surety Bonds Surety Bond Industry Best Practices Deloitte’s experience in developing and implementing leading practices for the Surety Bond industry offers additional insights related to the New Starts process. Area Strategy & Policy Leading Practice New Starts Applications / Implications • Established financial guidelines and procedures are approved by management. The guidelines and procedures are periodically reviewed and re-approved by management and compared to industry practices. • FTA has a well-established process for reviewing and revising policies based on changing legislation and program needs. However, iterations have been too frequent in the past. When FTA makes changes, it should also make changes clearer and more transparent by better communicating the changes to grantees. • Established guidelines and procedures are followed to identify missing documents and communication procedures and protocols with the agents are adhered to. • Formalized procedures for review and acceptance of applications could provide more uniformity across the program. • Criminal background checks are performed and management evaluated. Credit reports are obtained and reviewed when assessing the moral hazard of the Surety. • FTA has a well-established process for evaluating the organizational soundness of sponsoring agencies. • There should be a contracts manager for the management of bond contract guidelines, as well as for manuscript language. Active relationships with internal corporate legal department should be maintained. • FTA has well-established processes for developing language for and concluding FFGA contracts. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 17

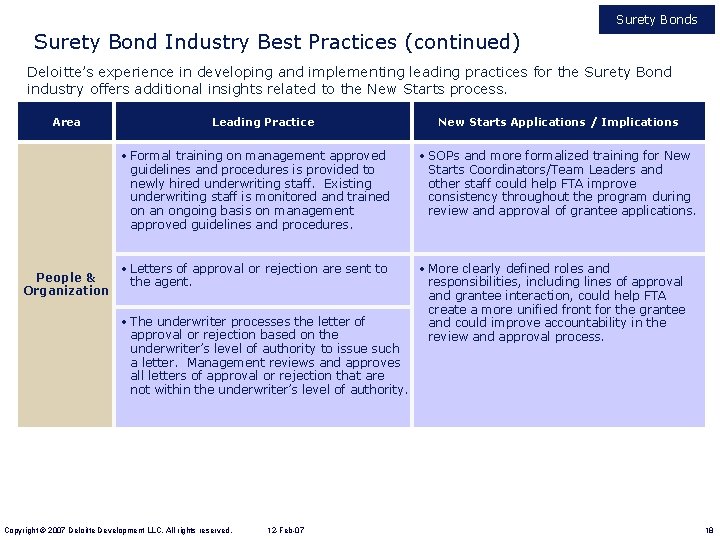

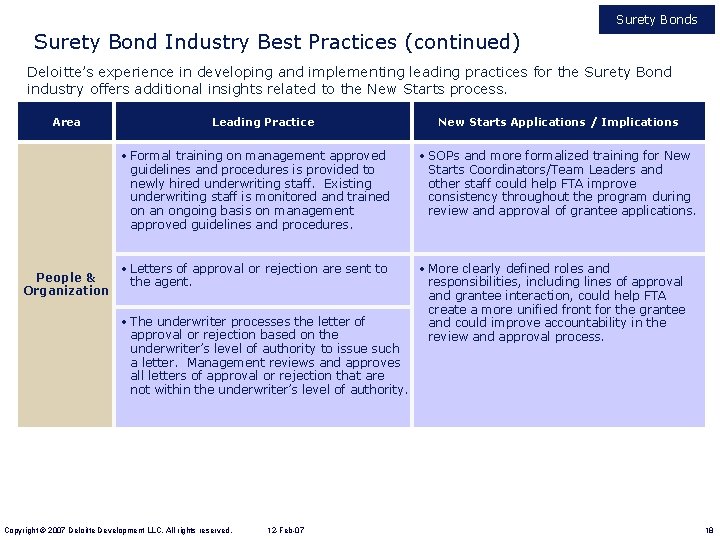

Surety Bonds Surety Bond Industry Best Practices (continued) Deloitte’s experience in developing and implementing leading practices for the Surety Bond industry offers additional insights related to the New Starts process. Area People & Organization Leading Practice New Starts Applications / Implications • Formal training on management approved guidelines and procedures is provided to newly hired underwriting staff. Existing underwriting staff is monitored and trained on an ongoing basis on management approved guidelines and procedures. • SOPs and more formalized training for New Starts Coordinators/Team Leaders and other staff could help FTA improve consistency throughout the program during review and approval of grantee applications. • Letters of approval or rejection are sent to the agent. • More clearly defined roles and responsibilities, including lines of approval and grantee interaction, could help FTA create a more unified front for the grantee and could improve accountability in the review and approval process. • The underwriter processes the letter of approval or rejection based on the underwriter’s level of authority to issue such a letter. Management reviews and approves all letters of approval or rejection that are not within the underwriter’s level of authority. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 18

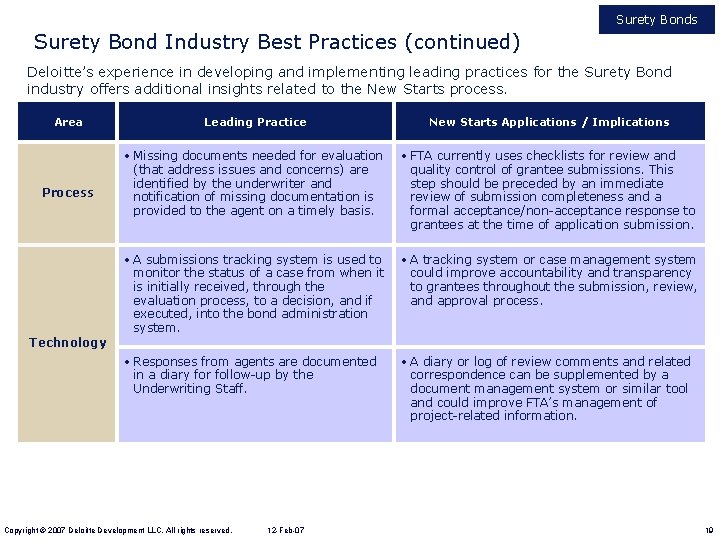

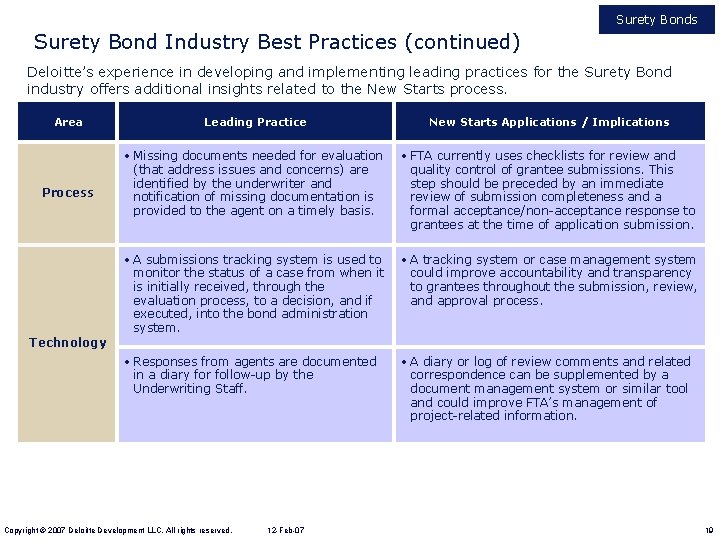

Surety Bonds Surety Bond Industry Best Practices (continued) Deloitte’s experience in developing and implementing leading practices for the Surety Bond industry offers additional insights related to the New Starts process. Area Process Leading Practice New Starts Applications / Implications • Missing documents needed for evaluation (that address issues and concerns) are identified by the underwriter and notification of missing documentation is provided to the agent on a timely basis. • FTA currently uses checklists for review and quality control of grantee submissions. This step should be preceded by an immediate review of submission completeness and a formal acceptance/non-acceptance response to grantees at the time of application submission. • A submissions tracking system is used to monitor the status of a case from when it is initially received, through the evaluation process, to a decision, and if executed, into the bond administration system. • A tracking system or case management system could improve accountability and transparency to grantees throughout the submission, review, and approval process. • Responses from agents are documented in a diary for follow-up by the Underwriting Staff. • A diary or log of review comments and related correspondence can be supplemented by a document management system or similar tool and could improve FTA’s management of project-related information. Technology Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 19

Public-Private Partnerships Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 20

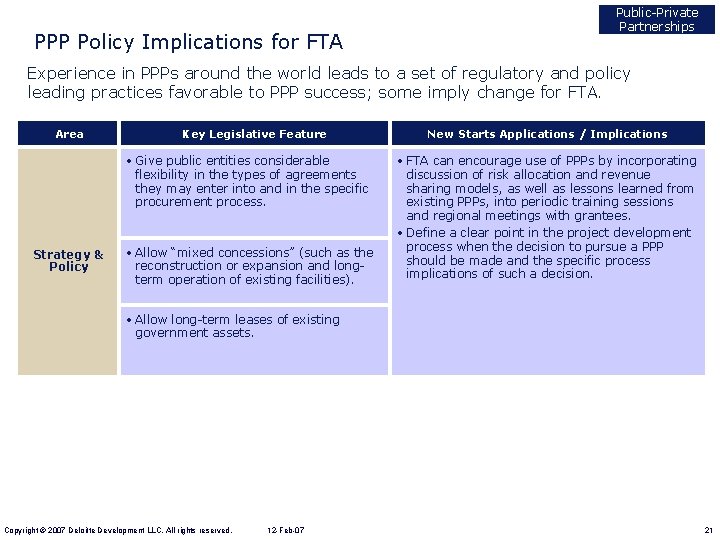

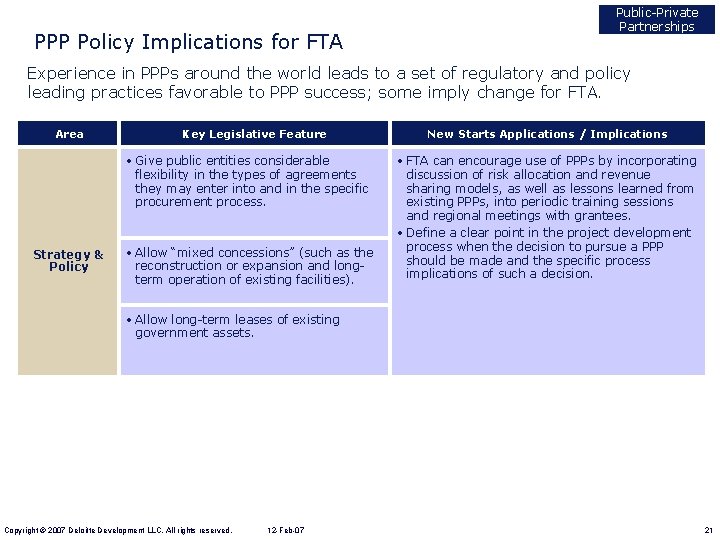

PPP Policy Implications for FTA Public-Private Partnerships Experience in PPPs around the world leads to a set of regulatory and policy leading practices favorable to PPP success; some imply change for FTA. Area Key Legislative Feature • Give public entities considerable flexibility in the types of agreements they may enter into and in the specific procurement process. Strategy & Policy • Allow “mixed concessions” (such as the reconstruction or expansion and longterm operation of existing facilities). New Starts Applications / Implications • FTA can encourage use of PPPs by incorporating discussion of risk allocation and revenue sharing models, as well as lessons learned from existing PPPs, into periodic training sessions and regional meetings with grantees. • Define a clear point in the project development process when the decision to pursue a PPP should be made and the specific process implications of such a decision. • Allow long-term leases of existing government assets. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 21

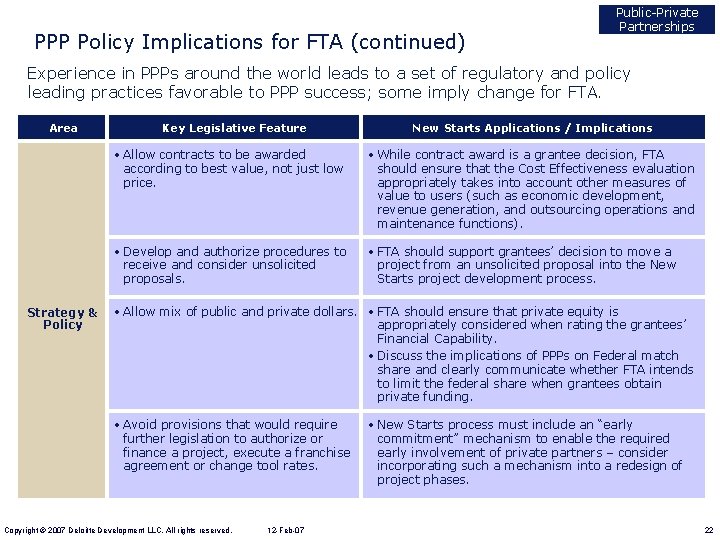

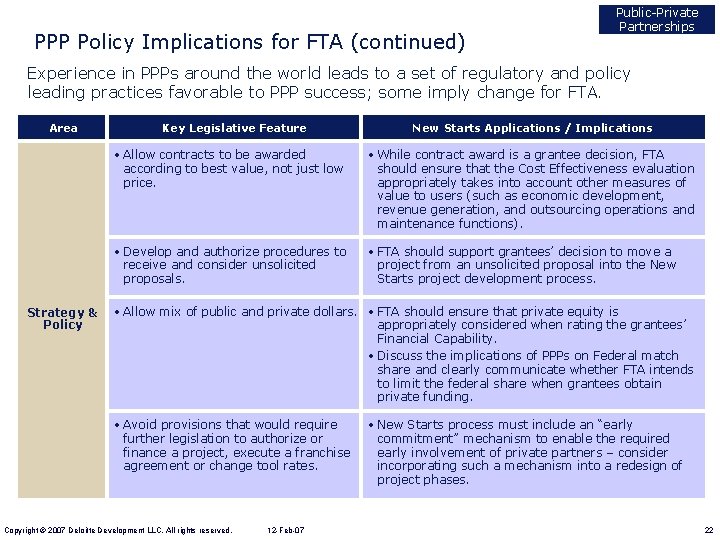

PPP Policy Implications for FTA (continued) Public-Private Partnerships Experience in PPPs around the world leads to a set of regulatory and policy leading practices favorable to PPP success; some imply change for FTA. Area Strategy & Policy Key Legislative Feature New Starts Applications / Implications • Allow contracts to be awarded according to best value, not just low price. • While contract award is a grantee decision, FTA should ensure that the Cost Effectiveness evaluation appropriately takes into account other measures of value to users (such as economic development, revenue generation, and outsourcing operations and maintenance functions). • Develop and authorize procedures to receive and consider unsolicited proposals. • FTA should support grantees’ decision to move a project from an unsolicited proposal into the New Starts project development process. • Allow mix of public and private dollars. • FTA should ensure that private equity is appropriately considered when rating the grantees’ Financial Capability. • Discuss the implications of PPPs on Federal match share and clearly communicate whether FTA intends to limit the federal share when grantees obtain private funding. • Avoid provisions that would require further legislation to authorize or finance a project, execute a franchise agreement or change tool rates. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 • New Starts process must include an “early commitment” mechanism to enable the required early involvement of private partners – consider incorporating such a mechanism into a redesign of project phases. 22

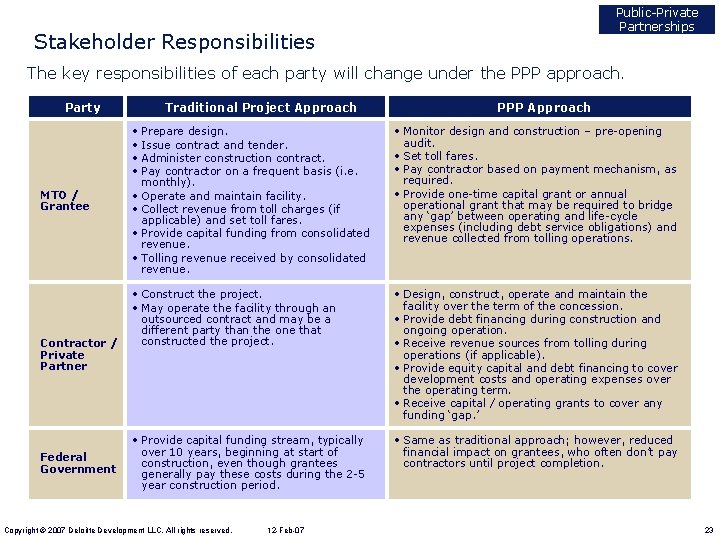

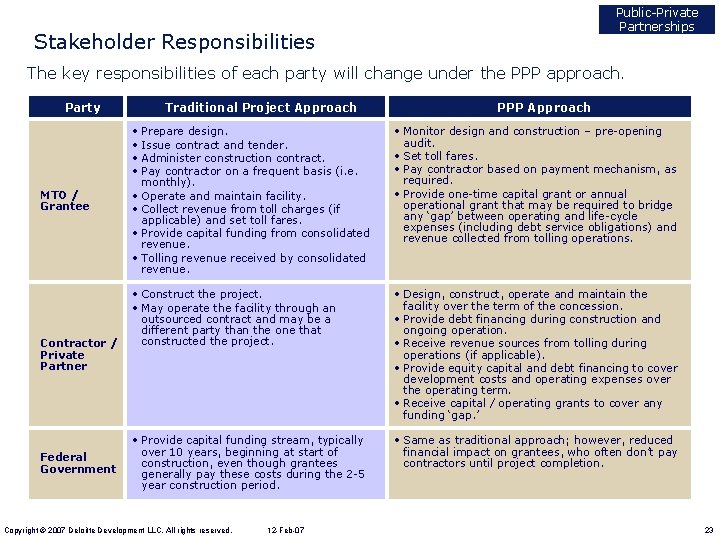

Public-Private Partnerships Stakeholder Responsibilities The key responsibilities of each party will change under the PPP approach. Party MTO / Grantee Contractor / Private Partner Federal Government Traditional Project Approach PPP Approach • Prepare design. • Issue contract and tender. • Administer construction contract. • Pay contractor on a frequent basis (i. e. monthly). • Operate and maintain facility. • Collect revenue from toll charges (if applicable) and set toll fares. • Provide capital funding from consolidated revenue. • Tolling revenue received by consolidated revenue. • Monitor design and construction – pre-opening audit. • Set toll fares. • Pay contractor based on payment mechanism, as required. • Provide one-time capital grant or annual operational grant that may be required to bridge any ‘gap’ between operating and life-cycle expenses (including debt service obligations) and revenue collected from tolling operations. • Construct the project. • May operate the facility through an outsourced contract and may be a different party than the one that constructed the project. • Design, construct, operate and maintain the facility over the term of the concession. • Provide debt financing during construction and ongoing operation. • Receive revenue sources from tolling during operations (if applicable). • Provide equity capital and debt financing to cover development costs and operating expenses over the operating term. • Receive capital / operating grants to cover any funding ‘gap. ’ • Provide capital funding stream, typically over 10 years, beginning at start of construction, even though grantees generally pay these costs during the 2 -5 year construction period. • Same as traditional approach; however, reduced financial impact on grantees, who often don’t pay contractors until project completion. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 23

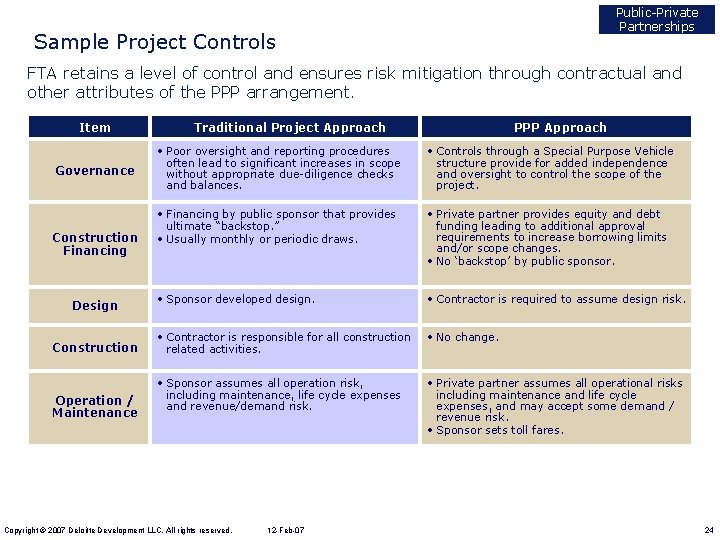

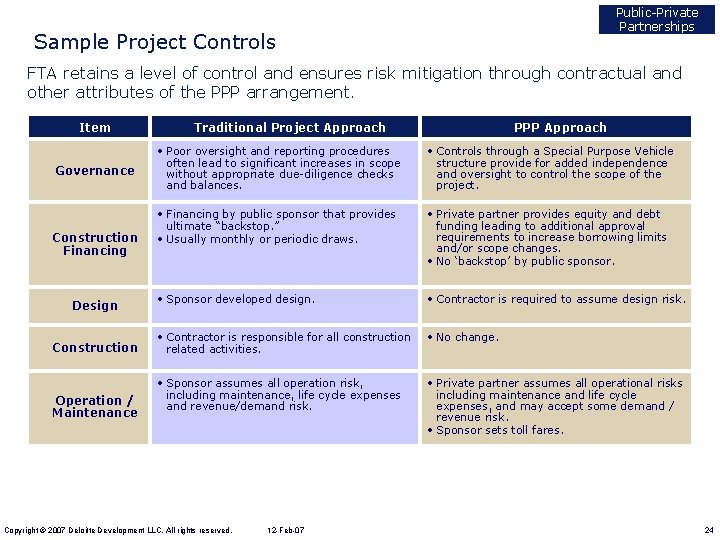

Public-Private Partnerships Sample Project Controls FTA retains a level of control and ensures risk mitigation through contractual and other attributes of the PPP arrangement. Item Governance Construction Financing Design Construction Operation / Maintenance Traditional Project Approach PPP Approach • Poor oversight and reporting procedures often lead to significant increases in scope without appropriate due-diligence checks and balances. • Controls through a Special Purpose Vehicle structure provide for added independence and oversight to control the scope of the project. • Financing by public sponsor that provides ultimate “backstop. ” • Usually monthly or periodic draws. • Private partner provides equity and debt funding leading to additional approval requirements to increase borrowing limits and/or scope changes. • No ‘backstop’ by public sponsor. • Sponsor developed design. • Contractor is required to assume design risk. • Contractor is responsible for all construction related activities. • No change. • Sponsor assumes all operation risk, including maintenance, life cycle expenses and revenue/demand risk. • Private partner assumes all operational risks including maintenance and life cycle expenses, and may accept some demand / revenue risk. • Sponsor sets toll fares. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 24

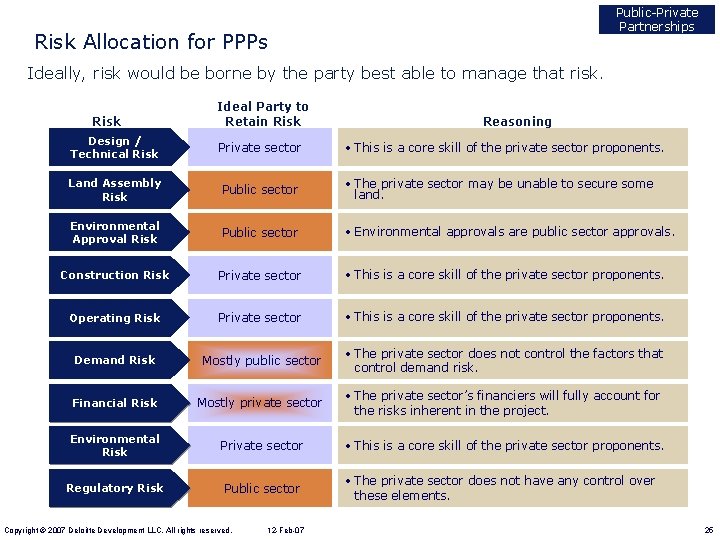

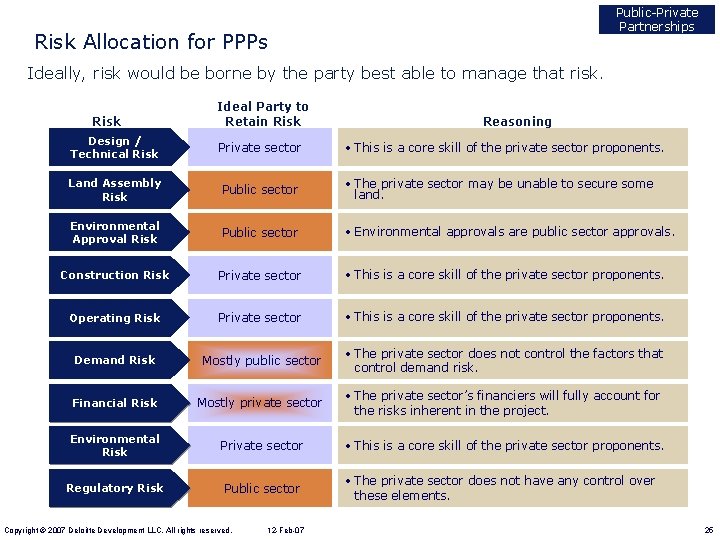

Public-Private Partnerships Risk Allocation for PPPs Ideally, risk would be borne by the party best able to manage that risk. Risk Ideal Party to Retain Risk Reasoning Design / Technical Risk Private sector • This is a core skill of the private sector proponents. Land Assembly Risk Public sector • The private sector may be unable to secure some land. Environmental Approval Risk Public sector • Environmental approvals are public sector approvals. Construction Risk Private sector • This is a core skill of the private sector proponents. Operating Risk Private sector • This is a core skill of the private sector proponents. Demand Risk Mostly public sector • The private sector does not control the factors that control demand risk. Financial Risk Mostly private sector • The private sector’s financiers will fully account for the risks inherent in the project. Environmental Risk Private sector • This is a core skill of the private sector proponents. Regulatory Risk Public sector • The private sector does not have any control over these elements. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 25

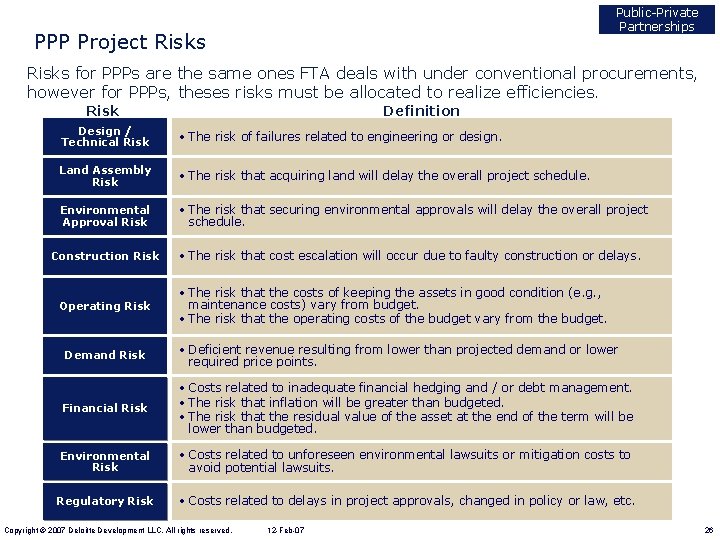

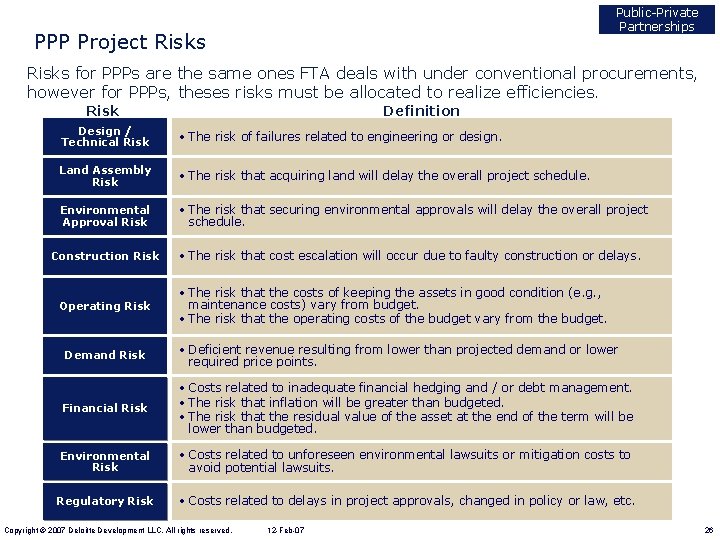

Public-Private Partnerships PPP Project Risks for PPPs are the same ones FTA deals with under conventional procurements, however for PPPs, theses risks must be allocated to realize efficiencies. Risk Definition Design / Technical Risk • The risk of failures related to engineering or design. Land Assembly Risk • The risk that acquiring land will delay the overall project schedule. Environmental Approval Risk • The risk that securing environmental approvals will delay the overall project schedule. Construction Risk Operating Risk • The risk that cost escalation will occur due to faulty construction or delays. • The risk that the costs of keeping the assets in good condition (e. g. , maintenance costs) vary from budget. • The risk that the operating costs of the budget vary from the budget. Demand Risk • Deficient revenue resulting from lower than projected demand or lower required price points. Financial Risk • Costs related to inadequate financial hedging and / or debt management. • The risk that inflation will be greater than budgeted. • The risk that the residual value of the asset at the end of the term will be lower than budgeted. Environmental Risk • Costs related to unforeseen environmental lawsuits or mitigation costs to avoid potential lawsuits. Regulatory Risk • Costs related to delays in project approvals, changed in policy or law, etc. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 26

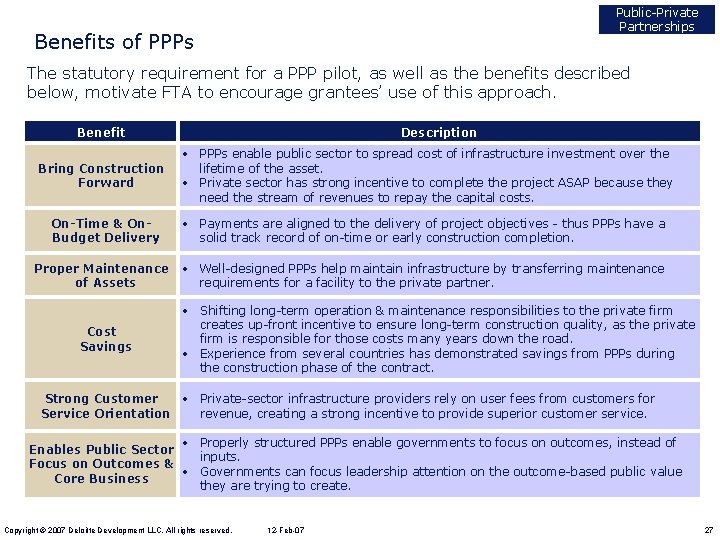

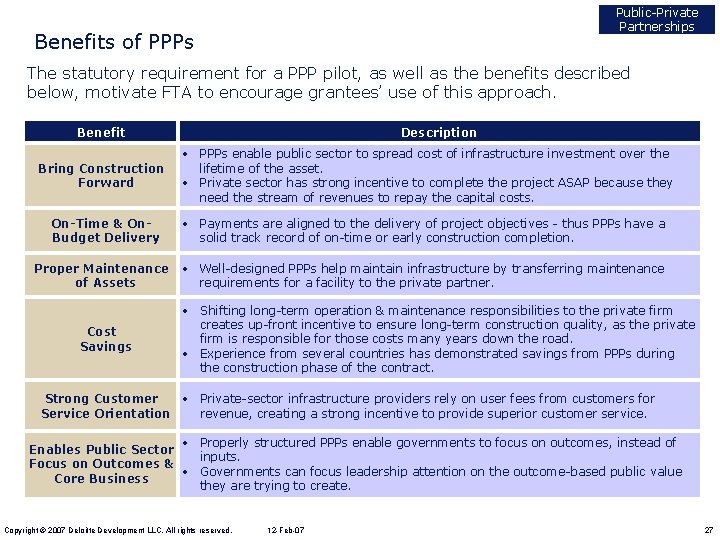

Public-Private Partnerships Benefits of PPPs The statutory requirement for a PPP pilot, as well as the benefits described below, motivate FTA to encourage grantees’ use of this approach. Benefit Bring Construction Forward On-Time & On. Budget Delivery Proper Maintenance of Assets Cost Savings Description • PPPs enable public sector to spread cost of infrastructure investment over the lifetime of the asset. • Private sector has strong incentive to complete the project ASAP because they need the stream of revenues to repay the capital costs. • Payments are aligned to the delivery of project objectives - thus PPPs have a solid track record of on-time or early construction completion. • Well-designed PPPs help maintain infrastructure by transferring maintenance requirements for a facility to the private partner. • Shifting long-term operation & maintenance responsibilities to the private firm creates up-front incentive to ensure long-term construction quality, as the private firm is responsible for those costs many years down the road. • Experience from several countries has demonstrated savings from PPPs during the construction phase of the contract. Strong Customer • Private-sector infrastructure providers rely on user fees from customers for Service Orientation revenue, creating a strong incentive to provide superior customer service. • Properly structured PPPs enable governments to focus on outcomes, instead of Enables Public Sector inputs. Focus on Outcomes & • Governments can focus leadership attention on the outcome-based public value Core Business they are trying to create. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 27

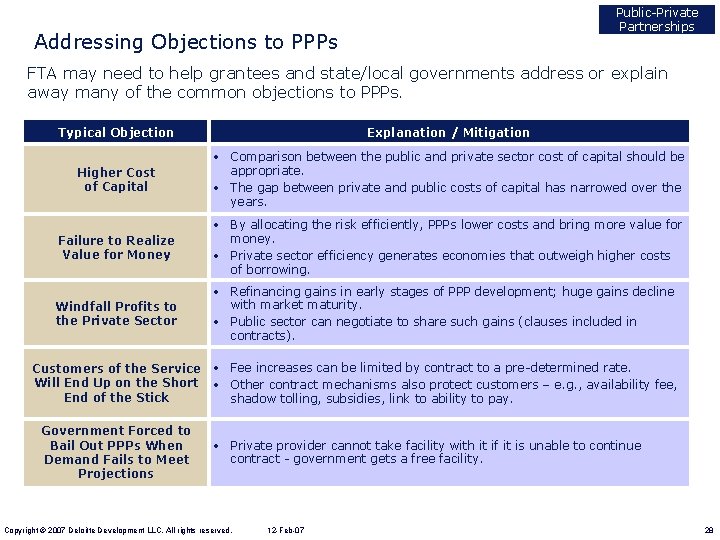

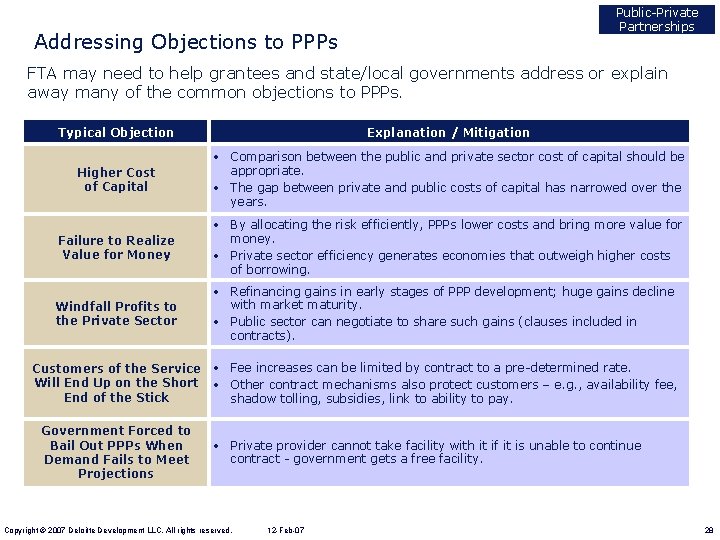

Public-Private Partnerships Addressing Objections to PPPs FTA may need to help grantees and state/local governments address or explain away many of the common objections to PPPs. Typical Objection Explanation / Mitigation Higher Cost of Capital • Comparison between the public and private sector cost of capital should be appropriate. • The gap between private and public costs of capital has narrowed over the years. Failure to Realize Value for Money • By allocating the risk efficiently, PPPs lower costs and bring more value for money. • Private sector efficiency generates economies that outweigh higher costs of borrowing. Windfall Profits to the Private Sector • Refinancing gains in early stages of PPP development; huge gains decline with market maturity. • Public sector can negotiate to share such gains (clauses included in contracts). Customers of the Service • Fee increases can be limited by contract to a pre-determined rate. Will End Up on the Short • Other contract mechanisms also protect customers – e. g. , availability fee, End of the Stick shadow tolling, subsidies, link to ability to pay. Government Forced to Bail Out PPPs When Demand Fails to Meet Projections • Private provider cannot take facility with it if it is unable to continue contract - government gets a free facility. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 28

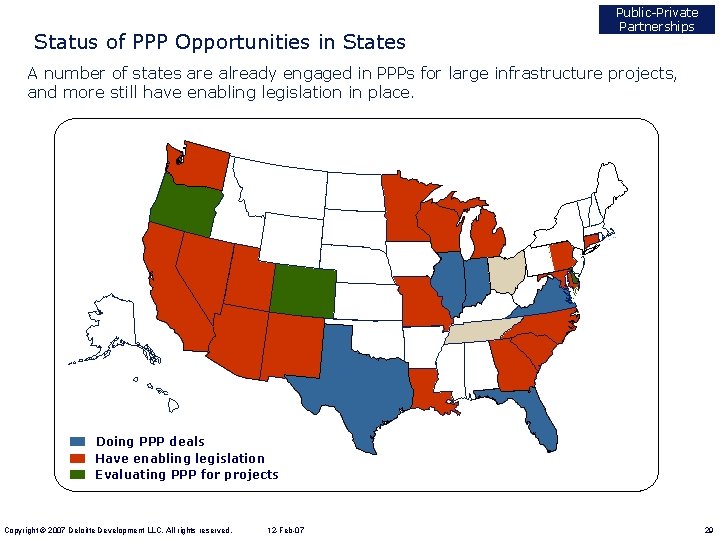

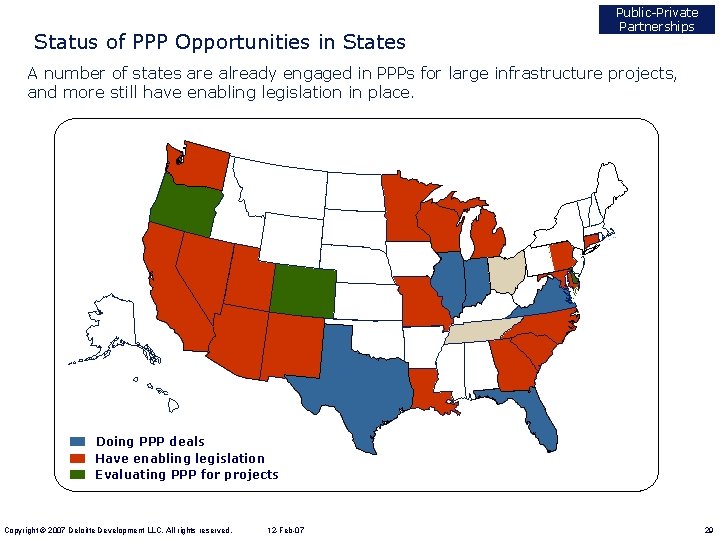

Status of PPP Opportunities in States Public-Private Partnerships A number of states are already engaged in PPPs for large infrastructure projects, and more still have enabling legislation in place. Doing PPP deals Have enabling legislation Evaluating PPP for projects Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 29

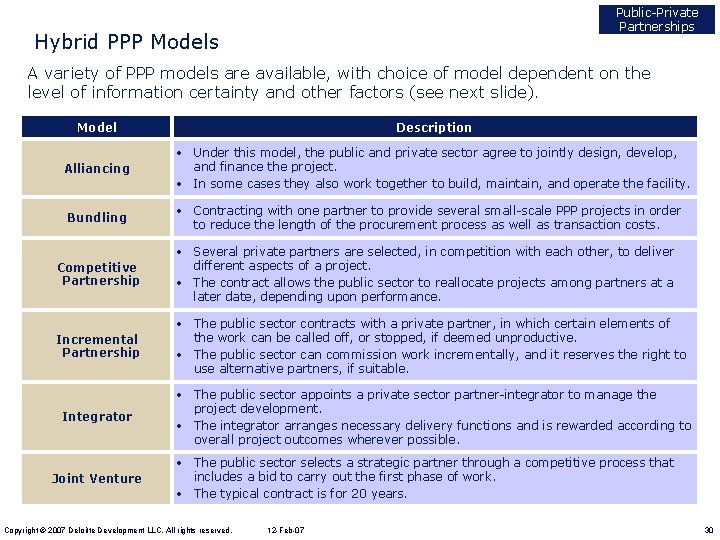

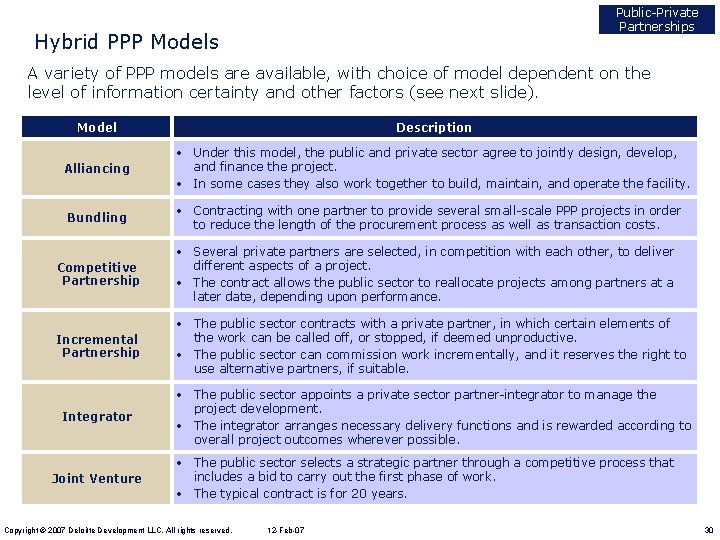

Public-Private Partnerships Hybrid PPP Models A variety of PPP models are available, with choice of model dependent on the level of information certainty and other factors (see next slide). Model Description Alliancing • Under this model, the public and private sector agree to jointly design, develop, and finance the project. • In some cases they also work together to build, maintain, and operate the facility. Bundling • Contracting with one partner to provide several small-scale PPP projects in order to reduce the length of the procurement process as well as transaction costs. Competitive Partnership • Several private partners are selected, in competition with each other, to deliver different aspects of a project. • The contract allows the public sector to reallocate projects among partners at a later date, depending upon performance. Incremental Partnership • The public sector contracts with a private partner, in which certain elements of the work can be called off, or stopped, if deemed unproductive. • The public sector can commission work incrementally, and it reserves the right to use alternative partners, if suitable. Integrator • The public sector appoints a private sector partner-integrator to manage the project development. • The integrator arranges necessary delivery functions and is rewarded according to overall project outcomes wherever possible. Joint Venture • The public sector selects a strategic partner through a competitive process that includes a bid to carry out the first phase of work. • The typical contract is for 20 years. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 30

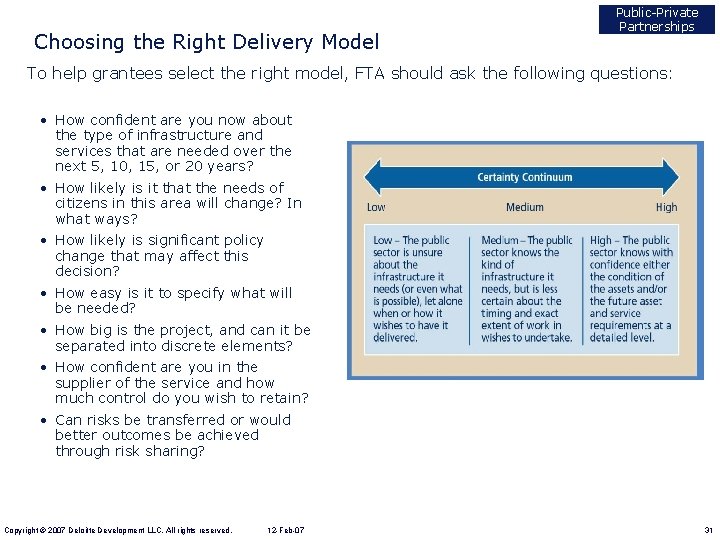

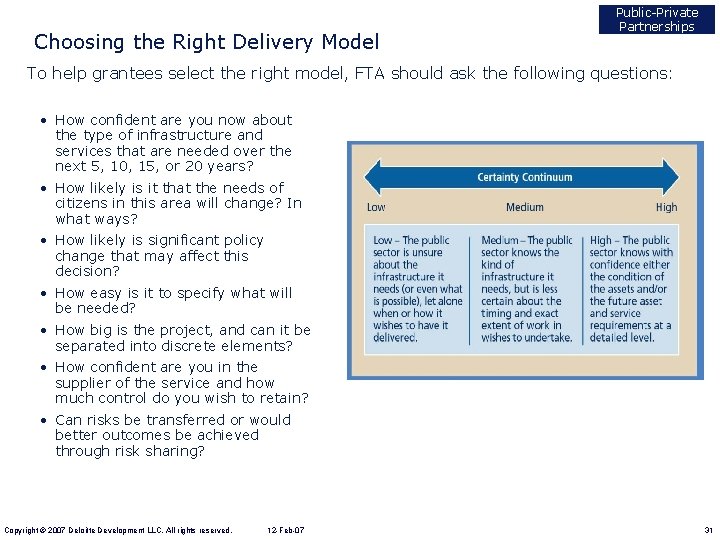

Choosing the Right Delivery Model Public-Private Partnerships To help grantees select the right model, FTA should ask the following questions: • How confident are you now about the type of infrastructure and services that are needed over the next 5, 10, 15, or 20 years? • How likely is it that the needs of citizens in this area will change? In what ways? • How likely is significant policy change that may affect this decision? • How easy is it to specify what will be needed? • How big is the project, and can it be separated into discrete elements? • How confident are you in the supplier of the service and how much control do you wish to retain? • Can risks be transferred or would better outcomes be achieved through risk sharing? Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 31

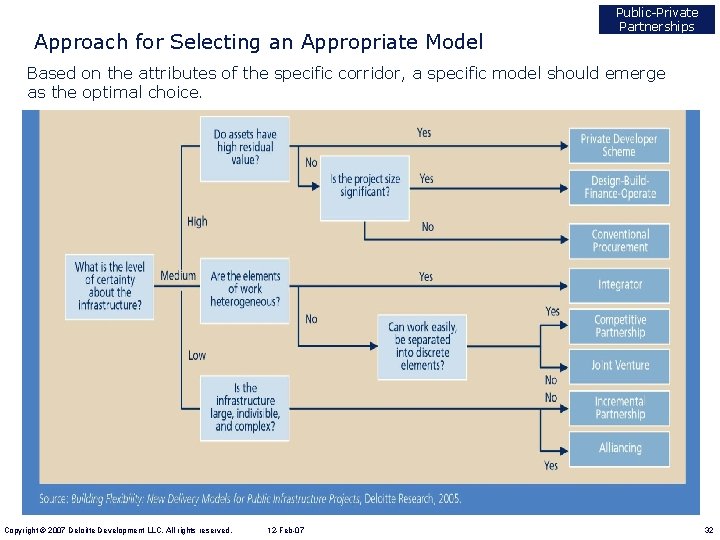

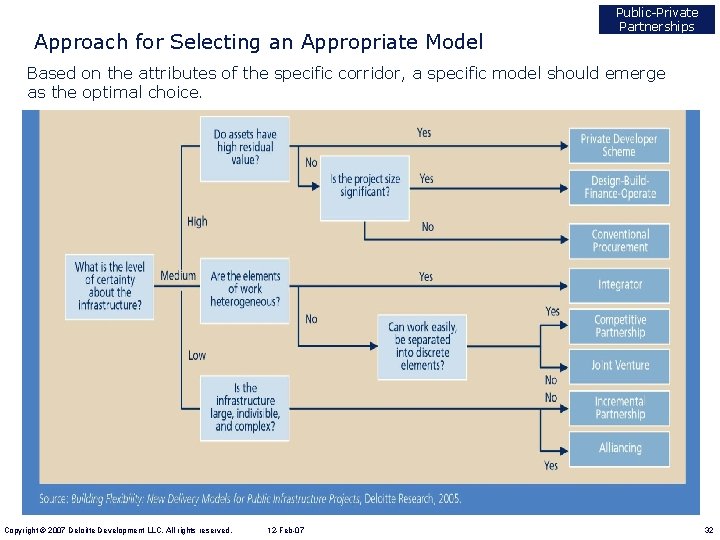

Approach for Selecting an Appropriate Model Public-Private Partnerships Based on the attributes of the specific corridor, a specific model should emerge as the optimal choice. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 32

Alternative Project Delivery Methods Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 33

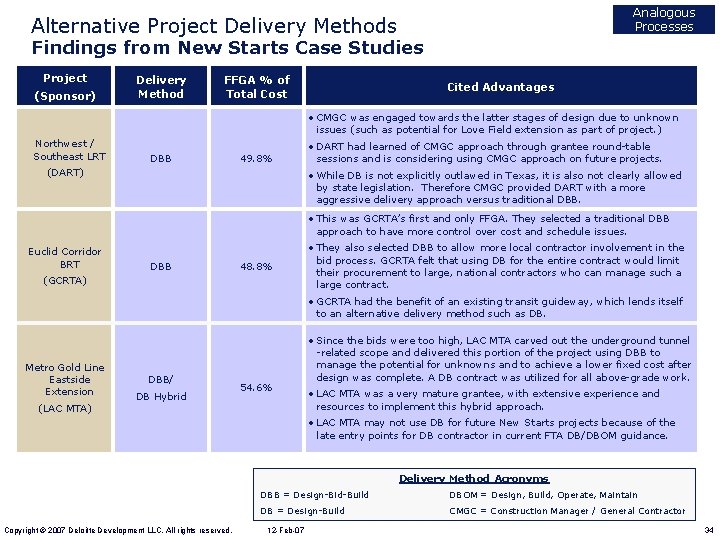

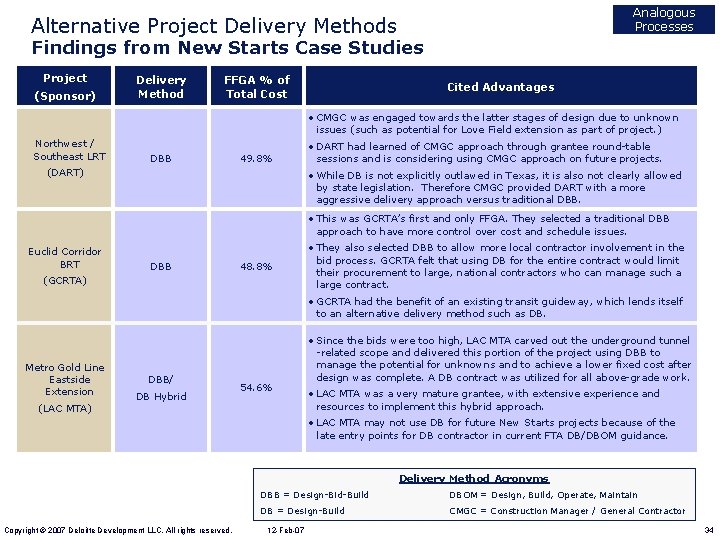

Analogous Processes Alternative Project Delivery Methods Findings from New Starts Case Studies Project (Sponsor) Delivery Method FFGA % of Total Cost Cited Advantages • CMGC was engaged towards the latter stages of design due to unknown issues (such as potential for Love Field extension as part of project. ) Northwest / Southeast LRT DBB 49. 8% (DART) • DART had learned of CMGC approach through grantee round-table sessions and is considering using CMGC approach on future projects. • While DB is not explicitly outlawed in Texas, it is also not clearly allowed by state legislation. Therefore CMGC provided DART with a more aggressive delivery approach versus traditional DBB. • This was GCRTA’s first and only FFGA. They selected a traditional DBB approach to have more control over cost and schedule issues. Euclid Corridor BRT DBB 48. 8% (GCRTA) • They also selected DBB to allow more local contractor involvement in the bid process. GCRTA felt that using DB for the entire contract would limit their procurement to large, national contractors who can manage such a large contract. • GCRTA had the benefit of an existing transit guideway, which lends itself to an alternative delivery method such as DB. Metro Gold Line Eastside Extension DBB/ DB Hybrid 54. 6% (LAC MTA) • Since the bids were too high, LAC MTA carved out the underground tunnel -related scope and delivered this portion of the project using DBB to manage the potential for unknowns and to achieve a lower fixed cost after design was complete. A DB contract was utilized for all above-grade work. • LAC MTA was a very mature grantee, with extensive experience and resources to implement this hybrid approach. • LAC MTA may not use DB for future New Starts projects because of the late entry points for DB contractor in current FTA DB/DBOM guidance. Delivery Method Acronyms Copyright © 2007 Deloitte Development LLC. All rights reserved. DBB = Design-Bid-Build DBOM = Design, Build, Operate, Maintain DB = Design-Build CMGC = Construction Manager / General Contractor 12 -Feb-07 34

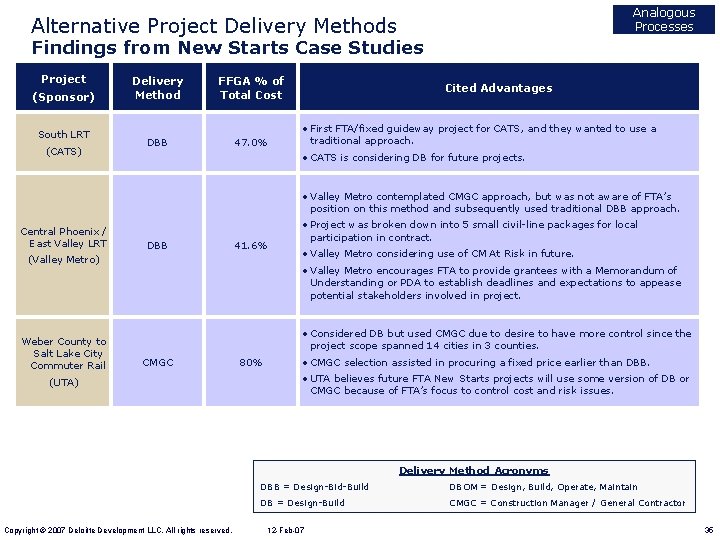

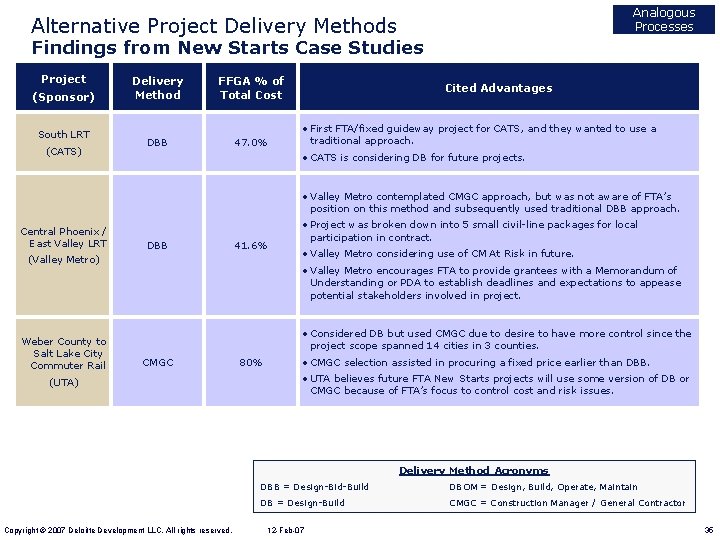

Analogous Processes Alternative Project Delivery Methods Findings from New Starts Case Studies Project (Sponsor) South LRT (CATS) Delivery Method FFGA % of Total Cost DBB 47. 0% Cited Advantages • First FTA/fixed guideway project for CATS, and they wanted to use a traditional approach. • CATS is considering DB for future projects. • Valley Metro contemplated CMGC approach, but was not aware of FTA’s position on this method and subsequently used traditional DBB approach. Central Phoenix / East Valley LRT DBB 41. 6% (Valley Metro) Weber County to Salt Lake City Commuter Rail • Project was broken down into 5 small civil-line packages for local participation in contract. • Valley Metro considering use of CM At Risk in future. • Valley Metro encourages FTA to provide grantees with a Memorandum of Understanding or PDA to establish deadlines and expectations to appease potential stakeholders involved in project. • Considered DB but used CMGC due to desire to have more control since the project scope spanned 14 cities in 3 counties. CMGC (UTA) 80% • CMGC selection assisted in procuring a fixed price earlier than DBB. • UTA believes future FTA New Starts projects will use some version of DB or CMGC because of FTA’s focus to control cost and risk issues. Delivery Method Acronyms Copyright © 2007 Deloitte Development LLC. All rights reserved. DBB = Design-Bid-Build DBOM = Design, Build, Operate, Maintain DB = Design-Build CMGC = Construction Manager / General Contractor 12 -Feb-07 35

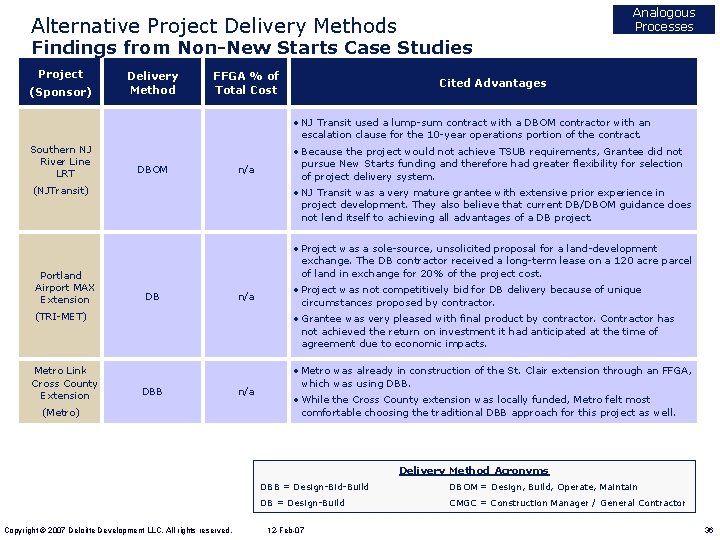

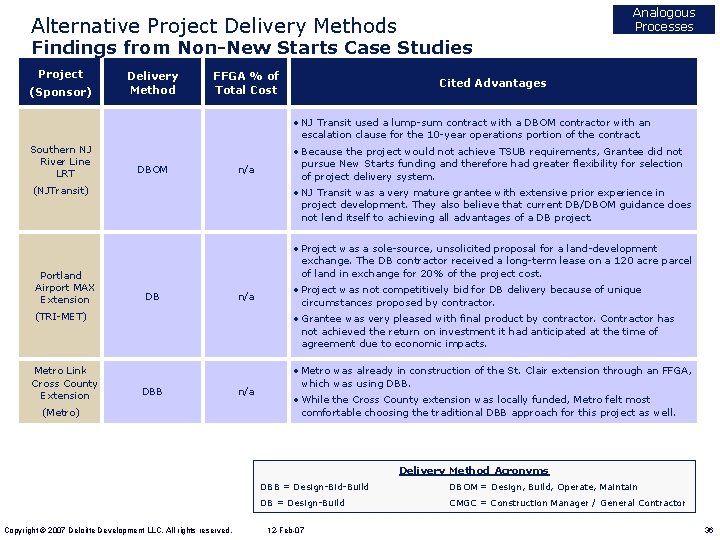

Analogous Processes Alternative Project Delivery Methods Findings from Non-New Starts Case Studies Project (Sponsor) Delivery Method FFGA % of Total Cost Cited Advantages • NJ Transit used a lump-sum contract with a DBOM contractor with an escalation clause for the 10 -year operations portion of the contract. Southern NJ River Line LRT DBOM n/a (NJTransit) Portland Airport MAX Extension • NJ Transit was a very mature grantee with extensive prior experience in project development. They also believe that current DB/DBOM guidance does not lend itself to achieving all advantages of a DB project. • Project was a sole-source, unsolicited proposal for a land-development exchange. The DB contractor received a long-term lease on a 120 acre parcel of land in exchange for 20% of the project cost. DB n/a (TRI-MET) Metro Link Cross County Extension • Because the project would not achieve TSUB requirements, Grantee did not pursue New Starts funding and therefore had greater flexibility for selection of project delivery system. • Project was not competitively bid for DB delivery because of unique circumstances proposed by contractor. • Grantee was very pleased with final product by contractor. Contractor has not achieved the return on investment it had anticipated at the time of agreement due to economic impacts. DBB (Metro) n/a • Metro was already in construction of the St. Clair extension through an FFGA, which was using DBB. • While the Cross County extension was locally funded, Metro felt most comfortable choosing the traditional DBB approach for this project as well. Delivery Method Acronyms Copyright © 2007 Deloitte Development LLC. All rights reserved. DBB = Design-Bid-Build DBOM = Design, Build, Operate, Maintain DB = Design-Build CMGC = Construction Manager / General Contractor 12 -Feb-07 36

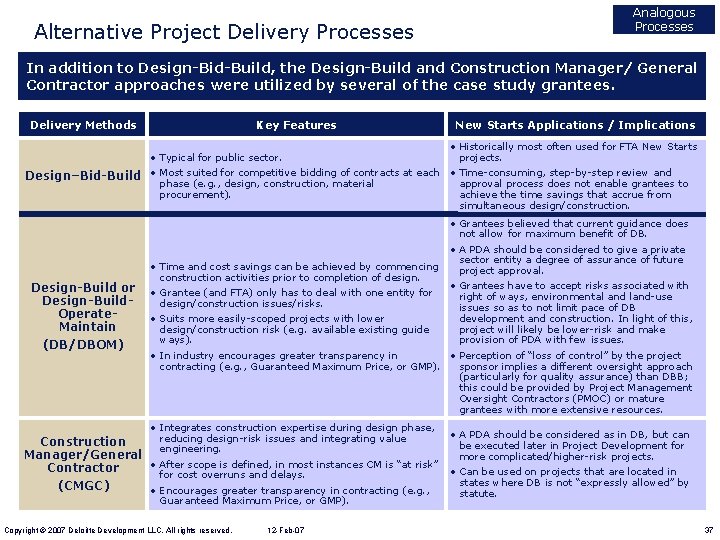

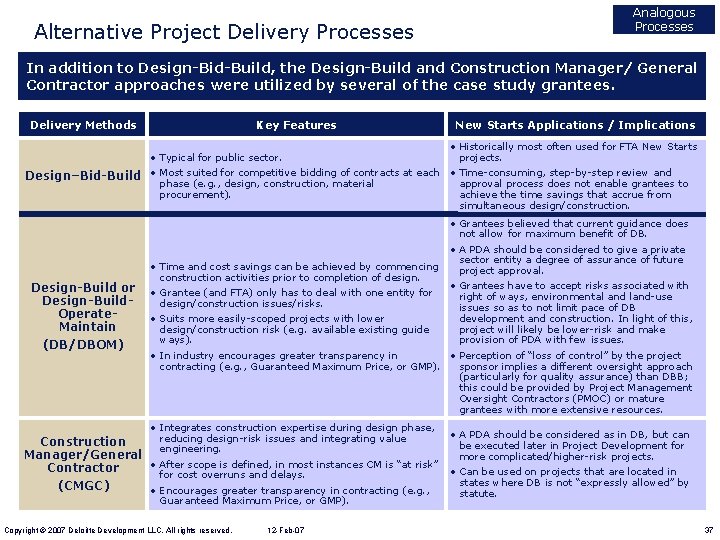

Alternative Project Delivery Processes Analogous Processes In addition to Design-Bid-Build, the Design-Build and Construction Manager/ General Contractor approaches were utilized by several of the case study grantees. Delivery Methods Key Features New Starts Applications / Implications • Historically most often used for FTA New Starts • Typical for public sector. projects. Design–Bid-Build • Most suited for competitive bidding of contracts at each • Time-consuming, step-by-step review and phase (e. g. , design, construction, material approval process does not enable grantees to procurement). achieve the time savings that accrue from simultaneous design/construction. • Design-Build or Design-Build. Operate. Maintain (DB/DBOM) • • Grantees believed that current guidance does not allow for maximum benefit of DB. • A PDA should be considered to give a private sector entity a degree of assurance of future Time and cost savings can be achieved by commencing project approval. construction activities prior to completion of design. • Grantees have to accept risks associated with Grantee (and FTA) only has to deal with one entity for right of ways, environmental and land-use design/construction issues/risks. issues so as to not limit pace of DB development and construction. In light of this, Suits more easily-scoped projects with lower project will likely be lower-risk and make design/construction risk (e. g. available existing guide provision of PDA with few issues. ways). • Perception of “loss of control” by the project In industry encourages greater transparency in sponsor implies a different oversight approach contracting (e. g. , Guaranteed Maximum Price, or GMP). (particularly for quality assurance) than DBB; this could be provided by Project Management Oversight Contractors (PMOC) or mature grantees with more extensive resources. • Integrates construction expertise during design phase, reducing design-risk issues and integrating value Construction engineering. Manager/General • After scope is defined, in most instances CM is “at risk” Contractor for cost overruns and delays. (CMGC) • Encourages greater transparency in contracting (e. g. , Guaranteed Maximum Price, or GMP). Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 • A PDA should be considered as in DB, but can be executed later in Project Development for more complicated/higher-risk projects. • Can be used on projects that are located in states where DB is not “expressly allowed” by statute. 37

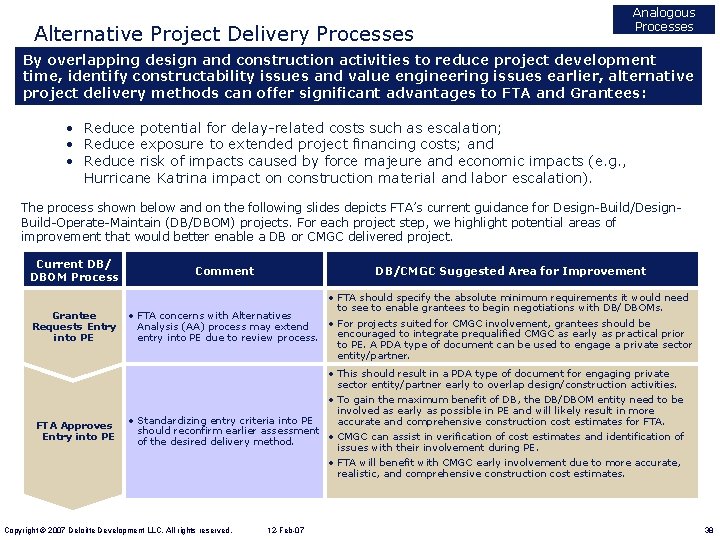

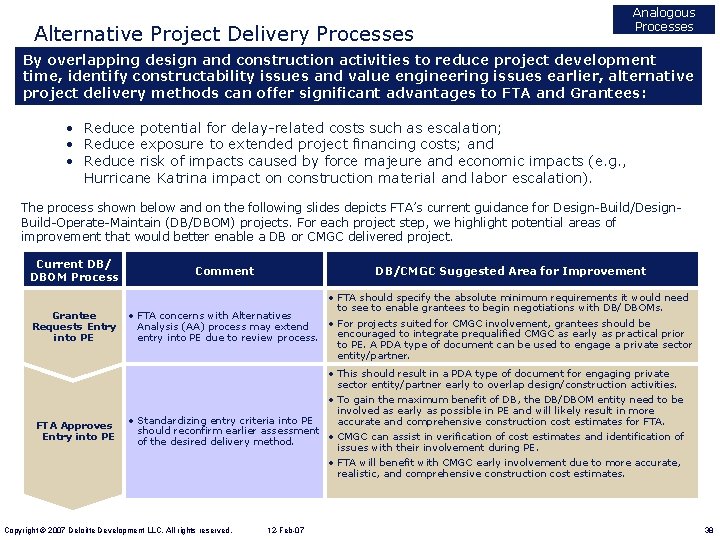

Alternative Project Delivery Processes Analogous Processes By overlapping design and construction activities to reduce project development time, identify constructability issues and value engineering issues earlier, alternative project delivery methods can offer significant advantages to FTA and Grantees: • Reduce potential for delay-related costs such as escalation; • Reduce exposure to extended project financing costs; and • Reduce risk of impacts caused by force majeure and economic impacts (e. g. , Hurricane Katrina impact on construction material and labor escalation). The process shown below and on the following slides depicts FTA’s current guidance for Design-Build/Design. Build-Operate-Maintain (DB/DBOM) projects. For each project step, we highlight potential areas of improvement that would better enable a DB or CMGC delivered project. Current DB/ DBOM Process Grantee Requests Entry into PE FTA Approves Entry into PE Comment DB/CMGC Suggested Area for Improvement • FTA should specify the absolute minimum requirements it would need to see to enable grantees to begin negotiations with DB/ DBOMs. • FTA concerns with Alternatives • For projects suited for CMGC involvement, grantees should be Analysis (AA) process may extend encouraged to integrate prequalified CMGC as early as practical prior entry into PE due to review process. to PE. A PDA type of document can be used to engage a private sector entity/partner. • This should result in a PDA type of document for engaging private sector entity/partner early to overlap design/construction activities. • To gain the maximum benefit of DB, the DB/DBOM entity need to be involved as early as possible in PE and will likely result in more • Standardizing entry criteria into PE accurate and comprehensive construction cost estimates for FTA. should reconfirm earlier assessment • CMGC can assist in verification of cost estimates and identification of of the desired delivery method. issues with their involvement during PE. • FTA will benefit with CMGC early involvement due to more accurate, realistic, and comprehensive construction cost estimates. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 38

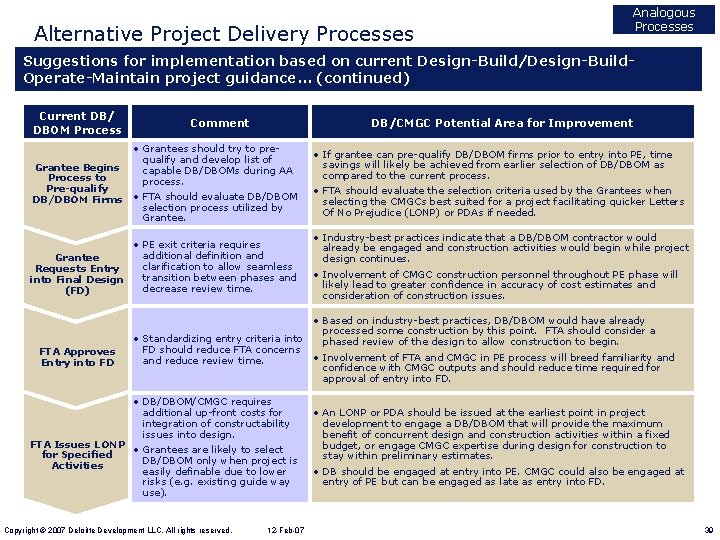

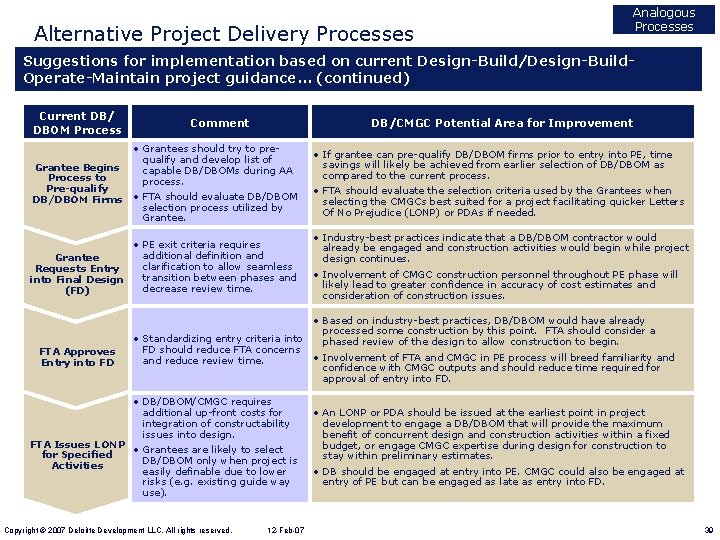

Alternative Project Delivery Processes Analogous Processes Suggestions for implementation based on current Design-Build/Design-Build. Operate-Maintain project guidance. . . (continued) Current DB/ DBOM Process Comment DB/CMGC Potential Area for Improvement • Grantees should try to prequalify and develop list of Grantee Begins capable DB/DBOMs during AA Process to process. Pre-qualify • FTA should evaluate DB/DBOM Firms selection process utilized by Grantee. • If grantee can pre-qualify DB/DBOM firms prior to entry into PE, time savings will likely be achieved from earlier selection of DB/DBOM as compared to the current process. • FTA should evaluate the selection criteria used by the Grantees when selecting the CMGCs best suited for a project facilitating quicker Letters Of No Prejudice (LONP) or PDAs if needed. • PE exit criteria requires additional definition and Grantee clarification to allow seamless Requests Entry transition between phases and into Final Design decrease review time. (FD) • Industry-best practices indicate that a DB/DBOM contractor would already be engaged and construction activities would begin while project design continues. • Involvement of CMGC construction personnel throughout PE phase will likely lead to greater confidence in accuracy of cost estimates and consideration of construction issues. FTA Approves Entry into FD • Standardizing entry criteria into FD should reduce FTA concerns and reduce review time. • DB/DBOM/CMGC requires additional up-front costs for integration of constructability issues into design. FTA Issues LONP • Grantees are likely to select for Specified DB/DBOM only when project is Activities easily definable due to lower risks (e. g. existing guide way use). Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 • Based on industry-best practices, DB/DBOM would have already processed some construction by this point. FTA should consider a phased review of the design to allow construction to begin. • Involvement of FTA and CMGC in PE process will breed familiarity and confidence with CMGC outputs and should reduce time required for approval of entry into FD. • An LONP or PDA should be issued at the earliest point in project development to engage a DB/DBOM that will provide the maximum benefit of concurrent design and construction activities within a fixed budget, or engage CMGC expertise during design for construction to stay within preliminary estimates. • DB should be engaged at entry into PE. CMGC could also be engaged at entry of PE but can be engaged as late as entry into FD. 39

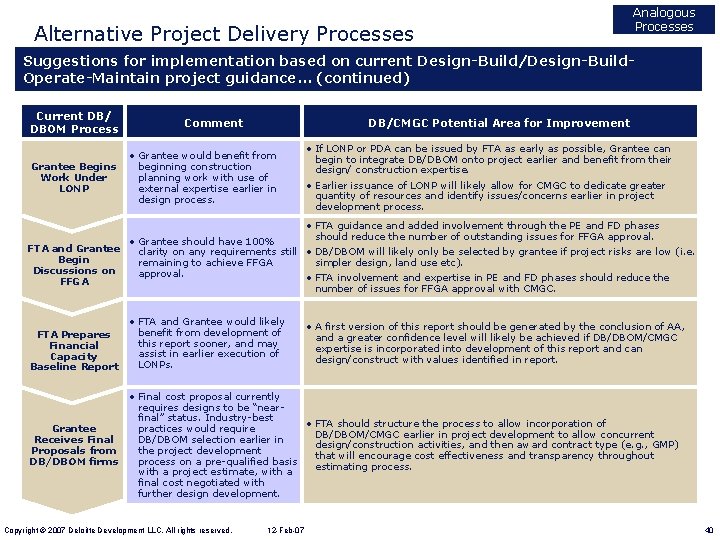

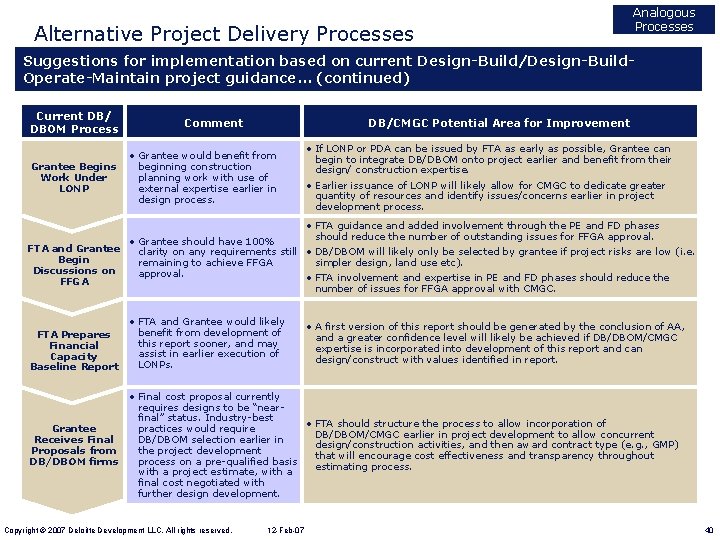

Alternative Project Delivery Processes Analogous Processes Suggestions for implementation based on current Design-Build/Design-Build. Operate-Maintain project guidance. . . (continued) Current DB/ DBOM Process Grantee Begins Work Under LONP Comment DB/CMGC Potential Area for Improvement • Grantee would benefit from beginning construction planning work with use of external expertise earlier in design process. • If LONP or PDA can be issued by FTA as early as possible, Grantee can begin to integrate DB/DBOM onto project earlier and benefit from their design/ construction expertise. • Earlier issuance of LONP will likely allow for CMGC to dedicate greater quantity of resources and identify issues/concerns earlier in project development process. • FTA guidance and added involvement through the PE and FD phases should reduce the number of outstanding issues for FFGA approval. • Grantee should have 100% FTA and Grantee clarity on any requirements still • DB/DBOM will likely only be selected by grantee if project risks are low (i. e. Begin remaining to achieve FFGA simpler design, land use etc). Discussions on approval. • FTA involvement and expertise in PE and FD phases should reduce the FFGA number of issues for FFGA approval with CMGC. FTA Prepares Financial Capacity Baseline Report • FTA and Grantee would likely benefit from development of this report sooner, and may assist in earlier execution of LONPs. • A first version of this report should be generated by the conclusion of AA, and a greater confidence level will likely be achieved if DB/DBOM/CMGC expertise is incorporated into development of this report and can design/construct with values identified in report. • Final cost proposal currently requires designs to be “nearfinal” status. Industry-best • FTA should structure the process to allow incorporation of Grantee practices would require DB/DBOM/CMGC earlier in project development to allow concurrent Receives Final DB/DBOM selection earlier in design/construction activities, and then award contract type (e. g. , GMP) Proposals from the project development that will encourage cost effectiveness and transparency throughout DB/DBOM firms process on a pre-qualified basis estimating process. with a project estimate, with a final cost negotiated with further design development. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 40

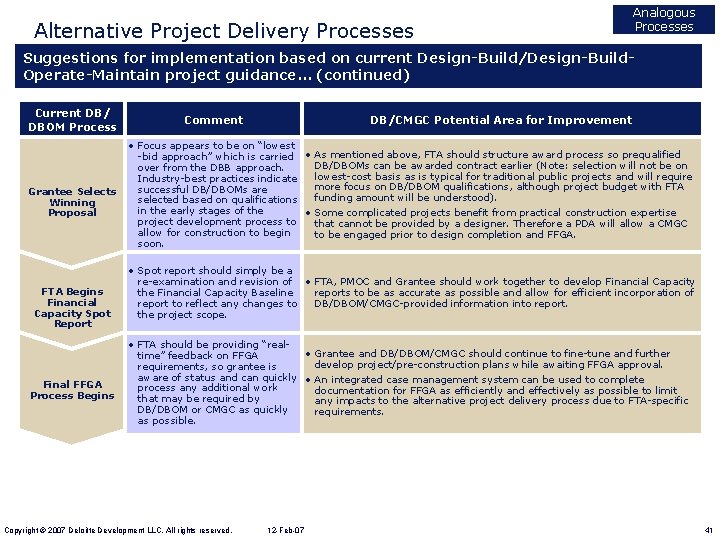

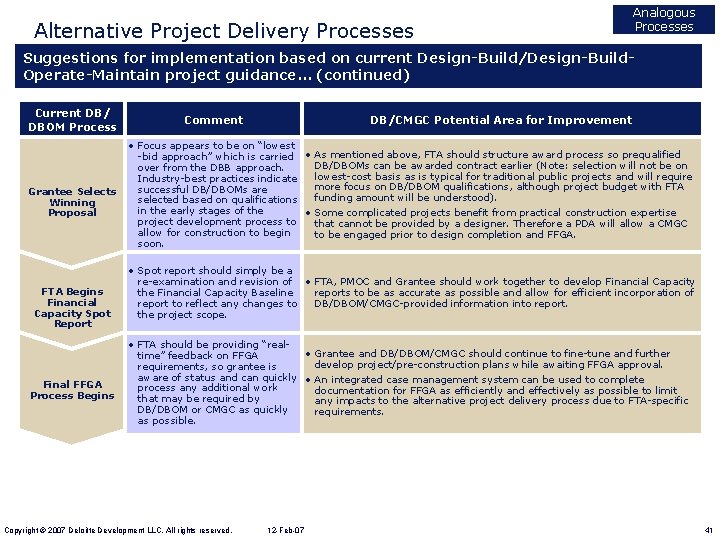

Alternative Project Delivery Processes Analogous Processes Suggestions for implementation based on current Design-Build/Design-Build. Operate-Maintain project guidance. . . (continued) Current DB/ DBOM Process Grantee Selects Winning Proposal FTA Begins Financial Capacity Spot Report Final FFGA Process Begins Comment DB/CMGC Potential Area for Improvement • Focus appears to be on “lowest -bid approach” which is carried • As mentioned above, FTA should structure award process so prequalified DB/DBOMs can be awarded contract earlier (Note: selection will not be on over from the DBB approach. lowest-cost basis as is typical for traditional public projects and will require Industry-best practices indicate more focus on DB/DBOM qualifications, although project budget with FTA successful DB/DBOMs are funding amount will be understood). selected based on qualifications in the early stages of the • Some complicated projects benefit from practical construction expertise project development process to that cannot be provided by a designer. Therefore a PDA will allow a CMGC allow for construction to begin to be engaged prior to design completion and FFGA. soon. • Spot report should simply be a re-examination and revision of • FTA, PMOC and Grantee should work together to develop Financial Capacity the Financial Capacity Baseline reports to be as accurate as possible and allow for efficient incorporation of report to reflect any changes to DB/DBOM/CMGC-provided information into report. the project scope. • FTA should be providing “real • Grantee and DB/DBOM/CMGC should continue to fine-tune and further time” feedback on FFGA develop project/pre-construction plans while awaiting FFGA approval. requirements, so grantee is aware of status and can quickly • An integrated case management system can be used to complete process any additional work documentation for FFGA as efficiently and effectively as possible to limit that may be required by any impacts to the alternative project delivery process due to FTA-specific DB/DBOM or CMGC as quickly requirements. as possible. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 41

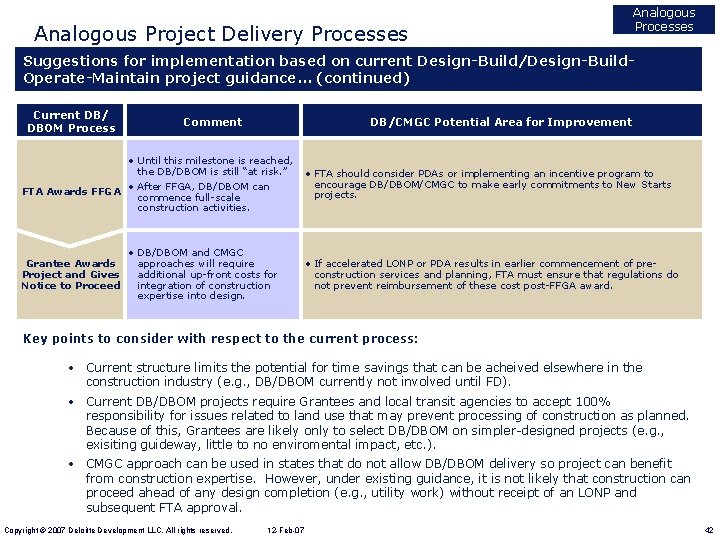

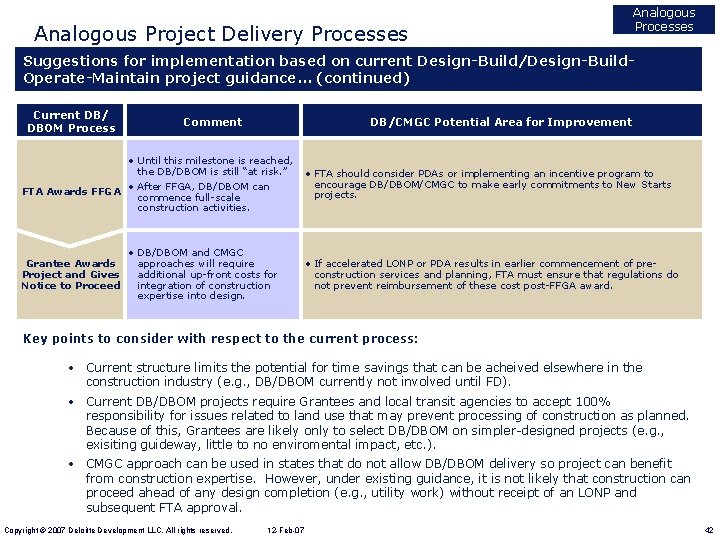

Analogous Project Delivery Processes Analogous Processes Suggestions for implementation based on current Design-Build/Design-Build. Operate-Maintain project guidance. . . (continued) Current DB/ DBOM Process Comment DB/CMGC Potential Area for Improvement • Until this milestone is reached, the DB/DBOM is still “at risk. ” • After FFGA, DB/DBOM can FTA Awards FFGA commence full-scale construction activities. Grantee Awards Project and Gives Notice to Proceed • DB/DBOM and CMGC approaches will require additional up-front costs for integration of construction expertise into design. • FTA should consider PDAs or implementing an incentive program to encourage DB/DBOM/CMGC to make early commitments to New Starts projects. • If accelerated LONP or PDA results in earlier commencement of preconstruction services and planning, FTA must ensure that regulations do not prevent reimbursement of these cost post-FFGA award. Key points to consider with respect to the current process: • Current structure limits the potential for time savings that can be acheived elsewhere in the construction industry (e. g. , DB/DBOM currently not involved until FD). • Current DB/DBOM projects require Grantees and local transit agencies to accept 100% responsibility for issues related to land use that may prevent processing of construction as planned. Because of this, Grantees are likely only to select DB/DBOM on simpler-designed projects (e. g. , exisiting guideway, little to no enviromental impact, etc. ). • CMGC approach can be used in states that do not allow DB/DBOM delivery so project can benefit from construction expertise. However, under existing guidance, it is not likely that construction can proceed ahead of any design completion (e. g. , utility work) without receipt of an LONP and subsequent FTA approval. Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 42

About Deloitte refers to one or more of Deloitte Touche Tohmatsu, a Swiss Verein, its member firms, and their respective subsidiaries and affiliates. Deloitte Touche Tohmatsu is an organization of member firms around the world devoted to excellence in providing professional services and advice, focused on client service through a global strategy executed locally in nearly 150 countries. With access to the deep intellectual capital of 120, 000 people worldwide, Deloitte delivers services in four professional areas — audit, tax, consulting, and financial advisory services — and serves more than one-half of the world’s largest companies, as well as large national enterprises, public institutions, locally important clients, and successful, fast-growing global growth companies. Services are not provided by the Deloitte Touche Tohmatsu Verein, and, for regulatory and other reasons, certain member firms do not provide services in all four professional areas. As a Swiss Verein (association), neither Deloitte Touche Tohmatsu nor any of its member firms has any liability for each other’s acts or omissions. Each of the member firms is a separate and independent legal entity operating under the names “Deloitte, ” “Deloitte & Touche, ” “Deloitte Touche Tohmatsu, ” or other related names. In the U. S. , Deloitte & Touche USA LLP is the member firm of Deloitte Touche Tohmatsu, and services are provided by the subsidiaries of Deloitte & Touche USA LLP (Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Tax LLP, and their subsidiaries) and not by Deloitte & Touche USA LLP. The subsidiaries of the U. S. member firm are among the nation’s leading professional services firms, providing audit, tax, consulting, and financial advisory services through nearly 30, 000 people in more than 80 cities. Known as employers of choice for innovative human resources programs, they are dedicated to helping their clients and their people excel. For more information, please visit the U. S. member firm’s website at www. deloitte. com/us. Member of Deloitte Touche Tohmatsu Copyright © 2007 Deloitte Development LLC. All rights reserved. 12 -Feb-07 43