3 Consolidated Financial StatementsDate of Acquisition Advanced Accounting

- Slides: 57

3 Consolidated Financial Statements—Date of Acquisition Advanced Accounting, Fifth Edition Slide 3 -1

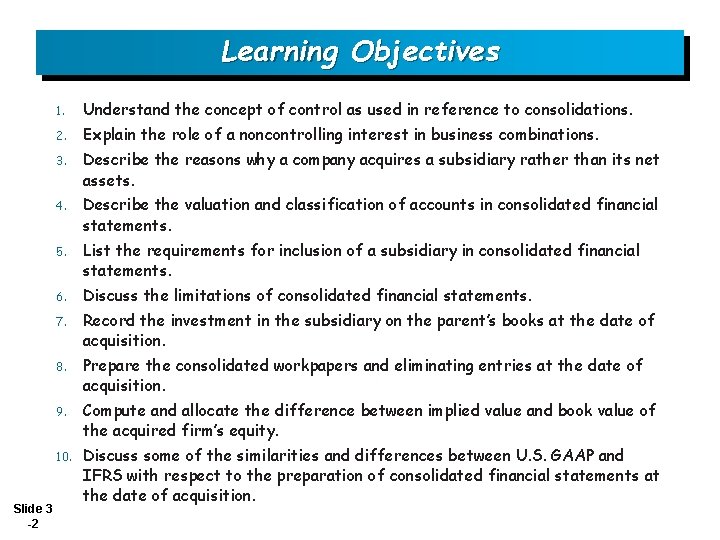

Learning Objectives Slide 3 -2 1. Understand the concept of control as used in reference to consolidations. 2. Explain the role of a noncontrolling interest in business combinations. 3. Describe the reasons why a company acquires a subsidiary rather than its net assets. 4. Describe the valuation and classification of accounts in consolidated financial statements. 5. List the requirements for inclusion of a subsidiary in consolidated financial statements. 6. Discuss the limitations of consolidated financial statements. 7. Record the investment in the subsidiary on the parent’s books at the date of acquisition. 8. Prepare the consolidated workpapers and eliminating entries at the date of acquisition. 9. Compute and allocate the difference between implied value and book value of the acquired firm’s equity. 10. Discuss some of the similarities and differences between U. S. GAAP and IFRS with respect to the preparation of consolidated financial statements at the date of acquisition.

Stock Acquisition Chapter Focus - Accounting for Stock Acquisitions When one company controls another company through direct or indirect ownership of its voting stock. Acquiring company referred to as the parent. Acquired company referred to as the subsidiary. Other shareholders considered noncontrolling interest. Parent records interest in subsidiary as an investment. If a subsidiary owns a controlling interest in one or more other companies, a chain of ownership is forged by which the parent company controls other companies. Slide 3 -3 LO 2 Noncontrolling interest (NCI).

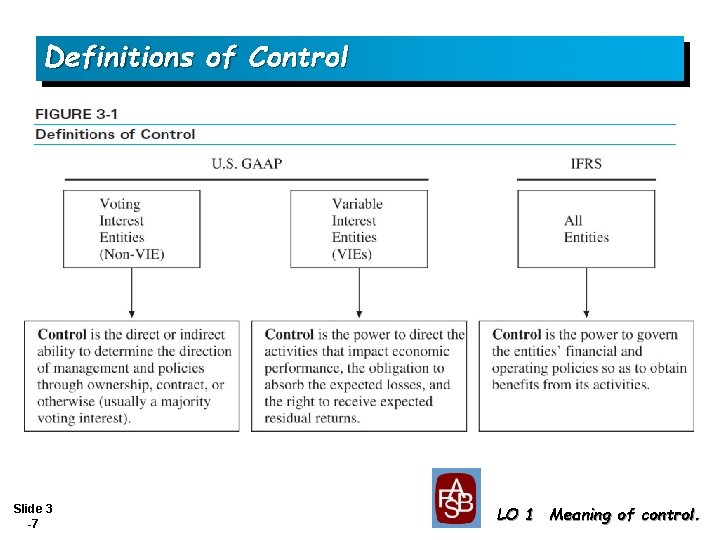

Definitions of Subsidiary and Control The Securities and Exchange Commission defines a subsidiary as an affiliate controlled by another entity, directly or indirectly, through one or more intermediaries. Control means the possession, direct or indirect, of the power to direct management and policies of another entity, whether through the ownership of voting shares, by contract, or otherwise. Slide 3 -4 LO 1 Meaning of control.

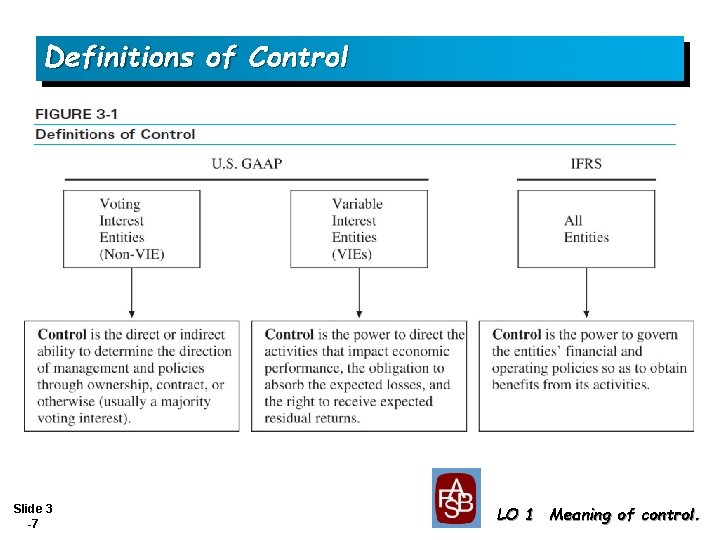

Definitions of Subsidiary and Control using U. S. GAAP: the direct or indirect ability to determine the direction of management and policies through ownership, contract, or otherwise FASB ASC paragraph 810 -10 -15 -8 states: the usual condition for a controlling financial interest is ownership of a majority voting interest Slide 3 -5 LO 1 Meaning of control.

Definitions of Subsidiary and Control However, application of the majority voting interest requirement may not identify the party with a controlling financial interest because the controlling financial interest may be achieved through arrangements that do not involve voting interests. The first step in determining whether the financial statements should be consolidated is to determine if the reporting entity has a variable interest in another entity, referred to as a potential variable interest entity (VIE). Slide 3 -6 LO 1 Meaning of control.

Definitions of Control Slide 3 -7 LO 1 Meaning of control.

Requirements for the Inclusion of Subsidiaries in the Consolidated Financial Statements Purpose of consolidated statements - to present the operating results and the financial position of a parent and all its subsidiaries as if they are one economic entity. Circumstances when majority-owned subsidiaries should be excluded from the consolidated statements: 1. Control does not rest with the majority owner. 2. Subsidiary operates under governmentally imposed uncertainty so severe as to raise significant doubt about the parent’s control. Slide 3 -8 LO 5 Requirements regarding consolidation of subsidiaries.

Reasons For Subsidiary Companies Advantages to acquiring a controlling interest in another company. 1. Stock acquisition is relatively simple. 2. Control of subsidiary can be accomplished with a smaller investment. 3. Separate legal existence of affiliates provides an element of protection of the parent’s assets. Slide 3 -9 LO 3 Acquiring assets or stock.

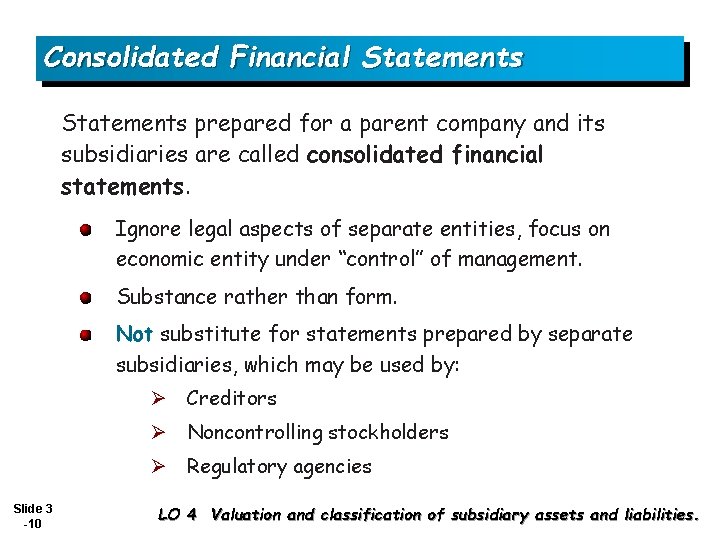

Consolidated Financial Statements prepared for a parent company and its subsidiaries are called consolidated financial statements. Ignore legal aspects of separate entities, focus on economic entity under “control” of management. Substance rather than form. Not substitute for statements prepared by separate subsidiaries, which may be used by: Ø Creditors Ø Noncontrolling stockholders Ø Regulatory agencies Slide 3 -10 LO 4 Valuation and classification of subsidiary assets and liabilities.

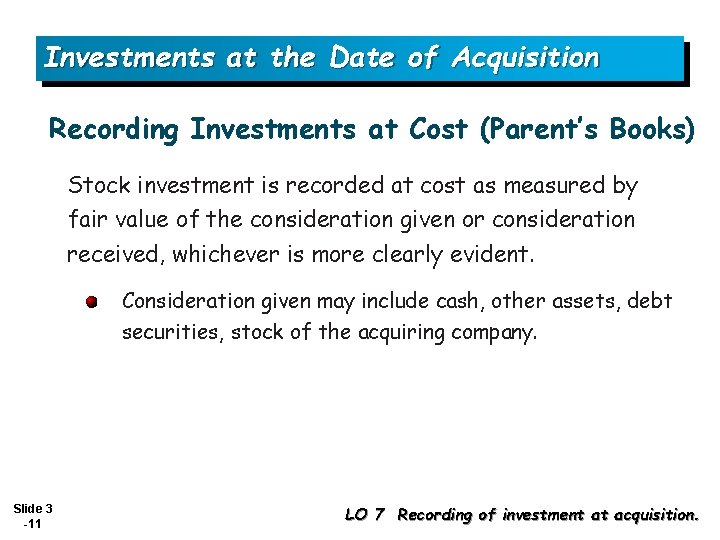

Investments at the Date of Acquisition Recording Investments at Cost (Parent’s Books) Stock investment is recorded at cost as measured by fair value of the consideration given or consideration received, whichever is more clearly evident. Consideration given may include cash, other assets, debt securities, stock of the acquiring company. Slide 3 -11 LO 7 Recording of investment at acquisition.

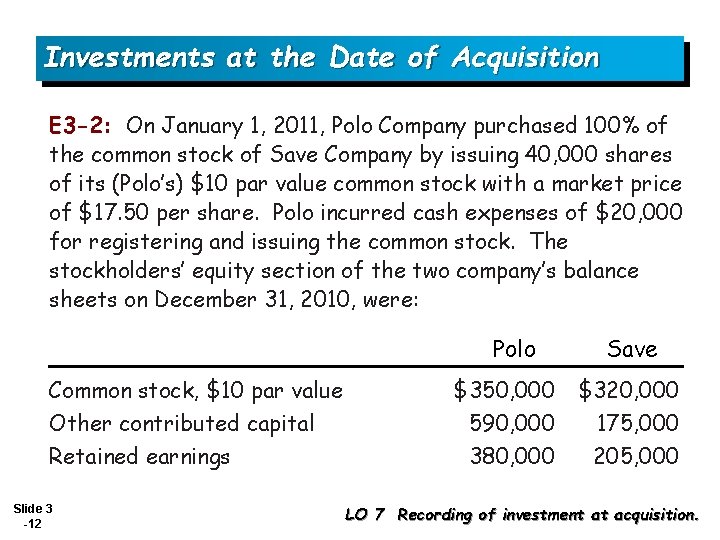

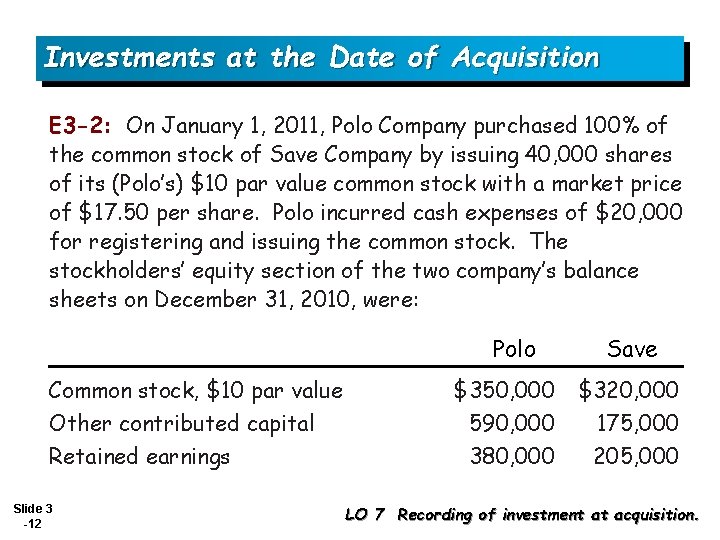

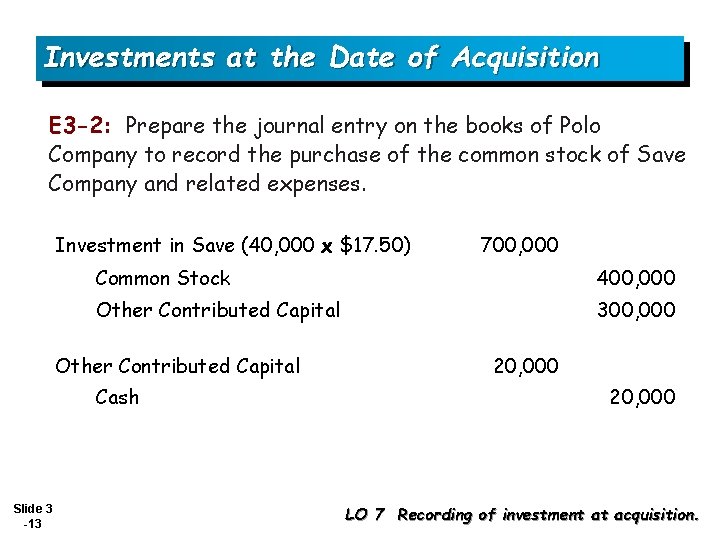

Investments at the Date of Acquisition E 3 -2: On January 1, 2011, Polo Company purchased 100% of the common stock of Save Company by issuing 40, 000 shares of its (Polo’s) $10 par value common stock with a market price of $17. 50 per share. Polo incurred cash expenses of $20, 000 for registering and issuing the common stock. The stockholders’ equity section of the two company’s balance sheets on December 31, 2010, were: Polo Common stock, $10 par value Other contributed capital Retained earnings Slide 3 -12 $350, 000 590, 000 380, 000 Save $320, 000 175, 000 205, 000 LO 7 Recording of investment at acquisition.

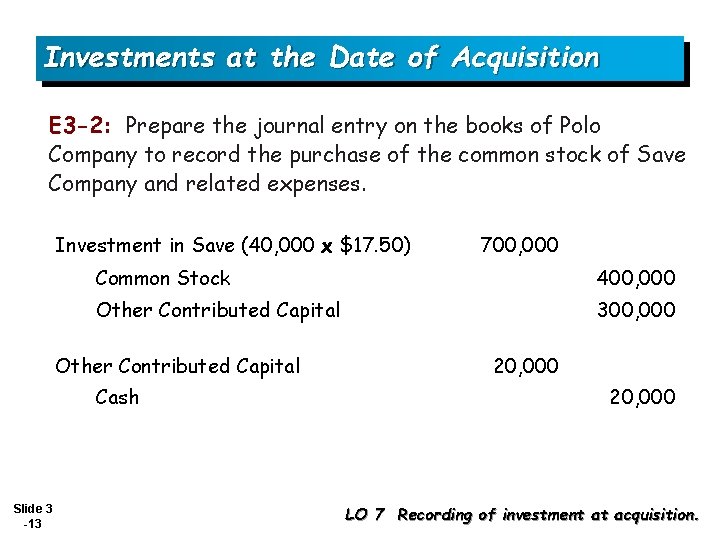

Investments at the Date of Acquisition E 3 -2: Prepare the journal entry on the books of Polo Company to record the purchase of the common stock of Save Company and related expenses. Investment in Save (40, 000 x $17. 50) Common Stock 400, 000 Other Contributed Capital 300, 000 Other Contributed Capital Cash Slide 3 -13 700, 000 20, 000 LO 7 Recording of investment at acquisition.

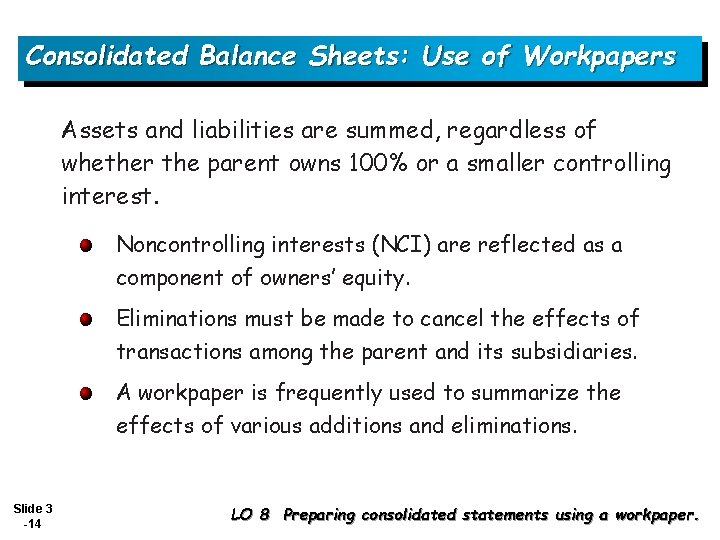

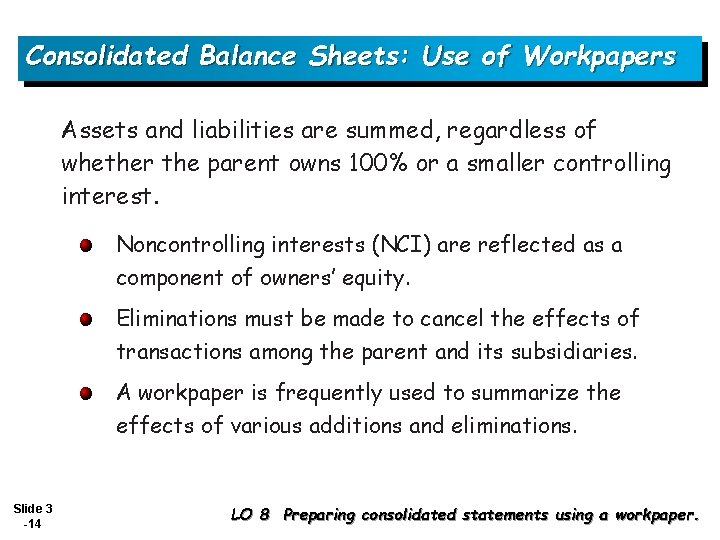

Consolidated Balance Sheets: Use of Workpapers Assets and liabilities are summed, regardless of whether the parent owns 100% or a smaller controlling interest. Noncontrolling interests (NCI) are reflected as a component of owners’ equity. Eliminations must be made to cancel the effects of transactions among the parent and its subsidiaries. A workpaper is frequently used to summarize the effects of various additions and eliminations. Slide 3 -14 LO 8 Preparing consolidated statements using a workpaper.

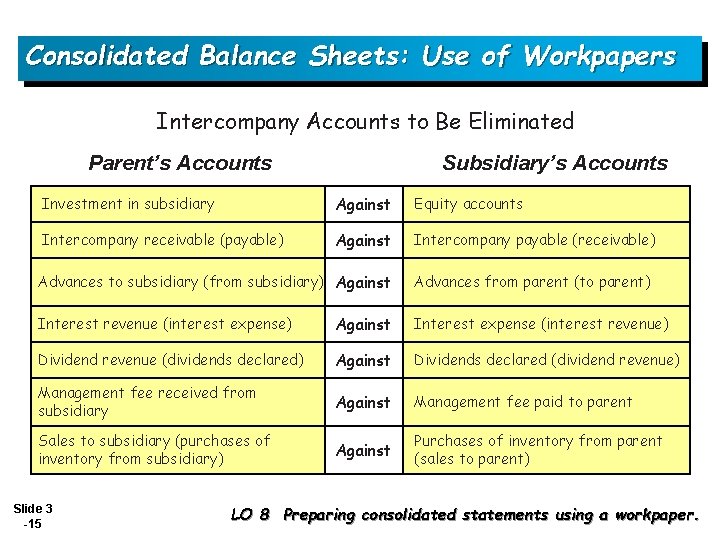

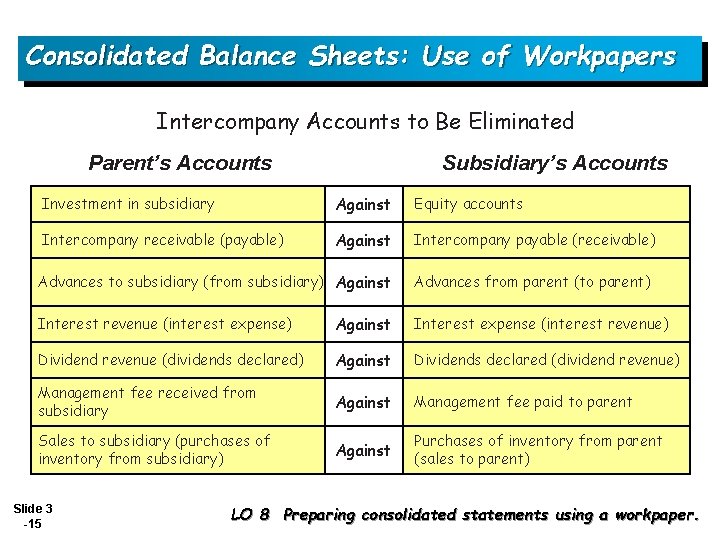

Consolidated Balance Sheets: Use of Workpapers Intercompany Accounts to Be Eliminated Parent’s Accounts Subsidiary’s Accounts Investment in subsidiary Against Equity accounts Intercompany receivable (payable) Against Intercompany payable (receivable) Advances to subsidiary (from subsidiary) Against Advances from parent (to parent) Interest revenue (interest expense) Against Interest expense (interest revenue) Dividend revenue (dividends declared) Against Dividends declared (dividend revenue) Management fee received from subsidiary Against Management fee paid to parent Sales to subsidiary (purchases of inventory from subsidiary) Against Purchases of inventory from parent (sales to parent) Slide 3 -15 LO 8 Preparing consolidated statements using a workpaper.

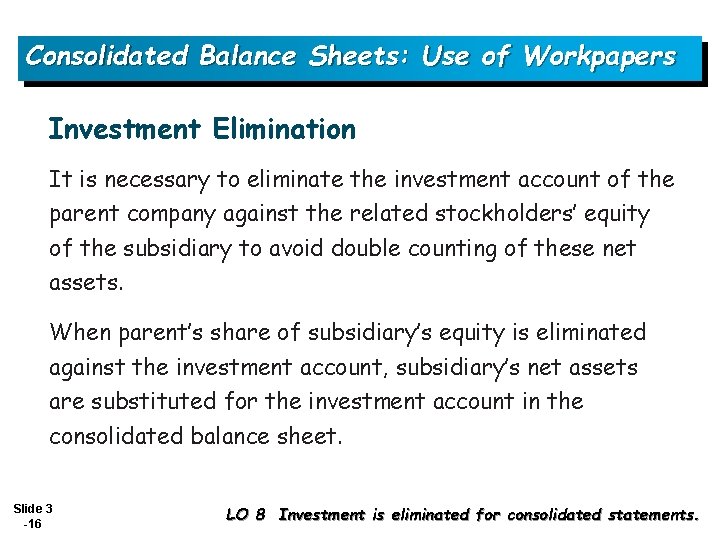

Consolidated Balance Sheets: Use of Workpapers Investment Elimination It is necessary to eliminate the investment account of the parent company against the related stockholders’ equity of the subsidiary to avoid double counting of these net assets. When parent’s share of subsidiary’s equity is eliminated against the investment account, subsidiary’s net assets are substituted for the investment account in the consolidated balance sheet. Slide 3 -16 LO 8 Investment is eliminated for consolidated statements.

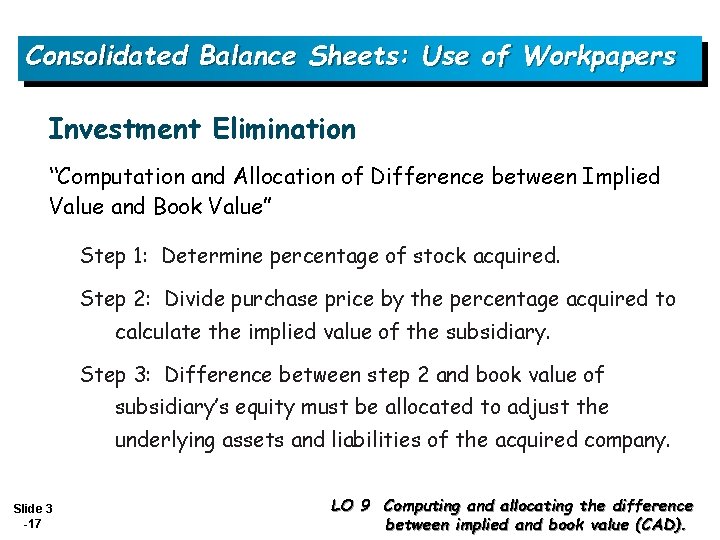

Consolidated Balance Sheets: Use of Workpapers Investment Elimination “Computation and Allocation of Difference between Implied Value and Book Value” Step 1: Determine percentage of stock acquired. Step 2: Divide purchase price by the percentage acquired to calculate the implied value of the subsidiary. Step 3: Difference between step 2 and book value of subsidiary’s equity must be allocated to adjust the underlying assets and liabilities of the acquired company. Slide 3 -17 LO 9 Computing and allocating the difference between implied and book value (CAD).

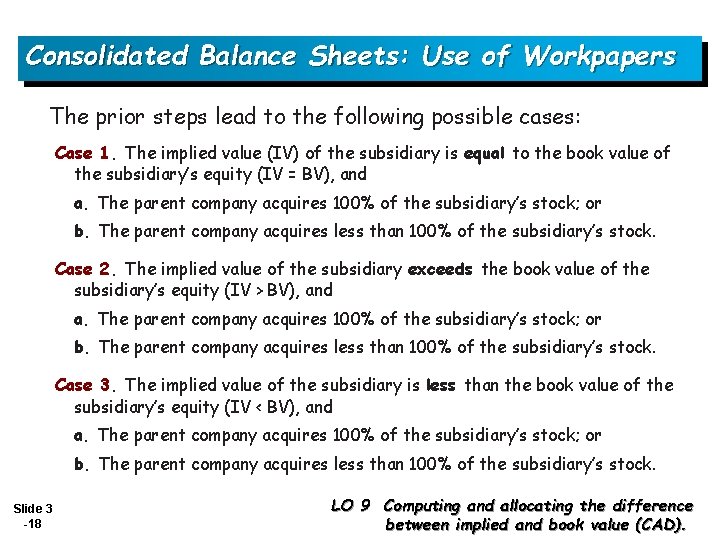

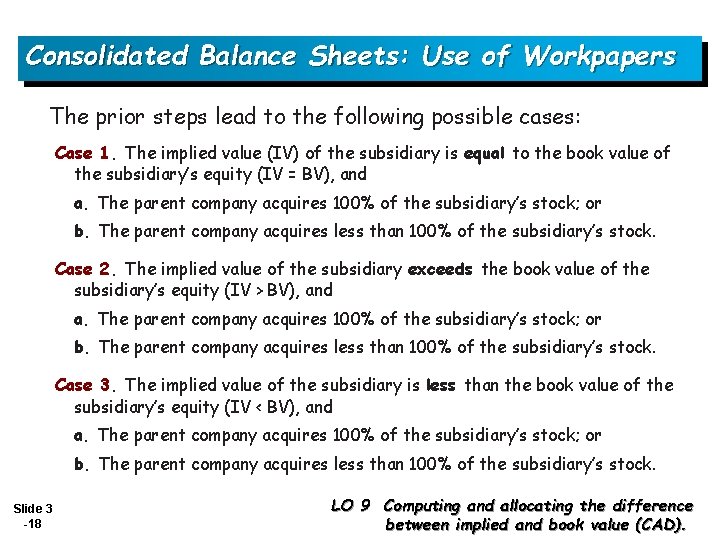

Consolidated Balance Sheets: Use of Workpapers The prior steps lead to the following possible cases: Case 1. The implied value (IV) of the subsidiary is equal to the book value of the subsidiary’s equity (IV = BV), and a. The parent company acquires 100% of the subsidiary’s stock; or b. The parent company acquires less than 100% of the subsidiary’s stock. Case 2. The implied value of the subsidiary exceeds the book value of the subsidiary’s equity (IV > BV), and a. The parent company acquires 100% of the subsidiary’s stock; or b. The parent company acquires less than 100% of the subsidiary’s stock. Case 3. The implied value of the subsidiary is less than the book value of the subsidiary’s equity (IV < BV), and a. The parent company acquires 100% of the subsidiary’s stock; or b. The parent company acquires less than 100% of the subsidiary’s stock. Slide 3 -18 LO 9 Computing and allocating the difference between implied and book value (CAD).

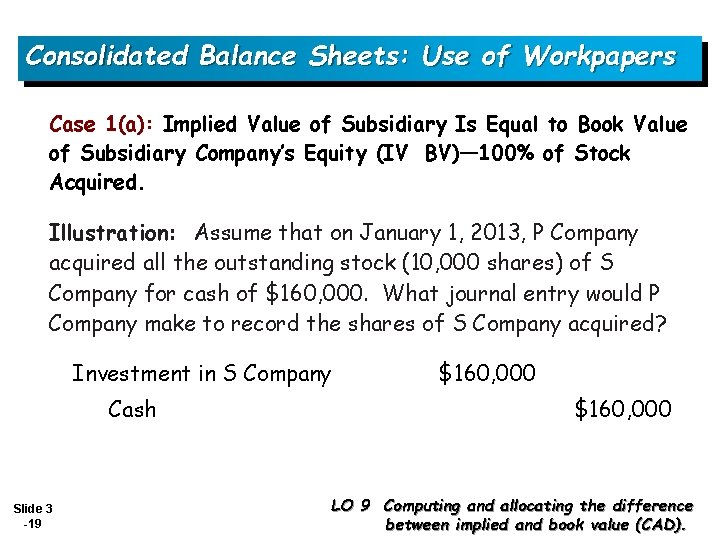

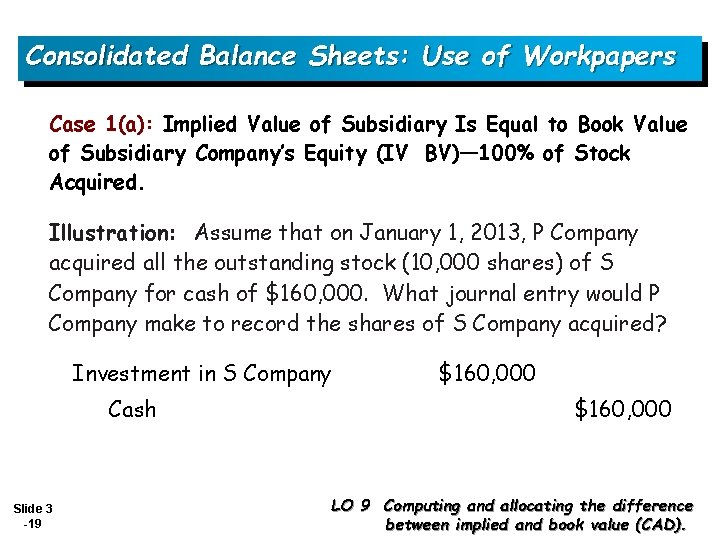

Consolidated Balance Sheets: Use of Workpapers Case 1(a): Implied Value of Subsidiary Is Equal to Book Value of Subsidiary Company’s Equity (IV BV)— 100% of Stock Acquired. Illustration: Assume that on January 1, 2013, P Company acquired all the outstanding stock (10, 000 shares) of S Company for cash of $160, 000. What journal entry would P Company make to record the shares of S Company acquired? Investment in S Company Cash Slide 3 -19 $160, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

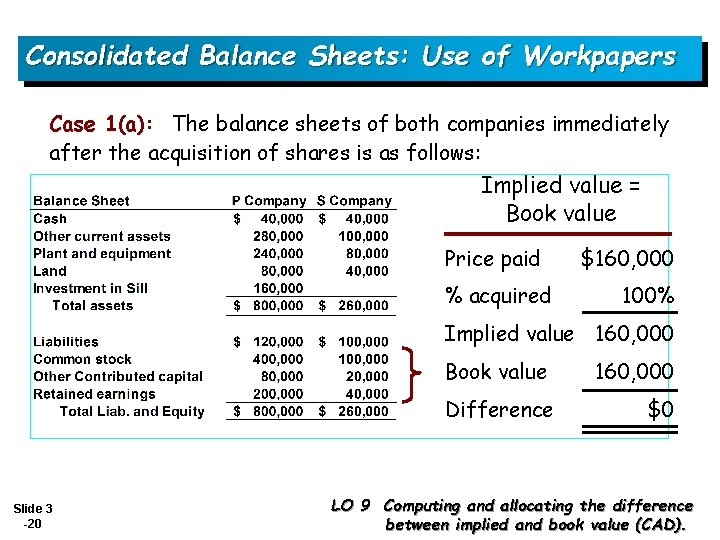

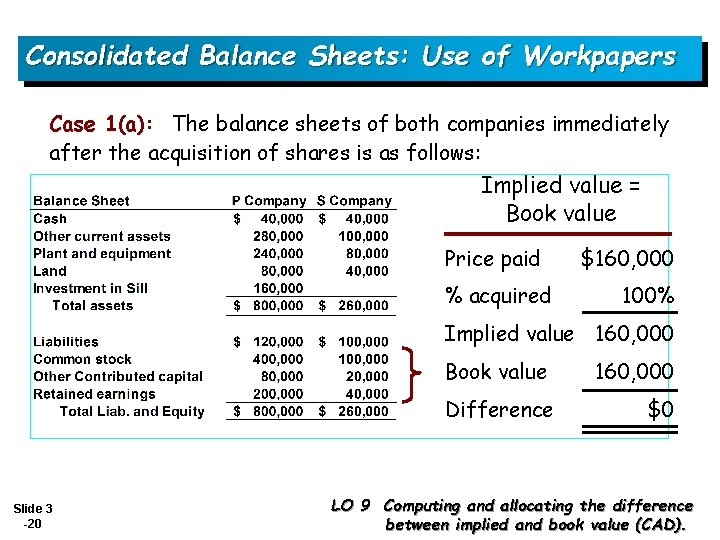

Consolidated Balance Sheets: Use of Workpapers Case 1(a): The balance sheets of both companies immediately after the acquisition of shares is as follows: Implied value = Book value Price paid % acquired $160, 000 100% Implied value 160, 000 Book value Difference Slide 3 -20 160, 000 $0 LO 9 Computing and allocating the difference between implied and book value (CAD).

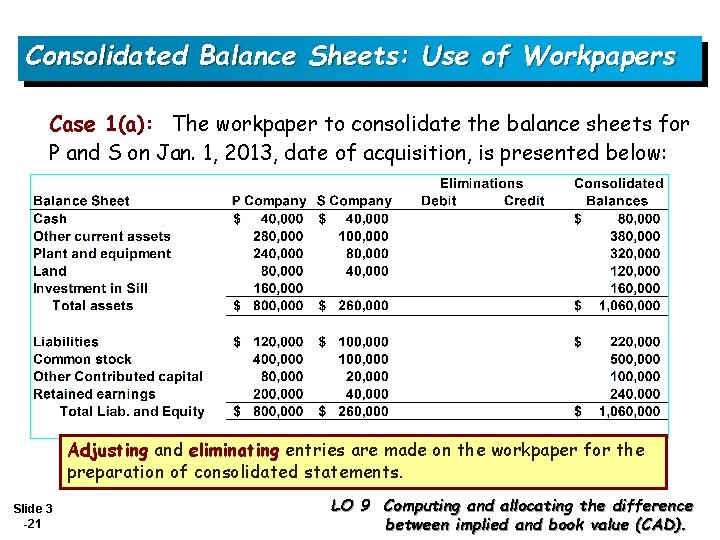

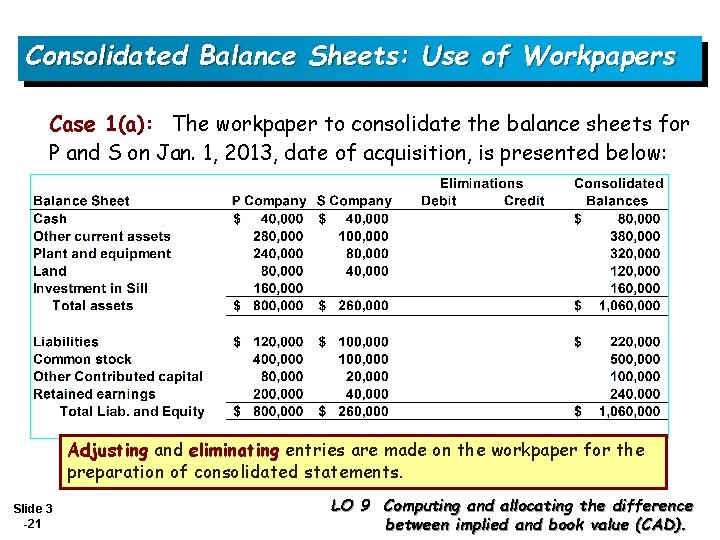

Consolidated Balance Sheets: Use of Workpapers Case 1(a): The workpaper to consolidate the balance sheets for P and S on Jan. 1, 2013, date of acquisition, is presented below: Adjusting and eliminating entries are made on the workpaper for the preparation of consolidated statements. Slide 3 -21 LO 9 Computing and allocating the difference between implied and book value (CAD).

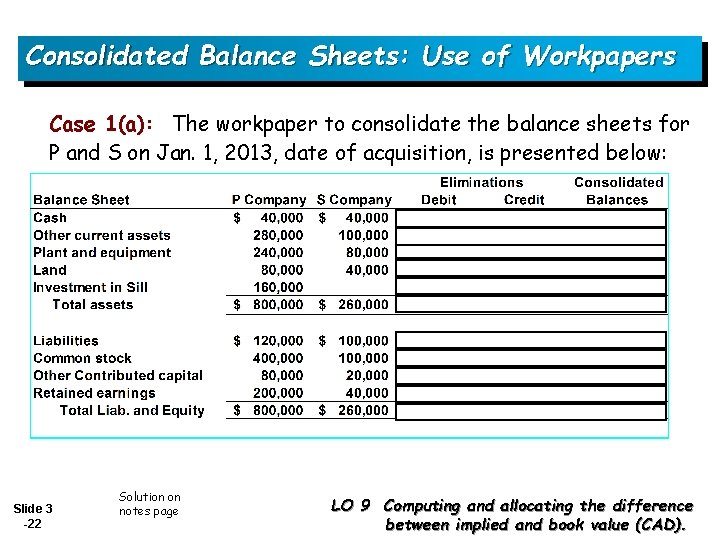

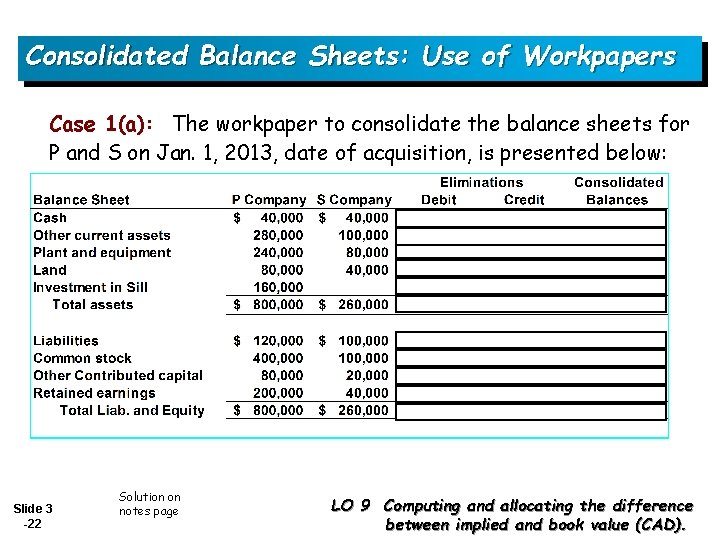

Consolidated Balance Sheets: Use of Workpapers Case 1(a): The workpaper to consolidate the balance sheets for P and S on Jan. 1, 2013, date of acquisition, is presented below: Slide 3 -22 Solution on notes page LO 9 Computing and allocating the difference between implied and book value (CAD).

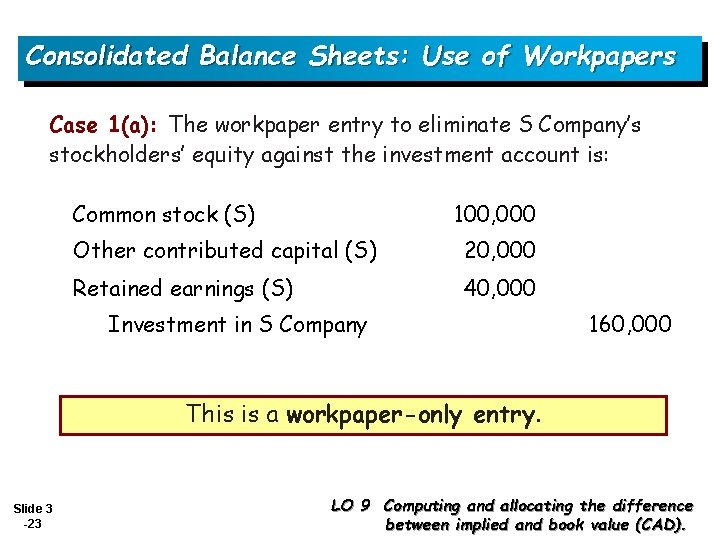

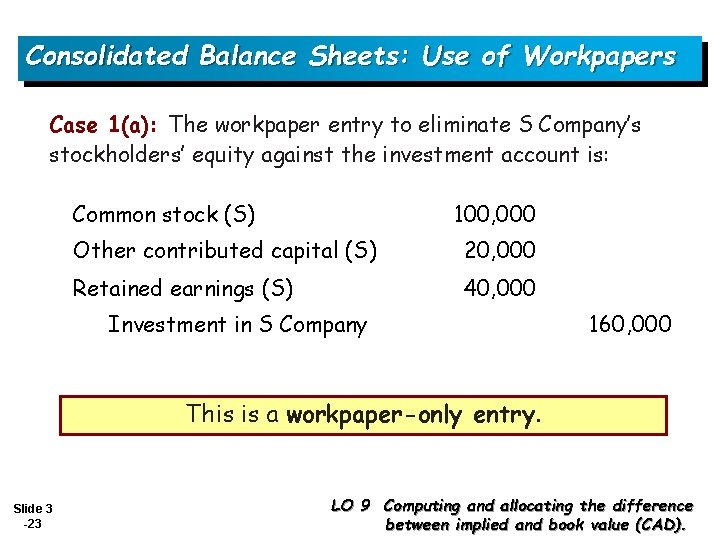

Consolidated Balance Sheets: Use of Workpapers Case 1(a): The workpaper entry to eliminate S Company’s stockholders’ equity against the investment account is: Common stock (S) 100, 000 Other contributed capital (S) 20, 000 Retained earnings (S) 40, 000 Investment in S Company 160, 000 This is a workpaper-only entry. Slide 3 -23 LO 9 Computing and allocating the difference between implied and book value (CAD).

Consolidated Balance Sheets: Use of Workpapers Case 1(a): Note the following on the workpaper. 1. The investment account and related subsidiary’s stockholders’ equity have been eliminated and the subsidiary’s net assets substituted for the investment account. 2. Consolidated assets and liabilities consist of the sum of the parent and subsidiary assets and liabilities in each classification. 3. Consolidated stockholders’ equity is the same as the parent company’s stockholders’ equity. Slide 3 -24 LO 9 Computing and allocating the difference between implied and book value (CAD).

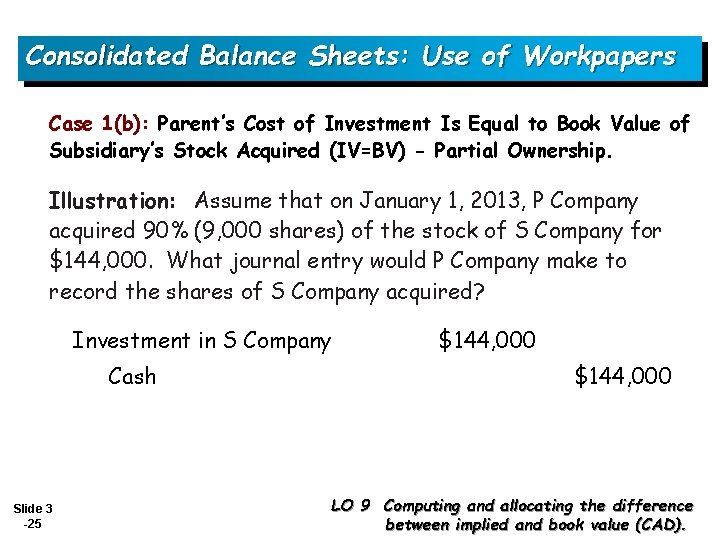

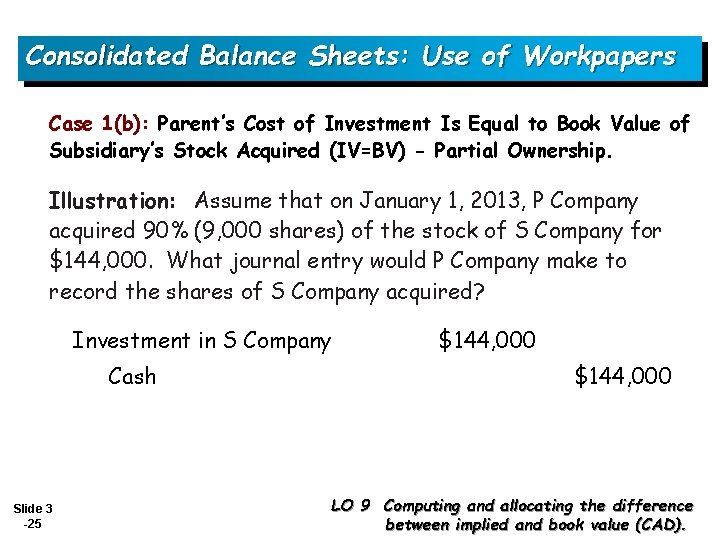

Consolidated Balance Sheets: Use of Workpapers Case 1(b): Parent’s Cost of Investment Is Equal to Book Value of Subsidiary’s Stock Acquired (IV=BV) - Partial Ownership. Illustration: Assume that on January 1, 2013, P Company acquired 90% (9, 000 shares) of the stock of S Company for $144, 000. What journal entry would P Company make to record the shares of S Company acquired? Investment in S Company Cash Slide 3 -25 $144, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

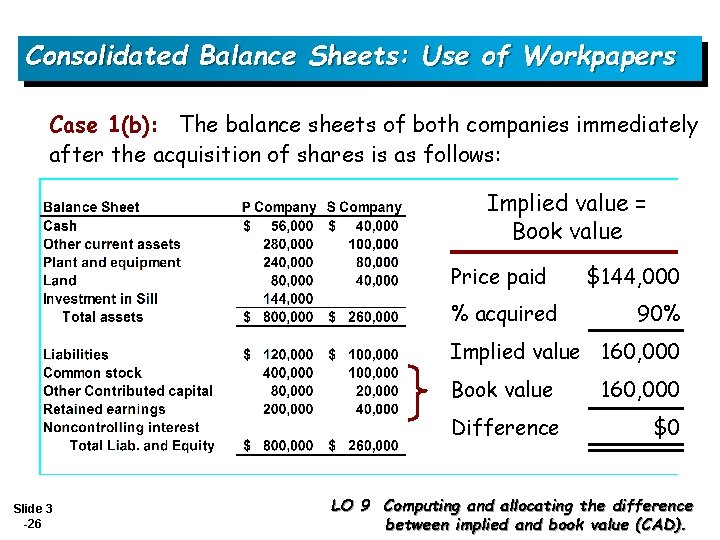

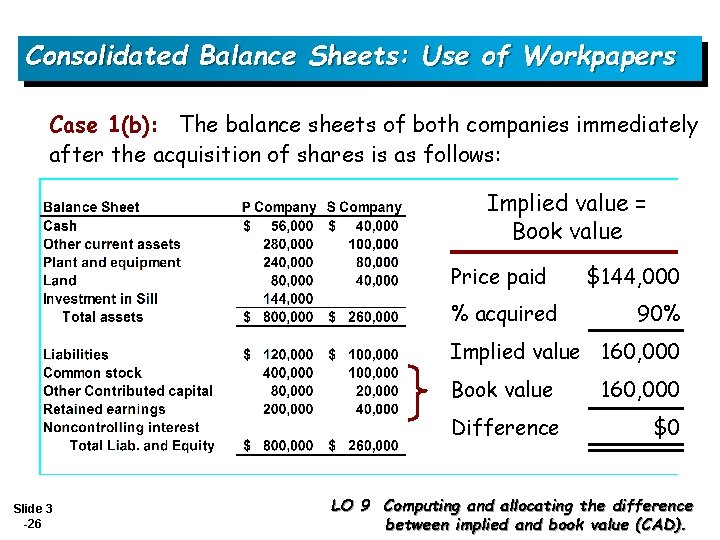

Consolidated Balance Sheets: Use of Workpapers Case 1(b): The balance sheets of both companies immediately after the acquisition of shares is as follows: Implied value = Book value Price paid % acquired $144, 000 90% Implied value 160, 000 Book value Difference Slide 3 -26 160, 000 $0 LO 9 Computing and allocating the difference between implied and book value (CAD).

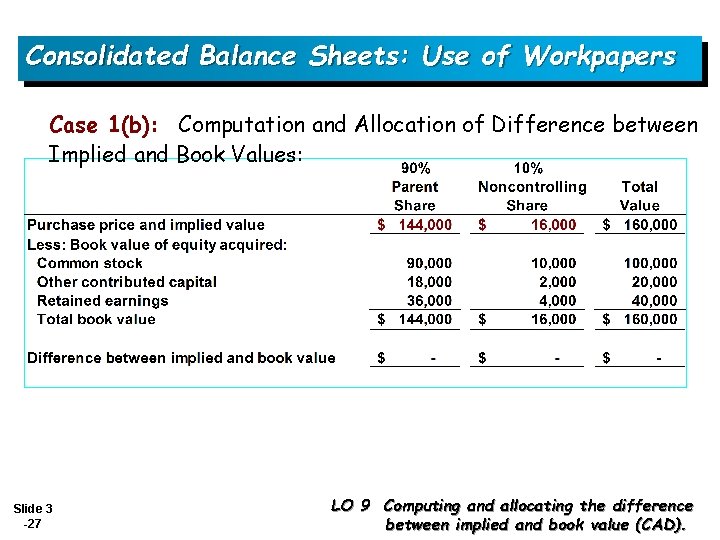

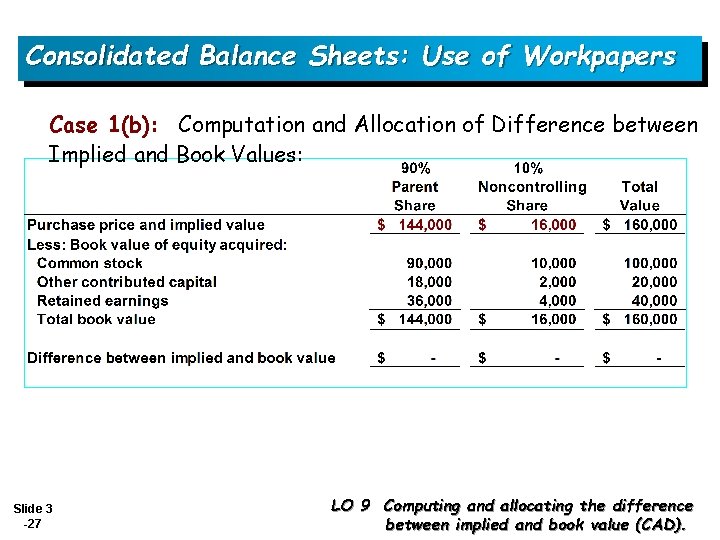

Consolidated Balance Sheets: Use of Workpapers Case 1(b): Computation and Allocation of Difference between Implied and Book Values: Slide 3 -27 LO 9 Computing and allocating the difference between implied and book value (CAD).

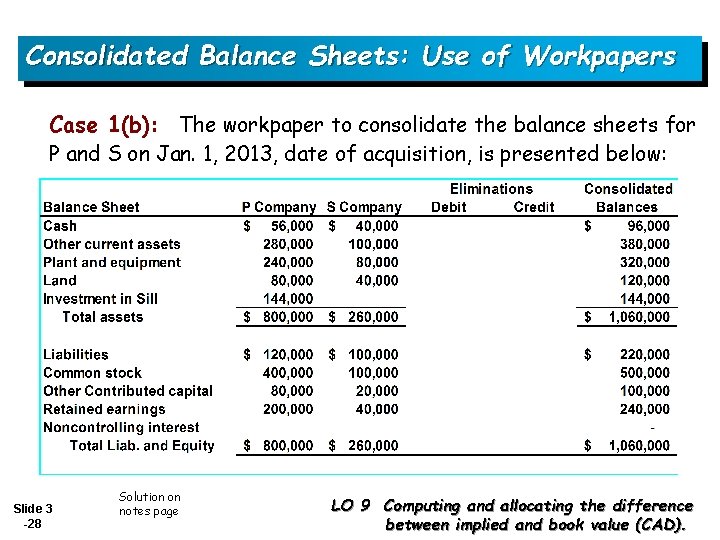

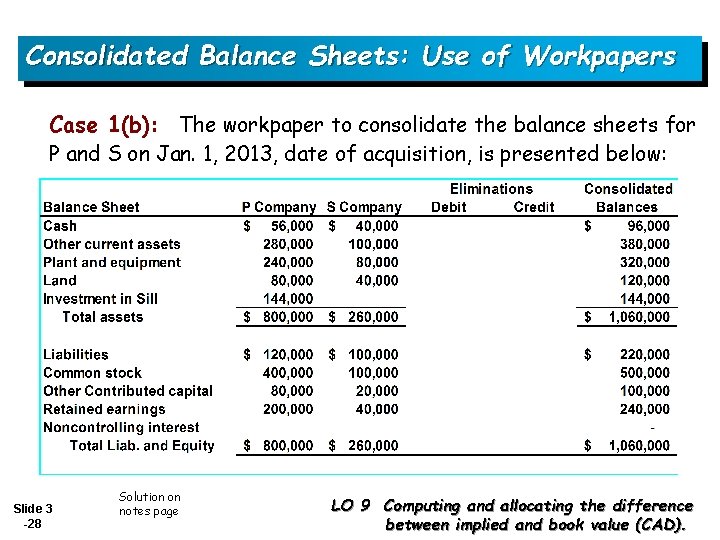

Consolidated Balance Sheets: Use of Workpapers Case 1(b): The workpaper to consolidate the balance sheets for P and S on Jan. 1, 2013, date of acquisition, is presented below: Slide 3 -28 Solution on notes page LO 9 Computing and allocating the difference between implied and book value (CAD).

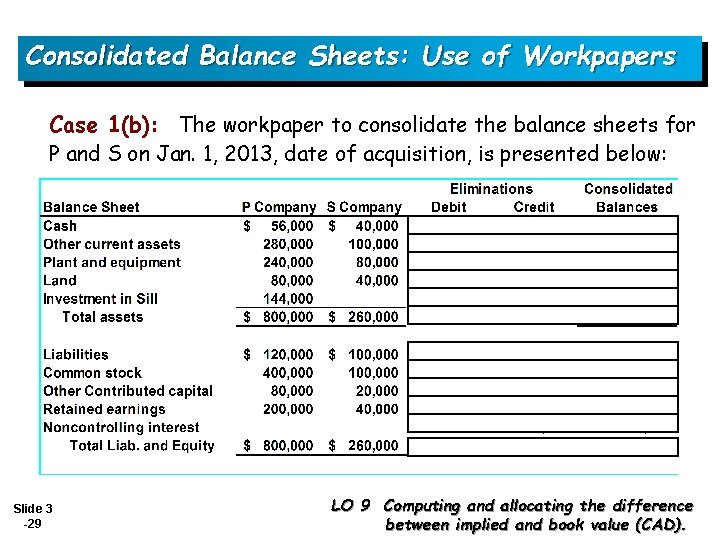

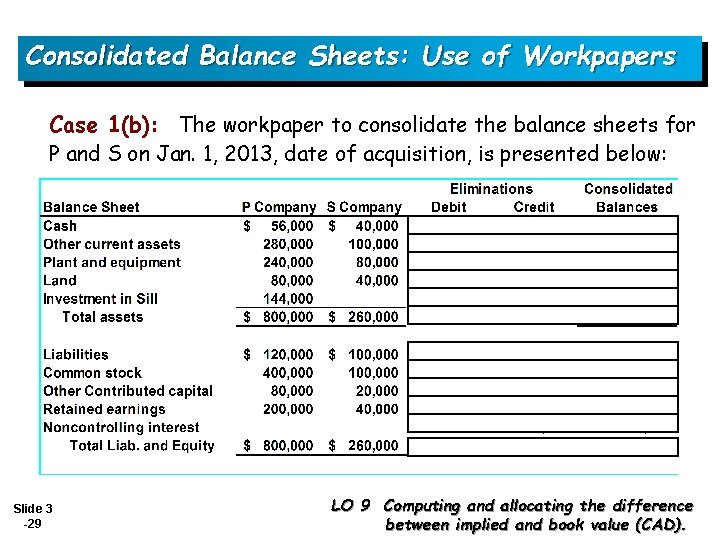

Consolidated Balance Sheets: Use of Workpapers Case 1(b): The workpaper to consolidate the balance sheets for P and S on Jan. 1, 2013, date of acquisition, is presented below: Slide 3 -29 LO 9 Computing and allocating the difference between implied and book value (CAD).

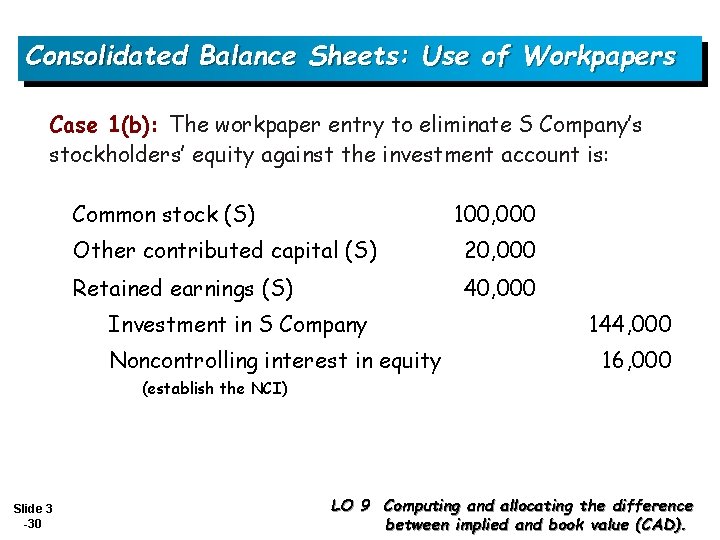

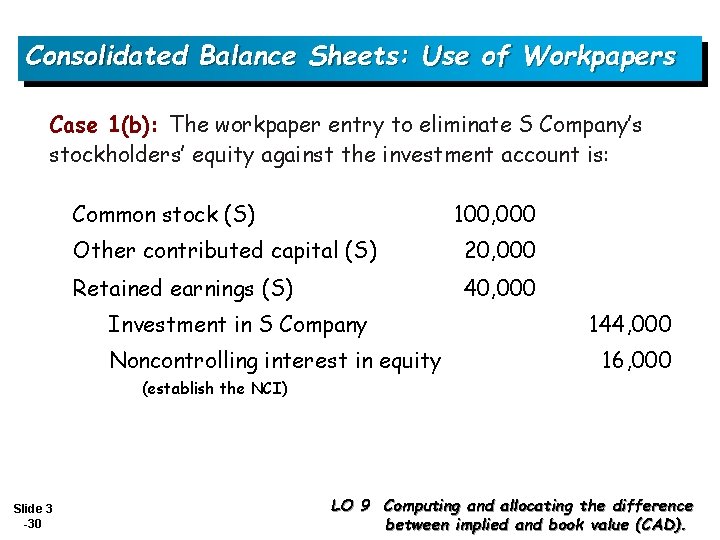

Consolidated Balance Sheets: Use of Workpapers Case 1(b): The workpaper entry to eliminate S Company’s stockholders’ equity against the investment account is: Common stock (S) 100, 000 Other contributed capital (S) 20, 000 Retained earnings (S) 40, 000 Investment in S Company Noncontrolling interest in equity 144, 000 16, 000 (establish the NCI) Slide 3 -30 LO 9 Computing and allocating the difference between implied and book value (CAD).

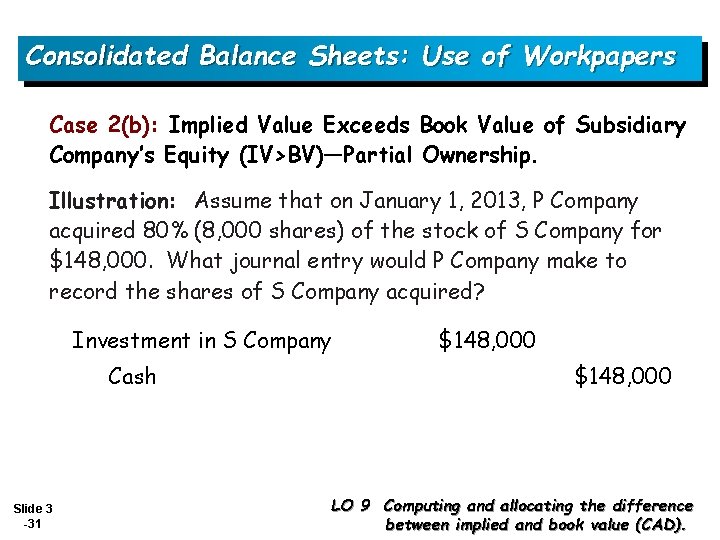

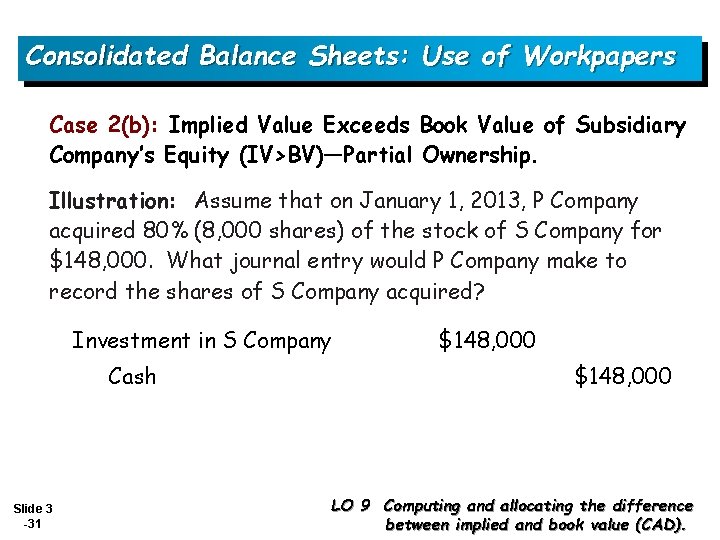

Consolidated Balance Sheets: Use of Workpapers Case 2(b): Implied Value Exceeds Book Value of Subsidiary Company’s Equity (IV>BV)—Partial Ownership. Illustration: Assume that on January 1, 2013, P Company acquired 80% (8, 000 shares) of the stock of S Company for $148, 000. What journal entry would P Company make to record the shares of S Company acquired? Investment in S Company Cash Slide 3 -31 $148, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

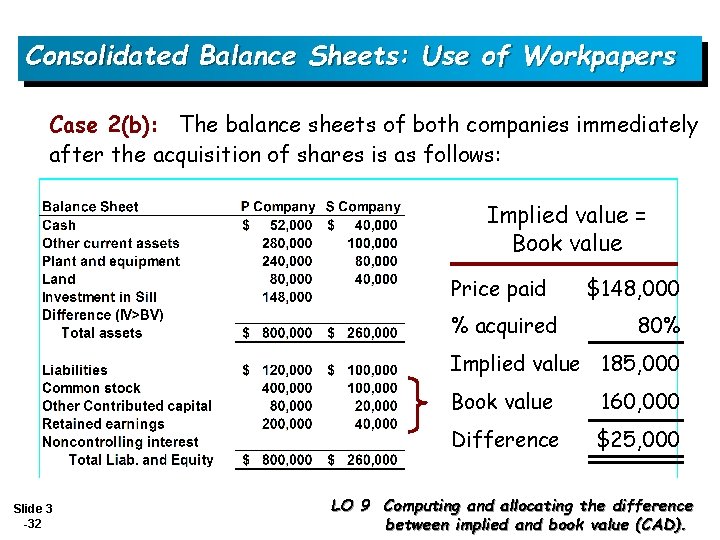

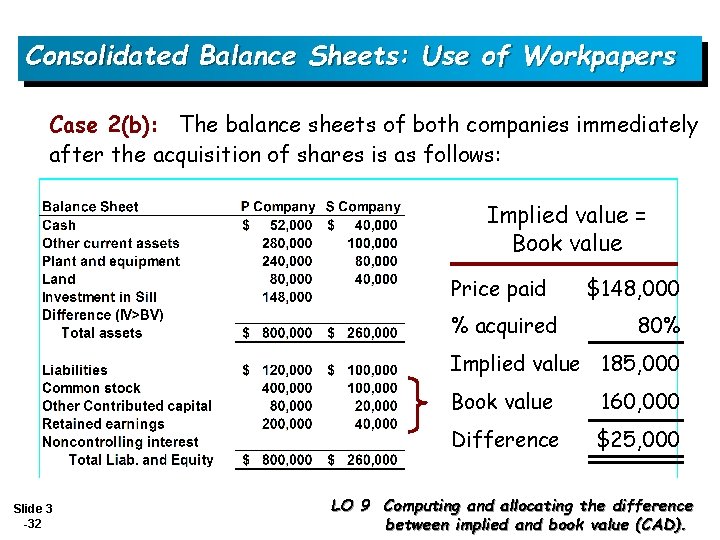

Consolidated Balance Sheets: Use of Workpapers Case 2(b): The balance sheets of both companies immediately after the acquisition of shares is as follows: Implied value = Book value Price paid % acquired $148, 000 80% Implied value 185, 000 Slide 3 -32 Book value 160, 000 Difference $25, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

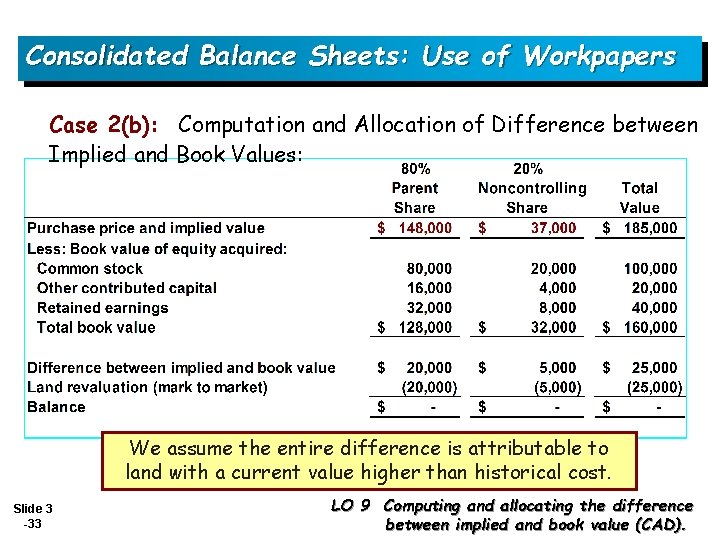

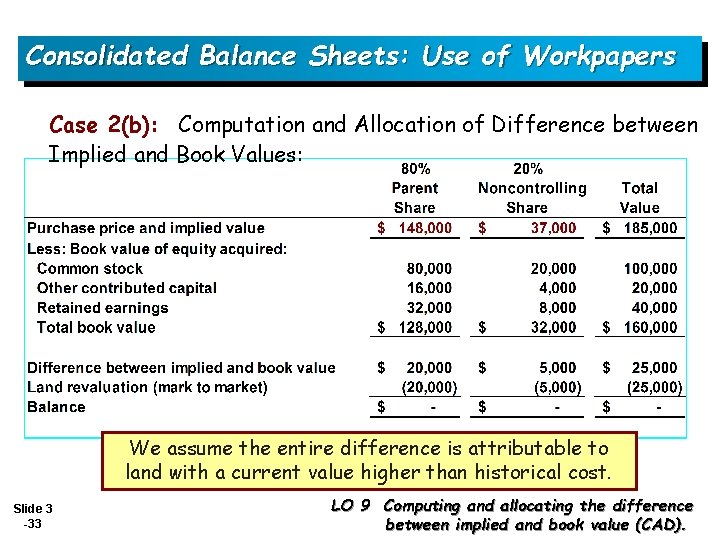

Consolidated Balance Sheets: Use of Workpapers Case 2(b): Computation and Allocation of Difference between Implied and Book Values: We assume the entire difference is attributable to land with a current value higher than historical cost. Slide 3 -33 LO 9 Computing and allocating the difference between implied and book value (CAD).

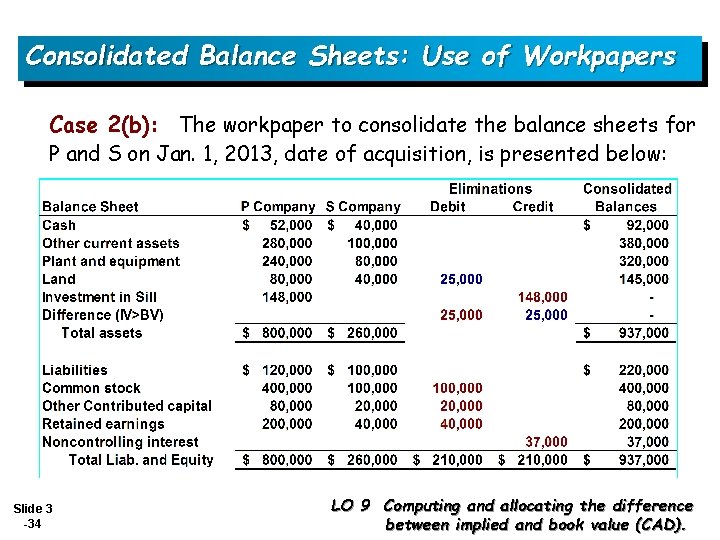

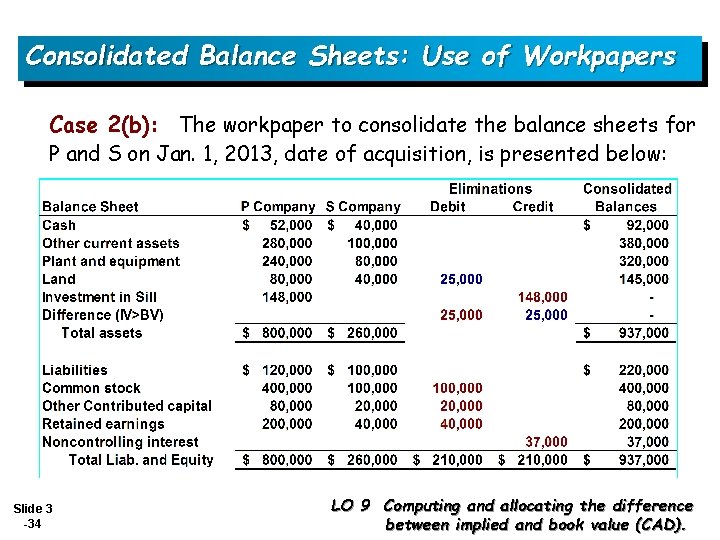

Consolidated Balance Sheets: Use of Workpapers Case 2(b): The workpaper to consolidate the balance sheets for P and S on Jan. 1, 2013, date of acquisition, is presented below: Slide 3 -34 LO 9 Computing and allocating the difference between implied and book value (CAD).

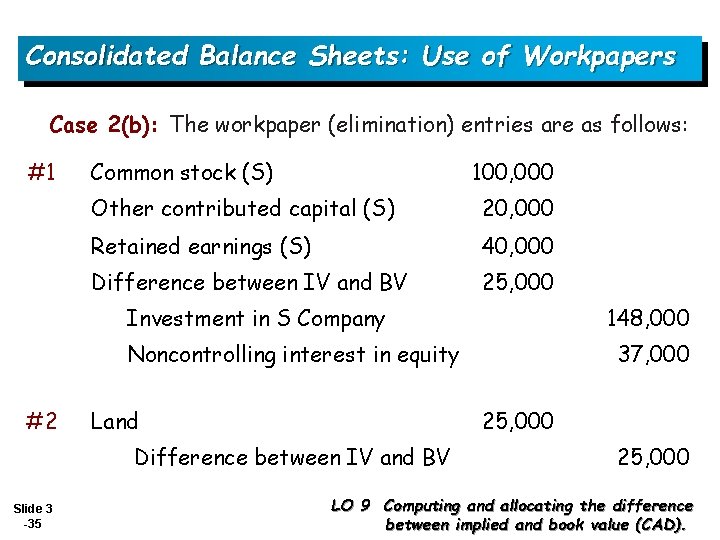

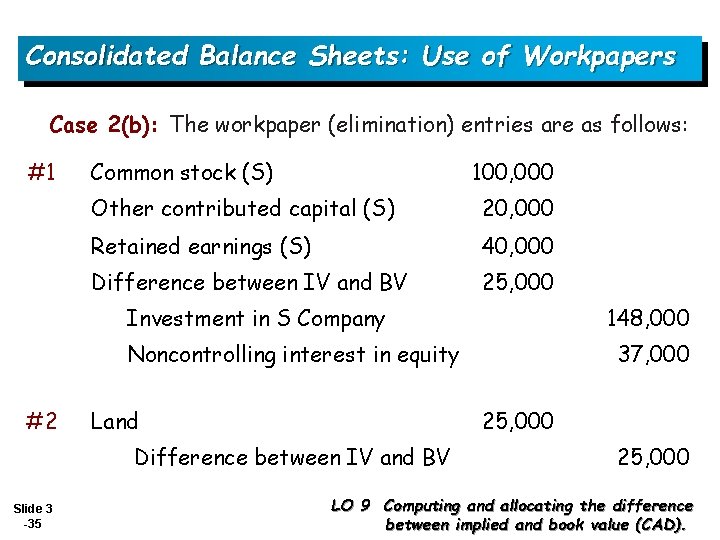

Consolidated Balance Sheets: Use of Workpapers Case 2(b): The workpaper (elimination) entries are as follows: #1 Common stock (S) 100, 000 Other contributed capital (S) 20, 000 Retained earnings (S) 40, 000 Difference between IV and BV 25, 000 Investment in S Company 148, 000 Noncontrolling interest in equity #2 Land 25, 000 Difference between IV and BV Slide 3 -35 37, 000 25, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

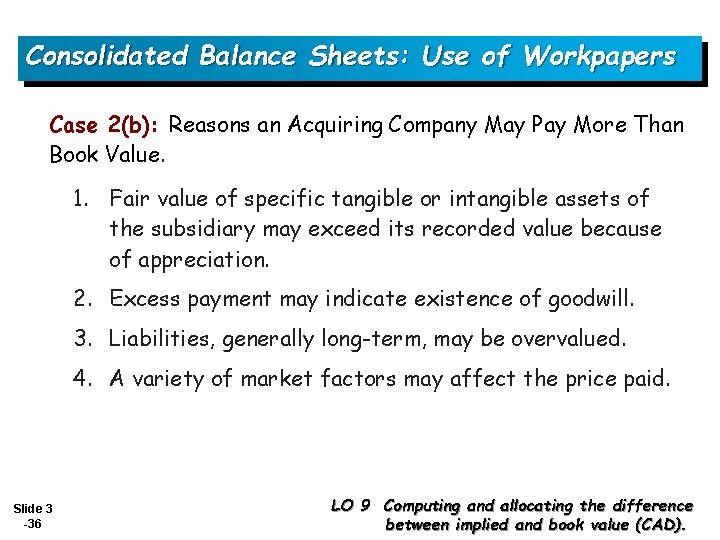

Consolidated Balance Sheets: Use of Workpapers Case 2(b): Reasons an Acquiring Company May Pay More Than Book Value. 1. Fair value of specific tangible or intangible assets of the subsidiary may exceed its recorded value because of appreciation. 2. Excess payment may indicate existence of goodwill. 3. Liabilities, generally long-term, may be overvalued. 4. A variety of market factors may affect the price paid. Slide 3 -36 LO 9 Computing and allocating the difference between implied and book value (CAD).

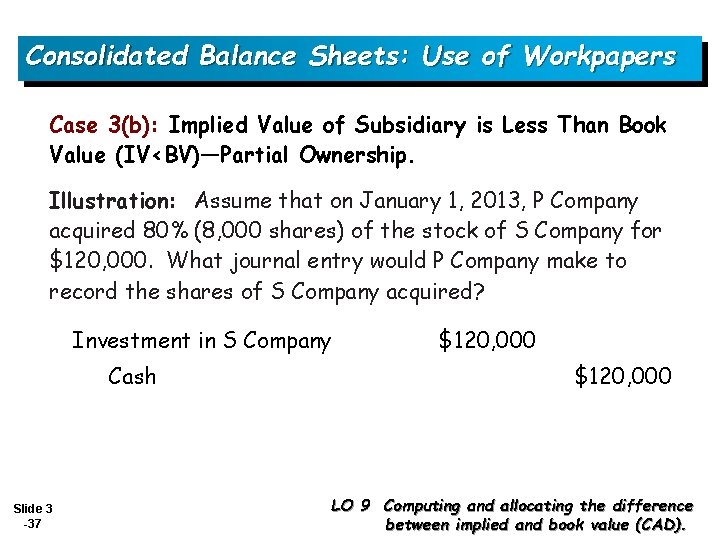

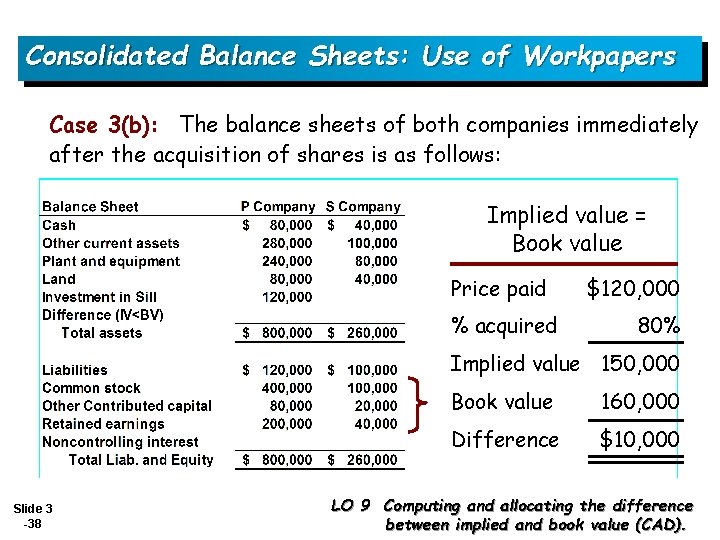

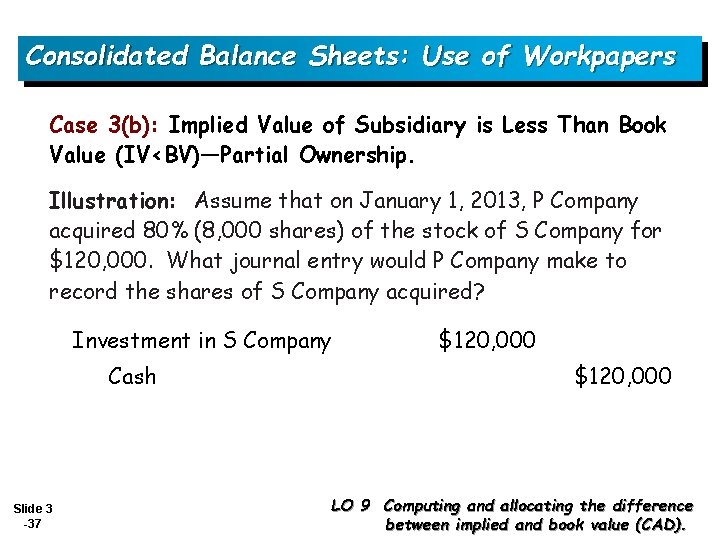

Consolidated Balance Sheets: Use of Workpapers Case 3(b): Implied Value of Subsidiary is Less Than Book Value (IV<BV)—Partial Ownership. Illustration: Assume that on January 1, 2013, P Company acquired 80% (8, 000 shares) of the stock of S Company for $120, 000. What journal entry would P Company make to record the shares of S Company acquired? Investment in S Company Cash Slide 3 -37 $120, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

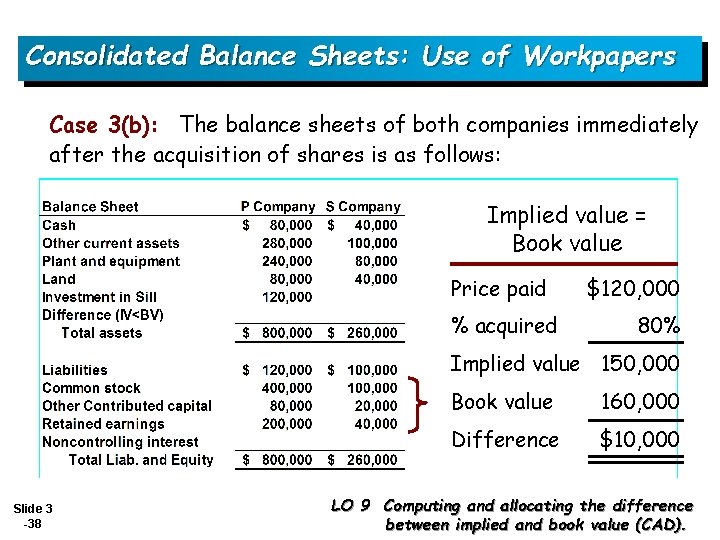

Consolidated Balance Sheets: Use of Workpapers Case 3(b): The balance sheets of both companies immediately after the acquisition of shares is as follows: Implied value = Book value Price paid % acquired $120, 000 80% Implied value 150, 000 Slide 3 -38 Book value 160, 000 Difference $10, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

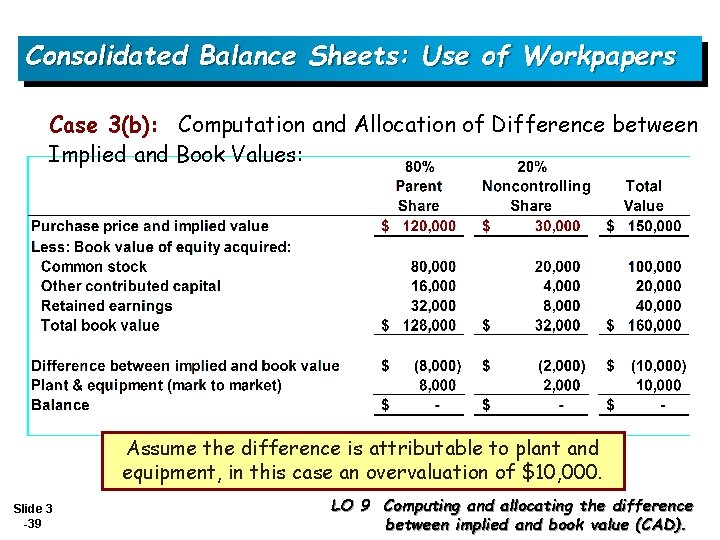

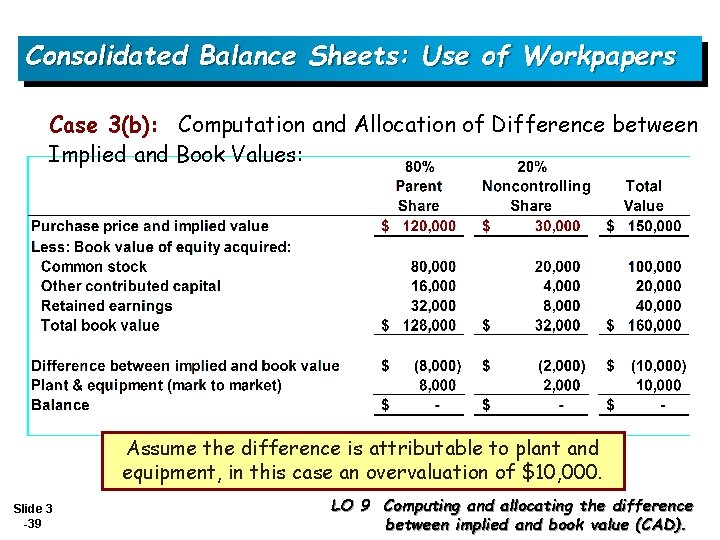

Consolidated Balance Sheets: Use of Workpapers Case 3(b): Computation and Allocation of Difference between Implied and Book Values: Assume the difference is attributable to plant and equipment, in this case an overvaluation of $10, 000. Slide 3 -39 LO 9 Computing and allocating the difference between implied and book value (CAD).

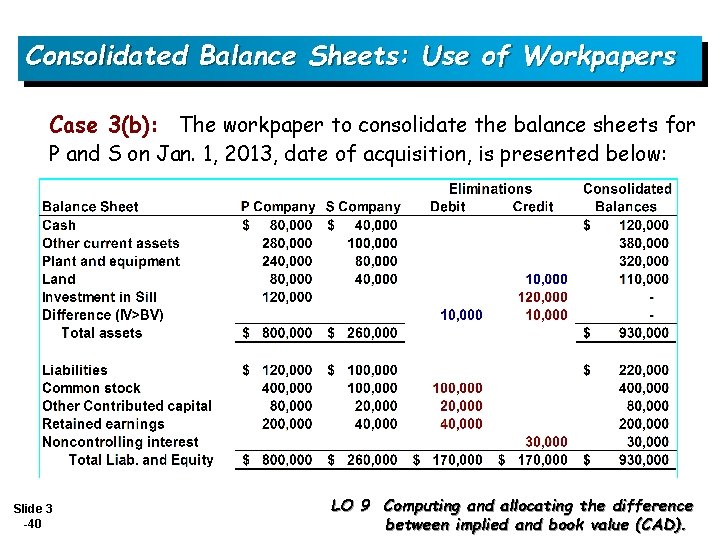

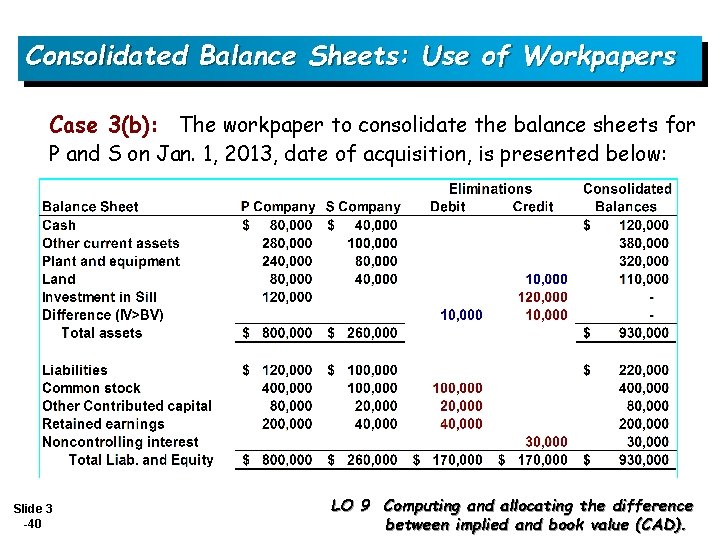

Consolidated Balance Sheets: Use of Workpapers Case 3(b): The workpaper to consolidate the balance sheets for P and S on Jan. 1, 2013, date of acquisition, is presented below: Slide 3 -40 LO 9 Computing and allocating the difference between implied and book value (CAD).

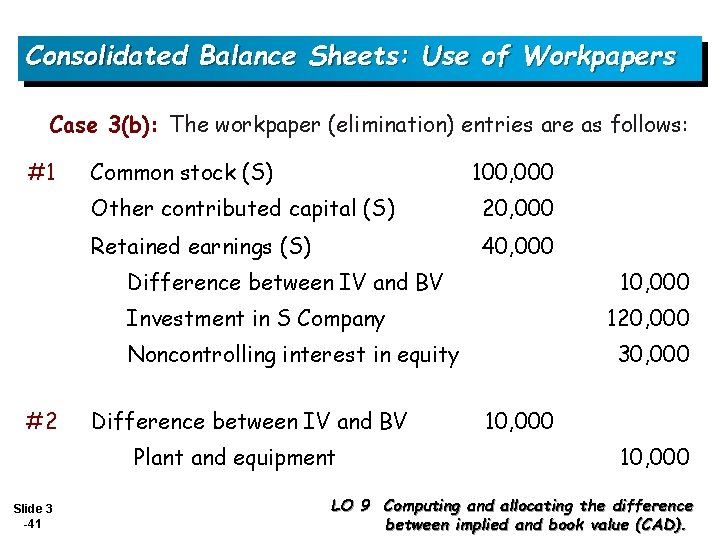

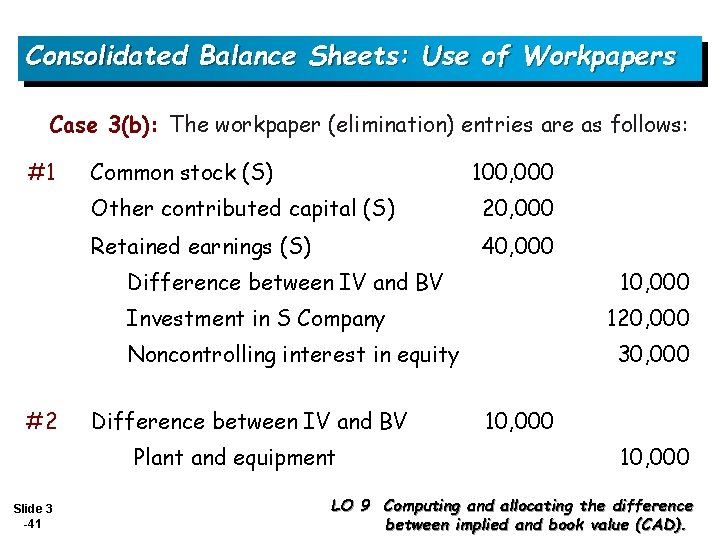

Consolidated Balance Sheets: Use of Workpapers Case 3(b): The workpaper (elimination) entries are as follows: #1 Common stock (S) 100, 000 Other contributed capital (S) 20, 000 Retained earnings (S) 40, 000 Difference between IV and BV 10, 000 Investment in S Company 120, 000 Noncontrolling interest in equity #2 Difference between IV and BV Plant and equipment Slide 3 -41 30, 000 10, 000 LO 9 Computing and allocating the difference between implied and book value (CAD).

Consolidated Balance Sheets: Use of Workpapers Review Question The noncontrolling interest in the subsidiary is reported as: a. Asset b. Liability c. Equity d. Expense Slide 3 -42 LO 9 Computing and allocating the difference between implied and book value (CAD).

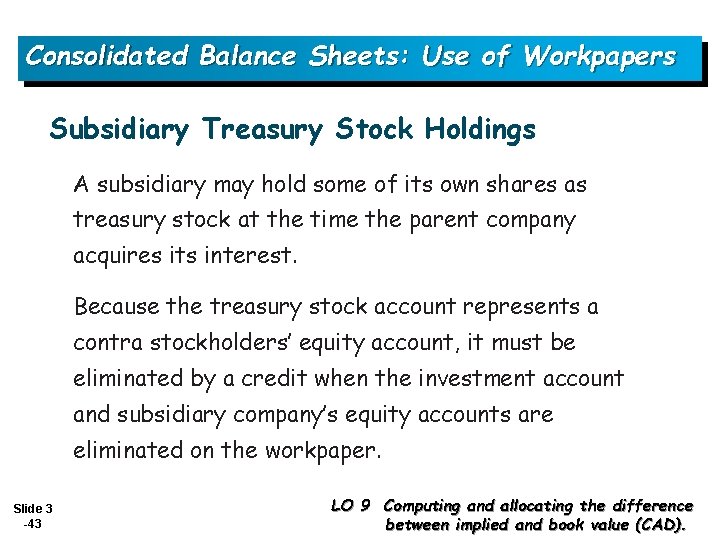

Consolidated Balance Sheets: Use of Workpapers Subsidiary Treasury Stock Holdings A subsidiary may hold some of its own shares as treasury stock at the time the parent company acquires its interest. Because the treasury stock account represents a contra stockholders’ equity account, it must be eliminated by a credit when the investment account and subsidiary company’s equity accounts are eliminated on the workpaper. Slide 3 -43 LO 9 Computing and allocating the difference between implied and book value (CAD).

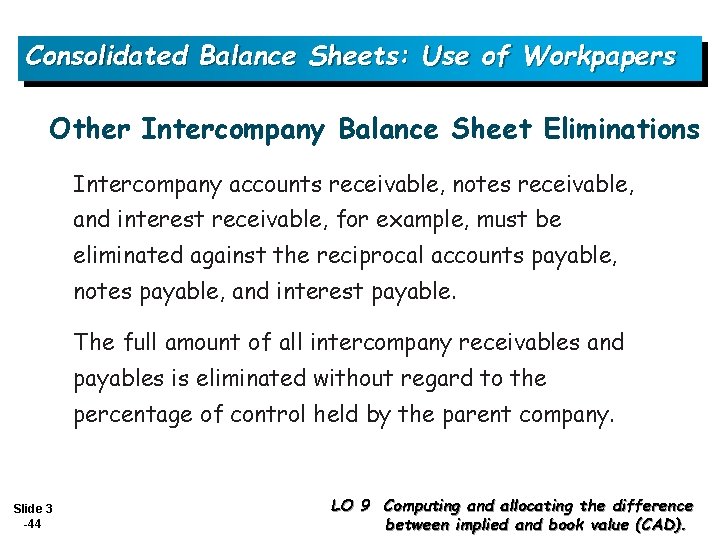

Consolidated Balance Sheets: Use of Workpapers Other Intercompany Balance Sheet Eliminations Intercompany accounts receivable, notes receivable, and interest receivable, for example, must be eliminated against the reciprocal accounts payable, notes payable, and interest payable. The full amount of all intercompany receivables and payables is eliminated without regard to the percentage of control held by the parent company. Slide 3 -44 LO 9 Computing and allocating the difference between implied and book value (CAD).

Consolidated Balance Sheets: Use of Workpapers Adjusting Entries Prior to Eliminating Entries At times, workpaper adjustments to accounting data may be needed before appropriate eliminating entries can be accomplished. Make on workpaper in eliminations columns or Adjust the subsidiary’s statements prior to their entry on the workpaper. Slide 3 -45 LO 9 Computing and allocating the difference between implied and book value (CAD).

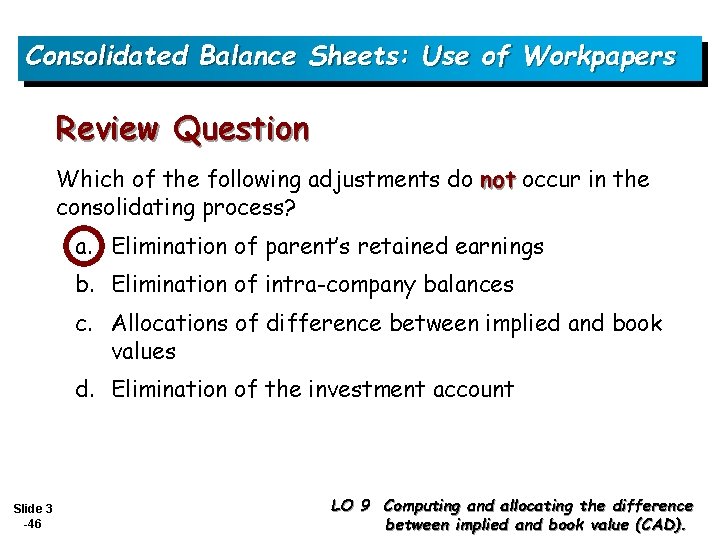

Consolidated Balance Sheets: Use of Workpapers Review Question Which of the following adjustments do not occur in the consolidating process? a. Elimination of parent’s retained earnings b. Elimination of intra-company balances c. Allocations of difference between implied and book values d. Elimination of the investment account Slide 3 -46 LO 9 Computing and allocating the difference between implied and book value (CAD).

Limitations of Consolidated Statements For Example: Little information of value in consolidated statements because they contain insufficient detail about the individual subsidiaries. Highly diversified companies operating across several industries, often the result of mergers and acquisitions, are difficult to analyze or compare. Slide 3 -47 LO 6 Limitations of consolidated statements.

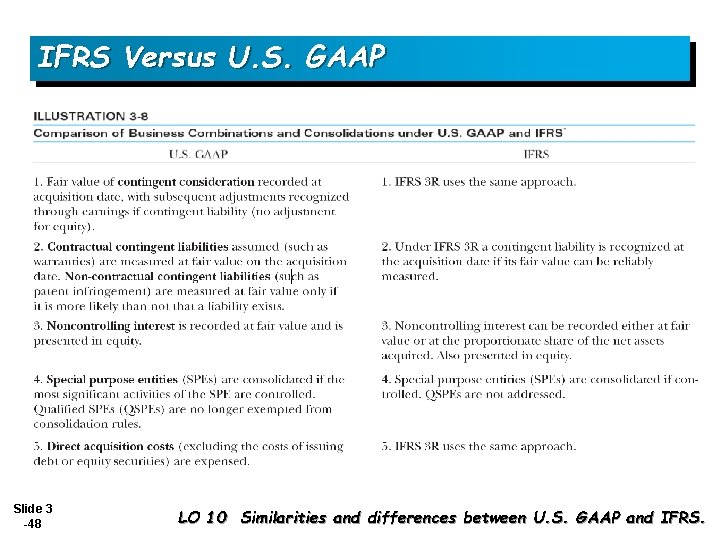

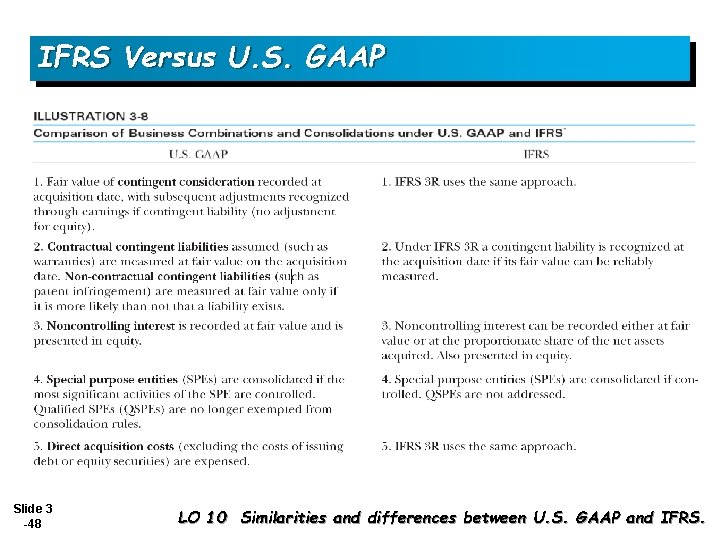

IFRS Versus U. S. GAAP Slide 3 -48 LO 10 Similarities and differences between U. S. GAAP and IFRS.

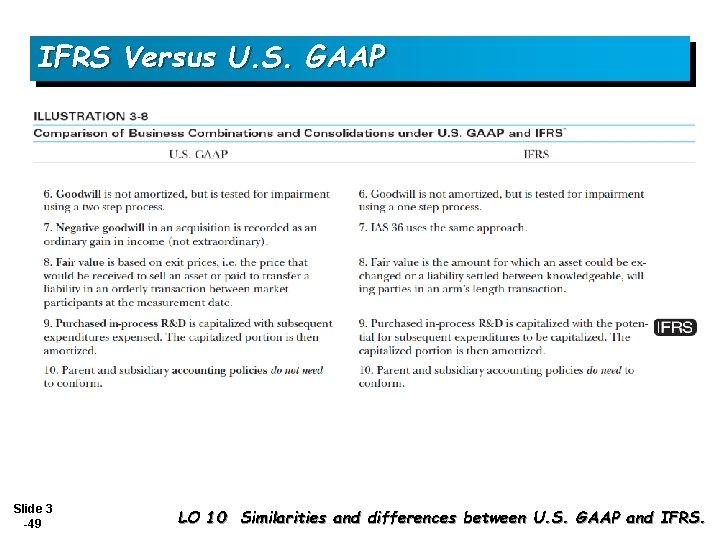

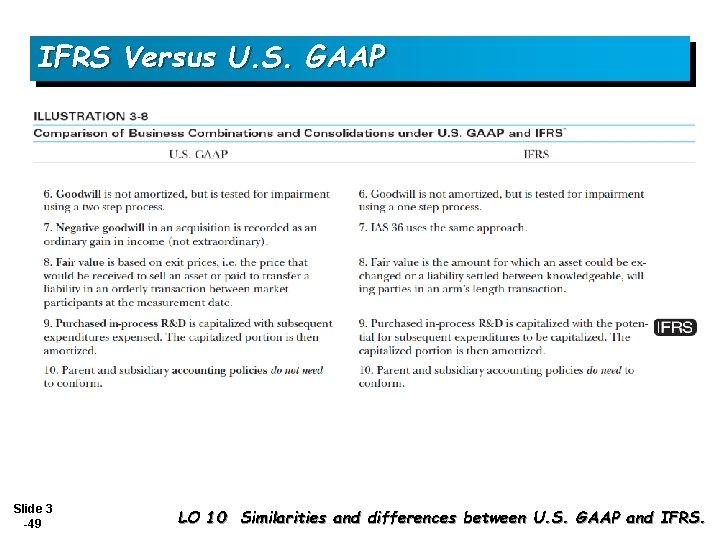

IFRS Versus U. S. GAAP Slide 3 -49 LO 10 Similarities and differences between U. S. GAAP and IFRS.

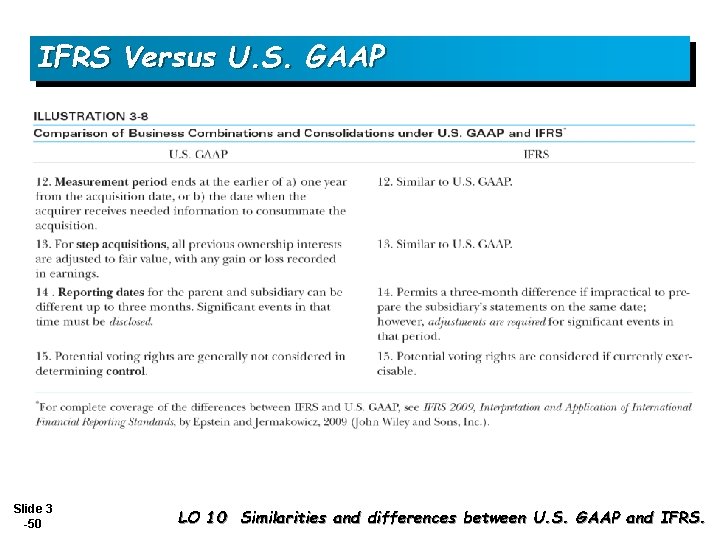

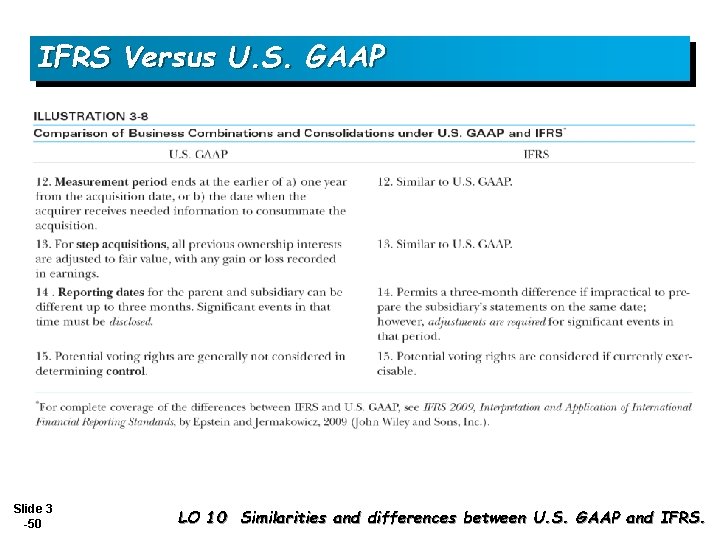

IFRS Versus U. S. GAAP Slide 3 -50 LO 10 Similarities and differences between U. S. GAAP and IFRS.

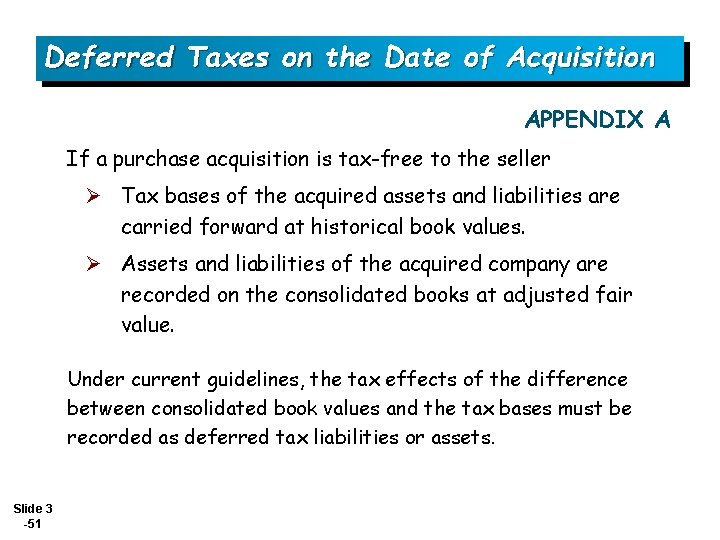

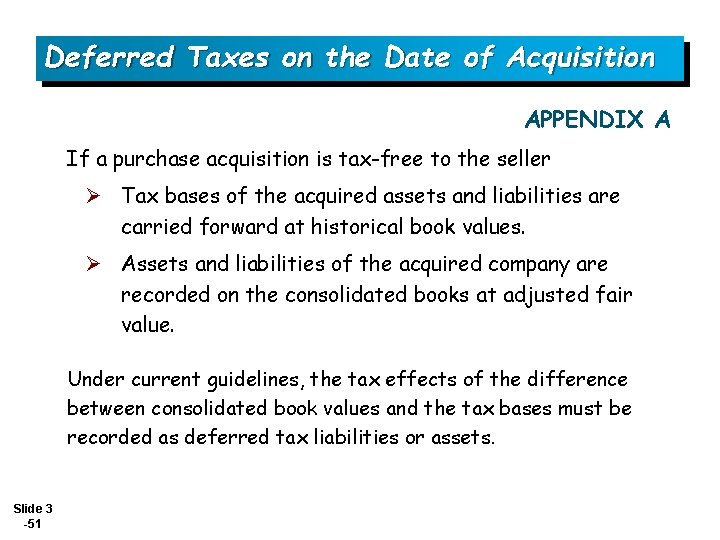

Deferred Taxes on the Date of Acquisition APPENDIX A If a purchase acquisition is tax-free to the seller Ø Tax bases of the acquired assets and liabilities are carried forward at historical book values. Ø Assets and liabilities of the acquired company are recorded on the consolidated books at adjusted fair value. Under current guidelines, the tax effects of the difference between consolidated book values and the tax bases must be recorded as deferred tax liabilities or assets. Slide 3 -51

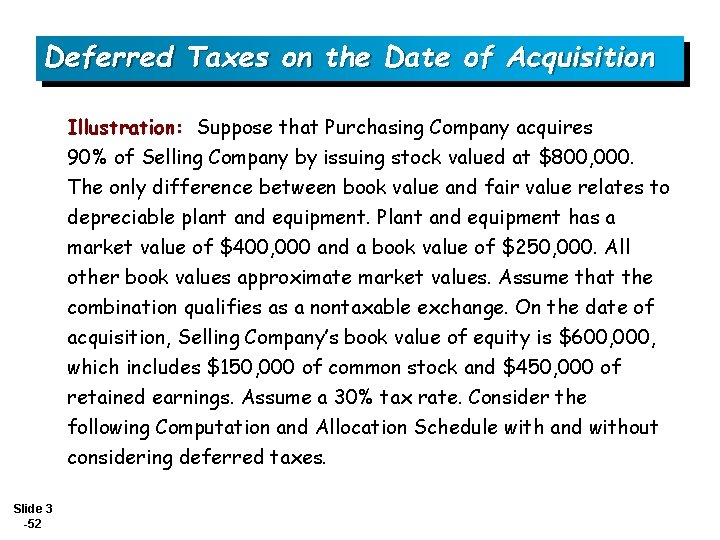

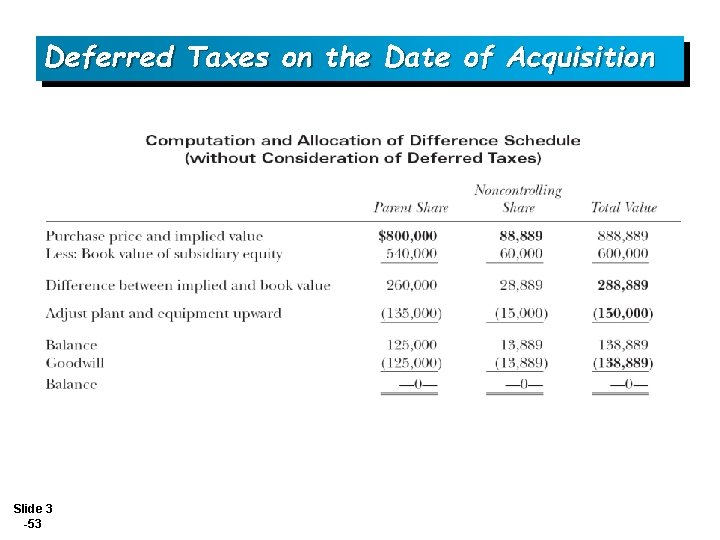

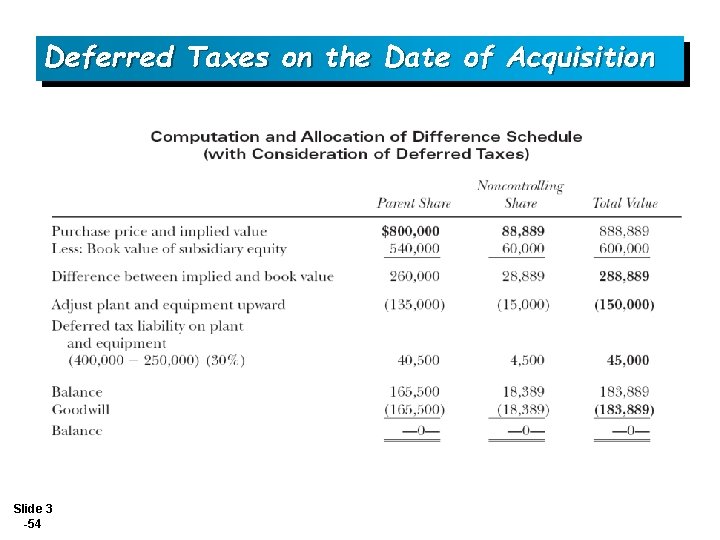

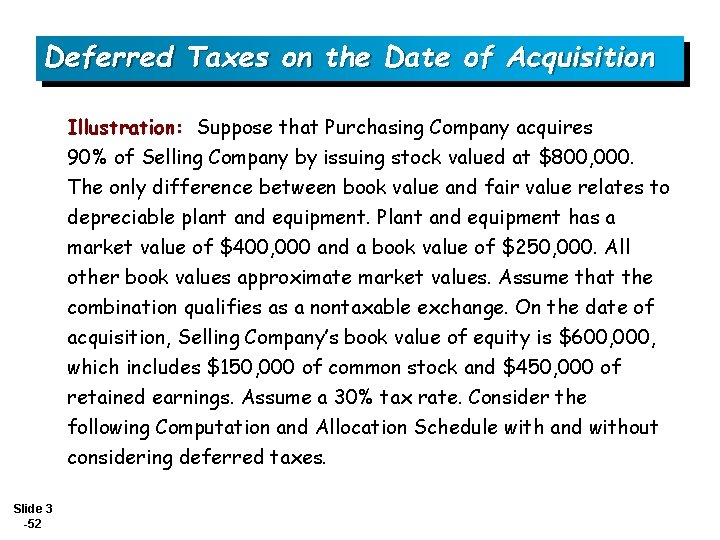

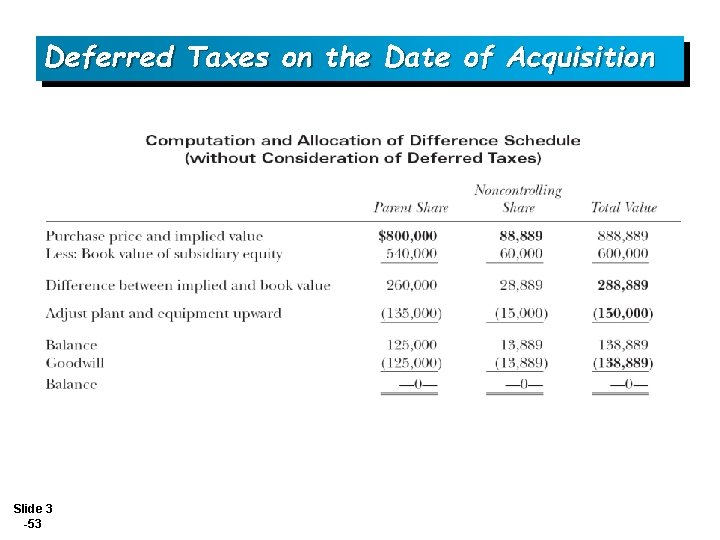

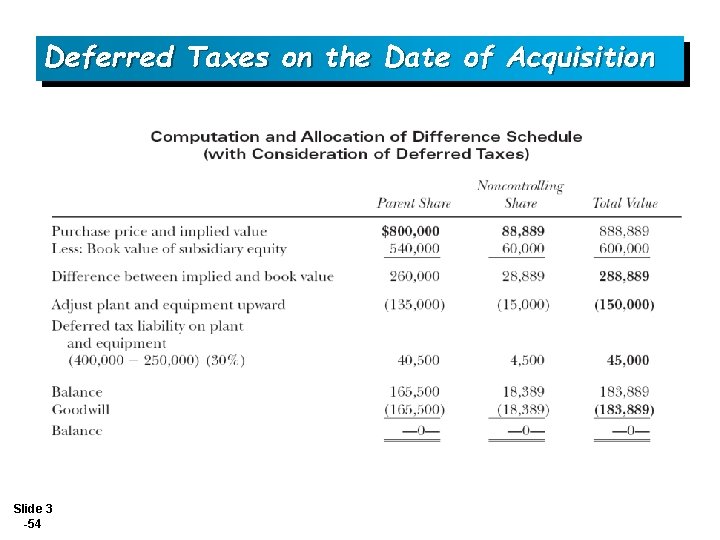

Deferred Taxes on the Date of Acquisition Illustration: Suppose that Purchasing Company acquires 90% of Selling Company by issuing stock valued at $800, 000. The only difference between book value and fair value relates to depreciable plant and equipment. Plant and equipment has a market value of $400, 000 and a book value of $250, 000. All other book values approximate market values. Assume that the combination qualifies as a nontaxable exchange. On the date of acquisition, Selling Company’s book value of equity is $600, 000, which includes $150, 000 of common stock and $450, 000 of retained earnings. Assume a 30% tax rate. Consider the following Computation and Allocation Schedule with and without considering deferred taxes. Slide 3 -52

Deferred Taxes on the Date of Acquisition Slide 3 -53

Deferred Taxes on the Date of Acquisition Slide 3 -54

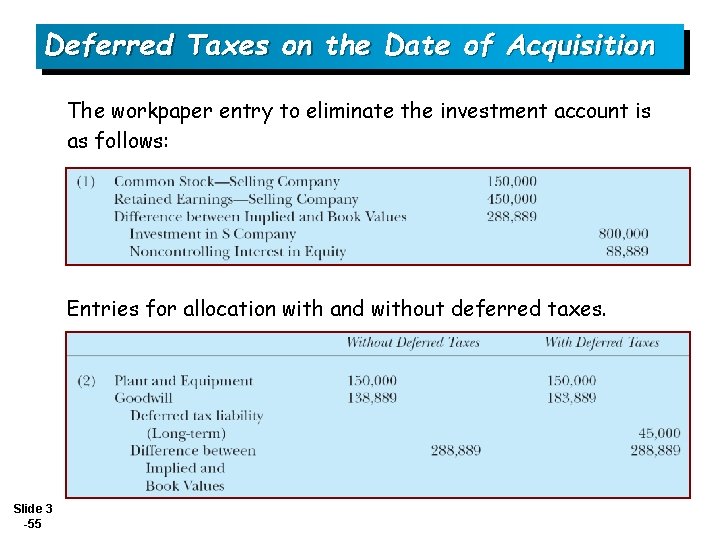

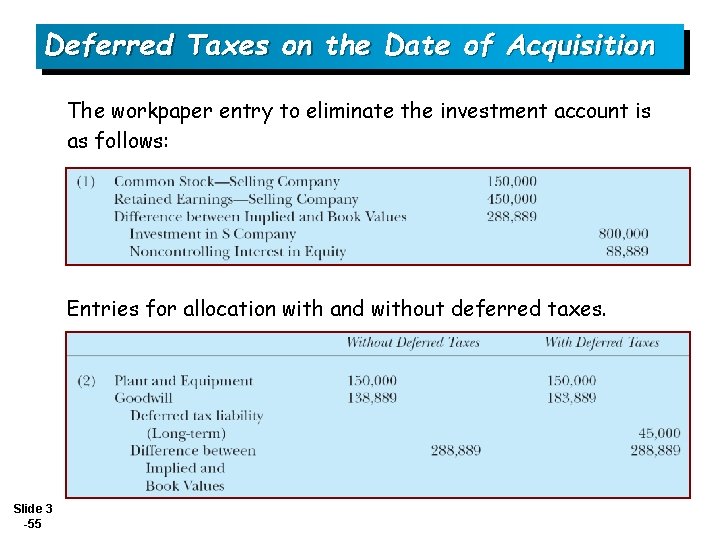

Deferred Taxes on the Date of Acquisition The workpaper entry to eliminate the investment account is as follows: Entries for allocation with and without deferred taxes. Slide 3 -55

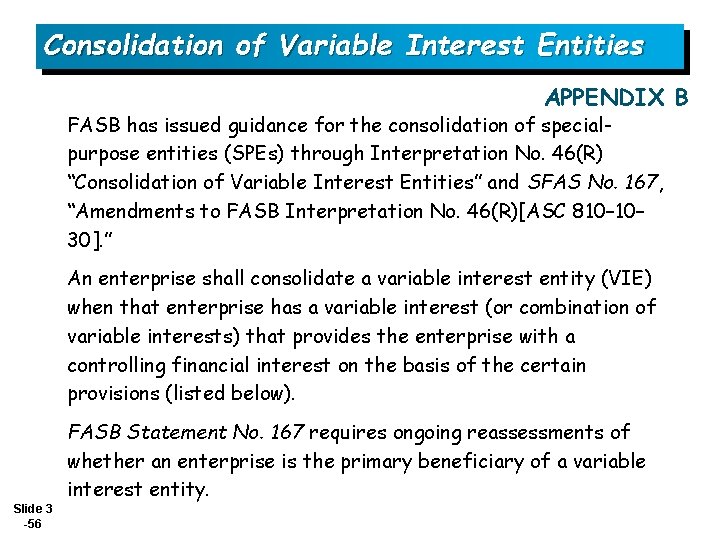

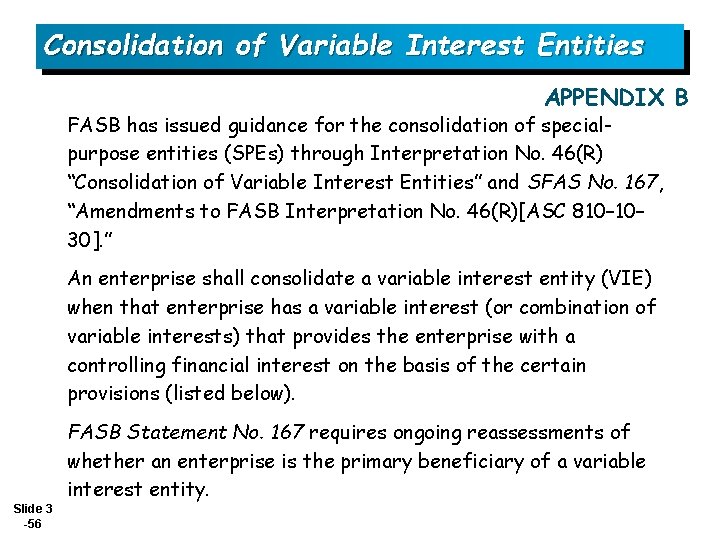

Consolidation of Variable Interest Entities APPENDIX B FASB has issued guidance for the consolidation of specialpurpose entities (SPEs) through Interpretation No. 46(R) “Consolidation of Variable Interest Entities” and SFAS No. 167, “Amendments to FASB Interpretation No. 46(R)[ASC 810– 30]. ” An enterprise shall consolidate a variable interest entity (VIE) when that enterprise has a variable interest (or combination of variable interests) that provides the enterprise with a controlling financial interest on the basis of the certain provisions (listed below). FASB Statement No. 167 requires ongoing reassessments of whether an enterprise is the primary beneficiary of a variable interest entity. Slide 3 -56

Copyright © 2012 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein. Slide 3 -57

Consolidated financial statements date of acquisition

Consolidated financial statements date of acquisition Normally consolidated and over consolidated soil

Normally consolidated and over consolidated soil Ias consolidated financial statements

Ias consolidated financial statements Partial equity method consolidation worksheet

Partial equity method consolidation worksheet Learning vs acquisition

Learning vs acquisition Financial accounting chapter 1

Financial accounting chapter 1 Role and responsibility of management accountant ppt

Role and responsibility of management accountant ppt Merger and acquisition financial modeling

Merger and acquisition financial modeling Consolidated shipping services

Consolidated shipping services Sezhub

Sezhub Consolidated balance sheet meaning

Consolidated balance sheet meaning Gepa statement examples

Gepa statement examples Shear eat

Shear eat Parent company theory

Parent company theory Consolidated companies are different sap

Consolidated companies are different sap Noc saga consolidated

Noc saga consolidated Consolidated service center

Consolidated service center People express airlines v consolidated rail corp

People express airlines v consolidated rail corp Abitibi consolidated

Abitibi consolidated Www.mchcp.org

Www.mchcp.org Sap b1if

Sap b1if Business intelligence project plan

Business intelligence project plan Equity accounted investments

Equity accounted investments Consolidated

Consolidated Intercompany process in sap sd

Intercompany process in sap sd How to draw mohr's circle for triaxial test

How to draw mohr's circle for triaxial test Consolidated monitoring

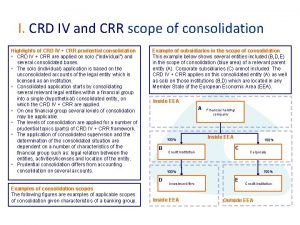

Consolidated monitoring I crd

I crd Clinical document architecture

Clinical document architecture Aquifer

Aquifer Consolidated trust

Consolidated trust Calaveras consolidated fire

Calaveras consolidated fire Consolidated business plan

Consolidated business plan Debra jeter

Debra jeter Introduction to managerial accounting ppt

Introduction to managerial accounting ppt Advanced cost and management accounting ppt

Advanced cost and management accounting ppt Oracle advanced cost accounting

Oracle advanced cost accounting Advanced accounting chapter 1

Advanced accounting chapter 1 Financial methods of motivation definition

Financial methods of motivation definition Tactical information systems

Tactical information systems Financial position statement

Financial position statement Scope of financial accounting

Scope of financial accounting Scope of financial accounting

Scope of financial accounting Management accounting nature and scope

Management accounting nature and scope Economic entity assumption

Economic entity assumption Construction accounting terms

Construction accounting terms Income statement in financial accounting

Income statement in financial accounting Managerial accounting chapter 2 solutions

Managerial accounting chapter 2 solutions Unit 5 lesson 2 financial accounting

Unit 5 lesson 2 financial accounting Unit 5 lesson 2 financial accounting

Unit 5 lesson 2 financial accounting Financial accounting chapter 13

Financial accounting chapter 13 Equity accounted investments

Equity accounted investments Kimmel financial accounting 7the edition

Kimmel financial accounting 7the edition Financial accounting chapter 9

Financial accounting chapter 9 The conceptual framework that underlies ifrs

The conceptual framework that underlies ifrs Luca pacioli father of accounting

Luca pacioli father of accounting Financial accounting hanlon

Financial accounting hanlon What is control account reconciliation

What is control account reconciliation