Transit Funding 101 FUNDING OPTIONS ON THE STATE

- Slides: 32

Transit Funding 101 FUNDING OPTIONS ON THE STATE, LOCAL, AND REGIONAL LEVELS ALIA ANDERSON + ANNIE FINKENBINDER RECONNECTING AMERICA DECEMBER 2009

King of the Road: Over 80% of Federal Funds go to Highways Dividing the Pie: $52. 6 billion for transit $5. 1 billion for highway safety $612 million for Safe Routes to Schools $370 million for Trails $100 million for nonmotorized $270 million for TCSP $200 billion for Highway Program

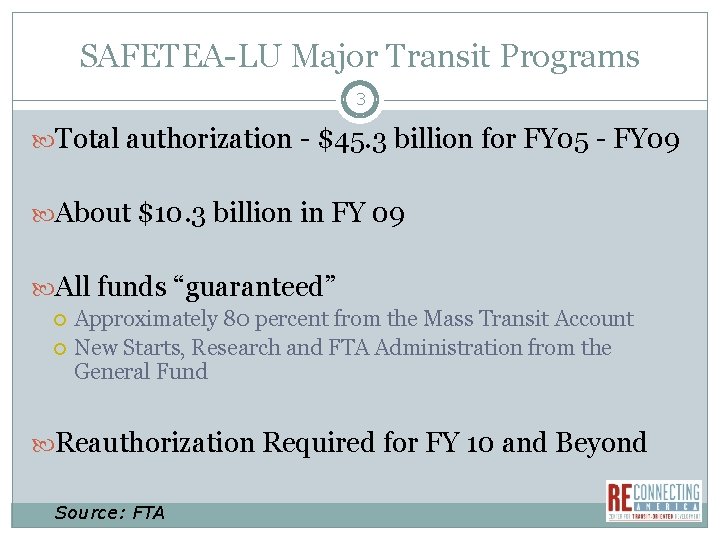

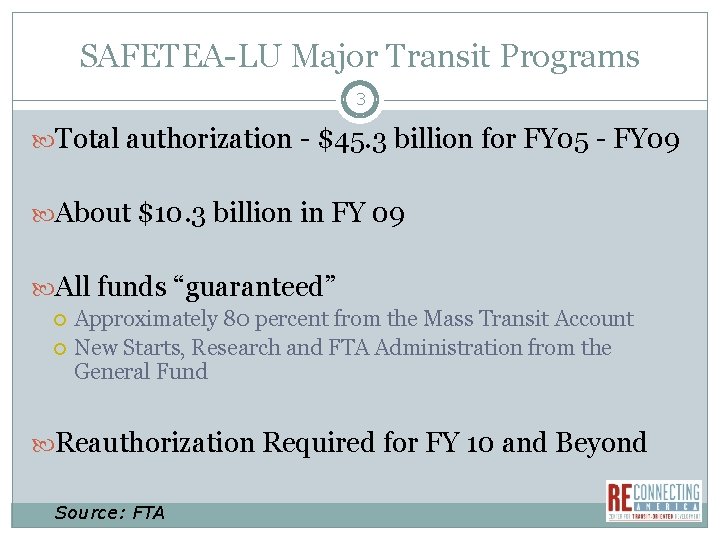

SAFETEA-LU Major Transit Programs 3 Total authorization - $45. 3 billion for FY 05 - FY 09 About $10. 3 billion in FY 09 All funds “guaranteed” Approximately 80 percent from the Mass Transit Account New Starts, Research and FTA Administration from the General Fund Reauthorization Required for FY 10 and Beyond Source: FTA

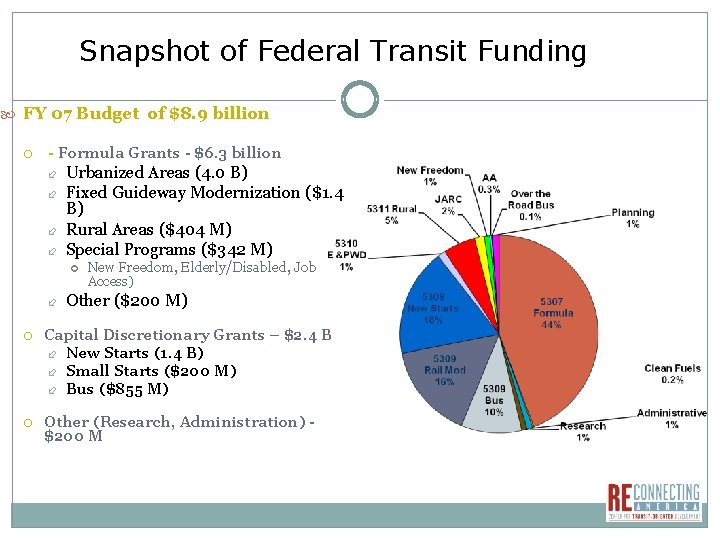

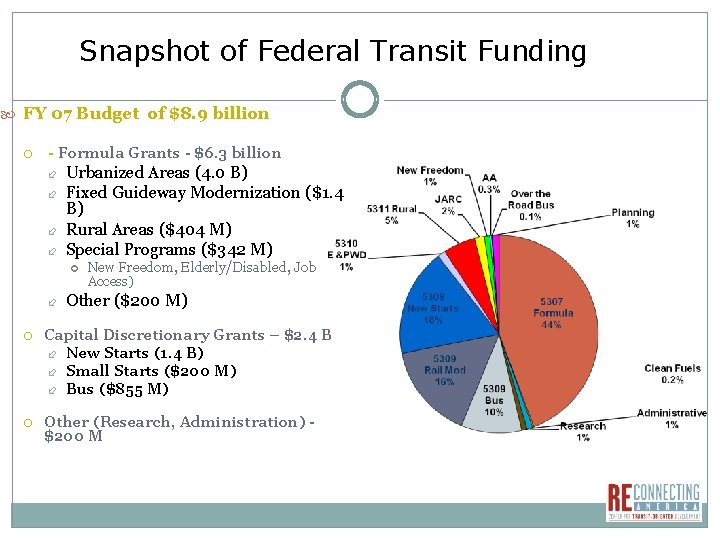

Snapshot of Federal Transit Funding FY 07 Budget of $8. 9 billion - Formula Grants - $6. 3 billion Urbanized Areas (4. 0 B) Fixed Guideway Modernization ($1. 4 B) Rural Areas ($404 M) Special Programs ($342 M) New Freedom, Elderly/Disabled, Job Access) Other ($200 M) Capital Discretionary Grants – $2. 4 B New Starts (1. 4 B) Small Starts ($200 M) Bus ($855 M) Other (Research, Administration) $200 M

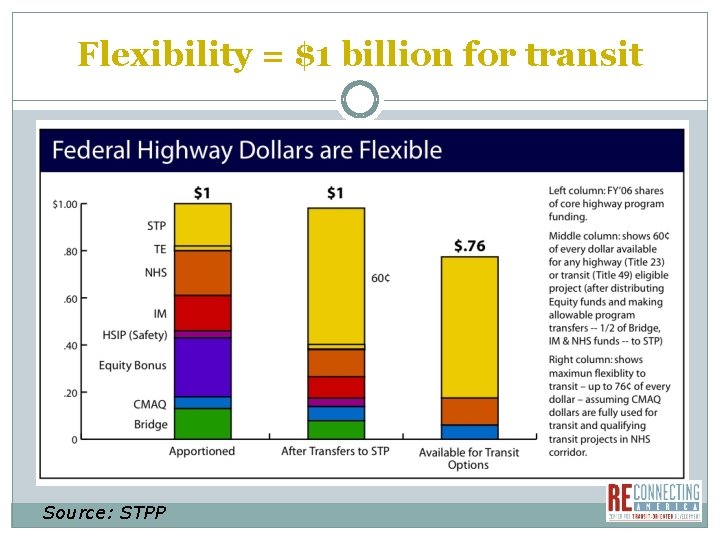

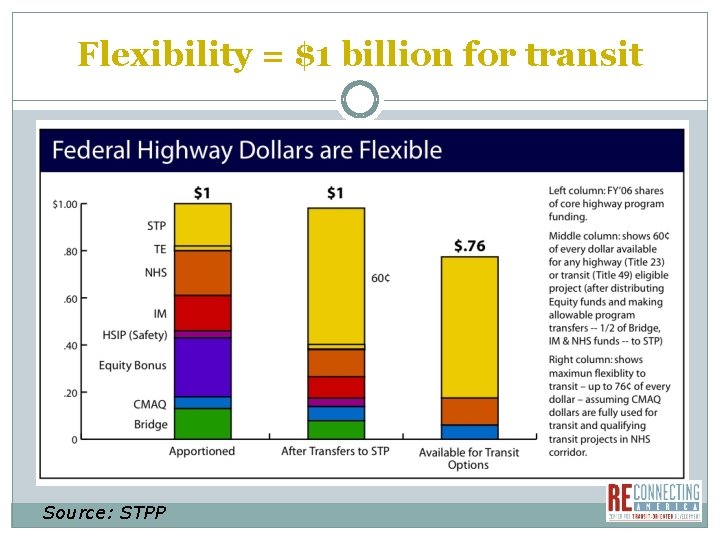

Flexibility = $1 billion for transit Source: STPP

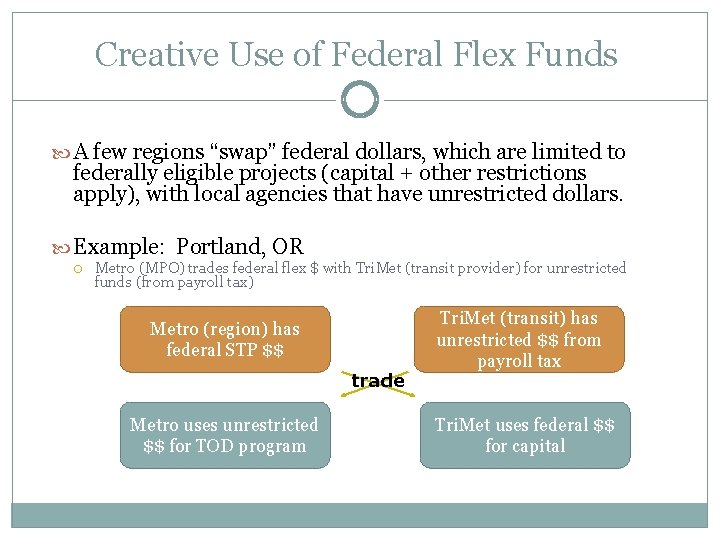

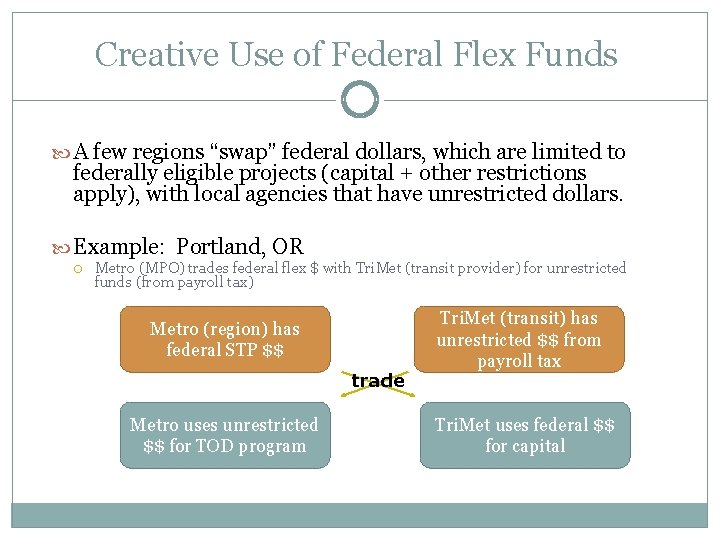

Creative Use of Federal Flex Funds A few regions “swap” federal dollars, which are limited to federally eligible projects (capital + other restrictions apply), with local agencies that have unrestricted dollars. Example: Portland, OR Metro (MPO) trades federal flex $ with Tri. Met (transit provider) for unrestricted funds (from payroll tax) Metro (region) has federal STP $$ trade Metro uses unrestricted $$ for TOD program Tri. Met (transit) has unrestricted $$ from payroll tax Tri. Met uses federal $$ for capital

Federal Focus on Capital Investment Formula funds cannot be used for operating costs for transit agencies serving urban areas with over 200, 000 people CMAQ exception for new service (5 years) In 2000: Federal share of all transit capital investment: 47% Federal share of all operating expenses: 5% Source: FTA Capital Investment- $9. 1 billion State, Local and Other Sources 53% Federal Gov’t 47%

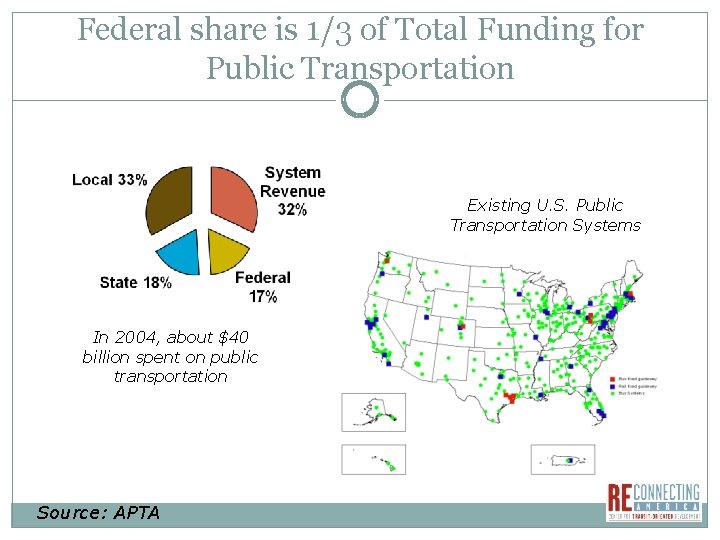

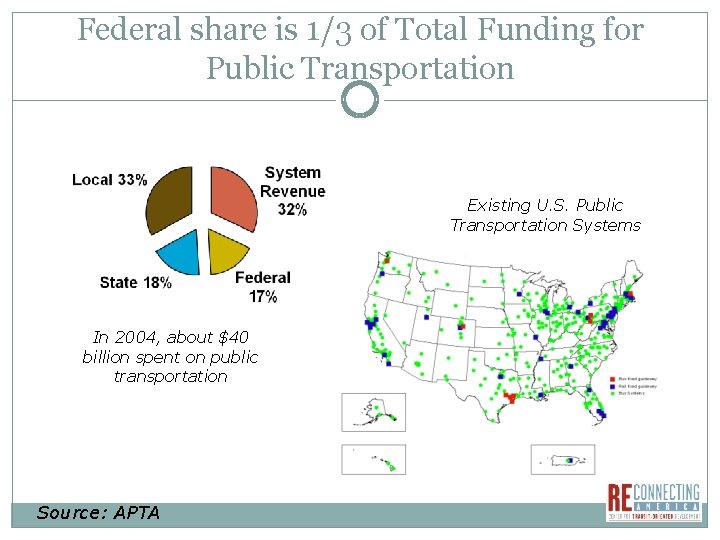

Federal share is 1/3 of Total Funding for Public Transportation Existing U. S. Public Transportation Systems In 2004, about $40 billion spent on public transportation Source: APTA

Who are the Players in Non-Federal Funds? State governments MPO or other regional governing entities Transit Agencies Cities/Counties/other local jurisdiction Private sector AUTHORITY TO LEVY TAXES VARIES FROM STATE TO STATE!

Basic Types of Non-Federal Funding Broad-based taxes Transportation-based taxes and fees Market-based mechanisms Financing schemes (bonding, loans) Project-based revenue streams Other funding sources

Broad-Based Taxes Sales tax (typically levied by regional or local entity) Property tax (typically levied by regional or local entity) Payroll tax (typically levied by regional or local entity)

Broad-Based Taxes: Sales Tax King County, WA (Seattle area) Sound Transit has authority to levy voter -approved tax 0. 4% sales tax approved by voters in 1996 A 0. 5% increase approved in 2008 Covers 66% of operating costs Sales tax was passed in 2008 as part of a larger transit package that included details about new capital investments and level of service improvements.

Broad-Based Taxes: Sales Tax Advantages of sales tax as transit funding mechanism Can generally be used for both operating and capital budgets. Local authorities can directly levy – Many transit agencies and regional governments are authorized to directly collect sales taxes. Potential for substantial revenue generation. In strong economies, could provide a large portion of a transit agencies’ budget thanks to large tax base.

Broad-Based Taxes: Sales Tax Pitfalls of sales tax as transit funding mechanism Not a predictable source of funding. In King County, revised revenue estimates for 2009 were $100 million short of estimate at time of approval. Regressive – Lower income households spend a greater percentage of their income on consumables, meaning they would contribute disproportionately to income level. Often needs public referendum for approval Something to consider depending on your state’s political climate. Already spent. Sales taxes are sometimes already earmarked for other public expenditures.

Transportation-based Taxes and Fees Gas Tax Rental car fee License, Registration, and Title Fees Vehicle Purchase and Lease Fees Parking Fees

Transportation-based Taxes and Fees – Parking Fees How They Work In most places, the revenues from parking fees go toward some combination of general funds, roads, and parking and vehicle enforcement. Transit agencies typically receive revenues from fees on their own parking facilities, but there also a few examples of cases in which revenues from municipallyowned parking facilities are used to fund transit (generally operating rather than capital costs).

Transportation-based Taxes and Fees – Parking Fees Chicago, IL The City of Chicago received a $153. 1 million grant in 2008 from USDOT for a congestion reduction pilot program. Two of these projects involve parking fees whose revenues will be directed toward transit: a “peak period pricing” program which will implement surcharges for on-street metered parking and off-street parking facilities in the central business district a fee system to help manage on-street loading zones in the downtown area.

Transportation-based Taxes and Fees – Parking Fees Advantages of parking fees as transit funding mechanism Can Serve as a “User Fee” Commuters, who as a group often impose the heaviest burden on the transportation network, help contribute to funding. Encourage better commuting decisions Parking fees might nudge individuals to consider taking transit rather than paying for parking. Progressive Fee The greatest burden typically falls on highincome individuals rather than lower-income populations who are both less likely to drive in general and less likely to choose to park in areas with high fees.

Transportation-based Taxes and Fees – Parking Fees Pitfalls of parking fees as transit funding mechanism Narrow tax base Revenue Generation Parking facilities owned by transit agencies do not have the potential to generate very substantial revenue streams by themselves. Municipally owned parking facilities can potentially be used to generate more substantial revenue streams, but the use of these revenues to fund transit is not currently widespread.

Market-Based Mechanisms Tolling Congestion Pricing Emission Fees VMT Fees

Market-Based Mechanisms– Congestion Pricing How They Work HOT lanes: Allow SOVs to pay to use HOV lanes, fee varies according to congestion (or time of day). Used in CA, CO, FL, MN, UT, WA. Many more under development. $$ for transit varies by project, must be secured from outset of project (CA I-15 project generates ~$1 M/yr for express bus service) Express Toll Lanes: All vehicles pay the same rates, which vary according to congestion. Planned in Maryland, revenue will be used for highway projects.

Financing Schemes General Obligation Bonds Private Activity Bonds State Infrastructure Bank Loans Grant Anticipation Notes Certificates of Participation

Financing Schemes -- Bonds How They Work Government entity that issues the bond sells it directly to investors, receiving cash payment in return from the investor. Investor at a designated future date, with interest. (The interest is usually determined at a rate lower than market value for privately funded projects. ) Depending on regulatory context in state/city, money collected from the sale of the bond must be spent at one time on the intended capital project, or spent within three to five years from the time the bond is issued.

Financing Schemes -- Bonds Types of Long-Term Bonds General obligation bonds - the issuer promises to repay the principal and interest in full faith. These bonds are approved by voters and are the most secure of the municipal bonds. They generally have low interest rates. Revenue bonds - repayment depends on revenue obtained from toll, charges, farebox revenues, or rents received from state-owned facilities. These bonds are issued by special agencies. Assessment bonds - repayment depends on the income received from property tax assessments within the locality of the bond.

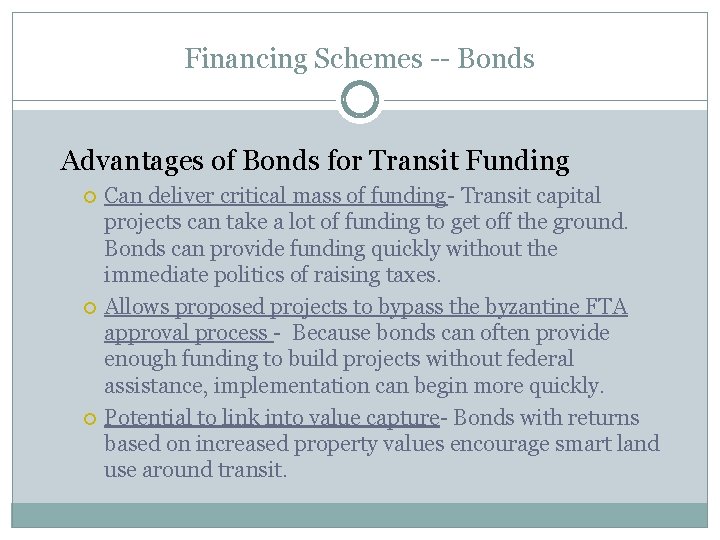

Financing Schemes -- Bonds Advantages of Bonds for Transit Funding Can deliver critical mass of funding- Transit capital projects can take a lot of funding to get off the ground. Bonds can provide funding quickly without the immediate politics of raising taxes. Allows proposed projects to bypass the byzantine FTA approval process - Because bonds can often provide enough funding to build projects without federal assistance, implementation can begin more quickly. Potential to link into value capture- Bonds with returns based on increased property values encourage smart land use around transit.

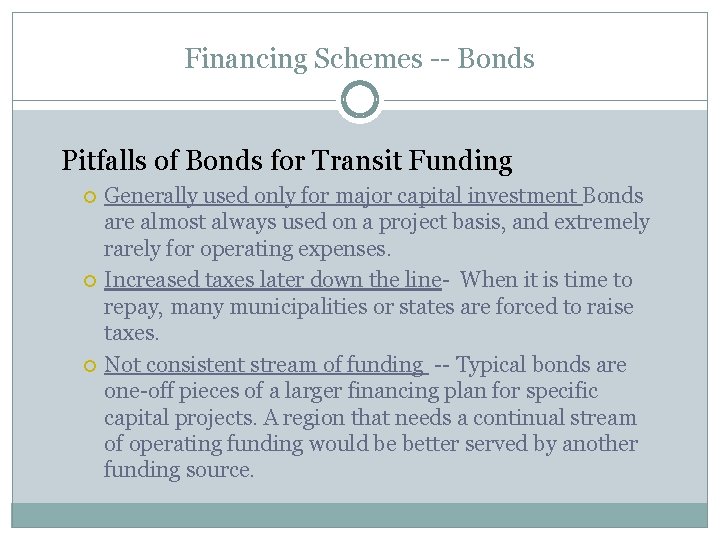

Financing Schemes -- Bonds Pitfalls of Bonds for Transit Funding Generally used only for major capital investment Bonds are almost always used on a project basis, and extremely rarely for operating expenses. Increased taxes later down the line- When it is time to repay, many municipalities or states are forced to raise taxes. Not consistent stream of funding -- Typical bonds are one-off pieces of a larger financing plan for specific capital projects. A region that needs a continual stream of operating funding would be better served by another funding source.

Value Capture Joint Development TIFs Assessment Districts Developer/Impact Fees

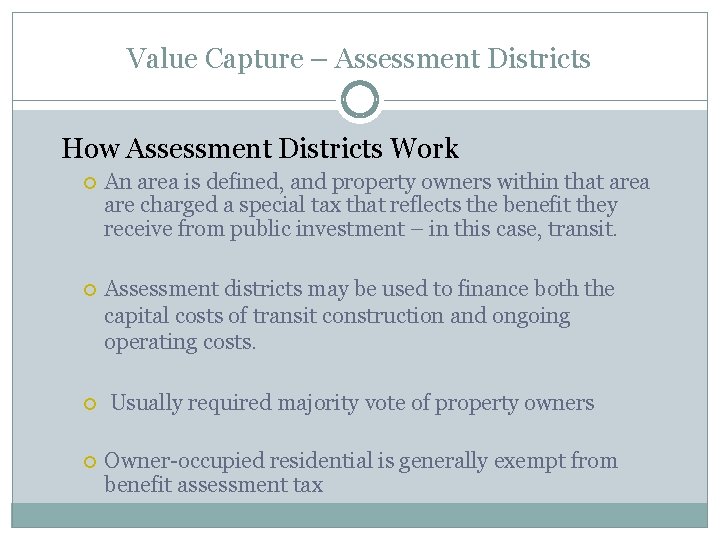

Value Capture – Assessment Districts How Assessment Districts Work An area is defined, and property owners within that area are charged a special tax that reflects the benefit they receive from public investment – in this case, transit. Assessment districts may be used to finance both the capital costs of transit construction and ongoing operating costs. Usually required majority vote of property owners Owner-occupied residential is generally exempt from benefit assessment tax

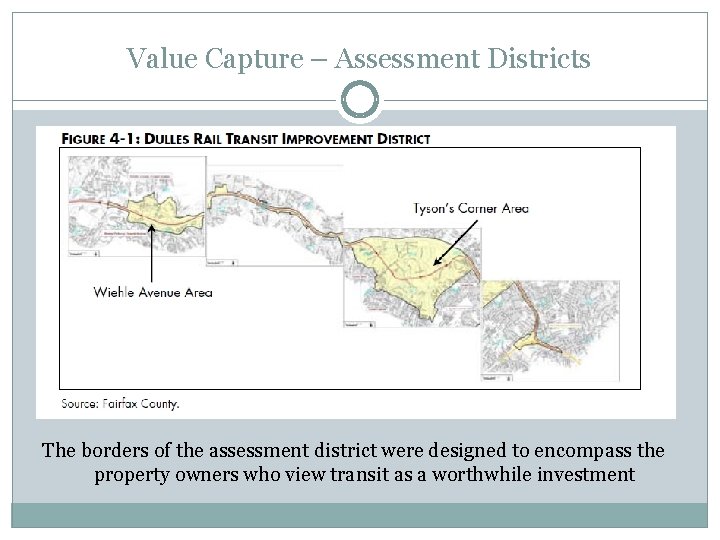

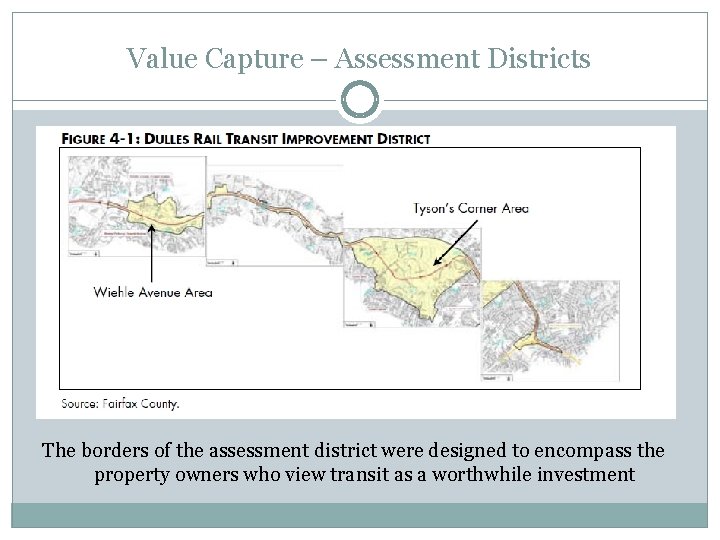

Value Capture – Assessment Districts Dulles Rail Transit Improvement District The assessment district only includes properties in Fairfax County, but at one point it was planned to include part of neighboring Loudoun County. The boundaries were eventually scaled back because a larger assessment district would not have received enough support to be implemented. The district is designed to generate about $400 m from commercial, industrial and multifamily properties along the corridor, about 15 % of the total cost This amount represents the Fairfax County portion of the local match required for federal funding of building the project.

Value Capture – Assessment Districts The borders of the assessment district were designed to encompass the property owners who view transit as a worthwhile investment

Value Capture – Assessment Districts Advantages of Assessment Districts Appealing to voters -- assessment districts can be appealing to the public as a funding mechanism for transit, since the amount that you pay to fund transit is directly determined by the amount that you benefit from it within a specific context. Land use connection - This is one of the only funding mechanisms that directly links land use and transit on its face, encouraging TOD. Versatile – Revenue can be used for both capital investment and ongoing operations over time.

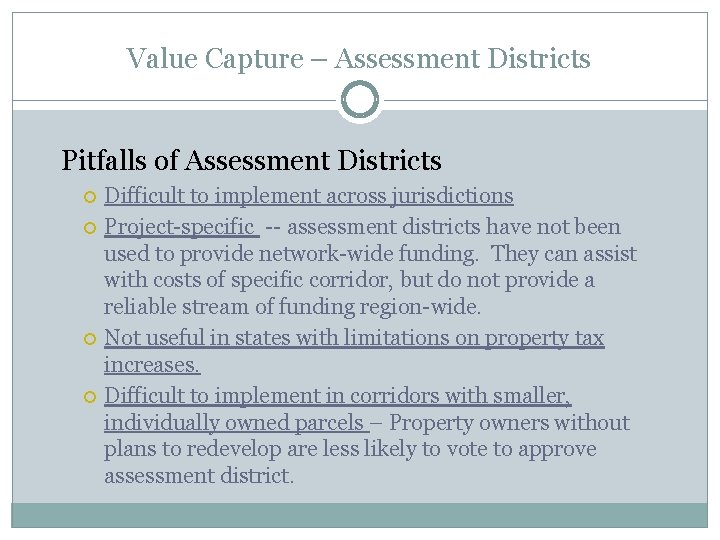

Value Capture – Assessment Districts Pitfalls of Assessment Districts Difficult to implement across jurisdictions Project-specific -- assessment districts have not been used to provide network-wide funding. They can assist with costs of specific corridor, but do not provide a reliable stream of funding region-wide. Not useful in states with limitations on property tax increases. Difficult to implement in corridors with smaller, individually owned parcels – Property owners without plans to redevelop are less likely to vote to approve assessment district.

Washington state transit insurance pool

Washington state transit insurance pool State funding

State funding Morgan housing application

Morgan housing application Mtm transit leadership

Mtm transit leadership Satellite look angle

Satellite look angle Www.tccard.transitcenter.com

Www.tccard.transitcenter.com Tiger transit clemson

Tiger transit clemson Pierce transit logo

Pierce transit logo Pengertian deposit in transit

Pengertian deposit in transit Rekonsiliasi adalah

Rekonsiliasi adalah Peering vs transit

Peering vs transit Slow transit förstoppning

Slow transit förstoppning Point de transit pompier

Point de transit pompier Transit bredband

Transit bredband Delaware county community transit

Delaware county community transit Chicago bus rapid transit

Chicago bus rapid transit Ford transit cape cod

Ford transit cape cod Camtran schedule

Camtran schedule Transit capacity and quality of service manual

Transit capacity and quality of service manual What are avalanche transit time devices

What are avalanche transit time devices Transit chek balance

Transit chek balance Ip transit price trends

Ip transit price trends Elemen industri pariwisata

Elemen industri pariwisata Clay county transit for elderly

Clay county transit for elderly Prague public transit co, inc.

Prague public transit co, inc. Mid coast corridor transit project

Mid coast corridor transit project Transit capacity and quality of service manual

Transit capacity and quality of service manual Tcrp 155

Tcrp 155 Business of making and serving prepared food and drink.

Business of making and serving prepared food and drink. Transit capacity and quality of service manual

Transit capacity and quality of service manual Bnj akaun transit panjar johor

Bnj akaun transit panjar johor Larry rubio

Larry rubio Transit capacity manual

Transit capacity manual