Reemplazar por una foto que ilustre el tema

- Slides: 25

Reemplazar por una foto que ilustre el tema. Sino eliminar Energy and Clean Energy in Central America Investment Opportunities within the Region Dr. Nick Rischbieth Executive President

• • 9, 033, 399 users 12, 453 MW installed capacity 5% increase per year during the past 5 years in installed capacity 3. 0 % energy consumption increase per year during the past 5 years 5, 683, 726 inhabitants without electricity (Guatemala, Honduras and Nicaragua accounting for 85 % of the total). In 2012, 64. 6 % of the Energy injected to the National Grids came from Renewable Energy (RE) sources. In 2012, 540 MW were added within the region, all coming from RE sources. This trend is expected to remain constant in line with market and environmental considerations.

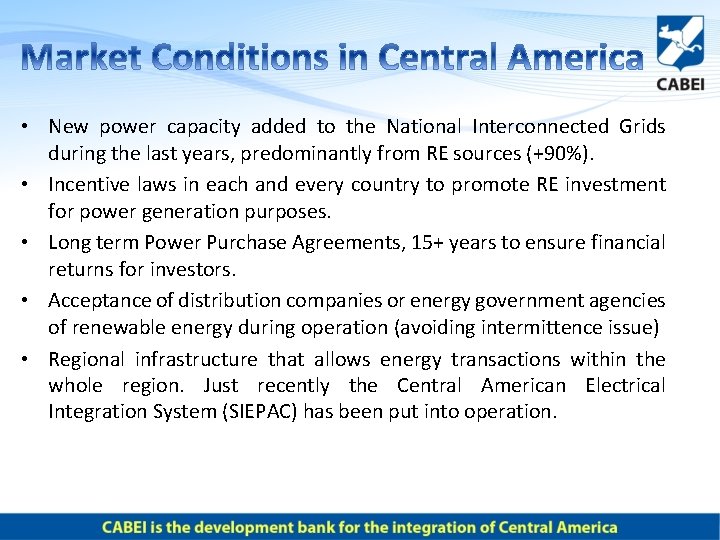

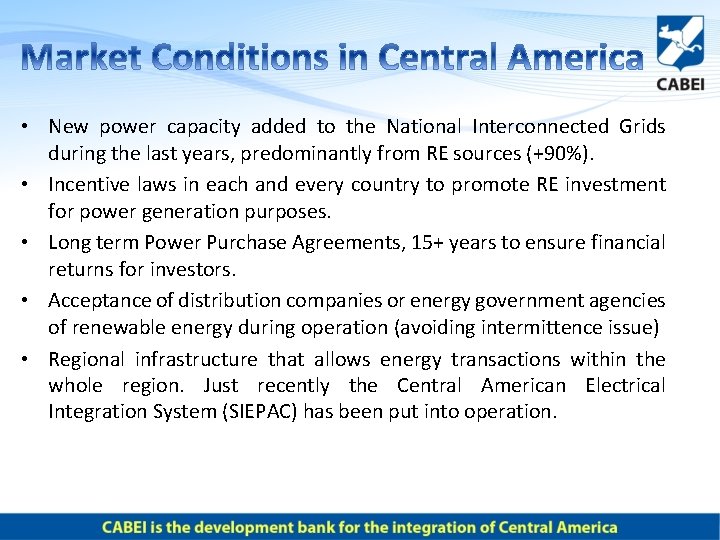

• New power capacity added to the National Interconnected Grids during the last years, predominantly from RE sources (+90%). • Incentive laws in each and every country to promote RE investment for power generation purposes. • Long term Power Purchase Agreements, 15+ years to ensure financial returns for investors. • Acceptance of distribution companies or energy government agencies of renewable energy during operation (avoiding intermittence issue) • Regional infrastructure that allows energy transactions within the whole region. Just recently the Central American Electrical Integration System (SIEPAC) has been put into operation.

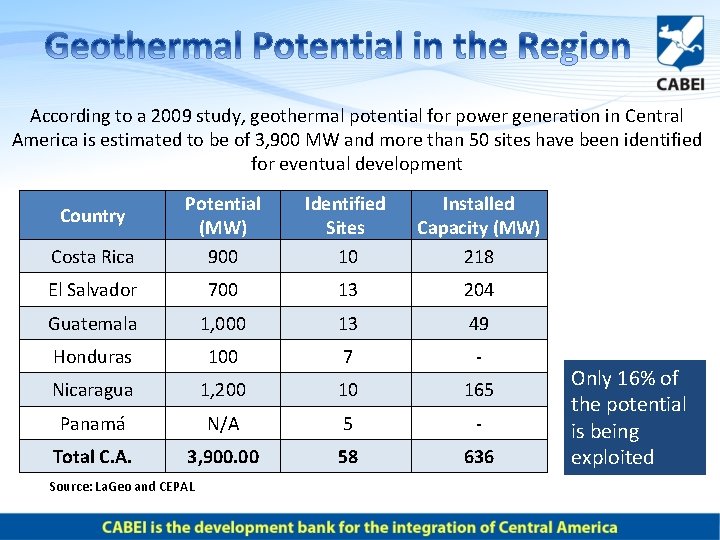

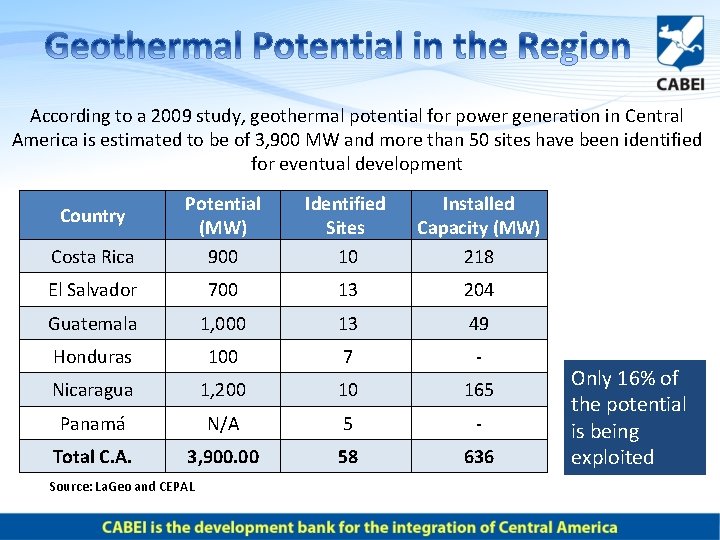

According to a 2009 study, geothermal potential for power generation in Central America is estimated to be of 3, 900 MW and more than 50 sites have been identified for eventual development Costa Rica Potential (MW) 900 Identified Sites 10 Installed Capacity (MW) 218 El Salvador 700 13 204 Guatemala 1, 000 13 49 Honduras 100 7 - Nicaragua 1, 200 10 165 Panamá N/A 5 - Total C. A. 3, 900. 00 58 636 Country Source: La. Geo and CEPAL Only 16% of the potential is being exploited

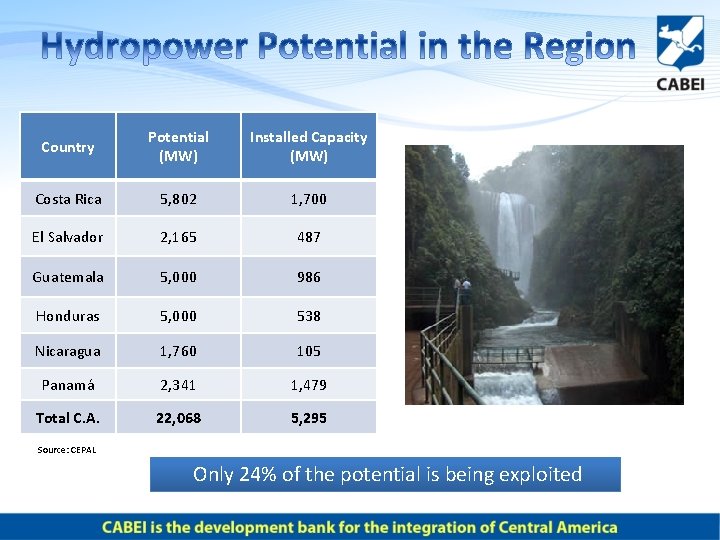

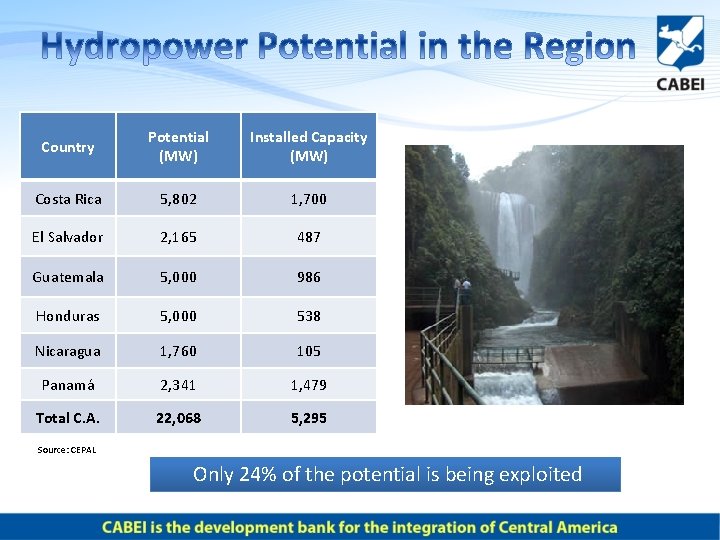

Country Potential (MW) Installed Capacity (MW) Costa Rica 5, 802 1, 700 El Salvador 2, 165 487 Guatemala 5, 000 986 Honduras 5, 000 538 Nicaragua 1, 760 105 Panamá 2, 341 1, 479 Total C. A. 22, 068 5, 295 Source: CEPAL Only 24% of the potential is being exploited

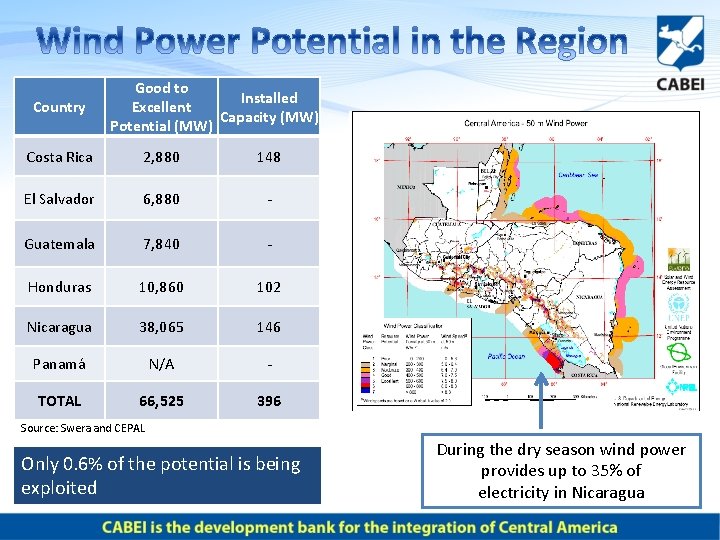

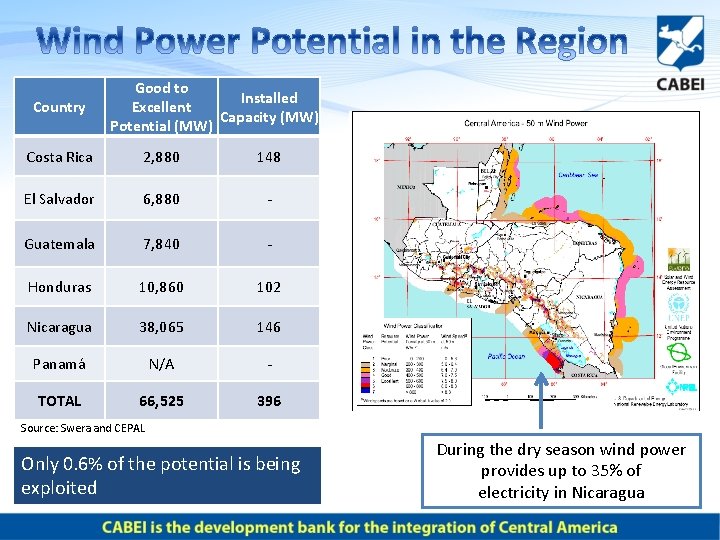

Country Good to Installed Excellent Capacity (MW) Potential (MW) Costa Rica 2, 880 148 El Salvador 6, 880 - Guatemala 7, 840 - Honduras 10, 860 102 Nicaragua 38, 065 146 Panamá N/A - TOTAL 66, 525 396 Source: Swera and CEPAL Only 0. 6% of the potential is being exploited During the dry season wind power provides up to 35% of electricity in Nicaragua

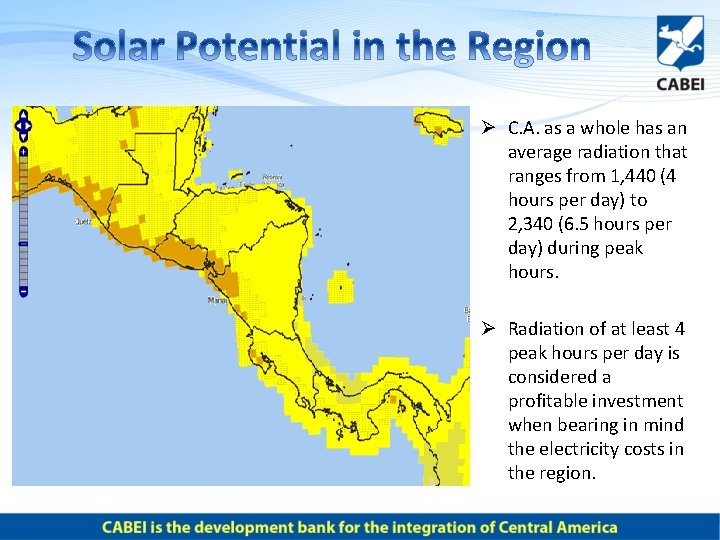

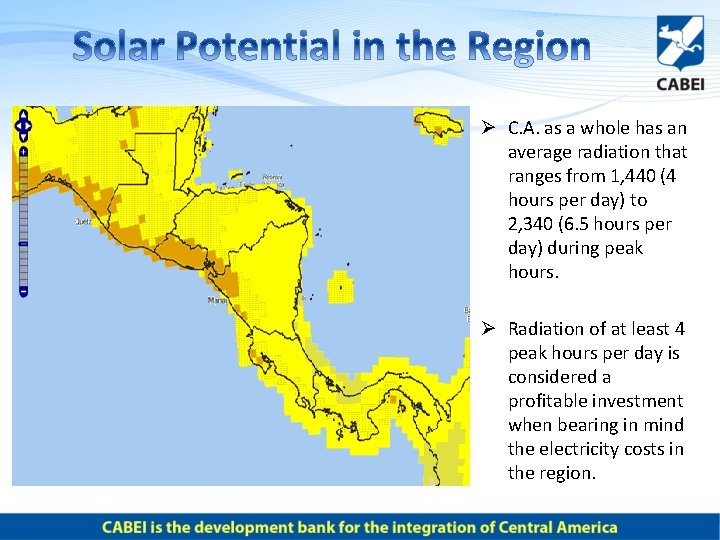

Ø C. A. as a whole has an average radiation that ranges from 1, 440 (4 hours per day) to 2, 340 (6. 5 hours per day) during peak hours. Ø Radiation of at least 4 peak hours per day is considered a profitable investment when bearing in mind the electricity costs in the region.

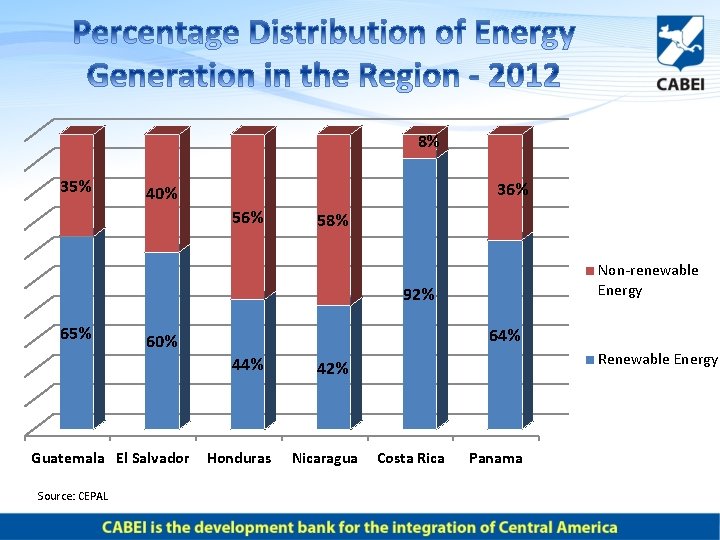

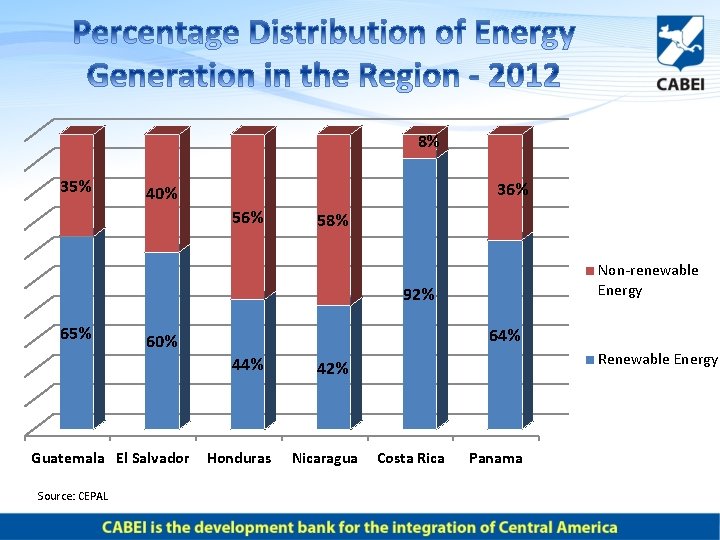

8% 35% 36% 40% 56% 58% Non-renewable Energy 92% 65% 64% 60% 44% Guatemala El Salvador Source: CEPAL Honduras Renewable Energy 42% Nicaragua Costa Rica Panama

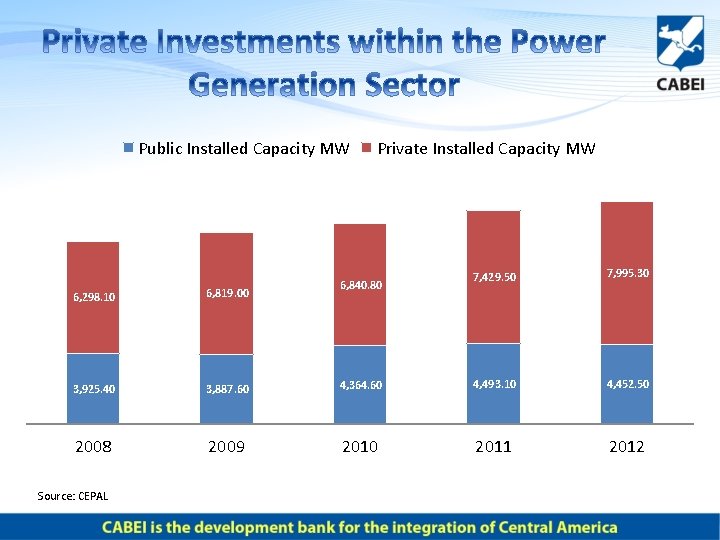

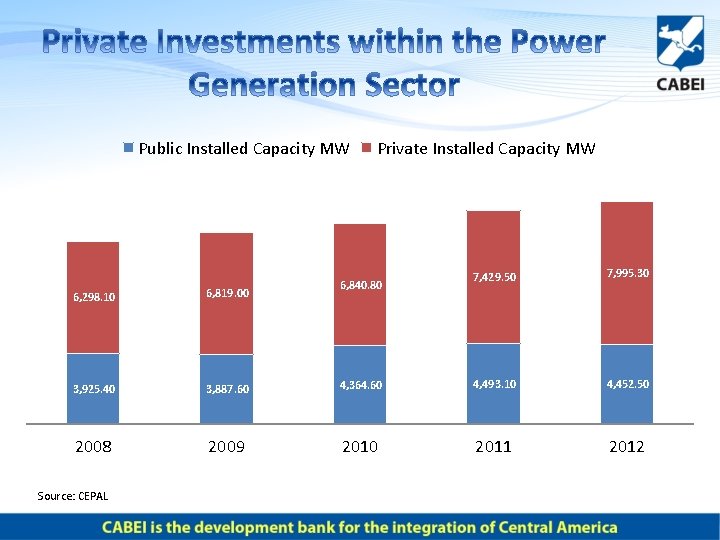

Public Installed Capacity MW Private Installed Capacity MW 6, 840. 80 7, 429. 50 7, 995. 30 6, 298. 10 6, 819. 00 3, 925. 40 3, 887. 60 4, 364. 60 4, 493. 10 4, 452. 50 2008 2009 2010 2011 2012 Source: CEPAL

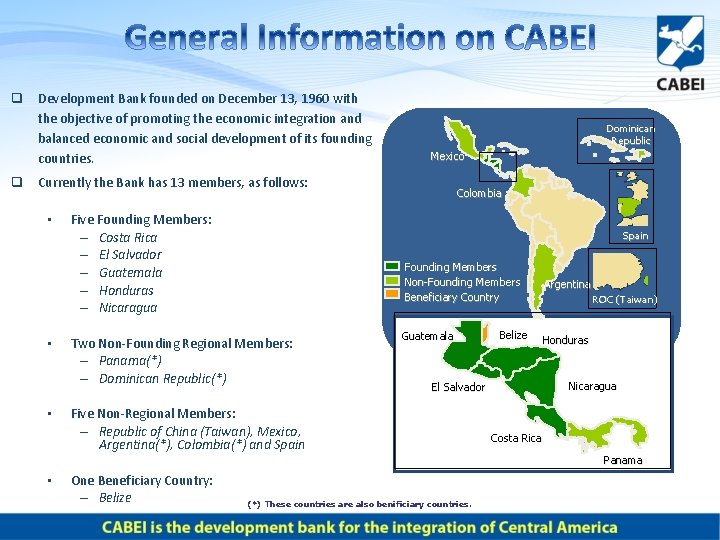

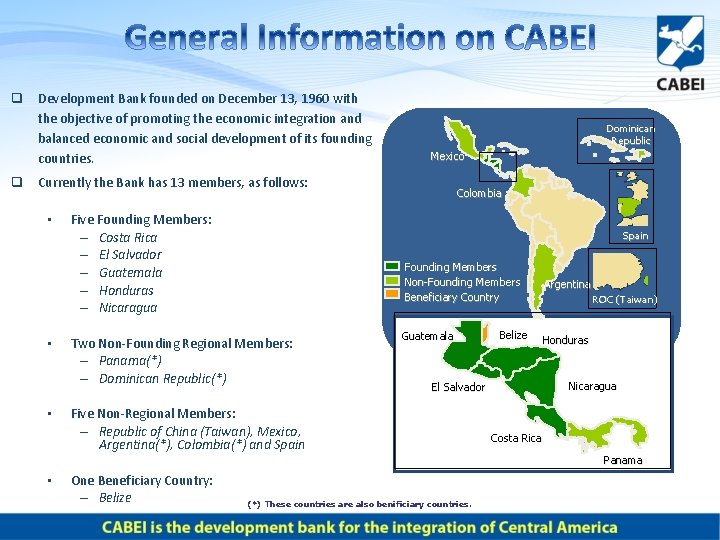

q Development Bank founded on December 13, 1960 with the objective of promoting the economic integration and balanced economic and social development of its founding countries. Dominican Republic Mexico q Currently the Bank has 13 members, as follows: • • • Five Founding Members: – Costa Rica – El Salvador – Guatemala – Honduras – Nicaragua Colombia Spain Founding Members Non-Founding Members Beneficiary Country Two Non-Founding Regional Members: – Panama(*) – Dominican Republic(*) Guatemala Belize ROC (Taiwan) Honduras Nicaragua El El Salvador Five Non-Regional Members: – Republic of China (Taiwan), Mexico, Argentina(*), Colombia(*) and Spain Argentina Costa Rica Panama • One Beneficiary Country: – Belize (*) These countries are also benificiary countries.

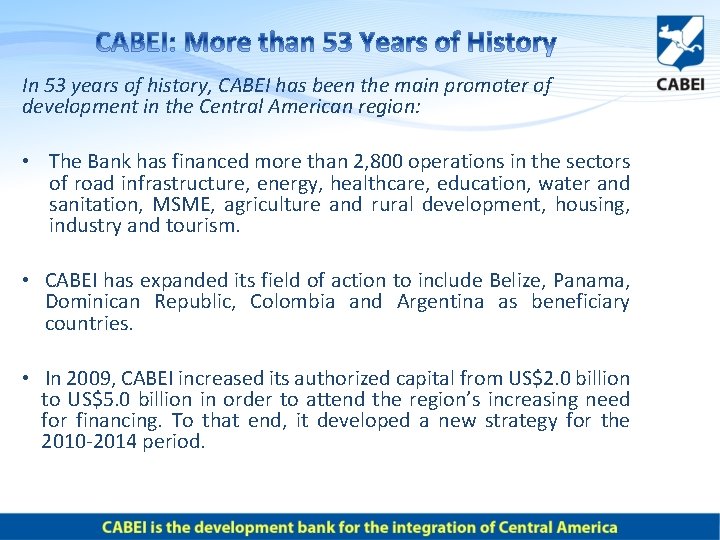

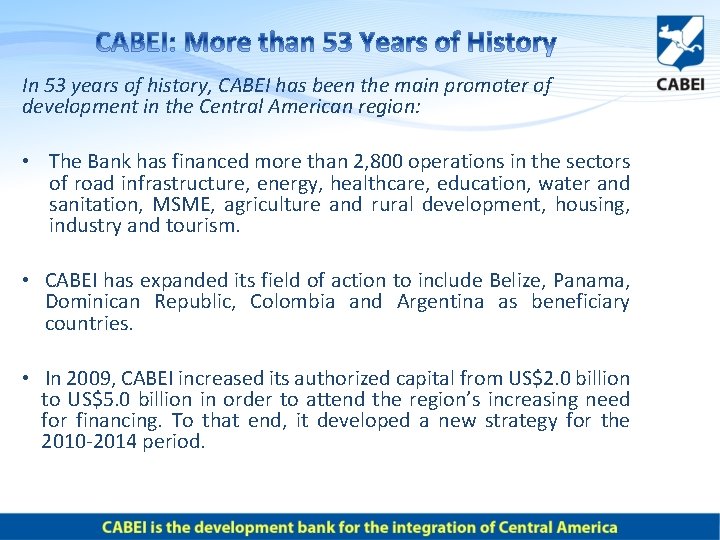

In 53 years of history, CABEI has been the main promoter of development in the Central American region: • The Bank has financed more than 2, 800 operations in the sectors of road infrastructure, energy, healthcare, education, water and sanitation, MSME, agriculture and rural development, housing, industry and tourism. • CABEI has expanded its field of action to include Belize, Panama, Dominican Republic, Colombia and Argentina as beneficiary countries. • In 2009, CABEI increased its authorized capital from US$2. 0 billion to US$5. 0 billion in order to attend the region’s increasing need for financing. To that end, it developed a new strategy for the 2010 -2014 period.

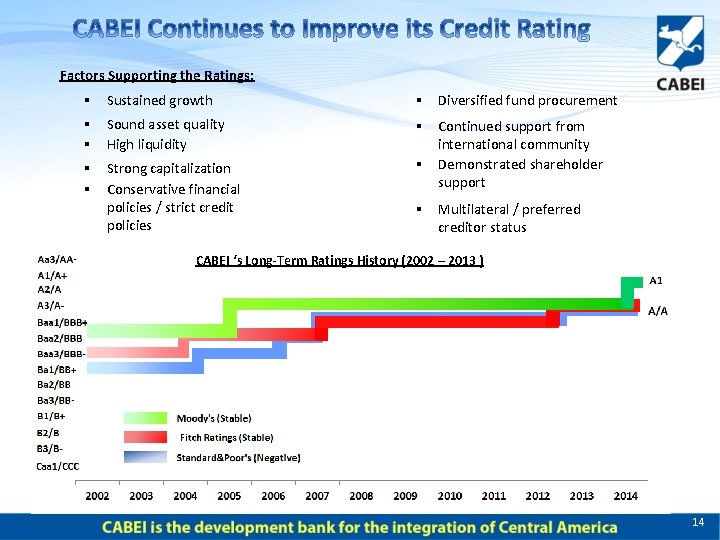

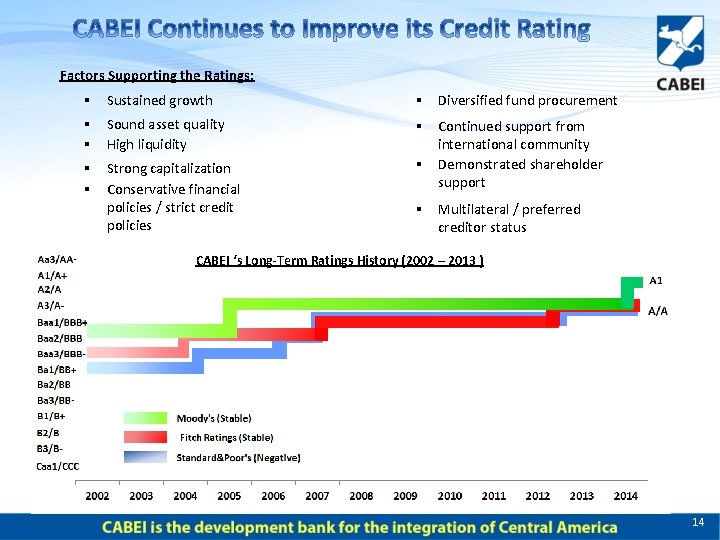

Factors Supporting the Ratings: § Sustained growth § Diversified fund procurement § Sound asset quality § High liquidity § Continued support from international community § Demonstrated shareholder support § Strong capitalization § Conservative financial policies / strict credit policies § Multilateral / preferred creditor status CABEI ‘s Long-Term Ratings History (2002 – 2013 ) 14

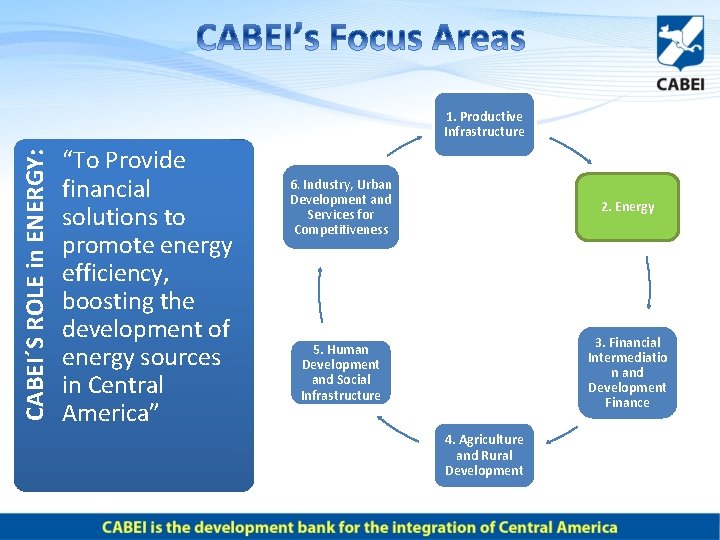

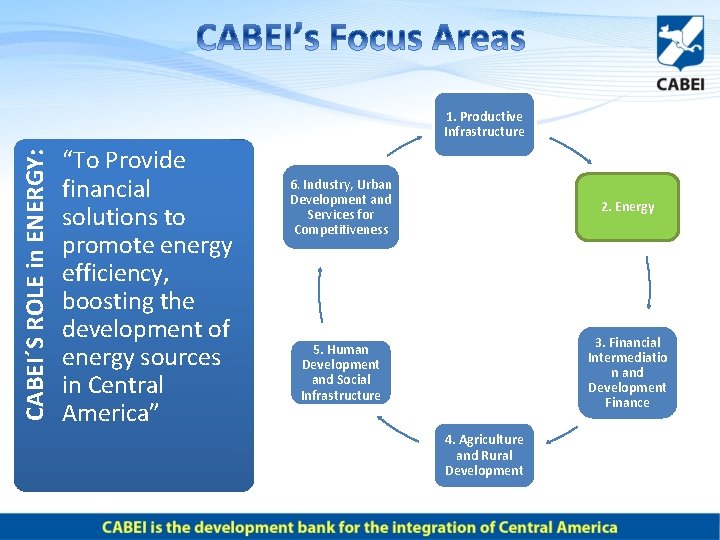

CABEI´S ROLE in ENERGY: 1. Productive Infrastructure “To Provide financial solutions to promote energy efficiency, boosting the development of energy sources in Central America” 6. Industry, Urban Development and Services for Competitiveness 2. Energy 5. Human Development and Social Infrastructure 3. Financial Intermediatio n and Development Finance 4. Agriculture and Rural Development

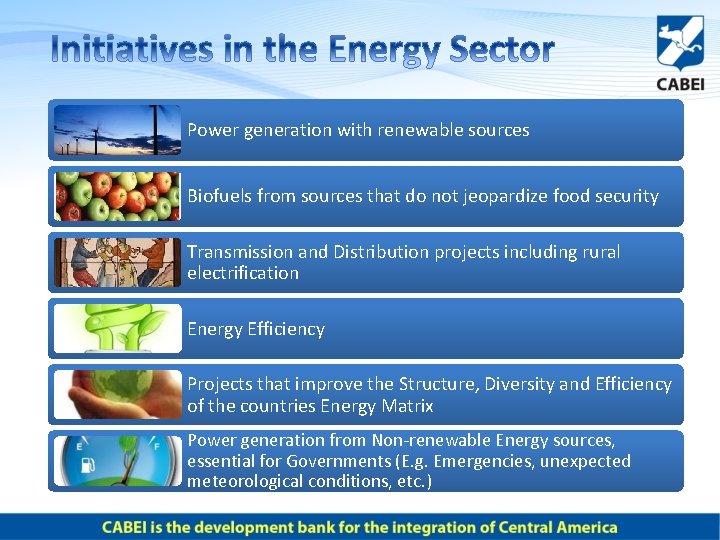

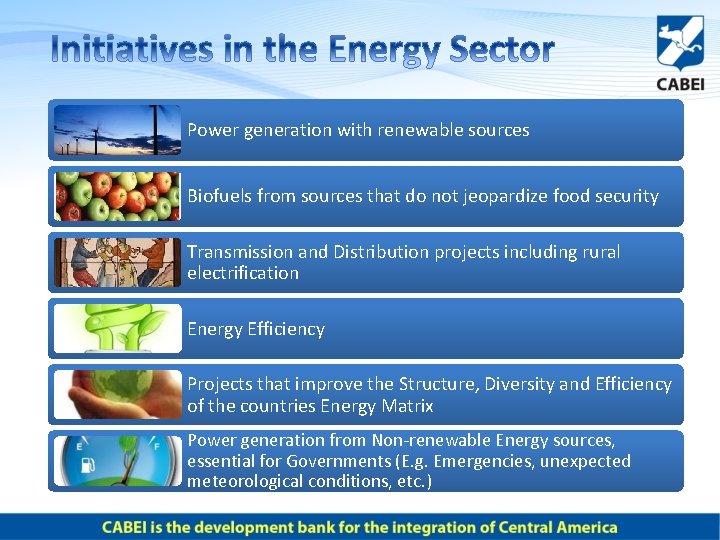

Power generation with renewable sources Biofuels from sources that do not jeopardize food security Transmission and Distribution projects including rural electrification Energy Efficiency Projects that improve the Structure, Diversity and Efficiency of the countries Energy Matrix Power generation from Non-renewable Energy sources, essential for Governments (E. g. Emergencies, unexpected meteorological conditions, etc. )

More than 170 projects with a total investment of more than US$2. 9 billion) 64% Renewable 19% Energy Infrastructure (SIEPAC) Approximately 4, 505 MW Equivalent to 36% of the installed capacity in the Central American region More than 30 million tons of reduction in greenhouse gases Public sector 72% Private sector 28%

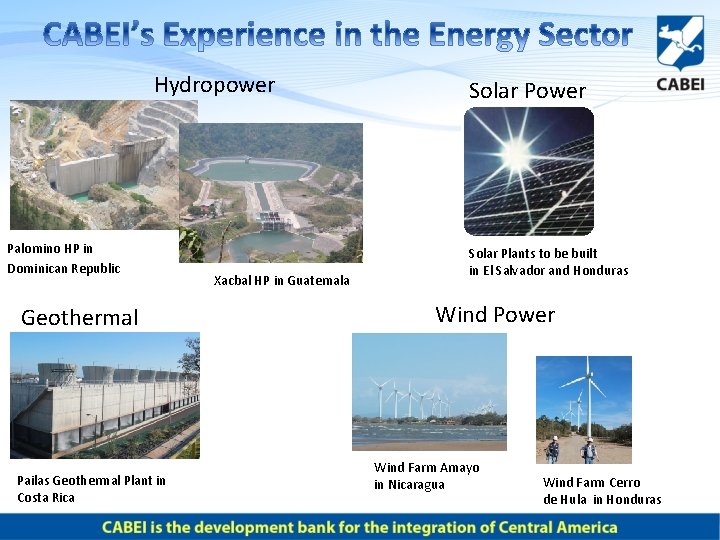

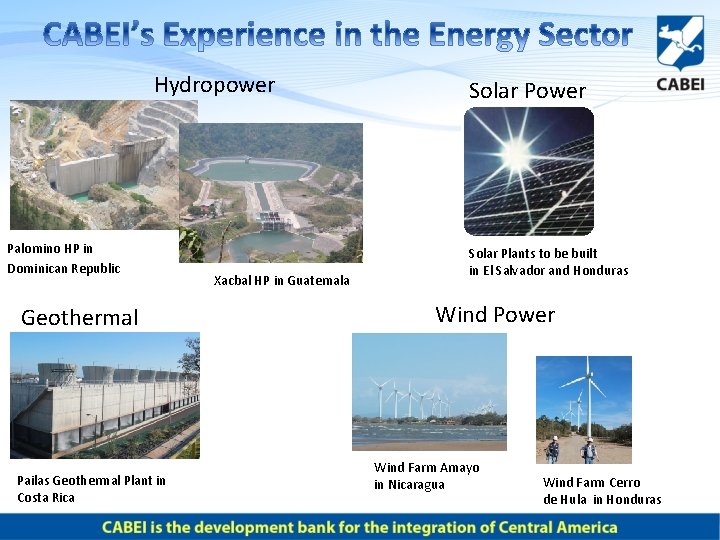

Hydropower Solar Power Palomino HP in Dominican Republic Solar Plants to be built in El Salvador and Honduras Geothermal Pailas Geothermal Plant in Costa Rica Xacbal HP in Guatemala Wind Power Wind Farm Amayo in Nicaragua Wind Farm Cerro de Hula in Honduras

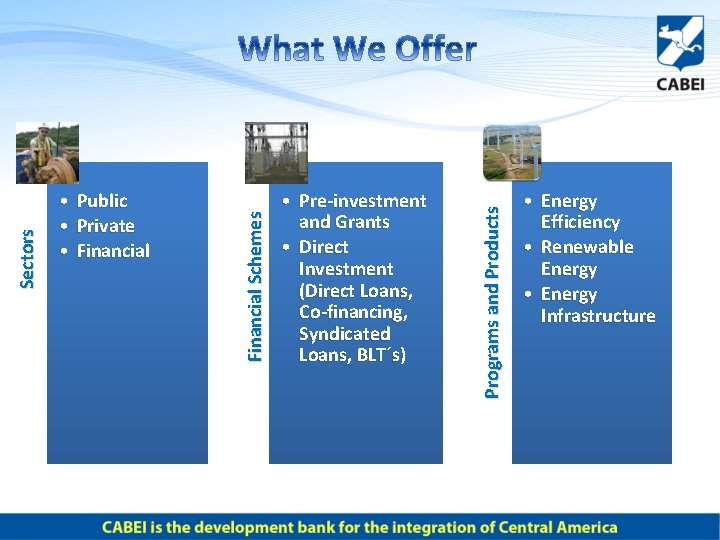

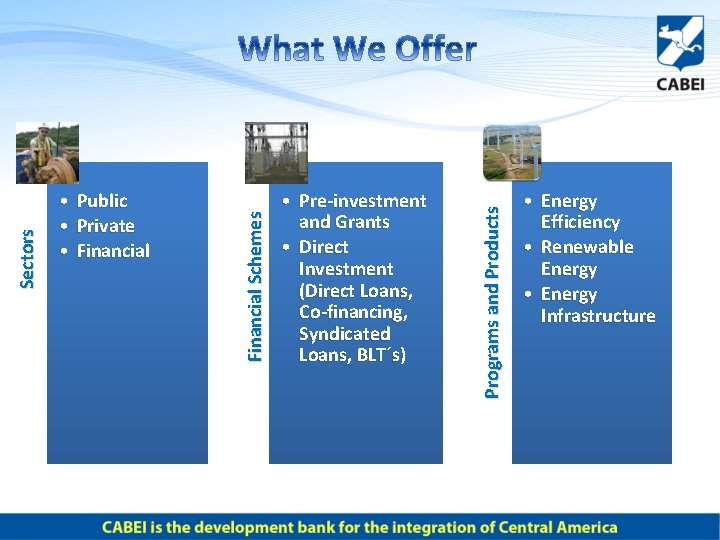

• Pre-investment and Grants • Direct Investment (Direct Loans, Co-financing, Syndicated Loans, BLT´s) Programs and Products Public Private Financial Schemes Sectors • • Energy Efficiency • Renewable Energy • Energy Infrastructure

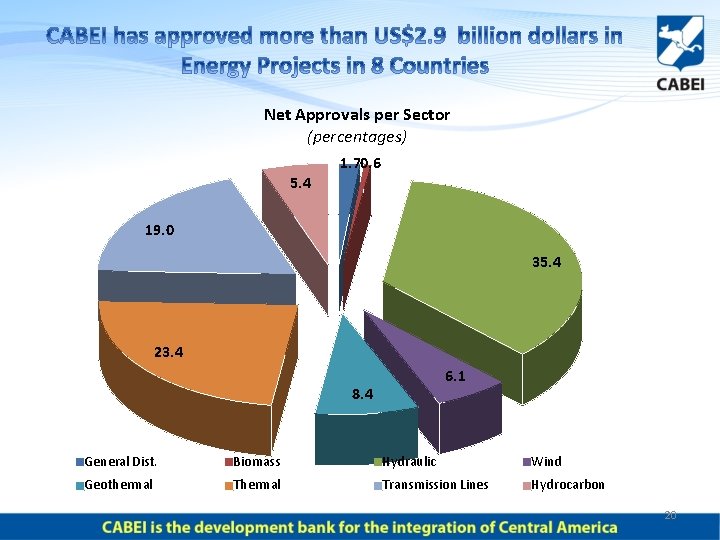

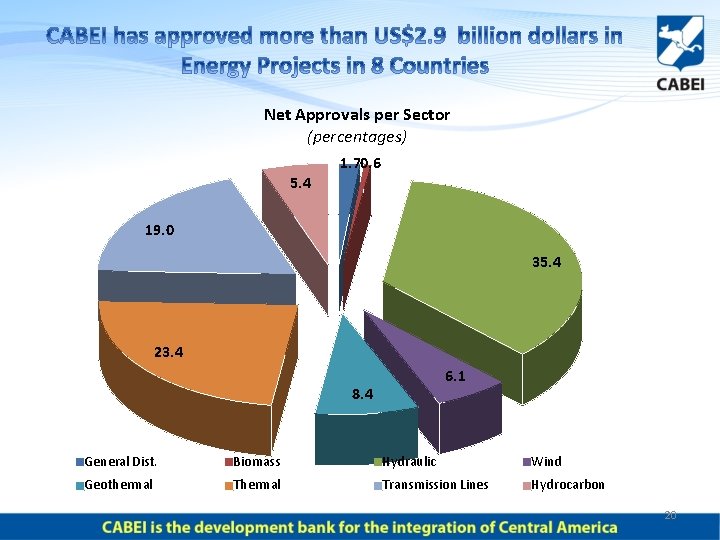

Net Approvals per Sector (percentages) 1. 70. 6 5. 4 19. 0 35. 4 23. 4 6. 1 8. 4 General Dist. Biomass Hydraulic Wind Geothermal Transmission Lines Hydrocarbon 20

• CABEI expects to approve US$360 MM during 2014 in the Energy sector (25% of the Bank´s investment portfolio). • Projects to be funded during 2014: Wind Power, Hydro, Geothermal and Private investments (mainly in Honduras) due to the Deregulation of the Transmission and Distribution lines.

• Stronger links with National Goverments, other Multilaterals (IADB, WB, CAF) and Bilateral Financial Institutions (KFW) will lead to new projects, such as: (a) Joint Geothermal Development Facilities to boost investment within this renewable energy source. (b) Distribution Generated Energy with help of solar technology and a considerable increase in solar energy interconnected to National Grids capable of supplying neighbouring countries through existing infraestructure. (c) New power additions from Wind Power throughout the region. (d) Introduction of Natural Gas as a cleaner and more efficient source of Energy, displacing Bunker fuel.

• CABEI is committed to financing RE energy projects and maintaining its position as main financial provider of the Central American region. • CABEI will maintain its support to national and regional interventions such as those identified within the Central American Integration System and Mesoamerica Project. • New power generation will come, most likely, from RE investments due to market and environmental considerations. • Every single country in the region has opened the power generation sector to private investors.

• Deregulated Energy Markets in Guatemala, El Salvador, Nicaragua and Panama, will allow investments in power generation, distribution and high voltage transmission (only GUA and ES allow private investments in high voltage). • Honduras is currently deregulating its Energy sector with a clear decision to allow investments in Transmission and Distribution (currently only the power generation sector is open to private investments). • The introduction of RE will need investment from distribution/energy related companies in order to cope with the intermittence issue of these technologies. • US$1. 5 billion per year will be required to fulfill energy investment needs in the region.

Thank you Central American Bank for Economic Integration

Que ilustre

Que ilustre Conector de sin embargo

Conector de sin embargo Reemplazar la jerarquía con equipos autodirigidos

Reemplazar la jerarquía con equipos autodirigidos Reemplazar la jerarquía con equipos autodirigidos

Reemplazar la jerarquía con equipos autodirigidos Foto de hamster foto de hamster

Foto de hamster foto de hamster Sexto dia da trezena de santo antônio

Sexto dia da trezena de santo antônio Colegio de abogados de lambayeque

Colegio de abogados de lambayeque Ilustre el quijote

Ilustre el quijote Ilustre colegio de abogados de lambayeque

Ilustre colegio de abogados de lambayeque Las personas valen por lo que son y no por lo que tienen

Las personas valen por lo que son y no por lo que tienen Med pub

Med pub Redes sociales verticales y horizontales

Redes sociales verticales y horizontales Buscar imagenes por foto

Buscar imagenes por foto Buscar imagenes por foto

Buscar imagenes por foto Buscar imagenes por foto

Buscar imagenes por foto Nbr 15287

Nbr 15287 Tema-tema teologi perjanjian lama

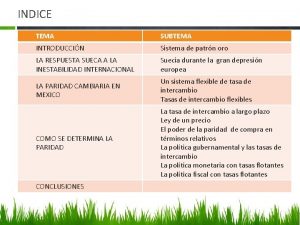

Tema-tema teologi perjanjian lama El tema y sub tema

El tema y sub tema Que tipo de entrevistas hay

Que tipo de entrevistas hay Aliran tertua didalam seni lukis modern yaitu aliran

Aliran tertua didalam seni lukis modern yaitu aliran Ejemplos de delimitación de la investigación

Ejemplos de delimitación de la investigación Pon tres ejemplos de pilares vigas y tirantes

Pon tres ejemplos de pilares vigas y tirantes Instrumentos tipicos de cantabria

Instrumentos tipicos de cantabria Una foto suya

Una foto suya Que es un buscador

Que es un buscador Por fuera muy colorido

Por fuera muy colorido