Personal Finance SIXTH EDITION Chapter 4 Using Tax

- Slides: 48

Personal Finance SIXTH EDITION Chapter 4 Using Tax Concepts for Planning* Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Chapter Objective (1 of 2) 4. 1 Provide a background on taxes 4. 2 Explain how to determine your tax filing status 4. 3 Demonstrate how to calculate your gross income 4. 4 Show deductions and exemptions can be used Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Chapter Objective (2 of 2) 4. 5 Explain how to determine your taxable income, tax liability, and refund or additional taxes owed 4. 6 Explain how tax planning fits within your financial plan Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (1 of 10) • Taxes are an integral part of our economy • They are paid on earned income, consumer purchases, wealth transfers and capital assets • Special taxes are levied on things like alcohol, cigarettes and gasoline Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (2 of 10) • Corporations pay income tax on profits • Homeowners pay property taxes • Taxes are used to pay for government services and programs • Most individuals pay taxes at federal, state and local levels Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (3 of 10) • Federal tax system is administered by the Internal Revenue Service (IRS) • Taxes are paid in several ways – At the time of a transaction – Through payroll withholding – By making estimated quarterly payments • Tax year for federal income tax ends on Dec. 31 with taxes filed by April 15 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (4 of 10) • Tax Law Changes – Economic Growth and Tax Relief Reconciliation Act of 2001: tax cut package designed to provide short-term economic stimulus through tax relief for taxpayers § Provisions scheduled to phased in between 2001 and 2011 when the law was scheduled to expire Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (5 of 10) – Jobs and Growth Tax Relief Act of 2003: an act that accelerated much of the tax relief resulting from the 2001 Tax Relief Act § Individual rates lowered 2 -3% § Child tax credit increased to $1, 000 § Standard deduction increased for married taxpayers Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (6 of 10) – Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010: Legislation that extended many of the previous tax law provisions through the year 2012 – American Taxpayers Relief Act of 2012: Permanently set in place many provisions from the 2010 legislation Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (7 of 10) – Affordable Care Act of 2010: Legislation requiring everyone must obtain health insurance and report medical coverage status on their tax return § If proof of health insurance is not provided a penalty will be assessed Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (8 of 10) • Social Security and Medicare Taxes – Earned Income: Earned income represents salary or wages – FICA (Federal Insurance Contribution Act): Taxes paid to fund the Social Security System and Medicare – Medicare: a government health insurance program that covers people over age 65 and provides payments to health care providers in the case of illness Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (9 of 10) • Social Security and Medicare Taxes – Your employer matches the amount that is withheld from your wages § Social Security taxes equal 6. 2% of your salary up to a maximum level of $118, 500 as of 2015 § Medicare taxes are 1. 45 % of your earned income – Self-employed people must pay both parts of these taxes themselves— 15. 3% Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Background on Taxes (10 of 10) • Personal income taxes: taxes imposed on income earned – If you earn income you must file a Form 1040, 1040 A or 1040 EZ to determine your tax liability – Filing deadline is April 15 of each year Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online • Go to www. irs. gov/ • This Web site provides information about tax rates, guidelines, and deadlines Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Filing Status • Taxpayers must specify a filing status for their tax return because different rates are associated with each status. – Single – Married filing jointly – Married filing separately – Head of household – Qualifying widow(er) with dependent child Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

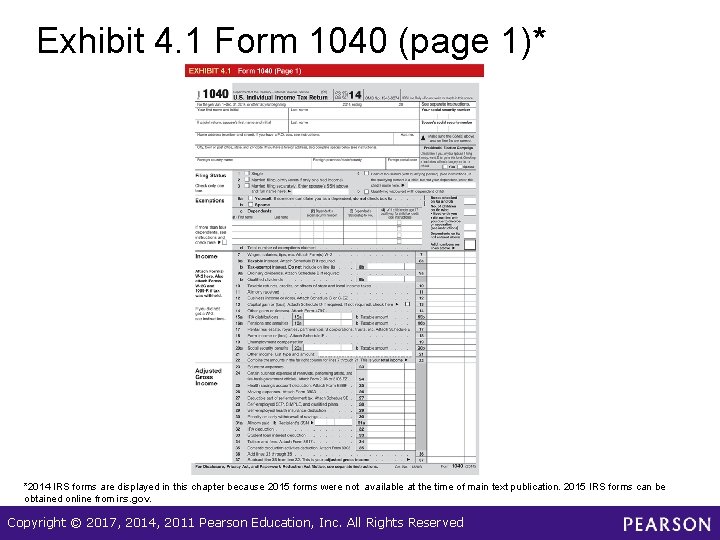

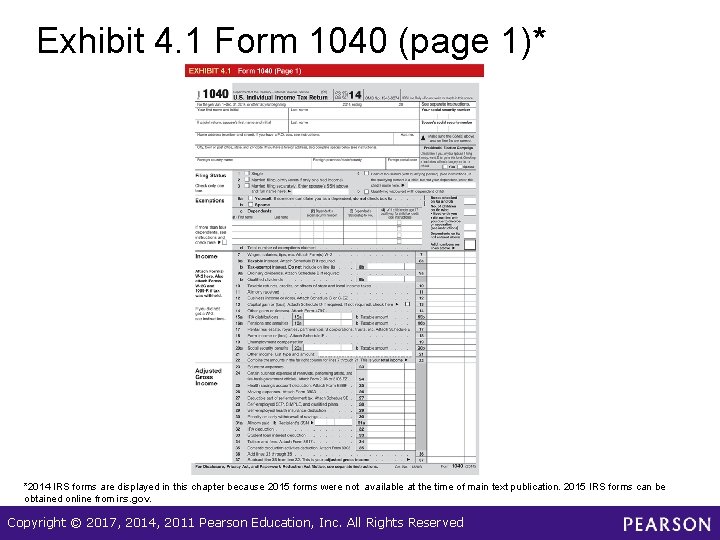

Exhibit 4. 1 Form 1040 (page 1)* *2014 IRS forms are displayed in this chapter because 2015 forms were not available at the time of main text publication. 2015 IRS forms can be obtained online from irs. gov. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

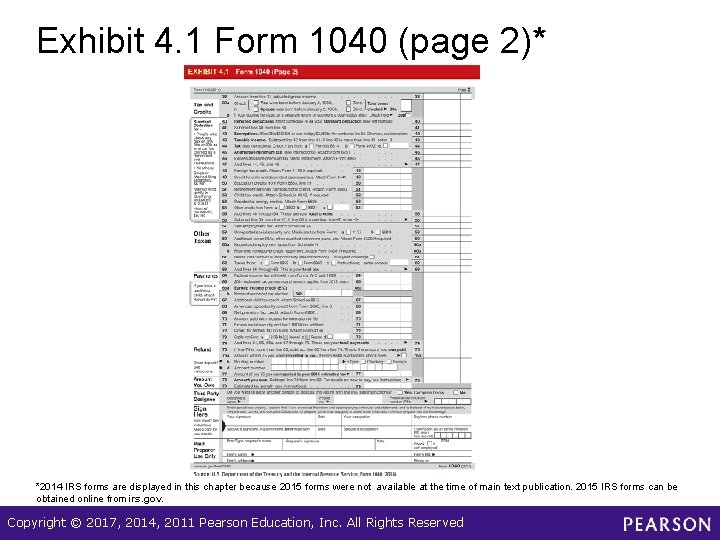

Exhibit 4. 1 Form 1040 (page 2)* *2014 IRS forms are displayed in this chapter because 2015 forms were not available at the time of main text publication. 2015 IRS forms can be obtained online from irs. gov. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Gross Income (1 of 5) • Gross income: all reportable income from any source, including salary, interest income, dividend income, and capital gains received during the tax year – Wages and Salaries—including bonuses, but excluding contributions to an employee sponsored retirement account – Interest income: interest earned from investments or loans to other individuals Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Gross Income (2 of 5) – Dividend income: income received in the form of dividends paid on stocks or mutual funds – Capital gain: income earned when an asset is sold at a higher price than was paid for it § Short-term capital gain: a gain on assets that were held less than 12 months § Long-term capital gain: a gain on assets that were held for 12 months or longer Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Gross Income (3 of 5) – Capital gains tax: the tax that is paid on a gain earned as a result of selling an asset for more than the purchase price § The tax rate on a long-term capital gain is lower than the tax rate on ordinary income § The tax rate that applies depends on your tax bracket but ranges between 0% and 20% Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Gross Income (4 of 5) • Determining gross income – Gross income: all reportable income from any source, including salary, interest income, dividend income, and capital gains received during the tax year Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

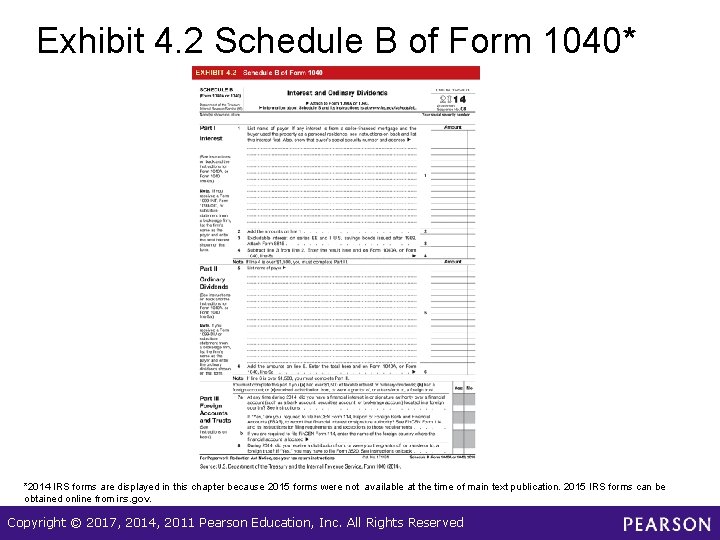

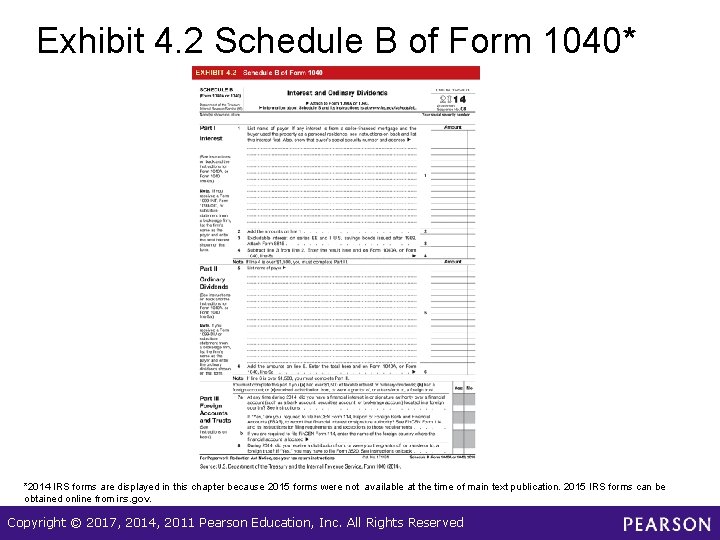

Exhibit 4. 2 Schedule B of Form 1040* *2014 IRS forms are displayed in this chapter because 2015 forms were not available at the time of main text publication. 2015 IRS forms can be obtained online from irs. gov. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

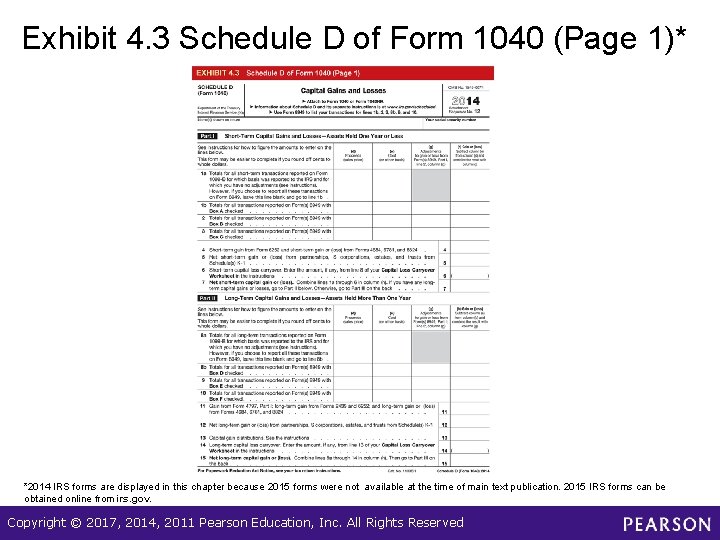

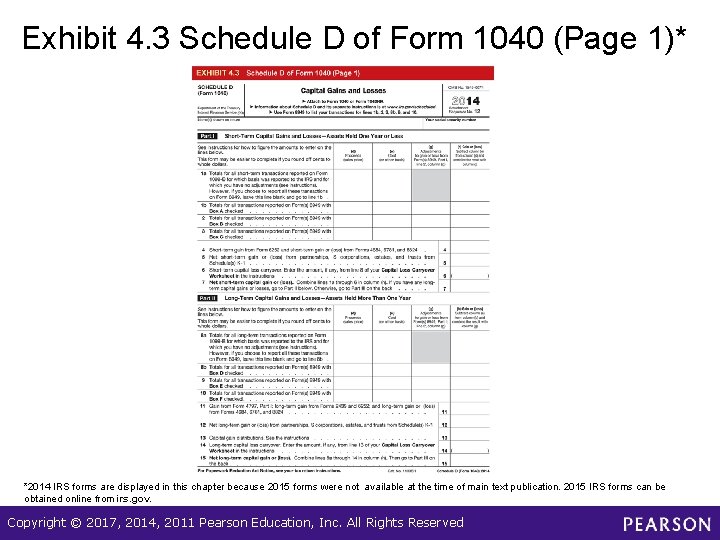

Exhibit 4. 3 Schedule D of Form 1040 (Page 1)* *2014 IRS forms are displayed in this chapter because 2015 forms were not available at the time of main text publication. 2015 IRS forms can be obtained online from irs. gov. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

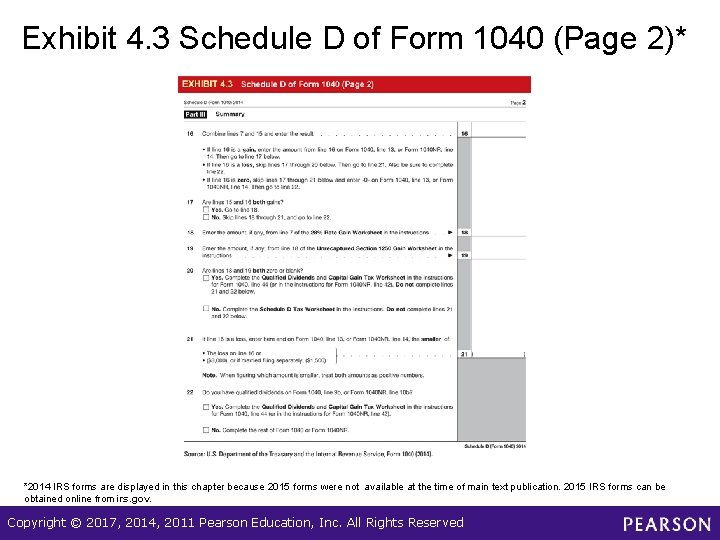

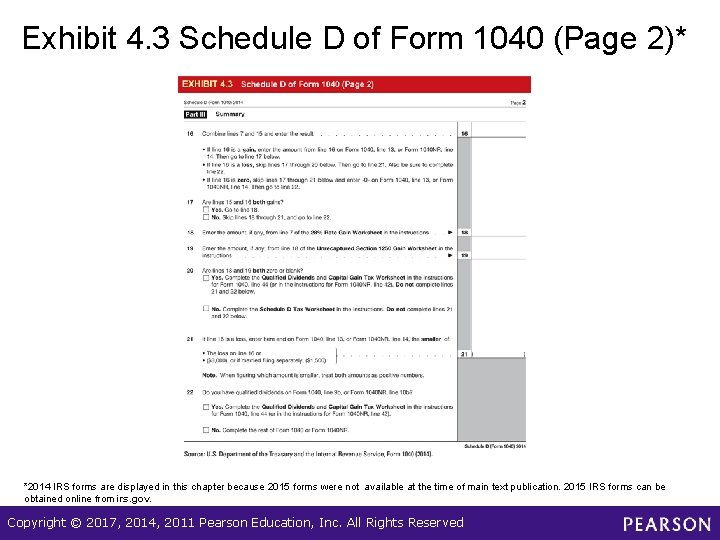

Exhibit 4. 3 Schedule D of Form 1040 (Page 2)* *2014 IRS forms are displayed in this chapter because 2015 forms were not available at the time of main text publication. 2015 IRS forms can be obtained online from irs. gov. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Gross Income (5 of 5) • Determining gross income – Determined by adding your salary, net business income, interest income, dividend income, and capital gains • Adjusted gross income: adjusts gross income for contributions to IRAs, alimony payments, interest paid on student loans, and other special circumstances Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Deductions and Exemptions (1 of 6) • Standard deduction: a fixed amount that can be deducted from adjusted gross income to determine taxable income – Not affected by income – Affected by filing status and age – Adjusted by the IRS each year to keep pace with inflation Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

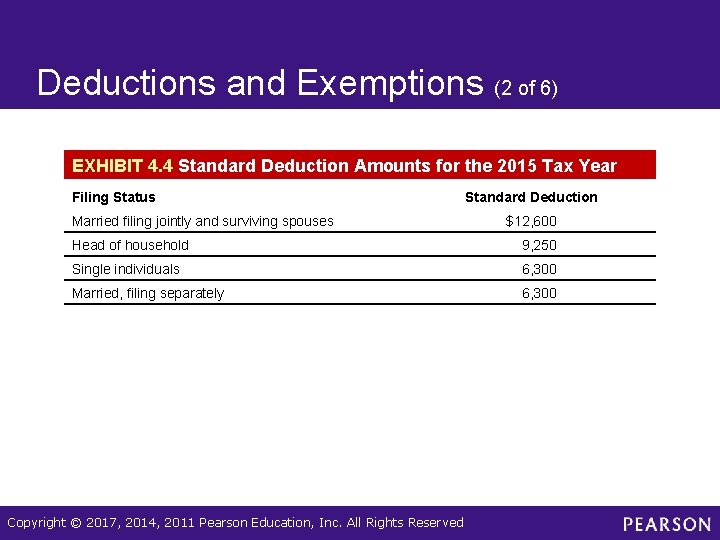

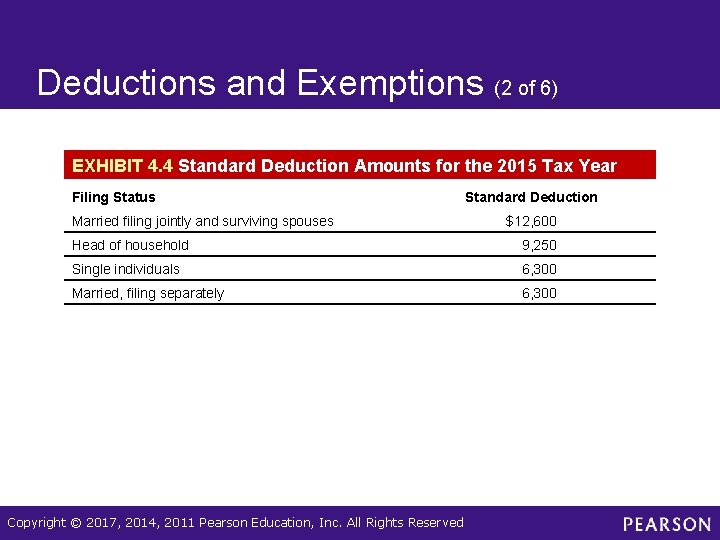

Deductions and Exemptions (2 of 6) EXHIBIT 4. 4 Standard Deduction Amounts for the 2015 Tax Year Filing Status Married filing jointly and surviving spouses Standard Deduction $12, 600 Head of household 9, 250 Single individuals 6, 300 Married, filing separately 6, 300 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Deductions and Exemptions (3 of 6) • Itemized deductions: specific expenses that can be deducted to reduce taxable income – Interest expense - interest paid on borrowed money— primarily interest on mortgages – State income tax: an income tax imposed by some states on people who receive income from employers in that state § Local income taxes also deductible when itemizing Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Deductions and Exemptions (4 of 6) – Real estate tax: a tax imposed on a home or other real estate in the county where the property is located – Medical expenses: medical expenses in excess of 10. 0% of adjusted gross income may also be itemized – Charitable gifts § Gifts to qualified organizations – Cash or property § Be sure to keep receipts and records of gifts Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Deductions and Exemptions (5 of 6) – Other expenses § Theft losses, job expenses if substantial – Summary of deductible expenses § Total deductible expenses to decide whether to itemize or use the standard deduction Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

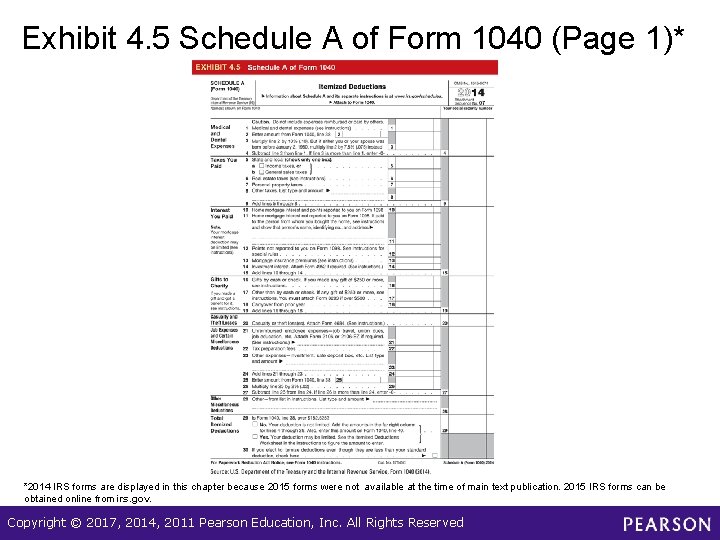

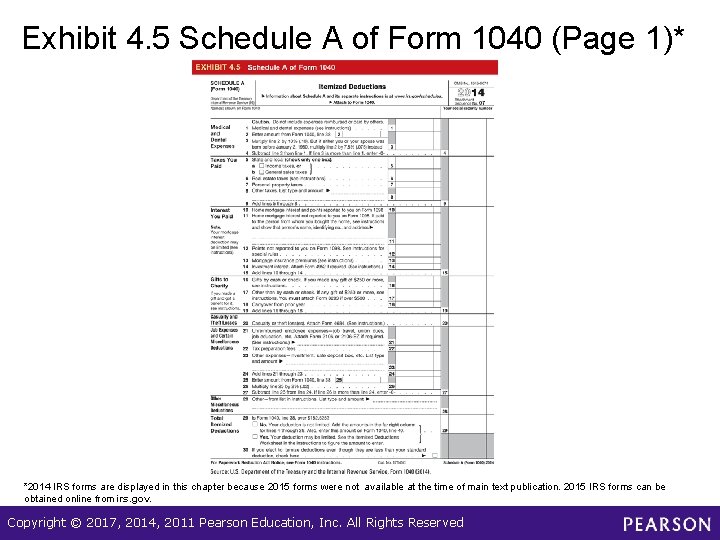

Exhibit 4. 5 Schedule A of Form 1040 (Page 1)* *2014 IRS forms are displayed in this chapter because 2015 forms were not available at the time of main text publication. 2015 IRS forms can be obtained online from irs. gov. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online • Go to www. turbotax. com • Use the tools on this Web site to estimate your tax liability for the year and tax refund if applicable – You will need to input income, filing status, exemptions and deductions to obtain the estimates Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

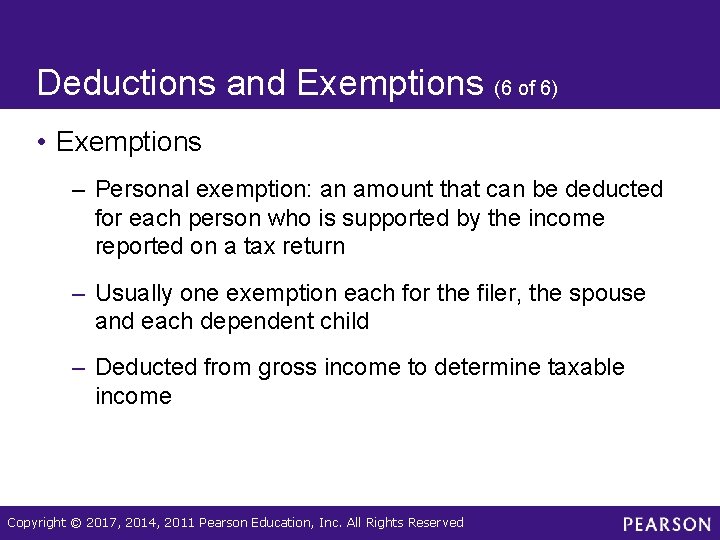

Deductions and Exemptions (6 of 6) • Exemptions – Personal exemption: an amount that can be deducted for each person who is supported by the income reported on a tax return – Usually one exemption each for the filer, the spouse and each dependent child – Deducted from gross income to determine taxable income Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

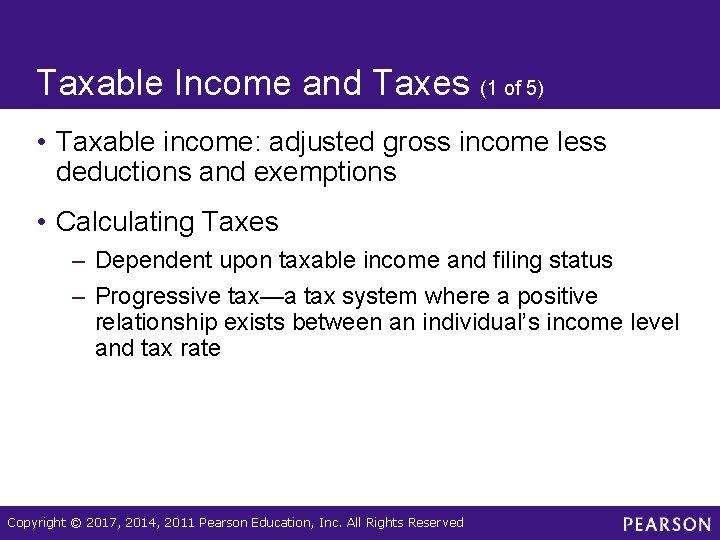

Taxable Income and Taxes (1 of 5) • Taxable income: adjusted gross income less deductions and exemptions • Calculating Taxes – Dependent upon taxable income and filing status – Progressive tax—a tax system where a positive relationship exists between an individual’s income level and tax rate Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

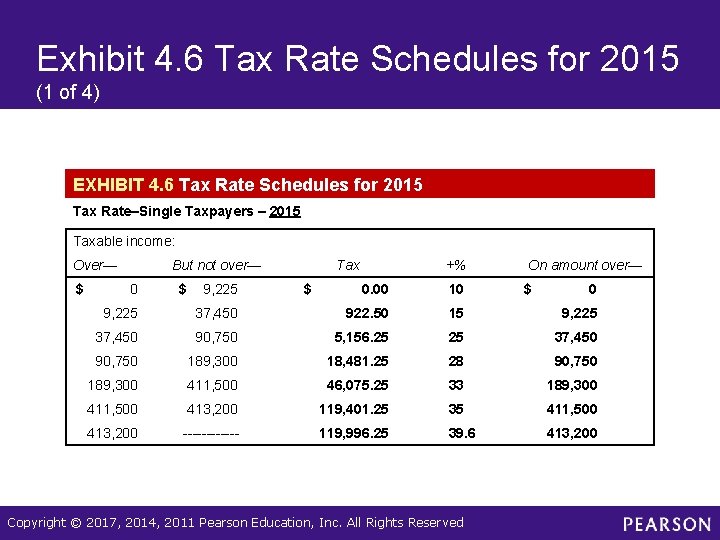

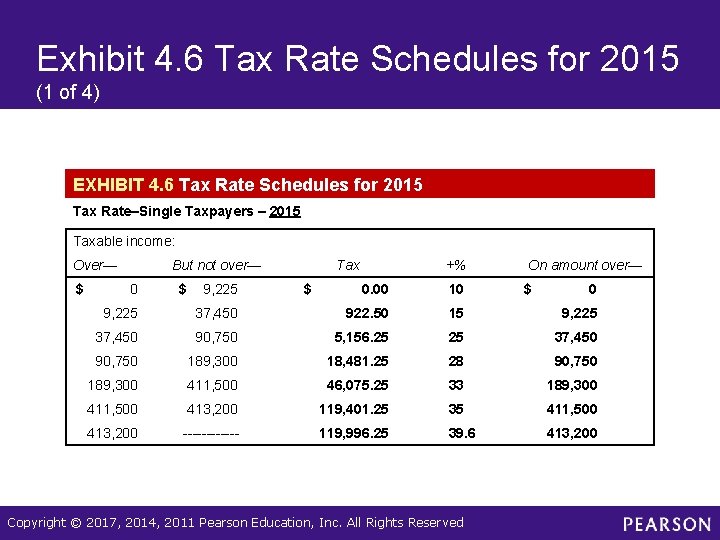

Exhibit 4. 6 Tax Rate Schedules for 2015 (1 of 4) EXHIBIT 4. 6 Tax Rate Schedules for 2015 Tax Rate–Single Taxpayers – 2015 Taxable income: Over— $ But not over— 0 $ 9, 225 Tax $ +% 0. 00 10 On amount over— $ 0 9, 225 37, 450 922. 50 15 9, 225 37, 450 90, 750 5, 156. 25 25 37, 450 90, 750 189, 300 18, 481. 25 28 90, 750 189, 300 411, 500 46, 075. 25 33 189, 300 411, 500 413, 200 119, 401. 25 35 411, 500 413, 200 ------ 119, 996. 25 39. 6 413, 200 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

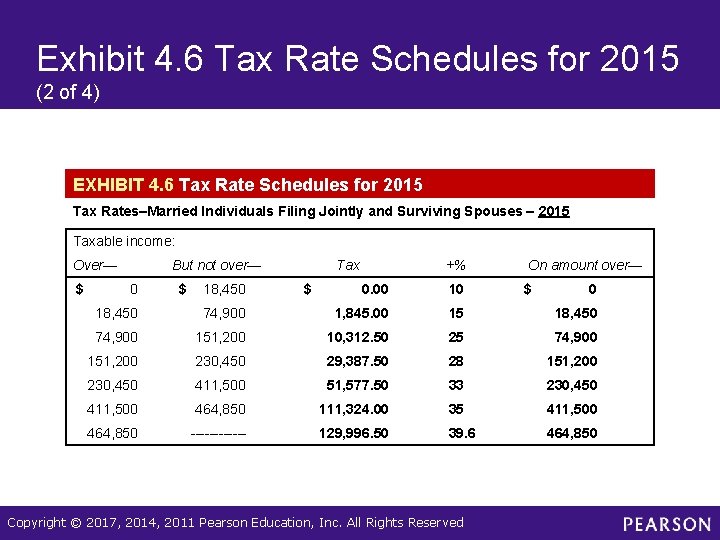

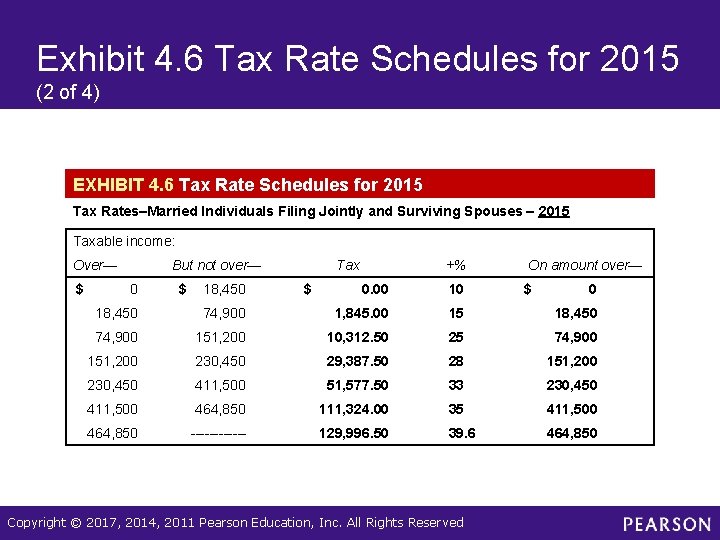

Exhibit 4. 6 Tax Rate Schedules for 2015 (2 of 4) EXHIBIT 4. 6 Tax Rate Schedules for 2015 Tax Rates–Married Individuals Filing Jointly and Surviving Spouses – 2015 Taxable income: Over— $ But not over— 0 $ 18, 450 Tax $ +% 0. 00 10 On amount over— $ 0 18, 450 74, 900 1, 845. 00 15 18, 450 74, 900 151, 200 10, 312. 50 25 74, 900 151, 200 230, 450 29, 387. 50 28 151, 200 230, 450 411, 500 51, 577. 50 33 230, 450 411, 500 464, 850 111, 324. 00 35 411, 500 464, 850 ------ 129, 996. 50 39. 6 464, 850 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

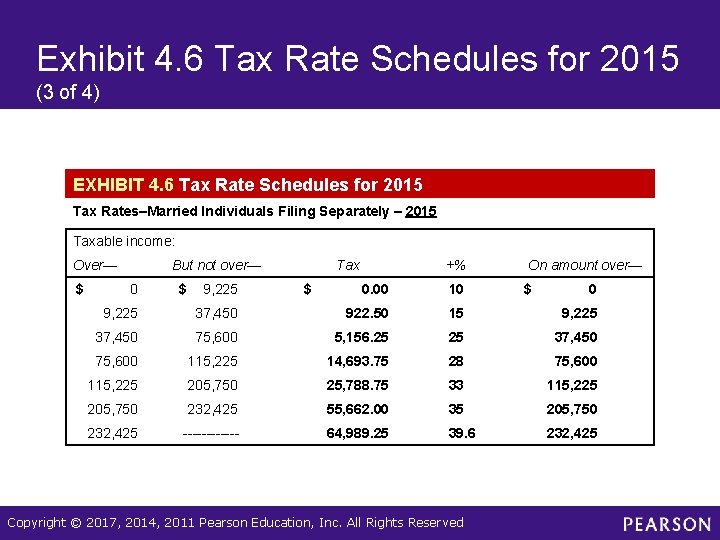

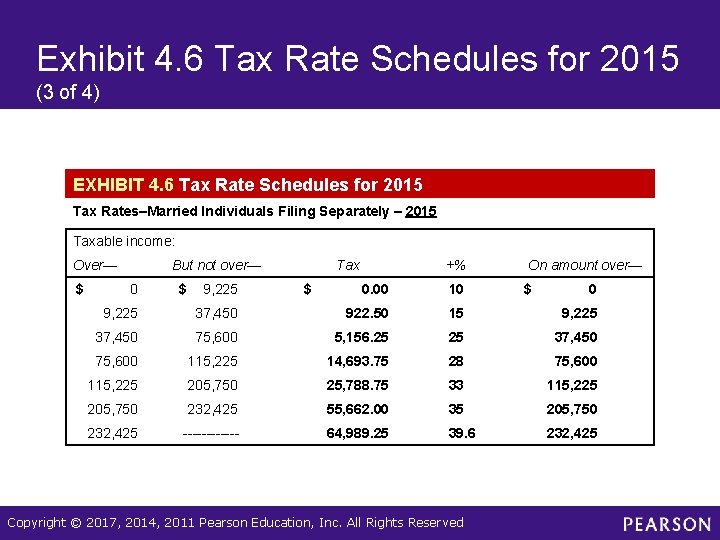

Exhibit 4. 6 Tax Rate Schedules for 2015 (3 of 4) EXHIBIT 4. 6 Tax Rate Schedules for 2015 Tax Rates–Married Individuals Filing Separately – 2015 Taxable income: Over— $ But not over— 0 $ 9, 225 Tax $ +% 0. 00 10 On amount over— $ 0 9, 225 37, 450 922. 50 15 9, 225 37, 450 75, 600 5, 156. 25 25 37, 450 75, 600 115, 225 14, 693. 75 28 75, 600 115, 225 205, 750 25, 788. 75 33 115, 225 205, 750 232, 425 55, 662. 00 35 205, 750 232, 425 ------ 64, 989. 25 39. 6 232, 425 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

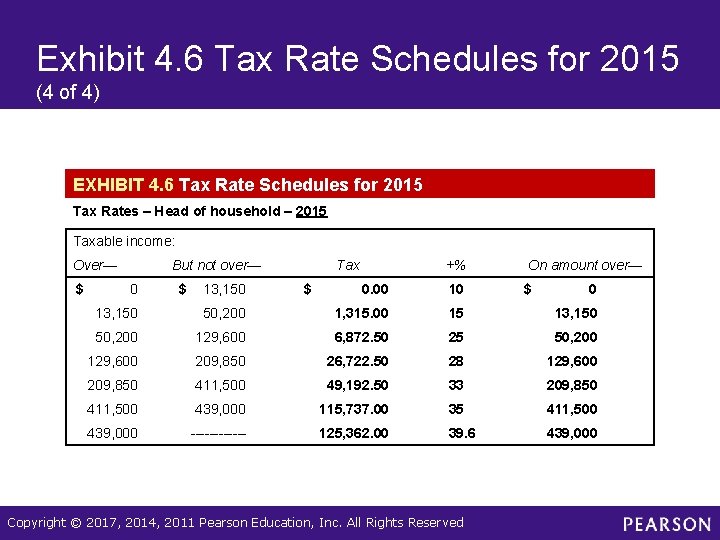

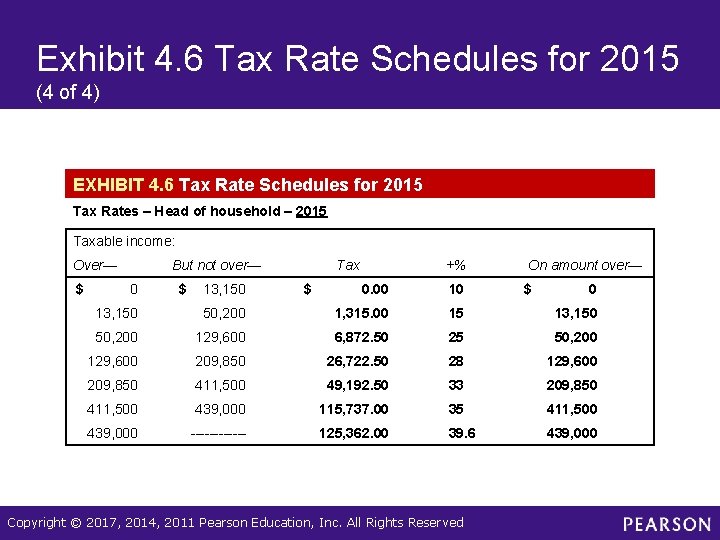

Exhibit 4. 6 Tax Rate Schedules for 2015 (4 of 4) EXHIBIT 4. 6 Tax Rate Schedules for 2015 Tax Rates – Head of household – 2015 Taxable income: Over— $ But not over— 0 $ 13, 150 Tax $ +% 0. 00 10 On amount over— $ 0 13, 150 50, 200 1, 315. 00 15 13, 150 50, 200 129, 600 6, 872. 50 25 50, 200 129, 600 209, 850 26, 722. 50 28 129, 600 209, 850 411, 500 49, 192. 50 33 209, 850 411, 500 439, 000 115, 737. 00 35 411, 500 439, 000 ------ 125, 362. 00 39. 6 439, 000 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Taxable Income and Taxes (2 of 5) – Determining your tax liability § Determine filing status and follow the instructions on the tax schedule Tax Liability = Tax on Base + [Percentage on Excess over the Base x (Taxable Income – Base)] Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Taxable Income and Taxes (3 of 5) • Tax credits: specific amounts used to directly reduce tax liability – Child tax credit: a tax credit allowed for each child in a household § Currently $1, 000 § Available as a refund to low-income workers who owe no income tax § In 2017 the credit will not be allowed to exceed the taxpayer’s liability Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Taxable Income and Taxes (4 of 5) – College expense credit: a tax credit allowed to those who contribute toward their dependents’ college expenses – Coverdell Savings Accounts: tax-free accounts that can be used for a variety of school expenses – Section 529 College Savings Plan § Allows tax benefits for parents who set aside money for their children’s future college expenses § Available to all parents, regardless of income Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Taxable Income and Taxes (5 of 5) – Earned income credit: a credit used to reduce tax liability for low-income taxpayers – Other tax credits are also available, for example for child care and adoptions Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online • Go to turbotax. intuit. com/tax-tools/ • This Web site provides an estimate of your tax liability for the year and the tax refund that you may receive, based on your income, filing status, exemptions and deductions. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

How Tax Planning Fits Within Your Financial Plan (1 of 5) • The key tax planning decisions for building your financial plan are: – What tax savings are currently available to you? – How can you increase your tax savings in the future? – Should you increase/decrease the amount of your withholding – What records should you keep? Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

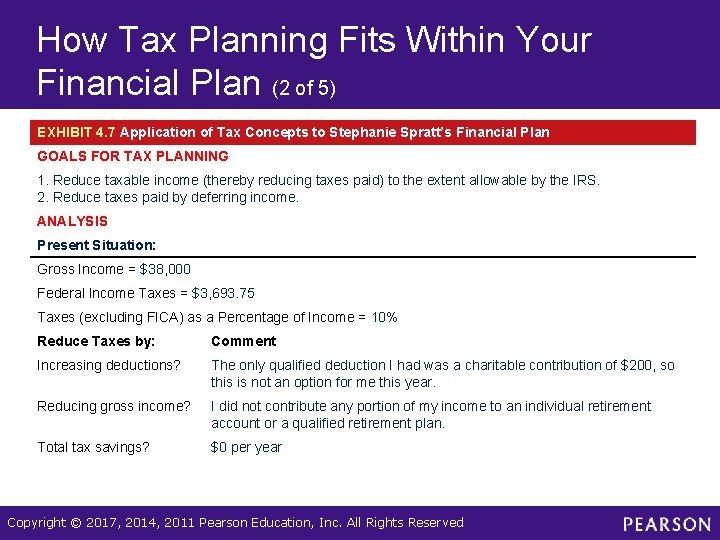

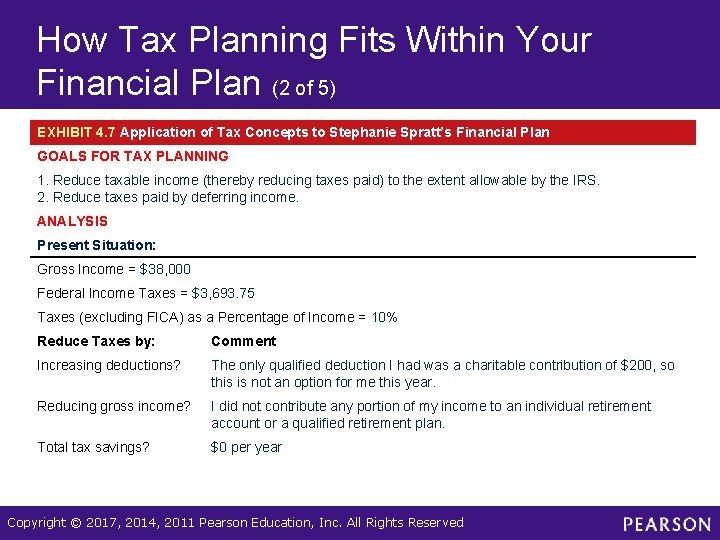

How Tax Planning Fits Within Your Financial Plan (2 of 5) EXHIBIT 4. 7 Application of Tax Concepts to Stephanie Spratt’s Financial Plan GOALS FOR TAX PLANNING 1. Reduce taxable income (thereby reducing taxes paid) to the extent allowable by the IRS. 2. Reduce taxes paid by deferring income. ANALYSIS Present Situation: Gross Income = $38, 000 Federal Income Taxes = $3, 693. 75 Taxes (excluding FICA) as a Percentage of Income = 10% Reduce Taxes by: Comment Increasing deductions? The only qualified deduction I had was a charitable contribution of $200, so this is not an option for me this year. Reducing gross income? I did not contribute any portion of my income to an individual retirement account or a qualified retirement plan. Total tax savings? $0 per year Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

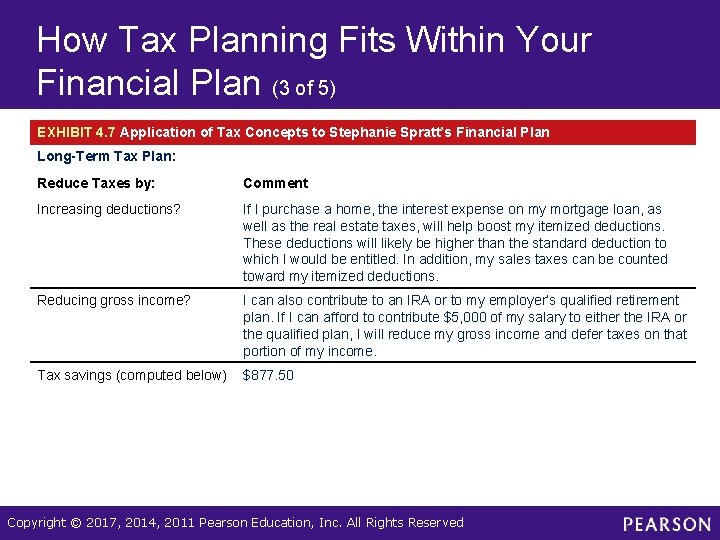

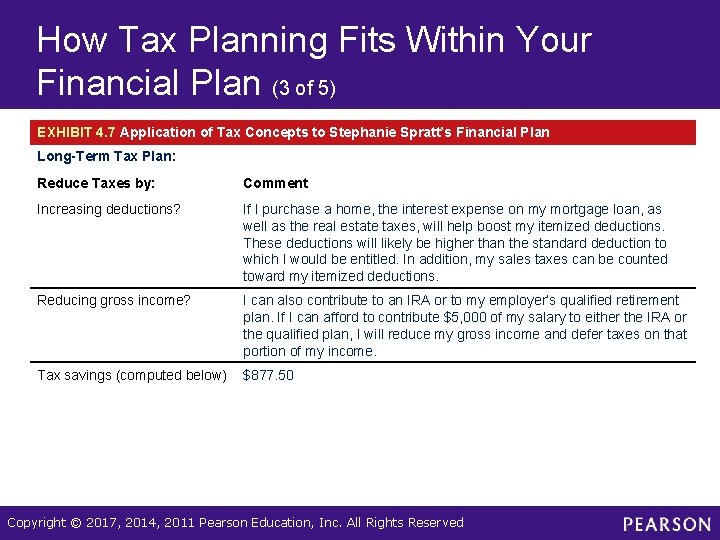

How Tax Planning Fits Within Your Financial Plan (3 of 5) EXHIBIT 4. 7 Application of Tax Concepts to Stephanie Spratt’s Financial Plan Long-Term Tax Plan: Reduce Taxes by: Comment Increasing deductions? If I purchase a home, the interest expense on my mortgage loan, as well as the real estate taxes, will help boost my itemized deductions. These deductions will likely be higher than the standard deduction to which I would be entitled. In addition, my sales taxes can be counted toward my itemized deductions. Reducing gross income? I can also contribute to an IRA or to my employer’s qualified retirement plan. If I can afford to contribute $5, 000 of my salary to either the IRA or the qualified plan, I will reduce my gross income and defer taxes on that portion of my income. Tax savings (computed below) $877. 50 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

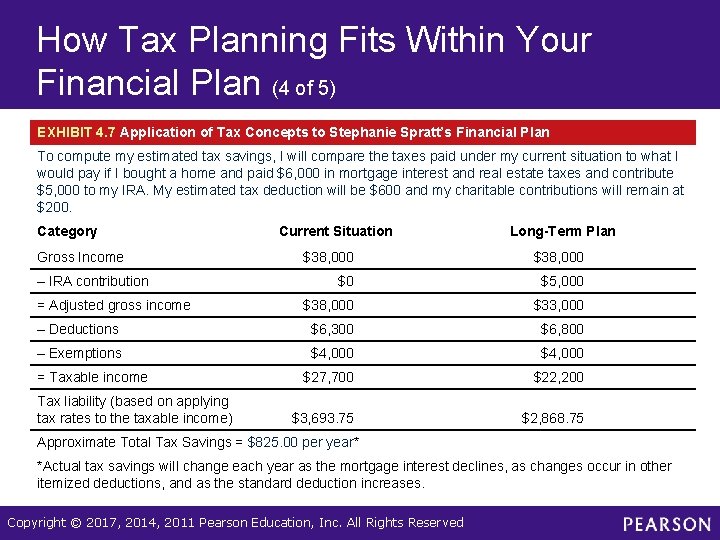

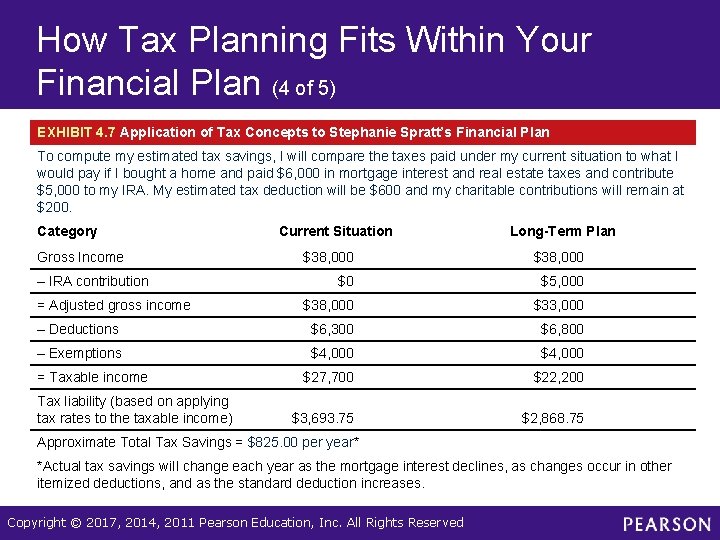

How Tax Planning Fits Within Your Financial Plan (4 of 5) EXHIBIT 4. 7 Application of Tax Concepts to Stephanie Spratt’s Financial Plan To compute my estimated tax savings, I will compare the taxes paid under my current situation to what I would pay if I bought a home and paid $6, 000 in mortgage interest and real estate taxes and contribute $5, 000 to my IRA. My estimated tax deduction will be $600 and my charitable contributions will remain at $200. Category Gross Income Current Situation Long-Term Plan $38, 000 $0 $5, 000 $38, 000 $33, 000 – Deductions $6, 300 $6, 800 – Exemptions $4, 000 $27, 700 $22, 200 $3, 693. 75 $2, 868. 75 – IRA contribution = Adjusted gross income = Taxable income Tax liability (based on applying tax rates to the taxable income) Approximate Total Tax Savings = $825. 00 per year* *Actual tax savings will change each year as the mortgage interest declines, as changes occur in other itemized deductions, and as the standard deduction increases. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

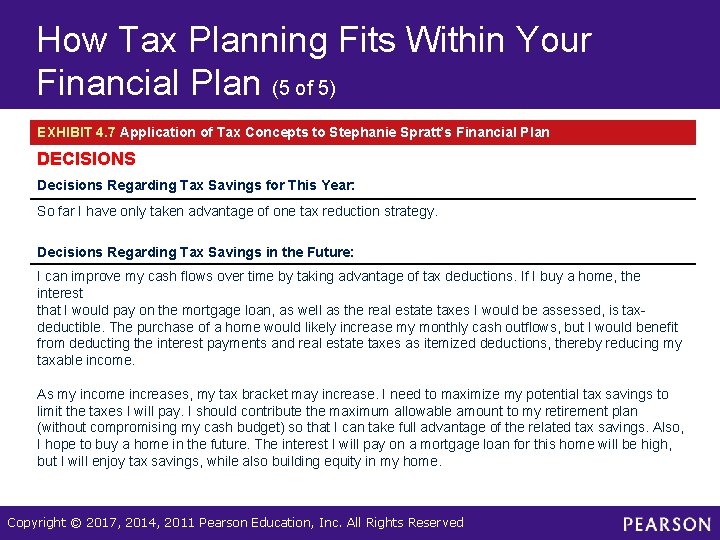

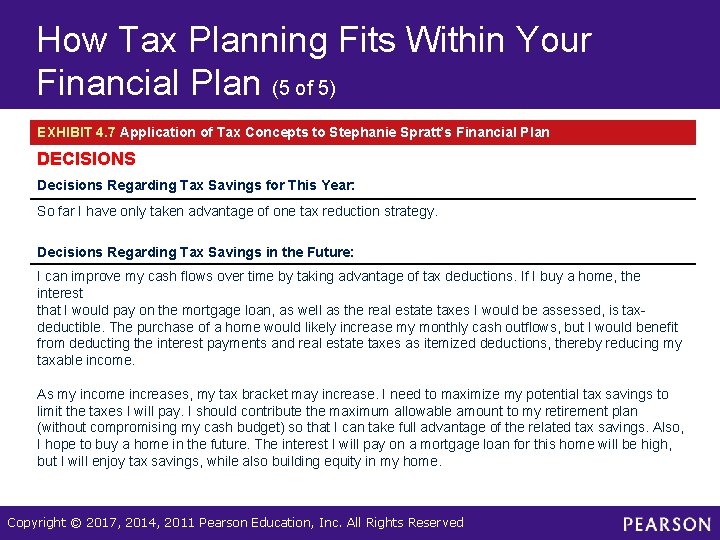

How Tax Planning Fits Within Your Financial Plan (5 of 5) EXHIBIT 4. 7 Application of Tax Concepts to Stephanie Spratt’s Financial Plan DECISIONS Decisions Regarding Tax Savings for This Year: So far I have only taken advantage of one tax reduction strategy. Decisions Regarding Tax Savings in the Future: I can improve my cash flows over time by taking advantage of tax deductions. If I buy a home, the interest that I would pay on the mortgage loan, as well as the real estate taxes I would be assessed, is taxdeductible. The purchase of a home would likely increase my monthly cash outflows, but I would benefit from deducting the interest payments and real estate taxes as itemized deductions, thereby reducing my taxable income. As my income increases, my tax bracket may increase. I need to maximize my potential tax savings to limit the taxes I will pay. I should contribute the maximum allowable amount to my retirement plan (without compromising my cash budget) so that I can take full advantage of the related tax savings. Also, I hope to buy a home in the future. The interest I will pay on a mortgage loan for this home will be high, but I will enjoy tax savings, while also building equity in my home. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved