Personal Finance SIXTH EDITION Chapter 8 Managing Your

- Slides: 32

Personal Finance SIXTH EDITION Chapter 8 Managing Your Credit Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Chapter Objectives 8. 1 Provide a background on credit cards 8. 2 Explain credit repayment 8. 3 Describe how to review the credit card statement 8. 4 Explain credit card regulations 8. 5 Offer tips on using credit cards 8. 6 Explain how managing your credit fits within your financial plan Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Credit Cards (1 of 4) Advantages • No need to carry large amounts of cash • Free financing as long as you pay in full each month • Monthly statement for recordkeeping Disadvantages • Can make purchases that you can’t afford • Allows spending beyond your means • Excessive spending can continue with minimum payments Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

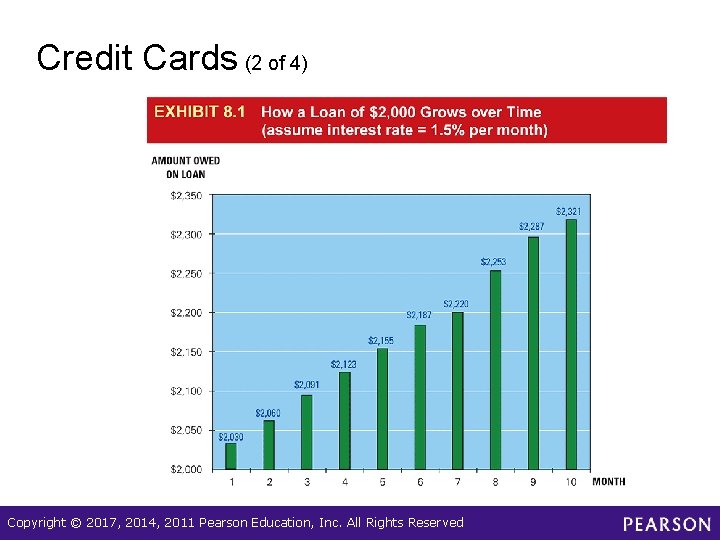

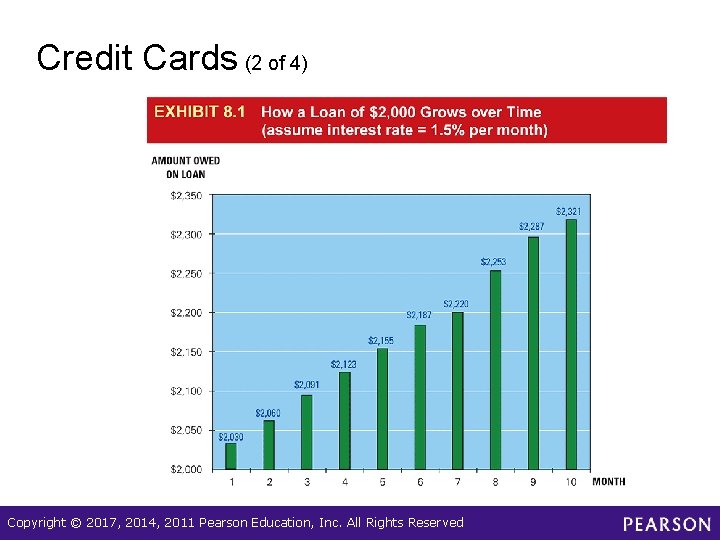

Credit Cards (2 of 4) Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Credit Cards (3 of 4) • Applying for a credit card – Personal information § § § Cash inflows Cash outflows Credit history Capital Collateral – Credit check § Credit card issuer obtains a credit report Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Credit Cards (4 of 4) – Other information that creditors evaluate § Income § Existing debt level § Current economic conditions Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Characteristics of Credit Cards (1 of 3) • Types of credit cards – Most popular are Master. Card, Visa and American Express § Master. Card and Visa allow financing § Most American Express cards require payment in full – Retail (or proprietary) credit card: a credit card that is honored by a specific retail establishment § Retail stores and gas stations § Limits purchases to a single merchant Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Characteristics of Credit Cards (2 of 3) • Credit limit—maximum amount of credit allowed • Overdraft protection—allows purchases beyond credit limit • Annual fee • Incentives to use the card – Prestige cards: credit cards, such as gold or platinum cards, issued by a financial institution to individuals who have an exceptional credit standing Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Characteristics of Credit Cards (3 of 3) • Grace period—period between time of purchase and when payment is due • Interest Rate – Types of interest rates charged on credit cards § May be fixed, variable or tiered – Regulations on interest rates – new regulations more favorable to users – Cash advances Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online (1 of 4) • Go to the Money section of CNN. com and got to the Personal Finance section containing calculators • This Web site provides – Estimates of when you might be debt free – Estimates of your future credit card payments based on interest rates, card balance, and the desired payoff time Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Finance Charges (1 of 2) • Finance charge: the interest that you must pay as a result of using credit • Average daily balance method – Most frequently used – Interest charged on average daily balance at the end of every day in the billing period • Previous Balance Method – Interest charged on the balance at the beginning of the new billing period Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Finance Charges (2 of 2) • Adjusted Balance Method – Interest is charged based on the balance at the end of the new billing period Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online (2 of 4) • Go to the Credit cards section of http: //www. consumerfinance. gov • This Web site provides tips on selecting a credit card. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating Credit Repayment (1 of 4) • Simple interest rate: the percentage of credit that must be paid as interest on an annual basis • Annual percentage rate (APR): the simple interest rate including any fees charged by the creditor – Allows comparison among potential lenders Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating Credit Repayment (2 of 4) • Impact of interest rate on the amount you owe – The larger the interest rate, the higher the interest payments • Impact of financing period on credit payments – Total interest paid depends on the length of the financing period Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

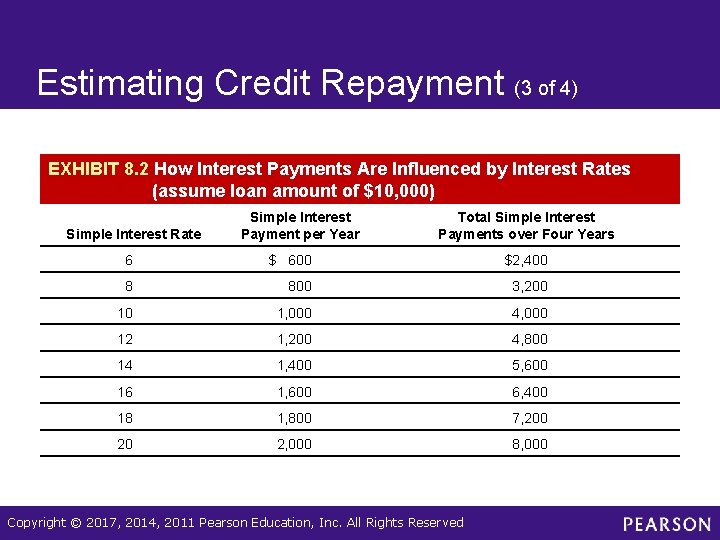

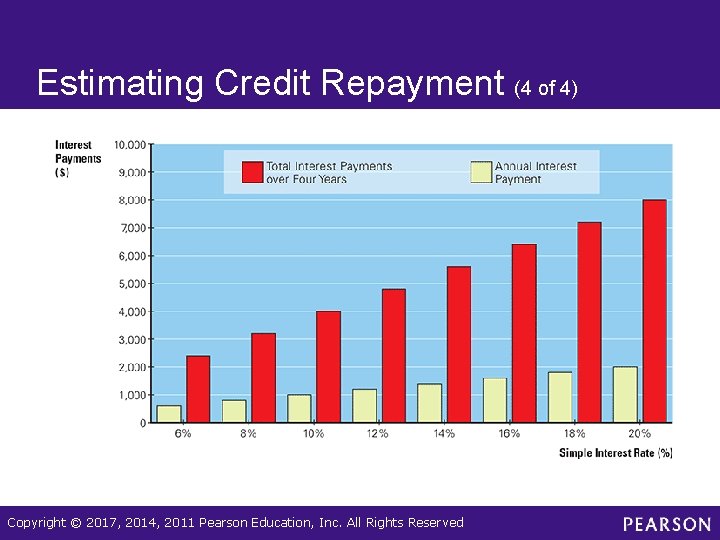

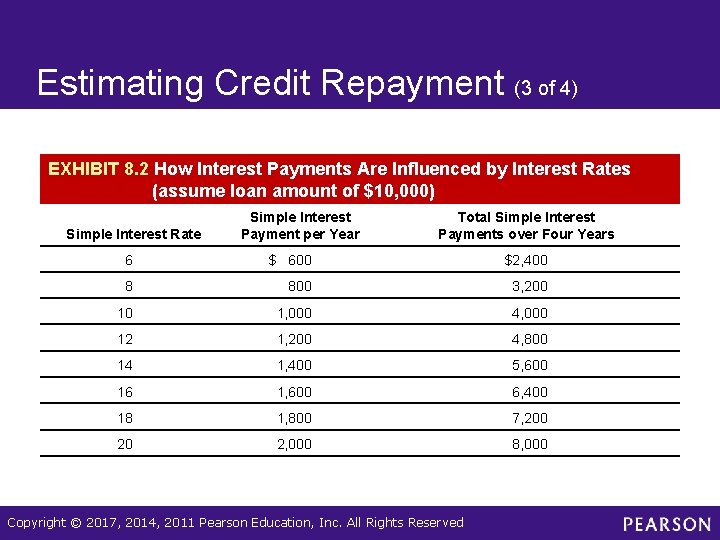

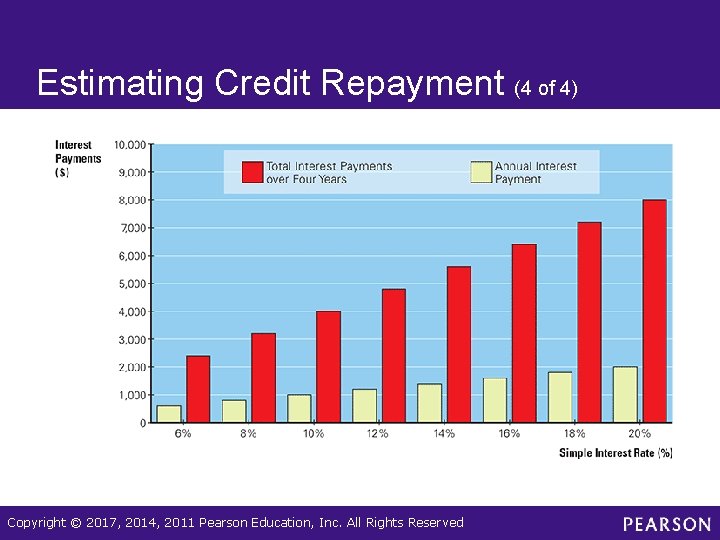

Estimating Credit Repayment (3 of 4) EXHIBIT 8. 2 How Interest Payments Are Influenced by Interest Rates (assume loan amount of $10, 000) Simple Interest Rate Simple Interest Payment per Year Total Simple Interest Payments over Four Years 6 $ 600 $2, 400 8 800 3, 200 10 1, 000 4, 000 12 1, 200 4, 800 14 1, 400 5, 600 16 1, 600 6, 400 18 1, 800 7, 200 20 2, 000 8, 000 Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Estimating Credit Repayment (4 of 4) Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Credit Card Statement (1 of 2) • Statements typically sent at the end of the billing cycle • Lists: – – – – Previous balance Purchases Cash advances Payments Finance charge New balance Minimum payment Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Credit Card Statement (2 of 2) • Always scrutinize statement for errors • Dispute any errors, but pay correct charges in a timely manner • Customer service number and/or dispute instructions included on statement Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Regulation of Credit Cards (1 of 2) • Credit CARD Act – Passed in 2009; contains provisions to protect consumers § § § Conditions for fees Advance notice to change interest rate Promotional interest rate guidelines Payment period Credit limit Disclosure about paying balance due Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Regulation of Credit Cards (2 of 2) § Restrictions for cardholders less than age 21 § Summary of provisions • Consumer Financial Protection Bureau – Created in 2010 as part of Financial Reform Act – Goal is to enforce consumer finance laws – Makes sure consumers receive full disclosure of information to help them make financial decisions Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online (3 of 4) • Go to http: //www. ftc. gov • Insert the search term “equal credit opportunity rights” • This Web site provides information about various laws that protect your rights when using credit Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Tips on Using Credit Cards (1 of 5) • Use a credit card only if you can cover the bill • Impose a tight credit limit • Reduce credit limit when the economy weakens • Pay credit card bills before investing money • Pay off credit card debt before other debt • Avoid credit repair services Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

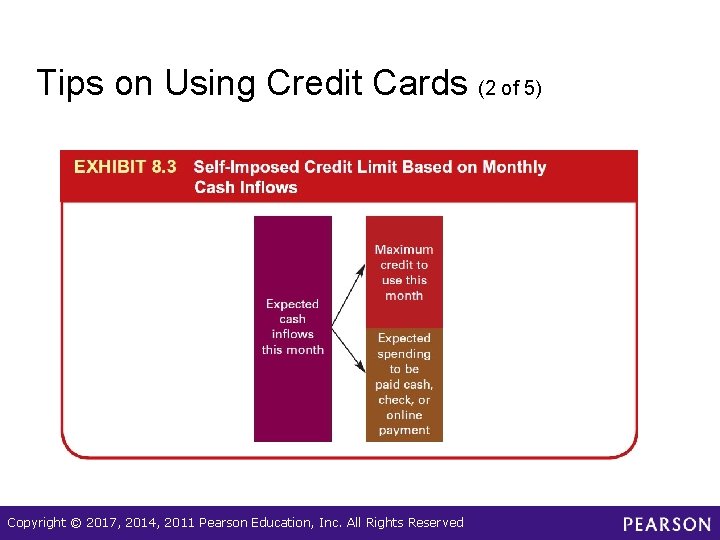

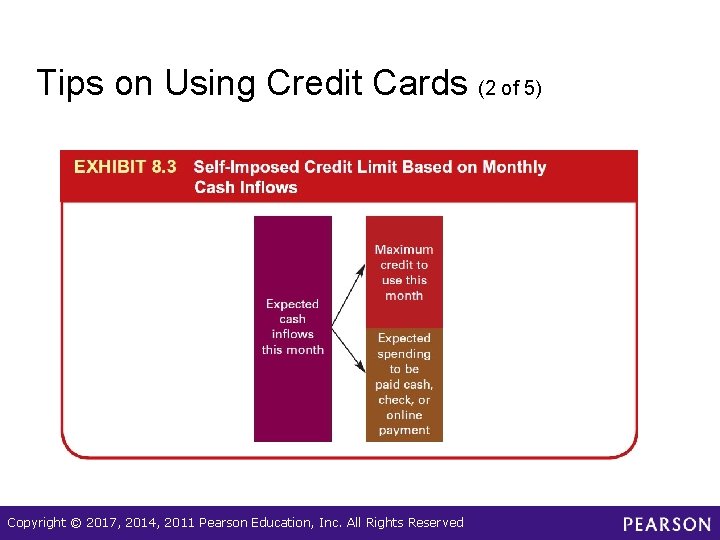

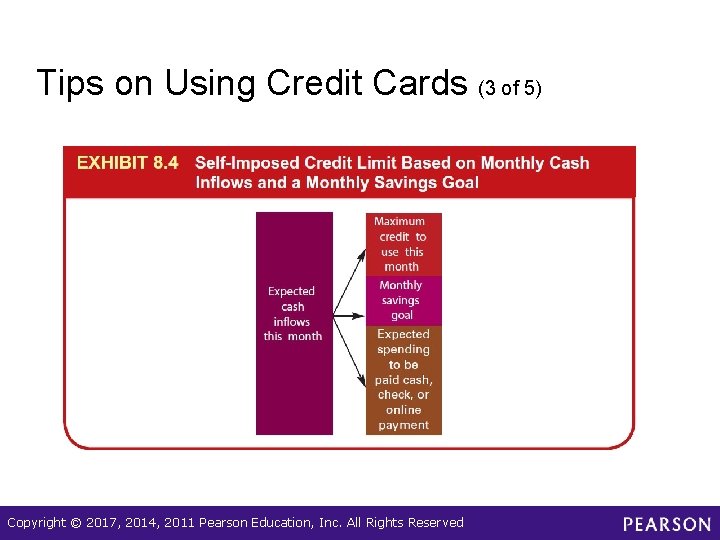

Tips on Using Credit Cards (2 of 5) Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

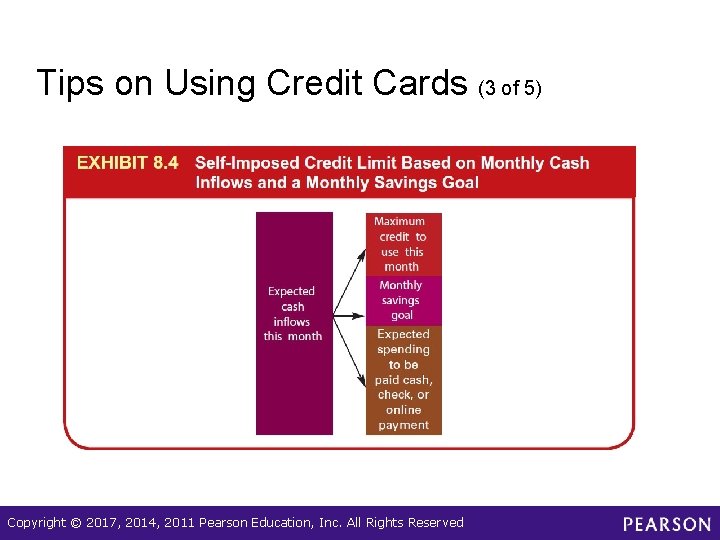

Tips on Using Credit Cards (3 of 5) Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Financial Planning Online (4 of 4) • Go to the consumer information section of http: //www. ftc. gov • This Web site provides information about establishing, using and protecting credit. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Tips on Using Credit Cards (4 of 5) • Resolving an excessive credit balance – Spend as little as possible – Consider ways to increase income – Borrow from a family member – Get a debt consolidation loan – Sell assets for cash – Reduce everyday expenses Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

Tips on Using Credit Cards (5 of 5) – Personal bankruptcy: a plan proposed to the court in which you repay at least a portion of your debt and pay attorney and filing fees § Chapter 7 allows the discharge of almost all debts, but also have to surrender assets to pay debt § Chapter 13 allows you to keep your assets, but the court takes control of your finances and devises a 3– 5 year repayment plan Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

How Credit Management Fits Within Your Financial Plan (1 of 4) • Key credit management decisions for your financial plan are: – What limit should you impose on your credit card? – When should you use credit? Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

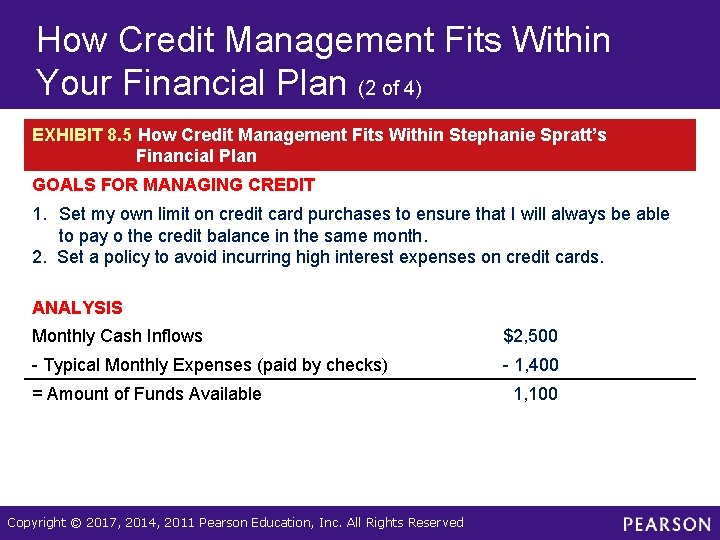

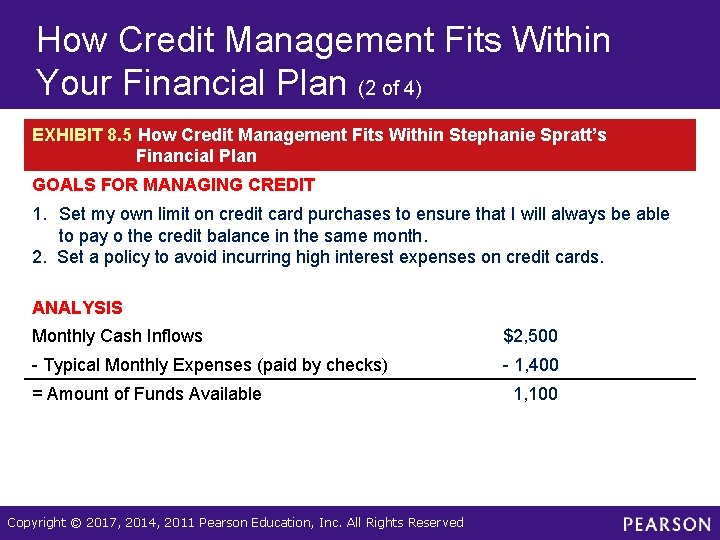

How Credit Management Fits Within Your Financial Plan (2 of 4) EXHIBIT 8. 5 How Credit Management Fits Within Stephanie Spratt’s Financial Plan GOALS FOR MANAGING CREDIT 1. Set my own limit on credit card purchases to ensure that I will always be able to pay o the credit balance in the same month. 2. Set a policy to avoid incurring high interest expenses on credit cards. ANALYSIS Monthly Cash Inflows $2, 500 - Typical Monthly Expenses (paid by checks) - 1, 400 = Amount of Funds Available Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved 1, 100

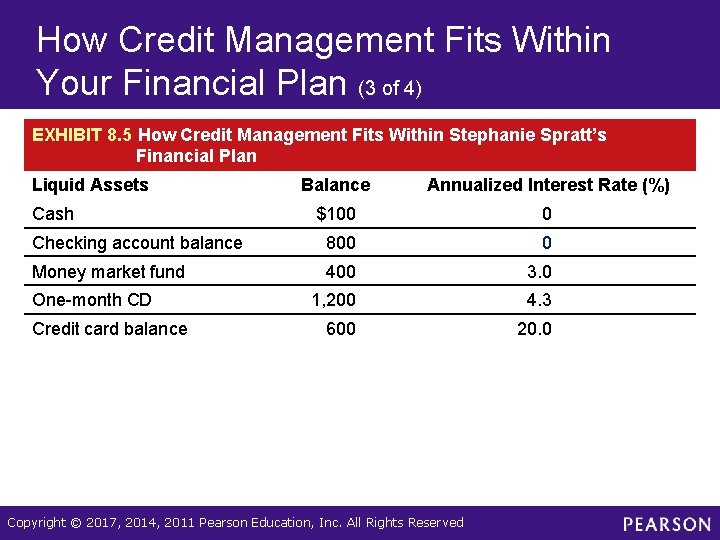

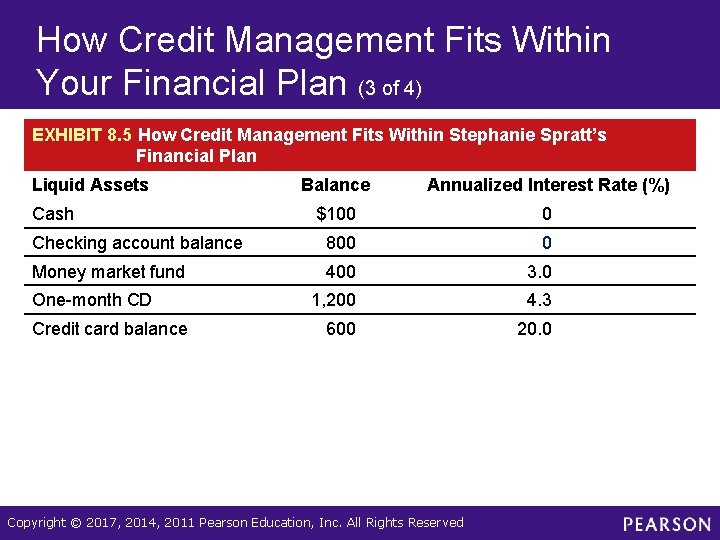

How Credit Management Fits Within Your Financial Plan (3 of 4) EXHIBIT 8. 5 How Credit Management Fits Within Stephanie Spratt’s Financial Plan Liquid Assets Balance Annualized Interest Rate (%) $100 0 Checking account balance 800 0 Money market fund 400 3. 0 1, 200 4. 3 600 20. 0 Cash One-month CD Credit card balance Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved

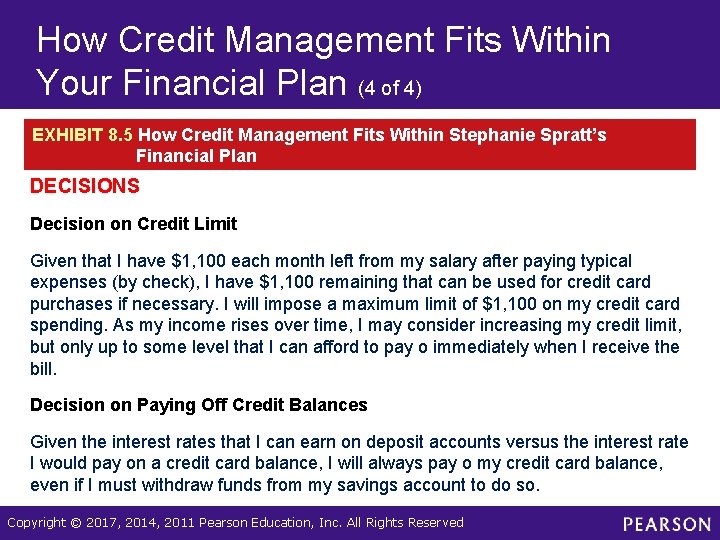

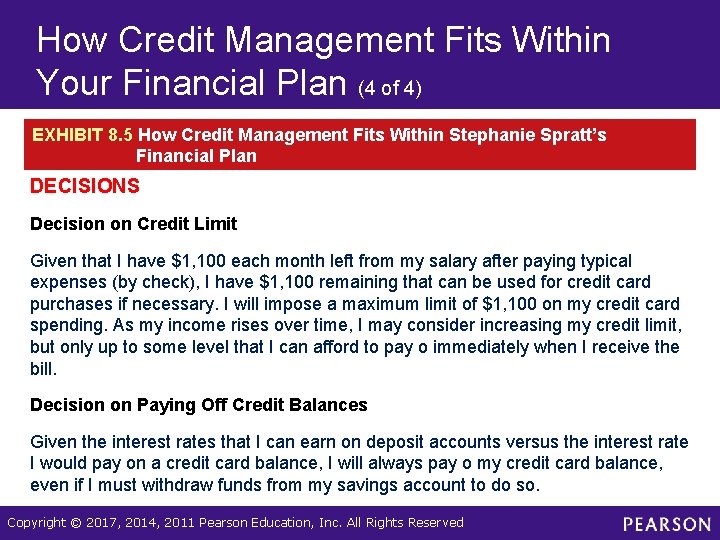

How Credit Management Fits Within Your Financial Plan (4 of 4) EXHIBIT 8. 5 How Credit Management Fits Within Stephanie Spratt’s Financial Plan DECISIONS Decision on Credit Limit Given that I have $1, 100 each month left from my salary after paying typical expenses (by check), I have $1, 100 remaining that can be used for credit card purchases if necessary. I will impose a maximum limit of $1, 100 on my credit card spending. As my income rises over time, I may consider increasing my credit limit, but only up to some level that I can afford to pay o immediately when I receive the bill. Decision on Paying Off Credit Balances Given the interest rates that I can earn on deposit accounts versus the interest rate I would pay on a credit card balance, I will always pay o my credit card balance, even if I must withdraw funds from my savings account to do so. Copyright © 2017, 2014, 2011 Pearson Education, Inc. All Rights Reserved