Intermediate Accounting Seventeenth Edition Kieso Weygandt Warfield Chapter

- Slides: 75

Intermediate Accounting Seventeenth Edition Kieso ● Weygandt ● Warfield Chapter 4 Income Statement and Related Information This slide deck contains animations. Please disable animations if they cause issues with your device.

Learning Objectives After studying this chapter, you should be able to: 1. Understand the uses and limitations of an income statement. 2. Describe the content and format of the income statement. 3. Discuss how to report various income items. 4. Explain the reporting of accounting changes and errors. 5. Describe related stockholders’ equity statements. Copyright © 2019 John Wiley & Sons, Inc. 2

Preview of Chapter 4 (1 of 5) Income Statement and Related Information Income Statement • Usefulness • Limitations • Quality of earnings Copyright © 2019 John Wiley & Sons, Inc. 3

Preview of Chapter 4 (2 of 5) Income Statement and Related Information Content and Format of the Income Statement • Elements • Intermediate components • Condensed income statements • Single-step income statements Copyright © 2019 John Wiley & Sons, Inc. 4

Preview of Chapter 4 (3 of 5) Income Statement and Related Information Reporting Various Income Items • Unusual and infrequent gains and losses • Discontinued operations • Noncontrolling interest in income • Earnings per share • Summary Copyright © 2019 John Wiley & Sons, Inc. 5

Preview of Chapter 4 (4 of 5) Income Statement and Related Information Accounting Changes and Errors • Changes in accounting principle • Change in accounting estimates • Corrections of errors • Summary Copyright © 2019 John Wiley & Sons, Inc. 6

Preview of Chapter 4 (5 of 5) Income Statement and Related Information Related Stockholders’ Equity Statements • Retained earnings statement • Comprehensive income • Statement of stockholders’ equity • Balance sheet presentation Copyright © 2019 John Wiley & Sons, Inc. 7

Learning Objective 1 Identify the Uses and Limitations of an Income Statement Copyright © 2019 John Wiley & Sons, Inc. 8

Income Statement Usefulness • Evaluate past performance of the company • Provide a basis for predicting future performance • Help assess the risk or uncertainty of achieving future cash flows LO 1 Copyright © 2019 John Wiley & Sons, Inc. 9

Income Statement Limitations • Companies omit items they cannot measure reliably • Income is affected by the accounting methods employed • Income measurement involves judgment LO 1 Copyright © 2019 John Wiley & Sons, Inc. 10

Income Statement Quality of Earnings Companies have incentives to manage income to meet or beat Wall Street expectations, so that • market price of stock increases and • value of stock options increase. Quality of earnings is reduced if earnings management results in information that is less useful for predicting future earnings and cash flows. LO 1 Copyright © 2019 John Wiley & Sons, Inc. 11

Learning Objective 2 Describe the Content and format of the Income Statement Copyright © 2019 John Wiley & Sons, Inc. 12

Content and Format of the Income Statement Elements of the Income Statement Revenues – Inflows or other enhancements of assets of an entity or settlements of its liabilities during a period from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations. Examples include sales, fees, interest, dividends, and rents. LO 2 Copyright © 2019 John Wiley & Sons, Inc. 13

Elements of the Income Statement (Expenses) Expenses – Outflows or other using-up of assets or incurrences of liabilities during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity’s ongoing major or central operations. Examples include cost of goods sold, depreciation, interest, rent, salaries and wages, and taxes. LO 2 Copyright © 2019 John Wiley & Sons, Inc. 14

Elements of the Income Statement (Gains and Losses) Gains – Increases in equity (net assets) from peripheral or incidental transactions of an entity except those that result from revenues or investments by owners. Losses – Decreases in equity (net assets) from peripheral or incidental transactions of an entity except those that result from expenses or distributions to owners. Gains and losses result from the sale of investments or plant assets, settlement of liabilities, and write-offs of assets due to impairments or casualty. LO 2 Copyright © 2019 John Wiley & Sons, Inc. 15

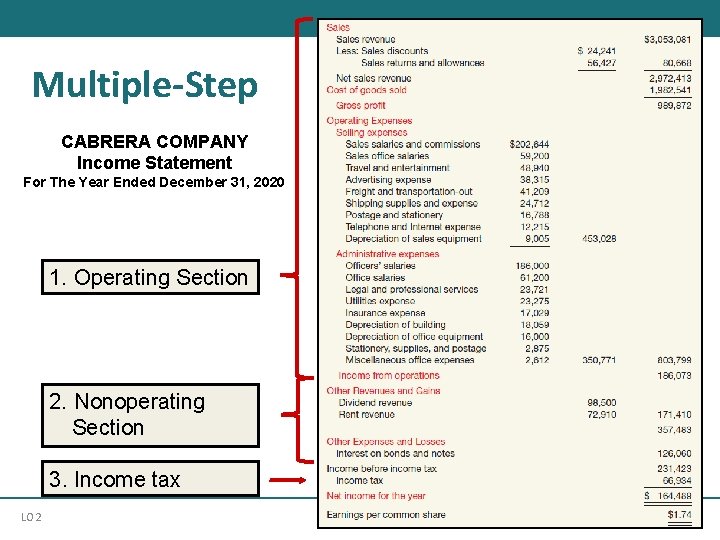

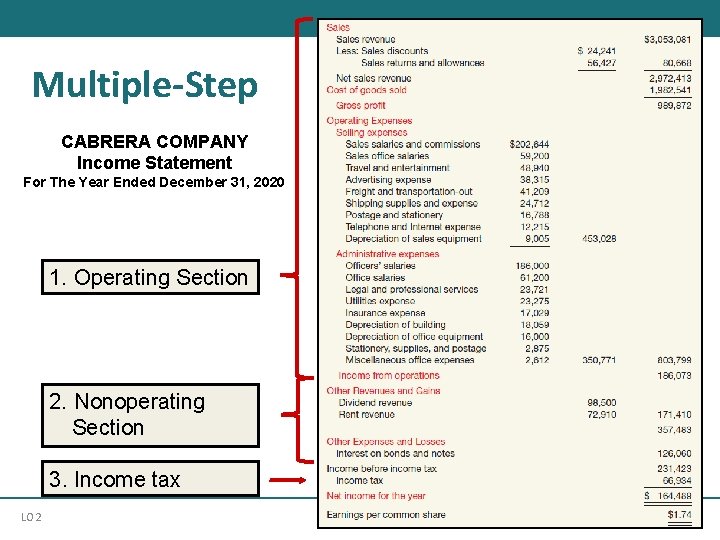

Intermediate Components of the Income Statement Multiple-Step Income Statement • Separates operating transactions from nonoperating transactions • Matches costs and expenses with related revenues • Highlights certain components of income that analysts use assessing financial performance LO 2 Copyright © 2019 John Wiley & Sons, Inc. 16

Intermediate Components Common to present some or all of the following sections and totals within the income statement. 1. Operating section 2. Nonoperating section 3. Income tax 4. Discontinued operations 5. Noncontrolling interest 6. Earnings per share LO 2 Copyright © 2019 John Wiley & Sons, Inc. 17

Multiple-Step CABRERA COMPANY Income Statement For The Year Ended December 31, 2020 1. Operating Section 2. Nonoperating Section 3. Income tax LO 2

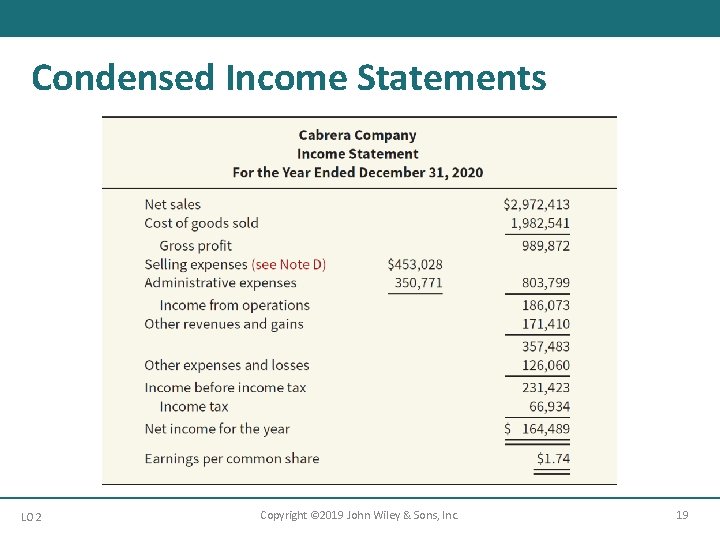

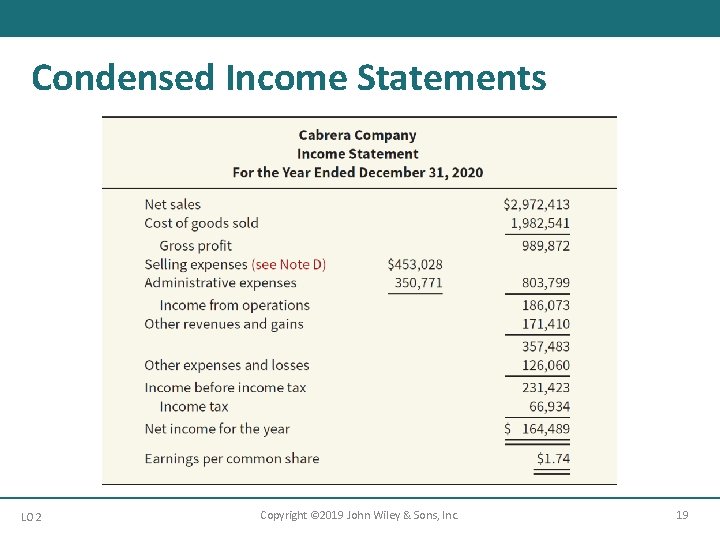

Condensed Income Statements LO 2 Copyright © 2019 John Wiley & Sons, Inc. 19

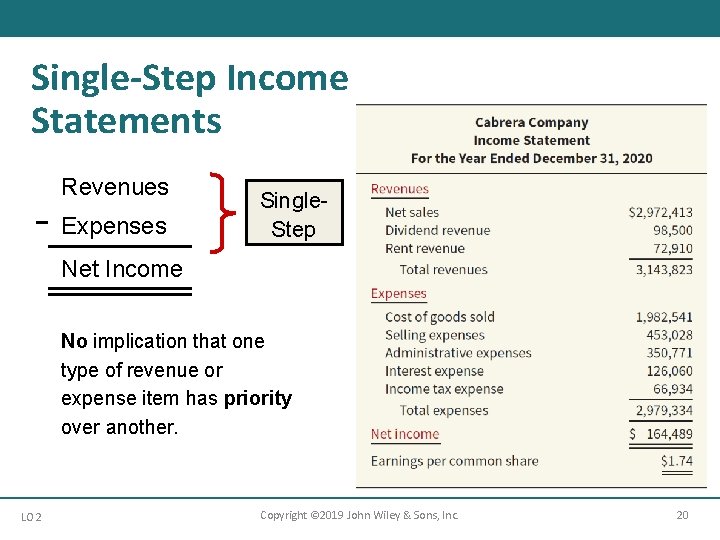

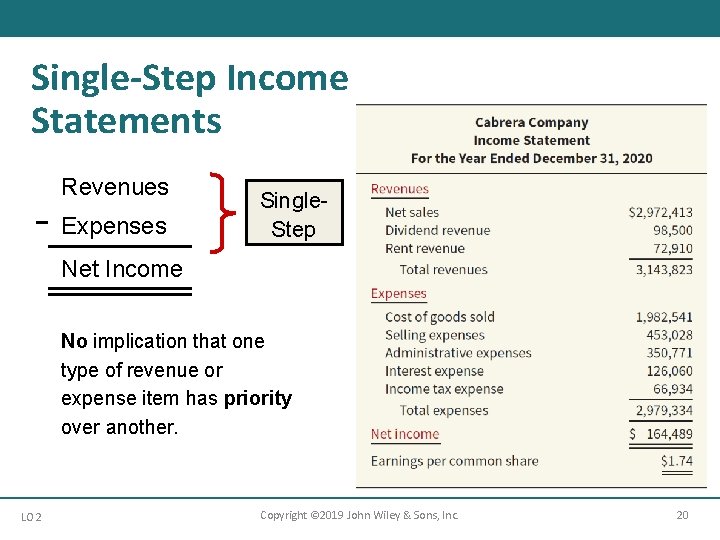

Single-Step Income Statements Revenues Expenses Single. Step Net Income No implication that one type of revenue or expense item has priority over another. LO 2 Copyright © 2019 John Wiley & Sons, Inc. 20

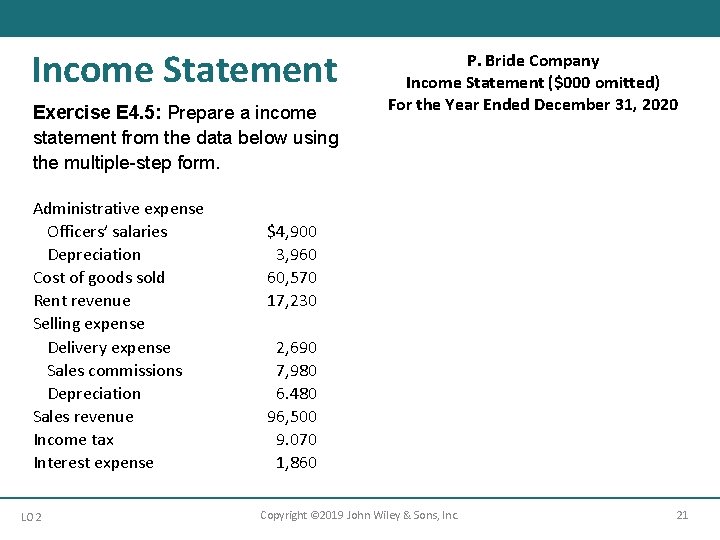

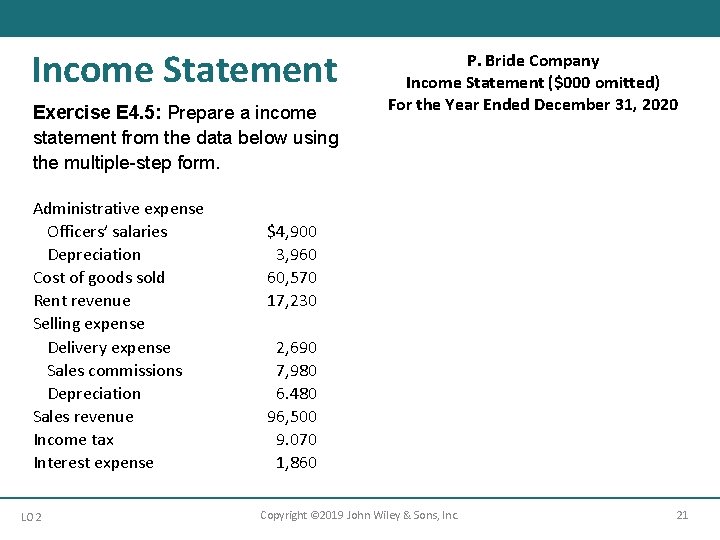

Income Statement Exercise E 4. 5: Prepare a income statement from the data below using the multiple-step form. Administrative expense Officers’ salaries Depreciation Cost of goods sold Rent revenue Selling expense Delivery expense Sales commissions Depreciation Sales revenue Income tax Interest expense LO 2 $4, 900 3, 960 60, 570 17, 230 2, 690 7, 980 6. 480 96, 500 9. 070 1, 860 P. Bride Company Income Statement ($000 omitted) For the Year Ended December 31, 2020 Sales revenue Cost of goods sold Gross profit Operating expenses: Selling expense Administrative expense Total operating expenses Income from operations Other revenue (expense): Rent revenue Interest expense Total other Income before tax Income tax Net income Copyright © 2019 John Wiley & Sons, Inc. $96, 500 60, 570 35, 930 17, 250 8, 860 26, 010 9, 920 17, 230 (1, 860) 15, 370 25, 290 9, 070 $16, 220 21

Format of the Income Statement Review Question A separation of operating and non operating activities of a company exists in a. both a multiple-step and single-step income statement. b. a multiple-step but not a single-step income statement. c. a single-step but not a multiple-step income statement. d. neither a single-step nor a multiple-step income statement. LO 2 Copyright © 2019 John Wiley & Sons, Inc. 22

Format of the Income Statement Review Question Answer A separation of operating and non operating activities of a company exists in a. both a multiple-step and single-step income statement. b. a multiple-step but not a single-step income statement. c. a single-step but not a multiple-step income statement. d. neither a single-step nor a multiple-step income statement. LO 2 Copyright © 2019 John Wiley & Sons, Inc. 23

Learning Objective 3 Discuss How to Report Various Income Items Copyright © 2019 John Wiley & Sons, Inc. 24

Reporting Various Income Items Companies are required to report unusual and infrequent items as part of net income so users can better determine the long-run earning power of the company. These income items fall into four general categories: 1. Unusual gains and losses 2. Discontinued operations 3. Noncontrolling interest Modified all inclusive concept 4. Earnings per share LO 3 Copyright © 2019 John Wiley & Sons, Inc. 25

Reporting Various Income Items Unusual and Infrequent Gains and Losses a. Unusual. High degree of abnormality and of a type clearly unrelated to, or only incidentally related to, the ordinary and typical activities of the company, taking into account the environment in which it operates. b. Infrequency of occurrence. Type of transaction that is not reasonably expected to recur in the foreseeable future, taking into account the environment in which the company operates. LO 3 Copyright © 2019 John Wiley & Sons, Inc. 26

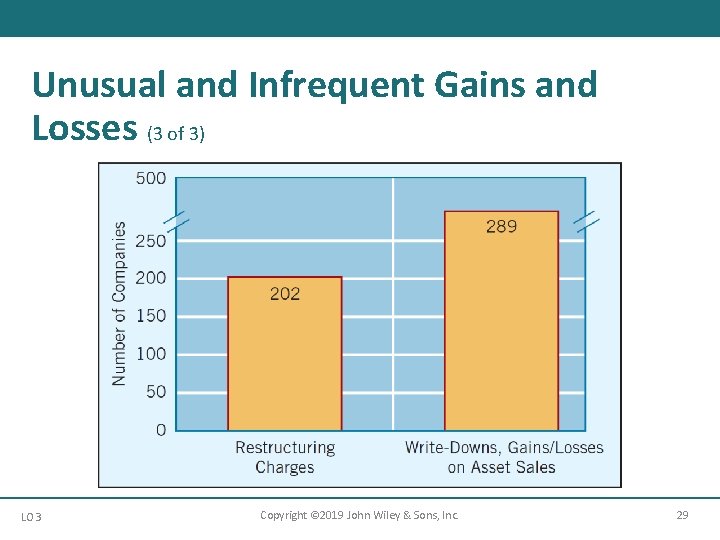

Unusual and Infrequent Gains and Losses (1 of 3) Common types of unusual or infrequent gains and losses: • Losses on write-down (impairment) of receivables; inventories; property, plant, and equipment; goodwill or other intangible assets • Restructuring charges • Gains and losses from sale or abandonment of property, plant and equipment • Effects of a strike LO 3 Copyright © 2019 John Wiley & Sons, Inc. 27

Unusual and Infrequent Gains and Losses (2 of 3) Common types of unusual or infrequent gains and losses: • Gains and losses on extinguishment (redemption) of debt obligations. • Gains and losses related to casualties such as fires, floods, and earthquakes. • Gains or losses on sale of investment securities. LO 3 Copyright © 2019 John Wiley & Sons, Inc. 28

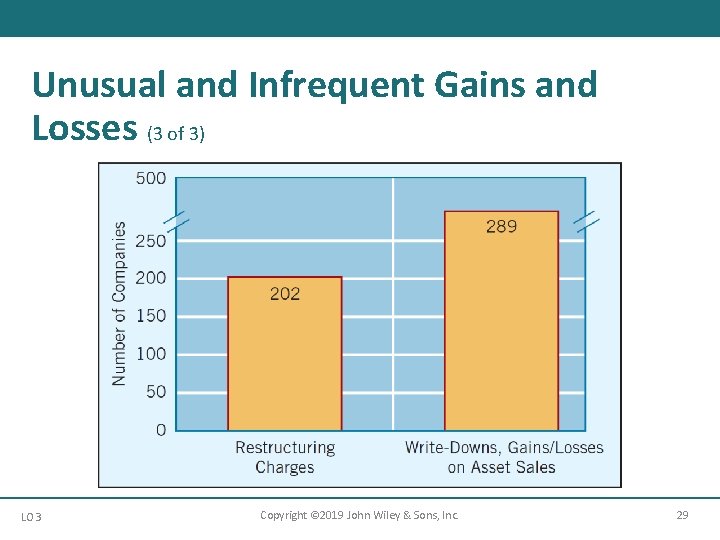

Unusual and Infrequent Gains and Losses (3 of 3) LO 3 Copyright © 2019 John Wiley & Sons, Inc. 29

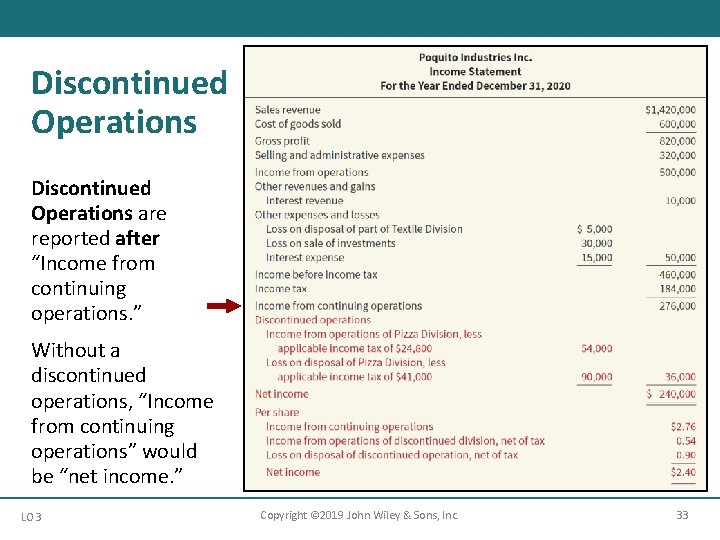

Reporting Various Income Items Discontinued Operations Occurs when two things happen: 1. A company eliminates the results of operations of a component of the business. 2. The elimination of a component that represents a strategic shift, having a major effect on the company’s operations and financial results. Amounts are reported “net of tax. ” LO 3 Copyright © 2019 John Wiley & Sons, Inc. 30

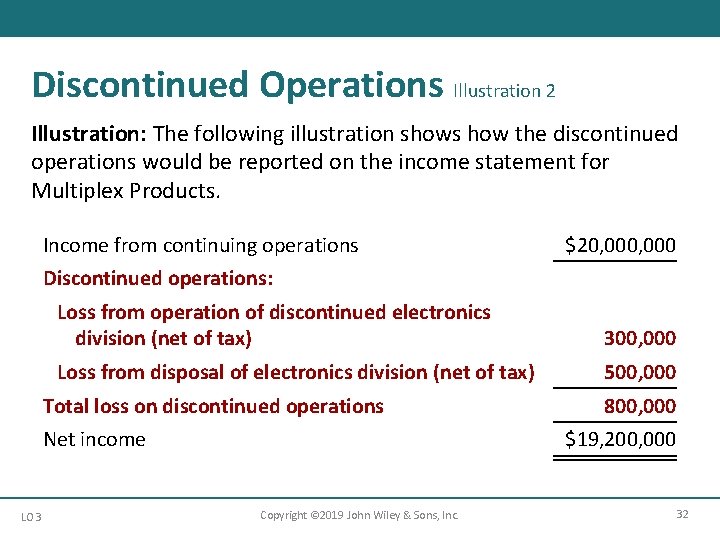

Discontinued Operations Illustration 1 Illustration: Multiplex Products Inc. , a highly diversified company, decides to discontinue its electronics division. During the current year, the electronics division lost $300, 000 (net of tax). Multiplex Products sold the division at the end of the year at a loss of $500, 000 (net of tax). Multiplex determines that the electronics division discontinuation meets the strategic shift criteria because the division is a major line of business (its assets exceed 20 percent of Multiplex’s total assets). The following illustration shows how the discontinued operations would be reported on the income statement for Multiplex Products. LO 3 Copyright © 2019 John Wiley & Sons, Inc. 31

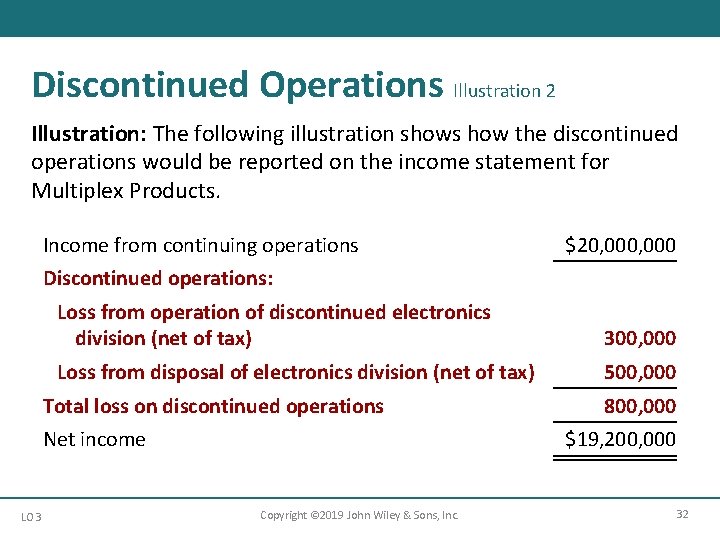

Discontinued Operations Illustration 2 Illustration: The following illustration shows how the discontinued operations would be reported on the income statement for Multiplex Products. Income from continuing operations $20, 000 Discontinued operations: Loss from operation of discontinued electronics division (net of tax) 300, 000 Loss from disposal of electronics division (net of tax) 500, 000 Total loss on discontinued operations Net income LO 3 800, 000 $19, 200, 000 Copyright © 2019 John Wiley & Sons, Inc. 32

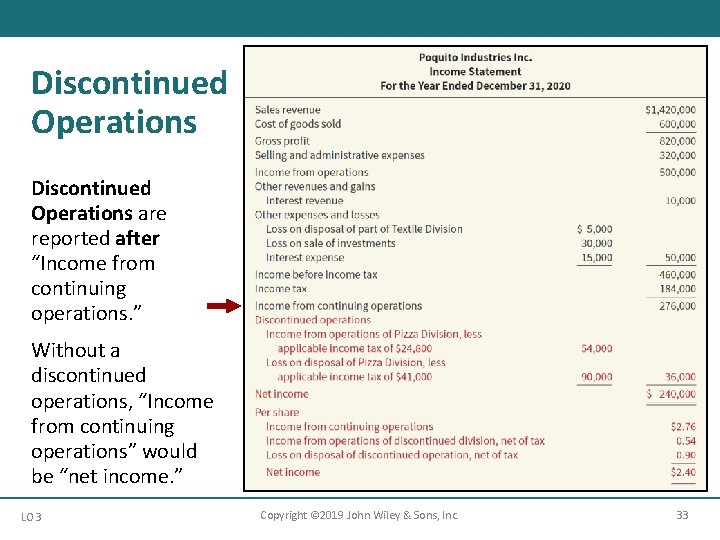

Discontinued Operations are reported after “Income from continuing operations. ” Without a discontinued operations, “Income from continuing operations” would be “net income. ” LO 3 Copyright © 2019 John Wiley & Sons, Inc. 33

Discontinued Operations Intraperiod Tax Allocation • Allocation of tax within a period • Helps users understand impact of income taxes on various components of net income • Intraperiod tax allocation is used for: 1. Income from continuing operations 2. discontinued operations LO 3 Copyright © 2019 John Wiley & Sons, Inc. 34

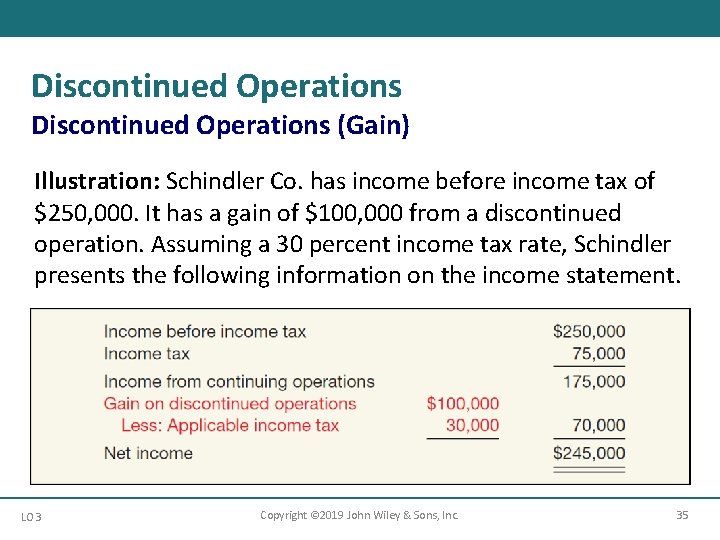

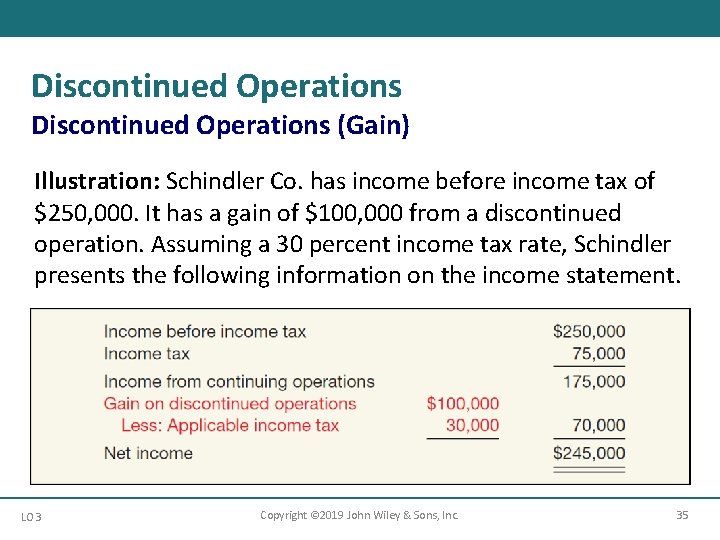

Discontinued Operations (Gain) Illustration: Schindler Co. has income before income tax of $250, 000. It has a gain of $100, 000 from a discontinued operation. Assuming a 30 percent income tax rate, Schindler presents the following information on the income statement. LO 3 Copyright © 2019 John Wiley & Sons, Inc. 35

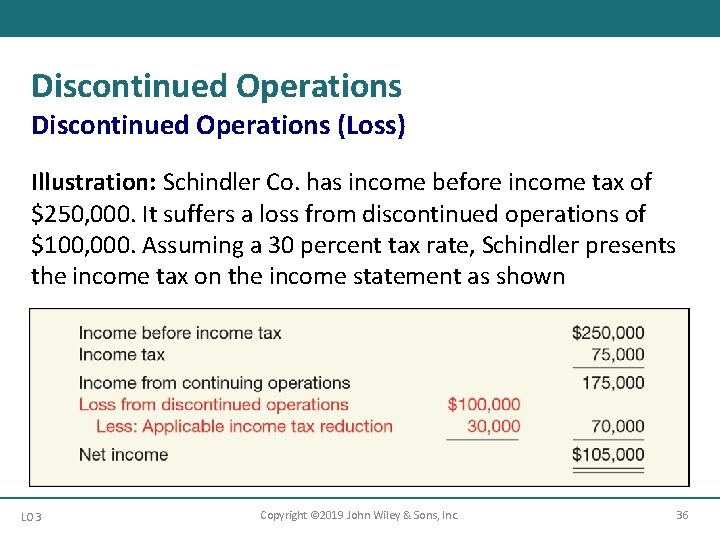

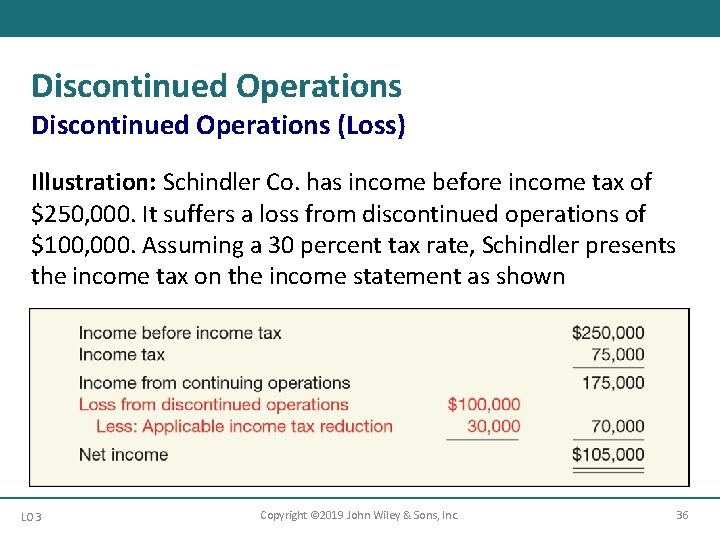

Discontinued Operations (Loss) Illustration: Schindler Co. has income before income tax of $250, 000. It suffers a loss from discontinued operations of $100, 000. Assuming a 30 percent tax rate, Schindler presents the income tax on the income statement as shown LO 3 Copyright © 2019 John Wiley & Sons, Inc. 36

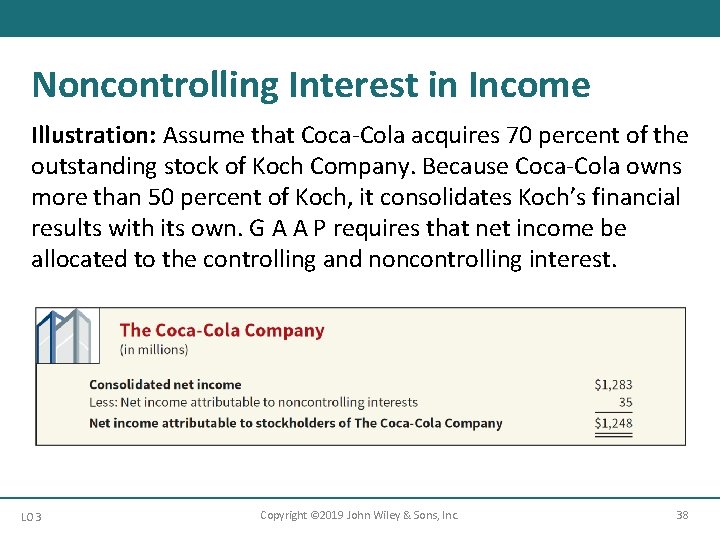

Reporting Various Income Items Noncontrolling Interest in Income When a company owns substantial interests (generally greater than 50%) in another company, GAAP generally require that the financial statements of both companies be consolidated together into one set of financials. Noncontrolling interest is the portion of equity (net assets) interest in a subsidiary not attributable to the parent company. LO 3 Copyright © 2019 John Wiley & Sons, Inc. 37

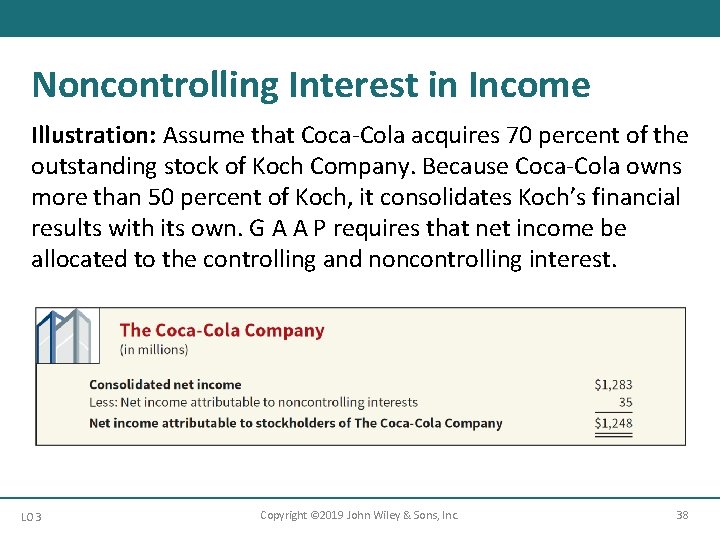

Noncontrolling Interest in Income Illustration: Assume that Coca-Cola acquires 70 percent of the outstanding stock of Koch Company. Because Coca-Cola owns more than 50 percent of Koch, it consolidates Koch’s financial results with its own. G A A P requires that net income be allocated to the controlling and noncontrolling interest. LO 3 Copyright © 2019 John Wiley & Sons, Inc. 38

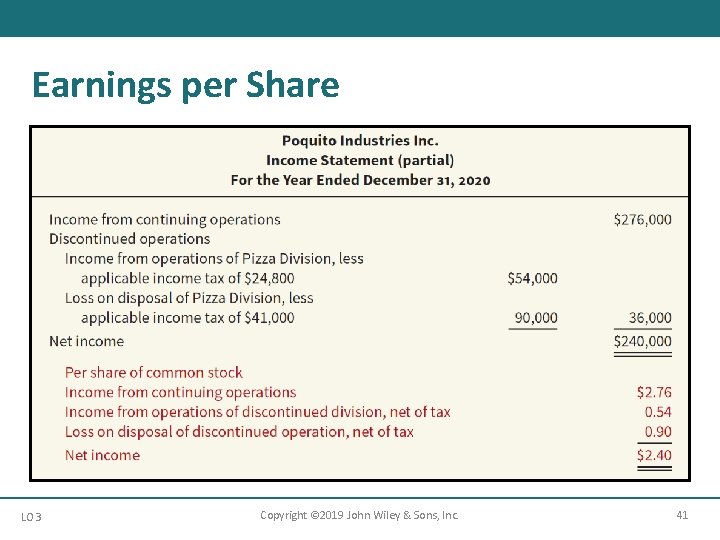

Reporting Various Income Items Earnings per Share Net Income - Preferred Dividends Weighted Average of Common Shares Outstanding • A significant business indicator • Measures the dollars earned by each share of common stock • Must be disclosed on the income statement LO 3 Copyright © 2019 John Wiley & Sons, Inc. 39

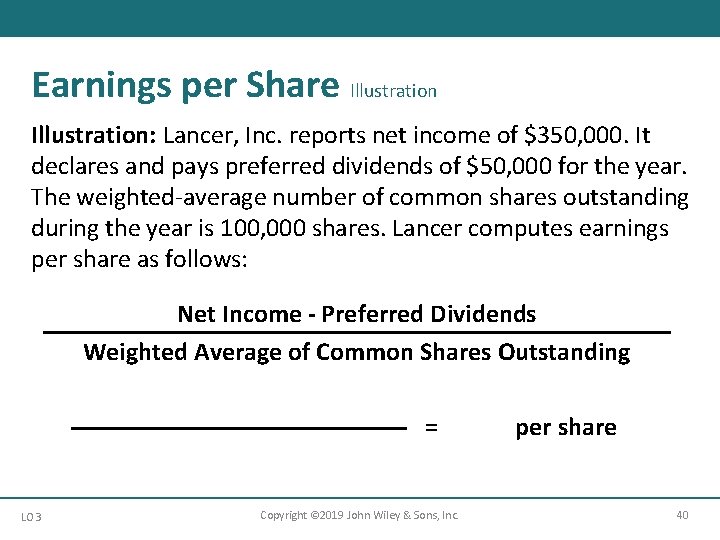

Earnings per Share Illustration: Lancer, Inc. reports net income of $350, 000. It declares and pays preferred dividends of $50, 000 for the year. The weighted-average number of common shares outstanding during the year is 100, 000 shares. Lancer computes earnings per share as follows: Net Income - Preferred Dividends Weighted Average of Common Shares Outstanding $350, 000 - $50, 000 100, 000 LO 3 = $3. 00 per share Copyright © 2019 John Wiley & Sons, Inc. 40

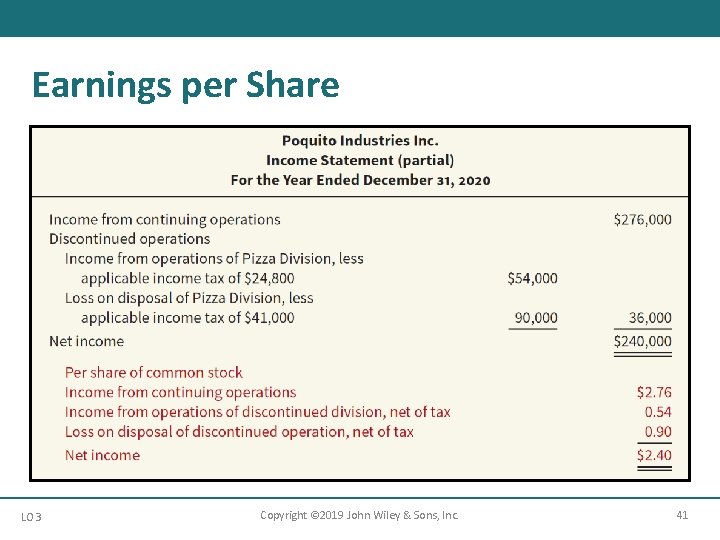

Earnings per Share LO 3 Copyright © 2019 John Wiley & Sons, Inc. 41

Learning Objective 4 Explain the Reporting of Accounting Changes and Errors LO 4 Copyright © 2019 John Wiley & Sons, Inc. 42

Accounting Changes and Errors Changes in Accounting Principle • Retrospective adjustment • Cumulative effect adjustment to beginning retained earnings • Approach preserves comparability across years • Examples include: LO 4 § change from F I F O to average cost § change from percentage-of-completion to completed-contract method Copyright © 2019 John Wiley & Sons, Inc. 43

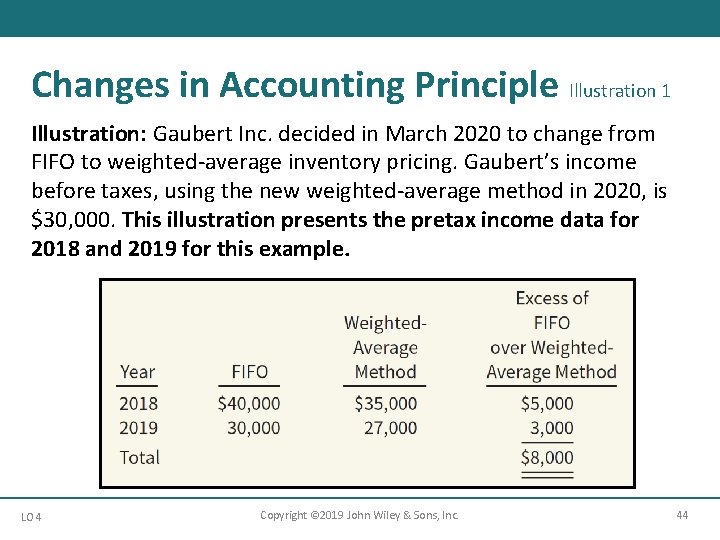

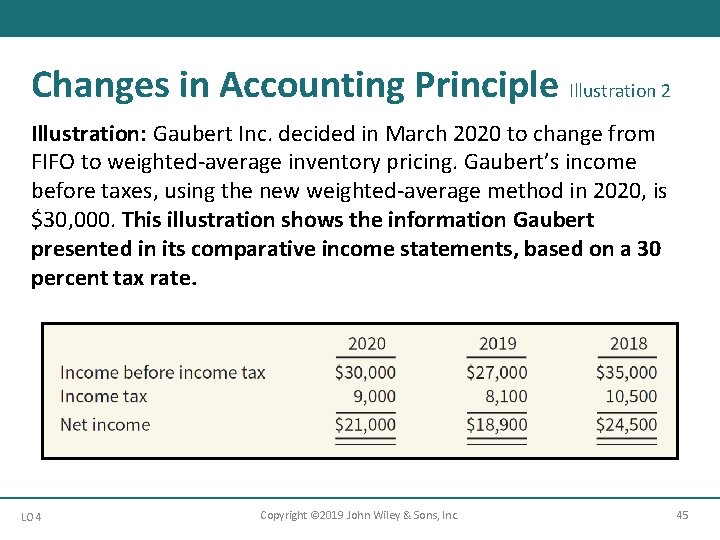

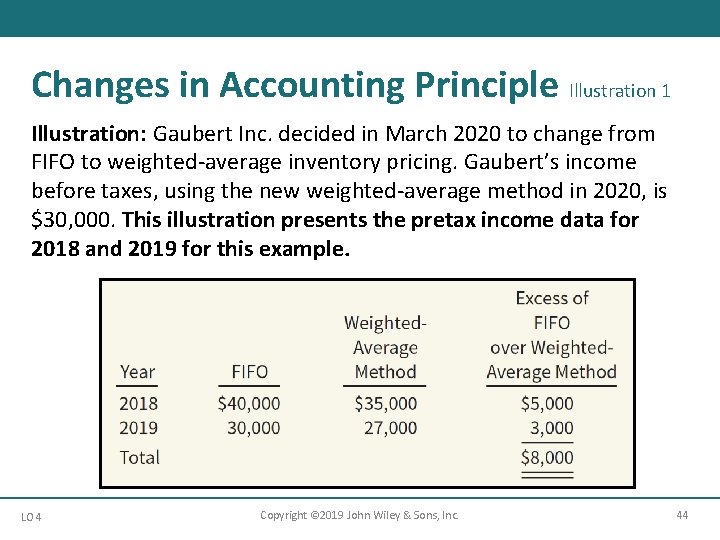

Changes in Accounting Principle Illustration 1 Illustration: Gaubert Inc. decided in March 2020 to change from FIFO to weighted-average inventory pricing. Gaubert’s income before taxes, using the new weighted-average method in 2020, is $30, 000. This illustration presents the pretax income data for 2018 and 2019 for this example. LO 4 Copyright © 2019 John Wiley & Sons, Inc. 44

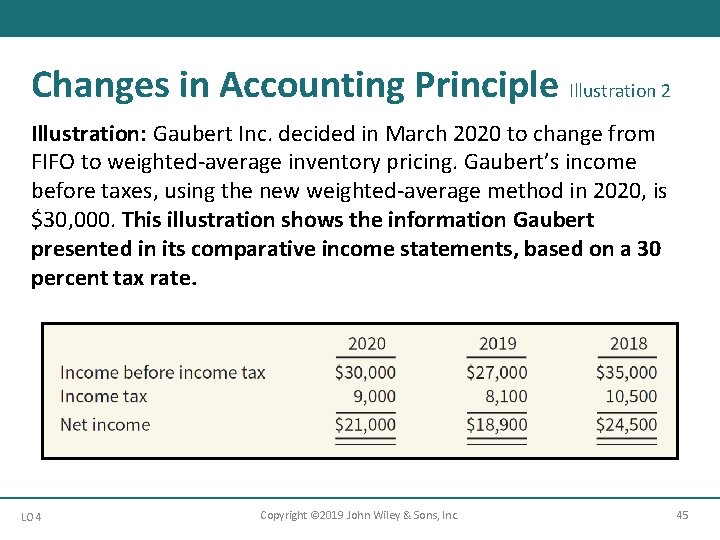

Changes in Accounting Principle Illustration 2 Illustration: Gaubert Inc. decided in March 2020 to change from FIFO to weighted-average inventory pricing. Gaubert’s income before taxes, using the new weighted-average method in 2020, is $30, 000. This illustration shows the information Gaubert presented in its comparative income statements, based on a 30 percent tax rate. LO 4 Copyright © 2019 John Wiley & Sons, Inc. 45

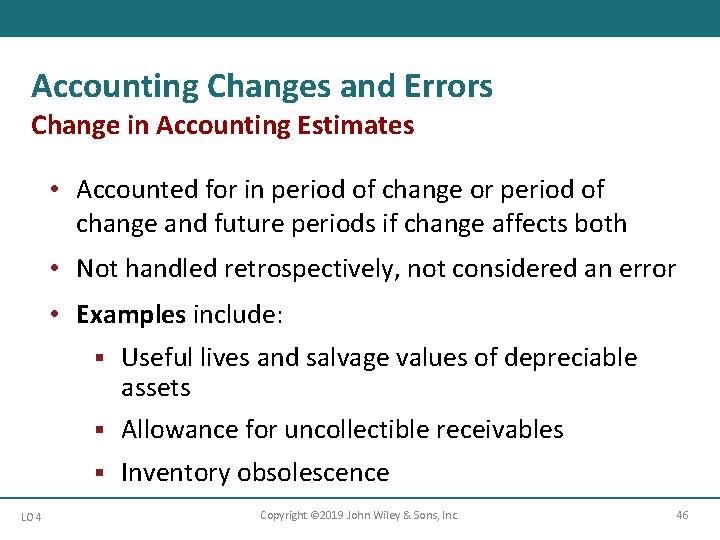

Accounting Changes and Errors Change in Accounting Estimates • Accounted for in period of change or period of change and future periods if change affects both • Not handled retrospectively, not considered an error • Examples include: LO 4 § Useful lives and salvage values of depreciable assets § Allowance for uncollectible receivables § Inventory obsolescence Copyright © 2019 John Wiley & Sons, Inc. 46

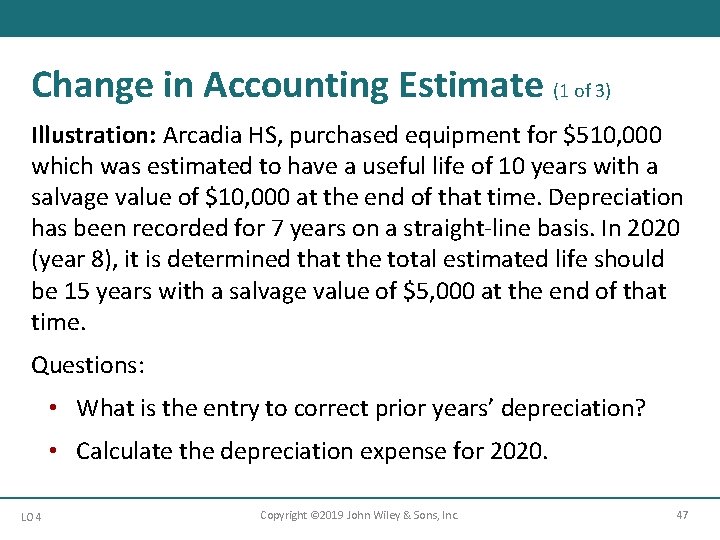

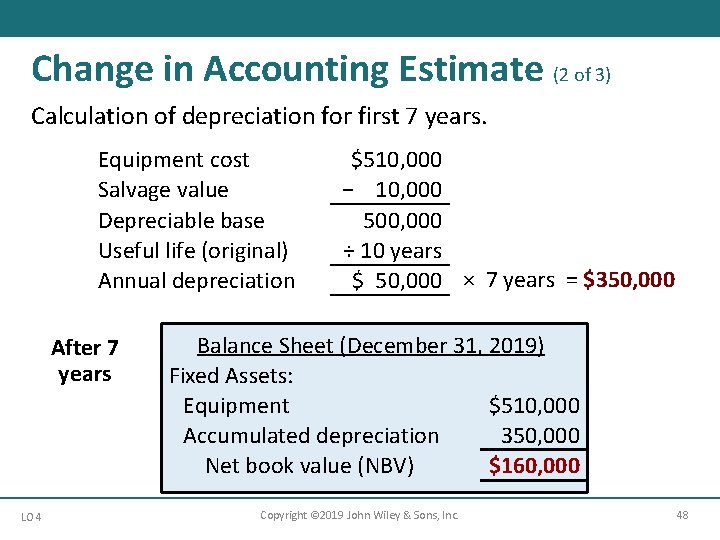

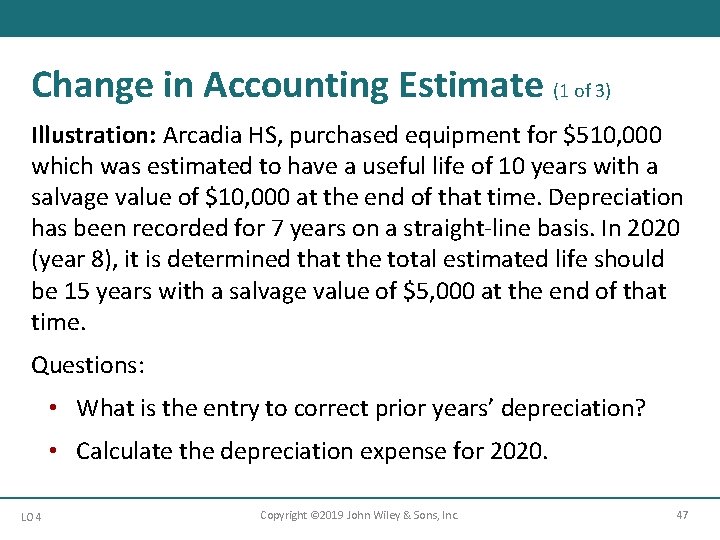

Change in Accounting Estimate (1 of 3) Illustration: Arcadia HS, purchased equipment for $510, 000 which was estimated to have a useful life of 10 years with a salvage value of $10, 000 at the end of that time. Depreciation has been recorded for 7 years on a straight-line basis. In 2020 (year 8), it is determined that the total estimated life should be 15 years with a salvage value of $5, 000 at the end of that time. Questions: • What is the entry to correct prior years’ depreciation? • Calculate the depreciation expense for 2020. LO 4 Copyright © 2019 John Wiley & Sons, Inc. 47

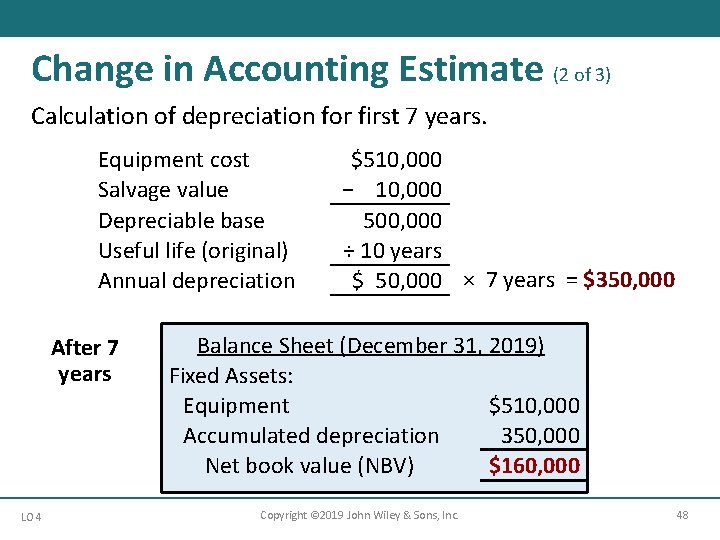

Change in Accounting Estimate (2 of 3) Calculation of depreciation for first 7 years. Equipment cost Salvage value Depreciable base Useful life (original) Annual depreciation After 7 years LO 4 $510, 000 − 10, 000 500, 000 ÷ 10 years $ 50, 000 × 7 years = $350, 000 Balance Sheet (December 31, 2019) Fixed Assets: Equipment $510, 000 Accumulated depreciation 350, 000 Net book value (NBV) $160, 000 Copyright © 2019 John Wiley & Sons, Inc. 48

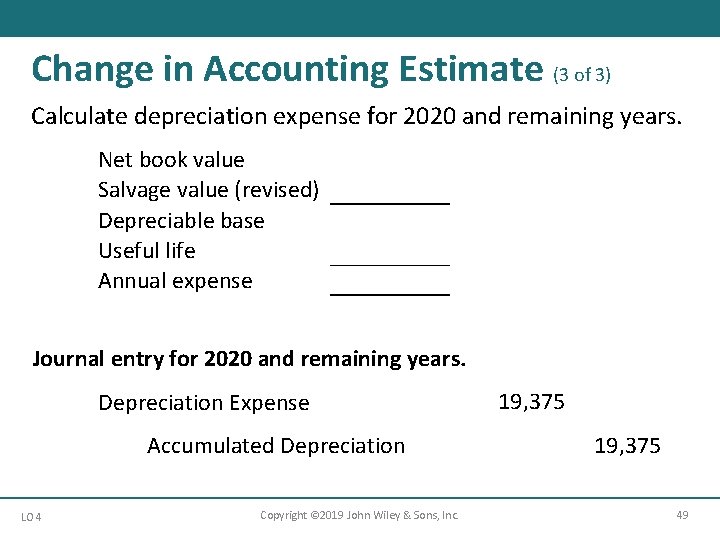

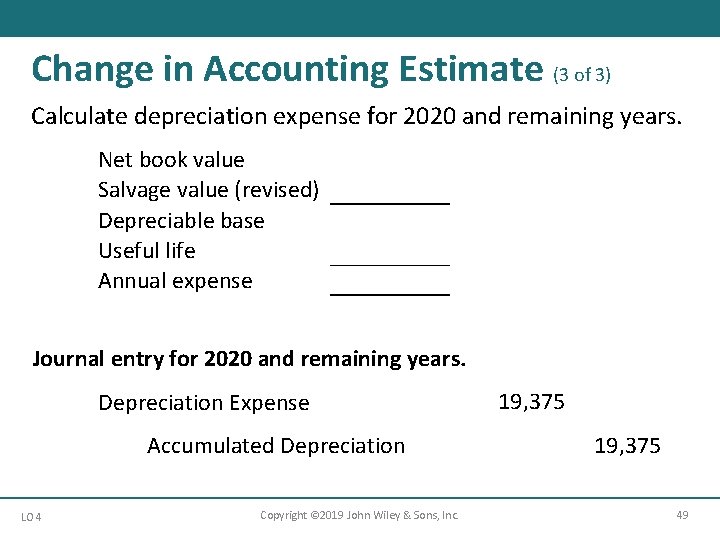

Change in Accounting Estimate (3 of 3) Calculate depreciation expense for 2020 and remaining years. Net book value Salvage value (revised) Depreciable base Useful life Annual expense $160, 000 − 5, 000 155, 000 ÷ 8 years $ 19, 375 Journal entry for 2020 and remaining years. Depreciation Expense Accumulated Depreciation LO 4 Copyright © 2019 John Wiley & Sons, Inc. 19, 375 49

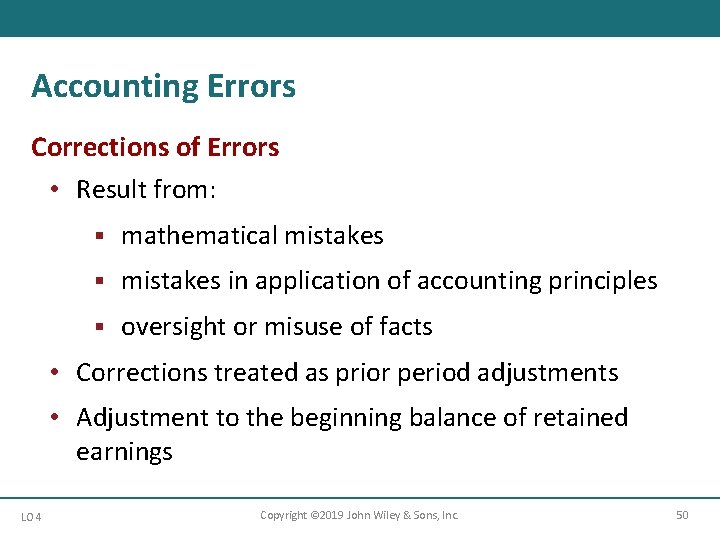

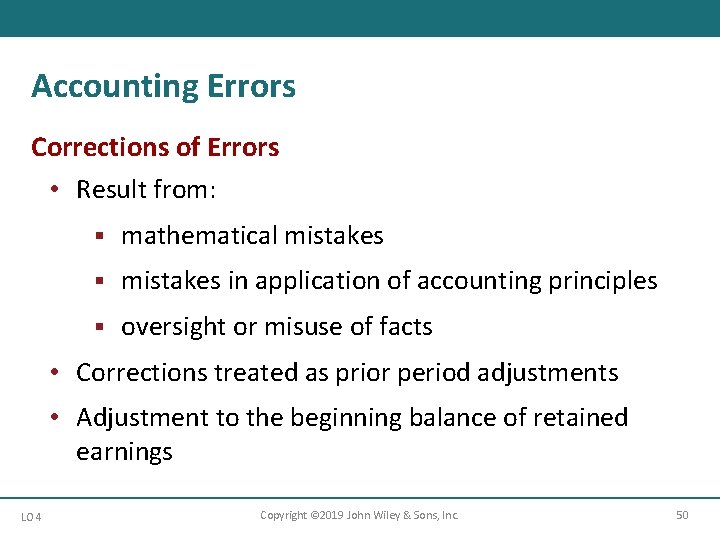

Accounting Errors Corrections of Errors • Result from: § mathematical mistakes § mistakes in application of accounting principles § oversight or misuse of facts • Corrections treated as prior period adjustments • Adjustment to the beginning balance of retained earnings LO 4 Copyright © 2019 John Wiley & Sons, Inc. 50

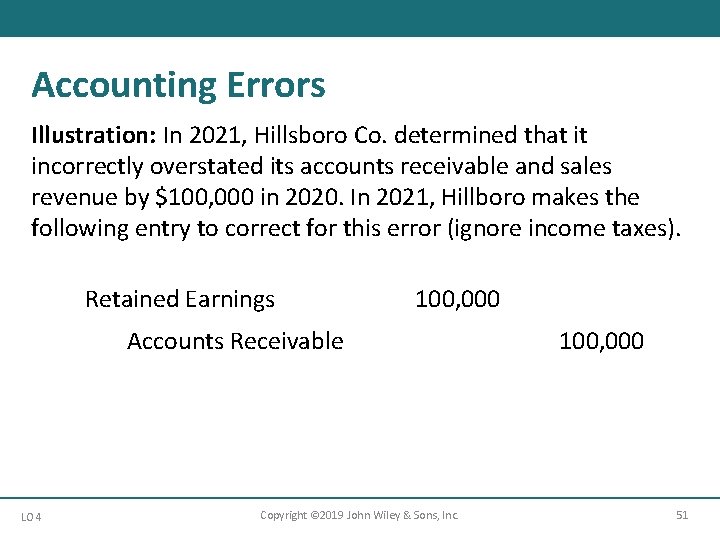

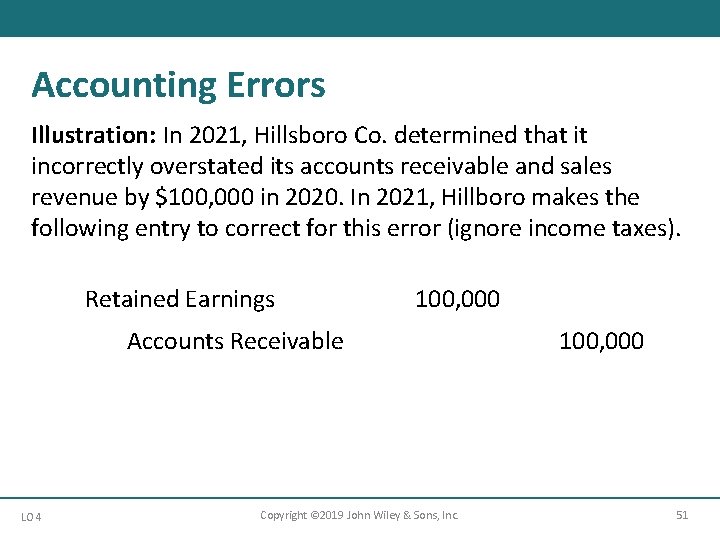

Accounting Errors Illustration: In 2021, Hillsboro Co. determined that it incorrectly overstated its accounts receivable and sales revenue by $100, 000 in 2020. In 2021, Hillboro makes the following entry to correct for this error (ignore income taxes). Retained Earnings 100, 000 Accounts Receivable LO 4 Copyright © 2019 John Wiley & Sons, Inc. 100, 000 51

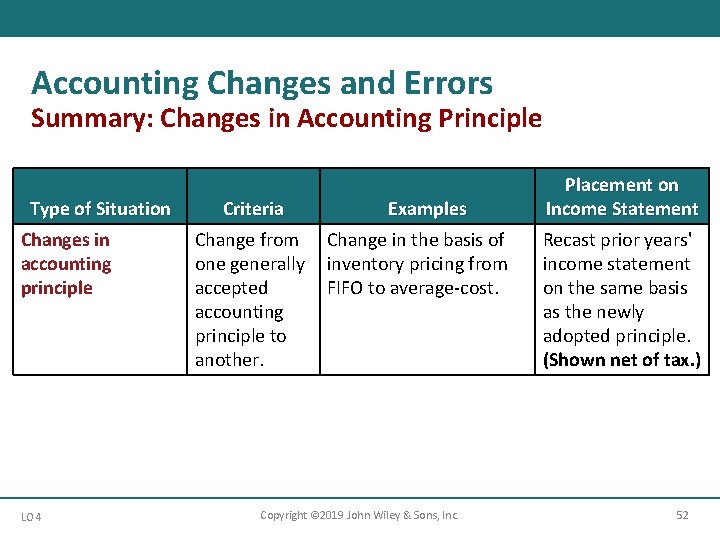

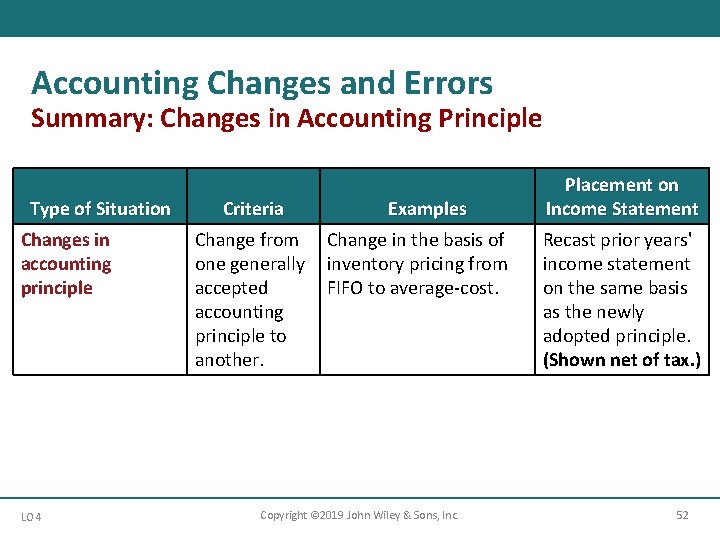

Accounting Changes and Errors Summary: Changes in Accounting Principle Type of Situation Changes in accounting principle LO 4 Criteria Change from one generally accepted accounting principle to another. Examples Change in the basis of inventory pricing from FIFO to average-cost. Copyright © 2019 John Wiley & Sons, Inc. Placement on Income Statement Recast prior years' income statement on the same basis as the newly adopted principle. (Shown net of tax. ) 52

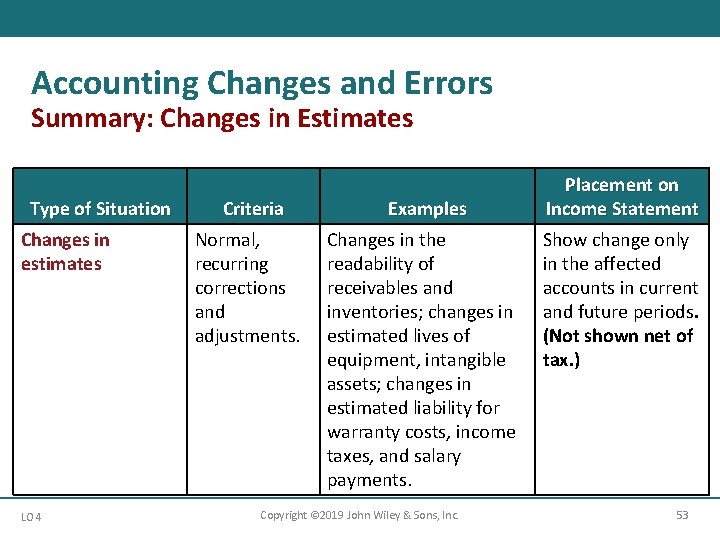

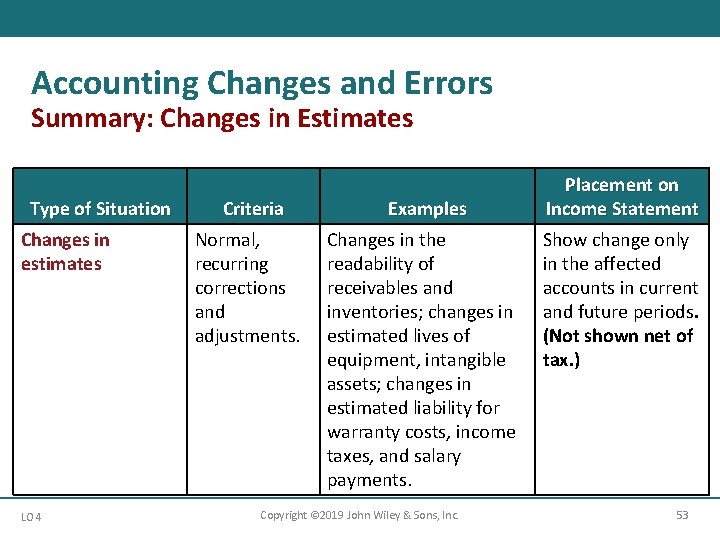

Accounting Changes and Errors Summary: Changes in Estimates Type of Situation Changes in estimates LO 4 Criteria Normal, recurring corrections and adjustments. Examples Changes in the readability of receivables and inventories; changes in estimated lives of equipment, intangible assets; changes in estimated liability for warranty costs, income taxes, and salary payments. Copyright © 2019 John Wiley & Sons, Inc. Placement on Income Statement Show change only in the affected accounts in current and future periods. (Not shown net of tax. ) 53

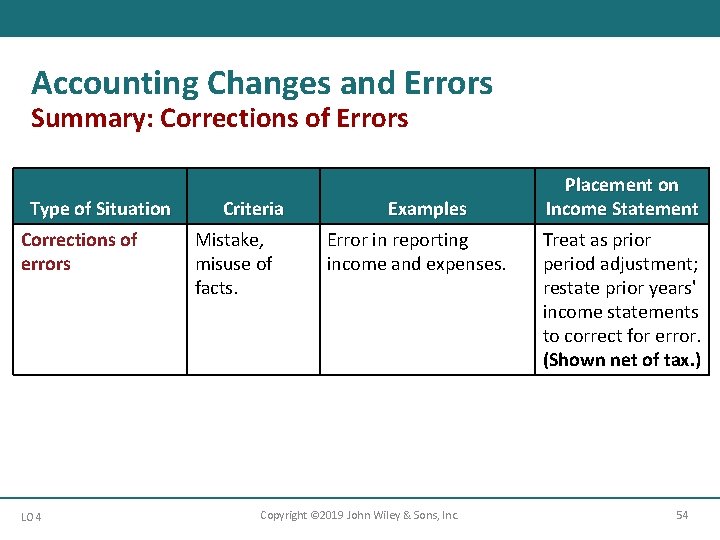

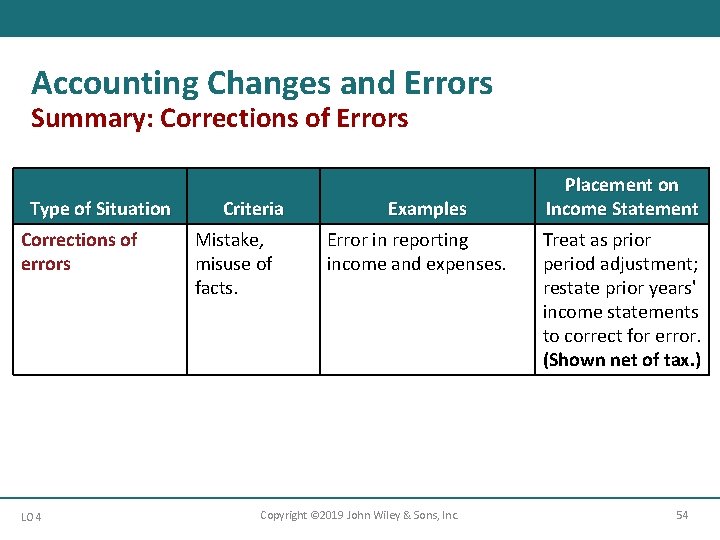

Accounting Changes and Errors Summary: Corrections of Errors Type of Situation Corrections of errors LO 4 Criteria Mistake, misuse of facts. Examples Error in reporting income and expenses. Copyright © 2019 John Wiley & Sons, Inc. Placement on Income Statement Treat as prior period adjustment; restate prior years' income statements to correct for error. (Shown net of tax. ) 54

Learning Objective 5 Describe Related Stockholders’ Equity Statements Copyright © 2019 John Wiley & Sons, Inc. 55

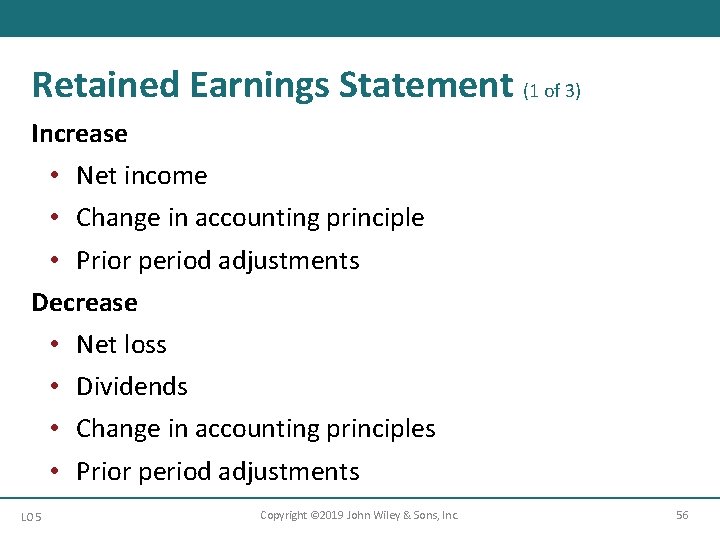

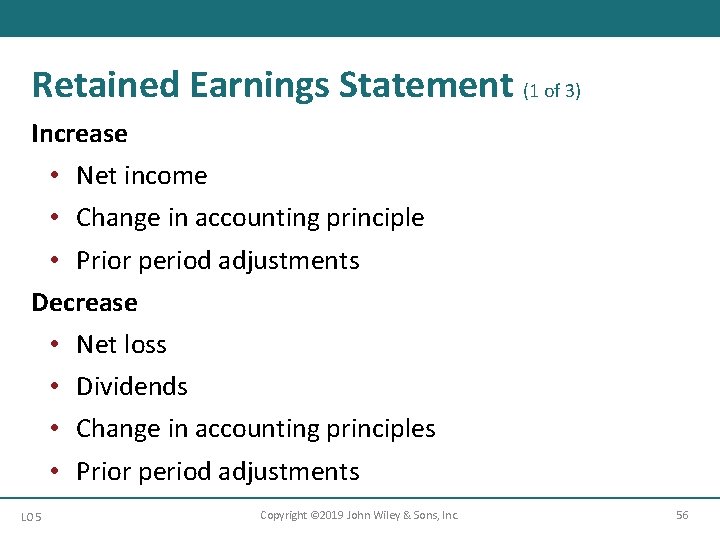

Retained Earnings Statement (1 of 3) Increase • Net income • Change in accounting principle • Prior period adjustments Decrease • Net loss • Dividends • Change in accounting principles • Prior period adjustments LO 5 Copyright © 2019 John Wiley & Sons, Inc. 56

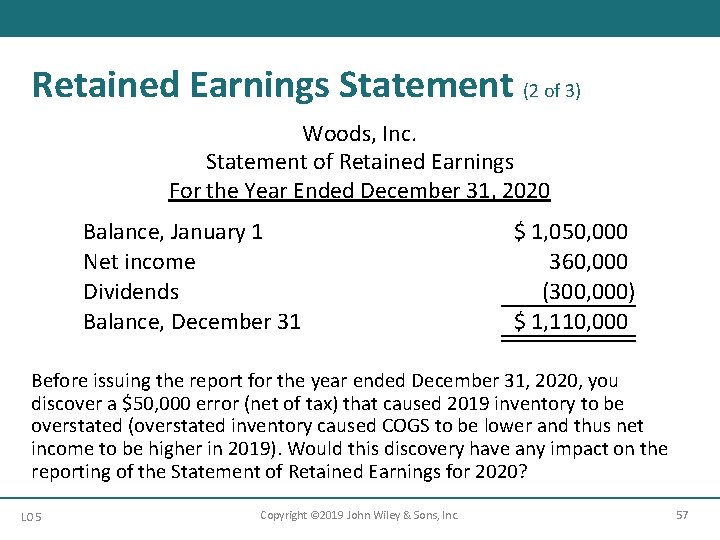

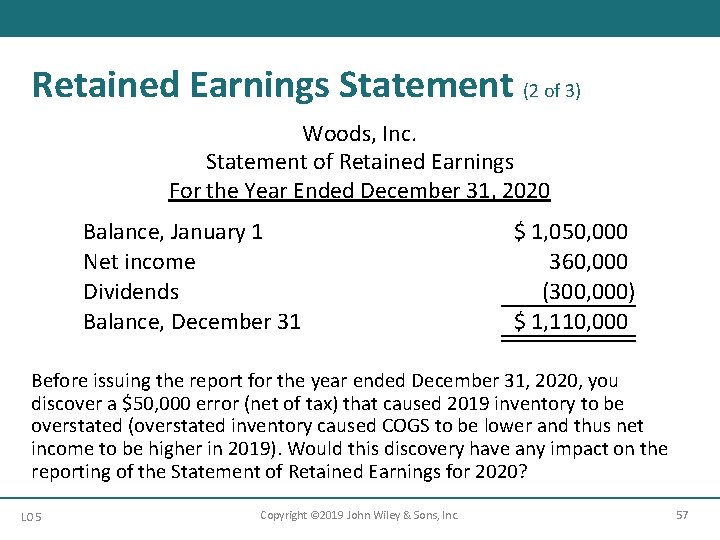

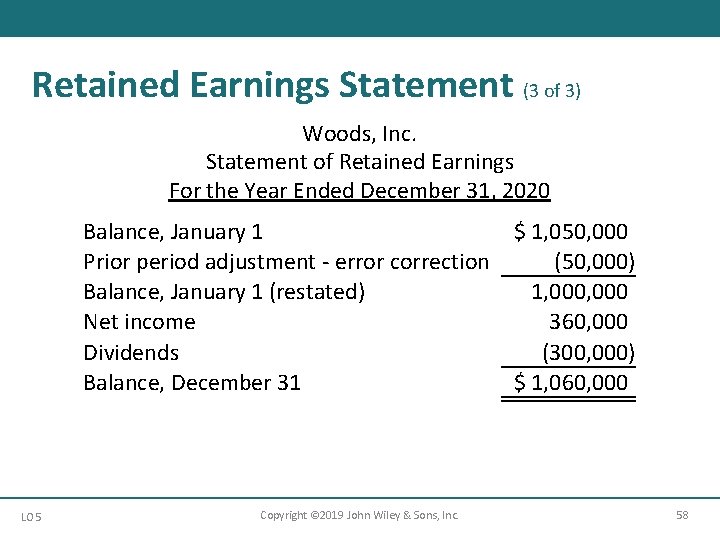

Retained Earnings Statement (2 of 3) Woods, Inc. Statement of Retained Earnings For the Year Ended December 31, 2020 Balance, January 1 Net income Dividends Balance, December 31 $ 1, 050, 000 360, 000 (300, 000) $ 1, 110, 000 Before issuing the report for the year ended December 31, 2020, you discover a $50, 000 error (net of tax) that caused 2019 inventory to be overstated (overstated inventory caused COGS to be lower and thus net income to be higher in 2019). Would this discovery have any impact on the reporting of the Statement of Retained Earnings for 2020? LO 5 Copyright © 2019 John Wiley & Sons, Inc. 57

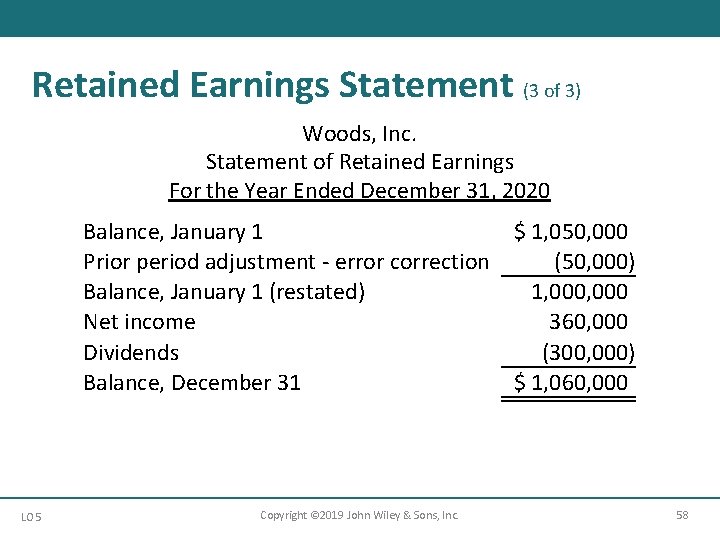

Retained Earnings Statement (3 of 3) Woods, Inc. Statement of Retained Earnings For the Year Ended December 31, 2020 Balance, January 1 $ 1, 050, 000 Prior period adjustment - error correction (50, 000) Balance, January 1 (restated) 1, 000 Net income 360, 000 Dividends (300, 000) Balance, December 31 $ 1, 060, 000 LO 5 Copyright © 2019 John Wiley & Sons, Inc. 58

Retained Earnings Statement Restrictions on Retained Earnings Disclosed • In notes to the financial statements • As Appropriated Retained Earnings LO 5 Copyright © 2019 John Wiley & Sons, Inc. 59

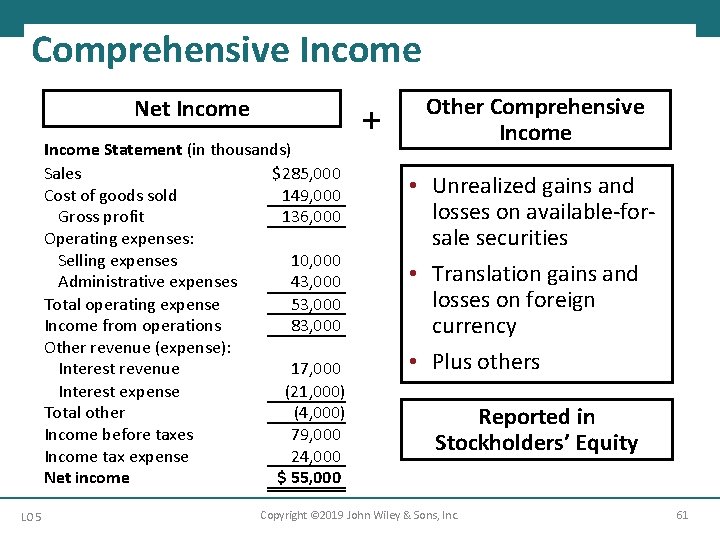

Comprehensive Income All changes in equity during a period except those resulting from investments by owners and distributions to owners. Includes: • all revenues and gains, expenses and losses reported in net income, and • all gains and losses that bypass net income but affect stockholders’ equity LO 5 Copyright © 2019 John Wiley & Sons, Inc. 60

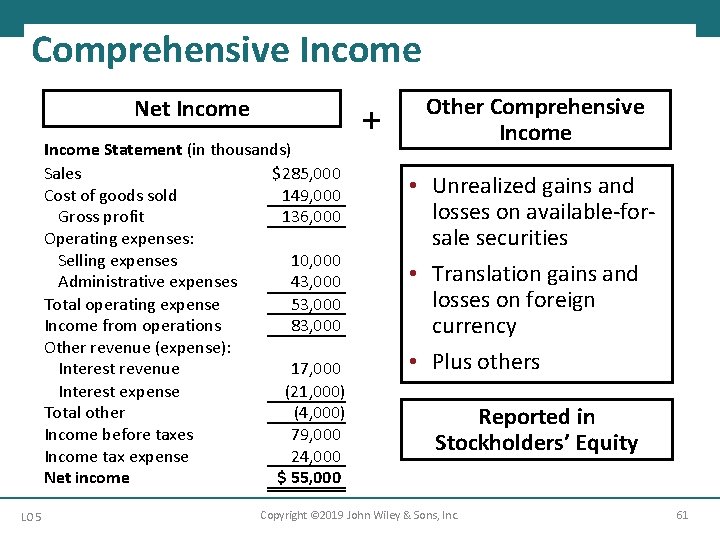

Comprehensive Income Net Income Statement (in thousands) Sales $285, 000 Cost of goods sold 149, 000 Gross profit 136, 000 Operating expenses: Selling expenses 10, 000 Administrative expenses 43, 000 Total operating expense 53, 000 Income from operations 83, 000 Other revenue (expense): Interest revenue 17, 000 Interest expense (21, 000) Total other (4, 000) Income before taxes 79, 000 Income tax expense 24, 000 Net income $ 55, 000 LO 5 + Other Comprehensive Income • Unrealized gains and losses on available-forsale securities • Translation gains and losses on foreign currency • Plus others Reported in Stockholders’ Equity Copyright © 2019 John Wiley & Sons, Inc. 61

Comprehensive Income Review Question Gains and losses that bypass net income but affect stockholders' equity are referred to as a. comprehensive income. b. other comprehensive income. c. prior period income. d. unusual gains and losses. LO 5 Copyright © 2019 John Wiley & Sons, Inc. 62

Comprehensive Income Review Question Answer Gains and losses that bypass net income but affect stockholders' equity are referred to as a. comprehensive income. b. other comprehensive income. c. prior period income. d. unusual gains and losses. LO 5 Copyright © 2019 John Wiley & Sons, Inc. 63

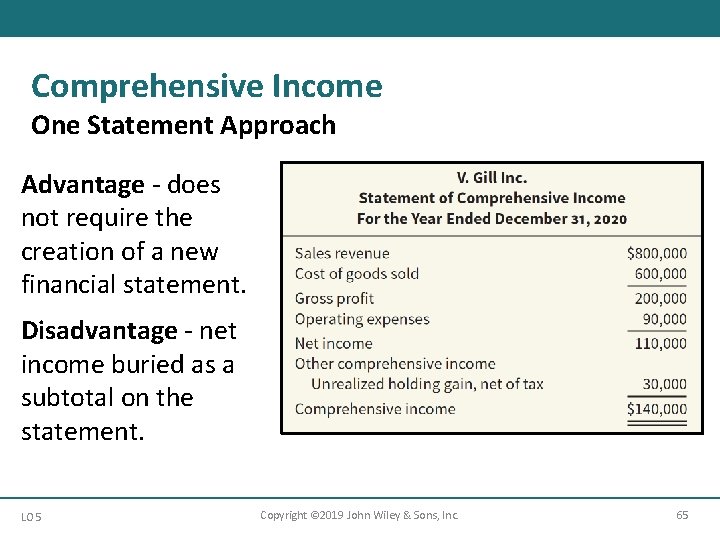

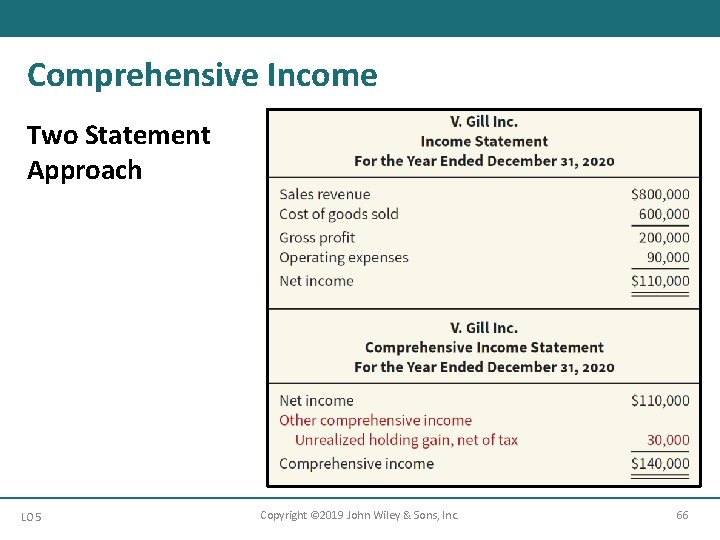

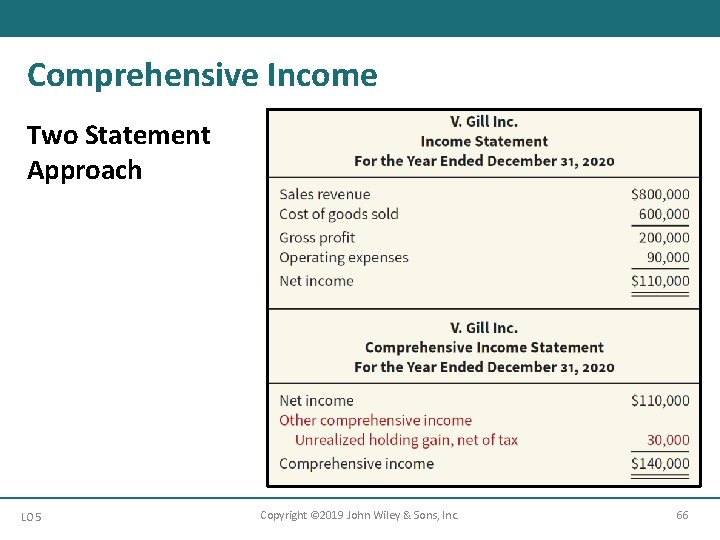

Comprehensive Income Companies must display the components of other comprehensive income in one of two ways: 1. A single continuous statement (one statement approach) or 2. two separate, but consecutive statements of net income and other comprehensive income (two statement approach). LO 5 Copyright © 2019 John Wiley & Sons, Inc. 64

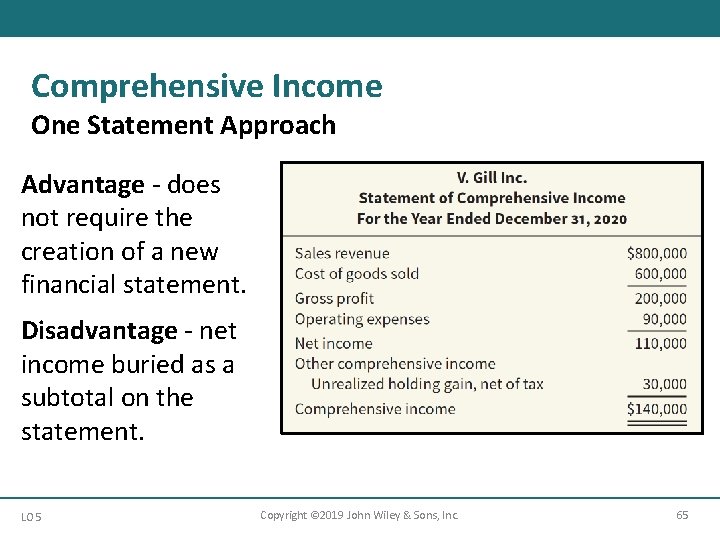

Comprehensive Income One Statement Approach Advantage - does not require the creation of a new financial statement. Disadvantage - net income buried as a subtotal on the statement. LO 5 Copyright © 2019 John Wiley & Sons, Inc. 65

Comprehensive Income Two Statement Approach LO 5 Copyright © 2019 John Wiley & Sons, Inc. 66

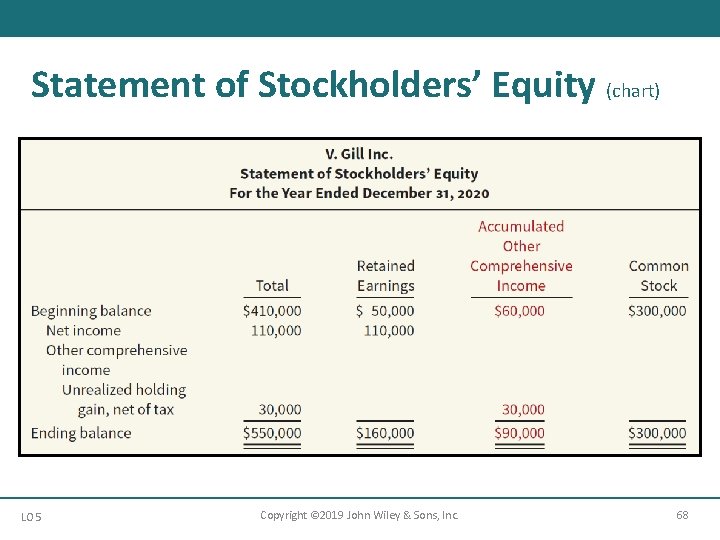

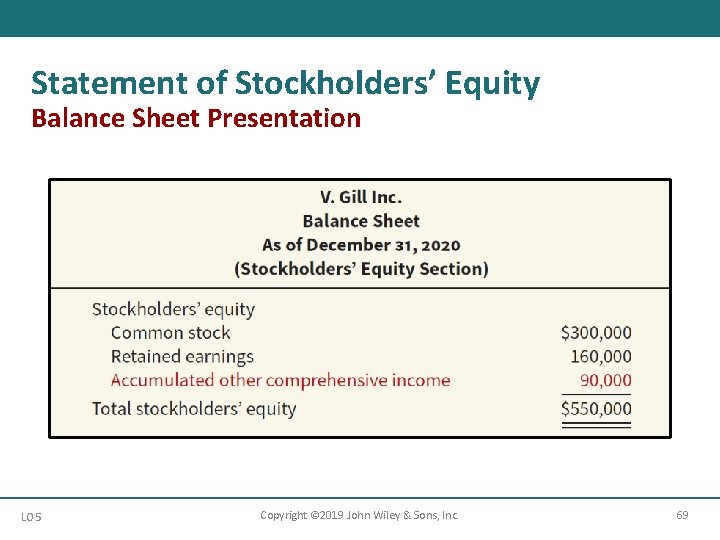

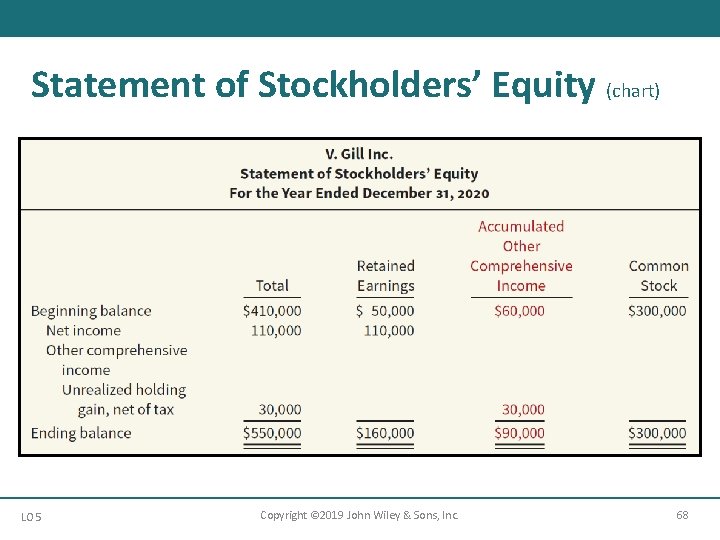

Statement of Stockholders’ Equity • Reports changes in each stockholders’ equity account and total equity for the period • Following items are disclosed in the statement: LO 5 § Contributions (issuances of shares) and distributions (dividends) to owners § Reconciliation of carrying amount of each component of stockholders’ equity from beginning to end of period Copyright © 2019 John Wiley & Sons, Inc. 67

Statement of Stockholders’ Equity (chart) LO 5 Copyright © 2019 John Wiley & Sons, Inc. 68

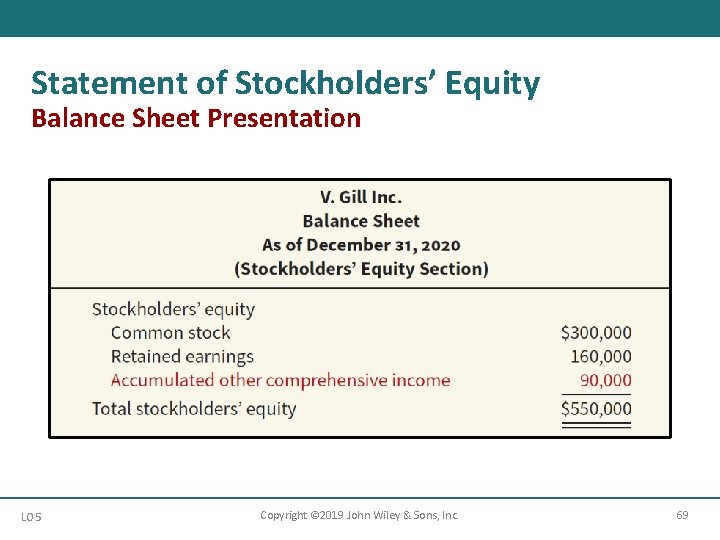

Statement of Stockholders’ Equity Balance Sheet Presentation LO 5 Copyright © 2019 John Wiley & Sons, Inc. 69

Learning Objective 6 Compare the Accounting Procedures for Income Reporting Under GAAP and IFRS Copyright © 2019 John Wiley & Sons, Inc. 70

IFRS Insights (1 of 4) Relevant Facts Similarities • Both GAAP and IFRS require companies to indicate the amount of net income attributable to noncontrolling interest. • With the recent FASB Accounting Standards Update, under both I FRS and GAAP, unusual and infrequent income items are reported in Income before income taxes (i. e. , not an extraordinary item treatment, with reporting similar to discontinued operations). • Both GAAP and IFRS follow the same presentation guidelines for discontinued operations, but IFRS defines a discontinued operation more narrowly. Both standard-setters have indicated a willingness to develop a similar definition to be used in the joint project on financial statement presentation. LO 6 Copyright © 2019 John Wiley & Sons, Inc. 71

IFRS Insights (2 of 4) Relevant Facts Similarities • Both GAAP and IFRS have items that are recognized in equity as part of comprehensive income but do not affect net income. Both G AAP and IFRS allow a one statement or two statement approach to preparing the statement of comprehensive income. Differences • Presentation of the income statement under G AAP follows either a single-step or multiple-step format. IFRS does not mention a singlestep or multiple-step approach. • Under IFRS, companies must classify expenses by either nature or function. GAAP does not have that requirement, but the S EC requires a functional presentation. LO 6 Copyright © 2019 John Wiley & Sons, Inc. 72

IFRS Insights (3 of 4) Relevant Facts Differences • IFRS identifies certain minimum items that should be presented on the income statement. GAAP has no minimum information requirements. However, the SEC rules have more rigorous presentation requirements. • IFRS does not define key measures like income from operations. S EC regulations define many key measures and provide requirements and limitations on companies reporting non-GAAP/IFRS information. • Under IFRS, revaluation of property, plant, and equipment, and intangible assets is permitted, with gains reported as other comprehensive income. The effect of this difference is that application of IFRS results in more transactions affecting equity but not net income. LO 6 Copyright © 2019 John Wiley & Sons, Inc. 73

IFRS Insights (4 of 4) On The Horizon The I A S B and FASB have worked on a project that would restructure the financial statements. One stage of this project will address the issue of how to classify various items in the income statement. A main goal of this new approach is to provide information that better represents how businesses are run, that is, an idea to require comprehensive income be reported in a combined statement of comprehensive income. This approach draws attention away from just one number—net income. This broad project is on hold; both Boards are working on separate, narrower projects in response to non-GAAP reporting. LO 6 Copyright © 2019 John Wiley & Sons, Inc. 74

Copyright © 2019 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein. Copyright © 2019 John Wiley & Sons, Inc. 75