Intermediate Accounting 11 th Edition Kieso Weygandt and

- Slides: 17

Intermediate Accounting, 11 th Edition Kieso, Weygandt, and Warfield Chapter 2: The Conceptual Framework Prepared by Jep Robertson and Renae Clark New Mexico Sate University Las Cruces, New Mexico

Chapter 2: The Conceptual Framework After studying this chapter, you should be able to: 1. Describe the usefulness of a conceptual framework. 2. Describe the FASB's efforts to construct a conceptual framework. 3. Understand the objectives of financial reporting. 4. Identify the qualitative characteristics of accounting information.

Chapter 2: The Conceptual Framework 5. Define the basic elements of financial statements. 6. Describe the basic assumptions of accounting. 7. Explain the application of the basic principles of accounting. 8. Describe the impact that constraints have on reporting accounting information.

Objectives of the Conceptual Framework • The Framework was to be the foundation for building a set of coherent accounting standards and rules. • The Framework is to be a reference of basic accounting theory for solving emerging practical problems of reporting.

Statements of Financial Accounting Concepts • The FASB has issued seven Statements of Financial Accounting Concepts (SFACs) to date (Statements 1 through 7. ) • These statements set forth major recognition and reporting issues. • Statement 4 pertains to reporting by nonbusiness entities. • The other six statements pertain to reporting by business enterprises.

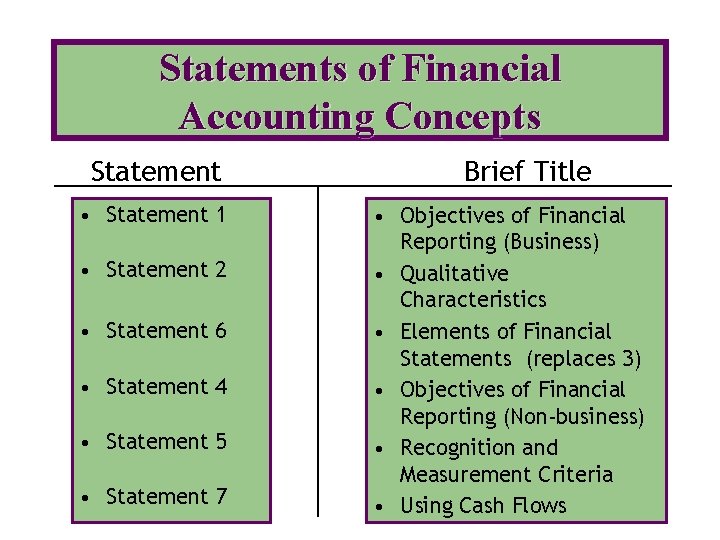

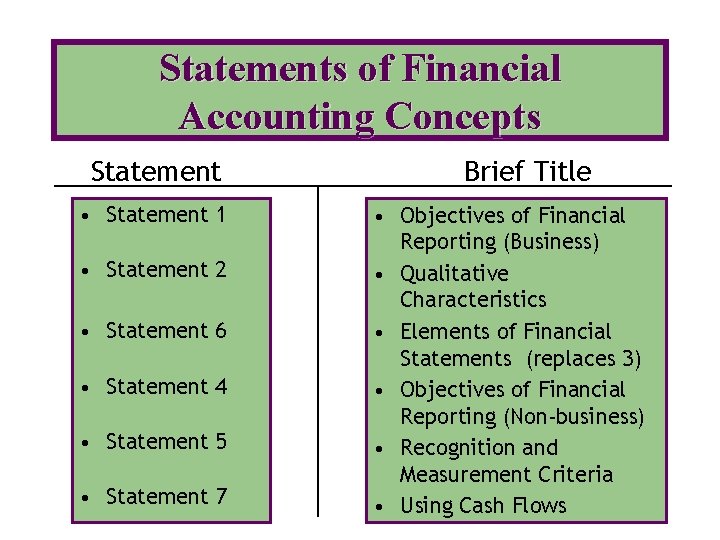

Statements of Financial Accounting Concepts Statement • Statement 1 • Statement 2 • Statement 6 • Statement 4 • Statement 5 • Statement 7 Brief Title • Objectives of Financial Reporting (Business) • Qualitative Characteristics • Elements of Financial Statements (replaces 3) • Objectives of Financial Reporting (Non-business) • Recognition and Measurement Criteria • Using Cash Flows

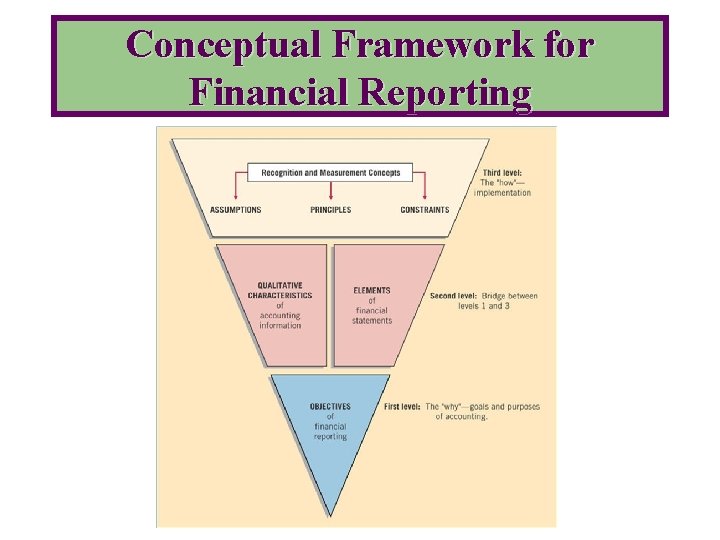

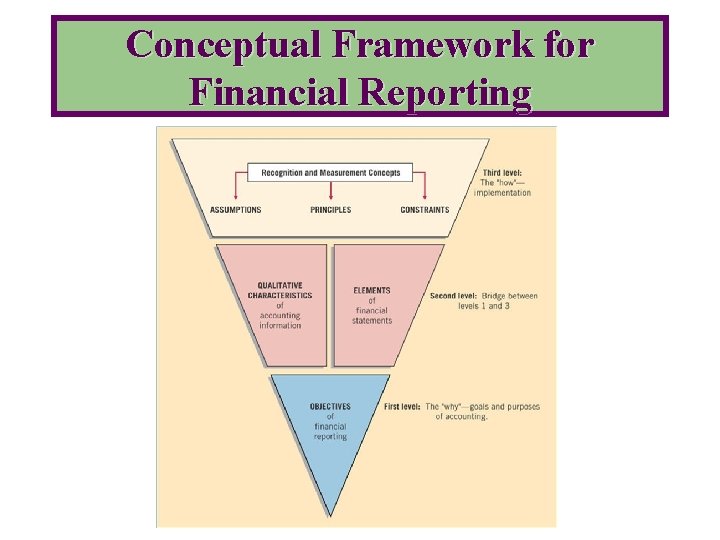

Overview of the Conceptual Framework The Framework has three different levels, comprised of: • The first level consists of objectives. • The second level explains financial elements and characteristics of information. • The third level incorporates recognition and measurement criteria.

Conceptual Framework for Financial Reporting

Basic Objectives of Financial Reporting To provide information: • about economic resources, the claims on those resources and changes in them. • that is useful to those making investment and credit decisions. • that is useful to present and future investors, creditors in assessing future cash flows. • to individuals who reasonably understand business and economic activities.

Hierarchy of Accounting Qualities

Qualitative Characteristics of Accounting Information • Primary qualities of accounting information are relevance and reliability. • Secondary qualities are comparability and consistency of reported information.

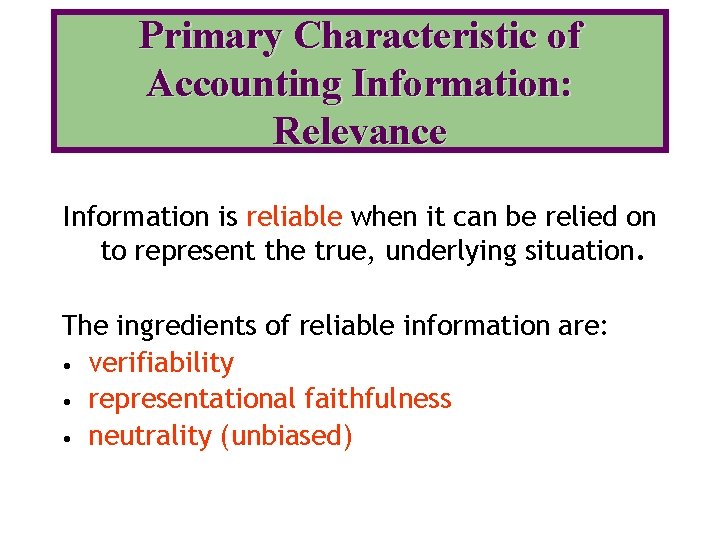

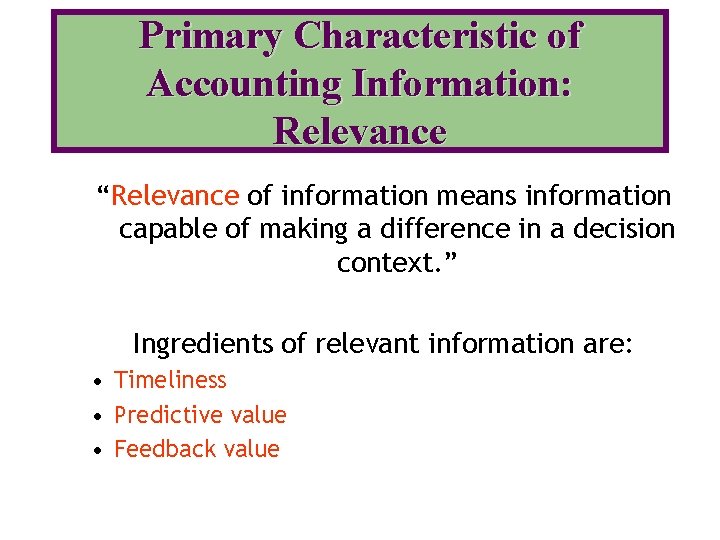

Primary Characteristic of Accounting Information: Relevance “Relevance of information means information capable of making a difference in a decision context. ” Ingredients of relevant information are: • Timeliness • Predictive value • Feedback value

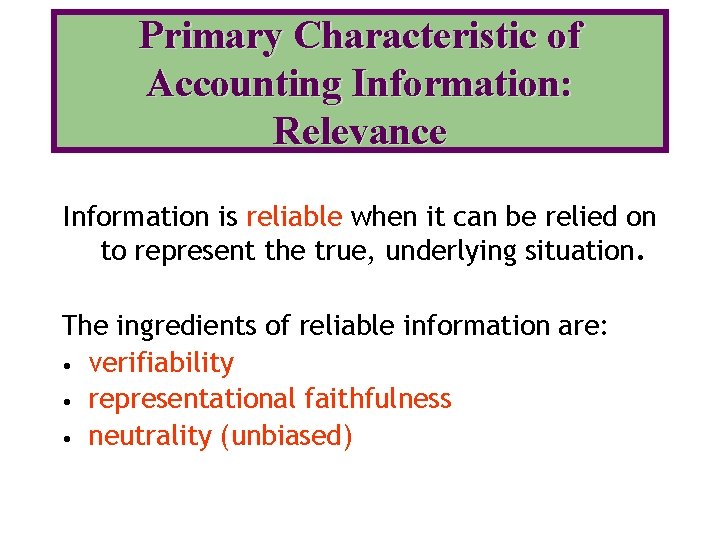

Primary Characteristic of Accounting Information: Relevance Information is reliable when it can be relied on to represent the true, underlying situation. The ingredients of reliable information are: • verifiability • representational faithfulness • neutrality (unbiased)

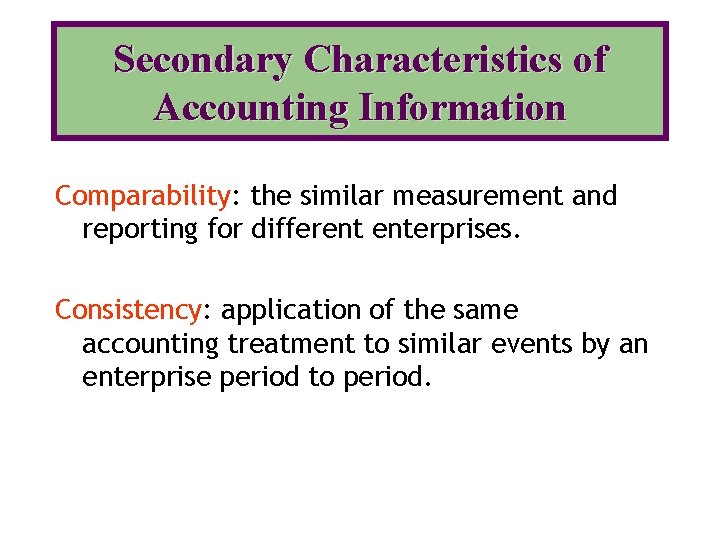

Secondary Characteristics of Accounting Information Comparability: the similar measurement and reporting for different enterprises. Consistency: application of the same accounting treatment to similar events by an enterprise period to period.

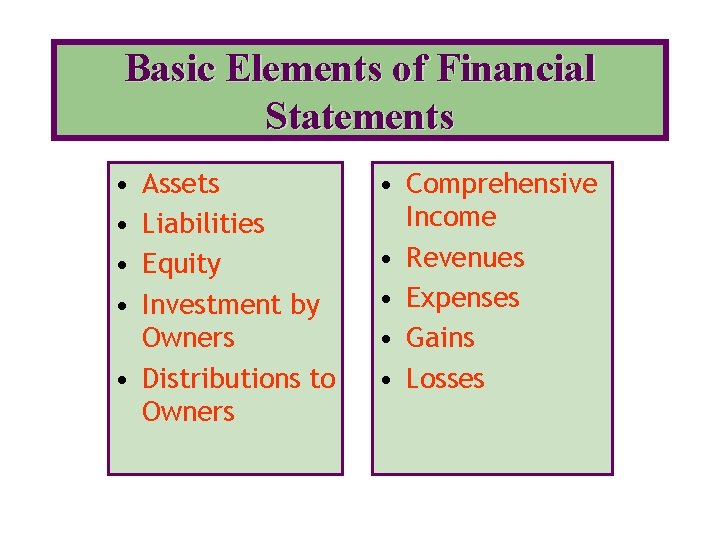

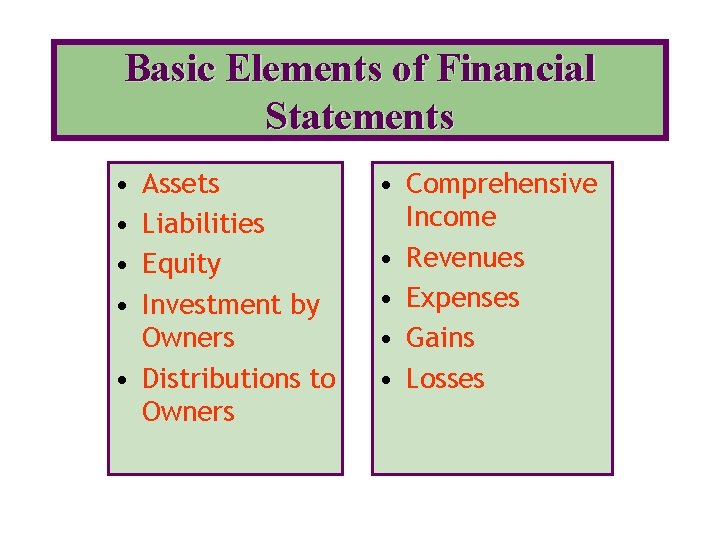

Basic Elements of Financial Statements • • Assets Liabilities Equity Investment by Owners • Distributions to Owners • Comprehensive Income • Revenues • Expenses • Gains • Losses

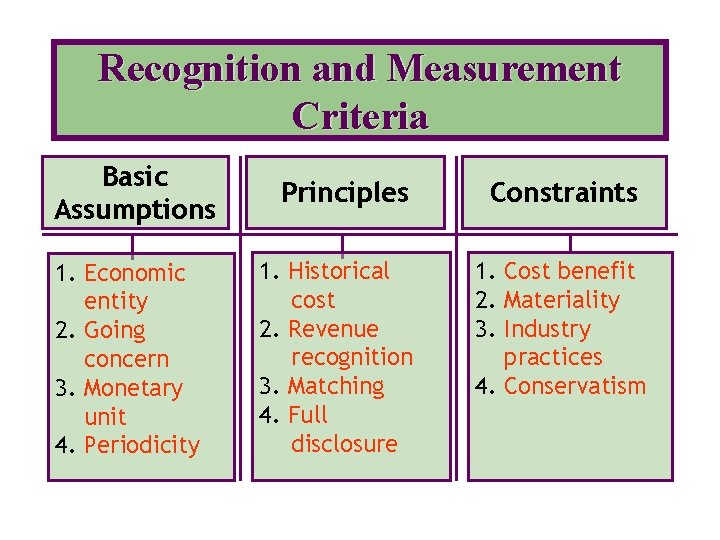

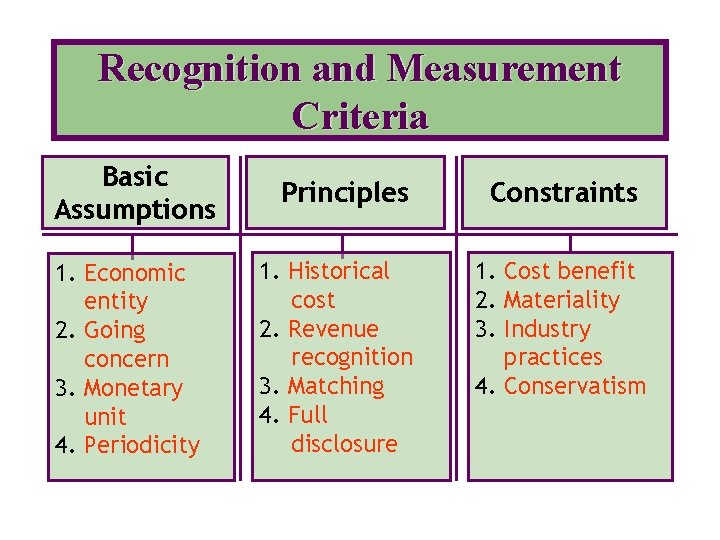

Recognition and Measurement Criteria Basic Assumptions 1. Economic entity 2. Going concern 3. Monetary unit 4. Periodicity Principles 1. Historical cost 2. Revenue recognition 3. Matching 4. Full disclosure Constraints 1. Cost benefit 2. Materiality 3. Industry practices 4. Conservatism

COPYRIGHT Copyright © 2004 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

Kimmel weygandt kieso financial accounting 5th edition

Kimmel weygandt kieso financial accounting 5th edition Kimmel weygandt kieso accounting 5th edition

Kimmel weygandt kieso accounting 5th edition Kimmel weygandt kieso accounting 5th edition

Kimmel weygandt kieso accounting 5th edition Financial and managerial accounting weygandt kimmel kieso

Financial and managerial accounting weygandt kimmel kieso Kieso weygandt warfield

Kieso weygandt warfield Weygandt kimmel kieso

Weygandt kimmel kieso Chapter 21 accounting for leases kieso terjemahan

Chapter 21 accounting for leases kieso terjemahan Chapter 14 intermediate accounting kieso bahasa indonesia

Chapter 14 intermediate accounting kieso bahasa indonesia Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting

Intermediate accounting Impairment in finance meaning

Impairment in finance meaning Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting chapter 17 investments solutions

Intermediate accounting chapter 17 investments solutions Bearing note

Bearing note