Grouper Acquisition Opportunity July 2006 CONFIDENTIAL Agenda Acquisition

- Slides: 33

Grouper Acquisition Opportunity July 2006 CONFIDENTIAL

Agenda • Acquisition Highlights • Executive Summary • Appendix 2

ACQUISITION HIGHLIGHTS CONFIDENTIAL

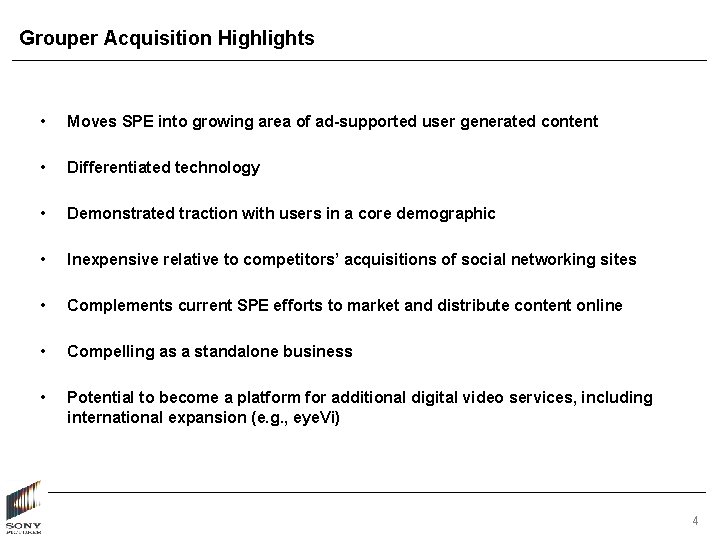

Grouper Acquisition Highlights • Moves SPE into growing area of ad-supported user generated content • Differentiated technology • Demonstrated traction with users in a core demographic • Inexpensive relative to competitors’ acquisitions of social networking sites • Complements current SPE efforts to market and distribute content online • Compelling as a standalone business • Potential to become a platform for additional digital video services, including international expansion (e. g. , eye. Vi) 4

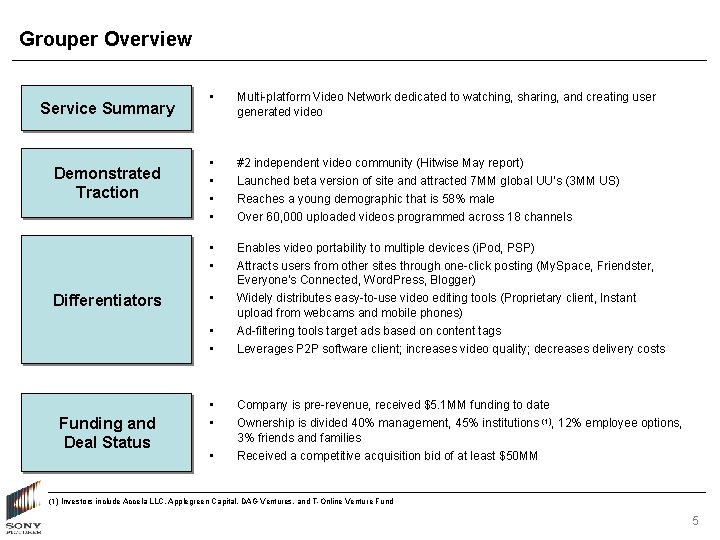

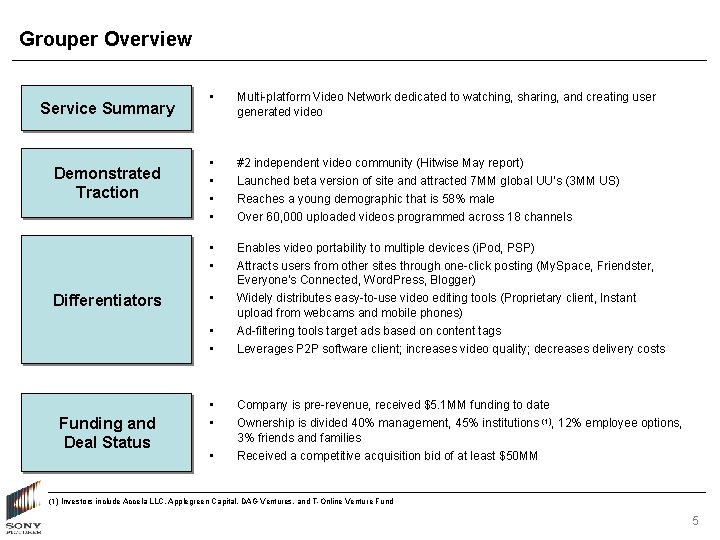

Grouper Overview Service Summary Demonstrated Traction Differentiators • Multi-platform Video Network dedicated to watching, sharing, and creating user generated video • • #2 independent video community (Hitwise May report) Launched beta version of site and attracted 7 MM global UU’s (3 MM US) • • Enables video portability to multiple devices (i. Pod, PSP) Attracts users from other sites through one-click posting (My. Space, Friendster, Everyone’s Connected, Word. Press, Blogger) Widely distributes easy-to-use video editing tools (Proprietary client, Instant upload from webcams and mobile phones) Ad-filtering tools target ads based on content tags Leverages P 2 P software client; increases video quality; decreases delivery costs • • • Funding and Deal Status • • • Reaches a young demographic that is 58% male Over 60, 000 uploaded videos programmed across 18 channels Company is pre-revenue, received $5. 1 MM funding to date Ownership is divided 40% management, 45% institutions (1), 12% employee options, 3% friends and families Received a competitive acquisition bid of at least $50 MM (1) Investors include Accela LLC, Applegreen Capital, DAG Ventures, and T-Online Venture Fund 5

EXECUTIVE SUMMARY CONFIDENTIAL

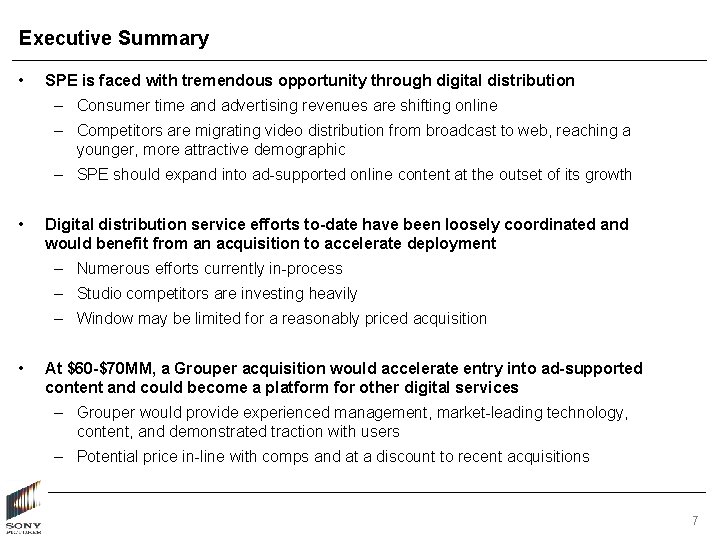

Executive Summary • SPE is faced with tremendous opportunity through digital distribution – Consumer time and advertising revenues are shifting online – Competitors are migrating video distribution from broadcast to web, reaching a younger, more attractive demographic – SPE should expand into ad-supported online content at the outset of its growth • Digital distribution service efforts to-date have been loosely coordinated and would benefit from an acquisition to accelerate deployment – Numerous efforts currently in-process – Studio competitors are investing heavily – Window may be limited for a reasonably priced acquisition • At $60 -$70 MM, a Grouper acquisition would accelerate entry into ad-supported content and could become a platform for other digital services – Grouper would provide experienced management, market-leading technology, content, and demonstrated traction with users – Potential price in-line with comps and at a discount to recent acquisitions 7

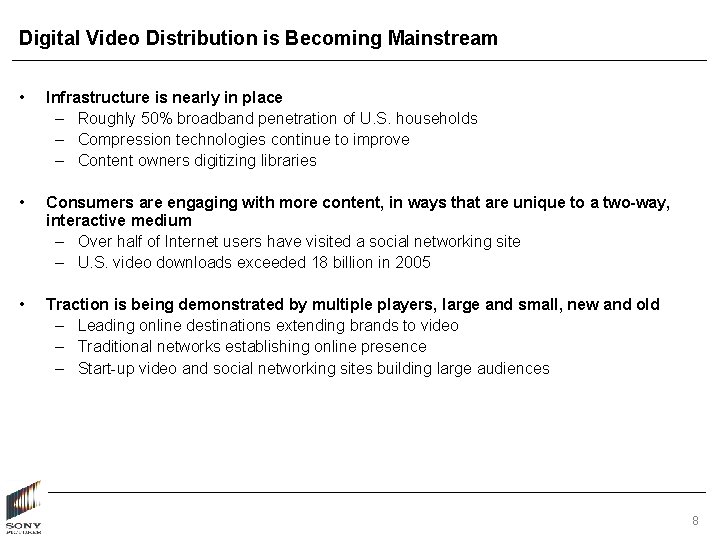

Digital Video Distribution is Becoming Mainstream • Infrastructure is nearly in place – Roughly 50% broadband penetration of U. S. households – Compression technologies continue to improve – Content owners digitizing libraries • Consumers are engaging with more content, in ways that are unique to a two-way, interactive medium – Over half of Internet users have visited a social networking site – U. S. video downloads exceeded 18 billion in 2005 • Traction is being demonstrated by multiple players, large and small, new and old – Leading online destinations extending brands to video – Traditional networks establishing online presence – Start-up video and social networking sites building large audiences 8

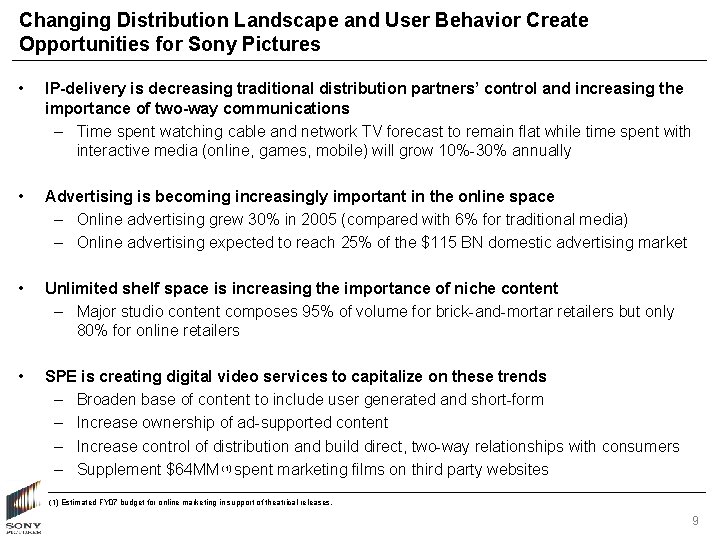

Changing Distribution Landscape and User Behavior Create Opportunities for Sony Pictures • IP-delivery is decreasing traditional distribution partners’ control and increasing the importance of two-way communications – Time spent watching cable and network TV forecast to remain flat while time spent with interactive media (online, games, mobile) will grow 10%-30% annually • Advertising is becoming increasingly important in the online space – Online advertising grew 30% in 2005 (compared with 6% for traditional media) – Online advertising expected to reach 25% of the $115 BN domestic advertising market • Unlimited shelf space is increasing the importance of niche content – Major studio content composes 95% of volume for brick-and-mortar retailers but only 80% for online retailers • SPE is creating digital video services to capitalize on these trends – Broaden base of content to include user generated and short-form – Increase ownership of ad-supported content – Increase control of distribution and build direct, two-way relationships with consumers – Supplement $64 MM (1) spent marketing films on third party websites (1) Estimated FY 07 budget for online marketing in support of theatrical releases. 9

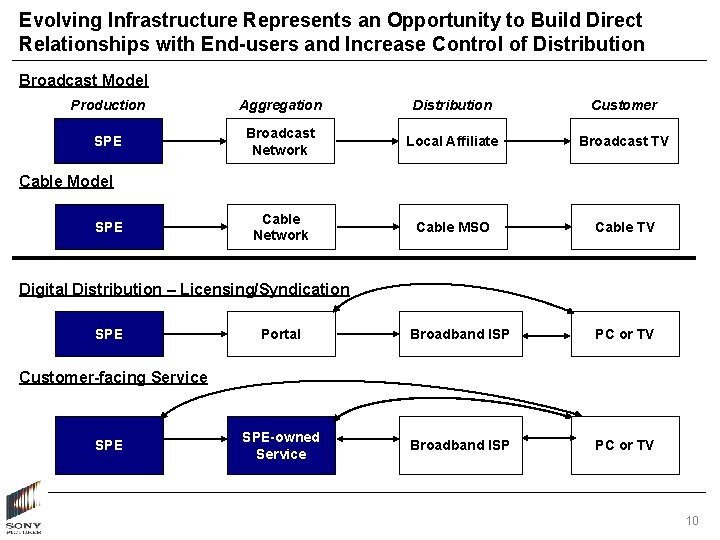

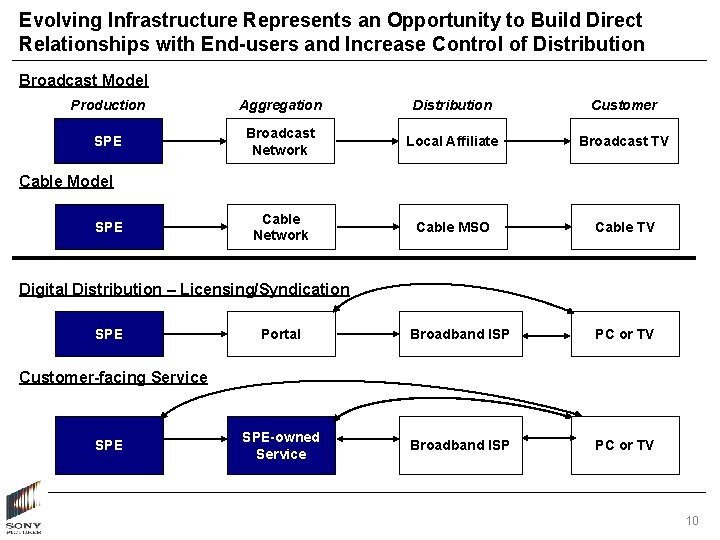

Evolving Infrastructure Represents an Opportunity to Build Direct Relationships with End-users and Increase Control of Distribution Broadcast Model Production Aggregation Distribution Customer SPE Broadcast Network Local Affiliate Broadcast TV Cable Network Cable MSO Cable TV Cable Model SPE Digital Distribution – Licensing/Syndication SPE Portal Broadband ISP PC or TV SPE-owned Service Broadband ISP PC or TV Customer-facing Service SPE 10

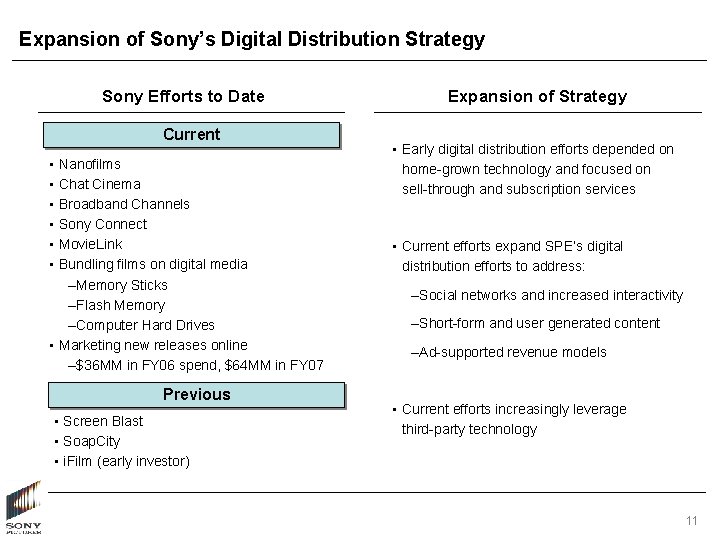

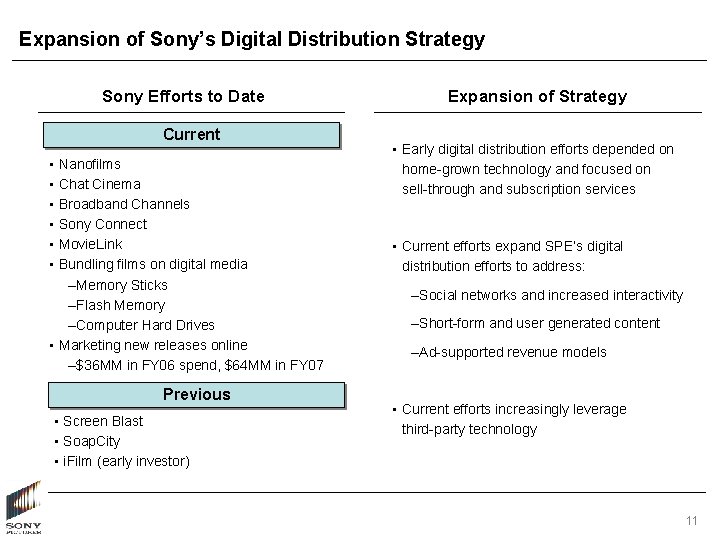

Expansion of Sony’s Digital Distribution Strategy Sony Efforts to Date Current • • • Nanofilms Chat Cinema Broadband Channels Sony Connect Movie. Link Bundling films on digital media –Memory Sticks –Flash Memory –Computer Hard Drives • Marketing new releases online –$36 MM in FY 06 spend, $64 MM in FY 07 Previous • Screen Blast • Soap. City • i. Film (early investor) Expansion of Strategy • Early digital distribution efforts depended on home-grown technology and focused on sell-through and subscription services • Current efforts expand SPE’s digital distribution efforts to address: –Social networks and increased interactivity –Short-form and user generated content –Ad-supported revenue models • Current efforts increasingly leverage third-party technology 11

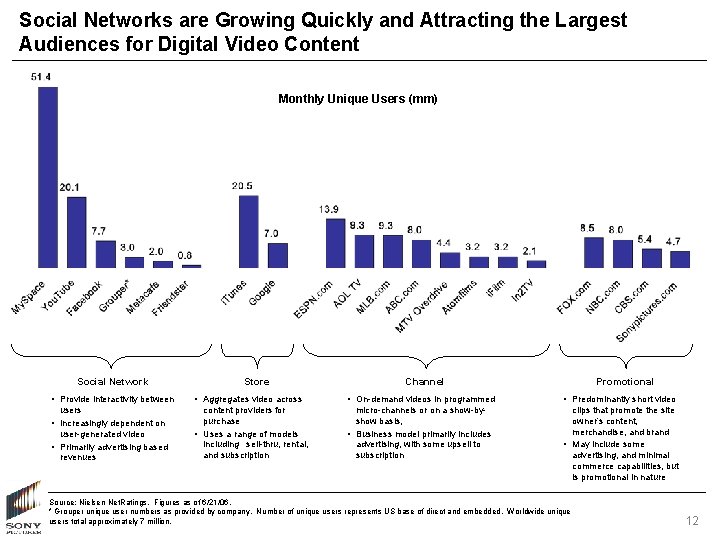

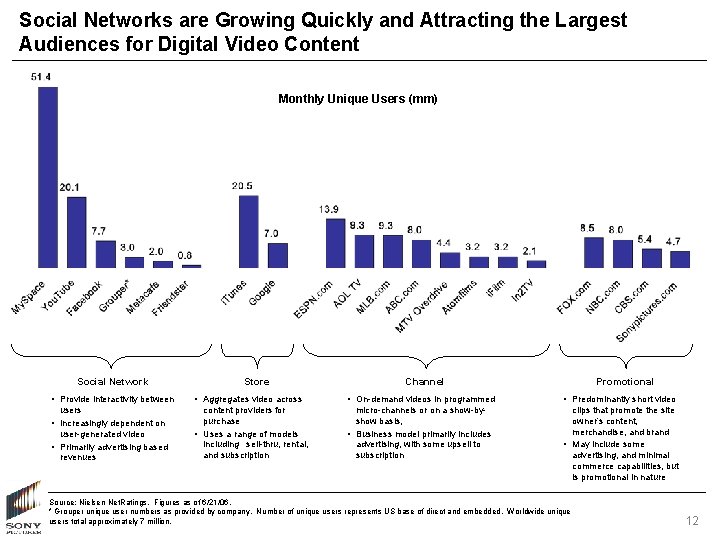

Social Networks are Growing Quickly and Attracting the Largest Audiences for Digital Video Content Monthly Unique Users (mm) Social Network Store Channel Promotional • Provide interactivity between • Aggregates video across • On-demand videos in programmed • Predominantly short video users • Increasingly dependent on user-generated video • Primarily advertising based revenues content providers for purchase • Uses a range of models including sell-thru, rental, and subscription micro-channels or on a show-byshow basis, • Business model primarily includes advertising, with some upsell to subscription clips that promote the site owner’s content, merchandise, and brand • May include some advertising, and minimal commerce capabilities, but is promotional in nature Source: Nielsen Net. Ratings. Figures as of 6/21/06. * Grouper unique user numbers as provided by company. Number of unique users represents US base of direct and embedded. Worldwide unique users total approximately 7 million. 12

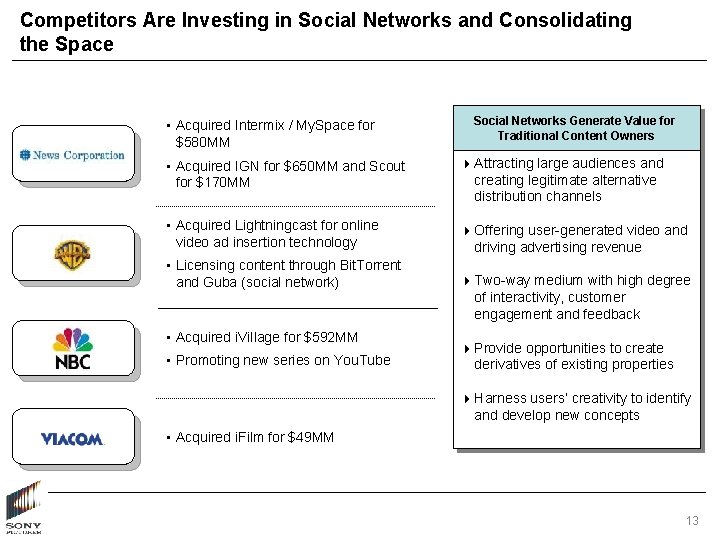

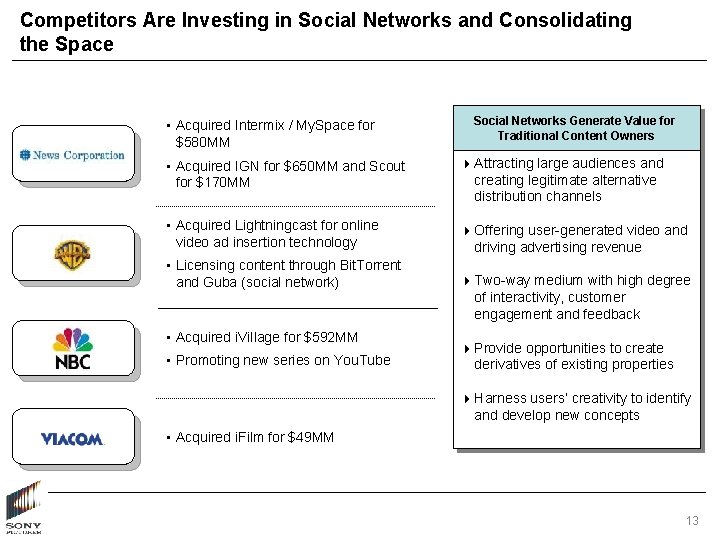

Competitors Are Investing in Social Networks and Consolidating the Space • Acquired Intermix / My. Space for $580 MM Social Networks Generate Value for Traditional Content Owners • Acquired IGN for $650 MM and Scout for $170 MM 4 Attracting large audiences and • Acquired Lightningcast for online video ad insertion technology 4 Offering user-generated video and • Licensing content through Bit. Torrent and Guba (social network) • Acquired i. Village for $592 MM • Promoting new series on You. Tube creating legitimate alternative distribution channels driving advertising revenue 4 Two-way medium with high degree of interactivity, customer engagement and feedback 4 Provide opportunities to create derivatives of existing properties 4 Harness users’ creativity to identify and develop new concepts • Acquired i. Film for $49 MM 13

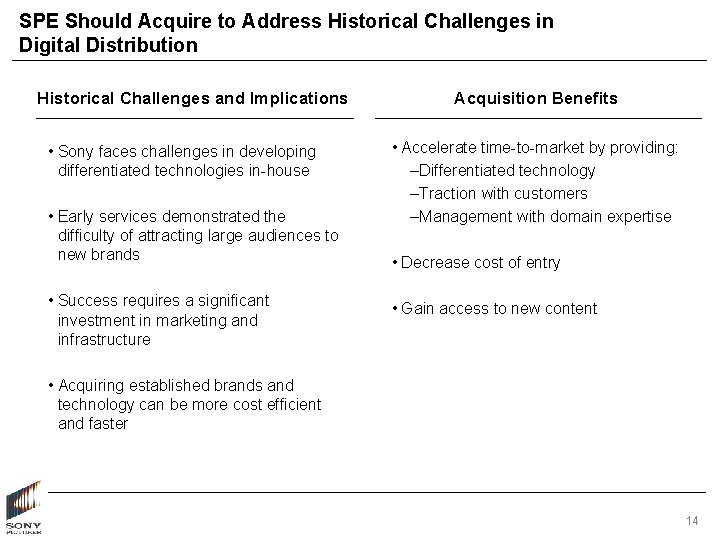

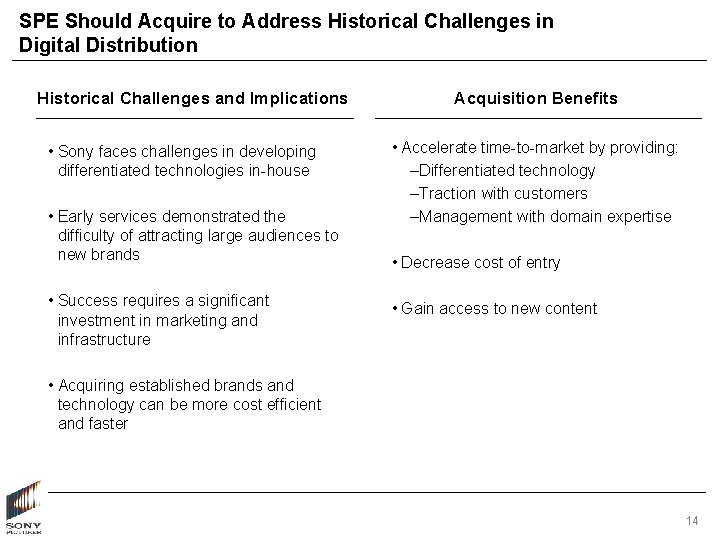

SPE Should Acquire to Address Historical Challenges in Digital Distribution Historical Challenges and Implications • Sony faces challenges in developing differentiated technologies in-house • Early services demonstrated the difficulty of attracting large audiences to new brands • Success requires a significant investment in marketing and infrastructure Acquisition Benefits • Accelerate time-to-market by providing: –Differentiated technology –Traction with customers –Management with domain expertise • Decrease cost of entry • Gain access to new content • Acquiring established brands and technology can be more cost efficient and faster 14

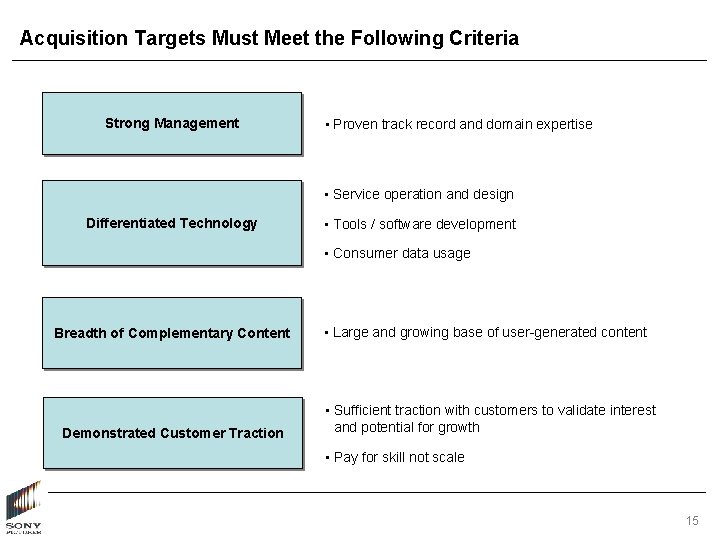

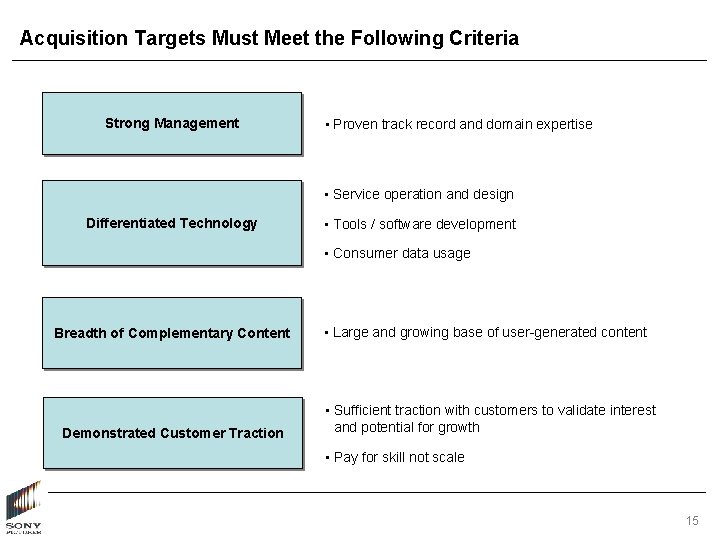

Acquisition Targets Must Meet the Following Criteria Strong Management • Proven track record and domain expertise • Service operation and design Differentiated Technology • Tools / software development • Consumer data usage Breadth of Complementary Content Demonstrated Customer Traction • Large and growing base of user-generated content • Sufficient traction with customers to validate interest and potential for growth • Pay for skill not scale 15

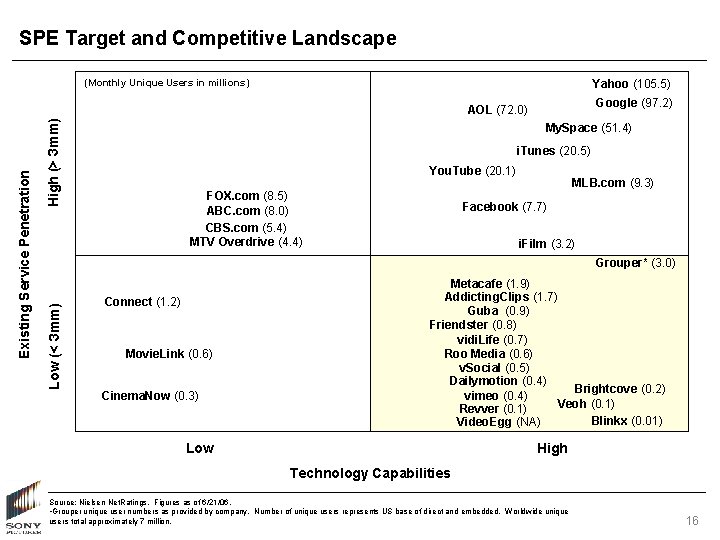

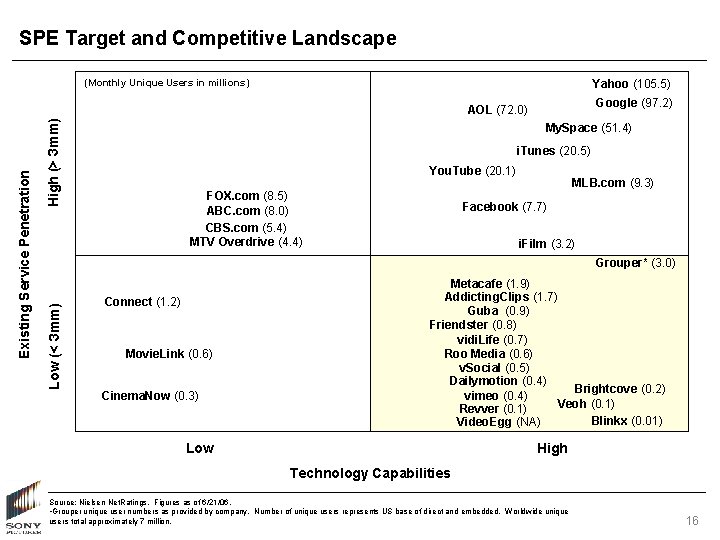

SPE Target and Competitive Landscape (Monthly Unique Users in millions) Yahoo (105. 5) Google (97. 2) High (> 3 mm) My. Space (51. 4) i. Tunes (20. 5) You. Tube (20. 1) FOX. com (8. 5) ABC. com (8. 0) CBS. com (5. 4) MTV Overdrive (4. 4) MLB. com (9. 3) Facebook (7. 7) i. Film (3. 2) Grouper* (3. 0) Low (< 3 mm) Existing Service Penetration AOL (72. 0) Connect (1. 2) Movie. Link (0. 6) Cinema. Now (0. 3) Metacafe (1. 9) Addicting. Clips (1. 7) Guba (0. 9) Friendster (0. 8) vidi. Life (0. 7) Roo Media (0. 6) v. Social (0. 5) Dailymotion (0. 4) Brightcove (0. 2) vimeo (0. 4) Veoh (0. 1) Revver (0. 1) Blinkx (0. 01) Video. Egg (NA) Low High Technology Capabilities Source: Nielsen Net. Ratings. Figures as of 6/21/06. • Grouper unique user numbers as provided by company. Number of unique users represents US base of direct and embedded. Worldwide unique users total approximately 7 million. 16

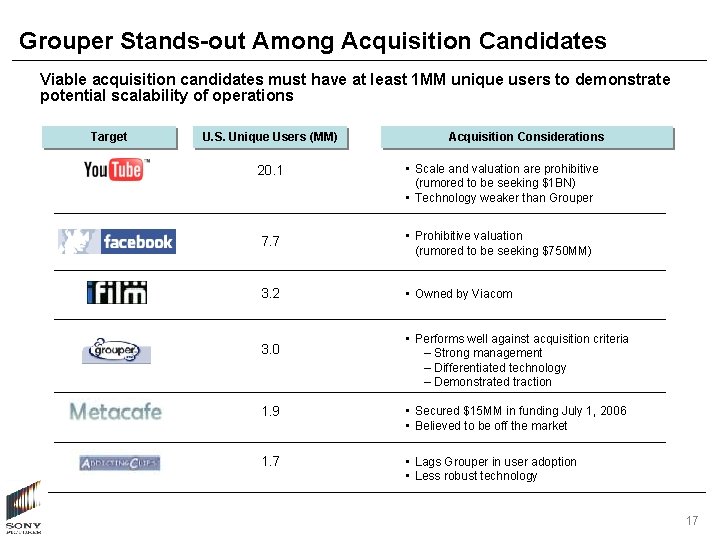

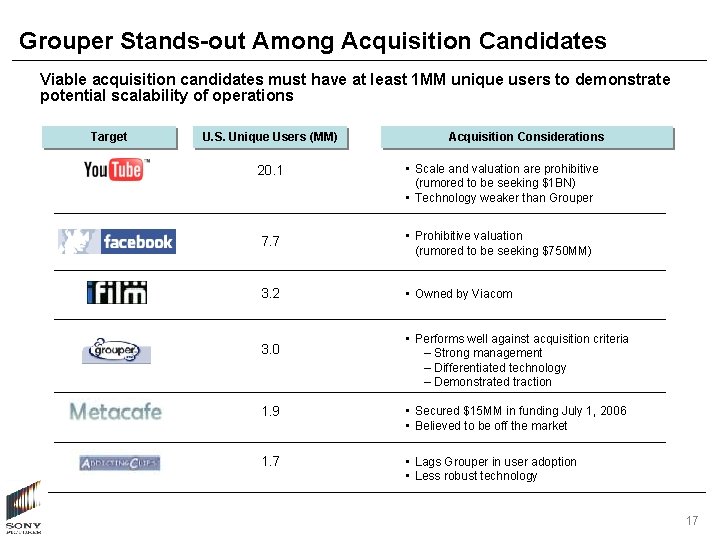

Grouper Stands-out Among Acquisition Candidates Viable acquisition candidates must have at least 1 MM unique users to demonstrate potential scalability of operations Target U. S. Unique Users (MM) Acquisition Considerations 20. 1 • Scale and valuation are prohibitive (rumored to be seeking $1 BN) • Technology weaker than Grouper 7. 7 • Prohibitive valuation (rumored to be seeking $750 MM) 3. 2 • Owned by Viacom 3. 0 • Performs well against acquisition criteria – Strong management – Differentiated technology – Demonstrated traction 1. 9 • Secured $15 MM in funding July 1, 2006 • Believed to be off the market 1. 7 • Lags Grouper in user adoption • Less robust technology 17

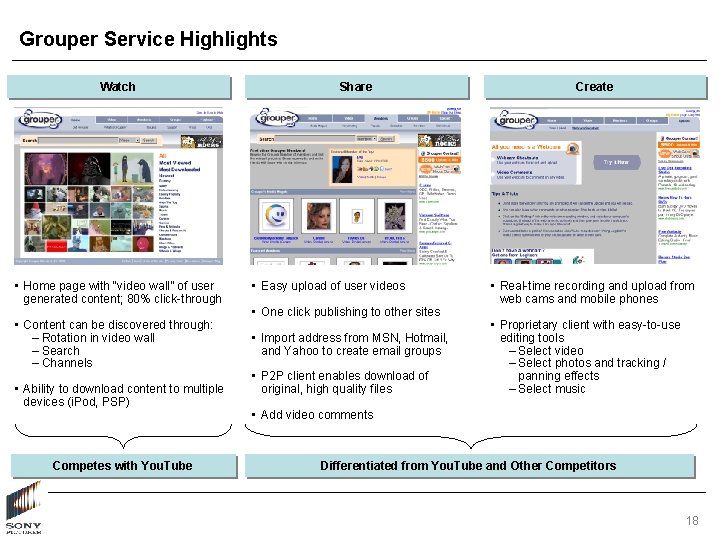

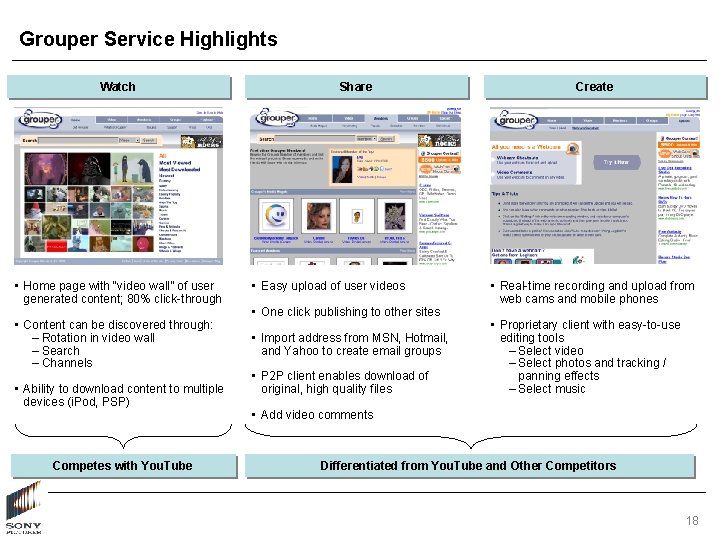

Grouper Service Highlights Watch • Home page with “video wall” of user generated content; 80% click-through • Content can be discovered through: – Rotation in video wall – Search – Channels • Ability to download content to multiple devices (i. Pod, PSP) Competes with You. Tube Share • Easy upload of user videos • One click publishing to other sites • Import address from MSN, Hotmail, and Yahoo to create email groups • P 2 P client enables download of original, high quality files Create • Real-time recording and upload from web cams and mobile phones • Proprietary client with easy-to-use editing tools – Select video – Select photos and tracking / panning effects – Select music • Add video comments Differentiated from You. Tube and Other Competitors 18

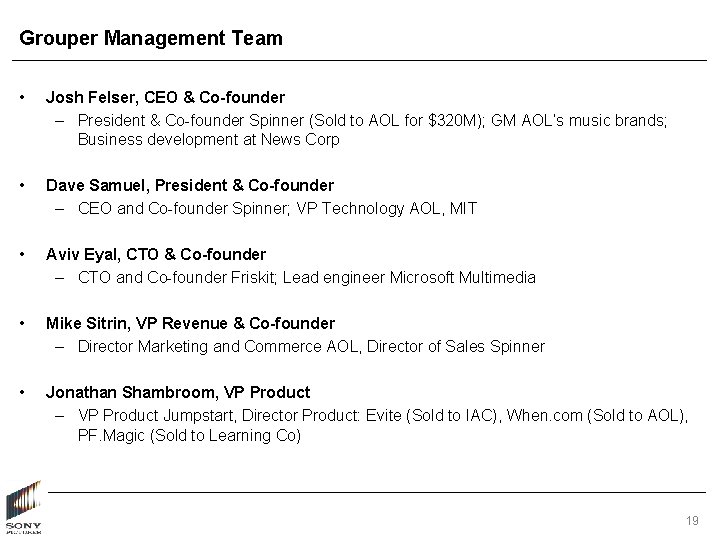

Grouper Management Team • Josh Felser, CEO & Co-founder – President & Co-founder Spinner (Sold to AOL for $320 M); GM AOL’s music brands; Business development at News Corp • Dave Samuel, President & Co-founder – CEO and Co-founder Spinner; VP Technology AOL, MIT • Aviv Eyal, CTO & Co-founder – CTO and Co-founder Friskit; Lead engineer Microsoft Multimedia • Mike Sitrin, VP Revenue & Co-founder – Director Marketing and Commerce AOL, Director of Sales Spinner • Jonathan Shambroom, VP Product – VP Product Jumpstart, Director Product: Evite (Sold to IAC), When. com (Sold to AOL), PF. Magic (Sold to Learning Co) 19

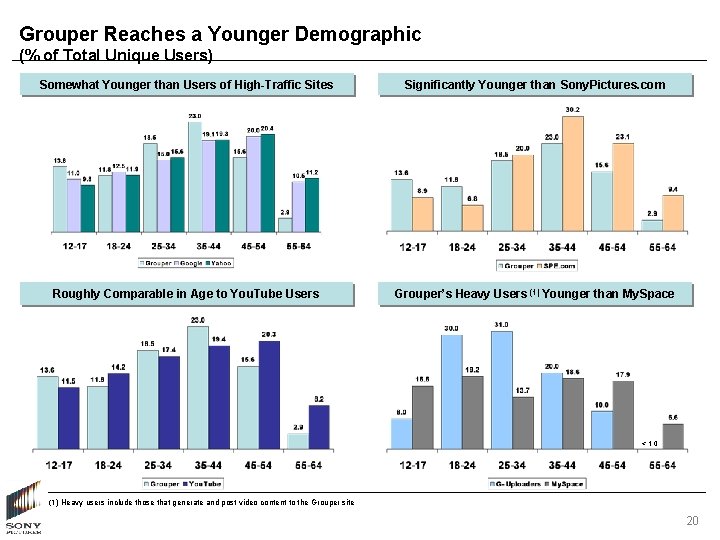

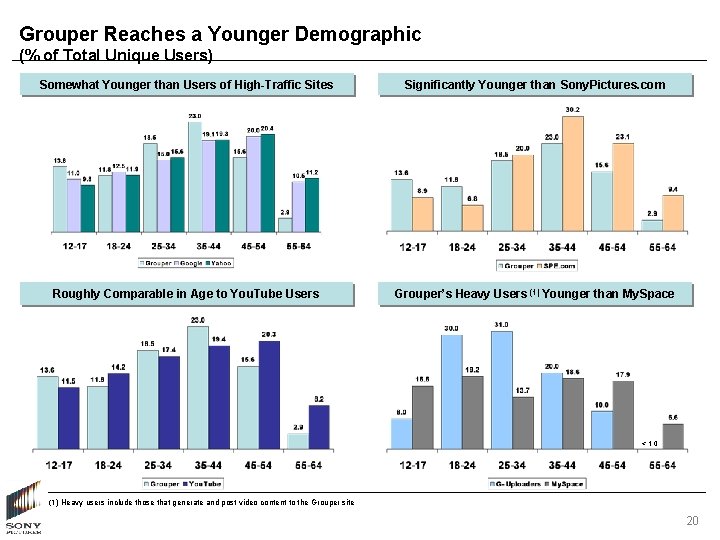

Grouper Reaches a Younger Demographic (% of Total Unique Users) Somewhat Younger than Users of High-Traffic Sites Significantly Younger than Sony. Pictures. com Roughly Comparable in Age to You. Tube Users Grouper’s Heavy Users (1) Younger than My. Space < 1. 0 (1) Heavy users include those that generate and post video content to the Grouper site 20

Grouper Performance Against Competitors Monthly Unique Users (mm) Technology P 2 P Client Ease of Use Content Features Quality of Content Community Connections Management Strength of Leadership 3. 0 • Strong, experienced team 1. 7 • Unknown 0. 4 • Unknown 0. 9 • Weak team 3. 2 • Strong (but captive to Viacom) 1. 9 • Unknown 0. 1 • Average NA • Unknown 0. 7 • Unknown 0. 4 • Unknown 0. 5 • Unknown 20. 1 • Young, limited experience 21

Tim Schaff Summary Comments on Grouper • More versatile technology and more expansive vision than You. Tube • Very sharp management team • Sufficient user base to demonstrate operational scalability • More comprehensive suite of technical capabilities – Though not patented, Sony has an opportunity to rectify • Potential for international expansion • Jump-starts Sony’s development efforts vs. internal hiring • SPE managed service presents an opportunity to decouple from hardware business challenges • Important to integrate management with SPE’s overall vision and operations • 12 -24 month build path will require follow-through commitment from SPE and Sony 22

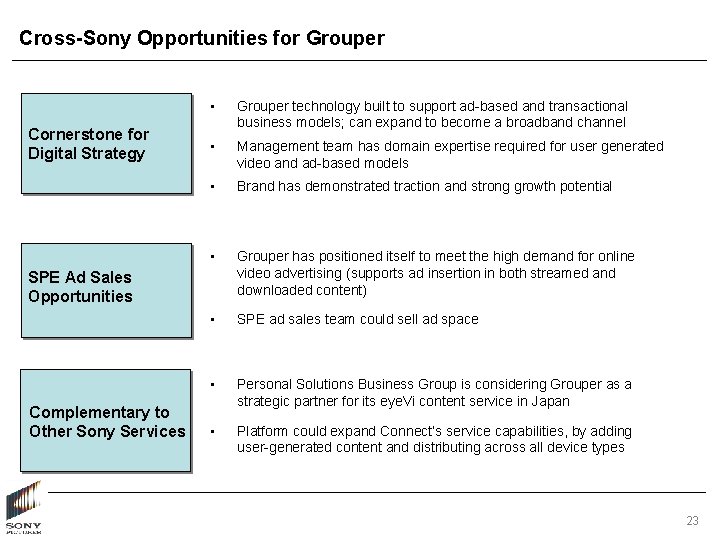

Cross-Sony Opportunities for Grouper Cornerstone for Digital Strategy • Grouper technology built to support ad-based and transactional business models; can expand to become a broadband channel • Management team has domain expertise required for user generated video and ad-based models • Brand has demonstrated traction and strong growth potential • Grouper has positioned itself to meet the high demand for online video advertising (supports ad insertion in both streamed and downloaded content) • SPE ad sales team could sell ad space • Personal Solutions Business Group is considering Grouper as a strategic partner for its eye. Vi content service in Japan • Platform could expand Connect’s service capabilities, by adding user-generated content and distributing across all device types SPE Ad Sales Opportunities Complementary to Other Sony Services 23

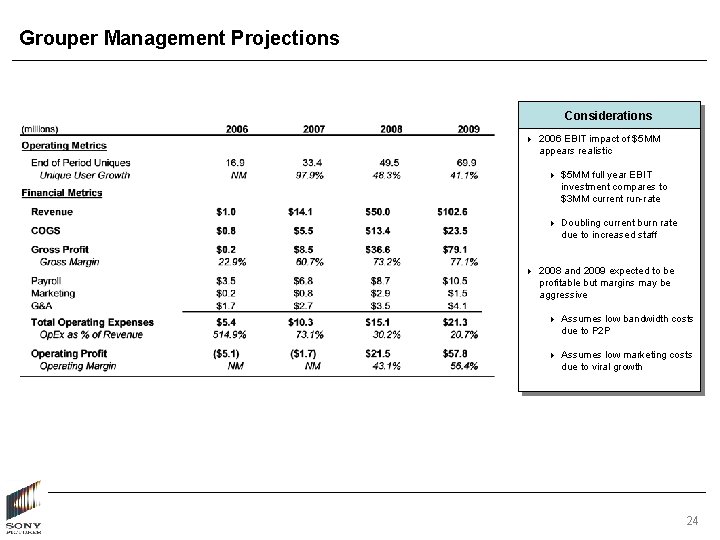

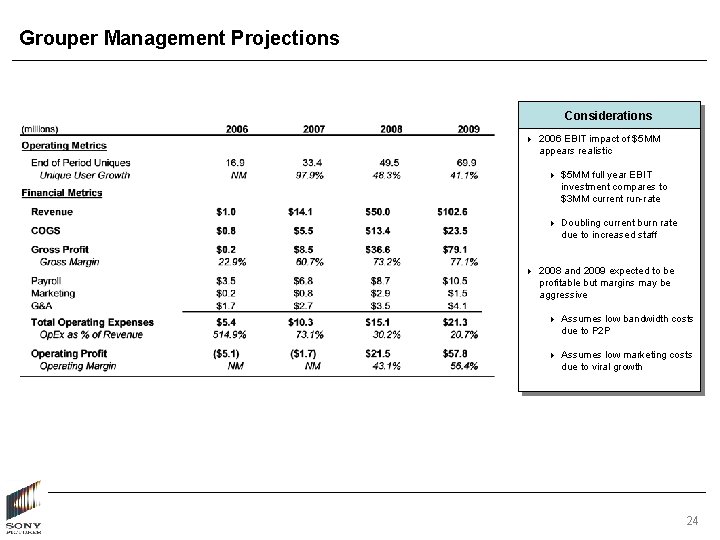

Grouper Management Projections Considerations 4 2006 EBIT impact of $5 MM appears realistic 4 $5 MM full year EBIT investment compares to $3 MM current run-rate 4 Doubling current burn rate due to increased staff 4 2008 and 2009 expected to be profitable but margins may be aggressive 4 Assumes low bandwidth costs due to P 2 P 4 Assumes low marketing costs due to viral growth 24

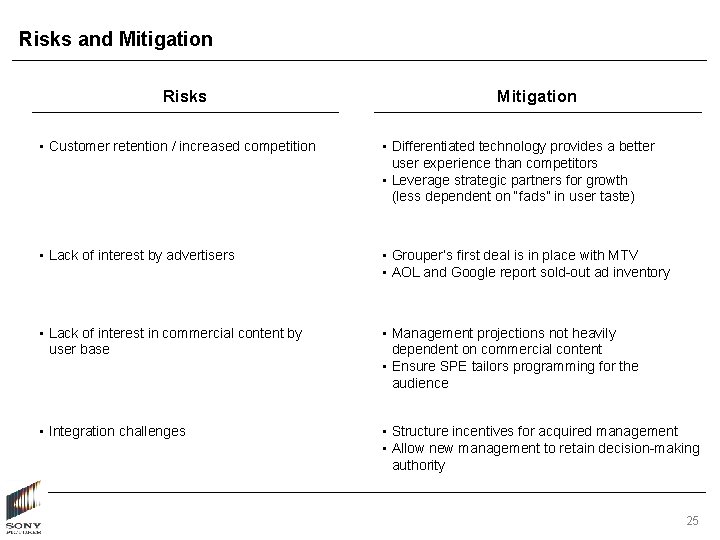

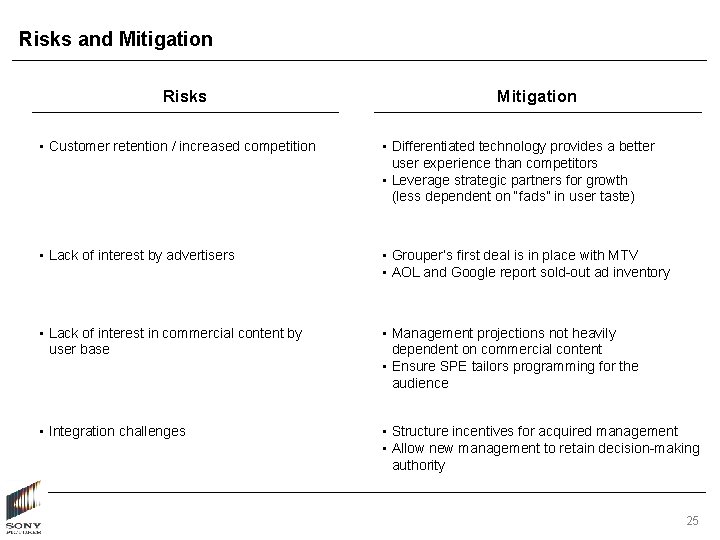

Risks and Mitigation Risks Mitigation • Customer retention / increased competition • Differentiated technology provides a better user experience than competitors • Leverage strategic partners for growth (less dependent on “fads” in user taste) • Lack of interest by advertisers • Grouper’s first deal is in place with MTV • AOL and Google report sold-out ad inventory • Lack of interest in commercial content by user base • Management projections not heavily dependent on commercial content • Ensure SPE tailors programming for the audience • Integration challenges • Structure incentives for acquired management • Allow new management to retain decision-making authority 25

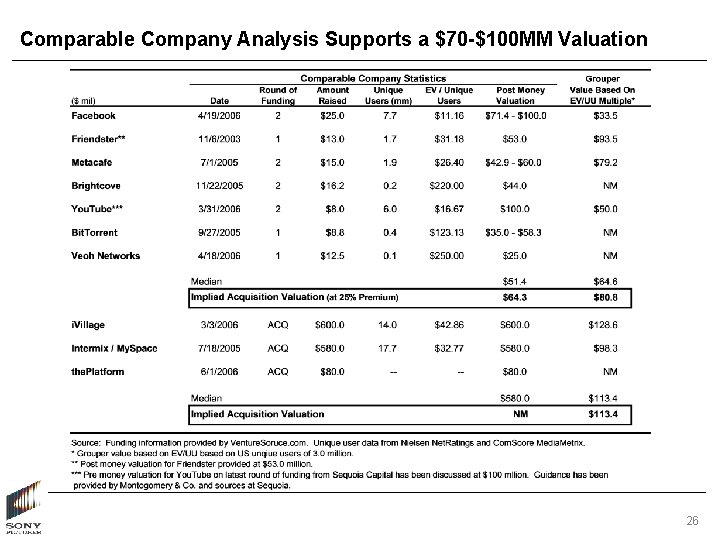

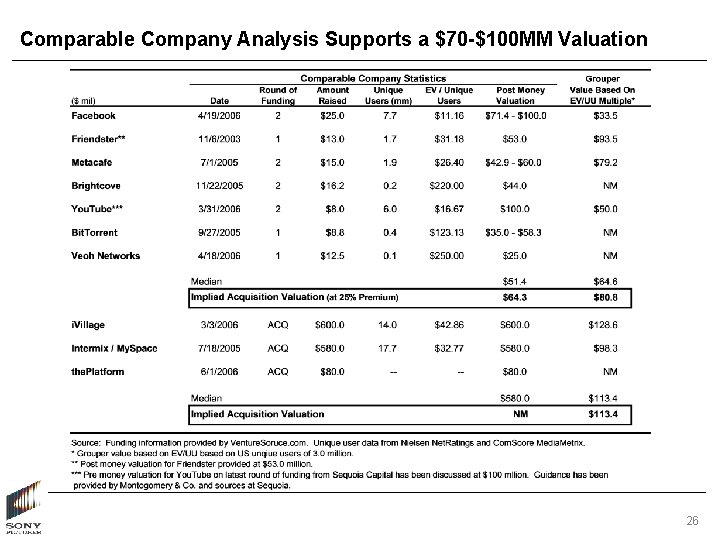

Comparable Company Analysis Supports a $70 -$100 MM Valuation 26

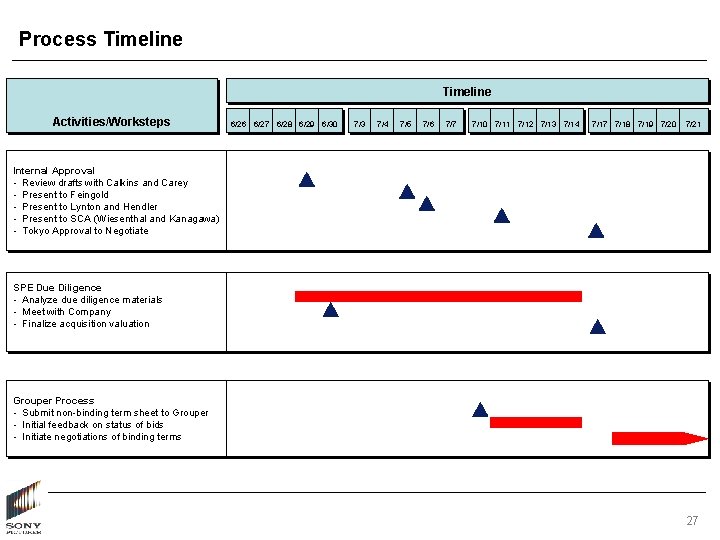

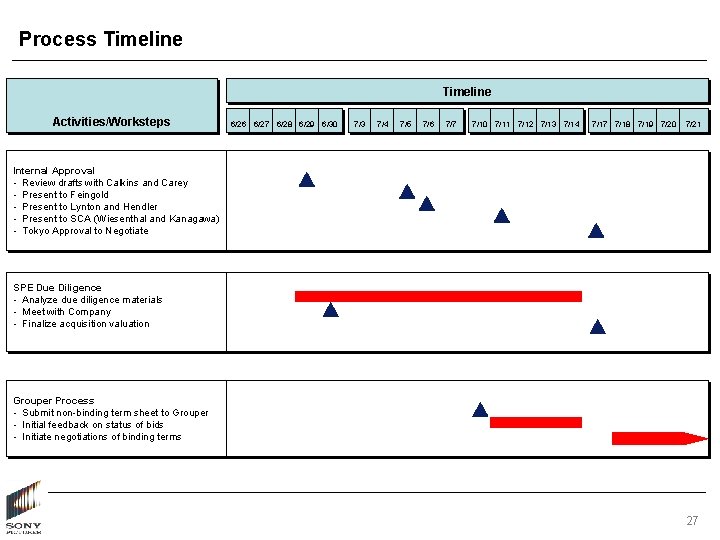

Process Timeline Activities/Worksteps 6/26 6/27 6/28 6/29 6/30 7/3 7/4 7/5 7/6 7/7 7/10 7/11 7/12 7/13 7/14 7/17 7/18 7/19 7/20 7/21 Internal Approval • Review drafts with Calkins and Carey • Present to Feingold • Present to Lynton and Hendler • Present to SCA (Wiesenthal and Kanagawa) • Tokyo Approval to Negotiate SPE Due Diligence • Analyze due diligence materials • Meet with Company • Finalize acquisition valuation Grouper Process • Submit non-binding term sheet to Grouper • Initial feedback on status of bids • Initiate negotiations of binding terms 27

APPENDIX CONFIDENTIAL

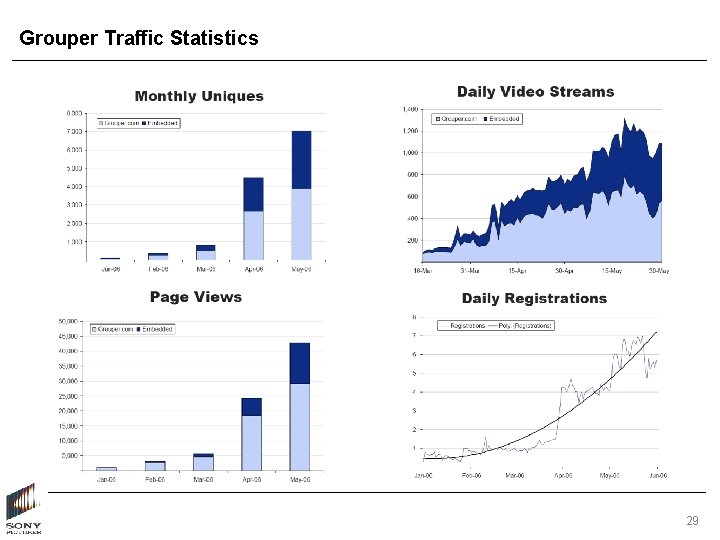

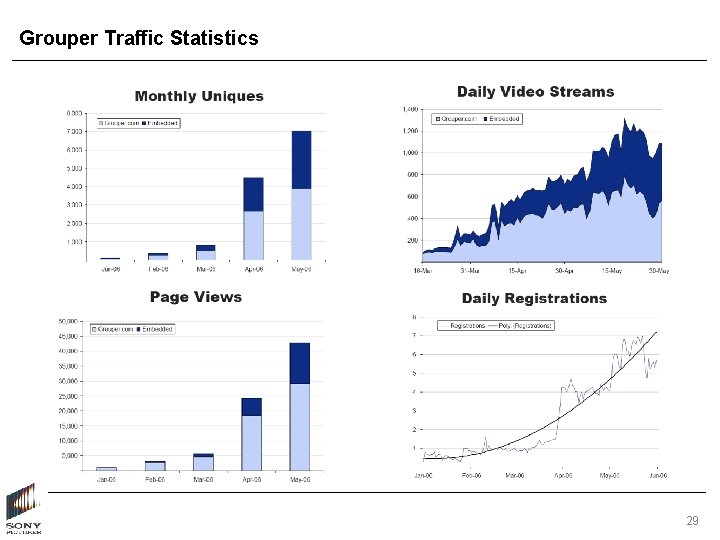

Grouper Traffic Statistics 29

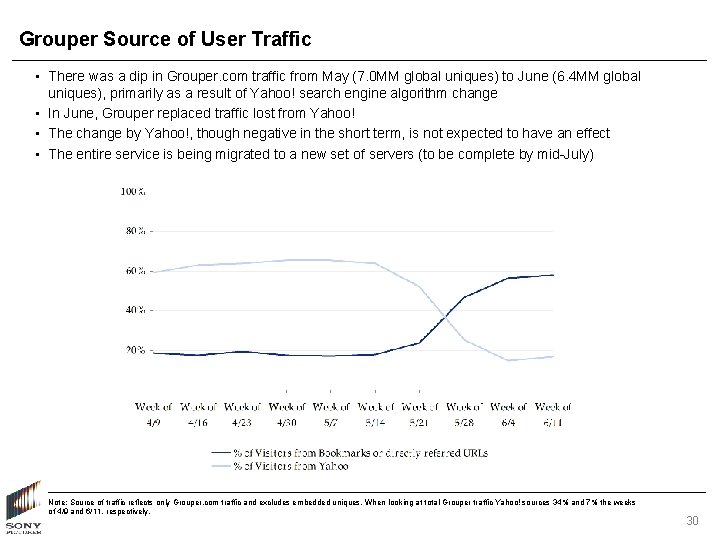

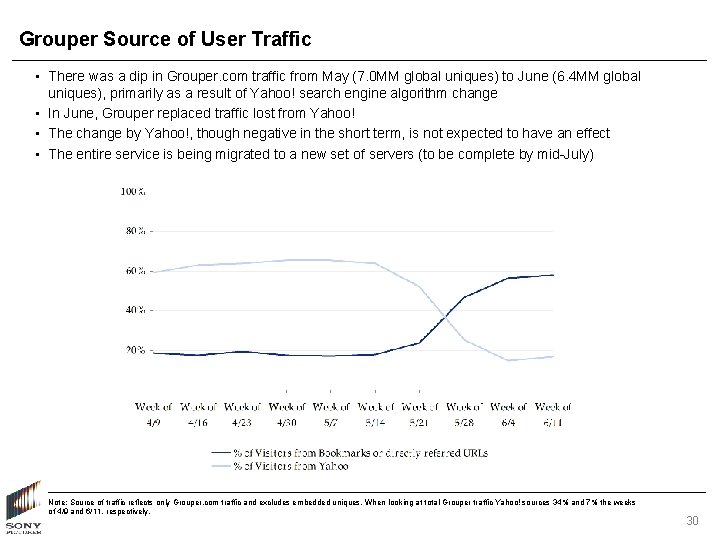

Grouper Source of User Traffic • There was a dip in Grouper. com traffic from May (7. 0 MM global uniques) to June (6. 4 MM global uniques), primarily as a result of Yahoo! search engine algorithm change • In June, Grouper replaced traffic lost from Yahoo! • The change by Yahoo!, though negative in the short term, is not expected to have an effect • The entire service is being migrated to a new set of servers (to be complete by mid-July) Note: Source of traffic reflects only Grouper. com traffic and excludes embedded uniques. When looking at total Grouper traffic Yahoo! sources 34% and 7% the weeks of 4/9 and 6/11, respectively. 30

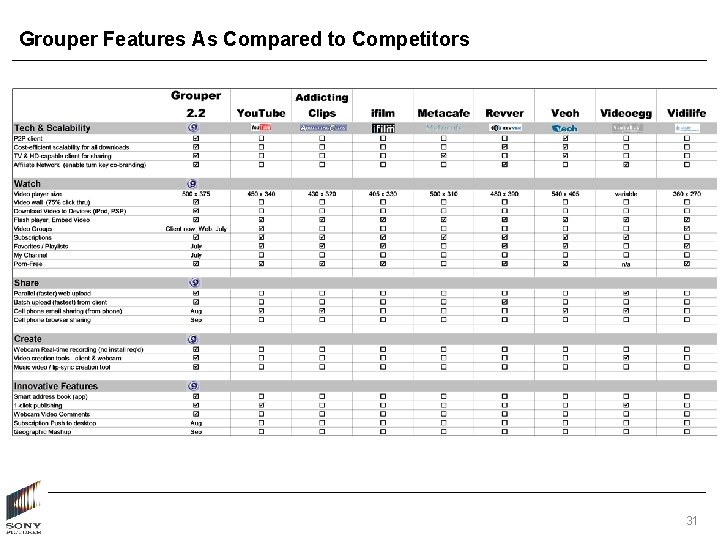

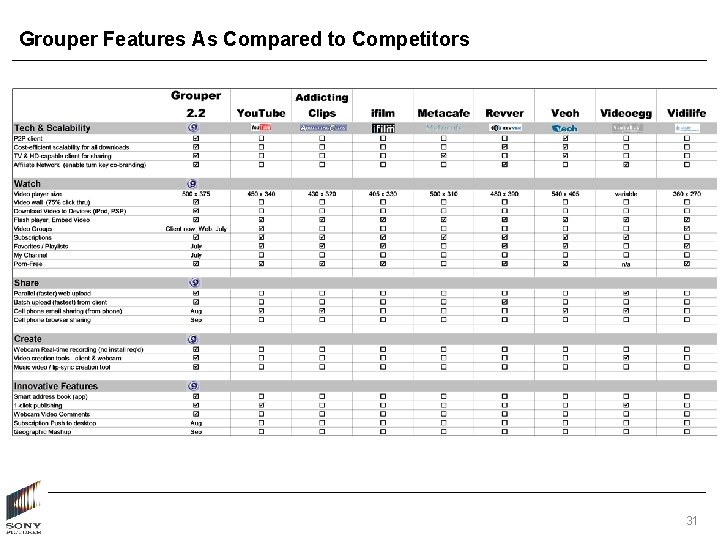

Grouper Features As Compared to Competitors 31

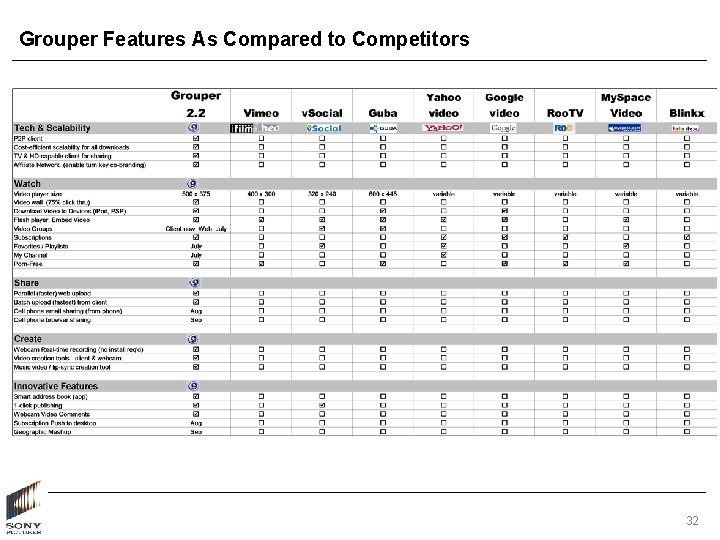

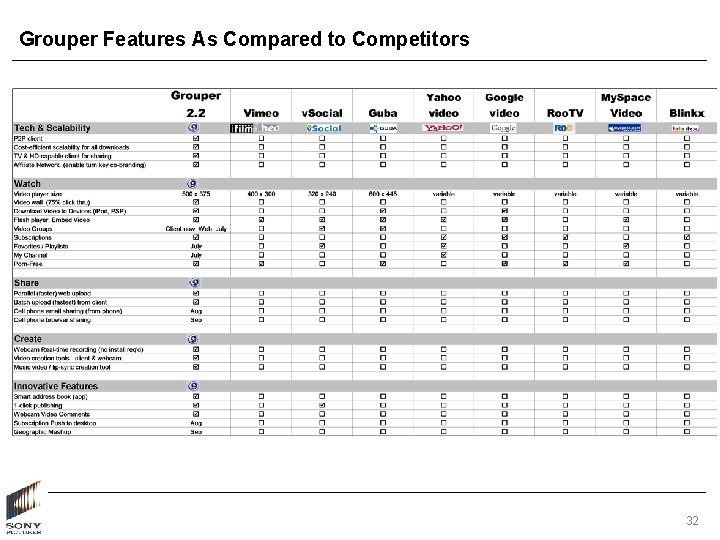

Grouper Features As Compared to Competitors 32

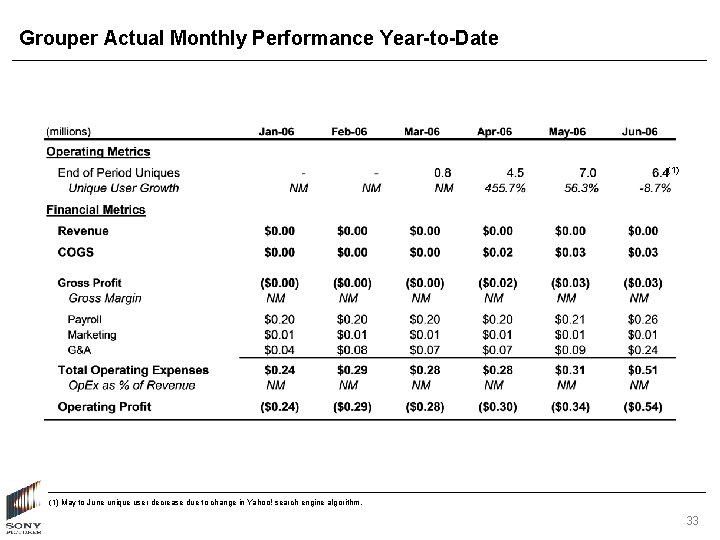

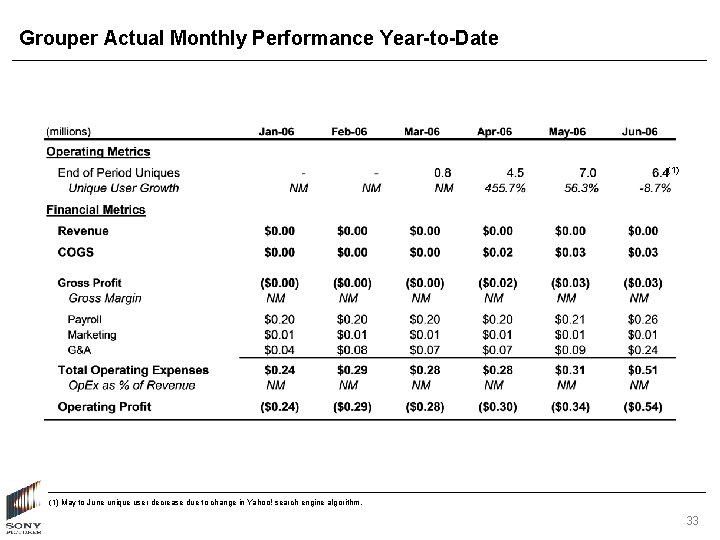

Grouper Actual Monthly Performance Year-to-Date (1) May to June unique user decrease due to change in Yahoo! search engine algorithm. 33

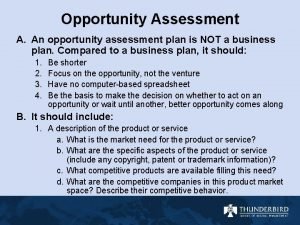

What is opportunity assessment plan

What is opportunity assessment plan Agenda sistemica y agenda institucional

Agenda sistemica y agenda institucional Drg-grouper

Drg-grouper Contoh casemix

Contoh casemix Etg grouper

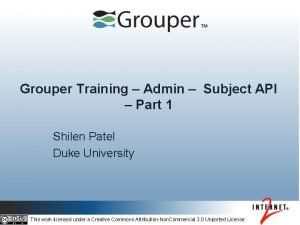

Etg grouper Xxxghm

Xxxghm Grouper identity management

Grouper identity management Admin grouper

Admin grouper Acg grouper

Acg grouper Duke grouper

Duke grouper Acm

Acm Grouper vs halibut

Grouper vs halibut Drg grouper

Drg grouper Grouper admin

Grouper admin Language acquisition vs language learning

Language acquisition vs language learning The hot july sun beat relentlessly down

The hot july sun beat relentlessly down Monday 13th july

Monday 13th july Ctdssmap payment schedule july 2021

Ctdssmap payment schedule july 2021 July 30 2009 nasa

July 30 2009 nasa Harris burdick archie smith boy wonder

Harris burdick archie smith boy wonder July 16 1776

July 16 1776 Malaga in july

Malaga in july July 2 1937 amelia earhart

July 2 1937 amelia earhart Miss cuba receives an invitation

Miss cuba receives an invitation Diferença entre eclipse lunar e solar

Diferença entre eclipse lunar e solar Super saturday tribal bingo july 4

Super saturday tribal bingo july 4 On july 18 2001 a train carrying hazardous chemicals

On july 18 2001 a train carrying hazardous chemicals Sources nso frenchhowell neill mit technology...

Sources nso frenchhowell neill mit technology... A strange day in july picture

A strange day in july picture Growth of leaf yeast experiment

Growth of leaf yeast experiment June 22 to july 22

June 22 to july 22 Poppies in july imagery

Poppies in july imagery July 1969

July 1969 2001 july 15

2001 july 15