Euro Challenge 2010 The Euro Area Emerging from

- Slides: 13

Euro Challenge 2010 The Euro Area: Emerging from the crisis Presentation by Sarah Cartmell as of January 4, 2010, Economist at the Delegation of the European Union to the United States

The roots of the crisis… • • • Rapid credit growth Low interest rates Housing bubbles Global imbalances Financial alchemy US-EU linked

Why is the Euro area so affected? • US and Europe closely connected • EU banks bought US ‘toxic’ assets • After Lehman collapse, crisis worsens dramatically • Sharp fall in German exports • Spanish and Irish housing bubbles burst • Euro area economy less flexible

Europe’s response to the crisis The ECB cuts interest rates to historically low levels, adopts unconventional measures Oct 08: euro area governments adopt concerted action plan to support their financial systems Dec 08: EU governments adopt European Economic Recovery Plan a coordinated fiscal stimulus

Europe’s response to the crisis ECB cuts benchmark interest rate to historical low of 1. 00% and injects liquidity. Bank rescue plans in effect in 17 countries (€ 300 billion in recapitalisation operations and € 2. 5 trillion in loan guarantees) European Economic Recovery Plan: 18 fiscal stimulus plans (overall fiscal injection is 5% of GDP in 2009 -10)

But remember…. Europe is NOT a homogenous place • One monetary policy, many fiscal policies • Different countries, different starting positions

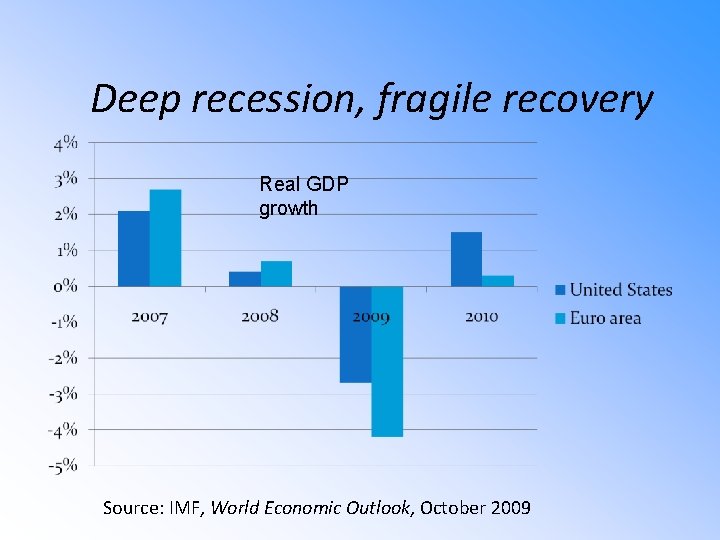

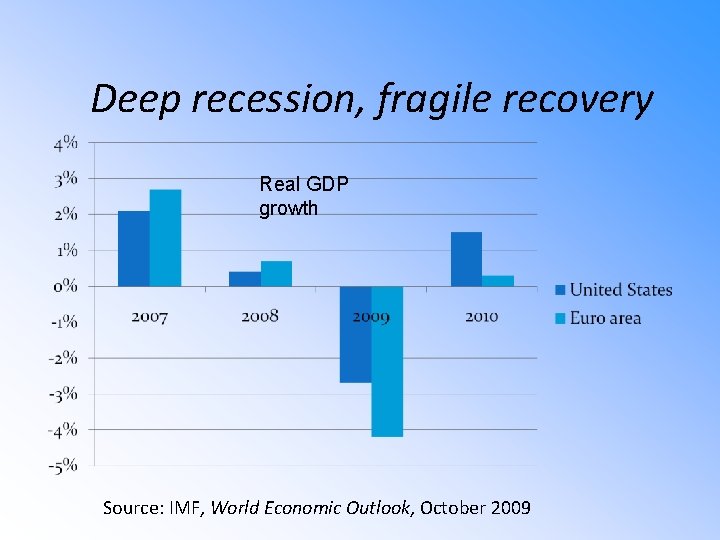

Deep recession, fragile recovery Real GDP growth Source: IMF, World Economic Outlook, October 2009

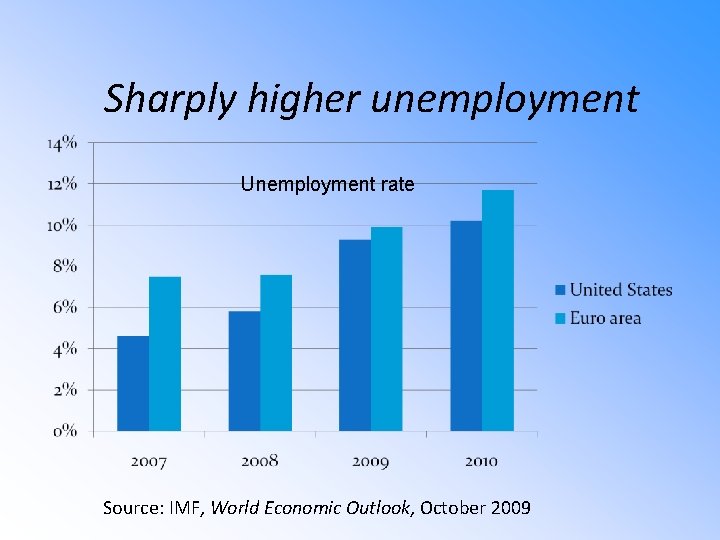

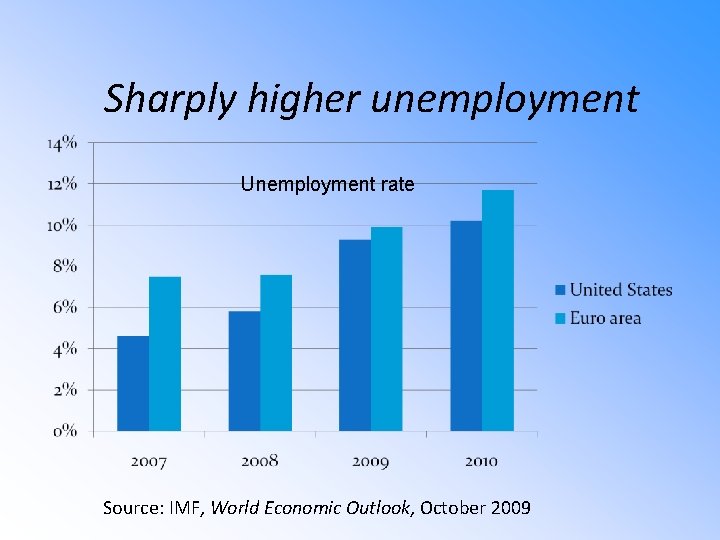

Sharply higher unemployment Unemployment rate Source: IMF, World Economic Outlook, October 2009

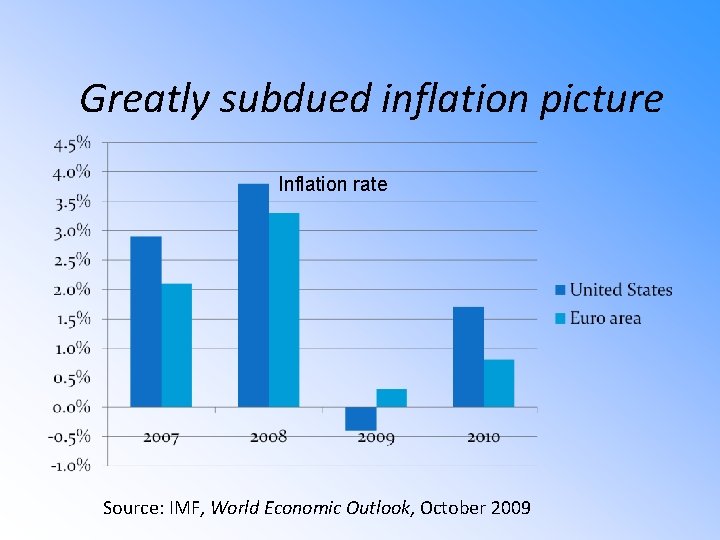

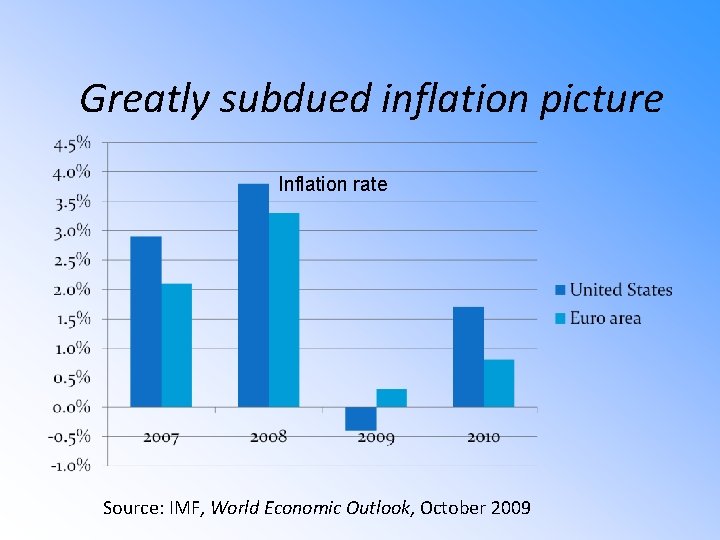

Greatly subdued inflation picture Inflation rate Source: IMF, World Economic Outlook, October 2009

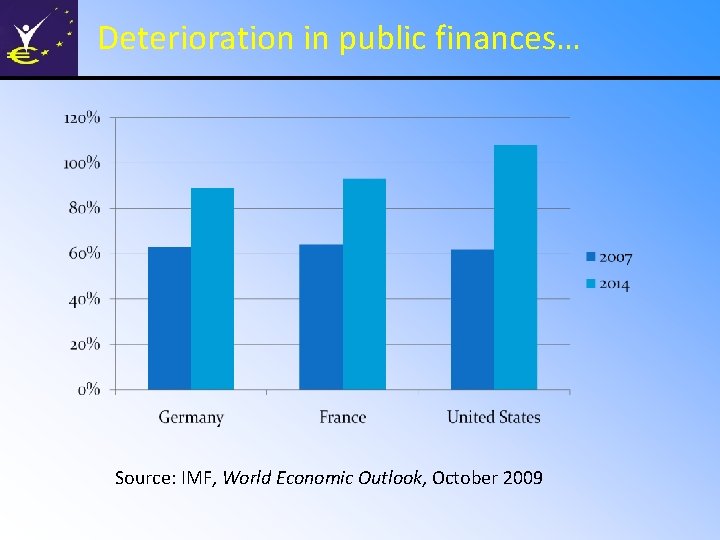

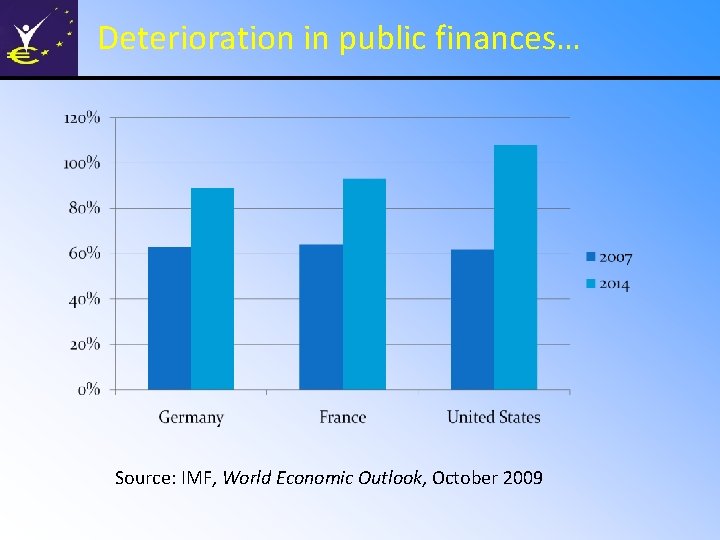

Deterioration in public finances… Source: IMF, World Economic Outlook, October 2009

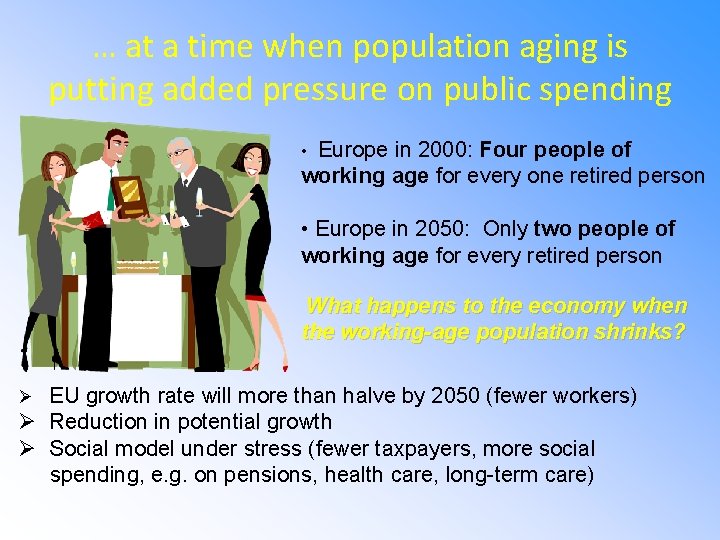

… at a time when population aging is putting added pressure on public spending • Europe in 2000: Four people of working age for every one retired person • Europe in 2050: Only two people of working age for every retired person What happens to the economy when the working-age population shrinks? Ø EU growth rate will more than halve by 2050 (fewer workers) Ø Reduction in potential growth Ø Social model under stress (fewer taxpayers, more social spending, e. g. on pensions, health care, long-term care)

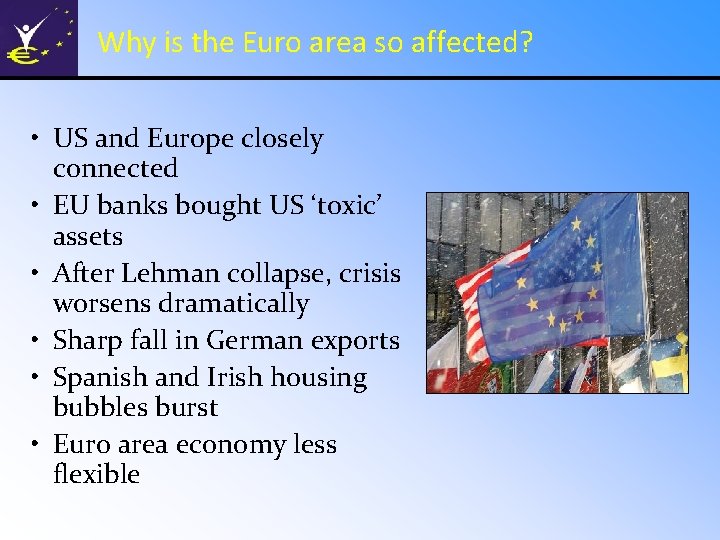

Looking ahead: Timing is everything! Vs. Jean-Claude Trichet Ben Bernanke “We pledge today to sustain our strong policy response until a durable recovery is secured” (Leaders’ Statement, Pittsburgh G 20 Summit)

I hope that we will all have an exciting Euro Challenge experience! Thank you for your attention.

Fallon sherrock smoking

Fallon sherrock smoking Thế nào là mạng điện lắp đặt kiểu nổi

Thế nào là mạng điện lắp đặt kiểu nổi Mật thư anh em như thể tay chân

Mật thư anh em như thể tay chân Lời thề hippocrates

Lời thề hippocrates Vẽ hình chiếu đứng bằng cạnh của vật thể

Vẽ hình chiếu đứng bằng cạnh của vật thể Thang điểm glasgow

Thang điểm glasgow Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Sự nuôi và dạy con của hổ

Sự nuôi và dạy con của hổ Các loại đột biến cấu trúc nhiễm sắc thể

Các loại đột biến cấu trúc nhiễm sắc thể điện thế nghỉ

điện thế nghỉ Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thế nào là sự mỏi cơ

Thế nào là sự mỏi cơ Bổ thể

Bổ thể Phản ứng thế ankan

Phản ứng thế ankan