EEEcon 458 Introduction to Economics Consumers Surplus J

- Slides: 31

EE/Econ 458 Introduction to Economics: Consumer’s Surplus J. Mc. Calley These slides are your main resource for this topic. 1

Introduction We want to see, for an electricity market, how individual prices are set what it means to have an efficient electricity market how an electricity market can achieve efficiency simply from the self-interested actions of its individual agents. This is microeconomics, i. e. , decisions of individual units (firms, companies, households, individual consumers) within an economy It is not macroeconomics, i. e. , the behavior of entire economies (determination of total investment and consumption, how central banks manage money and interest rates, what causes international financial crises). 2

Introduction We do not have time in this course to treat this topic as you would in a course dedicated to microeconomics, but we will establish the following essential concepts: • • • Supply and demand functions ECON 101: Principles of Microeconomics, (3 -0) Cr. 3. Consumers surplus F. S. SS. Resource allocation, opportunity cost, comparative and absolute advantage. Supply and Producers surplus demand. Marginal analysis. Theories of production Market efficiency and consumption, pricing, and the market system. Perfect and imperfect competition and strategic Market equilibrium Competitive equilibrium behavior. Factor markets. Present discounted value. 301: Intermediate Microeconomics. (3 -0) Cr. 3 -4. F. S. SS. Theory of consumer and business behavior; optimal consumption choices and demand; theory of firm behavior; costs, production, and supply; competitive and imperfectly competitive markets; theory of demand for & supply of factors of production; general equilibrium analysis. Recitation required for 4 crdts. ECON 501: Microeconomics. (4 -0) Cr. 4. F. Prereq: ECON 301, credit or enrollment in ECON 500 or equivalent background in calculus and statistics. The theory of the consumer, theory of the firm, perfect and imperfect competition, welfare economics, and selected topics in general 3 equilibrium and uncertainty.

Introduction Jordan Bakke, Manager, Policy Studies, MISO “We really like your EE students who know something about economics, and we see (and hire) them quite a bit. But we also really like your Econ students who know something about EE, but we have not seen so many of them. ” 4

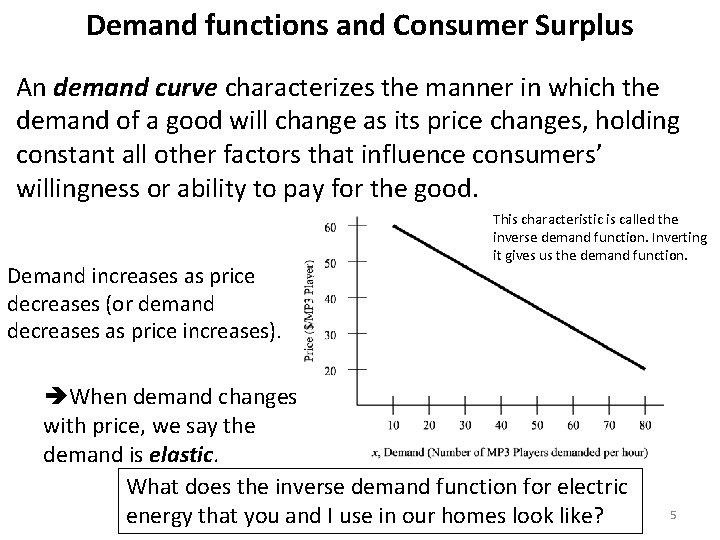

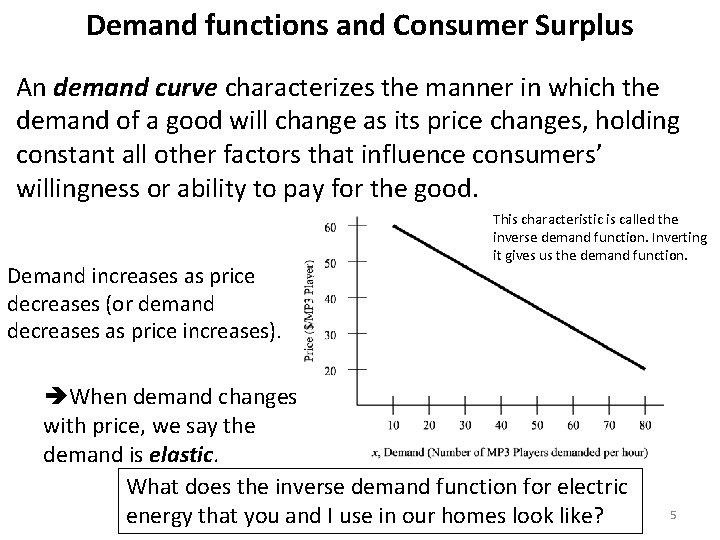

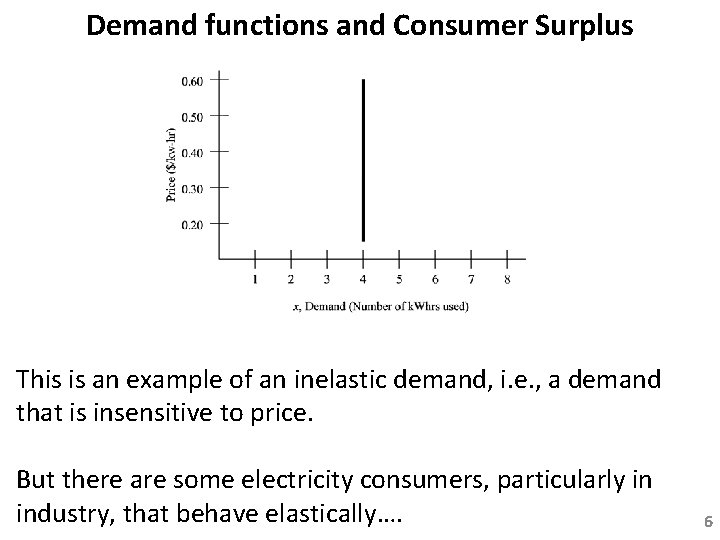

Demand functions and Consumer Surplus An demand curve characterizes the manner in which the demand of a good will change as its price changes, holding constant all other factors that influence consumers’ willingness or ability to pay for the good. Demand increases as price decreases (or demand decreases as price increases). This characteristic is called the inverse demand function. Inverting it gives us the demand function. When demand changes with price, we say the demand is elastic. What does the inverse demand function for electric energy that you and I use in our homes look like? 5

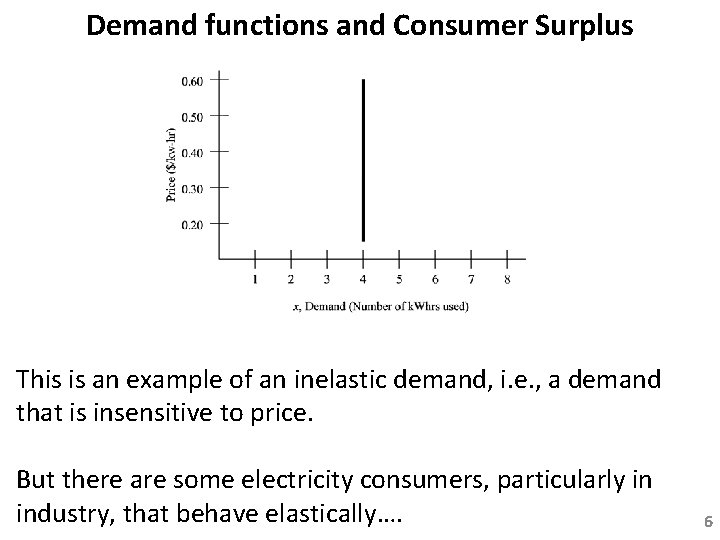

Demand functions and Consumer Surplus This is an example of an inelastic demand, i. e. , a demand that is insensitive to price. But there are some electricity consumers, particularly in industry, that behave elastically…. 6

Demand functions and Consumer Surplus 7

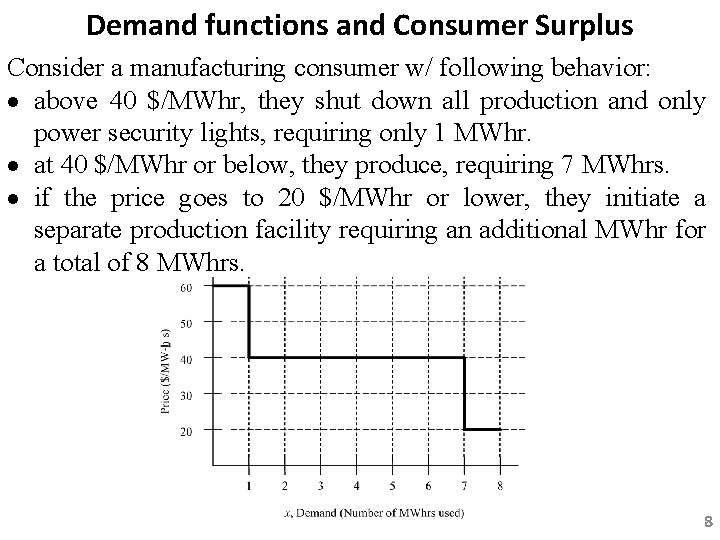

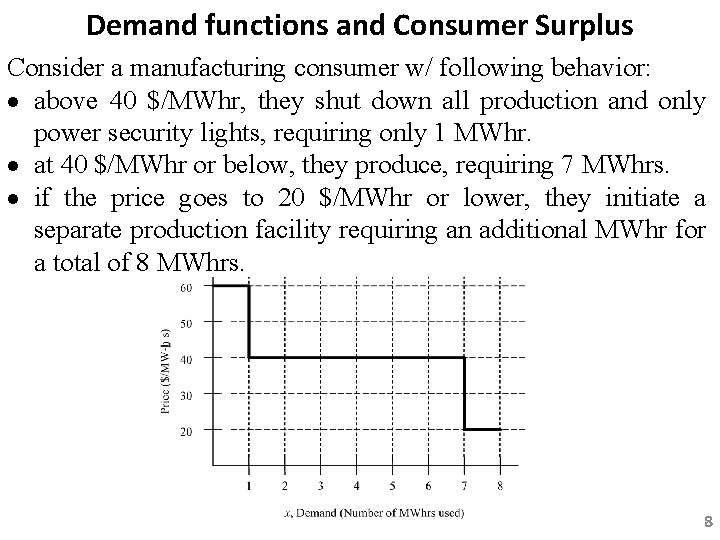

Demand functions and Consumer Surplus Consider a manufacturing consumer w/ following behavior: above 40 $/MWhr, they shut down all production and only power security lights, requiring only 1 MWhr. at 40 $/MWhr or below, they produce, requiring 7 MWhrs. if the price goes to 20 $/MWhr or lower, they initiate a separate production facility requiring an additional MWhr for a total of 8 MWhrs. 8

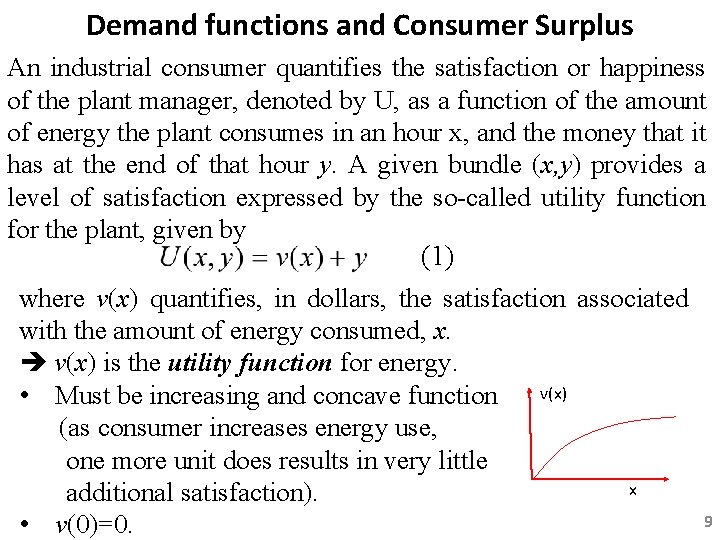

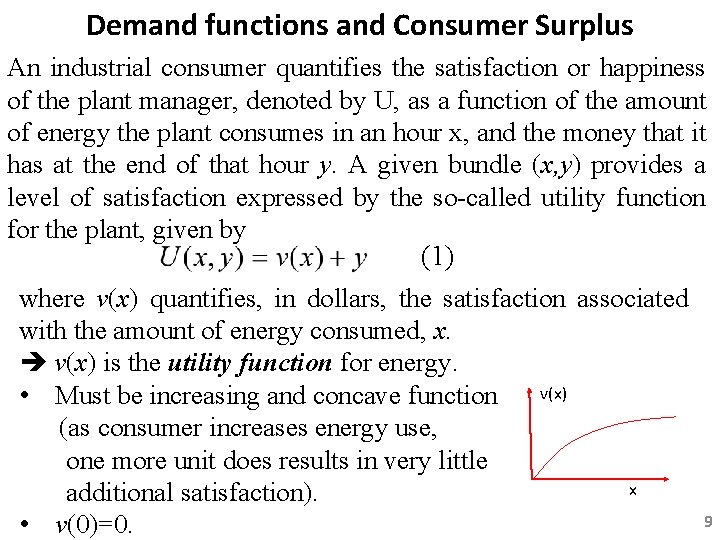

Demand functions and Consumer Surplus An industrial consumer quantifies the satisfaction or happiness of the plant manager, denoted by U, as a function of the amount of energy the plant consumes in an hour x, and the money that it has at the end of that hour y. A given bundle (x, y) provides a level of satisfaction expressed by the so-called utility function for the plant, given by (1) where v(x) quantifies, in dollars, the satisfaction associated with the amount of energy consumed, x. v(x) is the utility function for energy. v(x) • Must be increasing and concave function (as consumer increases energy use, one more unit does results in very little x additional satisfaction). • v(0)=0. 9

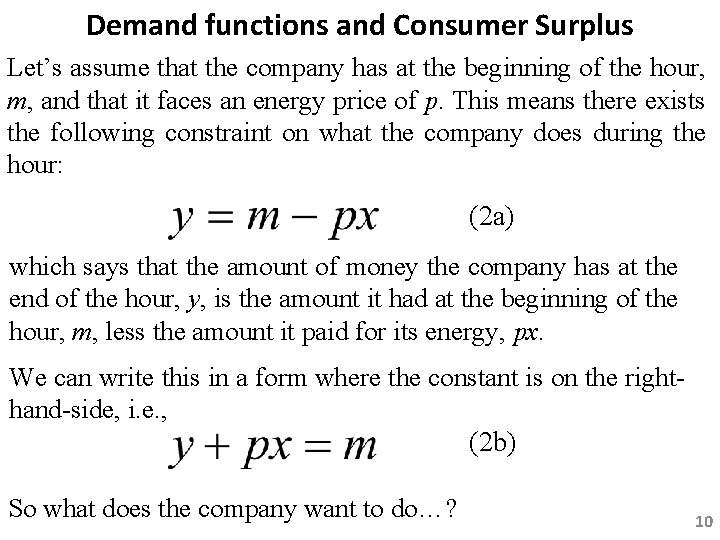

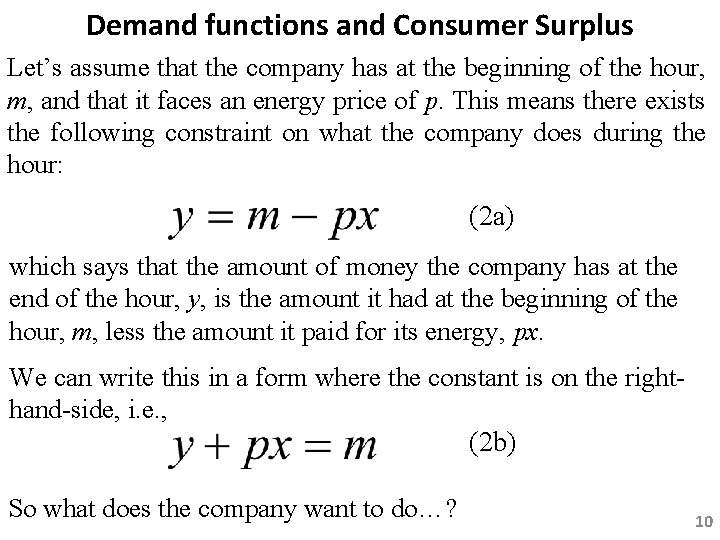

Demand functions and Consumer Surplus Let’s assume that the company has at the beginning of the hour, m, and that it faces an energy price of p. This means there exists the following constraint on what the company does during the hour: (2 a) which says that the amount of money the company has at the end of the hour, y, is the amount it had at the beginning of the hour, m, less the amount it paid for its energy, px. We can write this in a form where the constant is on the righthand-side, i. e. , (2 b) So what does the company want to do…? 10

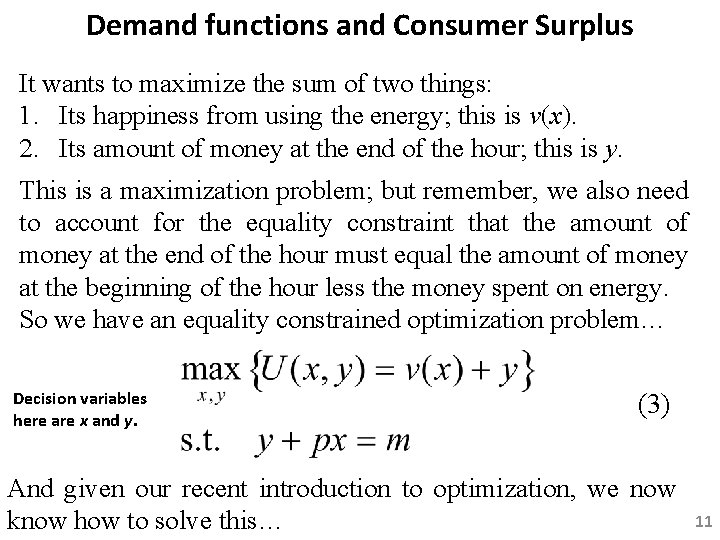

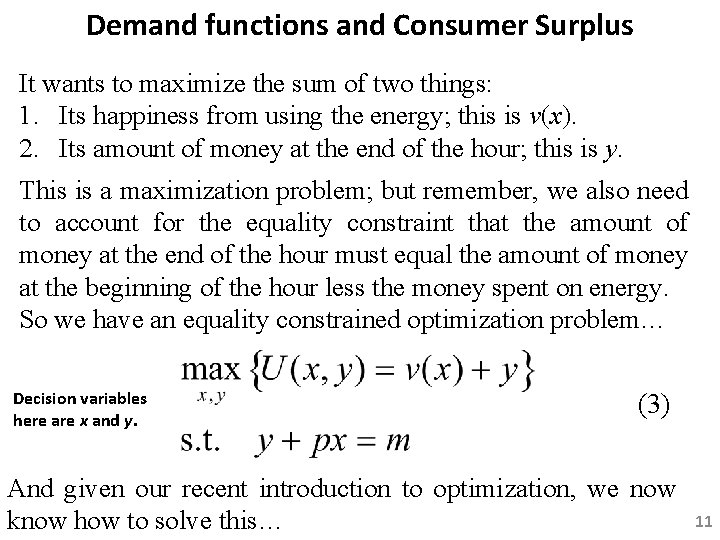

Demand functions and Consumer Surplus It wants to maximize the sum of two things: 1. Its happiness from using the energy; this is v(x). 2. Its amount of money at the end of the hour; this is y. This is a maximization problem; but remember, we also need to account for the equality constraint that the amount of money at the end of the hour must equal the amount of money at the beginning of the hour less the money spent on energy. So we have an equality constrained optimization problem… Decision variables here are x and y. (3) And given our recent introduction to optimization, we now know how to solve this… 11

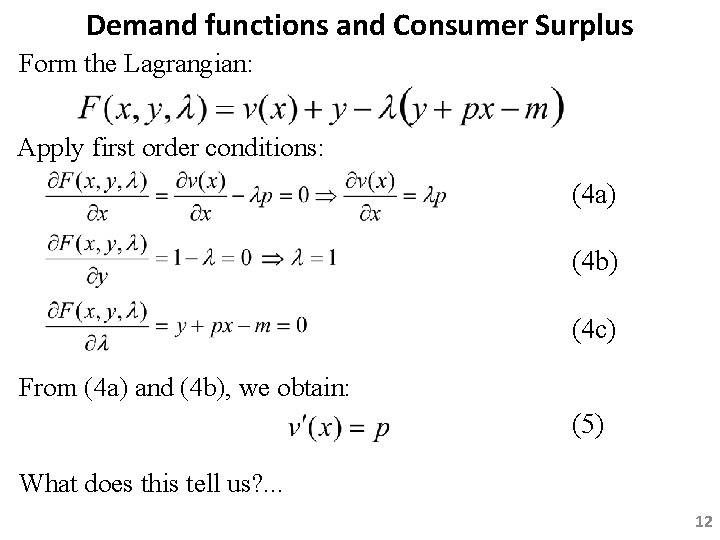

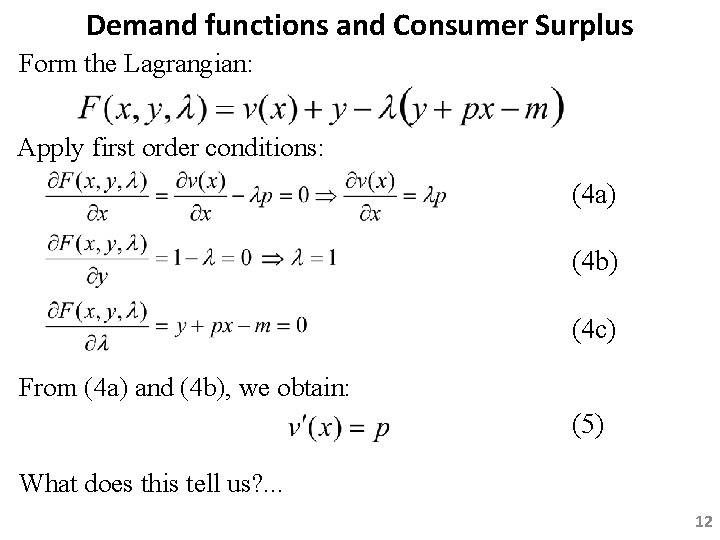

Demand functions and Consumer Surplus Form the Lagrangian: Apply first order conditions: (4 a) (4 b) (4 c) From (4 a) and (4 b), we obtain: (5) What does this tell us? . . . 12

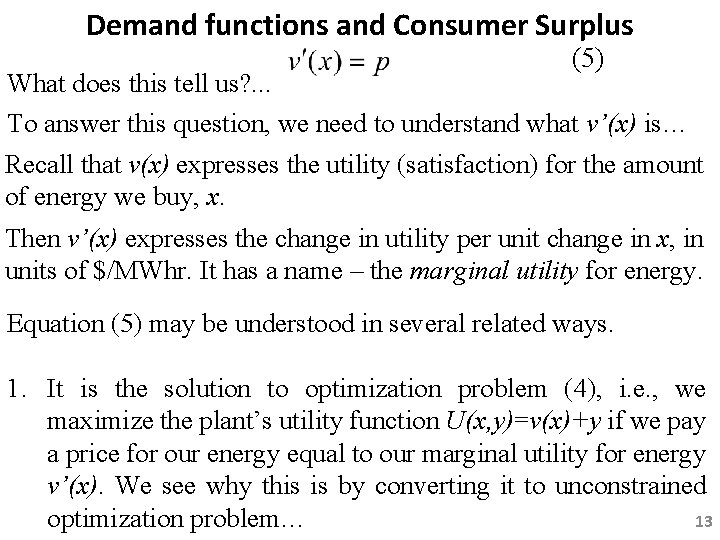

Demand functions and Consumer Surplus (5) What does this tell us? . . . To answer this question, we need to understand what v’(x) is… Recall that v(x) expresses the utility (satisfaction) for the amount of energy we buy, x. Then v’(x) expresses the change in utility per unit change in x, in units of $/MWhr. It has a name – the marginal utility for energy. Equation (5) may be understood in several related ways. 1. It is the solution to optimization problem (4), i. e. , we maximize the plant’s utility function U(x, y)=v(x)+y if we pay a price for our energy equal to our marginal utility for energy v’(x). We see why this is by converting it to unconstrained optimization problem… 13

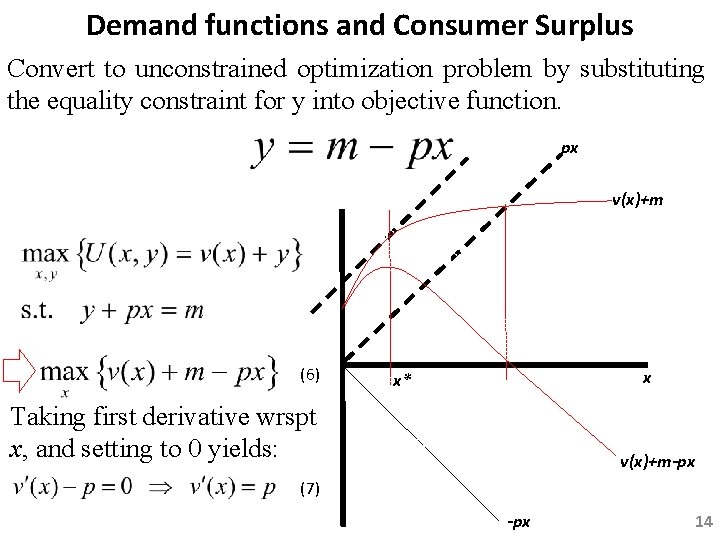

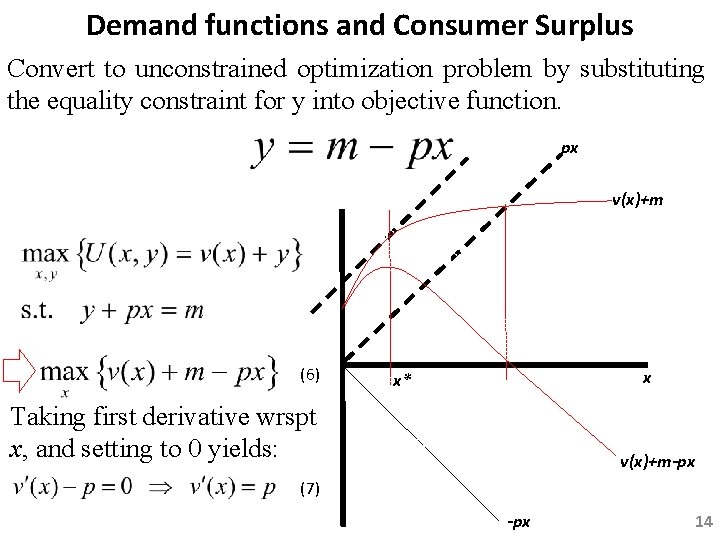

Demand functions and Consumer Surplus Convert to unconstrained optimization problem by substituting the equality constraint for y into objective function. px v(x)+m D D Taking first derivative wrspt x, and setting to 0 yields: x x* D (6) v(x)+m-px (7) -px 14

Demand functions and Consumer Surplus (5) What does this tell us? . . . 2. Two bounds: • The marginal utility v’(x) provides an upper bound to what the company should be willing to pay for one more unit of energy. If they have to pay more than v’(x), then what they have to pay for the energy exceeds the value of what they can do with that energy, i. e. , p>v’(x). • The marginal utility v’(x) also provides a lower bound to what the company should be willing to pay for one more unit of energy. If they pay less than v’(x), then they are losing out on energy for which they value beyond what they have to pay for it, i. e. , p<v’(x). Conclusion: The willingness to pay for each additional unit of energy should equal the price paid for that energy: v’(x)=p. 15

Demand functions and Consumer Surplus (5) What does this tell us? . . . 3. It always pays the consumer to buy more of any commodity whose marginal utility (measured in money) exceeds its price (the marginal cost of the commodity to the consumer), and less of any commodity whose marginal utility is less than its price. Definition: The inverse demand function, p=v’(x), expresses price as a function of demand. Definition: The demand function, x(p), expresses demand as a function of price. 16

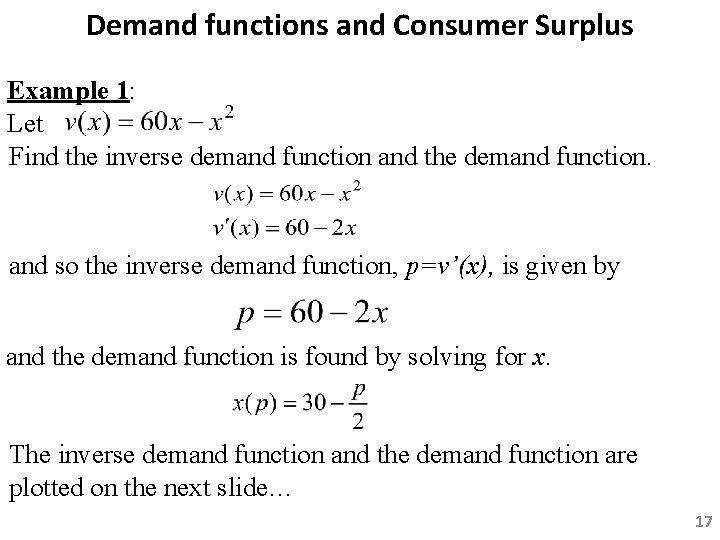

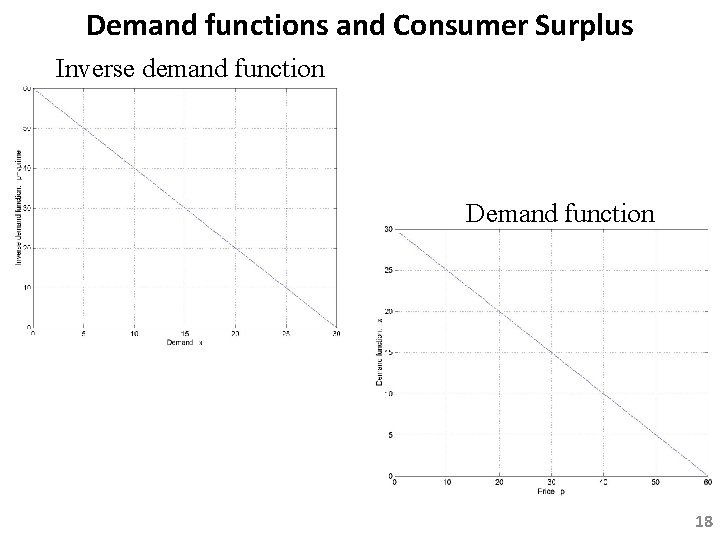

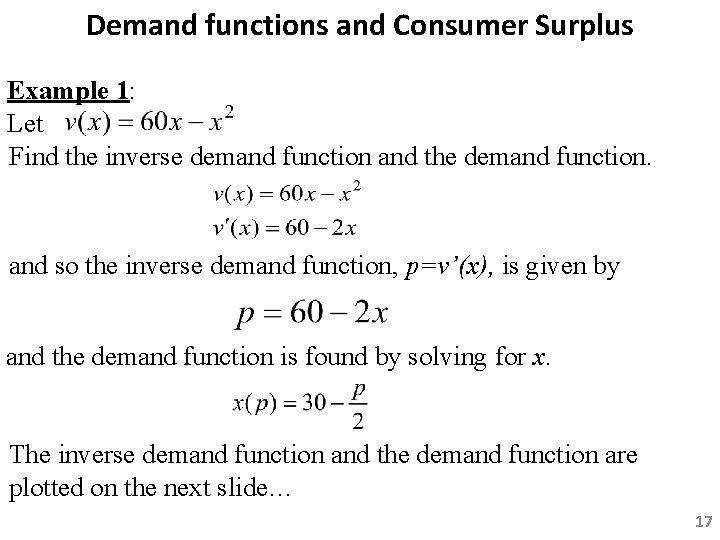

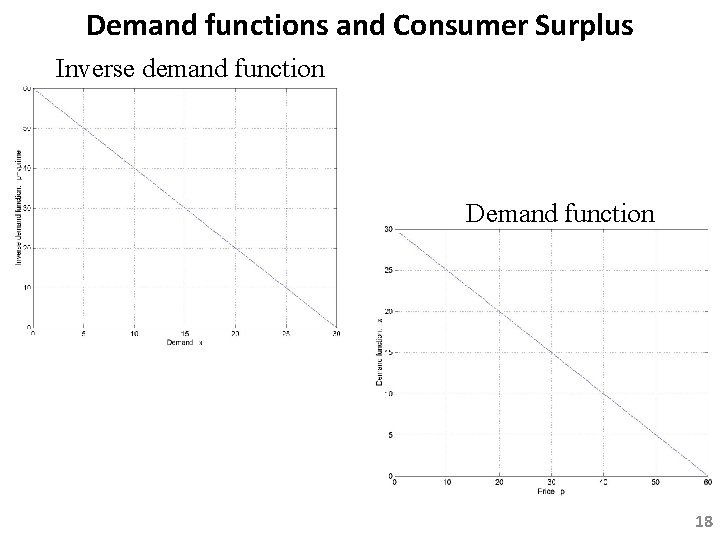

Demand functions and Consumer Surplus Example 1: Let Find the inverse demand function and the demand function. and so the inverse demand function, p=v’(x), is given by and the demand function is found by solving for x. The inverse demand function and the demand function are plotted on the next slide… 17

Demand functions and Consumer Surplus Inverse demand function Demand function 18

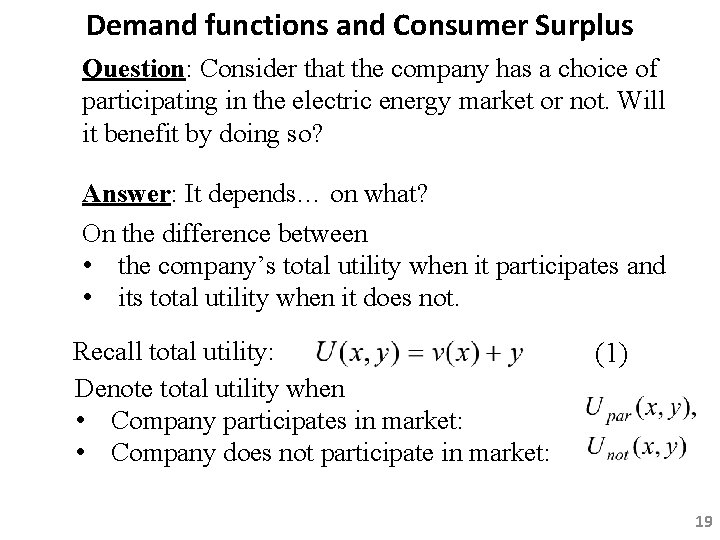

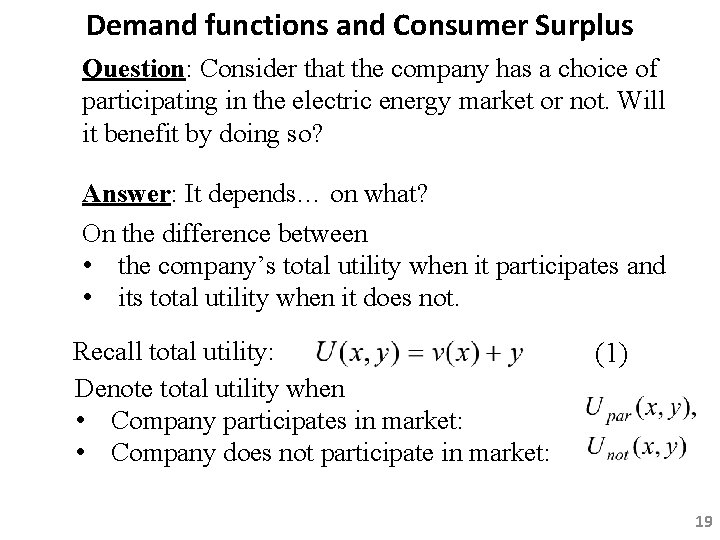

Demand functions and Consumer Surplus Question: Consider that the company has a choice of participating in the electric energy market or not. Will it benefit by doing so? Answer: It depends… on what? On the difference between • the company’s total utility when it participates and • its total utility when it does not. Recall total utility: Denote total utility when • Company participates in market: • Company does not participate in market: (1) 19

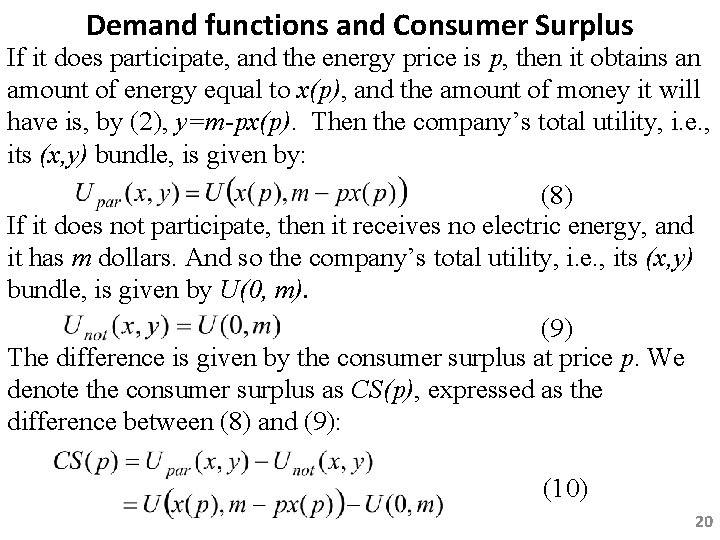

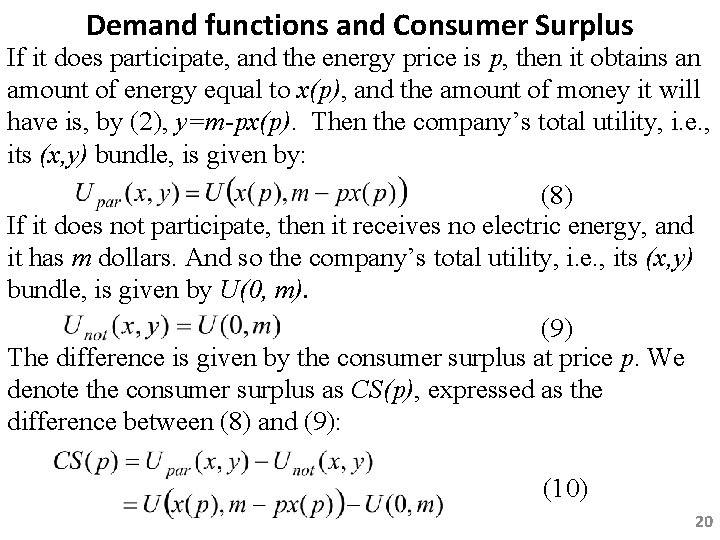

Demand functions and Consumer Surplus If it does participate, and the energy price is p, then it obtains an amount of energy equal to x(p), and the amount of money it will have is, by (2), y=m-px(p). Then the company’s total utility, i. e. , its (x, y) bundle, is given by: (8) If it does not participate, then it receives no electric energy, and it has m dollars. And so the company’s total utility, i. e. , its (x, y) bundle, is given by U(0, m). (9) The difference is given by the consumer surplus at price p. We denote the consumer surplus as CS(p), expressed as the difference between (8) and (9): (10) 20

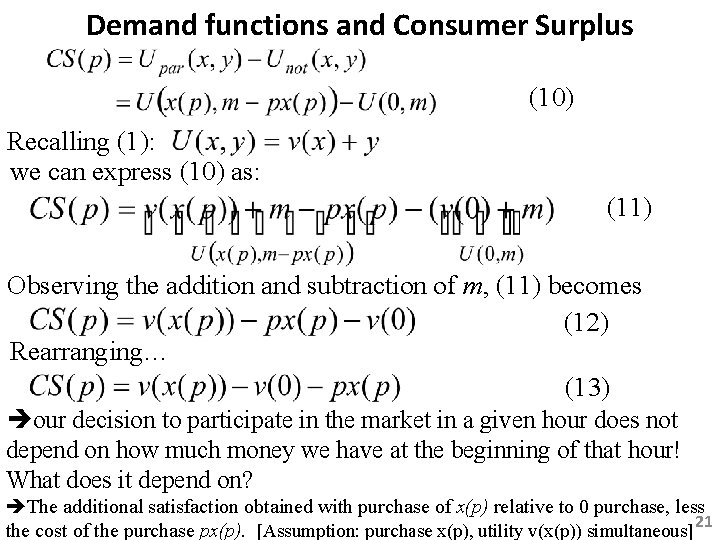

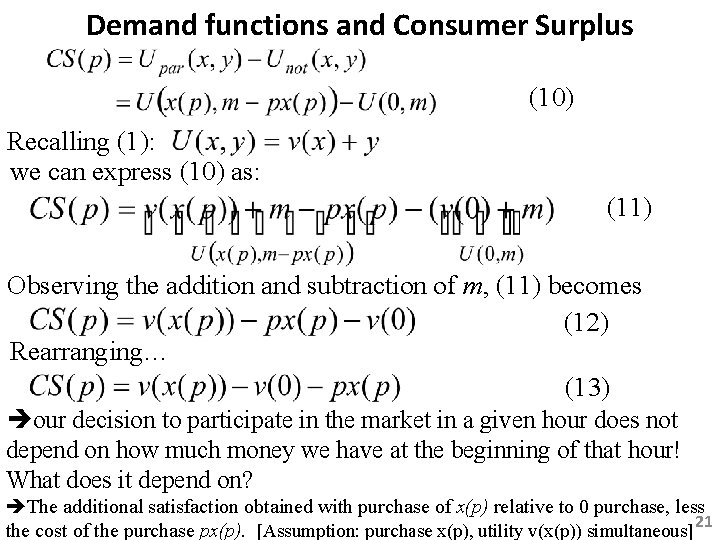

Demand functions and Consumer Surplus (10) Recalling (1): we can express (10) as: (11) Observing the addition and subtraction of m, (11) becomes (12) Rearranging… (13) our decision to participate in the market in a given hour does not depend on how much money we have at the beginning of that hour! What does it depend on? The additional satisfaction obtained with purchase of x(p) relative to 0 purchase, less the cost of the purchase px(p). [Assumption: purchase x(p), utility v(x(p)) simultaneous] 21

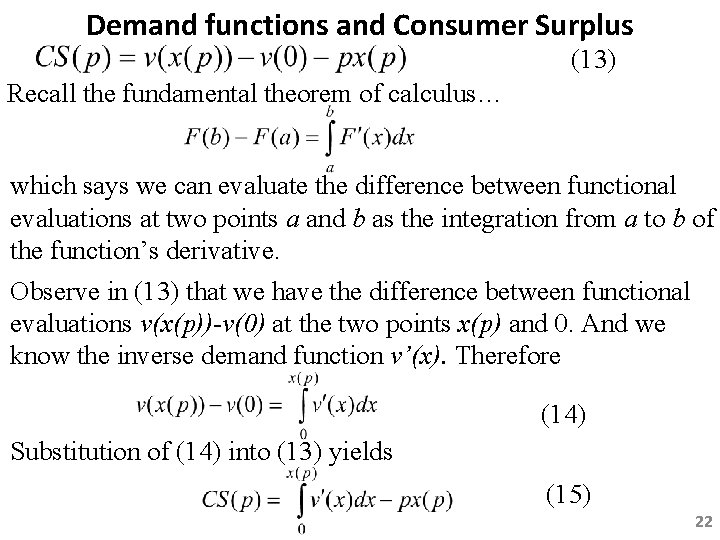

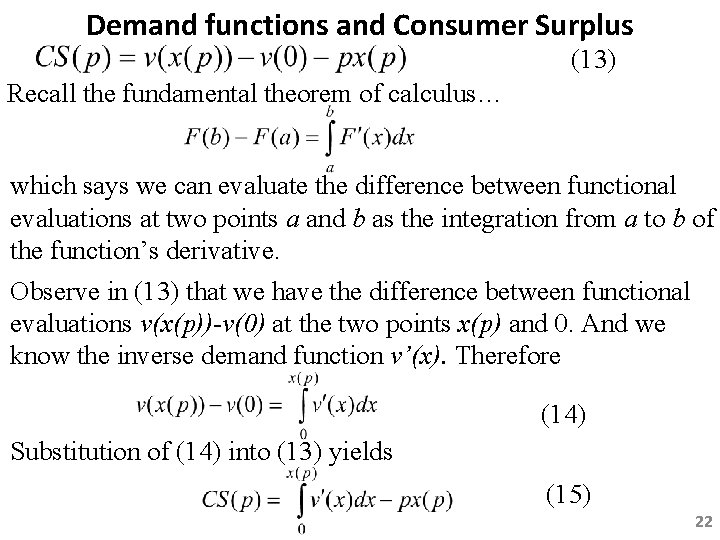

Demand functions and Consumer Surplus (13) Recall the fundamental theorem of calculus… which says we can evaluate the difference between functional evaluations at two points a and b as the integration from a to b of the function’s derivative. Observe in (13) that we have the difference between functional evaluations v(x(p))-v(0) at the two points x(p) and 0. And we know the inverse demand function v’(x). Therefore (14) Substitution of (14) into (13) yields (15) 22

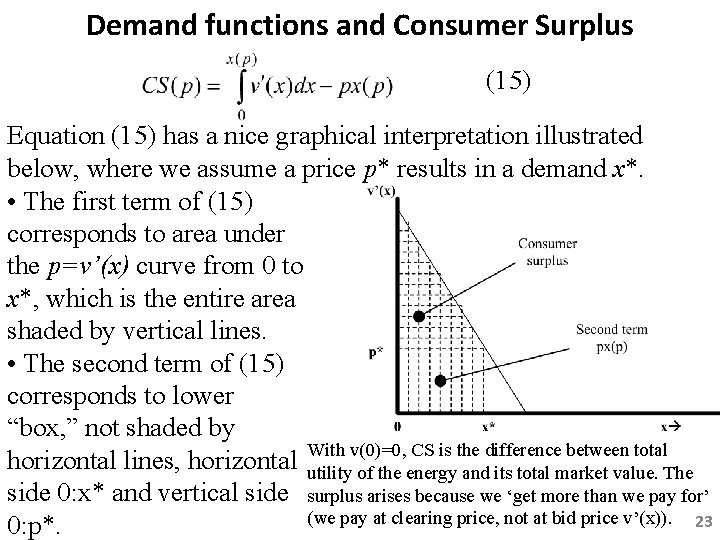

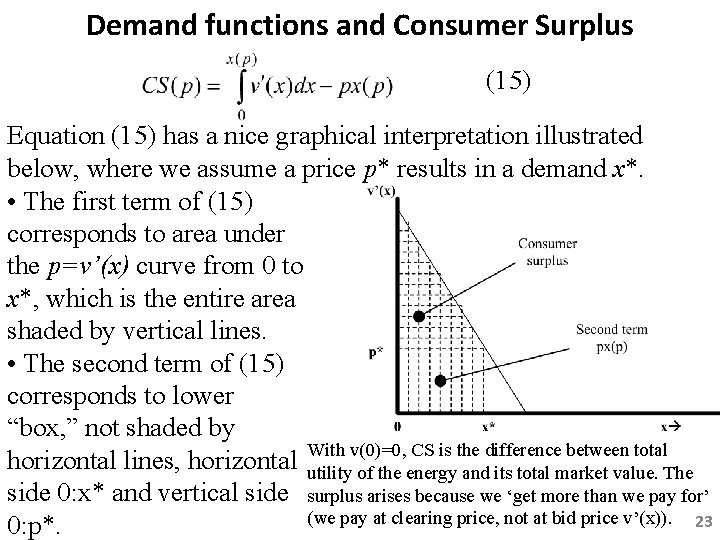

Demand functions and Consumer Surplus (15) Equation (15) has a nice graphical interpretation illustrated below, where we assume a price p* results in a demand x*. • The first term of (15) corresponds to area under the p=v’(x) curve from 0 to x*, which is the entire area shaded by vertical lines. • The second term of (15) corresponds to lower “box, ” not shaded by v(0)=0, CS is the difference between total horizontal lines, horizontal With utility of the energy and its total market value. The side 0: x* and vertical side surplus arises because we ‘get more than we pay for’ (we pay at clearing price, not at bid price v’(x)). 23 0: p*.

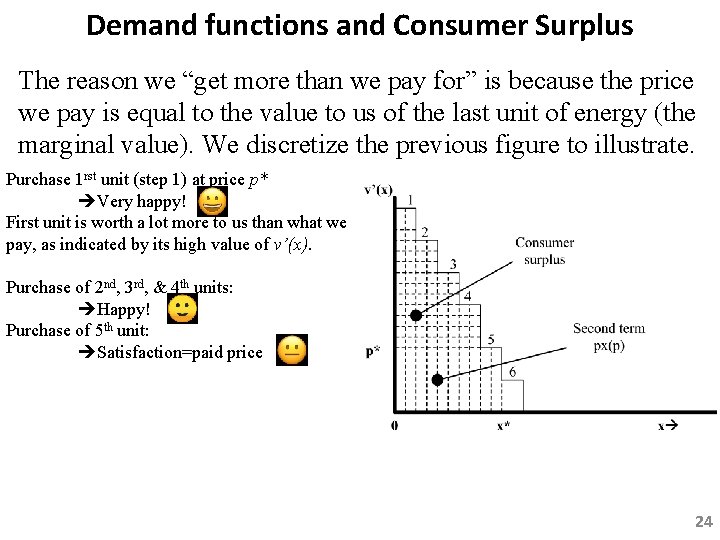

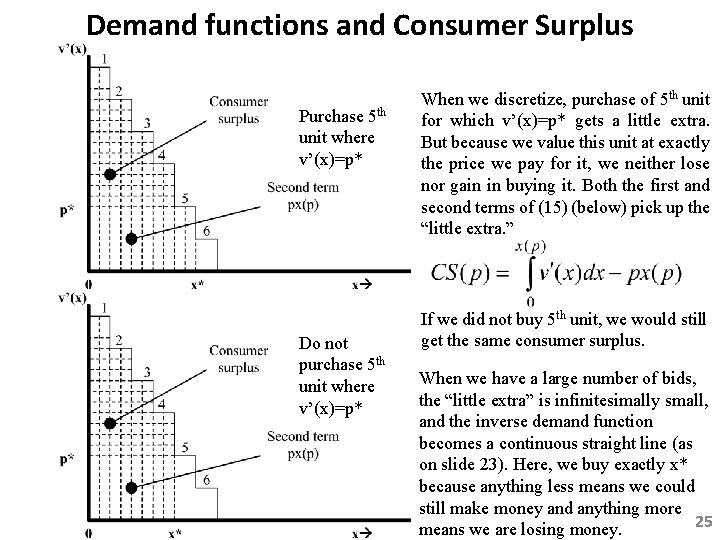

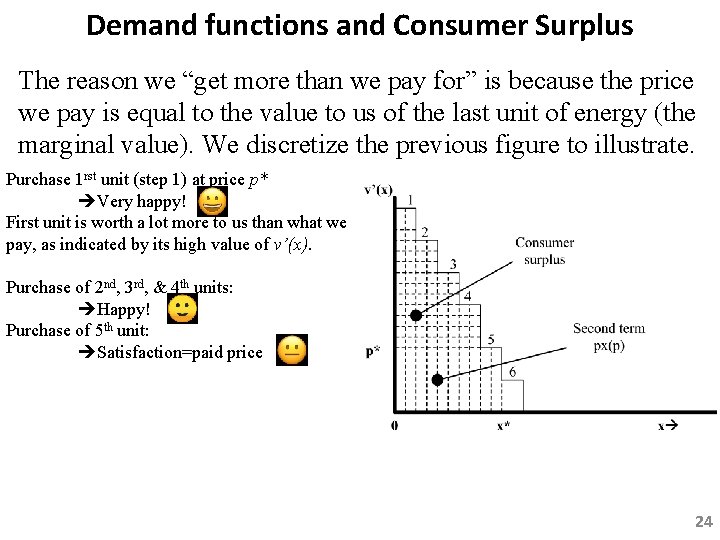

Demand functions and Consumer Surplus The reason we “get more than we pay for” is because the price we pay is equal to the value to us of the last unit of energy (the marginal value). We discretize the previous figure to illustrate. Purchase 1 rst unit (step 1) at price p* Very happy! First unit is worth a lot more to us than what we pay, as indicated by its high value of v’(x). Purchase of 2 nd, 3 rd, & 4 th units: Happy! Purchase of 5 th unit: Satisfaction=paid price 24

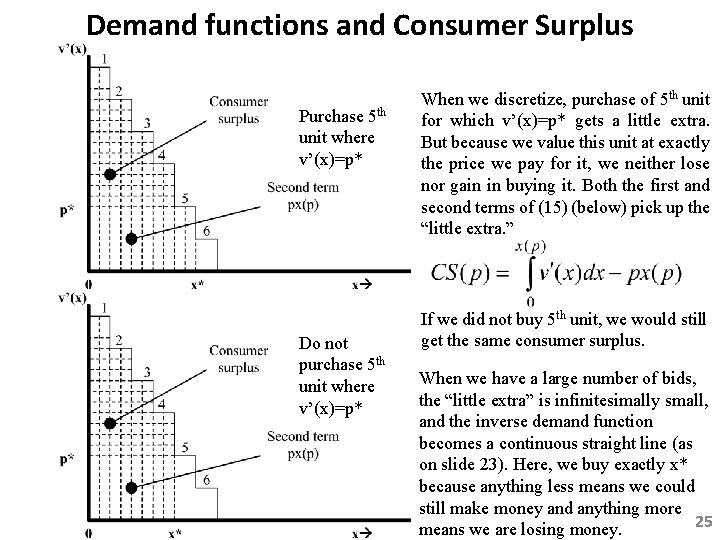

Demand functions and Consumer Surplus Purchase 5 th unit where v’(x)=p* Do not purchase 5 th unit where v’(x)=p* When we discretize, purchase of 5 th unit for which v’(x)=p* gets a little extra. But because we value this unit at exactly the price we pay for it, we neither lose nor gain in buying it. Both the first and second terms of (15) (below) pick up the “little extra. ” If we did not buy 5 th unit, we would still get the same consumer surplus. When we have a large number of bids, the “little extra” is infinitesimally small, and the inverse demand function becomes a continuous straight line (as on slide 23). Here, we buy exactly x* because anything less means we could still make money and anything more 25 means we are losing money.

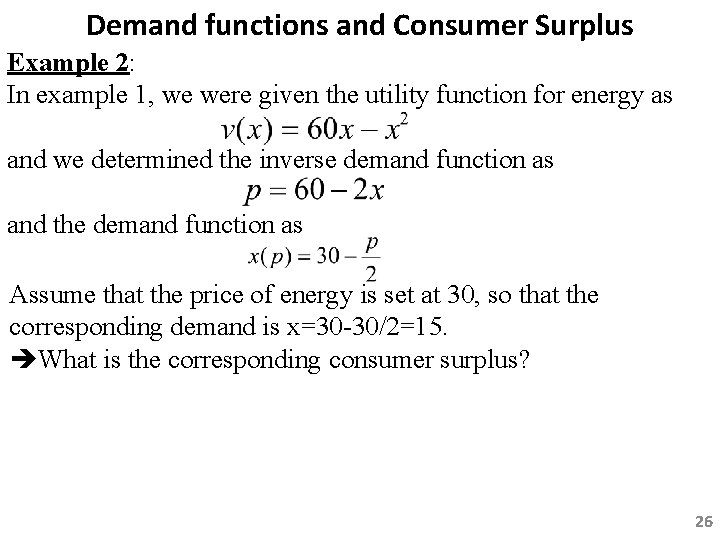

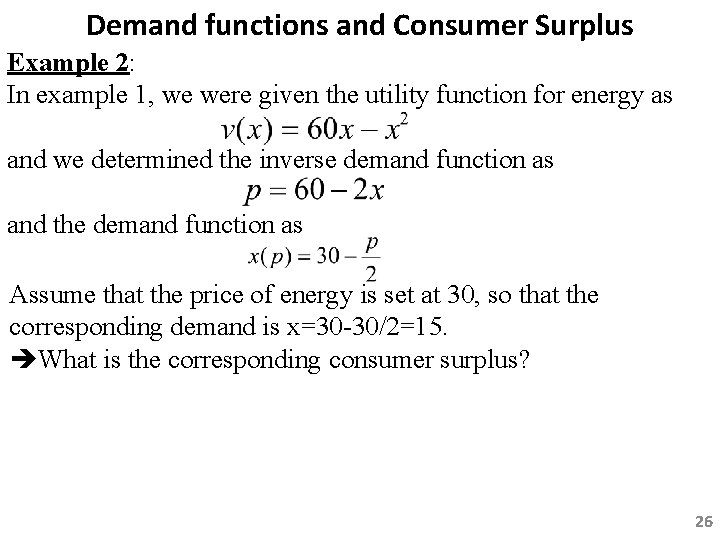

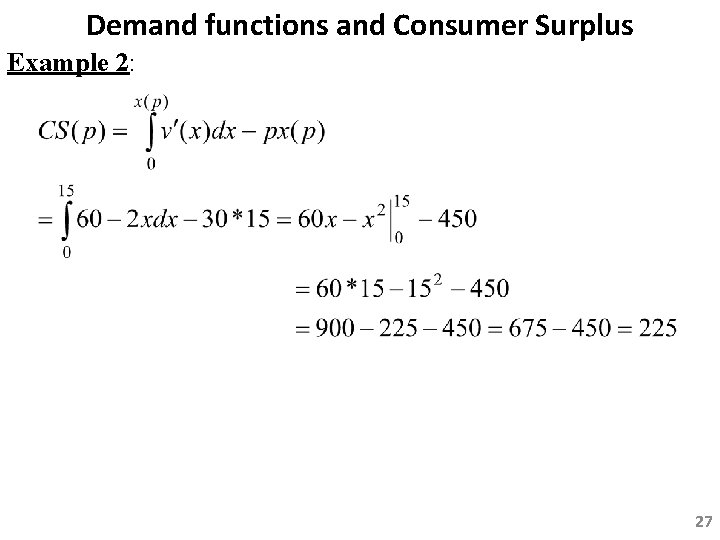

Demand functions and Consumer Surplus Example 2: In example 1, we were given the utility function for energy as and we determined the inverse demand function as and the demand function as Assume that the price of energy is set at 30, so that the corresponding demand is x=30 -30/2=15. What is the corresponding consumer surplus? 26

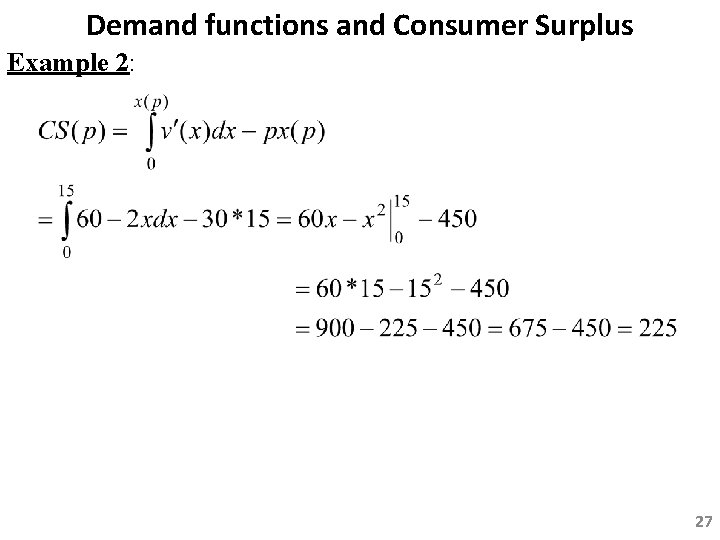

Demand functions and Consumer Surplus Example 2: 27

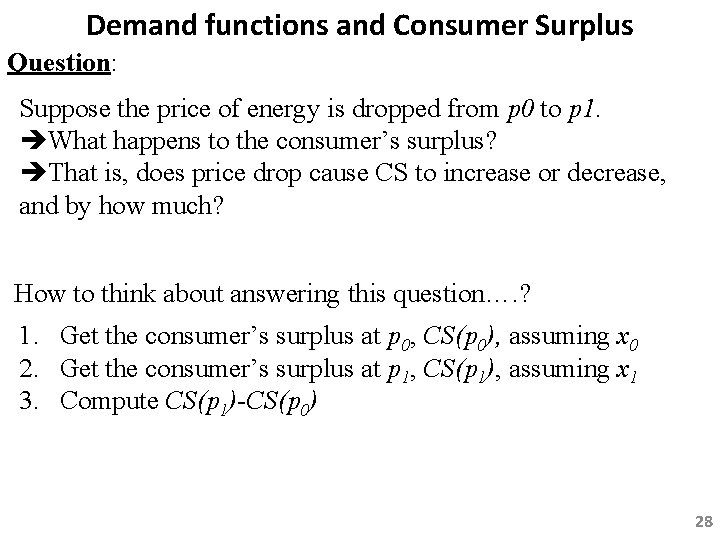

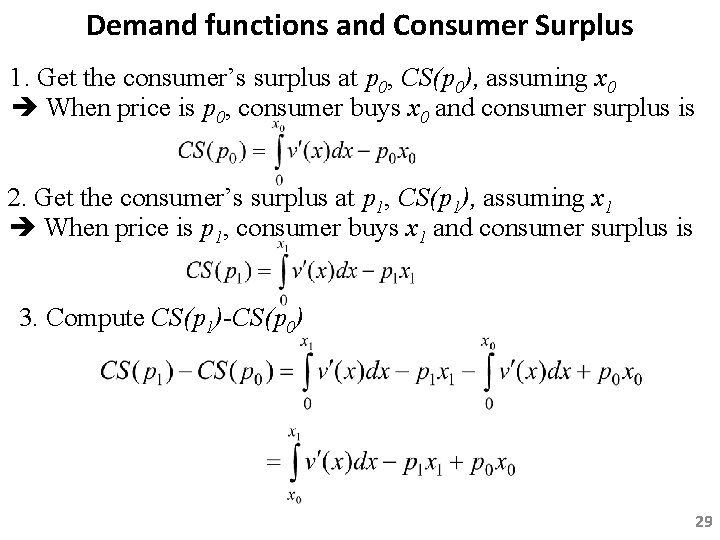

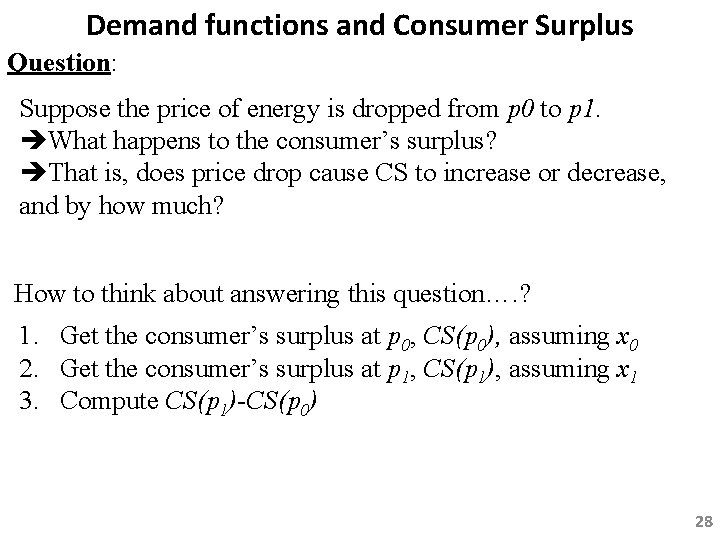

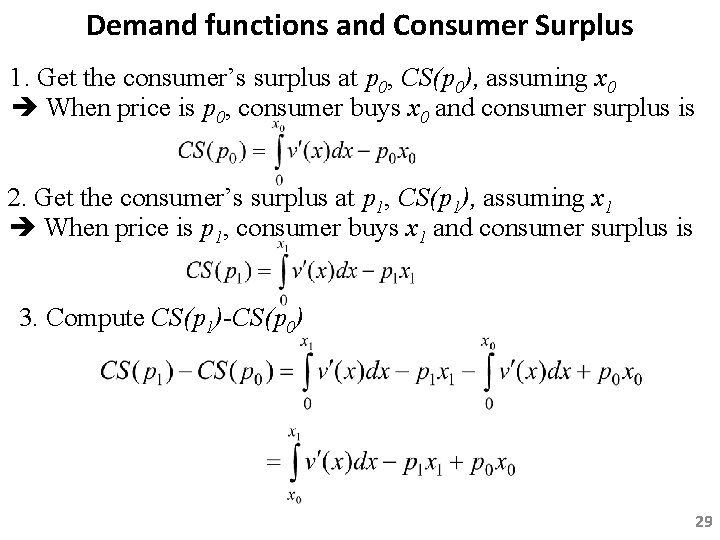

Demand functions and Consumer Surplus Question: Suppose the price of energy is dropped from p 0 to p 1. What happens to the consumer’s surplus? That is, does price drop cause CS to increase or decrease, and by how much? How to think about answering this question…. ? 1. Get the consumer’s surplus at p 0, CS(p 0), assuming x 0 2. Get the consumer’s surplus at p 1, CS(p 1), assuming x 1 3. Compute CS(p 1)-CS(p 0) 28

Demand functions and Consumer Surplus 1. Get the consumer’s surplus at p 0, CS(p 0), assuming x 0 When price is p 0, consumer buys x 0 and consumer surplus is 2. Get the consumer’s surplus at p 1, CS(p 1), assuming x 1 When price is p 1, consumer buys x 1 and consumer surplus is 3. Compute CS(p 1)-CS(p 0) 29

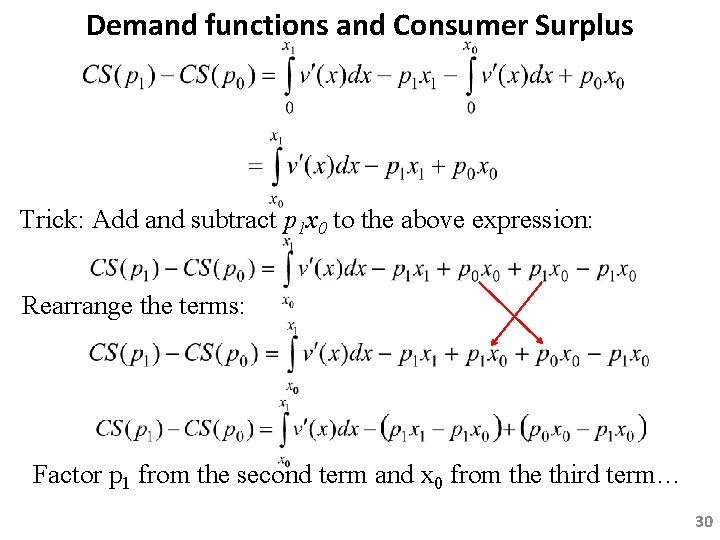

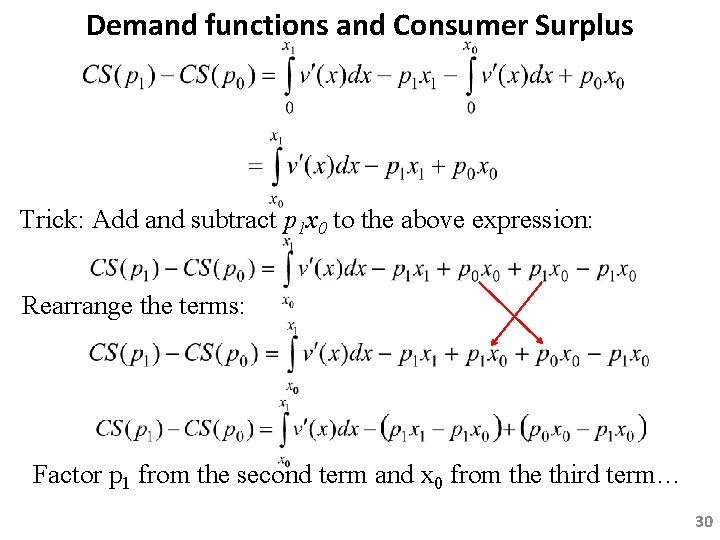

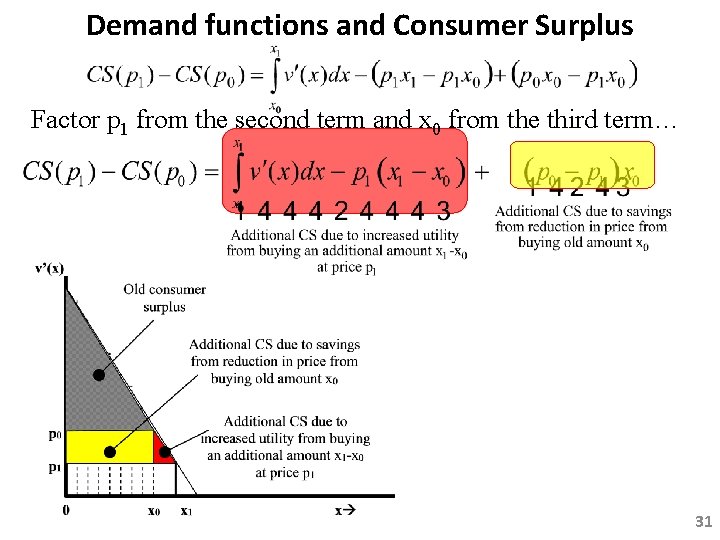

Demand functions and Consumer Surplus Trick: Add and subtract p 1 x 0 to the above expression: Rearrange the terms: Factor p 1 from the second term and x 0 from the third term… 30

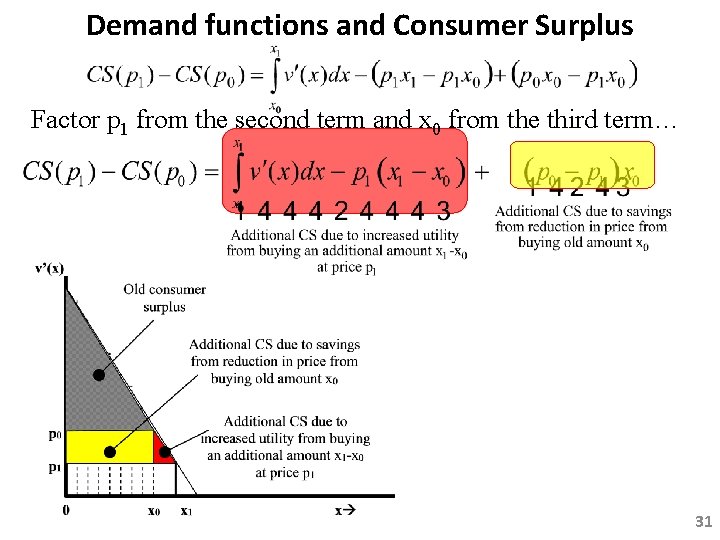

Demand functions and Consumer Surplus Factor p 1 from the second term and x 0 from the third term… 31

Producer

Producer Consumer surplus and producer surplus

Consumer surplus and producer surplus Consumer surplus and producer surplus

Consumer surplus and producer surplus Eeecon

Eeecon Eeecon

Eeecon Food chain vs food web

Food chain vs food web Producers primary consumers secondary consumers

Producers primary consumers secondary consumers Producer surplus example

Producer surplus example Komplemen 9 dari 458

Komplemen 9 dari 458 Penjumlahan bilangan octal 45 (8) + 17 (8) = …

Penjumlahan bilangan octal 45 (8) + 17 (8) = … Ece 458

Ece 458 Eecs 458

Eecs 458 Selin aviyente

Selin aviyente Maastricht university school of business and economics

Maastricht university school of business and economics Non mathematical economics

Non mathematical economics Producer surplus formula

Producer surplus formula Marx surplus value

Marx surplus value Government tariffs

Government tariffs Producer surplus tax

Producer surplus tax Suatu lembaga yang

Suatu lembaga yang Surplus

Surplus Surplus vs shortage

Surplus vs shortage Consumer surplus with subsidy

Consumer surplus with subsidy Consumer surplus in monopolistic competition

Consumer surplus in monopolistic competition Consumer surplus in a monopoly

Consumer surplus in a monopoly How to calculate consumer surplus

How to calculate consumer surplus Social surplus

Social surplus Marx surplus value

Marx surplus value Surplus production

Surplus production Surplus del produttore

Surplus del produttore Consumer surplus in a monopoly

Consumer surplus in a monopoly When are consumer and producer surplus maximized?

When are consumer and producer surplus maximized?